UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

IDX SYSTEMS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

IDX SYSTEMS CORPORATION

40 IDX Drive

P.O. Box 1070

South Burlington, Vermont 05403

NOTICE OF 2003 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 19, 2003

To the Stockholders:

The 2003 Annual Meeting of Stockholders of IDX Systems Corporation will be held at the Clarion Hotel and Conference Center at 1117 Williston Road, South Burlington, Vermont 05403, on Monday, May 19, 2003 at 10:00 a.m., local time, to consider and act upon the following matters:

| | 1. | | To elect one Class I Director to serve for the ensuing two years and four Class II Directors to serve for the ensuing three years. |

| | 2. | | To approve an amendment to the Company’s 1995 Stock Option Plan to increase the maximum number of shares with respect to which options may be granted to any participant in a calendar year from 147,000 shares to 700,000 shares. |

| | 3. | | To consider and act upon such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

Stockholders of record at the close of business on March 24, 2003 are entitled to notice of, and to vote at, the meeting. The stock transfer books of the Company will remain open for the purchase and sale of the Company’s common stock.

All stockholders are cordially invited to attend the meeting.

By order of the Board of Directors,

ROBERT W. BAKER, JR.,Secretary

South Burlington,

Vermont April 21, 2003

Whether or not you expect to attend the Annual Meeting, please complete, date and sign the enclosed Proxy Card and promptly mail it in the enclosed envelope in order to assure representation of your shares at the Annual Meeting. No postage need be affixed if the Proxy Card is mailed in the United States.

IDX SYSTEMS CORPORATION

40 IDX Drive

P.O. Box 1070

South Burlington, Vermont 05403

PROXY STATEMENT FOR THE 2003 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 19, 2003

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of IDX Systems Corporation for use at the 2003 Annual Meeting of Stockholders to be held on May 19, 2003 and at any adjournment or adjournments of that meeting. All proxies will be voted in accordance with the instructions contained therein, and if no choice is specified, the proxies will be votedin favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before it is exercised by delivery of written revocation to the Secretary of the Company.

The Company’s Annual Report for the year ended December 31, 2002 is being mailed to stockholders with the mailing of this Notice and Proxy Statement on or about April 21, 2003.

A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2002, as filed with the Securities and Exchange Commission, except for exhibits, will be furnished without charge to any stockholder upon written request to Investor Relations, IDX Systems Corporation, 40 IDX Drive, P.O. Box 1070, South Burlington, Vermont 05403. Such material may also be accessed electronically by means of the SEC’s home page on the Internet athttp://www.sec.gov.

Voting Securities and Votes Required

On March 24, 2003, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 29,228,147 shares of common stock of the Company, $.01 par value per share. Each share is entitled to one vote.

Under the Vermont Business Corporation Act, the holders of a majority of the shares of common stock issued, outstanding and entitled to vote on any matter shall constitute a quorum with respect to that matter at the Annual Meeting. Shares of common stock present in person or represented by proxy (including such shares that abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present.

For the election of Directors set forth in Proposal 1, it is required under the Vermont Business Corporation Act that there be an affirmative vote of the holders of a plurality of all the votes cast by the stockholders entitled to vote at the Annual Meeting at which a quorum is present. If a quorum exists, action on any other matter, including Proposal 2, properly coming before the Annual Meeting is approved if the votes cast by the holders of the shares of common stock voting on such matter exceed the votes cast opposing such matter, unless more than a majority of the votes is required by statute or the Company’s Second Amended and Restated Articles of Incorporation, as amended (the “Charter”).

Shares that abstain from voting as to a particular matter and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter will not be counted as votes in favor of such matter and also will not be counted as votes cast or shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on a matter that requires the affirmative vote of a certain percentage of the votes cast or shares voting on a matter.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information, as of January 31, 2003, with respect to the beneficial ownership of the Company’s common stock by:

| | • | | each person known by the Company to own beneficially more than 5% of the outstanding shares of the Company’s common stock; |

| | • | | each current Director and nominee for Director; |

| | • | | each executive officer named in the Summary Compensation Table under the heading “Executive Compensation” below (a “Named Executive Officer”); |

| | • | | and all current Directors and executive officers of the Company as a group. |

The number of shares of common stock beneficially owned by each Director or executive officer is determined under the rules of the Securities and Exchange Commission (the “SEC”), and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power, as well as any shares that the individual has the right to acquire within 60 days after January 31, 2003, through the exercise of any stock option or other right. Unless otherwise indicated, each person has sole investment and voting power (or shares such power with his or her spouse) with respect to the shares set forth in the following table. The inclusion herein of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares.

2

Name and Address of Beneficial Owner

| | Shares of IDX Common Stock Beneficially Owned

| | Percentage of IDX Common Stock Outstanding (1)

| |

5% Stockholders | | | | | |

Richard E. Tarrant (2) c/o IDX Systems Corporation 40 IDX Drive South Burlington, VT 05403 | | 5,693,360 | | 19.5 | % |

Robert H. Hoehl (3) 8473 Bay Colony Drive Biltmore # 1602 Naples, FL 34108 | | 2,985,288 | | 10.2 | % |

Cynthia K. Hoehl (4) 8473 Bay Colony Drive Biltmore # 1602 Naples, FL 34108 | | 2,978,018 | | 10.2 | % |

Wellington Management Company, LLP (5) 75 State Street Boston, MA 02109 | | 3,819,700 | | 13.1 | % |

Amy E. Tarrant (6) Fairholt 570 South Prospect Street Burlington, VT 05401 | | 2,483,593 | | 8.5 | % |

CLSP, L.P., CLSP II, L.P., CLSP/SBS I, L.P., CLSP/SBS II, L.P., Cooper Hill Partners, L.P., Cooper Hill Partners, LLC and Jeffrey Casdin (collectively, the “Cooper Hill Group”) (7) 230 Park Avenue New York, NY 10169 | | 1,532,700 | | 5.2 | % |

Strong Capital Management, Inc. and Richard S. Strong (8) 100 Heritage Reserve Menomanee Falls, WI 53051 | | 1,778,875 | | 6.1 | % |

|

Other Directors | | | | | |

Henry M. Tufo, M.D. (9) | | 39,186 | | * | |

Mark F. Wheeler, M.D. (10) | | 27,748 | | * | |

Allen Martin, Esq. (11) | | 25,716 | | * | |

Stuart H. Altman, Ph.D. (12) | | 23,162 | | * | |

David P. Hunter (13) | | 4,673 | | * | |

Connie R. Curran, EdD | | 1,650 | | * | |

William L. Asmundson | | 1,500 | | * | |

|

Director and Named Executive Officer | | | | | |

James H. Crook, Jr. (14) | | 310,897 | | 1.1 | % |

|

Other Named Executive Officers | | | | | |

Walt N. Marti (15) | | 44,394 | | * | |

Thomas W. Butts (16) | | 25,000 | | * | |

Lawrence A. Krassner (17) | | 119,250 | | * | |

All current directors and executive officers as a group (17 persons) (18) | | 11,955,864 | | 41.0 | % |

| * | | Represents holdings of less than one percent. |

3

| (1) | | Number of shares deemed outstanding includes 29,205,560 shares issued and outstanding as of January 31, 2003, plus any shares subject to options held by the person or entity in question that are exercisable on or within 60 days after January 31, 2003. |

| (2) | | Includes (i) 2,704,165 shares held by Mr. Tarrant, individually; (ii) 30,000 shares which Mr. Tarrant has a right to acquire within sixty days of January 31, 2002; (iii) 2,166,025 shares held by Amy E. Tarrant in her sole name, which shares are subject to a Stock Restriction and Voting Agreement, dated as of April 29, 1999 (the “Voting Agreement”), pursuant to which Mr. Tarrant has full voting power as to such shares and as to which shares Mr. Tarrant disclaims beneficial ownership; (iv) 267,568 shares held by Amy E. Tarrant, as trustee of two trusts (133,784 shares each and the beneficiaries of which are certain of the Tarrant’s children), which shares are subject to an informal voting arrangement between Amy E. Tarrant and Mr. Tarrant with Mr. Tarrant having full voting power and as to which shares Mr. Tarrant disclaims beneficial ownership; (v) 401,352 shares held by Mr. Tarrant’s three sons (133,784 shares each) which shares are subject to the Voting Agreement, pursuant to which Mr. Tarrant has full voting power as to such shares and as to which shares Mr. Tarrant disclaims beneficial ownership; (vi) 74,250 shares held by the Richard E. Tarrant Foundation, a Vermont non-profit corporation, the officers and trustees of which include Mr. Tarrant, and as to which shares Mr. Tarrant disclaims beneficial ownership; and (vii) 50,000 shares held by the Amy E. Tarrant Foundation, a Vermont non-profit corporation, the officers and trustees of which are Amy E. Tarrant and certain of the Tarrant children, as to which shares Amy E. Tarrant and Mr. Tarrant disclaim beneficial ownership, and which shares are subject to an informal voting arrangement between Amy E. Tarrant and Mr. Tarrant with Mr. Tarrant sharing voting power with the Amy E. Tarrant Foundation. Excludes 4,680,847 shares that may become subject to a voting trust upon the death or incompetence of Mr. Hoehl. |

| (3) | | Includes (i) 7,340 shares which Mr. Hoehl has a right to acquire within sixty days of January 31, 2003; (ii) 1,250,794 shares held by Cynthia K. Hoehl as trustee of the Robert H. Hoehl FLITE Trust U/A 12/12/01, a Florida intangible tax exemption trust, as to which shares Mr. Hoehl shares voting power with Mrs. Hoehl, as trustee, pursuant to an informal voting arrangement; (iii) 980,617 shares held by Cynthia K. Hoehl, Trustee of the Robert H. Hoehl Grantor Retained Annuity Trust U/A 12/12/01, as to which shares Mr. Hoehl shares voting power with Mrs. Hoehl, as trustee, pursuant to an informal voting arrangement, and as to which shares Mr. and Mrs. Hoehl each disclaim beneficial ownership; (iv) 666,537 shares held by Mrs. Hoehl, as trustee of three trusts (three trusts for 222,179 shares each), the beneficiaries of which are the Hoehl’s children, as to which shares Mr. Hoehl shares voting power with Mrs. Hoehl, as trustee, pursuant to an informal voting arrangement, and as to which shares Mr. and Mrs. Hoehl each disclaim beneficial ownership; and (v) 80,000 shares held by the Hoehl Family Foundation, a Vermont non-profit corporation, the officers and trustees of which are Mr. and Mrs. Hoehl and certain of their children, and as to which shares Mr. and Mrs. Hoehl each disclaim beneficial ownership. Excludes 2,704,165 shares held by Mr. Tarrant, 2,318,200 shares held by Amy E. Tarrant and 401,352 shares held by Mr. Tarrant’s three sons that may become subject to a voting trust upon the death or incompetence of Mr. Tarrant. |

| (4) | | Includes (i) 1,250,794 shares held by Cynthia K. Hoehl as trustee of the Robert H. Hoehl FLITE Trust U/A 12/12/01, a Florida intangible tax exemption trust, as to which shares Mr. Hoehl shares voting power with Mrs. Hoehl, as trustee, pursuant to an informal voting arrangement; (ii) 980,617 shares held by Cynthia K. Hoehl, Trustee of the Robert H. Hoehl Grantor Retained Annuity Trust U/A 12/12/01, as to which shares Mr. Hoehl shares voting power with Mrs. Hoehl, as trustee, pursuant to an informal voting arrangement, and as to which shares Mr. and Mrs. Hoehl each disclaim beneficial ownership; (iii) 666,537 shares held by Mrs. Hoehl, as trustee of three trusts (three trusts for 222,179 shares each), the beneficiaries of which are the Hoehls’ children, as to which shares Mr. Hoehl shares voting power with Mrs. Hoehl, as trustee, pursuant to an informal voting arrangement, and as to which shares Mr. and Mrs. Hoehl each disclaim beneficial |

4

| | ownership; (iv) 80,000 shares held by the Hoehl Family Foundation, a Vermont non-profit corporation, the officers and trustees of which are Mr. and Mrs. Hoehl and certain of their children, and as to which shares Mr. and Mrs. Hoehl each disclaim beneficial ownership; and (v) 70 shares held by Mrs. Hoehl as custodian for Alexandra T. Becker, UGTMA/VT. |

| (5) | | Based solely on a Schedule 13G/A filed with the SEC on February 12, 2003. Represents 3,819,700 shares which are held of record by clients of Wellington Management Company, LLP (“Wellington”), which shares may be deemed to be beneficially owned by Wellington in its capacity as investment adviser, and of which Wellington has shared power to vote or direct the vote of 1,539,800 shares and shared power to dispose or to direct the disposition of 3,819,700 shares. |

| (6) | | Based partly on a Schedule 13G/A filed by Amy E. Tarrant with the SEC on February 14, 2003. Includes (i) 2,166,025 shares held by Amy E. Tarrant in her sole name pursuant to which shares are subject to the Voting Agreement, pursuant to which Mr. Tarrant has full voting power of such shares; (ii) 267,568 shares held by Amy E. Tarrant, as trustee, which are subject to an informal voting arrangement between Amy E. Tarrant and Richard E. Tarrant with Richard E. Tarrant having full voting power; and (iii) 50,000 shares held by the Amy E. Tarrant Foundation as to which such shares Amy E. Tarrant and Richard E. Tarrant each disclaim beneficial ownership. |

| (7) | | Based solely on a Schedule 13G/A filed by the Cooper Hill Group with the SEC on February 14, 2003. CLSP, CLSP II, CLSP/SBS I and CLSP/SBS II are each private investment partnerships with shared power to vote or to direct the vote of, and to dispose or to direct the disposition of, 564,000, 389,000, 208,800 and 71,900 shares, respectively. As the sole general partner of CLSP, CLSP II, CLSP/SBS I and CLSP/SBS II, Cooper Hill Partners, LLC has shared power to vote or to direct the vote of, and to dispose or to direct the disposition of, 1,233,700 shares, and may be deemed the beneficial owner of such shares. Pursuant to an investment advisory contract, Cooper Hill Partners, L.P. has shared power to vote or to direct the vote of, and to dispose or to direct the disposition of, the 299,000 shares held by CLSP Overseas, Ltd., and may be deemed the beneficial owner of such shares. Jeffrey Casdin is the managing member of Cooper Hill Partners, LLC and of Casdin Capital, LLC, which is the general partner of Cooper Hill Partners, L.P. Mr. Casdin has shared power to vote or to direct the vote of, and to dispose or to direct the disposition of, 1,532,700 shares held by the above entities, and may be deemed the beneficial owner of such shares. |

| (8) | | Based solely on a Schedule 13G jointly filed by Strong Capital Management, Inc. (“Strong Capital”) and Richard S. Strong, the Chairman of the Board of Strong Capital, with the SEC on February 7, 2003. Represents 1,778,875 shares of the Company’s common stock which are held of record by clients of Strong Capital, which shares may be deemed to be beneficially owned by Strong Capital in its capacity as investment adviser, and of which Strong Capital has shared power to vote or direct the vote of 1,768,525 shares and shared power to dispose or to direct the disposition of 1,778,875 shares. |

| (9) | | Includes 4,000 shares held by Dr. Tufo’s spouse. Also includes 9,009 shares subject to outstanding stock options held by Dr. Tufo that are exercisable on or within 60 days after January 31, 2002. |

| (10) | | Includes 3,125 shares held in the Company’s 401(k) plan and 21,220 shares subject to outstanding stock options held by Dr. Wheeler that are exercisable on or within 60 days after January 31, 2002. Also includes 3,403 shares held jointly by Dr. Wheeler and his spouse. |

| (11) | | Includes 11,510 shares held by Mr. Martin as Trustee of the Allen Martin Revocable Trust. Also includes 11,800 shares subject to outstanding stock options that are exercisable on or within 60 days after January 31, 2003. |

| (12) | | Includes 18,454 shares subject to outstanding stock options held by Dr. Altman that are exercisable on or within 60 days after January 31, 2003. |

| (13) | | Includes 4,447 shares subject to outstanding stock options held by Mr. Hunter that are exercisable on or within 60 days after January 31, 2002. |

5

| (14) | | Includes 11,478 shares held jointly by Mr. Crook and his spouse. Also includes 49,530 shares held by Mr. Crook’s spouse, as trustee of a trust whose beneficiaries are his three children, as to which shares Mr. Crook disclaims beneficial ownership. Also includes 104,936 shares subject to outstanding stock options that are exercisable on or within 60 days after January 31, 2003. |

| (15) | | Includes 1,500 shares held jointly by Mr. Marti and his spouse and 1,126 shares held by Mr. Marti’s spouse. Also includes 39,900 shares subject to outstanding stock options that are exercisable on or within 60 days after January 31, 2003. |

| (16) | | Consists of 25,000 shares subject to outstanding stock options that are exercisable on or within 60 days after January 31, 2003. |

| (17) | | Includes 44,250 shares subject to outstanding stock options that are exercisable on or within 60 days after January 31, 2003. |

| (18) | | Includes a total of 314,245 shares subject to outstanding stock options that are exercisable on or within 60 days after January 31, 2003. |

6

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board of Directors is divided into three classes (designated Class I Directors, Class II Directors and Class III Directors), with members of each class serving for staggered three-year terms. The Class II Directors have terms that expire at this Annual Meeting of Stockholders, the Class I Directors (with the exception of Mr. Asmundson) have terms that expire at the 2005 Annual Meeting of Stockholders, and the Class III Directors have terms that expire at the 2004 Annual Meeting of Stockholders. In each case, members of each class hold office until their successors have been duly elected and qualified, subject to their earlier death, resignation or removal. There are no family relationships between or among any Directors of the Company.

The Company currently has a ten member Board of Directors. In June 2002, the Board elected William L. Asmundson as a Class I Director. In December 2002, the Board of Directors elected Connie R. Curran, EdD as a Class II Director. In April 2003, the Board elected James H. Crook, Jr. as a Class II Director. Steven M. Lash resigned as a Class II Director on February 13, 2002. Pursuant to the Charter, any Director elected by the Board to fill a vacancy, such as Mr. Asmundson, Dr. Curran and Mr. Crook, serves until the next annual meeting of shareholders, notwithstanding the class of such Director. The proxies mailed with this proxy statement cannot be voted for a greater number of persons than the nominees named in this proxy statement.

The nominee for Class I Director, William L. Asmundson, is presently serving as a Class I Director of the Company. The nominees for Class II Directors, Henry M. Tufo, M.D., David P. Hunter, Dr. Curran and Mr. Crook are presently serving as Class II Directors of the Company. Dr. Tufo has been a Director since November 1995, Mr. Hunter has been a Director since September 2001, Mr. Asmundson has been a Director since June 2002, Dr. Curran has been a Director since December 2002 and Mr. Crook has been a Director since April 2003. The persons named in the enclosed proxy will vote for the election of each of the nominees unless the proxy is marked otherwise or unless one or more nominees is unable or unwilling to serve. If elected, Mr. Asmundson will serve until the 2005 Annual Meeting of the Stockholders and Dr. Tufo, Mr. Hunter, Dr. Curran and Mr. Crook will serve until the 2006 Annual Meeting of Stockholders (subject to the election and qualification of their successors and to their earlier death, resignation or removal). Each of the nominees has indicated his or her willingness to serve, if elected; however, if any nominee should be unable or unwilling to serve, the proxies may be voted for a substitute nominee designated by the Board or the Board may reduce the number of Directors.

Set forth below are the names of, and certain information with respect to, the members of the Board (including the nominees for Director). Information with respect to the number of shares of common stock beneficially owned by each Director, directly or indirectly, as of January 31, 2003, appears under the heading “Security Ownership of Certain Beneficial Owners and Management.”

NOMINEE FOR CLASS I DIRECTOR

William L. Asmundson, age 65, has served as a Director of the Company since June 2002. Mr. Asmundson was Vice Chairman of Rockefeller & Co., the investment office for the Rockefeller Family, from January 2001 to September 2001, and served as President and Chief Executive Officer of Rockefeller & Co. from November 1998 to December 2000. Mr. Asmundson retired effective December 31, 2001. From 1984 to 1998, Mr. Asmundson served in other positions at Rockefeller & Co. Prior to 1984, Mr. Asmundson served in various positions at New Court Securities Corp. (now Rothschild Inc.), including as Managing Director and Executive Vice President of Rothschild Asset Management. Mr. Asmundson presently serves on the Board of Datascope Corporation, a publicly-traded medical device company.

7

CLASS I DIRECTORS

Richard E. Tarrant, age 60, is Chairman of the Board of the Company. Mr. Tarrant co-founded the Company in 1969 and has served as a Director since that time. Mr. Tarrant served as Chief Executive Officer of the Company through December 31, 2002, when be became Chairman of the Board. Mr. Tarrant was also President of the Company from 1969 to February 1999. Mr. Tarrant served as a member of the Board of Trustees for the University Health Center (Vermont), an academic medical center, from July 1988 to December 1994 and as Chairman of the University Health Center (Vermont) from 1992 to 1994. He also served as a trustee of the University of Vermont from March 1994 to February 2000 and of Saint Michael’s College from October 1990 to May 1993. Since May 1996, he has served as a member of the Vermont Business Roundtable and is a director of Fletcher Allen Healthcare, an academic medical center. Mr. Tarrant is also a member of the Board of Directors of Allscripts Healthcare Solutions, Inc., a publicly-traded company.

Allen Martin, Esq., age 65, has served as a Director of the Company since February 1999. Mr. Martin is an attorney and was a director at Downs Rachlin Martin PLLC from 1970 until he retired in December 2002 where he served as head of that firm’s Health Care Practice Group and also concentrated in corporate and utility finance law. Mr. Martin is a Director and the Chairman of the Board of WICOR Americas, Inc., a privately held company, which is the leading manufacturer of insulation systems for electrical power transformers in North America. Mr. Martin is also a Director and Chairman of the Finance Committee of Union Mutual Insurance Company, a property and casualty mutual insurance company.

NOMINEES FOR CLASS II DIRECTORS

Henry M. Tufo, M.D., age 63, has served as a Director of the Company since November 1995. Dr. Tufo is Professor of Medicine at the University of Vermont College of Medicine and practices internal medicine at the Given Health Center. He currently is an independent consultant for matters relating to point-of-care mobile technology. Dr. Tufo served as a consultant to the Company from September 1999 through June 2000, as Executive Vice President from September 1995 to September 1999, as Chief Operating Officer from September 1996 to February 1999, as Vice President and Chief Medical Officer from August 1995 to September 1995, and as a consultant from February 1995 to August 1995. Dr. Tufo is the Chairman of Vermont Medical Center Indemnity Company, a captive insurance company which is wholly owned by Fletcher Allen Healthcare, Inc. Dr. Tufo was the founding President and Chief Executive Officer of University Health Center (Vermont) from July 1989 to December 1994.

David P. Hunter, age 57, has served as a Director of the Company since September 2001. Mr. Hunter co-founded and was the Chief Executive Officer of the Hunter Group, a nationally recognized healthcare consulting and management company, since July 1987. He served from June 1985 through July 1987 as President, Chief Operating Officer, Chief Executive Officer and board member of certain affiliates of Voluntary Hospitals of America, a not-for-profit health system. He also served as President, Chief Executive Officer and Executive Vice President of certain affiliates of Burlington County Memorial Hospital/Nexus Healthcare Corp., a New Jersey not-for-profit health system, from June 1978 through July 1985.

Connie R. Curran, RN, EdD, FAAN, age 55, has served as a Director of the Company since December 2002. She is currently the founder and president of Your Virtual Executive, an organization focused on implementing solutions to improve the lives of patients and caregivers. From 1995 to 2000, Dr. Curran served as

8

president and chief executive officer of CurranCare, LLC, a healthcare consulting company. Upon the acquisition of CurranCare by Cardinal Health Consulting Services in November, 2000 until February, 2002, Dr. Curran served as President of Cardinal Health Consulting Services, a consulting company with expertise in surgical services, hospital operations and redesign, case management and home care. Dr. Curran has also served as Vice President of the American Hospital Association, National Director of Patient Care Services for APM, Inc. and Dean of at the Medical College of Wisconsin. She is a faculty member of the American College of Healthcare Executives and the Estes Park Institute and serves on the board of directors of The National Student Nurses Association and Silver Cross Hospital. Dr. Curran also serves as a Director of CardioDynamics International Corp., a publicly-traded company.

James H. Crook, Jr., age 46, has served as a Director of the Company since April 2003. He has served as the Company’s Chief Executive Officer since January 1, 2003. Mr. Crook has also served as President and Chief Operating Officer of the Company since February 1999. Mr. Crook joined the Company in 1981, served as Vice President from June 1984 to February 1999, and was a Director of the Company from July 1984 to June 1995. Mr. Crook has been a member of the Board of Directors of Champlain College since 1996. Mr. Crook has also been a member of the Board of Directors of Kids on the Block Vermont, a not-for-profit educational puppet troupe, since 2002.

CLASS III DIRECTORS

Robert H. Hoehl, age 61, co-founded the Company in 1969 and served as Chairman of the Board until January 2003, when he became Vice Chairman. Since October 1996, Mr. Hoehl has assisted the Chief Executive Officer of the Company with new business initiatives and acquisitions. Mr. Hoehl served as Executive Vice President of the Company until his retirement in October 1996. Mr. Hoehl has been a trustee of Saint Michael’s College since 1994, a director of the Preservation Trust of Vermont since 1997 and served as a director of SymQuest Group, Inc., a privately-held provider of customized business solutions, from 1999 until February 2003.

Stuart H. Altman, Ph.D., age 65, has served as a Director of the Company since November 1995. Dr. Altman has been a Professor of National Health Policy at The Heller School at Brandeis University since 1977. He served as Dean of The Heller School from September 1977 to June 1993 and as Professor of Economics at Brown University from 1966 to 1970. In November 1997, Dr. Altman was appointed by President Clinton to the Bipartisan Commission on the Future of Medicare. He was a four-term chairman of the U.S. Congressional Prospective Payment Assessment Commission from 1983 to April 1996 and served as a senior member of the Clinton-Gore Health Policy Transition Group from November 1992 to January 1993. Dr. Altman is a member of the Board of Directors of OrthoLogic Corp., a publicly-traded developer, manufacturer and marketer of orthopedic devices designed to promote the healing of musculoskeletal tissue. He is also a member of the Foundation Board of the Health Plan of New York, a not-for-profit health maintenance organization that provides health care services and health insurance coverage throughout the New York metropolitan area. Since December 2001, Dr. Altman has been a member of the Board of Directors of Lincare Holdings Inc., a publicly-traded provider of oxygen, home medical equipment and other respiratory therapy services. Since September 2002, Dr. Altman has also been a member of the Tufts-New England Medical Center, a not-for-profit teaching hospital system.

Mark F. Wheeler, M.D., MPH, age 53, has served as a Director of the Company since February 1999 and as its Chief Technical Architect since July 1997. Dr. Wheeler co-founded PHAMIS Inc. in 1981 and served as its Director of Research and Development from its founding until its acquisition by IDX in July 1997.

9

Board of Directors and Committee Meetings

The Board of Directors of the Company held four meetings and acted 11 times by written consent during 2002. All Directors attended at least 75% of the meetings of the Board held during the respective periods for which each has been a Director in 2002. In addition, all Directors who served on committees of the Board attended at least 75% of the meetings of such committees held during the respective periods for which they served.

The Company has a standing Audit Committee of the Board which provides the opportunity for direct contact between the Company’s independent auditors and the Board. The Audit Committee has responsibility for:

| | • | | recommending the appointment of the Company’s independent auditors, |

| | • | | reviewing the scope and results of audits, and |

| | • | | reviewing the Company’s internal accounting control policies and procedures. |

The Audit Committee held six meetings and acted two times by unanimous consent in 2002. The current members of the Audit Committee are Mr. Asmundson (Chairman), Dr. Altman and Mr. Hunter. Mr. Lash served as the Chairman of the Audit Committee until his resignation as a Director on February 13, 2002, and Mr. Hunter was appointed to fill this vacancy on March 4, 2002. Mr. Martin served as Chairman until he resigned from the committee on September 9, 2002, and Mr. Asmundson was appointed to fill this vacancy on September 9, 2002. See “Report of the Audit Committee” below.

The Company also has a standing Compensation Committee of the Board which, among other things, provides recommendations to the Board regarding salaries and incentive compensation for employees and consultants of the Company. The Compensation Committee:

| | • | | establishes and modifies the compensation of certain officers of the Company, |

| | • | | administers all of the Company’s stock option and other equity-based employee benefit plans, |

| | • | | grants stock options under the Company’s stock option plans, including, through a subcommittee composed solely of non-employee Directors, to certain executive officers of the Company, and |

| | • | | engages, determines the terms of any employment agreements and arrangements with, and is responsible for the termination of, certain officers of the Company. |

The Compensation Committee held one meeting and acted five times by unanimous written consent in 2002. The subcommittee held no meetings and acted six times by unanimous written consent in 2002. The current members of the Compensation Committee are Dr. Altman (Chairman), Mr. Tarrant and Mr. Hunter. The members of the subcommittee are Dr. Altman and Mr. Hunter. Mr. Lash served as a member of both the Compensation Committee and its subcommittee until his resignation as a Director on February 13, 2002, and Mr. Hunter was appointed to fill both these vacancies on March 4, 2002. Mr. Tarrant did not participate in decisions concerning his own compensation or in decisions concerning stock options granted to executive officers of the Company, except for with respect to two grants to executive officers in March of 2002, which were made by the entire Compensation Committee. See “Report of the Compensation Committee” below.

The Company also has a standing Benefits Committee which carries out all of the duties and obligations of the Company as plan administrator under its employee health and welfare benefit plans. The committee held no meetings during 2002 and did not act by unanimous written consent. The members of the committee are Dr. Tufo (Chairman) and Dr. Altman.

10

The Company also has an Internet Committee which considers matters and transactions related to the Company’s Internet strategy. The committee held no meetings and did not act by unanimous written consent in 2002. The current members of the committee are Mr. Hoehl (Chairman), Mr. Martin, Mr. Tarrant and Dr. Wheeler. Mr. Lash served on the Internet Committee until his resignation as a Director on February 13, 2002.

The Company also has a Nominating Committee which oversees and supervises the nominating process for Directors to the Company’s Board and ensures that appropriate procedures are in place for the selection and presentation of qualified candidates to the Board for membership on the Board. The Board established the Nominating Committee in March 2002, and the committee held no meetings and acted twice by unanimous written consent during 2002. The members of the committee are Mr. Tarrant (Chairman), Mr. Martin and Dr. Altman. Pursuant to the Nominating Committee Charter, prospective director nominees are identified by the Nominating Committee or referred to it by Board members, management, shareholders or other appropriate external sources. Shareholders are encouraged to submit appropriate recommendations, with a full statement of the qualifications of the recommended nominee, directly to the Nominating Committee.

The Company had a standing Committee on Interested Director Transactions which considers transactions in which Directors have an interest. The committee held no meetings and did not act by unanimous written consent in 2002. Mr. Lash served as a member of this committee until his resignation as a Director on February 13, 2002. Dr. Altman served as Chairman of this committee, and was its sole member after Mr. Lash’s resignation. The committee was dissolved by the Board on September 9, 2002.

Board of Directors Compensation

All of the Directors are reimbursed for reasonable out-of-pocket expenses incurred in connection with their attendance at Board and committee meetings. Each non-employee Director earns:

| | • | | a $1,500 fee for attendance at each regular and special meeting of the Board; and |

| | • | | a $500 fee for each regular and special meeting of the Board, if such Director attends such meeting by conference call. |

Each non-employee Director who serves as the chairman of a committee of the Board also earns an annual fee of $1,000. Non-employee Directors who serve as committee members also receive $500 for attendance at committee meetings which are not scheduled on the dates of meetings of the full Board. Employee Directors do not receive any compensation in their capacities as Directors.

For the year ended December 31, 2002, the current non-employee Directors were paid the following in fees: Dr. Altman, $14,000; Mr. Martin, $13,300; Dr. Tufo, $11,000; Mr. Hoehl, $11,000; Mr. Hunter, $16,250, Mr. Asmundson, $10,200 and Dr. Curran, $1,500. Former director Mr. Lash received $500 in fees in 2002.

1995 Director Stock Option Plan. The 1995 Director Stock Option Plan, as amended (the “1995 Director Plan”), was adopted by the Board and approved by the stockholders of the Company in September 1995. Amendments to the 1995 Director Plan were adopted by the Board in February, March and April 1997 and March 2001 and approved by the stockholders in May and July 1997 and May 2001, respectively.

11

Under the current terms of the 1995 Director Plan, Directors of the Company who are not employees of the Company or any subsidiary of the Company are eligible to receive non-statutory options to purchase shares of common stock. Currently, a total of 160,000 shares of common stock may be issued upon exercise of options granted under the 1995 Director Plan.

Pursuant to the current terms of the 1995 Director Plan, the selection of a non-employee Director as a recipient of an option, the timing of the grant of any such option, the exercise price of any such option and the number shares of common stock subject to any such option are determined by (1) the Board or (2) a committee or subcommittee composed solely of two or more non-employee Directors (within the meaning of Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended) having full authority to act in the matter.

Options granted under the 1995 Director Plan are not transferable by the optionee except by will or by the laws of descent and distribution. Each option granted under the 1995 Director Plan shall terminate and may no longer be exercised on the earlier of (1) the date ten years after the date of grant or (2) the date one year after the optionee ceases to serve as a Director of the Company (but in no event later than ten years after the date of grant); provided that, in the event an optionee ceases to serve as a Director due to his or her death or disability (within the meaning of Section 22(e)(3) of the Internal Revenue Code of 1986, as amended), then the exercisable portion of the option may be exercised, within the period of one year following the date the optionee ceases to serve as a Director (but in no event later than ten years after the date of grant), by the optionee or by the person to whom the option is transferred by will, by the laws of descent and distribution, or by written notice.

On May 20, 2002, Dr. Altman, Mr. Martin, Dr. Tufo, Mr. Hoehl and Mr. Hunter were each granted an option under the 1995 Director Plan to purchase 4,508 shares of common stock at an exercise price of $17.75 per share, which options will become fully vested and exercisable on the anniversary of the date of grant.

Only July 17, 2002, Mr. Asmundson was granted an option under the 1995 Director Plan to purchase 4,533 shares of common stock at an exercise price of $11.81 per share, which options will become fully vested and exercisable on June 3, 2003.

On December 16, 2002, Dr. Curran was granted an option under the 1995 Director Plan to purchase 2,446 shares of common stock at an exercise price of $17.50 per share, which options will become fully vested and exercisable on December 9, 2003.

2002 Stock Incentive Plan for Non-Employee Directors. The 2002 Stock Incentive Plan for Non-Employee Directors (“2002 Stock Incentive Plan”) was adopted by the Board of the Company in March 2002. The material terms of the 2002 Stock Incentive Plan are described below, under “Equity Compensation Plan Information.”

On May 20, 2002, Dr. Altman, Mr. Martin, Dr. Tufo and Mr. Hoehl were each issued 564 shares of common stock and Mr. Hunter was issued 226 shares of common stock under the 2002 Stock Incentive Plan in connection with their service as non-employee Directors of the Company.

12

Compensation of Executive Officers

SUMMARY COMPENSATION

The following table sets forth certain information with respect to the annual and long-term compensation for the last three fiscal years of the Company’s Chief Executive Officer and the Company’s four other most highly compensated executive officers during fiscal 2002 (the “Named Executive Officers”).

| | | | | Annual Compensation

| | Long Term Compensation Awards

| |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | | Other Annual Compensation(1) ($)

| | Restricted Stock Awards

| | | Securities Underlying Options (#)

| | All Other Compensation ($)

| |

Richard E. Tarrant(2) Former Chief Executive Officer | | 2002 2001 2000 | | $ | 372,984 372,984 372,984 | | $ | 132,000 24,850 99,173 | | | — — — | | | — — — | | | — 50,000 — | | $ | — 5,100 — | (3) |

James H. Crook, Jr.(2) President and Chief Executive Officer | | 2002 2001 2000 | | | 355,000 355,000 355,000 | | | 107,000 20,000 60,173 | | | — — — | | | — — — | | | 147,000 133,000 147,000 | | | 6,000 5,100 10,200 | (3) (3) (3) |

Walt N. Marti Vice President/General Manager, Imagecast Division | | 2002 2001 2000 | | | 185,000 185,000 165,000 | | | 174,820 15,000 110,628 | | | — — — | | | — — — | | | 10,000 — — | | | 6,000 5,100 10,200 | (3) (3) (3) |

Thomas W. Butts(4) President/General Manager, Flowcast Division | | 2002 2001 2000 | | | 265,657 — — | | | 281,250 — — | (5) | | — — — | | | — — — | | | 100,000 — — | | | — — | |

Lawrence A. Krassner(6) President/General Manager, Carecast Division | | 2002 2001 2000 | | | 330,000 178,750 — | | | 165,000 — — | | | — — — | | $ | — 1,201,125 | (8) | | 30,000 — — | | | 115,503 — — | (7) |

| (1) | | In accordance with the rules of the Securities and Exchange Commission, other compensation in the form of perquisites and other personal benefits have been omitted in those instances where such perquisites and other personal benefits constituted less than the lesser of $50,000 or 10% of the total of annual salary and bonus for the Named Executive Officer for the fiscal year. |

| (2) | | Mr. Tarrant served as Chief Executive Officer during the year ended December 31, 2002. Mr. Crook became Chief Executive Officer effective January 1, 2003. Mr. Tarrant continues to serve as Chairman of the Board of Directors and as a Director. |

| (3) | | Represents the Company’s profit sharing plan contribution. |

| (4) | | Mr. Butts became President/General Manager, Flowcast Division, on January 14, 2002. |

| (5) | | Includes a signing bonus of $75,000, pursuant to the Employment, Noncompetition and Nondisclosure Agreement between the Company and Mr. Butts, dated January 17, 2002. |

| (6) | | Mr. Krassner became President/General Manager, Carecast Division, on June 11, 2001. |

| (7) | | Consists of $115,503 in relocation expenses in 2002. |

| (8) | | Reflects a restricted stock award of 75,000 shares in 2001. As of December 31, 2002, the value of Mr. Krassner’s restricted stock holdings, as calculated pursuant to Regulation S-K 402(b)(2)(iv)(A), was $1,283,250. To the extent that the Company pays dividends on its common stock, Mr. Krassner is entitled to receive payment of dividends on the shares of restricted stock, subject to any restrictions with respect to those shares pursuant to the Restricted Stock Agreement between the Company and Mr. Krassner, dated June 11, 2001 (the “Restricted Stock Agreement”). |

13

Option Grants in 2002

The following table sets forth certain information concerning grants of stock options during the year ended December 31, 2002 to each of the Named Executive Officers. The Company granted no stock appreciation rights during fiscal 2002.

| | | Individual Grants

| | |

| | | Number of Shares Underlying Options Granted (1) (#)

| | Percent of Total Options Granted To Employees in Fiscal Year (%)

| | | Exercise Price Per Share ($/Sh)

| | | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

| | | | | | | 5% ($)

| | 10% ($)

|

Richard E. Tarrant | | — | | — | | | | — | | | — | | | — | | | — |

James H. Crook, Jr. | | 147,000 | | 10.8 | % | | $ | 17.545 | | | 12/30/12 | | $ | 1,621,992 | | $ | 4,110,445 |

Walt N. Marti | | 10,000 | | 0.7 | % | | $ | 10.935 | 5 | | 7/11/12 | | $ | 68,773 | | $ | 174,284 |

Thomas W. Butts | | 100,000 | | 7.4 | % | | $ | 12.555 | | | 1/14/12 | | $ | 789,263 | | $ | 2,000,147 |

Lawrence A. Krassner | | 30,000 | | 2.2 | % | | $ | 12.60 | | | 1/2/12 | | $ | 237,722 | | $ | 602,435 |

| (1) | | All options to purchase shares of the common stock of the Company vest according to various schedules over periods of time ranging from less than one year to eight years from date of grant. Vesting of certain options may accelerate upon the Company’s achievement of certain financial goals. |

| (2) | | Amounts represent hypothetical gains that could be achieved for options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date options are granted assuming a ten year realizable period. Actual gains, if any, on stock option exercises will depend on the future performance of the Company’s common stock and the date on which options are exercised. |

Aggregated Options Exercises in 2002 and Year-End 2002 Option Values

The following table sets forth certain information regarding stock options exercised during the year ended December 31, 2002 and stock options held as of December 31, 2002 by the Named Executive Officers.

Name

| | Shares Acquired on Exercise (#)

| | Value Realized(1) ($)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#) Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at Fiscal Year-End(2) ($) Exercisable/Unexercisable

|

Richard E. Tarrant | | — | | — | | 30,000/50,000 | | $104,550/$0 |

James H. Crook, Jr. | | — | | — | | 104,936/430,501 | | $296,225/$0 |

Walt N. Marti | | — | | — | | 39,900/37,250 | | $110,880/$86,148 |

Thomas W. Butts | | — | | — | | 0/100,000 | | $0/$456,000 |

Lawrence A. Krassner | | — | | — | | 36,750/140,250 | | $16,170/$183,810 |

| (1) | | Value is calculated based on the option exercise price and the closing market price of the common stock on the date of exercise, multiplied by the number of shares as to which the exercise relates. |

| (2) | | The closing price for the Company’s common stock as reported by the Nasdaq National Market on December 31, 2002, the last trading day prior to the end of the fiscal year, was $17.03. Value is calculated on the basis of the difference between the option exercise price and $17.03, multiplied by the number of shares of common stock underlying the option. |

14

Equity Compensation Plan Information

The following table provides information about the securities authorized for issuance under the Company’s equity compensation plans as of December 31, 2002:

| | | (a)

| | (b)

| | (c)

| |

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights(1)

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(2)

| |

Equity compensation plans approved by security holders (3) | | 4,822,994 | | $ | 18.24 | | 3,404,210 | (4) |

Equity compensation plans not approved by security holders(5) | | None | | | None | | 62,518 | |

| | |

| |

|

| |

|

|

Total | | 4,822,994 | | $ | 18.24 | | 3,466,728 | (4) |

| | |

| |

|

| |

|

|

| (1) | | This table excludes an aggregate of 59,379 shares issuable upon exercise of outstanding options assumed by the Company in connection with the acquisition of PHAMIS, Inc. by the Company. The weighted average exercise price of the excluded options is $24.81. |

| (2) | | Under the 1994 Incentive Stock Option Plan (the “1994 Plan”), the Company may award stock appreciation rights in addition to options; however, the Company has never issued any stock appreciation rights under such plan. Under the Restricted Stock Agreement, the Company may award only restricted stock. Under the 2002 Stock Incentive Plan, the Company may award either unrestricted common stock or restricted stock. |

| (3) | | Consists of the 1985 Incentive Stock Option Plan (the “1985 Plan”), the 1994 Plan, the 1995 Stock Option Plan, the 1995 Employee Stock Purchase Plan and the 1995 Director Plan. The 1985 Plan and the 1994 Plan were terminated for purposes of future issuances or eligibility in March 1995 and upon the Company’s initial public offering, respectively. |

| (4) | | Includes 694,835 shares issuable under the Company’s 1995 Employee Stock Purchase Plan. |

| (5) | | Consists of the 2002 Stock Incentive Plan and the Restricted Stock Agreement. |

The 2002 Stock Incentive Plan, for which stockholder approval was neither sought nor obtained, was adopted by the Board of the Company in March 2002. Up to 25,000 shares may be awarded under the 2002 Stock Incentive Plan. As of December 31, 2002, 2,482 shares of unrestricted common stock had been awarded.

Under the terms of the 2002 Stock Incentive Plan, Directors of the Company who are not employees of the Company or any subsidiary of the Company are eligible to receive grants of unrestricted and restricted stock.

Pursuant to the terms of the 2002 Stock Incentive Plan, the Board may grant awards of unrestricted and restricted stock to non-employee directors and shall determine the number of awards, as well as the terms and conditions of each type of award. The Board may at any time provide that any award become immediately exercisable in full or in part, free of some or all restrictions or condition, or otherwise realizable in full or in part, as the case may be.

Awards granted under the 2002 Stock Incentive Plan are not transferable by the non-employee director except by will or by the laws of descent and distribution. No awards under the 2002 Stock Incentive Plan shall be granted after March 18, 2012. The Board will determinate the effect of an award upon disability, death, retirement, authorized leave of absence or other changes in status.

15

Pursuant to the Restricted Stock Agreement, for which stockholder approval was neither sought nor obtained, the Company has reserved 115,000 shares of Common Stock for the issuance of restricted stock to Mr. Krassner, of which 75,000 shares had been awarded as of December 31, 2002. In February 2003, pursuant to the Restricted Stock Agreement, the Company issued 20,000 shares of restricted stock to Mr. Krassner, based on the achievement of certain performance objectives by the Company’s Integrated Services Division, which is now the Company’s Carecast Division (“Carecast”). In February 2004, the Company will issue up to 20,000 shares of restricted stock to Mr. Krassner, based on the achievement of certain performance objectives by Carecast. The purchase price of the stock subject to the Restricted Stock Agreement is $.01 per share, and the shares vest on the fourth anniversary of the date of grant.

Employment Agreements

Krassner Employment Agreement. On June 11, 2001, the Company entered into an Employment, Noncompetition and Nondisclosure Agreement with Mr. Krassner, which provides for the employment of Mr. Krassner as President/General Manager of Carecast. The employment agreement provides for an annual base salary of $330,000 with annual increases by an amount to be determined, but not less than the annual percentage CPI increase. In addition, Mr. Krassner will be among the Company’s executive officers entitled to the benefit of any “change of control” agreements that the Company may adopt in the future. Pursuant to the employment agreement, the Company has reimbursed Mr. Krassner for certain relocation expenses in the amount of $115,503.

The employment agreement provides for annual cash bonuses, option grants and restricted stock awards based on Carecast achieving certain performance objectives. Pursuant to the employment agreement, the Company entered into a Restricted Stock Agreement with Mr. Krassner, pursuant to which Mr. Krassner received an initial award of 75,000 shares of restricted stock at a purchase price of $.01 per share on June 28, 2001. In February 2003, pursuant to the Restricted Stock Agreement, the Company issued 20,000 shares of restricted stock to Mr. Krassner, based on the achievement of certain performance objectives by Carecast. In February 2004, Mr. Krassner will be eligible to receive a restricted stock award of up to 20,000 shares based on Carecast achieving certain performance objectives. Mr. Krassner’s employment with the Company is at-will and may be terminated by the Company or Mr. Krassner at any time with or without cause. In the event the Company terminates Mr. Krassner’s employment without cause (as defined in the employment agreement), then (a) he will receive his base salary for the twelve months following the termination date at the rate in effect at such time and, if the termination date does not fall on a calendar year end, a proportionate amount of his previous year’s bonus, (b) any outstanding but unexercisable options granted prior to the termination date which, by their terms, would have become exercisable within the 12 months following the termination date will become immediately exercisable, and such options and any previously exercisable options shall remain exercisable until the second anniversary of the termination date and (c) all restrictions on the shares of restricted stock awarded as of the termination date will lapse.

Butts Employment Agreement. On January 14, 2002, the Company entered into an Employment, Noncompetition and Nondisclosure Agreement with Mr. Butts, which provides for the employment of Mr. Butts as President/General Manager of the Company’s Enterprise Solutions Division, which is now the Company’s Flowcast Division (“Flowcast”). The employment agreement provides for an annual base salary of $275,000 with annual increases in an amount to be determined. Pursuant to the employment agreement, the Company paid Mr. Butts a $75,000 one-time sign-on bonus in January 2002. In addition, Mr. Butts will be among the employees of the Company entitled to the benefit of a Supplemental Retirement Benefit Plan, should one be adopted by the Company.

16

The employment agreement provides for annual cash bonuses and option awards, based on Flowcast achieving certain performance objectives. In addition, the employment agreement provides for certain assurances by the Company should the accumulated net value of options granted to Mr. Butts fall below $3,000,000 as of January 14, 2007, and certain other conditions are met. Mr. Butts’s employment with the Company is at-will and may be terminated by the Company or Mr. Butts at any time with or without cause. In the event the Company terminates Mr. Butts without cause (as defined in the employment agreement) or Mr. Butts terminates his employment for good reason (as defined in the employment agreement), then (a) if such termination is prior to or on January 14, 2004, he will receive his base salary for 24 months in a lump sum, (b) if such termination is after January 14, 2004, he will receive his base salary for 12 months in a lump sum and if the termination date does not fall on a calendar year end, a proportionate amount of his previous year’s bonus, (c) any outstanding but unexercisable options granted prior to the termination date which, by their terms, would have become exercisable within the 12 months following the termination date will become immediately exercisable, and such options and any previously exercisable options shall remain exercisable until the first anniversary of the termination date, (d) the Company shall pay Mr. Butts any amounts owed to him and (e) the Company shall make payments for Mr. Butts’s COBRA coverage for 12 months following the date of termination.

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee are Dr. Altman, Mr. Hunter and Mr. Tarrant. Mr. Lash served as a member of the Compensation Committee and its subcommittee until his resignation as a Director on February 13, 2002, and Mr. Hunter was appointed to fill this vacancy on March 4, 2002. Mr. Tarrant, the former Chief Executive Officer of the Company, did not participate in decisions concerning his own compensation or in decisions concerning stock options granted to executive officers of the Company, except for with respect to two grants to executive officers in March of 2002, which were made by the entire Compensation Committee.

The following is a description of certain transactions involving the Company and/or certain members of its Board, its Compensation Committee or its executive management.

4901 LBJ Freeway, Dallas, Texas. Mr. Tarrant is the President and a director of LBJ Real Estate Inc., a Vermont corporation (“LBJ Real Estate”). The other executive officers of LBJ Real Estate include Mr. Hoehl (Vice President) and John A. Kane (Vice President and Treasurer); and the other directors of LBJ Real Estate include Mr. Kane. LBJ Real Estate has no compensation committee or other board committee performing similar functions. The stockholders of LBJ Real Estate include Messrs. Tarrant and Hoehl. LBJ Real Estate holds a 1% general partnership interest in 4901 LBJ Limited Partnership, a Vermont limited partnership (“LBJ”), and Messrs. Hoehl, Tarrant, Robert F. Galin, Kane and two other employees of the Company hold the remaining 72.95% limited partnership interest.

Pursuant to a lease effective July 1, 2002, the Company leases office space located at 4901 LBJ Freeway from LBJ. The Company paid to LBJ approximately $555,000 in total for rent expenses and $52,746 in pass-through occupancy expenses during the year ended December 31, 2002. On October 17, 2002, the Audit Committee approved the 2002 lease by the Company.

Allscripts Healthcare Solutions, Inc. The sale of ChannelHealth to Allscripts was completed on January 8, 2001 and as a result, the Company received approximately 7,497,838 shares of common stock of Allscripts Healthcare and the Directors and executive officers of the Company received the following shares of common stock of Allscripts Healthcare, and/or had the following options to purchase common stock of ChannelHealth

17

converted into options to purchase shares of common stock of Allscripts Healthcare: Mr. Tarrant, 35,416 shares and no options; Dr. Altman, 3,373 shares and 675 options; Mr. Hoehl, 31,834 shares and no options; Dr. Tufo, 5,059 shares and no options; Mr. Martin, 7,146 shares and 675 options; Dr. Wheeler, 6,746 shares and 5,060 options; Mr. Crook, no shares and 35,417 options; Mr. Galin, no shares and 30,357 options; Mr. Kane, no shares and 26,984 options; Stephen Gorman, no shares and 10,794 options; and Mr. Marti, no shares and 10,794 options. In addition, Pequot Private Equity Fund II, L.P. received 857,498 shares of common stock of Allscripts Healthcare.

In addition, the Company and Allscripts Healthcare entered into a ten-year strategic alliance agreement to cooperatively develop, market and sell integrated clinical and practice management products. This strategic alliance agreement prohibits the Company from formally collaborating with another partner to integrate the Company’s Group Practice Management System and IDXtend products with such partner’s products that would compete with the Allscripts Healthcare products. Similarly, Allscripts Healthcare may not develop any practice management products or enter into a similar collaborative relationship with certain competitors of the Company.

As a part of the transaction, Mr. Tarrant was elected to the board of directors of Allscripts Healthcare and, so long as the Company continues to own at least 25% of the shares of common stock of Allscripts Healthcare acquired by the Company in the merger, the Company will have the right to elect one member to the board of directors. Mr. Tarrant does not serve as a member of the compensation committee of Allscripts Healthcare.

Stock Redemption Agreement. Mr. Tarrant and Mr. Hoehl (together with the trustees of the trust referenced below, the “Founding Stockholders”) and the Company entered into a Redemption Agreement, as amended, to provide for the orderly control and management of the Company and to provide a source of funds for disabled Founding Stockholders and the estates of deceased Founding Stockholders. The agreement provides that neither Founding Stockholder may transfer his shares of common stock during the period commencing on April 1, 1993 and ending on the date both Founding Stockholders are deceased or incompetent, without the consent of the other Founding Stockholder.

Each of Mr. Tarrant and Mr. Hoehl agreed that, in the event of his death or incompetency while the other is living and competent, the guardian or executor of such person shall enter into a voting trust agreement that gives the other Founding Stockholder the right to vote the shares of common stock of the deceased or incompetent Founding Stockholder. In the event that any shares of common stock are transferred to any of the Company or a Founding Stockholder, or an affiliate of the Company or a Founding Stockholder, pursuant to the terms of the voting trust agreement or otherwise (other than in a registered public offering), such transferee will take such shares of common stock subject to the voting trust agreement, and as a condition precedent to the transfer, must agree in writing to be bound by the terms of the voting trust agreement.

Report of the Compensation Committee

Executive Compensation Philosophy. The Company’s executive compensation program is designed to align executive compensation with financial performance, business strategies and Company values and objectives. This program seeks to enhance the profitability of the Company, and thereby enhance stockholder value, by linking the financial interests of the Company’s executives with those of its stockholders. Under the guidance of the Compensation Committee of the Board, the Company has developed and implemented an executive compensation program to achieve these objectives while providing executives with compensation opportunities that are competitive with companies of comparable size in related industries. The program is more heavily oriented to bonus than other comparable companies. It is the Company’s philosophy to pay less-than-market base salary and greater-than-market incentives.

18

In applying this philosophy, the Compensation Committee has established a program to (1) attract and retain executives of outstanding abilities who are critical to the long-term success of the Company, and (2) reward executives for attainment of business objectives and enhancement of stockholder value by providing equity ownership in the Company. Through these objectives, the Company integrates its compensation programs with its annual and long-term strategic initiatives.

Executive Compensation Program. The Compensation Committee, which is comprised solely of two outside Directors and the former CEO, approves the executive compensation program on an annual basis, including specific levels of compensation for all executive officers. The current members of the Compensation Committee are Dr. Altman (Chairman), Mr. Tarrant and Mr. Hunter. Mr. Lash served as a member of the Compensation Committee and its subcommittee until his resignation as a Director on February 13, 2002, and Mr. Hunter was appointed to fill this vacancy on March 4, 2002. The Company’s executive compensation program has been designed to implement the objectives described above and is comprised of the following fundamental elements:

| | • | | a base salary that is determined by individual contributions and sustained performance within an established competitive salary range, and |

| | • | | an incentive program that rewards executives for meeting specific business objectives. |

Each of these elements of compensation is discussed below.

Salary. Salary levels for the Company’s executive officers are determined based primarily on industry comparative studies performed by a nationally recognized executive compensation consulting firm. Salaries for executive officers are reviewed by the Compensation Committee on an annual basis. The Compensation Committee believes its current executive compensation, including salary and incentive compensation, to be at industry standards.

Long-Term Incentive Compensation. The Company’s long-term incentive compensation program is primarily implemented through the grant of stock options. This program is intended to align executive interests with long-term interests of stockholders by linking executive compensation with stockholder enhancement. In addition, the program motivates executives to improve long-term stock market performance by allowing them to develop and maintain a long-term equity ownership position in the Company’s common stock. Stock options are granted at prevailing market prices and will only have value if the Company’s stock price increases in the future. Options vest according to various schedules over periods of time ranging from less than one year to eight years from date of grant. Vesting of certain options may accelerate upon the Company’s achievement of certain financial goals. Further, executives generally must be employed by the Company at the time of vesting in order to exercise the options. The Compensation Committee, through a subcommittee composed solely of nonemployee Directors, authorizes the number of shares to be issued pursuant to option grants made to the Company’s executive officers. Stock options are awarded by the Compensation Committee based on individual achievements and a formula related to the cash compensation of executives.

Chief Executive Officer Compensation. The Compensation Committee evaluates the performance of the Chief Executive Officer on an annual basis and reports its assessment to the outside members of the Board. The Compensation Committee’s assessment of the Chief Executive Officer is based on a number of factors, including the following:

| | • | | achievement of short- and long-term financial and strategic targets and objectives, considering factors such as sales and earnings per share; |

19

| | • | | the Company’s position within the industry in which it competes; |

| | • | | overall economic climate; |

| | • | | individual contribution to the Company; and |

| | • | | such other factors as the Compensation Committee may deem appropriate. |

The salary of the Chief Executive Officer is reviewed by the Compensation Committee on an annual basis and, in determining any salary adjustment, the Compensation Committee considers the above factors. Based upon a review of such factors, the 2002 salary for Mr. Tarrant, who served as the Company’s Chief Executive Officer during the year ended December 31, 2002, was $355,000. This is lower than comparable salary levels at other companies within the industry per Mr. Tarrant’s request.

Compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), generally disallows a tax deduction to public companies for certain compensation in excess of $1 million paid to the company’s Chief Executive Officer and the four other most highly compensated executive officers. Certain compensation, including qualified performance-based compensation, will not be subject to the deduction limit if certain requirements are met. In general, the Company structures and administers its stock option plans in a manner intended to comply with the performance-based exception to Section 162(m). Nevertheless, there can be no assurance that compensation attributable to awards granted under the Company’s stock option plans will be treated as qualified performance-based compensation under Section 162(m). In addition, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that may be subject to the limit when the Compensation Committee believes such payments are appropriate and in the best interests of the Company and its stockholders, after taking into consideration changing business conditions and the performance of its employees.

By the Compensation Committee of the Board of Directors of IDX Systems Corporation

Stuart H. Altman, Ph.D.

Richard E. Tarrant

David P. Hunter*

* appointed to the Compensation Committee on March 4, 2002

20

Stock Performance Graph

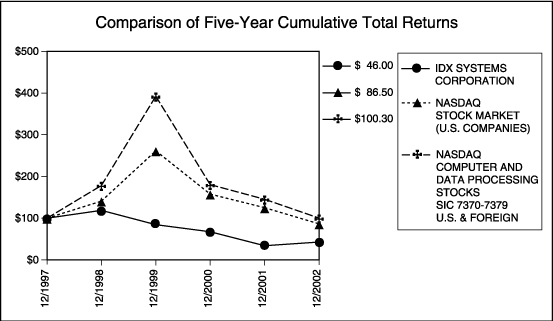

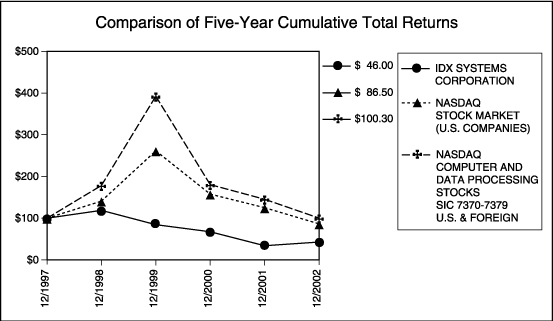

The Company’s common stock has been listed for trading on the Nasdaq National Market under the symbol “IDXC” since November 17, 1995. The comparative stock performance graph below compares the cumulative stockholder return on common stock of the Company for the last five fiscal years with cumulative total return on

(1) the Nasdaq Total U.S. Index, and

(2) the Nasdaq Computer & Data Processing Index.

The graph assumes an investment of $100 in each of the Company’s common stock, the Nasdaq Total U.S. Index and the Nasdaq Computer & Data Processing Index, and reinvestment of all dividends. Measurement points are the last trading day of the years ended December 31, 1997, December 31, 1998, December 31, 1999, December 31, 2000, December 31, 2001 and December 31, 2002.

IDX Systems Corporation Comparative Performance Graph

| | | 12/31/1997

| | 12/31/1998

| | 12/31/1999

| | 12/31/2000

| | 12/31/2001

| | 12/31/2002

|

IDX Systems Corporation | | $ | 100.00 | | $ | 118.9 | | $ | 84.5 | | $ | 67.6 | | $ | 35.2 | | $ | 46.0 |

Nasdaq Total U.S. Index | | $ | 100.00 | | $ | 141.0 | | $ | 261.5 | | $ | 157.8 | | $ | 125.2 | | $ | 86.5 |

Nasdaq Computer & Data Processing Index | | $ | 100.00 | | $ | 178.4 | | $ | 392.4 | | $ | 180.6 | | $ | 145.4 | | $ | 100.3 |

21

Report of the Audit Committee of the Board of Directors

The Audit Committee of the Board of Directors of the Company is currently composed of three members and acts under a written charter first adopted and approved in June 2000, as amended in June 2001. Mr. Lash served as Chairman of the Audit Committee until his resignation as a Director on February 13, 2002, and Mr. Hunter was appointed to fill this vacancy on March 4, 2002. Mr. Martin served as Chairman from March 4, 2002 to September 9, 2002, when he resigned from the committee and was replaced by Mr. Asmundson. The current members of the Audit Committee are Dr. Altman, Mr. Asmundson (Chairman) and Mr. Hunter. The current members of the Audit Committee are independent directors, as defined by the rules of the Nasdaq Stock Market. The Board intends to maintain compliance with the rules of the Nasdaq Stock Market regarding audit committee membership requirements.

The Audit Committee reviewed the Company’s audited financial statements for the year ended December 31, 2002 and discussed these financial statements with the Company’s management. The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards 61 (Communication with Audit Committees) with Ernst & Young LLP, the Company’s independent auditors. SAS 61 requires the Company’s independent auditors to discuss with the Company’s Audit Committee, among other things, the following:

| | • | | methods to account for significant unusual transactions; |

| | • | | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| | • | | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| | • | | disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. |

The Company’s independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). In addition, the Audit Committee discussed with the independent auditors the matters disclosed in this letter and their independence from the Company. The Audit Committee also considered whether the independent auditors’ provision of the other, non-audit related services to the Company, which are referred to in the section entitled “Independent Auditors Fees and Other Matters”, is compatible with maintaining such auditors’ independence.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company’s board of directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002.

By the Audit Committee of the Board of Directors of IDX Systems Corporation

Allen Martin, Esq.*

Stuart H. Altman, Ph.D.

William L. Asmundson**

David P. Hunter

| * | | resigned from the Audit Committee on September 9, 2002 |

| ** | | appointed to the Audit Committee on September 9, 2002 |

22

Independent Auditors Fees and Other Matters

Audit Fees

Ernst & Young LLP billed the Company an aggregate of $381,500 in fees for professional services rendered in connection with the audit of our financial statements for the most recent fiscal year and the reviews of the financial statements included in each of the Company’s Quarterly Reports on Forms 10-Q during the year ended December 31, 2002.

Financial Information Systems Design and Implementation Fees

Ernst & Young LLP did not bill the Company any amount for professional services to the Company and its affiliates for the year ended December 31, 2002 in connection with the design and implementation of financial information systems/the operation of information systems/the management of local area networks.

All Other Fees

Ernst & Young LLP billed the Company an aggregate of $15,100 in fees for other services rendered to the Company and its affiliates for the year ended December 31, 2002.

Section 16 Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors, executive officers and holders of more than 10% of the Company’s common stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Based solely on its review of copies of Section 16(a) reports filed by the reporting persons or written representations from reporting persons that no Form 5 filing was required for such person, the Company believes that all filings required to be made by reporting persons of the Company during the year ended December 31, 2002, were timely made in accordance with the requirements of the Exchange Act.

Certain Relationships and Related Transactions

Real Estate Transactions