Exhibit 99.(a)(5)(iv)

[ubiqus] CERTIFICATE OF ACCURACY I, the undersigned, Arend Bakker, declare that I am fluent in the English and Dutch languages; that I have translated, transcribed, reviewed and/or edited the following Dutch source file. Van Dijck Tab 23.pdf I certify that to the best of my knowledge, ability and belief the same is a true and complete translation/transcription of the documents presented to me. /s/ Arend Bakker (Translator) www.ubiqus.com Ubiqus — West Coast Meeting Services Ubiqus — East Coast 2222 Martin Street, Suite 212 Transcription 22 Cortlandt Street, Suite 802 Irvine, CA 92612 Translation / Interpretation New York, NY 10007 ph. (949) 477 4972 Audience Response Systems ph. (212) 227 7440

From: Dijk, van, J.A. (Johannes) (W&O Financial BC Portfolio Management)

Sent: Friday, October 24, 2008 9:53 AM

To: Blok, E. (Eelco) (Board of Directors KPN); Costermans, H.J. (Huib) (W&O Financial Manager); Dijk, V. (Vincent) (W&O PFM Manager); Farwerck, J.F.E. (Joost) (W&O Director)

Cc: Koetsier, J.M. (Jeroen) (W&O Financial BC Portfolio Management); Krijger, P. (Paul) (W&O Financial BC Portfolio Management); Nijs, de, H.W. (Henk) (W&O Financial BC Portfolio Management); Essing, P.J.M. (Pieter) (W&O PFM WS Interconnection Services); Erp, van, P.C. (Peter) (W&O PFM WS Interconnection Services)

Subject: ibasis bp 2009 and acquisition update v02.ppt

Follow Up Flag: Follow up

Flag Status: Yellow

Attachements: ibasis bp 2009 and acquisition update v02.ppt

Gentlemen, Hereby a status update business plan iBasis 2009. Greetings Johannes

From: Dijk, van, J.A. (Johannes) (W&O Financin BC Portfolio Management)

Sent: Friday, October 24, 2008 9 53 AM

To. Blok, E. (Eelco) (Raad van Bestuur KPN); Costermans, H.J. (Huib) (W&O Financiën Manager); Dijk, V. (Vincent) (W&O PFM Manager); Farwerck, J. F. E. (Joust) (W&O Directeur) Cc: Koetsier, J.M. (Jeroen) (W&O Financiën BC Portfolio Management); Krijger, P. (Paul) (W&O Financiën BC Portfolio Management); Nijs, de, H.W. (Henk) (W&O Financiën BC Portfolio Management); Easing, P.J. M. (Pieter) (W&O PFM WS Interconnection Services); Erp., van, P C. (Peter) (W&O PFM WS Interconnection Services)

Subject: ibasis bp 2009 and aquisition update v02.ppt

Follow Up Flag: Opvolgen

Flag Status: Yellow

Attachments: ibasis bp 2009 and aquisition update v02.ppt

Heren, Hierbij een status update businessplan iBasis 2009.

Gr Johannes

| | | JX 051 | |

Confidential | | KPN00034401 | |

kpn iBasis Acquisition & Business Plan 2009 Status Update October 2008 1 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 November 2007 Confidential KPN00034403

kpn 0 Zakelijke Markt, KPN B.V. Boekwinst iBasis Confidential 15 november 2007 Confidential KPN00034402

Contents 1. What we thought in 2007. Original KPN KGCS/iBasis case 2. What we see happening in 2008 Observations Summary Observations Financial Performance Observations Trading Traffic 3. How will 2009 look like Business plan Market value iBasis 4. Concluding Summary analysis & findings Next steps 2 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034404

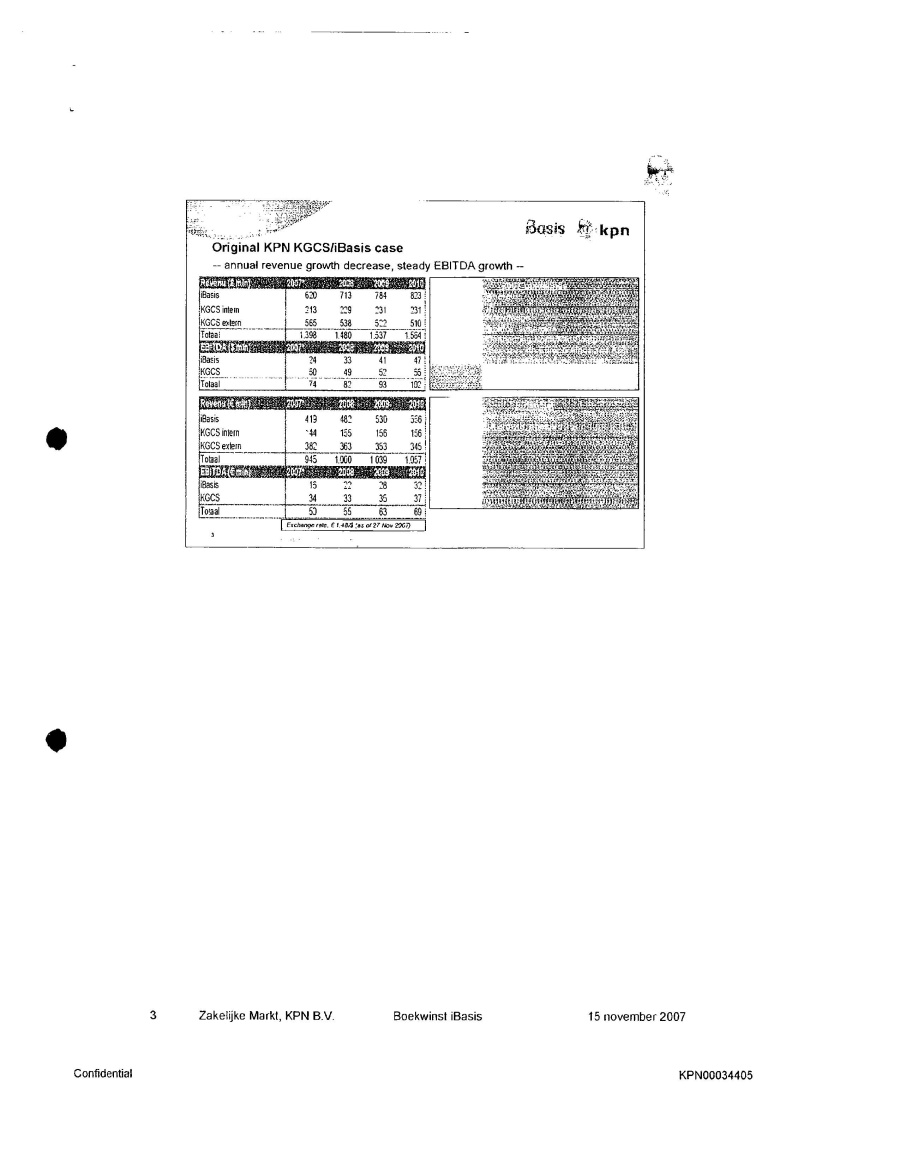

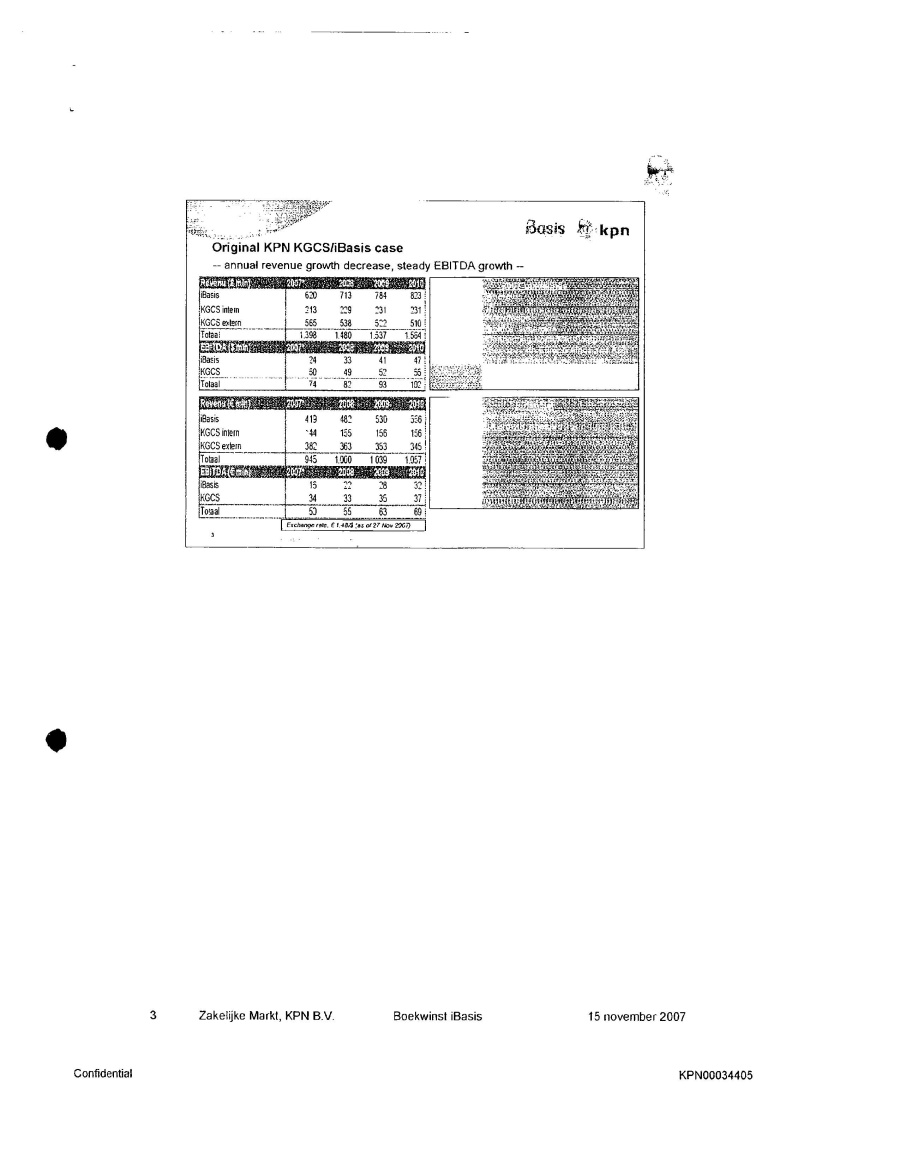

iBasis kpn Original KPN KGCS/iBasis case annual revenue growth decrease, steady EBITDA growth Revenue ($min) 2007 2008 2009 2010 iBasis 620 713 784 823 KGCS intern 213 229 231 231 KGCS extern 565 538 522 510 Totaal 1,398 1,480 1,537 1,564 EBITDA ($min) 2007 2008 2009 2010 iBasis 24 33 41 47 KGCS 50 49 52 55 Totaal 74 82 93 102 Revenue (€ min) 2007 2008 2009 2010 iBasis 419 482 530 556 KGCS intern 44 155 156 156 KGCS extern 382 363 353 345 Totaal 945 1.000 1.039 1.057 EBITDA (€ min) 2007 2008 2009 2010 iBasis 15 22 28 32 KGCS 34 33 35 37 Totaal 50 55 63 69 Exchange rate. € 1.485 (as of 27 Nov 2007) 3 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 1007 Confidential KPN00034405

1. What we thought in 2007 Original HPN KGCS/iBasis case 2. What we see happening in 2008 Observations Summary Observations Financial Performance Observations Trading Traffic 3. How will 2009 look like Business plan Market value iBasis 4. Concluding Summary analysis & findings Next steps 4 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034406

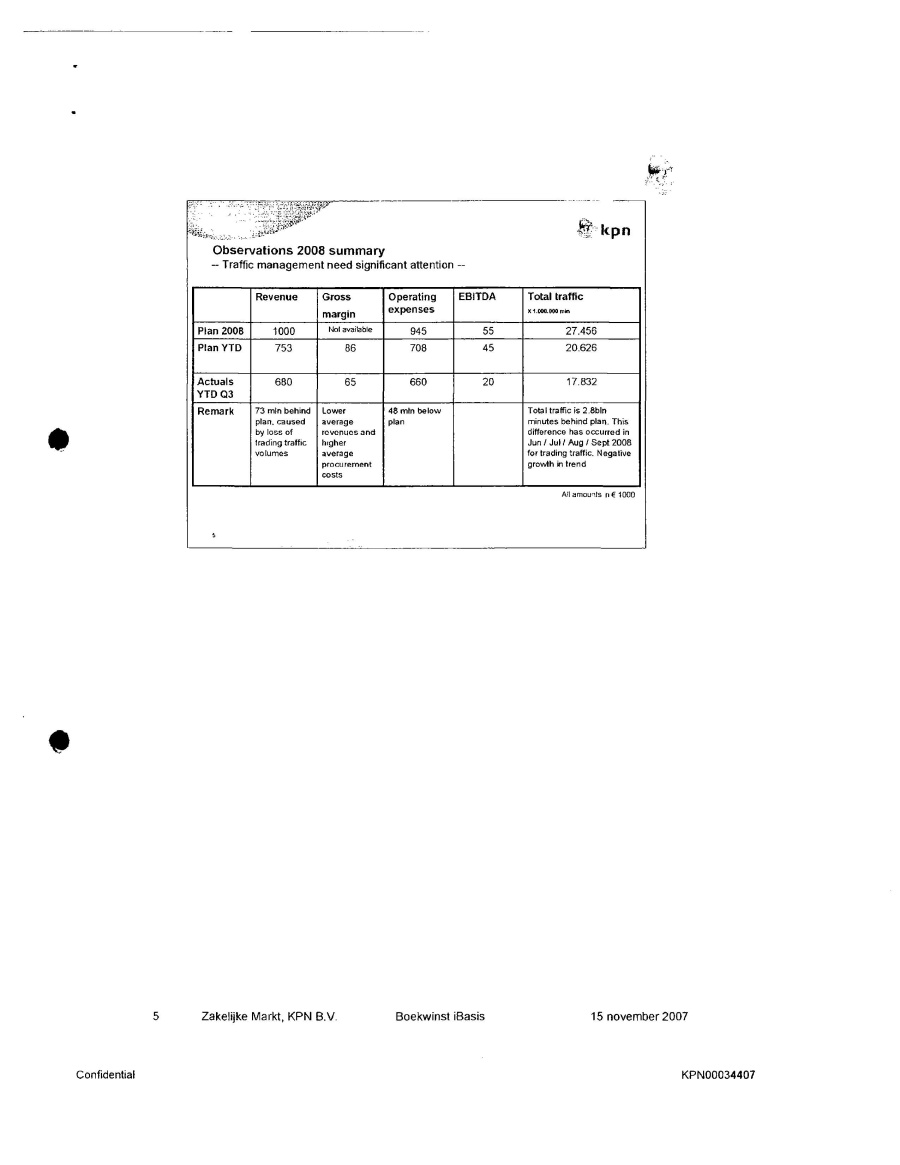

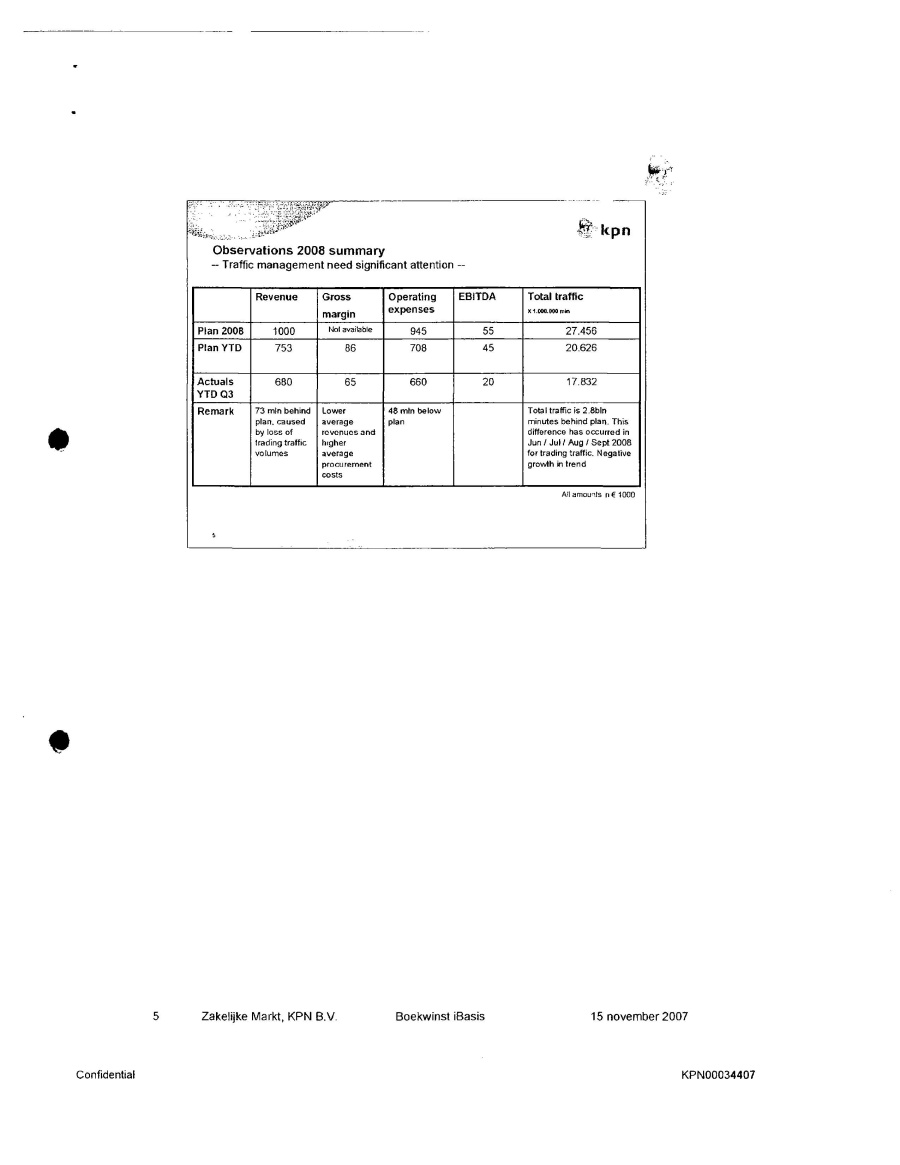

kpn Observations 2008 summary Traffic management need significant attention Revenue Gross margin Operating expenses EBITDA Total traffic x 1,000,000 min Plan 2008 1000 Not available 945 55 27.456 Plan YTD 753 86 708 45 20.626 Actuals YTD Q3 680 65 660 20 17.832 Remark 73 min behind plan, caused by loss of trading traffic volumes Lower average revenues and higher average procurement costs 48 min below plan Total traffic is 2.8bln minutes behind plan. This difference has occurred in Jun / Jul / Aug / Sept 2008 for trading traffic. Negative growth in trend All amounts in € 1000 5 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034407

kpn Observations financial performance: EBITDA in detail EBITDA far behind plan due to lower revenues and traffic EBITDA DEVELOPMENT ACTUAL 2006 vs ANNUAL PLAN 50,000 45,000 40,000 35,000 30,000 25,000 20,000 15,000 10, 000 5,000 0 JAN FEB MAR APR MAY JUN JUL AUG SEP On average compared to the previous month in 2008 the EBITDA September is € 1.9 min above average (incidentals 0,7 min) Outlook 2008 an EBITDA of € 27 min seems achievable 6 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034408

kpn Observations trading traffic Growth synergies not happening, negative traffic growth since April 2008 Relative Development Trading Traffic 2008 in comparison to 2007 Total traffic minutes YTD 2008 are 17.8 billion minutes. The lack of trading traffic minutes causes the decline in the total traffic. Also this traffic shows a negative development related to 2007 KPN GCS and iBasis expected the greatest benefits from this traffic stream 7 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034409

kpn 1. What we thought in 2007 Original KPN KGCS/iBasis case 2. What we see happening in 2008 Observations Summary Observations Financial Performance Observations Trading Traffic How will 2009 look like Business plan Market value iBasis Concluding Summary analysis & findings Next steps 8 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidentail KPN00034410

2009 key plan figures, as delivered on October 6th 2008 very aggressive targets based on 2008 YEE All amounts in €1000 Revenue EBITDA Operating expenses Trading traffic x1.000.000 min 2008 Plan 753 45 708 27.456 2008 YEE 940 27 913 Not available 2009 Plan 1003(10% growth on YEE) 43 (60% growth on YEE) 960 15% growth on YEE) Not available 2010 Plan * 1021 44 977 Not available 2011 Plan * 1040 45 995 Not available * prognoses by KPN team analysts 9 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034411

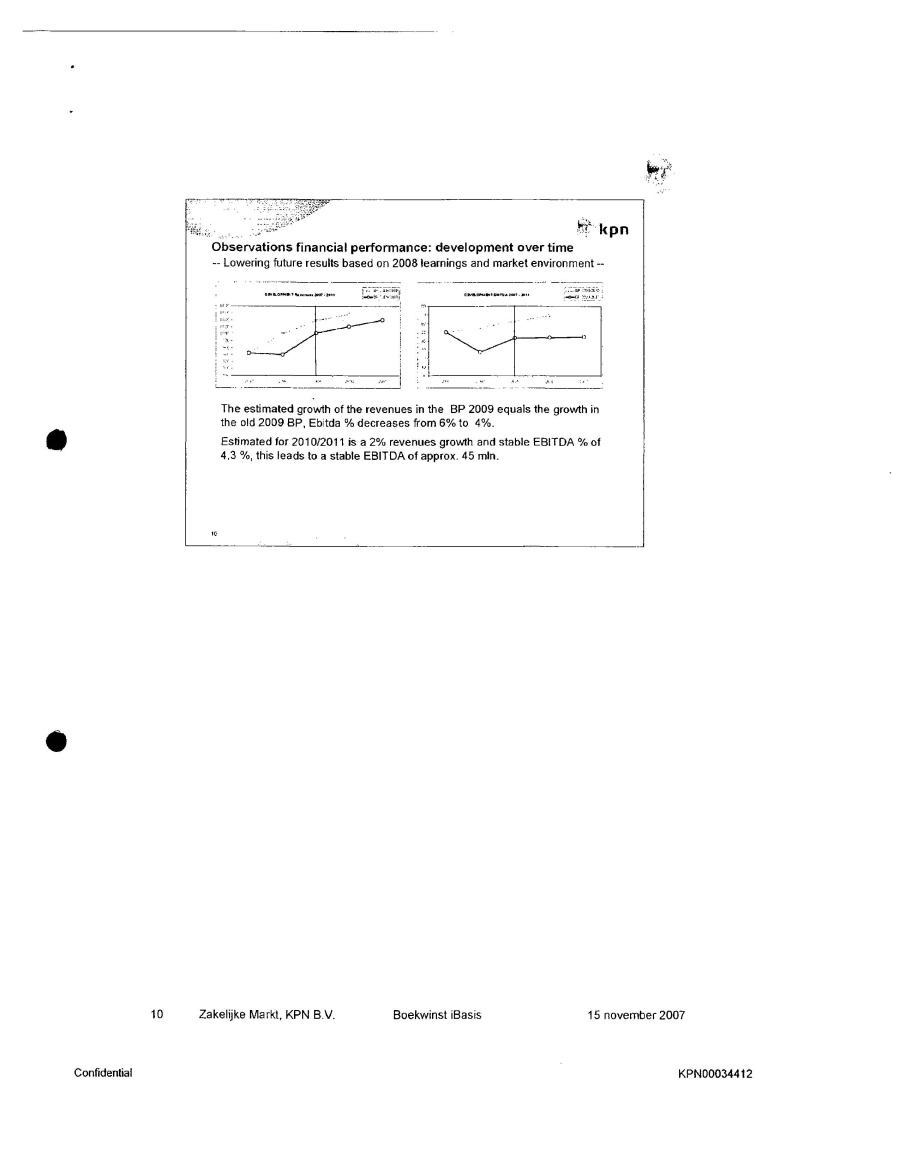

kpn Observations financial performance: development over time Lowering future results based on 2008 learnings and market environment The estimated growth of the revenues in the BP 2009 equals the growth in the old 2009 BP, Ebitda % decreases from 6% to 4%. Estimated for 2010/2011 is a 2% revenues growth and stable EBITDA % of 4.3 %, this leads to a stable EBITDA of approx. 45 min. 10 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00024412

kpn Intercompanies Intercompanies showing growth on revenues from KPN Parties 2008 Estimated n/t? 2009 Revenues Expenses Revenues Expenses SNT Deutschland (AG) 993 0 903 INS 1,347 7,949 74 4,600 W&O Central 0 0 W&O Voice Services 102,808 103,475 94,200 84,800 RES 663 300 Network Operator 0 1,500 BASE NV 22,062 6,023 31,726 4,076 E-Plus Germany 63,621 4,901 40,000 4,418 F-Plus Spain 112 0 497 T2 Belgium 563 31 560 540 IT ML 0 1,473 350 181,265 126,236 177,956 100,584 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN 00034413

kpn Market value iBasis (Oct 20th 2008) After one year in business the market value has dropped by 80% Date Stock Rate Dollar xrate Stock % in Euro Value on KPN Stock 20 10 2009 2.35 0.7511 73,375.000 100% 113,528,332 40,121.074 35% 52,077,021 KPN Contribution 31-10-2007 Additional cash for KPN CCS 20,000,000 Cash Payment from KPN to iBasis 40,000.000 Net Profit KPN GCS 22,000,000 Multipliers 4.0 Estimated value of KPN GCS 80,000,000 Subtotal Contribution 148,000,000 Book Profit 72,000,000 Total value contributed by KPN 76,000,000 20-10-2008 Current surplus value -13,922,929 Outstanding stock KPN Shares Institutional Board Members Others Institutionals GMT Capital Cor. Millenium Mana. Kampe, Conway & Greywolf Capita. Barclays Global Other institutional 12 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034414

kpn Contents 1. What we thought in 2007 Original KPN KGCS/iBasis case 2. What we see happening in 2008 Observations Summary Observations Financial Performance Observations Trading Traffic 3. How will 2009 look like Business plan Market value iBasis 4. Concluding Summary analysis & findings Next steps 13 Zakelijke Markt, KPN B.V. boekwinst iBasis 15 november 2007 Confidential KPN00034415

kpn Summary of analysis & findings Time for action KPN GCS and iBasis expected the greatest benefits from this traffic stream Total trading traffic minutes far behind plan The lack of trading traffic minutes causes the decline in the total traffic. This traffic too shows a negative development related to 2007 Expect lower margins due to fierce competition in EU and potentially other regions The estimated growth of the revenues in the BP 2009 equals the growth in the old 2009 BP, EBITDA % decreases from 6% to 4% Estimated for 2010/2011 is a 2% revenues growth and stable EBITDA % of 4,3% that leads to a stable EBITDA of approx. 45 min. 14 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034416

Next steps Discussion topics Nov 6th meeting Business Plan "Back to Growth" Independent iBasis operations Dec 15th iBasis BP 2009 finalized Updated & signed framework & schedules Jan 15th 15 Zakelijke Markt, KPN B.V. Boekwinst iBasis 15 november 2007 Confidential KPN00034417

DEVELOPMENT Revenues 2007 - 2011 BP 2008-2010 BP 2009-2011 1,080 1,060 1,040 1,020 1,000 980 960 940 920 900 880 2007 2008 2009 2010 2011 Confidential KPN00034418

Aquisitiecase - - toezeggingen versus Actuals

iBasis Group Amounts Euro x 1000

Revenues

EBITDA Analyse

iBasis

YEE EBITDA is -56% beneden plan 2008. Gevolg van achterblijvende omzet van - 10% en lagere Kosten van - 7%. Dit ten gevolge van achterblijvende volumes van 13% YEE EBITDA is -56% beneden plan 2008. Gevolg van achterblijvende omzet van - 10% en lagere Kosten van - - 7%. Dit ten gevolge van achterblijvende volumes van 13% YEE EBITDA is 56% beneden plan 2008 Gevolg van achterblijvende omzet en lagere kosten ten gevolge van achterblijvende volumes In relatie tot de hoogtse van de omzet liggen de kosten 3% boven plan Kawntiteiten zorgen voor absolute daling van omzet en kosten Prijs per minuut stijgt. waarbij de inkoop harder toeneemt dan de gemiddelde verkoopprijs per minuut Ontwikkeling aandelenkoers Aandelen KPN Aankoopkoers (30-09-07) Confidential KPN 0034421

Huidige koers (20-10-08)

Wisselkoers

1 Q4 2007 Q3 2008 YEE 2008 AP 2008 BP 2008 BP 2010 BP 2011 916 29 945 708 94% -49 -7% 660 97% Plan 753 940 1,000 1,038 1,057 -6% 2% Actual 245 680 940 -10% BP 2009-2011 1,003 1,021 1,040 Plan 45 24 55 63 69 -56% 6% Actual 5 20 27 -56% BP 2009-2011 43 44 45 0.0430707988 2 -10% - 10% -7% - 7% -13% - 13% Dollarwaarde 40,121,074 stuke 10.750 USD 431,301,546 USD Confidential KPN00034423

| | 2.060 USD | 82,649,412 USD | |

| 9/30/2007 | 1.414 EUR | | |

| 10/20/2008 | 1.331 EUR | | |

Revenues 2007 2008 2009 2010 2011 GROEI 2008 2009 2010 2011 BP 2008-2010 945 1,000 1,039 1,057 5.82% 3.90% 1.73% BP 2009-2011 945 940 1,003 1,021 1,040 -0.53% 6.70% 1.83% 1.83% Costs 2007 2008 2009 2010 2011 GROEI 2008 2009 2010 2011 BP 2008-2010 895 945 976 988 5.59% 3.28% 1.23% BP 2009-2011 895 913 960 977 995 2.01% 5.13% 1.83% 1.83% EBITDA 2007 2008 2009 2010 2011 GROEI 2008 2009 2010 2011 BP 2008-2010 50 55 63 69 10.00% 14 55% 9.52% BP 2009-2011 50 27 43 44 45 - -46.00% 60.00% 1.83% 1.83% Development EBITDA 2008-2011 BP 2008- 2010 BP 2009-2011 80 70 60 50 40 30 20 10 0 2007 2008 2009 2010 2011 DEVELOPMENT Revenues 2007 - 2011 BP 2008- 2010 BP 2009-2011 1,080 1,060 1,040 1,020 1,000 980 960 940 920 900 880 2007 2008 2009 2010 2011 Confidential KPN00034425

Development EBITDA 2007-2011 BP 2008-2010 BP 2009-2011 80 70 60 50 40 30 20 10 0 2007 2008 2009 2010 2011 Confidential KPN00034426

Aquisitiecase - - toezeggingen versus Actuals

iBasis Group

Amounts Euro x 1000

Revenues

EBITDA

Analyse iBasis

YEE EBITDA is -56% beneden plan 2008. Gevolg van achterblijvende omzet van - 10% en lagere kosten van - 7%. Dit ten gevolge van achterblijvende volumes van 13% YEE EBITDA is -56% beneden plan 2008. Gevolg van achterblijvende omzet van - 10% en lagere kosten van - - 7%. Dit ten gevolge van achterblijvende volumes van 13% YEE EBITDA is 56% beneden plan 2008 Gevolg van achterblijvende omzet en lagere koten ten gevolge van achterblijvende volumes In relatie tot de hoogtse van de omzet liggen de kosten 3% boven plan Kwantiteiten zorgen voor absolute daling van omzet en kosten Prije per minuut stijgt. waarbij de inkoop toeneemt dan de gemiddelde verkoopprijs per minuut Ontwikkeling aandelenkoers Aandelen KPN Aankoopkoers (30-09-07) Confidential KPN 0034429

Huidige koers (20-10-08)

Wisselkoers

1 Q4 2007 Q3 2008 YEE 2008 AP 2008 BP 2009 BP 2010 BP 2011 916 29 945 708 94% -49 - -7% 660 97% Plan 753 940 1,000 1,038 1,057 -6% 2% Actual 245 680 940 - -10% BP 2009-2011 1,003 1,021 1,040 Plan 45 24 55 63 69 -56% 6% Actual 5 20 27 - -56% BP 2009-2011 43 44 45 0.043070788 2 -10% - 10% -7% - 7% -13% - 13% Dollarwaarde 40,121,074 stuks 10.750 USD 431,301,546 USD Confidential KPN000344331

| | 2.060 USD | 82,649,412 USD | |

| 9/30/2007 | 1.414 EUR | | |

| 10/20/2008 | 1.331 EUR | | |

Revenues 2007 2008 2009 2010 2011 GROEI 2008 2009 2010 2011 BP 2008-2010 945 1,000 1,039 1,057 5.82% 3.90% 1.73% BP 2009-2011 945 940 1,003 1,021 1,040-0.53% 6.70% 1.83% 1.83% Costs 2007 2008 2009 2010 2011 GROEI 2008 2009 2010 2011 BP 2008-2010 895 945 976 988 5.59% 3.28% 1.23% BP 2009-2011 895 913 960 977 995 2.01% 5.13% 1.83% 1.893% EBITDA 2007 2008 2009 2010 2011 GROEI 2008 2009 2010 2011 BP 2008-2010 50 55 63 69 10.00% 14.55% 9.52% BP 2009-2011 50 27 43 44 45 -46.00% 60.00% 1.83% 1.83% Development EBITDA 2007-2011 BP 2008-2010 BP 2009-2011 80 70 60 50 40 30 20 10 0 2007 2008 2009 2010 2011 Development Revenues 2007-2011 BP 2008-2010 BP 2009-2011 1,080 1,060, 1,040, 1,020, 1, 000, 980, 960, 940, 920, 900, 880 2007, 2008, 2009 2010 2011 Confidential KPN00034433