| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

| |

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☒ | Soliciting Material under §240.14a-12 |

| |

| Blount International, Inc. |

(Name of Registrant as Specified In Its Charter) |

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | | |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| (4) | Proposed maximum aggregate value of transaction: |

| | | |

| (5) | Total fee paid: |

| | | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | | |

| (2) | Form, Schedule or Registration Statement No.: |

| | | |

| (3) | Filing Party: |

| | | |

| (4) | Date Filed: |

As previously disclosed, on December 9, 2015, Blount International, Inc., a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with ASP Blade Intermediate Holdings, Inc., a Delaware corporation (“Parent”), and ASP Blade Merger Sub, Inc., a newly formed Delaware corporation and wholly owned subsidiary of Parent (“Merger Sub”), providing for the merger of Merger Sub with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of Parent. Parent and Merger Sub are beneficially owned by affiliates of American Securities LLC. Upon the terms and subject to the conditions of the Merger Agreement, at the effective time of the Merger, each share of Company common stock issued and outstanding immediately prior to the effective time of the Merger (other than certain excluded shares) will be converted into the right to receive $10.00 in cash, without interest.

This communication is being furnished to disclose certain information (the “Selected Information”) that the Company intends to make available to prospective debt financing sources that are expected to finance a portion of the consideration payable by Parent to the Company’s stockholders in connection with the transactions contemplated by the Merger Agreement. Completion of the Merger remains subject to approval by the Company’s stockholders, receipt of certain regulatory approvals and other customary closing conditions. There can be no assurance that the Merger will be completed, and the contemplated financing will not occur if the Merger is not completed.

The Selected Information, which is contained in Annex A to this communication, constitutes only a portion of the materials being made available to prospective lenders and is summary information that is intended to be considered in the context of the Company’s filings with the Securities and Exchange Commission (“SEC”) and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company disclaims any intention or obligation to update or revise any such information as a result of developments occurring after the date of this communication, except as required by law.

The Selected Information includes the presentation and discussion of certain financial information that differs from that which is reported by the Company in accordance with accounting principles generally accepted in the United States (“GAAP”). The non-GAAP financial measures as set forth in the Selected Information may differ from similarly titled measures presented by other companies. The Company has provided reconciliations of such non-GAAP financial measures to the most directly comparable GAAP financial measures. Readers are encouraged to review the related GAAP financial measures and such reconciliations, and readers should consider non-GAAP financial measures only as supplements to, not as substitutes for or as superior measures to, measures of financial performance prepared in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking Statements

“Forward-looking statements” in this communication, including without limitation statements regarding the proposed transaction, the expected timetable for completing the proposed transaction, the Company’s “outlook,” “expectations,” “beliefs,” “plans,” “indications,” “estimates,” “anticipations,” “guidance” and their variants, as defined by the Private Securities Litigation Reform Act of 1995, are based upon available information and upon assumptions that the Company believes are reasonable; however, these forward-looking statements involve certain risks and should not be considered indicative of actual results that the Company may achieve in the future. There are a number of factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, in particular, among other things, the ability to consummate the proposed transaction in the time frame expected by the parties or at all; any conditions imposed on the parties in connection with the consummation of the proposed transactions; the ability to obtain requisite regulatory approvals on the proposed terms and schedule; the ability to obtain approval of the proposed transaction by the Company’s stockholders and the satisfaction of the other conditions to the consummation of the proposed transaction; the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers and customers; the ability of third parties to fulfill their obligations relating to the proposed transaction, including providing financing under current financial market conditions; and the other factors and financial, operational and legal risks or uncertainties described in the Company’s public filings with the SEC, including the “Risk Factors” and “Forward Looking Statements” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and subsequent Quarterly Reports on Form 10-Q. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. The Company disclaims any intention or obligation to update or revise any forward-looking statements as a result of developments occurring after the date of this document except as required by law.

Important Additional Information

This communication may be deemed to be solicitation material in respect of the proposed acquisition of the Company by American Securities LLC and P2 Capital Partners, LLC. In connection with the proposed acquisition, the Company filed a preliminary proxy statement with the SEC on January 12, 2016, and Amendment No. 1 thereto on February 12, 2016, and plans to file other relevant materials with the SEC, including the Company’s proxy statement in definitive form. Before making any voting decision, stockholders of the Company are urged to read all relevant documents filed with the SEC, including the Company’s definitive proxy statement when it becomes available, because they contain important information about the proposed transaction and the parties to the proposed transaction.Investors and security holders are able to obtain the documents (once available) free of charge at the SEC’s website at www.sec.gov, or free of charge from the Company on the Investor Relations Page of its corporate website at http://www.blount.com, or by directing a request to Blount International, Inc., Investor Relations, 4909 SE International Way, Portland, Oregon 97222.

Participants in Solicitation

The Company and its directors, executive officers and other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from the Company’s stockholders with respect to the proposed transaction. Information about the Company’s directors and executive officers is set forth in the Company’s Proxy Statement on Schedule 14A for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 21, 2015. Information concerning the interests of the Company’s participants in the solicitation, which may, in some cases, be different than those of the Company’s stockholders generally, is set forth in the preliminary proxy statement relating to the proposed transaction, Amendment No. 1 thereto and other materials filed by the Company with the SEC, and will be set forth in the definitive proxy statement relating to the proposed transaction when it becomes available. Investors should read such materials carefully before making any voting or investment decision.

Annex A

Selected Information March 2016 Blount International

Disclaimer CERTAIN STATEMENTS CONTAINED IN THIS COMMUNICATION ARE FORWARD LOOKING BASED ON ASSUMPTIONS OF FUTURE EVENTS WHICH MAY NOT PROVE TO BE ACCURATE. THEY INVOLVE RISK AND UNCERTAINTY. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE EXPECTED OR IMPLIED. WE DISCLAIM ANY INTENTION OR OBLIGATION TO UPDATE OR REVISE FORWARD-LOOKING STATEMENTS AS A RESULT OF DEVELOPMENTS OCCURRING AFTER THE DATE HEREOF, EXCEPT AS REQUIRED BY LAW. WE DIRECT YOU TO THE CAUTIONARY STATEMENTS DETAILED IN RECENT NEWS RELEASES AND SEC FILINGS. THIS COMMUNICATION INCLUDES THE PRESENTATION AND DISCUSSION OF CERTAIN FINANCIAL INFORMATION THAT DIFFERS FROM WHAT IS REPORTED UNDER ACCOUNTING PRINCIPLES GENERALLY ACCEPTED IN THE UNITED STATES (“GAAP”). THESE NON-GAAP FINANCIAL MEASURES, INCLUDING EBITDA, MANAGEMENT EBITDA, MANAGEMENT PF EBITDA AND BANK EBITDA, ARE PRESENTED IN ORDER TO SUPPLEMENT THE READERS’ UNDERSTANDING AND ASSESSMENT OF THE FINANCIAL PERFORMANCE OF BLOUNT INTERNATIONAL, INC. WE HAVE PROVIDED RECONCILIATIONS OF SUCH NON-GAAP FINANCIAL MEASURES TO THE MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES ON PAGE 5 OF THIS COMMUNICATION. READERS ARE ENCOURAGED TO REVIEW THE RELATED GAAP FINANCIAL MEASURES AND SUCH RECONCILIATIONS, AND READERS SHOULD CONSIDER NON-GAAP MEASURES ONLY AS SUPPLEMENTS TO, NOT AS SUBSTITUTES FOR OR AS SUPERIOR MEASURES TO, MEASURES OF FINANCIAL PERFORMANCE PREPARED IN ACCORDANCE WITH GAAP

3 Well-Established Brands and Leading Market Share Blount has a leading market share in cutting chain and other chain saw accessories and is known for both quality and value amongst professional and consumer end users 2014 Global Market Size Saw Chain Manufacturers – 387 million Feet Others 0% Blount 53% OEM X 38% China 9% Guide Bars – 30 million Units Others 1% Blount 37% OEM X 25% OEM Y 6% China 30% Source: Company estimates.

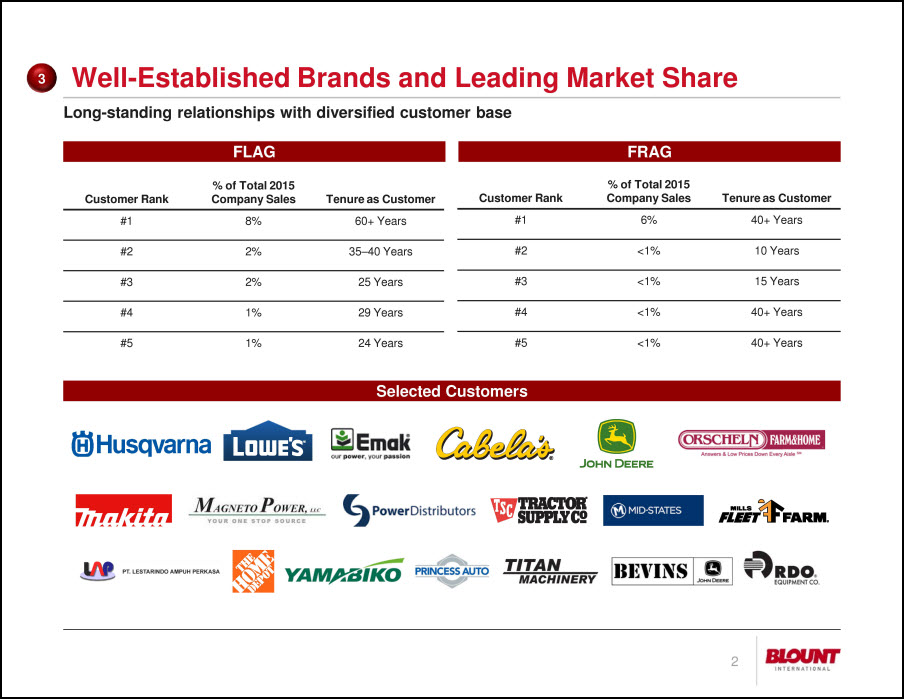

3 Well-Established Brands and Leading Market Share Long-standing relationships with diversified customer base FLAG Customer Rank % of Total 2015 Company Sales Tenure as Customer #1 8% 60+ Years #2 2% 35–40 Years #3 2% 25 Years #4 1% 29 Years #5 1% 24 Years FRAG Customer Rank % of Total 2015 Company Sales Tenure as Customer #1 6% 40+ Years #2 <1% 10 Years #3 <1% 15 Years #4 <1% 40+ Years #5 <1% 40+ Years Selected Customers

2014 to 2015 Blount Revenue Bridge Blount Revenue Bridge FLAG $ mm FX Impact $945 ($6) ($2) ($40) ($33) ($6) ($30) $2 $829 $500 $750 $1,000 2014A U.S. Sales P&V Foreign Currency P&V(1) USD in Foreign Markets FX Translation KOX, PBL & Mix FRAG CCF 2015A Commentary 63% of Blount revenue reduction directly attributable to currency fluctuations, both translational and through volume effects due to sales in USD in foreign countries 26% of Blount revenue reduction due to FRAG underperformance from sustained down cycle in U.S. agricultural markets Blount has achieved less drastic reductions compared to other blue-chip agricultural businesses (20%+ drops in 2015) Chain Sales Performance(2) 2014 Sales Short Term Impact Revenue Impact Volume Price Revenue USD in U.S. 21% Local Currency in Foreign Markets 23% USD in Foreign Markets 56% OE Softness Distributor Consolidation (9.8%) 2.5% (7.6%) Near-Term Translation Impact (1.6%) (15.4%) (16.8%) Volume – destocking Price (14.0%) (1.3%) (15.1%) Note: Gross revenue used as proxy for net due to lack of data for FLAG currency and chain revenue breakdowns. 1. Normal course price and volume fluctuations in foreign countries; not directly attributable to foreign exchange. 2. Excludes KOX and PBL.

2014 to 2015 EBITDA Bridge EBITDA Bridge ($ mm) FLAG $138 $1 ($14) ($2) ($1) $3 ($18) ($6) $1 ($1) $101 $9 $110 $0 $40 $80 $120 $160 2014A Management EBITDA FX Translation USD in Foreign Markets U.S. Sales Other Mix Steel Other Cost / Mix FRAG CCF Corporate 2015A Management EBITDA PF/Due Diligence Adjustments 2015A Bank EBITD(2) 1. Management EBITDA as used throughout this communication is a non-GAAP financial measure that has previously been disclosed by the Company under the label “Adjusted EBITDA” and is reconciled to the nearest GAAP measure for the periods 2013 through 2015 on page 5 of this communication. 2. Bank EBITDA as used throughout this communication is a non-GAAP financial measure that presents “Consolidated EBITDA” as it is expected to be calculated under the credit facilities expected to be used by the acquirers to finance a portion of the merger consideration (the “Credit Facilities”). Bank EBITDA is reconciled to the nearest GAAP measure on page 5 of this communication.

Bank EBITDA Reconciliation Bank EBITDA Reconciliation ($ mm) 2013A 2014A 2015A Operating Income $37.5 $64.2 ($46.8) Depreciation 33.5 31.4 30.6 Non-cash acquisition accounting 14.8 13.6 11.8 EBITDA, Reported $85.7 $109.2 ($4.4) Management adjustments: Impairment of acquired intangible assets 1 24.9 21.1 78.8 Stock-based compensation 5.6 4.9 6.0 Asset write-off 1.2 -- -- Pension settlement -- -- 10.2 Acquisition costs -- -- 7.7 Facility closure & restructuring 6.0 2.8 2.5 Total Management adjustments 37.7 28.8 105.2 Management EBITDA $123.5 $138.0 $100.8 Proforma adjustments:(1) Q3'15 reduction in force savings -- -- 2.5 Internal control remediation costs 2 3.3 0.4 2.9 Public company cost savings 1.5 1.5 1.7 Other PF adjustments 0.4 (1.7) (0.5) Total proforma adjustments(2) 5.2 0.2 6.6 Management PF EBITDA (before defined benefit plan cash costs) $128.7 $138.2 $107.5 Due diligence adjustments: Remove defined benefit plans GAAP expense 3a 8.2 4.7 7.6 Include defined benefit plans gross cash costs 3b (8.1) (13.4) (5.3) Bank EBITDA (after defined benefit plan cash costs) $128.9 $129.6 $109.8 Commentary 1) Represents non-cash impairment charges for trademark intangible assets and goodwill, with the impairment triggered as a result of weakening economic conditions and declining sales primarily in the FRAG business 2) The company incurred internal control remediation costs that have been added back. The higher than average advisor costs are a result of (i) the remediation of internal control issues, and (ii) higher than normal external audit fees as a result of the increased level of work required to perform the audits 3) Defined benefit plan net cash a. GAAP defined benefit plan expense that has been historically recorded is not generally reflective of actual cash defined benefit plan costs. b. In adjustment 3a, the GAAP defined benefit plan cost was excluded. This adjustment, 3b, presents the pre-tax defined benefit plan cash cost, which reflects the Company’s actual historical cash outflow related to defined benefit pension plans Currency: $mm Note FY13 FY14 FY15 Removed defined benefit plan GAAP P&L expense a 8.2 4.7 7.6 Include defined benefit plan gross cash cost b (8.1) (13.4) (5.3) Net adjustment for defined benefit plans costs $0.1 ($8.7) $2.3 Note: Numbers may not sum due to rounding. 1. Cost savings expected to result from the acquisition are included in the Credit Facilities definition labeled “Consolidated EBITDA.” 2. Pro forma adjustments for the three fiscal years 2013, 2014, and 2015 allocated to segments as follows (respectively): FLAG – 56%, 43%, 69%; FRAG – 20%, 51%, 27%; CCF / Corporate – 24%, 6%, 4%.