QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Advent Software, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

ADVENT SOFTWARE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 17, 2006

To the Stockholders of Advent Software Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the "Annual Meeting") of Advent Software, Inc. (the "Company" or "Advent"), a Delaware corporation, will be held on Wednesday, May 17, 2006 at 9:00 a.m., local time, at Advent's principal executive offices located at 301 Brannan Street, San Francisco, California 94107, for the following purposes:

- 1.

- To elect eight directors to serve for the ensuing year and until their successors are duly elected and qualified.

- 2.

- To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2006.

- 3.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on March 24, 2006 are entitled to notice of and to vote at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, you are urged to mark, sign and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the Annual Meeting may vote in person even if he or she has already returned a proxy.

|

|

Graham V. Smith

Secretary |

San Francisco, California

April 17, 2006 |

|

|

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE REQUESTED TO COMPLETE AND PROMPTLY RETURN THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED.

ADVENT SOFTWARE, INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

The enclosed proxy is solicited on behalf of Advent Software, Inc. (the "Company" or "Advent") for use at the Annual Meeting of Stockholders (the "Annual Meeting") to be held on Wednesday, May 17, 2006 at 9:00 a.m., local time, and at any adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at Advent's principal executive offices located at 301 Brannan Street, San Francisco, California 94107. The Company's telephone number at that location is (415) 543-7696.

These proxy solicitation materials were mailed on or about April 17, 2006, together with the Company's 2005 Annual Report to Stockholders, to all stockholders entitled to notice of and to vote at the Annual Meeting.

Record Date

Stockholders of record at the close of business on March 24, 2006 (the "Record Date") are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, 30,068,248 shares of the Company's common stock, $0.01 par value (the "Common Stock"), were issued and outstanding. For information regarding security ownership by management and by the beneficial owners of more than 5% of the Company's Common Stock, see "Beneficial Security Ownership of Management and Certain Beneficial Owners."

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted upon. A proxy may be revoked by (1) delivering to the Secretary of the Company at the Company's principal executive offices a written notice of revocation or a duly executed proxy, in either case bearing a later date than the prior proxy relating to the same shares or (2) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not of itself revoke a proxy). Any written notice of revocation or subsequent proxy must be received by the Secretary of the Company prior to the taking of the vote at the Annual Meeting.

Voting and Solicitation

Each stockholder is entitled to one vote for each share of Common Stock held by such stockholder on the Record Date on all matters properly submitted for the vote of stockholders at the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors.

The cost of soliciting proxies will be borne by the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of the Company's directors, officers and regular employees, without additional compensation, personally or by telephone, telegram, letter, electronic mail, or facsimile.

1

Quorum; Abstentions; Broker Non-Votes

The presence, in person or by proxy, of the holders of a majority of the shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. A plurality of the votes duly cast is required for the election of directors. If a plurality of votes duly cast is not received for the election of a director from our shareholders, the Board may reconsider whether it should appoint another director. The affirmative vote of a majority of the votes duly cast is required to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company.

Under the General Corporation Law of the State of Delaware, an abstaining vote and broker "non-vote" are counted as present and entitled to vote and are, therefore, included for the purposes of determining whether a quorum is present at the Annual Meeting; however, broker "non-votes" are not deemed to be "votes cast." As a result, broker "non-votes" are not included in the tabulation of the voting results on the election of directors or issues requiring approval of a majority of the votes cast and, therefore, do not have the effect of votes in opposition in such tabulations. Abstaining votes are deemed to be "votes cast" and will have the effect of votes against issues requiring approval of a majority of the votes cast; however, only affirmative votes will affect the outcome of the election of directors and, therefore, abstentions will not have an impact on the election.

A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Deadline for Receipt of Stockholder Proposals

Stockholders may present proper proposals for inclusion in the Company's proxy statement and for consideration at the next annual meeting of its stockholders by submitting their proposals in writing to the Secretary of the Company in a timely manner. In order to be included in the Company's proxy materials for the 2006 annual meeting of stockholders, stockholder proposals must be received by the Secretary of the Company no later than December 22, 2006, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934 (the "Exchange Act").

In addition, the Company's Bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made by (1) the Board of Directors, (2) the Corporate Governance and Nominating Committee or (3) any stockholder entitled to vote who has delivered written notice to the Secretary of the Company not less than 120 calendar days before the one year anniversary of the date on which the Company first mailed its proxy statement to stockholders in connection with the previous year's annual meeting of stockholders, which notice may contain specified information concerning the nominees and concerning the stockholder proposing such nominations. If a stockholder wishes to recommend a candidate for consideration by the Corporate Governance and Nominating Committee as a potential nominee for the Company's Board of Directors, see the procedures discussed in "Proposal One: Election of Directors—Corporate Governance Matters".

The Company's Bylaws also provide that the only business that may be conducted at an annual meeting is business that is: (1) specified in the notice of meeting (or any supplement thereto) given by or at the direction of the Board of Directors, (2) properly brought before the meeting by or at the direction of the Board of Directors, or (3) properly brought before the meeting by any stockholder entitled to vote who has written notice delivered to or mailed and received at the Company's principal executive offices no later than December 22, 2006, which notice must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters.

A copy of the full text of the Bylaw provisions discussed above may be obtained by writing to the Secretary of the Company. All notices of proposals by stockholders, whether or not included in the Company's proxy materials, should be sent to Advent Software, Inc., Corporate Secretary, 301 Brannan Street, San Francisco, California 94107.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees

Eight directors are to be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company's eight nominees named below. In the event that any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. It is not expected that any nominee will be unable or will decline to serve as a director. In the event any nominee is unable or declines to serve as a director at the time of the 2006 Annual Meeting, the proxies will be voted for any nominee who may be proposed by the Corporate Governance and Nominating ("CG&N") Committee and designated by the present Board of Directors to fill the vacancy. All eight nominees are currently directors, and all were elected to the Board by the stockholders at the last annual meeting with the exception of Messrs. Battle and Kirsner. Messrs. Battle and Kirsner were elected to the Board in June 2005 and January 2006, respectively, upon the recommendation of the CG&N Committee. Mr. Battle was recommended to the CG&N Committee by Mr. Scully and Mr. Kirsner was recommended to the CG&N Committee by Mr. Battle. After conducting its evaluation, including interviews with each nominee, the CG&N Committee recommended the election of each nominee to the Board of Directors. The term of office of each person elected as a director will continue until the next annual meeting of stockholders or until a successor has been elected and qualified.

Information Regarding Nominees and Other Directors

Nominees

The name of and certain information regarding each nominee as of March 31, 2006 are set forth below.

Name

| | Age

| | Principal Occupation

|

|---|

| John H. Scully | | 61 | | Managing Director, SPO Partners & Company |

| Stephanie G. DiMarco | | 48 | | Chief Executive Officer and President of the Company |

| A. George Battle | | 62 | | Chairman of the Board, Fair Issac Company |

| Terry H. Carlitz | | 54 | | Independent Business Advisor |

| James D. Kirsner | | 62 | | Independent Business Advisor |

| James P. Roemer | | 58 | | Former Chairman of the Board, ProQuest Company |

| Wendell G. Van Auken | | 61 | | Managing Director, Mayfield |

| William F. Zuendt | | 59 | | President and Chief Operating Officer (Retired), Wells Fargo and Company |

Mr. Scully has been a director since October 2003 and was appointed Chairman of the Board in December 2003. Mr. Scully currently serves as managing director of SPO Partners & Co., a private investment firm he co-founded in 1991, and is a director of Plum Creek Timber Company and the privately-held Hotel Equity Funds. He also is a Vice Chairman of the Board of Trustees at Stanford University and the Vice Chairman of Stanford Hospital and Clinics. In addition, Mr. Scully is chairman and founder of the Making Waves Educational Program. Mr. Scully holds an M.B.A. from Stanford University and an A.B. from Princeton University's Woodrow Wilson School of Public and International Affairs.

Ms. DiMarco founded Advent in June 1983. She served as Chairman of the Board from November 1995 until December 2003. Ms. DiMarco currently serves as Chief Executive Officer and President of the Company since her permanent appointment to the position in December 2003 after

3

serving on an interim basis from May 2003. Previously, she had served as President since founding Advent until April 1997 and as Chief Executive Officer until November 1999. She serves on the Advisory Board of the College of Engineering at the University of California, Berkeley, and is a San Francisco Foundation board member. Ms. DiMarco holds a B.S. in Business Administration from the University of California at Berkeley.

Mr. Battle has been a director since June 2005. Mr. Battle was the CEO and Chairman of the Board of Ask Jeeves, Inc. from 2000 to 2005. He was also director of PeopleSoft, Inc. from 1995 to 2004, and chaired the Transaction Committee of the Board during its 18 month deliberations regarding the Oracle tender offer. Mr. Battle is currently a director of Netflix Inc. and of Expedia Inc. and is Chairman of the Board of Fair Isaac Co. He is also a member of the Board of Directors of the Masters Select family of funds. As a Senior Fellow of the Aspen Institute, Mr. Battle is a seminar moderator for the Aspen Institute and has lectured at Stanford Business School, University of California-Berkeley Business School, the Amos Tuck School at Dartmouth, and American University. Mr. Battle retired from Andersen Consulting in 1995, having joined the firm in 1968 and served as a partner from 1978. From 1982 through 1995, he held a series of management positions in the firm including Worldwide Managing Partner—Market Development and Managing Partner—U.S. Operations and Planning. He was also a member of the firm's Executive Committee, Global Management Council and Partner Income Committee. Mr. Battle holds an economics degree from Dartmouth College and a M.B.A. from Stanford University.

Ms. Carlitz has been a director since February 2003. Ms. Carlitz is a director of Hyperion Solutions Corporation and of Photon Dynamics, Inc. From 1999 to 2002, Ms. Carlitz served as Chief Financial Officer and director of Saba Software, Inc., a provider of human capital management applications. From 1998 to 1999, she served as Senior Vice President of Operations and Chief Financial Officer of SPL WorldGroup B.V., a provider of customer relationship management solutions for the energy industry, and from 1995 to 1998 as Chief Financial Officer of Infinity Financial Technology, a provider of derivatives trading and risk management solutions until its merger with SunGard Data Systems. She held various senior financial management positions at Apple Computer from 1987 to 1995. She holds a M.B.A. from Stanford University and a B.S. from San Jose State University. Ms. Carlitz is a member of the Management Board of Stanford University's Graduate School of Business and serves on the Board of Advisors for the College of Business at San Jose State University.

Mr. Kirsner has been a director since January 2006. Mr. Kirsner currently serves on the Boards of Directors of the Bank of Marin and Cool Systems, Inc. He previously was a member of the Board of Directors of Ask Jeeves, Inc., until its sale in July of 2005. Mr. Kirsner was a Partner at Arthur Andersen in its Audit and Business Advisory Practice for over 25 years through 1993, providing a wide range of professional services, primarily to financial services firms. Mr. Kirsner then served as Chief Financial Officer and Head of Barra Ventures at Barra, Inc., a leading investment risk management services company from 1993 to 2001. Most recently, Mr. Kirsner was a consultant and interim Chief Operations Officer for Tukman Capital Management. Mr. Kirsner holds a BS degree in economics and an MS degree in accounting from the Wharton School of the University of Pennsylvania. Mr. Kirsner was also a general course student at the London School of Economics.

Mr. Roemer has been a director since March 2004. Mr. Roemer served as Chairman of ProQuest Company from 1998 to 2004, as ProQuest's Chief Executive Officer from 1997 to 2003, and as President from 1995 to 2001. From January 1994 to June 1995, he served as President and Chief Executive Officer of ProQuest Information and Learning Company. In October 1991, Mr. Roemer joined ProQuest as President and Chief Operating Officer of ProQuest Business Solutions Company and was promoted to President and Chief Executive Officer of that company in September 1993. Prior to joining ProQuest Company, he was President of the Michie Group, Mead Data Central from December 1989 to October 1991. From January 1982 to December 1989 he was Vice President and General Manager of LexisNexis, an online information service. Mr. Roemer attended the University of

4

Cincinnati and completed the Executive Program at the University of Virginia and the Program for Management Development at Harvard University.

Mr. Van Auken has been a director since September 1995. Mr. Van Auken is a Managing Director of various entities affiliated with Mayfield, a venture capital firm, which he joined in October 1986. Mr. Van Auken holds a M.B.A. from Stanford University and a B.E.E. from Rensselaer Polytechnic Institute. Mr. Van Auken is a director of Montgomery Street Income Securities, Inc., an investment company.

Mr. Zuendt has been a director since August 1997. Mr. Zuendt retired as President and Chief Operating Officer of Wells Fargo & Company and its principal subsidiary, Wells Fargo Bank, in 1997. Mr. Zuendt joined Wells Fargo in 1973 with responsibility for its computer systems and operations. He directed Wells Fargo's retail banking business throughout the 1980's and was appointed President in 1994. Mr. Zuendt earned a M.B.A from Stanford University and a B.S. in mathematics from Rensselaer Polytechnic Institute.

Board Meetings and Committees

During 2005, the Board of Directors held a total of four meetings (including regularly scheduled and special meetings) and took action eight times by unanimous written consent. No incumbent director during the last year, while a member of the Board of Directors, attended fewer than 75% of (i) the total number of meetings of the Board of Directors or (ii) the total number of meetings held by all committees on which such director served, except for Messrs. Battle and Kirsner who were appointed to the Board of Directors in June 2005 and January 2006, respectively.

The Board of Directors of the Company has three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee. The membership of each committee as of the date of this proxy statement, the number of meetings held by each commmittee in fiscal 2005 and other descriptive information is summarized below.

Director

| | Audit Comitteee

| | Compensation

Committee

| | Corporate Governance and

Nominating Committee

|

|---|

| A. George Battle | | | | X | | X |

| Terry H. Carlitz | | X | | Chair | | X |

| Stephanie G. DiMarco* | | | | | | |

| James D. Kirsner | | | | | | X |

| James P. Roemer | | | | X | | X |

| John H. Scully | | | | X | | X |

| Wendell G. Van Auken | | Chair | | | | X |

| William F. Zuendt | | X | | | | Chair |

| Total Meetings in 2005 | | 31 | | 4 | | 2 |

| Total Actions by Unanimous Written Consent in 2005 | | 0 | | 14 | | 2 |

- *

- Chief Executive Officer

Audit Committee. As of the date of this proxy statement, the Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, consists of Messrs. Van Auken and Zuendt and Ms. Carlitz, each of whom is "independent," as defined by the listing standards of The Nasdaq Stock Market for audit committee members and meets the criteria for independence under Rule 10A-3(b)(1) of the Exchange Act. Effective as of our annual meeting date, Mr. Kirsner will join our Audit Committee. The Board of Directors has determined that Messrs. Kirsner, Van Auken and Zuendt and Ms. Carlitz are "audit committee financial experts" as defined under the rules of the

5

Securities and Exchange Commission (the "SEC"). The Audit Committee acts pursuant to a written charter adopted and approved by the Board of Directors, which is available at the Company's web site,www.advent.com. The Audit Committee is responsible for, among other things, assisting the Board of Directors in fulfilling its responsiblities for oversight of (i) the integrity of the financial statements of the Company, (ii) the compliance by the Company with legal and regulatory requirements related to financial affairs and reporting, (iii) the qualifications, independence and performance of the Company's independent registered public accounting firm and (iv) the system of internal controls regarding finance, accounting and legal compliance of the Company. See also "Report of the Audit Committee of the Board of Directors".

Compensation Committee. As of the date of this proxy statement, the Compensation Committee consists of Messrs. Battle, Scully and Roemer and Ms. Carlitz, each of whom is "independent" as defined in the listing standards of The Nasdaq Stock Market. The Compensation Committee acts pursuant to a written charter adopted and approved by the Board of Directors, which is available at the Company's web site,www.advent.com. The Compensation Committee is responsible for, among other things, (i) reviewing and approving the compensation and benefits for the Company's officers and other employees, (ii) administering the Company's stock purchase and stock option plans, and (iii) making recommendations to the Board of Directors regarding such matters. See also "Report of the Compensation Committee of the Board of Directors".

Corporate Governance and Nominating Committee. As of the date of this proxy statement, the Corporate Governance and Nominating Committee consists of all of the directors other than Ms. DiMarco, each of whom is "independent" as defined in the listing standards of The Nasdaq Stock Market. The Corporate Governance and Nominating Committee acts pursuant to a written charter adopted and approved by the Board of Directors, which is available at the Company's web site,www.advent.com. The Corporate Governance and Nominating Committee is responsible for (i) overseeing compliance by the Board of Directors and its committees with applicable laws and regulations, including those promulgated by the SEC and the listing standards of The Nasdaq Stock Market, (ii) development of general criteria regarding the qualifications and selection of board members and recommending candidates for election to the Board of Directors, (iii) developing overall governance guidelines, (iv) overseeing the performance and compensation of the Board of Directors, and (v) reviewing and making recommendations regarding the composition and mandate of Board committees.

Director Compensation

As discussed above, the Corporate Governance and Nominating Committee evaluates and makes recommendations to the Board regarding the form and amount of compensation for non-employee directors. Directors who are employees of Advent receive no compensation for service on the Board. Advent's director compensation program is designed to enable continued attraction and retention of highly qualified directors by ensuring that director compensation is in line with peer companies competing for director talent, and is designed to address the time, effort, expertise and accountability required of active Board membership. In general, the Corporate Governance and Nominating Committee and the Board believe that annual compensation for non-employee directors should consist of both a cash component, designed to compensate members for their service on the Board and its Committees, and an equity component, designed to align the interests of directors and shareowners and, by vesting over time, to create an incentive for continued service on the Board.

The Corporate Governance and Nominating Committee annually reviews director compensation, including, among other things, comparing Advent's director compensation practices with those of other public companies of comparable size. In conducting such review, the committee may, in its discretion, retain the services of a compensation consultant.

6

Cash Compensation. Each non-employee director, other than the Chairman of the Board, receives an annual retainer of $30,000, and the Chairman of the Board receives an annual retainer of $40,000. The Chair of the Audit Committee receives an annual fee of $25,000, and the directors who serve on the Audit Committee receive $15,000 per annum. The Chair of the Compensation Committee receives an annual fee of $15,000, and the directors who serve on the Compensation Committee receive $10,000 per annum. The Chair of the Corporate Governance and Nominating Committee receives an annual fee of $10,000, and the directors who serve on the Corporate Governance and Nominating Committee receive $5,000 per annum.

All retainers and fees are paid quarterly, and the non-employee directors are eligible for reimbursement of their expenses incurred in connection with attendance at Board meetings in accordance with Advent policy.

Option Grants. Non-employee directors had been eligible to participate in the Company's 1995 Director Option Plan (the "Director Plan"). Under the Director Plan, each non-employee director was automatically granted an option to purchase 30,000 shares on the date upon which such person first became a director (the "Initial Options") with an exercise price equal to the fair market value of the Company's Common Stock on the date of grant. Thereafter, each non-employee director was automatically granted an option to purchase 6,000 shares of Common Stock on December 1st of each year (the "Annual Options"), provided he or she had served as a director for at least six months as of such date. Options granted under the Director Plan have a term of ten years unless terminated sooner upon termination of the optionee's status as a director or otherwise pursuant to the terms of the Director Plan. Initial Options granted under the Director Plan vest as to twenty percent (20%) of the shares on the first anniversary date of grant and the remaining 80% of the shares vest in equal monthly installments over the ensuing four years. Approximately 8.33% of the shares subject to the Annual Options grants vest four years and one month after the date of grant and the remaining shares shall vest in equal monthly installments over the next 11-month period.

The Director Plan terminated in November 2005 and there were no options granted under this plan during 2005.

Directors are eligible to be granted options under the 2002 Stock Plan. Effective April 1, 2005, each non-employee director is eligible to receive (i) an initial option grant of 30,000 shares upon joining the Board, which shall vest over four years with 25% vesting after one year of service and in equal monthly installments over the ensuing three years, and (ii) on each annual meeting date an annual grant of 12,000 shares vesting in 12 equal monthly installments. Options have a term of ten years, unless terminated sooner upon termination of the optionee's status as a director or otherwise pursuant to the 2002 Stock Plan. The Corporate Governance and Nominating Committee may recommend changes to the levels of option grants, which must be approved by the full Board.

Corporate Governance Matters

Code of Ethics. Advent's Board of Directors has adopted a Code of Business Ethics and Conduct for its directors, officers, and employees, including its principal executive and senior financial officers, which is available on Advent's web site,www.advent.com. If the Board makes any substantive amendment to this Code of Business Ethics and Conduct or grants any waiver, including any implicit waiver, from the provision of the Code to one of our principal executive or senior financial officers, we will disclose the nature of the amendment or waiver on Advent's web site, located atwww.advent.com, or in a current report on Form 8-K.

Independence of the Board of Directors. The Board has determined that all directors other than Ms. DiMarco are "independent directors" as defined in the listing standards of The Nasdaq Stock Market.

7

Contacting the Board of Directors. Any stockholder who desires to contact our Chairman of the Board or the other members of our Board of Directors may do so by writing to: Board of Directors, c/o Chairman of Corporate Governance and Nominating Committee, Advent Software, Inc., 301 Brannan Street, San Francisco, California 94107. Communications will be distributed to the Chairman of the Board or the other members of the Board as appropriate depending on the facts and circumstances outlined in the communication received.

Attendance at annual stockholder meetings by the Board of Directors. Although the Company does not have a formal policy regarding attendance by members of the Board at the Company's annual meeting of stockholders, the Company encourages, but does not require, directors to attend. At the time of the Company's 2005 annual meeting, the Company had six directors, all of whom attended the meeting.

Process for nominating candidates for election to the Board of Directors. Stockholder nominations to the Board of Directors must meet the requirements set forth in Section 2.5 of the Company's Bylaws. Under these requirements, nominations for election to the Board of Directors may be made at a meeting of stockholders by any stockholder who is entitled to vote in the election of directors and provides timely written notice to the Secretary of the Company. This notice must contain specified information concerning the nominee and concerning the stockholder proposing the nomination. In order to be timely, a stockholder's notice must be delivered to or mailed and received by the Secretary of the Company not less than 120 calendar days before the one year anniversary of the date on which the Company first mailed its proxy statement to stockholders in connection with the previous year's annual meeting of stockholders. For a copy of the Company's Bylaws, please write to the Corporate Secretary at the Company's executive offices set forth above.

Process for recommending candidates for election to the Board of Directors. The Corporate Governance and Nominating Committee is responsible for, among other things, determining the criteria for membership to the Board of Directors and recommending candidates for election to the Board of Directors. It is the policy of the Committee to consider recommendations for candidates to the Board of Directors from stockholders. Stockholder recommendations for candidates to the Board of Directors must be directed in writing to Advent Software, Inc., Corporate Secretary, 301 Brannan Street, San Francisco, California 94107, and must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years, and evidence of the recommending person's ownership of the Company's Common Stock.

The Committee's general criteria and process for evaluating and identifying the candidates that it selects, or recommends to the full Board for selection, as director nominees, are as follows:

- •

- The Committee regularly reviews the composition and size of the Board.

- •

- In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the Committee seeks to achieve a balance of knowledge, experience and capability on the Board and considers (1) the size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board, (2) such factors as issues of character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like, and (3) such other factors as the Committee may consider appropriate.

- •

- While the Committee has not established specific minimum qualifications for Director candidates, the Committee believes that candidates and nominees must reflect a Board that is comprised of directors who (1) are predominantly independent, (2) are of high integrity, (3) have broad, business-related knowledge and experience at the policy-making level in business, or technology, including an understanding of the financial services industry and

8

Advent's business in particular, (4) have qualifications that will increase overall Board effectiveness and (5) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to Audit Committee members.

- •

- With regard to candidates who are properly recommended by stockholders or by other means, the Committee will review the qualifications of any such candidate, which review may, at the Committee's discretion, include interviewing references for the candidate, direct interviews with the candidate, background checks by the Committee or by a third party service provider or other actions that the Committee deems necessary or proper.

- •

- In evaluating and identifying candidates, the Committee has the authority to retain and terminate any third-party search firm that is used to identify director candidates, and has the authority to approve the fees and retention terms of any search firm.

- •

- The Committee will apply these same principles when evaluating Board candidates who may be elected initially by the full Board to fill vacancies or add additional directors prior to the annual meeting of stockholders at which directors are elected.

- •

- After completing its review and evaluation of director candidates, the Committee recommends to the full Board of Directors the director nominees for selection.

Required Vote

The eight nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them shall be elected as directors, whether or not such affirmative votes constitute a majority of the shares voted. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum for the transaction of business, but they have no legal effect under Delaware law.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE NOMINEES LISTED ABOVE.

9

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has selected PricewaterhouseCoopers LLP, independent registered public accounting firm, to audit the financial statements of the Company for the year ending December 31, 2006. PricewaterhouseCoopers LLP has audited the Company's financial statements since 1989. A representative of PricewaterhouseCoopers LLP is expected to be present at the meeting, where they will be available to respond to appropriate questions and, if they desire, to make a statement.

FEES TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

SERVICES RENDERED DURING FISCAL YEAR 2005

The following table presents fees for professional audit services rendered by PricewaterhouseCoopers LLP for the audit of our annual financial statements for the year ended December 31, 2005 and 2004 and fees incurred for other services rendered by PricewaterhouseCoopers during those periods.

| | 2005

| | 2004

|

|---|

| Audit Fees(1) | | $ | 1,702,648 | | $ | 1,966,194 |

| Tax(2) | | | 6,899 | | | 21,731 |

| | |

| |

|

| Total | | $ | 1,709,547 | | $ | 1,987,925 |

| | |

| |

|

- (1)

- The audit fees for the year ended December 31, 2005 and 2004 reflect fees incurred for professional services rendered in connection with the integrated audits of the Company's annual financial statements and internal control over financial reporting, reviews of the Company's quarterly financial statements, issuance of consents, and assistance with review of documents filed with the SEC.

- (2)

- The tax fees for the years ended December 31, 2005 and 2004 were for services related to tax compliance, tax advice, and tax planning including the preparation and review of federal, state and international tax returns and assistance with tax audits.

Under the Charter of the Audit Committee, the Audit Committee has to pre-approve audit and permissible non-audit services provided to the Company by the independent registered public accounting firm. The Audit Committee may delegate to one or more designated members of the Audit Committee the authority to pre-approve audit and permissible non-audit services, provided such pre-approval decision is presented to the full Audit Committee at its scheduled meetings.

For the year ended December 31, 2005 and 2004, all audit fees and tax fees shown in the table above were pre-approved by the Audit Committee.

Required Vote

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm is not required by the Company's Bylaws, or other applicable legal requirement. However, as a matter of good corporate practice, the Board of Directors has conditioned its appointment of the Company's independent registered public accounting firm upon the receipt of the affirmative vote of a majority of the shares represented, in person or by proxy, and duly cast at the Annual Meeting, which shares voting affirmatively also constitute at least a majority of the required quorum. In the event that the stockholders do not approve the selection of PricewaterhouseCoopers LLP, the appointment of the independent registered public accounting firm

10

will be reconsidered by the Audit Committee and the Board of Directors. Even if the selection is ratified, the Board at its discretion and at the direction of the Audit Committee may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP, AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2006. THE EFFECT OF AN ABSTENTION IS THE SAME AS A VOTE "AGAINST" THE RATIFICATION OF THE APPOINTMENT.

11

BENEFICIAL SECURITY OWNERSHIP OF MANAGEMENT

AND CERTAIN BENEFICIAL OWNERS

The following table sets forth the beneficial ownership of Common Stock of the Company as of March 24, 2006 for the following: (i) each person or entity who is known by the Company to own beneficially more than 5% of the outstanding shares of the Company's Common Stock; (ii) each of the Company's directors or nominees for director; (iii) the Company's Chief Executive Officer and each of the officers ("Named Officers") named in the Summary Compensation Table on page 15 hereof; and (iv) all directors and executive officers of the Company as a group.

5% Stockholders, Directors and Officers

| | Shares

Beneficially

Owned(1)

| | Percentage

Beneficially

Owned(1)(2)

|

|---|

| 5% Stockholders | | | | |

SPO Partners & Co.(3)(4)

591 Redwood Highway, Suite 3215

Mill Valley, CA 94941 |

|

6,411,300 |

|

21.32 |

Legg Mason Inc.(3)(5)

399 Park Avenue

New York, NY 10022 |

|

4,532,847 |

|

15.08 |

Ameriprise Financial Inc.(3)

145 Ameriprise Financial Center

Minneapolis, MN 55474 |

|

1,561,900 |

|

5.19 |

DiMarco/Harleen Revocable Trust(6)

c/o Advent Software, Inc.

301 Brannan Street

San Francisco, CA 94107 |

|

2,307,631 |

|

7.67 |

|

Directors and Named Officers |

|

|

|

|

John H. Scully(7) |

|

6,438,300 |

|

21.41 |

Stephanie G. DiMarco(6) |

|

2,307,631 |

|

7.67 |

Terry H. Carlitz(8) |

|

31,500 |

|

* |

James P. Roemer(9) |

|

25,000 |

|

* |

Wendell G. Van Auken(10) |

|

71,700 |

|

* |

William F. Zuendt(11) |

|

71,500 |

|

* |

Dan T. H. Nye(12) |

|

180,872 |

|

* |

Graham V. Smith(13) |

|

168,346 |

|

* |

David P. Hess(14) |

|

64,359 |

|

* |

Lily S. Chang(15) |

|

517,739 |

|

1.72 |

A. George Battle |

|

5,000 |

|

* |

All directors and executive officers as a group (13 persons)(16) |

|

9,923,231 |

|

33.00 |

- *

- Less than 1%

12

- (1)

- The number and percentage of shares beneficially owned is determined under rules of the Securities and Exchange Commission (the "SEC"), and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within sixty days of March 24, 2006 through the exercise of any stock option or other right. Unless otherwise indicated in the footnotes, each person has sole voting and investment power (or shares such powers) with respect to the shares shown as beneficially owned.

- (2)

- The total number of shares of the Company's common stock outstanding as of March 24, 2006 was 30,068,248.

- (3)

- This information was obtained from filings made with the SEC pursuant to Sections 13(d), 13(f) or 13(g) of the Exchange Act.

- (4)

- 5,766,600 of the shares of common stock are owned directly by SPO Partners II, LP and indirectly by SPO Advisory Parters, LP in its capacity as the sole general partner of SPO Partners and SPO Advisory Corp., in its capacity as the sole general partner of SPO Advisory. 644,700 of the shares of common stock are owned directly by San Francisco Partners II, LP and indirectly by SF Advisory Partners, LP in its capacity as the sole general partner of SF Partners LP and SPO Advisory Corp., in its capacity as the sole general partner of SF Advisory.

- (5)

- Includes 3,092,826 shares of common stock benefically owned by CAM North America LLC, 1,398,205 shares of common stock benefically owned by Smith Barney Fund Management LLC, 2,800 shares of common stock beneficially owned by TIMCO Asset Management Inc., and 39,016 shares of common stock benefically owned by Salomon Brothers Asset Management Inc., as jointly reported on Schedule 13G filed on January 10, 2006.

- (6)

- Ms. DiMarco is President and Chief Executive Officer of the Company. Share amounts include 1,253,536 shares of common stock held in the name of DiMarco/Harleen Revocable Living Trust, 154,827 shares of Common Stock held in the name of DiMarco/Harleen 1996 Charitable Trust, 2,200 shares held in the name of the DiMarco/Harleen 1995 Children's Trust, 62,563 shares held in the name of the Stephanie DiMarco Annuity Trust DTD 1/23/03, 62,563 shares held in the name of the James B. Harleen Annuity Trust DTD 1/23/03 and 1,400 shares that held in the Pauline DiMarco Irrevocable Trust in which Stephanie DiMarco and James Harleen disclaim beneficial ownership. In addition, includes options to purchase 756,042 shares of Common Stock exercisable within 60 days of March 24, 2006.

- (7)

- Includes 6,411,300 shares held by SPO Partners & Co., a company in which Mr. Scully serves as a managing director and 27,000 shares of Common Stock exercisable by Mr. Scully within 60 days of March 24, 2006. 5,766,600 of the shares of common stock are owned directly by SPO Partners II, LP and indirectly by SPO Advisory Parters, LP in its capacity as the sole general partner of SPO Partners and SPO Advisory Corp., in its capacity as the sole general partner of SPO Advisory. 644,700 of the shares of common stock are owned directly by San Francisco Partners II, LP and indirectly by SF Advisory Partners, LP in its capacity as the sole general partner of SF Partners LP and SPO Advisory Corp., in its capacity as the sole general partner of SF Advisory.

- (8)

- Includes options to purchase 31,500 shares of common stock exercisable within sixty days of March 24, 2006.

- (9)

- Includes options to purchase 25,000 shares of common stock exercisable within sixty days of March 24, 2006.

- (10)

- Share amounts include 27,200 shares held by Wendell G. & Ethel S. Van Auken Trust and options to purchase 44,500 shares of common stock exercisable within sixty days of March 24, 2006.

13

- (11)

- Share amounts include 45,000 shares held by the Zuendt Family Trust. Includes options to purchase 26,500 shares of common stock exercisable within sixty days March 24, 2006.

- (12)

- Includes options to purchase 168,834 shares of common stock exercisable within sixty days of March 24, 2006.

- (13)

- Includes options to purchase 164,417 shares of common stock exercisable within sixty days of March 24, 2006.

- (14)

- Includes options to purchase 57,216 shares of common stock exercisable within sixty days of March 24, 2006.

- (15)

- Includes 4,000 common shares held by the Lily S. Chang Charitable Remainder Trust and 220,551 held by the Lily S. Chang Trust. In addition, includes options to purchase 280,667 shares of common stock exercisable within sixty days of March 24, 2006.

- (16)

- Includes options to purchase 1,619,177 shares of common stock exercisable within sixty days of March 24, 2006.

COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT

Section 16(a) of the Exchange Act ("Section 16(a)") requires the Company's officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities, to file reports of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the SEC. Such officers, directors and ten-percent stockholders are also required by SEC rules to furnish the Company with copies of all such forms that they file.

Other than as provided in this proxy statement, based solely on its review of the copies of such forms received by the Company, or written representations from certain reporting persons that all Forms required for such persons were filed, the Company believes that during 2005 all Section 16(a) filing requirements applicable to its officers, directors and ten-percent stockholders were complied with, except for Mr. Battle's Form 3 which was subsequently amended on Form 3/A in April 2006.

14

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company's Compensation Committee was formed in October 1995 and as of the date hereof is composed of Ms. Carlitz and Messrs. Battle, Roemer and Scully. No interlocking relationship exists between any member of the Company's Board of Directors or Compensation Committee and any member of the board of directors or compensation committee of any other company, nor has any such interlocking relationship existed in the past. No member of the Compensation Committee is or was formerly an officer or an employee of the Company or its subsidiaries.

The Company has entered into indemnification agreements with each of its directors and officers. Such agreements require the Company to indemnify such individuals to the fullest extent permitted by law.

EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The following table summarizes compensation paid to the Chief Executive Officer and each of the four other most highly compensated executive officers whose salary plus bonus exceeded $100,000 for the year ended December 31, 2005:

| |

| | Annual Compensation

| | Long-term

Compensation

Awards

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

$

| | Bonus

$

| | Securities

Underlying

Options (#)

| | All Other

Compensation(1)

$

|

|---|

Stephanie G. DiMarco

Chief Executive Officer and President | | 2005

2004

2003 | | 360,000

360,000

3,406 | | 240,000

227,003

— | | 115,000

200,000

100,000 | | 33,257

14,131

13,651 |

David P. Hess(2)

Senior Vice President |

|

2005

2004

2003 |

|

245,000

225,000

— |

|

143,000

54,977

— |

|

—

60,000

— |

|

14,744

22,566

— |

Dan T. H. Nye(3)

Executive Vice President |

|

2005

2004

2003 |

|

260,000

260,000

240,000 |

|

176,250

218,962

58,830 |

|

40,000

—

245,000 |

|

16,913

21,421

11,625 |

Graham V. Smith(4)

Executive Vice President, Chief

Financial Officer and Secretary |

|

2005

2004

2003 |

|

300,000

300,000

231,846 |

|

164,316

217,273

76,830 |

|

40,000

—

245,000 |

|

16,090

20,310

3,456 |

Lily S. Chang

Executive Vice President |

|

2005

2004

2003 |

|

270,000

270,000

240,000 |

|

172,141

213,184

43,830 |

|

40,000

—

20,000 |

|

16,324

8,779

9,833 |

- (1)

- Includes contributions made by the Company pursuant to the 401(k) Plan, premiums paid for life insurance where the Company is not the beneficiary, and amounts paid for health care, gym memberships, car allowance and parking benefits.

- (2)

- Mr. Hess was not an executive officer in 2003, but was paid salary and bonuses of $265,663 and all other compensation of $44,603 in 2003. In addition, Mr. Hess was granted options to purchases 79,332 shares of Common Stock in 2003.

15

- (3)

- Mr. Nye was granted options to purchase 200,000 shares of Common Stock in 2002. These options were cancelled and reissued in 2003 in conjunction with the Company's Stock Option Exchange program.

- (4)

- Mr. Smith joined Advent in January 2003.

Option Grants In Last Fiscal Year

The following table shows, as to each of the officers named in the Summary Compensation Table, information concerning stock options granted during the year ended December 31, 2005.

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation

for Option Term(4)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(1)

| | Percent of

Total Options

Granted to

Employees in

Year(2)

| |

| |

|

|---|

Name

| | Exercise

Price

Per Share

| | Expiration

Date(3)

|

|---|

| | 5%

| | 10%

|

|---|

| Stephanie G. DiMarco | | 115,000 | | 8.2 | % | $ | 18.25 | | 1/2/2014 | | $ | 1,319,893 | | $ | 3,344,867 |

David P. Hess |

|

— |

|

— |

|

|

— |

|

— |

|

$ |

— |

|

$ |

— |

Dan T. H. Nye(5) |

|

40,000 |

|

2.9 |

% |

$ |

18.25 |

|

1/28/2015 |

|

$ |

459,093 |

|

$ |

1,163,432 |

Graham V. Smith(5) |

|

40,000 |

|

2.9 |

% |

$ |

18.25 |

|

1/28/2015 |

|

$ |

459,093 |

|

$ |

1,163,432 |

Lily S. Chang(5) |

|

40,000 |

|

2.9 |

% |

$ |

18.25 |

|

1/28/2015 |

|

$ |

459,093 |

|

$ |

1,163,432 |

- (1)

- The option grants to officers noted in this table were all granted under the 2002 Stock Plan and have exercise prices equal to the fair market value on the date of grant. All such options have ten-year terms and vest over a five-year period

- (2)

- The Company granted options to purchase 1,402,980 shares of Common Stock in 2005.

- (3)

- Options may terminate before their expiration upon the termination of optionee's status as an employee or consultant, the optionee's death or an acquisition of the Company.

- (4)

- Potential realizable value assumes that the stock price increases from the exercise price from the date of grant until the end of the option term (10 years) at the annual rate specified (5% and 10%). The assumed annual rates of appreciation are specified in SEC rules and do not represent the Company's estimate or projection of future stock price growth. The Company does not necessarily agree that this method can properly determine the value of an option.

- (5)

- Officers Nye, Smith and Chang were each granted options to purchase 40,000 shares of Common Stock in January 2005.

Option Exercises and Holdings

The following table sets forth, for each of the officers in the Summary Compensation Table, certain information concerning stock options exercised during 2005, and the number of shares subject to both exercisable and unexercisable stock options as of December 31, 2005. Also reported are values for "in-the-money" options that represent the positive spread between the respective exercise prices of outstanding stock options and the fair market value of the Company's Common Stock as of December 31, 2005.

16

Aggregated Option Exercises in 2005 and 2005 Year-end Option Values

| |

| |

| | Number of Securities

Underlying Unexercised

Options at Year End

| | Value of Unexercised

In-the-Money Options

at Year End ($)(1)

|

|---|

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Stephanie G. DiMarco | | — | | $ | — | | 525,719 | | 339,281 | | $ | 9,506,354 | | $ | 3,617,496 |

| David P. Hess | | 10,416 | | $ | 147,914 | | 58,466 | | 75,617 | | $ | 555,320 | | $ | 809,182 |

| Dan T. H. Nye | | 26,167 | | $ | 306,488 | | 152,000 | | 106,833 | | $ | 1,630,336 | | $ | 1,109,550 |

| Graham V. Smith | | 5,000 | | $ | 80,607 | | 137,000 | | 143,000 | | $ | 1,995,895 | | $ | 1,940,305 |

| Lily S. Chang | | 14,021 | | $ | 251,180 | | 197,000 | | 45,000 | | $ | 1,554,357 | | $ | 494,380 |

- (1)

- Market value of underlying securities based on the closing price of the Company's Common Stock on December 30, 2005 (the last trading day of 2005) on The Nasdaq National Market of $28.91 minus the exercise price.

Equity Compensation Plan Information

The following table summarizes as of December 31, 2005, the number of outstanding options granted to employees, directors and non-employees, as well as the number of securities remaining available for future issuance, under the Company's compensation plans:

| | (a)

| | (b)

| | (c)

| |

|---|

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities remaining

available for future issuance

under equity compensation

plans excluding securities

reflected in column (a)

| |

|---|

| Equity compensation plans approved by security holders | | 5,450,910 | | $ | 19.26 | | 4,964,196 | (1) |

| | |

| |

| |

| |

| Equity compensation plans not approved by security holders(2) | | 38,560 | | $ | 18.96 | | 27,298 | |

| | |

| |

| |

| |

| Total | | 5,489,470 | | $ | 19.26 | | 4,991,494 | |

| | |

| |

| |

| |

- (1)

- Advent's 1995 Employee Stock Purchase Plan expired on 10/5/05. Includes 1,927,983 shares available for future issuance under the 2005 Employee Stock Purchase Plan.

- (2)

- Amounts correspond to Advent's 1998 Non-statutory Stock Option Plan, described below.

Our 1998 Non-statutory Stock Option Plan, which was not subject to stockholder approval, was adopted in 1998. This plan permitted the grant of options to purchase up to 300,000 shares to be granted to eligible employees. Officers and members of the Board of Directors are not eligible to participate in this plan. The plan is intended to help the Company attract and retain outstanding individuals in order to promote the Company's success. Only non-statutory stock options may be granted under the plan. The plan is administered by the Board of Directors. This includes the number of shares covered by each option, its exercise price, any conditions to exercise and the term of the option. Our Board of Directors generally is authorized to amend or terminate the plan, but no amendment or termination of the plan may adversely affect any option previously granted under the plan without the written consent of the participant. See Note 11 of Notes to Consolidated Financial Statements, contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2005, for a further description of the terms of the plan.

17

Repricing Table

The following table sets forth certain information regarding all repricings of options held by any executive officer during the period that the Company has been subject to the Exchange Act reporting requirements (which period is less than 10 years):

Name

| | Date

| | Number of

Securities

Underlying

Options/ SARs

repriced or

Amended (#)

| | Market Price of

Stock at Time of

Repricing or

Amendment ($)

| | Exercise Price

at Time of

Repricing or

Amendment ($)

| | New

Exercise

Price ($)

| | Length of Original

Option Term

Remaining at

Date of Repricing

or Amendment

|

|---|

John Geraci

Former Executive Vice

President, Marketing and

Client Services | | 6/5/03 | | 225,000 | | $ | 14.65 | | $ | 20.90 | | $ | 18.88 | | 7 years 300 days |

Dan Nye

Executive Vice President,

Sales and Services |

|

6/5/03 |

|

200,000 |

|

$ |

14.65 |

|

$ |

28.32 |

|

$ |

18.88 |

|

8 years 336 days |

CHANGE IN CONTROL ARRANGEMENTS

Options to purchase shares of the Company's Common Stock held by the Named Executive Officers and the Company's non-employee directors have been granted under the 2002 Stock Plan or the 1992 Stock Plan. In the event of a change in control of the Company, the successor corporation must assume the option, substitute an equivalent award, convert the option into an option to purchase the consideration received by the stockholders of the Company or cancel the option after payment to the optionee of the fair market value of the shares subject to the option, less the exercise price. If there is no assumption, substitution, conversion or payment, such options will become fully vested and exercisable prior to the change in control.

In March 2006, the Compensation Committee authorized the Company to enter into an Executive Severance Plan for the benefit of certain of the Company's senior executive officers in an effort to ensure the continued service of the Company's key executives. Under the terms of the Executive Severance Plan, each senior executive officer, including the Chief Executive Officer and Chief Financial Officer, is entitled to certain payments if the executive's employment with the Company terminates other than voluntarily or for cause. If the executive's employment is terminated other than voluntarily or for cause, then the executive is entitled to receive severance pay at a rate equal to their base salary rate then in effect for a period of twelve months from termination, continued coverage of Company health benefits for twelve months, and have all the executive's equity awards accelerate as to twelve months of additional vesting. If the executive's employment is terminated for death or disability, then executive is entitled to receive pay at a rate equal to their base salary then in effect for a period of six months from termination and continued coverage of Company health benefits for six months. If the executive's employment is terminated other than voluntarily without good reason or for cause and within twelve months of a change of control, then the executive will receive pay at a rate equal to their base salary for a period of twelve months from termination, continued coverage of Company health benefits for twelve months, and have all the executive's equity awards accelerate as to thirty months of additional vesting

18

CERTAIN RELATIONSHIPS

John Scully, Chairman of our Board of Directors, served on the board of directors of ProQuest Company from 1988 to 2003. During part of this period, James Roemer, another of our directors, was Chairman and CEO of ProQuest. In addition, Messrs. Roemer and Battle own less than a 1% interest in SPO Partners II, L.P., an investment partnership managed by SPO Partners & Co., of which Mr. Scully is a Managing Director.

James Kirsner, member of our Board of Directors, served on the board of directors of Ask Jeeves, Inc. from 2001 to 2005. During this period, A. George Battle, another of our directors, was Executive Chairman or CEO of Ask Jeeves, Inc.

As of December 31, 2004, Citigroup, Inc. ("Citigroup") owned approximately 12% of the voting stock of Advent. Effective December 1, 2005, Citigroup sold the Asset Management division of Citigroup Global Markets Inc. to Legg Mason, Inc. ("Legg Mason"). As of December 31, 2005, Citigroup owned less than 5% of the voting stock of Advent. Advent recognized approximately $2.1 million and $1.1 million of revenue from Citigroup during fiscal 2005 and 2004, respectively. The Company's accounts receivable from Citigroup was $0.3 million and $0.7 million as of December 31, 2005 and 2004, respectively. As of December 31, 2005, Legg Mason owned approximately 15% of the voting stock of Advent. Advent recognized approximately $0.4 million of revenue from Legg Mason during fiscal 2005. The Company's accounts receivable from Legg Mason was $0.1 million as of December 31, 2005.

19

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

As of the date of this proxy statement, the Compensation Committee of the Board of Directors (the "Committee") consists of directors A. George Battle, Terry H. Carlitz, James P. Roemer and John H. Scully, none of whom is an employee or officer of the Company. Ms. Carlitz is the Chair of the Compensation Committee. The Committee's purpose is to:

- •

- provide oversight of the Company's compensation policies, plans and benefits programs;

- •

- assist the Board in discharging its responsibilities relating to (i) oversight of the compensation of the Company's Chief Executive Officer and other executive officers (including officers reporting under Section 16 of the Exchange Act), and (ii) approving and evaluating the executive officer compensation plans, policies and programs of the Company; and

- •

- review and recommend for Board approval the Company's equity compensation plans for its executive officers and employees.

The roles and responsibilities of the Compensation Committee are reflected in a written charter, which is periodically reviewed and revised by the Committee and the Board. The Compensation Committee meets at scheduled times during the year and holds additional meetings from time to time to review and discuss executive compensation issues. The Compensation Committee may also consider and take action by written consent. Advent's Human Resources Department supports the Compensation Committee in its work and in some cases acts pursuant to delegated authority to fulfill various functions in administering Advent's compensation programs. The Compensation Committee has the authority to engage the services of outside advisers, experts and others to assist the Committee. During 2005, the Committee employed an independent consultant to provide advice and information relating to executive and director compensation. The independent consultant assisted the Committee in the creation of executive bonus structures, equity incentives and in evaluating base salary levels.

Executive Compensation Philosophy

Advent's executive compensation program is designed to achieve four primary objectives:

- •

- Attract and retain highly skilled executives who will create and sustain stockholder value.

- •

- Reinforce a sense of urgency to improve market position and achieve the Company's operational objectives.

- •

- Support a strong pay-for-performance culture that provides market-leading compensation commensurate with outstanding performance.

- •

- Align the interests of the executive officers with the long-term interests of the Company's stockholders, thereby enhancing stockholder value.

The main components the Company has used to support these objectives are base salary, annual cash incentive and stock options. For each of these three elements, Advent's strategy has been to examine peer group compensation practices and target the 50thpercentile of the peer group for base salary and 50th to 60th percentile for total cash and equity compensation. However, the Compensation Committee has historically approved compensation levels for officers above and below the target pay position based on individual and company performance relative to the peer group to ensure an appropriate pay-for-performance alignment.

Peer Group

The Compensation Committee examines the compensation practices of two peer groups to assess the competitiveness of executive officer compensation practices and levels. The first peer group ("Current Peers") includes software companies that are in a similar range with respect to several

20

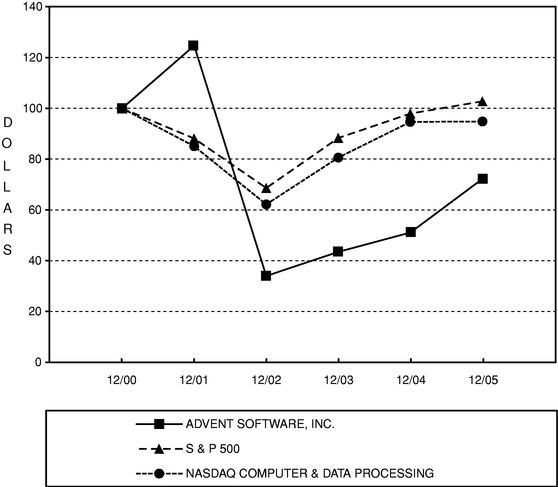

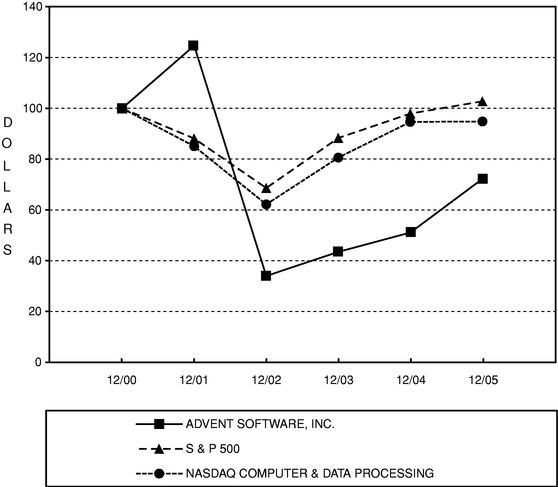

metrics, principally business strategy, market capitalization, revenue, and number of employees. The pay practices of the Current Peers are the primary benchmark used when considering the competitiveness of officer compensation levels. The second peer group ("Next Stage Peers") includes software companies deemed to be industry leaders as measured by financial performance, stockholder value creation and market share. The compensation policies of Next Stage Peers are reviewed so that the Compensation Committee can understand best compensation practices of highly successful companies and determine whether any of these practices have applicability to Advent. The companies in either peer group may include some or all of the companies that are included in the market indices in the graph included under "Performance Measurement Comparison" in this proxy statement, labor market competitors and other companies regarded as having executive compensation best practices.

The peer group is reviewed annually by the Compensation Committee and adjustments are made as necessary to ensure the group continues to properly reflect the market in which Advent competes for talent. The Compensation Committee also reviews annually the executive pay practices of other similarly situated companies as reported in industry surveys and reports from compensation consulting firms. This information is considered when making recommendations for each element of compensation.

Elements of Compensation

Compensation for officers and key employees includes both cash and equity elements, as further described below.

Cash compensation consists of base salary, which is determined by the level of responsibility, expertise and experience of the employee, and competitive conditions in the industry. Based on the experience of the Committee members and on a third party compensation consultant, the Committee believes that the salaries of its officers fall within the software industry norm. In addition, cash bonuses may be awarded to officers and other key employees. Compensation for sales personnel also includes sales commissions tied to annual and quarterly targets.

Advent uses the annual bonus program to reward the contribution of the executive officers toward the achievement of key corporate objectives. Executive officer target bonus opportunities range from approximately 40% to 50% of base salary. Officers may earn up to 200% of their target annual bonus award based on overachievement of the plan goals. At the beginning of each year, the Board of Directors or the Compensation Committee approves specific goals for the upcoming year, for purposes of its bonus plan. In addition to traditional measures of corporate and business unit performance, such as revenue and profit performance, the Compensation Committee emphasizes other indications of performance, including individual performance, and approves associated weightings. These accomplishments necessarily involve a subjective assessment of corporate performance by the Compensation Committee. Moreover, the Compensation Committee does not base its considerations on any single performance factor, but rather considers a mix of factors and evaluates company and individual performance against that mix.

In the first quarter of the year following the fiscal year for which bonuses are to be paid and before payment, the Board of Directors or the Compensation Committee approves the percent of goal achieved for each corporate goal, along with the overall percent of corporate goal achievement for purposes of bonus plan payouts.

Compensation tied to the performance of the Company's Common Stock is a key element of executive compensation. Officers and other employees of the Company are eligible to participate in the

21

2002 Stock Plan and the 2005 Employee Stock Purchase Plan (the "Purchase Plan" and, collectively with the 2002 Stock Plan, the "Option Plans"), which was adopted in May of 2005 to replace our expiring 1995 Employee Stock Purchase Plan. The Option Plans permit the Board of Directors or the Committee to grant stock options and other equity vehicles to employees on such terms as the Board or the Committee may determine subject to the limitations of the plans. The Committee, or a sub-committee consisting of Ms. DiMarco in the case of non-executive grants under our 2002 Stock Plan, currently administers stock option grants to employees.

In determining the size of a stock option grant to a new officer or other key employee, the Committee takes into account equity participation by comparable employees within the Company, external competitive circumstances and other relevant factors. The Committee has also adopted a set of guidelines for use with option grants to employees other than executive officers which were established using information gathered by an independent third party consultant in order to assist with option grants, and will only grant options outside of such guidelines with specific documentation regarding the reason for the differential. Additional options may be granted to current employees to reward exceptional performance or to provide additional unvested equity incentives.

The Employee Stock Purchase Plan permits employees to acquire Common Stock of the Company through payroll deductions and promotes broad-based equity participation throughout the Company. The Committee believes that both of its Option Plans align the interests of the employees with the long-term interests of the stockholders.

Due to changes in equity accounting regulations and the related shift in equity compensation practices in Advent's industry, the Compensation Committee asked management to conduct a comprehensive review of Advent's executive and broader employee equity program in 2005. The purpose of this review was to determine if the current stock option program: (i) supports Advent's executive/employee attraction and retention initiatives; (ii) provides the appropriate incentive to executives and employees to create long-term stockholder value; and (iii) serves the best interests of Advent's stockholders.

Based on this review, the Compensation Committee believes that restricted stock units and stock appreciation rights best achieve the objectives stated above, and therefore in 2006 the Committee intends to issue primarily those vehicles instead of the stock options it has historically granted. For executives, approximately 70% of their equity award will be delivered in stock appreciation rights and approximately 30% will be delivered in restricted stock units. This mix reflects the Compensation Committee's pay-for-performance orientation because an individual receives value from the stock appreciation right award only if Advent's stock price increases (which benefits all stockholders). The Company will continue to monitor developments in this area and the Compensation Committee retains the discretion, if necessary, to make adjustments to the equity program consistent with the objectives stated above.

The benefits offered to Advent's executive officers are substantially the same as those offered to all Advent employees. The Company provides medical and other benefits to executives that are generally available to other employees. The Company also maintains a 401(k) Plan to provide retirement benefits through tax deferred salary deductions for all its employees. Employee contributions, limited to 15% of compensation, up to $14,000, are matched 50% by the Company, up to 6% of employee compensation. In addition to the employer matching contribution, Advent may make a profit sharing contribution to the 401(k) Plan at the discretion of the Board of Directors, although Advent has not done so since 2001. The Company also provides gym membership benefits to Advent's executive officers which are also offered to all Vice Presidents and above.

22

Review of 2005 Executive Compensation (excluding the Chief Executive Officer)

In January 2005, the Compensation Committee met to review and approve executive officer salary increases. After considering the factors listed above under "Elements of Compensation—Cash Compensation," the Chief Executive Officer's input with respect to the executive officer group (except the Chief Executive Officer), and promotions or changes in responsibilities that took place during the year, the Compensation Committee approved a salary increase for one of the Named Executive Officers and otherwise determined to continue the current salary levels of its executives resulting, for the Named Executive Officers, in the base salary levels reported in the "Summary Compensation Table" beginning on page 15.