| Average Compensation Actually Paid to Non-PEO NEOs | | 2022 | | | 2021 | |

| Average Summary Compensation Table Total | | $ | 427,550 | | | $ | 338,637 | |

| Less, average value of Stock Awards reported in Summary Compensation Table | | $ | (57,300 | ) | | | — | |

| Plus, average year-end fair value of outstanding and unvested equity awards granted in the year | | $ | 37,825 | | | | — | |

| Plus, average fair value as of vesting date of equity awards granted and vested in the year | | | — | | | | — | |

| Plus (less), average year over year change in fair value of outstanding and unvested equity awards granted in prior years | | | — | | | | — | |

| Plus (less), average year over year change in fair value of equity awards granted in prior years that vested in the year | | | — | | | $ | 112,341 | |

| Less, prior year-end fair value for any equity awards forfeited in the year | | | — | | | | — | |

| Plus, dividends or other earnings paid on awards in the covered fiscal year prior to vesting if not otherwise included in the SCT Total for the covered fiscal year | | | — | | | | — | |

| Average Compensation Actually Paid to Non-PEO NEOs | | $ | 408,075 | | | $ | 450,978 | |

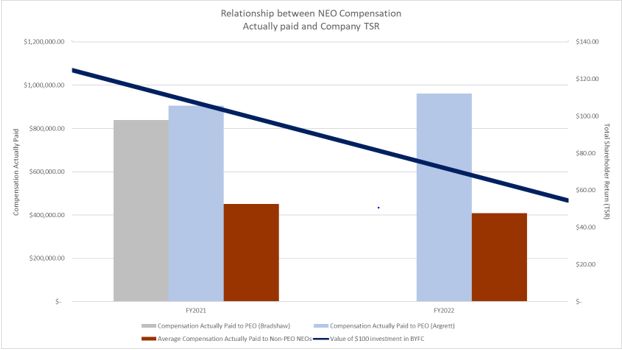

5 Total Shareholder Return (TSR) is calculated by dividing (a) the sum of (i) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (ii) the difference between the Company’s share price at the end of each fiscal year shown and the beginning of the measurement period, and the beginning of the measurement period by (b) the Company’s share price at the beginning of the measurement period. The beginning of the measurement period for each year in the table is December 31, 2020.

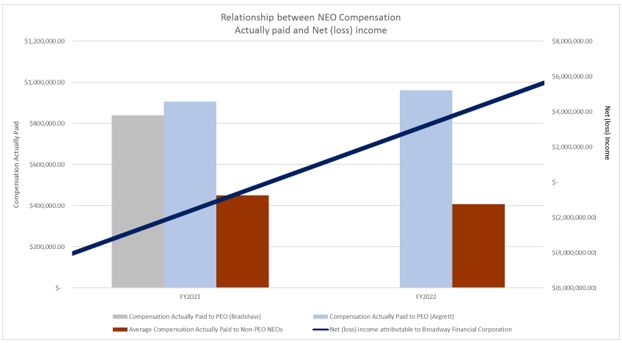

6 The dollar amounts reported represent the amount of net income reflected in the Company’s audited financial statements for the applicable year.

Description of Certain Relationships between Information Presented in the Pay versus Performance Table

While the Company utilizes several performance measures to align executive compensation with Company performance, all of those Company measures are not presented in the Pay versus Performance table. Moreover, the Company generally seeks to incentivize long-term performance, and therefore does not specifically align the Company’s performance measures with compensation that is actually paid (as computed in accordance with SEC rules) for a particular year. In accordance with SEC rules, the Company is providing the following descriptions of the relationships between information presented in the Pay versus Performance table.

Compensation Actually Paid and Cumulative TSR

Compensation Actually Paid and Net Income

Effective January 1, 2022, the non-employee directors of the Company are entitled to a quarterly fee of $12,500 (“Board Service Retainer”). In addition, outside directors who serve as Chair of one or more committees receive an additional quarterly fee of $1,500 (“Committee Chair Service Retainer”). In lieu of the Board Service Retainer payments, any outside director who serves as Lead Independent Director receives a quarterly fee of $14,000, and any outside director who serves as Chair of the Board receives a quarterly fee of $15,000. In addition, each calendar year the Company issues $12,000 in unrestricted stock to each outside director for service during such year.

Members of the Board do not receive separate compensation for their service on the board of directors of the Bank.

The following table summarizes the compensation paid to non-employee directors for the year ended December 31, 2022.

| Name | | Fees Earned or Paid in Cash(1) | | | Stock Awards(2) | | | Total | |

| Wayne-Kent A. Bradshaw | | $ | 66,000 | | | $ | 12,000 | | | $ | 78,000 | |

| Robert C. Davidson | | $ | 56,000 | | | $ | 12,000 | | | $ | 68,000 | |

| Mary Ann Donovan | | $ | 50,000 | | | $ | 12,000 | | | $ | 62,000 | |

John Driver3 | | $ | 37,500 | | | | - | | | $ | 37,500 | |

| Marie C. Johns | | $ | 62,000 | | | $ | 12,000 | | | $ | 74,000 | |

| William A. Longbrake | | $ | 56,000 | | | $ | 12,000 | | | $ | 68,000 | |

| David J. McGrady | | $ | 56,000 | | | $ | 12,000 | | | $ | 68,000 | |

| Dutch C. Ross III | | $ | 56,000 | | | $ | 12,000 | | | $ | 68,000 | |

| (1) | Includes payments of annual retainer fees, and retainer fees paid to chairs of Board committees. |

| (2) | The amounts shown reflect the aggregate fair value of stock awards on the grant date, as determined in accordance with FASB ASC Topic 718. For each director, the number of shares of Common Stock was determined by dividing the grant date value of the award, $12,000, by $1.78, the closing price of the Company’s Common Stock on February 16, 2022, the date of grant. As of December 31, 2022, none of the directors held any outstanding equity awards. |

| (3) | Mr. Driver was appointed to the Board on May 13, 2022 to fill a vacancy created when Mr. Jack Thompson resigned from the Board on September 15, 2021. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions by us with related persons are subject to formal written policies, as well as regulatory requirements and restrictions. These requirements and restrictions include Sections 23A and 23B of the Federal Reserve Act and the Federal Reserve’s Regulation W (which govern certain transactions by us with our affiliates) and the Federal Reserve’s Regulation O (which governs certain loans by the Bank to its executive officers, directors, and principal stockholders). We have adopted policies to comply with these regulatory requirements and restrictions. The Company’s current loan policy provides that all loans made by the Company or its subsidiary to its directors and executive officers or their associates must be made on substantially the same terms, including interest rates, collateral and repayment terms, as those prevailing at the time for comparable transactions with other persons of similar creditworthiness who are not related to the Company and must not involve more than the normal risk of collectability or present other unfavorable features. As of December 31, 2022, the Company did not have any loans to related parties or affiliates. Loans to insiders and their related interests require approval by the Board, or a Board designated committee. We also apply the same standards to any other transactions with an insider. Personal loans made to any executive officer or director must comply with Regulation O. Additionally, loans and other related party transactions are subject to Audit Committee review and approval requirements.

From time to time, City First Enterprises and the Bank will each make an investment in the same community development project. These loans by the Bank are made in the ordinary course of business on substantially the same terms, including interest rate and collateral, as those prevailing at the time for comparable loans with persons not related to the Bank, and do not involve more than the normal risk of collectability or present other unfavorable features. All such loans are reviewed, approved, or ratified by the Director’s Loan Committee of the Bank and are made in accordance with the Bank’s lending and credit policies.

Parents of the Company

City First Enterprises is the owner of 6,622,236 shares of our Voting Common Stock, which represents approximately 13.59% of our Voting Common Stock outstanding. In addition, four members of our Board – Mr. Argrett, our President and CEO, Ms. Donovan, Dr. Longbrake, and Mr. McGrady – are also members of the Board of Directors of City First Enterprises as of March 31, 2023.

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Exchange Act requires the Company’s executive officers and directors, and persons who own more than 10% of the Company’s Voting Common Stock, to report to the SEC their initial ownership of shares of the Company’s common stock and any subsequent changes in that ownership. Specific due dates for these reports have been established by the SEC and any late filings or failures to file are to be disclosed in this Proxy Statement. The Company’s executive officers and directors, and persons who own more than 10% of the Company’s Voting Common Stock are required by SEC rules to furnish the Company with copies of all forms that they file pursuant to Section 16(a) of the Exchange Act. To our knowledge, all required reports pursuant to Section 16(a) were filed by the Company’s directors and officers on a timely basis, with the exception of a late Form 3 filing for John Driver, due to an administrative error.

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Board has appointed Moss Adams LLP (“Moss Adams”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. This appointment is being submitted to the stockholders for their consideration and ratification as a matter of good corporate governance. If the appointment of Moss Adams is not ratified by the stockholders, the Audit Committee will consider the stockholders’ vote in deciding whether to reappoint Moss Adams as independent registered public accounting firm in the future.

It is anticipated that representatives of Moss Adams will be present at the Annual Meeting. The Moss Adams representatives will be given an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions from stockholders. Moss Adams performed the independent audits of the Company’s consolidated financial statements for the fiscal years ended December 31, 2022 and 2021.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF MOSS ADAMS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. |

Principal Accountant Fees and Services

The Audit Committee reviews and pre-approves all audit and non-audit services performed by its independent registered public accounting firm, as well as the fees charged for such services, in accordance with the pre-approval policies and procedures that have been established by the Audit Committee. All fees incurred in the years ended December 31, 2022 and 2021 for services rendered by Moss Adams were approved by the Audit Committee. No non-audit services were provided by Moss Adams for the years indicated.

The following table sets forth the aggregate fees billed to us by Moss Adams for the years indicated, inclusive of out-of-pocket expenses.

| 2022 | | 2021 | |

| (In thousands) | |

Audit fees(1) | $ | 409 | | $ | 390 | |

Audit-related fees(2) | | — | | | — | |

| Tax fees | | — | | | — | |

| All other fees | | — | | | — | |

| Total fees | $ | 409 | | $ | 390 | |

| (1) | Aggregate fees billed for professional services rendered for the audit of the Company’s consolidated annual financial statements included in the Company’s Annual Report on Form 10-K and for the reviews of the Company’s consolidated financial statements included in the Company’s Quarterly Reports on Form 10-Q. The services provided by the independent accounts are for SEC-related filings only. |

PROPOSAL 3. ADVISORY (NON-BINDING) VOTE TO APPROVE

EXECUTIVE COMPENSATION

Our overall executive compensation program, as described in this Proxy Statement, is designed to pay for performance and directly align the interests of our executive officers with the long-term interests of our stockholders.

Our stockholders are asked to vote to approve, on an advisory (non-binding) basis, the compensation of our Named Executive Officers as disclosed in this Proxy Statement in accordance with SEC rules. Accordingly, stockholders will be asked at the Annual Meeting to vote on the following resolution:

“Resolved, that the stockholders of Broadway Financial Corporation hereby approve the compensation of the Named Executive Officers as disclosed in the Summary Compensation Table and other tables and narratives of the Proxy Statement for the Annual Meeting pursuant to Item 402 of Regulation S-K.”

This vote will not be binding on the Company’s Board and may not be construed as overruling a decision by the Board or create or imply any additional fiduciary duty of the Board. Nor will it affect any compensation paid or awarded to any executive officer. The Compensation and Benefits Committee and the Board may, however, take the outcome of the vote into account when considering future executive compensation arrangements. The Company’s Board has adopted a policy to include an advisory resolution to approve the compensation of our Named Executive Officers (a “say-on-pay” vote) annually. Accordingly, unless the Board modifies its policy on the frequency of future “say-on-pay” votes, the next advisory vote to approve our executive compensation will occur at the 2024 Annual Meeting of Stockholders.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT. |

PROPOSAL 4. APPROVAL OF AN AMENDMENT AND RESTATEMENT OF THE 2018 LONG-TERM INCENTIVE PLAN

Summary

The Board is requesting stockholder approval of an amendment and restatement of our 2018 Long-Term Incentive Plan (the “2018 Plan”) to increase the number of shares reserved for issuance thereunder by 3,900,000 shares. If stockholders approve this Proposal 4, the number of shares of our common stock that may be delivered pursuant to awards granted under the 2018 Plan will be 5,193,109 shares.

On April 16, 2023, the Board approved the amendment and restatement of the 2018 Plan, including the proposed increase to the shares issuable thereunder, subject to stockholder approval.

We also maintain the Amended and Restated Broadway Financial Corporation 2008 Long-Term Incentive Plan (the “2008 Plan” and, together with the 2018 Plan, the “Plans”), but ceased granting awards under such plan as of July 25, 2018. As of March 31, 2023, (i) a total of 250,000 shares of our common stock were then subject to outstanding options granted under the 2008 Plan and no options have been granted under the 2018 Plan, (ii) 423,594 shares of our common stock were then subject to unvested full value awards granted under the 2018 Plan and no shares of our common stock were subject to unvested full value awards under the 2008 Plan and (iii) 321,469 shares were available for new award grants under the 2018 Plan (without taking into account the 3,900,000 shares that would be added to the 2018 Plan if stockholders approve this Proposal 4). As of March 31, 2023, the average weighted per share exercise price of all outstanding stock options granted under the Plans was $1.62 (no stock options were issued under the 2018 Plan) and the weighted average remaining contractual term was 3.13 years. If stockholders do not approve this proposal, we will continue to have the authority to grant awards under the 2018 Plan, but the proposed 3,900,000 share increase in the 2018 Plan share limit will not be effective and could result in a serious disruption of our compensation programs and could limit our ability to provide retention incentives to our executives and other employees.

The Company uses equity-based compensation, such as options and other Company stock related awards, as key elements of its compensation packages. If stockholders do not approve the proposal, we would need to grant cash and other non-equity rewards to these individuals. The Board has approved the 2018 Plan, as amended and restated, and is recommending it to stockholders for approval because the Company believes it is important for the employees and directors of the Company and its subsidiaries to have an equity interest in the Company, and to be eligible to receive cash incentive awards. Approval of this Proposal 4 will help achieve this goal and is necessary in order for the Company to continue making equity awards to employees and directors at competitive levels.

(If Proposal 5 is approved and the Board implements the reverse stock split, the amount of shares reserved for issuance under the 2018 Plan will be proportionately adjusted in the same manner and at the same time as all other shares.)

Award Burn Rate

The following table presents information regarding our net burn rate for the past three complete fiscal years:

| | | 2022 | | | 2021 | | | 2020 | |

Options granted | | | 0 | | | | 0 | | | | 0 | |

Options expired | | | (200,000 | ) | | | 0 | | | | 0 | |

Full value awards granted (excluding non-employee directors) | | | 495,262 | | | | 64,516 | | | | 140,218 | |

Less: shares subject to canceled, terminated or forfeited awards | | | (71,668 | ) | | | 0 | | | | 0 | |

Net shares granted | | | 423,594 | | | | 64,516 | | | | 140,218 | |

Weighted average basic common shares outstanding | | | 72,409,020 | | | | 60,151,556 | | | | 27,163,427 | |

Net burn rate(1)(2) | | | 0.31 | % | | | 0.13 | % | | | 0.52 | % |

| (1) | Net burn rate is equal to (x) divided by (y), where (x) is equal to the sum of total options granted during the fiscal year, plus the total full value awards granted during the fiscal year, minus the total number of shares subject to stock options and full value awards canceled, terminated or forfeited during the fiscal year without the awards having become vested or paid, as the case may be, and where (y) is equal to our weighted average basic common shares outstanding for each respective year. |

| (2) | For the three-year period ended December 31, 2022, our average annual net burn rate using the methodology described in note (1) above was 0.32%. |

We currently expect that the additional shares requested for the 2018 Plan under this proposal would provide us with flexibility to continue to grant equity-based awards for approximately 7 years, assuming a level of grants consistent with the number of equity-based awards granted during 2022 and usual levels of shares becoming available for new awards as a result of forfeitures of outstanding awards throughout the projected period and projected future usage. However, this is only an estimate, in our management’s judgment, based on current circumstances. The total number of shares that are awarded under the 2018 Plan in any one year or from year to year may change based on any number of variables, including, without limitation, the results achieved by the Company for the prior fiscal year relative to plan for various performance metrics, such as net interest income, net interest rate margin, earnings per share, efficiency ratio. returns on assets and equity, the value of our common stock (since higher stock prices generally require that fewer shares be issued to produce awards of the same grant date fair value), changes in competitors’ compensation practices or changes in compensation practices in the market generally, changes in the number of our employees, changes in the number of our directors and officers, acquisition activity and the potential need to grant awards to new employees in connection with acquisitions, the need to attract, retain and incentivize key talent, the types of awards we grant, and how we choose to balance total compensation between cash and equity-based awards. The type and terms of awards granted may also change in any one year or from year to year based on any number of variables, including, without limitation, changes in competitors’ compensation practices or changes in compensation practices generally, and the need to attract, retain and incentivize key talent. Notwithstanding the above, management estimates that the likely stock awards under this proposal will have negligible impact on the Company’s earnings per share over the next five years.

Dilution

The following table shows the total number of shares of our common stock that were (i) subject to unvested full value awards granted under the 2018 Plan, (ii) subject to outstanding stock options granted under the Plans and (iii) available for new award grants under the 2018 Plan, in each case, as of each of December 31, 2022 and March 31, 2023. In this Proposal 4, the number of shares of our common stock subject to awards granted during any particular period or outstanding on any particular date is presented based on the actual number of shares of our common stock covered by those awards.

| | | December 31, 2022 | | | March 31, 2023 | |

| Shares subject to unvested full value awards | | | 423,594 | | | | 320,574 | |

| Shares subject to outstanding stock options | | | 250,000 | | | | 250,000 | |

| Shares available for new award grants under the 2018 Plan | | | 395,309 | | | | 321,469 | (1) |

(1) | This does not take into account the 3,900,000 shares that would be added to the 2018 Plan if stockholders approve this proposal. |

To help assess the potential dilutive impact of this proposal, the number of shares of our common stock outstanding at the end of each of the last three fiscal years is as follows: 28,038,154 shares outstanding at the end of fiscal year 2020, 71,768,419 shares outstanding at the end of fiscal year 2021 and 73,432,517 shares outstanding at the end of fiscal year 2022. The number of shares of our common stock outstanding as of March 31, 2023 was 73,506,357.

The closing market price of our common stock on The Nasdaq Capital Market on March 31, 2023 was $1.05.

Our Board believes that approval of the amendment and restatement of the 2018 Plan, including the proposed increase to the shares reserved for issuance thereunder, will promote our interests and those of our stockholders and will help us continue to be able to attract, motivate, retain and reward persons important to our success.

Summary of the 2018 Amended Plan

In July 2018, the Company first adopted the 2018 Plan, with 1,293,109 shares available for future grant. On April 16, 2023, the Board adopted the Amended and Restated 2018 Long-Term Incentive Plan (the “2018 Amended Plan”) to increase the number of shares available for future grant by 3,900,000 shares, which is subject to the approval of stockholders under this Proposal 4. Below is a high-level summary of the material terms of the 2018 Plan (as set forth in the 2018 Amended Plan). This summary is qualified in its entirety by reference to the complete text of the 2018 Amended Plan, a copy of which is attached hereto as Appendix B.

Purpose. The purpose of the 2018 Amended Plan is to (i) attract and retain well qualified employees; (ii) motivate the Company’s key employees and non-employee directors, by means of appropriate incentives, to achieve the Company’s long-range goals; (iii) provide incentive compensation opportunities that are competitive with those of other similar companies; and (iv) further align participants’ interests with those of the Company’s other stockholders through compensation that is based on the Company’s common stock; and thereby promote the long-term interest of the Company and its subsidiaries, including the growth in value of the Company’s equity and enhancement of long-term stockholder return.

Eligibility. Awards may be granted to all employees and non-employee directors of the Company or its subsidiaries, as well as consultants and other persons providing services to the Company or its subsidiaries, except that non-employees may not be granted incentive stock options. As of March 31, 2023, all of our ninety-three (93) employees and each of our eight non-employee directors were eligible to participate in the 2018 Amended Plan. As of March 31, 2023, we had no other individuals providing services to us as consultants who were eligible to participate in the 2018 Amended Plan.

Types of Awards. The 2018 Amended Plan provides for the grant of incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), non-statutory stock options, stock appreciation rights (“SARs”), full value awards and cash incentive awards. Dividend equivalents may also be provided in connection with awards under the 2018 Amended Plan.

Authorized Shares. Subject to adjustment for certain dilutive or related events, the aggregate maximum number of shares of our common stock that may be issued pursuant to stock awards under the 2018 Amended Plan, as aggregated from time to time (the “Share Reserve”), is 5,193,109 shares. The Share Reserve will not be reduced if an award or any portion thereof is canceled or forfeited.

The maximum number of shares of common stock that may be issued upon the exercise of incentive stock options is 5,193,109.

The aggregate amount of all compensation granted to any member of the Board during any fiscal year of the Company, including any stock awards (based on grant date fair market value computed as of the date of grant in accordance with applicable financial accounting rules) and any cash retainer or meeting fee paid or provided for service on the Board or any committee thereof, or any stock award granted in lieu of any such cash retainer or meeting fee, shall not exceed $100,000.

Shares issued under the 2018 Amended Plan may consist of authorized but unissued shares and, to the extent permitted by applicable law, previously issued shares that have been reacquired by the Company and are held as treasury shares, including shares purchased in the open market or in private transactions.

Plan Administration. The 2018 Amended Plan will be administered by a committee (the “Committee”) of two or more members of the Board who are selected by the Board. The Committee has the authority to operate and administer the 2018 Amended Plan, including the powers to: (i) select the persons to whom Awards under the 2018 Amended Plan will be granted within the eligibility criteria of the 2018 Amended Plan, the types of awards to be granted and the applicable terms, conditions, performance criteria, restrictions and other provisions of the awards; (ii) amend, cancel or suspend awards; (iii) interpret the 2018 Amended Plan and establish, amend and rescind rules and regulations for administration of the 2018 Amended Plan and awards, including the ability to correct any error in the 2018 Amended Plan or any award document; and (iv) take actions it determines necessary or appropriate with respect to the 2018 Amended Plan and any award document to avoid acceleration of income recognition or imposition of penalties under Code Section 409A. The Committee may delegate all or any portion of its responsibilities or powers under the 2018 Amended Plan to persons selected by it. To the extent not prohibited by applicable law or the applicable rules of any stock exchange, the Board will be authorized to take any action under the 2018 Amended Plan that would otherwise be the responsibility of the Committee. All determinations, interpretations and constructions made by the Committee (or authorized person or persons delegated powers and responsibilities by the Committee) will be final and binding on all persons.

Options. The Committee may grant an incentive stock option or non-qualified stock option. Except as described below, the exercise price for an option must not be less than the fair market value of the stock at the time the option is granted or, with respect to incentive stock options, less than 110% of the fair market value if the recipient owns stock representing more than 10% of the total combined voting power of all classes of stock of the Company or any subsidiary. The exercise price of an option may not be decreased after the date of grant nor may an option be surrendered to the Company as consideration for the grant of a replacement option with a lower exercise price, except as approved by the Company’s stockholders or as a result of adjustments for corporate transactions as described below. In addition, the Committee may grant options with an exercise price less than the fair market value of the stock at the time of grant in replacement for awards under other plans assumed in connection with business combinations if the Committee determines that doing so is appropriate to preserve the benefit of the awards being replaced.

Options will be exercisable in accordance with the terms established by the Committee. The full purchase price of each share of Stock purchased upon the exercise of any option must be paid at the time of exercise of an option. Except as otherwise determined by the Committee, the purchase price of an option will be payable in cash, by promissory note, or in shares (valued at fair market value as of the day of exercise), or a combination thereof. The Committee, in its discretion, may impose such conditions, restrictions, and contingencies on shares acquired pursuant to the exercise of an option as the Committee determines to be desirable. In no event will an option be granted with an effective period of more than ten years after the grant date (or five years, in the case of an incentive stock option issued to a recipient who, at the time the option is granted, owns stock representing more than 10% of the total combined voting power of all classes of stock of the Company or any subsidiary).

Stock Appreciation Rights. An SAR entitles the recipient to receive the amount (in cash or stock) by which the fair market value of a specified number of shares of stock on the exercise date exceeds an exercise price established by the Committee. Except as described below, the 2018 Amended Plan provides that the exercise price for an SAR must not be less than the fair market value of the share of stock at the time the SAR is granted or, if less, the exercise price of the tandem option. In addition, the Committee may grant SARs with an exercise price less than the fair market value of the stock at the time of grant in replacement for awards under other plans assumed in connection with business combinations if the Committee determines that doing so is appropriate to preserve the benefit of the awards being replaced. The Committee may grant an SAR independent of any option grant and may also grant an option and an SAR in tandem with each other. SARs and options granted in tandem may be granted on different dates but may have the same exercise price. SARs will not be exercisable after the expiration of ten years from the date of grant and will be exercisable in accordance with the terms established by the Committee. The Committee, in its discretion, may impose such conditions, restrictions, and contingencies on shares of stock acquired pursuant to the exercise of an SAR as the Committee determines to be desirable.

Full Value Awards. The following types of “full value awards” may be granted pursuant to the 2018 Amended Plan, as determined by the Committee:

| • | The Committee may grant shares of stock that may be in return for previously performed services, or in return for the participant surrendering other compensation that may be owed to the recipient. |

| • | The Committee may grant shares of stock that are contingent on the achievement of performance or other objectives during a specified period. |

| • | The Committee may grant shares of stock subject to a risk of forfeiture or other restrictions that lapse upon the achievement of one or more goals relating to completion of service by the recipient, or the achievement of performance or other objectives. |

Any such awards will be subject to such other conditions, restrictions and contingencies as the Committee determines. If the right to become vested in a full value award is conditioned on the completion of a specified period of service with the Company or the subsidiary, without achievement of performance measures (as described below) or other performance objectives being required as a condition of vesting, and without it being granted in lieu of other compensation, then the required period of service for full vesting will not be less than one year (subject to accelerated vesting, to the extent provided by the Committee, in the event of the participant’s death, disability, retirement, change of control or involuntary termination).

Cash Incentive Awards. The Committee may grant cash incentive awards (including the right to receive payment of shares of stock having the value equivalent to the cash otherwise payable) that may be contingent on achievement of a recipient’s performance objectives over a specified period established by the Committee. The grant of cash incentive awards may also be made subject to such other conditions, restrictions and contingencies, as may be determined by the Committee.

No Repricing. Other than in connection with an adjustment involving a corporate transaction, the exercise price of stock options or SARs may not be decreased after the date of grant without stockholder approval.

Performance Measures. The 2018 Amended Plan provides that grants of full value and cash incentive awards may be made based upon, and subject to achieving, performance measures selected by the Committee, which may include one or more of the following Company, subsidiary, operating unit or division performance measures: (i) net earnings; (ii) net interest income; (iii) operating or interest rate margins; (iv) earnings per share; (v) efficiency ratio or other cost control measures or objectives; (vi) return on equity; (vii) return on assets; (viii) stock price; (ix) comparisons with stock market indices; (x) regulatory achievements; (xi) economic value added metrics; (xii) strategic business objectives, consisting of one or more objectives based on meeting specified volume or market share targets, business expansion goals, or goals relating to acquisitions or divestitures; or (xiii) any combination thereof. Each goal may be expressed on an absolute and/or relative basis, may be based on or otherwise employ comparisons based on internal targets, the past performance of the Company and/or the past or current performance of other companies, and in the case of earnings-based measures, may use or employ comparisons relating to capital, stockholders’ equity and/or shares outstanding or investments, or to assets or net assets.

Transferability. Unless otherwise provided by the Committee, awards under the 2018 Amended Plan will not be transferable except as designated by the recipient by will or by the laws of descent and distribution.

Certain Adjustments. In the event of a corporate transaction involving the Company (including, without limitation, any stock dividend, stock split, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination or exchange of shares), the Committee may adjust awards to preserve the benefits or potential benefits of the awards. Action by the Committee for this purpose may include: (i) adjustment of the number and kind of shares which may be delivered under the 2018 Amended Plan; (ii) adjustment of the number and kind of shares subject to outstanding awards; (iii) adjustment of the exercise price of outstanding options and SARs; and (iv) any other adjustments that the Committee determines to be equitable (which may include, without limitation, (a) replacement of awards with other awards which the Committee determines have comparable value and which are based on stock of a company resulting from the transaction, and (b) cancellation of the award in return for cash payment of the current value of the award, determined as though the Award is fully vested at the time of payment, provided that in the case of an option or SAR, the amount of such payment may be the excess of the value of the stock subject to the option or SAR at the time of the transaction over the exercise price). If Proposal 5 is approved and the Board implements the reverse stock split, the amount of shares reserved for issuance under the 2018 Amended Plan will be proportionately adjusted in the same manner and at the same time as all other shares.

Change in Control. The 2018 Amended Plan provides that, unless determined otherwise by the Committee, upon a participant’s termination of employment within 12 months of a change in control, the vesting of full value awards under the 2018 Amended Plan will be accelerated and options and stock appreciation rights will remain exercisable for up to one year or the award’s earlier expiration date, if applicable. Notwithstanding the foregoing, in the event of a plan of liquidation, reorganization, merger, consolidation, sale of all or substantially all of the Company’s assets or a similar transaction in which the Company is not the surviving entity, all awards will become vested and exercisable, as applicable, if a successor corporation does not agree to assume or substitute such awards. A “Change in Control” is defined in the 2018 Amended Plan generally to occur when a person or group of persons acting in concert acquires beneficial ownership of, or makes a tender offer for, 20% or more of a class of the Company’s equity securities or in the event of a merger or other form of business combination, sale of all or substantially all of the Company’s assets, a plan of liquidation for the Company is adopted or a solicitation of our stockholders seeking approval of any of the foregoing is made by anyone other than our Board or a majority of the Board ceases to consist of persons who were directors as of the adoption date of the 2018 Amended Plan or persons who were nominated by such directors, or in certain other circumstances constituting a change in control as defined for specified regulatory purposes.

Amendment and Termination. The 2018 Amended Plan may be amended or terminated at any time by the Board, and the Board or the Committee may amend any award document granted under the 2018 Amended Plan, provided that no amendment or termination may adversely affect the rights of any participant under the award granted prior to the date such amendment is adopted without the participant’s written consent. The Board may not amend the provision of the 2018 Amended Plan related to repricing without approval of the Company’s stockholders. The 2018 Amended Plan will remain in effect as long as any awards under it are outstanding, but no new awards may be granted after April 16, 2030.

U.S. Federal Income Tax Consequences of Awards Under the 2018 Amended Plan

The following discussion is intended only as a brief summary of the material U.S. federal income tax rules that are generally relevant to the 2018 Amended Plan awards as of the date of this Proxy Statement. The laws governing the tax aspects of awards are highly technical and such laws might change. The following discussion does not address state, local or non-U.S. income tax rules applicable to awards under the 2018 Amended Plan.

Upon the exercise of a SAR or stock option, other than an incentive stock option, an award recipient will recognize ordinary income equal to the excess of the fair market value of the stock subject to such SAR or option on the date of exercise over the exercise price for such SAR or stock option. The Company generally will be entitled to a corresponding federal income tax deduction equal to the amount of ordinary income recognized by the recipient. Upon the sale or exchange of the stock acquired upon exercise, the recipient will generally recognize a long- or short-term capital gain or loss, depending on whether the recipient held the stock for more than one year from the date of exercise. With respect to incentive stock options, a recipient generally will not recognize taxable income when the incentive stock option is exercised, unless the recipient is subject to the alternative minimum tax. If the recipient sells the stock more than two years after the incentive stock option was granted and more than one year after the incentive stock option was exercised, the recipient will recognize a long-term capital gain or loss, measured by the difference between the sale price and the exercise price of the shares. The Company will not receive a tax deduction with respect to the exercise of an incentive stock option if the incentive stock option holding period is satisfied. Award recipients do not recognize any taxable income, and the Company is not entitled to a deduction, upon the grant of a stock appreciation right, a nonqualified stock option or an incentive stock option.

The recipient of a full value award or cash award generally will not recognize taxable income at the time of grant as long as the award is subject to a substantial risk of forfeiture as a result of performance-based and/or service-based vesting requirements. The recipient generally will recognize ordinary income when the substantial risk of forfeiture expires or is removed unless, in the case of an award other than restricted stock, the payment of cash or issuance of stock in settlement of the award is deferred until sometime after the vesting date, in which case, the recipient generally will recognize ordinary income upon receipt of such cash or stock. The Company generally will be entitled to a corresponding deduction equal to the amount of income the recipient recognizes. If the recipient holds shares of stock received upon settlement of an award for more than one year, the capital gain or loss when the recipient sells the shares will be long-term.

If an award is accelerated under the 2018 Amended Plan in connection with a “change in control” (as this term is used under the Code), we may not be permitted to deduct the portion of the compensation attributable to the acceleration (“parachute payments”) if it exceeds certain threshold limits under the Code (and certain related excise taxes may be triggered).

U.S. federal income tax law generally prohibits a publicly held company from deducting compensation paid to certain current or former officers that qualify as “covered employees” within the meaning of Section 162(m) of the Code that exceeds $1 million during the tax year.

Aggregate Past Grants Under the 2018 Amended Plan

The benefits that will be awarded or paid in the future under the 2018 Amended Plan are not currently determinable. Such awards are within the discretion of the Committee, and the Committee has not determined future awards or who might receive them. Notwithstanding the foregoing, non-employee directors are entitled to receive annual grants under the 2018 Amended Plan and on February 21, 2023, each non-employee director received an award of 9,230 shares of unrestricted Class A common stock with a grant date fair value of $12,000 on such date and it is expected they will receive another such award in 2024. The following table shows information regarding the distribution of awards covering shares granted under the 2018 Amended Plan as of March 31, 2023 among the persons and groups identified below. The closing market price of our common stock on The Nasdaq Capital Market on March 31, 2023 was $1.05.

| | | Number of Shares Underlying Options | | | Number of Shares Underlying Stock Awards | |

| Name and Position |

| Exercisable | | | Unexercisable |

|

| | |

| Named Executive Officers | |

| | |

| | |

| |

Brian E. Argrett Chief Executive Officer | | | 0 | | | | 0 | | | | 201,770 | |

Brenda J. Battey Chief Financial Officer | | | 0 | | | | 0 | | | | 94,894 | |

Ruth McCloud Chief Operating Officer | | | 0 | | | | 0 | | | | 80,828 | |

| Total for current executive officers as a group | | | 0 | | | | 0 | | | | 472,768 | |

| Total for current non-employee directors as a group | | | 0 | | | | 0 | | | | 372,782 | |

| Total for each associate of any such directors or executive officers | | | 0 | | | | 0 | | | | 0 | |

Each other person who has received 5% or more of the options, warrants or rights under the 2018 Amended Plan | | | 0 | | | | 0 | | | | 0 | |

All employees, including any current officers who are not executive officers, as a group | | | 0 | | | | 0 | | | | 145,644 | |

| Total | | | 0 | | | | 0 | | | | 991,194 | |

Registration With the SEC. The Company intends to file with the SEC a registration statement on Form S-8 covering the new shares reserved for issuance under the 2018 Amended Plan in the second half of 2023.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL TO APPROVE THE COMPANY’S AMENDED AND RESTATED 2018 LONG-TERM INCENTIVE PLAN. |

PROPOSAL 5. PROPOSAL TO EFFECT A REVERSE STOCK SPLIT

WITH NO CHANGE TO AUTHORIZED SHARES

Overview

On April 16, 2023, the Board unanimously approved, subject to stockholder approval, a proposed amendment to our amended and restated certificate of incorporation (“Certificate of Incorporation”) to effect a reverse stock split of the outstanding shares of Class A common stock, Class B common stock, and Class C common stock by combining outstanding shares of common stock into a lesser number of outstanding shares of common stock at a ratio ranging from 1 share-for-2 shares up to a ratio of 1 share-for-10 shares (the “Ratio Range”), which ratio will be selected by the Board and set forth in a public announcement, with no change to the number of shares of common stock authorized under our Certificate of Incorporation (the “Reverse Stock Split”). The foregoing description of the proposed amendment is a summary and is subject to the full text of the proposed amendment, which is attached to this proxy statement as Appendix A (the “Certificate of Amendment”).

If stockholders approve this Proposal 5, the Board, in its sole discretion, will have the authority to decide, at any time prior to December 31, 2023, whether to implement the Reverse Stock Split. If the Board determines that the Reverse Stock Split would be in the best interests of Broadway Financial Corporation and its stockholders, the Board will cause the Certificate of Amendment to be filed with the Delaware Secretary of State and effect the Reverse Stock Split. The Reverse Stock Split could become effective as soon as the business day immediately following the Annual Meeting. The Board, in its sole discretion, may also elect not to implement the Reverse Stock Split.

We believe the Reverse Stock Split may be necessary for the company to maintain the listing of its Class A common stock on The Nasdaq Capital Market (“Nasdaq”) if recent market conditions persist. As described in more detail in the subsection titled “—Reasons for the Reverse Stock Split” below, the Board believes that having the time-limited authority to effect the Reverse Stock Split is a critical proactive step to maintain the Company’s Nasdaq listing and continue efforts to build stockholder value. Following approval of this Proposal 5 at the Annual Meeting, no further action on the part of stockholders will be required to either implement or abandon the Reverse Stock Split.

The proposed amendment, if effected, will effect a Reverse Stock Split of the outstanding shares of Class A common stock, Class B common stock, and Class C common stock (which three classes together are referred to in this Proposal 5 as the Company’s “Common Stock”) at a reverse stock split ratio range of 1-for-2 through 1-for-10, as determined by our Board at a later date. As of March 31, 2023, 48,721,223 shares of our Class A common stock, 11,404,618 shares of our Class B common stock, and 13,380,516 shares of our Class C common stock were issued and outstanding. Based on such number of shares of our Common Stock issued and outstanding, immediately following the effectiveness of the Reverse Stock Split (and without giving any effect to the payment of cash in lieu of fractional shares), we will have, depending on the reverse stock split ratio selected by our Board, issued and outstanding shares of stock as illustrated in the table under the caption “—Effects of the Reverse Stock Split—Effect on Shares of Class A Common Stock, Class B Common Stock, and Class C Common Stock.”

All holders of Class A common stock, Class B common stock, and Class C common stock will be affected proportionately by the Reverse Stock Split. No fractional shares of Class A common stock, Class B common stock, and Class C common stock will be issued as a result of the Reverse Stock Split. Instead, any stockholder who would have been entitled to receive a fractional share as a result of the Reverse Stock Split will receive cash payments in lieu of such fractional share. Each stockholder will hold the same percentage of the outstanding Common Stock immediately following the Reverse Stock Split as that stockholder did immediately prior to the Reverse Stock Split, except to the extent that the Reverse Stock Split results in stockholders receiving cash in lieu of fractional shares. The par value of our common stock will continue to be $0.01 per share (see “—Effects of the Reverse Stock Split”).

Reasons for the Reverse Stock Split

Our Board has determined that it is desirable and in the best interests of Broadway Financial Corporation and its stockholders to combine our shares of Class A common stock, Class B common stock, and Class C common stock at a reverse stock split ratio in the range of 1-for-2 through 1-for-10, as determined by the Board at a later date. Our Board authorized the Reverse Stock Split as an important proactive measure to maintain our ability to continue to meet Nasdaq criteria for continued listing. Our Class A common stock is publicly traded and listed on Nasdaq under the symbol “BYFC.” Accordingly, for these and other reasons discussed below, we believe that effecting the Reverse Stock Split is in Broadway Financial Corporation’s and our stockholders’ best interests.

We believe that the Reverse Stock Split will help us achieve a number of important goals:

| 1. | Maintain Nasdaq Listing |

The continued listing requirements for Nasdaq include a requirement that shares trade above $1.00. If an issuer’s shares have a minimum closing bid price of less than $1.00 for 30 trading days or more, the issuer may be subject to delisting. Our Class A common stock closed at or below $1.00 per share for 22 consecutive days from July to August 2022 and for 25 consecutive trading days from November to December 2022. On April 18, 2023, our Class A common stock closed at $1.01 per share. In the event our Class A common stock fails to maintain the minimum closing bid price of $1.00 for a period of 30 consecutive trading days, we will receive a written notification from The Nasdaq Stock Market LLC that we have failed to comply with the minimum bid price requirement. We believe that if we fail to comply with the minimum bid price requirement and the Reverse Stock Split is not approved by stockholders, it is likely that our Class A common stock will be delisted from The Nasdaq Capital Market.

Effecting the Reverse Stock Split and reducing the number of outstanding shares of our Class A common stock should, absent other factors, result in an increase in the per share market price of our Class A common stock, although we cannot provide any assurance that our minimum bid price would, following the Reverse Stock Split, continue to trade over the applicable minimum bid price requirements. While we are currently in compliance with the continued listing requirements for Nasdaq, we believe that obtaining approval for the Reverse Stock Split is an important proactive measure to maintain our ability to continue to meet such continued listing requirements. In addition, obtaining approval of the Reverse Stock Split at the Annual Meeting allows us to seek stockholder approval of this Proposal 5 in a more efficient and cost-effective manner than calling a Special Meeting of Stockholders at a later date for the sole purpose of seeking stockholder approval of a reverse stock split.

| 2. | Make Class A Common Stock More Attractive to Investors |

In addition, we believe that the Reverse Stock Split may make our Class A common stock more attractive to a broader range of institutional and other investors. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. We believe that the Reverse Stock Split may make our Class A common stock a more attractive and cost-effective investment for many investors, which may enhance the liquidity and value of the Class A common stock.

| 3. | Provide Flexibility for Future Transactions |

The Reverse Stock Split will also effectively increase the number of authorized and unissued shares of our Class A common stock, Class B common stock, and Class C common stock available for future issuance by the amount of the reduction in outstanding shares effected by the Reverse Stock Split. As illustrated in the table under the caption “—Effects of the Reverse Stock Split—Effect on Shares of Class A Common Stock, Class B Common Stock, and Class C Common Stock,” only approximately 16% of our authorized shares of Class A common stock remain available for future issuance. By increasing the number of authorized and unissued shares of our Common Stock, our Board and management will have increased flexibility to issue shares of Class A common stock for capital raising, strategic, compensatory, or other purposes.

Although reducing the number of outstanding shares of our Class A common stock, Class B common stock, and Class C common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share trading price of our Class A common stock, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the per share trading price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the per share trading price of our Class A common stock will increase (proportionately to the reduction in the number of shares of our common stock after the Reverse Stock Split or otherwise) following the Reverse Stock Split or that the per share trading price of our Class A common stock will not decrease in the future.

Exchange Ratio. The purpose of seeking stockholder approval of exchange ratios within the Ratio Range (rather than a fixed exchange ratio) is to provide the Company with the flexibility to achieve the desired results of the Reverse Stock Split. If the stockholders approve this Proposal 5, then the Board, in its sole discretion, would effect the Reverse Stock Split only upon the determination by the Board that a reverse split would be in the best interests of the Company and our stockholders at that time. If the Board were to effect the Reverse Stock Split, then the Board or such committee would set the timing for such a split and select the specific ratio within the Ratio Range (the “Final Ratio”). Following approval of this Proposal 5 at the Annual Meeting, no further action on the part of stockholders would be required to either implement or abandon the Reverse Stock Split. If the stockholders approve this Proposal 5, and the Board determines to effect the Reverse Stock Split, we would communicate to the public additional details regarding the Reverse Stock Split, including the Final Ratio selected by the Board. If the Board does not implement the Reverse Stock Split prior to December 31, 2023, then the authority granted in this Proposal 5 to implement the Reverse Stock Split will automatically terminate. The Board reserves its right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to the filing of the Certificate of Amendment with the Delaware Secretary of State of the State, it determines, in its sole discretion, that this Proposal 5 is no longer in the best interests of the Company and our stockholders.

No Authorized Share Reduction. Under Delaware law, the implementation of the Reverse Stock Split does not require a reduction in the total number of authorized shares of our Class A common stock, Class B common stock, and Class C common stock. If stockholders adopt and approve the amendment to the Certificate of Incorporation to effect the Reverse Stock Split, the authorized number of shares of our Class A common stock, Class B common stock, and Class C common stock will not be reduced by a corresponding ratio. However, the Company could consider reducing the number of authorized shares following the Reverse Stock Split if the effective increase is deemed excessive by the Board.

Criteria to Be Used for Determining Whether to Implement Reverse Stock Split

In determining whether to implement the Reverse Stock Split, if any, following receipt of stockholder approval of this Proposal 5, the Board may consider, among other things, various factors, such as:

| • | the historical trading price and trading volume of our Class A common stock; |

| • | our capitalization (including the number of shares of common stock issued and outstanding); |

| • | Nasdaq continued listing requirements, and other rules and guidance from Nasdaq; |

| • | the potential devaluation of our market capitalization as a result of the Reverse Stock Split; |

| • | the then-prevailing trading price and trading volume of our Class A common stock and the expected impact of the Reverse Stock Split on the trading market for our Class A common stock in the short- and long-term; and |

| • | prevailing general market and economic conditions. |

Certain Risks and Potential Disadvantages Associated with the Reverse Stock Split

We cannot assure you that the proposed Reverse Stock Split will result in an increase of our stock price over the long term. As noted above, a principal purpose of the Reverse Stock Split is to increase the trading price of our Class A common stock to enhance our ability to continue to satisfy Nasdaq’s continued listing requirements. However, the effect of the Reverse Stock Split on the per share trading price of our Class A common stock cannot be predicted with any certainty, and the history of reverse stock splits for other companies is varied, particularly since some investors may view a reverse stock split negatively. It is possible that the per share trading price of our Class A common stock after the Reverse Stock Split will not increase in the same proportion as the reduction in the number of our outstanding shares of Class A common stock following the Reverse Stock Split. In addition, although we believe the Reverse Stock Split may enhance the marketability of our Class A common stock to certain potential investors, we cannot assure you that, if implemented, our Class A common stock will be more attractive to investors. Even if we implement the Reverse Stock Split, the per share trading price of our Class A common stock may decrease due to factors unrelated to the Reverse Stock Split, including the Company’s business and financial performance, general market conditions, and prospects for future success. If the Reverse Stock Split is consummated and the per share trading price of the Class A common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split.

We cannot assure you that our Class A common stock will maintain its value as a result of the proposed Reverse Stock Split. There can be no assurance that the total market capitalization of the Class A common stock (i.e., the aggregate value of all shares of Class A common stock at the then market price) immediately after implementation of this Proposal 5 will be equal to or greater than the total market capitalization immediately before this Proposal 55 or that the per share market price of the Class A common stock following implementation of this Proposal 5 will remain higher than the per share market price immediately before the implementation of this Proposal 5 or equal or exceed the direct arithmetical result of the implementation of this Proposal 5.

The proposed Reverse Stock Split may decrease the liquidity of our Class A common stock and result in higher transaction costs. The liquidity of our Class A common stock may be negatively impacted by the Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly if the per share trading price does not increase as a result of the Reverse Stock Split. In addition, if the Reverse Stock Split is implemented, it will increase the number of our stockholders who own “odd lots” of fewer than 100 shares of common stock. Brokerage commission and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of common stock. Accordingly, the Reverse Stock Split may not achieve the desired results of increasing marketability of our Class A common stock as described above.

Our Board believes, however, that these potential effects are outweighed by the benefits of the Reverse Stock Split.

Effective Time and Ratio Range

The effective time of the Reverse Stock Split (the “Effective Time”), if approved by stockholders and implemented by the Board, will be the date and time set forth in the Certificate of Amendment that is filed with the Delaware Secretary of State. The Board, in its sole discretion, will have the authority to decide, prior to December 31, 2023, whether to implement the Reverse Stock Split. The Effective Time could occur as soon as the business day immediately following the Annual Meeting. The exact timing of the filing of the Certificate of Amendment will be determined by our Board based on its evaluation as to when such action will be the most advantageous to the Company and our stockholders.

If the Board does not implement the Reverse Stock Split prior to December 31, 2023, then the authority granted in this Proposal 5 to implement the Reverse Stock Split will automatically terminate. The Board reserves its right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to the filing of the Certificate of Amendment with the Delaware Secretary of State, it determines, in its sole discretion, that this Proposal 5 is no longer in the best interests of the Company and our stockholders.

The ratio of the Reverse Stock Split, if approved and implemented, will be selected in the range of 1-for-2 through 1-for-10, as determined by the Board in its sole discretion. Our purpose for requesting authorization to implement the Reverse Stock Split at a ratio to be determined by the Board, as opposed to a ratio that is fixed in advance, is to give the Board the flexibility to take into account then-current market conditions and changes in the price of our Class A common stock and to respond to any other developments that may be relevant when considering the appropriate ratio. If the stockholders approve the Reverse Stock Split, then the Board will be authorized to proceed with the Reverse Stock Split prior to December 31, 2023. In determining whether to proceed with the Reverse Stock Split and setting the Final Ratio, if any, the Board will consider a number of factors, including market conditions, existing and expected trading prices of the Company’s Class A common stock, actual or forecasted results of operations, Nasdaq listing requirements, the Company’s additional funding requirements and the amount of the Company’s authorized but unissued Class A common stock, Class B common stock, and Class C common stock.

Fractional Shares

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders of record who otherwise would be entitled to receive fractional shares because they hold a number of pre-split shares not evenly divisible by the number of pre-split shares for which each post-split share is to be reclassified, will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the stockholder would otherwise be entitled multiplied by the closing price of the common stock on Nasdaq on the date immediately preceding the Effective Time. The ownership of a fractional interest will not give the holder thereof any voting, dividend, or other rights except to receive payment therefor as described herein.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, where the Company is domiciled, and where the funds will be deposited, sums due for fractional interests that are not timely claimed after the Effective Time of the split may be required to be paid to the designated agent for each such jurisdiction, unless correspondence has been received by us or the transfer agent concerning ownership of such funds within the time permitted in such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds will have to seek to obtain them directly from the state to which they were paid.

Effects of the Reverse Stock Split

General

After the Effective Time of the Reverse Stock Split, if implemented by our Board, each stockholder other than the stockholders receiving cash payments in lieu of fractional shares will own a reduced number of shares of Class A common stock, Class B common stock, and Class C common stock, as applicable. The principal effect of the Reverse Stock Split will be to proportionately decrease the number of outstanding shares of our Class A common stock, Class B common stock, and Class C common stock based on the reverse stock split ratio selected by our Board. The Reverse Stock Split will not change the terms of the Class A common stock, Class B common stock, Class C common stock, or Preferred Stock. As of the Effective Time of the Reverse Stock Split, we would also adjust and proportionately decrease the number of shares of our Common Stock reserved for issuance upon exercise of, and adjust and proportionately increase the exercise price of, all options and warrants and other rights to acquire our Common Stock. As of the Effective Time of the Reverse Stock Split, the number of shares of Common Stock held by the Company as treasury shares will also be reduced proportionately based on the exchange ratio of the Reverse Stock Split.

Voting rights and other rights of the holders of our Class A common stock, Class B common stock, and Class C common stock will not be affected by the Reverse Stock Split, except to the extent that the Reverse Stock Split results in any stockholders owning a fractional share. For example, a holder of 2% of the voting power of the outstanding shares of our Class A common stock immediately prior to the effectiveness of the Reverse Stock Split will generally continue to hold 2% (assuming there is no impact as a result of the payment of cash in lieu of issuing fractional shares) of the voting power of the outstanding shares of Class A common stock after the Reverse Stock Split. Our Class B and Class C common stock is non-voting common stock and has no voting power except as provided by law.

The number of stockholders of record will not be affected by the Reverse Stock Split (except to the extent any are cashed out as a result of holding fractional shares).

Effect on Shares of Class A Common Stock, Class B Common Stock, and Class C Common Stock

The following table contains approximate information, based on share information as of March 31, 2023 relating to our Common Stock and outstanding options, based on illustrative ratios within the Ratio Range and information regarding our authorized shares assuming that this Proposal 5 is approved and the Reverse Stock Split is implemented:

| Status | | Pre-Reverse Stock Split | | | Post-Reverse

Stock Split 1:2 | | | Post-Reverse Stock Split 1:5 | | | Post-Reverse Stock Split 1:10 | |

| Number of Shares Authorized | | | | | | | | | | | | |

| Class A Common Stock | | | 75,000,000 | | | | 75,000,000 | | | | 75,000,000 | | | | 75,000,000 | |

| Class B Common Stock | | | 15,000,000 | | | | 15,000,000 | | | | 15,000,000 | | | | 15,000,000 | |

| Class C Common Stock | | | 25,000,000 | | | | 25,000,000 | | | | 25,000,000 | | | | 25,000,000 | |

| Number of Shares Authorized but Not Outstanding or Reserved | | | | | | | | | | | | | | | | |

| Class A Common Stock | | | 12,326,792 | | | | 43,663,397 | | | | 62,465,359 | | | | 68,732,680 | |

| Class B Common Stock | | | 3,595,382 | | | | 9,297,691 | | | | 12,719,077 | | | | 13,859,539 | |

| Class C Common Stock | | | 11,619,484 | | | | 18,309,742 | | | | 22,323,897 | | | | 23,661,949 | |

| Number of Shares Issued and Outstanding | | | | | | | | | | | | | | | | |

| Class A Common Stock | | | 48,721,223 | | | | 24,360,611 | | | | 9,744,244 | | | | 4,872,122 | |

| Class B Common Stock | | | 11,404,618 | | | | 5,702,309 | | | | 2,280,923 | | | | 1,140,461 | |

| Class C Common Stock | | | 13,380,516 | | | | 6,690,258 | | | | 2,676,103 | | | | 1,338,051 | |

| Number of Shares Reserved for Future Issuance | | | | | | | | | | | | | | | | |

| Class A Common Stock | | | 13,701,985 | | | | 6,850,992 | | | | 2,740,397 | | | | 1,370,198 | |

| Class B Common Stock | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Class C Common Stock | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Number of Shares Reserved for Issuance Pursuant to Outstanding Options | | | | | | | | | | | | | | | | |

| Class A Common Stock | | | 250,000 | | | | 125,000 | | | | 50,000 | | | | 25,000 | |

| Class B Common Stock | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Class C Common Stock | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Weighted-Average Exercise Price of Outstanding Options | | | | | | | | | | | | | | | | |

| Class A Common Stock | | $ | 1.62 | | | $ | 3.24 | | | $ | 8.10 | | | $ | 16.20 | |

| Class B Common Stock | | | - | | | | - | | | | - | | | | - | |

| Class C Common Stock | | | - | | | | - | | | | - | | | | - | |

This chart is for illustrative purposely only and other ratios within the Ratio Range besides those shown above could be selected by the Board.

After the Effective Time of the Reverse Stock Split, our Class A common stock would have a new committee on uniform securities identification procedures (“CUSIP number”), a number used to identify such shares.

Our Class A common stock is currently registered under Section 12(b) of the Securities Exchange Act of 1934, as amended, the (“Exchange Act”), and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split will not affect the registration of our Class A common stock under the Exchange Act or the listing of our Class A common stock on Nasdaq. Following the Reverse Stock Split, our Class A common stock will continue to be listed on Nasdaq under the symbol “BYFC.”

Because we will not reduce the number of authorized shares of Class A common stock, Class B common stock, and Class C common stock, the overall effect of the Reverse Stock Split will be an increase in authorized but unissued shares of Class A common stock, Class B common stock, and Class C common stock as a result of the Reverse Stock Split. These authorized shares of Class A common stock, Class B common stock, and Class C common stock may be issued at the discretion of the Board, subject to applicable limitations. Any future issuances of shares of Class A common stock, Class B common stock, or Class C common stock will have the effect of diluting the percentage of stock ownership and voting rights of the present holders of Class A common stock, Class B common stock, and Class C common stock.

Release No. 34-15230 of the staff of the SEC requires disclosure and discussion of the effects of any action, including this Proposal 5, that may be used as an anti-takeover mechanism. Because this Proposal 5 provides that the number of authorized shares of (i) Class A common stock remains at 75,000,000 shares, (ii) Class B common stock remains at 15,000,000 shares, and (iii) Class C common stock remains at 25,000,000 shares, the Certificate of Amendment that is filed with the Delaware Secretary of State of the State, if any such amendment is filed, will result in a relative increase in the number of authorized but unissued shares of our Class A common stock, Class B common stock, and Class C common stock in relation to the number of outstanding shares of our Class A common stock, Class B common stock, and Class C common stock, respectively, after the Reverse Stock Split and could, under certain circumstances, have an anti-takeover effect, although this is not the purpose or intent of the Board. The primary purpose of the proposed Reverse Stock Split is to provide the Board with a mechanism to raise the per share trading price of our Class A common stock by lowering the number of shares outstanding. However, a relative increase in the number of our authorized shares of Class A common stock, Class B common stock, and Class C common stock could enable the Board to render more difficult or discourage an attempt by a party attempting to obtain control of the Company by tender offer or other means. The issuance of Class A common stock in a public or private sale, merger or similar transaction would increase the number of outstanding shares of Class A common stock entitled to vote, increase the number of votes required to approve a change of control of the Company and dilute the interest of a party attempting to obtain control of the Company. Any such issuance could deprive stockholders of benefits that could result from an attempt to obtain control of the Company, such as the realization of a premium over market price that such an attempt could cause. Moreover, the issuance of Class A common stock to persons friendly to the Board could make it more difficult to remove incumbent officers and directors from office even if such change were favorable to stockholders generally. The Company has no present intent to use the relative increase in the number of authorized shares of Class A common stock, Class B common stock, and Class C common stock for anti-takeover purposes, and the proposed Certificate of Amendment is not part of a plan by the Board to adopt any anti-takeover provisions. However, if this Proposal 5 is approved by the stockholders, then a greater number of shares of our Class A common stock, Class B common stock, and Class C common stock would be available for such purpose than currently is available. The Company is not aware of any pending or threatened efforts to obtain control of the Company, and the Board has no present intent to authorize the issuance of additional shares of Class A common stock, Class B common stock, or Class C common stock to discourage such efforts if they were to arise.

Effect on Par Value

The proposed amendment to our Certificate of Incorporation will not affect the par value of our common stock, which will remain at $0.01.

Effect on Preferred Stock

Pursuant to our Certificate of Incorporation, our authorized stock includes 1,000,000 shares of Preferred Stock, par value $0.01 per share. The Company has 150,000 shares of Preferred Stock outstanding. The proposed amendment to our Certificate of Incorporation to effect the Reverse Stock Split will not impact the total authorized number of shares of preferred stock or the par value of the preferred stock.

Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following discussion is a summary of the material U.S. federal income tax consequences of the proposed Reverse Stock Split to holders of our Common Stock. This discussion is based on the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury Regulations promulgated thereunder, judicial decisions, and published rulings and administrative pronouncements of the U.S. Internal Revenue Service (the “IRS”), in each case in effect as of the date of this proxy statement. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely affect a holder of our Common Stock. We have not sought and will not seek any rulings from the IRS regarding the matters discussed below. There can be no assurance the IRS or a court will not take a contrary position to that discussed below regarding the tax consequences of the proposed Reverse Stock Split.

This discussion is limited to “U.S. Holders” (as defined below) who hold their Common Stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all U.S. federal income tax consequences relevant to the particular circumstances of a stockholder, including the impact of the Medicare contribution tax on net investment income. In addition, it does not address consequences relevant to holders of Common Stock that are subject to special rules, including, without limitation:

| • | Real estate investment trusts; |

| • | Regulated investment companies; |

| • | Tax-exempt organizations; |

| • | Governmental organizations; |

| • | Brokers and dealers in securities, commodities or currencies; |

| • | Traders in securities that elect to use a mark-to-market method of accounting for their securities; |

| • | Stockholders deemed to sell shares of Common Stock under the constructive sale provisions of the Code; |

| • | Stockholders who hold Common Stock as part of a position in a straddle or as part of a hedging, conversion or integrated transaction for U.S. federal income tax purposes or U.S. holders that have a functional currency other than the U.S. dollar; |

| • | Stockholders who actually or constructively own 10% or more of our voting stock; |

| • | Stockholders that acquired our Common Stock through the exercise of employee stock options or otherwise as compensation or through a tax-qualified retirement plan; |

| • | Stockholders that hold Common Stock in an individual retirement account, 401(k) plan or similar tax-favored account; or |

| • | Certain former citizens or long-term residents of the United States. |