| Filed by Comcast Corporation pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 |

| Subject Company: The Walt Disney Company |

| Commission File No. 001-11605 |

| Date: March 8, 2004 |

The following slide presentation was used by Comcast Corporation at Bear Stearns’ 17th Annual Media, Entertainment & Information Conference:

|

|

| Safe Harbor |

| Caution Concerning Forward-Looking Statements |

| This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify those so-called “forward-looking statements” by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of those words and other comparable words. We wish to take advantage of the “safe harbor” provided for by the Private Securities Litigation Reform Act of 1995 and we caution you that actual events or results may differ materially from the expectations we express in our forward-looking statements as a result of various risks and uncertainties, many of which are beyond our control. Factors relating to our acquisition in November 2002 of a substantial number of cable systems and factors relating to our business generally could cause actual results to differ materially. These factors include, but are not limited to, the following: (1) we may find the integration of the newly acquired cable systems more difficult, time-consuming or costly than we expect, (2) we may not realize the combination benefits we expect from the acquisition of the newly acquired cable systems or these benefits may take longer to achieve, (3) we may incur greater-than-expected operating costs, financing costs, litigation costs, subscriber loss and business disruption, including, without limitation, difficulties in maintaining relationships with employees, subscribers, suppliers or franchising authorities, following the acquisition, (4) changes in laws and regulations, (5) changes in the competitive environment, (6) changes in technology, (7) industry consolidation and mergers, (8) franchise related matters, (9) market conditions that may adversely affect the availability of debt and equity financing for working capital, capital expenditures or other purposes, (10) demand for the programming content we distribute or the willingness of other video program distributors to carry our content, (11) general economic conditions and (12) other risks described from time to time in reports and other documents we file with the Securities and Exchange Commission. Our presentation may also contain non-GAAP financial measures, as defined in Regulation G, adopted by the SEC. We provide a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure in our quarterly earnings releases, which can be found on the investor relations page of our web site at www.cmcsa.com |

Investors and security holders are urged to read the disclosure documents regarding the proposed Comcast/Disney transaction, when they become available, because they will contain important information. The disclosure documents will be filed with the Commission by Comcast. Investors and security holders may obtain a free copy of the disclosure documents (when they are available) and other documents filed by Comcast with the Commission at the Commission’s website atwww.sec.gov. The disclosure documents and these other documents may also be obtained for free from Comcast by directing a request to Comcast Corporation, 1500 Market Street, Philadelphia, Pennsylvania 19102-2148, Attention: General Counsel. Comcast and certain of its directors and officers may be deemed to be “participants” in solicitations of proxies or consents from Comcast’s and Disney’s shareholders. A detailed list of the names, titles and interests of these persons is contained in a filing made by Comcast with the Commission pursuant to Rule 425 on February 11, 2004. |

|  | |

| • | Largest U.S. Cable Company | |

| • | Largest U. S. Broadband Provider | |

| • | A Growing Portfolio of Valuable Cable Channels | |

| ||

| A History of Growth | |||||||||

| . . . Fueled by Cable | |||||||||

| ($s and Subs In Millions) | 1990 | 1998 | 2003 | ||||||

| Cable Revenue | $591 | $2,287 | $17,491 | ||||||

| Cable OCF | $264 | $1,101 | $6,350 | ||||||

| Basic Subscribers | 2.4 | 4.5 | 21.5 | ||||||

| �� | |||||||||

| High-Speed Internet Subs | -0- | .142 | 5.3 | ||||||

| Revenue Generating Units | 2.4 | 4.7 | 35.7 | ||||||

| Employees | 3,500 | 10,600 | 60,000 | ||||||

| Building Value in Content | ||||

| Value Today | ||||

| • | Averaged 18% OCF Growth over 10 years | ||

| • | 37% IRR on original investment | $14.1B | ||

| • | 28% subscriber growth since 1999 • 74MM subscribers in 2003 | $1.75 - $2.25B | ||

| • | 540% subscriber growth since 1999 • 24MM subscribers in 2003 | $300 - $600MM | |

| • | 92% subscriber growth since 1999 • 50MM subscribers in 2003 | $1.25 - $1.75B | |

| • | 176% subscriber growth since 1999 • 50MM subscribers in 2003 | $700MM - $1.0B | |

| • | Regional sports network covers 8.2MM subs and entire Mid-Atlantic customer base | $400 - $600MM | |

| • | Video Game Related Programming • Launched 2002 - 12MM subscribers today | $200 - $300MM | |

| $18.7 - $20.3B | ||||

| Source: | Wall Street equity research estimates. Value represents 100% of the equity for each entity. | |||

| 2003 Was A Defining Year | ||

| n | Successful Cable Integration | |

| n | ATTB: 1.5X our size with 12.5 million subscribers and 40,000 employees | |

| n | Key Integration Metrics Achieved …Ahead of Schedule | |

| Ö | Improve Operating Cash Flow | |||

| n | OCF 2002: $4.9Bn –> 2003: $6.35Bn | |||

| n | ATTB OCF Margins: 16% –> 35% | |||

| Ö | Stop Basic Subscriber Losses | |||

| n | Net Adds 2002: (415K) –> 2003: 125-150K | |||

| Ö | Accelerate Rebuilds | |||

| n | ATTB Plant Ungraded 2002: 72% –> 2003: 93% | |||

| n | Rebuilt Plantform Drives New Businesses | |||

| Comcast Digital Cable | |||

| Subscribers (000s) | |||

| |||

| Comcast Digital Cable | ||||||

| Strategy | ||||||

| Compete and Build Value Through Consisten Product Enhancements | ||||||

| "TV on your terms" | ||||||

| | | | | | | ||||

| Availability (% of basic subscribers) | VOD | HDTV | DVR | |||

| YE03 | 50% | 75% | 10% | |||

| YE04 | 85% | 85% | 100% | |||

| ||||||

| Comcast On Demand | |||

| "TV on your terms" | |||

| Real-time interactivity offers significant competitive advantage | |||

| Movies | + | Time Shifted Programming | |

| | | | | ||

| Impulse | Subscription No additional charge to premium customers | "Best of" Cable and Broadcasting No additional charge | |

|  |  | |

| Comcast High-Speed Internet | |||

| Subscribers (000s) | |||

| |||

Comcast High-Speed Internet

Building A Superior Product with Superior Features

| ||||||

| • | Doubled Download Speed: 3Mbps | |||||

| • | Enhancing Comcast.net Portal | |||||

| • | Over 50% of customers use portal | |||||

| • | Over 60% use Comcast e-mail | |||||

| • | 100% Broadband Portal | |||||

| • | Adding Content |  | ||||

| • | Streaming Video Packages | |||||

| • | Kids, Sports News | |||||

| • | Video Chat |  | ||||

| • | Video Games | |||||

| Telephone | ||||||

| • | Improve Economics of Existing | • | 1.25MM Subscribers | |||

| Circuit-Switched Business | ||||||

| • | OCF Margin YE04: 25% | • | 9.4MM Homes or 24% of cable footprint | |||

| • | Penetration: 13.5% | |||||

| • | Develop VoIP | |||||

| ||||||

| • | Build on Existing Phone Experience | |||||

| • | Expand VoIP Launches in 2004: | |||||

| Philadelphia, Springfield, MA and | ||||||

| Indianapolis, IN | ||||||

| • | Set Stage for 2005 Rollout | |||||

| • | 50% of plant VoIP-Ready by YE04 | |||||

| • | 95% of plant VoIP-Ready by YE05 | |||||

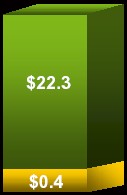

| Balance Sheet Strength | ||||

| Significant Debt Reduction | ||||

| $ In Billions | November 18, 2002 | December 31, 2003 | ||

| Cash | $1.6 Bn | ||

| QUIPS | Net Debt excluding cash: | $21.1 Bn1 | ||

| Bridge Loan | Non-Strategic Assets: | $10 - $12 Bn | ||

| Bank Debt (> 1yr) |  | |||

| Public Debt | ||||

| Other | ||||

| Total | $34.81 | $22.72 | ||

| 1Excludes $5.5 billion of notes exchangeable into common stcok | ||||

| 2Excludes $4.3 billion of notes exchangeable into common stcok | ||||

| Non-Strategic Assets | |

| Asset Value: $10 - $12 Billion | |

| • | $1.5 Billion Liberty Media Stock |

| • | $1.5 Billion in TWX Stock |

| • | 21% Interest in Time Warner Cable |

| • | Other Cable Partnerships |

| Significant FCF Generation | ||

| Decrease in total cable capital expenditures | ...leads to significant FCF* generation | |

|  | |

| *Operating Cash Flow less Cap Ex, Interest Expense and Cash Taxes. All amounts exclude QVC and One-Time Tax Payments. | ||

Why Disney?

Combination Creates Significant New Business Opportunities

| n | Launch New Cable Channels | |

| n | Maximize On Demand Capability for Digital Cable Customers | |

| n | VOD Movies In Attractive Windows | |

| n | Time Shifted ABC Programming | |

| n | ESPN Interactive Television Features | |

| n | Develop New Services For Broadband Customers | |

| n | Disney, ESPN, ABC Content For comcast.net Portal | |

| n | Streaming Internet Video Subscription Packages | |

| Increases the Value of Content and Distribution |

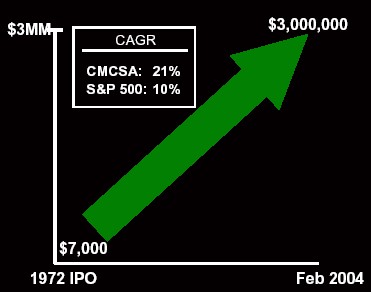

Consistent Shareholder Value Creation

| ||

| 1,000 shares of Comcast purchased in the IPO for $7 per share | ||

| ||

| Note: (1) Published on September 27, 2002 |

|

|