UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement |

¨ | | Definitive Additional Materials |

¨ | | Soliciting Material Pursuant to §240.14a-12 |

Emeritus Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i) (4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

EMERITUS CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 14, 2006

To the Shareholders of Emeritus Corporation:

The annual meeting of shareholders of Emeritus Corporation will be held in the South Cascade Room of the Harbor Club, Norton Building, 801 Second Avenue, 17th Floor, Seattle, Washington 98104, on Wednesday, June 14, 2006, at 10:00 a.m., local time, and any adjournments thereof, to consider and act upon the following matters:

| 1. | To elect two directors into Class I of the Board of Directors. |

| 2. | To approve the Emeritus 2006 Equity Incentive Plan. |

| 3. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2006. |

| | 4. | To transact such other business as may properly come before the meeting and any adjournments thereof. |

The Board of Directors recommends that you vote FOR the election of the director nominees, FOR the Emeritus Corporation 2006 Equity Incentive Plan and FOR the ratification of appointment of KPMG LLP as our independent registered public accounting firm.

The Board of Directors has fixed the close of business on April 14, 2006, as the record date for the determination of shareholders entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements thereof. Shareholders are cordially invited to attend the annual meeting in person.

By Order of the Board of Directors

/s/ Daniel R. Baty

Daniel R. Baty

Chairman of the Board

and Chief Executive Officer

Seattle, Washington

April 28, 2006

EMERITUS CORPORATION

3131 Elliott Avenue, Suite 500

Seattle, Washington 98121

PROXY STATEMENT

This proxy statement and the enclosed proxy card, which was first mailed to our shareholders on or about May 12, 2006, is furnished to shareholders in connection with the solicitation of proxies by the Board of Directors for the annual meeting of shareholders to be held at the South Cascade Room of the Harbor Club, Norton Building, 801 Second Avenue, 17th Floor, Seattle, Washington 98104, on Wednesday, June 14, 2006, at 10:00 a.m., local time and any adjournments or postponements of the annual meeting. You may revoke your proxy in writing at any time before it is exercised by filing with our Corporate Secretary a written revocation or a duly executed proxy bearing a later date. You may also revoke your proxy by attending the annual meeting and voting in person. If the enclosed form of proxy is properly executed and returned, it will be voted in accordance with the instructions given, unless revoked.

As of April 14, 2006, the record date for the annual meeting, there were 17,890,534 shares of common stock issued and outstanding. Holders of common stock are entitled to one vote for each share. Therefore the total number of votes entitled to be cast at the annual meeting is 17,890,534 votes. Holders of common stock representing a majority of total votes entitled to be cast, present in person or represented by proxy, will constitute a quorum.

Directors will be elected by a plurality of the votes present by proxy or in person at the annual meeting. Shareholders are not entitled to cumulate votes in the election of directors. The proposal to ratify the appointment of the accountants will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. The 2006 Equity Incentive Plan will be approved if a majority of the total votes cast on the proposal vote to approve the plan.

Abstention from voting on any of the proposals will not affect the outcome of the proposal since no vote will have been cast for the proposal. Brokers who hold shares for the accounts of their clients have discretionary authority to vote shares as to which instructions are not given with respect to the election of directors and the ratification of the appointment of accountants. Brokers do not have discretionary authority to vote on the proposal to approve the 2006 Equity Incentive Plan but broker non-votes will not affect the outcome of this proposal. Abstentions and broker non-votes will be counted for purposes of determining whether there is a quorum at the annual meeting.

We will bear the cost of soliciting proxies. Certain of our directors, officers, and regular employees, without additional compensation, will solicit proxies personally or by telephone or facsimile. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares of common stock for their expenses in forwarding solicitation materials to such beneficial owners.

As of the date hereof, we are not aware of any matters to be voted upon at the annual meeting other than as stated in the accompanying Notice of Annual Meeting of Shareholders. The accompanying proxy gives discretionary authority to the person named therein to vote the shares in his best judgment if any other matters are properly brought before the annual meeting.

PROPOSAL FOR ELECTION OF DIRECTORS

(PROPOSAL 1)

The Board of Directors is divided into three classes. One class is elected each year by the shareholders. At the annual meeting, two directors will be elected to serve for a term of three years, expiring on the date of the annual meeting of shareholders in 2009. All of the nominees are currently directors. If elected, the nominees will continue in office until a successor has been elected or until resignation or removal in the manner provided by our Bylaws. The names of directors nominated for the terms, as well as the directors whose terms will continue after the annual meeting, are listed below.

Pursuant to a shareholders’ agreement dated as of December 10, 1999, we and Mr. Baty have agreed to take all necessary action to elect a number of directors selected by Saratoga Partners IV, L.P. that constitutes not less than the percentage of the entire Board that equals Saratoga's percentage ownership of our voting securities. Based on a Board of eight directors, Saratoga is entitled to select at least three directors, but has thus far chosen to select only two. Since 1999, Messrs. Niemiec and Durkin have been nominated and elected under this arrangement.

Nominees for Election

Class I Directors (terms to expire in 2009)

Robert E. Marks (age 54), has been a director of Emeritus since July 2005, when he was appointed to the Board. From 1994 to the present, Mr. Marks has been the President of Marks Ventures, LLC, a private equity investment firm. He is a director and Chairman of the Board of Denny's Corporation and a director of Soluol Chemical Company and Brandrud Furniture Company, as well as a member of the Board of Trustees of the Fisher House Foundation and The International Rescue Committee.

David W. Niemiec (age 56), has served as a director of Emeritus since December 30, 1999. From September 1998 to November 2001, Mr. Niemiec was a Managing Director of Saratoga Management Company LLC, the manager of a group of private equity investment funds operated under the name of Saratoga Partners. Currently, he acts as an advisor to the group. Prior to joining the Saratoga Group, he worked at the investment banking firm of Dillon, Read & Co. beginning in 1974 and served as its Vice Chairman from 1991 through September 1997, when the firm was acquired by Swiss Bank Corporation. From September 1997 to February 1998, he was Managing Director of the successor firm, SBC Warburg Dillon Read, Inc.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE DIRECTOR NOMINEES

Continuing Directors

Class II Directors (terms to expire in 2007)

Stanley L. Baty (age 34), has served as a director since September 2004. Mr. Baty is the son of Daniel R. Baty, Chairman of the Board and Chief Executive Officer. Stanley L. Baty is the Vice President for Columbia Pacific Management, Inc. (“CPM”), where he is responsible for real estate related investment decisions. Prior to that, from 1994 to 1996, Mr. Baty was a financial analyst for Nomura Securities Corporation.

Raymond R. Brandstrom (age 53), one of Emeritus's founders, has served as a director since its inception in 1993. From 1993 to March 1999, Mr. Brandstrom also served as Emeritus's President and Chief Operating Officer. In March 2000, Mr. Brandstrom was elected Vice President of Finance, Chief Financial Officer and Secretary of Emeritus. From May 1992 to October 1996, Mr. Brandstrom served as President of Columbia Pacific Group, Inc. and CPM. From May 1992 to May 1997, Mr. Brandstrom served as Vice President and Treasurer of Columbia Winery, a company previously affiliated with Mr. Baty that is engaged in the production and sale of table wines.

T. Michael Young (age 61), has been a director of Emeritus since April 2004, when he was appointed to the Board. He is the Chairman of the Board of Directors of Metal Supermarkets (Canada), Ltd., a privately-held metal distributor with locations in the United States, Canada, Europe, and the Middle East, and has held this position since December 2005. From December 2002 through December 2005 he was President and Chief Executive Officer of that company. In October 2003, he was elected to the Board of Directors of that company. Prior to that, from June 1998 to May 2002, Mr. Young was Chairman of the Board of Transportation Components, Inc., a publicly-held distributor of replacement parts for commercial trucks and trailers, and also served as its President and Chief Executive Officer from June 1998 to May 2001. On May 7, 2001, Transportation Components filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division. The company was later liquidated in June 2002. In March 2005, Mr. Young joined the Board of Directors of Restoration Hardware, Inc., a public company whose shares are traded on the NASDAQ Exchange. Mr. Young is a Certified Public Accountant and former partner of Arthur Andersen & Co.

Class III Directors (term to expire in 2008)

Daniel R. Baty (age 62), one of Emeritus's founders, has served as its Chief Executive Officer and as a director since its inception in 1993 and became Chairman of the Board in April 1995. Mr. Baty also has served as the Chairman of the Board of Holiday Retirement Corporation since 1987 and served as its Chief Executive Officer from 1991 through September 1997. Since 1984, Mr. Baty has also served as Chairman of the Board of Columbia Pacific Group, Inc. and, since 1986, as Chairman of the Board of Columbia Pacific Management, Inc (“CPM”). Both of these companies are wholly owned by Mr. Baty and are engaged in developing independent living facilities and providing consulting services for that market. Mr. Baty is the father of Stanley L. Baty, a current director of our company.

Bruce L. Busby (age 62), has been a director of Emeritus since April 2004, when he was appointed to the Board. Mr. Busby served as Chairman and Chief Executive Officer of The Hillhaven Corporation prior to its merger with Vencor, Inc. in 1995, when he retired. Hillhaven was a publicly-held operator of skilled nursing facilities based in Tacoma, Washington, and prior to its merger, it operated 350 facilities in 36 states. During his tenure with Hillhaven, Mr. Busby served as the Chief Executive Officer and as a director beginning in April 1991 and as that company’s Chairman of the Board from September 1993 until the merger with Vencor. Mr. Busby, who has been a Certified Public Accountant for over thirty years, has been retired since 1995.

Charles P. Durkin, Jr. (age 67), has served as a director of Emeritus since December 30, 1999. Mr. Durkin is one of the founders of Saratoga Partners, a private equity investment firm. Since Saratoga's formation as an independent entity in September 1998, he has been a Managing Director of Saratoga Management Company LLC, the manager of the Saratoga Partners funds. Prior to that, from September 1997, he was a Managing Director of SBC Warburg Dillon Read, Inc., the successor entity to Dillon, Read & Co., where Mr. Durkin started his investment banking career in 1966 and became a Managing Director in 1974.

Information on Committees of the Board of Directors and Meetings

The Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. A majority of our Board of Directors is composed of independent directors, who each meet the independent listing standards of the American Stock Exchange.

The Audit Committee. Our Audit Committee currently consists of Messrs. Busby (Chairman), Young, and Marks, each of whom is independent in accordance with applicable rules promulgated by the Securities and Exchange Commission ("SEC") and the American Stock Exchange Listing standards (Patrick R. Carter, Lord Carter of Coles, served on the committee through October 2005, when he resigned). The Audit Committee selects and retains the independent registered public accounting firm to audit the Company's annual financial statements, approves the terms of the engagement of the independent registered public accounting firm and reviews and approves the fees charged for audits and for any non-audit assignments. The Audit Committee's responsibilities also include overseeing (1) the integrity of the Company's financial statements, which includes reviewing the scope and results of the annual audit by the independent registered public accounting firm, any recommendations of the independent registered public accounting firm resulting from the annual audit and management's response thereto and the accounting principles being applied by the Company in financial reporting, (2) the Company's compliance with legal and regulatory requirements, (3) the independent registered public accounting firm’s qualifications and independence, (4) the performance of the Company's internal and independent registered public accounting firm, and (5) such other related matters as may be assigned to it by the Board of Directors. The Board of Directors has adopted a written charter for the Audit Committee, which was revised as of April 19, 2004, a copy of which is posted on the Company's website at http://www.emeritus.com/Investors/default.aspx The Audit Committee met nine times during 2005.

The Board of Directors has determined that each of Mr. Young and Mr. Busby qualify as an "audit committee financial expert" as defined in Section 401(h) of Regulation S-K promulgated by the SEC and that all members of the Audit Committee are financially literate and independent in accordance with the requirements of the SEC and the American Stock Exchange.

Compensation Committee. Our Compensation Committee is responsible for administering our executive compensation programs including salaries, incentives, and other forms of compensation for directors, officers and our other key employees, and making recommendations with respect to such programs to the Board; administering the 1995 Stock Incentive Compensation Plan and the proposed 2006 Equity Incentive Plan; and recommending policies relating to benefit plans to the Board. In April 2004, the Board of Directors adopted a written Compensation Committee Charter. Our Compensation Committee currently consists of Robert E. Marks (Chairman) and Messrs. Busby, and Durkin (Patrick R. Carter, Lord Carter of Coles, served on the Compensation Committee through October 2005, when he resigned). The Compensation Committee held one meeting during 2005.

Nominating and Corporate Governance Committee. The Board adopted a Nominating and Corporate Governance Committee Charter in April 2004 and implemented the charter in June 2004. Prior to that time, the entire Board carried out nominating responsibilities. Our Nominating and Corporate Governance Committee currently consists of Messrs. Niemiec (Chairman), Young and Busby. It held two meeting during 2005.

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become members of the Board, approving and recommending director candidates to the Board, developing and recommending to the Board our corporate governance principles and policies, and monitoring compliance with these principles and policies. All the members of the Nominating and Corporate Governance Committee are independent directors within the meaning of Section 121A of the listing standards of the American Stock Exchange. The

Nominating and Corporate Governance Committee's charter is available at our website at http://www.emeritus.com/Investors/default.aspx.

The Nominating and Corporate Governance Committee charter establishes director selection guidelines (the "Director Selection Guidelines") for guidance in determining and identifying qualification requirements for directors, board composition criteria, and the procedure for the selection of new directors. The Director Selection Guidelines are attached as an annex to our Nominating and Corporate Governance Committee charter, which can be found on our website at http://www.emeritus.com/Investors/default.aspx. In accordance with the Director Selection Guidelines, the Committee will review the following considerations, among others, in its evaluation of candidates for nomination: personal and professional ethics, training, commitment to fulfill the duties of the Board of Directors, commitment to understanding our business, commitment to engage in activities in our best interests, independence, diversity, industry knowledge and contacts, financial or accounting expertise, leadership qualities,

public company board of director and committee experience, and other relevant qualifications. A director candidate’s ability to devote adequate time to Board of Directors and committee activities is also considered.

The Nominating and Corporate Governance Committee will consider candidates recommended by shareholders. Shareholders wishing to suggest director candidates should submit their suggestions in writing to the Nominating Committee, c/o our Corporate Secretary, providing the candidate's name, biographical data, and other relevant information outlined in the Director Selection Guidelines. The Committee will review shareholder-recommended nominees based on the same criteria as its own nominees. Shareholders who intend to nominate a director for election at the 2007 Annual Meeting of Shareholders must provide advance written notice of such nomination to the Corporate Secretary in the manner described below under “Shareholder Proposals.” To date, the Company has not received any recommendations from shareholders requesting that the Board consider a candidate for inclusion among the slate of nominees in the Company's proxy statement.

Board and Committee Meetings. During 2005, there were thirteen meetings of the Board of Directors. All board members attended at least 83% of the aggregate number of meetings of the Board of Directors and each committee of which he was a member. We do not have a specific policy requiring director attendance at the annual meeting; however, we encourage our directors to be present at the annual meeting and available to answer stockholder questions. All but one of our directors attended last year's annual meeting.

Audit Committee Report

The Board found that the Audit Committee members of Messrs. Busby, Marks, Young, and Carter (through October 2005) are independent as that term is defined in Section 121A of the American Stock Exchange listing standards. The Audit Committee has reviewed and discussed the audited financial statements for fiscal 2005 with the management of the Company. Additionally, the Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees. The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and has discussed with the independent registered public accounting firm the independent registered public accounting firm’s independence. Based on the discussions and reviews noted above, the Audit Committee recommended to the Company's Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for fiscal year 2005.

Audit Committee (2006)

Bruce L. Busby (Chairman)

Patrick Carter, Lord Carter of Coles (through October 2005)

Robert E. Marks

T. Michael Young

Non-Employee Director Compensation

Employee directors do not receive any separate compensation for their service on the Board of Directors. We currently pay our non-employee directors an annual payment of $15,000 and $1,500 for each board meeting or committee meeting they attend. We also reimburse them for all reasonable expenses incurred in connection with their attendance. Under the Emeritus Amended and Restated Stock Option Plan for Non-employee Directors, each non-employee director automatically receives an option to purchase 2,500 shares of our common stock at the time of his initial election or appointment to the Board. In addition, each non-employee director automatically receives an option to purchase 7,500 shares of our common stock immediately following each year's annual meeting of shareholders. All options granted under the plan fully vest on the day immediately prior to the annual shareholders meeting that follows the date of grant, and expire 10 years after the date of grant, with the exception of the option for 2,500 shares granted at the time of a director's initial election or appointment to the Board, which is vested immediately upon grant. The exercise price for these options is the fair market value of our common stock on the grant date.

Code of Conduct, Code of Ethics and Reporting of Concerns

We have adopted a Code of Conduct that provides ethical standards and policies applicable to all our officers, employees and directors in the conduct of their work. The Code of Conduct requires that our officers, employees and directors avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in our best interest.

We have also adopted a Code of Ethics for our chief executive officer, our chief financial officer, our principal accounting officer and controller. This Code of Ethics supplements our Code of Conduct and is intended to promote honest and ethical conduct, full and accurate reporting, and compliance with laws as well as other matters.

The Code of Conduct and Code of Ethics is available at our website at http://www.emeritus.com/Investors/default.aspx.

We have also established procedures for the confidential and anonymous submission and receipt of complaints regarding accounting and auditing matters, conflicts of interests, securities violations and other matters. These procedures provide substantial protections to employees who report company misconduct.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of April 14, 2006, certain information with respect to the beneficial ownership of our common stock and our subordinated convertible debentures (on an as-converted basis) by:

| * | each person that we know owns more than 5% of the common stock, |

| * | each current officer named in Summary Compensation Table below, and |

| * | all directors and executive officers as a group. |

Beneficial ownership is determined in accordance with rules of the SEC and includes shares over which the indicated beneficial owner exercises voting and/or investment power. Shares of stock subject to options, convertible debentures currently exercisable or exercisable within 60 days are deemed outstanding for computing the percentage ownership of the person holding the options or convertible debentures, but are not deemed outstanding for computing the percentage ownership of any other person. Except as otherwise indicated, we believe the beneficial owners of the common stock listed below, based on information furnished by them, have sole voting and investment power with respect to the shares listed opposite their names. Unless otherwise indicated, the following officers, directors and shareholders can be reached at the principal offices of Emeritus.

The table includes the beneficial ownership of the subordinated convertible debentures as converted into common stock and shares of stock options currently exercisable or exercisable within 60 days .

| | | Shares of Emeritus | |

| | | Common Stock | |

| | | Amount and Nature | | | |

| | | of Beneficial | | | |

Name and Address | | Ownership | | Percent of Class (1) | |

| | | | | | |

| Daniel R. Baty (2) (3) ……………………... | | | 5,911,605 | | | 31.7 | % |

| c/o Emeritus Corporation | | | | | | | |

| 3131 Elliott Avenue, Suite 500 | | | | | | | |

| Seattle, WA 98121 | | | | | | | |

| | | | | | | | |

| Raymond R. Brandstrom (4) …………….…. | | | 599,575 | | | 3.3 | % |

| c/o Emeritus Corporation | | | | | | | |

| 3131 Elliott Avenue, Suite 500 | | | | | | | |

| Seattle, WA 98121 | | | | | | | |

| | | | | | | | |

| Stanley L. Baty (5) …………...…….……….. | | | 1,021,023 | | | 5.7 | % |

| c/o Emeritus Corporation | | | | | | | |

| 3131 Elliott Avenue, Suite 500 | | | | | | | |

| Seattle, WA 98121 | | | | | | | |

| | | | | | | | |

| Gary S. Becker (6) ………..…..…………….. | | | 145,579 | | | * | |

| | | | | | | | |

| Suzette P. McCanless (7) ………...……..……… | | | 139,516 | | | * | |

| | | | | | | | |

| P. Kacy Kang (8) ……………..…………….. | | | 45,082 | | | * | |

| | | | | | |

| | | Shares of Emeritus | |

| | | Common Stock | |

| | | Amount and Nature | | | |

| | | of Beneficial | | | |

Name and Address | | Ownership | | Percent of Class (1) | |

| | | | | | |

| David W. Niemiec (9) ………………..……... | | | 55,457 | | | * | |

| | | | | | | | |

| Charles P. Durkin, Jr. (10) ………..…....…….. | | | 6,440,616 | | | 35.5 | % |

| | | | | | | | |

| Bruce L. Busby (11) ………….………….…. | | | 10,000 | | | * | |

| | | | | | | | |

| T. Michael Young (12) ………...…………… | | | 10,000 | | | * | |

| | | | | | | | |

| Robert E. Marks (13) ……….…….………… | | | 2,500 | | | * | |

| | | | | | | | |

| B.F., Limited Partnership (14) …….….…….. | | | 4,074,839 | | | 21.9 | % |

| 3131 Elliott Avenue, Suite 500 | | | | | | | |

| Seattle, WA 98121 | | | | | | | |

| | | | | | | | |

| Saratoga Partners IV, L.P. (15) ………..……. | | | 6,422,616 | | | 35.5 | % |

| 535 Madison Avenue | | | | | | | |

| New York, NY 10022 | | | | | | | |

| | | | | | | | |

| All directors and executive officers as a group | | | 13,812,135 | | | 70.1 | % |

| (14 persons) (2) (15) (16) | | | | | | | |

* Less than 1%.

(1) Based on 17,890,534 outstanding shares as of April 14, 2006.

(2) Includes 1,786,767 shares held directly and 3,357,550 shares held by B.F., Limited Partnership, of which Columbia-Pacific Group, Inc., a company wholly-owned by Mr. Baty, is the general partner and of which Mr. Baty is a limited partner. In addition, this figure represents (a) approximately 405,926 shares of common stock into which certain subordinated debentures held by Columbia Select, L.P., are convertible, and (b) approximately 311,363 shares of common stock into which certain subordinated debentures held by Catalina General, L.P., are convertible. B.F., Limited Partnership is the general partner of both such limited partnerships.

(3) Includes options exercisable within 60 days for the purchase of 49,999 shares.

| (4) | Includes options exercisable within 60 days for the purchase of 242,000 shares. |

| (5) | Represents 10,000 shares owned directly, and 830, 994 common shares owned indirectly and held by B.F., Limited Partnership, of which Mr. Baty owns a 24.75% interest. Also includes Mr. Baty's prorated share (177,529 indirect shares) of common shares issuable under certain subordinated debentures held by B.F., Limited Partnership. In addition, this figure includes options exercisable within 60 days for the purchase of 2,500 shares. |

| (6) | Includes options exercisable within 60 days for the purchase of 143,500 shares. |

| (7) | Includes options exercisable within 60 days for the purchase of 128,500 shares. |

| (8) | Includes options exercisable within 60 days for the purchase of 45,000 shares. |

(9) Includes (i) 36,131 shares of outstanding common stock and 1,326 shares of common stock issuable on conversion of $29,167 principal amount of convertible subordinated debentures, all of which are held by Saratoga Management Company LLC as agent and attorney-in-fact for Mr. Niemiec and (ii) options exercisable within 60 days for the purchase of 18,000 shares. Mr. Niemiec may be deemed to have no dispositive or voting power over the common stock or debentures for which Saratoga Management Company acts as agent and attorney-in-fact. See footnote (10) hereof.

(10) Includes (i) 6,195,343 shares of outstanding common stock held by or voted by Saratoga Partners and its affiliates, of which Mr. Durkin is a principal, (ii) 227,273 shares of common stock issuable on conversion of $5.0 million principal amount of convertible subordinated debentures held by Saratoga Partners and its affiliates, and (iii) options exercisable within 60 days for the purchase of 18,000 shares. Mr. Durkin may be deemed to have sole dispositive power over 82,792 shares of outstanding common stock and 3,038 shares of common stock issuable on conversion of the debentures. See footnote (9) regarding shares beneficially owned by Mr. Niemiec that are included in these figures.

(11) Includes options exercisable within 60 days for the purchase of 10,000 shares.

(12) Includes options exercisable within 60 days for the purchase of 10,000 shares.

(13) Includes options exercisable within 60 days for the purchase of 2,500 shares.

(14) B.F., Limited Partnership may be deemed to have voting and dispositive power over some of these shares, based upon publicly available information. Of these shares, 3,357,550 are held of record by B.F., Limited Partnership, 405,926 are held of record by Columbia Select, L.P., and 311,363 are held of record by Catalina General, L.P. The shares held by Columbia Select, L.P. and Catalina General, L.P. represent the number of common shares into which certain subordinated debentures are convertible. B.F., Limited Partnership is the general partner of both such limited partnerships.

(15) Includes 6,195,343 shares currently held or voted by Saratoga Partners and its affiliates and 227,273 shares into which debentures held by Saratoga Partners and its affiliates are convertible. Mr. Durkin, an Emeritus director, is a principal of Saratoga Partners and its affiliates. Until November 2001, Mr. Niemiec, another Emeritus director, was also a principal of Saratoga Partners and its affiliates.

(16) Includes options exercisable within 60 days for the purchase of 854,499 shares.

Equity Compensation Plan Information

The following table provides information as of December 31, 2005, regarding shares of common stock that may be issued under our equity compensation plans. The table below excludes information about the 2006 Equity Incentive Plan, which has been approved by the Board of Directors subject to shareholder approval at the annual meeting.

| | | | | | | | | | | | | | |

| | | | | | | | | Number of shares remaining | | | | Total of | |

| | | Number of shares to be | | | | Weighted-average | | available for future issuance | | | | shares | |

| | | issued upon exercise of | | | | exercise price of | | under equity compensation | | | | reflected in | |

| | | outstanding options, | | | | outstanding options, | | plans (excluding shares | | | | columns (a) | |

| | | warrants and rights | | | | warrants and rights | | reflected in column (a) | | | | and (c) | |

| Plan Category | | (a) | | | | (b) | | (c) | | | | (d) | |

| | | | | | | | | | | | | | |

| Equity compensation plans | | | | | | | | | | | | | | | | | | | |

| approved by shareholders | | | 1,349,381 | | | (1 | ) | | 3.81 | | | 419,935 | | | (2 | ) | | 1,769,316 | |

| | | | | | | | | | | | | | | | | | | | |

| Equity compensation plans | | | | | | | | | | | | | | | | | | | |

| not approved by shareholders | | | - | | | | | | - | | | - | | | | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Total | | | 1,349,381 | | | | | | 3.81 | | | 419,935 | | | | | | 1,769,316 | |

| | | | | | | | | | | | | | | | | | | | |

__________________

(1) Includes shares subject to stock options under the Amended and Restated 1995 Stock Incentive Plan, which expired in September 2005, and shares subject to outstanding options under the Amended and Restated Stock Option Plan for Non-employee Directors.

(2) Represents 205,935 shares available for purchase under the Employee Stock Purchase Plan and 214,000 shares available for grant under the Amended and Restated Stock Option Plan for Nonemployee Directors.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table presents certain information with respect to compensation we paid with respect to fiscal years ended December 31, 2005, 2004, and 2003, to our chief executive officer and to our other four most highly compensated officers as of December 31, 2005:

| | | | | | | | | | | Long-Term | | | |

| | | | | | | | | | | Compensation | | | |

| | | | | Annual Compensation | | Awards | | | |

| | | | | | | | | Other Annual | | Securities | | All Other | |

| | | | | | | Bonus ($) | | Compensation | | Underlying | | Compensation | |

| Name and Principal Position | | Year | | Salary ($) | | (1) | | ($)(2) | | Options | | ($)(4) | |

| Daniel R. Baty (3) | | | 2005 | | $ | 300,000 | | | - | | | - | | | - | | | - | |

| Chairman and Chief | | | 2004 | | $ | 287,500 | | | - | | | - | | | - | | | - | |

| Executive Officer | | | 2003 | | | - | | $ | 250,000 | | | - | | | 50,000 | | | - | |

| | | | | | | | | | | | | | | | | | | | |

| Raymond R. Brandstrom | | | 2005 | | $ | 207,083 | | $ | - | | $ | 6,000 | | | - | | $ | 18,000 | |

| Vice President of Finance, | | | 2004 | | $ | 200,000 | | $ | 65,000 | | $ | 6,000 | | | - | | $ | 18,000 | |

| Chief Financial Officer | | | 2003 | | $ | 197,783 | | $ | 65,000 | | $ | 6,000 | | | 40,000 | | $ | 14,664 | |

| | | | | | | | | | | | | | | | | | | | |

| Gary S. Becker | | | 2005 | | $ | 207,083 | | $ | - | | $ | 6,600 | | | - | | $ | 15,969 | |

| Senior Vice President, | | | 2004 | | $ | 200,000 | | $ | 65,000 | | $ | 6,236 | | | - | | $ | 23,202 | |

| Operations | | | 2003 | | $ | 194,750 | | $ | 65,000 | | $ | 6,264 | | | 40,000 | | $ | 22,614 | |

| | | | | | | | | | | | | | | | | | | | |

| Suzette P. McCanless | | | 2005 | | $ | 197,083 | | $ | 30,000 | | $ | 6,000 | | | - | | $ | 19,500 | |

| Vice President, Operations | | | 2004 | | $ | 190,000 | | $ | 52,600 | | $ | 6,000 | | | - | | $ | 18,000 | |

| - Eastern Division | | | 2003 | | $ | 187,667 | | $ | 52,600 | | $ | 6,000 | | | 35,000 | | $ | 11,438 | |

| | | | | | | | | | | | | | | | | | | | |

| P. Kacy Kang | | | 2005 | | $ | 178,333 | | $ | 30,000 | | $ | 6,300 | | | - | | | - | |

| Vice President, Operations | | | 2004 | | $ | 160,000 | | $ | 50,000 | | $ | 6,212 | | | - | | $ | 7,200 | |

| - Western Division | | | 2003 | | $ | 155,800 | | $ | 45,000 | | $ | 6,188 | | | | | $ | 22,500 | |

| | |

| (1) | Represents amounts paid or to be paid with respect to the corresponding fiscal year under the Company’s corporate incentive plan. |

| (2) | Consists of amounts paid for parking fees, health club memberships, health insurance, and cellular telephone expense. |

| (3) | From inception through 2002, Mr. Baty did not receive a salary or bonus. In 2003, the Compensation Committee changed this practice. |

| (4) | Consists of Emeritus contribution to a deferred contribution plan ($18,000, $15,969, $19,500, and zero in 2005, $18,000, $23,202, $18,000, and $7,200 in 2004 and $14,664, $22,614, $11,438, $22,500 in 2003 for Messrs. Brandstrom, and Becker, Ms. McCanless, and Mr. Kang, respectively ). |

Option Grants in Last Fiscal Year

There were no options granted during the last fiscal year to any of the executive officers named in the Summary Compensation Table.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Suzette McCanless and P. Kacy Kang were the only officers to exercise options during the fiscal year ended December 31, 2005 . The following table also presents certain information regarding options held as of December 31, 2005, by each of the following executive officers:

| | | | | | | | | | | | | | |

| | | | | | | Number of Shares Underlying | | Value of Unexercised | |

| | | Shares | | Value | | Unexercised Options at | | In-the-Money Options at | |

| | | Acquired | | Realized | | December 31, 2005 | | December 31, 2005 ($)(2) | |

| Name | | Exercise (#) | | ($) (1) | | Exercisable (#) | | Unexercisable (#) | | Exercisable ($) | | Unexercisable ($) | |

| | | | | | | | | | | | | | |

| Daniel R. Baty | | | - | | | - | | | 33,333 | | | 16,666 | | $ | 583,327 | | $ | 283,322 | |

| Raymond R. Brandstrom | | | - | | | - | | | 228,667 | | | 13,333 | | $ | 4,225,419 | | $ | 226,661 | |

| Gary S. Becker | | | - | | | - | | | 130,167 | | | 13,333 | | $ | 2,369,679 | | $ | 226,661 | |

| Suzette P. McCanless | | | 5,000 | | $ | 93,800 | | | 116,834 | | | 11,666 | | $ | 2,128,818 | | $ | 198,322 | |

| P. Kacy Kang | | | 30,000 | | $ | 503,940 | | | 33,334 | | | 11,666 | | $ | 576,678 | | $ | 198,322 | |

(1) Based on the difference between the fair market value of our common stock on the date of exercise and the exercise price of the option.

(2) Calculated by determining the difference between the fair market value of the securities underlying the options at December 31, 2005, and the exercise price of the options.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors consists of three non-employee directors. The Compensation Committee is responsible for establishing and administering our executive compensation programs. Our objective is to pay competitively in order to attract quality executive personnel who best meet our needs, retain and motivate these executives to achieve superior performance, link individual compensation to individual and company performance, and align executives' financial interests with those of our shareholders.

Executive compensation generally consists of three components: base salary, cash bonuses, and long-term incentive awards. The Compensation Committee has established each executive's compensation package by considering (a) the salaries of executive officers in similar positions in companies in the same industry as Emeritus and in related industries, (b) the experience and contribution levels of the individual executive officer and (c) our financial performance. Companies used as a reference for considering compensation levels include all, of the companies constituting the peer group in our stock performance graph. The Committee also relies upon the recommendations of the chief executive officer in matters related to the individual performance of the other executive officers because the Committee believes that the chief executive officer is the most qualified to make this assessment. Base salaries for executive officers generally have been designed to be less than those paid by competitors in the assisted living industry. These lower base salaries historically have been combined with stock option grants so that a significant portion of the executives' pay is tied to performance of our stock. Although we are proposing a new 2006 Equity Incentive Plan to replace our Amended and Restated 1995 Stock Incentive Plan, which expired in 2005, the extent that equity incentives will be used in combination with salaries and bonuses continues to be under review.

Base Salaries. In 2005, base salaries were established as described above.

Prior to 2005, we granted stock options to provide a long-term incentive opportunity that is directly linked to shareholder value. Options were granted with an exercise price equal to the market value of the common stock on the date of grant and become exercisable in 33 1/3 % annual increments beginning one year after the date of grant. To encourage stock retention, all options were granted as incentive stock options to the maximum extent possible under the Internal Revenue Code (the "Code"). We did not, however, grant any material stock options in 2005. Management and the Compensation Committee began in 2004 to evaluate the effectiveness of stock options and other forms of equity compensation, including restricted stock grants and restricted stock units, in providing incentives as well as the costs and the accounting impact of these various alternatives. The Compensation Committee continues to assess the effectiveness, cost and reporting of long-term incentive compensation and, although this assessment is not complete, the Committee believes that equity incentives will be a smaller component of executive compensation packages. In view of this trend, the Committee believes that cash salary and bonus levels for our executives in 2005 and 2006 are closer to industry norms than in past years.

Annual Incentives. To date, the Compensation Committee has not established a regular annual incentive or bonus plan for executive officers but awards discretionary cash bonuses based on its review of individual performance and our financial results. Our top three senior executive officers, including our chief executive officer, did not receive cash bonuses for performance in 2005, based on the recommendations of our chief executive officer. Other senior executives received bonuses designed to establish their total compensation comparable to other similar executives in the industry.

Chief Executive Officer Compensation. Our chief executive officer, Mr. Baty, a founder of Emeritus, beneficially owns shares (directly and indirectly) and holds exercisable options representing approximately 31.7% of our common stock. Because of this significant equity stake, Mr. Baty had chosen to receive no base salary in the past. This compensation pattern was established prior to our initial public offering and the Compensation Committee had continued it through 2002, recognizing that Mr. Baty's principal compensation would be the inherent value of his equity stake. In past years, the Compensation Committee granted options to Mr. Baty consistent with grants to other executive officers. In 2003, however, the Committee and Mr. Baty reconsidered this practice. The Committee recognized that Emeritus had grown significantly in size and complexity in the last several years, and that Mr. Baty had made a substantial contribution to progress in stabilizing the business and improving cash flow. The Committee, of course, recognized Mr. Baty's significant investment in Emeritus, as well as his role as a party in a number of transactions having to do with the acquisition, financing and management of Emeritus assisted living communities. These "related party" transactions, which are described in "Certain Transactions," have been considered and approved by a special committee of independent directors. In view of these factors, the Committee concluded that Mr. Baty's contribution as chief executive officer should properly be evaluated separately from his

ownership position and his other relationships with us and should be consistent with the compensation for chief executive officers of other companies in similar circumstances. Accordingly, in 2003, Mr. Baty was awarded stock options to purchase 50,000 shares at $3.95 per share and a bonus of $250,000. The Committee has also established a base salary of $300,000 for 2004 and 2005 and $350,000 for 2006 for Mr. Baty. These compensation decisions were made taking into account general compensation levels of other similarly situated companies and the compensation paid to our other senior executives.

Tax Deductibility of Executive Compensation. Section 162(m) of the Code includes potential limitations on the deductibility for federal income tax purposes of compensation in excess of $1 million paid or accrued with respect to any of the executive officers whose compensation is required to be reported in our proxy statement. Certain performance-based compensation that has been approved by shareholders is not subject to the deduction limit. Our equity incentive plans are structured to qualify options as performance-based compensation under Section 162(m). For 2006, the Compensation Committee does not expect that there will be any nondeductible compensation.

Compensation Committee (2005)

Robert E. Marks (Chairman)

Patrick R. Carter, Lord Carter of Coles (through October 2005)

Bruce L. Busby

Charles P. Durkin

Compensation Committee Interlocks and Insider Participation

None.

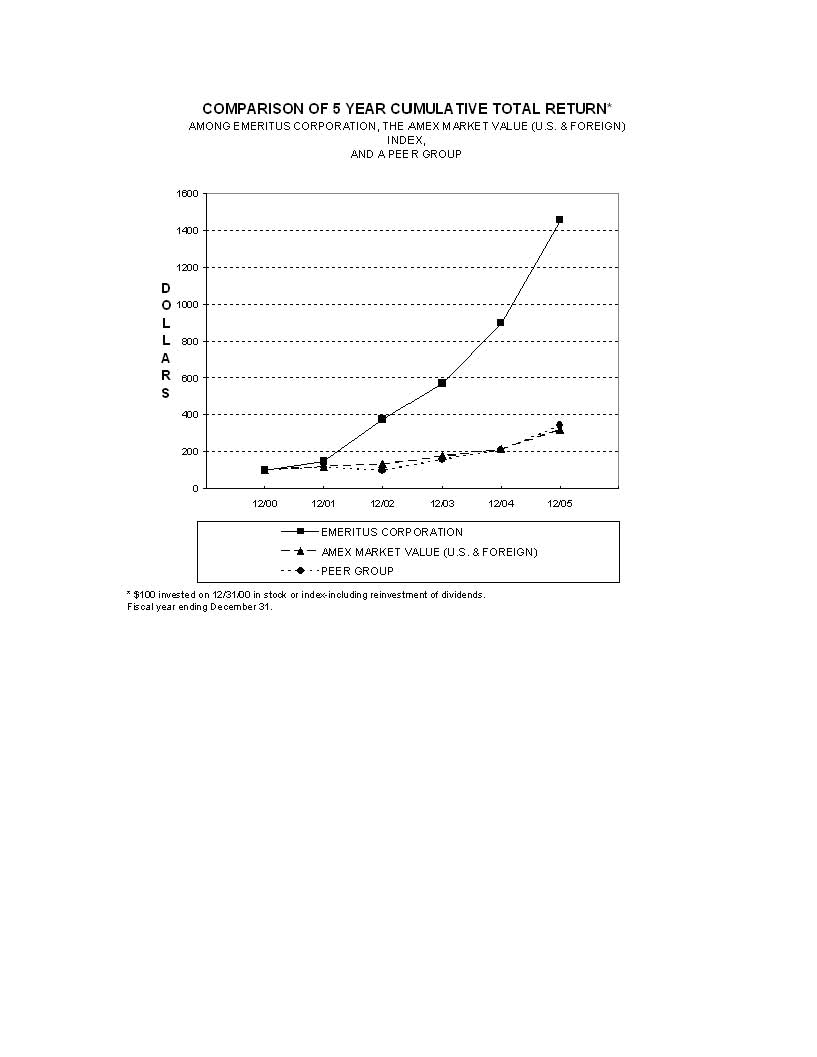

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative total return on shares of our common stock with the cumulative total return of the AMEX Market Value Index and a peer group selected by us for the period beginning on December 31, 2000, and ending on December 31, 2005, the end of our last fiscal year. In making this comparison, we have assumed an investment of $100 in shares of the Company's common stock, the AMEX Market Value Index, and the peer group, with all dividends reinvested. Stock price performance shown below for the common stock is historical and not necessarily indicative of future price performance.

| | | EMERITUS CORPORATION | | PEER GROUP | | AMEX MARKET VALUE |

| | | | | | | |

| 2000 | | 100.00 | | 100.00 | | 100.00 |

| 2001 | | 146.78 | | 113.75 | | 119.14 |

| 2002 | | 374.96 | | 97.05 | | 132.57 |

| 2003 | | 571.13 | | 157.09 | | 176.02 |

| 2004 | | 897.39 | | 207.94 | | 214.97 |

| 2005 | | 1457.39 | | 340.90 | | 319.96 |

Given the relative volatility of the assisted living industry, we revise our peer group from time to time to include companies that have entered the assisted living market. As the industry begins to mature and consolidate, we remove certain companies previously included in our peer group as they are acquired or as their focus of services shifts away from the assisted living residences.

The peer group consists of the following three companies: American Retirement Corporation, Capital Senior Living Corp., and Sunrise Assisted Living, Inc.

CHANGE OF CONTROL ARRANGEMENTS

Amended and Restated 1995 Stock Incentive Plan. In the event of (a) the merger or consolidation of Emeritus in which it is not the surviving corporation or pursuant to which shares of common stock are converted into cash, securities, or other property (other than a merger in which holders of common stock immediately before the merger have the same proportionate ownership of the capital stock of the surviving corporation immediately after the merger); (b) the sale, lease, exchange, or other transfer of all or substantially all of our assets (other than a transfer to a majority-owned subsidiary); or (c) the approval by the holders of common stock of any plan or proposal for our liquidation or dissolution, each outstanding option under our Amended and Restated 1995 Stock Incentive Plan will automatically accelerate so that it will become 100% vested and exercisable immediately before such transaction, except to the extent that options are assumed by the successor corporation. The vesting of such assumed options accelerates at the time an optionee's employment is terminated for reasons other than "cause" or by the optionee for "good reason" following a change of control.

CERTAIN TRANSACTIONS

Community Agreements with Baty-Related Entities

On September 30, 2004, we completed the first phase of a transaction to lease up to 20 assisted living communities in 12 states, with 1,824 units. Of these 20 communities, 16 were owned by an investor group in which Mr. Baty held a 21.3% indirect financial interest and four communities were owned by other entities controlled by Mr. Baty and in which the Baty family partnership had financial interests. These communities were acquired by an independent REIT for an approximate $170.8 million investment and are being leased to us. We completed the lease on the first 18 communities on September 30, 2004. One additional community was leased on March 31, 2005, and another on September 1, 2005. Of the 20 communities included in the lease, we previously managed 18, leased one, and one was new to our portfolio.

The lease of these 20 communities has a term of 15 years, with one 15-year renewal option. The annualized cash lease payment for the communities is approximately $15.5 million per year, with inflators to the extent the change in

the consumer price index exceeds 0%, not to exceed 40 basis points during years two through four and 30 basis points thereafter, as calculated with respect to the REIT's investment basis in the properties. All of the leases are triple-net leases. The 18 initial leases have cross-default provisions and are cross-collateralized with all of our other leases and loans relating to other communities owned by the REIT. All of the leases contain certain financial and other covenants. We have the right of first refusal to purchase these leased communities and Mr. Baty personally guarantees our obligations under the lease. As compensation for facilitating the lease and for the guarantee, Mr. Baty will receive, based on a prescribed formula, 50% of the positive cash flow of the 20 communities and will be responsible for 50% of any negative cash flow, as defined in the cash flow sharing agreement. Mr. Baty earned $632,000 for the year ended December 31, 2005, under this agreement. We have the right to purchase Mr. Baty’s 50% interest in the cash flow of the 20 communities for 50% of the lesser of six times cash flow or the fair market value of that cash flow. For purposes of this transaction, cash flow is defined as actual cash flow after management fees of 5% of revenues payable to us, actual capital expenditures, and certain other agreed adjustments.

In connection with this transaction, the investor group that owned 16 of the communities also transferred five other communities to Mr. Baty, who entered into a agreement with us to manage these communities under an agreement providing for fees equal to 5% of revenues, an indefinite term, unless terminated for cause, and a right of first refusal in the event of the sale of the community. In March 2006, one community was sold and the management arrangement was terminated, leaving four managed communities. During 2005, we received $517,000 under this management agreement. In April 2006, one of the communities was sold and the related management arrangement terminated.

At January 1, 2005, we also managed eight other assisted living communities owned by five entities that Mr. Baty controlled and in which he and/or the Baty family partnership held varying direct and indirect financial interests ranging from 22.2% to 50.0%. The management agreements generally provided for fees ranging from 4% to 6% of revenues, were for indefinite terms, unless terminated for cause, and granted us a right of first refusal on sale of the property. During 2005, two of the communities were sold by these entities and the management arrangements terminated. In January 2006, one community was discontinued and in April 2006 one community was sold. In January 2006, we opened a new managed community in which Mr. Baty has a financial interest. We have also agreed to acquire one community (as described below), which leaves four of these communities under continuing management agreements with three Baty-related entities. During 2005, we received $965,000 in management fees from all communities in this group, including those that have been discontinued.

We have agreed to purchase an Everett, Washington community that we manage and one-half of which is owned by a Baty-related entity. The cash payment is $5.1 million. The property is subject to a conventional mortgage with an existing principal balance of approximately $5.6 million, interest at 6.75% and a 25-year amortization. The transaction has been approved by the Board of Directors and other parties but no agreements have yet been executed.

We have an agreement with Mr. Baty which governs the operating, accounting, and payment procedures relating to the foregoing entities in which Mr. Baty had a financial interest, including prompt repayment of any balances that are temporarily outstanding as a result of normal operations and interest on average outstanding balances at LIBOR plus 3%. As of December 31, 2005, there were no material outstanding balances (net of funds held by us for application to outstanding balances).

Fretus Lease

In October 2002, we entered into a lease agreement with Fretus Investors LLC, for 24 assisted living communities in six states containing an aggregate of approximately 1,650 units. Fretus is a private investment joint venture between Fremont Realty Capital, which holds a 65% stake, and an entity controlled by Mr. Baty, which holds a 35% minority stake. Mr. Baty holds a 36% indirect interest in the minority entity. Mr. Baty is guarantor of a portion of the debt and controls the entity that is the administrative member of Fretus. Fretus, in turn, leases the communities to us. We have no obligation with respect to the communities other than our responsibilities under the lease, which includes an option to purchase at fair market value, subject to a minimum purchase price, solely at our discretion. The Fretus lease is for an initial 10-year period with two 5-year extensions and includes an opportunity for us to acquire the communities during the third, fourth, or fifth year and the right under certain circumstances for the lease to be cancelled as to one or more properties upon the payment of a termination fee. The lease is a net lease. Originally, the base rent was equal to (i) the debt service on the outstanding senior mortgage granted by Fretus, and (ii) an amount necessary to provide a 12% annual return on equity to Fretus. The initial senior mortgage debt was for $45.0 million and interest accrued at LIBOR plus 3.5%, subject to a floor of 6.25%. The Fretus initial equity was approximately $24.8 million but increased to $25 million at December 31, 2004 as a result of additional capital

contributions for specified purposes. Based on the initial senior mortgage terms and Fretus equity, the rent was approximately $500,000 per month. In addition to the base rent, the lease also provided for percentage rent equal to a percentage (ranging from 7% to 8.5%) of gross revenues in excess of a specified threshold commencing with the thirteenth month of the lease. Total rent expense in 2004, was approximately $5.9 million.

In October 2005, Fretus refinanced the senior mortgage debt, increasing the debt to $90 million (which returned the Fretus investors’ original equity and provided $20 million of additional cash), with interest accrued at LIBOR plus 2.65%, subject to a LIBOR cap of 5.3% (This is a cap on our rent, not on the mortgage debt) and a maturity in October 2008. In connection with this refinancing, which required our consent, our rent payment was adjusted by one half of the amount by which the interest cost of the original mortgage debt differed from the interest cost of the refinanced debt. Based on current LIBOR rates, this would reduce our rental by approximately $392,000 per year. As LIBOR changes, this adjustment will change and, in a higher interest rate environment, our rent could increase by one half of the amount by which the interest cost of the refinance debt exceeds the interest cost of the original mortgage debt. In connection with the amendment, our maximum annual rental for the remaining term of the lease was limited to $7.2 million. During 2005, our total rent expense under this lease was approximately $6.1 million.

Series B Preferred Stock

In December 1999, we sold 30,000 shares of our Series B preferred stock (the "Series B Stock") to Saratoga Partners IV, L.P. and its related investors ("Saratoga") for a purchase price of $1,000 per share and in August 2000, we issued to Saratoga a seven-year warrant to purchase one million shares of our common stock at an original exercise price of $4.30 per share, but subsequently adjusted to $4.20 per share after the effect of anti-dilution provisions stipulated in the warrant agreement. On March 6, 2006, we issued 829,597 shares of common stock pursuant to the exercise of the warrants. The shares were purchased pursuant to a "net exercise" provision of the warrants in which 170,403 shares subject to the warrants were used to pay the exercise price of $4.2 million. The shares used to pay the exercise price were valued at $24.65 per share under the terms of the warrants.

On June 30, 2005, we entered into an agreement with Saratoga that provided for the conversion of the Series B Stock held by Saratoga upon the payment of accrued and unpaid cash dividends on the Series B Stock in the amount of approximately $10.8 million. Upon such payment, which occurred on June 30, 2005, Saratoga converted all of the outstanding Series B Stock to common stock in accordance with the agreement. The Series B Stock owned by Saratoga consisted of 36,970 shares with a stated value of $1,000 per share, of which 30,000 shares were issued in December 1999 for a price of $30.0 million and 6,970 shares were issued as dividends of additional Series B Stock since December 1999.

The Series B Stock was entitled to receive quarterly dividends in a combination of cash and additional shares of Series B Stock. The initial rate for the dividend was 6% of the stated value of $1,000 per share, of which 2% was payable in cash and 4% was payable in additional Series B Stock. Starting in January 2004, the dividend rate moved to 7%, of which 3% was payable in cash and 4% in Series B Stock. The Series B Stock provided for an “arrearage rate” if the cash portion of the dividend was not paid, increasing the cash portion of the dividend to 7%. The arrearage rate became effective in October 2000, thus accruing dividends at an 11% rate, 7% in cash and 4% in additional shares of Series B Stock. We had issued the additional Series B Stock dividends on a quarterly basis on the first day of the month after the end of each quarter. However, the cash portion of the dividend had not been paid since 2000, which resulted in an accumulated liability of approximately $10.8 million as of March 31, 2005No interest was required to be accrued on the unpaid cash dividends. On June 30, 2005, the Series B Stock was converted into 5,365,746 shares of common stock.

Under a shareholders' agreement between Saratoga and Mr. Baty entered into at the time the Series B Stock was issued, Saratoga is entitled to board representation at a percentage of the entire Board of Directors, rounded up to the nearest whole director, that is represented by the voting power of equity securities attributable to the Series B Stock owned by Saratoga and its related investors. The shareholders' agreement also provides for a minimum of two Saratoga directors. Under this agreement, Saratoga is currently entitled to designate three of eight members of the Board, but thus far has chosen to select only two. Saratoga's right to designate directors terminates if Saratoga has sold more than 50% of its initial investment and its remaining shares represent less than 5% of the outstanding shares of common stock on a fully diluted basis or it is unable to exercise independent control over its shares.

The shareholders' agreement provides that neither Saratoga nor Mr. Baty is permitted to purchase voting securities in excess of a defined limit. That limit for both Saratoga and Mr. Baty is 110% of the number of shares of common stock beneficially owned by Saratoga and its related investors at the completion of the original financing (including

securities originally issued and those issued as dividend with respect thereto). These restrictions will terminate 18 months after the date on which Saratoga and its related investors cease to hold securities representing 5% of the outstanding shares of Common stock on a fully diluted basis. The shareholders' agreement also provides that if Mr. Baty contemplates selling 30% or more of the common stock he owns, Saratoga and its related investors would have the right to participate in the sale on a proportionate basis.

Alterra Transactions

In December 2003, we invested $7.7 million (representing an 11% ownership interest) in a limited liability company that acquired Alterra Healthcare Corporation, a national assisted living company headquartered in Milwaukee, Wisconsin that was the subject of a voluntary Chapter 11 bankruptcy. Alterra operated 304 assisted living communities in 22 states. The purchase price for Alterra was $76 million and the transaction closed on December 4, 2003, following approval by the Bankruptcy Court. The members of the limited liability company consist of an affiliate of Fortress Investment Group LLC, a New York based private equity fund, which is the managing member, an entity controlled by Mr. Baty, and us. Under the limited liability company agreement, original ownership interests were 50%, 25%, and 25%, respectively. Distributions were first allocated to Fortress until it received its original investment of $49 million together with a 15% preferred return, and then allocated to the three investors in proportion to their percentage interests, as defined in the agreement.

In June 2005, Fortress purchased 50% our interest in Alterra, as well as the interest of the Baty-related entity, in Alterra for $50 million in cash, $25 million each. The members of the limited liability company entered into a Membership Interest Purchase Agreement whereby, concurrent with the sale and purchase of the membership interests, the parties entered into an Amended and Restated LLC Agreement. The resulting membership interests of Fortress, us and the Baty-related entity were then 75%, 12.5%, and 12.5%, respectively.

In November 2005, we sold our remaining interest in Alterra through the public offering of Brookdale Senior Living, Inc. (“Brookdale”), as did the Baty-related entity. Our shares in Brookdale had been acquired through the merger of Alterra and Brookdale. In total, including the June 2005 transaction, we received approximately $62.3 million in cash and recorded gains of approximately $55.4 million in the year ended 2005 related to our investment in Alterra, as did the Baty-related entity. Neither we nor the Baty-related entity has any further ownership interest in Brookdale.

Convertible Debentures

In November 2005, we completed an offer to exchange our outstanding 6.25% Convertible Subordinated Debentures due 2006 for new 6.25% Convertible Subordinated Debentures due 2008. In the exchange offer, $26.6 million of the $32.0 million principal amount of outstanding debentures were exchanged. The remaining $5.4 million principal amount of outstanding debentures continued outstanding and was paid at maturity in January 2006. The terms of the existing debentures and the new debentures were substantially the same, except that the maturity of the new debentures is July 1, 2008, instead of January 1, 2006, and the new debentures can not be redeemed at our election. The new debentures are convertible into common stock at the rate of $22 per share, which equates to 1,210,227 shares of common stock. Interest on the new debentures is payable semiannually on January 1 and July 1 of each year. The new debentures are unsecured, and subordinated to all our other indebtedness.

Of the $32.0 million principal amount of the original debentures, $15.8 million were owned by Mr. Baty or entities that he and Stanley L. Baty control and in which they have financial interests (the “Baty Entities”) and $5.0 million were owned by Saratoga Partners and their affiliates (the “Saratoga Entities”). All of the these debentures were exchanged in the exchange offer.

On June 30, 2005, we entered into an agreement with the Baty Entities and the Saratoga Entities providing that if the interest rate of the new debentures was 8.0% per annum and at the expiration of the exchange offer any existing debentures have not been exchanged for new debentures, then the Saratoga Entities and the Baty Entities would purchase a principal amount of new debentures equal to the principal amount of existing debentures that had not been exchanged, excluding any existing debentures that have not been exchanged by any of the Saratoga Entities or Baty Entities. The agreement provided that the Saratoga Entities, as a group, would purchase 24% of any additional new debentures and the Baty Entities, as a group, would purchase 76% of any additional new debentures. The purchase of additional new debentures, if required, would be effective December 30, 2005. In October 2005, the interest rate of the new debentures was established at 6.25% per annum instead of 8.0%. In connection with that

change, the agreement was terminated and replaced by an agreement in which each of the Baty Entities and the Saratoga Entities agreed that, if it did not exchange all of its existing debentures for new debentures, it would lend the Company on December 30, 2005 an amount equal to the principal amount of existing debentures that it has retained. The indebtedness would mature July 1, 2008, would not be convertible, would bear interest at 6.25% per annum payable semiannually on January 1 and July 1, would be on a parity as to payment with the new debentures and would be subject to the same events of default as set forth in the indenture governing the new debentures. Because the Baty Entities and Saratoga Entities exchanged all of their debentures in the exchange offer, this agreement had no effect.

Painted Post Partners

During 1995, Messrs. Baty and Brandstrom formed Painted Post Partners, a New York general partnership, to facilitate the operation of assisted living communities in the state of New York, a state that generally requires that natural persons be designated as the licensed operators of assisted living communities. We have entered into administrative services agreements with the partnership for the term of the underlying leases. The administrative services agreements provide for fees that would equal or exceed the profit of a community operated efficiently at full occupancy and, unless reset by agreement of the parties, will increase automatically on an annual basis in accordance with changes in the Consumer Price Index. In addition, we have agreed to indemnify the partners against losses and, in exchange, the partners have agreed to assign any profits to us. As part of their general noncompetition agreements with us, each of Messrs. Baty and Brandstrom has agreed that, in the event either ceases to be a senior executive of Emeritus, they will transfer his interest in the partnership for a nominal charge to his successor at Emeritus or other person designated by us.

Noncompetition Agreements

We have entered into noncompetition agreements with Messrs. Baty and Brandstrom. These agreements provide that they will not compete with us, directly or indirectly, in the ownership, operation, or management of assisted living communities anywhere in the United States and Canada during the terms of their employment and for a period of two years following the termination of their employment. The agreements also provide, however, that they may hold (1) up to a 10% limited partnership interest in a partnership engaged in such business, (2) less than 5% of the outstanding equity securities of a public company engaged in such business, or (3) interests in the New York partnership described above. These agreements do not limit Mr. Baty's current role with Holiday Retirement Corporation. Mr. Baty has agreed, however, that if Holiday operates or manages assisted living communities, other than as a limited component of independent living communities consistent with its current operations, he will not personally be active in the management, operation, or financing of such facilities, nor will he hold any separate ownership or other interest therein.

During 2005, Mr. Baty requested waivers under the noncompetition agreement for the development of two assisted living communities for Alzheimer patients that we had declined to participate in. After review by a special committee of independent directors, we entered into a management agreement with respect to one such community including the following provisions: (i) we manage the community for a perpetual term, unless terminated for cause or the community is sold, with fees equal to the greater of $5,000 per month or 6% of revenues, (ii) we have an option to purchase the community during the fourth through the tenth year at the greater of fair market value or a price that yields a 15% internal rate of return on the owner’s equity, and (iii) through the tenth year, we would have a right of first refusal in the event of the sale of the community. We are currently negotiating similar option and right of first refusal arrangements (which do not include management agreements) with respect to six other communities, but no agreement has yet been reached.

PROPOSAL TO ADOPT THE EMERITUS 2006 EQUITY INCENTIVE PLAN

(PROPOSAL 2)

We are asking shareholders to approve the Emeritus 2006 Equity Incentive Plan (the "2006 Plan"). Our Amended and Restated 1995 Stock Incentive Plan expired in September 2005 and we no longer have the ability to offer equity incentive compensation to our key executives and employees. Although options to purchase 1,159,291 shares of common stock are currently outstanding, we have not granted any significant options since 2003. As accounting and other rules governing equity incentives and executive compensation become more stable and as we develop our compensation philosophy for the future, we believe that the 2006 Plan will enable us to continue to offer competitive compensation packages to our key executives and employees that are responsive to evolving compensation practices that increasingly emphasize a diverse mix of traditional stock options together with other types of equity awards.

The various types of awards available under the 2006 Plan will give us greater flexibility to respond to market changes in equity compensation practices for executive level personnel. We believe that stock options have been a critical component of our long-term incentive and retention program, particularly for executive personnel, central corporate personnel and regional operating personnel. While stock options have been the vehicle used to align the interests of our employees with those of shareholders, we intend to evaluate the merits of other equity vehicles and believe that the availability of other types of equity awards will be valuable.

The following summary does not purport to be a complete description of the 2006 Plan. A copy of the complete text of the 2006 Plan is attached to this proxy statement as Appendix A, and the following description is qualified in its entirety by reference to the text of the 2006 Plan.

Summary of Terms

Purpose. The purpose of the 2006 Plan is to enhance our long-term shareholder value by offering opportunities to selected individuals to participate in our growth and success, enabling us to attract and retain the services of well-qualified individuals.

Shares Available for Issuance. The 2006 Plan authorizes the issuance of up to 1,000,000 shares of common stock. The shares authorized under the 2006 Plan are subject to adjustment in the event of a stock split, stock dividend, recapitalization or similar event. Shares issued under the 2006 Plan will consist of authorized and unissued shares.

If an award granted under the 2006 Plan lapses, expires, terminates or is forfeited or surrendered without having been fully exercised or without the issuance of all the shares subject to the award, the shares covered by that award will again be available for use under the 2006 Plan. Shares that are (i) tendered by a participant or retained by us as payment for the purchase price of an award or to satisfy tax withholding obligations or (ii) covered by an award that is settled in cash will be available for issuance under the 2006 Plan. In addition, awards granted as substitute awards in connection with acquisition transactions will not reduce the number of shares authorized for issuance under the 2006 Plan.

Administration. The 2006 Plan will be administered by our Compensation Committee. The Compensation Committee, subject to the terms of the 2006 Plan, selects the individuals to receive awards, determines the terms and conditions of all awards and interprets the provisions of the 2006 Plan. The Compensation Committee's decisions, determinations and interpretations are binding on all holders of awards granted under the 2006 Plan. Subject to the terms of the 2006 Plan, the Board of Directors may delegate administration of the 2006 Plan to one or more committees consisting of at least two members of the Board or to one or more senior executive officers within specific limits, including limits that no such officer may grant awards under the 2006 Plan to himself or to any person subject to Section 16 of the Securities Exchange Act of 1934, as amended.

Eligibility. Our employees, non-employee directors, consultants, advisors and independent contractors or those of our related companies are eligible to receive awards under the 2006 Plan. Although the we employ approximately 9,000 persons, we have not in the past, and do not intend under the 2006 Plan, to consider most staff at the community level for awards. In view of this, at April 30, 2006, approximately 300 employees and six non-employee directors would be eligible to participate in the 2006 Plan.

Types of Awards.

Stock Options. Both nonqualified and incentive stock options may be granted under the 2006 Plan. The Compensation Committee determines the exercise price for stock options, which may not be less than 100% of the fair market value of the common stock on the date of grant (except for awards granted as substitute awards in connection with acquisition transactions). As of April 25, 2006, the closing sales price for our common stock as reported by the American Stock Exchange was $21.98. The exercise price for stock options may be paid by an optionee in cash, through a broker-assisted cashless exercise, by delivery of previously owned shares or by such other consideration permitted by the Compensation Committee. The Compensation Committee also establishes the vesting schedule for each option granted and the term of each option, which term cannot exceed ten years from the date of grant. If not provided otherwise in the instrument evidencing an option, options will typically vest in equal annual installments over three years.

Unless otherwise provided in the instrument evidencing an option, a participant generally will be able to exercise the vested portion of his or her option for (i) three months following termination of employment or services for reasons other than cause, retirement, disability or death and (ii) one year following termination due to retirement, disability or death. If a participant is terminated for cause, all options held by that participant generally will automatically expire.

Stock Appreciation Rights ("SARs"). The Compensation Committee may grant SARs as a right in tandem with the number of shares underlying stock options granted under the 2006 Plan or on a stand-alone basis. SARs are the right to receive a payment per share of the SAR exercised in stock or in cash equal to the excess of the share's fair market value on the date of exercise over its fair market value on the date the SAR was granted. Exercise of an SAR issued in tandem with a stock option will result in a reduction of the number of shares underlying the related stock option to the extent of the SAR exercise.