Filed Pursuant to Rule 424(b)(3)

File No. 333-128542

PROSPECTUS SUPPLEMENT NO. 1

(To Prospectus Dated October 4, 2005)

Manhattan Pharmaceuticals, Inc.

25,627,684 Shares

Common Stock

The information contained in this Prospectus Supplement amends and updates our prospectus dated October 4, 2005 (the “Prospectus”), and should be read in conjunction therewith. Please keep this Prospectus Supplement with your Prospectus for future reference.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is November 14, 2005

Forward-Looking Information

This prospectus supplement, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as anticipate, estimate, plan, project, continuing, ongoing, expect, management believes, we believe, we intend and similar words or phrases. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in this prospectus or incorporated by reference.

Because the factors discussed in this prospectus or incorporated by reference could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any such forward-looking statements. These statements are subject to risks and uncertainties, known and unknown, which could cause actual results and developments to differ materially from those expressed or implied in such statements. Such risks and uncertainties relate to, among other factors: the development of our drug candidates; the regulatory approval of our drug candidates; our use of clinical research centers and other contractors; our ability to find collaborative partners for research, development and commercialization of potential products; acceptance of our products by doctors, patients or payors; our ability to market any of our products; our history of operating losses; our ability to compete against other companies and research institutions; our ability to secure adequate protection for our intellectual property; our ability to attract and retain key personnel; availability of reimbursement for our product candidates; the effect of potential strategic transactions on our business; our ability to obtain adequate financing; and the volatility of our stock price. These and other risks are detailed in the prospectus under the discussion entitled “Risk Factors,” as well as in our reports filed from time to time under the Securities Act and/or the Exchange Act. You are encouraged to read these filings as they are made.

Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Interim Financial Statements - Quarter Ended September 30, 2005

Included in this prospectus supplement beginning at page F-1 are our interim financial statements as of and for the three and nine months ended September 30, 2005, including the accompanying footnotes thereto. These interim financial statements, which were included in our Quarterly Report on Form 10-QSB for the quarter ended September 30, 2005, should be read in conjunction with the audited financial statements as of and for the year ended December 31, 2004, which were included in the Prospectus.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with the financial statements and the notes to those statements included in this prospectus supplement. This discussion includes forward-looking statements that involve risks and uncertainties. As a result of many factors, such as those set forth under “Risk Factors” in the Prospectus, our actual results may differ materially from those anticipated in these forward-looking statements.

S-2

Results of Operations

Three-Month Period Ended September 30, 2005 vs 2004

During the quarters ended September 30, 2005 and 2004, we had no revenue. We do not expect to have significant revenues relating to our product candidates in development prior to September 30, 2006.

For the quarter ended September 30, 2005, research and development expense was $1,370,733 as compared to $1,678,939 for the third quarter of 2004. The decrease of $308,206 is due primarily to completion of studies of our propofol lingual spray candidate partially offset by an acceleration of our Oleoyl-estrone drug candidate.

For the quarter ended September 30, 2005, general and administrative expense was $490,894 as compared to $562,752 for the quarter ended September 30, 2004. The decrease of $71,858 is due primarily to decreases in consulting, outside services and rent expense of approximately $68,000, $37,000 and $21,000 respectively. These decreases are partially offset by increases in taxes, travel and entertainment, directors’ fees and all other expenses of approximately $17,000, $13,000, $11,000 and $13,000, respectively.

For the quarter ended September 30, 2005, interest and other income was $49,137 as compared to $47,614 for the quarter ended September 30, 2004. The increase of $1,523 is due primarily to an increase in cash balances and short-term investments.

Net loss for the quarter ended September 30, 2005, was $1,812,490 as compared to $2,194,077 for the quarter ended September 30, 2004. This decrease in net loss is attributable primarily to decreases in research and development expenses of $308,206 and general and administrative expenses of $71,858, partially offset by an increase in interest and other income of $1,523.

Preferred stock dividends of $75,018 and $102,273 reduced earnings per share for the three months ended September 30, 2005 and 2004 by $0.00 and $0.00, respectively.

Nine-Month Period Ended September 30, 2005 vs 2004

During the nine months ended September 30, 2005 and 2004, we had no revenue. We do not expect to have significant revenues relating to our product candidates in development prior to September 30, 2006.

For the nine months ended September 30, 2005, research and development expense was $3,292,008 as compared to $2,907,173 for the nine months ended September 30, 2004. The increase of $384,835 is due primarily to an acceleration of pre-clinical development of our Oleoyl-estrone drug candidate.

For the nine months ended September 30, 2005, general and administrative expense was $1,537,298 as compared to $1,443,745 for the nine months ended September 30, 2004. The increase of $93,553 is due primarily to increases in payroll and investor relations expenses of approximately $92,000 and $59,000, respectively. In addition we had increases in expenses related to taxes, directors’ fees and travel and entertainment of approximately $45,000, $34,000 and $25,000, respectively. These increases are partially offset by reductions in consulting, outside services and all other expenses of approximately $114,000, $29,000 and $18,000, respectively.

For the nine months ended September 30, 2005, interest and other income was $117,484 as compared to $128,705 for the nine months ended September 30, 2004. The decrease of $11,221 is due primarily to a reduction in cash balances and short-term investments.

Net loss for the nine months ended September 30, 2005, was $16,599,629 as compared to $4,151,031 for the nine months ended September 30, 2004. This increase in net loss is attributable primarily to the in-process research and development charge of $11,887,807 related to the acquisition of Tarpan. Additionally, there were increases in research and development expenses of $384,835 and general and administrative expenses of $93,553 as well as a reduction in interest and other income of $11,221. Finally in 2004 we had a realized gain on sale of marketable equity securities of $71,182, which we did not have in the current year.

Preferred stock dividends of $326,419 and $495,078 reduced earnings per share for the nine months ended September 30, 2005 and 2004 by $0.01 and $0.02, respectively.

S-3

Liquidity and Capital Resources

From inception to September 30, 2005, we incurred a deficit during the development stage of $30,881,083 primarily as a result of losses, and we expect to continue to incur additional losses through at least September 30, 2006 and for the foreseeable future. The acquisition of Tarpan will increase these losses. These losses have been incurred through a combination of research and development activities related to the various technologies under our control and expenses supporting those activities.

We have financed our operations since inception primarily through equity financing and our licensing and sale of residual royalty rights of CT-3 to Indevus. During the nine months ended September 30, 2005, we had a net increase in cash and cash equivalents of $10,963,152. This increase resulted from net cash provided by financing activities, substantially all of which was from the net proceeds of $12,269,604 from the private placement of 11,917,680 shares of common stock at $1.11 and $1.15 per share and investing activities, which included proceeds from the sale of short-term investments, of $3,494,147. These increases are partially offset by net cash used in operating activities of $4,182,664. Total liquid resources including short term investments as of September 30, 2005 were $12,878,601 compared to $5,419,872 at December 31, 2004.

Our current liabilities as of September 30, 2005 were $1,808,695 compared to $1,195,705 at December 31, 2004, an increase of $612,990. The increase was primarily due to an increase in expenditures associated with the commencement of our Phase I clinical trial for our Oleoyl-estrone product candidate. As of September 30, 2005, we had working capital of $11,090,084 compared to $4,264,293 at December 31, 2004.

We recently completed a private placement offering of units consisting of shares of our common stock and warrants to purchase additional shares of common stock. The private placement was completed in two separate closings held on August 26, 2005 and August 30, 2005. In the August 26 closing, we sold a total of 10,808,971 shares of common stock and five-year warrants to purchase 2,161,767 shares for total gross proceeds of approximately $12 million. The warrants issued at the August 26 closing are exercisable at a price of $1.44 per share. On August 30, 2005, we closed on the sale of an additional 1,108,709 shares of common stock and warrants to purchase 221,741 common shares, which resulted in gross proceeds of approximately $1.28 million. The warrants issued in connection with the August 30 closing are exercisable at a price of $1.49 per share. Accordingly, the total gross proceeds resulting from the private placement was $13.27 million, before deducting selling commissions and expenses.

We engaged Paramount BioCapital, Inc. an affiliate of a significant stockholder of the Company, as placement agent and paid total cash commissions of $836,360, of which $121,625 was paid to certain selected dealers engaged by Paramount in connection with the private placement and issued five-year warrants to purchase an aggregate of 538,191 shares of common stock exercisable at a price of $1.44 per share, of which Paramount received warrants to purchase 459,932 common shares. In connection with the August 30 closing, we paid cash commissions to Paramount of $88,550 and issued an additional five-year warrant to purchase 55,000 common shares at a price of $1.49 per share. After deduction of these selling commissions and expenses, we realized aggregate net proceeds from our August 2005 private placement of approximately $12.2 million. Timothy McInerney and Dr. Michael Weiser, each a director of the Company, are employees of Paramount BioCapital, Inc.

In accordance with the terms of the private placement, we agreed to file a registration statement under the Securities Act within 30 days of the final closing of the private placement covering the resale of the shares sold in the private placement, including the shares issuable upon the exercise of the warrants.

As a result of this offering, we expect that our current cash position is sufficient to fund our operations, including the development of our three product candidates, through 2006.

Our available working capital and capital requirements will depend upon numerous factors, including progress of our research and development programs, our progress in and the cost of ongoing and planned pre-clinical and clinical testing, the timing and cost of obtaining regulatory approvals, the cost of filing, prosecuting, defending, and enforcing patent claims and other intellectual property rights, competing technological and market developments, changes in our existing collaborative and licensing relationships, the resources that we devote to developing manufacturing and commercializing capabilities, the status of our competitors, our ability to establish collaborative arrangements with other organizations and our need to purchase additional capital equipment.

S-4

Our continued operations will depend on whether we are able to raise additional funds through various potential sources, such as equity and debt financing, other collaborative agreements, strategic alliances, and our ability to realize the full potential of our technology in development. Such additional funds may not become available on acceptable terms and there can be no assurance that any additional funding that we do obtain will be sufficient to meet our needs in the long term. Through September 30, 2005, a significant portion of our financing has been through private placements of common stock and warrants. Unless our operations generate significant revenues and cash flows from operating activities, we will continue to fund operations from cash on hand and through the similar sources of capital previously described. We can give no assurances that any additional capital that we are able to obtain will be sufficient to meet our needs. Management believes that we will continue to incur net losses and negative cash flows from operating activities for the foreseeable future. Based on the resources available to us at September 30, 2005, management believes that we will need additional equity or debt financing or will need to generate revenues during 2006 through licensing our products or entering into strategic alliances to be able to sustain our operations beyond 2006 and we will need additional financing thereafter until we can achieve profitability, if ever.

Research and Development Projects

Oleoyl-estrone. In January 2005, the United States Food and Drug Administration (FDA) accepted our filed Investigational New Drug Application (IND) for the human clinical testing of oleoyl estrone. This IND allowance was granted on the preclinical chemistry, manufacturing, and safety data submitted to the FDA by the Company.

In February 2005, we began dosing patients in our first Phase I trial in Basel, Switzerland to evaluate the safety and tolerability of defined doses of orally administered oleoyl-estrone in obese adults, in accordance with FDA guidelines after obtaining formal approval from the Swiss medical regulatory authority, Swissmedic. The objective of this human Phase I dose-escalation study was to determine the pharmacokinetic profile of oleoyl-estrone, as well as its safety and tolerability in obese adult volunteers of both genders. The study was completed in two parts, Phase Ia and Phase Ib. In May 2005, we concluded Phase Ia, in which 36 obese volunteers received a single dose of either OE or a placebo, in a dose escalating manner. The Phase Ib trial was a 7-day repeat-dose, dose escalation trial that evaluated 24 obese volunteers in four cohorts, randomized 2 to 1, active to placebo. Both Phase Ia and Phase Ib have been completed. Results from both studies will also be used, in conjunction with extensive preclinical work, to establish the protocol and obtain approval to begin Phase II clinical trials. The trial was being conducted under the IND accepted by the FDA in January 2005. Oleoyl-estrone was well tolerated at all doses and demonstrated no serious adverse events. In addition, there was evidence of reduction in weight and evidence of a reduction in desire to eat and hunger level, reduced fasting glucose, reduced LDL cholesterol and other key measures. Oleoyl-estrone also showed reversible, dose dependent elevations in estrone and estradiol levels as well as reductions in testosterone levels.

To date, we have incurred $6,697,551 of project costs related to our development of oleoyl-estrone, including milestone payments triggered under our license agreement for oleoyl-estrone, of which $2,712,058 and $1,714,333 was incurred in the first nine months of 2005 and 2004, respectively. Currently, we anticipate that we will need to expend approximately an additional $1,000,000 to $1,500,000 in development costs in fiscal 2005. Since oleoyl-estrone is regarded by the FDA as a new entity, it is not realistic to predict the size and the design of the study at this time.

Although we currently have sufficient capital to fund our anticipated 2005 R&D expenditures relating to oleoyl-estrone, we will need to raise additional capital in order to complete the anticipated five or six year development program for the product. If we are unable to raise such additional capital, we may have to sublicense our rights to oleoyl-estrone to a third party as a means of continuing development, or, although less likely, we may be required to abandon further development efforts altogether, either of which would have a material adverse effect on the prospects of our business.

In addition to raising additional capital, whether we are successful in developing oleoyl-estrone is dependent on numerous other factors, including unforeseen safety issues, lack of effectiveness, significant unforeseen delays in the clinical trial and regulatory approval process, both of which could be extremely costly, and inability to monitor patients adequately before and after treatments. Additional risks and uncertainties are also described in the Prospectus. The existence of any of these factors could increase our development costs or make successful completion of development impractical, which would have a material adverse affect on the prospects of our business.

S-5

Lingual Spray Propofol. We are currently working to develop, manufacture and commercialize a propofol lingual spray. In July 2004, we released the results of the first human trial for our proprietary lingual spray formulation of propofol. In January 2005, the FDA accepted our IND for the initiation of the human clinical trials in the United States required for FDA approval of Propofol Lingual Spray (Propofol LS). We continue to pursue FDA approval of Propofol LS under 505(b)2 regulatory pathway. Section 505(b)2 of the U.S. Food, Drug & Cosmetic Act allows the FDA to approve a drug on the basis of existing data in the scientific literature or data used by the FDA in the approval of other drugs. Accordingly, the FDA has indicated to us that we will be able to utilize Section 505(b)2 to proceed directly to a pivotal Phase III trial for lingual spray propofol following completion of Phase I trials. We are actively planning the next steps of the clinical development process for Propofol LS, meeting with scientific advisors, Novadel and other research organizations regarding formulation, reviewing existing data, developing trial design, and evaluating plans to re-enter the clinic.

To date, we have incurred $2,801,285 of project costs related to our development of propofol lingual spray, of which $184,345 and $1,266,644 was incurred during the first nine months of 2005 and 2004, respectively. Currently, we anticipate that we will need to expend approximately an additional $375,000 to $750,000 in development costs in fiscal 2005 and at least an aggregate of approximately $3,000,000 to $5,000,000 until we receive FDA approval for propofol, should we opt to continue development until then, including anticipated 2005 costs. As with our development of oleoyl-estrone, we believe we currently have sufficient capital to fund our development activities of propofol lingual spray during 2005 and 2006. Since our business does not generate any cash flow, however, we will need to raise additional capital to continue development of the product beyond 2006. We expect to raise such additional capital through debt financings or by selling shares of our capital stock. To the extent additional capital is not available when we need it, we may be forced to sublicense our rights to propofol lingual spray or abandon our development efforts altogether, either of which would have a material adverse effect on the prospects of our business.

PTH (1-34). To date, we have incurred $395,606 of project costs related to our development of PTH (1-34), which was incurred since April 1, 2005, the date of the Tarpan Therapeutics, Inc. acquisition. Currently, we anticipate that we will need to expend approximately an additional $750,000 to $1,500,000 in development costs in fiscal 2005. We are working toward re-entering the clinic utilizing the existing open physician IND. In addition, we are planning for a meeting with the FDA to discuss our development plan for PTH (1-34). In light of the information available from the development of FORTEO® (which contains recombinant human parathyroid hormone (1-34), [rhPTH(1-34)]) and in the absence of the meeting with the FDA, we are not able to realistically predict the size and the design of the study at this time. As with our development of our other product candidates, we believe we currently have sufficient capital to fund our development activities of PTH (1-34) in their entirety during 2005. FORTEO® is a registered trademark of Eli Lilly and Company.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements.

Recently Issued Accounting Standards

In December 2004, the FASB issued SFAS No. 123(R) (revised 2004), “Share-Based Payment”, which amends SFAS Statement No. 123 and will be effective for our quarter ending March 31, 2006. The new standard will require us to expense employee stock options and other share-based payments over the vesting period. The new standard may be adopted in one of three ways - the modified prospective transition method, a variation of the modified prospective transition method or the modified retrospective transition method. We are currently evaluating how we will adopt the standard and evaluating the effect that the adoption of SFAS 123(R) will have on our financial position and results of operations.

Preliminary Results of Oleoyl-Estrone Phase I Clinical Trial

On October 17, 2005, we issued a press release announcing preliminary results from two Phase I clinical trials of oleoyl-estrone. Excerpts from the press release are set forth below:

S-6

“October 17, 2005 - Manhattan Pharmaceuticals, Inc. (AMEX: MHA) announced preliminary results from two Phase I clinical trials of oleoyl-estrone (OE), an experimental, orally administered small molecule in development for the treatment of obesity. The data were presented in a poster yesterday at the 2005 Annual Scientific Meeting of NAASO, The Obesity Society, in Vancouver, BC.

The Phase I study, conducted in Switzerland, was done in two parts which consisted of a single dose study and a seven day repeat dose study. The primary purpose was to assess the safety, tolerability and pharmacokinetics of OE. Some efficacy parameters were included and measured in the repeat dose component of the study.

Highlights of the study included:

| · | OE was generally well tolerated at all doses investigated. |

| · | OE demonstrated evidence of reduction in weight. |

| · | OE demonstrated evidence of: reduction in desire to eat and hunger level, reduction in prospective food consumption, reduced fasting glucose, reduced LDL cholesterol and changes in other key measures. |

| · | There were no clinically significant changes in the physical exams, vital signs, ECGs, coagulation or liver function tests. |

| · | No serious adverse events were reported. Clinical laboratory findings included reversible, dose-dependent elevations in estrone and estradiol levels as well as reductions in testosterone levels. |

Phase Ia was a dose-escalating study to measure OE's pharmacokinetic profile, safety and tolerability in 36 obese males and females ages 18-65, with a body mass index greater than 30.0 (a BMI of greater than 30.0 is classified as obese per guidelines from the U.S. Department of Health and Human Services). Twelve of the subjects received placebo and 24 received a single dose of OE in one of six doses ranging from 1mg to 150mg.

Phase Ib measured OE's safety and tolerability in 24 obese volunteers in four cohorts of six patients each who received either placebo or OE in doses ranging from 10mg to 150mg once daily for seven consecutive days. The protocol provided that subjects should maintain their normal diet and level of activity, but required that subjects abstain from consuming alcohol.

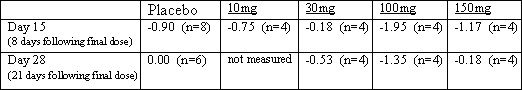

The OE-treated groups in the Phase Ib study demonstrated evidence of greater weight loss than the placebo group. Weights were assessed at baseline, Day 15, and Day 28. Weight loss appeared to be maintained for longer periods in the OE groups compared to placebo at Day 28, twenty-one days following cessation of treatment. This data may support the contention that the mechanism of action of OE involves a "resetting" of the ponderostat, or appetite "set point". It also provides a rationale for testing alternative regimens such as low or intermittent dosing.

Average change from baseline weight (in kilograms)

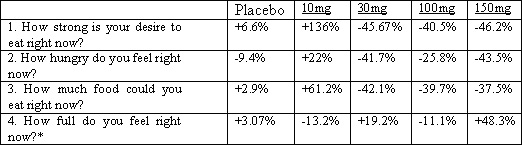

The OE-treated groups in the Phase Ib study also demonstrated evidence of a reduction in the feeling of desire to eat, hunger level and prospective food consumption as measured by changes in the visual analogue scales (VAS).

S-7

Average percent change in VAS scores as measured day 7 vs. baseline

* Note: In items 1, 2 and 3 increasing VAS scores indicate an increase in desire to eat. In item 4 an increase in VAS score indicates an increase in fullness.

OE was generally well tolerated. The most common side effects reported included headache, back pain, and diarrhea. No serious adverse events were reported.

Total mean cholesterol decreased at Day 7 at the 100mg and 150mg dose. Mean HDL-cholesterol increased and mean LDL-cholesterol decreased with a trend toward improvement in the LDL-to-HDL cholesterol ratio, even at the lower doses. Mean glucose concentration decreased in a reversible and dose dependent manner and remained decreased at Day 15. Mean estradiol and estrone levels were elevated, while mean testosterone levels were suppressed, all in a reversible and dose dependent manner. In addition, there were no clinically significant changes in the physical exams, vital signs, ECG's, coagulation or liver function tests.

The preliminary plasma concentration-time profiles show that the plasma concentration of OE did not increase with the administered dose level. There were no significantly elevated plasma concentrations of OE on Day 7 which may indicate that there is no clear accumulation in plasma after daily oral dosing for seven consecutive days. In this small sample study there were no clear differences between the sexes with respect to plasma concentration.

"Given the current crisis that we face with the growing prevalence of obesity, I am encouraged to see signs of efficacy in this study, though the metabolic and hormonal effects merit further study. Obesity and its complications, particularly type 2 diabetes, are rapidly becoming the number one health threat around the globe. Oleoyl-estrone may provide a new treatment option," said J. Larry Jameson, M.D., a leading endocrinologist who is Professor and Chairman of Medicine at Northwestern University Medical School.

"We are excited to have seen this much evidence of benefit in a phase I trial with only 7 days of exposure" said Doug Abel, President and CEO of Manhattan Pharmaceuticals. "We are working closely with our scientific and clinical advisors to interpret this data and finalize study designs. We plan to initiate a phase IIa trial early next year."

The full scientific poster of these results can be viewed on the company's website at www.manhattanpharma.com

ABOUT OLEOYL-ESTRONE

Oleoyl-estrone (OE) is an orally administered small molecule that has been shown to cause significant weight loss in extensive preclinical animal studies, without the need for dietary modifications. Developed by researchers at the University of Barcelona, OE has been tested in both obese and lean rats; treatment with OE resulted in significant weight loss even in the presence of abundant food and water. We believe that OE may prove to be a safe and effective treatment of obesity, potentially representing a significant advantage over currently available anti-obesity medications.

ABOUT OBESITY

Obesity is one of the most common metabolic disorders in the world. Nearly 61% of all Americans are considered to be overweight, and 26% percent are considered to be obese. The World Bank estimates that obesity alone accounts for more than 12% of the U.S. national health care budget. The National Institutes of Health estimated that direct costs for the treatment of obesity in 1988 were in excess of $45 billion and accounted for nearly 8% of the total national cost of health care; a decade later, annual direct costs for the treatment of obesity had risen to $102.2 billion dollars. As these statistics illustrate, obesity is a rapidly growing, costly disease, for which there is currently no effective treatment.”

S-8

Page | |

Unaudited Interim Financial Statements: | |

Condensed Consolidated Balance Sheets as of September 30, 2005 and December 31, 2004 | F-2 |

Condensed Consolidated Statements of Operations for the Three and Nine Months Ended September 30, 2005 and the cumulative period from August 6, 2001 (date of inception) to September 30, 2005 | F-3 |

Condensed Consolidated Statement of Changes in Stockholders’ Equity (Deficiency) for the period from August 6, 2001 (date of inception) to September 30, 2005 | F-4 |

Condensed Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2005 and the cumulative period from August 6, 2001 (date of inception) to September 30, 2005 | F-5 |

Notes to Unaudited Condensed Consolidated Financial Statements | F-6 |

F-1

MANHATTAN PHARMACEUTICALS, INC. AND SUBSIDIARIES | |||||||||||

| (A Development Stage Company) | |||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||

| (Unaudited) |

September 30, | December 31, | ||||||

Assets | 2005 | 2004 | |||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 11,868,808 | $ | 905,656 | |||

| Short-term investments, available for sale, at market | 1,009,793 | 4,514,216 | |||||

| Prepaid expenses | 20,178 | 40,126 | |||||

| Total current assets | 12,898,779 | 5,459,998 | |||||

| Property and equipment, net | 104,001 | 119,017 | |||||

| Other assets | 70,506 | 70,506 | |||||

| Total assets | $ | 13,073,286 | $ | 5,649,521 | |||

Liabilities and Stockholders’ Equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 1,713,516 | $ | 1,143,603 | |||

| Accrued expenses | 95,179 | 52,102 | |||||

| Total liabilities | 1,808,695 | 1,195,705 | |||||

| Commitments and Contingencies | |||||||

| Stockholders’ equity: | |||||||

| Series A convertible preferred stock, $.001 par value. | |||||||

| Authorized 1,500,000 shares; 0 and 854,373 shares issued and | |||||||

| outstanding at September 30, 2005 and December 31, 2004, respectively | |||||||

| (liquidation preference aggregating $0 and $8,973,730 at | |||||||

| September 30, 2005 and December 31, 2004, respectively) | — | 854 | |||||

| Common stock, $.001 par value. Authorized 150,000,000 shares; | |||||||

| 59,415,257 and 28,309,187 shares issued and outstanding | |||||||

| at September 30, 2005 and December 31, 2004, respectively | 59,415 | 28,309 | |||||

| Additional paid-in capital | 41,932,542 | 18,083,208 | |||||

| Deficit accumulated during development stage | (30,881,083 | ) | (13,955,035 | ) | |||

| Dividends payable in shares | 150,756 | 303,411 | |||||

| Accumulated other comprehensive income | 2,961 | 13,237 | |||||

| Unearned consulting services | — | (20,168 | ) | ||||

| Total stockholders’ equity | 11,264,591 | 4,453,816 | |||||

| Total liabilities and stockholders' equity | $ | 13,073,286 | $ | 5,649,521 | |||

| See accompanying notes to unaudited condensed consolidated financial statements. |

F-2

| (A Development Stage Company) | |||||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||

| (Unaudited) |

Cumulative | ||||||||||||||||

period from | ||||||||||||||||

August 6, 2001 | ||||||||||||||||

(inception) to | ||||||||||||||||

Three Months ended September 30, | Nine Months ended September 30, | September 30, | ||||||||||||||

2005 | 2004 | 2005 | 2004 | 2005 | ||||||||||||

| Revenue | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||

| Costs and expenses: | ||||||||||||||||

| Research and development | 1,370,733 | 1,678,939 | 3,292,008 | 2,907,173 | 9,894,442 | |||||||||||

| General and administrative | 490,894 | 562,752 | 1,537,298 | 1,443,745 | 5,662,788 | |||||||||||

| In-process research and development charge | — | — | 11,887,807 | — | 11,887,807 | |||||||||||

| Impairment of intangible assets | — | — | — | — | 1,248,230 | |||||||||||

| Loss on disposition of intangible assets | — | — | — | — | 1,213,878 | |||||||||||

| Total operating expenses | 1,861,627 | 2,241,691 | 16,717,113 | 4,350,918 | 29,907,145 | |||||||||||

| Operating loss | (1,861,627 | ) | (2,241,691 | ) | (16,717,113 | ) | (4,350,918 | ) | (29,907,145 | ) | ||||||

| Other (income) expense: | ||||||||||||||||

| Interest and other income | (49,137 | ) | (47,614 | ) | (117,484 | ) | (128,705 | ) | (309,173 | ) | ||||||

| Interest expense | — | — | — | — | 23,893 | |||||||||||

| Realized gain on sale of marketable equity securities | — | — | — | (71,182 | ) | (71,182 | ) | |||||||||

| Total other income | (49,137 | ) | (47,614 | ) | (117,484 | ) | (199,887 | ) | (356,462 | ) | ||||||

| Net loss | (1,812,490 | ) | (2,194,077 | ) | (16,599,629 | ) | (4,151,031 | ) | (29,550,683 | ) | ||||||

| Preferred stock dividends (including imputed amounts) | (75,018 | ) | (102,273 | ) | (326,419 | ) | (495,078 | ) | (1,330,400 | ) | ||||||

| Net loss applicable to common shares | $ | (1,887,508 | ) | $ | (2,296,350 | ) | $ | (16,926,048 | ) | $ | (4,646,109 | ) | $ | (30,881,083 | ) | |

| Net loss per common share: | ||||||||||||||||

| Basic and diluted | $ | (0.04 | ) | $ | (0.09 | ) | $ | (0.44 | ) | $ | (0.17 | ) | ||||

| Weighted average shares of common stock outstanding: | ||||||||||||||||

| Basic and diluted | 44,667,025 | 26,866,155 | 38,174,238 | 26,585,823 | ||||||||||||

| See accompanying notes to unaudited condensed consolidated financial statements. |

F-3

| (A Development Stage Company) | ||||||||||||||||||||||||||||||||||

| Condensed Consolidated Statement of Stockholders' Equity (Deficiency) | ||||||||||||||||||||||||||||||||||

| (Unaudited) |

Deficit | Dividends | Total | ||||||||||||||||||||||||||||||||

Series A | accumulated | payable in | Accumulated | stock- | ||||||||||||||||||||||||||||||

convertible | Additional | during | Series A | other | Unearned | holders' | ||||||||||||||||||||||||||||

preferred stock | Common stock | paid-in | Subscription | development | preferred | comprehensive | consulting | equity | ||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | capital | receivable | stage | shares | income/(loss) | costs | (deficiency) | ||||||||||||||||||||||||

| Stock issued at $0.0004 per share for subscription receivable | — | $ | — | 10,167,741 | $ | 10,168 | $ | (6,168 | ) | $ | (4,000 | ) | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||

| Net loss | — | — | — | — | — | — | (56,796 | ) | — | — | — | (56,796 | ) | |||||||||||||||||||||

| Balance at December 31, 2001 | — | — | 10,167,741 | 10,168 | (6,168 | ) | (4,000 | ) | (56,796 | ) | — | — | — | (56,796 | ) | |||||||||||||||||||

| Proceeds from subscription receivable | — | — | — | — | — | 4,000 | — | — | — | — | 4,000 | |||||||||||||||||||||||

| Stock issued at $0.0004 per share for license rights | — | — | 2,541,935 | 2,542 | (1,542 | ) | — | — | — | — | — | 1,000 | ||||||||||||||||||||||

| Stock options issued for consulting services | — | — | — | — | 60,589 | — | — | — | — | (60,589 | ) | — | ||||||||||||||||||||||

| Amortization of unearned consulting services | — | — | — | — | — | — | — | — | — | 22,721 | 22,721 | |||||||||||||||||||||||

| Sales of common stock at $0.63 per share through private placement, net of expenses | — | — | 3,043,332 | 3,043 | 1,701,275 | — | — | — | — | — | 1,704,318 | |||||||||||||||||||||||

| Net loss | — | — | — | — | — | (1,037,320 | ) | — | — | — | (1,037,320 | ) | ||||||||||||||||||||||

| Balance at December 31, 2002 | — | — | 15,753,008 | 15,753 | 1,754,154 | — | (1,094,116 | ) | — | — | (37,868 | ) | 637,923 | |||||||||||||||||||||

| Common stock issued at $0.63 per share, net of expenses | — | — | 1,321,806 | 1,322 | 742,369 | — | — | — | — | — | 743,691 | |||||||||||||||||||||||

| Effect of reverse acquisition | — | — | 6,287,582 | 6,287 | 2,329,954 | — | — | — | — | — | 2,336,241 | |||||||||||||||||||||||

| Amortization of unearned consulting costs | — | — | — | — | — | — | — | — | — | 37,868 | 37,868 | |||||||||||||||||||||||

| Unrealized loss on short-term investments | — | — | — | — | — | — | — | — | (7,760 | ) | — | (7,760 | ) | |||||||||||||||||||||

| Payment for fractional shares for stock combination | — | — | — | — | (300 | ) | — | — | — | — | — | (300 | ) | |||||||||||||||||||||

| Preferred stock issued at $10 per share, net of expenses | 1,000,000 | 1,000 | — | — | 9,045,176 | — | — | — | — | — | 9,046,176 | |||||||||||||||||||||||

| Imputed preferred stock dividend | 418,182 | — | (418,182 | ) | — | — | ||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | — | (5,960,907 | ) | — | — | — | (5,960,907 | ) | |||||||||||||||||||||

| Balance at December 31, 2003 | 1,000,000 | 1,000 | 23,362,396 | 23,362 | 14,289,535 | — | (7,473,205 | ) | — | (7,760 | ) | — | 6,832,932 | |||||||||||||||||||||

| Exercise of stock options | — | — | 27,600 | 27 | 30,073 | — | — | — | — | — | 30,100 | |||||||||||||||||||||||

| Common stock issued through private placement at $1.10 per share, net of expenses | — | — | 3,368,952 | 3,369 | 3,358,349 | — | — | — | — | — | 3,361,718 | |||||||||||||||||||||||

| Conversion of preferred stock to common stock | (170,528 | ) | (171 | ) | 1,550,239 | 1,551 | (1,380 | ) | — | — | — | — | — | — | ||||||||||||||||||||

| Preferred stock dividends paid by issuance of shares | 24,901 | 25 | — | — | 281,073 | — | — | (282,388 | ) | — | — | (1,290 | ) | |||||||||||||||||||||

| Preferred stock dividend accrued | — | — | — | — | — | — | (585,799 | ) | 585,799 | — | — | — | ||||||||||||||||||||||

| Warrants issued for consulting services | — | — | — | — | 125,558 | — | — | — | — | (120,968 | ) | 4,590 | ||||||||||||||||||||||

| Amortization of unearned consulting costs | — | — | — | — | — | — | — | — | — | 100,800 | 100,800 | |||||||||||||||||||||||

| Reversal of unrealized loss on short-term investments and unrealized gain on short-term investments | — | — | — | — | — | — | — | — | 20,997 | — | 20,997 | |||||||||||||||||||||||

| Net loss | — | — | — | — | — | — | (5,896,031 | ) | — | — | — | (5,896,031 | ) | |||||||||||||||||||||

| Balance at December 31, 2004 | 854,373 | 854 | 28,309,187 | 28,309 | 18,083,208 | — | (13,955,035 | ) | 303,411 | 13,237 | (20,168 | ) | 4,453,816 | |||||||||||||||||||||

| Common stock issued through private placement at $1.11 and $1.15 per share, net of expenses | — | — | 11,917,680 | 11,918 | 12,257,686 | — | — | — | — | — | 12,269,604 | |||||||||||||||||||||||

| Exercise of stock options | — | — | 32,400 | 33 | 32,367 | — | — | — | — | — | 32,400 | |||||||||||||||||||||||

| Exercise of warrants | — | — | 278,080 | 277 | 68,214 | — | — | — | — | — | 68,491 | |||||||||||||||||||||||

| Conversion of preferred stock to common stock | (896,154 | ) | (896 | ) | 8,146,858 | 8,147 | (7,251 | ) | — | — | — | — | — | — | ||||||||||||||||||||

| Preferred stock dividends paid by issuance of shares | 41,781 | 42 | — | — | 477,736 | — | — | (479,074 | ) | — | — | (1,296 | ) | |||||||||||||||||||||

| Preferred stock dividend accrued | — | — | — | — | — | — | (326,419 | ) | 326,419 | — | — | — | ||||||||||||||||||||||

| Stock based compensation | — | — | — | — | 28,054 | — | — | — | — | 20,168 | 48,222 | |||||||||||||||||||||||

| Reversal of unrealized gain on short-term investments | — | — | — | — | — | — | — | — | (10,276 | ) | — | (10,276 | ) | |||||||||||||||||||||

| Costs associated with private placement | — | — | — | — | (49,725 | ) | — | — | — | — | — | (49,725 | ) | |||||||||||||||||||||

| Stock issued in connection with acquisition of Tarpan Therapeutics, Inc. | — | — | 10,731,052 | 10,731 | 11,042,253 | — | — | — | — | — | 11,052,984 | |||||||||||||||||||||||

| Net loss | — | — | — | — | — | — | (16,599,629 | ) | — | — | — | (16,599,629 | ) | |||||||||||||||||||||

| Balance at September 30, 2005 | — | $ | — | 59,415,257 | $ | 59,415 | $ | 41,932,542 | $ | — | $ | (30,881,083 | ) | $ | 150,756 | $ | 2,961 | $ | — | $ | 11,264,591 | |||||||||||||

| See accompanying notes to unaudited condensed consolidated financial statements. |

F-4

| (A Development Stage Company) | |||||||||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||||||||

| (Unaudited) |

Cumulative | ||||||||||

period from | ||||||||||

August 6, 2001 | ||||||||||

(inception) to | ||||||||||

Nine months ended September 30, | September 30, | |||||||||

2005 | 2004 | 2005 | ||||||||

| Cash flows from operating activities: | ||||||||||

| Net loss | $ | (16,599,629 | ) | $ | (4,151,031 | ) | $ | (29,550,683 | ) | |

| Adjustments to reconcile net loss to | ||||||||||

| net cash used in operating activities: | ||||||||||

| Common stock issued for license rights | — | — | 1,000 | |||||||

| Stock based compensation | 48,222 | 70,560 | 209,611 | |||||||

| Warrants issued for consulting services | — | — | 4,590 | |||||||

| Amortization of intangible assets | — | — | 145,162 | |||||||

| Gain on sale of marketable equity securities | — | (71,182 | ) | (71,182 | ) | |||||

| Depreciation | 40,233 | 15,806 | 73,793 | |||||||

| Non cash portion of in-process research and development charge | 11,721,623 | — | 11,721,623 | |||||||

| Loss on impairment of intangible assets | — | — | 1,248,230 | |||||||

| Loss on disposition of intangible assets | — | — | 1,213,878 | |||||||

| Changes in operating assets and liabilities, net of acquisitions: | ||||||||||

| Decrease in prepaid expenses | 19,948 | 2,291 | 38,067 | |||||||

| Increase in other assets | — | (70,506 | ) | (70,506 | ) | |||||

| Increase in accounts payable | 543,862 | 838,019 | 1,363,730 | |||||||

| Increase (decrease) in accrued expenses | 43,077 | (329,200 | ) | (445,142 | ) | |||||

| Net cash used in operating activities | (4,182,664 | ) | (3,695,243 | ) | (14,117,829 | ) | ||||

| Cash flows from investing activities: | ||||||||||

| Purchase of property and equipment | (23,180 | ) | (131,298 | ) | (168,074 | ) | ||||

| Cash paid in connection with acquisitions | — | — | (32,808 | ) | ||||||

| Purchase of short-term investments | — | — | (5,000,979 | ) | ||||||

| Proceeds from sale of short-term investments | 3,494,147 | 431,089 | 4,425,236 | |||||||

| Proceeds from sale of license | — | — | 200,001 | |||||||

| Cash acquired in acquisition | 6,777 | — | 6,777 | |||||||

| Net cash provided by (used in) investing activities | 3,477,744 | 299,791 | (569,847 | ) | ||||||

| Cash flows from financing activities: | ||||||||||

| Proceeds from issuances of notes payable to stockholders | — | — | 233,500 | |||||||

| Repayments of notes payable to stockholders | (651,402 | ) | — | (884,902 | ) | |||||

| Proceeds from issuance of note payable to bank | — | — | 600,000 | |||||||

| Repayment of note payable to bank | — | — | (600,000 | ) | ||||||

| Proceeds from subscriptions receivable | — | — | 4,000 | |||||||

| Payment for fractional shares for stock combination | (1,296 | ) | (1,290 | ) | (2,286 | ) | ||||

| Proceeds from sale of common stock, net | 12,269,604 | 3,361,718 | 18,078,730 | |||||||

| Costs associated with private placement | (49,725 | ) | — | (49,725 | ) | |||||

| Proceeds from sale of preferred stock, net | — | — | 9,046,176 | |||||||

| Proceeds from exercise of stock options | 32,400 | 30,100 | 62,500 | |||||||

| Proceeds from exercise of warrants | 68,491 | — | 68,491 | |||||||

| Net cash provided by financing activities | 11,668,072 | 3,390,528 | 26,556,484 | |||||||

| Net increase (decrease) in cash and cash equivalents | 10,963,152 | (4,924 | ) | 11,868,808 | ||||||

| Cash and cash equivalents at beginning of period | 905,656 | 7,413,803 | — | |||||||

| Cash and cash equivalents at end of period | $ | 11,868,808 | $ | 7,408,879 | $ | 11,868,808 | ||||

| Supplemental disclosure of cash flow information: | ||||||||||

| Interest paid | $ | — | $ | — | $ | 26,934 | ||||

| Supplemental disclosure of noncash investing and financing activities: | ||||||||||

| Stock options/warrants issued for consulting services | $ | 312,954 | $ | 120,968 | $ | 494,511 | ||||

| Preferred stock dividends accrued | 326,419 | 495,078 | 912,218 | |||||||

| Conversion of preferred stock to common stock | 829 | — | 1,000 | |||||||

| Preferred stock dividends paid by issuance of shares | 477,736 | — | 759,134 | |||||||

| Issuance of common stock for acquisitions | 11,052,984 | — | 13,389,226 | |||||||

| Marketable equity securities received in connection with | ||||||||||

| sale of license | — | — | 359,907 | |||||||

| Net liabilities assumed in business combination | (675,416 | ) | — | (675,416 | ) | |||||

| See accompanying notes to unaudited condensed consolidated financial statements. |

F-5

MANHATTAN PHARMACEUTICALS, INC. and SUBSIDIARIES

(A Development Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

September 30, 2005

(1) BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information. Accordingly, the consolidated financial statements do not include all information and footnotes required by accounting principles generally accepted in the United States of America for complete annual financial statements. In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments, consisting of only normal recurring adjustments, considered necessary for a fair presentation. Interim operating results are not necessarily indicative of results that may be expected for the year ending December 31, 2005 or for any subsequent period. These unaudited condensed consolidated financial statements should be read in conjunction with audited financial statements of Manhattan Pharmaceuticals, Inc. and its subsidiaries (“Manhattan” or the “Company”) as of and for the year ended December 31, 2004, which are included in the Prospectus. The condensed consolidated balance sheet as of December 31, 2004 has been derived from the audited consolidated financial statements included in the Prospectus.

(2) LIQUIDITY

The Company reported a net loss of $16,599,629 and negative cash flows from operating activities of $4,182,664 for the nine months ended September 30, 2005. The net loss from date of inception, August 6, 2001, to September 30, 2005 amounts to $29,550,683.

Management believes that the Company will continue to incur net losses through at least September 30, 2006 and for the foreseeable future. Based on the resources of the Company available at September 30, 2005, management believes that the Company will need additional equity or debt financing or will need to generate revenues during 2006 through licensing of its products or entering into strategic alliances to be able to sustain its operations beyond 2006 and that it will need additional financing thereafter until it can achieve profitability, if ever.

The Company’s continued operations will depend on its ability to raise additional funds through various potential sources such as equity and debt financing, collaborative agreements, strategic alliances and its ability to realize the full potential of its technology in development. Additional funds may not become available on acceptable terms, and there can be no assurance that any additional funding that the Company does obtain will be sufficient to meet the Company’s needs in the long term. Through September 30, 2005, a significant portion of the Company’s financing has been through private placements of common and preferred stock. Until and unless the Company’s operations generate significant revenues and cash flows from operating activities, the Company will attempt to continue to fund operations from cash on hand and through the sources of capital previously described.

As described in Note 6, the Company recently completed a private placement offering of units consisting of shares of its common stock and warrants to purchase additional shares of common stock. The private placement was completed in two separate closings held on August 26, 2005 and August 30, 2005, respectively. In the August 26 closing, the Company sold a total of 10,808,971 shares of common stock and five-year warrants to purchase 2,161,767 shares for total gross proceeds of approximately $12 million. The warrants issued at the August 26 closing are exercisable at a price of $1.44 per share. On August 30, 2005, the Company closed on the sale of an additional 1,108,709 shares of common stock and warrants to purchase 221,741 common shares, which resulted in gross proceeds of approximately $1.28 million. The warrants issued in connection with the August 30 closing are exercisable at a price of $1.49 per share. Accordingly, the total gross proceeds resulting from the private placement was $13.27 million, before deducting selling commissions and expenses.

F-6

MANHATTAN PHARMACEUTICALS, INC. and SUBSIDIARIES

(A Development Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

September 30, 2005

The terms of the Company’s Series A Preferred Stock, which was originally issued in November 2003, provided for its automatic conversion upon the Company’s completion of a financing that results in gross proceeds to of at least $10 million at a pre-money valuation of the Company of at least $30 million. Accordingly, as a result of the August 26, 2005 closing of the Company’s private placement discussed above, all of the remaining outstanding shares of the Company’s Series A Preferred Stock automatically converted into shares of the Company’s common stock. As of such date, there were 729,626 shares of Series A Preferred Stock outstanding, which, upon the closing of the private placement, converted into an aggregate of 6,632,957 shares of common stock (at a rate of 9.0909 common shares per share of preferred stock).

(3) COMPUTATION OF NET LOSS PER COMMON SHARE

Basic net loss per common share is calculated by dividing net loss applicable to common shares by the weighted-average number of common shares outstanding for the period. Diluted net loss per common share is the same as basic net loss per common share, since potentially dilutive securities from stock options, stock warrants and convertible preferred stock would have an antidilutive effect because the Company incurred a net loss during each period presented. The amount of potentially dilutive securities excluded from the calculation was 12,754,038 and 16,161,738 as of September 30, 2005 and 2004, respectively.

(4) STOCK OPTIONS

On January 11, 2005, the Company granted directors and employees options to purchase an aggregate of 367,280 shares of common stock under the Company’s 2003 Stock Option Plan at an exercise price of $1.00 per share. 168,030 shares subject to these options vest in three equal annual installments starting on the grant date and continuing each anniversary thereafter, provided the optionee continues in service. 50,000 shares subject to these options vest in two equal annual installments starting on January 3, 2006, provided the optionee continues in service, and 149,250 shares subject to these options vest in three equal annual installments starting one year from the grant date, provided the optionee continues in service. On April 1, 2005, the Company granted its Chief Executive Officer an option to purchase an aggregate of 2,923,900 shares of common stock under the Company’s 2003 Stock Option Plan at an exercise price of $1.50 per share. The option vests in three equal installments, on November 1, 2005, November 1, 2006 and November 1, 2007. On June 16, 2005, the Company granted a consultant options to purchase an aggregate of 100,000 shares of common stock under the Company’s 2003 Stock Option Plan at an exercise price of $1.60 per share. On August 29, 2005, the Company granted a consultant options to purchase an aggregate of 250,000 shares of common stock under the Company’s 2003 Stock Option Plan at an exercise price of $1.50 per share. All shares subject to these options, with the exception of the options granted on August 29, 2005, vest in thirty-six equal monthly installments beginning on the first month anniversary of the date of the grant, provided the consultant continues to provide services to the Company. The shares subject to the options granted on August 29, 2005 vest as follows: 25,000 options vest immediately; 50,000 upon reaching a share price goal of $2.50; 75,000 upon reaching a share price goal of $3.50; and 100,000 upon reaching a share price goal of $5.00.

F-7

MANHATTAN PHARMACEUTICALS, INC. and SUBSIDIARIES

(A Development Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

September 30, 2005

The Company uses the intrinsic value method of accounting for employee stock options pursuant to the provisions of APB Opinion No. 25. Since all of the options granted by the Company have been at exercise prices that were at least equal to the market value at the date of grant, there were no charges to operations upon issuance. Had compensation costs been determined using the Black-Scholes option pricing model in accordance with the fair value method prescribed by Statement of Financial Accounting Standards No. 123 (“SFAS No. 123”) for all options issued to employees and amortized over the vesting period, the Company’s net loss applicable to common shares and net loss per common share (basic and diluted) would have been increased to the pro forma amounts indicated below.

Three months ended | Nine months ended | ||||||||||||

September 30, | September 30, | ||||||||||||

2005 | 2004 | 2005 | 2004 | ||||||||||

| Net loss applicable to common shares, as reported | $ | (1,887,508 | ) | $ | (2,296,350 | ) | $ | (16,926,048 | ) | $ | (4,646,109 | ) | |

Deduct: Total stock-based employee | |||||||||||||

| compensation expense determined | |||||||||||||

| under fair value method | (393,305 | ) | (432,923 | ) | (954,524 | ) | (997,211 | ) | |||||

| Net loss applicable to common shares, pro forma | $ | (2,280,813 | ) | $ | (2,729,273 | ) | $ | (17,880,572 | ) | $ | (5,643,320 | ) | |

| Net loss per common share - basic | |||||||||||||

| As reported | $ | (0.04 | ) | $ | (0.09 | ) | $ | (0.44 | ) | $ | (0.17 | ) | |

| Pro forma | (0.05 | ) | (0.10 | ) | (0.47 | ) | (0.21 | ) | |||||

As a result of amendments to SFAS No. 123, the Company will be required to expense the fair value of employee stock options over the vesting period, beginning January 1, 2006.

The fair value of each option granted is estimated on the date of the grant using the Black-Scholes option pricing model with the following weighted average assumptions used for the grants in the nine months ended September 30, 2005: dividend yield of 0%; expected volatility of 69%; risk-free interest rate of 4.1%; and expected lives of five years. The following assumptions were used for the grants in the nine months ended September 30, 2004: dividend yield of 0%; expected volatility of 82%; risk-free interest rate of 3.2%; and expected lives of eight years. The following weighted average assumptions were used for the grants in the three months ended September 30, 2005: dividend yield of 0%; expected volatility of 69%; risk-free interest rate of 4.1%; and expected lives of five years. The following weighted average assumptions were used for the grants in the three months ended September 30, 2004: dividend yield of 0%; expected volatility of 73.6%; risk-free interest rate of 2.0%; and expected lives of five years.

F-8

MANHATTAN PHARMACEUTICALS, INC. and SUBSIDIARIES

(A Development Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

September 30, 2005

(5) ACQUISITION OF TARPAN THERAPEUTICS, INC.

On April 1, 2005, the Company entered into an Agreement and Plan of Merger (the “Agreement”) with Tarpan Therapeutics, Inc., a Delaware corporation (“Tarpan”), and Tarpan Acquisition Corp., a Delaware corporation and wholly-owned subsidiary of the Company (“TAC”). The Agreement provided that TAC would merge with and into Tarpan, with Tarpan remaining as the surviving corporation and a wholly-owned subsidiary of the Company (the “Merger”). The Merger was completed April 1, 2005. In consideration for their shares of Tarpan capital stock and in accordance with the Agreement, the stockholders of Tarpan received 10,731,052 shares of the Company’s common stock such that, upon the effective time of the Merger, the Tarpan stockholders collectively received approximately 20 percent of the Company’s outstanding common stock on a fully-diluted basis. Based on the five day average price of the Company’s common stock of $1.03 per share, the purchase price totaled $11,052,984, plus $166,184 of acquisition costs. At the time of the Merger, Tarpan had outstanding indebtedness of $651,000 resulting from a series of promissory notes issued to Paramount BioCapital Investments, LLC and Horizon BioMedical Ventures, LLC, both of which are owned or controlled by Dr. Lindsay Rosenwald. The notes were amended at the time of the Merger to provide that one-half of the outstanding indebtedness was payable upon completion of the Merger and the remaining one-half was payable at such time as the Company raised at least $5 million in new financing. The Notes were repaid as a result of the sale of units in August 2005 (see Note 6).

The acquisition of Tarpan has been accounted for by the Company under the purchase method of accounting in accordance with Statement of Financial Accounting Standards No. 141 “Business Combinations”. Under the purchase method, assets acquired and liabilities assumed by the Company are recorded at their estimated fair values and the results of operations of the acquired company are consolidated with those of the Company from the date of acquisition.

Several of Tarpan’s former stockholders are directors or significant stockholders of the Company. Dr. Rosenwald and various trusts established for the benefit of Dr. Rosenwald and members of his immediate family collectively beneficially owned approximately 46 percent of Tarpan’s common stock and beneficially own approximately 26 percent of the Company’s common stock. In addition, Joshua Kazam, David Tanen, Dr. Michael Weiser and Timothy McInerney, all of whom were members of the Company’s board of directors at the time of the transaction, collectively owned approximately 13.4 percent of Tarpan’s outstanding common stock. Dr. Weiser and Mr. McInerney are also employed by Paramount BioCapital, Inc., an entity owned and controlled by Dr. Rosenwald. As a result of such relationships between the Company and Tarpan, the Company’s board of directors established a special committee to consider and approve the Agreement. The members of the special committee did not have any prior relationship with Tarpan.

Upon completion of the Merger, Douglas Abel, formerly chief executive officer of Tarpan, was appointed President and Chief Executive Officer and director of the Company. As contemplated by the merger agreement, the Company entered into an employment agreement dated April 1, 2005 with Mr. Abel. The employment agreement has a three-year term commencing on April 1, 2005, which may be extended for additional one-year periods thereafter. Under the agreement, Mr. Abel is entitled to an annual salary of $300,000, in addition to health, disability insurance and other benefits. The annual salary shall be increased to $325,000 at such time as the Company completes a financing transaction that results in aggregate gross proceeds to the Company of at least $5,000,000, retroactive to the date of the employment agreement, which condition was satisfied in August 2005. In addition, the Company will pay Mr. Abel a cash bonus of $200,000 in the first year and he may receive a discretionary bonus in the first and subsequent years of up to 50 percent of his base salary. Pursuant to his employment agreement, Mr. Abel was granted an option to purchase an aggregate of 2,923,900 shares of common stock at a price of $1.50 per share. The option vests in three equal installments, on November 1, 2005, November 1, 2006, and November 1, 2007.

F-9

MANHATTAN PHARMACEUTICALS, INC. and SUBSIDIARIES

(A Development Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

September 30, 2005

The excess purchase price paid by the Company to acquire the net assets of Tarpan was allocated to acquired in-process research and development totaling $11,887,807. As required by FASB Interpretation No. 4, “Applicability of FASB Statement No. 2 to Business combinations Accounted for by the Purchase Method “ (“FIN4”), the Company recorded a charge in its statements of operations for the nine months ended September 30, 2005 for the in-process research and development. Tarpan is a biopharmaceutical company engaged in the development of the Phase II pharmaceutical product candidate, PTH (1-34). The acquisition of Tarpan gives Manhattan this third product candidate. Results of operations of Tarpan are included in the consolidated financials since April 1, 2005.

A summary of the allocation of the purchase price is as follows:

| Assets purchased: | ||||

| Cash | $ | 6,777 | ||

| Property and equipment | 2,037 | |||

| Acquired in-process research and development | 11,887,807 | |||

| Total | 11,896,621 | |||

| Liabilities assumed: | ||||

| Accounts payable | 26,051 | |||

| Notes payable - related parties | 651,402 | |||

| Total | 677,453 | |||

| Net purchase price | $ | 11,219,168 | ||

The following unaudited pro forma financial information presents the condensed consolidated results of operations of the Company and Tarpan, as if the acquisition had occurred on January 1, 2005 and 2004 instead of April 1, 2005, after giving effect to certain adjustments, including the issuance of the Company’s common stock as part of the purchase price. The unaudited pro forma information does not necessarily reflect the results of operations that would have occurred had the entities been a single company during these periods.

F-10

MANHATTAN PHARMACEUTICALS, INC. and SUBSIDIARIES

(A Development Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

September 30, 2005

Three months ended | Nine months ended | ||||||||||||

September 30, | September 30, | ||||||||||||

2005 | 2004 | 2005 | 2004 | ||||||||||

| Net loss | $ | (1,812,490 | ) | $ | (2,200,061 | ) | $ | (16,726,890 | ) | $ | (16,350,524 | ) | |

| Weighted average number of common shares outstanding | 44,667,025 | 37,597,207 | 41,724,954 | 37,316,875 | |||||||||

| Loss per common share - basic and fully diluted | $ | (0.04 | ) | $ | (0.06 | ) | $ | (0.40 | ) | $ | (0.44 | ) | |

(6) PRIVATE PLACEMENT OF COMMON SHARES

The Company recently completed a private placement offering of units consisting of shares of its common stock and warrants to purchase additional shares of common stock. The private placement was completed in two separate closings held on August 26, 2005 and August 30, 2005, respectively. In the August 26 closing, the Company sold a total of 10,808,971 shares of common stock and five-year warrants to purchase 2,161,767 shares for total gross proceeds of approximately $12 million. The warrants issued at the August 26 closing are exercisable at a price of $1.44 per share. On August 30, 2005, the Company closed on the sale of an additional 1,108,709 shares of common stock and warrants to purchase 221,741 common shares, which resulted in gross proceeds of approximately $1.28 million. The warrants issued in connection with the August 30 closing are exercisable at a price of $1.49 per share. Accordingly, the total gross proceeds resulting from the private placement was $13.27 million, before deducting selling commissions and expenses.

The Company engaged Paramount BioCapital, Inc. (“Paramount”) an affiliate of a significant stockholder of the Company, as placement agent and paid total cash commissions of $836,360, of which $121,625 was paid to certain selected dealers engaged by Paramount in connection with the private placement and issued five-year warrants to purchase an aggregate of 538,191 shares of common stock exercisable at a price of $1.44 per share, of which Paramount received warrants to purchase 459,932 common shares. In connection with the August 30 closing, the Company paid cash commissions to Paramount of $88,550 and issued an additional five-year warrant to purchase 55,000 common shares exercisable at a price of $1.49 per share. After deduction of these selling commissions and expenses, the Company realized aggregate net proceeds from its August 2005 private placement of approximately $12.3 million. Timothy McInerney and Dr. Michael Weiser, each a director of the Company, are employees of Paramount BioCapital, Inc.

The terms of the Company’s Series A Preferred Stock, which was originally issued in November 2003, provided for its automatic conversion upon the Company’s completion of a financing that resulted in gross proceeds of at least $10 million and a “pre-money valuation” of the Company of at least $30 million. Accordingly, as a result of the August 26, 2005 closing of the Company’s private placement discussed above, all of the remaining outstanding shares of the Company’s Series A Preferred Stock automatically converted into shares of the Company’s common stock. As of such date, there were 729,626 shares of Series A Preferred Stock outstanding, which, upon the closing of the private placement, converted into an aggregate of 6,632,957 shares of common stock (at a rate of 9.0909 common shares per share of preferred stock).

F-11

MANHATTAN PHARMACEUTICALS, INC. and SUBSIDIARIES

(A Development Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

September 30, 2005

(7) SUBSEQUENT EVENTS

On October 21, 2005, the Company issued 675,675 shares of common stock to Cato BioVentures, an affiliate of Cato Research, Inc., in exchange for forgiveness of $750,000 of accounts payable owed by the Company to Cato Research, Inc. The transaction was completed on the same terms as the private placement described earlier which closed on August 26, 2005.

F-12