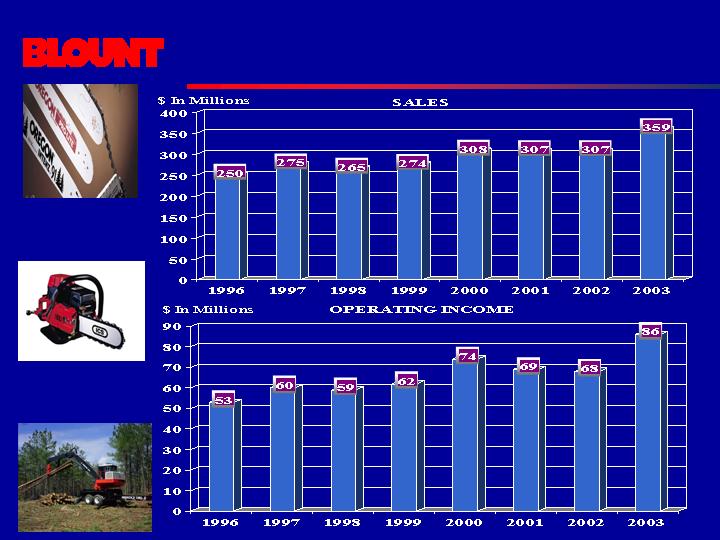

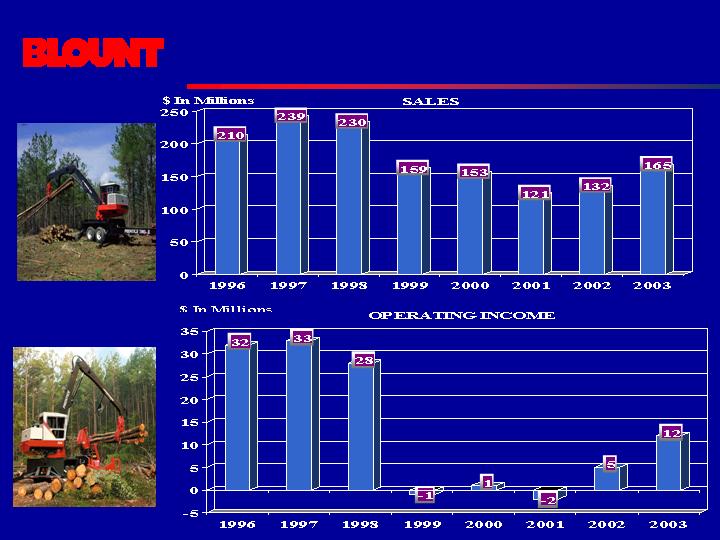

Industrial and Power Equipment

The Industrial & Power Equipment segment (“IPEG”) operates

through two units, the Forestry & Industrial Equipment Division

(“FIED”) and Gear Products (“Gear”)

FIED manufacturers hydraulic timber harvesting equipment under

the Hydro-Ax, Prenctice, CTR, Timber King and Fabtek brand

names

Gear Products is a leading manufacturer of rotational system

components for mobile heavy equipment

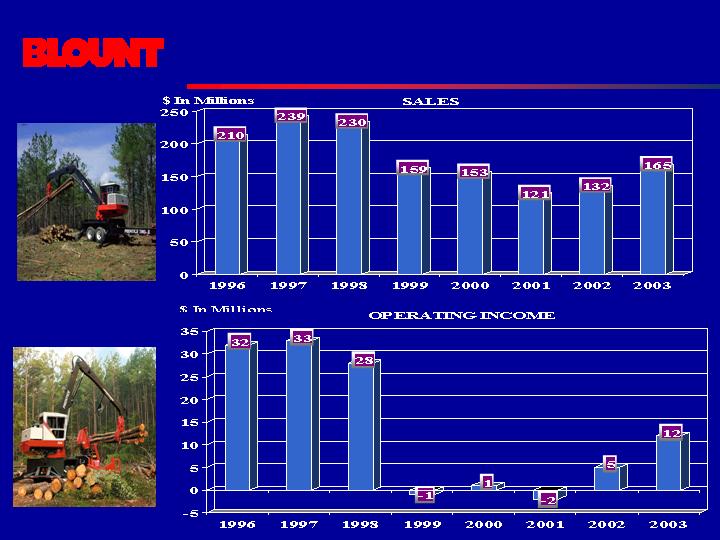

In 2003 IPEG posted sales of $165 million (+25%) and operating

income of $12 million (two-fold increase)

Factors affecting the business include commodity prices, currency,

inventory levels and imports

Industrial & Power Equipment

Industrial and Power Equipment

Industrial and Power Equipment

Business Dynamics - FIED

Factors Affecting the Business

Commodity Prices

Currency

Inventory Levels

Imports

Consolidation

Competition

Distribution

New Products

Lowered Operating Costs

Forestry is our Business

A Leading North American Manufacturer of

Purpose-Build Forestry Equipment.

Long-term Committed to the Worldwide

Forest Products Industry with Leading and

High Quality Product.

Direction

Continued Lean Manufacturing

Reduce cost / breakeven

Cash / working capital management

International opportunities

New product development

Marketing Alliance

Forestry & Industrial Equipment Division

Forestry and Industrial Equipment

Marketing alliance with Caterpillar

Strengthens Blount’s position

Sale of Blount/CAT Manufactured products

into Caterpillar dealer network with

Timberking brands

Maintains existing Blount dealer network

with Blount brands

Blount produces 17 of the 26 products

Long-term marketing and supply agreements

$14 million in sales during 2003 (partial

year)

Industrial and Power Equipment

Business Dynamics – Gear Products

Manufacturer of rotational systems components

for mobile heavy equipment. Products include

bearings and drives

Acquired in 1991

OEM Supplier

Only Complete Rotational System

Price Sensitive

Markets Served

Construction

Utility

Forestry

Telecommunication

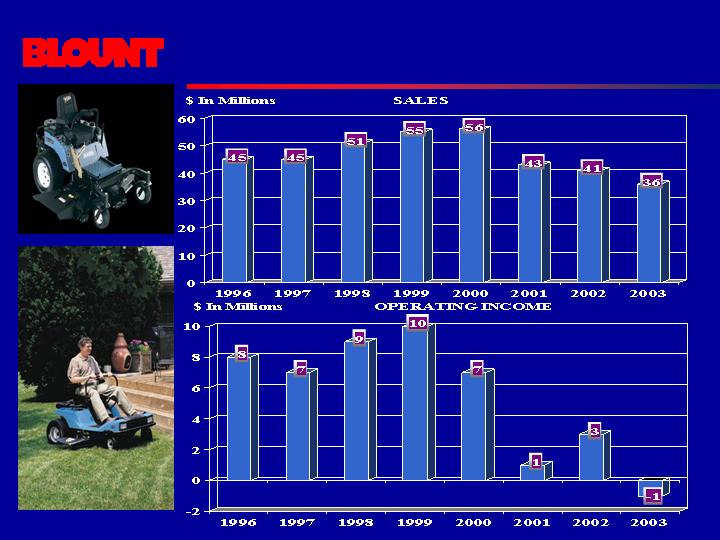

Financial Overview

Financial Overview

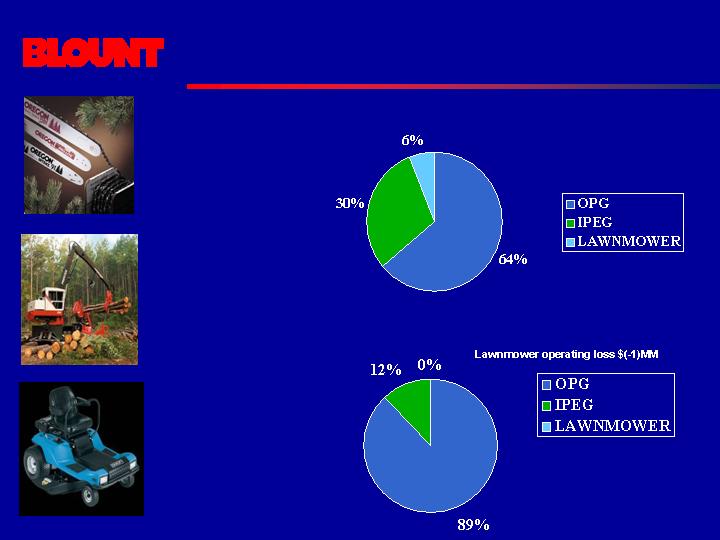

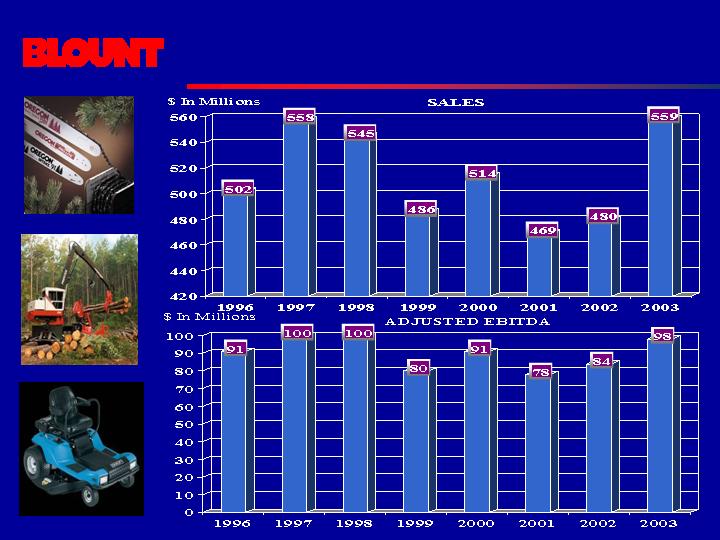

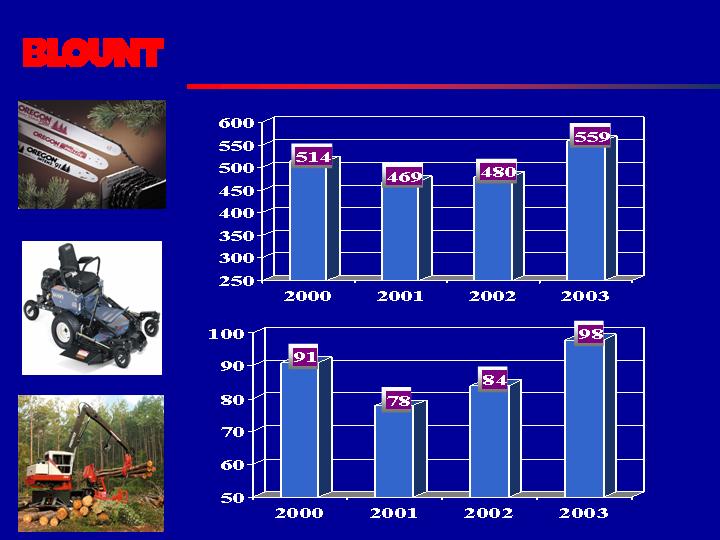

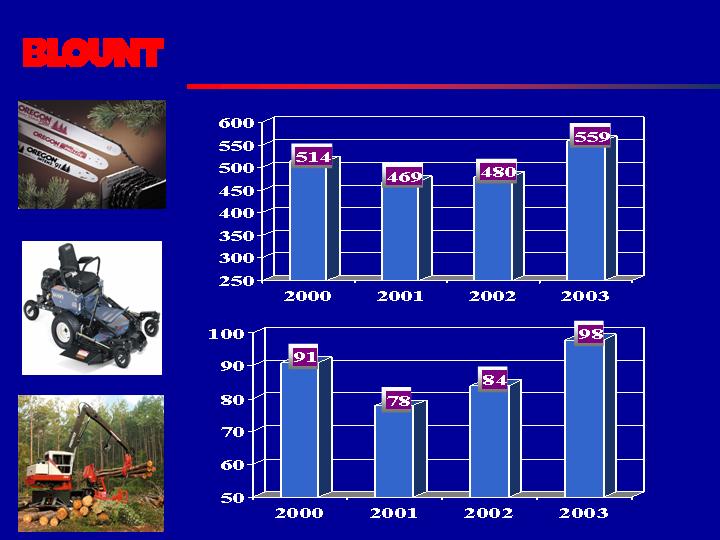

$ In Millions ADJUSTED EBITDA

$ In Millions SALES

3% Compound Growth Since 2000

FINANCIAL OVERVIEW

2000 2001 2002 2003

Segment Operating Income

Outdoor Products $74.3 $69.4 $67.7 $86.2

Lawn Mower 6.7 0.9 2.7 (1.2)

Industrial & Power Equipment 1.1 (1.7) 5.2 11.7

Elimination 0.3

Total Segments $82.1 68.6 75.9 96.7

Corporate Expenses (10.3) (7.7) (6.2) (12.7)

Depreciation/Amortization/ 18.8 17.4 13.9 13.5

Other

______ ______ _____ ______

Adjusted EBITDA(1) $ 90.6 $78.3 $83.6 $97.5

===== ==== ===== ====

(1) Earnings Before Interest, Taxes, Depreciation, Amortization

and Non-Recurring

Financial Overview

Operating Cash Flow

$ Millions

&nb sp;

2002 2003

Adjusted EBITDA $ 83.6 $ 97.5

-Cash Interest �� (64.9) (63.9)

-CAPEX (17.1) (16.5)

-Asset Sales 8.0 (0.6)

-Sporting Equipment Sale (22.6) 25.0

-Other 8.9 (2.8)

Total Operating Cash Flow $ (4.1) $ 38.7

===== =====

Financial Overview

Outstanding Debt/ Leverage

2002 2003 Comments

Term Loan/Revolver $ 134.4 $ 115.5 - Refinanced May 2003

with GECC as agent

7% Senior Notes 149.4 149.7 - Due June 2005 must be refinanced by March 2005

13% Senior Subordinated Notes 325.0 323.2 - Due August 2009

Preferred Equivalent Security 18.7 22.1 - 12% non-cash PIKs

Total Balance Sheet Debt $ 627.5 $ 610.5

========= ========

Cash on Hand $ 26.4 $ 35.2

========= ========

Net debt excluding cash/

preferred equivalent security $ 582.4 $ 553.3

========= ========

Net leverage 7.0X 5.7X

Financial Overview

- Credit Statistics

Covenant Requirements:

Minimum EBITDA

Until 9/30/2005 $75 Million

9/30/2005 to 9/30/2006 $80 Million

Remainder of Term $85 Million

Fixed Coverage Ratio .85x

Maximum Capital Expenditures $20 Million +

carryover

4th Quarter

2003 - Financial

LTM EBITDA $ 97.5

Total Debt $ 610.5

Total Leverage Ratio 6.3

Net Leverage Ratio 5.7

Fixed Coverage Ratio 1.05

Wrap-Up

Continued Cash Flow Generation

Operating improvements

Non-core asset sales

Offshore Production Opportunities

Focus on Capital Structure Improvements and Debt Reduction