iBasis, Inc.

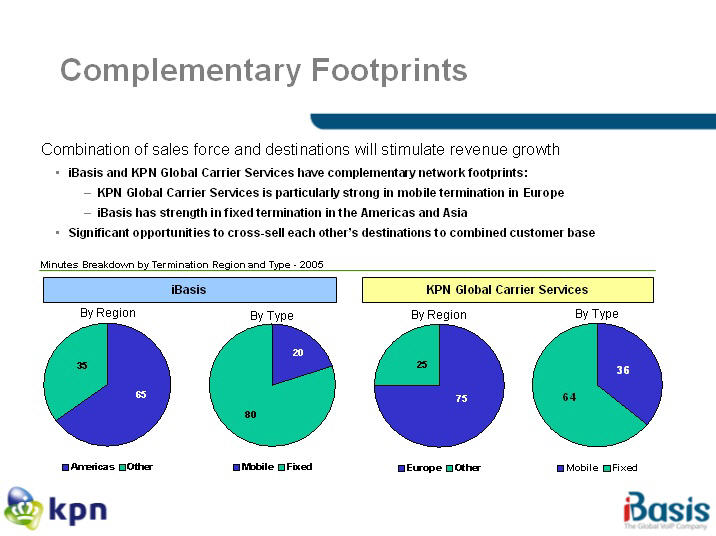

Complementary Footprints Combination of sales force and destinations will stimulate revenue growth iBasis and KPN Global Carrier Services have complementary network footprints: KPN Global Carrier Services is particularly strong in mobile termination in Europe iBasis has strength in fixed termination in the Americas and Asia Significant opportunities to cross-sell each other’s destinations to combined customer base Minutes Breakdown by Termination Region and Type - 2005 iBasis KPN Global Carrier Services By Region By Type Americas Mobile Europe Other Fixed

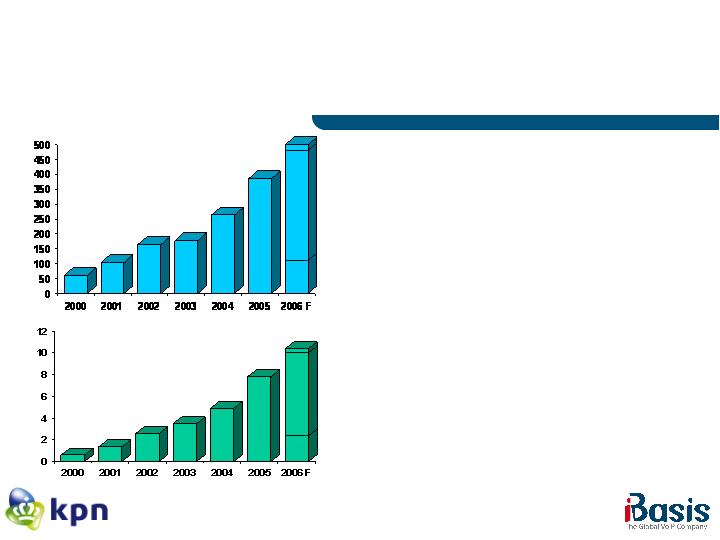

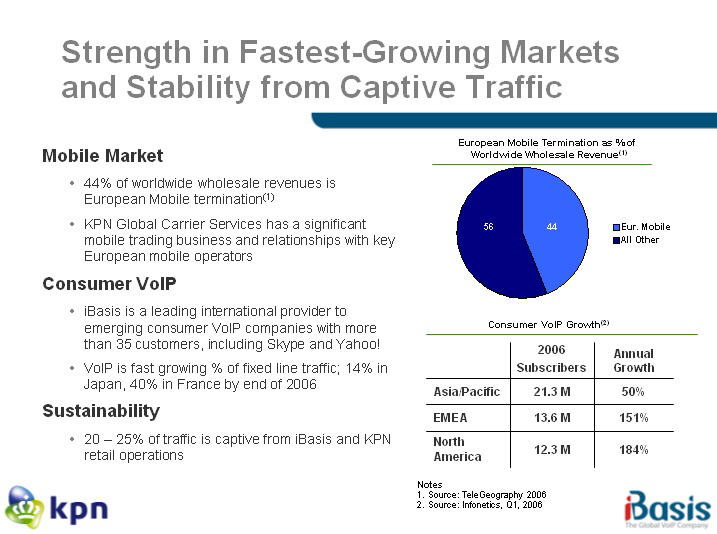

Strength in Fastest-Growing Markets and Stability from Captive Traffic Mobile Market 44% of worldwide wholesale revenues is European Mobile termination(1) KPN Global Carrier Services has a significant mobile trading business and relationships with key European mobile operators Consumer VoIP iBasis is a leading international provider to emerging consumer VoIP companies with more than 35 customers, including Skype and Yahoo! VoIP is fast growing % of fixed line traffic; 14% in Japan, 40% in France by end of 2006 Sustainability 20 - 25% of traffic is captive from iBasis and KPN retail operations European Mobile Termination as % of Worldwide Wholesale Revenue(1) Consumer VoIP Growth(2) 2006 Subscribers Annual Growth Asia/Pacific 21.3 M 50% EMEA 13.6 M 151% North America 12.3 M 184% Notes Source: TeleGeography 2006 Source: Infonetics, Q1, 2006

Press Release:

KPN to Merge International Wholesale Business Into iBasis

KPN to Become Majority Shareholder; iBasis Shareholders to Receive Post-Closing Dividend of $113 Million

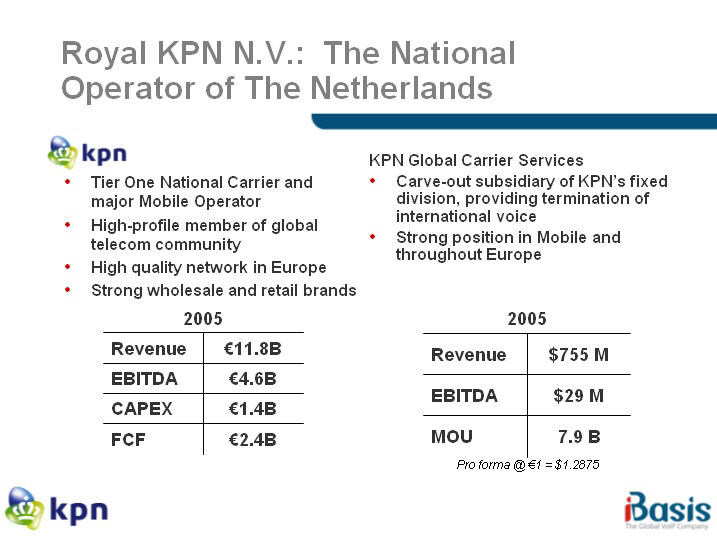

BURLINGTON, MA, USA, and THE HAGUE, THE NETHERLANDS, JUNE 21, 2006 - iBasis (NASDAQ:IBAS), the global VoIP company, and Royal KPN N.V., the national carrier of The Netherlands, today announced that they have signed a definitive agreement to merge KPN’s international voice wholesale business into iBasis. This combination will establish iBasis as one of the five largest international wholesale voice carriers in the world, with pro forma 2005 revenues exceeding USD 1.1 billion and more than 15 billion minutes in 2005. iBasis will acquire KPN subsidiary KPN Global Carrier Services and receive USD 55 million in cash from KPN in return for the issuance of approximately 40 million shares of iBasis common stock, which represent a 51 percent ownership interest in iBasis on a diluted basis.

iBasis shareholders of record immediately prior to closing will receive a dividend of USD 113 million immediately following closing. In connection to payment of the dividend, outstanding options will be adjusted to preserve their equity value. The transaction, which is subject to customary closing conditions, including regulatory approvals and the approval of iBasis shareholders, is expected to be completed before the end of 2006.

Ad Scheepbouwer, Chairman and CEO of KPN commented: “We are very pleased to merge our international wholesale voice business into iBasis, given its leadership in VoIP and its strong growth profile. This transaction is an important step for KPN that will clearly contribute to the realization of our existing All IP strategy and our transformation into an All IP operator. Consolidation of iBasis revenues will contribute to the growth of our fixed activities and increase the contribution of IP-based services in our portfolio.”

“This transaction will establish the expanded iBasis as a Tier One player in the international wholesale voice market and one of the top five carriers of international traffic worldwide,” said Ofer Gneezy, President and CEO of iBasis. “In addition to its strengths in Europe, KPN Global Carrier Services provides long term sustainable revenues and bilateral relationships with major carriers around the world, as well as significant mobile traffic and relationships with European mobile operators. The combined depth, breadth and high quality of both networks are a tremendous benefit to our customers and to the internal sources of traffic, including KPN’s international traffic and iBasis’ retail prepaid traffic.”

Rationale

The transaction combines the companies’ strengths in two of the fastest growing segments of global telecommunications: mobile services and consumer VoIP. Furthermore the combination results in complementary geographic coverage by bringing together KPN Global Carrier Services’ extensive European and Asian footprint with iBasis’ strong presence in the Americas and Asia. KPN Global Carrier Services brings an established business in mobile services, including a reliable and high quality product portfolio and relationships with more than 100 mobile operators, as well as international traffic from KPN’s Dutch, German and Belgian operations. iBasis brings a global VoIP network comprising over 1,000 points of presence in more than 100 countries and interconnections with more than 400 carriers worldwide. iBasis is a leading international provider to emerging consumer VoIP companies, including major brands like Yahoo! and Skype.

As a result, KPN Global Carrier Services’ customers gain access to broader and more cost-efficient termination capacity in other regions, while iBasis customers gain access to a portfolio of dfanium services for mobile traffic and greater capacity in Europe. The international traffic stream from KPN’s retail services coupled with iBasis’ own retail traffic provides a strong and sustainable basis for continuing growth.

Pre-tax cost synergies of more than USD 10 million per year are expected in the medium term, resulting primarily from improved termination rates due to the increase in scale and economies of scale in the back office.

Financial details

Following completion of the transaction and after the post-closing dividend of USD 113 million has been paid to the existing shareholders, iBasis will continue to have a strong financial profile with virtually no debt.

Combined 2005 revenues of USD 1.1 billion is based on iBasis 2005 revenue of USD 0.4 billion and KPN Global Carrier Services 2005 revenue on a GAAP basis of USD 0.8 billion assuming current Euro/Dollar exchange rates, adjusted by USD 0.1 billion to reflect market rates on intra-company revenue transactions with KPN. This adjusted revenue is a non-GAAP measure used to present information about the combined company’s operations (see Use of Non-GAAP Financial Measure, below).

Anticipated financial results, as if the two entities were combined for the full year 2006, assuming the current Euro/Dollar exchange rate, and excluding synergies and integration-related expenses are:

Revenues of USD 1.2 - 1.25 billion

EBITDA of USD 45 - 50 million

Governance

Following completion of the transaction Ofer Gneezy will continue to serve as President and CEO, and Gordon VanderBrug will continue to serve as Executive Vice President of iBasis. The seven-member board of directors will consist of current directors Ofer Gneezy, as chairman, Robert Brumley, Charles Corfield, Frank King, and Gordon VanderBrug. KPN will appoint two non-executive directors: Eelco Blok, Member of the Board of Management of KPN and responsible for the Fixed Division and Joost Farwerck, Director of Segment Wholesale and Operations at KPN. In addition, KPN will nominate two independent Board members as the terms of the existing independent directors come up for renewal.

iBasis’ headquartes will remain in Burlington, Massachusetts, USA.

Listing on NASDAQ.

As previously announced, iBasis stock will begin trading on NASDAQ today, June 21, under the symbol IBAS. iBasis stock previously traded on OTCBB under the symbol IBSE.

Investor/analyst call

A joint investor/analyst conference call is scheduled for June 21, 16.00 hours CET /10:00 a.m. EDT. Dial-in numbers for the conference call are: US 1-8774527894: UK 0800-0288238; rest of Europe + 31 20 531 58 71. Replay conference call, dial in replay: +31 70 315 43 00, code replay: 124 424#

Access to the live webcast will be available on the KPN website at http://www.kpn.com/kpn/show/id=1430486/

About KPN

KPN offers telecommunication services to both consumers and businesses. The core activities are telephony, Internet and television services in the Netherlands, mobile telecom services in Germany, the Netherlands and Belgium and data services in Western Europe. KPN is the market leader in the major segments of the Dutch telecom market and is actively growing market share in the new IP and DSL markets. Through E-Plus and BASE, KPN occupies a strong position in the mobile markets in Germany and Belgium respectively.

As of March 31, 2006, KPN’s 28,647 employees served 6.7 million fixed-line subscribers and 2.2 million Internet customers in the Netherlands as well as 21.6 million mobile customers in Germany, the Netherlands and Belgium. KPN was privatized in 1989. KPN’s shares are listed on the stock exchanges in Amsterdam, New York, London and Frankfurt.

About iBasis

Founded in 1996, iBasis (NASDAQ:IBAS) is a leading wholesale carrier of international long distance telephone calls and a provider of retail prepaid calling services, including the Pingo® web-based offering (www.pingo.com) and disposable calling cards, which are sold through major distributors and available at retail stores throughout the U.S. iBasis customers include many of the largest telecommunications carriers in the world, including AT&T, Cable & Wireless, China Mobile, China Unicom, Verizon, Sprint, Skype, Yahoo, and Telefonica. iBasis carried approximately 8 billion minutes of international voice over IP (VoIP) traffic in 2005, and is one of the largest carriers of international voice traffic in the world. For four consecutive years service providers named iBasis the best international wholesale carrier in ATLANTIC-ACM’s annual International Wholesale Carrier Report Card[1]. The Company can be reached at its worldwide headquarters in Burlington, Massachusetts, USA at 781-505-7500 or on the Internet at www.ibasis.com.

iBasis and Pingo are registered marks, and the global VoIP company is a trademark of iBasis, Inc. All other trademarks are the property of their respective owners.

This communication may be deemed to be solicitation material in respect of the proposed transaction between iBasis and Royal KPN. In connection with the proposed transaction, iBasis intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A. STOCKHOLDERS OF IBASIS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING IBASIS’S PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site, http://www.sec.gov, and iBasis’s stockholders will receive information at an appropriate time on how to obtain transaction-related documents for free from iBasis. Such documents are not currently available.

Participants in Solicitation

Royal KPN and its directors and executive officers, and iBasis and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of iBasis Common Stock in respect of the proposed transaction. Information about the directors and executive officers of Royal KPN is set forth in the Annual Report on Form 20-F for the year ended 2005, which was filed with the SEC on March 14, 2006. Information about the directors and executive officers of iBasis is set forth in iBasis’s proxy statement for its 2006 Annual Meeting of Stockholders, which was filed with the SEC on March 23, 2006. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the transaction when it becomes available.

Safe Harbor for Forward-Looking Statements

Statements in this document regarding the proposed transaction between iBasis and Royal KPN, including the expected timetable for completing the transaction, the expected dividend payment, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding the parties’ future expectations, beliefs, goals or prospects constitute forward-looking statements made within the meaning of Section 21E of the Securities Exchange Act of 1934. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates” and similar expressions) should also be considered forward-looking statements. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements, including the parties’ ability to consummate the transaction due to regulatory restrictions, the failure to receive stockholder approval, or other reasons, the ability of iBasis and Royal KPN to successfully integrate their operations and employees, the ability to realize anticipated synergies, the emergence of new competitive initiatives resulting from rapid technological advances or changes in pricing in the market, business conditions and volatility and uncertainty in the markets that iBasis and Royal KPN serve, and the other factors described in iBasis’s Quarterly Report on Form 10-Q for its most recently completed fiscal quarter and Annual Report on Form 10-K for its most recently completed fiscal year and Royal KPN’s Annual Report on Form 20-F for its most recently completed fiscal year all of which are available at www.sec.gov. The parties expressly disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this release.

Use of Non-GAAP Financial Measures

Adjusted revenue for KPN reflect adjustments to market rates on intra-company revenue transactions with Royal KPN N.V. Investors are cautioned that the adjusted revenue information contained in this press release is not a financial measure under United States generally accepted accounting principles. In addition, it should not be construed as an alternative to any other measures of performance determined in accordance with generally accepted accounting principles. This adjusted revenue measure is presented because iBasis believes that it is helpful to some investors as a measure of the combined company’s potential operating trends. iBasis cautions investors that Non-GAAP financial information by its nature, departs from traditional accounting conventions; accordingly, its use can make it difficult to compare this information with information provided by other companies.

For further information:

| Media | | Investors | |

| Chris Ward | Marinus Potman | Richard Tennant | Eric Hageman |

| iBasic, Inc | KPN | iBasis, Inc. | KPN |

| +1 781 505 7557 | +31 70 44 66 300 | +1 781 505 7409 | + 31 70 34 39 144 |

| cward@ibasis.net | marinus.potman@kpn.com | ir@ibasis.net | ir@kpn.com |

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction between iBasis and KPN. In connection with the proposed transaction, iBasis intends to file the proxy statement with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, INCLUDING THE IBASIS PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT IBASIS, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain the documents free of charge at the SEC's website, www.sec.gov, and will receive information at an appropriate time on how to obtain transaction-related documents for free from iBasis and will be able to view such documents on the iBasis website at www.ibasis.com. Such documents are not currently available.

Participants in Solicitation

KPN and its directors and executive officers, and iBasis and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of iBasis Common Stock in respect of the proposed transaction. Information about the directors and executive officers of KPN is set forth in the Annual Report on Form 20-F for the year ended December 31, 2005, which was filed with the SEC on March 14, 2006. Information about the directors and executive officers of iBasis is set forth in iBasis’s proxy statement for its 2006 Annual Meeting of Stockholders, which was filed with the SEC on March 23, 2006. Investors and security holders may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the transaction when it becomes available.

Safe Harbor for Forward-Looking Statements

Statements in this document regarding the proposed transaction between iBasis and KPN, including the expected timetable for completing the transaction, the expected dividend payment, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding the parties’ future expectations, beliefs, goals or prospects, constitute forward-looking statements under Section 21E of the Securities Exchange Act of 1934 and involve risks and uncertainties. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates” and similar expressions) should also be considered forward-looking statements. A number of important factors could cause actual results or

events to differ materially from those indicated by such forward-looking statements, including the parties’ ability to consummate the transaction due to regulatory restrictions, the failure to receive stockholder approval, the ability of iBasis and KPN to successfully integrate their operations and employees, the ability to realize anticipated synergies, the emergence of new competitive initiatives resulting from rapid technological advances or changes in pricing in the market, business conditions and volatility and uncertainty in the markets that iBasis and KPN serve, and the other factors described in iBasis’s Quarterly Report on Form 10-Q for its most recently completed fiscal quarter and Annual Report on Form 10-K for its most recently completed fiscal year, and in KPN’s Annual Report on Form 20-F, and other SEC filings, all of which are available at www.sec.gov. Such forward-looking statements are only as of the date they are made, and we expressly disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this release.