SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

|

¨ Definitive Additional Materials | | |

|

¨ Soliciting Material Pursuant to §240.14a-11(c) or

§240.14a-12 | | |

Schlotzsky’s Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

SCHLOTZSKY’S, INC.

203 Colorado Street

Austin, Texas 78701

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held June 23, 2003

Dear Shareholder:

You are invited to attend the 2003 Annual Meeting of the Shareholders of Schlotzsky’s, Inc. (the “Company”) to be held at The Four Seasons Hotel, 98 San Jacinto Boulevard, Austin, Texas 78701 on Monday, June 23, 2003, at 10:30 a.m. Central Time. Shareholders will act on the following:

| 1. | | The election of three Class B directors to the Board of Directors to serve until the 2006 Annual Meeting of Shareholders and the election of one Class A director to the Board of Directors to serve until the 2005 Annual Meeting of Shareholders, or until their respective successors have been duly elected or appointed (Item 1 on the proxy card); |

| 2. | | To transact such other business as may properly come before the meeting, including consideration of a shareholder proposal on the sale of the Company, if it is presented at the meeting (Item 2 on the proxy card). |

The Board of Directors recommends that you voteFOR Item 1 on the proxy card.

The Board of Directors recommends that you voteAGAINST Item 2 on the proxy card.

All shareholders of record as of the close of business on May 5, 2003 are entitled to notice of and to vote at the meeting. The holders of at least a majority of the outstanding shares of the Company entitled to vote at the meeting is required to be present at the meeting or represented by proxy to constitute a quorum.

It is important that your shares be represented at the meeting. Please mark, sign and date the enclosed proxy card and return it promptly in the enclosed envelope. You may attend the meeting regardless of whether you have returned a proxy card.

|

By Order of the Board of Directors, |

|

/s/ JOHN C. WOOLEY

|

Chairman of the Board, President and Chief Executive Officer |

May 23, 2003

1

Your Vote Is Important

Please sign and promptly return your proxy in the enclosed envelope.

SCHLOTZSKY’S, INC.

203 Colorado Street

Austin, Texas 78701

512-236-3600

www.schlotzskys.com

Proxy Statement

Introduction

Solicitation of Proxies

The enclosed proxy is solicited by the Board of Directors of Schlotzsky’s, Inc. (the “Company”) to be voted at the Annual Meeting of Shareholders to be held on Monday, June 23, 2003, at 10:30 a.m. Central Time, at The Four Seasons Hotel, 98 San Jacinto Boulevard, Austin, Texas 78701, and any adjournments thereof. This Proxy Statement and the accompanying proxy card are being mailed to the shareholders of the Company on or about May 23, 2003.

Voting by Proxy

All shares represented by proxies will be voted at the meeting in the manner directed thereon or, if no directions are made, the shares represented by such proxies will be voted for the election of the nominees for director and, other than broker nonvotes, against the shareholder proposal as noted on the enclosed proxy. The Board of Directors does not know of any other matters to be acted upon at the meeting. However, if any other matter properly comes before the meeting, the holders of the proxies will vote them in accordance with their best judgment. A shareholder may revoke a proxy at any time before it is voted by voting the shares in person at the Annual Meeting or by giving written notice to Schlotzsky’s, Inc., Attention: Corporate Secretary, 203 Colorado Street, Austin, Texas 78701, stating that the proxy has been revoked.

Cost of Soliciting Proxies

The Company’s directors, officers and employees (without any additional compensation other than out-of-pocket expenses) may solicit proxies in person or by telephone, fax or email. Stockbrokers and other nominees will be requested to forward solicitation material to the beneficial owners of shares to request authority to execute proxies and will be reimbursed for their expenses. The Company will pay the expenses of soliciting proxies. The Company has retained Innisfree M&A Incorporated to aid in the solicitation of proxies, at an estimated cost of $10,000 plus reimbursement for reasonable out-of-pocket expenses.

2

Attendance at Meeting

Only shareholders, their proxy holders and the Company’s invited guests may attend the Annual Meeting. For admission to the meeting, shareholders who own shares of the Company’s common stock, no par value (“Common Stock”) in their own names should stop at the Annual Meeting registration table to have their ownership verified in the Company’s record shareholder list. Those who have beneficial ownership of Common Stock that is held of record by a broker or other nominee (often referred to as holding in “street name”) should also stop at the registration table to show account statements or letters from their brokers or nominees confirming they are beneficial owners of Common Stock as of the record date of the Annual Meeting.

Security Ownership

Shareholders who have registered their ownership of Common Stock with the Company’s transfer agent, Computershare Investor Services LLC, will receive this Proxy Statement and an enclosed proxy card directly from the transfer agent on behalf of the Company. Such record shareholders may vote by proxy or in person at the Annual Meeting as described in this Proxy Statement.

Shareholders who hold Common Stock in “street name” will receive this Proxy Statement and a special voting instruction card from their stockbrokers or other nominees. As beneficial owners of Common Stock, “street name” shareholders have the right to direct their nominees how to vote and they are invited to attend the Annual Meeting. However, because they are not record shareholders, “street name” shareholders cannot vote their shares in person at the meeting.

Quorum and Voting

The close of business on May 5, 2003 is the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. As of such date, there were 7,319,887 shares of Common Stock outstanding and entitled to vote at the meeting.

The presence in person or by proxy of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the meeting will constitute a quorum at the meeting. Each outstanding share of Common Stock is entitled to one vote on each matter properly presented at the meeting. Any abstentions or “broker non-votes” (shares held by a stockbroker or other nominee who does not have express or discretionary authority to vote on a particular matter) will be counted as present at the meeting for the purpose of determining a quorum.

Directors are elected by a plurality of the votes cast in the election; cumulative voting is not permitted. Therefore, at this Annual Meeting the four nominees who receive the most votes cast will be elected as directors. Should a nominee become unavailable to serve, the shares will be voted for a substitute designated by the Board of Directors, or for fewer than four nominees if, in the judgment of the proxy holders, such action is necessary or desirable. Abstentions and broker nonvotes will have the effect of neither a vote for nor a vote against the nominees.

Approval of the shareholder proposal requires the affirmative vote of the holders of a majority of the shares of Common Stock entitled to vote at the meeting and represented in person or by proxy. Abstentions will have the effect of votes against the shareholder proposal. Broker nonvotes will have the effect of neither a vote for nor a vote against the shareholder proposal.

Shares of Common Stock held by the Company or any subsidiary of the Company will not be considered present or entitled to vote.

3

Election of Directors

(ITEM 1 ON PROXY CARD)

The Bylaws of the Company provide that the directors of the Company shall be divided into three classes, with each class to be as nearly equal in number as possible, classified as Class A, Class B, and Class C, the term of office of directors of Class B to expire at this year’s Annual Meeting of shareholders, that of Class C to expire at the 2004 annual meeting of shareholders, and that of Class A to expire at the 2005 annual meeting of shareholders. Jeffrey Wooley and Raymond Rodriguez currently serve as Class A directors, Floor Mouthaan currently serves as a Class B director, and John Wooley and Azie Taylor Morton currently serve as Class C directors.

On May 14, 2003, the Board of Directors increased the number of directors from five to eight in the manner provided in the Bylaws of the Company and pursuant to a resolution adopted by the Board of Directors increasing the number of Class A directors from two to three and the number of Class B directors from one to three. Therefore, there are currently two vacancies in Class B and one vacancy in Class A.

Floor Mouthaan, a current member of the Board of Directors, has been nominated for re-election at the Annual Meeting as a Class B director for a term of office expiring at the 2006 annual meeting of shareholders. Pike Powers and Sarah Weddington have been nominated for election at the Annual Meeting as Class B directors for terms of office to expire at the 2006 annual meeting of shareholders to fill the vacancies occurring in Class B by reason of the increase in the number of Class B directors. John Sharp has been nominated for election at the Annual Meeting as a Class A director for a term of office to expire at the 2005 annual meeting of shareholders to fill the vacancy occurring in Class A by reason of the increase in the number of Class A directors.

If any nominee for a director position becomes unavailable for election, discretionary authority is conferred by the enclosed proxy to the proxies named therein to vote for a substitute. The Board of Directors has no reason to believe that any nominee will be unavailable for election.

4

|

|

| | Pike Powersis 62 years of age and has been a partner in the law firm of Fulbright & Jaworski, L.L.P. since 1978. He served as a Texas State Representative from 1972 to 1979 and was executive assistant to Texas Governor Mark White in 1983. Mr. Powers served as president of Texas Young Lawyers Association from 1975 to 1976 and as a member of the American Bar Association standing committee for the Federal Judiciary from 1993 to 1996. Mr. Powers received a BA from Lamar University in 1962 and a JD from The University of Texas School of Law in 1965. |

|

|

| | John Sharp is 52 years of age and has served as a principal in the tax consulting firm Ryan & Company since 1998. Mr. Sharp served as Texas Comptroller of Public Accounts from 1991 to 1998 and as a Texas Railroad Commissioner from 1985 to 1991. He served as a Texas State Senator from 1982 to 1985 and as a Texas State Representative from 1979 to 1982. Mr. Sharp received a BA from Texas A&M University in 1972 and a MPA in public administration from Southwest Texas State University in 1975. |

|

|

| | Sarah Weddingtonis 58 years of age and is a lawyer, author, speaker and adjunct professor at The University of Texas at Austin. She served as director of the Texas Office of State-Federal Relations from 1983 to 1985, as Assistant to President Jimmy Carter from 1978 to 1981 and as General Counsel of the U.S. Department of Agriculture from 1977 to 1978. Dr. Weddington served as a Texas State Representative from 1973 to 1977. She served as Assistant Reporter for the American Bar Association Committee to revise the Ethical Standards for Lawyers from 1967 to 1969. Dr. Weddington received a BA from McMurry University in 1964 and a JD from The University of Texas School of Law in 1967. |

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RE-ELECTION OF FLOOR MOUTHAAN AND THE ELECTION OF PIKE POWERS, JOHN SHARP AND SARAH WEDDINGTON. |

5

Directors and Executive Officers

The current directors and executive officers of the Company are:

Name/Position with the Company

| | Age

| | Present Term Expires

| | Year First Elected Director

|

Azie Taylor Morton (1)(2) Director | | 67 | | 2004 | | 1996 |

Floor Mouthaan (1)(2) Director | | 57 | | 2003 | | 1994 |

Raymond A. Rodriguez (1) Director | | 45 | | 2005 | | 1994 |

John C. Wooley (3) Chairman of the Board, President and CEO | | 54 | | 2004 | | 1981 |

Jeffrey J. Wooley (3) Director, Senior Vice President and Secretary | | 57 | | 2005 | | 1981 |

Richard H. Valade Executive Vice President, Treasurer and CFO | | 54 | | N/A | | N/A |

Darrell W. Kolinek Senior Vice President of Restaurant Operations | | 52 | | N/A | | N/A |

Joyce Cates Senior Vice President of Franchise Operations | | 55 | | N/A | | N/A |

| (1) | | Member of the Audit Committee. |

| (2) | | Member of the Compensation Committee. |

| (3) | | Member of the Executive Committee. |

6

|

| | | |

| | Azie Taylor Mortonhas been President of GRW Capital Corporation of Texas, a financial services firm in Austin, since 1999, and she was its Director of Marketing from 1993 to 1999. Ms. Morton served in the federal government during the Kennedy, Johnson and Carter administrations, including her appointment as Treasurer of the United States in 1977, and she has served in local and state governments as well. She also was a franchisee and a member of the Board of Directors of Wendy’s International, Inc. She was a member of the Board of Trustees of Citizens Funds, a mutual fund, from 1992 to 2001, and served as its Chair from 1996 to 2001. |

| | | |

|

|

| | Floor Mouthaanhas been a managing director of Gold-Zack AG, a German investment banking firm, since July 2000. He was the managing director of Greenfield Capital Partners, B.V., from 1995 to 2000. Mr. Mouthaan was the chief executive officer of Noro (Nederland) B.V., an international venture capital fund located in Zeist, the Netherlands, from 1988 to 1995. He worked as a partner and managing partner of Deloitte & Touche in Amsterdam from 1978 to 1988. |

| | | |

|

|

| | Raymond A. Rodriguezhas been President of RAR Service Group, Inc., a financial services and consulting firm located in Long Grove, Illinois, since 1985. Mr. Rodriguez is an officer and principal shareholder of Barmar Enterprises, Inc., an area developer for the Company in the Chicago, Illinois area since 1992, and has been an owner of two Schlotzsky’s Deli restaurants in Chicago since 1993, another in Northfield, Illinois since 1995, and a fourth in Gurnee, Illinois since 1998. |

| | | |

|

|

| | John C. Wooleyhas served as Chairman of the Board of Directors and President of the Company since 1981 and as Chief Executive Officer since 1995. From 1974 to 1981, he participated in various real estate development and investment activities. Mr. Wooley earned a BBA in accounting in 1970 and a JD in 1974, both from The University of Texas at Austin. |

| | | |

|

7

|

|

| | Jeffrey J. Wooleyhas served the Company as Secretary since 1981 and as Senior Vice President since 1995. Mr. Wooley also served the Company as General Counsel from 1981 through 1997, and as Vice President from 1981 through 1995. Prior to 1981, Mr. Wooley was engaged in the private practice of law in Colorado and Texas. Mr. Wooley received a BA degree from Rice University in 1968 and a JD from The University of Texas at Austin in 1972. Jeffrey Wooley and John Wooley are brothers. |

| | | |

|

|

| | Richard H. Valadehas served as Executive Vice President, Treasurer and Chief Financial Officer of the Company since August 2000. Mr. Valade was an independent business/ accounting consultant from September 1999 to August 2000. From September 1988 to August 1999, he was a Partner with Arthur Andersen LLP in Detroit, Michigan. Mr. Valade received a BBA degree from University of Michig an in 1971 and an MBA degree from The George Washington University in 1975. In May 1998, Mr. Valade made an offer of settlement to the Securities and Exchange Commission (“SEC”) pursuant to which the SEC entered an order censuring Mr. Valade for issuing an unqualified audit report on 1992 financial statements for a drug store company without obtaining sufficient competent evidential matter concerning the existence of store inventory while Mr. Valade was the engagement partner at Arthur Andersen LLP for that company. |

| | | |

|

|

| | Darrell W. Kolinekjoined the Company in 1980 as Operations Supervisor. He became Director of Franchise Services in 1991. Mr. Kolinek was appointed Vice President of Franchise Services in January 1995, Senior Vice President of Franchise Services in July 1995, Senior Vice President of Franchise Relations in February 1999 and Senior Vice President of Restaurant Operations in July 1999. Mr. Kolinek attended Southwest Texas State University. |

| | | |

|

|

| | Joyce Catesjoined the Company in 1994 as Franchise Sales Administrator. In February 1995, she was appointed Office Administrator. In December 1995, she was promoted to Vice President of Corporate Administration. In January 1998, she became Vice President of Executive Administration. In October 1999, she was named Vice President of Franchise Operations. In October 2000, she was named Senior Vice President of Franchise Operations. Ms. Cates received a Bachelor of Science degree from Texas Women’s University in 1969. |

| | | |

|

8

Board Committees

The Board of Directors has standing Audit, Compen-sation and Executive Committees.

The Audit Committee is responsible for overseeing the Company’s financial reporting process on behalf of the Board of Directors. The Audit Committee annually selects the independent accountants as auditors for the Company, reviews the scope and fees of the annual audit and any special audit and reviews the results with the auditors, reviews accounting practices and policies of the Company with the auditors, reviews the adequacy of the accounting and financial controls of the Company and submits recommendations to the Board of Directors regarding oversight and compliance with accounting principles and legal requirements. The Audit Committee is comprised of directors Azie Taylor Morton, Floor Mouthaan and Raymond A. Rodriguez.

The Compensation Committee reviews salaries and benefits of the executive officers of the Company, outlines their job descriptions, establishes guidelines for performance, administers the Company’s 1993 Stock Option Plan, as amended, and makes recommendations to the Board of Directors regarding the compensation of executive officers and the overall compensation policies of the Company. The Compensation Committee is comprised of directors Azie Taylor Morton and Floor Mouthaan.

The Executive Committee has authority to take any action which can be taken by the entire Board of Directors, except actions reserved to other committees or which may be taken only by the full Board of Directors under law or pursuant to the Company’s Bylaws. The Executive Committee is comprised of John Wooley and Jeffrey Wooley.

The Board of Directors held eight meetings in person and acted by unanimous written consent three times during fiscal year 2002. The Audit Committee met four times and acted by unanimous written consent one time during fiscal year 2002. The Compensation Committee met two times and acted by unanimous written consent eight times during fiscal year 2002. The Executive Committee did not meet but acted by unanimous written consent six times during fiscal year 2002. Each of the current directors attended at least 75% of the meetings of the Board of Directors and the meetings of the committees on which such director served.

Compensation of Directors

Directors who are not officers or employees of, or consultants to, the Company received a retainer of $1,000 per month, $1,500 for each meeting of the Board of Directors attended and $1,500 per committee meeting attended during fiscal year 2002. Floor Mouthaan is reimbursed a flat amount of $1,500 for travel expenses for each trip to the site of a Board or committee meeting. He was reimbursed a total of $6,000 in 2002 for travel expenses related to Board and committee meetings.

In January 2001, the Board of Directors approved resolutions granting 10,000 stock options under the Company’s 1993 Stock Option Plan, as amended, (the “1993 Plan”), to each of the non-employee directors of the Company then in office: Azie Taylor Morton, Floor Mouthaan and Raymond A. Rodriguez. These options are exercisable from the grant date at the exercise price of $3.7406 per share, which was the fair market value of the Common Stock on the grant date as calculated pursuant to the 1993 Plan. Each of the non-employee directors abstained from voting with respect to the grant of options to himself. The Compensation Committee of the Board of Directors, which is designated as the Administrator of the 1993 Plan, ratified these grants of options, with each member of the Compensation Committee abstaining from voting with respect to options granted to himself.

9

Summary Compensation Table

The following table sets forth certain information with respect to the compensation paid by the Company for services rendered during the fiscal years ended December 31, 2002, 2001 and 2000 to the Company’s chief executive officer and each of the other four persons serving as executive officers on December 31, 2002 (collectively, the “named executive officers”).

| | | | | | | | | | Long-Term Compensation Awards |

| | | Annual Compensation

| | Awards

| | Payouts

|

Name and Principal Position

| | Year

| | | Salary ($)

| | Bonus ($) (1)

| | Securities Underlying Options (#)

| | All Other Compensation ($)

|

|

John C. Wooley Chairman of the Board, President and CEO | | 2002 2001 2000 | | | 377,287 300,000 247,120 | | -0- 150,000 -0- | | -0- -0- -0- | | | 186,462 (2) 184,212 (3) 5,250 (4) |

|

Jeffrey J. Wooley Director, Senior VP and Secretary | | 2002 2001 2000 | | | 282,965 225,000 178,612 | | -0- 112,500 -0- | | -0- -0- -0- | | | 178,677 (5) 96,197 (6) 2,702 (4) |

|

Richard H. Valade Executive VP, Treasurer and CFO | | 2002 2001 2000 | (9) | | 243,000 225,000 84,375 | | -0- 112,500 -0- | | -0- -0- 100,000 | | $ | 11,402 (7) 12,757 (8) 39,100 (10) |

|

Darrell W. Kolinek Senior VP of Restaurant Operations | | 2002 2001 2000 | | | 170,000 155,000 139,520 | | -0- -0- -0- | | -0- 40,000 20,000 | | | 7,472 (11) 340 (4) 698 (4) |

|

Joyce Cates Senior VP of Franchise Operations | | 2002 2001 2000 | | | 170,000 128,750 97,472 | | -0- -0- -0- | | -0- 25,000 1,000 | | | 6,800 (4) 2,281 (4) 992 (4) |

| (1) | | Paid pursuant to the applicable executive officers’ employment agreements |

| (2) | | Includes (i) a bonus advance of $150,000 paid in January 2002, to be repaid to the Company with 60% of the net bonus, if any, for each year beginning with the 2002 bonus, (ii) a $29,021 payment for unused vacation accrued during 2002, to be paid by the Company in 2003, and (iii) a $7,441 employer matching contribution to his 401K plan account. |

| (3) | | Includes (i) a bonus advance of $150,000 paid in January 2001, to be repaid to the Company with 60% of the net bonus, if any, for each year beginning with the 2002 bonus, (ii) a $28,962 payment for unused vacation accrued during 2001, and (iii) a $5,250 employer matching contribution to his 401K plan account. His employment agreement was amended in January 2002 to eliminate the provision for 150,000 stock options, or an economically equivalent benefit, which was to have been granted in 2001. |

| (4) | | Employer matching contribution to 401K plan account. |

| (5) | | Includes a (i) a bonus advance of $140,000 to be repaid to the Company with 60% of the net bonus, if any, for each year beginning with the 2002 bonus, (ii) a $21,766 payment for unused vacation accrued during 2002, to be paid by the Company in 2003, (iii) a $2,640 premium paid for dependent medical insurance, (iv) a $6,844 premium paid for life and disability insurance, and (v) a $7,427 employer matching contribution to his 401K plan account. In lieu of the $140,000 advance referenced in (i) above, the Company executed a promissory note with Jeff due and payable by January 31, 2004. |

| (6) | | Includes (i) a bonus advance of $50,000 to be repaid to the Company with 60% of the net bonus, if any, for each year beginning with the 2002 ; (ii) an advance of $17,000 that was repaid in April 2002; (iii) a $21,721 payment for unused vacation accrued during 2001; (iv) a $4,082 premium paid for dependent medical insurance; (v) $1,113 premium paid for supplemental life insurance; and (vi) a $2,281 employer matching contribution to his 401K plan account. His employment agreement was amended in December 2001 to eliminate the provision for 100,000 stock options, or an economically equivalent benefit, which was to have been granted in 2001. |

| (7) | | Includes (i) a $2,640 premium paid for dependent medical insurance, and (ii) a $1,472 premium paid for supplemental life insurance, and (iii) a $7,290 employer matching contribution to his 401K plan account. |

| (8) | | Includes (i) $7,200 of relocation expenses, (ii) a $4,082 premium paid for dependent medical insurance, (iii) a $912 premium paid for supplemental life insurance, and (iv) a $563 employer matching contribution to his 401K plan account. |

| (9) | | Mr. Valade’s employment with the Company began August 15, 2000. |

| (10) | | Includes (i) $28,125 of consulting fees paid by the Company to Mr. Valade before his employment with the Company and (ii) $10,975 of relocation expenses. |

| (11) | | Includes (i) a $672 premium paid for supplemental life insurance, and (ii) a $6,800 employer matching contribution to his 401K plan account. |

10

Option Grants in Last Fiscal Year

No stock options were granted in 2002 to the executive officers included in the Summary Compensation Table. The Company has not granted any stock appreciation rights.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Set forth in the following table is summary information regarding all unexercised options as of the end of fiscal year 2002 for each of the executive officers included in the Summary Compensation Table. None of such executive officers exercised options in fiscal year 2002.

| | | Number of Securities Underlying Unexercised Options at Fiscal Year-End(#)

| | Value of Unexercised In-the-Money Options at Fiscal Year-End($) (1)

|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

John C. Wooley | | -0- | | -0- | | -0- | | -0- |

Jeffrey J. Wooley | | -0- | | -0- | | -0- | | -0- |

Richard H. Valade | | 100,000 | | -0- | | -0- | | -0- |

Darrell W. Kolinek | | 86,771 | | 6,667 | | $14,400 | | -0- |

Joyce Cates | | 50,334 | | 6,666 | | $ 9,000 | | -0- |

| (1) | | The closing price per share of Common Stock on December 31, 2002 was $3.36. |

Report of the Compensation Committee on Executive Compensation

The Compensation Committee is responsible for reviewing salaries and benefits of certain executive officers of the Company, outlining their job descriptions, establishing guidelines for performance, administering the Company’s 1993 Stock Option Plan and Employee Stock Purchase Plan and making recommendations to the full Board of Directors regarding compensation for the executive officers and the overall compensation policies of the Company. The Compensation Committee of the Board of the Directors is currently comprised of two independent directors. The Compensation Committee consists of only independent directors who are appointed by the full Board of Directors, and no member of the Compensation Committee serves or has previously served as an employee or officer of the Company.

Compensation Philosophy

Compensation for executive officers of the Company has generally been based upon the following criteria: level of responsibility at the Company; individual performance and commitment to the Company; level of relevant experience; the amount of compensation paid to executive officers of comparable companies; the amount of time and effort required by the position (both generally and for the fiscal year); contributions to the profitability of the Company; assessment of risks associated with losing the benefit of the individual’s services; and number of years of service with the Company.

The Compensation Committee has periodically obtained advice from independent consultants regarding the compensation of the Company’s executive officers. Based on such advice, the Compensation Committee has applied an approach to executive compensation that includes three primary elements: base salary and other employment benefits at levels determined under the criteria described in the paragraph above; annual bonuses to certain executive officers based on the Company’s financial performance; and stock option grants to certain executive officers to assure that their efforts are closely aligned with the interests of the Company’s shareholders and to promote the long-term growth of the Company. Through these elements, the Company seeks to

11

link the financial interests of the Company’s executive officers to the interests of the shareholders, encourage support of the Company’s long-term goals, tie executive compensation to the Company’s performance, attract and retain talented leadership and encourage significant stock ownership of the Company’s common stock by the executive officers. The Compensation Committee used these criteria in establishing the employment agreements with executive officers of the Company.

Executive Compensation

In March 1998, the Compensation Committee approved an Employment Agreement with John C. Wooley, the Company’s President and Chief Executive Officer. In April 2000, at John’s request, the Compensation Committee canceled all stock options previously granted to him by the Company. In July 2000, the Compensation Committee amended the Employment Agreement to remove the cash bonus provision for the year 2000. In January 2001, the Compensation Committee approved an Amended and Restated Employment Agreement. As amended, John’s employment agreement includes the following provisions:

| • | | a rolling four-year term, to be automatically extended on December 31 of each year; |

| • | | base salary in 2002 of $377,287 calculated according to formula based on 2001 base salary and increase in the Company’s 2001 EBITDA (earnings before interest, taxes, depreciation and amortization); |

| • | | base salary increase in future years, according to formula based on prior year’s base salary and increase in the Company’s EBITDA up to a maximum increase of 100% per year; |

| • | | cash bonus based on the Company’s EBITDA, up to 100% of base salary; |

| • | | advances of $150,000 in January 2001 and January 2002, with repayment from portion of future cash bonuses; |

| • | | other employment benefits related to insurance premiums; |

| • | | upon any termination of employment by the Company or upon certain events following a change in control of the Company, salary and other benefits paid for up to four years and remaining 2001 and 2002 advance balance, if any, will be deemed earned; and |

| • | | repayment of certain loans from the Company to John to commence when certain personal guaranties by John of Company obligations are released. See “Certain Relationships and Related Transactions” below. |

John’s employment agreement also provided for a grant of 150,000 stock options on June 1, 2001 at the then-current market price and with immediate vesting, subject to any Compensation Committee action and approval by the Company’s shareholders necessary to increase the shares issuable under the 1993 Stock Option Plan or a benefit economically equivalent to the foregoing stock options, if required Compensation Committee or shareholder action did not occur. In December 2001, and January 2002, the Compensation Committee approved amendments to his employment agreement, resulting in: (i) the elimination of the stock option grant and the economic equivalent benefit provisions; and (ii) the addition of the bonus advances described above.

John did not receive a bonus for 2002, and his salary for 2003 will remain the same as it was in 2002.

In January 2001, the Compensation Committee approved an Amended and Restated Employment Agreement with Jeffrey J. Wooley, the Company’s Secretary and Senior Vice President. The employment agreement includes the following provisions:

| • | | a rolling four-year term, to be automatically extended on December 31 of each year; |

| • | | base salary in 2002 of $282,965 calculated according to formula based on 2001 base salary and increase in the Company’s 2001 EBITDA (earnings before interest, taxes, depreciation and amortization); |

| • | | base salary increase in future years, according to formula based on prior year’s base salary and increase in the Company’s EBITDA up to a maximum increase of 100% per year; |

| • | | cash bonus based on the Company’s EBITDA, up to 100% of base salary; |

12

| • | | advances of $50,000 in January 2001 and $140,000 in January 2002, with repayment from portion of future cash bonuses; |

| • | | other employment benefits related to insurance premiums; |

| • | | upon any termination of employment by the Company or upon certain events following a change in control of the Company, salary and other benefits paid for up to four years and remaining 2001 and 2002 advance balance, if any, will be deemed earned; and |

| • | | repayment of certain loans from the Company to Jeff to commence when certain personal guaranties by Jeff of Company obligations are released. See “Certain Relationships and Related Transactions” below. |

Jeff’s employment agreement also provided for a grant of 100,000 stock options on June 1, 2001, at the then-current market price and with immediate vesting, subject to any Compensation Committee action and approval by the Company’s shareholders necessary to increase the shares issuable under the 1993 Stock Option Plan or a benefit economically equivalent to the foregoing stock options, if required Compensation Committee or shareholder action did not occur. In December 2001, and January 2002, the Compensation Committee approved amendments to his employment agreement, resulting in: (i) the elimination of the stock option grant and the economic equivalent benefit provisions; and (ii) the addition of the bonus advances described above.

Jeff did not receive a bonus for 2002, and his salary for 2003 will remain the same as it was in 2002.

The Company also has an employment agreement with Richard H. Valade, its Executive Vice President, Treasurer and Chief Financial Officer, which was approved by the Compensation Committee in 2000. This agreement includes the following provisions:

| • | | initial term of two years to be renewed automatically for successive one-year terms; |

| • | | base salary of $225,000; |

| • | | other employment benefits related to insurance premiums; |

| • | | grant of 100,000 stock options; |

| • | | cash bonus, up to 100% of salary, based on parameters to be determined annually; |

| • | | future compensation increases which may be awarded in the Company’s discretion; and |

| • | | payment of salary, bonus and other benefits for one year upon termination of employment by the Company without cause or upon certain events following a change in control of the Company. |

Rick did not receive a bonus for 2002, and his salary for 2003 will remain the same as it was in 2002.

In 2000, the Company entered into employment agreements with each of Darrell W. Kolinek (Senior Vice President Restaurant Operations) and Joyce Cates (Senior Vice President Franchise Operations). These agreements, which were extended in 2001, provided for (i) base salary, (ii) other employment benefits and (iii) payment of salary and benefits for six (6) months upon termination of employment by the Company without cause or for one (1) year upon certain events following a change in control of the Company. These agreements expired in May 2002 and have not been renewed.

Federal Tax Considerations

The Company intends that total compensation, including annual bonuses or stock option grants, will satisfy the conditions necessary for deductibility by the Company under Section 162(m) of the Internal Revenue Code, which limits the ability of the Company to deduct any compensation in excess of $1,000,000 per year for federal income tax purposes unless such conditions are met.

Submitted by the Compensation Committee:

Azie Taylor Morton, Chair

Floor Mouthaan

13

Compensation Committee Interlocks and Insider Participation

There are no relationships or transactions required to be reported in this section under the applicable securities regulations.

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of shares of Common Stock, as of the close of business on May 5, 2003 (except as otherwise indicated), by each person or group (as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934 (“Exchange Act”) known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock, each current director and director nominee of the Company, each executive officer included in the Summary Compensation Table and all current directors, director nominees and executive officers of the Company as a group. Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to the shares of Common Stock shown as beneficially owned by them. Beneficial ownership as reported in the table has been determined in accordance with Rule 13d-3 under the Exchange Act and represents the number of shares of Common Stock for which a person, directly or indirectly, through any contract, management, understanding, relationship or otherwise, has or shares voting power, including the power to vote or direct the voting of such shares, or investment power, including the power to dispose or to direct the disposition of such shares, and includes shares which may be acquired within 60 days after May 5, 2003. The percentages are based upon 7,319,887 shares outstanding as of May 5, 2003, which excludes shares owned by the Company.

Substantially all of the shares beneficially owned by John Wooley and Jeffrey Wooley are pledged to secure personal indebtedness.

14

| | | Shares Beneficially Owned

| |

Name

| | Number

| | | Percent of Class

| |

Joseph G. Beard | | 1,185,650 | (1) | | 16.2 | % |

Dimensional Fund Advisors, Inc. | | 604,850 | (2) | | 8.3 | % |

Azie Taylor Morton | | 12,300 | (3) | | * | |

Floor Mouthaan | | 10,000 | (4) | | * | |

Raymond A. Rodriguez | | 28,169 | (5) | | * | |

John C. Wooley | | 794,662 | (6) | | 10.9 | % |

Jeffrey J. Wooley | | 157,651 | (7) | | 2.2 | % |

Richard H. Valade | | 107,008 | (8) | | 1.5 | % |

Darrell W. Kolinek | | 138,745 | (9) | | 1.9 | % |

Joyce Cates | | 57,000 | (10) | | * | |

Pike Powers | | 0 | | | * | |

John Sharp | | 0 | | | * | |

Sarah Weddington | | 0 | | | * | |

All executive officers, director nominees and directors as a group (eleven persons) | | 1,304,393 | (11) | | 17.1 | % |

| (1) | | Based on review of Schedule 13D/9A dated April 28, 2003. Includes 422,600 shares owned by Joseph G. Beard directly or through accounts for his children, for which sole voting and investment power is held by Mr. Beard, and 763,050 shares owned by Westdale Properties America I, Ltd. (“WPA”), for which shared voting and investment power is held by Mr. Beard, WPA, JGB Ventures I, Ltd. (“JV”), JGB Holdings, Inc. (“JH”), and Ronald Kimel as Trustee. The address of Mr. Beard, WPA, JV and JH is 3300 Commerce Boulevard East, Dallas, Texas 75226. The address of Mr. Kimel is 444 Adelaide Street West, Toronto, Ontario M5V1S7, Canada. The Schedule 13D/9A indicates that the persons and entities identified in this footnote may be deemed to comprise a “group” under applicable securities law. |

| (2) | | Based on review of Schedule 13G/A dated February 3, 2003. The address for Dimensional Fund Advisors, Inc. is 1299 Ocean Avenue, 11th Floor, Santa Monica, California 90401. |

| (3) | | Includes 12,300 shares which may be purchased from the Company pursuant to currently exercisable stock options. |

| (4) | | Includes 10,000 shares which may be purchased from the Company pursuant to currently exercisable stock options. |

| (5) | | Includes 10,000 shares which may be purchased from the Company pursuant to currently exercisable stock options. |

| (6) | | Includes 1,142 shares held by a trust for the benefit of John Wooley and Jeffrey Wooley (the “Wooley Trust”), for which John Wooley is a co-trustee. |

| (7) | | Includes 1,142 shares held by the Wooley Trust, for which Jeffrey Wooley is a co-trustee. |

| (8) | | Includes 5,000 shares held in an investment account jointly owned by Mr. Valade and his wife. Also includes 100,000 shares which may be purchased from the Company pursuant to currently exercisable options granted by the Company to Mr. Valade. |

| (9) | | Includes (i) 93,438 shares which may be purchased by Mr. Kolinek from the Company pursuant to currently exercisable options and (ii) 41,938 shares which may be purchased by Mr. Kolinek’s wife from the Company pursuant to currently exercisable options. |

| (10) | | Includes 57,000 shares which may be purchased from the Company pursuant to currently exercisable options. |

| (11) | | Shares deemed to be beneficially owned by more than one executive officer or director have only been counted once in determining total shares beneficially owned by all executive officers and directors as a group. Includes 324,676 shares which may be purchased from the Company pursuant to currently exercisable options. |

15

Section 16(A) Beneficial Ownership Reporting Compliance

The directors, executive officers and certain shareholders of the Company are required under federal securities law to file reports with the Securities and Exchange Commission regarding their ownership of Company stock. The Company believes that all such persons complied with their filing requirements during fiscal year 2002.

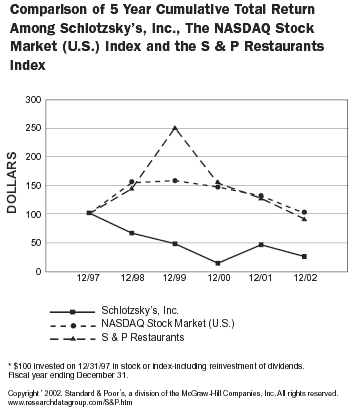

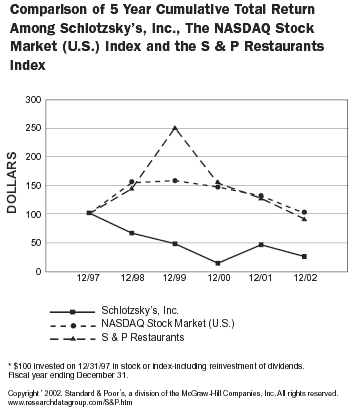

Stock Price Performance Graph

The graph below compares the cumulative total return for the Company’s Common Stock during the five year period ended December 31, 2002 to that of the NASDAQ Stock Market (U.S.) Index and the Standard & Poor’s Restaurants Index. Each of the three measures of cumulative total return assumes a $100 initial investment and reinvestment of any dividends. The stock performance shown on the graph below is not necessarily indicative of future price performance.

Audit Fees for 2002

The Audit Committee has engaged Grant Thornton LLP as the independent accountants to audit the Company’s financial statements for fiscal year 2003. Grant Thornton LLP served as the Company’s independent accountants and provided tax preparation and consulting services to the Company during fiscal year 2002. Representatives of Grant Thornton LLP are expected to be present at the Annual Meeting of Shareholders, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

The following table sets forth the aggregate amount of fees billed to the Company by Grant Thornton LLP for services rendered for fiscal year 2002. Grant Thornton LLP does not provide any tax consulting services to any Company executive.

Audit Fees | | $ | 129,590 |

Audit Related Fees (1) | | $ | 24,262 |

Tax Fees (2) | | $ | 84,264 |

All Other Fees (3) | | $ | 2,682 |

| (1) | | Audit Related Fees include primarily audits of certain affiliated entities and services performed in connection with inclusion of the Company’s financial statements in its Uniform Franchise Offering Circulars. |

| (2) | | Tax Fees primarily include fees for federal and state and local tax consulting and compliance services. |

| (3) | | All Other Fees relate to consultations and services related to a proposed transaction. |

Report of the Audit Committee

In accordance with the written Audit Committee Charter, which was reviewed but not amended in 2002, the Audit Committee is responsible for overseeing the Company’s financial reporting process on behalf of the Board of Directors. The Audit Committee annually selects the independent accountants as auditors for the Company, reviews the scope and fees of the annual audit and any special audit and reviews the results with the auditors, reviews accounting practices and policies of the Company with the auditors, reviews the adequacy of the accounting and financial controls of the Company, and submits recommendations to the Board of Directors regarding oversight and

16

compliance with accounting principles and legal requirements. The Company’s management team has the primary responsibility for the Company’s financial reporting process, principles and internal controls as well as preparation of the Company’s financial statements. The Company’s independent auditor, Grant Thornton LLP, is responsible for performing an audit of the Company’s financial statements and for expressing an opinion as to the fair presentation of the financial statements in accordance with generally accepted accounting principles.

The members of the Audit Committee are each deemed to be independent as required by the listing standards of the NASDAQ National Market as applicable to the Company. Each member satisfies the requirements set forth in applicable NASDAQ rules and guidelines.

The Audit Committee has reviewed and discussed with the Company’s management and its independent auditors the audited financial statements for the fiscal year ended December 31, 2002. The Audit Committee has also reviewed with the Company’s management and its independent auditors various issues that may affect the Company’s financial operations and reports, including but not limited to critical accounting policies, known trends and uncertainties, internal accounting controls and related party transactions.

The Audit Committee has discussed with the Company’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61. The Audit Committee has received the written disclosures and the letter from the Company’s independent auditors as required by Independence Standards Board Standard No. 1. The Audit Committee has also discussed with the independent auditors their independence from the Company and has considered all non-audit related services the independent auditors have performed for the Company in 2002, and whether such services are compatible with maintaining their independence. In 2002, Grant Thornton LLP handled the Company’s tax matters. It is expected that Grant Thornton LLP will also handle the Company’s tax matters in 2003. The Audit Committee has determined, based on its review and discussions, that Grant Thornton LLP is independent from the Company and its management.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002 filed with the Securities and Exchange Commission. The Audit Committee has selected Grant Thornton LLP to be the Company’s independent auditor for the 2003 fiscal year.

Submitted by the Audit Committee:

Floor Mouthaan, Chair

Azie Taylor Morton

Raymond A. Rodriguez

Shareholder Proposal (ITEM 2 ON PROXY CARD)

The Company has been informed that one of its shareholders intends to present a proposal at the Annual Meeting. The Board of Directors and the Company are not responsible for the contents of the proposal and supporting statement set forth below. The proposal has been carefully considered by the Board of Directors. For the reasons stated after the proposal and its supporting statement, the Board of Directors recommends a vote “AGAINST” the proposal. To be approved, the proposal must receive the affirmative vote of the holders of a majority of shares present in person or by proxy and entitled to vote on this proposal.

The shareholder, whose name, address and current ownership information will be provided upon written or oral request to the Company’s Corporate Secretary, has notified the Company that it intends to present the following proposal at the Annual Meeting:

PROPOSAL

Proposal – Sale of the Company

The shareholders request our Board of Directors to pursue a sale of the Company in one or more parts in an open, publicly announced fashion with a view to consummating such transactions not later than February 1, 2004.

Supporting Statement

Shareholder value has declined:

| 1. | | The value of Schlotzsky’s, Inc.’s stock has declined from approximately $6.50 per share in January 2002 to approximately $3 per share in December 2002. |

17

| 2. | | Five years ago Schlotzsky’s, Inc.’s stock, at times, was traded at a value of over $20 per share. |

Financial and business performance have also declined:

| 3. | | Schlotzsky’s, Inc. reported net income of $876,000, or $0.12 per diluted share, for the nine months ending September 30, 2002, compared to net income of $2,001,000, or $0.27 per diluted share, in the prior nine month period. |

| 4. | | Systemwide sales (including franchised and Company-owned restaurants) and same store sales of Schlotzsky’s, Inc. declined 7.7% and 6.3%, respectively, in 2002 compared to the third quarter in 2001. |

| 5. | | Schlotzsky’s, Inc. reported $1,651,000 of earnings before interest, taxes, depreciation and amortization for the third quarter of 2002, down from $2,540,000 for the third quarter of 2001. |

| 6. | | Schlotzsky’s, Inc. debt as a percentage of shareholder’s equity has increased from approximately 53% at the end of 2001 to approximately 80% at the end of September, 2002. |

| 7. | | During 2001, Schlotzsky’s, Inc. and its franchisees opened only 18 new Schlotzsky’s-Registered Trademark-Deli restaurants, compared to 32 and 66 in the previous two years. |

| 8. | | During 2001, 2000 and 1999, Schlotzsky’s, Inc. and its franchisees closed 73, 91 and 61 restaurants, respectively. |

Sale of the Company is called for:

| 9. | | Some Schlotzsky’s, Inc. shareholders are disappointed in the decline of their stock value and the poor financial and business performance of the Company. These shareholders seek to increase shareholder value for all Schlotzsky’s Inc. shareholders through an open, publicly announced sale of the company. |

In the interest of shareholder value vote yes.

Board of Directors’ Statement in Opposition to Shareholder Proposal

(ITEM 2 ON PROXY CARD)

The Board of Directors of the Company unanimously recommends a vote “AGAINST” this proposal because we believe it is not in the best interest of our shareholders.

The proposal requests that the Board “pursue a sale of the Company in one or more parts in an open, publicly announced fashion with a view to consummating such transactions not later than February 1, 2004.” The proposal makes no reference to price, market conditions, or the strategic plans of the Company. Such a sale of the Company, without regard to these factors, would be totally inconsistent with the Board’s duty to maximize shareholder value.

The Board believes that the proposed process would lead to a deterioration in the value of the Company for the following reasons:

| (1) | | The initiation of a sale in the auction-like manner contemplated by the proposal would be inconsistent with the shareholders’ interests. In the Board’s opinion, such an auction could create a “forced sale” atmosphere that could have the effect of reducing the perceived value of the Company to a “fire sale” level, thus forcing the Company to negotiate with bidders from a position of weakness. Further, we believe an “open” auction would limit the Board’s ability to negotiate confidentially, thus undermining its negotiating position with potential suitors. Moreover, the Board believes that the uncertainty created by a publicly announced auction would adversely affect relationships with lenders, customers, suppliers, employees, and franchisees, in addition to derailing discussions with prospective franchisees and other prospective business partners. The Board believes that a publicly announced auction would seriously disrupt operations for many months and could lead to a deterioration in the value of the Company. |

| (2) | | The timing of the proposed sale is ill-advised given current weakened market conditions and the long-term prospects for the Company. There are a number of reasons not to “auction” the Company at this time, including, during recent years, the weakened state of the economy, the severe price drop in the stock market, decreased consumer confidence, concerns and |

18

| | | uncertainty about terrorism, and dramatic declines in growth, earnings and valuation among certain companies in the retail and restaurant industries. In addition, the Board believes that to put a “for sale” sign on the Company while the Company’s stock is near historically low prices, and during a bear market, would be an invitation to “bottom feeders” to approach the Company with offers that represent a premium to only a few investors and speculators, to the detriment of long-term shareholders. |

In addition, the Board supports management’s strategic plans for the future growth of the Company and believes that the Company is well positioned for growth in the emerging fast casual sector of the restaurant industry. The Company’s brand development initiatives include menu enhancements, nutritional improvements, new restaurant designs, new marketing programs, enhanced franchisee support, an improved franchise licensing program, supply chain improvements, advances in the grocery and retail sales channels, improved technology applications, and recruitment of experienced personnel for execution of these plans. Evidence of the potential of these plans is reflected in higher sales at the Company flagship restaurant that has recently implemented many of these changes, positive customer response to new menu items and restaurant design enhancements, and industry leadership recognition.

With this strong strategic direction, the Board believes the best way to maximize shareholder value is to solidify the Company’s position in the fast casual sector as consumers move away from the traditional “fast food” menu of hamburgers and fries toward higher quality food. The Board believes that the Company’s strategies for capitalizing on this opportunity have the greatest potential to yield increased shareholder value.

Like all shareholders, the Board would like to see a higher stock price. In accordance with its fiduciary responsibility, the Board has always been open, and will continue to be open, to any bona fide proposal for the acquisition of the Company that would maximize shareholder value. The Board believes, however, that approval of this proposal would be detrimental to shareholder value and would disrupt the public market for the Company’s common stock.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “AGAINST” THIS PROPOSAL.

Certain Relationships and Related Transactions

John Wooley and Jeffrey Wooley have personally guaranteed and pledged collateral in connection with obligations of the Company to various lenders and lessors. The Company has agreed to indemnify both of them against liabilities, costs and expenses they may incur under such guarantees. The approximate total amount of the guaranteed obligations was $1,139,024 at December 31, 2002.

John Wooley and Jeffrey Wooley signed various promissory notes to the Company to evidence obligations owed to predecessor entities. As amended, these loans accrue interest at 8% per year as long as certain personal guarantees (described above) by John Wooley and Jeffrey Wooley in favor of the Company remain outstanding, and then convert to a five-year term. The largest aggregate amount of such indebtedness during 2002, and the balance of these loans as of December 31, 2002, was approximately $150,900 for John Wooley and $307,500 for Jeffrey Wooley. In 2003, the Company arranged a $1,000,000 four-month facility with John Wooley and Jeffrey Wooley. This facility accrues interest at 6.0 %, terminates on August 8, 2003, and is secured by our intellectual property, contract rights and certain intangibles.

In 2001, the Company issued promissory notes to Jeffrey Wooley in the amounts of (i) $112,500 in lieu of payment for his 2001 bonus, and (ii) $140,000 for his bonus advance payable in 2002 under the terms of his employment agreement. As amended, these notes will mature on January 31, 2004. The notes accrue interest at 7% per year, with accrued interest payable monthly. In 2003, the Company borrowed $150,000 on a short-term basis. This short term debt accrues interest at 5.2% per year, matures on June 25, 2003, and is collateralized by a certificate of deposit pledged by Jeffrey Wooley.

A predecessor-in-interest to Third & Colorado, LP. (“T&C”), in which John Wooley and Jeffrey Wooley are controlling members, is the borrower under a term loan and a line of credit from the Company, secured by mortgages on a parcel of land in Austin, Texas previously sold by the Company to T&C’s predecessor-in-interest. As amended, both loans accrue interest at 8% per year as long as certain personal guarantees (described above) by John Wooley and Jeffrey Wooley in favor of the

19

Company remain outstanding, and then convert to a ten-year term. The largest aggregate amount of such indebtedness during 2002, and the balance of these loans as of December 31, 2002, was $1,075,483.

The Company leases its corporate headquarters in the central business district of downtown Austin, Texas from T&C under a ten-year lease beginning in November 1997. The lease provides for: approximately 29,400 square feet of office space at $12.95 per square foot of annual net rent; approximately 11,950 square feet of additional space originally designated for storage but now used primarily for offices, rent free for the first three years, $1.25 per square foot for the next three years, and $2.50 per square foot for the last four years; varying numbers of parking spaces at below-market rates for the first six years and market rates for the last four years; and reimbursement of certain expenses. In 1996, after review of an analysis by an independent appraiser, the disinterested members of the Board of Directors approved the terms of the lease and determined that such terms were no less favorable to the Company than those available from unaffiliated third parties. In 2002, the Company paid to T&C $476,443 for office and storage space, $124,589 for approximately 150 parking spaces, and $41,026 for taxes and insurance.

Bonner Carrington Corporation European Market (“BCCE”), is the master licensee of the Company for Germany, France and certain other territories. In connection with such master licenses, BCCE has executed promissory notes payable to the Company. As amended, the notes bear interest at 9% per annum and provide for installment payments of principal and interest through December 2007. The largest aggregate amount of indebtedness during 2002, and the balance outstanding on December 31, 2002, owed by BCCE to the Company under such notes was approximately $582,561. The Company owns a 7.5% preferred stock interest in BCCE, has an option to acquire an additional 10% preferred stock interest in BCCE, and has options to acquire BCCE and its territories at predetermined prices through December 2011. The Company also holds a promissory note of Bonner Carrington LP, a Texas limited partnership and affiliate of BCCE (“BCLP”). The largest aggregate amount of such indebtedness during 2002, and the balance outstanding on December 31, 2002, owed under this note was approximately $413,697. In 1998, affiliates of BCCE acquired a minority membership interest in T&C.

In 2002, the Company paid $50,000 to BCLP for an option to take over a long-term ground lease for a potential Company-operated restaurant site in the Austin area. The Company exercised this option in January 2003 at the exercise price of $100,000. In March 2003, the Company entered into a construction coordination and consulting agreement with BCLP in connection with the development of this and other restaurant sites.

Raymond Rodriguez, a director of the Company, owns interests in the area developer for and several franchisees in the Chicago area. During 2002, the Company paid this area developer approximately $107,953 in compensation based on franchise fees and royalties generated in the applicable territory, and these franchisees paid the Company approximately $93,333 in royalties. The Company believes that the terms of the area development agreement and the franchise agreements with the entities affiliated with Mr. Rodriguez are as favorable to the Company as those with other area developers or franchisees.

In February 2001, the Company granted to Triad Media Ventures LLC (“Triad”) warrants to purchase 30,000 shares of the Company’s Common Stock at an exercise price of $4.50 per share. The warrants were granted in connection with a credit facility from Triad to Schlotzsky’s National Advertising Association, Inc. (“NAA”) and Schlotzsky’s N.A.M.F., Inc. which are affiliates of the Company, in the principal amount of $3,000,000 to fund the purchase of certain cable television advertising rights (on December 31, 2002, NAA merged into NAMF). Floor Mouthaan, a director of the Company, served on the investment committee of Triad until May 2002, but he did not have management control over Triad and he expressly disclaimed beneficial ownership of these shares. Nevertheless, the grant of warrants was treated as a related party transaction, was determined to be on terms no less favorable to the Company than those available from unaffiliated third parties and was approved, by the disinterested members of the Board of Directors.

Sino-Caribbean Corporation, a Texas corporation (“SCC”), is the master licensee of the Company for China. In connection with such master licenses, SCC has executed promissory notes payable to the Company. As amended, the notes bear interest at 10% per year and provide for installment payments of principal and interest through December 2006. The largest aggregate amount of indebtedness during 2002, and the balance

20

outstanding on December 31, 2002, owed by SCC to the Company under such notes was approximately $775,000. Karl Martin, an employee of the Company, has an ownership interest in SCC.

Pike Powers, a director nominee, is a partner with the law firm Fulbright & Jaworski L.L.P. Schlotzsky’s N.A.M.F., Inc., an affiliate of the Company, retained another partner at Fulbright & Jaworski L.L.P. to handle certain intellectual property matters. The fees incurred in 2003 for that engagement were less than $10,000.

Certain of the transactions described above were entered into between related parties and therefore were not the result of arms-length negotiations. Accordingly, the terms of these transactions may be more or less favorable to the Company than might have been obtained from unaffiliated third parties. During fiscal year 2002, the Company did not, and in the future will not, enter into any transactions in which the directors, executive officers or principal shareholders of the Company or their affiliates have a material interest, unless such transactions are determined to be on terms that are no less favorable to the Company than those that the Company could obtain from unaffiliated third parties, and are approved, by a majority of the independent and disinterested members of the Board of Directors.

Shareholder Proposals for Next Annual Meeting

Any shareholder who wants to present a proposal at the 2004 Annual Meeting (including nominations to serve on the Board of Directors) or who wants such proposal to be considered for inclusion in the Company’s proxy statement for that meeting must deliver written notice to the Company between December 21, 2003 and January 20, 2004. Any proposal delivered outside of such dates will be considered untimely. Such notice would need to comply with the requirements of federal securities regulations and the Company’s Bylaws and it must be delivered to the following address: Schlotzsky’s, Inc., Attention: Corporate Secretary, 203 Colorado Street, Austin, Texas 78701. A copy of the Bylaws is also available by writing to such address.

Annual Report to Shareholders

The Company has arranged for a copy of its Annual Report to Shareholders for fiscal year 2002, which includes the annual report on Form 10-K, to be mailed to each record shareholder and each beneficial owner with this Proxy Statement. A RECORD SHAREHOLDER OR BENEFICIAL SHAREHOLDER MAY ALSO OBTAIN A COPY OF THE ANNUAL REPORT ON FORM 10-K AT NO CHARGE, OR A COPY OF EXHIBITS THERETO FOR A REASONABLE CHARGE, BY WRITING TO SCHLOTZSKY’S, INC., INVESTOR RELATIONS, 203 COLORADO STREET, AUSTIN, TEXAS 78701. The Annual Report is also available on our website at www.schlotzskys.com.

Forward-Looking Statements

This Proxy Statement may contain “forward-looking statements,” as defined under federal securities laws. Any such statements reflect the Company’s expectations based on current information. Actual future results may be materially different because of various risks and uncertainties, including those identified in the Company’s Form 10-K and other filings with the Securities and Exchange Commission.

21

(recycle graphic) Printed on recycled paper

+

Schlotzsky’s, Inc. | | 000000 0000000000 0 0000 |

|

MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6

| | 000000000.000 ext 000000000.000 ext 000000000.000 ext 000000000.000 ext 000000000.000 ext 000000000.000 ext 000000000.000 ext Holder Account Number C 1234567890 J N T |

| | | ¨ | | Mark this box with an X if you have made changes to your name or address details above. |

Annual Meeting Proxy Card

Directors

1. The Board of Directors recommends a vote “FOR” the listed nominees. | | |

| | | For | | Withhold | | For All Except | | |

01 - Floor Mouthaan 02 - Pike Powers 03 - John Sharp 04 - Sarah Weddington | | ¨ | | ¨ | | ¨

| | Instruction: To withhold authority to vote for any individual nominee, mark the box “For All Except” and write that nominee’s name in the space provided.

Nominee Exception |

|

Proposal The Board of Directors recommends a vote “AGAINST” the following proposal. | | |

| | | For | | Against | | Abstain | | |

2. Proposal on the sale of the Company. | | ¨ | | ¨ | | ¨ | | |

In their discretion, the Proxies are authorized to vote upon such business as may properly come before the meeting or any adjournment thereof. | | | | | | | | |

Authorized Signatures - Sign Here - This section must be completed for your instructions to be executed.

Please sign exactly as name appears on this proxy card. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full name by President or other authorized officer. If a partnership, please sign partnership name by authorized person.

Signature 1 - Please keep signature within the box | | Signature 2 - Please keep signature within the box | | Date (mm/dd/yyyy) |

|

| | | | | ¨¨/¨¨ /¨¨¨¨ |

|

¨ | | 1 U P X H H H P P P P 002009 | | + |

Proxy—Schlotzsky’s, Inc.

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned hereby appoints John C. Wooley and Jeffrey J. Wooley, or either of them, as Proxies, each with full power of substitution, to represent and to vote, as designated below, all shares of Common Stock of Schlotzsky’s, Inc. (the “Company”) held of record by the undersigned on May 5, 2003, at the Annual Meeting of Shareholders to be held on June 23, 2003, and any adjournment thereof.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE LISTED NOMINEES AND AGAINST PROPOSAL 2.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY, USING THE ENCLOSED ENVELOPE.

(Continued, and to be signed on reverse side)