Company Overview March 2023

2 Forward-Looking Statements Forward-Looking Statements This presentation contains projections and other forward-looking statements within the meaning of federal securities laws. These projections and statements reflect Riley Exploration Permian, Inc.’s (“Riley Permian”) current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. A discussion of these factors is included in Riley Permian’s periodic reports filed with the U.S. Securities and Exchange Commission (“SEC”). All statements, other than historical facts, that address activities that Riley Permian assumes, plans, expects, believes, intends or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. The forward-looking statements are based on management’s current beliefs, based on currently available information, as to the outcome and timing of future events, including the volatility of oil, natural gas and NGL prices; the scope, duration, and reoccurrence of any epidemics or pandemics (including, specifically, the coronavirus disease 2019 (“COVID-19”) pandemic and any related variants), including reactive or proactive measures taken by governments, regulatory agencies and businesses related to the pandemic, and the effects of COVID-19 on the oil and natural gas industry, pricing and demand for oil and natural gas and supply chain logistics; regional supply and demand factors, any delays, curtailment delays or interruptions of production, and any governmental order, rule or regulation that may impose production limits; cost and availability of gathering, pipeline, refining, transportation and other midstream and downstream activities; severe weather and other risks that lead to a lack of any available markets; our ability to successfully complete mergers, acquisitions and divestitures; the risk that the Company's EOR project may not perform as expected or produce the anticipated benefits; risks relating to our operations, including development drilling and testing results and performance of acquired properties and newly drilled wells; any reduction in our borrowing base on our revolving credit facility from time to time and our ability to repay any excess borrowings as a result of such reduction; the impact of our derivative strategy and the results of future settlement; our ability to comply with the financial covenants contained in our credit agreement; conditions in the capital, financial and credit markets and our ability to obtain capital needed for development and exploration operations on favorable terms or at all; the loss of certain tax deductions; risks associated with executing our business strategy, including any changes in our strategy; inability to prove up undeveloped acreage and maintain production on leases; risks associated with concentration of operations in one major geographic area; legislative or regulatory changes, including initiatives related to hydraulic fracturing, emissions, and disposal of produced water, which may be negatively impacted by regulation or legislation; the ability to receive drilling and other permits or approvals and rights-of-way in a timely manner (or at all), which may be restricted by governmental regulation and legislation; risks related to litigation; evolving geopolitical and military hostilities in other areas of the world; and cybersecurity threats, technology system failures and data security issues. These forward-looking statements involve certain risks and uncertainties that could cause the results to differ materially from those expected by the management of Riley Permian. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the risk that Riley Permian may reduce, suspend or totally eliminate dividend payments in the future, whether variable or fixed, due to insufficient liquidity or other factors, potential adverse reactions or changes to the business or operations of Riley Permian resulting from the recently completed merger, including Riley Permian’s future financial condition, results of operations, strategy and plans; changes in capital markets and the ability of Riley Permian to finance operations in the manner expected; the risk that the Company’s EOR and CCUS projects may not perform as expected or produce the anticipated benefits; the risks of oil and gas activities; and the fact that operating costs and business disruption may be greater than expected following the consummation of the merger. Riley Permian encourages readers to consider the risks and uncertainties associated with projections and other forward-looking statements. In addition, Riley Permian assumes no obligation to publicly revise or update any forward-looking statements based on future events or circumstances. For additional discussion of the factors that may cause us not to achieve our financial projections and/or production estimates, see Riley Permian’s filings with the SEC, including its forms 10-K, 10-Q and 8-K and any amendments thereto. We do not undertake any obligation to release publicly the results of any future revisions we may make to this prospective data or to update this prospective data to reflect events or circumstances after the date of this presentation. Therefore, you are cautioned not to place undue reliance on this information. None of the information contained in this presentation has been audited by any independent auditor. This presentation is prepared as a convenience for securities analysts and investors and may be useful as a reference tool. Riley Permian may elect to modify the format or discontinue publication at any time, without notice to securities analysts or investors. Use of non-GAAP Financial Information This presentation includes certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These measures include (i) Adjusted Net Income, (ii) Adjusted EBITDAX, (iii) Cash Margins, (iv) Free Cash Flow and (v) PV-10. These non-GAAP financial measures are not measures of financial performance prepared or presented in accordance with GAAP and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation, and users of any such information should not place undue reliance thereon. See the Company’s website, www.rileypermian.com, for the descriptions and reconciliations of non-GAAP measures presented in this presentation to the most directly comparable financial measures calculated in accordance with GAAP. Oil & Gas Reserves The SEC generally permits oil and natural gas companies, in filings made with the SEC, to disclose proved reserves, which are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserves that meet the SEC’s definitions for such terms. In this presentation, Riley Permian may use the terms “resource potential,” “resource play,” “estimated ultimate recovery,” or “EURs,” “type curve” and “standardized measure,” each of which the SEC guidelines restrict from being included in filings with the SEC without strict compliance with SEC definitions. These terms refer to Riley Permian’s internal estimates of unbooked hydrocarbon quantities that may be potentially discovered through exploratory drilling or recovered with additional drilling or recovery techniques. “Resource potential” is used by Riley Permian to refer to the estimated quantities of hydrocarbons that may be added to proved reserves, largely from a specified resource play potentially supporting numerous drilling locations. A “resource play” is a term used by Riley Permian to describe an accumulation of hydrocarbons known to exist over a large areal expanse and/or thick vertical section potentially supporting numerous drilling locations, which, when compared to a conventional play, typically has a lower geological and/or commercial development risk. “EURs” are based on Riley Permian’s previous operating experience in a given area and publicly available information relating to the operations of producers who are conducting operations in these areas. Unbooked resource potential or “EURs” do not constitute reserves within the meaning of the Society of Petroleum Engineer’s Petroleum Resource Management System or SEC rules and do not include any proved reserves. Actual quantities of reserves that may be ultimately recovered from Riley Permian’s interests may differ substantially from those presented herein. Factors affecting ultimate recovery include the scope of Riley Permian’s ongoing drilling program, which will be directly affected by the availability of capital, decreases in oil, natural gas liquids and natural gas prices, well spacing, drilling and production costs, availability and cost of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, negative revisions to reserve estimates and other factors, as well as actual drilling results, including geological and mechanical factors affecting recovery rates. “EURs” from reserves may change significantly as development of Riley Permian’s core assets provides additional data. In addition, Riley Permian’s production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling cost increases. “Type curve” refers to a production profile of a well, or a particular category of wells, for a specific play and/or area.

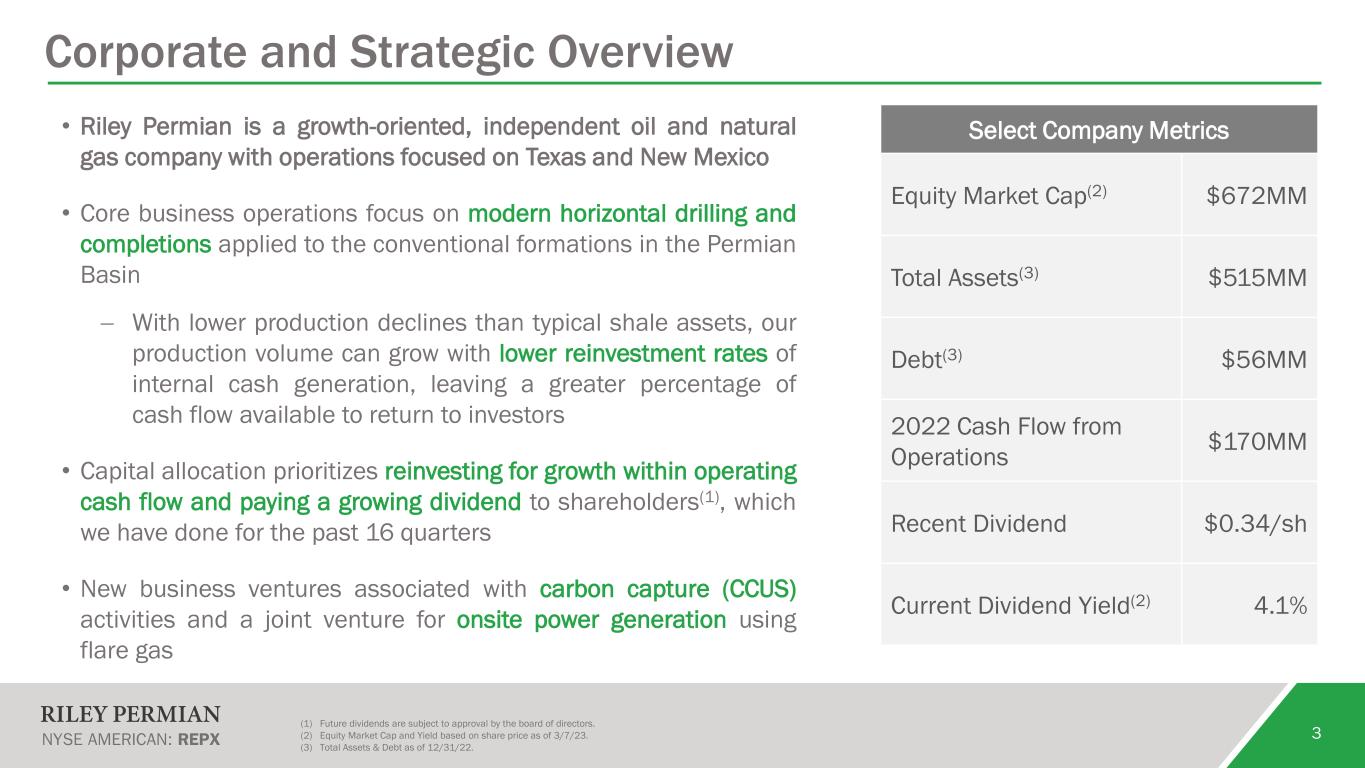

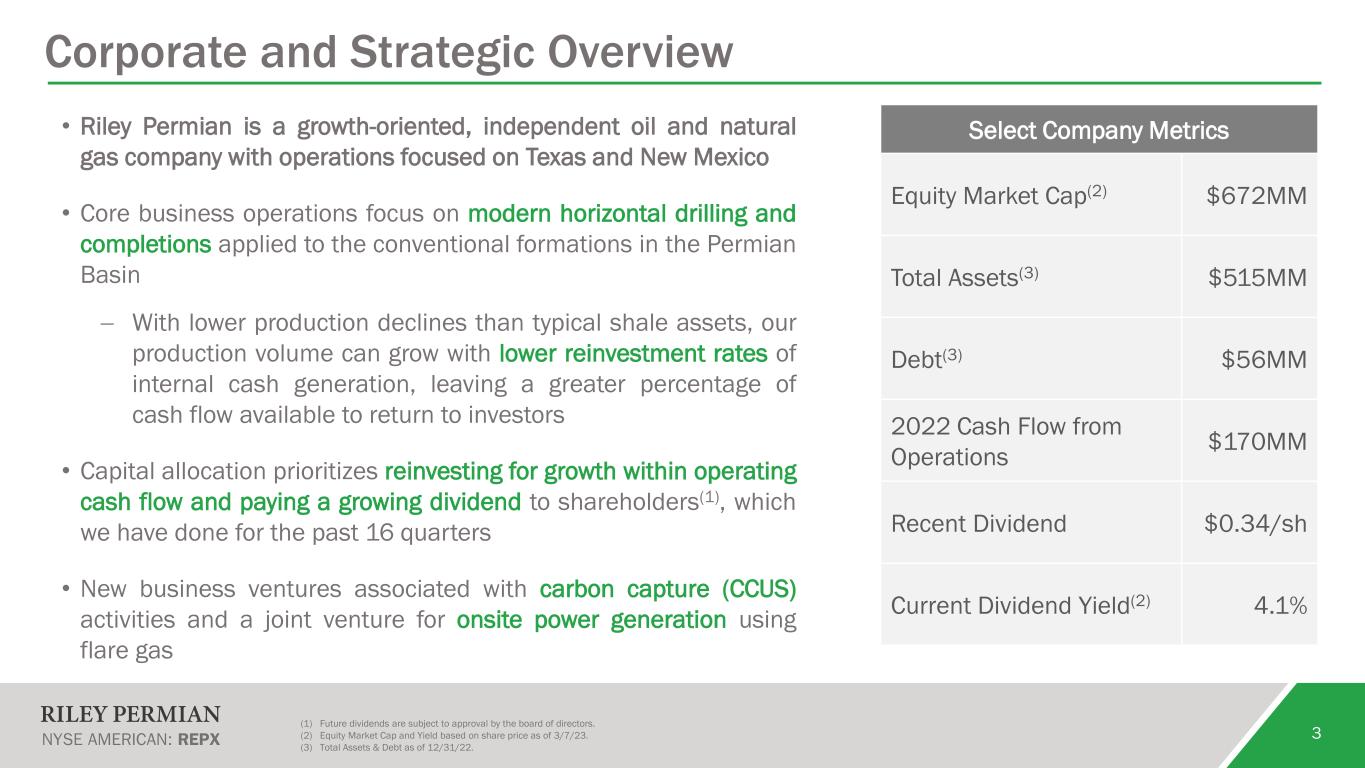

Corporate and Strategic Overview • Riley Permian is a growth-oriented, independent oil and natural gas company with operations focused on Texas and New Mexico • Core business operations focus on modern horizontal drilling and completions applied to the conventional formations in the Permian Basin − With lower production declines than typical shale assets, our production volume can grow with lower reinvestment rates of internal cash generation, leaving a greater percentage of cash flow available to return to investors • Capital allocation prioritizes reinvesting for growth within operating cash flow and paying a growing dividend to shareholders(1), which we have done for the past 16 quarters • New business ventures associated with carbon capture (CCUS) activities and a joint venture for onsite power generation using flare gas 3 (1) Future dividends are subject to approval by the board of directors. (2) Equity Market Cap and Yield based on share price as of 3/7/23. (3) Total Assets & Debt as of 12/31/22. Select Company Metrics Equity Market Cap(2) $672MM Total Assets(3) $515MM Debt(3) $56MM 2022 Cash Flow from Operations $170MM Recent Dividend $0.34/sh Current Dividend Yield(2) 4.1%

Prime Core Asset in Yoakum County, Texas 4 Platang Field “Champions” Legacy Regional Development Riley Permian’s Modern Development • The San Andres is a proven, conventional reservoir that has been producing for over 100 years • Relative to shale, the San Andres reservoir has excellent natural permeability and porosity, which allows large volumes of fluids to move through the rock to the borehole, with only moderate stimulation • The Wasson and Brahaney Fields are giant, legacy oilfields on the Northwest Shelf of the Permian Basin, located primarily in Yoakum County, TX • These fields commenced development in the 1930s and have produced over 2.3 billion barrels of oil • These fields were developed with several thousand vertical wells, many of which are still producing ~10 bopd • Operators of Wasson and Brahaney include oil majors and large cap companies, and they have been using water and CO2 injection for decades to enhance recovery • Within this premier geologic setting, Riley Permian’s focus is on horizontal development of a net ~26K acre position (Platang Field, or “Champions”) • The San Andres’ moderate depth generally leads to lower drilling costs compared to many of the Permian shale plays • Riley Permian has ~80 active, operated horizontal wells producing an average of ~150 bopd • Our oldest producing horizontal well is 7 years old; our average horizontal well age is 3.8 years old • This combination of high average production per well (with low base decline) and younger well life leads to lower operating costs relative to marginal vertical wells • Until 2022, we had not employed water or CO2 enhancement techniques on this asset, but we currently have a pilot program in progress to test viability

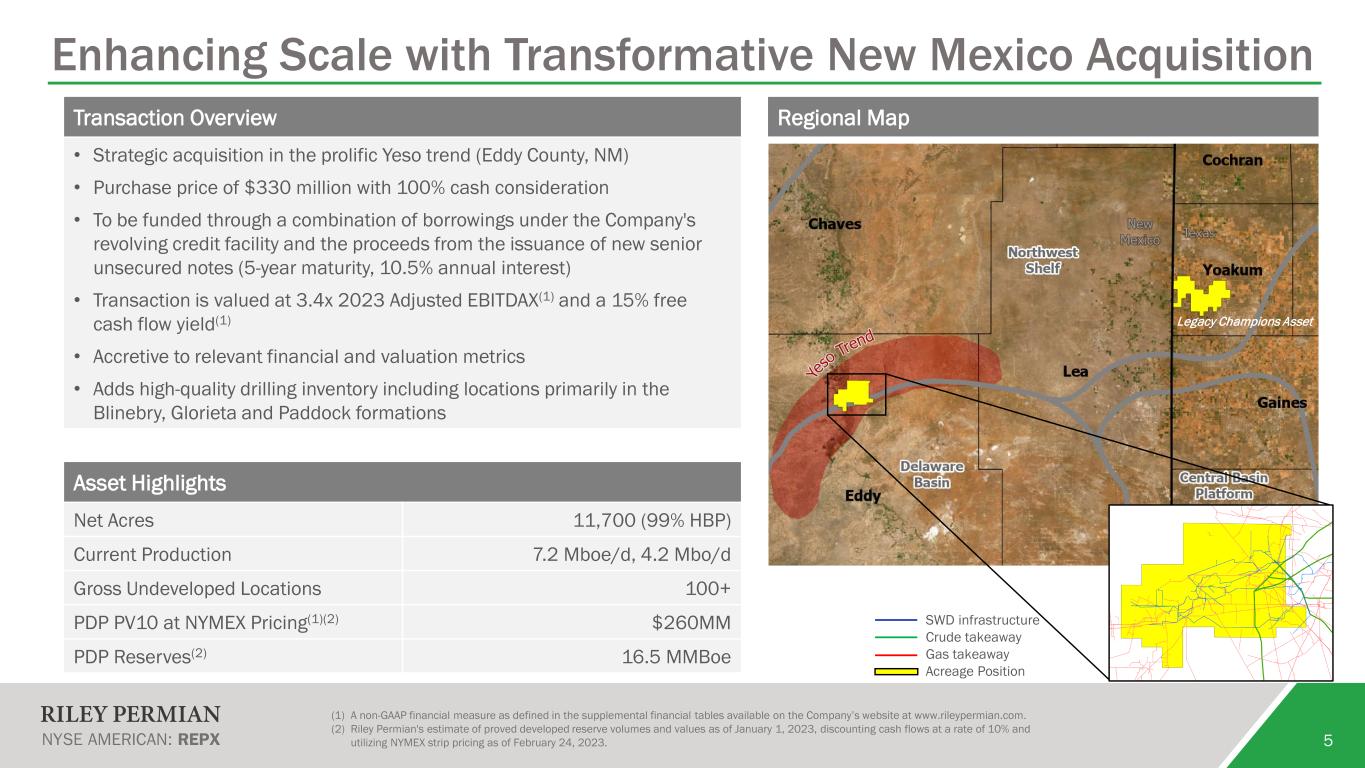

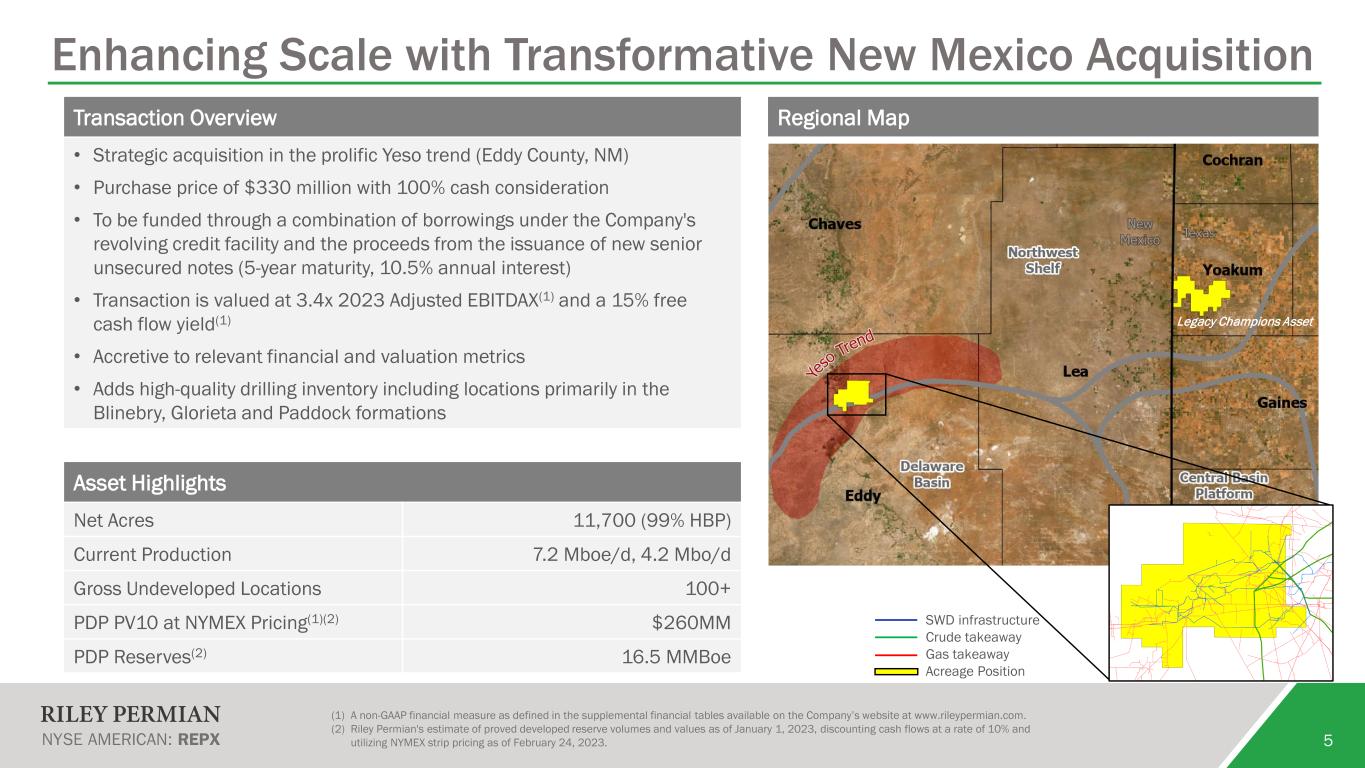

Transaction Overview Regional Map • Strategic acquisition in the prolific Yeso trend (Eddy County, NM) • Purchase price of $330 million with 100% cash consideration • To be funded through a combination of borrowings under the Company's revolving credit facility and the proceeds from the issuance of new senior unsecured notes (5-year maturity, 10.5% annual interest) • Transaction is valued at 3.4x 2023 Adjusted EBITDAX(1) and a 15% free cash flow yield(1) • Accretive to relevant financial and valuation metrics • Adds high-quality drilling inventory including locations primarily in the Blinebry, Glorieta and Paddock formations Asset Highlights Net Acres 11,700 (99% HBP) Current Production 7.2 Mboe/d, 4.2 Mbo/d Gross Undeveloped Locations 100+ PDP PV10 at NYMEX Pricing(1)(2) $260MM PDP Reserves(2) 16.5 MMBoe 5 Enhancing Scale with Transformative New Mexico Acquisition (1) A non-GAAP financial measure as defined in the supplemental financial tables available on the Company’s website at www.rileypermian.com. (2) Riley Permian's estimate of proved developed reserve volumes and values as of January 1, 2023, discounting cash flows at a rate of 10% and utilizing NYMEX strip pricing as of February 24, 2023. SWD infrastructure Crude takeaway Gas takeaway Acreage Position Legacy Champions Asset

Total Net Production MBoe/d Adjusted EBITDAX(1) $MM Dividends per Share $/Sh 6 Track Record of Consistent Growth and Shareholder Returns (1) A non-GAAP financial measure as defined in the supplemental financial tables available on the Company’s website at www.rileypermian.com. 3.9 5.6 5.7 6.7 8.8 4.1 6.6 7.2 9.2 11.5 2018 2019 2020 2021 2022 Oil, MBbls/d 0.92 0.83 1.08 1.27 2018 2019 2020 2021 2022 41 68 81 97 176 2018 2019 2020 2021 2022

Improving Capital Efficiency: More Growth with Less Spending Increased Allocation of Capital to Dividends + Balance Sheet Materially Increased FCF(1) 7 Reinvesting for Significant Growth While Also Increasing FCF(1) $MM Note: All periods shown above are for the 12 months ended 12/31/21 or 12/31/22. (1) A non-GAAP financial measure as defined in the supplemental financial tables available on the company’s website at www.rileypermian.com. 0% 10% 20% 30% 40% 0% 25% 50% 75% 100% Y/ Y Oi l P ro du ct io n G ro w th Reinvestment Rate: Cash Capex before Acquisitions vs CFFO 2021 2022 88% 66% 12% 34% 2021 2022 Dividends and Balance Sheet Cash Capex before Acquisitions

Environmental Social Governance • Formed JV to use flare gas for onsite power generation which will reduce emissions • Pursuing CCUS activities to capture and storage industrial CO2 • Onsite pipelines transport nearly all production volumes, eliminating trucking and associated emissions • Our 2022 pneumatic device replacement project has resulted in a 92% reduction in methane emissions from pneumatic devices • Providing low-cost, reliable and secure energy to society • U.S.-based workforce, with zero offshoring of employed labor, producing U.S. natural resources • Zero recordable employee injuries in 2021 and 2022 • Large majority of employees are also stockholders, granted through long-term incentive plans • Prioritizing long-term corporate sustainability and creating value for shareholders • Balanced board of directors: significant shareholder representation; 4 of 6 directors are independent; 3 of 6 diverse (gender or ethnicity) • 100% of committee representation is from independent directors • Executive alignment with shareholders as 2/3rds of executive’s target incentive compensation is in the form of stock Committed to ESG Engagement 8 Responsibly producing some of the world’s most demanded natural resources

CO2 Investment Highlights: Inflation Hedge, Yield-Oriented Growth Story 9(1) Future dividends are subject to approval by the board of directors. Yield based on share price as of 3/7/23. Multi-year track record of organic growth in production, cash flow and reserves across commodity cycles Premier, oil-based, conventional assets with low decline rates that enables capital efficiency Proven and aligned management team with substantial expertise across disciplines and long-term perspective Operating and financial performance metrics compete with top E&Ps Potential upside through new ventures such EOR, CCUS and power JV Consistent dividend payer with 4.1% current annualized yield; corporate objective to grow the dividend annually(1)

Appendix 10[ insert footnotes here ]

Capitalization Summary 11 RILEY PERMIAN NYSE: REPX Share Price1 [$25.95] Shares Out1 [19.54MM] Market Cap1 [$507MM] Debt1 [$61MM] Insider Holdings [32%] Current Qrtly. Dividend1 [$0.34/Sh.] Ann. Dividend Yield1,2 [4.8%] 1) As of [10/28/22]. 2) Future dividends are subject to approval by the board of directors. (1) Source: SEC Filings. Insiders include Yorktown, management and the board of directors. (2) Includes affiliated entity holdings aggregated from Form 4 filings. (3) Future dividends are subject to approval by the board of directors. > 5% Holders and Insiders as of 3/7/231 Shares (MM) Ownership % Share Price (3/7/23) $33.32 Yorktown Energy Partners2 5.51 27.3% Shares Outstanding, MM (3/7/23) 20.2 Bluescape Energy Partners 5.22 25.9% Equity Value, $MM $671.7 Balmon Investments2 2.02 10.0% VandenBrink Estate2 1.97 9.8% Credit Facility Debt, $MM (12/31/22) $56.0 Riley Permian Management 0.83 4.1% Cash and Cash Equivalents, $MM (12/31/22) (13.3) Board of Directors 0.03 0.2% Enterprise Value, $MM $714.4 Estimated Public Float 4.58 22.7% Total 20.16 100.0% Total Insider Ownership 6.37 31.6% Current Qrtly. Dividend3: $0.34/Sh Total shares inclusive of restricted stock awards Balance as of: 12/31/2022 Annual Dividend Yield3: 4.1% Syndication: 6 banks with Truist Bank as Administrative Agent Debt to EV: 7.8% Interest Rate: Term SOFR + 285-385bps Maturity: April 2026 Equity Ownership Credit FacilityMarket Capitalization NYSE: REPX $56MM Drawn $169MM Available Liquidity $- $50 $100 $150 $200 $250 $M M $225MM Borrowing Base

Existing Proved Reserves Based on SEC Pricing(1) 12 Commodity Volume Mix Developed vs Undeveloped Volume Mix Developed vs Undeveloped PV-10(2) Mix 78 MMBoe 78 MMBoe $802 MM NYMEX value(3), $1.4BN SEC value (1) Reserves based on third party estimates as of 12/31/22, prepared by Netherland Sewell & Associates, Inc. Boe metrics converts gas mcf on a 1:6 basis to oil barrels and NGL barrels on a 1:1 basis with oil barrels. (2) A non-GAAP financial measure as defined in the supplemental financial tables available on the Company’s website at www.rileypermian.com. (3) Utilizes NYMEX pricing as of 12/31/22. 63% 37% PDP PUD 63% 19% 18% Oil NGL Nat Gas 72% 28% PDP PUD

13 Hedging Positions as of 3/3/23 Note: Q1 2023 derivative positions shown include some contracts that have settled as of 3/3/23 2023 2024 2025 Calendar Quarters 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q CRUDE OIL Fixed Swap - Volume, Bbls/Qtr 225,000 315,000 216,000 189,000 60,000 60,000 60,000 60,000 - Weighted Average Price, $/Bbl $53.65 $62.78 $63.04 $62.51 $71.60 $71.60 $71.60 $71.60 $0.00 Collars - Volume, Bbls/Qtr 210,000 300,000 330,000 330,000 363,000 330,000 300,000 300,000 315,000 Weighted Average Floor Price, $/Bbl $70.95 $71.50 $68.64 $68.64 $61.16 $60.91 $61.00 $61.00 $60.00 Weighted Average Ceiling Price, $/Bbl $89.96 $88.98 $88.85 $88.85 $86.95 $87.41 $85.50 $85.50 $77.98 Total Oil Price Hedges, Bbls/Qtr 435,000 615,000 546,000 519,000 423,000 390,000 360,000 360,000 315,000 CRUDE OIL BASIS Mid/Cush Basis Swaps - Volume, Bbls/Qtr 240,000 360,000 360,000 360,000 240,000 240,000 240,000 240,000 - Weighted Average Price, $/Bbl $1.28 $1.28 $1.28 $1.28 $0.87 $0.87 $0.87 $0.87 $0.00 NATURAL GAS Swaps - Volume, MMBtu/Qtr - 450,000 450,000 400,000 375,000 375,000 375,000 375,000 375,000 Weighted Average Price, $/MMBtu $0.00 $2.60 $2.60 $3.23 $3.61 $3.17 $3.17 $3.75 $4.05 Collars - Volume, MMBtu/Qtr - 300,000 300,000 300,000 300,000 255,000 255,000 255,000 255,000 Weighted Average Floor Price, $/MMBtu $0.00 $2.55 $2.55 $3.12 $3.40 $2.95 $2.95 $3.42 $3.65 Weighted Average Ceiling Price, $/MMBtu $0.00 $3.20 $3.20 $4.07 $4.50 $3.72 $3.72 $4.54 $4.95 Total NG Price Hedges, MMBtu/Qtr - 750,000 750,000 700,000 675,000 630,000 630,000 630,000 630,000

Additional Information 14 Company www.rileypermian.com 29 E. Reno Ave., Ste 500 Oklahoma City, OK 73104 Investor Relations Direct: 405-415-8699 ir@rileypermian.com