Lehman Brothers Merchant

Banking Partners II L.P.

Annual Meeting

November 11, 2004

Blount International, Inc.

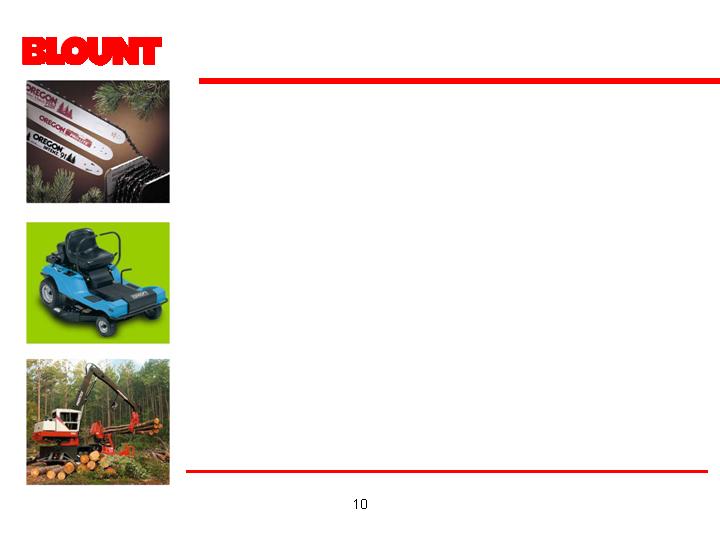

Outdoor Industrial and Power Lawnmower

Products Equipment

Agenda

Introduction

Company Overview

Recent Developments

Financial Overview

Next Steps

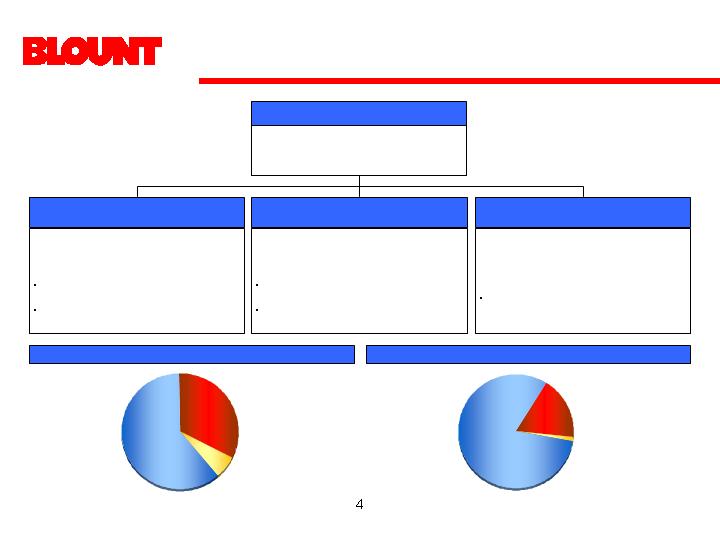

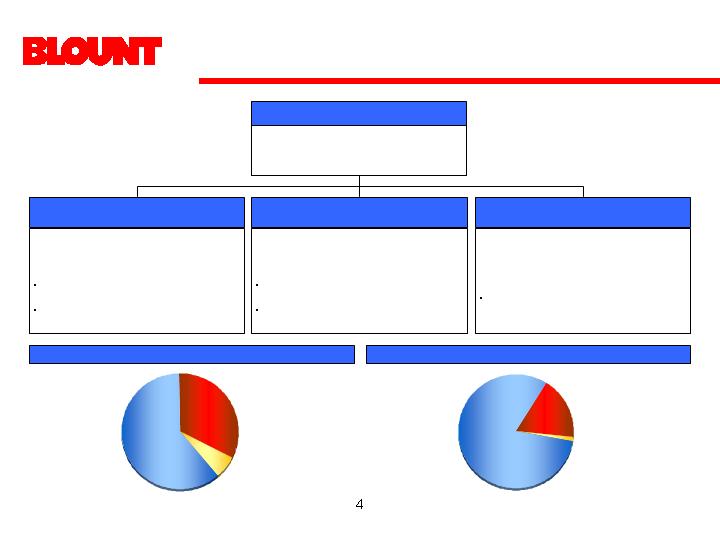

Company Overview

Blount International

LTM Sales (mm): $668

LTM EBITDA (mm) $123

Margin 18.4%

Outdoor Products Group

(“OPG”)

LTM Sales (mm): $407

LTM EBITDA (mm): $111

Margin 27.3%

Oregon Cutting Systems – Saw

chain, bar & accessories

ICS – Diamond cutting chain for

concrete industry

Industrial Power & Equipment

Group (“IPEG”)

LTM Sales (mm): $217

LTM EBITDA (mm): $26

Margin 12.0%

Forestry & Industrial Equipment –

Timber harvesting equipment

Gear Products – Rotational bearings

gear components

Lawnmower

LTM Sales (mm): $44

LTM EBITDA (mm): $2

Margin 4.5%

Dixon – ZTR ® ride-on lawnmowers

LTM Revenues

LTM EBITDA

___________________________

Note: LTM for period ending September 30, 2004. Segment EBITDA figures exclude corporate expenses.

OPG

61%

Lawnmower

7%

IPEG

32%

OPG

80%

IPEG

19%

Lawnmower

1%

Company Overview

Recent Developments

Recent Developments

Next steps discussed at last year’s annual meeting

Focus on capital structure improvements and debt reduction

Continued cash flow generation

Offshore production opportunities

Sell non-core assets

Recent Developments

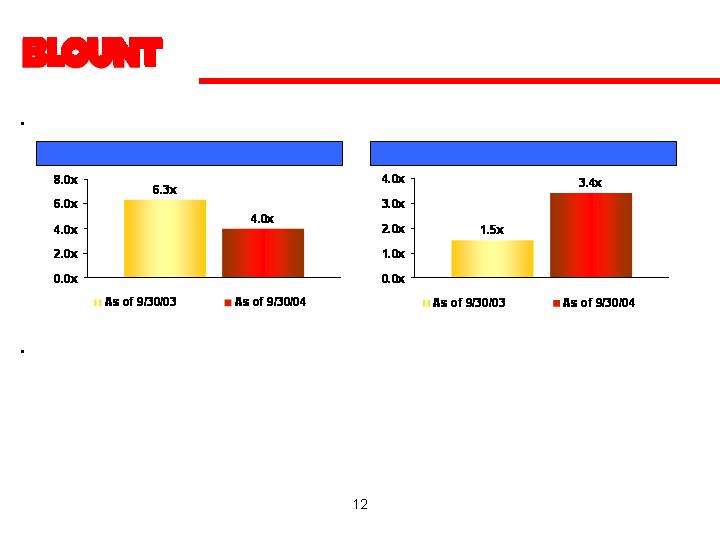

Focus on Capital Structure Improvements and Debt Reduction

In August 2004, Blount issued $138 million of primary equity, $175 million of

Senior Subordinated Notes, and amended and restated its existing Credit

Facilities

Proceeds were used to redeem existing Senior and Senior Subordinated

Notes and preferred equivalent security

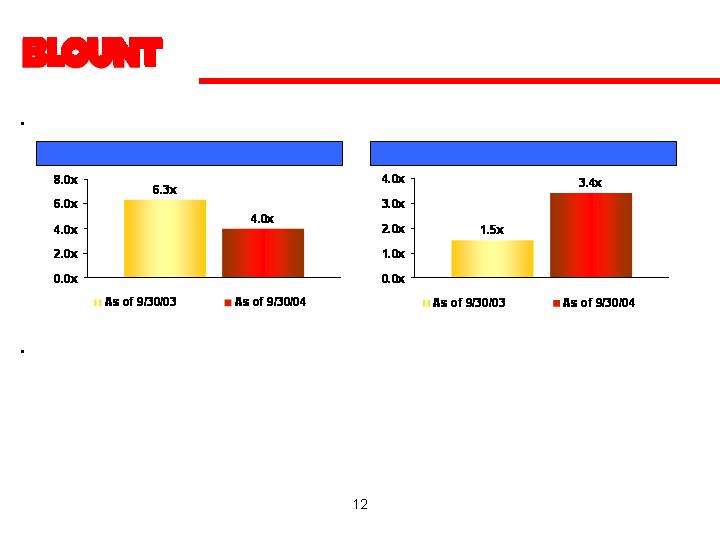

Over the past year Blount has decreased net debt by $90.0 million and

reduced net leverage from 6.3x to 4.0x

The recapitalization transaction lowered interest expense by over $30

million annually and extended maturities on the Company’s indebtedness

Recent Developments

Offshore Production

Opportunities

Broke ground on new 110,000

square foot facility in Fuzhou,

China

$16 million investment over

next 3 years; expected to

generate $6.5 million in

operating income annually

Artist rendition of facility in Fuzhou, China

China facility will focus on labor-intensive manufacturing processes and

procurement of high quality, low cost materials for North American facilities

Recent Developments

Continued Cash Flow Generation

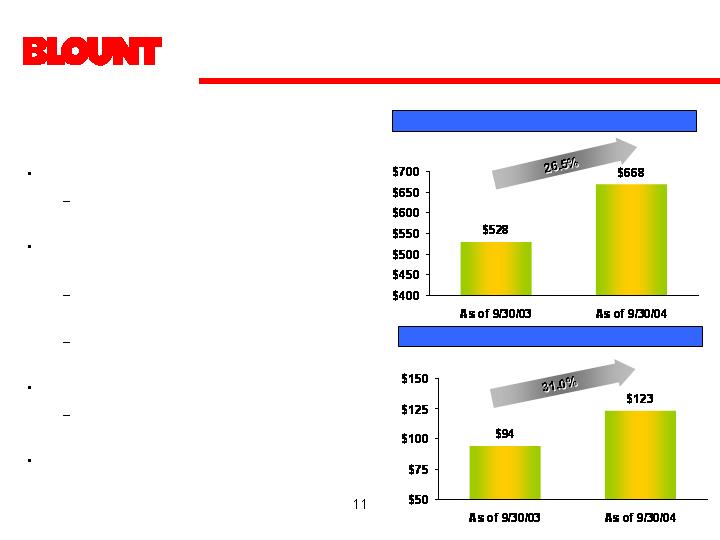

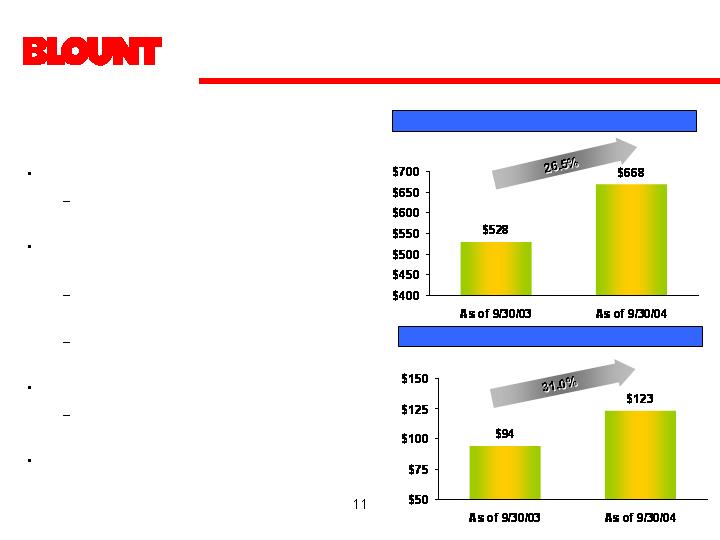

LTM EBITDA increased from $94.1 mm (as of 9/30/03) to $123.3 million

(as of 9/30/04), a $29.2 million, or 31.0%, increase

Strong operating results primarily due to solid business growth across all

segments

Continue to monitor capital expenditures and corporate overhead

Sell Non-Core Assets

Continue to seek opportunities to divest non-core businesses

New management at two divisions

Solid sales and profit growth in 2004

Financial Overview

LTM period ended September 30, 2004 vs. LTM

period ended September 30, 2003:

LTM Sales increased by $140 million or 26.5%

Continuing recovery of the domestic pulp and

paper market

Strong growth in all three segments (OPG

~16.8%, IPEG ~50.4 %, Lawnmower ~25.3%)

Substantial volume increases in all three

businesses

Third consecutive quarter of $100+ million

sales in the OPG segment

LTM EBITDA increased by $29 million or 31.0%

Driven by increase in sales and leveraging of

existing cost structure

Backlog increased by $40 million, or 36.0%, from

$111 on September 30, 2003 to $151 million on

September 30, 2004

LTM Sales

LTM EBITDA

17.8%

18.4%

$ in MM

$ in MM

Financial Overview

The Amended and Restated Credit Facilities have manageable covenants and

are structured to allow for maximum debt repayment

Financial Overview

Significantly reduced leverage and improved interest coverage since last year

Interest Coverage

Net Leverage

Next Steps

Continued Cash Flow Generation

Continue to Focus on Capital Structure Improvements and Debt

Reduction

Invest in Capacity

Expand IPEG’s International Market Reach

Sell Non-Core Assets