UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant S

Filed by a Party other than the Registrant £

Check appropriate box:

| £ | Preliminary Proxy Statement |

| £ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| S | Definitive Proxy Statement |

| £ | Definitive Additional Materials |

| £ | Soliciting Material under Rule 14a-12 |

Emeritus Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| £ | Fee computed on table below per Exchange Act Rules 14a-6 (i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| £ | Fee paid previously with preliminary materials: |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

March 30, 2011

To the Shareholders of Emeritus Corporation:

You are cordially invited to attend the 2011 annual meeting of shareholders of Emeritus Corporation to be held at the South Cascade Room of the Harbor Club, 801 Second Avenue, Seattle, Washington 98104, on Tuesday, May 24, 2011, at 10:00 a.m., local time. Our Board of Directors has fixed the close of business on March 25, 2011 as the record date for determining those shareholders entitled to notice of, and to vote at, the annual meeting of our shareholders and any adjournments thereof.

The Notice of Annual Meeting and proxy statement, both of which accompany this letter, provide details regarding the business to be conducted at the meeting, including proposals for the election of directors, an advisory resolution on executive compensation, an advisory vote on the frequency of future advisory votes on executive compensation, and the ratification of KPMG LLP as our independent registered accounting firm.

Our Board of Directors recommends that you vote FOR each of the proposals including a vote of every three years on executive compensation described in this proxy statement.

Your vote is very important. Please vote your shares promptly, whether or not you expect to attend the meeting in person. To vote your shares, please refer to the instructions on the proxy card or voting instruction form, or review the section entitled Voting of Proxies; Revocation of Proxies beginning on page 3 of the accompanying proxy statement. Returning the proxy card or otherwise submitting your proxy does not deprive you of your right to attend the annual meeting of our shareholders and vote in person.

This proxy statement is dated March 30, 2011 and is first being mailed to Emeritus shareholders on or about April 12, 2011.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 24, 2011

The annual meeting of shareholders of Emeritus Corporation will be held at the South Cascade Room of the Harbor Club, 801 Second Avenue, Seattle, Washington 98104, on Tuesday, May 24, 2011, at 10:00 a.m., local time, and any adjournments thereof, to consider and act upon the following matters:

| 1. | To elect one director nominated by our Board of Directors into Class I of our Board of Directors to serve until the 2012 annual meeting of shareholders and three directors nominated by our Board of Directors into Class III of our Board of Directors to serve until the 2014 annual meeting of shareholders; |

| 2. | To hold an advisory resolution on the compensation we pay our named executive officers, as disclosed in these materials; |

| 3. | To hold an advisory vote on whether an advisory vote on the compensation we pay our named executive officers should be held every one, two or three years; |

| 4. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2011; and |

| 5. | To transact such other business as may properly come before the meeting and any adjournments thereof. |

The Board of Directors recommends that you vote FOR the election of each of the director nominees, FOR the approval of the advisory resolution on executive compensation, to conduct future advisory votes on executive compensation EVERY THREE YEARS, and FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm.

The Board of Directors has fixed the close of business on March 25, 2011, as the record date for the determination of shareholders entitled to notice of, and to vote at, the annual meeting of our shareholders and any adjournments or postponements thereof. Shareholders are cordially invited to attend the annual meeting of our shareholders in person.

To vote your shares, please refer to the instructions on the proxy card or voting instruction form, or review the section entitled Voting of Proxies; Revocation of Proxies beginning on page 3 of the accompanying proxy statement.

By order of the Board of Directors,

| | | |

| | | /s/ Granger Cobb Granger Cobb President and Chief Executive Officer |

Seattle, Washington

March 30, 2011

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 24, 2011

Our proxy statement is attached. The proxy statement and our 2010 annual report to shareholders are available on our website at http://www.emeritus.com/investors. Additionally, and in accordance with Securities and Exchange Commission rules, you may access our proxy materials at http://bnymellon.mobular.net/bnymellon/esc

| TABLE OF CONTENTS |

| | Page |

| THE ANNUAL MEETING OF SHAREHOLDERS | 3 |

| Date, Time and Place of the Annual Meeting | 3 |

| Matters to be Considered at the Annual Meeting | 3 |

| Record Date; Shares Entitled to Vote | 3 |

| Voting of Proxies; Revocation of Proxies | 3 |

| Quorum; Broker Abstentions and Broker Non Votes | 4 |

| Expenses of Solicitation | 4 |

| Householding | 5 |

| Recommendation of Our Board | 5 |

| PROPOSAL 1 ELECTION OF DIRECTORS | 6 |

| Class I Nominee for Terms Expiring in 2012 | 6 |

| Class III Nominees for Terms Expiring in 2014 | 7 |

| Class I Directors Whose Terms Will Expire in 2012 | 7 |

| Class II Directors Whose Terms Will Expire in 2013 | 8 |

| PROPOSAL 2 ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION | 9 |

| PROPOSAL 3 ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION | 10 |

| PROPOSAL 4 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 11 |

| BOARD OF DIRECTORS AND CORPORATE GOVERNANCE. | 12 |

| Independence of the Board of Directors | 12 |

| Board Leadership Structure | 12 |

| Risk Oversight | 12 |

| Board Attendance | 13 |

| Information on Committees of the Board of Directors and Meetings | 13 |

| Shareholder Communications with the Board of Directors | 15 |

| TABLE OF CONTENTS |

| | Page |

| Code of Conduct, Code of Ethics and Reporting of Concerns | 15 |

| Compensation Committee Interlocks and Insider Board Participation | 16 |

| Executive Officers | 17 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 20 |

| EQUITY COMPENSATION PLAN INFORMATION | 22 |

| EXECUTIVE COMPENSATION | 23 |

| COMPENSATION DISCUSSION AND ANALYSIS | 23 |

| Executive Summary | 23 |

| Executive Compensation Program Objectives | 24 |

| Setting Executive Compensation | 24 |

| Role of Compensation Committee | 24 |

| Role of Executive Officers in Compensation Decisions | 25 |

| Executive Compensation Components | 26 |

| Tax Implications | 30 |

| 2011 Compensation | 30 |

| COMPENSATION COMMITTEE REPORT | 31 |

| EXECUTIVE COMPENSATION TABLES | 32 |

| Summary Compensation Table | 32 |

| 2010 Grants of Plan Based Awards | 34 |

| Outstanding Equity Awards at 2010 Fiscal Year-End | 35 |

| 2010 Option Exercises and Stock Vested | 36 |

| 2010 Nonqualified Deferred Compensation | 36 |

| Potential Payments upon Termination or Change in Control | 37 |

| DIRECTOR COMPENSATION | 40 |

| 2010 Director Compensation | 40 |

| 2010 Director Compensation Table | 41 |

| 2011 Director Compensation | 42 |

| TRANSACTIONS WITH RELATED PERSONS | 43 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 46 |

| TABLE OF CONTENTS |

| | Page |

| REPORT OF THE AUDIT COMMITTEE | 47 |

| SHAREHOLDER PROPOSALS | 48 |

| Submission of Shareholder Proposals for Inclusion in the Proxy Statement | 48 |

| Advanced Notice Procedures for Director Nominations and Other Business | 48 |

| OTHER INFORMATION | 48 |

| Directions | 49 |

THE ANNUAL MEETING OF SHAREHOLDERS

This proxy statement of Emeritus Corporation (“Emeritus,” the “Company,” “we,” or “us”) is furnished in connection with the solicitation of proxies from the holders of our common stock by our Board of Directors for use at the 2011 annual meeting of our shareholders. We are first making this proxy statement available to you on or about April 12, 2011.

Date, Time and Place of the Annual Meeting

The 2011 annual meeting of our shareholders will be held at the South Cascade Room of the Harbor Club, 801 Second Avenue, Seattle, Washington 98104, on Tuesday, May 24, 2011, at 10:00 a.m., local time.

Matters to be Considered at the Annual Meeting

The purpose of the annual meeting of our shareholders is to consider and vote on the proposals described below and any other matters that may properly come before the annual meeting or any adjournment or postponement of the annual meeting.

| 1. | To elect one director nominated by our Board of Directors into Class I of our Board of Directors to serve until the 2012 annual meeting of shareholders and three directors nominated by our Board of Directors into Class III of our Board of Directors to serve until the 2014 annual meeting of shareholders; |

| 2. | To hold an advisory resolution on the compensation we pay our named executive officers, as disclosed in these materials; |

| 3. | To hold an advisory vote on whether an advisory vote on the compensation we pay our named executive officers should be held every one, two or three years; |

| 4. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2011; and |

| 5. | To transact such other business as may properly come before the meeting and any adjournments thereof. |

Record Date; Shares Entitled to Vote

We have fixed the close of business on March 25, 2011 as the record date for the determination of holders of our common stock entitled to notice of, and to vote at, the annual meeting of our shareholders and any adjournment or postponement of the annual meeting. Each holder of record of our common stock on the record date is entitled to one vote for each share held on all matters to be voted on at the annual meeting of our shareholders. No other shares of our capital stock are entitled to notice of, and to vote at, the annual meeting of our shareholders. At the close of business on the record date, we had 44,253,336 shares of common stock outstanding and entitled to vote.

Voting of Proxies; Revocation of Proxies

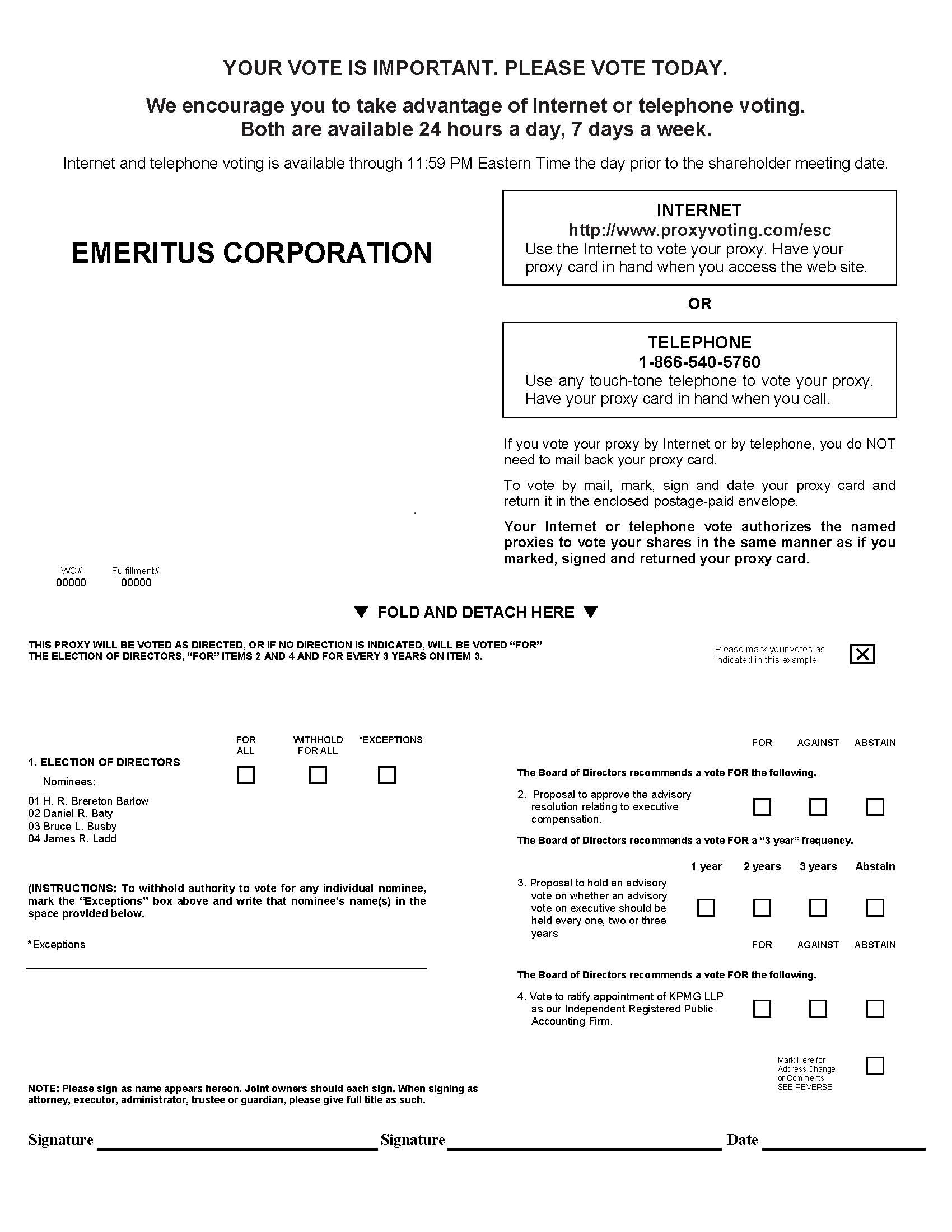

If you vote your shares of Emeritus common stock by signing and returning the enclosed proxy in the enclosed prepaid and addressed envelope, your shares will be voted at the annual meeting of our shareholders as you indicate on your proxy, unless your proxy is revoked. You are urged to mark the box on the proxy card, following the instructions included on your proxy card, to indicate how to vote your shares. If no instructions are indicated on your signed proxy card, your shares will be voted: (i) FOR the election of H. R. Brereton Barlow, Daniel R. Baty, Bruce L. Busby and James R. Ladd to our Board of Directors; (ii) FOR the approval of the advisory resolution on executive compensation; (iii) to conduct future advisory votes on executive compensation EVERY THREE YEARS; and (iv) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2011.

If you are a registered shareholder you may also vote your shares by accessing the Internet website specified in the printed proxy card and by following the instructions provided on the website. Chapter 23B.07.220 of the

Washington Business Corporation Act allows the electronic transmission of proxies to the person, firm, organization, or agent who is holder of the proxy. Alternatively, if you are a registered shareholder you may vote your shares by calling the telephone number specified in the printed proxy card and by following the instructions provided on the phone line. If your shares are held in an account at a brokerage firm, bank, or other custodian you must instruct such institution on how to vote your shares. Your broker, bank, or other custodian will vote your shares only if you provide instructions on how to vote by following the voting instructions provided to you by your broker, bank, or other custodian. If you do not instruct your broker, bank or other custodian, they will not be able to vote your shares other than for the proposal relating to the ratification of the appointment of our independent registered public accounting firm. Please refer to the information forwarded by your broker, bank or other custodian to see what voting options are available to you.

You may revoke your proxy at any time prior to its use by delivering a signed notice of revocation to our Corporate Secretary at our corporate offices at 3131 Elliott Avenue, Suite 500, Seattle, Washington 98121, by delivering a new duly executed proxy prior to the annual meeting of our shareholders or, if you are a holder of record, by attending the annual meeting and voting in person. If you hold your shares in “street name,” you must get a proxy from your broker, bank or other custodian to vote your shares in person at the annual meeting. If you voted by the Internet or telephone and wish to change your vote, you may go to the Internet site or call the toll-free number specified in the proxy card or voting instructions, whichever is applicable to your earlier vote, and follow the directions for changing your vote. Attendance at the annual meeting of our shareholders does not in itself constitute the revocation of a proxy.

Quorum; Broker Abstentions and Broker Non-Votes

A quorum, consisting of the holders of 22,126,669 shares (a majority of the shares entitled to vote as of the record date for the annual meeting of our shareholders), must be present in person or by proxy before any action may be taken at the annual meeting. Broker non-votes and abstentions will be treated as shares that are present for purposes of determining the presence of a quorum.

Directors will be elected by a plurality of the votes present by proxy or in person at the annual meeting of our shareholders. Shareholders are not entitled to cumulate votes in the election of directors. The proposals to approve a resolution on executive compensation and to ratify the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm will be approved if a majority of the total votes cast on the proposals vote in favor of them. Regarding the proposal to conduct future advisory votes on executive compensation every three years, the option of one year, two years or three years that receives the highest number of votes cast by shareholders will be the frequency for the advisory vote on executive compensation that has been selected by shareholders.

Abstention from voting on any of the proposals will not affect the outcome of the proposals since no vote will have been cast for the proposals. Brokers who hold shares for the accounts of their clients have discretionary authority to vote shares with respect to the ratification of the appointment of our independent registered public accounting firm if specific instructions are not given. Brokers do not have discretionary authority to vote on the election of our directors, the proposal to approve a resolution on executive compensation and the proposal to conduct future advisory votes on executive compensation every three years. Broker non-votes will not affect the outcome of these proposals because broker non-votes are not considered votes cast.

Expenses of Solicitation

We will bear the cost of soliciting proxies. Certain of our directors, officers, and other employees, without additional compensation, may solicit proxies personally or by telephone, e-mail, or facsimile. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares of common stock for their expenses in forwarding solicitation materials to such beneficial owners.

Householding

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of this proxy statement may have been sent to multiple shareholders in your household. Emeritus will promptly deliver a separate copy of this proxy statement to you if you write or call our Corporate Secretary at the following address or phone number: 3131 Elliott Avenue, Suite 500, Seattle, Washington 98121, telephone: (206) 298-2909. You may also access a copy of this proxy statement and our 2010 Annual Report on our website http://www.emeritus.com/investors. Additionally, and in accordance with Securities and Exchange Commission rules, you may access our proxy materials at http://bnymellon.mobular.net/bnymellon/esc. If you wish to receive separate copies of an annual report or proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee, or, if you are a record holder, you may contact Emeritus, as applicable, at the above address and phone number.

Recommendation of Our Board of Directors

Our Board of Directors, by a unanimous vote of those directors present, approved an advisory resolution on executive compensation and to conduct future advisory votes on executive compensation every three years. The Audit Committee of our Board of Directors approved the appointment of KPMG as our independent registered public accounting firm. The Nominating and Corporate Governance Committee of our Board of Directors recommended to our Board of Directors and our Board of Directors unanimously approved the nominations of H. R. Brereton Barlow, Daniel R. Baty, Bruce L. Busby and James R. Ladd for election to our Board of Directors.

The Emeritus Board of Directors recommends that you vote: (i) FOR each of the nominees for election to our Board of Directors; (ii) FOR approval of the advisory resolution on executive compensation; (iii) to conduct future advisory votes on executive compensation EVERY THREE YEARS; and (iv) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2011.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes. One class is elected each year by the shareholders. At the annual meeting of our shareholders, one director will be elected to serve for a term of one year, expiring on the date of the 2012 annual meeting of shareholders and three directors will be elected to serve for a term of three years, expiring on the date of the 2014 annual meeting of shareholders. If elected, the nominees will continue in office until a successor has been elected or until resignation or removal in the manner provided by our amended and restated bylaws. The names of the directors nominated for the terms, as well as the directors whose terms will continue after the annual meeting of our shareholders, are listed below. The biographies of each nominee and each continuing director contains information regarding the person’s service as a director, business experience, director positions with publicly traded companies held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused our Board of Directors and our Nominating and Corporate Governance Committee to determine that the person should serve as a member of our Board of Directors.

Pursuant to the terms of a shareholders’ agreement entered into in connection with our September 2007 acquisition of Summerville Senior Living, Inc., which we sometimes refer to as Summerville or the Summerville acquisition, Mr. Daniel R. Baty and his affiliated entities (the “Baty shareholders”), Saratoga Partners IV, L.P., Saratoga Coinvestment IV, LLC, and Saratoga Management Company, LLC (the “Saratoga shareholders”) and AP Summerville, LLC (“AP Summerville”), AP Summerville II, LLC (“AP Summerville II”), Apollo Real Estate Investment Fund III, L.P. (“AREIF III”) and Apollo Real Estate Investment Fund IV, L.P. (“AREIF IV” and together with AP Summerville, AP Summerville II and AREIF III, the “Apollo shareholders”) agreed to vote their shares to elect one representative designated by the Apollo shareholders, one representative designated by the Saratoga shareholders and one representative designated by the Baty shareholders to our Board of Directors so long as each shareholder group beneficially owns at least 5% of our outstanding shares or one-half of the amount of shares beneficially owned by the shareholder group immediately following the closing of the Summerville acquisition. On September 16, 2010, Messrs. David Niemiec and Charles P. Durkin, Jr., who represented the Saratoga shareholders, resigned as directors. The Saratoga shareholders have elected to not designate a new board representative, although they have not permanently waived their right to designate a representative under the shareholders’ agreement. The Apollo shareholders have designated Mr. Koenig as their representative pursuant to this shareholders agreement. The Baty shareholders have designated Stanley L. Baty as their representative pursuant to this shareholder agreement. In addition, pursuant to the shareholders agreement, the Baty shareholders, the Apollo shareholders and the Saratoga shareholders agreed to vote their shares to appoint Granger Cobb as director.

Nominees for Election

Class I Director Whose Term Will Expire in 2012

H. R. Brereton Barlow (age 60), has served as a member of our Board of Directors since March 2011. Mr. Barlow has served as the Chief Executive Officer of Premera Blue Cross since 2000. Mr. Barlow joined Premera in 1997 as its Chief Financial Officer and was promoted to serve as Chief Operating Officer. Previously, he served as Chief Financial Officer of Health Net, a major subsidiary of Health Systems International, a health maintenance organization, and AHI Healthcare Systems Inc., a primary and specialty care provider network. Prior to his employment with Health Net and AHI Healthcare Systems Inc., Mr. Barlow was a partner with Deloitte & Touche, LLP. Mr. Barlow currently serves on several boards of directors, including Blue Cross Blue Shield Association, Seattle University College of Nursing Advisory Board, National Institute for Health Care Management, Premera Blue Cross, University of Washington Business School, and Washington Healthcare Forum. Mr. Barlow brings to the Board extensive executive experience in the healthcare industry, particularly in accounting, finance, and operations.

Class III Directors Whose Terms Will Expire in 2014

Daniel R. Baty (age 67), one of the founders of Emeritus, has served as a member of our Board of Directors since our inception in 1993 and as Chairman of the Board of Directors since April 1995. Mr. Baty also served as our Chief Executive Officer since the founding of Emeritus until the completion of the Summerville acquisition in 2007, and as our Co-Chief Executive Officer until January 2011. Mr. Baty remains an employee and executive officer of our Company. Mr. Baty served as the Chairman of the Board of Directors of Holiday Retirement Corporation from 1987 to 2007 and served as its Chief Executive Officer from 1991 through September 1997. Since 1984, Mr. Baty has also served as Chairman of the Board of Directors of Columbia Pacific Group, Inc. and, since 1986, as Chairman of the Board of Directors of Columbia Pacific Management, Inc. Both of these companies are wholly owned by Mr. Baty and engage in developing independent living facilities and providing consulting services for that market. Mr. Baty is the father of Stanley L. Baty, a current director of our Company. We believe Mr. Baty is qualified to serve on our Board of Directors because he brings extensive executive and board level experience in the domestic and international healthcare industries, including the areas of real estate transactions, operations, management and corporate finance, and in-depth knowledge of our business as one of our co-founders and as one of our largest shareholders.

Bruce L. Busby (age 67), has served as a member of our Board of Directors since April 2004. Mr. Busby served as Chairman and Chief Executive Officer of The Hillhaven Corporation from 1993 until its merger with Vencor, Inc. in 1995. Hillhaven was a publicly-held operator of skilled nursing facilities and other health care related businesses based in Tacoma, Washington. Mr. Busby, who was a certified public accountant for over thirty years, has been retired since 1995. We believe Mr. Busby is qualified to serve on our Board of Directors because he brings extensive executive and board experience from the healthcare industry, particularly in accounting, finance, and operations.

James R. Ladd (age 68), has served as a member of our Board of Directors since September 2010. Mr. Ladd has served as the Senior Vice President of Finance and Operations for the Institute for Systems Biology since October 2009 and as a Partner in the consulting firm of Tatum, LLC since 2004. From March 2004 to June 2007, Mr. Ladd also served as Executive Vice President, Finance and Operations of City University of Seattle. Mr. Ladd is Chairman of the Boards of Directors of both Seattle Children’s Hospital and the Washington Society of CPAs and also serves on the Board of Directors of Sparling, Inc. Mr. Ladd was a managing partner of the Seattle and Tokyo offices of Deloitte & Touche, LLP, and has served in other executive finance and operations management positions during his career and is a certified public accountant. Mr. Ladd is also a board member of the Nishimachi Foundation and a board member and treasurer of the Skagit Aero Education Museum. We believe Mr. Ladd is qualified to serve on our Board of Directors because he brings extensive executive and board experience from both the public and private sector, particularly in finance and accounting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR

EACH OF THE DIRECTOR NOMINEES.

Continuing Directors

Class I Directors Whose Terms Will Expire in 2012

Stuart Koenig (age 58), has served as a member of our Board of Directors since September 2007, when we completed the Summerville acquisition. Mr. Koenig has been associated with Apollo Real Estate Advisors since 1995 and is a partner and its Chief Financial Officer. Prior to 1995, Mr. Koenig was a Vice President in the Real Estate Principal Investment Area of Goldman, Sachs & Co. where he served as Controller and Director of Investor Relations for the Whitehall real estate investment funds. We believe Mr. Koenig is qualified to serve on our board of directors because he brings extensive executive experience in real estate and healthcare industry investments, investor relations, financial management and executive compensation.

Robert E. Marks (age 59), has served as a member of our Board of Directors since July 2005. Since 1994, Mr. Marks has been the President of Marks Ventures, LLC, a private equity investment firm. Mr. Marks is a director and Chairman of the Audit and Finance Committee of Denny’s Corporation, as well as a member of the Board of

Trustees of the Fisher House Foundation, a member of the Board of Trustees of the Greenwich, Connecticut Public Library, a member of the Board of Trustees of the Greenwich Field Club, and a member of the Board of Trustees of The International Rescue Committee. We believe Mr. Marks is qualified to serve on our board of directors because he brings extensive finance, investment and executive compensation experience in the service industries.

Class II Directors Whose Terms Will Expire in 2013

Stanley L. Baty (age 39), has served as a member of our Board of Directors since September 2004. Mr. Baty is the son of Daniel R. Baty, Chairman of our Board of Directors. Since November 1996, Mr. Stan Baty has served as the Vice President of Columbia Pacific Management, Inc., where he is responsible for real estate related investment decisions. From 1994 to 1996, Mr. Stan Baty was a financial analyst for Nomura Securities Corporation. We believe Mr. Baty is qualified to serve on our board of directors because he brings experience in real estate investment and operations, acquisitions, and financial analysis.

Raymond R. Brandstrom (age 58), one of the founders of Emeritus, has served as a member of our Board of Directors since our inception in 1993. From 1993 to March 1999, Mr. Brandstrom served as our President and Chief Operating Officer. Mr. Brandstrom served as our Vice President of Finance, Chief Financial Officer and Secretary from 2000 to 2007, and upon completion of the Summerville acquisition, he became our Executive Vice President—Finance, a position he held until his retirement from this position on December 21, 2009. Mr. Brandstrom remains an employee of our Company, Vice Chairman of the Board of Directors, and Corporate Secretary. From May 1992 to October 1996, Mr. Brandstrom served as President of Columbia Pacific Group, Inc. and Columbia Pacific Management, Inc., which are owned by Daniel R. Baty. From May 1992 to May 1997, Mr. Brandstrom served as Vice President and Treasurer of Columbia Winery, a company previously affiliated with Mr. Baty that is engaged in the production and sale of table wines. Mr. Brandstrom is a director and member of the audit committee of Red Lion Hotels Corporation, a publicly held company. We believe Mr. Brandstrom is qualified to serve on our Board of Directors because he brings extensive healthcare industry experience in finance, financial reporting, real estate investment and operations, and in-depth knowledge of our business as one of our co-founders.

Granger Cobb (age 50), has served as our President and Chief Executive Officer since January 2011 and as a member of our Board of Directors since September 2007. Mr. Cobb previously served as our President and Co-Chief Executive Officer since September 2007, when we completed our acquisition of Summerville. He served as President, Chief Executive Officer and a director of Summerville from 2000 until the September 2007 Summerville acquisition. Mr. Cobb joined Summerville in 1998 with its acquisition of Cobbco, Inc., a California-based assisted living company founded by Mr. Cobb in 1989. Mr. Cobb is active in several industry associations and has served on the Boards of Directors of the Assisted Living Federation of America (“ALFA”), the National Investment Center for the Seniors Housing & Care Industry (“NIC”), and the political action committees for ALFA and the California Assisted Living Association (“CALA”). Mr. Cobb currently serves as the chairman of ALFA. Mr. Cobb was president of CCK Health Care, Inc., a company which filed a voluntary petition for relief under Chapter 7 of the United States Bankruptcy Code in 2004. Mr. Cobb is the brother of Melanie Werdel, the Executive Vice President—Administration of our Company. We believe Mr. Cobb is qualified to serve on our Board of Directors because he brings extensive executive management and operating experience in the senior residential, assisted living, and skilled nursing industries, and in-depth knowledge of our business as our Chief Executive Officer.

Richard W. Macedonia (age 67), has served as a member of our Board of Directors since November 2008. Since September 2007, Mr. Macedonia has served as Chief Executive Officer Emeritus of Sodexo, Inc., a provider of integrated food and facilities management services. From January 2004 to September 2007, Mr. Macedonia served as Chief Executive Officer and Chief Operating Officer of Sodexo, Inc. Mr. Macedonia began his career with Sodexho Alliance SA in 1968 as a unit manager in the Campus Services Divisions. Mr. Macedonia held various positions at Sodexo and its affiliates, from June 2003 to 2007, including, Group Chief Operating Officer of Sodexo Alliance SA, Executive Vice President, President and Chief Executive Officer of Sodexo North America and President of Sodexho’s Health Care Services Division. Mr. Macedonia has served in various executive management positions with predecessor companies SAGA Corporation and Marriott International, Inc. and was appointed as a Division Vice President with Sodexo in 1998. We believe Mr. Macedonia is qualified to serve on our Board of Directors because he brings extensive executive experience in the food services, facilities management and healthcare services industries, as well as leadership in the areas of corporate diversity and best places to work practices.

ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables our shareholders to vote to approve, on an advisory, or non-binding basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules. This advisory proposal, commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on our named executive officers’ compensation. This advisory resolution is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

Our Compensation Committee is responsible for designing and administering our executive compensation program and has designed our executive compensation program to provide a competitive compensation and benefits package that reflects Company performance and job complexity, yet ensures job retention, motivation and alignment with the interests of our shareholders. We encourage shareholders to read the Compensation Discussion and Analysis in this proxy statement, which describes the processes our Compensation Committee used to determine the structure and amounts of the compensation of our named executive officers in fiscal 2010 and how our executive compensation philosophy, policies and procedures operate and are designed to achieve our compensation objectives. The Compensation Committee and the Board of Directors believe that the policies and procedures in the Compensation Discussion and Analysis are effective in achieving the Company’s goals and that the named executive officers in this proxy statement have contributed to the Company’s successes.

Accordingly, we ask our shareholders to vote FOR the following resolution at the annual meeting of our shareholders:

RESOLVED, that the shareholders of Emeritus Corporation (the “Company”) approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table, and the other related tables and disclosures in the Proxy Statement for the Company’s 2011 annual meeting of shareholders.

This advisory resolution is non-binding on the Company, the Compensation Committee or our Board of Directors. Although non-binding, our management, the Board of Directors and our Compensation Committee value the opinions of our shareholders and will review and consider the voting results when making future decisions regarding our executive compensation program.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF THE ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION.

PROPOSAL 3

ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

In accordance with the Dodd-Frank Act, we are also asking shareholders to vote on the frequency of future advisory, or non-binding, votes on executive compensation reflected in Proposal Number 2. You may vote for a “say-on-pay” vote frequency of every one year, two years or three years, or you may abstain from expressing a preference. The option of one year, two years or three years that receives the highest number of votes cast by shareholders will be the frequency for the advisory vote on executive compensation that has been selected by shareholders. This advisory “frequency” vote is required at least once every six years beginning with our 2011 annual meeting of shareholders.

The Board of Directors has determined that holding an advisory vote on executive compensation every three years is the most appropriate policy for Emeritus at this time, and recommends that shareholders vote for future advisory votes on executive compensation to occur every third year. In arriving at its recommendation, our Board considered that setting a three-year period for holding an advisory resolution on executive compensation will allow our shareholders to provide us with their input on our compensation philosophy, policies and practices disclosed in the proxy statement yet allow an effective timeframe for the Company to respond to the shareholders’ feedback. However, shareholders are not being asked to vote to approve or disapprove the Board’s recommendation. Instead, shareholders are being asked to vote on the frequency of holding an advisory vote every one year, every two years, or every three years.

This vote on the frequency of future advisory votes on executive compensation is not binding on the Company, the Compensation Committee, or our Board of Directors. Although non-binding, our management, the Board and the Compensation Committee will carefully review the voting results.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE TO CONDUCT FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION EVERY THREE YEARS.

PROPOSAL 4

RATIFICATION OF APPOINTMENT OF KPMG AS OUR

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors has selected KPMG to continue as our independent registered public accounting firm for the fiscal year ending December 31, 2011. KPMG has audited our accounts since July 28, 1995. The Board of Directors is submitting the Audit Committee’s selection of KPMG to the shareholders for ratification.

Appointment of our independent registered public accounting firm is not required to be submitted to a vote of our shareholders for ratification. However, our Board of Directors has chosen to submit this matter to the shareholders as a matter of good corporate practice. If the shareholders fail to ratify the appointment, the Audit Committee of our Board of Directors may reconsider whether to retain KPMG, and may retain KPMG or another firm without resubmitting the matter to our shareholders. Even if the appointment is ratified, the Audit Committee of our Board of Directors may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company.

The following table presents the aggregate fees for professional services rendered by KPMG.

| | | 2010 | | | 2009 | |

| Audit fees (1) | | $ | 1,053,250 | | | $ | 1,165,000 | |

| Tax fees (2) | | | - | | | | 183,358 | |

| Total | | $ | 1,053,250 | | | $ | 1,348,358 | |

| (1) | KPMG’s aggregate fees billed for the audit of our annual consolidated financial statements, the audit of our internal controls over financial reporting, quarterly reviews and services that are normally provided by an independent registered public accounting firm in connection with statutory and regulatory filings or engagements, including relating to the Securities and Exchange Commission (the “SEC”). |

| (2) | KPMG’s aggregate fees billed for professional services rendered for tax compliance, including tax services related to the Summerville acquisition. |

Our Audit Committee has considered whether KPMG’s provision of non-audit services is compatible with maintaining the independence of KPMG. Our Audit Committee’s written charter requires that all services KPMG may provide to us, including audit services and permitted audit-related services, be approved in advance by the Audit Committee. In the event that an audit or non-audit service requires approval prior to the next scheduled meeting of the Audit Committee, the Chairman of the Audit Committee has been authorized to approve such services. Any such approvals will be reported to the Audit Committee at its next scheduled meeting. In 2010 and 2009, 100% of all services provided by KPMG were pre-approved by the Audit Committee or the Chairman of the Audit Committee in accordance with the above policy.

A representative of KPMG is expected to be present at the annual meeting of shareholders with the opportunity to make a statement, if the representative so desires, and is expected to be available to respond to appropriate questions from shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR

THE RATIFICATION OF KPMG AS OUR INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independence of the Board of Directors

Section 303A.01 of the New York Stock Exchange Listed Company Manual (the “NYSE Manual”) requires that a majority of the members of our Board of Directors qualify as independent, as defined by Section 303A.02 of the NYSE Manual. Our Board reviewed the independence of our directors in accordance with the applicable standards of the New York Stock Exchange, as well as other applicable laws and regulations. In the case of directors who serve on our Audit Committee, our Board also reviews their independence under Rule 10A-3 promulgated under the Exchange Act. In order to meet the definition of “independent” under Section 303A.02 of the NYSE Manual, a director, among other things, must not be an employee of the company, must not be an immediate family member of an executive officer, and must not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of director.

Our Board of Directors has determined that a majority of the members of our Board qualify as independent. Based on an analysis of the independence of our directors, our Board of Directors determined that H. R. Brereton Barlow, Bruce L. Busby, Stuart Koenig, James R. Ladd, Richard W. Macedonia, and Robert E. Marks are independent.

Board Leadership Structure

In connection with Mr. Baty’s resignation as Co-Chief Executive Officer in January 2011, we changed our leadership structure such that Mr. Baty is Chairman of the Board of Directors and Mr. Cobb is President and Chief Executive Officer. Previously, Mr. Baty was both Co-Chief Executive Officer and Chairman of the Board of Directors. Mr. Baty is a founder of the Company, as well as our largest individual shareholder and has extensive healthcare industry experience. In accordance with our Corporate Governance Guidelines, a copy of which is posted on our website at http://www.emeritus.com/Investors, the Board of Directors does not have a policy on whether the same person should serve as both the chief executive officer and chairman of the Board of Directors or, if the roles are separate, whether the chairman should be selected from the nonemployee directors or should be an employee. The Board of Directors believes that it should have the flexibility to make these determinations at any given point in a manner that it believes best to provide appropriate leadership for the Company. The Board of Directors believes that its current leadership structure, with Mr. Baty serving as Chairman of the Board and Mr. Cobb serving as President and Chief Executive Officer, is appropriate given their past experience.

Historically, the Chairman of the Nominating and Corporate Governance Committee presided over executive sessions of our Board of Directors. In 2010, the Board of Directors elected Mr. Niemiec to the role of lead independent director. Upon Mr. Niemiec’s resignation from the Board of Directors in September 2010, the Board elected Mr. Koenig to the role of lead independent director. Our Chief Executive Officer consults periodically with the lead independent director on board-related matters and on issues facing the Company. In addition, the lead independent director serves as the principal liaison between the Chairman of the Board of Directors and the independent directors and presides at executive sessions of non-management directors.

The Board provides guidance and oversight with respect to our overall performance, strategic plans, key corporate policies and decisions and enterprise risk management. Among other things, it approves acquisitions, dispositions and other transactions, advises management on key financial and business objectives and monitors our progress with respect to these matters. The entire Board of Directors is engaged in risk management oversight. In its oversight role, the Board of Directors reviews financial and operating performance, including occupancy trends, debt maturities and, reports on economic conditions, at least quarterly. The Board of Directors annually reviews the Company’s strategic plan, which addresses, among other things, enterprise risks facing the Company. The Audit Committee assists the Board of Directors in its oversight of risk management by monitoring financial performance, financial reporting and liquidity and capital resources.

Board Attendance

During 2010, there were seven meetings of the Board of Directors. Of the 19 aggregate number of meetings of the Board of Directors and its committees, only two meetings had less than 100% attendance. We do not have a specific policy requiring director attendance at the annual meeting of shareholders; however, we encourage our directors to be present at the annual meeting and available to answer shareholder questions. All but one of our directors attended the annual meeting held in 2010.

Information on Committees of the Board of Directors and Meetings

The Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The following table provides current membership and chairmanship information for each of the committees.

| Board Members | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Special Committee of Independent Directors | Subcommittee for Performance Based Compensation |

| | | | | | |

| H. R. Brereton Barlow | | X | | | X |

| Bruce L. Busby | X | | X | | |

| Stuart Koenig** | | X | | X* | |

| James R. Ladd | X | | | X | |

| Richard Macedonia | X* | | X | X | |

| Robert E. Marks | | X* | X* | | X |

* indicates Chairman of that Committee

** indicates Lead Independent Director beginning September 16, 2010

The Audit Committee. Section 303A.07 of the NYSE Manual requires that our Audit Committee consist of a minimum of three members, all of which must satisfy the independence standards of Section 303A.02 of the NYSE Manual and the applicable rules promulgated by the SEC, must be financially literate and at least one member of which must have accounting or related financial management expertise. Our Audit Committee consists of Messrs. Busby, Ladd, and Macedonia (Chairman), each of whom are independent within the meaning of Section 303A.02 of the NYSE Manual and the applicable rules promulgated by the SEC. The Audit Committee met four times during 2010.

The Audit Committee selects and retains an independent registered public accounting firm to audit the annual financial statements, approves the terms of the engagement of the independent registered public accounting firm and reviews and approves the fees charged for audits and for any non-audit assignments. The Audit Committee’s responsibilities also include overseeing (1) the integrity of the financial statements and internal controls over financial reporting, which includes reviewing the scope and results of the annual audit by the independent registered public accounting firm, any recommendations of the independent registered public accounting firm resulting from the annual audit and management’s response thereto, and any reports from the independent registered public accounting firm regarding critical accounting principles and policies being applied by Emeritus in financial reporting, (2) compliance with legal and regulatory requirements, (3) the independent registered public accounting firm’s qualifications and independence, (4) the satisfactory performance of the independent registered public accounting firm in providing the agreed upon services, and (5) such other related matters as may be assigned to it by our Board of Directors. The Board has adopted a written charter for the Audit Committee, a copy of which is posted on the Company’s website at http://www.emeritus.com/Investors.

The Board of Directors has determined that Messrs. Busby, Ladd, and Macedonia each qualify as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC and that all members of the Audit Committee are financially literate and independent in accordance with the requirements of the SEC and the New York Stock Exchange.

Compensation Committee. Section 303A.05 of the NYSE Manual requires that our Compensation Committee consist of entirely independent directors. The Compensation Committee consists of Messrs. Marks (Chairman), Barlow, Koenig, and, until March 10, 2011, Mr. Busby, all of whom are independent within the meaning of Section 303A.02 of the NYSE Manual and the applicable rules promulgated by the SEC. The Compensation Committee held five meetings during 2010.

Our Compensation Committee is responsible for administering our executive compensation programs including salaries, incentives, and other forms of compensation for directors, officers, and our other key employees, and making recommendations with respect to such programs to the Board of Directors; administering the equity incentive plans; and recommending policies relating to benefit plans to the Board. The Board has adopted a written Compensation Committee charter that is available at our website at http://www.emeritus.com/Investors. The Compensation Committee’s charter allows it to delegate its authority in appropriate circumstances to subcommittees or one or more members of the Board of Directors or Emeritus officers.

In August 2007, the Board established a subcommittee to oversee qualified performance-based compensation that currently consists of two non-employee directors, Mr. Barlow and Mr. Marks and, until March 10, 2011, Mr. Busby. This subcommittee has the responsibility of approving equity awards to executive officers and directors for which the exemption provided under Rule 16b-3 under the Exchange Act is sought, approving any performance-based compensation paid or awarded to Section 162(m) covered employees, and approving equity awards or other performance-based compensation paid or awarded to other employees. The subcommittee did not meet in 2010.

In 2010, the Compensation Committee engaged an independent compensation consultant. The compensation consultant regularly attends the Compensation Committee meetings, provides information on compensation trends and practices and provides assistance to the Committee in evaluating our executive compensation policy and programs. Towers Watson & Co. served as the Committee’s 2010 compensation consultant. Towers Watson & Co. does not provide services to our management without the Committee’s approval, but has been directed by the Committee to work in cooperation with management as necessary to gather information to carry out its obligation to the Committee. Towers Watson & Co. provided information in order to facilitate decision making for the overall compensation strategy for our executives. This information consisted of a survey group proxy study, general healthcare industry market data, benchmarks for stock option issuances, and recommendations on types of equity awards for executive compensation. During 2010, Towers Watson & Co. and its affiliates did not provide additional services to the Company in an amount in excess of $120,000.

Although the Compensation Committee determines the compensation and other terms of employment of the named executive officers and other executives, the Compensation Committee also relies upon the recommendations of the Chief Executive Officer and the Chief Financial Officer in matters related to the individual performance of the other executive officers because the Compensation Committee believes that the Chief Executive Officer and the Chief Financial Officer are the most qualified to make this assessment. The Compensation Committee then reviews and considers these recommendations in its deliberations, taking into account each executive officer’s success in achieving individual performance goals and objectives, and the performance goals and objectives deemed relevant.

Nominating and Corporate Governance Committee. Section 303A.04 of the NYSE Manual requires that our Nominating and Corporate Governance Committee consist of entirely independent directors. Our Nominating and Corporate Governance Committee consists of Messrs. Marks (Chairman), Busby, and Macedonia, all of whom are independent within the meaning of Section 303A.02 of the NYSE Manual. The Nominating and Corporate Governance Committee held three meetings during 2010.

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become members of the Board of Directors, approving and recommending director candidates to the Board, developing and recommending to the Board our corporate governance principles and policies, and monitoring compliance with these principles and policies. The Nominating and Corporate Governance Committee charter establishes director selection guidelines (the “Director Selection Guidelines”) for guidance in determining qualification requirements for directors, Board composition criteria, and the procedure for the selection of new directors. The Director Selection Guidelines are attached as an exhibit to our Nominating and Corporate Governance Committee charter, which can be found on our website at http://www.emeritus.com/Investors.

Annually, the Nominating and Corporate Governance Committee considers and recommends to the Board a slate of directors for election at the next annual meeting of shareholders. In selecting the slate, the Nominating and Corporate Governance Committee considers (i) incumbent directors who have indicated a willingness to continue to serve on the Board, (ii) other individuals as determined by the Nominating and Governance Committee and (iii) candidates, if any, nominated by our shareholders. Additionally, if at any time during the year a seat on the Board becomes vacant or a new seat is created, the Nominating and Corporate Governance Committee considers and recommends a candidate to the Board for appointment to fill the seat.

In accordance with the Director Selection Guidelines, the Nominating and Corporate Governance Committee will consider the following, among other things, in its evaluation of candidates for nomination: personal and professional ethics, training, commitment to fulfilling the duties of the Board of Directors, commitment to understanding our business, commitment to engaging in activities in our best interests, independence, diversity, industry knowledge, financial or accounting expertise, leadership qualities, public company board of director and committee experience, and other relevant qualifications. A director candidate’s ability to devote adequate time to Board of Directors and committee activities is also considered.

The Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity. However, diversity is one factor considered by the Nominating and Corporate Governance Committee in evaluating overall board composition and evaluating appropriate director candidates.

The Nominating and Corporate Governance Committee will consider candidates recommended by shareholders. Shareholders wishing to suggest director candidates should submit their suggestions in writing to the Chairperson of the Nominating and Corporate Governance Committee, c/o our Corporate Secretary, providing the candidate’s name, biographical data, and other relevant information outlined in the Director Selection Guidelines. The Committee will review shareholder-recommended nominees based on the same criteria as its own nominees. Shareholders who intend to nominate a director for election at the 2011 annual meeting of shareholders must provide advance written notice of such nomination to the Corporate Secretary in the manner described below under Shareholder Proposals. We have not received any recommendations from shareholders requesting that the Board of Directors consider a candidate for inclusion among the slate of nominees in this proxy statement.

Shareholder Communications with the Board of Directors

Shareholders and other interested parties may contact the Board of Directors as a group or any individual director by sending written correspondence to the following address: Board of Directors, Attn: Corporate Secretary, Emeritus Corporation, 3131 Elliott Avenue, Suite 500, Seattle, Washington 98121. Shareholders and other interested parties should clearly specify in each communication the name(s) of the group of directors or the individual to whom the communication is addressed.

Code of Conduct, Code of Ethics and Reporting of Concerns

We have adopted a Code of Conduct that provides ethical standards and policies applicable to all of our officers, employees and directors in the conduct of their work. The Code of Conduct requires that our officers, employees, and directors avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner, and otherwise act with integrity and in our best interest.

We have also adopted a Code of Ethics for our Chief Executive Officer, our Chief Financial Officer, our principal accounting officer and our controller (or persons performing similar functions). This Code of Ethics supplements our Code of Conduct and is intended to promote honest and ethical conduct, full and accurate reporting, and compliance with laws as well as other matters.

The Code of Conduct and the Code of Ethics are available at our website at http://www.emeritus.com/Investors. We have also established procedures for the confidential and anonymous submission and receipt of complaints regarding accounting and auditing matters, conflicts of interests, securities violations and other matters. These procedures provide substantial protections to employees who report company misconduct.

Compensation Committee Interlocks and Insider Board Participation

The Compensation Committee is comprised of Messrs. Marks (Chairman), Barlow, Koenig, and, until March 10, 2011, Mr. Busby, all of whom (except Mr. Barlow) served on the committee during 2010. None of the members of the Compensation Committee was an officer or employee of Emeritus during 2010, and none of such members is a former officer of Emeritus. Mr. Durkin served as a member of the Compensation Committee until September 16, 2010 when he resigned. Mr. Durkin is a member of Saratoga Associates IV, the general partner of Saratoga Partners IV, L.P, which together with related entities, beneficially owns approximately 9.4% of our common stock. Mr. Koenig is a Partner and the Chief Financial Officer of the Apollo Real Estate Investment Funds III and IV, which we refer to as AREIF, which collectively beneficially own approximately 14.7% of our common stock. We have entered into a number of transactions with the Saratoga entities and AREIF which are described in the section entitled, Transactions with Related Persons beginning on page 43 of this proxy statement.

Executive Officers

The following table presents certain information about our executive officers.

| Name | | Age | | Position |

| | | | | |

| Daniel R. Baty | | 67 | | Chairman of the Board |

| Granger Cobb | | 50 | | President and Chief Executive Officer |

| Robert C. Bateman | | 48 | | Executive Vice President—Finance and Chief Financial Officer |

| James Christopher Hyatt | | 37 | | Executive Vice President—Operations and Chief Operating Officer |

| Melanie Werdel | | 40 | | Executive Vice President—Administration |

| Budgie Amparo | | 47 | | Executive Vice President—Quality Services and Risk Management |

| Jayne Sallerson | | 48 | | Executive Vice President—Sales and Marketing |

| Christopher M. Belford | | 49 | | Senior Vice President—Operations |

| John Cincotta | | 48 | | Senior Vice President—Sales |

| Christopher R. Guay | | 39 | | Senior Vice President—Ancillary Services |

| Jim L. Hanson | | 56 | | Senior Vice President—Financial Services and Controller |

| Eric Mendelsohn | | 49 | | Senior Vice President—Corporate Development |

| Martin D. Roffe | | 63 | | Senior Vice President—Financial Planning |

| Sara E. Vadakin | | 50 | | Senior Vice President—Quality Services |

| Leo Watterson | | 58 | | Senior Vice President—Corporate Accounting and Chief Accounting Officer |

For biographical information for Messrs. Baty, and Cobb, please refer to the section entitled Proposal 1 - Election of Directors on page 6.

Robert C. Bateman has served as our Executive Vice President—Finance and Chief Financial Officer since December 2009. Prior to joining Emeritus, and throughout most of 2009, Mr. Bateman was Chief Financial Officer and Corporate Secretary of EagleView Technologies, Inc., a provider of detailed measurements from aerial images. From 2007 to 2009, Mr. Bateman was Chief Financial Officer of VisionGate, Inc., a medical device company. From 2004 to 2006, Mr. Bateman served as Senior Vice President and Chief Financial Officer of Fisher Communications, Inc., a publicly-held communications and media company, and from 2003 as its Vice President—Finance. From 1999 to 2003, Mr. Bateman served as Chief Financial Officer of Applied Microsystems Corp. Mr. Bateman currently serves on the Operator Advisory Board for the National Investment Center for the Seniors Housing and Care Industry and on ALFA’s CFO Executive Roundtable. Mr. Bateman has 24 years of experience in various financial and administrative capacities, including nine years at Ernst & Young LLP and subsequently serving as chief financial officer of five other companies, three of which were NASDAQ-listed publicly traded companies. Mr. Bateman is a certified public accountant and a certified management accountant.

James Christopher Hyatt has served as our Executive Vice President—Operations and Chief Operating Officer since April 2010. Mr. Hyatt previously served as our Senior Vice President—Operations since July 2009. Mr. Hyatt joined Emeritus in 1998 and was a Regional and Divisional Director of Operations until promoted to Vice President—Operations for the Southeast Division in May 2007. Mr. Hyatt has an extensive multi-site senior housing management background in operations, sales and marketing and quality services, including experience in the retirement living, assisted living, memory care and skilled nursing industry sectors. Prior to joining Emeritus, Mr. Hyatt worked in the acute care industry for seven years and has a total of 18 years experience in the healthcare industry. Mr. Hyatt has also served on, and assisted in, grass roots campaigns/committees with several state and local affiliations over the last decade.

Melanie Werdel has served as our Executive Vice President—Administration since joining Emeritus in September 2007, upon completion of the Summerville acquisition. Ms. Werdel previously served as Senior Vice President, Administration for Summerville overseeing corporate compliance, licensing standards and requirements and Summerville’s overall risk management and operational policies and procedures from December 2001 until we completed the Summerville acquisition. Prior to joining Summerville in 1998, Ms. Werdel served as the Vice President of Administration for Cobbco, Inc., a California-based assisted living and skilled nursing company founded by Mr. Cobb. Ms. Werdel has over 17 years of long-term care management experience and serves on the Executive Board of Directors for American Seniors Housing Association (ASHA). Ms. Werdel serves on the Government Relations Executive Roundtable for ALFA. Ms. Werdel is the sister of Mr. Cobb.

Budgie Amparo has served as our Executive Vice President—Quality Services and Risk Management since April 2010. Mr. Amparo previously served as our Senior Vice President—Quality and Risk Management since joining Emeritus in September 2007, upon completion of the Summerville acquisition. Previously, Mr. Amparo served as Vice President of Quality and Risk Management for Summerville from 2002 until we completed the Summerville acquisition. Mr. Amparo is a registered nurse with a master’s degree in nursing and has 23 years of combined healthcare experience in nursing education, acute care, skilled nursing, and assisted living. Prior to joining Summerville, Mr. Amparo worked for Kaiser Permanente where he opened Kaiser Permanente’s first subacute skilled nursing facility in northern California in 2002. Mr. Amparo also spent 10 years with Mariner Post-Acute Network in a variety of positions including overseeing quality assurance, clinical operations, and regulatory compliance for over 40 skilled nursing facilities in 11 states. Mr. Amparo is a member of the Clinical Executive Roundtable for ALFA.

Jayne Sallerson has served as our Executive Vice President—Sales and Marketing since April 2010. Ms. Sallerson previously served as our Senior Vice President—Marketing since September 2008. Ms. Sallerson joined Emeritus as Vice President of Marketing in September 2007, upon completion of the Summerville acquisition. Prior to joining Emeritus, Ms. Sallerson served as Vice President of Sales and Marketing for Summerville from 2003 to 2007 after having served as a Regional Director of Sales and Marketing for Summerville from 2000 to 2003. Ms. Sallerson has 26 years of sales and marketing experience in the healthcare and senior living industries. Prior to working in the senior living industry, Ms. Sallerson worked in the skilled nursing, durable medical equipment and rehabilitation industries in various sales and marketing roles. Ms. Sallerson is a member of the Sales and Marketing Executive Roundtable for ALFA and is a member of the organization's Operational Excellence Panel.

Christopher M. Belford has served as our Senior Vice President—Operations since January 2011. Mr. Belford previously served as our Vice President of Operations—South Central Division since September 2007. Mr. Belford joined Emeritus in January 2001 as Regional Director of Operations for California and was promoted to Divisional Director of Operations for the Southwest Division in May 2001. Mr. Belford was then promoted to Vice President of Operations—Central Division in October 2003. Prior to joining Emeritus, Mr. Belford served as Vice President of Operations for Regent Assisted Living, Inc. from 1996 to 2000. Mr. Belford has over 21 years of experience in senior housing industry with extensive experience in operations, nursing, assisted, and independent living facilities. Mr. Belford is active with industry associations, including ALFA.

John Cincotta has served as our Senior Vice President—Sales since September 2008. Mr. Cincotta joined Emeritus in 1997 as National Director of New Developments and became the National Sales and Marketing Training Director in 1999. Mr. Cincotta was promoted to National Director of Sales and Marketing in 2000 and to Senior Vice President—Sales and Marketing in September 2007. Mr. Cincotta has 20 years of experience in the healthcare industry, including five years in skilled nursing and 13 years in assisted living. Prior to joining Emeritus, Mr. Cincotta served as Divisional Sales and Marketing Director for Beverly Enterprises for the states of California and Washington and as the Regional Director of Sales and Marketing for The Hillhaven Corporation. The Hillhaven Corporation operated nursing centers, pharmacies, and retirement housing communities. Mr. Cincotta serves on the Sales and Marketing Executive Roundtable for ALFA.

Chris Guay has served as our Senior Vice President—Ancillary Services since November 2010. Previously, Mr. Guay served as our Northeast Division Vice President—Operations since May 2007. Mr. Guay joined Emeritus in 1998 and has extensive multi-site senior housing management experience in retirement living, assisted living, memory care, and skilled nursing communities. Prior to Emeritus, Mr. Guay worked in the rehabilitation therapy industry and has over 15 years of experience in the healthcare industry. Mr. Guay is active with industry associations, serving on several boards and committees of ALFA, the Massachusetts Assisted Living Facilities Association and the Florida Assisted Living Association over the last decade.

Jim L. Hanson has served as our Senior Vice President—Financial Services and Controller since September 2007. Mr. Hanson joined Emeritus in April 2000 and served as our Director of Financial Services. Prior to joining Emeritus, Mr. Hanson held various accounting, financial, and administrative positions spanning a 21-year career with Pepsico, Inc. Mr. Hanson is currently responsible for the overall management of the accounting and I.T. departments at Emeritus headquarters in Seattle, Washington. Mr. Hanson has over 33 years of experience in the financial services field.

Eric Mendelsohn has served as our Senior Vice President—Corporate Development since September 2007. Mr. Mendelsohn joined Emeritus as Director of Real Estate and Legal Affairs in February of 2006. Mr. Mendelsohn is currently responsible for the acquisition, development, and financing of new and existing Emeritus buildings. Mr. Mendelsohn has over 22 years of experience in real estate and related financing and is a member of the bar in both Washington State and Florida. Prior to joining Emeritus he served as a Transaction Officer for the University of Washington where he managed the acquisition, leasing, and financing of healthcare properties for the School of Medicine as well as other property needs for University of Washington clients.

Martin D. Roffe has served as our Senior Vice President—Financial Planning since September 2007. Mr. Roffe joined Emeritus as Director of Financial Planning in March 1998, and was promoted to Vice President of Financial Planning in October 1999. Mr. Roffe has 36 years of experience in the acute care, long-term care, and senior housing industries. Prior to joining Emeritus, from May 1987 until February 1996, Mr. Roffe served as Vice President of Financial Planning for The Hillhaven Corporation, where he also held the positions of Senior Application Analyst and Director of Financial Planning.

Sara E. Vadakin has served as our Senior Vice President—Quality Services since February 2011. Ms. Vadakin has worked in long-term care and senior living services for over 30 years, and was previously Corporate Vice President of Quality & Clinical Services for Assisted Living Concepts, Inc. from 2005 to 2011. Ms. Vadakin is a registered nurse and licensed nursing home administrator, with a bachelor’s degree in nursing and a master’s degree in educational psychology and community counseling. Over the years, progressive management roles have included Director of Education, Director of Nursing, Administrator, Nurse Consultant and Vice President of Clinical Services for both skilled nursing and assisted living communities across the United States. Ms. Vadakin has served on the Clinical Executive and Operations Excellence Advisory Committees of ALFA and was a past member of the JCAHO Professional Technical Advisory Committee for Long-Term Care. Ms. Vadakin was also recognized as a 2010 ALFA “Champion for Seniors” award winner.

Leo Watterson has served as our Senior Vice President—Corporate Accounting and Chief Accounting Officer since November 2009 after having served as the Company’s Vice President—Corporate Accounting and Chief Accounting Officer upon completion of the Summerville acquisition in September 2007. Mr. Watterson joined Emeritus as Director of Corporate Accounting in February 2005. Mr. Watterson is a certified public accountant and has over 30 years of experience in the long-term care and senior housing industries. Prior to joining Emeritus, Mr. Watterson spent four years in public accounting with a focus on audits of healthcare entities, served 12 years with The Hillhaven Corporation, and nine years with Sun Healthcare Group, Inc., an operator of long-term care facilities, pharmacies, and retirement housing communities.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 25, 2011, certain information with respect to the beneficial ownership of our common stock by:

| · | each person that we know owns more than 5% of our common stock; |

| · | each current officer named in the Summary Compensation Table below; and |

| · | all current directors and executive officers as a group. |

Beneficial ownership is determined in accordance with rules of the SEC and includes shares over which the indicated beneficial owner exercises voting and/or investment power. Shares of common stock subject to options currently exercisable or exercisable within 60 days are deemed outstanding for computing the percentage ownership of the person holding the options, but are not deemed outstanding for computing the percentage ownership of any other person. Except as otherwise indicated, we believe the beneficial owners of the common stock listed below, based on information furnished by them, have sole voting and investment power with respect to the shares listed opposite their names. Unless otherwise indicated, the address of each of the officers, directors, and shareholders named below is: c/o Emeritus Corporation, 3131 Elliott Avenue, Suite 500, Seattle, Washington 98121.

The table includes the beneficial ownership of stock options currently exercisable or exercisable within 60 days.

| | | Shares of Emeritus Common Stock | |

| | Amount and Nature of Beneficial Ownership | | | | |

| Named Executive Officers | | | | | | |

| | | | | | | |

Daniel R. Baty (2)(3) | | | 6,057,339 | | | | 13.7 | % |

| | | | | | | | | |

Granger Cobb (4) | | | 928,318 | | | | 2.1 | % |

| | | | | | | | | |

Robert C. Bateman (5) | | | 22,500 | | | | * | |

| | | | | | | | | |

James Christopher Hyatt (6) | | | 49,079 | | | | * | |

| | | | | | | | | |

Jayne Sallerson (7) | | | 29,750 | | | | * | |

| | | | | | | | | |

Melanie Werdel (8) | | | 68,708 | | | | * | |

| | | | | | | | | |

| Directors | | | | | | | | |

| | | | | | | | | |

H. R. Brereton Barlow (9) | | | 2,500 | | | | * | |

| | | | | | | | | |

Stanley L. Baty (3)(10) | | | 3,761,820 | | | | 8.5 | % |

| | | | | | | | | |

Raymond R. Brandstrom (11) | | | 699,076 | | | | 1.6 | % |

| | | | | | | | | |

Bruce L. Busby (12) | | | 75,000 | | | | * | |

| | | | | | | | | |

Stuart F. Koenig (13) | | | 25,000 | | | | * | |

| | | | | | | | | |

James R. Ladd (14) | | | 2,500 | | | | * | |

| | | | | | | | | |

Richard W. Macedonia (15) | | | 17,500 | | | | * | |

| | | | | | | | | |

Robert E. Marks (16) | | | 40,000 | | | | * | |

| | | | | | | | | |

| More than 5% Shareholders | | | | | | | | |

| | | | | | | | | |

The Apollo Funds (17) c/o AREIF 60 Columbus Circle, 20th Floor New York, NY 10023 | | | 6,510,100 | | | | 14.7 | % |

| | | | | | | | | |

Brandon D. Baty (3)(18) 600 University Street, Suite 2500 Seattle, WA 98101 | | | 3,736,920 | | | | 8.4 | % |

| | | | | | | | | |

B.F., Limited Partnership (19) Columbia-Pacific Group, Inc. 3131 Elliott Avenue, Suite 500 Seattle, WA 98121 | | | 3,651,920 | | | | 8.3 | % |

| | | | | | | | | |

FMR LLC (20) 82 Devonshire Street Boston, MA 02109 | | | 6,531,529 | | | | 14.8 | % |

| | | | | | | | | |

Saratoga Partners IV, L.P. (21) 535 Madison Avenue New York, NY 10022 | | | 4,177,646 | | | | 9.4 | % |

| | | | | | | | | |

All directors and executive officers as a group (23 persons) (3)(22) | | | 8,506,709 | | | | 18.6 | % |

| (1) | Based on 44,253,336 outstanding shares as of March 25, 2011. |

| (2) | Includes 2,335,419 shares held directly and options exercisable within 60 days for the purchase of 70,000 shares. |