UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material Pursuant to § 240.14a-12 |

PERICOM SEMICONDUCTOR CORPORATION

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Filed by Pericom Semiconductor Corporation

Commission File No. 000-27026

Pursuant to Rule 14a-12 Under the Securities Exchange Act of 1934

Subject Company: Pericom Semiconductor Corporation

Commission File No. 000-27026

Diodes to Acquire Pericom Semiconductor

September 3, 2015

Page 2

Safe Harbor Statement

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: Any statements set forth above that are not historical facts are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such statements include statements as to: the expected benefits of the acquisition, including the acquisition being immediately accretive; the efficiencies, cost savings, revenues, and enhanced product offerings, market position, and design and manufacturing capabilities of Diodes after the acquisition; and other statements identified by words such as “estimates,” “expects,” “projects,” “plans,” “will” and similar expressions.

Potential risks and uncertainties include, but are not limited to, such factors as: the possibility that the transaction may not be consummated, including as a result of any of the conditions precedent; the risk of superior acquisition proposal from other parties; the risk of Diodes being unable to obtain sufficient financing from lenders to complete the acquisition; the risk of global market downturn conditions and volatilities impacting the completion of the acquisition or the funding; the risk that Pericom’s business will not be integrated successfully into Diodes’; the risk that the expected benefits of the acquisition may not be realized, including the realization of the accretive effect of the acquisition; the risk that Pericom’s standards, procedures and controls will not be brought into conformance within Diodes’ operation; difficulties coordinating Diodes’ and Pericom’s new product and process development, hiring additional management and other critical personnel, and increasing the scope, geographic diversity and complexity of Diodes’ operations; difficulties in consolidating facilities and transferring processes and know-how; difficulties in reducing the cost of Pericom’s business; the diversion of our management’s attention from the management of our business; Diodes may not be able to maintain its current growth strategy or continue to maintain its current performance, costs and loadings in its manufacturing facilities; risks of domestic and foreign operations, including excessive operation costs, labor shortages, higher tax rates and Diodes’ joint venture prospects; unfavorable currency exchange rates; and the impact of competition and other risk factors relating to our industry and business as detailed from time to time in Diodes’ filings with the United States Securities and Exchange Commission.

Additional Information and Where to Find It

Pericom intends to file a proxy statement in connection with the merger. Investors and security holders are urged to read the proxy statement when it becomes available because it will contain important information about the transaction. Investors and security holders may obtain free copies of these documents (when they are available) and other documents filed with the SEC at the SEC’s web site at www.sec.gov. Diodes, Pericom and their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Pericom in connection with the merger. Information regarding the special interest of these directors and executive officers in the transaction will be included in the proxy statement described above. Additional information regarding the directors and executive officers of Period is also included in Pericom’s proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on October 16, 2014. Additional information regarding the directors and executive officers of Diodes is also included in Diodes’ proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 16, 2015. These documents are available free of charge at the SEC’s website at www.sec.gov and as described above.

|

|

Page 3

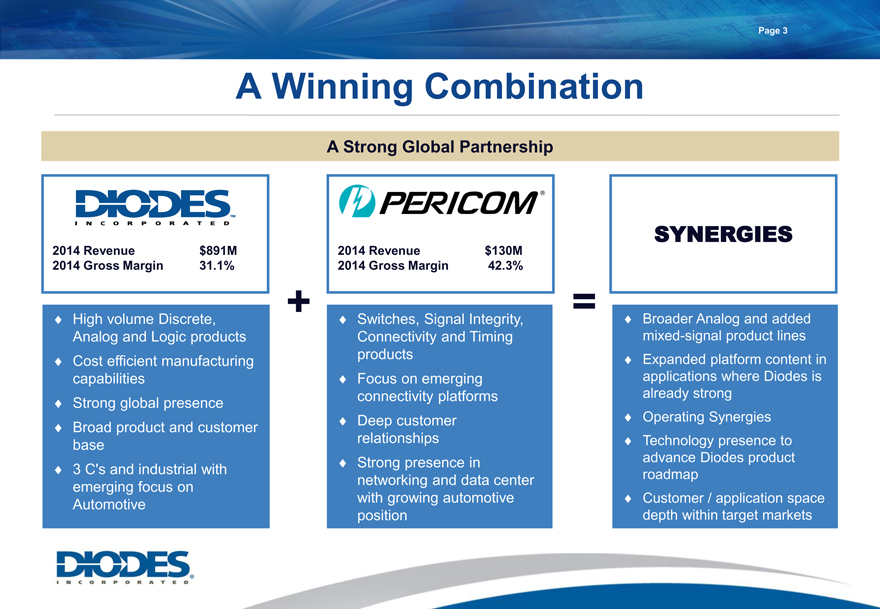

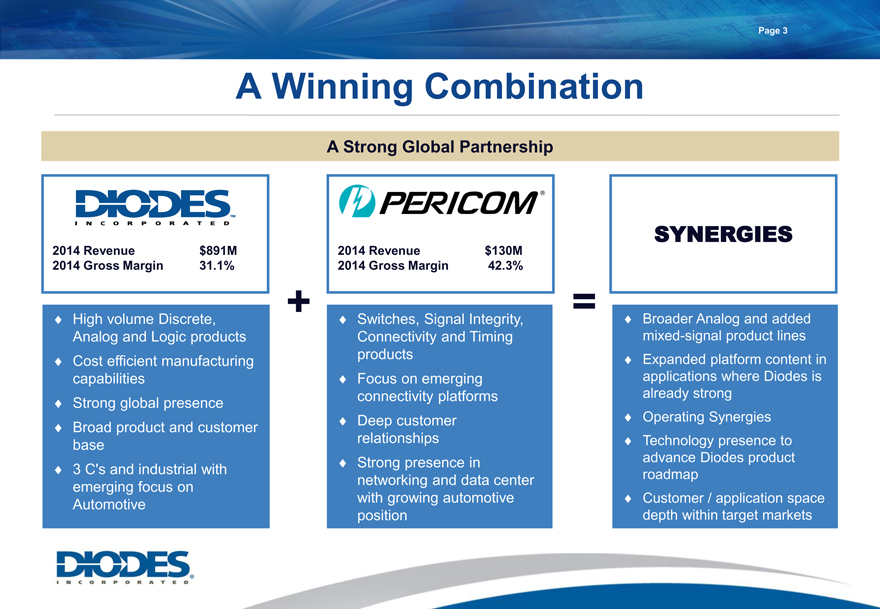

A Winning Combination

A Strong Global Partnership

2014 Revenue $891M 2014 Gross Margin 31.1%

2014 Revenue $130M

2014 Gross Margin 42.3%

SYNERGIES

High volume Discrete, Analog and Logic products Cost efficient manufacturing capabilities Strong global presence Broad product and customer base

3 C’s and industrial with emerging focus on Automotive

Switches, Signal Integrity, Connectivity and Timing products Focus on emerging connectivity platforms Deep customer relationships Strong presence in networking and data center with growing automotive position

Broader Analog and added mixed-signal product lines Expanded platform content in applications where Diodes is already strong Operating Synergies Technology presence to advance Diodes product roadmap Customer / application space depth within target markets

Page 4

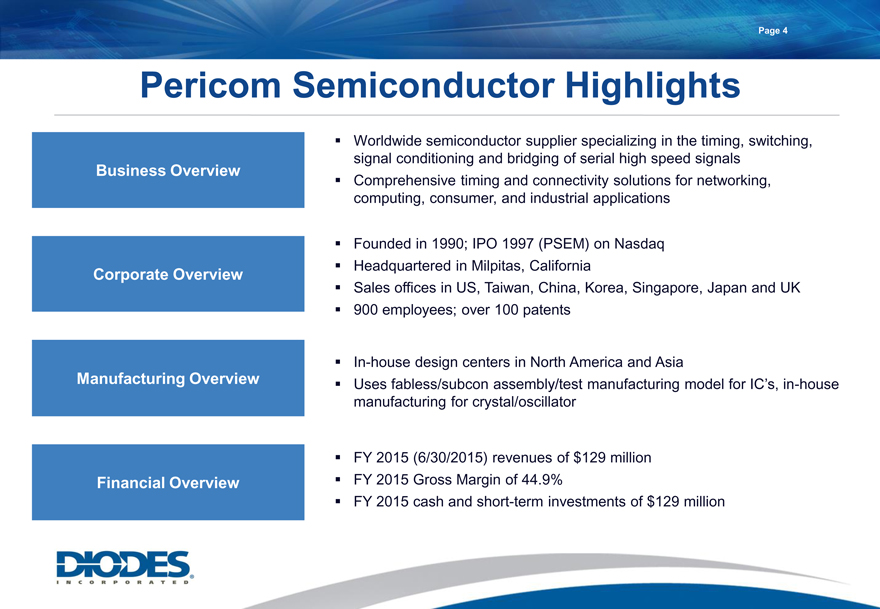

Pericom Semiconductor Highlights

Business Overview Corporate Overview Manufacturing Overview Financial Overview

Worldwide semiconductor supplier specializing in the timing, switching, signal conditioning and bridging of serial high speed signals Comprehensive timing and connectivity solutions for networking, computing, consumer, and industrial applications

Founded in 1990; IPO 1997 (PSEM) on Nasdaq Headquartered in Milpitas, California

Sales offices in US, Taiwan, China, Korea, Singapore, Japan and UK 900 employees; over 100 patents

In-house design centers in North America and Asia

Uses fabless/subcon assembly/test manufacturing model for IC’s, in-house manufacturing for crystal/oscillator

FY 2015 (6/30/2015) revenues of $129 million FY 2015 Gross Margin of 44.9%

FY 2015 cash and short-term investments of $129 million

Page 5

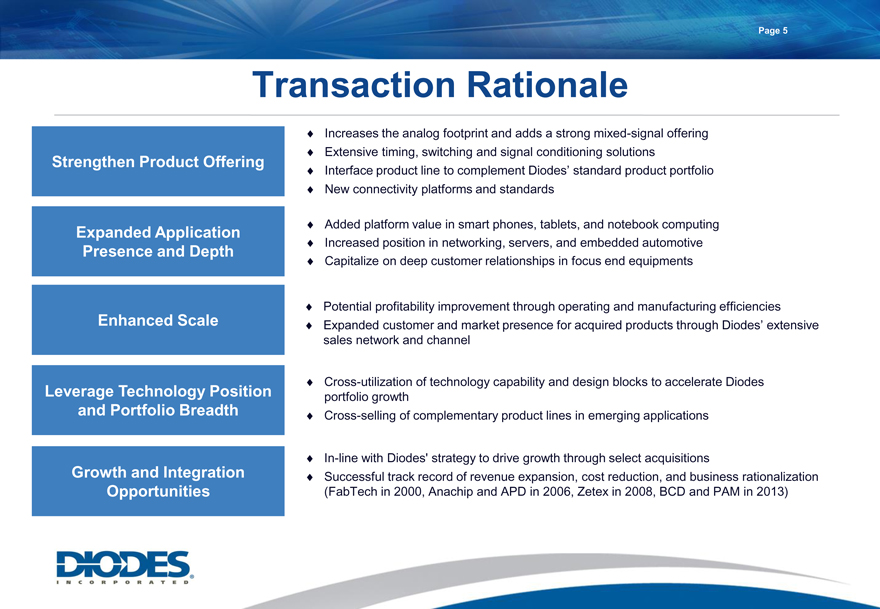

Transaction Rationale

Strengthen Product Offering

Expanded Application Presence and Depth

Enhanced Scale

Leverage Technology Position and Portfolio Breadth

Growth and Integration Opportunities

Increases the analog footprint and adds a strong mixed-signal offering Extensive timing, switching and signal conditioning solutions

Interface product line to complement Diodes’ standard product portfolio

New connectivity platforms and standards

Added platform value in smart phones, tablets, and notebook computing Increased position in networking, servers, and embedded automotive Capitalize on deep customer relationships in focus end equipments

Potential profitability improvement through operating and manufacturing efficiencies

Expanded customer and market presence for acquired products through Diodes’ extensive sales network and channel

Cross-utilization of technology capability and design blocks to accelerate Diodes portfolio growth Cross-selling of complementary product lines in emerging applications

In-line with Diodes’ strategy to drive growth through select acquisitions

Successful track record of revenue expansion, cost reduction, and business rationalization (FabTech in 2000, Anachip and APD in 2006, Zetex in 2008, BCD and PAM in 2013)

Page 6

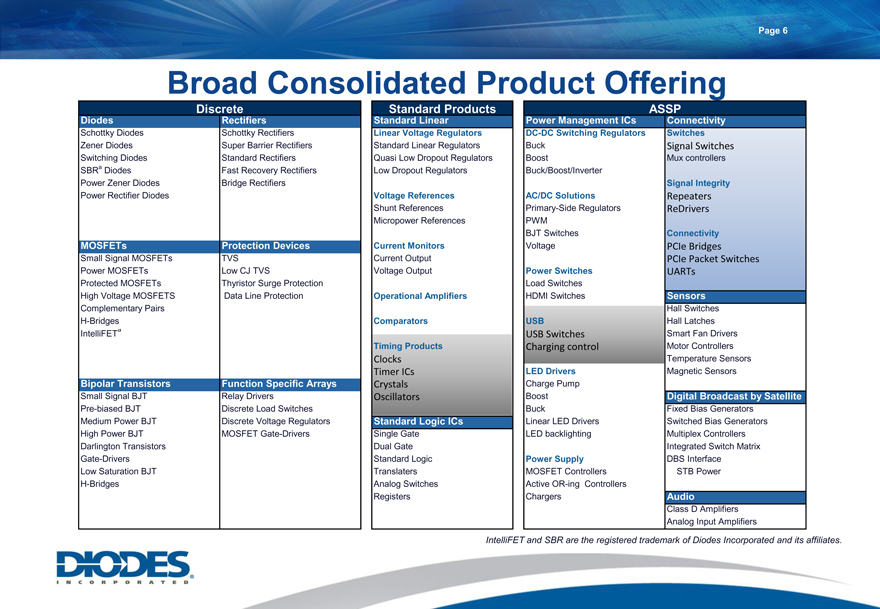

Broad Consolidated Product Offering

Discrete

Diodes Rectifiers

Schottky Diodes Schottky Rectifiers

Zener Diodes Super Barrier Rectifiers

Switching Diodes Standard Rectifiers

SBRâ Diodes Fast Recovery Rectifiers

Power Zener Diodes Bridge Rectifiers

Power Rectifier Diodes

MOSFETs Protection Devices

Small Signal MOSFETs TVS

Power MOSFETs Low CJ TVS

Protected MOSFETs Thyristor Surge Protection

High Voltage MOSFETS Data Line Protection

Complementary Pairs

H-Bridges

IntelliFETâ

Bipolar Transistors Function Specific Arrays

Small Signal BJT Relay Drivers

Pre-biased BJT Discrete Load Switches

Medium Power BJT Discrete Voltage Regulators

High Power BJT MOSFET Gate-Drivers

Darlington Transistors

Gate-Drivers

Low Saturation BJT

H-Bridges

Standard Products ASSP

Standard Linear Power Management ICs Connectivity

Linear Voltage Regulators DC-DC Switching Regulators Switches

Standard Linear Regulators Buck Signal Switches

Quasi Low Dropout Regulators Boost Mux controllers

Low Dropout Regulators Buck/Boost/Inverter

Signal Integrity

Voltage References AC/DC Solutions Repeaters

Shunt References Primary-Side Regulators ReDrivers

Micropower References PWM

BJT Switches Connectivity

Current Monitors Voltage PCIe Bridges

Current Output PCIe Packet Switches

Voltage Output Power Switches UARTs

Load Switches

Operational Amplifiers HDMI Switches Sensors

Hall Switches

Comparators USB Hall Latches

USB Switches Smart Fan Drivers

Timing Products Charging control Motor Controllers

Clocks Temperature Sensors

Timer ICs LED Drivers Magnetic Sensors

Crystals Charge Pump

Oscillators Boost Digital Broadcast by Satellite

Buck Fixed Bias Generators

Standard Logic ICs Linear LED Drivers Switched Bias Generators

Single Gate LED backlighting Multiplex Controllers

Dual Gate Integrated Switch Matrix

Standard Logic Power Supply DBS Interface

Translaters MOSFET Controllers STB Power

Analog Switches Active OR-ing Controllers

Registers Chargers Audio

Class D Amplifiers

Analog Input Amplifiers

IntelliFET and SBR are the registered trademark of Diodes Incorporated and its affiliates.

Page 7

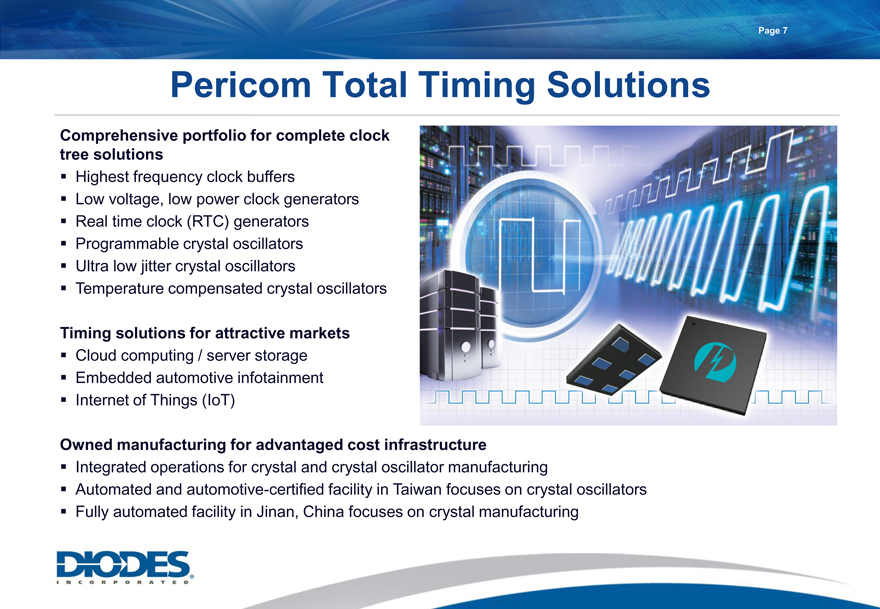

Pericom Total Timing Solutions

Comprehensive portfolio for complete clock tree solutions

Highest frequency clock buffers

Low voltage, low power clock generators Real time clock (RTC) generators Programmable crystal oscillators Ultra low jitter crystal oscillators Temperature compensated crystal oscillators

Timing solutions for attractive markets

Cloud computing / server storage Embedded automotive infotainment Internet of Things (IoT)

Owned manufacturing for advantaged cost infrastructure

Integrated operations for crystal and crystal oscillator manufacturing

Automated and automotive-certified facility in Taiwan focuses on crystal oscillators Fully automated facility in Jinan, China focuses on crystal manufacturing

Page 8

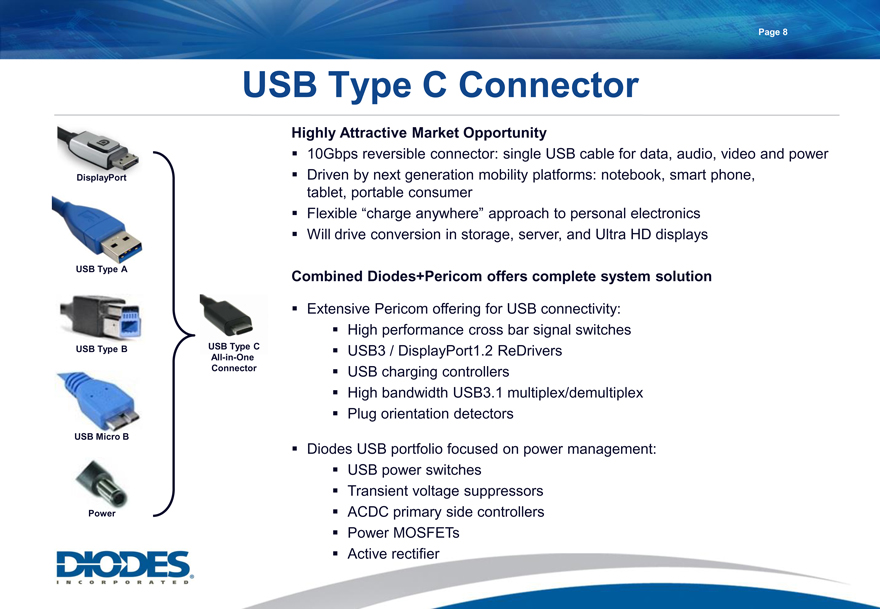

Highly Attractive Market Opportunity

10Gbps reversible connector: single USB cable for data, audio, video and power Driven by next generation mobility platforms: notebook, smart phone, tablet, portable consumer

Flexible “charge anywhere” approach to personal electronics

Will drive conversion in storage, server, and Ultra HD displays

Combined Diodes+Pericom offers complete system solution

Extensive Pericom offering for USB connectivity:

High performance cross bar signal switches USB3 / DisplayPort1.2 ReDrivers USB charging controllers High bandwidth USB3.1 multiplex/demultiplex Plug orientation detectors

Diodes USB portfolio focused on power management:

USB power switches

Transient voltage suppressors ACDC primary side controllers Power MOSFETs Active rectifier

Page 9

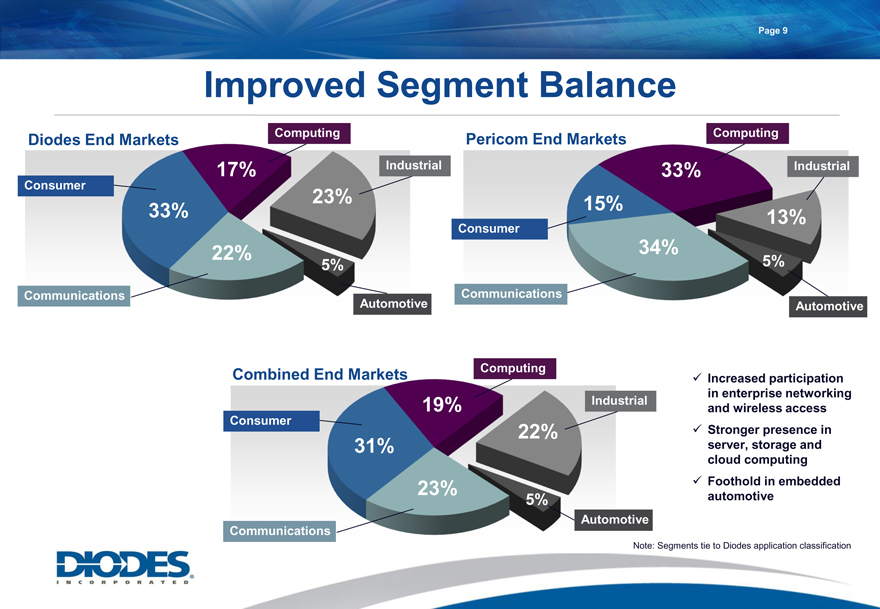

Improved Segment Balance

Diodes End Markets Computing Pericom End Markets Computing

17% Industrial 33% Industrial

Consumer

23% 15%

33% 13%

Consumer

22% 34%

5% 5%

Communications Communications

Automotive Automotive

Co Computing ? Increased participation

in enterprise networking

19% Industrial and wireless access

Consumer

22% ? Stronger presence in

31% server, storage and

cloud computing

23% ? Foothold in embedded

5% automotive

Automotive

Communications

Note: Segments tie to Diodes application classification

Page 10

Global Manufacturing Infrastructure

Neuhaus, Germany

Packaging Chengdu, China

Packaging

2

Oldham, UK 3 Jinan, China

Wafer Fab Crystal Fab, Packaging

1 1

4 Shanghai, China

5 6 Wafer Fab

Kansas City, MO 2 Shanghai, China

Wafer Fab Packaging

Jhongli, Taiwan

Oscillator Module Packaging

1

Page 11

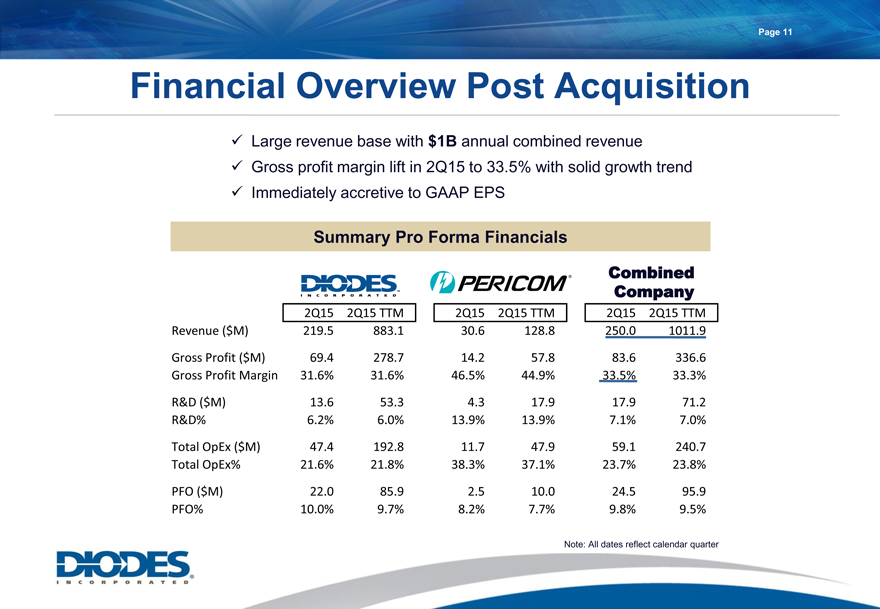

Financial Overview Post Acquisition

Large revenue base with $1B annual combined revenue

Gross profit margin lift in 2Q15 to 33.5% with solid growth trend Immediately accretive to GAAP EPS

Summary Pro Forma Financials

Company

2Q15 2Q15 TTM 2Q15 2Q15 TTM 2Q15 2Q15 TTM

Revenue ($M) 219.5 883.1 30.6 128.8 250.0 1011.9

Gross Profit ($M) 69.4 278.7 14.2 57.8 83.6 336.6

Gross Profit Margin 31.6% 31.6% 46.5% 44.9% 33.5% 33.3%

R&D ($M) 13.6 53.3 4.3 17.9 17.9 71.2

R&D% 6.2% 6.0% 13.9% 13.9% 7.1% 7.0%

Total OpEx ($M) 47.4 192.8 11.7 47.9 59.1 240.7

Total OpEx% 21.6% 21.8% 38.3% 37.1% 23.7% 23.8%

PFO ($M) 22.0 85.9 2.5 10.0 24.5 95.9

PFO% 10.0% 9.7% 8.2% 7.7% 9.8% 9.5%

Note: All dates reflect calendar quarter

Page 12

Pericom Fits Diodes’ M&A Strategy

SYNERGISTIC FACTORS Accretive in 1 year Enter new product area

Access to new markets / new customers Strengthen regional sales potential Gain access to process and/or packaging technology

Synergistic with Diodes’ packaging capabilities and capacity

Degree of

FIT

1

1

1

1

2

2

1=Very synergistic, 2=Synergistic, 3=Fairly Synergistic

Page 13

Diodes Strategy: Profitable Growth

Pericom is another key milestone

Thank you

Company Contact: Investor Relations Contact:

Diodes Incorporated Shelton Group

Laura Mehrl Leanne K. Sievers

Director of Investor Relations EVP, Investor Relations

P: 972-987-3959 P: 949-224-3874

E: laura_mehrl@diodes.com E: lsievers@diodes.com

www.diodes.com

Additional Information and Where to Find It

Pericom Semiconductor Corporation (“Pericom” or the “Company”) intends to file with the Securities and Exchange Commission (the “SEC”) a proxy statement in connection with its proposed acquisition by Diodes and furnish or file other materials with the SEC in connection with the proposed transaction. The definitive proxy statement will be sent or given to the shareholders of the Company and will contain important information about the proposed transaction and related matters. BEFORE MAKING ANY VOTING DECISION, PERICOM’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND THOSE OTHER MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. The proxy statement and other relevant materials (when they become available), and any other documents filed by Pericom with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the proxy statement from Pericom by contacting Pericom’s Investor Relations by telephone at (408) 232-9100, or by mail to Investor Relations Department, Pericom Semiconductor Corporation, 1545 Barber Lane, Milpitas, California 95035 or by going to Pericom’s Investor Relations page on its corporate website at www.pericom.com.

Participants in the Solicitation

Pericom and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Pericom in connection with the proposed transaction. Information regarding the interests of these directors and executive officers in the transaction described herein will be included in the proxy statement described above. Additional information regarding the directors and executive officers of Pericom is included in proxy statement for its 2014 Annual Meeting, which was filed with the SEC on October 16, 2014, and is supplemented by other public filings made, and to be made, with the SEC by Pericom.

Cautionary Statement Regarding Forward-Looking Statements

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including, but not limited to, the ability of the parties to consummate the proposed transaction; satisfaction of closing conditions to the consummation of the proposed transaction; the impact of the announcement of the proposed transaction on Pericom’s relationships with its employees, existing customers or potential future customers; and such other risks and uncertainties pertaining to the Pericom’s business as detailed in its filings with the SEC on Forms 10-K and 10-Q, which are available on the SEC’s website at www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. Pericom assumes no obligation to update any forward-looking statement contained in this document.