UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Consent Solicitation Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant o | |

Check the appropriate box:

| Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| |

| |

Blount International, Inc.

|

| (Name of Registrant as Specified In Its Charter) |

| |

|

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

| | | 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, |

| or the Form or Schedule and the date of its filing: |

| | |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing party: |

| | | |

| | (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 27, 2010

TO THE STOCKHOLDERS OF BLOUNT INTERNATIONAL, INC.:

The Annual Meeting of Stockholders of Blount International, Inc. (the “Corporation”) will be held at 10:00 A.M. P.D.T. on Thursday, May 27, 2010, in the Dogwood Room of the Corporation’s headquarters at 4909 SE International Way, Portland, Oregon 97222 for the following purposes:

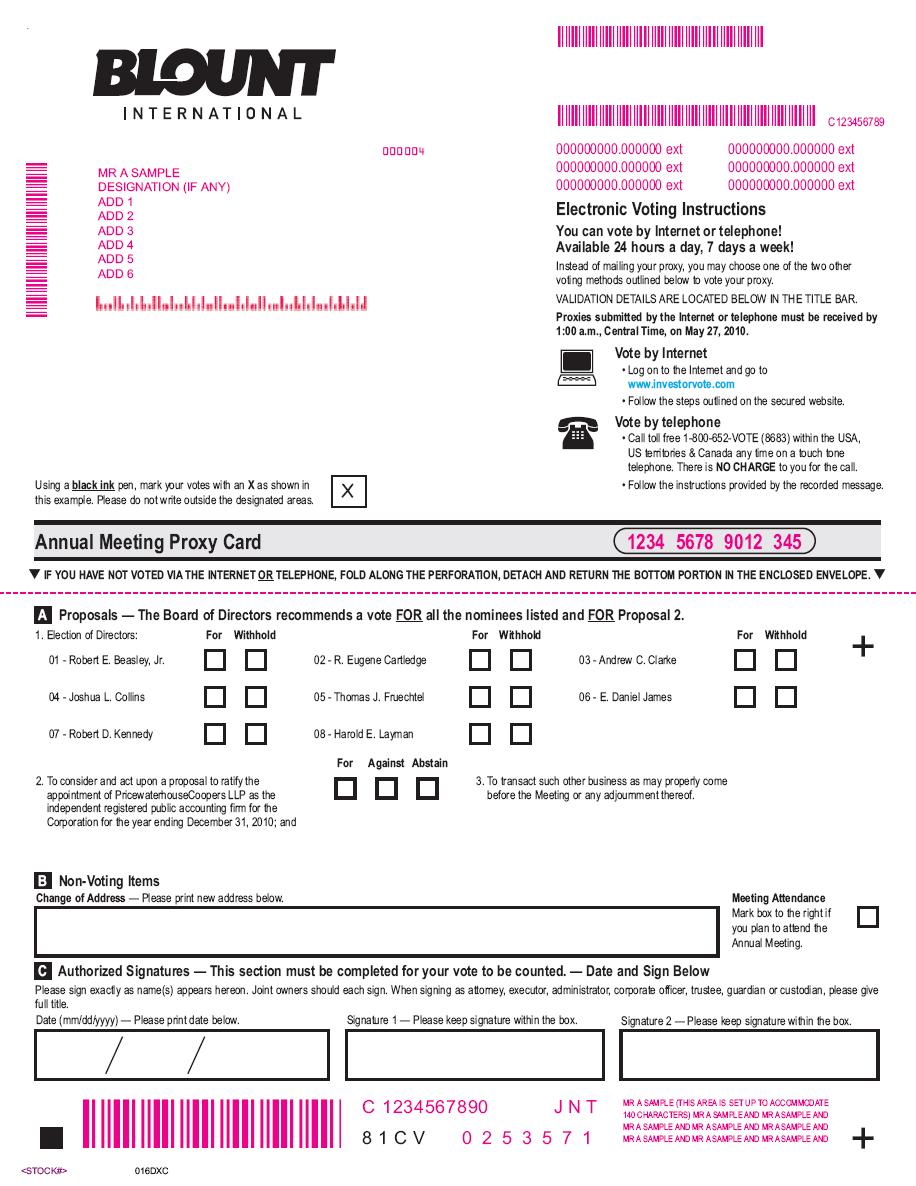

| 1. | To elect a Board of Directors to serve until the next Annual Meeting of Stockholders or until their successors have been elected and qualified; |

| 2. | To consider and act upon a proposal to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Corporation for the year ending December 31, 2010; and |

| 3. | To transact such other business as may properly come before the Annual Meeting of Stockholders to be held on May 27, 2010, or any adjournment thereof (the “Meeting”). |

The Board of Directors has fixed the close of business on Monday, March 29, 2010, as the record date for determining the stockholders entitled to notice of and to vote at the Meeting or any adjournment thereof.

TO ASSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE REQUESTED TO COMPLETE, DATE AND SIGN THE ACCOMPANYING FORM OF PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. ALTERNATIVELY, YOU MAY VOTE ONLINE AT www.investorvote.com.

| | By Order of the Board of Directors, |

| | |

| |  |

| | RICHARD H. IRVING, III |

| | Senior Vice President, General Counsel |

| | and Secretary |

4909 SE International Way

Portland, OR 97222

April 27, 2010

The Proxy Statement and Annual Report to Shareholders are available at:

http://www.shareholdermaterial.com/blount/

| Table of Contents | | Page No. |

| ANNUAL MEETING OF STOCKHOLDERS | | 3 |

| PRINCIPAL STOCKHOLDERS | | 5 |

| PROPOSAL 1 (Election of Directors) | | 7 |

| DIRECTOR NOMINEES’ BIOGRAPHICAL INFORMATION | | 7 |

| THE BOARD AND ITS COMMITTEES | | 14 |

| CRITERIA FOR NOMINATING DIRECTOR CANDIDATES | | 16 |

| DIVERSITY POLICY AND ITS APPLICATION | | 17 |

| NOMINATION OF CANDIDATES BY STOCKHOLDERS | | 17 |

| DIRECTOR COMPENSATION | | 18 |

| AUDIT COMMITTEE DISCLOSURE | | 21 |

| AUDIT COMMITTEE REPORT | | 21 |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | | 22 |

| COMPENSATION DISCUSSION & ANALYSIS | | 23 |

| Overall Objectives of the Executive Compensation Program | | 23 |

| Description of the Executive Compensation Program | | 25 |

| Short-Term Non-Equity Incentives: Executive Management Annual Incentive Plan | | 26 |

| Long-Term Equity Incentives | | 29 |

| COMPENSATION COMMITTEE REPORT | | 32 |

| EXECUTIVE OFFICERS | | 33 |

| EXECUTIVE COMPENSATION | | 34 |

| Summary Compensation Table | | 35 |

| All Other Compensation Table | | 36 |

| Grants of Plan-Based Awards | | 38 |

| Discussion of Summary Compensation and Plan-Based Award Tables | | 39 |

| Outstanding Equity Awards at Fiscal Year-End for 2009 | | 41 |

| Options Exercised and Stock Awards Vested | | 42 |

| 2009 Pension Benefits Table and Discussion | | 43 |

| Retirement Plans | | 44 |

| Freeze of Blount Retirement Plan | | 45 |

| 401(k) Retirement Savings Plan and Supplemental Retirement Savings Plan | | 45 |

| Nonqualified Deferred Compensation | | 47 |

| Potential Payments Upon Termination or Change-in-Control | | 47 |

| Payments Under Employment Agreements | | 48 |

| Payments Upon a Change-in-Control | | 49 |

| Payments Upon Termination, Death or Disability | | 49 |

| EMPLOYMENT AGREEMENTS | | 52 |

| CLIMATE CHANGE AND ITS POTENTIAL IMPACT | | 55 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING REQUIREMENTS | | 55 |

| SECTION 303A.12 CERTIFICATION TO THE NYSE | | 55 |

| SECTION 303A.14 WEBSITE AVAILABILITY OF CERTAIN DOCUMENTS | | 55 |

| CERTAIN TRANSACTIONS AND OTHER MATTERS | | 56 |

| EQUITY COMPENSATION PLAN TABLE | | 57 |

| PROPOSAL 2 (Ratify the Appointment of Independent Registered Public Accounting Firm) | | 58 |

| STOCKHOLDERS’ AND OTHER INTERESTED PARTIES’ COMMUNICATIONS WITH BOARD OF DIRECTORS | | 59 |

| STOCKHOLDERS’ PROPOSALS FOR 2011 ANNUAL MEETING | | 59 |

BLOUNT INTERNATIONAL, INC.

4909 SE International Way

Portland, Oregon 97222

503-653-8881

PROXY STATEMENT

for the

ANNUAL MEETING OF STOCKHOLDERS

to be held

May 27, 2010

This Proxy Statement is furnished in connection with the solicitation on behalf of the Board of Directors (the “Board”) of Blount International, Inc., a Delaware corporation, of your proxy for use at the Meeting, or at any adjournment thereof. It is anticipated that this Proxy Statement and the accompanying form of proxy will be mailed to stockholders on or about April 27, 2010.

Shares represented by each properly signed proxy on the accompanying form received by the Corporation in time to permit its use at the Meeting will be voted at the Meeting. Alternatively, you may also register your vote online at www.investorvote.com. However, you may revoke your proxy at any time prior to the actual voting thereof by giving notice in writing to the Secretary of the Corporation or by voting a subsequently dated proxy. If a specification is made, the shares will be voted in accordance with the specification. If a proxy is signed but no specification is made on the proxy, the shares represented by the proxy will be voted as recommended by the Board with respect to Proposals 1 and 2. The presence of a stockholder at the Meeting does not revoke his or her proxy; however, at the Meeting, there will be an opportunity for a stockholder in attendance to revoke his or her proxy and vote in person if he or she so requests.

Please note that, except where expressly stated otherwise, the information provided in this Proxy Statement constitutes the aggregation of such information as it related to Blount, Inc. prior to November 4, 1995 and to Blount International, Inc. after November 3, 1995. As of the close of business on November 3, 1995, as a result of a reorganization, Blount, Inc. merged with a wholly-owned subsidiary of Blount International, Inc. and became a wholly-owned subsidiary of Blount International, Inc. The stock of Blount, Inc. prior to the reorganization had been traded on the American Stock Exchange. The stock of Blount International, Inc. has been traded on the New York Stock Exchange, Inc. (“NYSE”) since the reorganization.

Please also note that as the result of a merger and recapitalization, which involved the Corporation and a subsidiary of Lehman Brothers Merchant Banking Partners II, L.P. (“LBMBP II”) and was completed on August 19, 1999, the Corporation issued cash and shares in a single class of common stock in exchange for the delivery and cancellation of its former Class A and Class B common shares. Throughout this document, this transaction is referred to as the “Merger and Recapitalization.”

Further, please note that on December 20, 2004, LBMBP II and its affiliates completed a secondary offering of 11,225,492 shares of the Corporation’s common stock. As a result of this transaction, for the first time since August 19, 1999, the closing date for the Merger and Recapitalization, LBMBP II and its affiliates no longer controlled fifty percent (50%) or more of the Corporation’s common stock. “Control” includes shares owned by or attributed to LBMBP II and its affiliates under applicable federal securities law. Throughout this document, this transaction is referred to as the “Change-in-Control.”

VOTING SECURITIES

Record Date and Vote Required

The Board has fixed the close of business on Monday, March 29, 2010, as the record date for determining stockholders entitled to notice of and to vote at the Meeting. Holders of shares of the Corporation’s single class of common stock as of the record date are entitled to vote at the Meeting by proxy or in person. As of such date, the Corporation had 48,209,361 shares issued, 382,380 shares held in treasury and 47,826,981 shares outstanding. There are no cumulative voting or preemptive rights.

The holders of common stock are entitled to one vote per share to elect the Directors and are entitled to one vote per share with respect to any other matter properly presented at the Meeting.

Directors are elected by the affirmative vote of a majority of the shares voted in the election, as distinct from a majority of shares outstanding. Similarly, except for certain special proposals, such as one to amend the Certificate of Incorporation, none of which is currently scheduled to come before the Meeting, the affirmative vote of a majority of the shares cast in the election is required to approve any other proposal properly presented at the Meeting, including Proposal 2, which is the only other proposal currently scheduled for the Meeting in addition to the election of Directors.

PRINCIPAL STOCKHOLDERS

To the best knowledge of the Corporation, the following table sets forth, as of March 29, 2010,* information concerning: (a) beneficial ownership of more than 5% of the common stock of the Corporation by certain persons (other than Director nominees) and (b) beneficial ownership of common stock of the Corporation by (i) each Director nominee, (ii) each Executive Officer named in the Summary Compensation Table other than Director nominees and (iii) all Director nominees and Executive Officers of the Corporation as a group. Except as otherwise indicated, all beneficial ownership stated in the table represents sole voting and investment power.

Name and Address of Beneficial Owners | | Shares Beneficially Owned | | Percent of Total Shares | | 60-Day Options (# shares) (1) |

| | | | | | | | | |

| (a) | | Holders of more than 5% common stock (other than Director nominees and Executive Officers named in the Summary Compensation Table) | | | | | | |

| | | First Eagle Investment Management LLC 1345 Avenue of the Americas New York, NY 10105 | | 11,830,553 | | 24.74% | | |

| | | Fidelity Management & Research Company 82 Devonshire Street Boston, MA 02109 | | 5,210,553 | | 10.89% | | |

| | | Lehman Brothers Holdings Inc. 745 Seventh Avenue New York, NY 10019 | | 4,718,999 | | 9.87% | | |

| | | BlackRock Institutional Trust Company 400 Howard Street San Francisco, CA 94105 | | 3,063,691 | | 6.41% | | |

| | | Gates Capital Management 1177 Avenue of the Americas New York, New York 10036 | | 3,003,229 | | 6.28% | | |

| (b)(i) | | Director Nominees | | | | | | |

| | | Robert E. Beasley, Jr. | | 0 | | | | |

| | | R. Eugene Cartledge | | 45,959 | | ** | | |

| | | Andrew C. Clarke | | 0 | | | | |

| | | Joshua L. Collins | | 10,000 | | ** | | |

| | | Thomas J. Fruechtel | | 14,446 | | ** | | |

| | | E. Daniel James | | (2) 7,653 | | ** | | |

| | | Robert D. Kennedy | | 30,000 | | ** | | |

| | | Harold E. Layman | | 17,411 | | ** | | |

| | | | | | | | | |

| (ii) | | Executive Officers named in the Summary Compensation Table (other than Director Nominee) and Retired CEO*** | | | | | | |

| | | Calvin E. Jenness | | (5)(6) 29,522 | | ** | | 129,000 |

| | | James S. Osterman*** | | 21,305 | | ** | | 439,400 |

| | | Kenneth O. Saito | | (5) 32,220 | | ** | | 215,655 |

| | | Russell L. German | | (5) 0 | | ** | | 0 |

| | | Richard H. Irving, III | | (5) 77,184 | | ** | | 115,000 |

| | | | | | | | | |

| (iii) | | All Director nominees, Executive Officers and Retired CEO as a group | | (3)(4)(6) 337,912 | | ** | | (3)(4)1,025,889 |

| (*) | The holdings of the stockholders who beneficially own 5% or more of the Corporation’s common stock are based on filings with the United States Securities and Exchange Commission (“SEC”) as of March 31, 2010. Additionally, to conform to valuation dates established by the Plan administrator, December 31, 2009 has been used for allocating the shares held by the Blount Retirement Savings Plan, a 401(k) plan, attributable to Messrs. Irving and Layman. The difference between the number of shares so attributed on such date and those that would be so attributed on March 31, 2010 is immaterial. |

| (**) | Less than 1.0% of total shares. |

| (***) | As of the close of business on December 18, 2009, Mr. James S. Osterman retired as an employee of the Corporation after serving more than fifty years and resigned his position as Chief Executive Officer (“CEO”). He remains as an non- employee Chairman of the Board until the Meeting. His salary, bonus and equity awards are included on this Proxy Statement as a former Executive Officer and not as a Director, a post for which he is not standing. His compensation elements for 2009 were higher than any of the Named Executive Officers (“NEOs”); therefore, three Other Executive Officers, in addition to Mr. Collins as CEO and Mr. Jenness as Chief Financial Officer (“CFO”), both required to be disclosed under SEC regulations, who were serving as of December 31, 2009 are shown to comprise the requisite five NEOs. |

| (1) | Under applicable rules of the SEC, beneficial ownership by principal stockholders of certain types of instruments that can be converted into shares of common stock within 60 days from the date of this Proxy Statement are required to be included in this table. Numbers in this column represent granted and fully-vested options, Stock Appreciation Rights (“SARs”), Restricted Stock Awards (“RSAs”) and Restricted Stock Units (“RSUs”) held respectively by each of the individuals shown above that can be exercised or otherwise vest within such period for the number of shares indicated. |

| (2) | Mr. James was a Managing Director of Lehman Brothers Inc. during a part of 2009 and may be deemed to share beneficial ownership of the shares of common stock shown as beneficially owned by Lehman Brothers Holdings Inc. and its affiliates (collectively, “Lehman Brothers,” unless specified to the contrary). Mr. James disclaims beneficial ownership of all such shares. |

| (3) | See Footnote (2) with respect to 4,718,999 shares that may be attributable to Mr. James, and have been included in the total. Mr. James disclaims any beneficial ownership with respect to these shares. If these shares are included in Mr. James’ total, the number of shares held by Director Nominees, Executive Officers and a Retired CEO would be 5,056,911 shares, or 10.6% of the shares outstanding as of the record date. If these 4,718,999 shares not included, the remaining 337,912 shares beneficially owned by the Director nominees, NEOs, a Retired CEO and five additional Executive Officers would constitute 0.71% of the total shares outstanding as of the record date. (The shares listed under the 60-day Options column have not been included in either calculation.) For purposes of the Table, it is assumed that Mr. James’ disclaimer of beneficial ownership is effective. |

| (4) | The total shares figure and the total 60-Day shares figure each represents, respectively, such shares held by the above eight Director Nominees and a former CEO, who retired as of December 18, 2009, the above four Executive Officers named in the Summary Compensation Table other than Director Nominees and five additional Executive Officers, a total of 18 individuals. See also, footnote 3 above regarding the potential attribution to Mr. James’ shares and footnote *** regarding Mr. Osterman’s retirement. 109,998 shares of RSAs or RSUs that are owned by seven Executive Officers, three of whom are NEOs, and Mr. Osterman vested in March of 2010 or, for one NEO, in June 2009, and, for Mr. Osterman, on December 21, 2009 following his retirement on December 18, 2009. These shares, net of the portion that was surrendered back to the 2006 Equity Incentive Plan (“2006 Equity Plan”), which is discussed below at Note 5, and any RSA that has not vested, which is discussed below at Note 6, have been included in the Shares Beneficially Owned column. This net amount is 69,688 shares. |

| (5) | The share totals are net of shares surrendered back to the 2006 Equity Plan on March 15, 2010 and, for Mr. Saito, on June 3, 2009 regarding a second tranche, and, for Mr. Osterman, on December 21, 2009 following his retirement on December 18, 2009, for the purposes of paying income taxes upon the vesting of a tranche or tranches of RSAs or RSUs by 16 individuals, including the following Executive Officers: |

| | Calvin E. Jenness | 4,869 | shares surrendered |

| | James S. Osterman | 17,962 | shares surrendered (on 12/21/09) |

| | Kenneth O. Saito | 3,824 | shares surrendered (2,996 on 3/15/10; 828 on 6/3/09) |

| | Russell L. German | 0 | shares surrendered |

| | Richard H. Irving, III | 4,869 | shares surrendered |

| | Four Other Executive Officers | 8,786 | shares surrendered |

| | On Mr. Osterman’s retirement as an employee on December 18, 2009, 50,666 shares of his equity grants vested. In order to account for taxes due on the vesting of these RSAs and RSUs, he surrendered 17,962 shares as of December 21, 2009. The net remaining 32,704 shares are counted in the total shares above. |

| (6) | RSAs, as distinct from RSUs, are considered issued and outstanding at the date of grant, though the shares remain subject to forfeiture until vested. Accordingly, the shares shown under “Shares Beneficially Owned” for the following individuals include the following number of unvested restricted stock award shares that remain subject to forfeiture until vested: |

| | Calvin E. Jenness | 7,000 | shares |

| | Four Other Executive Officers | 8,786 | shares |

ELECTION OF DIRECTORS

PROPOSAL 1

Directors

The By-laws of the Corporation, which may be amended by the Board, presently provide that the number of Directors that constitutes the whole Board be fixed from time to time by a vote of a majority of the whole Board. Since January 2, 2005, the full Board has consisted of eight members.

RECOMMENDATION OF THE BOARD OF DIRECTORS:

THE BOARD INTENDS TO NOMINATE AND TO VOTE ALL PROXIES RECEIVED BY THE BOARD FOR THE ELECTION OF THE PERSONS NAMED BELOW AS DIRECTORS OF THE CORPORATION EXCEPT TO THE EXTENT CONTRARY INSTRUCTIONS ARE SPECIFIED BY STOCKHOLDERS IN PROXIES RECEIVED OR IN PERSON AT THE MEETING.

Each Director to be elected shall hold office until the next Annual Meeting of Stockholders of the Corporation or until his successor is elected and qualified or until his earlier resignation or removal. Should any nominee fail to accept election, it is expected that the Board will cast all proxies received by it, as appropriate, in favor of the election of such other person for the office of Director as the Board may recommend. The Board has no reason to believe that any of the persons named below will fail to accept election as a Director. There were no arrangements or understandings between any Director and any other person pursuant to which such Director was or is to be selected as a Director.

Biographical Information

The following biographical information is furnished with respect to each nominee for election as Director at the Meeting:

ROBERT E. BEASLEY, JR., Age 64

Elected Director of the Corporation by the Board of Directors to fill the Director vacancy created by the retirement of Mr. Eliot M. Fried, effective January 1, 2010. Mr. Beasley is a member of the Nomination & Corporate Governance Committee.

Former Chairman, President and CEO of Hunter Fan Company of Memphis, Tennessee, a privately-held manufacturer of consumer and commercial ceiling fans and other consumer products, from 1991 until his retirement in 2007. Formerly, President of Hunter Fan Division from 1989 through 1991. Prior to that, Vice President of Marketing-Consumer Electronics for North American Philips Corporation of New York, New York, a publicly-held manufacturer and marketer of consumer, commercial and industrial products, from 1986 through 1989.

Mr. Beasley serves as a Director of Hunter Fan Company from 2007 to present.

Mr. Beasley is an “independent” Director under applicable NYSE and SEC rules and regulations. *

For the following reasons, the Board concluded that Mr. Beasley should serve as a Director of the Corporation in light of the Corporation’s business and structure at the time of the filing of this Proxy Statement. An important part of the Corporation’s business involves products that are consumer-oriented and sold, among other channels, through “Big Box” retail centers or through full-servicing dealers. Mr. Beasley has served the Hunter Fan Company for almost 20 years, most of which in the capacity as Chief Executive Officer. He continues to serve on the Board of the Hunter Fan Company, which makes consumer and commercial ceiling fans and other consumer home products, the major channel of distribution for which is “Big Box” retail outlets.

* A more complete explanation of the determination of “independence” is set forth at page 15 below.

While at the Hunter Fan Company, Mr. Beasley also had extensive experience with off-shore sourcing and manufacturing, including extensively from China, an important fit with the Corporation’s interest in (1) producing chain, bar and accessories at its newest facility in China, (2) procuring important components and finished products for several different product lines, including lawn and garden accessories and concrete-cutting and construction components, and (3) dealing with growing Chinese competition in the chain and bar lines.

Mr. Beasley’s 32-plus years as a marketer of consumer durables aligns with the Corporation’s primary products, as well as with its proposed new product development.

R. EUGENE CARTLEDGE, Age 80.

Director since April 2002; Chairman of the Audit Committee since April 2002; Member of the Compensation Committee since February 2004; Member of the Nominating & Corporate Governance Committee from February 2005 to February 2010. Formerly Director of the Corporation from September 1994 through August 19, 1999; formerly Chairman of the Compensation Committee and Member of the Acquisition, Audit and Executive Committees during this prior term.

Former Chairman of GrafTech International Ltd. of Parma, Ohio, a leading manufacturer of graphite and carbon products, from March 2005 until his retirement in February 2007; previously, Chairman of Savannah Foods & Industries, Inc. of Savannah, Georgia from 1996 until retirement in 1997; Chairman and Chief Executive Officer of Union Camp Corporation of Wayne, New Jersey from 1986 to 1994.

Mr. Cartledge formerly served on the Boards of Directors of GrafTech International Ltd. of Parma, Ohio; Delta Airlines, Inc. of Atlanta, Georgia; Sunoco, Inc. of Philadelphia, Pennsylvania; Chase Industries, Inc. of New York, New York and Formica Corp. of Warren, New Jersey until his retirement from the first in 2008, the second and third in 2002, from the fourth in 2003 and from the fifth in 2004. Mr. Cartledge served on the Compensation and Nomination Committees for GrafTech International Ltd.

Mr. Cartledge is an “independent” Director under applicable NYSE and SEC rules and regulations. *

For the following reasons, the Board concluded that Mr. Cartledge should serve as a Director of the Corporation in light of the Corporation’s business and structure at the time of the filing of this Proxy Statement. Mr. Cartledge has served as a Chairman or CEO of three public companies, GrafTech International, Ltd., Savannah Foods & Industries, Inc. and Union Camp Corporation. He has also served on numerous public company boards of directors, including GrafTech; Union Camp; Delta Airlines, Inc.; Sunoco, Inc.; Chase Industries, Inc. and Formica Corporation. In addition, Mr. Cartledge has served two tenures as a member of the Corporation’s Board, from 1994 to August 19, 1999, the date of the Merger and Recapitalization involving Lehman Brothers, and from 2002 to the present. This constitutes a total of over 13 years as a Director on the Corporation’s Board. This knowledge of the Corporation and its businesses, as well as its several transformations, is unparalleled.

Mr. Cartledge’s vast experience as a Chairman, CEO or board member of a diverse group of public companies make him a unique resource on matters involving corporate governance, corporate policy and ethics, finance, manufacturing and marketing. His knowledge of the global forestry and papermaking industry is invaluable in helping the Corporation understand and market to this very important segment of the Corporation’s customer base for the Outdoor Products segment and gear component business.

* A more complete explanation of the determination of “independence” is set forth at page 15 below.

ANDREW C. CLARKE, Age 39

Elected by the Board of Directors on April 13, 2010 as a Director nominee to fill the vacancy that will be created by Mr. Osterman’s retirement from the Board, subject to the approval of the stockholders at the Annual Meeting.

Since 2006, President and Director, and CEO since 2007, of Panther Expedited Services, Inc. of Seville, Ohio, a premium logistic provider that focuses on the automotive, life sciences, governmental and manufacturing segments and that is controlled by Fenway Partners, a private equity firm. Previously, Senior Vice President, Chief Financial Officer, Treasurer and Investor Relations, as well as Director, for Forward Air Corporation, a publicly-traded company, (2001-2006) or its subsidiary, Logtech Corporation (2000-2001), a diversified transportation services corporation. Before that, Mr. Clarke worked in investment banking, including from 1998 to 2000 with Deutsche Bank Alex Brown and from 1993 through1996 with A.G. Edwards & Sons, Inc.

In addition to serving on the Board of Directors for Panther Expedited Services, Mr. Clarke served on the Boards of Directors of Forward Air Corporation from 2000 to 2006 and of Pacer International, Inc., a publicly-traded company engaged in third-party logistics services, from 2005 to August 2009. He served as Chairman of the Audit Committee and member of the Compensation and Nominating & Corporate Governance Committees of Pacer. He also serves on the Advisory Board of Competitive Cyclist, a web-based retailer to serious road and mountain bike enthusiasts.

Mr. Clarke is an “independent” Director under applicable NYSE and SEC rules and regulations. *

For the following reasons, the Board concluded that Mr. Clarke should serve as a Director of the Corporation in light of the Corporation’s business structure at the time of the filing of this Proxy Statement. Mr. Clarke has served as CEO of one company, as CFO of a publicly-traded company and as a Director of three. He qualifies as a “financial expert” as that term is defined under applicable SEC and NYSE rules and regulations, and he has chaired the Audit Committee of a publicly-traded company. He has led two firms from a one-product focus to a diversified outlook that, together with his merger and acquisition investment banking experiences at A.G. Edwards, will assist the Corporation in its stated goal to grow and expand its business lines. Finally, his experience with Internet sales systems, both at Logtech and at Competitive Cyclist, parallel the Corporation’s newly-instituted business-to-business Internet sales efforts for its product lines, especially its lawn and garden products.

JOSHUA L. COLLINS, Age 45.

Director since January 2005; Member of Compensation Committee from January 2005 to December 2005. Member of the Nominating & Corporate Governance Committee from January 2008 to December 18, 2009.

Elected the Corporation’s Chief Executive Officer effective as of the close of business on December 18, 2009. As a result of becoming CEO, Mr. Collins, who continues as a Director, resigned from the Nominating & Corporate Governance Committee of the Board. Before that, Mr. Collins was elected President, Chief Operating Officer & CEO Designate as of October 19, 2009.

Previously, founder of Collins Willmott & Co. LLC, a private equity firm located in New York City, focused on providing growth capital to middle market companies in the industrial, consumer and energy sectors since January 2008; formerly, Principal of Lehman Brothers Merchant Banking from 2000 to January 2008, and Managing Director of Lehman Brothers Inc. from 2006 to January 2008; Senior Vice President of Lehman Brothers Inc. from 2003 to January 2008; joined Lehman Brothers Merchant Banking in 1996. Prior to joining Lehman Brothers, Mr. Collins served as an infantry officer and Captain in the United States Marine Corps.

* A more complete explanation of the determination of “independence” is set forth at page 15 below.

Mr. Collins also serves on the Board of Directors of Enduring Resources, LLC of Denver, Colorado, a private equity-backed producer of natural gas. Formerly, Mr. Collins served on the Boards of Directors for Phoenix Brands LLC of Stamford, Connecticut; Evergreen Copyright Acquisitions, LLC of Nashville, Tennessee; Cross Group, Inc. of Houma, Louisiana; Superior Highwall Holding, Inc. of Beckley, West Virginia; Eagle Energy Partners I, LP of Houston, Texas and Mediterranean Resources, LLC of Austin, Texas. Mr. Collins was on the Compensation Committee of Cross Group, Inc. and was also involved in determining executive compensation for the other companies on whose boards he sits, since these companies do not have compensation committees. Mr. Collins left these Boards in connection with his becoming CEO of the Corporation in order to devote more time to his new responsibilities.

Mr. Collins ceased to be an “independent” Director under applicable NYSE and SEC rules and regulations when he was elected President, Chief Operating Officer and CEO Designate as of October 19, 2009. He was elected President and CEO as of the close of business on December 18, 2009.

For the following reasons, the Board concluded that Mr. Collins should serve as a Director of the Corporation in light of the Corporation’s business structure at the time of the filing of this Proxy Statement. Mr. Collins was selected as CEO of the Corporation as of the close of business on December 18, 2009, after an extensive, comprehensive search, because of his knowledge of the Corporation and its business, which is based on working with the Corporation as a member of the Lehman Brothers’ team that consummated the Merger and Recapitalization in 1999 and as a Director since 2005; his experience in engaging in mergers and acquisitions and financial transactions; the energy and vision he brings to the job to increase the value of the business through both organic growth and making related acquisitions; and his experience on boards of directors of companies for which he participated as a private equity investor whose goal it was to increase shareholder and other investor value. Mr. Collins’ knowledge of finance, of the valuation of businesses and of capital markets make him a valuable addition. He has been instrumental in assisting with the Corporation’s equity and public debt security offerings, negotiated credit agreements and acquisitions or divestitures, as well as possessing a keen insight into foreign currency exchange matters, which is of vital importance to the Corporation with respect to the relationship of the United States dollar to the Canadian dollar and Brazilian real on the production side and to the European Union euro on the sales and marketing side.

In addition, as shown above, Mr. Collins has had extensive experience as a director and investor in entrepreneurial firms in a wide range of industries.

THOMAS J. FRUECHTEL, Age 59.

Director since December 2003; Member of Audit Committee since December 2003; Member of the Nominating & Corporate Governance Committee since February 2005.

President and Chief Executive Officer and Director of Leupold & Stevens, Inc., a sports optics company based in Portland, Oregon, since 1998. Previously, President and Chief Operating Officer from 1996, and Executive Vice President from 1995, for Simplicity Manufacturing, Inc., a manufacturer of lawnmowers and other outdoor power equipment; and from 1974 to 1995, various positions with the Corporation or a predecessor company, including President of the former Sporting Equipment Division and General Manager of the Oregon Cutting Division – Latin American Operations.

Mr. Fruechtel is an “independent” Director under applicable NYSE and SEC rules and regulations. *

For the following reasons, the Board of Directors concluded that Mr. Fruechtel should serve as a Director of the Corporation in light of the Corporation’s business and structure at the time of filing this Proxy Statement.

* A more complete explanation of the determination of “independence” is set forth at page 15 below.

Mr. Fruechtel has been associated with the Corporation as an executive or as a Director for over 28 years. He was influential in establishing the Corporation’s manufacturing facility in Curitiba, Brazil and its marketing base throughout Latin America. He served as President of one of the Company’s three segments, the Sporting Equipment Division. He has been CEO of two companies similar in size to the Corporation or larger, Leupold & Stevens and Simplicity Manufacturing, Inc. The latter, as a manufacturer of lawnmowers and other outdoor lawn and garden power equipment, relates to the Corporation’s lawn and garden unit business that makes lawnmower blades and markets other lawn and garden accessories.

Mr. Fruechtel has direct knowledge of the Corporation’s businesses, its customers and its markets. He brings broad awareness of the marketing of consumer whole goods. He also is very experienced in the procurement of precision products from South East Asia sources, including China. Mr. Fruechtel’s historical perspective of the Corporation and the focus on current changes in products, markets and trends in the sale of products to consumers assist the Board in understanding the Corporation’s options and evaluating its potential directions.

E. DANIEL JAMES, Age 45.

| Director since August 1999; Member of the Executive Committee from August 1999 to that committee’s termination in March 2010; Member of the Audit Committee from 1999 to February 2003; Member of the Compensation Committee from 1999 to December 2005 and again since February 2008. |

| Founder, Principal and Head of North America Operations for Trilantic Capital Partners, successor to Lehman Brothers Merchant Banking, from April 2009; previously, Principal of Lehman Brothers Merchant Banking and a Managing Director of Lehman Brothers Inc., New York, New York from April 2000. Prior to that, Mr. James was Senior Vice President from 1996. Mr. James had been with Lehman Brothers Inc. since June 1988. Prior to joining the Merchant Banking Group in 1996, Mr. James served in the Mergers and Acquisitions Group from 1990 and the Financial Institutions Group from 1988. |

| Mr. James also serves on the Boards of Directors for Phoenix Brands LLC of Stamford, Connecticut; Flagstone Reinsurance Holdings, Ltd. of Hamilton, Bermuda and Delos Insurance Company of New York, New York. |

Until April 2009, Mr. James was an employee of Lehman Brothers Inc., the former controlling shareholder of the Corporation until the Change-in-Control that occurred on December 20, 2004. As such, the three-year period of non-affiliation required for “independence” from the Corporation is measured from the date of the Change-in-Control. Mr. James, therefore, is considered to be an “independent” Director under applicable NYSE and SEC rules and regulations after December 20, 2007, since the other indicia of “independence” referred to at page 15 have also been determined to have been met. *

For the following reasons, the Board concluded that Mr. James should serve as a Director of the Corporation in light of the Corporation’s business and structure at the time of the filing of this Proxy Statement. Mr. James’ experience as a merchant investment banker; one of the architects of analyzing, negotiating and consummating the Merger and Recapitalization in 1999 on behalf of Lehman Brothers; his knowledge of the Corporation as representative of the controlling shareholder from 1999 to 2004; his Board experience for over eleven years; and his acute analytic abilities concerning public markets, including public equity and debt offerings, senior credit agreements and mergers, acquisitions and divestitures, all of which are important to the viability and growth of the Corporation over time, have served the Corporation, its stockholders and the Board well. Because of the nature of Mr. James’ position as a founder, principal and Head of North America for Trilantic Capital Partners, a private equity investment firm and successor to the Merchant Banking side of Lehman Brothers, Mr. James is able to offer cross-segment comparisons to other markets, lines of businesses and industries, to go along with his insight into the Corporation’s businesses.

* A more complete explanation of the determination of “independence” is set forth at page 15 below.

ROBERT D. KENNEDY, Age 77.

Director since January 2005. Chairman of the Compensation Committee from March 2010; Member of that Committee since 2005. Committee Chairman of the Nominating & Corporate Governance Committee from February 2005 to March 2010; Member of that Committee since 2005.

Former Chairman until September 1999 and Chief Executive Officer until June 1998 of UCAR International, Inc. of Wilmington, Delaware from 1998; previously, until 1995, various positions with Union Carbide Corporation of Danbury, Connecticut, including Chairman and Chief Executive Officer until 1995 from 1986, President and Chief Operating Officer of Union Carbide’s Chemical and Plastics segment from 1985, Executive Vice President from 1982, Senior Vice President from 1981 and President of Union Carbide’s Linde Division from 1977.

Mr. Kennedy served as a Director for Union Carbide to 2001 from 1985; member of the Boards of Directors for Hercules Corporation of Wilmington, Delaware until its merger with Ashland Inc. in 2008 and, until he retired in May 2005, for Sunoco, Inc. of Philadelphia, Pennsylvania. Member of the Nominating & Corporate Governance, Audit and Ethics Committees for Hercules; formerly, until May 2005, Chairman of the Nominating & Corporate Governance Committee and member of the Compensation Committee for Sunoco. Mr. Kennedy serves on the Advisory Board of RFE Investment Partners. He served on the Advisory Board of Blackstone Group until December 2004. Mr. Kennedy formerly served on the Boards of Directors of Union Camp Corporation of Wayne, New Jersey; General Signal Corporation of Stamford, Connecticut; Kmart Corporation of Troy, Michigan; International Paper Company of Stamford, Connecticut; Chase Industries, Inc. of New York City, New York and Birmingham Steel Corporation of Birmingham, Alabama.

Mr. Kennedy is an “independent” Director under applicable NYSE and SEC rules and regulations.*

For the following reasons, the Board concluded that Mr. Kennedy should serve as a Director of the Corporation in light of the Corporation’s business and structure at the time of the filing of this Proxy Statement. Mr. Kennedy brings an impeccable record of public corporation service at the highest levels for more than 33 years. He has served as Chairman and CEO of Union Carbide and UCAR International, Inc. He has served on the board of Union Carbide; Hercules Corporation; Sunoco, Inc.; Union Camp Corporation; General Signal Corporation; Kmart Corporation; International Paper Company; Chase Industries, Inc. and Birmingham Steel Corporation. His vast experience has guided the Corporation in the areas of corporate governance, ethics policy, Director and Executive Officer searches and the nomination of Directors, the self-evaluation program of the Board with respect to the performance of the Board as a whole, of each committee and of the CEO. He has acted as a representative on behalf of the Corporation in its dealings with third party investors, professional service providers and the like. His knowledge of complex manufacturing concepts, executive compensation issues and corporate best practices have provided an invaluable resource to the Board.

HAROLD E. LAYMAN, Age 63.

Director since August 1999; Chairman of Nominating & Corporate Governance Committee since March 2010; Member of the Audit Committee since 2007; Member of the Executive Committee from March 2001 to August 2002.

Former President of River Bend Management Group of Florida, LLC, an operator of golf courses, located in Ormond Beach, Florida. Former President and Chief Executive Officer of the Corporation from March 2001 to August 16, 2002; President and Chief Operating Officer from February 2000; Executive Vice President–Finance Operations and Chief Financial Officer from February 1997 and Senior Vice President and Chief Financial Officer of the Corporation from January 1993. Prior to 1993, Mr. Layman served as Senior Vice President–Finance and

* A more complete explanation of the determination of “independence” is set forth at page 15 below.

Administration and was a member of the Executive Committee of VME Group, N.V., The Hague, Netherlands, a manufacturer of automotive components and industrial equipment, from September 1988.

Mr. Layman also serves on the Boards of Directors of GrafTech International Ltd. of Parma, Ohio and Infinity Property & Casualty Corp. of Birmingham, Alabama. Mr. Layman chairs the Compensation Committee of GrafTech International and serves as Chairman of the Compensation Committee and as a member of the Nominating & Corporate Governance Committee of Infinity Property and Casualty. Formerly, Mr. Layman served on the Board of Grant Prideco, Inc. of Houston, Texas until its sale to National Oilwell Varco, Inc. in 2008. He chaired the Audit Committee of Grant Prideco.

Mr. Layman is an “independent” Director under applicable NYSE and SEC rules and regulations.*

For the following reasons, the Board concluded that Mr. Layman should serve as a Director of the Corporation in light of the Corporation’s business and structure at the time of the filing of this Proxy Statement. Mr. Layman had served the Corporation as an Executive Officer for nine years, two as President and CEO, and has served for eleven years as a Director of the Corporation. He is one of several of the Corporation’s Directors who have served as CEOs of major public corporations. Mr. Layman’s financial background, operational responsibilities and international business acumen are all very valuable tools in helping the Board guide the Corporation in its endeavors. Mr. Layman provides a very effective “bridge” from the Corporation’s pre-Lehman Brothers’ era to the Lehman Brothers’ Merger and Recapitalization period (1999-2004) to the post-Change-in-Control era (2004 to present). His service on three other public boards and his positions as chairman of these other companies’ audit, compensation and nominating & corporate governance committees provide a good reference point and resource for the Board.

Retirement of Chairman and CEO and of Lead Director

Mr. James S. Osterman retired as CEO and employee of the Corporation at the close of business on December 18, 2009, and will retire as the non-employee Chairman of the Board at the Meeting. He served as CEO for eight years and as Chairman for five years. He served the Corporation in various capacities for over 50 years, leading the Corporation, the Board and the stockholders with his able direction.

Mr. Eliot M. Fried retired as a Director and as Lead Director as of December 31, 2009. Mr. Fried served as a Director, Chairman of the Board and Lead Director, as well as Chairman of the Compensation Committee and member of the Executive, Audit and Nominating & Corporate Governance Committees, during the past ten years. His leadership to the Corporation and oversight of the important areas of corporate governance and independence of the Board served management and the stockholders well.

Separation or Combination of Chairman and CEO Positions

With the retirement of each of Mr. Osterman and Mr. Fried, the Board will be faced with selecting a new Chairman of the Board and, under certain circumstances, a new Lead Director as well. The Board has no specific policy requiring the separation of the offices of Chairman of the Board and CEO. The Board sees merit in combining the posts but also recognizes the reasons for separation of duties.

Historically, the Corporation has implemented each of the two leadership structures for periods of time dating back to at least 1993. (1993-1994, a combination of the two positions; 1995-1999, a separation of the two positions; 1999-2000, a combination of the two positions; 2001-2005, a separation of the two positions; 2005-2010, a combination of the two positions.)

The Board does believe, however, that in the event that the Chairmanship and CEO position are combined, there

* A more complete explanation of the determination of “independence” is set forth at page 15 below.

should also be a Lead Director who is independent from management. The Board’s guidelines on this issue are summarized as follows:

“Lead Director

| | The Lead Director is elected by the Board. The Lead Director shall be an “independent Director,” as that term is used in applicable NYSE and SEC rules or regulations. The Lead Director shall act as a liaison between the Chairman and the non-employee Directors, and shall preside at all meetings at which the Chairman is not present. The Lead Director has the authority to convene and chair meetings of the non-employee Directors without management’s participation and to raise matters with management or individual senior officers on behalf of the Board, as he or she deems appropriate. In addition, the Lead Director, on behalf of the non-employee Directors, shall have the power and authority to engage the services of special counsel or other experts as he or she determines appropriate.” |

The primary rationale for separating the offices of Chairman and CEO is one of providing certain corporate governance checks and balances. The primary reason for combining the two offices is one of communication and integration of the Corporation’s plans and strategies between the CEO and the Board. The Board feels that, given the Corporation’s strong policies on corporate governance and the requirement for a Lead Director who is independent from management during any time the Chairman and CEO posts are combined, either system is acceptable and that the decision should be based on the specific facts and circumstances existing at the time of the decision.

The Board and its Committees

The property, affairs and business of the Corporation are managed under the direction of the Board. The Board has standing Audit, Compensation and Nominating & Corporate Governance Committees, the principal functions of each of which are described below. (The Board formerly had an Executive Committee that was empowered under certain circumstances to act on behalf of the entire Board during the intervals between scheduled Board meetings. In January 2010, it was decided that modern communications were such that there was no need to have an Executive Committee, since special telephonic meetings of the whole Board can be convened as quickly as an Executive Committee meeting could. As such, the Executive Committee was eliminated. It had rarely met in the past five years or so.) As a result of the Change-in-Control that occurred on December 20, 2004, the Corporation no longer qualifies as a “controlled company” for purposes of Section 303A.00 of the New York Stock Exchange Listed Company Manual, and the Board and several of its committees are required to meet certain enhanced membership requirements:

| | The Corporation was required within one year after the Change-in-Control to assure that the membership of each of its Nominating & Corporate Governance and Compensation Committees was wholly-independent, and that the membership of the Board as a whole was made up of a majority of independent Directors. The membership of the Nominating & Corporate Governance Committee was wholly-independent upon formation in January 2005. The membership of the Compensation Committee became wholly-independent on December 20, 2005 upon the expiration of the terms of Messrs. Collins and James, employees of an affiliate of the former controlling shareholder, Lehman Brothers Holdings Inc., whose terms were scheduled to expire on the first anniversary of the Change-in-Control. The Board became a majority independent board on August 16, 2005, which was three years after the date that Mr. Layman ceased to be an employee of the Corporation, the requisite period of non-affiliation necessary to qualify as an independent Director. At that time, Mr. Layman joined Messrs. Cartledge, Fried, Fruechtel and Kennedy as independent Directors on the eight-person Board. (Mr. Layman was determined to be independent for reasons in addition to the passage of the requisite three-year period of non-affiliation. This determination is discussed below.) |

| | On December 20, 2007, three years after the Change-in-Control, the requisite three-year period of non-affiliation necessary to qualify as an independent Director had been met, and Mr. James, an employee of Lehman Brothers, the former controlling stockholder, and Mr. Collins, an employee of Lehman Brothers until January 2008, were each deemed to be “independent Directors,” since the Board determined that the other indicia of “independence,” discussed below, had also been met in addition to the expiration of the three-year period of non-affiliation. As such, Mr. Collins was appointed to the Nominating & Corporate |

| | Governance Committee in January 2008 and, in February 2008, Mr. James was appointed to the Compensation Committee. Each committee thereby retained a wholly-independent membership. |

Basis for Determination of “Independence” - In addition to meeting the requisite three year period of non-affiliation referred to above, where applicable, the Board has determined that Messrs. Beasley, Cartledge, Clarke, Fruechtel, James, Kennedy and Layman have no “material relationship,” as that term is defined under applicable SEC and NYSE standards, with the Corporation, either directly or indirectly, as a partner, shareholder or officer of another entity. The basis for this determination is the review of the applicable criteria by the Board and the review of questionnaires each Director-nominee submitted to the Secretary of the Corporation and the Nominating & Corporate Governance Committee.

The only relationships that these seven Directors have with the Corporation are based upon (i) the receipt of customary Director compensation for their service on the Board, which applies to six and will apply to Mr. Clarke upon election; (ii) the ownership of stock in the Corporation, which applies to five of the seven; (iii) the receipt of retirement benefits in the ordinary course from the Corporation’s qualified pension plan and the receipt of allocated units of common stock in the Corporation as part of the participation in the Blount Retirement Savings Plan, a 401(k) Plan, which applies solely to Mr. Layman in his capacity as a former employee retiree; or (iv) an affiliation with an organization, such as Lehman Brothers or successor entity in part that on occasion had provided services to the Corporation, such as investment banking services, but none of which is “material” under applicable SEC and NYSE rules and regulations, which applies solely to Mr. James. (The most such recent services were provided in 2005 and were not “material” in amount.) The nature of all of these types of relationships are deemed not to be “material” under applicable rules and regulations. Mr. James elected to receive compensation for his services beginning in 2009. For 2009, he chose to receive shares of common stock under the Blount International, Inc. Non-Employee Director Deferred Stock Unit Plan (the “Director Deferred Plan”), which is discussed below in more detail at page 18. Mr. Layman elected to receive compensation following the termination of his severance agreement with the Corporation in 2005. Mr. Collins had received Director compensation from 2008 until becoming an officer of the Corporation in October of 2009. The remaining four Directors, having never been employees of the Corporation or its then controlling stockholder for any period of time during their directorships, have always received compensation for their Board service.

During 2009, Mr. Fried, who retired as of December 31, 2009, was Lead Director, as well as Chairman of the Compensation Committee and member of the Audit and Nominating & Corporate Governance Committees, conducted four meetings of the non-employee Directors outside the presence of management and the management Director, Mr. James S. Osterman, Chairman of the Board, and at that time, CEO.

During the year ended December 31, 2009, the Board held five regular meetings, four special meetings and took no action by unanimous written consent in lieu of a meeting. Average attendance by Directors at Board and Committee meetings was 97%, and no director attended less than 83% of Board and applicable Committee meetings.

Audit Committee – Since Mr. Fried’s retirement as of December 31, 2009, the Audit Committee has consisted of three members, all of whom are independent Directors. (The Corporation’s prior status as a “controlled company” did not exempt it from the requirement to maintain a wholly-independent Audit Committee, and it has done so since February 2003. Therefore, the Change-in-Control did not affect the membership status of this Committee.) The functions of the Committee include (i) approving annually the appointment of the Corporation’s independent registered public accounting firm, (ii) reviewing the professional services, proposed fees and independence of such independent registered public accounting firm, (iii) reviewing the annual audit plans of such independent registered public accounting firm, (iv) reviewing the annual audit plans for the internal audit function, whether performed by an in-house staff, outsourcing arrangement or combination of both, (v) monitoring the activities of the independent registered public accounting firm and the internal audit function and (vi) reporting on such activities to the Board. The Committee held four regular meetings and no special meeting during 2009. The current members of the Committee are R. Eugene Cartledge, Thomas J. Fruechtel and Harold E. Layman. Mr. Cartledge is chairman of the Committee.

Compensation Committee – As a result of the retirement of Mr. Fried, the Compensation Committee consists of three members, all of whom are independent Directors. The functions of the Committee include

(i) approving compensation philosophy and guidelines for the Corporation’s executive employees, (ii) establishing a total compensation range for the Chief Executive Officer and appraising the performance of that Officer on a timely basis, (iii) approving salaries and changes in salaries for the other Executive Officers of the Corporation and such other executives as the Committee may deem appropriate, (iv) approving the participants, annual financial or other targets and amounts to be paid under the Corporation’s Executive Management Annual Incentive Plan (“EMAIP”), (v) reviewing and recommending to the Board any new executive incentive plans for stock options or other equity instruments, or additions to or revisions in existing plans, and approving any options or other awards granted under any such plans, (vi) reviewing from time to time the Corporation’s management resources and executive personnel selection, development, planning and succession processes and (vii) reporting on all such activities to the Board. The Committee held one regular meeting and two special meetings during 2009. The current members of the Committee are R. Eugene Cartledge, E. Daniel James and Robert D. Kennedy, all of whom are deemed to be independent Directors. Mr. Kennedy serves as Chairman of the Committee.

Nominating & Corporate Governance Committee – The Nominating & Corporate Governance Committee consists of four members, all of whom are non-employees and independent Directors. This Committee was formed following the Change-in-Control on December 20, 2004, upon the loss of the Corporation’s “controlled company” exemption from certain requirements of the New York Stock Exchange Listed Company Manual, including the requirement to have such a Committee. This Committee serves as the principal corporate governance and strategic planning arm of the full Board. The Committee identifies individuals qualified as a matter of background, achievement and leadership to become Board members and recommends candidates for election. The Committee held three regular meetings during 2009. The current members of the Committee are Robert E. Beasley, Jr., Thomas J. Fruechtel, Robert D. Kennedy and Harold E. Layman. Mr. Layman serves as Chairman.

During 2009, Messrs. Cartledge, Fried, Kennedy and Layman served on an ad hoc basis as a Succession Search Committee to find a new CEO to replace Mr. Osterman. This search resulted in Mr. Collins becoming President and CEO. Later, Messrs. Cartledge, Fried and Kennedy, along with Mr. Collins, served on an ad hoc basis as a Director Search Committee. This search resulted in the election of Mr. Beasley as Director in January 2010 and the nomination of Mr. Clarke by the Board on April 13, 2010. Altogether, the Search Committees held ten meetings during 2009.

Criteria for Nominating Director Candidates

Prospective nominees are considered based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the qualifications and standards established by the Nominating & Corporate Governance Committee. In identifying and recommending Board nominees, the Committee uses guidelines that it has developed with respect to qualifications for nominations to the Board and for continued membership on the Board.

If the Committee determines, in consultation with the full Board as appropriate, that additional inquiry is warranted, it may gather additional information about the prospective nominee’s background and experience. The Committee evaluates the prospective nominee against the qualifications and standards adopted by the Committee, including the following (the order is not necessarily meant to represent relative importance):

| | ● | ability to meet regulatory requirements, including standard of "independence," in accordance with NYSE, SEC and Internal Revenue Service regulations, as applicable, and as set forth in the Blount Corporate Governance Guidelines; |

| | | |

| | ● | experience in relevant industries; |

| | | |

| | ● | ability to represent the interests of the stockholders of the Corporation; |

| | | |

| | ● | leadership and judgment acumen; |

| | | |

| | ● | high personal and professional ethics, integrity and values; |

| | | |

| | ● | contribution to the level of diversity of skills, backgrounds, geography, experience, gender and racial makeup of the Board; |

| | ● | relevant education, age and professional experience, including accounting and financial knowledge; |

| | | |

| | ● | effectiveness of working with others; |

| | | |

| | ● | ability to make necessary time commitment and ability to make constructive contribution to Board; and |

| | | |

| | ● | if nominee is an incumbent, record of past performance (e.g., regularly attended Board and Committee meetings, kept informed about the Corporation and its businesses, participated in discussions at Board and Committee meetings and provided sound advice and counsel). |

The Committee, in its judgment, also considers such other factors as it deems relevant, including the current composition of the Board, the need for specific functional expertise and the evaluations of other prospective nominees. Further, the Committee may, but is not required to, utilize third party firms to assist in the identification or screening of prospective candidates. This past year, for example, the Committee retained the services of Heidrick & Struggles in both its executive search for a new CEO, which resulted in the election of Mr. Collins, and the search for new Board members, which resulted in the election of Mr. Beasley and the nomination of Mr. Clarke. The Committee believes it is not appropriate to fix any specific minimum qualifications or minimum number of qualifications that a candidate must meet before such candidate may be recommended by the Committee. It believes that each individual candidacy should be evaluated as a whole, taking into account all of the circumstances of that candidacy.

In connection with this evaluation, the Committee determines whether one or more members of the Committee, and others as appropriate, will interview prospective nominees. After completing this evaluation and interview process, the Committee recommends to the full Board the person or persons to be nominated by the Board and the Board determines the nominees for election after considering the recommendation and report of the Committee. During this past year, Mr. Collins, on one hand, and Mr. Beasley and Mr. Clarke, on the other hand, as well as other candidates for their respective positions, met with all of the Committee members, as well as with all or most of the members of the full Board.

Other factors considered relevant for membership on the Board are listed in the Charter for the Nominating & Corporate Governance Committee, as amended, and in the Corporation’s Corporate Governance Guidelines, both of which are posted at the Corporation’s website at www.blount.com.

Diversity Policy and Its Application

As stated above, gender and racial diversity, among other attributes, are standards to which the Committee aspires in selecting new members of the Board. This became a specific criterion in 2007; since that time, there have been only two searches resulting in the election or nomination of two new Directors. Although the Committee has evaluated several qualified applicants of racial or gender diversity, the Committee has not to date selected such a candidate to stand for election as a Director.

Nomination of Candidates by Stockholders

A stockholder who wishes to recommend a candidate for consideration by the Committee should submit his or her nomination to the Committee in accordance with the procedure set out at page 59 for communications with the Board, its Committees or a specific Director. Any such proposal should expressly refer to “Potential Candidate for Board Membership” as its subject, should be addressed to the attention of the Chairman of the Nominating & Corporate Governance Committee and must be submitted between 90 days and 120 days prior to the scheduled date for the next Annual Meeting of Stockholders. It is expected that the 2011 Annual Meeting will be sometime between May 14 and May 31. The actual date will be determined at the Board meeting scheduled for October 20, 2010. Inquiries may be made of the Secretary, as provided herein, after that time as to the date selected. The proposal should contain relevant information concerning such candidate, including name, address, current principal occupation, professional background and such other information as is required to be disclosed in

solicitations for proxies for the election of directors under Regulation 14A of the Securities Exchange Act of 1934, as amended. The process for identifying and evaluating candidates recommended by stockholders is the same as the process for identifying and evaluating candidates recommended by the Committee except that the current makeup of the Board and the existence or lack of a vacancy will be given greater weight, and the use of a third party service to assist in any review of the candidate is more likely, unless members of the Board have knowledge, personal or otherwise, of the individual nominated.

Compensation of Directors

Current Directors: Directors who are employees of the Corporation (or former employees receiving termination benefits) receive no compensation for their services as Directors. Employee Directors, of course, receive compensation in their respective capacities as employees of the Corporation, and all Directors receive reimbursement of travel and lodging expenses incurred in connection with their attendance at Board functions. Since December 9, 2004, the date of the adoption of an amendment to the Corporation’s Non-Employee Directors’ Compensation Program (“Program”), Directors who are not employees of the Corporation are each eligible to receive a quarterly stipend of $12,500, plus $1,000 per quarter if they are Chairman of the Board (and not an employee of the Corporation) or Lead Director, $1,000 per quarter for each Board Committee they chair and $1,000 for each Board or Committee meeting they attend. In addition, a qualifying Director under the Program may choose to participate in certain health, dental and life insurance plans of the Corporation.

On October 25, 2005, the Board amended the Program, effective December 13, 2005, to replace an earlier stock option alternative with a deferred stock unit plan. The Director Deferred Plan permits Directors eligible to participate in the Program to elect to receive all or a portion of their quarterly stipends, as well as chairman and meeting fees, in deferred stock units. This election must be made prior to the end of the previous calendar year, and the deferred stock units must be received in stock upon the termination of service by the Director. The deferred stock units attributable to any one Director are determined by dividing the total of the stipend and fees for one quarter selected by the Director for deferral under the Director Deferred Plan by the closing price per share for the Corporation’s common stock on the NYSE on the last trading day of the applicable calendar quarter. The resulting number represents the number of shares that the Corporation will buy, or transfer from treasury shares, and then credit to the Director pursuant to the terms of a rabbi trust created for this purpose. At the end of his or her term of service as a Director, the Director will receive a payment of shares equal to the number of shares that have been credited to his or her account. This form of compensation, with its delivery of shares in the future, aligns the interest of the Director with other stockholders.

Messrs. Cartledge; Collins, until he became an employee of the Corporation as of October 19, 2010; Fried, who retired as a Director as of December 31, 2009; Fruechtel; James; Kennedy and Layman qualified for benefits under the Program during 2009. Mr. Cartledge received $83,000 in Director fees and $69 in benefits; Mr. Fried $83,500 in fees and $69 in benefits; Mr. Fruechtel $66,000 in fees and $69 in benefits; Mr. Kennedy received $77,000 in fees and $69 in benefits; Mr. Layman received $68,000 in fees and $69 in Director benefits, as well as $3,960 in retiree medical benefits as a former employee of the Corporation; Mr. Collins received $45,500 for fees for a portion of 2009 and Mr. James received $58,000 in fees. Although eligible to participate in the Program since December 20, 2004, the date of the Change-in-Control, Mr. James chose not to receive fees or benefits under the Program from 2005 through 2008; however, Mr. James began accepting such fees or benefits beginning in January 2009.

NON-MANAGEMENT DIRECTORS’ COMPENSATION FOR FISCAL YEAR 2007, 2008 and 2009

| Name of Director | Year | Retainer/Fees Earned and Paid in Cash | Retainer/Fees Earned and Paid in Common Stock* | All Other Compensation** | Total |

R. E Beasley, Jr.1 | 2009 2008 2007 | N/A N/A N/A | N/A N/A N/A | N/A N/A N/A | N/A N/A N/A |

R. E. Cartledge | 2009 2008 2007 | $29,000 $71,000 $15,000 | $54,000 $0 $54,000 | $69 $1,560 $1,560 | $83,069 $72,560 $70,560 |

A. C. Clarke2 | 2009 2008 2007 | N/A N/A N/A | N/A N/A N/A | N/A N/A N/A | N/A N/A N/A |

J. L. Collins3 | 2009 2008 2007 | $45,500 $60,000 $0 | $0 $0 $0 | $0 $0 $0 | $45,500 $60,000 $0 |

E. M. Fried4 | 2009 2008 2007 | $84,000 $76,000 $72,000 | $0 $0 $0 | $69 $1,560 $1,560 | $84,069 $77,560 $73,560 |

T. J. Fruechtel | 2009 2008 2007 | $66,000 $64,000 $61,000 | $0 $0 $0 | $69 $1,560 $1,560 | $66,069 $65,560 $62,560 |

E. D. James3 | 2009 2008 2007 | $0 $0 $0 | $58,000 $0 $0 | $0 $0 $0 | $58,000 $0 $0 |

R. D. Kennedy | 2009 2008 2007 | $77,000 $66,000 $65,000 | $0 $0 $0 | $69 $1,560 $1,560 | $77,069 $67,560 $66,560 |

H.E. Layman | 2009 2008 2007 | $18,000 $11,000 $6,000 | $50,000 $50,000 $51,000 | $4,029*** $5,520*** $0 | $72,029 $62,560 $57,000 |

| * | Amounts represent retainer or fees deferred during 2009, 2008 and 2007 pursuant to the Director Deferred Plan described above. |

| ** | Amounts refer to the value of certain life and health insurance benefits in which the Director participates. |

| *** | Amount includes $1,560 in Director benefits and $3,960 in retiree medical benefits as a former employee of the Corporation. The latter is not included in “Total” for Mr. Layman, the former is. |

1 Mr. Beasley was elected a Director in January 2010.

2 Mr. Clarke was nominated by the Board on April 13, 2010 for election by the stockholders at the Meeting.

3 Mr. Collins and Mr. James had been eligible to receive fees and retainers since the Change-In-Control on December 20, 2004, but opted not to receive compensation in 2005, 2006 or 2007. Mr. Collins began accepting such fees and retainers beginning in January 2008, but ceased doing so from and after October 19, 2009 upon becoming an employee of the Corporation; Mr. James began receiving Director compensation in January 2009.

4 Mr. Fried retired from the Board as of December 31, 2009. Mr. Osterman, who retired as an employee and CEO as of the close of business on December 18, 2009, received no compensation as a Director during 2009 because he was an employee Director and Chairman at the time of the Board activities in 2009. He continues as a non-employee Director and Chairman of the Board until the Meeting.

NON-MANAGEMENT DIRECTORS’ STOCK OWNERSHIP FOR FISCAL 2007, 2008 and 2009

| Name of Director | Year | Deferred Stock Owned | Other Stock Owned* # of Shares | Blount Retirement Savings Plan, a 401(k) Plan | # of Shares Total |

R.E. Beasley, Jr.1 | 2009 2008 2007 | N/A N/A N/A | N/A N/A N/A | N/A N/A N/A | N/A N/A N/A |

R. E. Cartledge | 2009 2008 2007 | 7,250 -0- 4,400 | 38,709 38,709 34,309 | -0- -0- -0- | 45,959 38,709 38,709 |

A.C. 1 Clarke | 2009 2008 2007 | N/A N/A N/A | N/A N/A N/A | N/A N/A N/A | N/A N/A N/A |

J. L. Collins | 2009 2008 2007 | -0- -0- -0- | 10,000 -0- -0- | N/A -0- -0- | 10,000 -0- -0- |

E. M. Fried2 | 2009 2008 2007 | -0- -0- -0- | 65,000 65,000 65,000 | -0- -0- -0- | 65,000 65,000 65,000 |

T. J. Fruechtel | 2009 2008 2007 | -0- -0- -0- | 14,446 14,446 14,446 | -0- -0- -0- | 14,446 14,446 14,446 |

E. D. James | 2009 2008 2007 | 7,653 -0- -0- | -0- -0- -0- | -0- -0- -0- | 7,653 -0- -0- |

R. D. Kennedy | 2009 2008 2007 | -0- -0- -0 | 30,000 30,000 30,000 | -0- -0- -0- | 30,000 30,000 30,000 |

H. E. Layman | 2009 2008 2007 | 6,713 4,524 4,155 | 10,672 6,239 2,058 | 26 26 26 | 17,411 10,789 6,239 |

Advisory Directors: In May 1991, the Board approved, and in April 1994 amended, the Advisory Directors’ Recognition Plan. Each member of the Board who had served as a Director for at least five consecutive years, who had not been an employee vested in any employee benefits sponsored by the Corporation during his or her service on the Board and who was serving upon attainment of age 72 became an Advisory Director. Under this Plan, a Director who was or became eligible for Advisory Director status after July 1, 1991, was, at the end of his or her then current term, paid a quarterly benefit for life equal to the quarterly cash retainer, exclusive of Committee chairman fees, then being paid to that Director. The Advisory Directors’ Recognition Plan is unfunded and amounts due the participants covered thereby are general obligations of the Corporation. There was one participant under this plan during 2009, Mr. W. Houston Blount, who resigned as a Director in 1999 as a result of the Merger and Recapitalization. He received $25,000 in 2009. In February 2000, this plan was terminated, and subject to the

* This column lists the number of shares of the Corporation’s common stock as of the end of the respective fiscal year to which each director has sole voting and investment power.

1 Mr. Beasley was elected as a Director of the Corporation on January 1, 2010. Mr. Clarke was nominated by the Board on April 13, 2010 for election by the stockholders at the Meeting.

2 Mr. Fried retired from his position as a Director and as the Lead Director of the Corporation effective as of December 31, 2009.

fulfillment of obligations to the surviving Advisory Director, there will be no additional Advisory Directors or payments in the future.

AUDIT COMMITTEE DISCLOSURE

The Corporation has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee Charter was amended in February 2004 and incorporated in the 2004 Proxy Statement as Exhibit A. With respect to the independence of the Corporation’s Directors who serve on the Audit Committee, Mr. R. Eugene Cartledge, chairman, and members Thomas J. Fruechtel and Harold E. Layman, are all “independent” Directors, as defined by applicable rules and regulations of the SEC and NYSE. During 2009, Mr. Eliot M. Fried resigned as Lead Director, as a Director, as Chairman of the Compensation Committee and as a member of each of the Audit and Nominating & Corporate Governance Committees effective as of December 31, 2009.

The Board has determined that each of Messrs. Cartledge, Fried, Fruechtel and Layman qualifies as a “financial expert,” as defined by the SEC pursuant to Section 407 of the Sarbanes-Oxley Act. Three of these members have served as chief executive officers of publicly-traded or private companies in which capacity they supervised the chief financial officer function, a position previously held by one; one has been a member of the Investment Committee of a major investment banking firm; and all four possess (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of such accounting principles in connection with the accounting for estimates, accruals and reserves; (iii) experience actively supervising one or more persons engaged in preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Corporation’s financial statements; (iv) an understanding of internal controls and procedures for financial reporting and (v) an understanding of Audit Committee functions.

No member of the Audit Committee serves on the Audit Committee of more than two other public companies.