UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under §240.14a-12 |

PERICOM SEMICONDUCTOR CORPORATION

(Name of the Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Pericom Semiconductor

Enabling High-Speed Serial Connectivity

Investor Presentation

November 2015

1 Copyright Pericom Semiconductor Corp 2015

Forward Looking Statements

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including, but not limited to, the ability of the parties to consummate the proposed transaction; satisfaction of closing conditions to the consummation of the proposed transaction; the impact of the announcement of the proposed transaction on Pericom’s relationships with its employees, existing customers or potential future customers; and such other risks and uncertainties pertaining to Pericom’s business as detailed in its filings with the SEC on Forms 10-K and 10-Q, which are available on the SEC’s website at www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. Pericom assumes no obligation to update any forward-looking statement contained in this document.

2 Copyright Pericom Semiconductor Corp 2015

Additional Information and Where to Find It

Pericom has filed a definitive proxy statement and relevant documents in connection with the special meeting of the shareholders of Pericom at which the Pericom shareholders will consider certain proposals regarding the potential acquisition of

Pericom by Diodes Incorporated (the “Special Meeting Proposals”). Pericom and its directors and executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from

Pericom’s shareholders in connection with the Special Meeting Proposals.

SHAREHOLDERS OF PERICOM ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

The definitive proxy statement and other relevant documents filed with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the definitive proxy statement from

Pericom by contacting Pericom’s Investor Relations by telephone at (408) 232-9100, or by mail Pericom Semiconductor Corporation, 1545 Barber Lane, Milpitas, California 95035 or by going to Pericom’s Investor Relations page on its corporate website at www.pericom.com.

3 Copyright Pericom Semiconductor Corp 2015

Table of Contents

Introduction: The Pericom Board’s Recommendation to Shareholders

Background of Sale Process and Chronology of Discussions with Diodes and Montage

Diodes Transaction Overview

Risks Associated with Montage Offer

The Pericom Board’s Unanimous Decision to Reject the Montage

Offer and Recommend the Diodes Transaction

Appendix

¡ Key Parties

¡ CFIUS Considerations

4 Copyright Pericom Semiconductor Corp 2015

Introduction:

The Pericom Board’s Recommendation to Shareholders

5 Copyright Pericom Semiconductor Corp 2015

The Pericom Board’s Recommendation

The Pericom Board of Directors is pleased to have received two offers for the Company, both at attractive premiums

After careful and deliberate consideration, the Pericom Board of Directors determined that the Montage offer was not a Superior Proposal to the transactions contemplated by the Diodes Merger Agreement given the significant risks associated with the Montage offer, despite working closely with Montage

The Pericom Board of Directors unanimously recommends that Pericom shareholders approve the Diodes Merger Agreement and related matters

“Value is not value if it is not ultimately paid”

- Leo E. Strine, former Vice Chancellor of the Court of Chancery of the State of Delaware

6 Copyright Pericom Semiconductor Corp 2015

The Pericom Board’s Fiduciary Duty

The Pericom Board of Directors has a duty to Pericom’s shareholders to consider the likelihood of completing a transaction in assessing the overall value of an offer

Consistent with its fiduciary duties, the Pericom Board consulted extensively with its independent financial advisors and outside legal counsel

¡ At the instruction of the Board, Pericom’s management, independent financial advisors, and outside counsel repeatedly requested greater assurances from Montage to address the Board’s clearly communicated concerns about various risks

¡ Those risks included significant uncertainty regarding financing, regulatory approval, enforceability, and ability to close a transaction in a reasonable timeframe or at all

¡ Despite numerous requests, Montage was not able to address the Board’s concerns and provide the requisite assurance of its ability to finance and close a transaction with Pericom

Based on these factors, the Pericom Board concluded that the additional premium represented by the revised Montage offer is insufficient to outweigh the significantly higher risk that the Montage offer does not close

7 Copyright Pericom Semiconductor Corp 2015

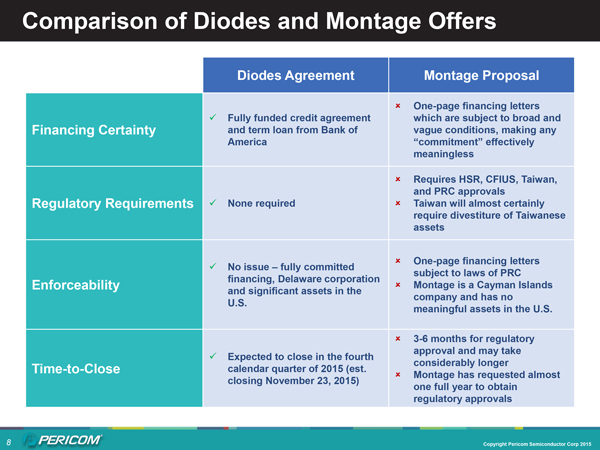

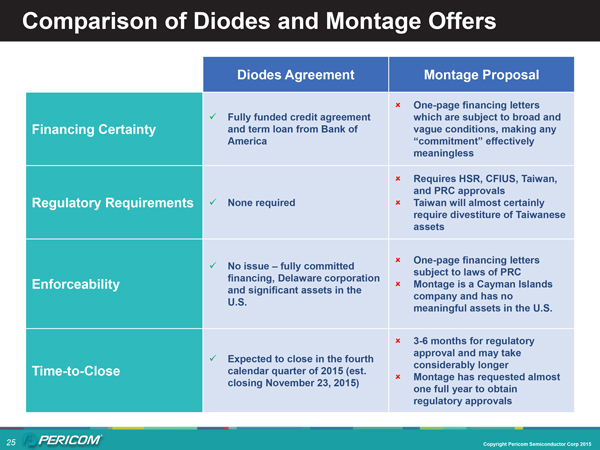

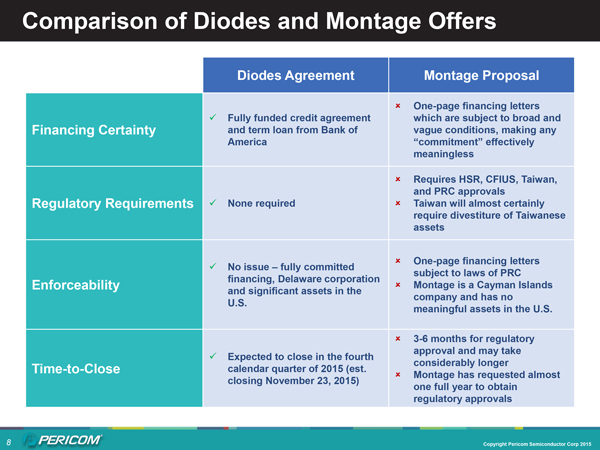

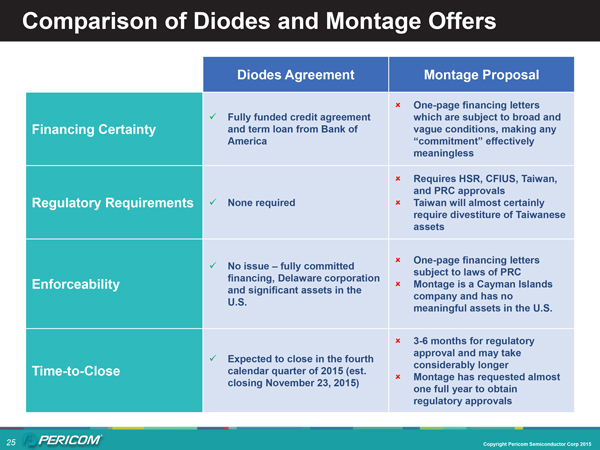

Comparison of Diodes and Montage Offers

| | | | |

| | Diodes Agreement | | Montage Proposal |

| Financing Certainty | | ü Fully funded credit agreement and term loan from Bank of America | | One-page financing letters which are

subject to broad and vague conditions,

making any “commitment” effectively

meaningless |

| | | | Requires HSR, CFIUS, Taiwan, and

PRC approvals |

| Regulatory Requirements | | ü None required | | Taiwan will almost certainly require

divestiture of Taiwanese assets |

| | ü No issue – fully committed financing, Delaware corporation

and significant assets in the U.S. | | One-page financing letters subject to

laws of PRC |

| Enforceability | | | Montage is a Cayman Islands company

and has no meaningful assets in the

U.S. |

| Time-to-Close | | ü Expected to close in the fourth calendar quarter of 2015 (+est. closing November 23, 2015) | | 3-6 months for regulatory approval and

may take considerably longer |

| | | Montage has requested almost one full

year to obtain regulatory approvals |

8 Copyright Pericom Semiconductor Corp 2015

Background of Sale Process and Chronology of Discussions with Diodes and Montage

9 Copyright Pericom Semiconductor Corp 2015

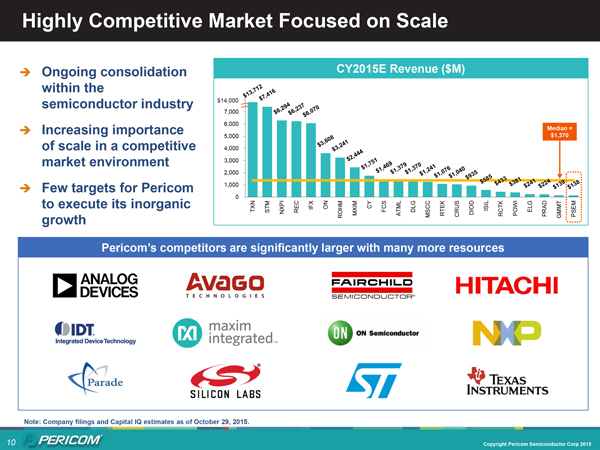

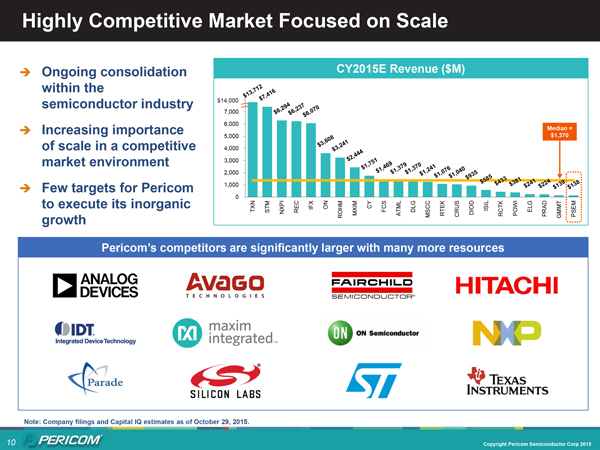

Highly Competitive Market Focused on Scale

Ongoing consolidation within the semiconductor industry

Increasing importance of scale in a competitive market environment

Few targets for Pericom to execute its inorganic growth

Pericom’s competitors are significantly larger with many more resources

Note: Company filings and Capital IQ estimates as of October 29, 2015.

10 Copyright Pericom Semiconductor Corp 2015

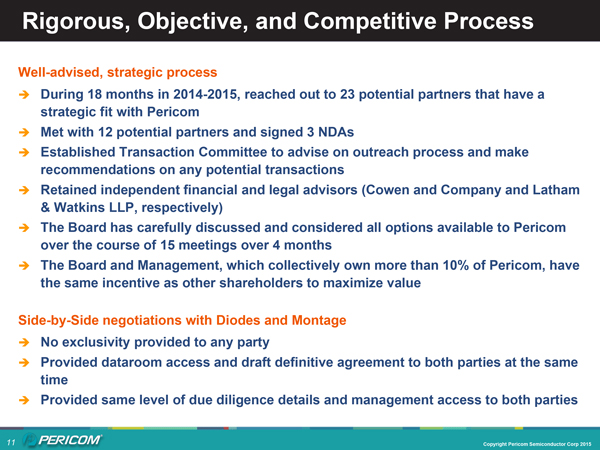

Rigorous, Objective, and Competitive Process

Well-advised, strategic process

During 18 months in 2014-2015, reached out to 23 potential partners that have a strategic fit with Pericom

Met with 12 potential partners and signed 3 NDAs

Established Transaction Committee to advise on outreach process and make recommendations on any potential transactions

Retained independent financial and legal advisors (Cowen and Company and Latham & Watkins LLP, respectively)

The Board has carefully discussed and considered all options available to Pericom over the course of 15 meetings over 4 months

The Board and Management, which collectively own more than 10% of Pericom, have the same incentive as other shareholders to maximize value

Side-by-Side negotiations with Diodes and Montage

No exclusivity provided to any party

Provided dataroom access and draft definitive agreement to both parties at the same time

Provided same level of due diligence details and management access to both parties

11 Copyright Pericom Semiconductor Corp 2015

Background of Sale Discussions

| | |

| 2014—2015 | | Management, through its financial advisors, reached out to 23 potential parties, met with 12 parties, including Diodes, and signed 3 NDAs. |

| March 13, 2015 | | Pericom meets with Montage, who expressed an interest in exploring a potential acquisition of Pericom. |

| May 18, 2015 | | Diodes delivered a written non-binding indication of interest to acquire the Company for $16.10 per share in cash. |

| June 11, 2015 | | Montage contacted Pericom to express their interest in a potential acquisition of the Company. |

| July 10, 2015 | | Montage presented Pericom with a written non-binding indication of interest of $17.00 per share in cash. |

| July 13, 2015 | | After negotiating, Diodes communicated its final offer of $17.00 per share. |

| July 17, 2015 | | After negotiating, Montage communicated its final offer of $18.00 per share. |

| July 24, 2015 | | Pericom provided access to an online dataroom and an initial draft of a proposed merger agreement to both Diodes and Montage. |

| July 24 –September 1, 2015 | | Engaged with Diodes and Montage in due diligence and negotiations over the definitive |

| | agreement. Made repeated requests to Montage to address Board’s concerns with |

| | Montage’s proposed definitive agreement, which were never adequately addressed. |

| September 2, 2015 | | Merger agreement with Diodes executed at $17.00 per share with expected close in the fourth calendar quarter of 2015. |

| September 17, 2015 | | Pericom received an unsolicited offer and a revised draft of the merger agreement from Montage to acquire the Company for $18.50 per share. |

12 Copyright Pericom Semiconductor Corp 2015

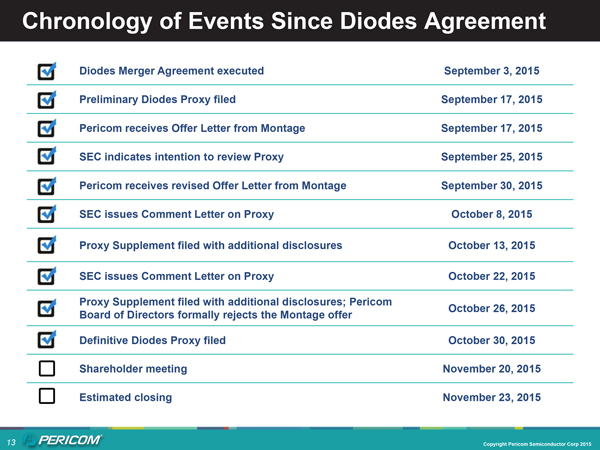

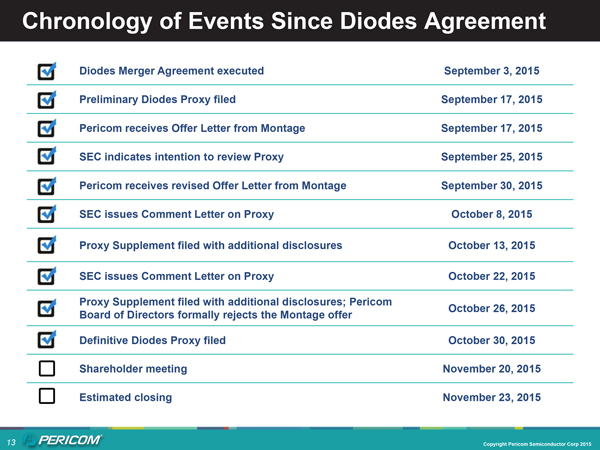

Chronology of Events Since Diodes Agreement

| | |

| Diodes Merger Agreement executed | | September 3, 2015 |

| Preliminary Diodes Proxy filed | | September 17, 2015 |

| Pericom receives Offer Letter from Montage | | September 17, 2015 |

| SEC indicates intention to review Proxy | | September 25, 2015 |

| Pericom receives revised Offer Letter from Montage | | September 30, 2015 |

| SEC issues Comment Letter on Proxy | | October 8, 2015 |

| Proxy Supplement filed with additional disclosures | | October 13, 2015 |

| SEC issues Comment Letter on Proxy | | October 22, 2015 |

| Proxy Supplement filed with additional disclosures; Pericom Board of Directors formally rejects the Montage offer | | October 26, 2015 |

| Definitive Diodes Proxy filed | | October 30, 2015 |

| Shareholder meeting | | November 20, 2015 |

| Estimated closing | | November 23, 2015 |

13 Copyright Pericom Semiconductor Corp 2015

Diodes Transaction Overview

14 Copyright Pericom Semiconductor Corp 2015

Transaction Overview

| | |

| Per-Share Consideration: | | $17.00 Per Share Cash Offer, No Financing Contingency |

| Total Value(1): | | $395.4 Million |

| Valuation Premium: | | 39.6% to $12.18 (9/2/15, 1-day prior to announcement) |

| | 39.3% to $12.20 (30-day VWAP) |

| Strategic Buyer: | | Diodes Incorporated |

| | Market Cap (as of 11/2/15): $1.1B |

| Transaction Timing: | | Pericom Shareholder Meeting: November 20, 2015 |

| | No HSR or Other Regulatory Approvals Required |

| Merger Agreement Terms: | | Straightforward Strategic Cash Merger |

| Estimated Closing Date: | | November 23, 2015 |

(1): Fully Diluted, based on 23,257,099 diluted shares outstanding as of October 30, 2015

15 Copyright Pericom Semiconductor Corp 2015

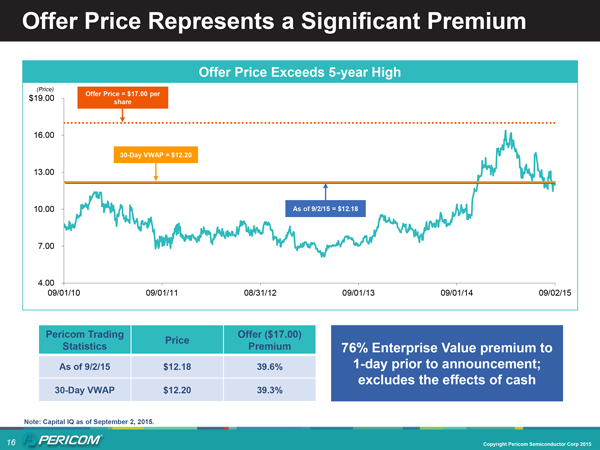

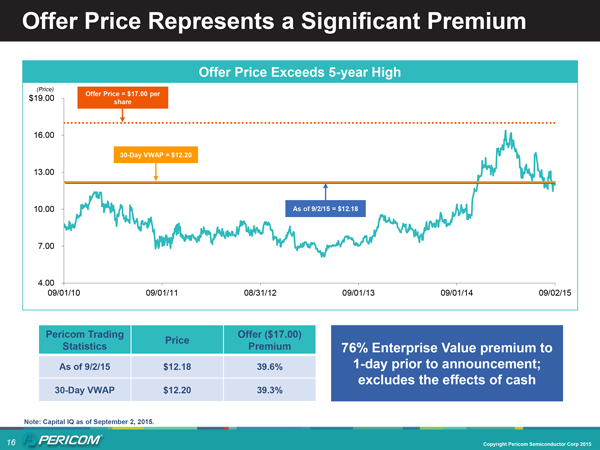

Offer Price Represents a Significant Premium

Offer Price Exceeds 5-year High

| | | | | | | | |

| Pericom Trading Statistics | | Price | | | Offer

($17.00)

Premium | |

| As of 9/2/15 | | $ | 12.18 | | | | 39.6 | % |

| 30-Day VWAP | | $ | 12.20 | | | | 39.3 | % |

76% Enterprise Value premium to 1-day prior to announcement; excludes the effects of cash

Note: Capital IQ as of September 2, 2015.

16 Copyright Pericom Semiconductor Corp 2015

Risks Associated with Montage Offer

17 Copyright Pericom Semiconductor Corp 2015

Summary of Montage Offer Risks

| | |

| | Montage Proposal ($18.50) |

| Financing Certainty | | 1-page financing letters are subject to broad and vague

conditions that provide lenders with excessive discretion to

withdraw their financing |

| | No real “commitment” at all |

| Regulatory Requirements | | Subject to HSR, CFIUS, Taiwan, and PRC regulatory

approvals; expected |

| | requirement to divest Taiwanese assets |

| Enforceability | | 1-page financing letters subject to laws of PRC |

| | Montage is a Cayman Islands company with no meaningful

assets in the U.S. |

| Time-to-Close | | Montage has requested almost one full year to obtain

regulatory approvals |

| | Regulatory approvals may never be provided, in which case,

the transaction |

| | may ultimately never close |

| | Long time-to-close increases risk that Montage cannot or

chooses not to close, potentially leaving Pericom shareholders

with nothing but a meager $21.5 million reverse breakup fee

as compensation |

18 Copyright Pericom Semiconductor Corp 2015

Montage Offer // Lack of Financing Certainty

| | |

| Montage Proposal – Issues / Risks | | Board Actions and Considerations |

| 1-page financing letters from China Electronics Financial Co., Ltd. and Bank of China Shanghai Pudong Branch that lack the information or rigor typically seen in financing commitment documents | | Since engaging in negotiations with Montage over the last 4+ months, repeatedly approached Montage and requested additional security of financing, such as: |

| | ¡ Full purchase price in escrow in the U.S.; |

| Broad and vague terms and conditions provide both lenders with excessive discretion to withdraw financing | | ¡ Barclays to finance the transaction, as they have done |

| | for other clients in the past; |

Financing from Bank of China is subject to evaluation by its committee and will not be issued until all the

conditions are fully satisfied; neither the Bank of China

nor Montage have provided further details of those

conditions | | ¡ Letter of credit from a U.S. based bank or the U.S.

branch of a Chinese bank; or |

| |

| | ¡ Credit facility in place |

| | |

Financing letter from China Electronics Financial Co.,

Ltd. expires on March 20, 2016 – prior to initial outside date of Montage’s proposal | | Requested additional details regarding the vague conditions of the current financing letters |

| | Requested a formal commitment letter with the rigor

typically seen in financing commitment documents and

necessitated by a transaction of this nature that outlines

all conditions to financing and is not subject to further

review |

Lack of enforceable commitment outside of China; both

1-page financing letters are subject to the laws of the

PRC | |

| |

| |

| |

Fully financed transaction (Diodes) vs. 1-page financing letters (Montage)

19 Copyright Pericom Semiconductor Corp 2015

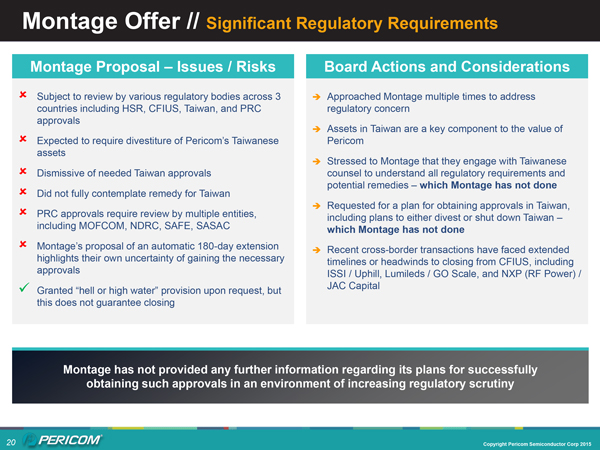

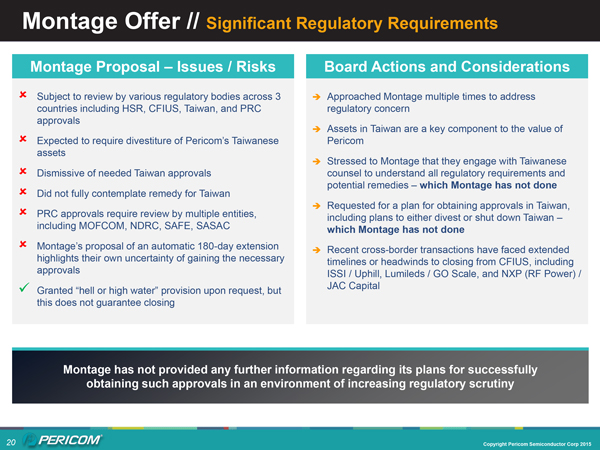

Montage Offer // Significant Regulatory Requirements

| | |

| Montage Proposal – Issues / Risks | | Board Actions and Considerations |

| Subject to review by various regulatory bodies across 3 countries including HSR, CFIUS, Taiwan, and PRC approvals | | Approached Montage multiple times to address regulatory concern |

| Expected to require divestiture of Pericom’s Taiwanese assets | | Assets in Taiwan are a key component to the value of Pericom |

| | Stressed to Montage that they engage with Taiwanese |

| Dismissive of needed Taiwan approvals | | counsel to understand all regulatory requirements and |

| Did not fully contemplate remedy for Taiwan | | potential remedies –which Montage has not done |

| PRC approvals require review by multiple entities, including MOFCOM, NDRC, SAFE, SASAC | | Requested plans for obtaining approvals in Taiwan, including plans to either divest or shut down Taiwan – which Montage has not done |

| Montage’s proposal of an automatic 180-day extension | | Recent cross-border transactions have faced extended |

| highlights their own uncertainty of gaining the necessary | | timelines or headwinds to closing from CFIUS, including |

| approvals | | ISSI / Uphill, Lumileds / GO Scale, and NXP (RF Power) / |

| ü Granted “hell or high water” provision upon request, but | | JAC Capital |

| this does not guarantee closing | | |

Montage has not provided any further information regarding its plans for successfully obtaining such approvals in an environment of increasing regulatory scrutiny

20 Copyright Pericom Semiconductor Corp 2015

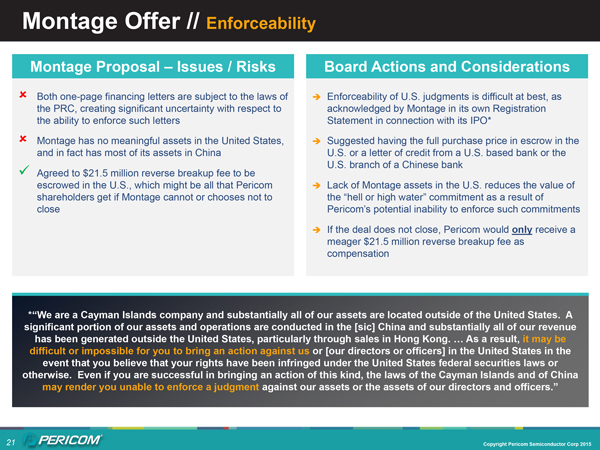

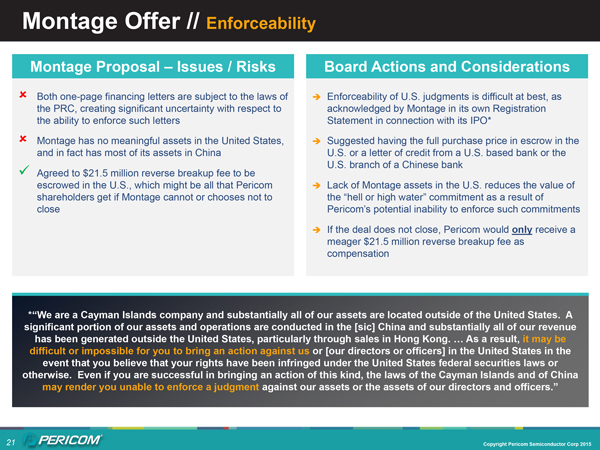

Montage Offer // Enforceability

| | |

| Montage Proposal – Issues / Risks | | Board Actions and Considerations |

| Both one-page financing letters are subject to the laws of the PRC, creating significant uncertainty with respect to the ability to enforce such letters | | Enforceability of U.S. judgments is difficult at best, as acknowledged by Montage in its own Registration Statement in connection with its IPO* |

| Montage has no meaningful assets in the United States, and in fact has most of its assets in China | | Suggested having the full purchase price in escrow in the U.S. or a letter of credit from a U.S. based bank or the |

| ü Agreed to $21.5 million reverse breakup fee to be escrowed in the U.S., which might be all that Pericom shareholders get if Montage cannot or chooses not to close | | U.S. branch of a Chinese bank Lack of Montage assets in the U.S. reduces the value of the “hell or high water” commitment as a result of Pericom’s potential inability to enforce such commitments |

| | If the deal does not close, Pericom would only receive a meager $21.5 million reverse breakup fee as compensation |

*“We are a Cayman Islands company and substantially all of our assets are located outside of the United States. A significant portion of our assets and operations are conducted in the [sic] China and substantially all of our revenue has been generated outside the United States, particularly through sales in Hong Kong. … As a result, it may be difficult or impossible for you to bring an action against us or [our directors or officers] in the United States in the event that you believe that your rights have been infringed under the United States federal securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of the Cayman Islands and of China may render you unable to enforce a judgment against our assets or the assets of our directors and officers.”

21 Copyright Pericom Semiconductor Corp 2015

Montage Offer // Timing Risk and Closing Uncertainty

Diodes Agreement

Shareholder Vote (November 20, 2015)

Expected to close within two business days following the vote

Regulatory Approval Period (3-6 months)

Uncertainty of Montage Proposal

Financing and enforceability risks

Regulatory approval to take at least 3–6 months and may take considerably longer

Montage’s proposal gives Montage up to almost one full year to obtain regulatory approvals

Such regulatory approvals may never be provided, in which case the transaction with Montage may ultimately never close

4Q15 (Diodes) vs. closing uncertainty (Montage)

22 Copyright Pericom Semiconductor Corp 2015

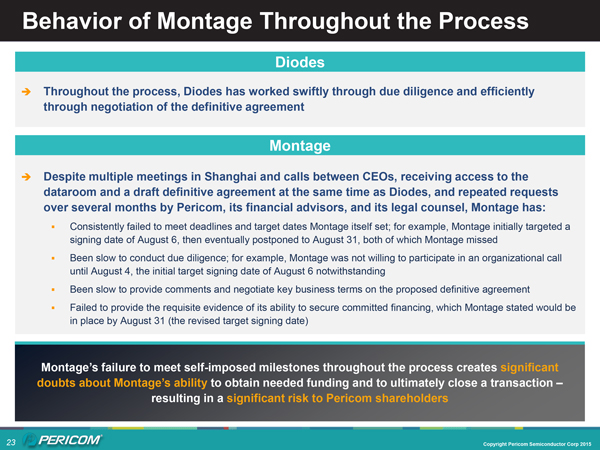

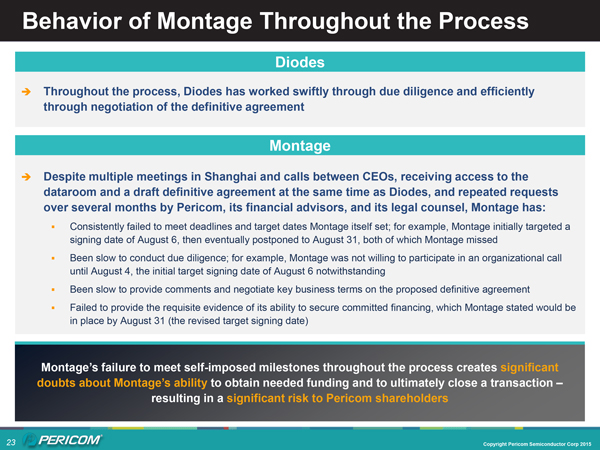

Behavior of Montage Throughout the Process

Diodes

Throughout the process, Diodes has worked swiftly through due diligence and efficiently through negotiation of the definitive agreement

Montage

Despite multiple meetings in Shanghai and calls between CEOs, receiving access to the dataroom and a draft definitive agreement at the same time as Diodes, and repeated requests over several months by Pericom, its financial advisors, and its legal counsel, Montage has:

¡ Consistently failed to meet deadlines and target dates Montage itself set; for example, Montage initially targeted a signing date of August 6, then eventually postponed to August 31, both of which Montage missed¡ Been slow to conduct due diligence; for example, Montage was not willing to participate in an organizational call until August 4, the initial target signing date of August 6 notwithstanding¡ Been slow to provide comments and negotiate key business terms on the proposed definitive agreement¡ Failed to provide the requisite evidence of its ability to secure committed financing, which Montage stated would be in place by August 31 (the revised target signing date)

Montage’s failure to meet self-imposed milestones throughout the process creates significant doubts about Montage’s ability to obtain needed funding and to ultimately close a transaction –resulting in a significant risk to Pericom shareholders

23 Copyright Pericom Semiconductor Corp 2015

The Pericom Board’s Unanimous Decision

To Reject the Montage Offer and Recommend the Diodes Transaction

24 Copyright Pericom Semiconductor Corp 2015

Comparison of Diodes and Montage Offers

| | | | |

| | Diodes Agreement | | Montage Proposal |

| Financing Certainty | | ü Fully funded credit agreement and term loan from Bank of America | | One-page financing letters which are

subject to broad and vague conditions,

making any “commitment” effectively

meaningless |

| | | | Requires HSR, CFIUS, Taiwan, and

PRC approvals |

| Regulatory Requirements | | ü None required | | Taiwan will almost certainly require

divestiture of Taiwanese assets |

| | ü No issue – fully committed financing, Delaware corporation and significant assets in the U.S. | | One-page financing letters subject to

laws of PRC |

| Enforceability | | | | Montage is a Cayman Islands company

and has no meaningful assets in the

U.S. |

| | ü Expected to close in the fourth

calendar quarter of 2015 (est. closing November 23, 2015) | | 3-6 months for regulatory approval and

may take considerably longer |

| Time-to-Close | | | Montage has requested almost one full

year to obtain regulatory approvals |

25 Copyright Pericom Semiconductor Corp 2015

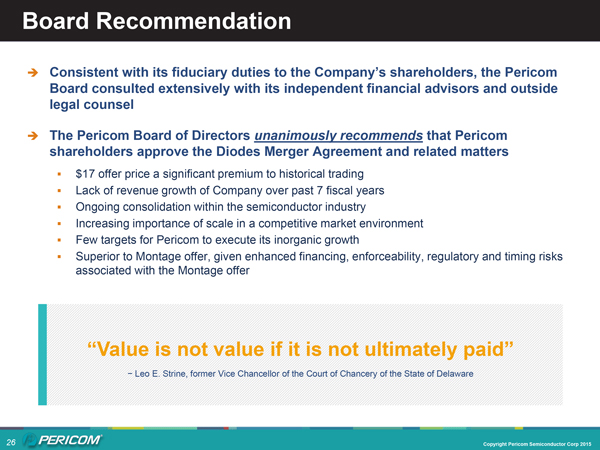

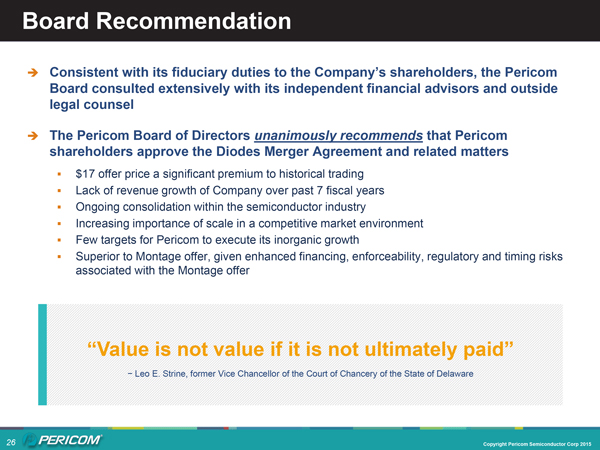

Board Recommendation

Consistent with its fiduciary duties to the Company’s shareholders, the Pericom

Board consulted extensively with its independent financial advisors and outside legal counsel

The Pericom Board of Directors unanimously recommends that Pericom shareholders approve the Diodes Merger Agreement and related matters

¡ $17 offer price a significant premium to historical trading¡ Lack of revenue growth of Company over past 7 fiscal years¡ Ongoing consolidation within the semiconductor industry

¡ Increasing importance of scale in a competitive market environment¡ Few targets for Pericom to execute its inorganic growth

¡ Superior to Montage offer, given enhanced financing, enforceability, regulatory and timing risks associated with the Montage offer

“Value is not value if it is not ultimately paid”

- Leo E. Strine, former Vice Chancellor of the Court of Chancery of the State of Delaware

26 Copyright Pericom Semiconductor Corp 2015

Thank you!

27 Copyright Pericom Semiconductor Corp 2015

Appendix

28 Copyright Pericom Semiconductor Corp 2015

A. KEY PARTIES

29 Copyright Pericom Semiconductor Corp 2015

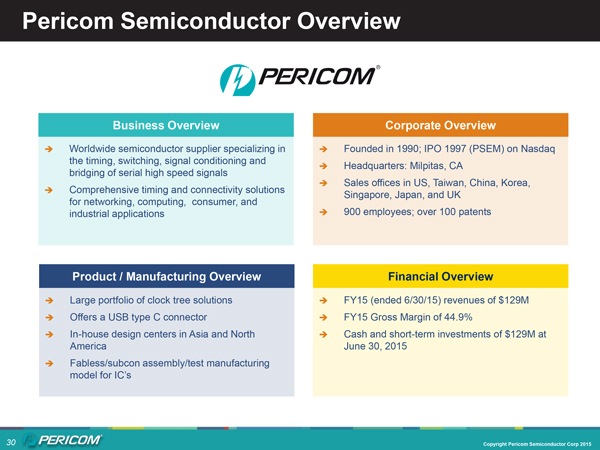

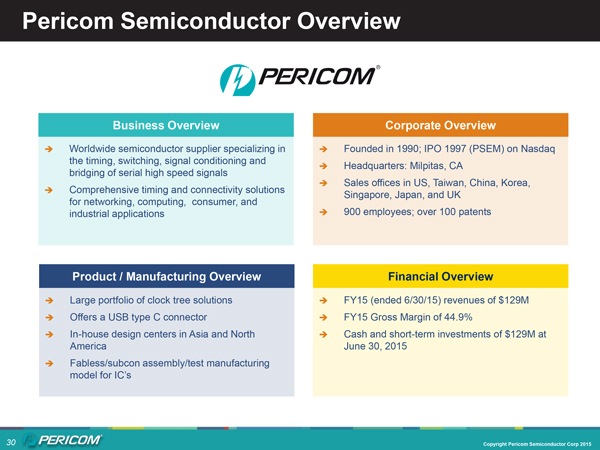

Pericom Semiconductor Overview

| | |

| Business Overview | | Corporate Overview |

| |

Worldwide semiconductor supplier specializing in the timing, switching, signal conditioning and bridging of serial high speed signals

Comprehensive timing and connectivity solutions for networking, computing, consumer, and industrial applications | | Founded in 1990; IPO 1997 (PSEM) on Nasdaq

Headquarters: Milpitas, CA

Sales offices in US, Taiwan, China, Korea, Singapore, Japan,

and UK

900 employees; over 100 patents |

| |

| Product / Manufacturing Overview | | Financial Overview |

| |

Large portfolio of clock tree solutions

Offers a USB type C connector

In-house design centers in Asia and North America

Fabless/subcon assembly/test manufacturing model for IC’s | | FY15 (ended 6/30/15) revenues of $129M

FY15 Gross Margin of 44.9%

Cash and short-term investments of $129M at June 30, 2015 |

30 Copyright Pericom Semiconductor Corp 2015

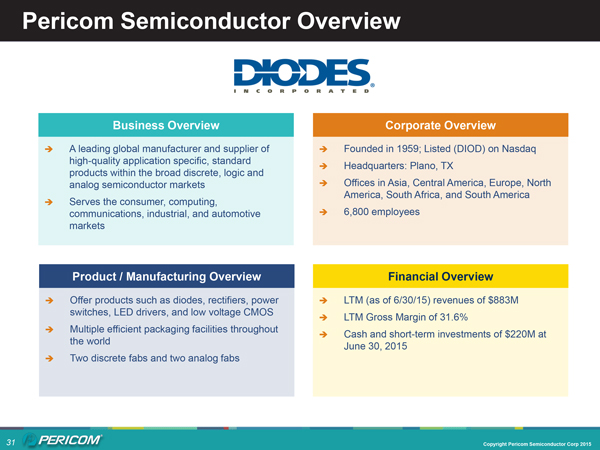

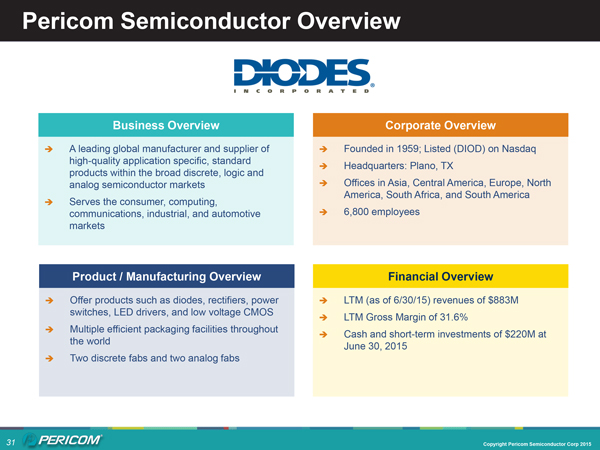

Pericom Semiconductor Overview

| | |

| Business Overview | | Corporate Overview |

A leading global manufacturer and supplier of high-quality application specific, standard products within the broad discrete, logic and analog semiconductor markets

Serves the consumer, computing, communications, industrial, and automotive markets | | Founded in 1959; Listed (DIOD) on Nasdaq

Headquarters: Plano, TX Offices in Asia, Central America,

Europe, North America, South Africa, and South America

6,800 employees |

| Product / Manufacturing Overview | | Financial Overview |

Offer products such as diodes, rectifiers, power switches, LED drivers, and low voltage CMOS

Multiple efficient packaging facilities throughout the world

Two discrete fabs and two analog fabs | | LTM (as of 6/30/15) revenues of $883M

LTM Gross Margin of 31.6%

Cash and short-term investments of $220M at June 30, 2015 |

31 Copyright Pericom Semiconductor Corp 2015

B. CFIUS CONSIDERATIONS

32 Copyright Pericom Semiconductor Corp 2015

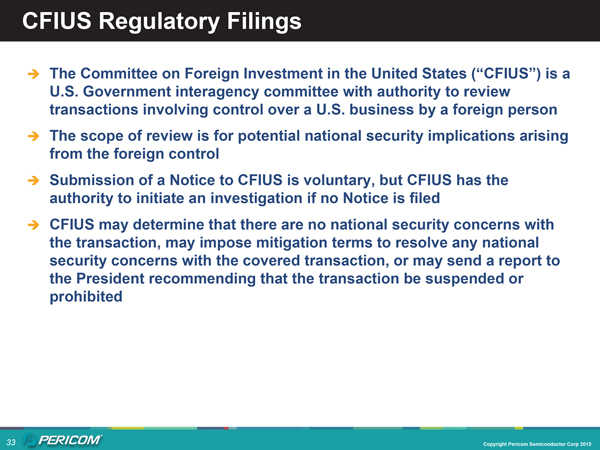

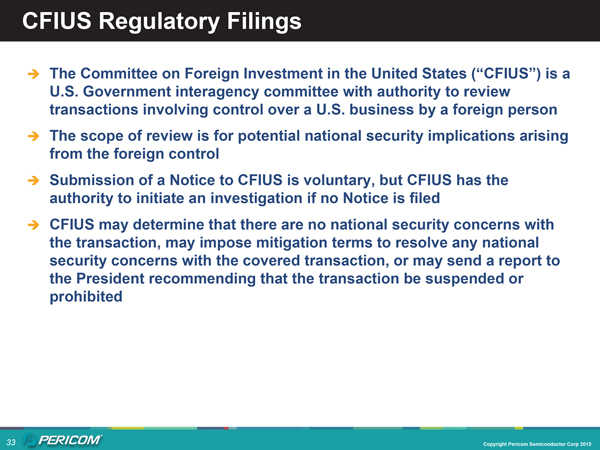

CFIUS Regulatory Filings

The Committee on Foreign Investment in the United States (“CFIUS”) is a

U.S. Government interagency committee with authority to review transactions involving control over a U.S. business by a foreign person

The scope of review is for potential national security implications arising from the foreign control

Submission of a Notice to CFIUS is voluntary, but CFIUS has the authority to initiate an investigation if no Notice is filed

CFIUS may determine that there are no national security concerns with the transaction, may impose mitigation terms to resolve any national security concerns with the covered transaction, or may send a report to the President recommending that the transaction be suspended or prohibited

33 Copyright Pericom Semiconductor Corp 2015

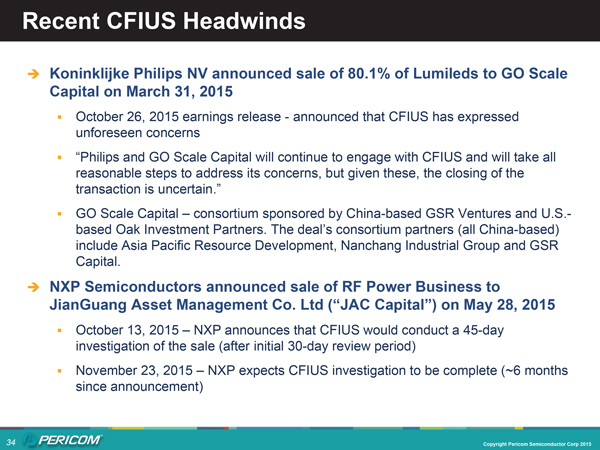

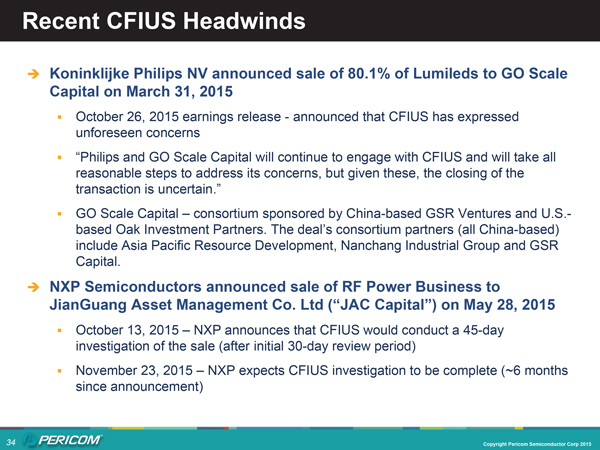

Recent CFIUS Headwinds

Koninklijke Philips NV announced sale of 80.1% of Lumileds to GO Scale Capital on March 31, 2015

¡ October 26, 2015 earnings release—announced that CFIUS has expressed unforeseen concerns

¡ “Philips and GO Scale Capital will continue to engage with CFIUS and will take all reasonable steps to address its concerns, but given these, the closing of the transaction is uncertain.”

¡ GO Scale Capital – consortium sponsored by China-based GSR Ventures and U.S.-based Oak Investment Partners. The deal’s consortium partners (all China-based) include Asia Pacific Resource Development, Nanchang Industrial Group and GSR Capital.

NXP Semiconductors announced sale of RF Power Business to

JianGuang Asset Management Co. Ltd (“JAC Capital”) on May 28, 2015

¡ October 13, 2015 – NXP announces that CFIUS would conduct a 45-day investigation of the sale (after initial 30-day review period)

¡ November 23, 2015 – NXP expects CFIUS investigation to be complete (~6 months since announcement)

34 Copyright Pericom Semiconductor Corp 2015