At the Annual Meeting, three directors will be elected, one for a one-year term and two for three-year terms. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election of the nominees named below. The Board of Directors believes that the nominees will stand for election and will serve if elected as directors. However, if any of the persons nominated by the Board of Directors fails to stand for election or is unable to accept election, the proxies will be voted for the election of such other person as the Board of Directors may recommend.

The Company’s Articles of Incorporation and Bylaws provide that the Board of Directors shall be composed of not less than six (6) and not more than nine (9) directors. The Board of Directors has fixed the number of directors at six (6). There is currently one vacancy on the Board of Directors. The Company’s directors are divided into three classes. The term of office of only one class of directors expires each year, and their successors are generally elected for terms of three years, and until their successors are elected and qualified. There is no cumulative voting for election of directors.

The following table sets forth the names of and certain information about the Board of Directors’ nominees for election as a director and those directors who will continue to serve after the Annual Meeting.

Neil R. Thornton has been a director of the Company since 1995. He was previously a director of the Company from 1986 to 1993. Mr. Thornton was President and Chief Executive Officer of American Steel, L.L.C., a distributor of carbon steel products, from 1985 until his retirement in January 1998.

The Board of Directors has determined that Wayne B. Kingsley, Richard A. Roman, and Neil R. Thornton are independent as defined by applicable Nasdaq Stock Market rules.

Retired Director

Michael C. Franson retired from the Board of Directors on August 18, 2005. In connection with Mr. Franson’s retirement, he also simultaneously retired as a member of the Compensation Committee and the Nominating Committee of the Board of Directors.

Board of Directors and Board Committees

The Board of Directors met five times during 2005. Each director attended more than 75 percent of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which he served. Members of the Board of Directors are encouraged to attend the Company’s annual meeting of shareholders each year. All of the members of the Board of Directors attended the Company’s 2005 Annual Meeting of Shareholders. The Board of Directors has an Executive Committee, an Audit Committee, a Compensation Committee and a Nominating Committee.

Executive Committee. The Executive Committee, comprised of Messrs. Dunham, Kingsley, and Tagmyer, exercises the authority of the Board of Directors between meetings of the Board, subject to certain limitations. The Executive Committee did not meet in 2005.

Audit Committee. The Audit Committee of the Board of Directors is responsible for monitoring the integrity of the Company’s consolidated financial statements, the Company’s systems of internal controls and the independence and performance of the Company’s independent auditors. The Board of Directors has adopted a written charter for the Audit committee. The Audit Committee is comprised of Messrs. Roman, Kingsley and Thornton. Each member of the Audit Committee is “independent” as defined by applicable Securities and Exchange Commission (“SEC”) and Nasdaq Stock Market rules. The Board of Directors has determined that Mr. Roman qualifies as an “audit committee financial expert” as defined by the rules of the SEC. The Audit Committee met seven times in 2005.

Compensation Committee. The Compensation Committee is comprised of Messrs. Roman and Thornton. The Compensation Committee determines the compensation levels of the Company’s executive officers, makes recommendations to the Board of Directors regarding changes in compensation and administers the Company’s stock option plans. The Compensation Committee met four times in 2005.

Nominating Committee; Nominations by Shareholders. The Nominating committee selects nominees for election as directors. The Nominating Committee is comprised of Messrs. Kingsley and Roman. Each of the members of the Nominating Committee is “independent” as defined by applicable Nasdaq Stock Market rules. The Nominating Committee met one time in 2005. The Nominating Committee has not adopted a written charter. The Nominating Committee will consider recommendations by shareholders of individuals to consider as candidates for election to the Board of Directors. Historically, the Company has not had a formal policy concerning shareholder recommendations to the Nominating Committee because it believes that the informal consideration process in place to date has been adequate given that the Company has never received any recommendations from shareholders as to candidates for election to the Board of Directors. The absence of such a policy does not mean, however, that a recommendation would not have been considered had one been received. The Nominating Committee intends to periodically review whether a more formal policy should be adopted. Shareholder recommendations as to candidates for election to the Board of Directors may be submitted to Corporate Secretary, Northwest Pipe Company, 200 SW Market Street, Suite 1800, Portland, Oregon 97201-5730. The Nominating Committee will evaluate potential nominees, including shareholder nominees, by reviewing qualifications, considering references, conducting interviews and reviewing such other information as

3

the members of the Committee deem relevant. The Nominating Committee has not employed any third parties to help identify or screen prospective directors in the past, but may do so at the discretion of the Committee.

The Company’s Bylaws permit shareholders to make nominations for the election of directors, if such nominations are made pursuant to timely notice in writing to the Company’s Secretary. To be timely, notice must be delivered to, or mailed to and received at, the principal executive offices of the Company not less than 60 days nor more than 90 days prior to the date of the meeting, provided that at least 60 days notice or prior public disclosure of the date of the meeting is given or made to shareholders. If less than 60 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be received by the Company not later than the close of business on the tenth day following the date on which such notice of the date of the meeting was mailed or such public disclosure was made. A shareholder’s notice of nomination must also set forth certain information specified in the Company’s Bylaws concerning each person the shareholder proposes to nominate for election and the nominating shareholder.

Communications with Directors

Shareholders and other parties interested in communicating directly with the members of the Board of Directors may do so by writing to: Board of Directors, Northwest Pipe Company, 200 SW Market Street, Suite 1800, Portland, Oregon 97201-5730.

See “Management—Executive Compensation” for certain information regarding compensation of directors.

The Board of Directors unanimously recommends that shareholders vote FOR the election of its nominees for directors. If a quorum is present, the Company’s Bylaws provide that directors are elected by a plurality of the votes cast by the shares entitled to vote. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting, but are not counted and have no effect on the determination of whether a plurality exists with respect to a given nominee.

MANAGEMENT

Executive Officers

Information with respect to the Company’s current executive officers is set forth below. Officers of the Company are elected by the Board of Directors and hold office until their successors are elected and qualified.

Name

| | | | Age

| | Current Position(s) with Company

|

|---|

| Brian W. Dunham | | | | 48 | | Director, Chief Executive Officer and President |

| Charles L. Koenig | | | | 63 | | Senior Vice President, Water Transmission |

| Robert L. Mahoney | | | | 44 | | Vice President, Chief Strategic Officer |

| Terrence R. Mitchell | | | | 50 | | Senior Vice President, Tubular Products |

| John D. Murakami | | | | 52 | | Vice President, Chief Financial Officer and Corporate Secretary |

| Gary A. Stokes | | | | 53 | | Senior Vice President, Sales and Marketing |

Information concerning the principal occupation of Mr. Dunham is set forth under “Election of Directors.”

Charles L. Koenig was named Senior Vice President, Water Transmission in July 2001. He had served as Vice President, Water Transmission since February 1997 and, prior to that, had served as Vice President—California Operations since 1993. He has been with the Company since 1992 and is a registered Professional Engineer. Previously, he was Operations Manager with Thompson Pipe and Steel Company, where he was employed for more than twenty years.

Robert L. Mahoney was named Vice President, Chief Strategic Officer in May 2005. He had served as Vice President, Corporate Development since July 1998, as Director of Business Planning and Development since 1996, and has been with the Company since 1992.

Terrence R. Mitchell was named Senior Vice President, Tubular Products in July 2001. He had served as Vice President, Tubular Products since May 1996, and as Vice President and General Manager—Kansas Division

4

since 1993. Mr. Mitchell has been with the Company since 1985. Prior to joining the Company, he was employed by Valmont Industries, another pipe manufacturer.

John D. Murakami was named Vice President, Chief Financial Officer in February 1997, and had served as Corporate Controller since September 1995. Prior to joining the Company, he was employed by Babler Brothers, Inc., a manufacturer of concrete pipe products.

Gary A. Stokes was named Senior Vice President, Sales and Marketing in July 2001 and had served as Vice President, Sales and Marketing since 1993. He has been with the Company since 1987. Mr. Stokes was previously employed by L. B. Foster Company for eleven years. He served as the Regional Manager responsible for L.B. Foster Company’s West Coast sales operations.

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning compensation awarded to, earned by or paid to the Company’s Chief Executive Officer and each of the four other most highly compensated executive officers of the Company determined as of the end of the last fiscal year (hereafter referred to as the “named executive officers”) for the fiscal years ended December 31, 2005, 2004 and 2003.

SUMMARY COMPENSATION TABLE

| | | |

| | Annual Compensation

| | Long Term

Compensation

| |

|---|

Name and Principal Position

| | | | Year

| | Salary

| | Bonus (1)

| | Stock

Options

Granted

| | All Other

Compensation

|

|---|

Brian W. Dunham

Director, Chief Executive Officer and President

| | | | 2005

2004

2003 | | $495,000

465,000

420,000

| | $310,561

581,250

— | | —

—

— | | $43,357(2)

35,213(2)

36,216(2) |

| |

Charles L. Koenig

Senior Vice President, Water Transmission

| | | | 2005

2004

2003 | | $227,500

217,500

207,000 | | $232,130

225,000

— | | —

—

— | | $40,970(2)

36,654(2)

35,859(2) |

| |

Robert L. Mahoney

Vice President, Chief Strategic Officer

| | | | 2005

2004

2003 | | $190,000

151,000

145,250 | | $102,176

188,750

— | | —

—

— | | $19,531(2)

13,522(2)

16,113(2) |

| |

John D. Murakami

Vice President, Chief Financial Officer and Secretary

| | | | 2005

2004

2003 | | $190,000

160,000

151,000 | | $102,301

200,000

— | | —

—

— | | $21,843(2)

17,362(2)

19,229(2) |

| |

Gary A. Stokes

Senior Vice President, Sales and Marketing

| | | | 2005

2004

2003 | | $237,500

225,000

213,200 | | $255,237

235,000

— | | —

—

— | | $30,332(2)

29,266(2)

28,846(2) |

| (1) | | Annual bonus represents amount earned during the year. Actual payments may be made over subsequent years. |

| (2) | | Represents matching amounts contributed to the Company’s 401(k) plan and the amount contributed to the Northwest Pipe Non-Qualified Savings Plan in 2005, 2004 and 2003, respectively. |

5

Stock Options

There were no option grants to the named executive officers in 2005.

Options Exercised in Last Fiscal Year and Fiscal Year End Option Values

The following table sets forth, for each of the named executive officers, the number of shares acquired upon option exercises during 2005 and the related value realized, and the number and value of unexercised options as of December 31, 2005.

| | | |

| |

| | Number of

Unexercised Options at

December 31, 2005

| | Value of Unexercised

In-the-Money Options at

December 31, 2005 (2)

| |

|---|

Name

| | | | Shares Acquired

on Exercise

| | Value

Realized (1)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Brian W. Dunham | | | | | 42,900 | | | $ | 743,028 | | | | 155,980 | | | | 6,842 | | | $ | 1,688,615 | | | $ | 73,159 | |

| Charles L. Koenig | | | | | 17,160 | | | $ | 281,767 | | | | 60,022 | | | | 2,330 | | | $ | 640,216 | | | $ | 25,063 | |

| Robert L. Mahoney | | | | | — | | | | — | | | | 32,992 | | | | 1,621 | | | $ | 362,992 | | | $ | 17,381 | |

| John D. Murakami | | | | | — | | | | — | | | | 43,522 | | | | 1,651 | | | $ | 473,089 | | | $ | 17,646 | |

| Gary A. Stokes | | | | | — | | | | — | | | | 60,595 | | | | 2,390 | | | $ | 647,057 | | | $ | 25,660 | |

| (1) | | The value realized is based on the difference between the market price at the time of exercise of the options and the applicable exercise price. |

| (2) | | The value of unexercised in-the-money options is calculated based on the closing price of the Company’s Common Stock on December 31, 2005, $26.76 per share. Amounts reflected are based on the assumed value minus the exercise price and do not necessarily indicate that the optionee sold such stock. |

Equity Compensation Plan Information

The following table provides information as of December 31, 2005 with respect to the shares of the Company’s Common Stock that may be issued under the Company’s existing equity compensation plans.

Plan Category

| | | | Number of

Securities to be

Issued upon

Exercise of

Outstanding

Options

| | Weighted Average

Exercise Price of

Outstanding Options

| | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans

|

|---|

| Equity Compensation Plans Approved by Shareholders (1) | | | | | 711,336 | | | $ | 16.063 | | | | 15,000 | |

| Equity Compensation Plans Not Approved by Shareholders (2) | | | | | — | | | | — | | | | — | |

| Total | | | | | 711,336 | | | $ | 16.063 | | | | 15,000 | |

| (1) | | Consists of the Company’s 1995 Stock Incentive Plan and the 1995 Stock Option Plan for Nonemployee Directors. |

| (2) | | The Company does not have any equity compensation plans or arrangements that have not been approved by shareholders. |

Change in Control Agreements

The Company has entered into change in control agreements (the “Agreements”) with its executive officers. Each of the Agreements was originally for a term ending July 19, 2001, provided that on that date and each anniversary thereafter, the term of the Agreements will be automatically extended by one year unless either party gives 90 days prior written notice that the term of an agreement shall not be so extended. If a “Change in

6

Control” (as defined in the Agreements and described below) occurs during the term of Agreements, the Agreements will continue in effect until two years after the Change in Control.

If an executive officer’s employment with the Company is terminated within two years after a Change in Control either by the Company without “Cause” (as defined in the Agreements and described below) or by the executive officer for “Good Reason” (as defined in the Agreements and described below), the executive officer will be entitled to receive his full base salary through the date of termination and any benefits or awards (both cash and stock) that have been earned or are payable through the date of termination plus (i) a lump sum payment equal to two year’s base salary (three years in the case of Mr. Dunham) and (ii) an amount equal to two times (three times in the case of Mr. Dunham) the average cash bonuses paid to the executive officer during the previous three years. In addition, the executive officer would be entitled to the continuation of health and insurance benefits for certain periods and all outstanding unvested stock options would immediately become fully vested. In the event that the payments made to an executive officer would be deemed to be a “parachute payment” under the Internal Revenue Code of 1986, an executive officer may choose to accept payment of a reduced amount that would not be deemed to be a “parachute payment.”

If an executive officer’s employment with the Company is terminated within two years after a Change in Control either by the Company for Cause or as a result of the executive officer’s disability or death, the executive officer will be entitled to receive his full base salary through the date of termination plus any benefits or awards (both cash and stock) that have been earned or are payable through the date of termination.

For purposes of the Agreements, a “Change in Control” includes (i) any merger or consolidation transaction in which the Company is not the surviving corporation, unless shareholders of the Company immediately before such transaction have the same proportionate ownership of common stock of the surviving corporation in the transaction, (ii) the acquisition by any person of 30 percent or more of the Company’s total combined voting power, (iii) the liquidation of the Company or the sale or other transfer of substantially all of its assets, and (iv) a change in the composition of the Board of Directors during any two-year period such that the directors in office at the beginning of the period and/or their successors who were elected by or on the recommendation of two-thirds of the directors in office at the beginning of the period do not constitute at least a majority of the Board of Directors. For purposes of the Agreements, “Good Reason” includes (i) an adverse change in the executive officer’s status, title, position(s) or responsibilities or the assignment to the executive of duties or responsibilities which are inconsistent with the executive officer’s status, title or position, (ii) a reduction in the executive officer’s base salary or the failure to pay compensation otherwise due to the executive officer, (iii) a requirement that the executive officer be based anywhere other than within 10 miles of his job location before the Change in Control, (iv) the Company’s failure to continue in effect any compensation or employee benefit plan or program in effect before the Change in Control or any act or omission that would adversely effect the executive officer’s continued participation in any such plan or program or materially reduce the benefits under such plan or program, and (v) the failure by the Company to require any successor to the Company to assume the Company’s obligations under the Agreements within 30 days after a Change in Control. For purposes of the Agreements, “Cause” means the willful and continued failure to satisfactorily perform the duties assigned to the executive officer within a certain period after notice of such failure is given and commission of certain illegal conduct.

Employment Agreement

The Company entered into an Employment Agreement (the “Employment Agreement”) with Mr. Tagmyer effective November 14, 2000. The Employment Agreement is for a term ending on December 31, 2010, unless terminated earlier by the parties. The Employment Agreement provides that through 2010, Mr. Tagmyer will receive a base salary of $150,000 per year. If the Employment Agreement is terminated by Mr. Tagmyer or by the Company for “cause” (as defined), Mr. Tagmyer would be paid all compensation and expenses to which he is entitled through the date of termination of the Employment Agreement. If the Employment Agreement is terminated by the Company for any reason other than for “cause” or as a result of Mr. Tagmyer’s death, Mr. Tagmyer would be entitled to receive all of the remaining payments that he would have been entitled to receive under the Employment Agreement if it had not been terminated. If the Employment Agreement is terminated as a result of Mr. Tagmyer’s death, Mr. Tagmyer’s beneficiary or estate would be entitled to receive

7

fifty percent of the remaining payments under the Employment Agreement to which Mr. Tagmyer would have been entitled had he survived. The Employment Agreement contains certain noncompetition provisions that apply to Mr. Tagmyer’s activities during the term of the Employment Agreement and for a period of one year after the later of the date of termination of the Agreement or the date the last payment is made under the Agreement.

Director Compensation

The members of the Company’s Board of Directors are reimbursed for their travel expenses incurred in attending Board meetings. In addition, each nonemployee member of the Board of Directors receives a $24,000 annual retainer, $1,000 for each Board meeting attended, $500 for each telephonic Board meeting attended and $500 for each meeting of a committee of the Board attended. In addition, each Committee Chairman receives an additional $5,000 annual retainer. The Company’s 1995 Stock Option Plan for Nonemployee Directors (the “1995 Nonemployee Director Plan”) provides that an option to purchase 5,000 shares of Common Stock is granted to each new nonemployee director at the time such person is first elected or appointed to the Board of Directors. In addition, each nonemployee director receives an option to purchase 2,000 shares of Common Stock annually after each annual meeting of shareholders. The number of options which may be granted under the 1995 Nonemployee Director Plan in any fiscal year may not exceed 20,000, subject to stock splits and similar events, and a total of 100,000 shares of Common Stock have been reserved for issuance upon exercise of stock options granted under the 1995 Nonemployee Director Plan. On May 10, 2005 options to purchase 2,000 shares of Common Stock, at $22.07 each, were granted to each of Messrs. Franson, Kingsley, Roman, and Thornton.

Compensation Committee Interlocks and Insider Participation

Messrs. Roman and Thornton, each of whom is an outside director, served on the Compensation Committee in 2005. No director or executive officer of the Company serves on the compensation committee of the board of directors of any company for which Messrs. Roman or Thornton serve as executive officers or directors.

8

COMPENSATION COMMITTEE REPORT

Under rules established by the SEC, the Company is required to provide certain data and information with regard to the compensation and benefits provided to the Company’s Chief Executive Officer and the four other most highly compensated executive officers. In fulfillment of this requirement, the Compensation Committee has prepared the following report for inclusion in this Proxy Statement.

Executive Compensation Philosophy

The Compensation Committee is composed entirely of independent, outside directors and is responsible for setting and monitoring policies governing compensation of executive officers. The Compensation Committee reviews the performance and compensation levels for executive officers, and sets salary and bonus levels and option grants under the Company’s stock option plans. The objectives of the Compensation Committee are to correlate executive compensation with the Company’s business objectives and performance and to enable the Company to attract, retain and reward executive officers who contribute to the long-term success of the Company.

The Omnibus Budget Act of 1993 added Section 162(m) to the Internal Revenue Code of 1986, which limits to $1,000,000 the deductibility of compensation (including stock-based compensation) individually paid to a publicly-held Company’s chief executive officer and the four other most highly compensated executive officers. The Board of Directors and the Compensation Committee intend to take the necessary steps to structure executive compensation policies to comply with this limit on deductibility of executive compensation.

Salaries. The Compensation Committee annually assesses the performance and sets the salary of the Company’s executive officers. Salaries for executive officers are based on a review of salaries for similar positions requiring similar qualifications. In determining executive officer salaries, the Compensation Committee reviews recommendations from management, which include information from salary surveys. Additionally, the Compensation Committee establishes both financial and operational based objectives and goals. The Compensation Committee considers not only the performance evaluations of executive officers but also reviews the financial condition of the Company in setting salaries.

Bonus Awards. The Compensation Committee believes that a significant portion of total cash compensation for executive officers should be subject to the Company’s attainment each year of specific financial performance criteria. This approach creates a direct incentive for executive officers to achieve desired performance goals and places a significant percentage of each executive officer’s compensation at risk. Consequently, each year the Compensation Committee establishes potential bonuses for executive officers based on the Company’s achievement of certain financial performance measures for the year, including sales and net income measures. Bonuses ranging in amounts from $40,050 to $310,561 were awarded for 2005 based on the Company’s partial achievement of the financial and other performance goals for 2005.

Stock Options. No stock options were issued to executive officers in 2005.

Chief Executive Officer Compensation.Mr. Dunham’s 2005 base salary was determined in the same manner as the other executives as described inSalaries above. The Compensation Committee approved Mr. Dunham’s 2005 annual base salary of $495,000, based on the salary survey data referred to above and compensation levels of Chief Executive Officers of comparable size companies in industries similar to the Company’s. Mr. Dunham also received a bonus of $310,561 for 2005 based on the Company’s partial achievement of certain financial and other performance goals.

COMPENSATION COMMITTEE

Richard A. Roman

Neil R. Thornton

9

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is comprised of three directors who are considered independent under applicable SEC and Nasdaq listing rules. The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of the Audit Committee charter is attached to this proxy statement as Appendix A.

The purpose of the Audit Committee is to assist the Board of Directors in its general oversight of the Company. The primary responsibilities of the Audit Committee are to oversee and monitor the integrity of the Company’s financial reporting process on behalf of the Board of Directors and report the results of its activities to the Board of Directors. The Audit Committee annually reviews and selects the Company’s independent registered public accounting firm and preapproves any non-audit work required of the public accounting firm.

Management is responsible for preparing the Company’s financial statements. The independent accountants are responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and to issue a report thereon, and for performing an independent audit of management’s assessment of the effectiveness of the Company’s internal controls over financial reporting, and the effectiveness of such. The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee serves a board-level oversight role in which it provides advice, counsel and direction to management and the independent accountants on the basis of the information it receives, discussions with the independent accountants and the experience of the Audit Committee’s members in business, financial and accounting matters.

In this context, the Audit Committee has reviewed and discussed the audited financial statements with management and the independent accountants. The Audit Committee also has discussed with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61 (“Communication with Audit Committees”).

The Company’s independent accountants also provided to the Audit Committee the written disclosures and letter required by Independence Standards Board Standard No. 1 (“Independence Discussions with Audit Committees”), and the Audit Committee discussed with the independent accountants that firm’s independence.

Based on the above discussions and review with management and the independent accountants, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Commission.

Respectfully submitted by the Audit Committee of the Board of Directors.

AUDIT COMMITTEE

Wayne B. Kingsley

Richard A. Roman

Neil R. Thornton

10

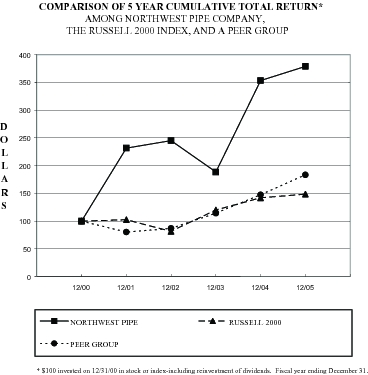

STOCK PERFORMANCE GRAPH

The SEC requires that registrants include in their proxy statement a line-graph presentation comparing cumulative five-year shareholder returns on an indexed basis, assuming a $100 initial investment and reinvestment of dividends, of (a) the registrant, (b) a broad-based equity market index and (c) an industry-specific index. The following graph includes the required information from December 31, 2000 through the end of the last fiscal year, December 31, 2005. The broad-based market index used is the Russell 2000 Index and the industry-specific index used is a peer group of companies consisting of Ameron International Corporation, Lindsay Manufacturing Co., Valmont Industries, Inc., and Maverick Tube Corporation.

| | | | Indexed Returns

| |

|---|

| | | | Northwest Pipe

Company

| | Russell 2000

Index

| | Peer Group

|

|---|

| December 31, 2000 | | | | | 100.00 | | | | 100.00 | | | | 100.00 | |

| December 31, 2001 | | | | | 231.50 | | | | 102.49 | | | | 80.16 | |

| December 31, 2002 | | | | | 244.96 | | | | 81.49 | | | | 86.78 | |

| December 31, 2003 | | | | | 188.46 | | | | 120.00 | | | | 114.20 | |

| December 31, 2004 | | | | | 353.27 | | | | 142.00 | | | | 147.38 | |

| December 31, 2005 | | | | | 378.90 | | | | 148.46 | | | | 183.37 | |

11

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended requires the Company’s directors and executive officers and persons who own more than ten percent of a registered class of the Company’s equity securities, to file initial reports of ownership and reports of changes in ownership of shares with the SEC. Such persons also are required to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on its review of the copies of such reports received by it with respect to 2005, or written representations from certain reporting persons, the Company believes that all filing requirements applicable to its directors, officers and persons who own more than ten percent of a registered class of the Company’s equity securities have been complied with for 2005.

12

STOCK OWNED BY MANAGEMENT AND PRINCIPAL SHAREHOLDERS

The table below sets forth certain information, as of March 15, 2006, regarding the beneficial ownership of the Common Stock by: (i) each person known by the Company to be the beneficial owner of 5% or more of its outstanding Common Stock, (ii) each of the named executive officers, (iii) each of the Company’s directors and (iv) all directors and executive officers as a group. The address of each of the named executive officers and directors is c/o Northwest Pipe Company, 200 SW Market Street, Suite 1800, Portland, Oregon 97201-5730.

| | | | Shares Beneficially

Owned(1)

| |

|---|

Name of Beneficial Owner

| | | | Shares

| | Percent

|

|---|

Wells Fargo & Company (2)

420 Montgomery Street,

San Francisco, CA 94104

| | | | | 954,065 | | | | 14.0 | % |

FMR Corp (3)

82 Devonshire Street

Boston, MA 02109

| | | | | 670,375 | | | | 9.8 | % |

Bank of America Corporation (4)

100 Federal Street North Tryon Street

Floor 25, Bank of America Corporate Center

Charlotte, NC 28255

| | | | | 653,332 | | | | 9.6 | % |

Dreman Value Management LLC (5)

520 East Cooper Avenue

Suite 230-4

Aspen, CO 81611

| | | | | 399,100 | | | | 5.8 | % |

Dimensional Fund (6)

1299 Ocean Avenue, 11th Floor

Santa Monica, CA 90401

| | | | | 377,449 | | | | 5.5 | % |

Becker Capital Management, Inc. (7)

1211 SW Fifth Avenue, Suite 2185

Portland, OR 97204

| | | | | 342,000 | | | | 5.0 | % |

| William R. Tagmyer | | | | | 268,171 | | | | 3.8 | % |

| Brian W. Dunham | | | | | 250,672 | | | | 3.6 | % |

| Charles L. Koenig | | | | | 117,836 | | | | 1.7 | % |

| Gary A. Stokes | | | | | 61,807 | | | | * | |

| Robert L. Mahoney | | | | | 32,190 | | | | * | |

| John D. Murakami | | | | | 46,125 | | | | * | |

| Wayne B. Kingsley | | | | | 32,583 | | | | * | |

| Neil R. Thornton | | | | | 29,378 | | | | * | |

| Richard A. Roman | | | | | 11,000 | | | | * | |

| All directors and executive officers as a group, (ten persons) | | | | | 904,376 | | | | 12.1 | % |

| (*) | | Represents beneficial ownership of less than one percent of the outstanding Common Stock. |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and includes voting power and investment power with respect to shares. Shares issuable upon the exercise of outstanding stock options that are currently exercisable or become exercisable within 60 days from March 15, 2006 are considered outstanding for the purpose of calculating the percentage of Common Stock owned by such person, but not for the purpose of calculating the percentage of Common Stock owned by any other person. The number of stock options that are exercisable within 60 days of March 15, 2006 is as follows: Mr. Tagmyer—164,039; Mr. Dunham—159,406; Mr. Koenig—61,210; Mr. Stokes—61,807; Mr. Mahoney—32,190;Mr. Murakami—44,347; Mr. Kingsley—20,000; Mr. Thornton—20,000; Mr. Roman—11,000; and all directors and officers as a group—628,613. |

13

| (2) | | The information as to beneficial ownership is based on a Schedule 13G/A filed with the Securities and Exchange Commission on February 3, 2006, reflecting its beneficial ownership of Common Stock as of December 31, 2005. The Schedule 13G/A states that Wells Fargo & Company beneficially owns 954,065 shares of Common Stock, including 876,515 shares as to which it has sole voting power and 935,265 shares as to which it has sole dispositive power. |

| (3) | | The information as to beneficial ownership is based on a Schedule 13G/A filed with the Securities and Exchange Commission by FMR Corp on February 14, 2006, reflecting its beneficial ownership of Common Stock as of December 31, 2005. The Schedule 13G/A states that FMR Corp has sole dispositive power with respect to 670,375 shares of Common Stock. |

| (4) | | The information as to beneficial ownership is based on a Schedule 13G/A filed with the Securities and Exchange Commission by Bank of America Corporation on February 8, 2006, reflecting its beneficial ownership of Common Stock as of December 31, 2005. The Schedule 13G/A states Bank of America Corporation has shared voting power with respect to 504,616 shares of Common Stock and shared dispositive power with respect to 653,332 shares of Common Stock. |

| (5) | | The information as to beneficial ownership is based on a Schedule 13G filed with the Securities and Exchange Commission by Dreman Value Management LLC on February 10, 2006, reflecting its beneficial ownership of Common Stock as of December 31, 2005. The Schedule 13G states that Dreman Value Management LLC has shared voting power and sole dispositive power with respect to 399,100 shares of Common Stock. |

| (6) | | The information as to beneficial ownership is based on a Schedule 13G/A filed with the Securities and Exchange Commission by Dimensional Fund Advisors Inc. on February 6, 2006, reflecting its beneficial ownership of Common Stock as of December 31, 2005. The Schedule 13G/A states that Dimensional Fund Advisors Inc. has sole voting and dispositive power with respect to 377,449 shares of Common Stock. |

| (7) | | The information as to beneficial ownership is based on a Schedule 13G filed with the Securities and Exchange Commission by Becker Capital Management, Inc. on February 10, 2006, reflecting its beneficial ownership of Common Stock as of December 31, 2005. The Schedule 13G states that Becker Capital Management, Inc. has sole voting power with respect to 314,500 shares of Common Stock and sole dispositive power with respect to 342,000 shares of Common Stock. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company has ongoing business relationships with certain affiliates of Wells Fargo & Company (“Wells Fargo”). Wells Fargo, together with certain of its affiliates, is the company’s largest shareholder. Since January 1, 2005, the Company has made the following payments to affiliates of Wells Fargo: (i) capital and operating lease payments pursuant to which the Company leases certain equipment from such affiliates, (ii) payments of interest and fees pursuant to letters of credit originated by such affiliates, (iii) payments of principal and interest on an industrial development bond, and (iv) payments of principal, interest and related fees in connection with loan agreements between the Company and such affiliates. For the year ended December 31, 2005, total payments made by the Company to Wells Fargo and its affiliates amounted to $3.3 million.

INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP served as the Company’s independent registered public accountants for the year ended December 31, 2005 and has been selected to serve as the Company’s independent registered public accountants for the year ending December 31, 2006. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting and will be given an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

14

Fees for services provided by the Company’s principal accountant, PricewaterhouseCoopers LLP, for the years ended December 31, 2005 and 2004 were as follows:

| | | | 2005

| | 2004

| |

|---|

| Audit fees (1) | | | | $ | 438,500 | | | $ | 506,000 | | | | | |

| Audit-related fees (2) | | | | | 23,000 | | | | 22,500 | | | | | |

| Tax fees (3) | | | | | 10,695 | | | | — | | | | | |

| Other fees (4) | | | | | 93,944 | | | | — | | | | | |

| Total fees | | | | $ | 566,139 | | | $ | 528,500 | | | | | |

| (1) | | Audit fees include fees for audits of the annual financial statements, including required quarterly reviews, and the audit of management’s assessment of the Company’s internal control over financial reporting. |

| (2) | | Audit-related fees include fees for audits of the Company’s employee benefit plans and consultations concerning financial accounting and reporting. |

| (3) | | Tax fees include fees for tax compliance, tax advice, and tax planning. |

| (4) | | Other fees include professional fees for business consultations and tax compliance. |

To help assure independence of the independent auditors, the Audit Committee has established a policy whereby all services of the principal accountant or other firms must be approved in advance by the Audit Committee; provided, however, that de minimis services may instead be approved by the Chief Executive Officer or the Chief Financial Officer. One hundred percent of the fees shown in the principal accountant fees schedule for 2005 and 2004 were approved by the Audit Committee.

DATE FOR SUBMISSION OF SHAREHOLDER PROPOSALS

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, some shareholder proposals may be eligible for inclusion in the Company’s 2006 proxy statement. Any such proposal must be received by the Company not later than December 1, 2006. Shareholders interested in submitting such a proposal are advised to contact knowledgeable counsel with regard to the detailed requirements of the applicable securities law. The submission of a shareholder proposal does not guarantee that it will be included in the Company’s proxy statement. Alternatively, under the Company’s bylaws, a proposal or nomination that a shareholder does not seek to include in the Company’s proxy statement pursuant to Rule 14a-8 may be delivered to the Secretary of the Company not less than 60 days nor more than 90 days prior to the date of an annual meeting, unless notice or public disclosure of the date of the meeting occurs less than 60 days prior to the date of such meeting, in which event, shareholders may deliver such notice not later than the 10th day following the day on which notice of the date of the meeting was mailed or public disclosure thereof was made. A shareholder’s submission must include certain specified information concerning the proposal or nominee, as the case may be, and information as to the shareholder’s ownership of common stock of the Company. Proposals or nominations not meeting these requirements will not be entertained at the annual meeting. If the shareholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Securities Exchange Act of 1934, the Company may exercise discretionary voting authority under proxies it solicits to vote in accordance with its best judgment on any such proposal or nomination submitted by a shareholder.

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors does not know of any other matters to be presented for action by the shareholders at the 2006 Annual Meeting. If, however, any other matters not now known are properly brought before the meeting, the persons named in the accompanying proxy will vote such proxy in accordance with the determination of a majority of the Board of Directors.

15

COST OF SOLICITATION

The cost of soliciting proxies will be borne by the Company. In addition to use of the mail, proxies may be solicited personally or by telephone by directors, officers and employees of the Company, who will not be specially compensated for such activities. Such solicitations may be made personally, or by mail, facsimile, telephone, telegraph or messenger. The Company will also request persons, firms and companies holding shares in their names or in the name of their nominees, which are beneficially owned by others, to send proxy materials to and obtain proxies from such beneficial owners. The Company will reimburse such persons for their reasonable expenses incurred in that connection.

16

ADDITIONAL INFORMATION

A copy of the Company’s Annual Report to Shareholders (including Form 10-K) for the year ended December 31, 2005 accompanies this Proxy Statement. The Company will provide, without charge, on the written request of any beneficial owner of shares of the Company’s Common Stock entitled to vote at the Annual Meeting, additional copies of the Company’s Annual Report. Written requests should be mailed to the Corporate Secretary, Northwest Pipe Company, 200 Market Street, Suite 1800, Portland, OR 97201-5730.

By Order of the Board of Directors,

Brian W. Dunham

Chief Executive Officer and President

Portland, Oregon

March 31, 2005

17

Appendix A

NORTHWEST PIPE COMPANY

Charter of the Audit Committee of the Board of Directors

I. Audit Committee Purpose

The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Audit Committee’s primary duties and responsibilities are to:

| • | | Monitor the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting and legal compliance.

|

| • | | Monitor the independence and performance of the Company’s independent auditors. |

| • | | Provide an avenue of communication among the independent auditors, management and the Board of Directors. |

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as anyone in the organization. The Audit Committee has the ability to retain, at the Company’s expense, special legal, accounting or other consultants or experts it deems necessary in the performance of its duties.

II. Audit Committee Composition and Meetings

Audit Committee members shall meet the applicable requirements of the Nasdaq Stock Market. The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be “independent” within the meaning of regulations promulgated from time to time by the Securities and Exchange Commission (“SEC”), the Nasdaq Stock Market or other appropriate authorities, free from any relationship that would interfere with the exercise of his or her independent judgment. All members of the Committee shall be able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and statement of cash flows, and at least one member shall have current or past employment experience in finance or accounting, requisite professional certification in accounting or other comparable experience or background. At least one member of the Audit Committee will meet the SEC definition of a “financial expert”. The “financial expert” will be independent of management and be named in the annual proxy statement.

Audit Committee members shall be appointed by the Board. If an Audit Committee Chair is not designated or present, the members of the Committee may designate a Chair by majority vote of the Committee membership.

The Committee shall meet at least seven times annually, four of which are special meetings to approve earnings release information, or more frequently as circumstances dictate. The Committee should meet privately in executive session at least annually with management, the independent auditors, and as a committee to discuss any matters that the Committee or each of these groups believe should be discussed.

III. Audit Committee Responsibilities and Duties

A. Review Procedures

| (1) | | Review and assess the adequacy of this Charter at least annually. Submit the charter to the Board of Directors for approval and have the document published in accordance with the regulations of the SEC. |

A-1

| (2) | | In consultation with the management and the independent auditors, consider the integrity of the Company’s financial reporting processes and controls. Discuss significant financial risk exposures and the steps management has taken to monitor, control and report such exposures. Review significant findings prepared by the independent auditors together with management’s responses. |

| (3) | | Review with financial management and the independent auditors the Company’s annual audited financial statements prior to filing of the Company’s annual audited financial statements with the SEC. Discuss any significant changes to the Company’s accounting principles or practices and any items required to be communicated by the independent auditors in accordance with SAS 61. |

| (4) | | Review with financial management and the independent auditors the company’s quarterly financial results prior to the filing of the Company’s quarterly financial statements with the SEC. Discuss any significant changes to the Company’s accounting principles or practices and any items required to be communicated by the independent auditors in accordance with SAS 61. The Chair of the Committee may represent the entire Audit Committee for purposes of this review. |

| (5) | | On at least an annual basis, review with the Company’s counsel, any legal matters that could have a significant impact on the organization’s financial statements, the Company’s compliance with applicable laws and regulations, and inquiries received from regulators or governmental agencies. |

B. Independent Auditors

| (1) | | The independent auditors are accountable to the Audit Committee and the Board of Directors. The Audit Committee shall review the independence and performance of the auditors and annually recommend to the Board of Directors the appointment of the independent auditors or approve any discharge of auditors when circumstances warrant. |

| (2) | | Pre-approval of all “audit related” services provided by the independent auditors. |

| • | | From time to time the Audit Committee may grant to the CEO and CFO the authority to request “audit related” services not covered by the generally accepted auditing standards audit, quarterly reviews and employee benefit plan engagement letters.

|

| (3) | | Approve the fees and other significant compensation to be paid to the independent auditors. |

| (4) | | On an annual basis, the Committee should require the independent auditors to deliver a formal written report describing all significant relationships that the independent auditors have with the Company that could impair the auditors’ independence, and review, discuss and take appropriate action with respect to such report. |

| (5) | | Review the independent auditors’ audit plan—discuss scope, staffing, locations, reliance upon management and the general audit approach. |

| (6) | | Consider the independent auditors’ judgments about the quality and appropriateness of the Company’s accounting principles as applied in its financial reporting. |

C. Other Audit Committee Responsibilities

| (1) | | Annually prepare a report to shareholders for inclusion in the Company’s annual proxy statement as required by the regulations of the SEC. |

| (2) | | Perform any other activities consistent with this Charter, the Company’s bylaws, and governing law, as the Committee or the Board deems necessary or appropriate. |

A-2

| (3) | | Maintain minutes of meetings and periodically report to the Board of Directors on significant results of the foregoing activities. |

| (4) | | Periodically perform self-assessment of Audit Committee performance. |

| (5) | | Review financial and accounting personnel succession planning within the Company. |

| (6) | | Establish procedures that meet the SEC requirements to receive, retain and treat complaints from employees and others about accounting, internal accounting controls or auditing matters through a confidential and anonymous submission process. |

A-3

| | | |

| Please | o |

| Mark Here |

| for Address |

| Change or |

| Comments |

| SEE REVERSE SIDE |

| | | | |

FOR the nominees listed below

(except as marked to the contrary below) | | WITHHOLD AUTHORITY

(to vote for the nominees listed below) |

| 1. PROPOSAL 1-Election of Director | o | | o |

| | | |

(Instructions: To withhold authority to vote for the nominee, strike a

line through the nominee's name in the list below.) |

| | | |

01 Brain W. Dunham for a three year term, expiring in 2009 | | | |

02 Richard A. Roman for a three year term, expiring in 2009 | | | |

03 Wayne B. Kingsley for a one year term, expiring in 2007 | | | |

| | | |

| | |

| | |

| | |

| 2. | Upon such other matters as may properly come before, or incident to the conduct of the Annual Meeting, the Proxy holders shall vote in such manner as they determine to be in the best interests of the Company. The Company is not presently aware of any such matters to be presented for action at the meeting. |

| |

| |

| THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF THE COMPANY. IF NO SPECIFIC DIRECTION ISGIVEN AS TO ANY OF THE ABOVE ITEMS, THIS PROXY WILL BE VOTED FOR THE NOMINEES NAMED INPROPOSAL 1. THE UNDERSIGNED SHAREHOLDER HEREBY ACKNOWLEDGES RECEIPT OF THE COMPANY'SPROXY STATEMENT AND HEREBY REVOKES ANY OTHER PROXY OR PROXIES PREVIOUSLY GIVEN. |

| | | | | | | | |

| | | | | | | | |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A

VOTEFOR THE NOMINEES NAMED ABOVE. | | | I do | o | do not | o | plan to attend the meeting.

(please check) |

| | | |

| | | | Please sign exactly as your name appears on the Proxy Card. If shares are registered in more than one name, the signatures of all such persons are required. A corporation should sign in its full corporate name by a duly authorized officer, stating his/her title. Trustees, guardians, executors and administrators should sign in their official capacity, giving their full titles as such. If a partnership is signing, please sign in the partnership name by authorized person(s). If you receive more than one Proxy Card, please sign and return all such cards in the accompanying envelope. |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | | | | | | | | | | | | | |

Signature | | Signature | | Dated: | | , 2005 |

| | | | | | | | | | | | | | |

5 FOLD AND DETACH HERE 5

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 11:59 PM Eastern Time

the day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner

as if you marked, signed and returned your proxy card.

| | | | | | | | | |

Internet

http://www.proxyvoting.com/nwpxUse the internet to vote your proxy. Have your proxy card in hand when you access the web site. | | OR | | Telephone

1-866-540-5760Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. | | OR | | Mail

Mark, sign and date

your proxy card and

return it in the

enclosed postage-paid

envelope. |

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

You can view the Annual Report and Proxy Statement

on the internet at www.nwpipe.com

NORTHWEST PIPE COMPANY

Proxy for Annual Meeting of Shareholders to be Held on May 9, 2006

| | The undersigned hereby names, constitutes and appoints William R. Tagmyer and Brian W. Dunham, or each of them acting in absence of the other, with full power of substitution, my true and lawful attorneys and Proxies for me and in my place and stead to attend the Annual Meeting of the Shareholders of Northwest Pipe Company (the "Company") to be held at 9:00 a.m. local time in Portland, Oregon on Tuesday, May 9, 2006 at the Heathman Hotel, 1001 SW Broadway, Portland, OR 97205 and at any adjournments or postponements thereof, and to vote all the shares of Common Stock held of record in the name of the undersigned on March 15, 2006, with all the powers that the undersigned would possess if he were personally present. |

| |

| | |

| |

| |

| (Continued, and to be marked, dated and signed, on the other side) |

Address Change/Comments (Mark the corresponding box on the reverse side)

You can now access your Northwest Pipe Company account online.

Access your Northwest Pipe Company stockholder account online via Investor ServiceDirect(R)(ISD).

Mellon Investor Services LLC, Transfer Agent for Northwest Pipe Company, now makes it easy and convenient to get current information on your shareholder account.

| | | | | |

| | * | View account status | * | View payment history for dividends |

| | * | View certificate history | * | Make address changes |

| | * | View book-entry information | * | Obtain a duplicate 1099 tax form |

| | | | * | Establish/change your PIN |

Visit us on the web at http://www.melloninvestor.com

For Technical Assistance Call 1-877-978-7778 between 9am-7pm

Monday-Friday Eastern Time

Investor ServiceDirect(R)is a registered trademark of Mellon Investor Services LLC