| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED

MARCH 31, 2007

COMMISSION FILE NO. 1-16349

INVESTORS CAPITAL HOLDINGS, LTD.

(Exact name of registrant in its charter)

(State or other jurisdiction of (I.R.S.Employer

incorporation or organization) Identification No.)

230 Broadway East

Lynnfield, Massachusetts 01940

(781) 593-8565

(Address, including zip code, and telephone number, including area code,

of Registrant's principal executive offices)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class Name of Each Exchange on Which Registered

Common Stock, $0.01 par value The American Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes {X} No { }

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. { }

Page 1

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes{ } No {X}

The aggregate market value of the shares of the registrant's common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold, as of the last business day of the registrant's most recently completed second fiscal quarter, was $9,285,870.

As of June 22, 2007, there were outstanding 6,220,967 shares of the $0.01 par value per share Common Stock of the registrant.

| Documents Incorporated by Reference |

Certain portions of the registrant's definitive proxy statement for the Annual Meeting of Stockholders to be held on August 23, 2007 are incorporated by reference in Items 10 through 14 of Part III of this Annual Report on Form 10-K.

| Investor Relations Contact: Robert Foney |

Page 2

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

Investors Capital Holdings, Ltd. and its wholly-owned subsidiaries are often referred to in this report, both individually and collectively, as the "Company" or with terms such as "we", "us", "our" and the like. When being referred to individually without reference to the other components of the Company, Investors Capital Holdings, Ltd. and its wholly-owned subsidiaries, Investors Capital Corporation, Eastern Point Advisors, Inc., ICC Insurance Agency, Inc., and Investors Capital Holdings Securities Corporation, are often referred to in this report as "ICH", "ICC", "EPA", “ICC Insurance” and “ICH Securities”, respectively.

| FORWARD-LOOKING STATEMENTS |

The statements, analyses, and other information contained herein relating to trends in our operations and financial results, the markets for our products, the future development of our business, and the contingencies and uncertainties to which we may be subject, as well as other statements including words such as "anticipate," "believe," "plan," "estimate," "expect," "intend," "will," "should," "may," and other similar expressions, are "forward-looking statements" under the Private Securities Litigation Reform Act of 1995. Such statements are made based upon management's current expectations and beliefs concerning future events and their effects on the Company. Our actual results may differ materially from the results anticipated in these forward-looking statements.

These forward-looking statements are subject to risks and uncertainties including, but not limited to, the risks discussed in Part I, Item 1A - “Risk Factors”.

Readers are also directed to other descriptions and discussions of risks and uncertainties that may be found in this report and other documents filed by the Company with the United States Securities and Exchange Commission (the “SEC”). We specifically disclaim any obligation to update or revise any forward-looking information, whether as a result of new information, future developments, or otherwise.

Page 3

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

Incorporated in 1995, ICH is a financial services holding company that operates primarily through its subsidiary, ICC, in two segments of the financial services industry:

- Broker-dealer servicesin support of trading and investment in securities such as corporate stocks andbonds, U.S. Government securities, municipal bonds, mutual funds, variable annuities and variablelife insurance, including provision of market information, internet trading and portfolio trackingfacilities and records management, and

- Investment advisory services, including asset management of individual client accounts and, until thethird quarter of our fiscal year ended March 31, 2006, management of two retail mutual funds.

Financial information pertaining to the Company for the fiscal years ended March 31, 2007, 2006 and 2005 is included in Part II of this document including, without limitation, selected financial data in Item 6 and financial statements and supplementary data in Item 8 thereof. See Part II, Item 8, Footnote 13 –“Segment Information” for information concerning each of the segments of the Company’s business with respect to the fiscal years ended March 31, 2007, 2006 and 2005, including revenues from external customers, a measure of profit or loss, and total assets.

BROKER-DEALER SERVICES

Investors Capital Corporation |

Investors Capital Corporation ("ICC") is a securities broker-dealer that is registered with the National Association of Securities Dealers ("NASD"), the Securities and Exchange Commission ("SEC"), the Municipal Securities Rule Making Board ("MSRB") and the Securities Investor Protection Corporation ("SIPC"). Headquartered in Lynnfield, Massachusetts, the wholly-owned subsidiary of ICH also is duly registered and doing business as a broker-dealer in all 50 states, the Commonwealth of Puerto Rico and the District of Columbia. ICC makes available multiple investment products and provides support, technology and back-office services to a network of approximately 675 independent registered representatives ("representatives"). Commissions derived from the provision of services and products to ICC's registered representatives represented approximately 97.4% of the Company's total revenues for the fiscal year ended March 31, 2007.

| | Broker-Dealer Representatives |

Our representatives sell investment products that are securities under federal and state law. Accordingly, they are required to qualify and register as representatives with our broker-dealer subsidiary under federal and state law. Depending upon their activities, they also may be required to qualify and register as investment adviser representatives. Our in-house training programs for representatives emphasize the long-range aspects of financial planning and investment products. We believe that the continuing education and support we provide to our registered representatives enables them to better inform and serve their clients.

Continuing to add productive registered representatives is an integral part of our growth strategy. We seek to recruit primarily experienced registered representatives who focus on assisting their clients in attaining their long-range financial goals. Once recruited, we focus on enhancing our representatives' professional knowledge, skills and value to their clients. During the fiscal year ended March 31, 2007, our average revenue per registered representative increased more than 27.87% to $115,530 compared to the

Page 4

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

previous fiscal year, more than offsetting a 8.04% decrease in the number of representatives in our national network.

In addition to a variety of valuable products and services, we offer prospective representatives an attractive commission payout and, if desired, the independence of owning and operating their own offices. Approximately 20 of our independent representatives work in Company-provided regional investment centers (see “-- Investment Center Model”, below). The remainder of our representatives generally pay substantially all of the costs associated with their offices and operations, while we concentrate on providing technical, regulatory, supervisory, compliance and other support services to our independent investment professionals. This allows expansion of our operations with relatively minimal capital outlay.

| | Compensation to Representatives |

Commission payouts to our registered representatives are negotiated and currently average 83.26% of the gross dealer concession generated from the sale of securities. Pursuant to the terms of our agreements with our registered representatives, and as permitted by current NASD rules, we provide our representatives, or their named beneficiaries, with continuing commissions on pre-existing business in the event of their retirement from the securities industry or death. Representatives grant to us the right to offset against commissions certain losses we may sustain as a result of their actions, omissions and errors. Our agreements with our representatives are terminable by either party with 15 days prior written notice, and do not contain either a confidentiality or non-compete provision.

| | Support to Representatives |

We provide a variety of services and products to our representatives to enhance their professionalism and productivity.

Technology Resources. Advanced technology, including client and corporate websites, enable our representatives and their clients to perform many tasks on-line, including:

- Opening of new accounts

- Monitoring of existing accounts

- Updating of client accounts

- Initiating and executing trading activities

- Viewing and downloading commission data

- Locating and exploring financial products

- Downloading client data

- Researching reports or inquiries on companies, securities and other pertinent financial topics

Approved Investment Products. We allow our representatives to offer a wide variety of approved investment products to their clients that are sponsored by well-respected, financially sound companies. We believe that this is critical to the success of our registered representatives and the Company. We follow a selective process in determining approved products to be offered to clients by our representatives, and we periodically review the product list for continued maintenance or removal of approved status.

Marketing. We provide advertising and public relations assistance to our representatives that enhance their profile, public awareness, and professional stature in the public's eye, including NASD-approved marketing materials, corporate and product brochures and client letters.

Supervision/Compliance. We maintain strong broker-dealer and investment adviser compliance programs. In addition to an eighteen-member home office staff that includes two dedicated compliance attorneys, we retain experienced field supervisors in NASD-recognized Offices of Supervisory Jurisdiction across the country that are charged with compliance responsibilities for defined groups of registered representatives including, in particular, newly-affiliated representatives. By positioning these

Page 5

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

compliance individuals in the field, we are able to more closely supervise and monitor the activities of our representatives to enhance their compliance with applicable laws, rules and regulations. Our compliance efforts are further enhanced by in-house computer systems and programs, including routine internal audits to ensure our compliance with anti-money laundering standards and other regulations under the USA Patriot Act.

Our representatives seek and value assistance in the area of compliance. Keeping in step with the latest industry regulations, our compliance department provides to our representatives, among other things:

- Advertising and sales literature review

- Field inspections, followed up with written findings and recommendations

- Weekly faxes and monthly conference calls on selected compliance topics

- Assistance with customer complaints and regulatory inquiries

- Workshops, seminars and in-house publications on various compliance matters

- Regional and national meetings

- Interpretation of rules and regulations and general compliance training

Clearing.We utilize the services of a clearing firm to clear our transactions on a fee-for-service basis. Our clearing firm processes most of the non-check and application securities transactions for our account and the accounts of our clients. Services of our clearing firm include billing and credit extension as well as control, receipt, custody and delivery of customer securities and funds. We pay a transaction charge for these services, relying on the operational capacity and the ability of our clearing firm for the orderly processing of security transactions. Engaging the processing services of a clearing firm exempts us from the application of certain capital reserve requirements and other complex regulatory requirements imposed by federal and state securities laws.

Commission revenue generated by ICC during the last three fiscal years was derived from the following activities:

| | | Fiscal Year Ended March 31, |

| Source of Commission Revenue | | 2007 | | 2006 | | 2005 |

| |

| Sale of mutual funds and unit investment trusts1: | | 20% | | 23% | | 19% |

| Sale of variable annuities and variable life insurance: | | 39% | | 38% | | 39% |

| Sale of individual stocks and bonds: | | 24% | | 22% | | 23% |

| Sale of direct participation programs: | | 16% | | 14% | | 11% |

| Other activities: | | 1% | | 3% | | 8% |

| | | | | | |

| Total | | 100% | | 100% | | 100% |

Direct participation programs predominantly involve equity investments in limited partnerships and real estate investment trusts ("REITS"). The increase in sales of this product type was directly correlated to the performance of the oil and gas programs and the real estate market since REITS and oil & gas programs make up 91.5% of this revenue category. As with other broker dealer products, sales commissions on REITS and oil and gas programs are comprised of a gross dealer concession on the invested amount.

Commission revenue from our mutual funds and variable annuity products continues to make up most of the revenue source; however, this relationship may not continue as our revenue mix becomes more diversified.

We believe there may be a trend in the future for commissions from stocks and bonds, as a percentage of total commissions, to increase due to our continued efforts to recruit representatives who are duly licensed to execute securities trades for their clients.

1Sale of mutual funds includes both sales of mutual funds through direct “check and application” and sales from our trading platform.

Page 6

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

| INVESTMENT ADVISORY SERVICES |

Historically since its inception in 1995, Eastern Point Advisors, Inc. ("EPA") served as our dedicated investment adviser subsidiary, providing investment advisory services to the investing public through its advisory service programs. These programs, which featured EPA-managed portfolios of load and no-load mutual funds, variable and /or individual securities, were provided to the public through as many as 100 investment adviser representatives. Extensive legal, data processing and other support services were provided by ICC to EPA in support of these activities in order to minimize duplication within EPA of needed administrative capabilities that were already possessed by ICC.

The involvement of two separate entities in servicing a single business line resulted in management overlap and other inefficiencies that, in addition to increasing costs, complicated compliance with internal oversight and regulatory filing requirements. Further, these arrangements hindered the full implementation of ICC’s emerging state-of-the-art trading and asset management technology platform to provide superior asset management services to representatives and their customers, such as portfolio performance reporting and account rebalancing.

To address these structural problems, management determined to transition the bulk of EPA’s advisory services to ICC, which commenced operations as a registered investment adviser in November 2003 doing business as Investment Capital Advisory Services (“ICA”). The transfer of EPA-managed assets to ICA management was commenced in fiscal year ended 2004 and completed in fiscal year ended 2006.

Additionally, ICA has been encouraging movement away from centralized delivery of advisory services to a more personalized delivery system that emphasizes close, technology-enabled interaction between independent representative and customer that can lead to more agile decision making and enhanced customer satisfaction and program participation. In support of this new business model, ICA has focused on recruiting additional registered investment adviser representatives and increasing the qualifications, technical competence and motivation of existing representatives. As of March 31, 2007, ICA had 365 registered investment advisors, for a 4.58% increase over the year earlier complement.

The success of these initiatives is reflected in the fact that the market value of assets under management by the Company as of March 31, 2007 rose to $515 million, representing a 627.9% increase over the market value three years earlier. The maximum annual fee charged for by ICA for these services is 2.9% of market value, which is paid by the customer in quarterly installments. Revenue from ICA and EPA asset management services totaled $6.77 million for the fiscal year ended March 31, 2007, or approximately 8.45% of total Company revenues for that period.

Currently, EPA’s business operations are limited to third party service agreements assisting in the conversion of investor representatives to the current ICA business model. EPA no longer has any licensed representatives other than its principals.

The Company ceased its mutual fund management services, which had been provided by EPA, during the third quarter of our fiscal year ended March 31, 2006. Management believed the risk/reward equation was beginning to shift away from the reward side as a result of increased costs to maintain our two funds, the Eastern Point Advisors Capital Appreciation Fund (previously named the Twenty Fund) and the Eastern Point Advisors Rising Dividend Growth Fund. Primarily, these increased costs were related to legal costs to meet new reporting and compliance requirements. In addition, management believed that providing mutual fund management services was straying from our core business of recruiting and providing quality customer service and technology to our independent financial representatives.

On October 24, 2005 Eastern Point Advisors, Inc. ("EPA"), a wholly-owned subsidiary of ICH, entered into a definitive agreement with Dividend Growth Advisors, LLC ("DGA") pursuant to which EPA

Page 7

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

agreed to terminate its Investment Advisory Agreement with Eastern Point Advisors Funds Trust (the "Trust") effective October 18, 2005 to permit the appointment by the Trust of DGA to supersede EPA as the Trust's investment adviser. EPA had served since 1999 as investment adviser for the Funds, which are sponsored by the Trust, and DGA had provided investment advisory services to the Trust since 2004 pursuant to a subcontract with EPA. DGA entered into a new advisory agreement directly with the Trust.

| | Investment Advisor Representatives |

Each of our investment adviser representatives must satisfy the state licensing requirements in the states in which they operate prior to their clients utilizing our investment advisory services. As of March 31, 2007 approximately 365 independent investment adviser representatives registered with the various state securities departments were affiliated with ICA.

| | Asset Allocation Strategy |

Registered investment advisers (“RIAs”) often provide advisory services through our representative-directed program where the asset allocation is performed directly by the independent representative. 2,958 investors participated in this program as of March 31, 2007, while 1,028 investors participated in our other advisory services programs where asset allocation is performed by ICA as the adviser.

Our asset allocation strategy is based on the principle that, by investing in a combination of asset classes, risk may be reduced while seeking enhanced returns. Combining asset classes that typically do not fluctuate in tandem may lower the volatility of the customer's investment portfolio while providing the potential for increased long-term returns. The Company utilizes the following steps in implementing our asset allocation strategy for each individual customer:

- We determine the customer's risk tolerance, investment goals, age, time horizon, investmentexperience and financial and personal circumstances using detailed questionnaires that arecompleted during personal interviews. Based upon these data, we recommend an overallinvestment allocation consisting of a suggested percentage of stocks, bonds, cash and/or otherinvestment products.

- Should the customer agree with the recommended overall investment allocation, we then selectwhat we believe to be appropriate investment vehicles for the particular customer from auniverse of mutual funds, variable annuities and individual securities and other investmentproducts.

- Following implementation of the recommended portfolio, we monitor portfolio performance,communicate the model's performance to the client quarterly, and make portfolio changes basedupon performance, the customer's financial situation, goals and risk tolerance and other relevantfactors.

| | Fee-Based Compensation Structure |

In conformity with the requirements of the Investment Advisers Act of 1940, compensation for our investment advisory services consists of an annual fee calculated as a percentage of total assets under management rather than a transaction-based commission or performance fee.

The Company operates retail investment centers in Topsfield and Braintree, Massachusetts; Bedford, New Hampshire; Manhattan, New York and Miami, Florida. Unlike the arrangement the Company has with its typical independent contractor representative, the Company funds the overhead operational cost of the investment centers and staffs the locations with registered representatives. The investment center representatives are typically on a lower payout schedule intended to offset the overhead costs incurred by

Page 8

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

the Company. The Company’s continued investment in this business model is contingent on achieving sustained growth and acceptable profit margins.

In certain states a licensed insurance entity is required in order for ICC representatives to sell life insurance and annuity products to their clients. Accordingly, the Company operates ICC Insurance Agency, Inc., a wholly-owned subsidiary of ICH that is duly licensed for such purposes in all states in which such licensing is required. All revenue realized by this entity flows through as revenue to the ICC segment.

In March 2005 Investors Capital Holdings Securities, Inc., ("ICH Securities") was formed as a wholly-owned subsidiary of ICH to hold cash for tax benefit purposes at the state level.

Key elements to achieve our corporate objectives include:

- Increase brand awareness; expand business presence.We plan to increase our brandrecognition to attract new clients and representatives. We are executing a comprehensivemarketing plan to attract more clients and experienced representatives, build market awareness,educate the investing public and maintain customer loyalty through direct marketing, advertisingthrough our marketing department, use of our web site, various public relations programs, weband live seminars, print advertising, radio, and television.

- Provide value-added services to our clients.We provide our clients with access to a pool of well-trained representatives, access to up-to-date market and other financial information, and directaccess to our trade desk that is online with various stock exchanges and institutional buyers andsellers. We will also continue to provide trading before and after traditional market hours to ourclients.

- Create technologically innovative solutions to satisfy client needs.We continue to pursueadditional technologies to service the rapidly evolving financial services industry. We areenhancing our web site to augment our clients’ ability to trade equity securities efficiently via theInternet, to monitor on-line the history and current status of their accounts at any time, and toaccess financial and other pertinent information. Also, we have developed personalized Internetweb sites for our representatives to provide their clients, through the use of passwords andfirewalls, a secure and private interface directly to our proprietary web site. This allows theseclients to perform market research, buy and sell securities on-line, monitor their accounts andutilize financial calculators.

- Provide technological solutions to our representatives. We believe that it is imperative that wecontinue to possess state-of-the-art technology so that our employees and independent registeredrepresentatives can effectively facilitate, measure and record business activity in a timely,accurate and efficient manner. By continuing our commitment to provide a highly capabletechnology platform to process business, we believe that the Company can achieve economies ofscale and potentially reduce the need to hire additional personnel.

- Expand our product and service offering through strategic relationships.We continue to pursuebusiness alliances to increase trading volume, capitalize on cross-selling opportunities, createadditional markets for our asset management programs and mutual fund sales, take advantage ofemerging market trends, create operational efficiencies and further enhance our name recognition.

Page 9

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

However, we have no present agreements, plans, arrangements or understandings regarding any acquisitions and have not identified any specific criteria that such acquisitions must meet.

Our competitors vary in size, scope and breadth of services offered. We encounter direct competition from numerous established full-commission and discount brokerage firms that have electronic brokerage services and full research capabilities. We also encounter competition from insurance companies with securities brokerage subsidiaries, financial institutions, mutual fund sponsors and others, including in particular those who utilize financial planning representatives who bear their own office expenses.

Many competitors have greater financial, technical, marketing and other resources, offer a wider range of services and financial products, and have greater name recognition and more extensive client bases.

We believe that our ability to compete in the broker-dealer and investment advisory segments of our business depends upon many factors both within and outside our control, including:

- Our ability to attract and retain a network of experienced investment professionals

- The effectiveness, ease of use, performance and features of our technology and services andoverall client satisfaction

- The price and quality of our services

- The volatility and performance of financial markets and the world economy

- Our ability to service our clients effectively and efficiently

- Our reputation in the financial services industry

- Our ability to foster compliance with applicable laws and regulations by employees andindependent representatives

OUR PROCESS

Check and Application |

The majority of transactions are conducted through a check and application process where a client check and an investment company’s product application is delivered to us for processing. Our review includes principal review and submission to the investment company or clearing firm.

Through the use of our remote electronic-entry trading platform, registered representatives can efficiently submit a wide range of equity trades online. The trades are reviewed by our principal and our clearing firm before processing.

The Company’s fixed-income trading desk uses a network of regional and primary dealers to execute trades across a broad array of fixed-income asset classes. The desk also utilizes several dealer-only electronic services that allow the desk to offer inventory and to efficiently execute trades.

Asset Allocation services are available through ICA, the Company’s federally-registered investment adviser subsidiary. The allocation services, for the most part, are executed through our online trading platform. Other allocation services are performed with the fund company directly.

Page 10

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

The securities industry is subject to extensive regulation under both federal and state law. The SEC is the federal agency responsible for administering the federal securities laws that apply to broker-dealers. ICC is a broker-dealer registered with the SEC. In addition to complying with the voluminous and complex rules set out in the Securities Exchange Act of 1934 and the rules promulgated thereunder, every registered broker-dealer that conducts business with the public is required to be a member of and subject to the rules of NASD or NYSE.

NASD has established conduct rules for securities transactions among broker-dealers and private investors, trading rules for the over-the-counter markets and operational rules for its member firms. NASD conducts examinations of member firms, investigates possible violations of the federal securities laws and its own rules and conducts disciplinary proceedings involving member firms and associated individuals. NASD administers qualification testing for all securities principals and registered representatives for its own account and on behalf of the state securities authorities. We are also subject to regulation under state law. We are currently registered as a broker-dealer in all 50 states, Puerto Rico and the District of Columbia.

The SEC and other regulatory bodies in the United States have rules with respect to net capital requirements that affect our broker-dealer subsidiary. These rules are designed to ensure that broker-dealers maintain adequate capital in relation to their liabilities, types of securities business conducted and the size of their customer business. These rules have the effect of requiring that a substantial portion of a broker-dealer's assets be kept in cash or highly liquid investments. Failure to maintain the required net capital may subject a firm to suspension or revocation of its registration with the SEC and suspension and expulsion by the NASD and other regulatory bodies, and ultimately may require its liquidation. The rules could restrict underwriting, trading activities, our ability to withdraw capital, pay dividends, pay interest on and repay the principal of any debt, among other matters.

| | Registered Investment Adviser Regulation |

The Investment Advisers Act of 1940 (the "Advisers Act"), and the rules promulgated thereunder, regulate the registration and compensation of investment advisers. Investment advisers are deemed to be fiduciaries for their clients and, as such, are held to a high standard of conduct. Investment advisers are subject to a similar level of oversight by the SEC and the various states as are broker-dealers. Investment advisers are required to register with the SEC and/or appropriate state regulatory agencies, are required to periodically file reports, and are subject to periodic or special examinations. Rules promulgated under the Advisers Act govern many aspects of the investment advisory business, such as advertisements by investment advisers and the custody or possession of funds or securities of a client. Most states require registration by investment advisers unless an exemption is available and impose annual registration fees. Some states also impose minimum capital requirements. There can be no assurance that compliance with existing and future requirements and legislation will not be costly and time consuming or otherwise adversely impact our business in this area.

| | Regulations Applicable to the Use of the Internet |

Due to the established popularity and use of the Internet and other online services, various regulatory authorities are considering laws and/or regulations with respect to the internet or other online services covering issues such as user privacy, pricing, content copyrights and quality of services. In addition, the growth and development of the market for online commerce may prompt more stringent consumer protection laws that may impose additional burdens on those companies conducting business online.

The recent increase in the number of complaints by online traders could lead to more stringent regulations of online trading firms and their practices by the SEC, NASD and other regulatory agencies. The applicability to the Internet and other online services of existing laws in various jurisdictions governing issues such as property ownership, sales and other taxes and personal privacy is also uncertain

Page 11

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

and may take years to resolve. Finally, as our services are available over the Internet in multiple states, and as we have numerous clients residing in these states, these jurisdictions may claim that we are required to qualify to conduct business as a foreign corporation in each such state. While ICC currently is registered as a broker-dealer in all 50 states, Puerto Rico and the District of Columbia, we are qualified to conduct business as a foreign corporation in only a few states. Failure by our company to qualify as a broker-dealer in other jurisdictions or as an out-of-state or "foreign" corporation in a jurisdiction where it is required to do so could subject us to taxes and penalties for the failure to qualify. Our business could be harmed by any new legislation or regulation, the application of laws and regulations from jurisdictions whose laws do not currently apply to our business or the applications of existing laws and regulations to the Internet and other online services.

As of March 31, 2007, we had 113 full-time employees, the majority of whom are located at our principal office in Lynnfield, Massachusetts. No employee is covered by a collective bargaining agreement or is represented by a labor union. We consider our employee relations to be excellent. We also enter into independent contractor arrangements on an as-needed basis to assist with various aspects of our business including programming and developing proprietary technologies.

The Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and in accordance therewith files reports, proxy statements and other information with the Securities and Exchange Commission (the “Commission”). Such reports, proxy statements and other information filed with the Commission by the Company can be inspected and copied at the public reference facilities maintained by the Commission at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission located athttp://www.sec.gov.

Our website address is http://www.investorscapital.com. We make available free of charge on or through our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information found on our website is not part of this or any other report we file with or furnish to the SEC. All such documents are also available in print at no charge to any shareholder who requests them in writing to Robert Foney, Manager Corporate Communications, 230 Broadway East, Lynnfield, MA 01940.

An investment in ICH common stock involves risk. Current and prospective investors should consider carefully the following risk factors, in addition to the other information contained in this and other reports and documents filed by us with the SEC, including documents incorporated herein by reference, before making investment decisions concerning ICH common stock. There may be additional risks of which we are currently unaware, or which we currently consider immaterial. Any of these risks could have a material adverse effect on our financial condition, our results of operations and the value of our common stock.

The price of our common stock may continue to be volatile.Our common stock historically has been thinly traded due, in part, to the fact that only about 1.8 million shares are held by non-affiliates of the Company. The market price of our common stock has fluctuated substantially in the past including during

Page 12

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

the last twelve months. The price of our common stock may be subject to fluctuations in the future in response to operating results, regulatory and other legal proceedings, general market movements and other factors. In addition, the stock market in recent years has experienced price and volume fluctuations that often have been unrelated or disproportionate to the operating performance of companies. These fluctuations, as well as other factors including general economic and market conditions, may adversely affect the market price of our common stock.

Aspects of our business are volatile and affected by factors beyond our control.Our business depends heavily on the conditions of the financial and securities markets, which in turn are affected by domestic and foreign economic conditions generally. These conditions, which can be impacted by a variety of factors such as business trends, actual and proposed legislation, political considerations, inflation, interest rates, and the popular perceptions of the health of the economy, are outside of our control, and therefore inject significant amounts of uncertainty and volatility into our business and financial results.

Any market decline could adversely affect our revenues and earnings. Because our revenues and earnings are derived from investments made by consumers, a substantial market decline or other event, such as the September 11, 2001 attacks, that negatively impacts the investment decisions made by consumers can have a substantial adverse effect on our operations, business results and stock price.

Assets under management, which impact revenue, may be subject to significant fluctuations.Our investment advisory fees are calculated as percentages of assets under management. A decline in securities prices or in the sale of investment products, whether due to recession or other damaging economic or political event, would likely reduce asset management fee income. Financial market declines or adverse changes in interest rates would generally negatively impact the level of assets under management by the Company and, consequently, our revenue and net income.

| Performance & Competition |

We face vigorous competition.The financial industry segments in which the Company and its subsidiaries operate are highly competitive, and many of our current and potential competitors have considerably greater financial, technical, marketing and other resources than are available to us and may offer a broader range of products or operate in more markets. Some operate in a different regulatory environment which may give them certain competitive advantages in the investment products and portfolio structures that they offer. If we are required to lower our fees in order to remain competitive, our net income could be significantly reduced because some of our expenses are fixed, especially over shorter periods of time, and others would not decrease as much as the resulting decrease in revenues.

We compete in our investment advisory operations based upon investment performance.The Company competes with other providers of investment advisor services primarily based on our investment performance. If we fail to deliver excellent performance for our clients, both in the short and long term, we will likely experience diminished investor interest and a diminished level of assets under management. Further, some institutions have proprietary products and distribution channels that make it more difficult for us to compete with them. If current or potential customers decide to use one or more of our competitors, we could face a significant decline in market share, assets under management, revenues and net income.

As a public company, we are subject to complex legal and accounting requirements that require us to incur substantial expense and expose us to risk of non-compliance. As a public company, we are subject to numerous legal and accounting requirements imposed by federal law, such as the Securities Exchange Act of 1934 and the Sarbanes-Oxley Act of 2002, as well as oversight by such entities as the SEC, the American Stock Exchange and the Public Company Accounting Oversight Board. The cost of

Page 13

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

compliance with many of these requirements is substantial, not only in absolute terms, but in relation to the overall scope of the operations of our business. Failure to comply with these requirements can have numerous adverse consequences including, such as our inability to file required reports on a timely basis, loss of market confidence, delisting of our securities and/or governmental or private actions against us. We cannot assure you that we will be able to comply with all of these requirements in the future or that the cost of such compliance will not prove to be a substantial competitive disadvantage vis-avis our competitors.

As a provider of financial services, we are subject to substantial governmental regulation. As a broker-dealer and investment adviser, our business is subject to a variety of federal securities laws, and rules and regulations promulgated thereunder, including the Securities Act of 1933, the Securities Exchange Act of 1934, the Investment Advisers Act of 1940 and the U.S. Patriot Act of 2001. In addition, we are subject to significant regulation and oversight by, among others, the SEC, NASD and state broker-dealer, investor advisory and insurance regulators. The principal purpose of such regulation typically is protection of the public, rather than protection of creditors and stockholders of financial services companies, and efforts taken to comply with such regulation is a costly but necessary burden on companies engaged in the financial services industry. Changes in these legal, regulatory, accounting, tax and compliance requirements could have a significant effect on our operations and results, including, but not limited to, increased expenses and reduced investor interest in investment products and services offered by us.

Any failure to maintain adequate internal controls could result in regulatory sanctions that could result in substantial fines and restrictions on our ability to make money.In the past our subsidiary broker-dealer, due to an accounting error, found itself inadvertently out compliance with its required net capital reserve, requiring an unanticipated capital infusion from ICH. While no regulatory action was taken against us in this instance, any failure to maintain adequate accounting procedures and internal controls could result in regulatory sanctions being applied against us that could require us to pay substantial fines and severely restrict or even terminate our ability to make money.

Any failure by our independent investment professionals to comply with regulatory requirements may cause us to incur losses or suffer substantial harm to our business and operations.Our investment professionals are required by law to be licensed with our subsidiaries as registered broker-dealer representatives and/or investment adviser representatives. Pursuant to these requirements, these investment professionals are subject to our supervision in the area of compliance with applicable federal and state securities laws, rules and regulations, as well as the rules and regulations of self-regulatory organizations such as the NASD. The violation of any regulatory requirements by us or our investment professionals could jeopardize our broker-dealer or investment adviser license and could subject us to fines, liability to customers, censure or even loss of license. As an example, an administrative complaint brought by the Massachusetts Securities Division, that alleged failure by ICC to adequately supervise sales of equity-indexed annuities by certain of its independent representatives, recently resulted in a settlement that included an obligation to pay at least $1 million in fines and customer restitutions, censure and a comprehensive review of our compliance and corporate governance systems and processes. Although we constantly strive to strengthen our already robust compliance procedures, there can be no assurance that there will not be further such administrative proceedings with equal or greater material adverse effect on our financial position and results of operations.

The financial services industry is subject to an increasing risk of legal proceedings.Many aspects of our business subject us to substantial risks of potential liability to customers and enforcement proceedings by state and federal regulators. Participants in the securities industry face an increasing amount of litigation and arbitration proceedings. Dissatisfied clients regularly make claims against securities firms for negligence, fraud, unauthorized trading and suitability, among other claims. Acts of fraud by independent representatives and others are often difficult to detect and deter, and we cannot assure investors that our risk management procedures and controls will prevent losses from fraudulent activity.

Page 14

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

There can be no assurance that the defense and resolution of such claims will not have a material adverse impact on our financial condition and results of operations.

Actual or alleged fraud and misconduct by investment professionals and employees has resulted in, and exposes us to an ongoing potential for, litigation and regulatory sanctions that could substantially harm our business and results of operations.Employees and investment professionals constantly expose us to the risk of significant losses as a result of employee errors, professional misconduct and fraud. Such misconduct could include binding us to transactions that exceed authorized limits or present unacceptable risks, or hiding from us unauthorized, unsuccessful or improper activities. It is not always possible to deter employee or independent contractor misconduct, and the precautions we take to prevent and detect this activity may not be effective in all cases.

We are routinely involved in legal proceedings that can burden our resources and pose an ongoing risk of adverse dispositions that could negatively impact our earnings and profits.By the nature of our business, we are continually involved with various judicial, regulatory and arbitration proceedings concerning matters arising in connection with the conduct of our business. At March 31, 2007, the Company was co-defendant with independent representatives in several arbitration and/or other legal proceedings with claims totaling approximately $3.2 million. Although we currently have insurance that may limit our exposure in these cases, if we are found liable in material amounts in these or other legal proceedings, such eventuality may result in restricting the availability and/or increasing the cost of insurance against such risks and may have a significant adverse effect on our earnings and profits.

Consumer fraud could harm our earnings and profits by requiring us to expend time and money and exposing us to financial loss and the potential for arbitration or other legal proceedings.We are constantly exposed to the risk of significant losses as a result of customer fraud. Activities such as authorizing trades and not accepting those trades if anticipated stock movement is not achieved, paying for transactions with bad funds, or improperly stating investment experience, net worth and income amount and tolerance for risk, could result in the expenditure of Company resources as well as exposure to potential losses through arbitration or other legal proceedings.

| Operations & Infrastructure |

Our operations and infrastructure, and those of service providers upon which we rely, may malfunction or fail.Our business is highly dependent on our ability to process, on a daily basis, a large number of transactions, using both in-house and out-sourced systems such as those maintained by our third-party clearing firm. The inability of these systems to accommodate ever increasing volumes of transactions could constrain our ability to expand our business. If any of these systems do not operate properly or are disabled, or if there are other shortcomings or failures in our internal processes, people or systems, we could suffer impairments, financial loss, a disruption of our business, liability to clients, regulatory intervention or reputational damage. We also face the risk of disruption in the infrastructure that supports our business, such as power grids and communications networks.

Any change in our clearing firm could result in our inability to process transactions in a timely manner which could adversely affect our business operations and profits.Our current clearing agreement is with Pershing LLC, an affiliate of The Bank of New York Company, Inc., which processes most non-check and application securities transactions for our account and the accounts of our customers. We also rely on our clearing firm for our Internet equity securities trading activities, which is a growing portion of our business. Our agreement with Pershing may be terminated by either party on ninety days written notice. A change in our clearing firm could result in the inability of our customers to transact business in a timely manner due to delays and errors in the transfer of their accounts, which, on a temporary basis, could affect our earnings and profits.

Page 15

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

Management’s ownership of our common stock assures their control of corporation actions requiring a shareholder vote.Chairman Ted Charles, individually, and the Company's executive officers as a whole, beneficially own in the aggregate a majority of the Company's common stock. Accordingly, they are able to determine the outcome of virtually all corporate actions requiring approval by the stockholders of the Company, including, without limitation, the election of directors and the approval of the sale of the Company or its assets.

Any loss of our senior management could adversely affect our business and financial condition through the loss of significant business relationships that may not be easily recreated.Our success is largely dependent on the skills, experience and performance of Theodore E. Charles, our chairman, chief executive officer and president whose long-term relationships with our investment professionals and product sponsors has been and continues to be a driving force behind our success, and Timothy B. Murphy, our executive vice president, treasurer and chief financial officer as well as the president of our broker-dealer subsidiary. The loss of Messrs. Charles and/or Murphy or other senior management could have an adverse effect on our business, financial condition and results of operations.

Any loss of key personnel could adversely affect our business.Except for our CEO and CFO, our key employees do not have employment contracts, and generally can terminate their employment at any time. Similarly, our independent representatives are not contractually prevented from terminating their affiliation with us at will. There can be no assurance that we will be able to retain or replace key in-house personnel or independent investment professionals. The loss of key personnel or independent representatives could damage our reputation and make it more difficult to retain and attract new employees, representatives or clients. A net loss of high-producing independent representatives could result in decreases in transactional fees as well as fees based on assets under management. On the other hand, replacement of any of key human resources may entail an increase in compensation costs that would decrease our net income.

We will continue to endeavor to understand, evaluate and, when possible, manage and control these and other business risks.

ITEM 1B. UNRESOLVED STAFF COMMENTS

EXECUTIVE OFFICERS OF THE REGISTRANT

The following sets forth, as of June 29, 2007, certain information with respect to each of the executive officers of ICH:

Theodore E. Charles, age 64, principal executive officer. A founder of Investors Capital Holdings, Mr. Charles has served as the Company’s chairman of the board, chief executive officer and president since its inception in 1995. Mr. Charles also has served as the chief executive officer of our subsidiaries, Investors Capital Corporation (“ICC”) and Eastern Point Advisors, Inc (“EPA”) since their founding in 1994 and 1995, respectively. Mr. Charles served on the Board of Directors of Revere Savings Bank of Massachusetts from 1997 to 2001 and served on the Advisory Board of Danvers Savings Bank from 2001 to 2003. Mr. Charles currently holds various securities licenses, including series 6, 63, 7 and 24, has been a member of the Financial Planning Association since 1985 and formerly served as Chairman of the Shareholder Advisory Board of Life USA Insurance Company. Mr. Charles is currently on the Board of Easter Seals of Massachusetts.

Timothy B. Murphy, age 42, principal financial officer and principal accounting officer. A founder of the Company, Mr. Murphy has served as executive vice president, treasurer and chief financial officer of the Company since its inception, and as president of its subsidiaries, ICC and EPA, since their respective inceptions. He entered the securities industry in 1991 as an operations manager in the Boston regional office of Clayton Securities. By 1994, he was serving as compliance officer of Baybanks Brokerage and

Page 16

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

a vice president of G.R. Stuart & Company, another brokerage firm. Mr. Murphy holds various securities licenses including series 4, 7, 24, 27, 53, 63 and 65.

Steven C. Preskenis, age 37. Mr. Preskenis has served as Chief Operating Officer of ICC, and has performed similar policy-making functions for ICH, since February 2006. Mr. Preskenis, who joined the Company in August 2000 as a compliance attorney, also has served as General Counsel of ICC, and has performed similar functions for ICH, since March 2003, and has served as Secretary of ICH since September 2005. Prior to joining ICC in August 2000, Mr. Preskenis served as an Alternative Dispute Resolution attorney with John Hancock Life Insurance Company commencing in 1998. Mr. Preskenis is a member of the Massachusetts Bar and a graduate of Suffolk University Law School. Mr. Preskenis currently holds securities licenses, including series 7 and 24.

Our principal executive offices, comprised of several office condominiums, are located in a 9,068 square foot facility at 230 Broadway, Lynnfield, MA. The Company also maintains an investment center in a 2,132 square foot facility at 218 Boston Street, Topsfield, MA. Both of these properties are leased from entities owned and controlled by the CEO and principal stockholder of ICH for a combined annual rent of $271,271. The Company believes the annual rent amounts are consistent with current market rates for comparable space in the same geographic areas. These leases were renewed and modified on April 1, 2007 and will expire on March 31, 2012.

The Company leases additional executive offices in a 3,346 square foot facility at Six Kimball Lane, Lynnfield, MA for $70,266 per year, and 7 other offices totaling approximately 9,300 square feet from unrelated parties for annual rents totaling $258,536. These leases expire from 2007 to 2011.

These properties, which are essentially fully used (other than the Miami office) by both the ICC and ICA segments of our business, are deemed by management to be adequate for current business purposes.

ITEM 3. LEGAL PROCEEDINGS.

MASSACHUSETTS PROCEEDINGS |

By administrative complaint dated November 16, 2005, the Securities Division (the "Division") of the Secretary of the Commonwealth of Massachusetts (the "State") brought an adjudicatory proceeding (the “Massachusetts Proceedings”) against ICC alleging violation of ICC’s supervisory obligations under State securities laws in connection with certain past sales of equity-indexed annuities. The complaint alleges, among other things, that ICC failed to properly supervise associated persons, thereby allowing allegedly unsuitable sales of these insurance products. The complaint, which seeks an order instructing ICC to cease such violations and to pay an unspecified administrative fine, also requests that ICC's registration as a securities broker-dealer in Massachusetts be suspended or revoked, that the firm be censured, and that it be ordered to fairly compensate purchasers of the insurance products for any losses attributable to wrongdoing by ICC.

On December 19, 2006 ICH and ICC entered into an agreement with the Division settling the Massachusetts Proceedings and a concurrent investigation into relationships between ICH and its subsidiaries, on the one hand, and Investors Marketing Services, Inc. (“IMS”) and IMS Insurance Agency, Inc. (“IMS Insurance”) on the other. IMS is owned by Ted Charles, ICH’s Chairman and CEO, and his spouse. IMS is a wholesaler of fixed insurance products, and a provider of fulfillment services, including graphic design work for ICC’s marketing brochures and ICH annual reports. IMS Insurance is an insurance agency owned by Mr. Charles’ spouse.

IMS participates without charge in ICC-hosted conferences where opportunities exist to provide insurance-related training and education to ICC representatives as well as to market and promote fixed insurance products and services. ICC also encourages its representatives to place fixed insurance

Page 17

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

business with IMS Insurance. Management believes that, in many instances, IMS Insurance offers superior services and commission arrangements to ICC and its insurance producers. When insurance is placed by ICC representatives through ICH’s subsidiary, ICC Insurance Agency, Inc. (“ICC Insurance”), IMS typically is utilized by ICC Insurance to provide administrative and other transaction-related services in return for an override.

| | In settling these proceedings, ICC agreed: |

- to cease and desist from violations of State securities laws,

- to pay a $500,000 administrative fine,

- to offer to reimburse losses and costs incurred by Massachusetts persons aged 75 or older (the“eligible purchasers”) in connection with the surrender, no later than December 31, 2007, of anyequity-indexed annuities purchased through ICC or its representatives during 2004 or 2005, andto offer an additional payment to ensure that no amount invested in a surrendered EIA yieldedless than 3%;

- to pay an additional administrative fine equal to the extent, if any, that ICC’s surrender-relatedpayments total less than $500,000, and

- to be censured by the Division.

In addition, ICC and ICH agreed to retain and act upon the advice of an independent consultant who would review and make recommendations with respect to ICC and ICH policies and procedures that are related to the various violations and failures alleged by the Division in these matters. The consultant’s initial recommendations have been received and are being reviewed by the Company. These recommendations include, among other things, improvements in:

- the supervisory regime for independent representatives, particularly relating to our Offices ofSupervisory Jurisdiction (“OSJs”)

- systems and procedures regarding the use, screening and archiving of emails

- recordkeeping

- risk management procedures

- the makeup, purview, operations and evaluation of the Board of Directors and its committees

- corporate governance guidelines and procedures

The cost of implementing the consultant’s recommendations, as and when finally agreed upon by the parties to the settlement, is not determinable to this time, but is not expected to be material to the financial condition or results of operations of the Company.

ICC and ICH will not be permitted to utilize proceeds from insurance policies to cover payments that will be made pursuant to the settlement.

Of the 63 eligible purchasers, four accepted our reimbursement offers and were paid a total of $24,824 through March 31, 2007, and three additional eligible purchasers accepted offers and were paid a total of $14,896 thereafter up to the filing of this Form 10-K. As of the filing of this Form 10-K, six further eligible purchasers have verbally indicated that they will be accepting offers totaling approximately $302,000 (of which approximately $140,000 is expected to be paid out in July 2007), although written confirmation of same has yet to be received by the Company.

No response has been received from the remaining eligible purchasers other than by a relative of a decedent. Management has determined that the likelihood of any further offers being accepted by eligible purchasers by the December 31, 2007 cutoff date and, if so, the total cost thereof, is too remote and/or indeterminate at this time to justify accruals for such costs additional to the portion of $500,000 that has not yet been paid out. Accordingly, $0.48 million was accrued for such purposes as of March 31, 2007. We will continue to assess our legal accrual resulting from the Massachusetts Settlement, and we will record additional accruals as needed in the future if and to the extent, if the likelihood of such costs, will exceed $500,000.

Page 18

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

Legal fees paid to defend these matters have reduced ICH earnings by an average of more than $120,000 per month from November 2005, when the administrative proceeding were instituted, and March 31, 2007. No significant further legal fees are expected to be incurred with respect to the proceedings or their settlement.

Although the censure of ICC by the Division cannot be taken as a positive event, the Company at this time is not able to predict the practical consequences thereof.

The Company operates in a highly litigious and regulated business and, as such, is a defendant or codefendant in various lawsuits and arbitrations additional to the Massachusetts Proceedings that are incidental to our securities business. The Company is vigorously contesting the allegations of the complaints in these cases and believes that there are meritorious defenses in each. Counsel is unable to respond concerning the likelihood of an outcome, whether favorable or unfavorable, because of inherent uncertainty routine in these matters. For the majority of pending claims, the Company's errors and omissions (E&O) policy limits the maximum exposure in any one case to between $75,000 and $100,000 and, in certain of these cases, the Company has the contractual right to seek indemnity from related parties. Management, in consultation with counsel, believes that resolution of pending litigation will not have a material adverse effect on the consolidated financial results of the Company.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

No matter was submitted to a vote of security holders of ICH during the fourth quarter of the fiscal year covered by this report.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

ICH's common stock has been trading on The American Stock Exchange (AMEX) under the symbol "ICH" since February 8, 2001. Prior to such date, there was no established public trading market for the common stock. As of June 22, 2007, there were 6,220,967 shares outstanding and 176 registered holders thereof.

The following table presents the high and low closing prices for the common stock of ICH on the AMEX for the periods indicated.

| | | High | | Low |

| Fiscal 2007 | | | | |

| January 1, 2007 through March 31, 2007 | | $6.45 | | $5.08 |

| October 1, 2006 through December 31, 2006 | | $6.05 | | $4.55 |

| July 1, 2006 through September 30, 2006 | | $6.45 | | $3.51 |

| April 1, 2006 through June 30, 2006 | | $4.17 | | $3.13 |

| |

| Fiscal 2006 | | | | |

| January 1, 2006 through March 31, 2006 | | $3.24 | | $2.20 |

| October 1, 2005 through December 31, 2005 | | $4.01 | | $3.00 |

| July 1, 2005 through September 30, 2005 | | $4.53 | | $3.71 |

| April 1, 2005 through June 30, 2005 | | $4.99 | | $4.03 |

Page 19

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

Investors Capital Holdings, Ltd. paid dividends on its common stock of $.02 and $0.04/share on May 16, 2005 and June 15, 2006, respectively, to shareholders of record on May 2, 2005 and May 12, 2006, respectively.

Future dividend decisions will be based on, and affected by, a number of factors, including the operating results and financial requirements of the Company and the impact of regulatory restrictions. For further information regarding restrictions on our ability to transfer funds to our shareholders, see Part I, Item 1. “Business – How We Are Regulated” and Part II, Item 7. “Management's Discussion and Analysis--Liquidity and Capital Resources” in this Form 10-K.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER COMPENSATION PLANS

| | | | | | | Number of securities |

| | | Number of securities | | | | remaining available for |

| | | to be issued | | Weighted-average | | future issuance under |

| | | upon exercise of | | exercise price of | | equity compensation plans |

| | | outstanding option, | | outstanding options, | | (excluding securities |

| Plan category | | warrants and rights | | warrants and rights | | reflected in column (a)) |

| | | (a) | | (b) | | (c) |

| |

| Equity compensation | | | | | | |

| plans approved by | | | | | | |

| security holders | | 121,989 | | 3.41 | | 596,365 |

| |

| Equity compensation | | | | | | |

| plans not approved | | | | | | |

| by security holders | | 150,000 | | $1.00 | | none |

| |

| Total | | 271,989 | | $2.08 | | 596,365 |

See “Footnote 16 – Benefit Plans” to the Registrant’s Financial Statements, contained in Part II, Item 8 of this Form 10-K, for a description of the material features of each compensation plan under which equity securities of the Registrant are authorized for issuance that was adopted without the approval of security holders.

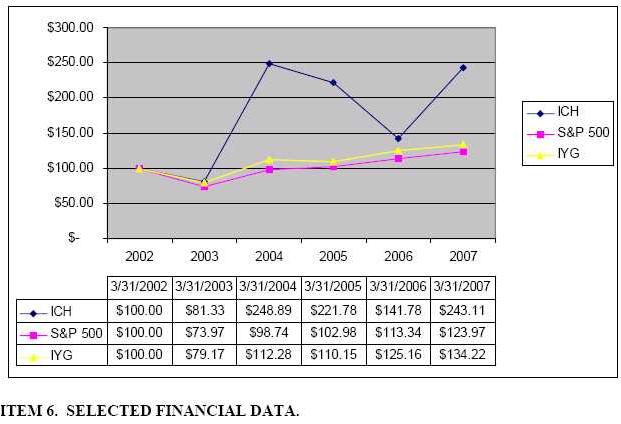

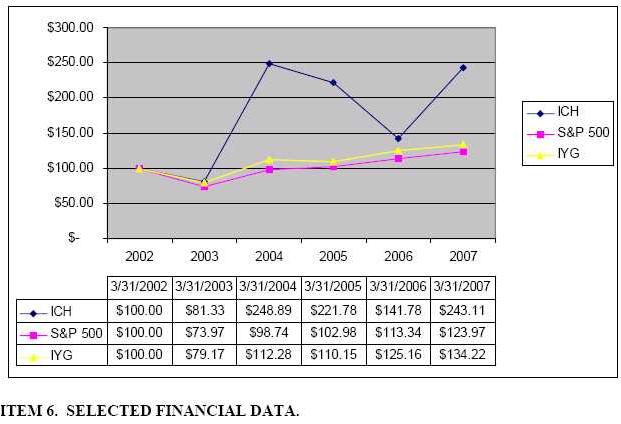

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN

AMONG INVESTORS CAPITAL HOLDINGS, LTD., STANDARD & POORS 500 INDEX ANDDOW JONES FINANCIAL SERVICES INDEX

The chart below compares the five-year cumulative total return, assuming the reinvestment of dividends, on Investor Capital Holdings, Ltd. common stock (ICH) with that of the Standard & Poors 500 Index (SP 500) and the Dow Jones Financial Services Index (IYG). This graph assumes $100 was invested on March 31, 2002, in each of Investors Capital Holdings, Ltd. common stock and the indicated indices.

Note: stock price performance shown in the graph below should not be considered indicative of potential future stock price performance.

Page 20

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

The following table sets forth certain selected historical consolidated financial data. The selected income statement data for each of the three years ended March 31, 2007, 2006 and 2005 and balance sheet data as of March 31, 2007 and 2006 have been derived from our audited consolidated financial statements and related notes included elsewhere in this Form 10-K and should be read in conjunction with those financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations, also included elsewhere in this Form 10-K. The following selected income statement data for the years ended March 31, 2004 and 2003 and balance sheet data as of March 31, 2005, 2004 and 2003 are derived from our audited consolidated financial statements not included herein. The following selected consolidated financial data have been prepared in accordance with accounting principals generally accepted in the United States of America.

Page 21

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

| | | | | For the Years Ended March 31, | | | | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| Income Statement Data: | | | | | | | | | | |

| Total revenues | | $80,053,028 | | $68,002,428 | | $55,165,534 | | $48,964,074 | | $34,797,047 |

| Operating (loss) income | | ($1,714,356) | | $870,966 | | $888,142 | | $1,400,331 | | $297,682 |

| Net (loss) income | | ($1,084,066) | | $449,638 | | $619,109 | | $790,413 | | $115,891 |

| Net Income (loss) per share, basic | | -$0.18 | | $0.08 | | $0.11 | | $0.14 | | $0.02 |

| Net income (loss) per share , diluted | | -$0.18 | | $0.08 | | $0.10 | | $0.14 | | $0.02 |

| Weighted average common shares | | | | | | | | | | |

| outstanding, basic | | 5,928,238 | | 5,766,686 | | 5,735,287 | | 5,720,843 | | 5,717,380 |

| Weighted average common shares | | | | | | | | | | |

| outstanding, diluted | | 6,100,855 | | 5,911,029 | | 5,922,204 | | 5,877,075 | | 5,790,060 |

| Cash dividends declared per share | | $0.04 | | $0.02 | | - | | - | | - |

| | | | | | | As of March 31, | | | | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| Balance Sheet Data: | | | | | | | | | | |

| Total assets | | $16,890,200 | | $15,325,827 | | $14,109,638 | | $13,388,879 | | $10,642,940 |

| Long-term obligations | | $2,128,151 | | $723,324 | | $1,150,668 | | $400,160 | | $703,884 |

| Shareholders' equity | | $10,255,538 | | $10,586,083 | | $10,182,783 | | $9,404,939 | | $8,248,640 |

| Shares outstanding | | 6,205,536 | | 5,790,361 | | 5,753,463 | | 5,727,713 | | 5,717,380 |

| Equity per share | | $1.65 | | $1.83 | | $1.77 | | $1.64 | | $1.44 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Management's discussion and analysis reviews our consolidated financial condition as of March 31, 2007 and 2006, the consolidated results of operations for the years ended March 31, 2007, 2006 and 2005 and, where appropriate, factors that may affect future financial performance. The discussion should be read in conjunction with the consolidated financial statements and related notes included elsewhere in this Form 10-K. Unless context requires otherwise, as used in this Management's Discussion and Analysis (i) the "current period" means the fiscal year ended March 31, 2007, (ii) the "prior period" means the fiscal year ended March 31, 2006, (iii) an increase or decrease compares the current period to the prior period, and (iv) all non-comparative amounts refer to the current period.

| FORWARD-LOOKING STATEMENTS |

The reader is urged to read the information contained in the "Forward-Looking Statements" and “Risk Factors” sections at the beginning of this report for a discussion of the use of forward-looking statements in this report as well as risks and uncertainties in attempting to predict our future performance based upon such statements.

We are a financial services holding company that, primarily through our subsidiaries, provides broker-dealer, investment advisory, insurance and related services. We operate in a highly regulated and competitive industry that is influenced by numerous external factors such as economic conditions, marketplace liquidity and volatility, monetary policy, global and national political events, regulatory developments, competition and investor preferences. Our revenues and net earnings may be either enhanced or diminished from period to period by one or more external factors.

Page 22

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

The Company operates primarily through its subsidiary, ICC/ICA, in the broker-dealer and investment advisory services segments of the financial services industry.

The Company provides broker-dealer services in support of trading and investment by its representatives’ customers in corporate equity and debt securities, U.S. Government securities, municipal securities, mutual funds, variable annuities and variable life insurance, including provision of market information, internet trading, portfolio tracking facilities and records management.

| | Investment Advisory Services |

The Company provides investment advisory services, including asset allocation and portfolio rebalancing, for its representative’s customers. In the past, investment advisory services were performed by both ICC and EPA. To avoid the duplication of effort involved in supporting two advisory services entities, the Company has consolidated its investment advisor services in ICC d/b/a ICA.

| | Recruitment and Support of Representatives |

A key component of our business strategy is to recruit more established and productive representatives who generate revenues in higher margin services and products. Additionally, we assist our existing representatives to develop and expand their business by providing to them a variety of support services and a diversified range of investment products for their clients. The Company focuses on providing substantial added value to our representatives that enables them to be more productive, particularly in high margin lines such as advisory services and trading/brokerage.

Support provided to assist representatives in pursuing consistent and profitable sales growth takes many forms, including: hi-tech trading systems, targeted financial assistance and a network of communication links with investment product companies such as regional and national conventions that provide forums for interaction to improve product knowledge, sales and client satisfaction. A newly formed business development unit will focus on providing representatives with programs and tools to grow their businesses both through new client acquisition and the advancement of their existing client relationships. These programs are also designed to enhance our ability to attract and retain new, productive representatives.

OUR PROCESS

Check and Application |

The majority of transactions are conducted through a check and application process whereby a check and an investment company's product application is delivered to us for processing. This includes principal review and submission to the investment company or clearing firm. Investments in technology have allowed the firm to move from a process that was previously paper intensive to a process that is virtually paper free. This has shortened the transaction cycle, reduced errors and created greater efficiencies. The firm continues its investment in technologies that will provide more efficient processes resulting in improved productivity.

Registered representatives can efficiently submit a wide range of security investments online through the use of our remote electronic-entry trading platform.

Page 23

| INVESTORS CAPITAL HOLDINGS LTD - 10-K |

| Fiscal Year Ended March 31, 2007 |

The Company's fixed-income trading desk uses a network of regional and primary dealers to execute trades across a broad array of fixed-income asset classes. The desk also utilizes several dealer-only electronic services that allow the desk to offer inventory and to execute trades. Our fixed income traders work with our representatives to develop portfolios for clients. This area has seen growth as interest rates have risen and more investors have become interested in retirement income.