Pericom Semiconductor: (NASDAQ: PSEM) Q3 Fiscal Year 2013 Earnings

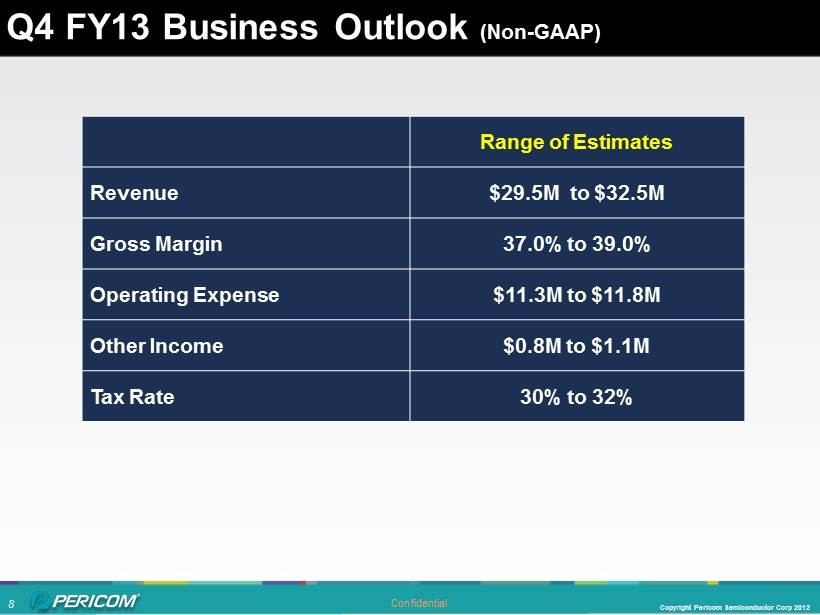

2 Copyright Pericom Semiconductor Corp 2012 Confidential » This presentation will include remarks about future expectations, plans and prospects for Pericom which constitute forward - looking statements for purposes of the safe - harbor provisions under applicable federal securities laws. Such forward - looking statements include the statements in the slide entitled ”Q4 FY13 Business Outlook”, which sets forth expected revenues, gross margin and other financial results for the fiscal four quarter . » Actual results may differ materially from our forward - looking statements, as a result of various important risks and uncertainties, including unexpected softness in demand for our products, price erosion for certain of our products, customer decisions to reduce inventory and other risks and uncertainties which are detailed and may be reviewed in the Company’s filings with the SEC. » All forward - looking statements included in this presentation are made as of the date of this presentation, and Pericom expressly disclaims any obligation to update the information provided in this presentation, except as required by law. » We encourage you to review our most recent annual report on Form 10 - K and our most recent quarterly report on Form 10 - Q filed with the SEC and, in particular the risk factor sections of those filings. Safe Harbor

3 Copyright Pericom Semiconductor Corp 2012 Confidential » Quarterly revenue of $30.4M » Flat Q - to - Q and decreased 9% vs. Q3 FY12 » Geographic distribution » Asia at 91%, North America at 6%, Europe at 3% » Channel sales mix » International distribution at 66%, CMs at 22%, OEMs at 8%, North America distribution at 4%. Q3 Earnings Overview (Non - GAAP Results)

4 Copyright Pericom Semiconductor Corp 2012 Confidential » Gross margin of 37.5% » Decreased 1.0% sequentially and increased 1.3% YoY » Operating expense of $11.3 M vs. $11.5 M last Q » Operating income of $0.0 M vs. $0.2 M last Q » Operating income margin of 0% » Net income of $1.0 M vs. $0.9 M last Q » Net profit margin of 3% » EPS of 4 cents vs. 4 cents last Q » Tax Rate of 31% for Q3 vs. 17% last Q Q3 Earnings Overview (Non - GAAP Results)

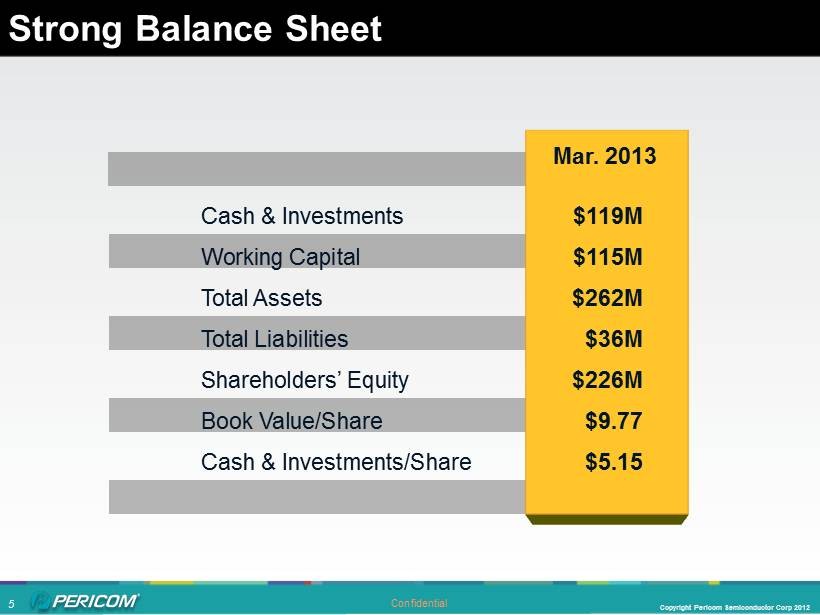

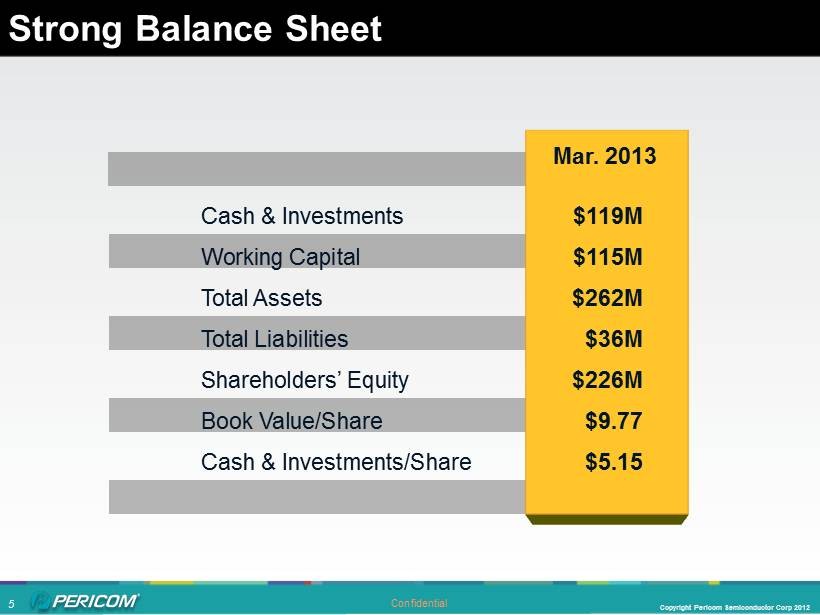

5 Copyright Pericom Semiconductor Corp 2012 Confidential Cash & Investments $ 119M Working Capital $ 115M Total Assets $ 262M Total Liabilities $36M Shareholders’ Equity $ 226M Book Value/Share $ 9.77 Cash & Investments/Share $ 5.15 Mar. 2013 Strong Balance Sheet

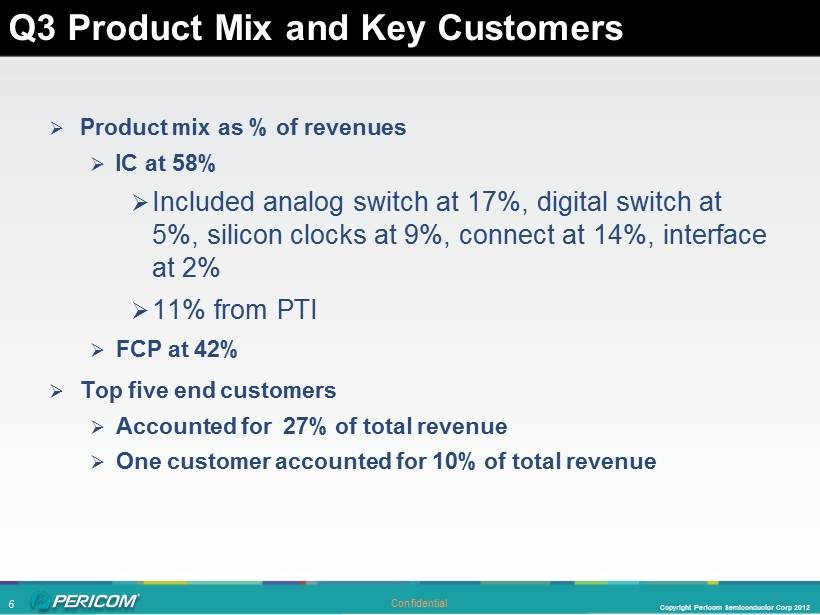

6 Copyright Pericom Semiconductor Corp 2012 Confidential » Product mix as % of revenues » IC at 58% » Included analog switch at 17%, digital switch at 5%, silicon clocks at 9%, connect at 14%, interface at 2% » 11% from PTI » FCP at 42% » Top five end customers » Accounted for 27% of total revenue » One customer accounted for 10% of total revenue Q3 Product Mix and Key Customers

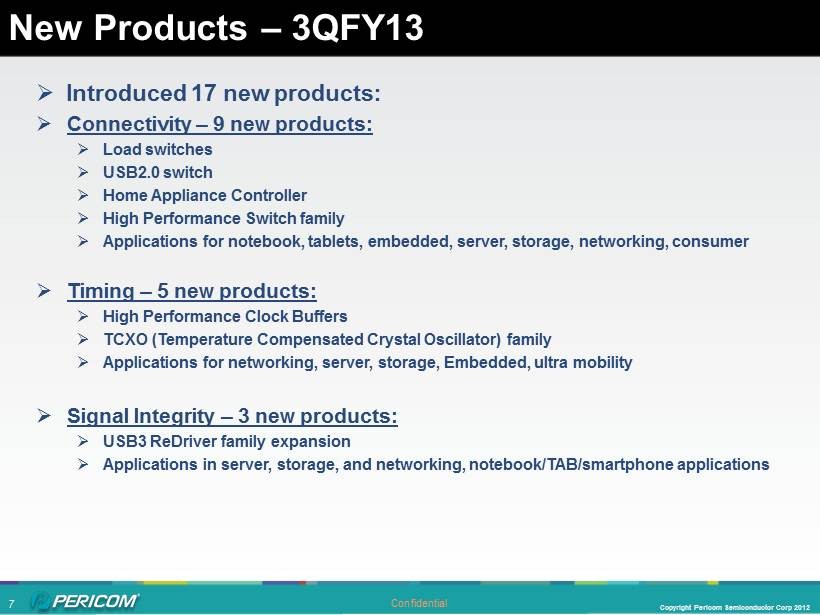

7 Copyright Pericom Semiconductor Corp 2012 Confidential » Introduced 17 new products: » Connectivity – 9 new products: » Load switches » USB2.0 switch » Home Appliance Controller » High Performance Switch family » Applications for notebook, tablets, embedded, server, storage, networking, consumer » Timing – 5 new products: » High Performance Clock Buffers » TCXO (Temperature Compensated Crystal Oscillator) family » Applications for networking, server, storage, Embedded, ultra mobility » Signal Integrity – 3 new products: » USB3 ReDriver family expansion » Applications in server, storage, and networking, notebook/TAB/smartphone applications New Products – 3QFY13

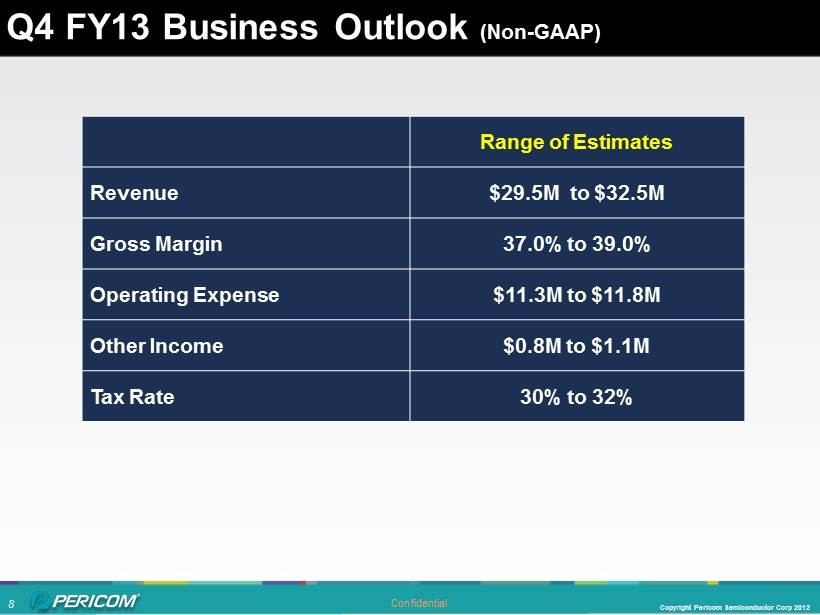

8 Copyright Pericom Semiconductor Corp 2012 Confidential Range of Estimates Revenue $29.5M to $32.5M Gross Margin 37.0% to 39.0% Operating Expense $11.3M to $11.8M Other Income $0.8M to $1.1M Tax Rate 30% to 32% Q4 FY13 Business Outlook (Non - GAAP)

9 Copyright Pericom Semiconductor Corp 2012 Confidential Pericom Semiconductor: Enabling Serial Connectivity ( Nasdaq : PSEM) Fiscal 3Q13 Earnings Q & A