Safe Harbor Statement

Forward-looking statements in this presentation, including without limitation the Company's "expectations," "beliefs," "indications," "estimates," "cautious optimism," and their variants, as defined by the Private Securities Litigation Reform Law of 1995, involve certain risks, uncertainties, assumptions and other factors that may cause the actual results subsequent to the date of this announcement to differ materially. Additional information containing factors that could cause actual results to differ from those in the forward-looking statements are contained in the Company's Form 10-K and other filings with the Securities and Exchange Commission.

| Blount International, Inc. |

| |  |

Lehman Brothers Merchant

Banking Partners II L.P.

Annual Meeting

November 20, 2003

| | |

|---|

| Outdoor Products | Industrial and Power

Equipment | Lawnmower |

| Agenda |

| |  |

| • • • | Company Overview Recent Developments Financial Overview |

| • | Next Steps |

| | |

| Company Overview |

| |  |

| Outdoor Products | Industrial & Power Equipment | Lawnmower |

| Oregon Cutting Systems Group | Forestry & Industrial Equipment Division | Dixon Industries |

| ICS | Gear Products | |

| Outdoor Products |

| |  |

• | The Outdoor Products segment (“OPG”) is the world’s leading manufacturer of chainsaw chains and guide bars |

• | The Outdoor Products segment operates through two subsidiaries, Oregon Cutting Systems Group (“Oregon”) and ICS |

• | Oregon produces a wide variety of cutting chain, chain saw guide bars and mechanical timber harvesting equipment |

• | ICS produces specialized concrete cutting equipment |

| • | For the period ending September 30, 2003, OPG posted LTM Revenues of $348.7 mm and LTM EBITDA of $93.9 mm |

• | Factors affecting the business include currency, competition, offshore production, and weather |

| Industrial & Power Equipment |

| |  |

• | The Industrial & Power Equipment segment (“IPEG”) operates through two subsidiaries, the Forestry & Industrial Equipment Division (“FIED”) and Gear Products (“Gear”) |

• | FIED manufacturers hydraulic timber harvesting equipment under the Hydro-Ax, Prentice, CTR and Fabtek brand names |

• | Gear Products is a leading manufacturer of rotational system components for mobile heavy equipment |

• | For the period ending September 30, 2003, IPEG posted LTM Revenues of $144.1 mm and LTM EBITDA of $9.4 mm |

• | Factors affecting the business include commodity prices, currency, inventory levels and imports |

| Lawnmower |

| |  |

• | The Lawnmower segment operates through its subsidiary, Dixon Industries (“Dixon”) |

• | Dixon manufacturers zero turning radius (ZTR) lawn mowers and related attachments |

• | For the period ending September 30, 2003, the Lawnmower segment posted LTM Revenues of $35.7 mm and LTM EBITDA of $0.7 mm |

• | Factors affecting the business include weather, competition, and a distribution channel shift |

| Recent Developments |

| |  |

• | Improve capital structure/leverage ratio |

| | — | In May of 2003, Blount closed a new $190 million senior credit facility, which includes a revolver of up to $67 million, a Term Loan A of up to $38 million, and a Term Loan B of up to $85 million |

| | | • | Proceeds of the facility were used to refinance the existing senior term loans and to fund working capital |

| | | • | The new facility will provide the Company with extended maturity on its credit facilities |

| | | • | The new facility also provides the Company with additional liquidity to make additional investments into chain manufacturing |

| | — | From September 30, 2002 to September 30, 2003, Blount reduced net debt by $15M to $569; during that time period, leverage improved from 7.1 to 6.1 |

| Recent Developments |

| |  |

• | Strategic Initiatives |

| | — | In March of 2003, Blount signed worldwide marketing and supply agreements with Caterpillar, Inc. |

| | • | The agreements are expected to strengthen the Company’s position as a leader in the forestry industry in North America and provide the Forestry and Industrial Equipment Division expanded distribution opportunities in worldwide markets

|

• | Continued cash flow generation |

| | — | LTM EBITDA increased from $81.8 mm (as of 9/30/02) to $94.1 million (as of 9/30/03), or $12.3 mm, a 15% increase |

| | — | Continue to monitor capital expenditures and corporate overhead |

| Recent Developments |

| |  |

• | Cost improvement activities |

| | — | Increased production in low-cost facility in Brazil |

| | — | Increased purchasing of components from off-shore |

| | — | ERP implementation is on track |

| | — | Lean manufacturing at IPEG plants |

| Financial Overview |

| |  |

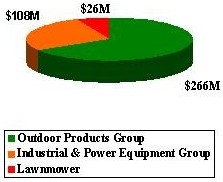

| Nine Months 2003

Total Sales $400M | Nine Months 2003 EBITDA

Contribution $72M |

|  | |

| | |

| Financial Overview |

| |  |

| ($ in millions)

| 9 Months Ended 9/30

|

| Sales EBIT EBITDA | 2003 $399.9 $ 61.9 $ 71.9 | 2002 $351.4 $ 51.5 $ 61.4 | |

| | | | |

| Financial Overview |

| |  |

| LTM EBITDA Total Debt Total Leverage Ratio |  l l

$ 94 $611 6.5 | |

|

Net Leverage Ratio

Fixed Coverage Ratio Covenant Requirements Minimum EBITDA |

6.1

1.06 | |

|

• Until 9/30/2005

• 9/30/2005 to 9/30/2006 • Remainder of Term Fixed CoverageRatio Maximum Capital Expenditures | |

$75 Million

$80 Million $85 Million .85x $20 Million |

| Next Steps |

| |  |

• | Continued Cash Flow Generation |

• | Offshore Production Opportunities |

• | Sell Non-Core Assets |

• | Focus on Capital Structure Improvements and Debt Reduction |