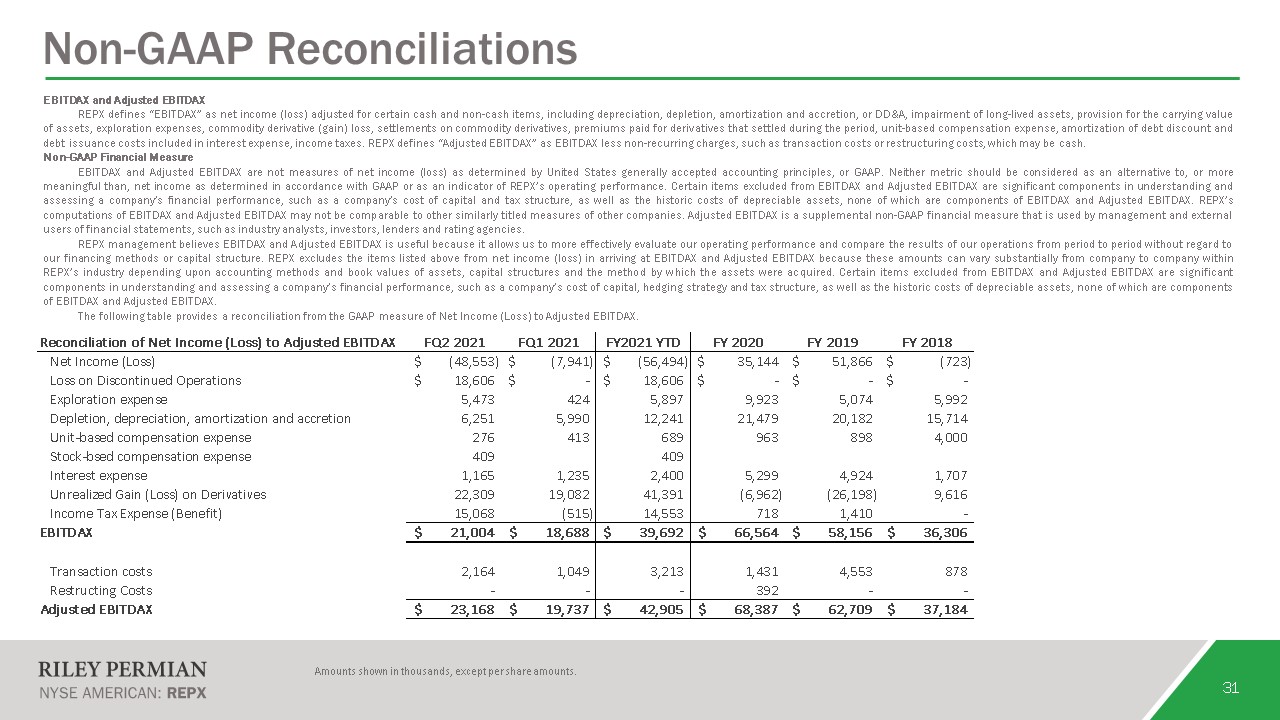

33 Forward-Looking Statements Forward-Looking Statements This presentation contains projections and other forward-looking statements within the meaning of federal securities laws. These projections and statements reflect Riley Exploration Permian, Inc.’s (“Riley Permian”) current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. A discussion of these factors is included in Riley Permian’s periodic reports filed with the U.S. Securities and Exchange Commission (“SEC”). This presentation also contains Riley Permian’s updated capital expenditure and production guidance for 2021 and certain forward-looking information with respect to 2022. The actual levels of production, capital expenditures, expenses and other estimates may be higher or lower than these estimates due to, among other things, uncertainty in drilling schedules, changes in market demand, availability and cost of drilling rigs and other equipment, failure of wells to produce in line with historic performance or our expectations, and unanticipated delays in production. All statements, other than historical facts, that address activities that Riley Permian assumes, plans, expects, believes, intends or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. The forward-looking statements are based on management’s current beliefs, based on currently available information, as to the outcome and timing of future events, including the current adverse industry and macroeconomic conditions, commodity price volatility, production levels, the impact of the recent presidential and congressional elections on energy and environmental policies and regulations, any other potential regulatory actions (including those that may impose production limits in the Permian Basin), the impact and duration of the ongoing COVID-19 pandemic, acquisitions and sales of assets, future dividends, production, drilling and capital expenditure plans, severe weather conditions (including the impact of the recent severe winter storms on production volumes), impact of impairment charges and effects of hedging arrangements. These forward-looking statements involve certain risks and uncertainties that could cause the results to differ materially from those expected by the management of Riley Permian. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the risk that Riley Permian may reduce, suspend or totally eliminate dividend payments in the future, whether variable or fixed, due to insufficient liquidity or other factors, potential adverse reactions or changes to the business or operations of Riley Permian resulting from the recently completed merger, including Riley Permian’s future financial condition, results of operations, strategy and plans; changes in capital markets and the ability of Riley Permian to finance operations in the manner expected; the risks of oil and gas activities; and the fact that operating costs and business disruption may be greater than expected following the consummation of the merger.Riley Permian encourages readers to consider the risks and uncertainties associated with projections and other forward-looking statements. In addition, Riley Permian assumes no obligation to publicly revise or update any forward-looking statements based on future events or circumstances. For additional discussion of the factors that may cause us not to achieve our financial projections and/or production estimates, see Riley Permian’s filings with the SEC, including its forms 10-K, 10-Q and 8-K and any amendments thereto. We do not undertake any obligation to release publicly the results of any future revisions we may make to this prospective data or to update this prospective data to reflect events or circumstances after the date of this presentation. Therefore, you are cautioned not to place undue reliance on this information. None of the information contained in this presentation has been audited by any independent auditor. This presentation is prepared as a convenience for securities analysts and investors and may be useful as a reference tool. Riley Permian may elect to modify the format or discontinue publication at any time, without notice to securities analysts or investors. Use of non-GAAP Financial Information This presentation includes certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These measures include (i) EBITDA, (ii) Adjusted EBITDA, (iii) Net Debt, (iv) Free Cash Flow and (v) PV-10. These non-GAAP financial measures are not measures of financial performance prepared or presented in accordance with GAAP and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation, and users of any such information should not place undue reliance thereon. See the Appendix for the descriptions and reconciliations of these non-GAAP measures presented in this presentation to the most directly comparable financial measures calculated in accordance with GAAP. Riley Permian is unable to provide a reconciliation of non-GAAP financial measures contained in this presentation that are presented on a forward-looking basis because Riley Permian is unable, without unreasonable efforts, to estimate and quantify the most directly comparable GAAP components, largely because predicting future operating results is subject to many factors outside of Riley Permian's control and not readily predictable and that are not part of Riley Permian's routine operating activities, including various domestic and international economic, regulatory, political and legal factors. Oil & Gas Reserves The SEC generally permits oil and natural gas companies, in filings made with the SEC, to disclose proved reserves, which are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserves that meet the SEC’s definitions for such terms. In this presentation, Riley Permian may use the terms “resource potential,” “resource play,” “estimated ultimate recovery,” or “EURs,” “type curve” and “standardized measure,” each of which the SEC guidelines restrict from being included in filings with the SEC without strict compliance with SEC definitions. These terms refer to Riley Permian’s internal estimates of unbooked hydrocarbon quantities that may be potentially discovered through exploratory drilling or recovered with additional drilling or recovery techniques. “Resource potential” is used by Riley Permian to refer to the estimated quantities of hydrocarbons that may be added to proved reserves, largely from a specified resource play potentially supporting numerous drilling locations. A “resource play” is a term used by Riley Permian to describe an accumulation of hydrocarbons known to exist over a large areal expanse and/or thick vertical section potentially supporting numerous drilling locations, which, when compared to a conventional play, typically has a lower geological and/or commercial development risk. “EURs” are based on Riley Permian’s previous operating experience in a given area and publicly available information relating to the operations of producers who are conducting operations in these areas. Unbooked resource potential or “EURs” do not constitute reserves within the meaning of the Society of Petroleum Engineer’s Petroleum Resource Management System or SEC rules and do not include any proved reserves. Actual quantities of reserves that may be ultimately recovered from Riley Permian’s interests may differ substantially from those presented herein. Factors affecting ultimate recovery include the scope of Riley Permian’s ongoing drilling program, which will be directly affected by the availability of capital, decreases in oil, natural gas liquids and natural gas prices, well spacing, drilling and production costs, availability and cost of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, negative revisions to reserve estimates and other factors, as well as actual drilling results, including geological and mechanical factors affecting recovery rates. “EURs” from reserves may change significantly as development of Riley Permian’s core assets provides additional data. In addition, Riley Permian’s production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling cost increases. “Type curve” refers to a production profile of a well, or a particular category of wells, for a specific play and/or area. The “standardized measure” of discounted future new cash flows is calculated in accordance with SEC regulations and a discount rate of 10%. Actual results may vary considerably and should not be considered to represent the fair market value of Riley Permian’s proved reserves.