Exhibit 99.1

Lima, Peru, February 5, 2020 – Credicorp (NYSE: BAP) announced its unaudited results for the fourth quarter of 2019. These results are consolidated according to IFRS in Soles.

Fourth Quarter and year-to-date 2019 results

In 4Q19, Credicorp registered net income of S/ 972.8 million, which translated into an ROAE and ROAA of 14.9% and 2.1% respectively. This result reflected a drop of -11% QoQ. The net income of Credicorp in 2019 was S/ 4,265 million, which represented an increase of +7.1%.

QoQ growth was attributable to an increase in net interest income (NII), which was driven by loan growth in local currency, primarily in Retail Banking. The aforementioned was offset by growth in the expense for provisions, mainly at BCP Stand-alone, and to an increase in operating expenses.

Higher net income in 2019 was due primarily to an increase in net interest income (NII) and to expansion in Non-financial income and in the net gain on securities in particular. This was, however, offset by growth in higher expenses for provisions for loan losses, the increase in operating expenses and an increase in tax provisions for withholding, which were set aside for taxes for dividend distribution for fiscal year 2019.

The results in 4Q19 and of the full year 2019 shows:

QoQ expansion in average daily loan balances in all segments, which was primarily attributable to loan growth in Retail Banking. The FY analysis, which eliminates seasonal effects, reveals that total loans measured in average daily balances grew 6.6%. This growth was led by Retail Banking and the Mortgage, Consumer, Credit Card and SME-Pyme segments in particular. Additionally, portfolio growth was driven mainly by local currency.

• NII expanded +3.4% QoQ and 6.9% FY. This was driven by an increase in average daily balances, which was mainly attributable to growth in higher-margin segments at BCP Stand-alone and in local currency. In this context, Retail Banking’s share of total loans. Interest expenses fell -3.3% QoQ and increased 8.9% FY after expenses for deposits rose due to the effect of the time deposit mix and the currency mix. Accordingly, the Net Interest Margin (NIM) was 5.46% in the 4Q19 and 5.39% in FY 2019, which represents an increase of +6 bps QoQ and +11 bps FY.

• Provisions for loan losses net recovered posted growth of 1.8%% QoQ and 20.5% FY. In this context, the cost of risk (CofR) for 4Q19 maintained steady QoQ at 1.77%. On the other hand, the CofR for FY 2019 was 1.60%, which represents a deterioration of +22 bps. This was primarily driven by an increase in the CofR at BCP Stand-alone after provisions were increased for the Retail Banking portfolio.

• In this context, the risk-adjusted NIM was 4.27% in the 4Q19 and 4.29% in the FY 2019. This represent an increase of +6 bps QoQ and a decrease of -4 pbs in the FY, which went hand-in-hand with an increase in the CofR.

• Non-financial increase fell slightly QoQ (-0.1%) after the net gain on securities (which posted an extraordinarily high level in 3Q19) and other non-financial income fell. This was attenuated by growth in net fee income in the banking business and at Credicorp Capital and to growth in the net gain on exchange differences. FY, non-financial income increased +11.1%, which was attributable to growth in the net gain on securities; net fee income; and other non-financial income.

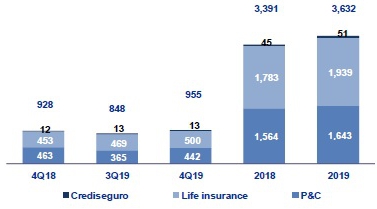

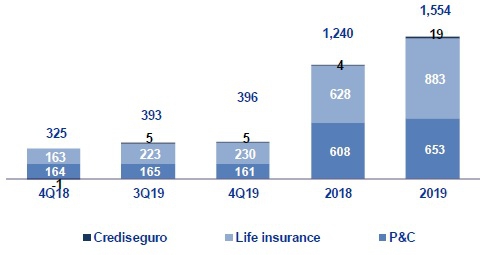

• The insurance underwriting result increased +15.5% QoQ and +5.9% FY, which was driven mainly by growth in net earned premiums in the life insurance and P & C businesses.

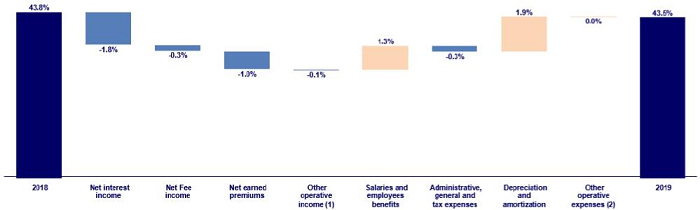

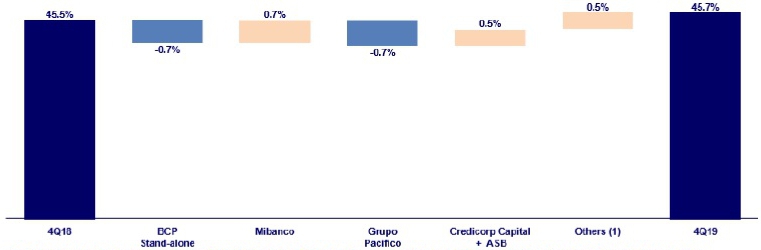

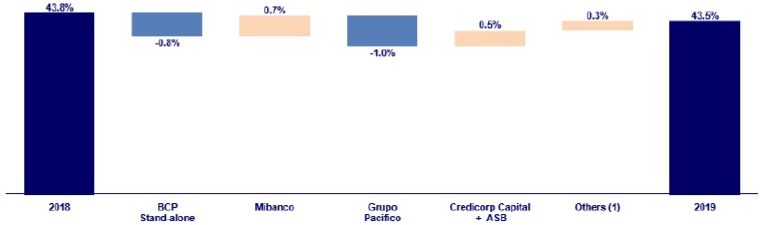

• The efficiency ratio increased +250 bps QoQ, which reflected a seasonal increase in operating expenses given that in the second half of every year, expenses register an uptick. Nonetheless, in the FY 2019, the efficiency ratio fell -30 bps FY. This was attributable to growth in net interest income (NII), which offset the increase in salaries and employee benefits.

Table of Contents

| Credicorp (NYSE: BAP): Fourth Quarter Results 2019 | 3 |

| Financial Overview | 3 |

| Credicorp and subsidiaries | 4 |

| 1. Interest-earning assets (IEA) | 5 |

| 1.1. Evolution of IEA | 5 |

| 1.2. Credicorp Loans | 6 |

| 1.2.1. Loan evolution by business segment | 6 |

| 1.2.2. Evolution of the level of dollarization by segment | 9 |

| 1.2.3. BCRP de-dollarization plan at BCP Stand-alone | 10 |

| 1.2.4. Market share in loans | 11 |

| 2. Funding Sources | 12 |

| 2.1. Funding Structure | 12 |

| 2.2. Deposits | 13 |

| 2.2.1. Deposits: dollarization level | 14 |

| 2.2.2. Market share in Deposits | 15 |

| 2.3. Other funding sources | 15 |

| 2.4. Loan / Deposit (L/D) | 16 |

| 2.5. Funding Cost | 17 |

| 3. Portfolio quality and Provisions for loan losses | 20 |

| 3.1. Provisions for loan losses | 20 |

| 3.2. Portfolio Quality: Delinquency ratios | 21 |

| 3.2.1. Delinquency indicators by business line | 22 |

| 4. Net Interest Income (NII) | 27 |

| 4.1. Interest Income | 27 |

| 4.2. Interest Expenses | 28 |

| 4.3. Net Interest Margin (NIM) and Risk-Adjusted NIM | 29 |

| 5. Non-Financial Income | 32 |

| 5.1. Fee Income | 33 |

| 5.1.1. By subsidiary | 33 |

| 5.1.2. Fee income in the Banking Business | 35 |

| 6. Insurance Underwriting Result | 37 |

| 6.1. Net earned premiums | 37 |

| 6.2. Net claims | 38 |

| 6.3. Acquisition Cost | 39 |

| 6.4. Total Underwriting result | 40 |

| 7. Operating Expenses and Efficiency | 41 |

| 7.1. Credicorp’s Administrative, General and Tax Expenses | 43 |

| 7.2. Efficiency Ratio | 44 |

| 8. Regulatory Capital | 46 |

| 8.1. Regulatory Capital – BAP | 46 |

| 8.2. Regulatory Capital – BCP Stand-alone based on Peru GAAP | 47 |

| 9. Distribution channels | 49 |

| 9.1. Universal Banking | 49 |

| 9.1.1. Points of contact by geographic area – BCP Stand-alone | 49 |

| 9.1.2. Transactions per channel – BCP Stand-alone | 50 |

| 9.1.3. Points of Contact – BCP Bolivia | 51 |

| 9.2. Microfinance | 51 |

| 9.2.1. Points of Contact – Mibanco | 51 |

| 10. Economic Perspectives | 52 |

| 10.1. Peru Economic Forecasts | 52 |

| 10.2. Main Economic Variables | 52 |

| 11. Appendix | 56 |

| 11.1. Credicorp | 56 |

| 11.2. BCP Consolidated | 58 |

| 11.3. Mibanco | 61 |

| 11.4. BCP Bolivia | 62 |

| 11.5. Credicorp Capital | 63 |

| 11.6. Atlantic Security Bank | 64 |

| 11.7. Grupo Pacifico | 66 |

| 11.8. Prima AFP | 68 |

| 11.9. Table of calculations | 69 |

Credicorp (NYSE: BAP): Fourth Quarter Results 2019

Financial Overview

| Credicorp Ltd. | Quarter | % change | Year | % change | ||||||||||||||||||||||||||||

| S/ 000 | 4Q18 | 3Q19 | 4Q19 | QoQ | YoY | 2018 | 2019 | 2019 / 2018 | ||||||||||||||||||||||||

| Net interest income | 2,244,252 | 2,277,384 | 2,354,122 | 3.4 | % | 4.9 | % | 8,489,104 | 9,077,181 | 6.9 | % | |||||||||||||||||||||

| Provision for credit losses on loan portfolio, net of recoveries | (407,954 | ) | (502,772 | ) | (511,660 | ) | 1.8 | % | 25.4 | % | (1,531,708 | ) | (1,845,937 | ) | 20.5 | % | ||||||||||||||||

| Risk-adjusted net interest income | 1,836,298 | 1,774,612 | 1,842,462 | 3.8 | % | 0.3 | % | 6,957,396 | 7,231,244 | 3.9 | % | |||||||||||||||||||||

| Non-financial income(1) | 1,153,234 | 1,270,586 | 1,269,497 | -0.1 | % | 10.1 | % | 4,410,808 | 4,902,039 | 11.1 | % | |||||||||||||||||||||

| Insurance underwriting result(1) | 121,154 | 125,775 | 145,213 | 15.5 | % | 19.9 | % | 471,418 | 499,024 | 5.9 | % | |||||||||||||||||||||

| Total expenses(1) | (1,749,181 | ) | (1,651,622 | ) | (1,885,784 | ) | 14.2 | % | 7.8 | % | (6,247,409 | ) | (6,658,591 | ) | 6.6 | % | ||||||||||||||||

| Profit before income tax | 1,361,505 | 1,519,351 | 1,371,388 | -9.7 | % | 0.7 | % | 5,592,213 | 5,973,716 | 6.8 | % | |||||||||||||||||||||

| Income taxes | (384,352 | ) | (403,771 | ) | (378,431 | ) | -6.3 | % | -1.5 | % | (1,520,909 | ) | (1,621,385 | ) | 6.6 | % | ||||||||||||||||

| Net profit | 977,153 | 1,115,580 | 992,957 | -11.0 | % | 1.6 | % | 4,071,304 | 4,352,331 | 6.9 | % | |||||||||||||||||||||

| Non-controlling interest | 20,220 | 22,545 | 20,127 | -10.7 | % | -0.5 | % | 87,439 | 87,027 | -0.5 | % | |||||||||||||||||||||

| Net profit attributable to Credicorp | 956,933 | 1,093,035 | 972,830 | -11.0 | % | 1.7 | % | 3,983,865 | 4,265,304 | 7.1 | % | |||||||||||||||||||||

| Net income / share (S/) | 12.00 | 13.70 | 12.20 | -11.0 | % | 1.7 | % | 49.95 | 53.48 | 7.1 | % | |||||||||||||||||||||

| Loans | 110,759,390 | 112,209,990 | 115,609,679 | 3.0 | % | 4.4 | % | 110,759,390 | 115,609,679 | 4.4 | % | |||||||||||||||||||||

| Deposits and obligations(1) | 104,551,311 | 107,391,720 | 112,005,385 | 4.3 | % | 7.1 | % | 104,551,311 | 112,005,385 | 7.1 | % | |||||||||||||||||||||

| Net equity | 23,839,243 | 26,000,638 | 26,237,960 | 0.9 | % | 10.1 | % | 23,839,243 | 26,237,960 | 10.1 | % | |||||||||||||||||||||

| Profitability | ||||||||||||||||||||||||||||||||

| Net interest margin(1)(2) | 5.64 | % | 5.40 | % | 5.46 | % | 6 bps | -18 bps | 5.28 | % | 5.39 | % | 11 bps | |||||||||||||||||||

| Risk-adjusted Net interest margin(1)(2) | 4.62 | % | 4.21 | % | 4.27 | % | 6 bps | -35 bps | 4.33 | % | 4.29 | % | -4 bps | |||||||||||||||||||

| Funding cost(1)(2) | 2.39 | % | 2.46 | % | 2.33 | % | -13 bps | -6 bps | 2.25 | % | 2.37 | % | 12 bps | |||||||||||||||||||

| ROAE(2) | 16.3 | % | 17.1 | % | 14.9 | % | -220 bps | -140 bps | 17.5 | % | 17.0 | % | -50 bps | |||||||||||||||||||

| ROAA(2) | 2.2 | % | 2.4 | % | 2.1 | % | -30 bps | -10 bps | 2.3 | % | 2.3 | % | 0 bps | |||||||||||||||||||

| Loan portfolio quality | ||||||||||||||||||||||||||||||||

| IOL ratio(3) | 2.81 | % | 2.98 | % | 2.85 | % | -13 bps | 4 bps | 2.81 | % | 2.85 | % | 4 bps | |||||||||||||||||||

| IOL over 90 days ratio | 2.13 | % | 2.26 | % | 2.15 | % | -11 bps | 2 bps | 2.13 | % | 2.15 | % | 2 bps | |||||||||||||||||||

| NPL ratio(4) | 3.97 | % | 4.07 | % | 3.88 | % | -19 bps | -9 bps | 3.97 | % | 3.88 | % | -9 bps | |||||||||||||||||||

| Cost of risk(2)(5) | 1.47 | % | 1.79 | % | 1.77 | % | -2 bps | 30 bps | 1.38 | % | 1.60 | % | 22 bps | |||||||||||||||||||

| Coverage ratio of IOLs | 158.9 | % | 148.8 | % | 153.7 | % | 490 bps | -520 bps | 158.9 | % | 153.7 | % | -520 bps | |||||||||||||||||||

| Coverage ratio of IOL 90-days | 210.4 | % | 196.0 | % | 204.5 | % | 850 bps | -590 bps | 210.4 | % | 204.5 | % | -590 bps | |||||||||||||||||||

| Coverage ratio of NPLs | 112.7 | % | 108.9 | % | 113.2 | % | 430 bps | 50 bps | 112.7 | % | 113.2 | % | 50 bps | |||||||||||||||||||

| Operating efficiency | ||||||||||||||||||||||||||||||||

| Efficiency ratio(1)(6) | 45.5 | % | 43.2 | % | 45.7 | % | 250 bps | 20 bps | 43.8 | % | 43.5 | % | -30 bps | |||||||||||||||||||

| Operating expenses / Total average assets(7) | 4.04 | % | 3.68 | % | 3.97 | % | 29 bps | -7 bps | 4.89 | % | 4.95 | % | 6 bps | |||||||||||||||||||

| Insurance ratios | ||||||||||||||||||||||||||||||||

| Combined ratio of P&C(1)(8)(9) | 100.2 | % | 97.9 | % | 94.1 | % | -380 bps | -610 bps | 100.3 | % | 98.4 | % | -190 bps | |||||||||||||||||||

| Loss ratio(9)(10) | 60.6 | % | 63.8 | % | 62.7 | % | -110 bps | 210 bps | 59.0 | % | 64.0 | % | 500 bps | |||||||||||||||||||

| Underwriting result / net earned premiums(9) | 7.5 | % | 7.2 | % | 8.9 | % | 170 bps | 140 bps | 8.1 | % | 7.1 | % | -100 bps | |||||||||||||||||||

| Capital adequacy(11) | ||||||||||||||||||||||||||||||||

| BIS ratio(12) | 14.16 | % | 15.45 | % | 14.47 | % | -98 bps | 31 bps | 14.16 | % | 14.47 | % | 31 bps | |||||||||||||||||||

| Tier 1 ratio(13) | 10.28 | % | 11.79 | % | 11.07 | % | -72 bps | 79 bps | 10.28 | % | 11.07 | % | 79 bps | |||||||||||||||||||

| Common equity tier 1 ratio(14) | 11.55 | % | 11.95 | % | 12.35 | % | 40 bps | 80 bps | 11.55 | % | 12.35 | % | 80 bps | |||||||||||||||||||

| Employees(1) | 34,024 | 35,174 | 35,846 | 1.9 | % | 5.4 | % | 34,024 | 35,846 | 5.4 | % | |||||||||||||||||||||

| Share Information | ||||||||||||||||||||||||||||||||

| Outstanding Shares | 94,382 | 94,382 | 94,382 | 0.0 | % | 0.0 | % | 94,382 | 94,382 | 0.0 | % | |||||||||||||||||||||

| Treasury Shares(15) | 14,621 | 14,621 | 14,621 | 0.0 | % | 0.0 | % | 14,621 | 14,621 | 0.0 | % | |||||||||||||||||||||

| Floating Shares | 79,761 | 79,761 | 79,761 | 0.0 | % | 0.0 | % | 79,761 | 79,761 | 0.0 | % | |||||||||||||||||||||

(1) Figures differ from previously reported, please consider the data presented on this report.

(2) Annualized.

(3) Internal overdue loans: includes overdue loans and loans under legal collection, according to our internal policy for overdue loans. Internal Overdue ratio: Internal overdue loans / Total loans.

(4) Non-performing loans (NPL): Internal overdue loans + Refinanced loans. NPL ratio: NPL / Total loans.

(5) Cost of risk: Annualized Provision for credit losses on loan portfolio, net of recoveries / Total loans.

(6) Efficiency ratio = (Salaries and employee benefits + Administrative expenses + Depreciation and amortization + Association in participation + Acquisition cost) / (Net interest income + Fee Income + Net gain on foreign exchange transactions + Net Gain From associates + Net gain on derivatives held for trading + Result on exchange differences + Net Premiums Earned).

(7) Operating expenses / Average of Total Assets. Average is calculated with period-beginning and period-ending balances.

(8) Combined ratio = (Net claims / Net earned premiums) + [(Acquisition cost + Operating expenses) / Net earned premiums]. Does not include Life insurance business.

(9) Considers Grupo Pacifico’s figures before eliminations for consolidation to Credicorp.

(10) Net claims / Net earned premiums.

(11) All Capital ratios are for BCP Stand-alone and based on Peru GAAP.

(12) Regulatory Capital / Risk-weighted assets (legal minimum = 10% since July 2011).

(13) Tier 1 = Capital + Legal and other capital reserves + Accumulated earnings with capitalization agreement + (0.5 x Unrealized profit and net income in subsidiaries) - Goodwill - (0.5 x Investment in subsidiaries) + Perpetual subordinated debt (maximum amount that can be included is 17.65% of Capital + Reserves + Accumulated earnings with capitalization agreement + Unrealized profit and net income in subsidiaries - Goodwill).

(14) Common Equity Tier I = Capital + Reserves – 100% of applicable deductions (investment in subsidiaries, goodwill, intangibles and net deferred taxes that rely on future profitability) + retained earnings + unrealized gains.

Adjusted Risk-Weighted Assets = Risk-weighted assets - (RWA Intangible assets, excluding goodwill, + RWA Deferred tax assets generated as a result of temporary differences in income tax, in excess of 10% of CET1, + RWA Deferred tax assets generated as a result of past losses).

(15) These shares are held by Atlantic Security Holding Corporation (ASHC).

3

Credicorp and subsidiaries

| Earnings contribution * | Quarter | % change | Year | % change | ||||||||||||||||||||||||||||

| S/ 000 | 4Q18 | 3Q19 | 4Q19 | QoQ | YoY | 2018 | 2019 | 2019 / 2018 | ||||||||||||||||||||||||

| Universal Banking | ||||||||||||||||||||||||||||||||

| BCP Stand-alone | 694,560 | 831,423 | 725,464 | -12.7 | % | 4.4 | % | 2,858,164 | 3,163,236 | 10.7 | % | |||||||||||||||||||||

| BCP Bolivia | 22,876 | 25,575 | 13,487 | -47.3 | % | -41.0 | % | 78,260 | 78,508 | 0.3 | % | |||||||||||||||||||||

| Microfinance | ||||||||||||||||||||||||||||||||

| Mibanco(1) | 99,778 | 95,137 | 100,034 | 5.1 | % | 0.3 | % | 445,169 | 391,688 | -12.0 | % | |||||||||||||||||||||

| Bancompartir S.A | - | - | (1,630 | ) | 0.0 | % | 0.0 | % | - | (1,630 | ) | 0.0 | % | |||||||||||||||||||

| Encumbra | 1,952 | 852 | 1,323 | 55.3 | % | -32.2 | % | 5,123 | 5,263 | 2.7 | % | |||||||||||||||||||||

| Insurance and Pensions | ||||||||||||||||||||||||||||||||

| Grupo Pacifico(2) | 105,492 | 88,949 | 113,760 | 27.9 | % | 7.8 | % | 349,130 | 376,999 | 8.0 | % | |||||||||||||||||||||

| Prima AFP | 30,471 | 42,394 | 46,829 | 10.5 | % | 53.7 | % | 139,586 | 196,590 | 40.8 | % | |||||||||||||||||||||

| Investment Banking and Wealth Management | ||||||||||||||||||||||||||||||||

| Credicorp Capital | (15,712 | ) | 13,010 | 4,631 | -64.4 | % | -129.5 | % | 34,261 | 43,883 | 28.1 | % | ||||||||||||||||||||

| Atlantic Security Bank | 17,071 | 43,376 | 42,824 | -1.3 | % | 150.9 | % | 111,965 | 186,540 | 66.6 | % | |||||||||||||||||||||

| Others(3) | 445 | (47,681 | ) | (73,892 | ) | 55.0 | % | -16704.9 | % | (37,793 | ) | (175,773 | ) | 365.1 | % | |||||||||||||||||

| Net income attributed to Credicorp | 956,933 | 1,093,035 | 972,830 | -11.0 | % | 1.7 | % | 3,983,865 | 4,265,304 | 7.1 | % | |||||||||||||||||||||

*Contributions to Credicorp reflect the eliminations for consolidation purposes (e.g. eliminations for transactions among Credicorp’s subsidiaries or between Credicorp and its subsidiaries).

(1) The figure is lower than the net income of Mibanco because Credicorp owns 99.921% of Mibanco (directly and indirectly).

(2) The contribution is higher than Grupo Pacifico’s net income because Credicorp owns 65.20% directly, and 33.59% through Grupo Credito.

(3) Includes Grupo Credito excluding Prima (Servicorp and Emisiones BCP Latam), others of Atlantic Security Holding Corporation and others of Credicorp Ltd.

| Quarter | Year | |||||||||||||||||||

| ROAE | 4Q18 | 3Q19 | 4Q19 | 2018 | 2019 | |||||||||||||||

| Universal Banking | ||||||||||||||||||||

| BCP Stand-alone | 19.4 | % | 21.7 | % | 18.2 | % | 20.3 | % | 20.4 | % | ||||||||||

| BCP Bolivia | 13.5 | % | 14.4 | % | 7.3 | % | 11.8 | % | 11.0 | % | ||||||||||

| Microfinance | ||||||||||||||||||||

| Mibanco(1) | 21.4 | % | 18.7 | % | 19.4 | % | 25.9 | % | 20.1 | % | ||||||||||

| Bancompartir | 0.0 | % | 0.0 | % | -16.0 | % | 0.0 | % | -16.0 | % | ||||||||||

| Encumbra | 13.3 | % | 5.8 | % | 8.9 | % | 9.1 | % | 8.9 | % | ||||||||||

| Insurance and Pensions | ||||||||||||||||||||

| Grupo Pacifico(2) | 16.3 | % | 11.0 | % | 14.7 | % | 12.9 | % | 14.0 | % | ||||||||||

| Prima | 19.4 | % | 26.0 | % | 27.3 | % | 22.3 | % | 29.5 | % | ||||||||||

| Investment Banking and Wealth Management | ||||||||||||||||||||

| Credicorp Capital | -8.8 | % | 9.3 | % | 3.1 | % | 4.6 | % | 6.5 | % | ||||||||||

| Atlantic Security Bank | 8.7 | % | 20.3 | % | 22.2 | % | 13.5 | % | 26.1 | % | ||||||||||

| Credicorp | 16.3 | % | 17.1 | % | 14.9 | % | 17.5 | % | 17.0 | % | ||||||||||

(1) ROAE including goodwill of BCP from the acquisition of Edyficar (Approximately US$ 50.7 million) was 19.9% in 4Q18, 17.5% in 3Q19 and 18.2% in 4Q19. On an annual basis it was 24.0% for 2018 and 18.8% for 2019.

(2) Figures include unrealized gains or losses that are considered in Pacifico’s Net Equity from the investment portfolio of Pacifico Vida. ROAE excluding such unrealized gains was 19.3% in 4Q18, 16.3% in 3Q19 and 19.9% in 4Q19. On an annual basis it was 16.1% for 2018 and 16.5% for 2019.

4

1. Interest-earning assets (IEA)

At the end of December 2019, IEAs posted growth of +1.7% QoQ, which was primarily attributable to an increase in loan balances. In the YoY evolution, which eliminates seasonal effects on loans, IEAs registered growth of +6.7%. This growth was mainly due to expansion relative to loans and available funds. Loans, which are the group’s most profitable asset, posted growth of +2.7% QoQ and +6.0% YoY in average daily balances. Expansion in this case was mainly attributable to the evolution of the loan portfolios at BCP Stand-alone subsidiary, where growth was driven primarily by an increase in the average daily balances of the Retail Banking portfolio, and, to a lesser degree, by an increase in average daily balances in the Wholesale Banking portfolio.

| Interest earning assets | As of | % change | ||||||||||||||||||

| S/ 000 | Dec 18 | Sep 19 | Dec 19 | QoQ | YoY | |||||||||||||||

| Cash and due from banks | 14,478,739 | 20,004,002 | 19,670,279 | -1.7 | % | 35.9 | % | |||||||||||||

| Interbank funds | 253,970 | 254,175 | 111,575 | -56.1 | % | -56.1 | % | |||||||||||||

| Total investments | 32,863,118 | 33,956,227 | 33,547,444 | -1.2 | % | 2.1 | % | |||||||||||||

| Cash collateral, reverse repurchase agreements and securities borrowing | 4,082,942 | 3,903,051 | 4,288,524 | 9.9 | % | 5.0 | % | |||||||||||||

| Financial assets designated at fair value through profit or loss | 521,185 | 617,387 | 620,544 | 0.5 | % | 19.1 | % | |||||||||||||

| Total loans(1) | 110,759,390 | 112,209,990 | 115,609,679 | 3.0 | % | 4.4 | % | |||||||||||||

| Total interest earning assets | 162,959,344 | 170,944,832 | 173,848,045 | 1.7 | % | 6.7 | % | |||||||||||||

| (1) Quarter-end balances. | ||||||||||||||||||||

| Total Investments | As of | % change | ||||||||||||||||||

| S/ 000 | Dec 18 | Sep 19 | Dec 19 | QoQ | YoY | |||||||||||||||

| Fair value through profit or loss investments | 3,512,445 | 3,808,137 | 3,864,531 | 1.5 | % | 10.0 | % | |||||||||||||

| Fair value through other comprehensive income investments | 25,195,835 | 26,794,192 | 26,205,867 | -2.2 | % | 4.0 | % | |||||||||||||

| Amortized cost investments | 4,154,838 | 3,353,898 | 3,477,046 | 3.7 | % | -16.3 | % | |||||||||||||

| Total investments | 32,863,118 | 33,956,227 | 33,547,444 | -1.2 | % | 2.1 | % | |||||||||||||

1.1. Evolution of IEA

Total loans

Total loans measured in quarter-end balances grew +3.0% QoQ, which was primarily attributable to growth in the loan portfolio at BCP Stand-alone and at Mibanco:

| (i) | At BCP stand-alone, Retail Banking posted the highest growth. This expansion was driven by all segments and by Mortgage and SME-Pyme in particular. The growth posted in Wholesale Banking was primarily attributable to the expansion seen in the Corporate segment. |

| (ii) | At Mibanco, growth in quarter-end balances QoQ was generated primarily by the Corporate and Mortgage segments, followed by the Consumer segment. |

YoY loans increased +4.4%, which was driven by growth in the majority of segments. Expansion was attributable, in order of contribution to growth, by:

| (i) | Growth in Retail Banking, which was led by the evolution of the Mortgage and Consumer segments. |

| (ii) | Loan growth at Mibanco and BCP Bolivia. |

Investments

Total investments fell -1.2% QoQ. In the YoY evolution, total investments increased +2.1% and reflected a slight recomposition where fair value through comprehensive income investments (formerly investments available for sale) and fair value through profit and loss investments posted growth in their share of total investments while investments at amortized cost registered a decrease in their share.

5

Other IEA

Available funds fell -1.7% QoQ but grew 35.8% YoY due to growth FC funds held in the BCRP and in foreign banks, which was in turn attributable growth in funding in foreign currency at BCP Stand-alone.

1.2. Credicorp Loans

1.2.1. Loan evolution by business segment

The table below shows the composition of loans by subsidiary and business segment measured in average daily balances. These balances provide the most complete picture of how loan interest, which constitutes Credicorp’s primary source of income, has evolved. Additionally, average daily balances reflect trends or variations to a different degree than quarter-end balances, which may include pre-payments or loans made at the end of the quarter. In comparative terms, these payments, affect average daily balances less than quarter-end balances and as such, the former provide a more balanced picture of loan evolution.

Average daily loan balances posted growth of +2.7% QoQ, which was mainly attributable to expansion in Corporate Banking and, to a lesser extent, in the results of Retail Banking through the Mortgage and Consumer segments. In YoY terms, growth in average daily loan balances registered favorable results, situating at +6.0%. This expansion was led by Retail Banking segments, which increased their share of total loans during this period, primarily through the Mortgage, Consumer, SME-Pyme and Credit Card segments. In terms of Wholesale Banking results, Middle Market Banking registered higher growth YoY. Growth in loan balances QoQ and YoY was reported mainly in local currency.

Loan evolution measured in average daily balances by segment(1)

| TOTAL LOANS | ||||||||||||||||||||||||||||||||

| Expressed in million S/ | % change | % Part. in total loans | ||||||||||||||||||||||||||||||

| 4Q18 | 3Q19 | 4Q19 | QoQ | YoY | 4Q18 | 3Q19 | 4Q19 | |||||||||||||||||||||||||

| BCP Stand-alone | 88,708 | 91,700 | 94,390 | 2.9 | % | 6.4 | % | 82.0 | % | 82.1 | % | 82.3 | % | |||||||||||||||||||

| Wholesale Banking | 46,476 | 46,434 | 47,446 | 2.2 | % | 2.1 | % | 43.0 | % | 41.6 | % | 41.4 | % | |||||||||||||||||||

| Corporate | 28,536 | 28,024 | 28,860 | 3.0 | % | 1.1 | % | 26.4 | % | 25.1 | % | 25.2 | % | |||||||||||||||||||

| Middle - Market | 17,939 | 18,410 | 18,586 | 1.0 | % | 3.6 | % | 16.6 | % | 16.5 | % | 16.2 | % | |||||||||||||||||||

| Retail Banking | 42,232 | 45,266 | 46,944 | 3.7 | % | 11.2 | % | 39.0 | % | 40.5 | % | 41.0 | % | |||||||||||||||||||

| SME - Business | 5,587 | 5,544 | 5,806 | 4.7 | % | 3.9 | % | 5.2 | % | 5.0 | % | 5.1 | % | |||||||||||||||||||

| SME - Pyme | 9,396 | 9,851 | 10,194 | 3.5 | % | 8.5 | % | 8.7 | % | 8.8 | % | 8.9 | % | |||||||||||||||||||

| Mortgage | 14,714 | 16,095 | 16,590 | 3.1 | % | 12.7 | % | 13.6 | % | 14.4 | % | 14.5 | % | |||||||||||||||||||

| Consumer | 7,506 | 8,239 | 8,659 | 5.1 | % | 15.4 | % | 6.9 | % | 7.4 | % | 7.6 | % | |||||||||||||||||||

| Credit Card | 5,029 | 5,538 | 5,695 | 2.8 | % | 13.3 | % | 4.6 | % | 5.0 | % | 5.0 | % | |||||||||||||||||||

| Mibanco | 9,763 | 10,068 | 10,310 | 2.4 | % | 5.6 | % | 9.0 | % | 9.0 | % | 9.0 | % | |||||||||||||||||||

| Bolivia | 7,152 | 7,431 | 7,563 | 1.8 | % | 5.7 | % | 6.6 | % | 6.7 | % | 6.6 | % | |||||||||||||||||||

| ASB | 2,547 | 2,467 | 2,363 | -4.2 | % | -7.2 | % | 2.4 | % | 2.2 | % | 2.1 | % | |||||||||||||||||||

| BAP’s total loans | 108,170 | 111,666 | 114,626 | 2.7 | % | 6.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||

| Highest growth in volumes | ||

| Largest contraction in volumes |

For consolidation purposes, loans generated in FC are converted to LC.

(1) Includes Work out unit, and other banking.

6

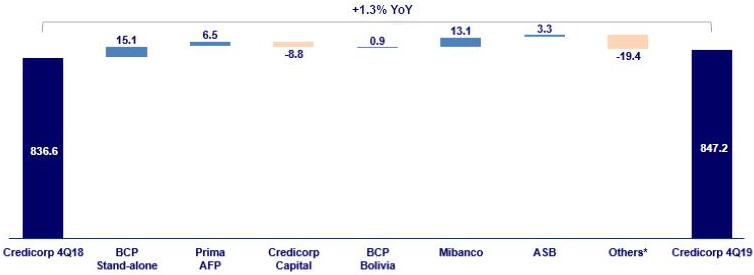

Loan Growth QoQ in Average Daily Balances

Expressed in millions of S/

+2.7% QoQ

The analysis per segment of the evolution of QoQ growth in average daily loan balances reveals:

| (i) | Portfolio growth in all segments at BCP Stand-alone and in other subsidiaries with the exception of ASB. |

| (ii) | The segment of Corporate Banking at BCP Stand-alone was the main contributor to portfolio growth. |

| (iii) | Expansion in the Retail Banking portfolio, which was led by the Mortgage and Consumer segments. |

It is important to note that real loan growth in average daily balances was situated at +3.0% QoQ, if we exclude the effect of a -2.0% depreciation in the US Dollar.

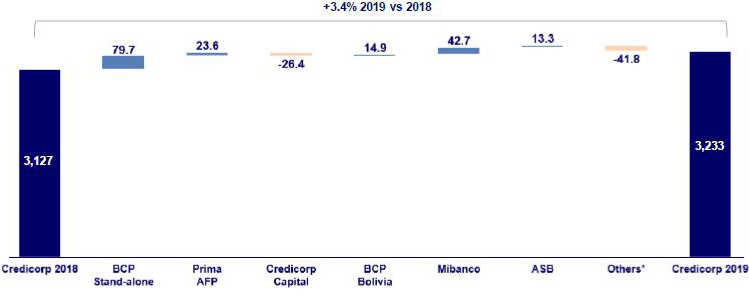

Loan Growth YoY in Average Daily Balances

Expressed in millions of S/

+6.0% YoY

The YoY analysis per segment, measured in average daily balances, reveals the follow:

| (i) | Growth was noteworthy in Retail Banking, led by expansion in the Mortgage segment (+S/ 1,876 million +12.7% YoY), which has sustained an uptick in growth over various quarters. |

7

| (ii) | Other significant variations were reported in Retail Banking by the Consumer segment (+S/ 1,153 million), SME-Pyme (+S/ 797 million) and Credit Cards (+S/666 million) and in Wholesale Banking, through the Middle Banking segment (+S/647 million) and Corporate segment (+S /324 million) in Wholesale Banking. |

| (iii) | Loan expansion at Mibanco (+5.6% YoY) reflects its strategy to expand financial inclusion (bringing new clients into the System) while continuing to assist our current clients in their quest to grow. |

| (iii) | Growth in loans at BCP Bolivia was situated at +5.7% YoY. This evolution was mainly attributable to growth in the Wholesale Banking portfolio, both in the Corporate and SME-Business segments. The Wholesale Banking portfolio contributed, although to a lesser extent, to YoY growth, primarily through its Mortgage segment (regulated portfolio). |

It is important to note that real loan growth YoY in average daily balances was situated at +6.2% YoY, if we exclude the effect of the -1.7% YoY depreciation of the dollar.

FY growth in average daily balances by segment

Expressed in millions S/

| TOTAL LOANS | ||||||||||||||||||||||||

| In millions of S/ | % change | % share | ||||||||||||||||||||||

| 2018 | 2019 | S/ | % | 2018 | 2019 | |||||||||||||||||||

| BCP Stand-alone | 85,043 | 90,935 | 5,892 | 6.9 | % | 81.8 | % | 82.1 | % | |||||||||||||||

| Wholesale Banking | 44,999 | 46,266 | 1,266 | 2.8 | % | 43.3 | % | 41.8 | % | |||||||||||||||

| Corporate | 28,037 | 28,155 | 118 | 0.4 | % | 27.0 | % | 25.4 | % | |||||||||||||||

| Middle - Market | 16,963 | 18,111 | 1,148 | 6.8 | % | 16.3 | % | 16.3 | % | |||||||||||||||

| Retail Banking | 40,044 | 44,670 | 4,626 | 11.6 | % | 38.5 | % | 40.3 | % | |||||||||||||||

| SME - Business | 5,332 | 5,487 | 155 | 2.9 | % | 5.1 | % | 5.0 | % | |||||||||||||||

| SME - Pyme | 8,903 | 9,754 | 851 | 9.6 | % | 8.6 | % | 8.8 | % | |||||||||||||||

| Mortgage | 13,977 | 15,831 | 1,854 | 13.3 | % | 13.4 | % | 14.3 | % | |||||||||||||||

| Consumer | 7,218 | 8,105 | 887 | 12.3 | % | 6.9 | % | 7.3 | % | |||||||||||||||

| Credit Card | 4,615 | 5,493 | 878 | 19.0 | % | 4.4 | % | 5.0 | % | |||||||||||||||

| Mibanco | 9,567 | 10,080 | 513 | 5.4 | % | 9.2 | % | 9.1 | % | |||||||||||||||

| Bolivia | 6,712 | 7,334 | 621 | 9.3 | % | 6.5 | % | 6.6 | % | |||||||||||||||

| ASB | 2,596 | 2,450 | -146 | -5.6 | % | 2.5 | % | 2.2 | % | |||||||||||||||

| BAP’s total loans | 103,919 | 110,799 | 6,880 | 6.6 | % | 100.0 | % | 100.0 | % | |||||||||||||||

| Highest growth in volumes | ||

| Largest contraction in volumes |

For consolidation purposes, loans generated in FC are converted to LC.

(1) Includes Work out unit, and other banking.

8

+6.6% Full Year Growth

Finally, the level of average daily loan balances for FY 2019 reported an increase of +6.6% with regard to the level of average daily loan balances for FY 2018. This growth was primarily attributable to loan growth in Retail Banking, which was driven mainly by the Mortgage, Consumer, Credit Card and SME-Pyme segments. The other segments that contributed significantly to growth were the Middle Market Banking (within Corporate Banking), Mibanco and BCP Bolivia.

1.2.2. Evolution of the level of dollarization by segment

Loan evolution by currency - average daily balances(1)(2)

| DOMESTIC CURRENCY LOANS | FOREIGN CURRENCY LOANS | % part. By currency | ||||||||||||||||||||||||||||||||||||||||||||||

| Expressed in million S/ | Expressed in million US$ | 4Q19 | ||||||||||||||||||||||||||||||||||||||||||||||

| 4Q18 | 3Q19 | 4Q19 | QoQ | YoY | 4Q18 | 3Q19 | 4Q19 | QoQ | YoY | LC | FC | |||||||||||||||||||||||||||||||||||||

| BCP Stand-alone | 54,843 | 57,636 | 60,870 | 5.6 | % | 11.0 | % | 10,041 | 10,132 | 10,000 | -1.3 | % | -0.4 | % | 64.5 | % | 35.5 | % | ||||||||||||||||||||||||||||||

| Wholesale Banking | 20,633 | 19,964 | 21,613 | 8.3 | % | 4.7 | % | 7,662 | 7,873 | 7,707 | -2.1 | % | 0.6 | % | 45.6 | % | 54.4 | % | ||||||||||||||||||||||||||||||

| Corporate | 12,302 | 11,320 | 12,854 | 13.6 | % | 4.5 | % | 4,814 | 4,969 | 4,775 | -3.9 | % | -0.8 | % | 44.5 | % | 55.5 | % | ||||||||||||||||||||||||||||||

| Middle - Market | 8,332 | 8,644 | 8,760 | 1.3 | % | 5.1 | % | 2,849 | 2,905 | 2,931 | 0.9 | % | 2.9 | % | 47.1 | % | 52.9 | % | ||||||||||||||||||||||||||||||

| Retail Banking | 34,210 | 37,672 | 39,257 | 4.2 | % | 14.8 | % | 2,379 | 2,258 | 2,293 | 1.5 | % | -3.6 | % | 83.6 | % | 16.4 | % | ||||||||||||||||||||||||||||||

| SME - Business | 2,556 | 2,614 | 2,695 | 3.1 | % | 5.5 | % | 899 | 871 | 928 | 6.5 | % | 3.3 | % | 46.4 | % | 53.6 | % | ||||||||||||||||||||||||||||||

| SME - Pyme | 9,124 | 9,628 | 9,982 | 3.7 | % | 9.4 | % | 81 | 66 | 63 | -4.6 | % | -21.8 | % | 97.9 | % | 2.1 | % | ||||||||||||||||||||||||||||||

| Mortgage | 11,892 | 13,632 | 14,250 | 4.5 | % | 19.8 | % | 837 | 733 | 698 | -4.7 | % | -16.6 | % | 85.9 | % | 14.1 | % | ||||||||||||||||||||||||||||||

| Consumer | 6,315 | 7,057 | 7,465 | 5.8 | % | 18.2 | % | 353 | 352 | 356 | 1.3 | % | 0.8 | % | 86.2 | % | 13.8 | % | ||||||||||||||||||||||||||||||

| Credit Card | 4,324 | 4,742 | 4,865 | 2.6 | % | 12.5 | % | 209 | 237 | 248 | 4.5 | % | 18.4 | % | 85.4 | % | 14.6 | % | ||||||||||||||||||||||||||||||

| Mibanco | 9,223 | 9,522 | 9,785 | 2.8 | % | 6.1 | % | 160 | 162 | 157 | -3.6 | % | -2.3 | % | 94.9 | % | 5.1 | % | ||||||||||||||||||||||||||||||

| Bolivia | - | - | - | - | - | 2,121 | 2,210 | 2,256 | 2.1 | % | 6.4 | % | - | 100.0 | % | |||||||||||||||||||||||||||||||||

| ASB | - | - | - | - | - | 755 | 734 | 705 | -3.9 | % | -6.7 | % | - | 100.0 | % | |||||||||||||||||||||||||||||||||

| Total loans | 64,066 | 67,158 | 70,655 | 5.2 | % | 10.3 | % | 13,077 | 13,238 | 13,117 | -0.9 | % | 0.3 | % | 61.6 | % | 38.4 | % | ||||||||||||||||||||||||||||||

| Highest growth in volumes | |

| Largest contraction in volumes |

(1) Includes Work out unit, and other banking.

(2) Figures differ from previously reported, please consider the data presented on this report.

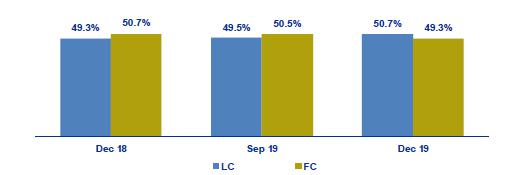

The analysis of loan expansion by currency shows that the QoQ and YoY expansion registered by the Wholesale and Retail segments, as well as by Mibanco, were driven by the LC portfolio. In contrast, a QoQ and YoY increase was posted in average daily balances in foreign currency in the Corporate Banking portfolio within Wholesale Banking and for the Mortgage and SME-Pyme segments in Retail Banking. A decrease was reported for the same period in the FC portfolio at ASB.

9

YoY evolution of the level of dollarization by segment(1)(2)(3)

(1) Average daily balances.

(2) The FC share of Credicorp’s loan portfolio is calculated including BCP Bolivia and ASB, however the chart shows only the loan books of BCP Stand-alone and Mibanco.

(3) The year with the historic maximum level of dollarization for Wholesale Banking was 2012, for Mibanco was 2016 and for the rest of segments was 2009.

At BCP Individual, the loan dollarization level fell YoY to situate at 36%. The downward trend in the dollarization level for the Mortgage segment continued, after falling 19% in December 2018 to 14% in December 2019. The aforementioned is a reflection of the fact that a large proportion of mortgage loans are denominated in LC.

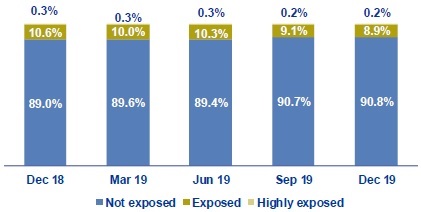

It is important to note that, as is evident in the figure below, the percentage of the loan portfolio that is highly exposed to FX-risk on credit risk remains very low.

FX risk on credit risk – BCP Stand-alone

1.2.3. BCRP de-dollarization plan at BCP Stand-alone

At the end of 2014, BCRP set up a Program to reduce the dollarization level of the loan book in the Peruvian Banking System. As part of this Program, BCRP set some targets to reduce the loan balances in US Dollars progressively at the end of June 2015, December 2015, December 2016, December 2017, December 2018 and December 2019. The balances that are subject to reduction targets are the total FC portfolio, with some exceptions, and the balance of the joint mortgage and car loan portfolio. The balance required at the end of December 2019 is as follows:

| (i) | For the total portfolio in FC, the goal set for 2018 will continue to apply. In this context, the balance at the end of December 2018 must represent no more than 80% of the total loan balance in FC reported at the end of September 2013 (excluding loans that meet certain requirements.) |

At the end of September 2019, BCP Stand-alone reported a compliance level of 106% with regard to the goal set by BCRP for December 2019.

10

| (ii) | For the combined FC Mortgage and Car portfolio, the target was adjusted in December 2018 to stipulate that the balance at the end of December of 2019 must represent no more than 40% of the balance of the combined Mortgage and Car portfolio reported at the end of February 2013. Every year, the target will be adjusted by 10% to reach a minimum of 5% of Net Equity. |

At the end of December 2019, BCP Stand-alone reported a compliance level of 92% of the dedollarization target set by BCRP.

1.2.4. Market share in loans

Market share in Peru(1)

(1) Market shares are different that previously reported because now includes non-performing loans in the sample.

Peruvian Financial System

At the end of November 2019, BCPStand-alone continued to lead the Peruvian financial market(1) with a market share (MS) of de 28.8%, which surpasses the 18.0% MS posted by its closest competitor. This level is higher than that obtained in 3Q19 (+20 bps) but lower than that registered in 4Q18 (-80 bps).Mibanco’s market share of the total financial system was situated at 3.2%, which was the same level posted in both 3Q19 and 4Q18.

In Wholesale Banking, the Corporate Banking segment reported growth of +40 bps in its MS with regard to 3Q19’s figure. Middle Market banking followed the same trend, increasing +20 bps. In the YoY evolution, Corporate Banking registered a drop of -170 bps in its MS while Middle Market banking was down -40bps. It is important to note that these segments at BCP continue to lead in their respective markets.

Within Retail Banking, BCP continued to lead the market in the Mortgage segment (+0 bps QoQ and +80 bps YoY) and in the SME-Business segment (+90 bps QoQ and +330 bps YoY) as both make gains in market share. In the Consumer and Credit Card segments, BCP continues to rank second for market share.

In the SME-Pyme segment, Mibanco continued to lead the market with an MS of 21.7%, which nonetheless represented a decline with regard to the figures reported in 3Q19 and 4Q18 of 22.2% respectively. BCP Stand-alone ranks second in this segment with an MS of 11.8%.

Bolivian Financial System

Finally, the MS ofBCP Boliviaheld steady in QoQ terms and in the previous year comparison. The subsidiary ranks fifth in the Bolivian financial system with a market share of 9.4%.

(1) Includes Multipurpose Banks, Finance Companies, Municipal and Rural Banks, EDPYMEs and Leasing and Mortgages Companies.

11

2. Funding Sources

At the end of 2019, total funding increased QoQ and YoY. The funding structure at Credicorp registered an increase in deposits, posting an uptick in its share of total funding. It is important to note the on-going expansion reported for savings deposits and non-interest bearing demand deposits, both of which constitute lower cost sources of funding. During this same period, time deposits, which imply somewhat higher costs, also increased considerably. All of the aforementioned offset the contraction registered on wholesale funding. Regarding Credicorps funding cost, the increase of 12 basis points in 2019 is due to (i) the currency mix effect, which reflected an increase in funding in local currency, which accounted for 90% of total funding expansion, and (ii) the rate effect, generated by the increase in time deposits of 8.7%.

| Funding | As of | % change | ||||||||||||||||||

| S/ 000 | Dec 18 | Sep 19 | Dec 19 | QoQ | YoY | |||||||||||||||

| Demand deposits | 32,515,165 | 32,626,001 | 34,213,188 | 4.9 | % | 5.2 | % | |||||||||||||

| Saving deposits | 32,593,978 | 33,681,765 | 35,179,770 | 4.4 | % | 7.9 | % | |||||||||||||

| Time deposits | 31,303,607 | 33,194,331 | 34,034,037 | 2.5 | % | 8.7 | % | |||||||||||||

| Severance indemnity deposits | 7,571,375 | 7,205,449 | 7,897,199 | 9.6 | % | 4.3 | % | |||||||||||||

| Interest payable | 567,186 | 684,174 | 681,191 | -0.4 | % | 20.1 | % | |||||||||||||

| Deposits and obligations | 104,551,311 | 107,391,720 | 112,005,385 | 4.3 | % | 7.1 | % | |||||||||||||

| Due to banks and correspondents | 8,448,139 | 8,624,286 | 8,841,732 | 2.5 | % | 4.7 | % | |||||||||||||

| BCRP instruments | 5,226,870 | 4,144,908 | 4,381,011 | 5.7 | % | -16.2 | % | |||||||||||||

| Repurchase agreements | 2,638,231 | 2,031,025 | 1,820,911 | -10.3 | % | -31.0 | % | |||||||||||||

| Bonds and notes issued | 15,457,540 | 17,160,564 | 14,946,363 | -12.9 | % | -3.3 | % | |||||||||||||

| Total funding | 136,322,091 | 139,352,503 | 141,995,402 | 1.9 | % | 4.2 | % | |||||||||||||

2.1. Funding Structure

Evolution of the funding structure and cost – BAP

(S/ billions)

The figure depicting the Evolution of Credicorp’s funding structure and cost is calculated with quarter-end balances. In global terms, the funding structure reflects:

| (i) | The importance of deposits as the main source of funding, which imply lower costs than other alternatives in the mix. The share of deposits in total funding increased considerably QoQ and YoY, situating at 78.8% (vs. 77.1% in Sep 19 and 76.7% in Dec 18). This growth was attributable to an increase in the volumes posted by all deposit types both QoQ and YoY. |

12

| (ii) | The shares of savings deposits and non-interest bearing demand deposits within the deposits mix continued to increase, registering growth both QoQ and YoY. At the end of Dec 19, they represented 57.0% of total deposits (vs. 56.6% in Sep 19 and 56.9% in Dec 18). Both deposit types are considered lower-cost alternatives within the deposit mix. It is important to note the on-going growth in time deposits, which had a negative impact on the funding cost for deposits due to a volume effect and rate effect. |

| (iii) | In terms of other funding sources, the QoQ analysis shows a contraction; this was mainly attributable to a decrease in the volume of Bonds and notes issued (-12.9%), whose share of total funding (10.5%) has fallen to its lowest level since 2014. In the YoY analysis, the decline was associated primarily with a drop in the volume of BCRP instruments, which have fallen consistently since 2016, when the special instruments issued by BCRP under its de-dollarization initiative began to expire. The share of BCRP instruments in total funding fell to 3.1% at the end of Dec 19 (vs. 3.8% in Dec 18). For further details, see section 2.3 Other funding sources. |

All of the aforementioned has allowed Credicorp to maintain a relatively stable cost of funding since 2016.

2.2. Deposits

| Deposits and obligations | As of | % change | ||||||||||||||||||

| S/ 000 | Dec 18 | Sep 19 | Dec 19 | QoQ | YoY | |||||||||||||||

| Demand deposits | 32,515,165 | 32,626,001 | 34,213,188 | 4.9 | % | 5.2 | % | |||||||||||||

| Saving deposits | 32,593,978 | 33,681,765 | 35,179,770 | 4.4 | % | 7.9 | % | |||||||||||||

| Time deposits | 31,303,607 | 33,194,331 | 34,034,037 | 2.5 | % | 8.7 | % | |||||||||||||

| Severance indemnity deposits | 7,571,375 | 7,205,449 | 7,897,199 | 9.6 | % | 4.3 | % | |||||||||||||

| Interest payable | 567,186 | 684,174 | 681,191 | -0.4 | % | 20.1 | % | |||||||||||||

| Deposits and obligations | 104,551,311 | 107,391,720 | 112,005,385 | 4.3 | % | 7.1 | % | |||||||||||||

Deposits and obligations grew 4.3% QoQ. The QoQ evolution of the mix of deposits shows:

| (i) | Growth insavings deposits, which increased 4.4% QoQ. This was driven primarily by an increase in the LC volume (which accounts for 84% of the increase). Growth reflects (i) payments of employee bonuses with saving accounts at BCP Stand-alone and Mibanco in the month of December and (ii) the results of campaigns to capture savings deposits through cost-efficient channels (Kiosko and Vía BCP). These channels drove almost 50% of the uptick in savings accounts openings at BCP Stand-alone. |

| (ii) | The 4.9% increase indemand deposits due to an increase in the deposit volume for non-interest bearing demand deposits (+40 bps), mainly from Middle-market at BCP Stand-alone. |

| (iii) | An increase in the volume oftime depositsat Mibanco, after different campaigns were rolled out, and at BCP Bolivia, which is implementing a strategy to capture deposits that offer more stability in the mid-term. |

| (iv) | Severance indemnity deposits, growth of 9.6% was reported after employers deposited the obligatory payment required every 4Q (the second of two statutory deposits). This deposit was made in November. |

InYoY terms, totaldeposits and obligations registered an increase across all deposit types, which translated into growth of 7.1% in the main source of funding.

13

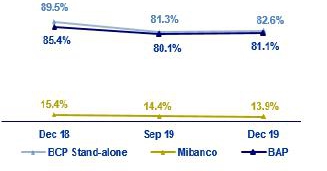

2.2.1. Deposits: dollarization level

Dollarization Level of Deposits(1)– BAP

(1) Q-end balances.

Credicorp - Deposit Dollarization measured in quarter-end balances

The dollarization level of Credicorp’s deposits fellQoQ after growth in LC volumes outpaced that of FC volumes.

Growth in LC volumes was seen across all deposit types, outpacing the expansion registered by FC volumes by four-fold. The increase in the LC volume was mainly attributable to savings deposits and to a lesser extent, to non-interest bearing demand deposits. Expansion in FC volumes was reported across all deposit types, with the exception of severance indemnity deposits, and was due primarily to growth in the level of savings deposits and interest-bearing demand deposits.

TheYoYevolution shows a similar trend to that seen QoQ, where growth in LC was two times higher than that posted by FC. LC deposits increased 10.1% YoY, compared to 4.2% for FC deposits for the same period. The aforementioned was attributable to growth in all types of LC deposits, which was primarily associated with an increase in the volume of savings deposits and time deposits. In the case of FC deposits, growth was also registered across all deposit types, with the exception of severance indemnity deposits. The evolution described was aligned with Credicorp’s objective of maintaining an adequate match between assets and liabilities by currency, respecting the group’s appetite for risk.

14

2.2.2. Market share in Deposits

Market share in Peru

Source: SBS

Peruvian Financial System

At the end of Nov 19, Credicorp’s subsidiaries in Peru, BCP Stand-alone and Mibanco, reported an MS of 29.9% and 2.8% (in comparison to 29.3% and 2.8% at the end of Sep 19, respectively). Credicorp continued to lead the market for total deposits, and is situated significantly ahead of its closest competitor (which holds a 19.1% market share).

In the YoY analysis, BCP Stand-alone registered a drop with regard to the level registered at the end of Dec 18. This was mainly due to a decrease in the MS of demand deposits. The MS of Mibanco also fell YoY (2.8% Nov 19 vs. 3.1% Dec 18) due to a contraction in the MS of time deposits, which fell from 7.0% in Dec 18 to 6.2% in Nov 19.

Bolivian Financial System

BCP Bolivia continued to rank fifth in the Bolivian financial system with a MS of 9.8% at the end of Dec 19 in comparison to 9.6% in Sep 19. In the YoY analysis, the figure for MS was the same as that seen at the end of Dec 18 (9.8%).

2.3. Other funding sources

| Other funding sources | As of | % change | ||||||||||||||||||

| S/ 000 | Dec 18 | Sep 19 | Dec 19 | QoQ | YoY | |||||||||||||||

| Due to banks and correspondents | 8,448,139 | 8,624,286 | 8,841,732 | 2.5 | % | 4.7 | % | |||||||||||||

| BCRP instruments | 5,226,870 | 4,144,908 | 4,381,011 | 5.7 | % | -16.2 | % | |||||||||||||

| Repurchase agreements | 2,638,231 | 2,031,025 | 1,820,911 | -10.3 | % | -31.0 | % | |||||||||||||

| Bonds and notes issued | 15,457,540 | 17,160,564 | 14,946,363 | -12.9 | % | -3.3 | % | |||||||||||||

| Total other funding sources | 31,770,780 | 31,960,783 | 29,990,017 | -6.2 | % | -5.6 | % | |||||||||||||

TheTotal of other funding sourcesfell -6.2% QoQ, which was primarily attributable to a decrease in the level of Bonds and notes issued. The aforementioned was slightly attenuated by an increase in Due to banks and correspondents and in BCRP instruments.

15

Due to banks and correspondents increased due to growth in the level of obligations with COFIDE and with companies in the Peruvian financial system through Mibanco and in LC. To a lesser extent, growth was attributable to new debt with foreign financial institutions in FC. These transactions were conducted in the month of November through BCP Stand-alone. The aforementioned was attenuated by a decrease in the exchange rate in a context in which FC represents approximately 60% of Due to banks and correspondents.

BCRP Instruments, where the slight increase QoQ was associated with growth in the level of regular repos with BCRP both at BCP Stand-alone and Mibanco.

Repurchase agreements fell QoQ due to the expiration of interbank repurchase agreements and Certificates of Deposits (CDs), mainly through ASB and BCP Stand-alone, both in FC.

Bonds and notes issuedreported a contraction of -12.9% QoQ. This was due to (i) the expiration of corporate and subordinated bonds at BCP Stand-alone, (ii) the advance redemption of a hybrid bond at BCP Stand-alone, and (iii) the variation in the exchange rate, which had a negative effect given that 73% of the total volume is in FC.

In theYoY evolution, a 5.6% reduction in other funding sources is evident. This was attributable to a reconfiguration of the funding structure to decrease the level of BCRP Instruments and repurchase agreements and increase the level of lower-cost deposits with higher liquidity levels.

2.4. Loan / Deposit (L/D)

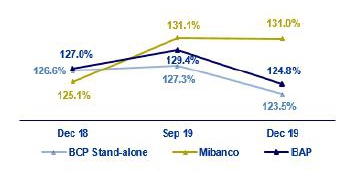

Loan / Deposit Ratio by Subsidiary

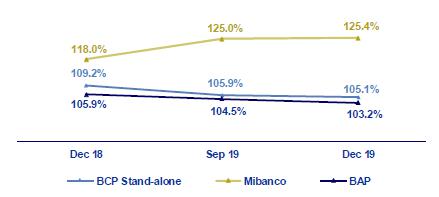

The L/D ratio at Credicorp fell QoQ to situate at 103.2% given that the increase in deposits (+4.3%) outpaced the growth posted by loans (+3.0%).

The analysis by subsidiary shows that the same trend is in play at BCP Stand-alone (105.1% Dec 19 vs. 105.9% Sep 19). The QoQ reduction in the L/D at BCP Stand-alone was generated in a scenario in which growth in the deposit volume (+3.5%) was greater than the expansion registered for loans (+2.7%); the aforementioned was driven by an increase in demand deposits and savings deposits. In the case of Mibanco, QoQ growth in the L/D was attributable to the fact that loan growth (+3.7%) outpaced the expansion registered for deposits (3.4%).

In the YoY analysis, the L/D ratio for Credicorp and its subsidiaries followed the same trend seen in the QoQ analysis, where growth in deposits exceeded loan growth (7.1% vs. 4.4%, respectively).

16

| Loan / Deposit Ratio by Currency | ||

| Local Currency | Foreign Currency | |

|  | |

In the QoQ analysis by currency, a reduction is evident in the L/D ratio in LC at Credicorp, which was attributable to an increase in LC deposits, which was driven by demand deposits and savings deposits at BCP Stand-alone. The L/D in FC at Credicorp registered growth of 100 bps QoQ after loan growth (+3.0%) exceeded the expansion reported for deposits (+1.8%). The aforementioned was in turn driven by loan growth in FC (+1.5%) and a contraction in FC deposits (-0.1%) at BCP Stand-alone.

In the YoY analysis, the L/D ratio in LC and FC at Credicorp fell after the deposit level in both currencies increased and outpaced loan growth.

2.5. Funding Cost

Funding Cost – Credicorp(1)

(1) The funding cost by currency is calculated with the average of period-beginning and period-end balances.

The funding cost at Credicorp fell QoQ and YoY. The QoQ evolution shows:

| (i) | Growth in the funding cost in FC (+8 bps), which was primarily attributable to an increase in interest expenses on bonds and notes issued; this accounts for 90% of the increase in expenses in FC (96% of which were generated by BCP Stand-alone). |

| (ii) | The reduction in the total funding cost (-13 bps), which was primarily due to a drop in the expense for all funding sources, which reflects the global trend toward lower interest rates. The mix of total funding has improved to favor higher volumes of lower-cost sources of funding, such as deposits. |

17

| (iii) | The drop in the cost of funding in LC (-36 bps), which was mainly driven by a decrease in interest expenses on bonds and notes issued at BCP Stand-alone after a drop was registered in the interest rates on corporate bonds issued in 3Q19. |

In the YoY analysis, the funding cost fell -6 bps due to:

| (i) | A more favorable deposit mix where lower-cost deposits such as savings and non-interest bearing demand deposits grew 7.9% and 6.4%, respectively. |

| (ii) | Due to the recomposition of the funding structure, given that deposits’ share of total funding increased significantly (from 76.7% in 4Q18 to 78.8% in 4T19), edging out BCRP Instruments (substitution with a less expensive source of funding). |

| (iii) | The reduction in national and international interest rates since 3Q19 meant that the impact of this shift was more visible in 4Q19. |

The FY analysis of the cost of funding reflects:

| (i) | The adoption of new requirements relative to IFRS 16, which has been in place since the beginning of 2019 and stipulates that part of the expenses for leases, which were previously registered in Administrative expenses, must be included in interest expenses. |

| (ii) | Higher expenses on deposits, which was mainly attributable to the volume, deposit mix and currency effects, where time deposits growth in LC (8.3%) is noteworthy. |

| (iii) | Higher interest expenses on bonds and notes issued at BCP Stand-alone in 3Q19, which was attributable to the liability management of bonds that carry one-off expenses. |

| (iv) | The aforementioned was partially attenuated by the group’s decision to secure lower-cost funding, such as deposits, and to reduce the volume of other, higher-cost funding sources such as BCRP Instruments and bonds and notes issued. Additionally, national and international interest rates fell in 3Q19, which had a positive effect on the funding cost in 4Q19. |

All of the aforementioned led the funding cost to increase 12 bps.

The cost of funding by subsidiary is depicted in the following figure:

Funding Cost by subsidiary– Credicorp

18

| (i) | The funding cost atBCP Stand-alone followed the same trend as that seen at Credicorp, where contractions were registered QoQ and YoY. In both cases, the decrease was generated by an increase in the volume of deposits and the impact of lower international interest rates (48% of the bank’s funding is in FC). In 2019, the funding cost increased 9 bps. This took place in a scenario marked by the following events at BCP Stand-alone: (i) the bank absorbed the most impact of the application of IFRS 16, (ii) the liability management of bonds in 3Q19, which included one-off expenses, and ii) 5.2% growth was recorded in time deposits, mainly in LC. |

| (ii) | The funding cost atMibanco registered considerable growth both QoQ and YoY, which reflects efforts to roll out a strategy to capture more retail funding by offering competitive rates. In this context, the increase in interest expenses (4.9% QoQ and 4.2% YoY), which outpaced growth in total funding (4.2% QoQ and 0.5% YoY), led this ratio to increase. FY, the funding cost remained stable due to mix and volume effects. The mix effect was attributable to the fact that the interest rates on deposits were lower than those associated with other sources of funding. The volume effect was driven by an increase in total funding in 4Q18 and 4Q19 (calculation denominator) and by growth in the deposit volume, which represents 78.7% of the funding mix. |

| (iii) | The funding cost atBCP Bolivia increased QoQ and YoY, which was primarily attributable to an increase in interest expenses (3.0% and 7.9%, respectively) on deposits, due to volume and mix effect (time deposits posted the highest growth). FY, growth of 14 bps was attributable to an increase in interest expenses on deposits. |

19

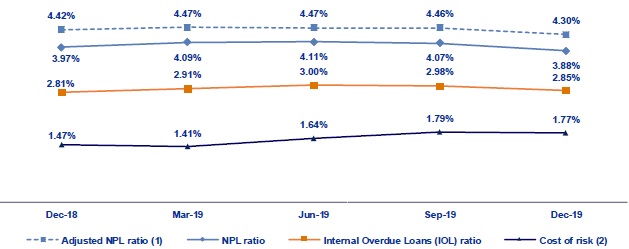

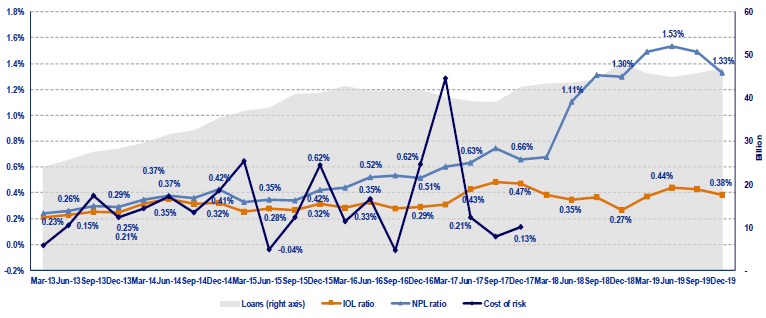

3. Portfolio quality and Provisions for loan losses

The Cost of Risk (CofR) at Credicorp fell 2 bps QoQ. This was primarily attributable to a reduction in provisions for loan losses at Mibanco after adjustments were made to origination and collection guidelines in 1H19. This offset the increase in provisions at BCP Bolivia, which was attributable to political uncertainty. In YoY terms and FY, the CofR at Credicorp rose 30 bps and 22 bps respectively due to an increase in provisions requirements in Retail Banking. The delinquency rations improved QoQ, which was mainly due to a reduction in the IOL portfolio in Wholesale Banking.

| Quarterly evolution of the Cost of Risk (bps) | Full Year evolution of the Cost of Risk (bps) |

|  |

(1) Includes BCP Bolivia, Encumbra, Bancompartir, ASB and eliminations for consolidation purposes

3.1. Provisions for loan losses

| Provision for credit losses on loan portfolio, net of recoveries | Quarter | % change | Year | % change | ||||||||||||||||||||||||||||

| S/ 000 | 4Q18 | 3Q19 | 4Q19 | QoQ | YoY | 2018 | 2019 | 2019 / 2018 | ||||||||||||||||||||||||

| Gross provision for credit losses on loan portfolio | (479,184 | ) | (568,034 | ) | (568,727 | ) | 0.1 | % | 18.7 | % | (1,814,898 | ) | (2,100,091 | ) | 15.7 | % | ||||||||||||||||

| Recoveries of written-off loans | 71,230 | 65,262 | 57,067 | -12.6 | % | -19.9 | % | 283,190 | 254,155 | -10.3 | % | |||||||||||||||||||||

| Provision for credit losses on loan portfolio, net of recoveries | (407,954 | ) | (502,772 | ) | (511,660 | ) | 1.8 | % | 25.4 | % | (1,531,708 | ) | (1,845,936 | ) | 20.5 | % | ||||||||||||||||

Provisions for loan losses net recoveries were relatively stable QoQ. This was due to the fact that provisions requirements fell at Mibanco after adjustments were made in origination and collection guidelines. This offset the increase in provisions at BCP Bolivia, and for the SME-Pyme segment in particular, in a context marked by political uncertainty. Additionally, provisions at BCP Stand-alone fell after provisions were reversed for some companies in the construction sector; this offset the increase in provisions in Retail Banking. The YoY increase, and FY increase were 25.7% and 20.5% respectively. FY growth was attributable to:

| (i) | Consumer: Growth in digital loans, which target higher risk clients. It is important to note that this product may imply higher risk but also generates higher income. |

| (ii) | SME-Pyme: This increase reflects an increase in the level of deterioration of loans to finance fixed assets and revolving credit. |

| (iii) | Credit Card: This result reflects an increase in the probability of default in the portfolio. This situation was related to the increase in individual indebtedness seen across the Peruvian financial system. |

The aforementioned was attenuated by a reversal in provisions in Wholesale Banking, specifically in the construction sector and in Mibanco for the reasons explained in the QoQ analysis.

Cost of risk

| Quarter | % change | Year | % change | |||||||||||||||||||||||||||||

| Cost of risk and Provisions | 4Q18 | 3Q19 | 4Q19 | QoQ | YoY | 2018 | 2019 | 2019 / 2018 | ||||||||||||||||||||||||

| Cost of risk(1) | 1.47 | % | 1.79 | % | 1.77 | % | -2 bps | 30 bps | 1.38 | % | 1.60 | % | 22 bps | |||||||||||||||||||

| Provision for credit losses on loan portfolio, net of recoveries / Net interest income | 18.2 | % | 22.1 | % | 21.7 | % | -30 bps | 360 bps | 18.0 | % | 20.3 | % | 190 bps | |||||||||||||||||||

(1) Annualized Provision for credit losses on loan portfolio, net of recoveries / Total loans.

In this context, the CofR at Credicorp remained stable QoQ but deteriorated 30 bps YoY and 22 bps FY given that growth in provisions outpaced the expansion registered for loans.

20

3.2. Portfolio Quality: Delinquency ratios

| Portfolio quality and Delinquency ratios | As of | % change | ||||||||||||||||||

| S/ 000 | Dec 18 | Sep 19 | �� | Dec 19 | QoQ | YoY | ||||||||||||||

| Total loans (Quarter-end balance) | 110,759,390 | 112,209,990 | 115,609,679 | 3.0 | % | 4.4 | % | |||||||||||||

| Allowance for loan losses | 4,952,392 | 4,977,809 | 5,070,279 | 1.9 | % | 2.4 | % | |||||||||||||

| Write-offs | 518,558 | 456,932 | 509,571 | 11.5 | % | -1.7 | % | |||||||||||||

| Internal overdue loans (IOLs)(1) | 3,117,078 | 3,346,389 | 3,297,791 | -1.5 | % | 5.8 | % | |||||||||||||

| Internal overdue loans over 90-days(1) | 2,353,669 | 2,539,751 | 2,479,940 | -2.4 | % | 5.4 | % | |||||||||||||

| Refinanced loans | 1,278,169 | 1,225,691 | 1,182,797 | -3.5 | % | -7.5 | % | |||||||||||||

| Non-performing loans (NPLs)(2) | 4,395,247 | 4,572,080 | 4,480,588 | -2.0 | % | 1.9 | % | |||||||||||||

| IOL ratio | 2.81 | % | 2.98 | % | 2.85 | % | -13 bps | 4 bps | ||||||||||||

| IOL over 90-days ratio(3) | 2.13 | % | 2.26 | % | 2.15 | % | -11 bps | 2 bps | ||||||||||||

| NPL ratio | 3.97 | % | 4.07 | % | 3.88 | % | -19 bps | -9 bps | ||||||||||||

| Coverage ratio of IOLs | 158.9 | % | 148.8 | % | 153.7 | % | 490 bps | -520 bps | ||||||||||||

| Coverage ratio of IOL 90-days | 210.4 | % | 196.0 | % | 204.5 | % | 850 bps | -590 bps | ||||||||||||

| Coverage ratio of NPLs | 112.7 | % | 108.9 | % | 113.2 | % | 430 bps | 50 bps | ||||||||||||

(1) Includes overdue loans and loans under legal collection. (Quarter-end balances)

(2) Non-performing loans include internal overdue loans and refinanced loans. (Quarter-end balances)

(3) Figures differ from previously reported, please consider the data presented in this report.

In terms of delinquency, it is important to note that:

| (i) | The total IOL portfolio fell 1.5% QoQ due to the increase in write-offs of the loans with more than 150 days of overdue and where already correctly provisioned in the SME-Pyme segment. In the YoY analysis, internal overdue loans increase 5.8%, which was primarily attributable to IOL loans of a small number of clients in the SME-Business and Wholesale segments. These loans have already been correctly provisioned. |

| (ii) | The NPL portfolio registered a 2.0% decrease QoQ. This was mainly attributable to the amortization of refinanced loans for Wholesale Banking loans in the construction sector, which led to a subsequent reduction in total refinanced loans. Despite this evolution, the NPL portfolio increased 1.9% YoY, in line with growth in the IOL portfolio. |

Delinquency ratios improved favorably QoQ in the context described above; nonetheless, in the YoY analysis, the IOL ratio deteriorated 4 bps given that growth in the IOL portfolio outpaced the expansion registered for loan expansion. The NPL ratio improved 9 bps YoY, in line with a drop in refinanced loans, mainly in the Wholesale Banking segment.

The coverage ratios improved QoQ given that the increase registered by the IOL portfolio and refinanced loan balances fell below the growth registered in net provisions for loan losses. In the YoY analysis, however, coverage for the IOL portfolio deteriorated due to the increase in write-offs during the year, which drove a decrease in the Allowance for loan losses.

Prior to analyzing the evolution of delinquency ratios, it is important to note that:

| (i) | Traditional delinquency ratios (IOL and NPL ratios) continue to be distorted by the presence of loans with real estate collateral (commercial and residential properties). This means that a significant portion of loans that are more than 150 days past due cannot be written-off (despite the fact that provisions have been set aside) given that a judicial process must be initiated to liquidate the collateral, which takes five years on average. |

| (ii) | In the second half (2H) of every year, loans are more dynamic, particularly in the SME-Pyme and Mibanco segments given that the main campaigns (Christmas and year-end campaigns) are held in the second semester (2H) and these short-term loans are paid off in 1H of the following year |

21

Delinquency Ratios

(1) Adjusted NPL ratio = (Non-performing loans+ Write-offs) / (Total loans + Write-offs).

(2) Cost of risk = Annualized provisions for loan losses net of recoveries / Total loans.

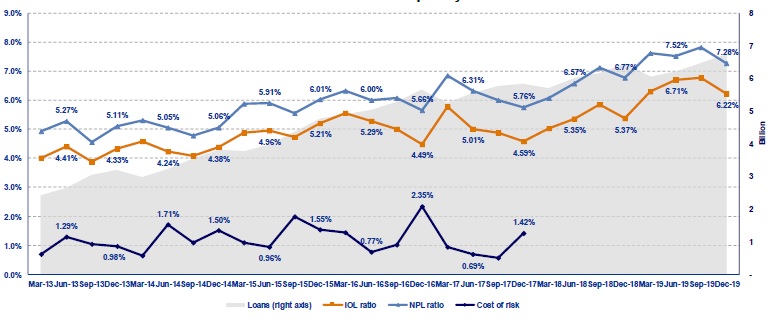

3.2.1. Delinquency indicators by business line

Wholesale Banking – Delinquency ratios

| (i) | The QoQ analysis shows a slight reduction in the IOL and NPL ratio. This decrease was primarily due to the amortization of loans that were included in the internal overdue loans, mainly from the construction sector. In the YoY evolution, the IOL and NPL ratio increased. This was primarily attributable to a migration of current loans to internal overdue loans in 1H19 and, to a lesser extent, to the reduction of loans measured in quarter-end balances. |

22

SME-Business – Delinquency ratios

| (ii) | Both the IOL and NPL ratios posted a decrease QoQ. This was mainly attributable to the fact that an IOL loan was recovered and subsequently migrated to the current loans portfolio. In the YoY analysis, however, the IOL and NPL ratios increased, which was attributable to a deterioration in the debt service capacity of a small number of clients in the 1S19. These loans have been fully provisioned or are backed by guarantees. It is important to note that this segment’s risk quality indicators are within the appetite for risk that has been set where the objective is to maximize the portfolio’s profitability by striking an adequate balance between risk quality and growth. |

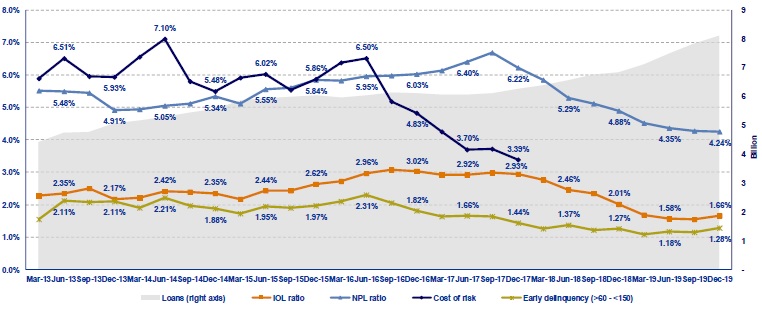

SME - Pyme – Delinquency ratios

| (iii) | In the SME-Pyme loan book, it is important to analyze the early delinquency ratio, which excludes loans that are overdue less than 60 days (volatile loans whose percentage of recovery is very high) and those overdue more than 150 days (loans that have been provisioned but which cannot be written off due to the existence of real estate collateral- commercial properties - that take five years on average to liquidate). |

| The early delinquency ratio registered an improvement QoQ. However, this ratio reported an increase YoY since the in the last three quarters. The aforementioned was attributable to the increase in provisions, which was in line with an uptick in deterioration for fixed asset loans and revolving credit. The IOL ratio and the NPL ratio, however, followed a different trend to post improvements QoQ and YoY. This was mainly attributable to the sale of a portfolio in the last quarter, the increase in the write-offs of loans with more than 150 overdue days, and to strong loan growth in SME-Pyme segment. |

23

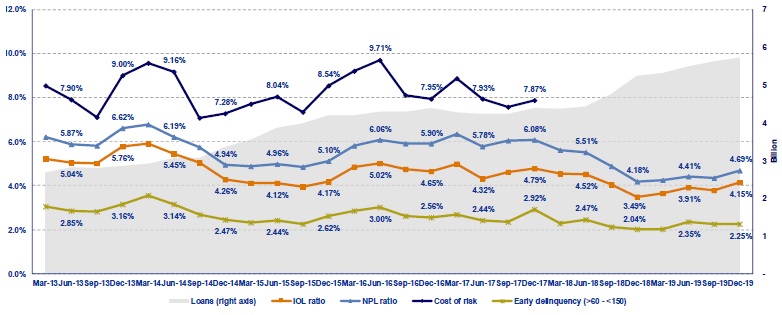

Mortgage – Delinquency ratios

| (iv) | In terms of Mortgage loans, it is important to remember that these ratios are also affected by the existence of real estate collateral, where the recovery process is protracted (around 5 years) and as such, impedes the bank’s capacity to write-off loans even if the same are completely provisioned. |

| Traditional delinquency ratios fell QoQ and YoY given that although total loans increased, the NPL portfolio remained at stable levels. |

| The early delinquency ratio, which excludes the effect of loans that are more than 150 days overdue, fell QoQ and YoY. It is important to note that this ratio is better than the average levels reported over the past three years and is within the business’s risk appetite. |

Consumer – Delinquency ratios

| (v) | The IOL ratio, NPL ratio and early delinquency ratio increased QoQ. This was due primarily to the increase registered for loans in riskier segments, which are sold through digital channels. In the YoY analysis, the IOL and NPL ratios posted improvements, in line with the sale of a portion of the IOL portfolio over the past three quarters. |

| It is important to note that the traditional delinquency ratios and early delinquency ratio are at the lowest levels seen in the past 5 years and reflect the positive results of different management and collections initiatives. |

| Although the delinquency ratios have improved, the consumer segment registered an increase in provisions that was, in part, attributable to the need to cover higher risks on certain products in the digital channel. Nevertheless, it is important to remember that products which imply higher risk also tend to generate higher profit and lower expenses. |

24

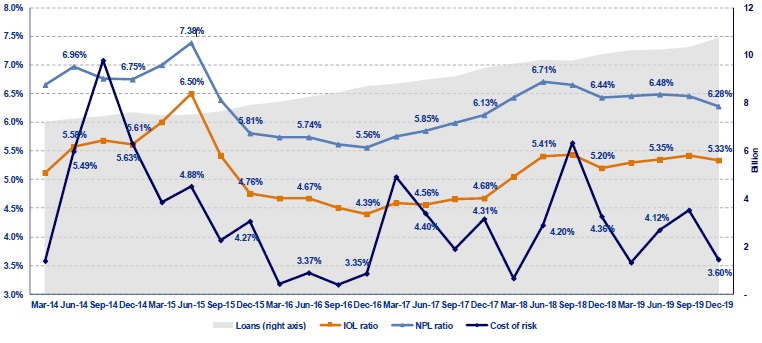

Credit Card – Delinquency ratios

| (vi) | The Credit Card segment registered an increase in its IOL and NPL ratios both QoQ and YoY. This growth has been on-going since the first quarter of the year and is attributable to the increase registered for individual indebtedness in the Peruvian financial system. This occurrence was attenuated by the sale of a portion of the IOL portfolio in the previous quarter. Early delinquency also increased YoY, which was attributable to the fact that more provisions were set aside in the second half of the year to cover an increase in the probability of default of the portfolio. |

Mibanco – Delinquency ratios

| (vii) | The IOL and NPL ratios fell QoQ. This was primarily attributable to growth in loans, which registered a decrease in risk after adjustments were made in 1H19, as indicated in section 3.1 Net provisions for loan losses. In the YoY analysis, the IOL portfolio posted growth, which was attributable to a drop in the number of loans that were written off during the year. The NPL ratio decrease YoY due to an improvement in the acceptance process for new loans, which led to the need for les refinancing. |

| The cost of risk improved QoQ and YoY, which reflected improvements in the new loan origination and in the collections process, as indicated in the previous paragraph. |

25

BCP Bolivia – Delinquency ratios

| (viii) | BCP Bolivia reported an improvement QoQ and YoY in its IOL and NPL ratio; this was primarily due to an increase in write-offs this quarter. |

| The cost of risk deteriorated QoQ and YoY; this was mainly attributable to an uncertain political environment in Bolivia, as indicated in section 3.1. Net provisions for loan losses, at to loan growth. |

26

| 4. | Net Interest Income (NII) |

In 4Q19, NII, the main source of income, posted positive results QoQ, with +3.4% growth, and YoY, with +4.9% expansion. Additionally, average interest earning assets grew +2.2% QoQ and +8.4% YoY. This led NIM to increase 6 bps QoQ but fall -18 bps YoY. In 2019, NII increased +6.9%, which led to a +11bps increase in NIM. The improvement over 2018’s result was attributable to an increase in interest income on loans, which was in turn due to an increase in average daily loan balances. NIM improved 6bps QoQ as a result of the reduction of cost of risk QoQ. Nevertheless, due to an increase in the cost of risk, risk-adjusted NIM contracted -35 bps YoY and -4bps in 2019.

| Net interest income | Quarter | % change | Year | % change | ||||||||||||||||||||||||||||

| S/ 000 | 4Q18 | 3Q19 | 4Q19 | QoQ | YoY | 2018 | 2019 | 2019 / 2018 | ||||||||||||||||||||||||

| Interest income | 3,033,544 | 3,123,672 | 3,172,695 | 1.6 | % | 4.6 | % | 11,522,634 | 12,381,663 | 7.5 | % | |||||||||||||||||||||

| Interest on loans | 2,625,181 | 2,701,117 | 2,768,468 | 2.5 | % | 5.5 | % | 10,041,097 | 10,664,519 | 6.2 | % | |||||||||||||||||||||

| Dividends on investments | 6,205 | 2,915 | 3,764 | 29.1 | % | -39.3 | % | 24,391 | 25,259 | 3.6 | % | |||||||||||||||||||||

| Interest on deposits with banks | 63,709 | 79,723 | 68,813 | -13.7 | % | 8.0 | % | 159,381 | 320,713 | 101.2 | % | |||||||||||||||||||||

| Interest on securities | 327,208 | 325,311 | 311,414 | -4.3 | % | -4.8 | % | 1,252,799 | 1,311,442 | 4.7 | % | |||||||||||||||||||||

| Other interest income | 11,241 | 14,606 | 20,236 | 38.5 | % | 80.0 | % | 44,966 | 59,730 | 32.8 | % | |||||||||||||||||||||

| Interest expense | 789,292 | 846,288 | 818,573 | -3.3 | % | 3.7 | % | 3,033,530 | 3,304,483 | 8.9 | % | |||||||||||||||||||||

| Interest on deposits | 324,622 | 372,822 | 367,257 | -1.5 | % | 13.1 | % | 1,202,025 | 1,458,910 | 21.4 | % | |||||||||||||||||||||

| Interest on borrowed funds | 157,205 | 151,221 | 141,552 | -6.4 | % | -10.0 | % | 623,001 | 590,908 | -5.2 | % | |||||||||||||||||||||

| Interest on bonds and subordinated notes | 233,233 | 236,567 | 209,238 | -11.6 | % | -10.3 | % | 911,006 | 900,172 | -1.2 | % | |||||||||||||||||||||

| Other interest expense(1) | 74,232 | 85,678 | 100,526 | 17.3 | % | 35.4 | % | 297,498 | 354,493 | 19.2 | % | |||||||||||||||||||||

| Net interest income(1) | 2,244,252 | 2,277,384 | 2,354,122 | 3.4 | % | 4.9 | % | 8,489,104 | 9,077,180 | 6.9 | % | |||||||||||||||||||||

| Risk-adjusted Net interest income(1) | 1,836,298 | 1,774,612 | 1,842,462 | 3.8 | % | 0.3 | % | 6,957,396 | 7,231,243 | 3.9 | % | |||||||||||||||||||||

| Average interest earning assets | 159,104,005 | 168,631,427 | 172,406,741 | 2.2 | % | 8.4 | % | 160,750,873 | 168,413,997 | 4.8 | % | |||||||||||||||||||||

| Net interest margin(1)(2) | 5.64 | % | 5.40 | % | 5.46 | % | 6 | bps | -18 | bps | 5.28 | % | 5.39 | % | 11 | bps | ||||||||||||||||

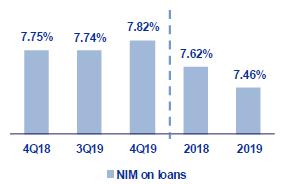

| NIM on loans(1)(2) | 7.75 | % | 7.74 | % | 7.82 | % | 8 | bps | 7 | bps | 7.62 | % | 7.46 | % | -16 | bps | ||||||||||||||||

| Risk-adjusted Net interest margin(1)(2) | 4.62 | % | 4.21 | % | 4.27 | % | 6 | bps | -35 | bps | 4.33 | % | 4.29 | % | -4 | bps | ||||||||||||||||

| Net provisions for loan losses / Net interest income(1)(2) | 18.18 | % | 22.08 | % | 21.73 | % | -35 | bps | 355 | bps | 18.04 | % | 20.34 | % | 230 | bps | ||||||||||||||||

(1) Figures differ from previously reported, please consider the data presented on this report.

(2) Annualized.

| 4.1. | Interest Income |

| Interest Income - LC | Interest Income – FC |

| (S/ millions) | (S/ millions) |

| |

In theQoQ analysis, the increase of +1.6% in Interest Income was due primarily to growth in interest income on loans, which was attributable to:

| (i) | Slight acceleration in the growth of average daily loan balances (+2.7% QoQ), which was led by Retail Banking. |

27

| (ii) | The mix per segment given that although Wholesale Banking continues to account for the largest percentage of loans with a share of 41.4%, Retail Banking increased its share to 40.5% in 3Q19 and 41.0% in 4Q19. Additionally, although mortgage loans lead growth in terms of volumes, segments that offer higher margins, such as Consumer and SME-Pyme, also registered a significant increase. |

| (iii) | The currency mix given that loan expansion was generated mainly in LC (5.2%), which offers higher margins that FC. Accordingly, the currency mix also favored growth in interest income on loans. |

In theYoY analysis, interest income expanded +4.6%, which represented lower growth than that registered in 3Q19. The increase in interest income was mainly attributable to growth in interest income on loans (+5.5%).

FY, interest income increased +6.9%. This was primarily due to an increase in interest income on loans, which was in turn attributable to:

| (i) | The volume effect due to an uptick in the pace of growth of average daily balances in all segments with the exception of ASB. This translated in growth of +6.6% of total loans and was driven primarily by Retail Banking, which registered a +11.6% increase in FY average daily loan balances. |

| (ii) | The mix by segment given that Retail Banking now accounts for 38.5% of total loans compared to 40.3% in 4Q18. |

| (iii) | The currency mix was also favorable given that the expansion in average daily balances was primarily driven by +9.2% growth in the FY LC portfolio. |

To a lesser extent, interest income increased by:

| (i) | The increase in interest on deposits in other banks, which reflects an increase in the volume of BCRP funds. It is important to note that the majority of the funds held in BCRP are in FC given that the reserve requirement for this currency is much lower than that associated with LC. |

| (i) | Slight growth in interest on securities, which was attributable to 10.0% YoY growth in the fair value through other comprehensive income investment portfolio and 4.0% in the fair value through profit and loss portfolio.Portfolio growth at the Credicorp level was attributable to expansion in the portfolios of Pacifico, ASB and Credicorp Capital which grew 158%, 35% and 8% respectively. |

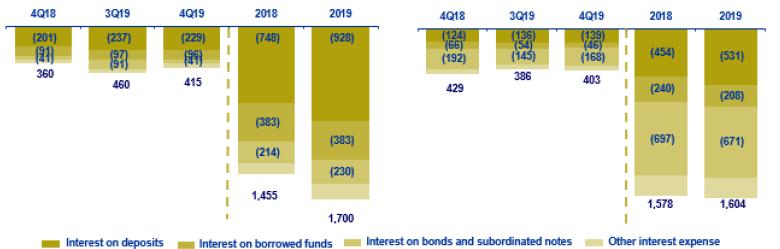

| 4.2. | Interest Expenses |

| Interest Expenses – LC | Interest Expenses – FC |

| (S/ millions) | (S/ millions) |

| |

In theQoQ analysis, interest expenses fell +3.3%, which was attributable, in order of importance, to a drop in interest expenses on bonds and subordinated notes and a contraction in interest on loans.

28

The 11.6% decline in expenses for bonds and subordinated notes was associated with the issuances made at BCP Stand-alone in the third quarter of the year to replace bonds that expire in 2020. As indicated in the previous report, a debt restructuring strategy has been applied to extend the tenure and reduce rates. The positive effects of these transactions have materialized this quarter given that FC bonds expired during this period. The financing provided by these bonds was replaced by issuing an additional amount at lower rates.

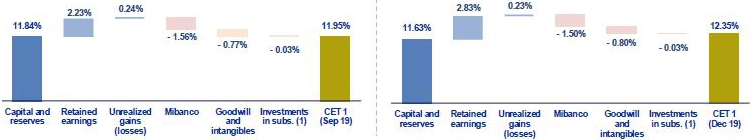

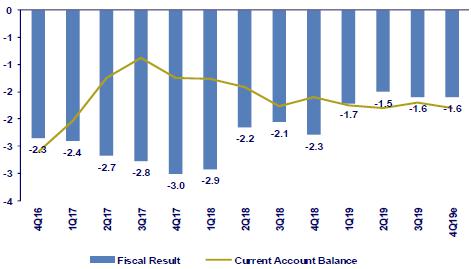

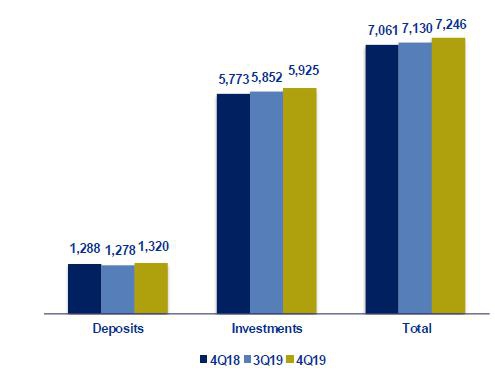

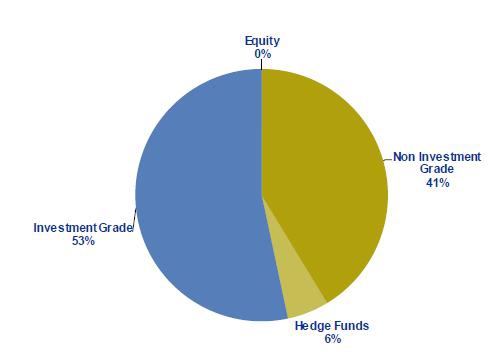

The -6.45 contraction in expenses for interest on loans was attributable to the expiration of loans for working capital and repurchasing agreements with the Central Bank of Peru. These expirations have been replaced with financing that carries lower rates, which reflects the decrease posted in market rates.