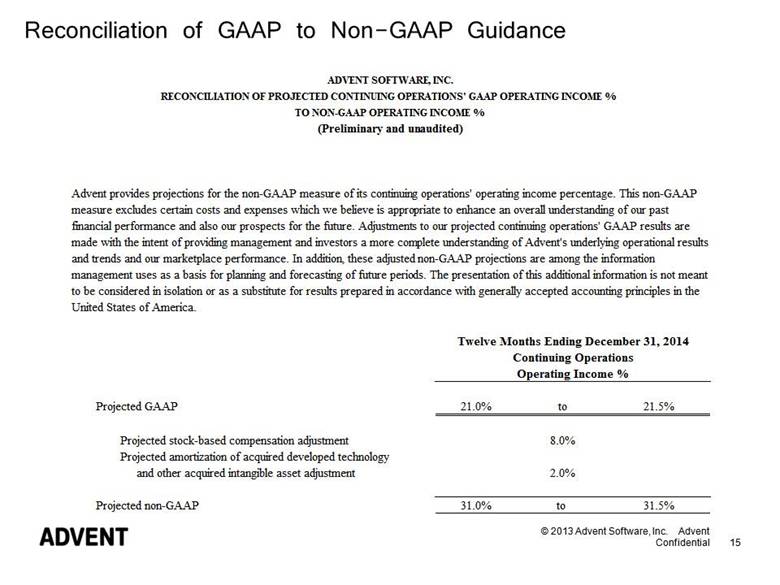

| FY13 Reconciliation of GAAP to Non-GAAP 14 Amount % of Net Revenues Amount % of Net Revenues GAAP gross margin 263,238 $ 68.7% 236,103 $ 65.8% Amortization of acquired intangibles 6,841 7,599 Stock-based compensation 6,744 3,641 Non-GAAP gross margin 276,823 $ 72.3% 247,343 $ 68.9% GAAP operating income 46,132 $ 12.0% 49,179 $ 13.7% Amortization of acquired intangibles 10,616 11,424 Stock-based compensation 48,179 20,801 Restructuring charges 3,770 3,634 Recapitalization costs 6,041 - Transaction related fees 565 - Non-GAAP operating income 115,303 $ 30.1% 85,038 $ 23.7% GAAP net income 28,752 $ 30,231 $ Amortization of acquired intangibles 10,616 11,424 Stock-based compensation 48,179 20,801 Restructuring charges 3,770 3,634 Recapitalization costs 6,692 - Transaction related fees 565 - Income tax adjustment (1) (27,892) (11,868) Non-GAAP net income 70,682 $ 54,222 $ GAAP net income 28,752 $ 30,231 $ Net interest 6,949 1,732 Provision for income taxes 10,167 17,328 Depreciation expense 11,531 11,796 Amortization expense 12,862 14,083 Stock-based compensation 48,179 20,801 Adjusted EBITDA 118,440 $ 95,971 $ Diluted net income per share GAAP 0.54 $ 0.58 $ Non-GAAP 1.32 $ 1.03 $ Shares used to compute diluted net income per share 53,378 52,425 (1) The estimated non-GAAP effective tax rate was 35% for the twelve months ended December 31, 2013 and 2012, respectively, and has been used to adjust the provision for income taxes for non-GAAP net income and non-GAAP diluted net income per share purposes. 2013 2012 ADVENT SOFTWARE, INC. RECONCILIATION OF SELECTED CONTINUING OPERATIONS' GAAP MEASURES TO NON-GAAP MEASURES (In thousands, except per share data) (Unaudited) To supplement our condensed consolidated financial statements presented in accordance with generally accepted accounting principles in the United States of America (or GAAP), Advent uses non-GAAP measures of continuing operations' gross margin, operating income, net income and net income per share, which are adjusted to exclude certain costs, expenses and income we believe appropriate to enhance an overall understanding of our past financial performance and also our prospects for the future. These adjustments to our current period GAAP results are made with the intent of providing both management and investors a more complete understanding of Advent’s underlying operational results and trends and our marketplace performance. In addition, these non-GAAP results are among the information management uses as a basis for our planning and forecasting of future periods. The presentation of this additional information is not meant to be considered in isolation or as a substitute for results prepared in accordance with GAAP. Twelve Months Ended December 31 |