Exhibit 99.1

|

Lima, Peru, November 06th, 2017 – Credicorp (NYSE:BAP) announced its unaudited results for the third quarter of 2017. These results are consolidated according to IFRS in Soles.

Third Quarter Results 2017

In 3Q17 Credicorp reported net income of S/ 1,218.3 million. This translated into ROAE and ROAA of 22.8% and 3.0%, respectively. Year-to-date (YTD), net income at Credicorp increased +15.6% with regard to the result for the same period in 2016, which represented ROAE and ROAA of 19.4% and 2.5%, respectively. These levels were similar to those reported for the same period last year (19.8% and 2.2%, respectively).

The results in 3Q17 show:

·Average daily loan balances grew only +0.9% QoQ but expanded +1.4% YoY. This growth was due mainly to loan expansion at Retail Banking segments and Mibanco, which offset the contraction in Corporate Banking loans. These levels of expansion, although low, reflect gradual recovery in the pace of loan growth for the second consecutive quarter. This recovery represents the beginning of a positive trend after the decrease reported in 1Q17. YTD, average daily balances grew +0.4% with regard to 4Q16’s levels, which represented an FX-adjusted expansion of +2.1% in a scenario in which the Sol has appreciated 2.71% thus far this year.

·In line with the gradual recovery in loan growth, mainly in higher-margin segments, net interest income (NII) increased +3.0% QoQ, +1.8% YoY, and +3.1% YTD. In this context the net interest margin (NIM) increased +8 bps QoQ but fell -13 bps YoY, which led the YTD level to remain stable at 5.35%.

·The cost of risk (CofR) fell -26 bps QoQ and -6 bps YoY to situate at 1.59%, which is the lowest level reported since 2013. This was mainly the result of a decrease in provisions, which reflected a decrease in provision requirements for the underlying portfolio and, to a lesser extent, a reduction in provisions for FEN. The improvement in the risk quality of the underlying portfolio was associated with a slight improvement in the majority of segments. In this context, the CofR was situated at 1.89% YTD.

·Risk-adjusted NIM recovered +23 bps QoQ but fell 6 bps YoY. In this context, risk-adjusted NIM recovered +1 bps YTD (4.15%), in line with the decrease in the CofR and the stability of NIM YTD.

·Non-financial income grew +21.7% QoQ and +28.3% YoY. This was mainly attributable to the gain on the sale of the remaining shares of BCI that amounted to S/ 281 million, which offset lower gains on FX transactions, investments in associates and other income. Fee income, the main source of non-financial income, fell slightly QoQ. Nevertheless, in YoY and YTD terms, fee income reported slight growth of +1.9% and +2.2%, respectively.

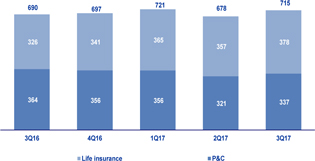

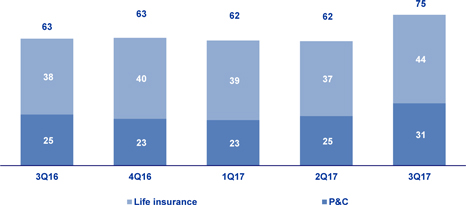

·The underwriting result contracted -2.8% QoQ, -10.1% YoY and -7.4% YTD. The drop QoQ was mainly due to an increase in the acquisition cost in the life insurance business, which was partially offset by higher net earned premiums primarily at the property and casualty business. In the YTD analysis, the decrease was due to an increase in claims in the property and casualty business due mainly to El Nino Phenomenon (FEN).

·The efficiency ratio improved 10 bps QoQ, 20 bps YoY and 40 bps in YTD. The aforementioned was attributable to a gradual recovery in income generation in the banking business. Adequate control over operating expenses led to QoQ growth for this component to hit a historic minimum for the last two years. |

Table of Contents

| Credicorp (NYSE: BAP): Third Quarter Results 2017 | 3 |

| Financial Overview | 3 |

| 1. Interest-earning assets (IEA) | 5 |

| 1.1 Evolution of IEA | 5 |

| 1.2 Credicorp Loans | 6 |

| 1.2.1 Loan evolution by business segment | 6 |

| 1.2.2 Evolution of dollarization by segment | 8 |

| 1.2.3 BCRP de-dollarization plan at BCP Stand-alone | 9 |

| 1.2.4 Market share in loans | 10 |

| 2. Funding Sources | 11 |

| 2.1 Funding Structure | 11 |

| 2.1 Deposits | 12 |

| 2.2.1 Deposit dollarization | 13 |

| 2.2.2 Market share in Deposits | 14 |

| 2.3 Other funding sources | 14 |

| 2.4 Loan / Deposit (L/D) | 15 |

| 2.5 Funding Cost | 16 |

| 2.6 Mutual Funds | 17 |

| 3. Portfolio quality and Provisions for loan losses | 18 |

| 3.1 Provisions for loan losses | 18 |

| 3.2 Portfolio Quality | 19 |

| 3.2.1 Delinquency indicators by business line | 21 |

| 4. Net Interest Income (NII) | 26 |

| 4.1 Interest Income | 26 |

| 4.2 Interest Expenses | 27 |

| 4.3 Net Interest Margin (NIM) and Risk-Adjusted NIM | 28 |

| 5. Non-Financial Income | 30 |

| 5.1 Fee Income | 31 |

| 5.1.1 By subsidiary | 31 |

| 5.1.2 Banking Business | 32 |

| 6. Insurance Underwriting Result | 34 |

| 6.1 Net earned premiums | 34 |

| 6.2 Net claims | 35 |

| 6.3 Acquisition cost | 36 |

| 7. Operating Expenses and Efficiency | 37 |

| 8. Regulatory Capital | 40 |

| 8.1 Regulatory Capital – BAP | 40 |

| 8.2 Regulatory Capital – BCP Stand-alone based on Peru GAAP | 41 |

| 9. Banking business’s Distribution channels | 43 |

| 10. Economic Perspectives | 46 |

| 11. Appendix | 51 |

| 11.1 Credicorp | 51 |

| 11.2 BCP Consolidated | 53 |

| 11.3 Mibanco | 56 |

| 11.4 BCP Bolivia | 57 |

| 11.5 Credicorp Capital | 58 |

| 11.6 Atlantic Security Bank | 59 |

| 11.7 Grupo Pacifico | 61 |

| 11.8 Prima AFP | 63 |

| 11.9 Table of calculations | 64 |

Credicorp (NYSE: BAP): Third Quarter Results 2017

Financial Overview

| Credicorp Ltd. | Quarter | % Change | YTD | % change | ||||||||||||||||||||||||||||

| S/ 000 | 3Q16 | 2Q17 | 3Q17 | QoQ | YoY | Sep 16 | Sep 17 | Sep 16 / Sep 17 | ||||||||||||||||||||||||

| Net interest income * | 1,996,152 | 1,972,705 | 2,032,423 | 3.0 | % | 1.8 | % | 5,838,256 | 6,021,215 | 3.1 | % | |||||||||||||||||||||

| Provision for loan losses, net of recoveries | (389,086 | ) | (433,219 | ) | (378,202 | ) | -12.7 | % | -2.8 | % | (1,326,234 | ) | (1,347,915 | ) | 1.6 | % | ||||||||||||||||

| Net interest income after provisions | 1,607,066 | 1,539,486 | 1,654,221 | 7.5 | % | 2.9 | % | 4,512,022 | 4,673,300 | 3.6 | % | |||||||||||||||||||||

| Non-financial income * | 999,344 | 1,053,960 | 1,282,477 | 21.7 | % | 28.3 | % | 2,943,138 | 3,376,969 | 14.7 | % | |||||||||||||||||||||

| Insurance services underwriting result | 136,700 | 126,445 | 122,959 | -2.8 | % | -10.1 | % | 400,605 | 371,683 | -7.2 | % | |||||||||||||||||||||

| Operating expenses | (1,429,847 | ) | (1,453,187 | ) | (1,445,137 | ) | -0.6 | % | 1.1 | % | (4,188,745 | ) | (4,305,435 | ) | 2.8 | % | ||||||||||||||||

| Operating income | 1,313,263 | 1,266,704 | 1,614,520 | 27.5 | % | 22.9 | % | 3,667,020 | 4,116,517 | 12.3 | % | |||||||||||||||||||||

| Income taxes | (338,018 | ) | (324,771 | ) | (371,563 | ) | 14.4 | % | 9.9 | % | (974,754 | ) | (1,022,002 | ) | 4.8 | % | ||||||||||||||||

| Net income | 975,245 | 941,933 | 1,242,957 | 32.0 | % | 27.5 | % | 2,692,266 | 3,094,515 | 14.9 | % | |||||||||||||||||||||

| Non-controlling interest | 25,451 | 21,713 | 24,656 | 13.6 | % | -3.1 | % | 72,651 | 66,420 | -8.6 | % | |||||||||||||||||||||

| Net income attributed to Credicorp | 949,794 | 920,220 | 1,218,301 | 32.4 | % | 28.3 | % | 2,619,615 | 3,028,095 | 15.6 | % | |||||||||||||||||||||

| Net income / share (S/) | 11.91 | 11.54 | 15.27 | 32.4 | % | 28.3 | % | 32.84 | 37.96 | 15.6 | % | |||||||||||||||||||||

| Total loans | 94,319,220 | 93,670,216 | 95,142,268 | 1.6 | % | 0.9 | % | 94,319,220 | 95,142,268 | 0.9 | % | |||||||||||||||||||||

| Deposits and obligations | 88,709,612 | 92,039,132 | 92,893,915 | 0.9 | % | 4.7 | % | 88,709,612 | 92,893,915 | 4.7 | % | |||||||||||||||||||||

| Net equity | 19,116,945 | 20,802,017 | 21,964,556 | 5.6 | % | 14.9 | % | 19,116,945 | 21,964,556 | 14.9 | % | |||||||||||||||||||||

| Profitability | ||||||||||||||||||||||||||||||||

| Net interest margin * | 5.47 | % | 5.26 | % | 5.34 | % | 8 bps | -13 bps | 5.35 | % | 5.35 | % | 0 bps | |||||||||||||||||||

| Risk adjusted Net interest margin * | 4.40 | % | 4.11 | % | 4.34 | % | 23 bps | -6 bps | 4.14 | % | 4.15 | % | 1 bps | |||||||||||||||||||

| Funding cost * | 2.07 | % | 2.12 | % | 2.07 | % | -5 bps | 0 bps | 2.03 | % | 2.11 | % | 8 bps | |||||||||||||||||||

| ROAE | 20.7 | % | 18.2 | % | 22.8 | % | 460 bps | 210 bps | 19.8 | % | 19.4 | % | -40 bps | |||||||||||||||||||

| ROAA | 2.4 | % | 2.3 | % | 3.0 | % | 70 bps | 60 bps | 2.2 | % | 2.5 | % | 30 bps | |||||||||||||||||||

| Loan portfolio quality | ||||||||||||||||||||||||||||||||

| Delinquency ratio over 90 days | 2.12 | % | 2.25 | % | 2.28 | % | 3 bps | 16 bps | 2.12 | % | 2.28 | % | 16 bps | |||||||||||||||||||

| Internal overdue ratio(1) | 2.79 | % | 2.93 | % | 3.02 | % | 9 bps | 23 bps | 2.79 | % | 3.02 | % | 23 bps | |||||||||||||||||||

| NPL ratio(2) | 3.64 | % | 3.92 | % | 4.03 | % | 11 bps | 39 bps | 3.64 | % | 4.03 | % | 39 bps | |||||||||||||||||||

| Cost of risk(3) | 1.65 | % | 1.85 | % | 1.59 | % | -26 bps | -6 bps | 1.87 | % | 1.89 | % | 2 bps | |||||||||||||||||||

| Coverage of internal overdue loans | 155.4 | % | 157.3 | % | 153.8 | % | -350 bps | -160 bps | 155.4 | % | 153.8 | % | -160 bps | |||||||||||||||||||

| Coverage of NPLs | 118.9 | % | 117.7 | % | 115.2 | % | -250 bps | -370 bps | 118.9 | % | 115.2 | % | -370 bps | |||||||||||||||||||

| Operating efficiency | ||||||||||||||||||||||||||||||||

| Efficiency ratio(4) * | 43.9 | % | 43.8 | % | 43.7 | % | -10 bps | -20 bps | 43.5 | % | 43.1 | % | -40 bps | |||||||||||||||||||

| Operating expenses / Total average assets | 3.69 | % | 3.63 | % | 3.62 | % | -1 bps | -7 bps | 3.50 | % | 3.70 | % | 20 bps | |||||||||||||||||||

| Insurance ratios | ||||||||||||||||||||||||||||||||

| Combined ratio of P&C(5) (6) | 88.0 | % | 97.9 | % | 95.8 | % | -210 bps | 780 bps | 89.1 | % | 96.7 | % | 760 bps | |||||||||||||||||||

| Loss ratio(6) | 56.9 | % | 59.1 | % | 57.8 | % | -130 bps | 90 bps | 57.3 | % | 47.9 | % | -940 bps | |||||||||||||||||||

| Underwriting result / net earned premiums(6) | 16.2 | % | 10.5 | % | 10.7 | % | 20 bps | -550 bps | 16.3 | % | 10.6 | % | -570 bps | |||||||||||||||||||

| Capital adequacy(7) | ||||||||||||||||||||||||||||||||

| Tier 1 Capital (S/ Million)(8) | 10,772 | 11,807 | 11,811 | 0.0 | % | 9.6 | % | 10,772 | 11,811 | 9.6 | % | |||||||||||||||||||||

| Common equity tier 1 ratio(9) | 10.64 | % | 11.54 | % | 11.93 | % | 39 bps | 129 bps | 10.64 | % | 11.93 | % | 129 bps | |||||||||||||||||||

| BIS ratio(10) | 15.56 | % | 16.71 | % | 16.35 | % | -36 bps | 79 bps | 15.56 | % | 16.35 | % | 79 bps | |||||||||||||||||||

| Employees | 33,115 | 33,343 | 33,467 | 0.4 | % | 1.1 | % | 33,115 | 33,467 | 1.1 | % | |||||||||||||||||||||

| Share Information | ||||||||||||||||||||||||||||||||

| Outstanding Shares | 94,382 | 94,382 | 94,382 | 0.0 | % | 0.0 | % | 94,382 | 94,382 | 0.0 | % | |||||||||||||||||||||

| Floating Shares(11) | 79,761 | 79,761 | 79,761 | 0.0 | % | 0.0 | % | 79,761 | 79,761 | 0.0 | % | |||||||||||||||||||||

| Treasury Shares | 14,621 | 14,621 | 14,621 | 0.0 | % | 0.0 | % | 14,621 | 14,621 | 0.0 | % | |||||||||||||||||||||

* This account or ratio has been modified retroactively, as a result of the improvement in the presentation of Credicorp's accounting. This improvement allowed to show the net gain in derivatives and the result by difference in exchange"

(1) Internal overdue loans: includes overdue loans and loans under legal collection, according to our internal policy for overdue loans. Internal Overdue Ratio: Internal Overdue Loans / Total Loans

(2) Non-performing loans (NPL): Internal overdue loans + Refinanced loans. NPL ratio: NPLs / Total loans.

(3) Cost of risk: Annualized provision for loan losses / Total loans.

(4) Calculation has been adjusted, for more detail see Appendix 11.9. Efficiency ratio = [Total Expenses + Acquisition Cost - Other expenses] / [Net Interest Income + Fee Income + Net Gain on Foreign Exchange Transactions + Net Gain from Subsidiaries + Net Premiums Earned]

(5) Combined ratio= (Net claims + General expenses + Fees + Underwriting expenses) / Net earned premiums. Does not include Life insurance business.

(6) Considers Grupo Pacifico's figures before eliminations for consolidation to Credicorp.

(7) All Capital ratios are for BCP Stand-slone and based on Peru GAAP

(8) Tier 1 = Capital + Legal and other capital reserves + Accumulated earnings with capitalization agreement + Unrealized profit and net income in subsidiaries - Goodwill - (0.5 x Investment in subsidiaries) + Perpetual subordinated debt (maximum amount that can be included is 17.65% of Capital + Reserves + Accumulated earnings with capitalization agreement + Unrealized profit and net income in subsidiaries - Goodwill).

(9) Common Equity Tier I = Capital + Reserves – 100% of applicable deductions (investment in subsidiaries, goodwill, intangibles and net deferred taxes that rely on future profitability) + retained earnings + unrealized gains.

(10) Regulatory Capital / Risk-weighted assets (legal minimum = 10% since July 2011)

(11) It includes common shares directly or indirectly owned by Dionisio Romero Paoletti (Chairman of the Board) and his family or companies owned or controlled by them. As of February 8, 2017, Romero family owned 13,243,553 common shares and as of February 8, 2017, they owned 13,137,638 shares.

| 3 |

Credicorp and subsidiaries

| Earnings contribution * | Quarter | % change | YTD | % change | ||||||||||||||||||||||||||||

| S/ 000 | 3Q16 | 2Q17 | 3Q17 | QoQ | YoY | Sep 16 | Sep 17 | Sep 17 / Sep 16 | ||||||||||||||||||||||||

| Banco de Crédito BCP(1) | 740,240 | 721,572 | 789,854 | 9.5 | % | 6.7 | % | 1,967,746 | 2,203,589 | 12.0 | % | |||||||||||||||||||||

| Mibanco(2) | 83,539 | 85,429 | 113,058 | 32.3 | % | 35.3 | % | 221,206 | 263,727 | 19.2 | % | |||||||||||||||||||||

| BCB | 20,599 | 26,670 | 10,371 | -61.1 | % | -49.7 | % | 62,169 | 56,635 | -8.9 | % | |||||||||||||||||||||

| Grupo Pacífico(3) | 87,196 | 77,791 | 82,591 | 6.2 | % | -5.3 | % | 237,925 | 240,572 | 1.1 | % | |||||||||||||||||||||

| Prima AFP | 41,840 | 38,545 | 29,401 | -23.7 | % | -29.7 | % | 121,455 | 109,657 | -9.7 | % | |||||||||||||||||||||

| Credicorp Capital | 19,179 | 26,486 | 14,288 | -46.1 | % | -25.5 | % | 62,354 | 55,288 | -11.3 | % | |||||||||||||||||||||

| Atlantic Security Bank | 57,220 | 43,344 | 42,778 | -1.3 | % | -25.2 | % | 100,764 | 126,442 | 25.5 | % | |||||||||||||||||||||

| Others(4) | (16,480 | ) | (14,188 | ) | 249,018 | -1855.1 | % | -1611.0 | % | 67,202 | 235,912 | -251.0 | % | |||||||||||||||||||

| Net income Credicorp | 949,794 | 920,220 | 1,218,301 | 32.4 | % | 28.3 | % | 2,619,615 | 3,028,095 | 15.6 | % | |||||||||||||||||||||

*Contributions to Credicorp reflect the eliminations for consolidation purposes (e.g. eliminations for transactions among Credicorp’s subsidiaries or between Credicorp and its subsidiaries)

(1) Includes Mibanco.

(2) The figure is lower than the net income of Mibanco because Credicorp owns 95.36% of Mibanco (directly and indirectly).

(3) The figure is lower than the net income before minority interest of Grupo Pacifico because Credicorp owns 98.79% of Grupo Pacifico (directly and indirectly).

(4) Includes Grupo Credito excluding Prima (Servicorp and Emisiones BCP Latam), others of Atlantic Security Holding Corporation and others of Credicorp Ltd.

| Quarter | YTD | |||||||||||||||||||

| ROAE * | 3Q16 | 2Q17 | 3Q17 | Sep 16 | Sep 17 | |||||||||||||||

| Banco de Crédito BCP(1) | 23.5 | % | 21.5 | % | 22.3 | % | 23.5 | % | 20.8 | % | ||||||||||

| Mibanco(2) | 23.6 | % | 24.3 | % | 30.0 | % | 21.7 | % | 22.5 | % | ||||||||||

| BCB | 13.8 | % | 17.9 | % | 6.7 | % | 14.3 | % | 12.1 | % | ||||||||||

| Grupo Pacífico(3) | 15.0 | % | 13.9 | % | 13.1 | % | 15.8 | % | 13.1 | % | ||||||||||

| Prima | 30.7 | % | 30.2 | % | 21.1 | % | 29.5 | % | 24.6 | % | ||||||||||

| Credicorp Capital(4) | 10.8 | % | 13.4 | % | 7.2 | % | 13.8 | % | 9.2 | % | ||||||||||

| Atlantic Security Bank | 27.9 | % | 22.4 | % | 20.6 | % | 18.3 | % | 19.6 | % | ||||||||||

| Credicorp | 20.7 | % | 18.2 | % | 22.8 | % | 19.8 | % | 19.4 | % | ||||||||||

(1) Banco de Crédito BCP includes BCP Stand-alone and Mibanco.

(2) ROAE including goodwill of BCP from the acquisition of Edyficar (Approximately US$ 50.7 million) was 21.4% in 3Q16, 22.1% in 2Q17 and 27.4% in 3Q17. YTD ROAE incluiding goodwill was 19.7% as of Sep 16 and 20.6% as of Sep 17.

(3) Figures include unrealized gains or losses that are considered in Pacifico’s Net Equity from the investment portfolio of Pacifico Vida. ROAE excluding such unrealized gains was 19.1% in 3Q16, 17.4% in 2Q17 and 17.1% in 3Q17. YTD ROAE excluding such unrealized gains was 18.5% as of Sep 16 and 16.1% as of Sep 17.

(4) ROAE including the fees paid by Credicorp Ltd related to the sale of BCI was 8.7% in 3Q17 and YTD it was 9.7% as of Sep 17.

| 4 |

| 1. | Interest-earning assets (IEA) |

Within IEA, loans expanded for the second consecutive quarter, although at a low rate. This was mainly attributable to growth at the Retail Banking segments and Mibanco, which are higher-margin businesses. In this context, the investment portfolio increased its share in total IEA, which reflects the investment strategy to maximize returns in a scenario of low loan growth.

| Interest earning assets | As of | % change | ||||||||||||||||||

| S/ 000 | Sep 16 | Jun 17 | Sep 17 | QoQ | YoY | |||||||||||||||

| BCRP and other banks | 23,394,407 | 25,361,757 | 22,763,956 | -10.2 | % | -2.7 | % | |||||||||||||

| Interbank funds | 207,518 | 227,212 | 59,038 | -74.0 | % | -71.6 | % | |||||||||||||

| Trading securities | 4,609,582 | 4,686,995 | 5,010,358 | 6.9 | % | 8.7 | % | |||||||||||||

| Investments available for sale | 19,949,532 | 22,016,939 | 26,380,715 | 19.8 | % | 32.2 | % | |||||||||||||

| Investment held to maturity | 4,243,603 | 5,086,185 | 4,267,588 | -16.1 | % | 0.6 | % | |||||||||||||

| Total loans(1) | 94,319,220 | 93,670,218 | 95,142,268 | 1.6 | % | 0.9 | % | |||||||||||||

| Total interest earning assets | 146,723,862 | 151,049,306 | 153,623,923 | 1.7 | % | 4.7 | % | |||||||||||||

(1) Quarter-end balance

| 1.1 | Evolution of IEA |

Total loans

Total loans, the group’s most profitable asset, maintained a stable share of IEA (61.9% in 3Q17 vs. 62.0% in 2Q17).

Loans posted nominal expansion QoQ of +1.6% and a currency-adjusted growth rate of +1.4% given that the Sol depreciated only 0.37% against the US Dollar this quarter while the dollarization level was situated at 41.3%. These levels of expansion, although low, reflect a gradual recovery in loan growth for the second consecutive quarter, which posted an upward trend after having registered a drop in 1Q17. Loan expansion at Credicorp is due mainly to:

| (i) | The increase in loans in the Middle-Market Banking, SME-Pyme and SME-Business at BCP Stand-alone; |

| (ii) | +5.9% expansion QoQ in loans at BCP Bolivia; and |

| (iii) | Growth of +1.8% QoQ at Mibanco. |

All of the aforementioned was partially offset by a decrease in Corporate Banking loans at BCP Stand-alone, which was attributable to aggressive competition in this segment.

The YoY evolution reflected slight growth in loans, which increased +0.9%. This fell below the level registered last quarter (+2.2%). The currency-adjusted growth rate was +2.6%, in line with the +3.97% appreciation of the Sol YoY. It is important to note that loan growth at BCP Bolivia (+16.0%) and at Mibanco (+7.9%) helped offset low loan expansion at BCP Stand-alone. Finally, loans grew +0.4% YTD.

Investments

Investments continue to increase their share in IEA due to an investment strategy to maximize the profitability of IEA to attenuate the effect of low loan-growth.

In this context, investments expanded +12.2% QoQ and +23.8% YoY, mainly due to higher volumes at BCP Stand-alone. The aforementioned was attributable to an increase in investments available for sale (+19.8% QoQ and +32.2% YoY), which was primarily associated with the purchase of Certificates of Deposit (CDs) from BCRP. This offset the contraction in investments held-to-maturity of -16.1% QoQ (YoY the level was stable).

| 5 |

Other IEA

BCRP and other banks fell -10.2% QoQ and -2.7% YoY due to a drop in BCRP balances, which was associated with the aforementioned purchase of BCRP certificates of deposit at BCP Stand-alone.

| 1.2 | Credicorp Loans |

| 1.2.1 | Loan evolution by business segment |

The table below shows the structure of loans by subsidiary and business segment measured in average daily balances. These balances may reflect trends or variations to a different degree than quarter-end balances given that the latter may include pre-payments or loans placed at the end of the quarter, which affect average daily balances to a lesser extent

Loan evolution measured in average daily balances by segment

| TOTAL LOANS | ||||||||||||||||||||||||||||

| Expressed in million soles | % change | % Part. in total loans | ||||||||||||||||||||||||||

| 3Q16 | 2Q17 | 3Q17 | QoQ | YoY | 3Q16 | 3Q17 | ||||||||||||||||||||||

| BCP Stand-alone | 77,295 | 76,915 | 77,488 | 0.7 | % | 0.2 | % | 82.5 | % | 81.6 | % | |||||||||||||||||

| Wholesale Banking | 41,178 | 40,456 | 40,331 | -0.3 | % | -2.1 | % | 43.9 | % | 42.4 | % | |||||||||||||||||

| Corporate | 27,392 | 26,653 | 25,899 | -2.8 | % | -5.4 | % | 29.2 | % | 27.3 | % | |||||||||||||||||

| Middle - Market | 13,786 | 13,803 | 14,432 | 4.6 | % | 4.7 | % | 14.7 | % | 15.2 | % | |||||||||||||||||

| Retail Banking | 35,413 | 35,723 | 36,434 | 2.0 | % | 2.9 | % | 37.8 | % | 38.3 | % | |||||||||||||||||

| SME - Business | 4,460 | 4,433 | 4,704 | 6.1 | % | 5.5 | % | 4.8 | % | 5.0 | % | |||||||||||||||||

| SME - Pyme | 7,598 | 7,922 | 8,240 | 4.0 | % | 8.5 | % | 8.1 | % | 8.7 | % | |||||||||||||||||

| Mortgage | 12,609 | 12,584 | 12,745 | 1.3 | % | 1.1 | % | 13.5 | % | 13.4 | % | |||||||||||||||||

| Consumer | 6,446 | 6,502 | 6,514 | 0.2 | % | 1.1 | % | 6.9 | % | 6.9 | % | |||||||||||||||||

| Credit Card | 4,299 | 4,283 | 4,230 | -1.2 | % | -1.6 | % | 4.6 | % | 4.5 | % | |||||||||||||||||

| Others(1) | 704 | 736 | 723 | -1.8 | % | 2.7 | % | 0.8 | % | 0.8 | % | |||||||||||||||||

| Mibanco | 8,158 | 8,689 | 8,840 | 1.7 | % | 8.4 | % | 8.7 | % | 9.3 | % | |||||||||||||||||

| Bolivia | 5,159 | 5,716 | 5,959 | 4.2 | % | 15.5 | % | 5.5 | % | 6.3 | % | |||||||||||||||||

| ASB | 3,086 | 2,816 | 2,723 | -3.3 | % | -11.8 | % | 3.3 | % | 2.9 | % | |||||||||||||||||

| BAP's total loans | 93,698 | 94,136 | 95,010 | 0.9 | % | 1.4 | % | 100.0 | % | 100.0 | % | |||||||||||||||||

For consolidation purposes, loans generated in FC are converted to LC.

(1) Includes Work out unit and other banking.

| Highest growth in volumes | |

| Largest contraction in volumes |

Loan evolution by currency - average daily balances

| DOMESTIC CURRENCY LOANS | FOREIGN CURRENCY LOANS | % part. by currency | ||||||||||||||||||||||||||||||||||||||||||||||

| Expressed in million Soles | Expressed in million USD | 3Q17 | ||||||||||||||||||||||||||||||||||||||||||||||

| 3Q16 | 2Q17 | 3Q17 | QoQ | YoY | 3Q16 | 2Q17 | 3Q17 | QoQ | YoY | LC | FC | |||||||||||||||||||||||||||||||||||||

| BCP Stand-alone | 48,768 | 46,871 | 47,243 | 0.8 | % | -3.1 | % | 8,433 | 9,227 | 9,309 | 0.9 | % | 10.4 | % | 61.0 | % | 39.0 | % | ||||||||||||||||||||||||||||||

| Wholesale Banking | 20,606 | 18,174 | 18,015 | -0.9 | % | -12.6 | % | 6,082 | 6,843 | 6,869 | 0.4 | % | 12.9 | % | 44.7 | % | 55.3 | % | ||||||||||||||||||||||||||||||

| Corporate | 13,669 | 11,479 | 11,118 | -3.1 | % | -18.7 | % | 4,057 | 4,660 | 4,550 | -2.4 | % | 12.1 | % | 42.9 | % | 57.1 | % | ||||||||||||||||||||||||||||||

| Middle-Market | 6,937 | 6,695 | 6,896 | 3.0 | % | -0.6 | % | 2,025 | 2,183 | 2,319 | 6.2 | % | 14.5 | % | 47.8 | % | 52.2 | % | ||||||||||||||||||||||||||||||

| Retail Banking | 27,879 | 28,366 | 28,895 | 1.9 | % | 3.6 | % | 2,227 | 2,259 | 2,320 | 2.7 | % | 4.2 | % | 79.3 | % | 20.7 | % | ||||||||||||||||||||||||||||||

| SME - Business | 2,121 | 2,117 | 2,229 | 5.3 | % | 5.1 | % | 692 | 711 | 762 | 7.1 | % | 10.2 | % | 47.4 | % | 52.6 | % | ||||||||||||||||||||||||||||||

| SME - Pyme | 7,184 | 7,599 | 7,926 | 4.3 | % | 10.3 | % | 122 | 99 | 97 | -2.5 | % | -21.0 | % | 96.2 | % | 3.8 | % | ||||||||||||||||||||||||||||||

| Mortgage | 9,266 | 9,413 | 9,589 | 1.9 | % | 3.5 | % | 989 | 974 | 972 | -0.2 | % | -1.7 | % | 75.2 | % | 24.8 | % | ||||||||||||||||||||||||||||||

| Consumer | 5,493 | 5,471 | 5,469 | 0.0 | % | -0.4 | % | 282 | 317 | 322 | 1.6 | % | 14.1 | % | 84.0 | % | 16.0 | % | ||||||||||||||||||||||||||||||

| Credit Card | 3,815 | 3,766 | 3,682 | -2.2 | % | -3.5 | % | 143 | 159 | 169 | 6.2 | % | 17.8 | % | 87.0 | % | 13.0 | % | ||||||||||||||||||||||||||||||

| Others(1) | 284 | 331 | 333 | 0.8 | % | 17.6 | % | 124 | 125 | 120 | -3.8 | % | -3.6 | % | 46.1 | % | 53.9 | % | ||||||||||||||||||||||||||||||

| Mibanco | 7,638 | 8,189 | 8,331 | 1.7 | % | 9.1 | % | 154 | 153 | 156 | 1.9 | % | 1.8 | % | 94.3 | % | 5.7 | % | ||||||||||||||||||||||||||||||

| Bolivia | - | - | - | - | - | 1,525 | 1,756 | 1,834 | 4.5 | % | 20.2 | % | - | 100.0 | % | |||||||||||||||||||||||||||||||||

| ASB | - | - | - | - | - | 912 | 865 | 838 | -3.1 | % | -8.1 | % | - | 100.0 | % | |||||||||||||||||||||||||||||||||

| Total loans | 56,406 | 55,060 | 55,574 | 0.9 | % | -1.5 | % | 11,025 | 12,001 | 12,138 | 1.1 | % | 10.1 | % | 58.5 | % | 41.5 | % | ||||||||||||||||||||||||||||||

(1) Includes Work out unit, and other banking.

| Highest growth in volumes | |

| Largest contraction in volumes |

| 6 |

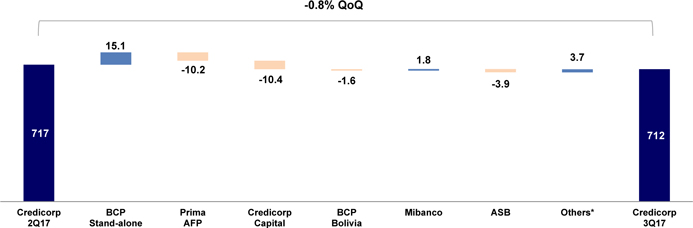

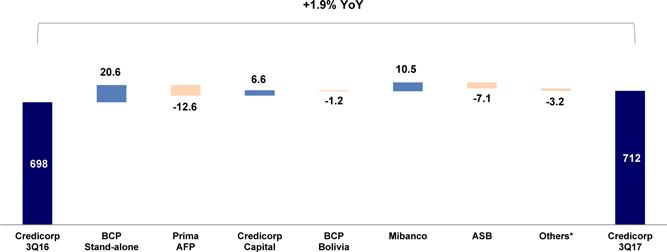

Average daily balances reported growth of only +0.9% QoQ, which is a rate lower than that posted for quarter-end balances (+1.6% QoQ) given that the latter recovered toward the end of the quarter. This increase was very balanced in terms of currency, so the currency mix of the loan book was relatively stable.

The higher level registered this quarter was due primarily to growth in Retail Banking at BCP Stand-alone, specifically in the SME-Business and SME-Pyme segments, and at Mibanco and BCP Bolivia.

Loan Growth QoQ in Average Daily Balances

Expressed in millions of soles

At BCP Stand-alone, Wholesale Banking posted a slight contraction QoQ due to a drop in Corporate Banking loans in both currencies, which reflects, to a large extent, the aggressive competition seen in this segment since 2016. This was attenuated by loan growth, particularly in FC, in Middle-Market Banking.

The QoQ increase in the Retail Banking portfolio at BCP Stand-alone was attributable to:

| (i) | Loan growth in SME-Pyme mainly in loans denominated in LC; |

| (ii) | Loan expansion in SME-Business in loans of both currencies; and |

| (iii) | An increase in Mortgage loans denominated in LC. |

All aforementioned helped offset the slight contraction in the Credit Card segment. In terms of the credit card segment, it is important to note that the strategy implemented to reduce clients’ level of leverage has had a negative impact on loan origination, but has allowed us to exercise more control and absorb the delinquency level that was registered at the end of 2015, which was above our risk appetite.

BCP Bolivia posted loan growth, which was situated at +4.2% QoQ in 2Q17, measured in average daily balances. This evolution was due to higher growth in the Wholesale Banking segment, which was primarily attributable to growth in Corporate Banking loans. Retail Banking also posted slight growth due to an increase in mortgage loans.

Mibanco’s loan book expanded +1.7% QoQ, measured in average daily balances, which is noteworthy given the context of low economic growth. Regardless, the speed of origination still remains below this segment’s potential.

ASB loans, measured in average daily balances, fell -3.3% QoQ, which was attributable to pre-payments of Back-to-Back loans.

All of the aforementioned is reflected in the change in the portfolio mix, where segments with higher margins such as SME-Pyme, SME-Business and Mibanco continue to increase their shares due to higher growth rates and to contractions in some segments in a context of growing competition and subsequently lower margins.

| 7 |

Loan Growth YoY in Average Daily Balances

Expressed in millions of soles

The analysis of total loans YoY measured in average daily balances shows growth of +1.4% that was led by Mibanco, Middle-Market Banking and SME-Pyme at BCP Stand-alone and by BCP Bolivia. YoY growth was due mainly to expansion in FC loans, which helped offset the contraction in average daily balances in LC.

Finally, average daily balances expanded +0.4% YTD and +2.1% adjusted for FX, in a scenario in which the Sol appreciated 2.71% since December.

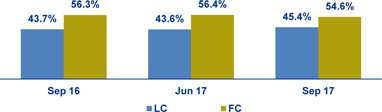

| 1.2.2 | Evolution of dollarization by segment |

YoY evolution of dollarization by Credicorp segment

(1) Average daily balances.

(2) The FC share of Credicorp’s loan portfolio is calculated including BCP Bolivia and ASB, however the chart shows only BCP Stand-alone and Mibanco’s loan books.

The analysis of the YoY evolution of Credicorp’s dollarization level shows an increase that is attributable to an increase in the dollarization level at BCP Stand-alone and, to a lesser extent, to expansion in loans at BCP Bolivia. It is important to note that BCP Bolivia’s loans are denominated in Bolivian Pesos and as such, are considered part of Credicorp’s FC portfolio when calculating the dollarization level.

| 8 |

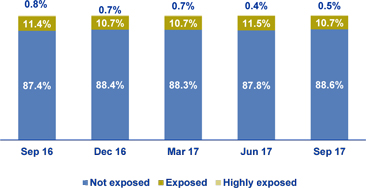

The chart above shows the levels of dollarization of the business segments at BCP Stand-alone and Mibanco. It is important to note that:

| (i) | Higher dollarization at BCP Stand-alone was due to an increase in this level in Wholesale Banking, which was in turn attributable to loans for clients in the fishing sector that have US dollar income generation; and |

| (ii) | The other segments posted stable dollarization levels with the exception of Mortgage, which continued its gradual dedollarization process. |

All of the aforementioned contributed to maintaining the percentage of the loan portfolio that is highly exposed to FX-risk on credit risk at relatively stable levels, which, as the figure shows, are close to 0%.

FX risk on credit risk – BCP Stand-alone

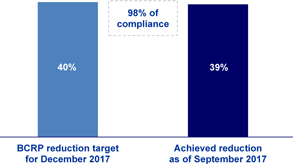

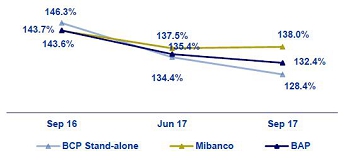

| 1.2.3 | BCRP de-dollarization plan at BCP Stand-alone |

At the end of 2014, BCRP established a Loan Dedollarization Program. Among the measures taken, progressive dedollarization goals were set for June 2015, December 2015 and December 2016 for the total portfolio in FC with some exceptions and for the joint mortgage and car portfolio. The balance required at the end of December 2017 has been adjusted in the following way:

| (i) | For the total portfolio in FC, the balance at the end of December 2017 should represent no more than 80% of the total loan balance at the end of September 2013 (excluding some loans). This goal is the same as that set for December 2016. It is important to note that at the end of 4Q16, Credicorp posted a compliance level of 144% for this goal; and |

| (ii) | For the FC portfolio in FC in the mortgage and car portfolio at the end of December 2017 must represent no more 60% of the balance at the end of February 2013. |

The bases for both goals are pegged to quarter-end balances in local accounting but the compliance level is calculated with monthly average daily balances for the reporting month.

| 9 |

The figures below show the percentage of compliance at the end of September 2017:

| Reduction target for total loans in FC | Reduction Target for “Mortgage & Car” loans in FC | |

| -at the end of September 2017 | -at the end of September 2017 | |

|  |

As is evident in the figures, BCP Stand-alone has achieved a comfortable compliance level for the loans that are subject to the dedollarization program. In terms of the Car + Mortgage portfolio, the compliance level is slightly below 100%, which reflects a slowdown in the speed of dedollarization in the Mortgage segment. Nevertheless, this is not of concern given that Credicorp still has three months to hit the reduction goal.

| 1.2.4 | Market share in loans |

Market share in Peru(1)

(1) Mortgage segment includes Mibanco's market share of 1% as of August 2017, June 2017 and September 2016.

(2) Consumer segment includes Mibanco's market share of 2.0% as of August 2017, 2.1% as of June 2017 and 2.2% as of September 2016.

(3) Corporate and Middle-market market shares are as of September 2017

At the end of August 2017, BCP Stand-alone continued to lead the market with a share of 28.7%, which is significantly higher than the level posted by its closest competitor. Nevertheless, this share falls below the 30.0% posted in 3Q16, which reflects high competition in the Wholesale Banking segment and low growth in the Retail Banking segments.

Corporate and Middle-Market Banking reduced their market share in -70 and -180 bps, respectively. However, it is worth mentioning that both maintained their leadership in their respective markets.

In Retail Banking, BCP also registered a relatively stable market share and continued to lead in the vast majority of its segments with the exception of SME-Business, where it ranked second. The banks remains committed to increasing its market share.

Mibanco slightly increased its market share in the SME-Pyme segment, going from 22.4% in September 2016 to 22.5% in August 2017.

Finally, BCP Bolivia’s market share grew QoQ and YoY, once again ranking fourth in the Bolivian Financial System.

| 10 |

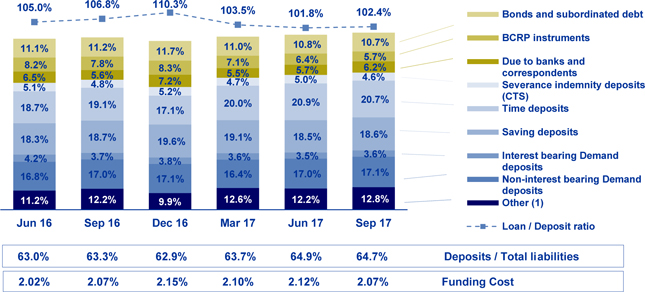

| 2. | Funding Sources |

In 2017, Credicorp’s funding structure shows a higher share of Deposits. In 3Q17, it is important to note: i) an increase in the funding volume, which was in line with a gradual recovery in loan growth; ii) significant expansion in Demand and Savings deposits, which are a lower-cost source of funding; and iii) the increase in Due to banks and correspondents in LC, which have replaced BCRP instruments, in line with the strategy to keep the currency and duration mistmatch within internal limits. All of the aforementioned led to a drop in interest expenses, which translated into a 5 bps drop QoQ in Credicorp’s funding cost.

| Funding | As of | % change | ||||||||||||||||||

| S/ 000 | Sep 16 | Jun 17 | Sep 17 | QoQ | YoY | |||||||||||||||

| Non-interest bearing demand deposits | 23,684,449 | 24,051,059 | 24,506,234 | 1.9 | % | 3.5 | % | |||||||||||||

| Interest bearing Demand deposits | 5,530,717 | 4,884,148 | 5,075,162 | 3.9 | % | -8.2 | % | |||||||||||||

| Saving deposits | 26,015,226 | 26,085,580 | 26,652,822 | 2.2 | % | 2.5 | % | |||||||||||||

| Time deposits | 26,515,785 | 29,576,960 | 29,619,222 | 0.1 | % | 11.7 | % | |||||||||||||

| Severance indemnity deposits | 6,611,956 | 7,039,767 | 6,609,242 | -6.1 | % | 0.0 | % | |||||||||||||

| Interest payable | 351,479 | 401,618 | 431,233 | 7.4 | % | 22.7 | % | |||||||||||||

| Total deposits | 88,709,612 | 92,039,132 | 92,893,915 | 0.9 | % | 4.7 | % | |||||||||||||

| Due to banks and correspondents | 7,770,822 | 8,066,962 | 8,867,185 | 9.9 | % | 14.1 | % | |||||||||||||

| BCRP instruments | 10,798,751 | 8,989,728 | 8,107,103 | -9.8 | % | -24.9 | % | |||||||||||||

| Bonds and subordinated debt | 15,571,172 | 15,295,673 | 15,236,054 | -0.4 | % | -2.2 | % | |||||||||||||

| Other liabilities(1) | 16,201,411 | 16,803,410 | 17,807,782 | 6.0 | % | 9.9 | % | |||||||||||||

| Total funding | 139,051,768 | 141,194,905 | 142,912,039 | 1.2 | % | 2.8 | % | |||||||||||||

(1) Includes acceptances outstanding, reserves for property and casualty claims, reserve for unearned premiums, reinsurance payable and other liabilities.

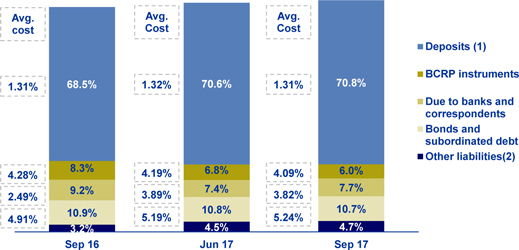

| 2.1 | Funding Structure |

Evolution of the funding structure and cost – BAP

(1) Includes acceptances outstanding, reserve for property and casualty claims, reserve for unearned premiums, reinsurance payable and other liabilities.

In the figure for the Evolution of the funding structure and cost at Credicorp is calculated based on quarter-end balances. This quarter, it is noteworthy the QoQ increase in the share ofDue to banks and correspondents, Savings deposits and Demand depositsin Credicorp’s funding mix, whileBCRP Instruments continue to post a drop in their share due to expirations of regular repos.

| 11 |

Deposits continued to represent the main funding source at Credicorp with a 64.7% share of total funding at the end of September 2017.

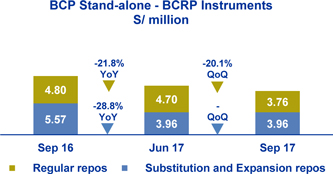

| The share ofBCRP Instrumentsin Credicorp’s total funding fell -70 bps QoQ. This was due primarily to the expiration ofRegular Reposwith BCRP. It is important to note that BCP Stand-alone accounts for approximately 95% of BCRP Instruments at the Credicorp level; the remainder corresponds to Mibanco. |  |

Given the importance of BCP Stand-alone’s funding, we have developed a figure to show its structure by tenure. It is evident that approximately 67.8% of the funding in BCRP Instruments have expiration dates in 2017 and 2018.

BCP Stand-alone - Funding structure by tenure YoY

At the end of June 2017

(1) Deposits include non-contractual deposits (Demand, Savings and Severance indemnity -CTS) and Time Deposits. The non-contractual deposits represent 76% of total deposits; 34% of the non-contractual deposits has tenure lower than 6 months and 66% of the non-contractual deposits has a duration higher than 6 months (10% ≤ 1 year, 30% between >1 year and ≤ 3 years, and 60% from >3 years onwards). (2) It includes Due to banks and correspondents and Bonds and subordinated debt. | At the end of September 2017

(1) Deposits include non-contractual deposits (Demand, Savings and Severance indemnity -CTS) and Time Deposits. The non-contractual deposits represent 77% of total deposits; 34% of the non-contractual deposits has tenure lower than 6 months and 66% of the non-contractual deposits has a duration higher than 6 months (9% ≤ 1 year, 31% between >1 year and ≤ 3 years, and 60% from >3 years onwards). (2) It includes Due to banks and correspondents and Bonds and subordinated debt. |

2.1 Deposits

| Deposits | As of | % change | ||||||||||||||||||

| S/ 000 | Sep 16 | Jun 17 | Sep 17 | QoQ | YoY | |||||||||||||||

| Non-interest bearing demand deposits | 23,684,449 | 24,051,059 | 24,506,234 | 1.9 | % | 3.5 | % | |||||||||||||

| Interest bearing Demand deposits | 5,530,717 | 4,884,148 | 5,075,162 | 3.9 | % | -8.2 | % | |||||||||||||

| Saving deposits | 26,015,226 | 26,085,580 | 26,652,822 | 2.2 | % | 2.5 | % | |||||||||||||

| Time deposits | 26,515,785 | 29,576,960 | 29,619,222 | 0.1 | % | 11.7 | % | |||||||||||||

| Severance indemnity deposits | 6,611,956 | 7,039,767 | 6,609,242 | -6.1 | % | 0.0 | % | |||||||||||||

| Interest payable | 351,479 | 401,618 | 431,233 | 7.4 | % | 22.7 | % | |||||||||||||

| Total deposits | 88,709,612 | 92,039,132 | 92,893,915 | 0.9 | % | 4.7 | % | |||||||||||||

Total deposits grew QoQ. This was primarily attributable to growth at BCP Stand-alone and, to a lesser extent, to expansion at BCP Bolivia.

Within the QoQ increase, growth insavings deposits by individuals is noteworthy, particularly in terms of main products such as payroll accounts, “my first account” and “award account” (different types of saving accounts for individuals, which were promoted through a large-scale advertising campaign). This expansion was the result of significant efforts to offset aggressive competition to capture deposits from individuals.

QoQ growth was also reported in i)non-interest bearing demand deposits,which was in turn due to a higher volume in current accounts in LC of Corporate Banking clients at BCP Stand-alone; and ii)Interest-bearing demand deposits,mainly in Corporate Banking in LC.

| 12 |

The increase intime deposits was due primarily attributable to corporate clientsat BCP Bolivia.

The aforementioned helped offset the seasonal contraction QoQ inSeverance indemnity deposits given that employers pay half a salary every 2Q and some employees opt to withdraw the excess accumulated in the following quarter (3Q).

InYoY terms, there was a significant 4.7% increase in total Deposits due to increases in the level of Time deposits and Non-interest bearing demand deposits.Growth in the latter was mainly attributable to expansion inCurrent accounts at BCP Stand-alone.

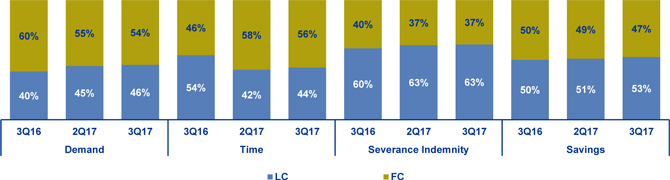

2.2.1 Deposit dollarization

Deposit Dollarization(1)– BAP

(1) Q-end balances.

Deposit dollarization at Credicorp fell QoQ. This was due primarily to an increase in Demand and Savings deposits, both a lower-cost funding source, in LC and at BCP Stand-alone. The aforementioned was accentuated by the contraction in FC deposits. All of the aforementioned was in line with our strategy to maintain an adequate balance of assets and liabilities by currency.

The YoY evolution shows a trend similar to that seen in the QoQ evolution, which was attributable to significant growth in Demand deposits (interest-bearing and non-interest bearing) and Savings deposits in LC through BCP Stand-alone, as the figure below shows.

BCP Stand-alone- Deposit Dollarization measured in average daily balances

The analysis of the evolution of the dollarization of deposits by type shows that all of the deposits report either lower or stable dollarization levels QoQ. It is noteworthy to note, the increase in Non-interest bearing demand and Savings deposits, both in LC.

In the YoY analysis, significant dedollarization was attributable to an increase in demand, savings and CTS deposits in LC. It is important to note that the increase in the dollarization level of Time deposits in 2016 was originated by corporate clients.

| 13 |

2.2.2 Market share in Deposits

Market share in Peru

Source: BCP

(1) Demand deposits includes Mibanco's market share of 0.1% at the end of September 2016, 0.2% at the end of June 2017 and August 2017.

(2) Savings deposits includes Mibanco's market share of 1.2% at the end of September 2016, June 2017 and August 2017.

(3) Time deposits includes Mibanco's narket share of 5.8% at the end of September 2016, and 5.9% at the end of June 2017 and August 2017.

(4) CTS or Severance indemnity deposits includes Mibanco's market share of 1.2% at the end of September 2016, June 2017 and August 2017.

At the end of August 2017, Credicorp’s subsidiaries in Peru, BCP and Mibanco, continued to lead in terms of total deposits with a market share (MS) of 32.5%. This result was situated approximately 13.6 percentage points above that of the group’s closest competitor.

In the QoQ analysis, the MS of total deposits remained stable (32.5% at the end of June 2017) due to the net effect between growth in the MS of savings deposits, and a drop in the MS of Time and CTS deposits.

The YoY analysis reveals an 80 bps increase in the market share of total deposits (31.7% at the end of September 2016). This was in line with growth in the MS of savings, demand and time deposits.

BCP Bolivia continued fourth in the Bolivian financial system with a stable MS that was situated at 10.0% at the end of September 2017 (compared to 10.2% at the end of June 2017).

2.3 Other funding sources

| Other funding sources | As of | % change | ||||||||||||||||||

| S/ 000 | Sep 16 | Jun 17 | Sep 17 | QoQ | YoY | |||||||||||||||

| Due to banks and correspondents | 7,770,822 | 8,066,962 | 8,867,185 | 9.9 | % | 14.1 | % | |||||||||||||

| BCRP instruments | 10,798,751 | 8,989,728 | 8,107,103 | -9.8 | % | -24.9 | % | |||||||||||||

| Bonds and subordinated debt | 15,571,172 | 15,295,673 | 15,236,054 | -0.4 | % | -2.2 | % | |||||||||||||

| Other liabilities(1) | 16,201,411 | 16,803,410 | 17,807,782 | 6.0 | % | 9.9 | % | |||||||||||||

| Total Other funding sources | 50,342,156 | 49,155,773 | 50,018,124 | 1.8 | % | -0.6 | % | |||||||||||||

(1) Includes acceptances outstanding, reserves for property and casualty claims, reserve for unearned premiums, reinsurance

payable and other liabilities.

TheTotal of other funding sources increased +1.8% QoQ, which was mainly attributable to a higher level of Due to banks and Correspondents at BCP Stand-alone and, to a lesser extent, at Mibanco.

Next in line was growth inOther liabilities, which was due to an increase in repo agreements with other banks at BCP Stand-alone and Credicorp Capital.

QoQ growth inDue to banks and correspondents originated in the last quarter of 3Q17 atBCP Stand-alone. This increase was due to a higher level of Interbank Funds in LC.

| 14 |

All of the aforementioned helped offset the contraction expected inBCRP Instruments, which decreased QoQ due to the expiration of regular repos.

In terms ofBonds and subordinated debt, a slight reduction was reported that was due primarily to the expiration of 3 debt instruments at the Credicorp Remittance Inc1 subsidiary and, to a lesser extent, to expiration of bonds in FC at BCP Stand-alone.

TheYoYanalysis shows a slight contraction in the total of Other funding sources, mainly at BCP Stand-alone, which was in line with the contraction in (i)BCRP Instruments,which was due primarily to expirations of substitution and expansion repos in 2017; and (ii)Bonds and subordinated debt,due to expirations in FC bonds.

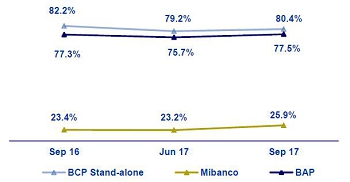

2.4 Loan / Deposit (L/D)

Loan / Deposit Ratio by Subsidiary

Credicorp’s L/D ratio increased QoQ to reach 102.4%. This was due to a +1.6% expansion in the QoQ growth in loans versus expansion of +0.9% QoQ in total deposits.

Loan / Deposit Ratio by Currency

| Local Currency | Foreign Currency | |

|  |

The QoQ analysis by currency reveals a drop in the L/D ratio in LC at Credicorp, which was in line with an expansion in LC deposits at BCP Stand-alone. The increase in the L/D ratio in LC at Mibanco reflected a scenario in which loans expanded while deposits contracted. This contraction was associated with Time deposit maturities in 3Q17. The L/D ratio in FC remained stable QoQ.

1 Subsidiary of Credicorp Ltd that makes issuances abroad that are guaranteed by future collections onf payment orders for fund transfers from abroad in US Dollars.

| 15 |

In the YoY analysis, the L/D ratio in LC fell, which was attributable to growth in LC deposits. This funding has replaced BCRP instruments. The aforementioned was accentuated by a drop in LC loans, mainly at BCP Stand-alone.

| 2.5 | Funding Cost |

Credicorp’s funding cost fell 5 bps QoQ given that interest expenses fell despite an increase in average total liabilities. This reflects the positive impact of:

| (i) | Growth in total funding that was attributable to an increase in the volume of deposits, our lowest-cost funding source. Additionally, the expansion in deposits was driven mainly by Demand and Savings deposits whose funding cost is the lowest among all deposit types. |

| (ii) | An increase in the level of Due to banks and correspondents, which represents the second largest source of funding to support the gradual recovery posted this quarter in loan growth. Furthermore, this source has also helped replace BCRP instruments that have matured while allowing us to maintain an adequate level of structural funding. |

| (iii) | The slight decrease in the funding cost in LC due to the drop in the Central Bank’s reference rate, and most importantly, the increase in liquidity in Soles, which in turn is the result of the Central Bank’s FX policy to soften the appreciation of the sol against the US Dollar. Initially, the reduction in the Central Bank’s reference rate stabilize the funding cost in LC, which had been growing since 2014. |

All of the aforementioned offset the increase in the funding cost generated by:

| (i) | Higher volumes of liabilities, mainly in Deposits and Due to banks and correspondents; and |

| (ii) | A change in the mix by currency given that funding in LC increased its share of total funding and the cost of LC funding is higher than that of FC. |

The following figure shows the funding cost per subsidiary:

| BCP | ||||||||||||||||||||||||

| Stand-alone | Mibanco | BCP Bolivia | ASB | Banking business | Credicorp(1) | |||||||||||||||||||

| 3Q16 | 2.01 | % | 5.07 | % | 1.99 | % | 2.23 | % | 2.25 | % | 2.07 | % | ||||||||||||

| 2Q17 | 2.09 | % | 4.84 | % | 2.19 | % | 1.68 | % | 2.29 | % | 2.12 | % | ||||||||||||

| 3Q17 | 2.02 | % | 4.78 | % | 2.55 | % | 1.40 | % | 2.24 | % | 2.07 | % | ||||||||||||

(1) Includes banking business results, other subsidiaries and consolidation adjustments.

The funding cost atBCP Stand-alone fell -7 bps QoQ. This was mainly due to a decrease in interest expenses on loans, which was in line with:

| (i) | Lower volumes of BCRP regular repos and of BCRP special repos at the end of 2Q17. |

| (ii) | Expansion in Demand and Savings deposits and Due to banks and correspondents to replace BCRP funding. The former were obtained at a lower cost than BCRP Instruments and helped maintain an adequate level of structural funding. All of the aforementioned took place in a scenario marked by a reduction in BCRP’s reference rate, which posted another drop in 3Q17 equivalent to 25 bps. |

The funding cost atBCP Boliviaincreased +36 bps QoQ due to growth in interest expenses on deposits (specifically time deposits with corporate clients).

The funding cost atMibanco fell -6 bps QoQ. This was due primarily to a drop in interest expenses on deposits, which was associated with maturities at the time deposit level (accounts held by individuals).

| 16 |

ASB posted a decrease in its funding cost due to an on-going decrease QoQ in financial expenses (-16.5% QoQ) and a slight drop in average liabilities (-0.4% QoQ).

The figure below shows the funding cost by source for the Banking Business2:

Banking Business – Funding Structure & Cost

These figures differ from those previously reported; consider the ones in this report.

(1) Deposits include Demand, Savings, Severance indemnity (CTS) and Time Deposits.

(2) It mainly includes outstanding acceptances and other payable accounts

2.6 Mutual Funds

| Mutual funds | As of | % change | ||||||||||||||||||

| S/ 000 | Sep 16 | Jun 17 | Sep 17 | QoQ | YoY | |||||||||||||||

| Mutual funds in Peru | 10,581,802 | 11,069,959 | 11,297,018 | 2.1 | % | 6.8 | % | |||||||||||||

| Mutual funds in Bolivia | 543,444 | 578,799 | 552,046 | -4.6 | % | 1.6 | % | |||||||||||||

| Total mutual funds | 11,125,246 | 11,648,758 | 11,849,065 | 1.7 | % | 6.5 | % | |||||||||||||

Mutual funds atCredicorp Capital Fondos Peru grew QoQ, mainly due to an increase in corporate funds. Nevertheless, the company’s market share at the end of September 2017 fell slightly (40.4% versus 41.5% at the end of June 2017). Despite this, Credicorp Capital Fondos Peru continued to lead the market in Peru and was situated approximately 19.2 percentage points above its closest competitor. In the YoY analysis, Credicorp Capital Fondos Peru reported +6.8% growth in its funds under management (FuMs).

FuMs atCredifondo Bolivia fell QoQ due to a decrease in the investment volume despite an increase in the number of clients, mainly in terms of individual investors. The market share in mutual funds was situated at 13.0 percent at the end of September 2017 vs. 13.8% at the end of June 2017. In this context, Credifondo Bolivia was the fourth largest competitor in the Bolivian market. In YoY terms, it reported expansion of +1.6% in FuMs.

2 Includes BCP Individual, Mibanco, BCP Bolivia and ASB.

| 17 |

| 3. | Portfolio quality and Provisions for loan losses |

In 3Q17, the cost of risk (CofR) fell -26 bps QoQ and -6 bps YoY to situate at 1.59%, the lowest level reported since 2013. This was primarily attributable to a drop in provisions, which was in line with a decrease in provision requirements for the underlying portfolio and, to a lesser extent, to lower provisions for the FEN. The improvement in the underlying portfolio’s risk quality was mainly due to a slight improvement in the majority of segments.

| Portfolio quality and Provisions for loan losses | Quarter | % change | ||||||||||||||||||

| S/ 000 | 3Q16 | 2Q17 | 3Q17 | QoQ | YoY | |||||||||||||||

| Gross Provisions | (489,514 | ) | (499,390 | ) | (447,504 | ) | -10.4 | % | -8.6 | % | ||||||||||

| Loan loss recoveries | 100,428 | 66,171 | 69,302 | 4.7 | % | -31.0 | % | |||||||||||||

| Provision for loan losses, net of recoveries | (389,086 | ) | (433,219 | ) | (378,202 | ) | -12.7 | % | -2.8 | % | ||||||||||

| Cost of risk(1) | 1.65 | % | 1.85 | % | 1.59 | % | -26 bps | -6 bps | ||||||||||||

| Provisions for loan losses / Net interest income | 19.5 | % | 22.0 | % | 18.6 | % | -340 bps | -90 bps | ||||||||||||

| Total loans (Quarter-end balance) | 94,319,220 | 93,670,216 | 95,142,268 | 1.6 | % | 0.9 | % | |||||||||||||

| Allowance for loan losses | 4,084,178 | 4,323,480 | 4,419,769 | 2.2 | % | 8.2 | % | |||||||||||||

| Write-offs(2) | 398,410 | 381,986 | 332,995 | -12.8 | % | -16.4 | % | |||||||||||||

| Internal overdue loans (IOLs)(3) | 2,627,587 | 2,749,047 | 2,874,071 | 4.5 | % | 9.4 | % | |||||||||||||

| Refinanced loans | 807,904 | 922,974 | 963,807 | 4.4 | % | 19.3 | % | |||||||||||||

| Non-performing loans (NPLs)(4) | 3,435,491 | 3,672,021 | 3,837,878 | 4.5 | % | 11.7 | % | |||||||||||||

| Delinquency ratio over 90 days | 2.12 | % | 2.25 | % | 2.28 | % | ||||||||||||||

| IOL ratio | 2.79 | % | 2.93 | % | 3.02 | % | ||||||||||||||

| NPL ratio | 3.64 | % | 3.92 | % | 4.03 | % | ||||||||||||||

| Coverage ratio of Internal overdue loans | 155.4 | % | 157.3 | % | 153.8 | % | ||||||||||||||

| Coverage ratio of NPLs | 118.9 | % | 117.7 | % | 115.2 | % | ||||||||||||||

(1) Annualized provisions for loans losses / Total loans.

(2) Figures differ from previously reported, please consider the data presented on this report.

(3) Includes overdue loans and loans under legal collection. (Quarter-end balances)

(4) Non-performing loans include past-due loans and refinanced loans. (Quarter-end balances).

3.1 Provisions for loan losses

The allowance for loan losses net recoveriesfell -12.7% QoQ and -2.8% YoY. This was due to:

| (i) | A decrease in provisions requirements for the underlying portfolio; this was seen in the majority of segments and was particularly noteworthy at Wholesale Banking, Mibanco, Credit Card and SME-Pyme. |

| (ii) | A drop in the provisions required for the portfolio due to the FEN, which totaled S/ 15 million in 2Q17 at Mibanco. |

All of the aforementioned, coupled with slight growth in total loans of +1.6% QoQ, translated into a contraction in theCofR3 of -26 bps QoQ and -6 bps YoY. In this scenario, the CofR was situated at 1.59%.

In this context, it is important to note the drop in the CofR for the underlying portfolio, which went from 1.79% in 2Q17 to 1.59% in 3Q17. The aforementioned was due to an improvement in the risk quality of the vast majority of segments and in Mibanco, Credit Cards and SME-Pyme in particular and to growth in loans, which will be explained later in this report. Year-to-date (YTD), the CofR for the underlying portfolio reported a drop of -16 bps, going from 1.87% in 2016 to 1.72% for the same period in 2017.

Thecoverage ratios for the internal overdue and non-performing loan portfolios fell although the allowance for loan losses increased (+2.2% QoQ and +8.2% YoY) given that the internal overdue and non-performing loan portfolios increased to a larger extent (+4.5% QoQ +9.4% YoY and +4.5% QoQ and + 11.7% YoY, respectively).

3 Annualized provisions for loan losses net of recoveries over total loans.

| 18 |

3.2 Portfolio Quality

(1) Adjusted NPL ratio = (Non-performing loans + Charge-offs) / (Total loans + Charge-offs).

(2) Cost of risk = Annualized provisions for loan losses net of recoveries / Total loans.

(3) The cost of risk of the Underlying portfolio for March 17 and June 17 was calculated eliminating provisions related to the construction sector and the El Nino weather phenomenon.

Prior to analyzing the evolution of Credicorp’s delinquency indicators, it is important to note that:

| (i) | Traditional delinquency indicators (IOL and NPL) continue to be distorted by the presence of real estate collateral (commercial and residential properties). This means that loans that are 150 days past due cannot be written off although provisions have been set aside, given that foreclosure takes 5 years on average. |

| (ii) | During the second semester (2H) every year, loans are more dynamic, particularly in the SME-Pyme and Mibanco segments given that the main financing campaigns (Christmas Season) are conducted in the second semester (2H). These short-term loans are paid in full in 1H of the following year. |

The figure above shows a slight QoQ increase in the adjusted NPL ratio due to higher growth in non-performing loans than in total loans. Accordingly, both the IOL and the NPL ratios show slight deterioration QoQ.

Growth in the internal overdue and non-performing loan portfolio (which includes refinanced loans) was in line with the increase reported in these portfolios, mainly in the SME-Pyme, Wholesale, Mibanco and Credit Card segments, and with a lower level of written-off loans.

| 19 |

The figure below shows the evolution of the cost of risk by business line and product:

Cost of risk by segment(1)

(1) Figures differ from previously reported, please consider the data presented on this report.

Prior to analyzing delinquency indicators by business line, it is important to note that, as is evident in the figure above, theCofRfell QoQ in most of the segments (Mortgage segment posted an atypical level in 1Q17). In YoY terms, the CofR contracted for the fourth consecutive quarter (not including 1Q17, which was affected by the FEN).

In the analysis YTD, it is important to note that the CofR as of September 2017 was situated at 1.89%, which was similar to the 1.87% reported for the same period in 2016. This is noteworthy given that:

| (i) | The level in 2017 includes provisions for FEN and for construction companies, which were registered in 1Q and 2Q; |

| (ii) | Loans reported slight growth in the context of slow economic growth and low internal demand over the last two years; and |

| (iii) | The underlying portfolio has registered a CofR of 1.72% YTD in 2017 while the level for the same period in 2016 was 1.87%. |

| 20 |

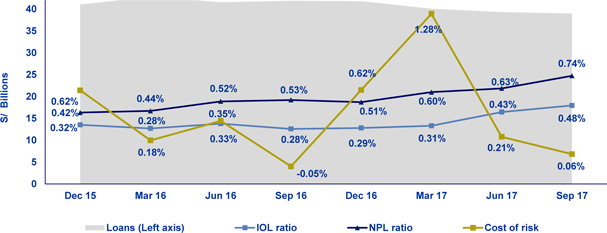

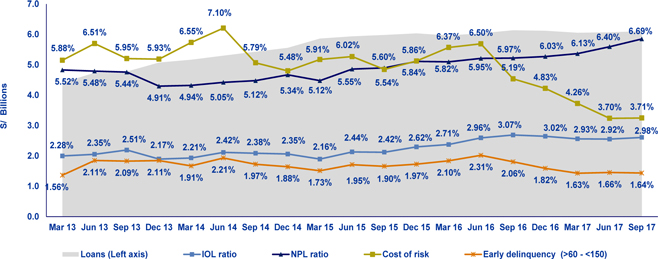

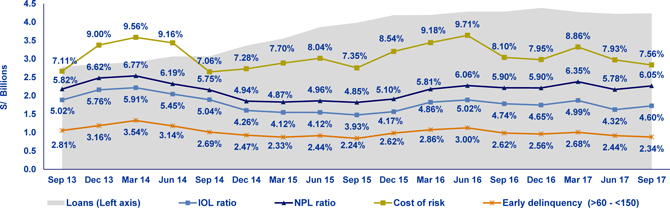

3.2.1 Delinquency indicators by business line

Wholesale Banking – Portfolio quality and cost of risk

| (i) | The CofR inWholesale Banking was situated at 0.06%, which represents a decrease of -15 bps QoQ. This decline was due to i) the reduction in provisions for Corporate and Middle-Market Banking clients, and ii) a provision reversal because a client in the Work-out unit agreed to give an asset as payment and as such, the loan was cancelled. This result is even more positive if we consider that this segment posted a QoQ contraction in loans. |

The NPL ratio increased slightly due to the deterioration in the situation of a certain number of clients, whose debt has been refinanced.

BCP Bolivia – Portfolio quality and cost of risk

| (ii) | BCP Bolivia reported an increase QoQ and YoY in the CofR due to higher provisions; this increase was partially offset by loan growth. Thus, the IOL and NPL ratios remained relatively stable. |

| 21 |

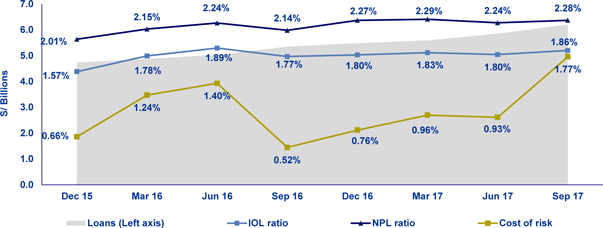

SME-Business – Portfolio quality and cost of risk

| (iii) | The CofR in the SME-Business fell QoQ and YoY, which was due primarily to a decrease in provisions in 3Q17 and to a lesser extent to loan growth. The reduction in provisions was attributable to: i) the improvement in loan book’s risk performance in 3Q, and ii) the recovery of some past due loans. |

The NPL ratio improved QoQ, which was in line with (i) the contraction in NPLs due to write-offs and recoveries of loans that were in a judicial process for collection; and (ii) the expansion of +4.0% in the loan book. YoY, the drop in the NPL ratio was due to higher growth rate in loans than that of NPLs. It is important to note that this business maintains its risk-quality indicators within the organization’s risk appetite.

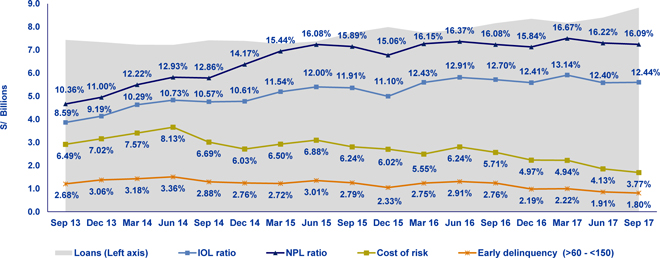

SME - Pyme – Portfolio quality and Cost of risk

| (iv) | With regard to theSME-Pyme,it is important to analyze the early delinquency indicator, which excludes loans that are overdue less than 60 days (volatile loans whose percentage of recovery is very high), and those more than 150 days overdue (loans that have been provisioned but cannot be written-off due to the existence of real estate collateral- commercial properties that require 5 years on average to liquidate). |

Since the beginning of 2014, early delinquency has followed a downward trend YoY that reflects continuous improvement in the risk quality of vintages, which in turn is explained by all adjustments made to the business model for SME-Pyme. All this is more evident in vintages originated in 2015. In 3Q17, early delinquency fell -96 bps YoY to hit its lowest level since 1Q13, prior to the delinquency problem that was triggered by the slowdown in the Peruvian economy.

| 22 |

In this context, the cost of risk fell -194 bps YoY to once again hit a record low for the last 3 years. This was due primarily to a reduction in provisions, in line with an improvement in the portfolio’s risk quality following the implementation of measures to fine-tune risk management.

Mortgage – Portfolio quality and Cost of risk(1)

(1) Figures differ from previously reported due to adjustments during the data processing that have been incorporated in this report.

| (v) | In terms ofMortgage loans, it is important to remember that these indicators have also been affected by the existence of real estate guarantees because the loans cannot be written-off until foreclosure, which takes 5 years on average. Nevertheless, QoQ traditional delinquency indicators area stable due to (i) loan growth; and (ii) lower level of loan amortization that affected this loan book after a change in AFP regulation (new regulation allowed affiliates to withdraw 25% of their funds to use them for new mortgages or to amortize existing loans, which translated into an amortization of approximately 8% of loan book over the last 12 months). |

The early delinquency indicator, which excludes the effect of loans that are more than 150 days overdue, is within the average range observed over the past two years.

The CofR increased +13 bps QoQ due to an increase in provisions, which reach more normalized levels. This was mainly attributable to the fact that in the last few quarters, these levels were unusually low due to an operating error in the MiVivienda portfolio that led the bank to set aside provisions for loans that were not required and that we reversed in previous months.

In the YoY analysis, early delinquency fell -19 bps and the cost of risk increased +6 bps, in line with an increase in provision expenses.

| 23 |

Consumer – Portfolio quality and Cost of risk(1)

(1) Figures differ from previously reported due to adjustments during the data processing that have been incorporated in this report.

| (vi) | In theConsumer portfolio, the CofR remained stable QoQ and decreased -148 bps YoY due to a reduction in provisions. This was due to (i) the extinction of vintages originated prior to 2015; and (ii) a change in the loan book’s risk profile. At the end of August 2017, 70% of the portfolio corresponded to vintages from 2016 or after, which have better risk quality than the ones of 2015 and before that triggered the delinquency problem. The portfolio’s new composition reflects the calibrated profile that was generated by the change in the risk policy for admissions, which led to a subsequent decrease in the level of provisions. |

Early delinquency fell -2 bps QoQ and -42 bps YoY due to an improvement in the risk quality of new vintages. Consequently, this indicator reached levels similar to those seen in 2013 but at a lower cost of risk. It is evident that we have room to increase the speed of growth, which will allow us to maximize the portfolio’s profitability while maintaining this loan book within the organization’s risk appetite. Higher growth is not reflected in the loan balances at the end of 3Q17 given that this new approach was initiated at the beginning of the quarter and will take time to fully implement.

Credit Card – Portfolio quality and Cost of risk(1)

(1) Figures differ from previously reported due to adjustments during the data processing that have been incorporated in this report.

| (vii) | TheCredit Card segment reported a drop QoQ and YoY in the CofR, which was in line with the reduction in provisions. The portfolio grew slightly QoQ given that, as discussed earlier, the decision to increase the speed of growth in this segment and meet the objective to maximize the portfolio’s profitability has yet to fully materialize in 3Q17. |

| 24 |

Early delinquency fell -10 bps QoQ and -28 bps YoY, which reflects the improvement in the quality of risk of new vintages after corrective measures were taken to address the delinquency problem that became evident at the end of 2015.

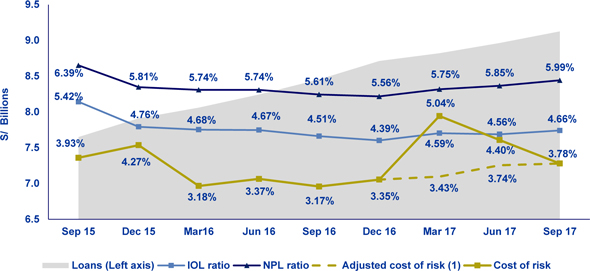

Mibanco – Portfolio quality and Cost of risk

(1) Adjusted cost of risk of March 2017 and June 2017 calculated eliminating provisions related to the El Nino weather phenomenon.

| (viii) | The cost of risk at Mibanco fell -62 bps QoQ, which was primarily due to a decrease in the provisions required for the El Nino Phenomenon (FEN) in 3Q17 and, to a lesser extent, to portfolio expansion. If we exclude the provisions set aside for FEN in 2Q17 (S 15.0 million), the CofR posts a relatively stable level QoQ. |

The non-performing portfolio posted a slight increase QoQ and YoY, which as attributable to the programs offered to clients that have been affected by FEN.

| 25 |

| 4. | Net Interest Income (NII) |

In line with a gradual recovery in loan growth, mainly in higher-margin segments, the risk-adjusted net interest margin posted a slight increase (+1bps) YTD. The aforementioned was due to a decrease in the CofR and the stability of NIM. NIM reported an increase QoQ that reflected the seasonality of loans as well as higher loan growth in LC and in higher-margin segments.

| Net interest income | Quarter | % change | YTD | % change | ||||||||||||||||||||||||||||

| S/ 000 | 3Q16 | 2Q17 | 3Q17 | QoQ | YoY | Sep 16 | Sep 17 | Sep 17 / Sep 16 | ||||||||||||||||||||||||

| Interest income | 2,712,138 | 2,715,901 | 2,768,798 | 1.9 | % | 2.1 | % | 7,958,185 | 8,224,478 | 3.3 | % | |||||||||||||||||||||

| Interest on loans | 2,392,826 | 2,353,070 | 2,396,969 | 1.9 | % | 0.2 | % | 7,036,313 | 7,111,698 | 1.1 | % | |||||||||||||||||||||

| Dividends on investments | 2,975 | 4,223 | 8,530 | 102.0 | % | 186.7 | % | 48,929 | 42,876 | -12.4 | % | |||||||||||||||||||||

| Interest on deposits with banks | 11,480 | 20,416 | 21,172 | 3.7 | % | 84.4 | % | 35,604 | 65,048 | 82.7 | % | |||||||||||||||||||||

| Interest on securities | 291,187 | 331,953 | 330,378 | -0.5 | % | 13.5 | % | 796,943 | 975,763 | 22.4 | % | |||||||||||||||||||||

| Other interest income | 13,670 | 6,239 | 11,749 | 88.3 | % | -14.1 | % | 40,396 | 29,093 | -28.0 | % | |||||||||||||||||||||

| Interest expense | 715,986 | 743,196 | 736,375 | -0.9 | % | 2.8 | % | 2,119,929 | 2,203,263 | 3.9 | % | |||||||||||||||||||||

| Interest on deposits | 271,089 | 284,093 | 287,046 | 1.0 | % | 5.9 | % | 788,794 | 838,673 | 6.3 | % | |||||||||||||||||||||

| Interest on borrowed funds | 203,756 | 199,127 | 185,962 | -6.6 | % | -8.7 | % | 615,436 | 583,595 | -5.2 | % | |||||||||||||||||||||

| Interest on bonds and subordinated notes | 191,288 | 210,905 | 203,083 | -3.7 | % | 6.2 | % | 569,967 | 622,147 | 9.2 | % | |||||||||||||||||||||

| Other interest expense | 49,853 | 49,071 | 60,284 | 22.9 | % | 20.9 | % | 145,732 | 158,848 | 9.0 | % | |||||||||||||||||||||

| Net interest income | 1,996,152 | 1,972,705 | 2,032,423 | 3.0 | % | 1.8 | % | 5,838,256 | 6,021,215 | 3.1 | % | |||||||||||||||||||||

| Risk-adjusted Net interest income | 1,607,066 | 1,539,486 | 1,654,221 | 7.5 | % | 2.9 | % | 4,512,022 | 4,673,300 | 3.6 | % | |||||||||||||||||||||

| Average interest earning assets | 146,035,709 | 149,939,696 | 152,336,614 | 1.6 | % | 4.3 | % | 145,413,797 | 150,033,279 | 3.2 | % | |||||||||||||||||||||

| Net interest margin(1) | 5.47 | % | 5.26 | % | 5.34 | % | 8 bps | -13 bps | 5.35 | % | 5.35 | % | 0 bps | |||||||||||||||||||

| NIM on loans | 8.33 | % | 8.13 | % | 8.22 | % | 9 bps | -11 bps | 8.22 | % | 8.03 | % | -19 bps | |||||||||||||||||||

| Risk-adjusted Net interest margin(1) | 4.40 | % | 4.11 | % | 4.34 | % | 23 bps | -6 bps | 4.14 | % | 4.15 | % | 1 bps | |||||||||||||||||||

| Net provisions for loan losses / Net interest income | 19.49 | % | 21.96 | % | 18.61 | % | -335 bps | -88 bps | 22.72 | % | 22.39 | % | -33 bps | |||||||||||||||||||

(1) Annualized.

Prior to beginning this discussion, it is important to remember that in order to manage NIM with greater precision and clarity, and to ensure better disclosure, in 1Q17 we began excluding the derivatives result from NII to include it in non-financial income. For comparative purposes, these changes have been applied retroactively to 3Q16.

4.1 Interest Income

Interest income increased +1.9% QoQ. This was due primarily to growth ininterest income on loans, which was in turn attributable to:

| (i) | VOLUMES: Growth in average daily loan balances, as explained in section 1.2 Credicorp Loans. |

| (ii) | MIX BY SEGMENT: The loan mix shows an increase in the share of higher-margin segments. This reflects the positive effect of seasonality in the second half of every year when the Retail Banking segments at BCP Stand-alone and Mibanco roll out their main financing campaigns to lead loan growth. It is important to note that within Retail Banking, the segments with higher growth were SME-Business, SME-Pyme and Mortgage. |

| (iii) | MIX BY CURRENCY: Reflecting slight growth in the share of LC loans in the portfolio mix by currency and interest rates for LC that are higher than those associated with FC. |

| (iv) | All of the aforementioned offset the negative effects generated by the contraction in Corporate Banking loans, which also posted lower margins due to aggressive competition. |

In theYoY analysis, interest income expanded +2.1%.Interest income on loans followed the same trend YoY as described above for the QoQ evolution. Additionally, and more significantly, the YoY increase in interest was positively affected by the increase ininterest income on securities due to more active management of the investment portfolio in a context of low loan growth to maximize the profitability of IEA.

YTD, the 3.3% increase in interest income was attributable to growth ininterest income on loans and to an increase in interest on securities, which was attributable to:

| 26 |

| (i) | VOLUMES: Growth in average daily loan balances, as explained in section 1.2 Credicorp Loans. |

| (ii) | MIX BY SEGMENT: If we exclude the seasonal effect in 3T, the mix showed an increase in higher-margin segments. It is important to note that within Retail Banking, SME-Business, SME-Pyme and Mortgage were the highest growth segments. |

| (iii) | MIX BY CURRENCY: The share of LC loans, which carry higher rates than their FC counterparts, increased their share of Retail Banking segments at BCP Stand-alone and Mibanco |

| (iv) | MIX WITHIN IEA: Investments, specifically investments available for sale, have grown significantly over the last year, which led interest income on securities to increase significantly |

4.2 Interest Expenses

Interest expenses fell -0.9% QoQ, which was attributable to:

| (i) | FUNDING STRUCTURE: Deposits, a lower-cost funding source, increased while the number of repo agreements with BCRP decreased. This drop in BCRP instruments was partially offset by the increase in Due to banks and correspondents. In this scenario, professional funding replaced BCRP funding. |

| (ii) | INTEREST RATE: The pace of renewals of Due to banks and correspondents was slowed in a context in which rates in Soles followed a negative trend, in line with the latest reduction in BCRP’s rate. |

| (ii) | MIX OF DEPOSITS: Deposits grew but growth was concentrated in lower-cost deposits such as Demand deposits and Savings deposits |

| (iii) | MIX BY CURRENCY IN DEPOSITS: the deposit volume in LC increased while the volume in FC decreased, which in previous periods would have led to an increase in expenses given that interest in LC is higher but in the current context, rates in Soles are following a downward trend. This change in the currency mix of deposits has not led to a significant increase in interest expenses. |

In theYoY analysis, interest income grew +2.8%, which was mainly attributable to higher expenses forInterest on Deposits. This scenario was generated by a volume effect and a rate effect given that the deposits that posted the highest growth were also those with the highest rates. It is also important to note that the drop inInterest on loans was attributable to a reduction in BCRP instruments, whose funding cost is higher than that of deposits.

| 27 |

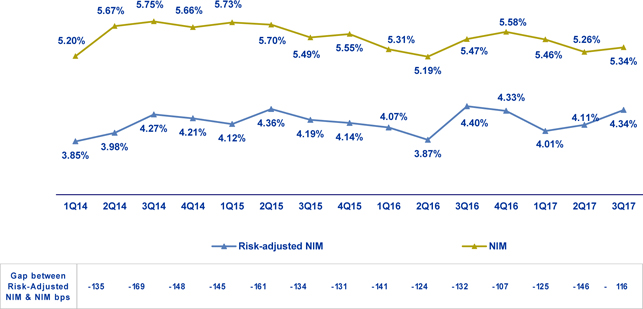

4.3 Net Interest Margin (NIM) and Risk-Adjusted NIM

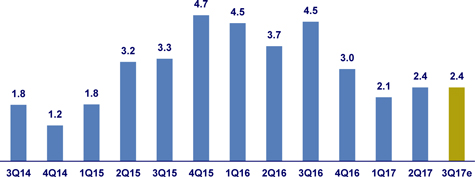

Credicorp’s NIM and Risk-Adjusted NIM4

(1) Starting on 1Q17, we exclude derivatives from the NII result. For comparative purposes, figures starting from 1Q16 have been recalculated with the new methodology

In theQoQ analysis,NIM recovered +8 bps due to growth in NII (+3.0% QoQ). This was due primarily to growth in Interest Income, as explained in the previous section, in a scenario in which average IEAs grew slightly (+1.6%). Risk-adjusted NIM has recovered to an even larger extent (+23 bps) given that in 3Q17, provisions for loan losses fell -12.7%.

In theYoY analysis, the drop in NIM was attributable to a scenario in which average IEA grew 4.3% while growth in NII as situated at 1.8%. Risk-Adjusted NIM posted a decline (-6 bps) given that provisions for loan losses fell -2.8% YoY. The evolution of these two indicators YoY is mainly due to the fact that growth in IEA was led by an expansion in the portfolio of investments, which is a less profitable asset than loans.

In the YTD analysis, NIM remained stable while risk-adjusted NIM posted a slight recovery(+1 bps), in line with a gradual recovery in loan growth that was accompanied by a risk management approach to ensure that our portfolios remain within the risk appetite in a scenario in which growth has stemmed from higher-margin segments such as Mibanco and Retail Banking at BCP Stand-alone. The aforementioned helped offset the contraction in Retail Banking margins due to aggressive competition.

4 NIM on loans is calculated as follows:

The share of loans within total earning assets is calculated by dividing the average of the beginning and closing balances of total loans for the reporting period, by the average of the beginning and closing balances of the interest earning assets for the reporting period.

| 28 |

| NIM on loans posted a recovery of +9 bpsQoQ, which was in line with growth in Mibanco and in Retail Banking segments at BCP Stand-alone due to the seasonality that affects these segments in the second half of the year. Nevertheless,YoY and YTD indicator deteriorated due to: i) a contraction in Wholesale Banking loans at BCP Stand-alone and ii) margins in this segment were pressured by aggressive competition. The aforementioned was attenuated by higher volumes in Retail Banking and Mibanco and higher margins at Mibanco. | NIM on loans

|

It is important to analyze NIM by subsidiary. The table below provides information on the interest margins for reach of Credicorp’s main subsidiaries.

| NIM Breakdown | BCP Stand-alone | Mibanco | BCP Bolivia | ASB | Credicorp(1) | |||||||||||||||

| 3Q16 | 4.82 | % | 15.21 | % | 4.77 | % | 2.25 | % | 5.47 | % | ||||||||||

| 2Q17 | 4.51 | % | 15.20 | % | 4.50 | % | 2.51 | % | 5.26 | % | ||||||||||

| 3Q17 | 4.54 | % | 15.91 | % | 4.18 | % | 2.75 | % | 5.34 | % | ||||||||||

| YTD - Sep 16 | 4.65 | % | 14.60 | % | 4.38 | % | 2.11 | % | 5.35 | % | ||||||||||

| YTD - Sep 17 | 4.57 | % | 15.60 | % | 4.36 | % | 2.53 | % | 5.35 | % | ||||||||||

NIM: Annualized Net interest income / Average period end and period beginning interest earning assets.

(1) Credicorp also includes Credicorp Capital, Prima, Grupo Credito and Eliminations for consolidation purposes.

The QoQ evolution of Global NIM by subsidiary shows a recovery in Credicorp’s margin that was primarily attributable toBCP Stand-alone and Mibanco, which represent around 65% and 23% of net interest income respectively.BCP Stand-aloneregistered a recovery in its margin that was associated primarily with loan growth in higher-margin segments (SME-Pyme and SME-Business) while atMibanco, the growth of 71bps posted in the margin is related to an increase in the loan volume and a decrease in interest expenses associated with Due to banks and correspondents given that many obligations were renewed at a lower rate.