SUPPLEMENT DATED APRIL 26, 2006 TO THE PROSPECTUS OF

MORGAN STANLEY AGGRESSIVE EQUITY FUND

Dated November 30, 2005

On April 25, 2006, the Board of Trustees of the Morgan Stanley Aggressive Equity Fund (the ‘‘Fund’’) approved an Agreement and Plan of Reorganization by and between the Fund and Morgan Stanley Capital Opportunities Trust (‘‘Capital Opportunities’’), pursuant to which substantially all of the assets of the Fund would be combined with those of Capital Opportunities and shareholders of the Fund would become shareholders of Capital Opportunities, receiving shares of Capital Opportunities equal to the value of their holdings in the Fund (the ‘‘Reorganization’’). Each shareholder of the Fund will receive the Class of shares of Capital Opportunities that corresponds to the Class of shares of the Fund currently held by that shareholder. The Reorganization is subject to the approval of shareholders of the Fund at a special meeting of shareholders to be held during the third quarter of 2006. A proxy statement formally detailing the proposal, the reasons for the Reorganization and information concerning Capital Opportunities will be distributed to shareholders of the Fund.

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE.

[GRAPHIC]

MORGAN STANLEY FUNDS

MORGAN STANLEY

AGGRESSIVE EQUITY FUND

A MUTUAL FUND THAT SEEKS CAPITAL GROWTH

[MORGAN STANLEY LOGO]

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE

SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO

THE CONTRARY IS A CRIMINAL OFFENSE.

PROSPECTUS

NOVEMBER 30, 2005

CONTENTS

THE FUND

Investment Objective 1

Principal Investment Strategies 1

Principal Risks 2

Past Performance 4

Fees and Expenses 6

Additional Investment Strategy Information 7

Additional Risk Information 8

Portfolio Holdings 9

Fund Management 9

SHAREHOLDER INFORMATION

Pricing Fund Shares 11

How To Buy Shares 12

Limited Portability 13

How To Exchange Shares 14

How To Sell Shares 16

Distributions 18

Frequent Purchases and Redemptions of Fund Shares 19

Tax Consequences 20

Share Class Arrangements 21

Additional Information 28

FINANCIAL HIGHLIGHTS 29

MORGAN STANLEY FUNDS Inside Back Cover

This PROSPECTUS contains important information about the Fund. Please read it

carefully and keep it for future reference.

THE FUND

INVESTMENT OBJECTIVE

[GRAPHIC]

Morgan Stanley Aggressive Equity Fund seeks capital growth.

PRINCIPAL INVESTMENT STRATEGIES

[GRAPHIC]

The Fund normally invests at least 80% of its assets in common stocks and other

equity securities of U.S. or foreign companies that offer the potential for

superior earnings growth in the opinion of the Fund's "Investment Adviser,"

Morgan Stanley Investment Advisors Inc. The Fund's other equity securities may

include preferred stock, depositary receipts or securities convertible into

common stock.

The Investment Adviser follows a flexible investment program in seeking to

achieve the Fund's investment objective. In accordance with the Fund's

investment strategy, the capitalization range of securities in which the Fund

may invest is consistent with the capitalization range of the Russell 3000

Growth Index, which as of October 31, 2005 is between $37 million and $359.6

billion. The Investment Adviser focuses on companies it believes have consistent

or rising earnings growth records, potential for strong free cash flow and

compelling business strategies. In this regard, the Investment Adviser studies

company developments, including business strategy and financial results.

Valuation is viewed in the context of prospects of sustainable earnings and cash

flow growth. The Investment Adviser generally considers selling a portfolio

holding when it determines that the holding no longer satisifies its investment

criteria.

The Fund may invest up to 25% of its net assets in foreign securities (including

depositary receipts), which may include emerging market securities classified as

American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs), American

Depositary Shares (ADSs), Global Depositary Shares (GDSs) or local shares of

emerging market countries. This percentage limitation, however, does not apply

to securities of foreign companies that are listed in the United States on a

national securities exchange.

Common stock is a share ownership or equity interest in a corporation. It may or

may not pay dividends, as some companies reinvest all of their profits back into

their businesses, while others pay out some of their profits to shareholders as

dividends. A depositary receipt is generally issued by a bank or financial

institution and represents an ownership interest in the common stock or other

equity securities of a foreign company.

[SIDENOTE]

CAPITAL GROWTH

AN INVESTMENT OBJECTIVE HAVING THE GOAL OF SELECTING SECURITIES WITH THE

POTENTIAL TO RISE IN PRICE RATHER THAN PAY OUT INCOME.

1

The Fund may also utilize options and futures and forward foreign currency

exchange contracts, and may invest a portion of its assets in convertible

securities. The Fund may invest up to 20% of its assets in fixed-income

securities.

PRINCIPAL RISKS

[GRAPHIC]

There is no assurance that the Fund will achieve its investment objective. The

Fund's share price and return will fluctuate with changes in the market value of

the Fund's portfolio securities. When you sell Fund shares, they may be worth

less than what you paid for them and, accordingly, you can lose money investing

in this Fund.

A principal risk of investing in the Fund is associated with its stock

investments. In general, stock values fluctuate in response to activities

specific to the company as well as general market, economic and political

conditions. Stock prices can fluctuate widely in response to these factors. The

Fund's emphasis on industries may cause its performance to be more sensitive to

developments affecting particular industries than a fund that places primary

emphasis on individual companies.

SMALL AND MEDIUM-SIZED COMPANIES. The Fund may invest in small and medium-sized

companies. Investing in securities of these companies involves greater risk than

is customarily associated with investing in more established companies. These

companies' stocks may be more volatile and less liquid than the stocks of more

established companies. These stocks may have returns that vary, sometimes

significantly, from the overall stock market.

FOREIGN SECURITIES. The Fund's investments in foreign securities may involve

risks that are in addition to the risks associated with domestic securities. One

additional risk is currency risk. While the price of Fund shares is quoted in

U.S. dollars, the Fund generally converts U.S. dollars to a foreign market's

local currency to purchase a security in that market. If the value of that local

currency falls relative to the U.S. dollar, the U.S. dollar value of the foreign

security will decrease. This is true even if the foreign security's local price

remains unchanged.

Foreign securities also have risks related to economic and political

developments abroad, including expropriations, confiscatory taxation, exchange

control regulation, limitations on the use or transfer of Fund assets and any

effects of foreign social, economic or political instability. Foreign companies,

in general, are not subject to the regulatory requirements of U.S. companies

and, as such, there may be less publicly available information about these

companies. Moreover, foreign accounting, auditing and financial reporting

standards generally are different from those applicable to U.S. companies.

Finally, in the event of a default of any foreign debt obligations, it may be

more difficult for the Fund to obtain or enforce a judgment against the issuers

of the securities.

Securities of foreign issuers may be less liquid than comparable securities of

U.S. issuers and, as such, their price changes may be more volatile.

Furthermore, foreign exchanges and broker-dealers are generally subject to less

government and exchange scrutiny and regulation than their U.S. counterparts. In

addition, differences in clearance and settlement procedures in foreign markets

may occasion delays in settlement of the Fund's trades effected in those markets

and could result in losses to the Fund due to subsequent declines in the value

of the securities subject to the trades.

2

Depositary receipts involve many of the same risks as those associated with

direct investment in foreign securities. In addition, the underlying issuers of

certain depositary receipts, particularly unsponsored or unregistered depositary

receipts, are under no obligation to distribute shareholder communications to

the holders of such receipts, or to pass through to them any voting rights with

respect to the deposited securities.

The foreign securities in which the Fund may invest may be issued by companies

located in emerging market countries. Compared to the United States and other

developed countries, emerging market countries may have relatively unstable

governments, economies based on only a few industries and securities markets

that trade a small number of securities. Securities issued by companies located

in these countries tend to be especially volatile and may be less liquid than

securities traded in developed countries. In the past, securities in these

countries have been characterized by greater potential loss than securities of

companies located in developed countries.

OTHER RISKS. The performance of the Fund also will depend on whether or not the

Investment Adviser is successful in applying the Fund's investment strategies.

The Fund is also subject to other risks from its permissible investments,

including the risks associated with its investments in fixed-income securities,

convertible securities, options and futures and forward foreign currency

exchange contracts. For more information about these risks, see the "Additional

Risk Information" section.

Shares of the Fund are not bank deposits and are not guaranteed or insured by

the FDIC or any other government agency.

3

PAST PERFORMANCE

[GRAPHIC]

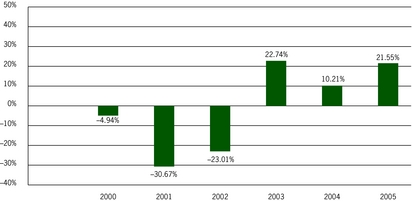

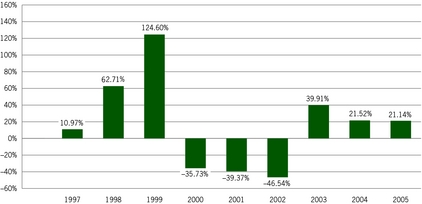

The bar chart and table below provide some indication of the risks of investing

in the Fund. The Fund's past performance (before and after taxes) does not

indicate how the Fund will perform in the future.

[CHART]

ANNUAL TOTAL RETURNS--CALENDAR YEARS

2000 -4.94%

2001 -30.67%

2002 -23.01%

2003 22.74%

2004 10.21%

The bar chart reflects the performance of Class B shares; the performance of the

other Classes will differ because the Classes have different ongoing fees. The

performance information in the bar chart does not reflect the deduction of sales

charges; if these amounts were reflected, returns would be less than shown. The

year-to-date total return as of September 30, 2005 was 11.10%.

During the periods shown in the bar chart, the highest return for a calendar

quarter was 12.57% (quarter ended December 31, 2003) and the lowest return for a

calendar quarter was -22.25% (quarter ended March 31, 2001).

[SIDENOTE]

ANNUAL TOTAL RETURNS

THIS CHART SHOWS HOW THE PERFORMANCE OF THE FUND'S CLASS B SHARES HAS VARIED

FROM YEAR TO YEAR OVER THE PAST FIVE CALENDAR YEARS.

4

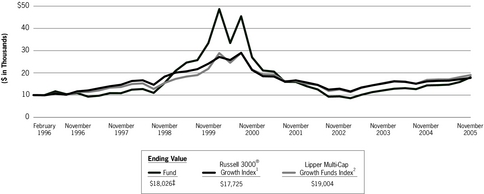

AVERAGE ANNUAL TOTAL RETURNS (AS OF DECEMBER 31, 2004)

LIFE OF FUND

PAST 1 YEAR PAST 5 YEARS (SINCE 02/24/99)

Class A--Return Before Taxes 5.25% -7.55% 0.83%

Class B--Return Before Taxes 5.21% -7.58% 0.85%

Class B--Return After Taxes on Distributions(1) 5.21% -8.44% 0.05%

Class B--Returns After Taxes on Distributions and

Sale of Fund Shares 3.39% -6.68% 0.33%

Class C--Return Before Taxes 9.20% -7.23% 1.02%

Class D--Return Before Taxes 11.29% -6.32% 2.01%

Russell 3000(R) Growth Index+(2) 6.93% -8.87% -3.28%

Lipper Multi-Cap Growth Funds Index+(3) 11.26% -7.00% -0.12%

+ Indexes are unmanaged and their returns do not include any sales charges or

fees. Such costs would lower performance. It is not possible to invest

directly in an index.

(1) These returns do not reflect any tax consequences from a sale of your

shares at the end of each period, but they do reflect any applicable sales

charges on such a sale.

(2) The Russell 3000(R) Growth Index measures the performance of those

companies in the Russell 3000(R) Index with higher price-to-book ratios and

higher forecasted growth values.

(3) The Lipper Multi-Cap Growth Funds Index is an equally weighted performance

index of the largest qualifying funds (based on net assets) in the Lipper

Multi-Cap Growth Funds classification. The Index is adjusted for capital

gains distributions and income dividends. There are currently 30 funds

represented in this Index.

Included in the table above are the after-tax returns for the Fund's Class B

shares. The after-tax returns for the Fund's other Classes will vary from the

Class B shares' returns. After-tax returns are calculated using the historical

highest individual federal marginal income tax rates during the period shown and

do not reflect the impact of state and local taxes. Actual after-tax returns

depend on an investor's tax situation and may differ from those shown, and

after-tax returns are not relevant to investors who hold their Fund shares

through tax deferred arrangements such as 401(k) plans or individual retirement

accounts. After-tax returns may be higher than before-tax returns due to foreign

tax credits and/or an assumed benefit from capital losses that would have been

realized had Fund shares been sold at the end of the relevant periods, as

applicable.

[SIDENOTE]

AVERAGE ANNUAL TOTAL RETURNS

THIS TABLE COMPARES THE FUND'S AVERAGE ANNUAL TOTAL RETURNS WITH THOSE OF AN

INDEX THAT REPRESENTS A BROAD MEASURE OF MARKET PERFORMANCE, AS WELL AS AN INDEX

THAT REPRESENTS A GROUP OF SIMILAR MUTUAL FUNDS, OVER TIME. THE FUND'S RETURNS

INCLUDE THE MAXIMUM APPLICABLE SALES CHARGE FOR EACH CLASS AND ASSUME YOU SOLD

YOUR SHARES AT THE END OF EACH PERIOD (UNLESS OTHERWISE NOTED).

5

FEES AND EXPENSES

[GRAPHIC]

The table below briefly describes the fees and expenses that you may pay if you

buy and hold shares of the Fund. The Fund offers four Classes of shares: Classes

A, B, C and D. Each Class has a different combination of fees, expenses and

other features, which should be considered in selecting a Class of shares. The

Fund does not charge account or exchange fees. However, certain shareholders may

be charged an order processing fee by the broker-dealer through which shares are

purchased, as described below. See the "Share Class Arrangements" section for

further fee and expense information.

SHAREHOLDER FEES

CLASS A CLASS B CLASS C CLASS D

Maximum sales charge (load) imposed on

purchases (as a percentage of offering price) 5.25%(1) None None None

Maximum deferred sales charge (load) (as a

percentage based on the lesser of the offering

price or net asset value at redemption) None(2) 5.00%(3) 1.00%(4) None

Redemption fee(5) 2.00% 2.00% 2.00% 2.00%

ANNUAL FUND OPERATING EXPENSES

CLASS A CLASS B CLASS C CLASS D

Advisory fee* 0.67% 0.67% 0.67% 0.67%

Distribution and service (12b-1) fees(6) 0.25% 1.00% 0.99% None

Other expenses* 0.50% 0.50% 0.50% 0.50%

Total annual Fund operating expenses* 1.42% 2.17% 2.16% 1.17%

* Expense information in the table has been restated to reflect current fees

(see "Fund Management").

(1) Reduced for purchases of $25,000 and over.

(2) Investments that are not subject to any sales charges at the time of

purchase are subject to a contingent deferred sales charge ("CDSC") of

1.00% that will be imposed if you sell your shares within 18 months after

purchase, except for certain specific circumstances.

(3) The CDSC is scaled down to 1.00% during the sixth year, reaching zero

thereafter. See "Share Class Arrangements" for a complete discussion of the

CDSC.

(4) Only applicable if you sell your shares within one year after purchase.

(5) Payable to the Fund on shares redeemed within seven days of purchase. See

"Shareholder Information -- How to Sell Shares" for more information on

redemption fees.

(6) The Fund has adopted a Rule 12b-1 Distribution Plan pursuant to which it

reimburses the distributor for distribution-related expenses (including

personal services to shareholders) incurred on behalf of Class A, Class B

and Class C shares in an amount each month up to an annual rate of 0.25%,

1.00% and 1.00% of the average daily net assets of Class A, Class B and

Class C shares, respectively.

[SIDENOTE]

SHAREHOLDER FEES

THESE FEES ARE PAID DIRECTLY FROM YOUR INVESTMENT.

ANNUAL FUND OPERATING EXPENSES

THESE EXPENSES ARE DEDUCTED FROM THE FUND'S ASSETS.

6

EXAMPLE

This example is intended to help you compare the cost of investing in the Fund

with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Fund, your investment has a

5% return each year and the Fund's operating expenses remain the same. Although

your actual costs may be higher or lower, the tables below show your costs at

the end of each period based on these assumptions, depending upon whether or not

you sell your shares at the end of each period.

IF YOU SOLD YOUR SHARES: IF YOU HELD YOUR SHARES:

---------------------------------------------- -----------------------------------------------

1 YEAR 3 YEARS 5 YEARS 10 YEARS 1 YEAR 3 YEARS 5 YEARS 10 YEARS

Class A $ 662 $ 951 $ 1,261 $ 2,138 $ 662 $ 951 $ 1,261 $ 2,138

Class B $ 720 $ 979 $ 1,364 $ 2,503 $ 220 $ 679 $ 1,164 $ 2,503

Class C $ 319 $ 676 $ 1,159 $ 2,493 $ 219 $ 676 $ 1,159 $ 2,493

Class D $ 119 $ 372 $ 644 $ 1,420 $ 119 $ 372 $ 644 $ 1,420

While Class B and Class C shares do not have any front-end sales charges, their

higher ongoing annual expenses (due to higher 12b-1 fees) mean that over time

you could end up paying more for these shares than if you were to pay front-end

sales charges for Class A shares.

ORDER PROCESSING FEE. Morgan Stanley DW Inc. ("Morgan Stanley DW") charges

clients an order processing fee of $5.25 (except in certain circumstances,

including, but not limited to, activity in fee-based accounts, exchanges,

dividend reinvestments and systematic investment and withdrawal plans) when a

client buys or redeems shares of the Fund. Please consult your Morgan Stanley

Financial Advisor for more information regarding this fee.

ADDITIONAL INVESTMENT STRATEGY INFORMATION

[GRAPHIC]

This section provides additional information relating to the Fund's investment

strategies.

OTHER INVESTMENTS. The Fund may invest up to 20% of its assets in debt

securities (including zero coupon bonds) issued by the U.S. government, U.S. or

foreign companies or foreign governments. The Fund may invest a portion of its

assets in convertible securities.

OPTIONS AND FUTURES. The Fund may purchase and sell stock index futures

contracts and may purchase put options on stock indexes and stock index futures.

Stock index futures, and options on stock indexes and stock index futures may be

used to facilitate trading, to increase or decrease the Fund's market exposure,

to seek higher investment returns or to seek to protect against a decline in the

value of the Fund's securities or an increase in prices of securities that may

be purchased.

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS. The Fund's investments also may

include forward foreign currency exchange contracts, which involve the purchase

or sale of a specific amount of foreign currency at the current

7

price with delivery at a specified future date. The Fund may use these contracts

to hedge against adverse movements in the foreign currencies in which portfolio

securities are denominated. In addition, the Fund may use these instruments to

modify its exposure to various currency markets.

DEFENSIVE INVESTING. The Fund may take temporary "defensive" positions in

attempting to respond to adverse market conditions. The Fund may invest any

amount of its assets in cash or money market instruments in a defensive posture

that may be inconsistent with the Fund's principal investment strategies when

the Investment Adviser believes it is advisable to do so.

Although taking a defensive posture is designed to protect the Fund from an

anticipated market downturn, it could have the effect of reducing the benefit

from any upswing in the market. When the Fund takes a defensive position, it may

not achieve its investment objective.

PORTFOLIO TURNOVER. The Fund may engage in active and frequent trading of

portfolio securities. The Financial Highlights Table at the end of this

PROSPECTUS shows the Fund's portfolio turnover rates during recent fiscal years.

A portfolio turnover rate of 200%, for example, is equivalent to the Fund buying

and selling all of its securities two times during the course of the year. A

high portfolio turnover rate (over 100%) could result in high brokerage costs

and an increase in taxable capital gains distributions to the Fund's

shareholders. See the sections on "Distributions" and "Tax Consequences."

The percentage limitations relating to the composition of the Fund's portfolio

apply at the time the Fund acquires an investment. Subsequent percentage changes

that result from market fluctuations generally will not require the Fund to sell

any portfolio security. However, the Fund may be required to sell its illiquid

securities holdings, or reduce its borrowings, if any, in response to

fluctuations in the value of such holdings. The Fund may change its principal

investment strategies without shareholder approval; however, you would be

notified of any changes.

ADDITIONAL RISK INFORMATION

[GRAPHIC]

This section provides additional information relating to the risks of investing

in the Fund.

FIXED-INCOME SECURITIES. All fixed-income securities are subject to two types of

risk: credit risk and interest rate risk. Credit risk refers to the possibility

that the issuer of a security will be unable to make interest payments and/or

repay the principal on its debt. Interest rate risk refers to fluctuations in

the value of a fixed-income security resulting from changes in the general level

of interest rates. When the general level of interest rates goes up, the prices

of most fixed-income securities go down. When the general level of interest

rates goes down, the prices of most fixed-income securities go up. (Zero coupon

securities are typically subject to greater price fluctuations than comparable

securities that pay interest.)

CONVERTIBLE SECURITIES. The Fund also may invest a portion of its assets in

convertible securities, which are securities that generally pay interest and may

be converted into common stock. These securities may carry risks associated with

both common stock and fixed-income securities.

8

OPTIONS AND FUTURES. If the Fund invests in stock index futures, or options on

stock indexes or stock index futures, its participation in these markets would

subject the Fund to certain risks. If the Investment Adviser's predictions of

movements in the direction of the stock index are inaccurate, the adverse

consequences to the Fund (e.g., a reduction in the Fund's net asset value or a

reduction in the amount of income available for distribution) may leave the Fund

in a worse position than if these strategies were not used. Other risks inherent

in the use of stock index futures, and options on stock indexes and stock index

futures, include, for example, the possible imperfect correlation between the

price of futures contracts and movements in the prices of the securities, and

the possible absence of a liquid secondary market for any particular instrument.

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS. Use of forward foreign currency

exchange contracts involves risks. If the Investment Adviser employs a strategy

that does not correlate well with the Fund's investments or the currencies in

which the investments are denominated, currency contracts could result in a loss

or a smaller gain than if the strategy had not been employed. The contracts also

may increase the Fund's volatility and, thus, could involve a significant risk.

PORTFOLIO HOLDINGS

[GRAPHIC]

A description of the Fund's policies and procedures with respect to the

disclosure of the Fund's portfolio securities is available in the Fund's

STATEMENT OF ADDITIONAL INFORMATION.

FUND MANAGEMENT

[GRAPHIC]

The Fund has retained the Investment Adviser--Morgan Stanley Investment Advisors

Inc.--to provide investment advisory services. The Investment Adviser is a

wholly-owned subsidiary of Morgan Stanley, a preeminent global financial

services firm that maintains leading market positions in each of its three

primary businesses: securities, asset management and credit services. Morgan

Stanley is a full service securities firm engaged in securities trading and

brokerage activities, as well as providing investment banking, research and

analysis, financing and financial advisory services. The Investment Adviser's

address is 1221 Avenue of the Americas, New York, NY 10020.

The Fund is managed within the Investment Adviser's U.S. Growth team. Current

members of the team responsible for the day-to-day management of the Fund

include Dennis P. Lynch and David S. Cohen, Managing Directors of the Investment

Adviser, Sam G. Chainani, an Executive Director of the Investment Adviser, and

Alexander Norton, a Vice President of the Investment Adviser. Mr. Lynch has

worked for the Investment Adviser since 1998 and began managing the Fund in June

2004. Prior to June 2004, Mr. Lynch worked in an investment management capacity

for the Investment Adviser. Mr. Cohen has worked for the Investment Adviser

since 1993 and began managing the Fund in June 2004. Prior to June 2004,

Mr. Cohen worked in an investment management capacity for the Investment

Adviser. Mr. Chainani has worked for the Investment Adviser since 1996 and began

[SIDENOTE]

MORGAN STANLEY INVESTMENT ADVISORS INC.

THE INVESTMENT ADVISER IS WIDELY RECOGNIZED AS A LEADER IN THE MUTUAL FUND

INDUSTRY AND HAD APPROXIMATELY $100 BILLION IN ASSETS UNDER MANAGEMENT OR

ADMINISTRATION AS OF OCTOBER 31, 2005.

9

managing the Fund in June 2004. Prior to June 2004, Mr. Chainani worked in an

investment management capacity for the Investment Adviser. Mr. Norton has worked

for the Investment Adviser since 1999 and began managing the Fund in July 2005.

Prior to July 2005, Mr. Norton worked in a research capacity for the Investment

Adviser. Mr. Lynch is the lead portfolio manager of the Fund. Messrs. Cohen,

Chainani and Norton are co-portfolio managers. Members of the team collaborate

to manage the assets of the Fund.

The Fund's STATEMENT OF ADDITIONAL INFORMATION provides additional information

about the portfolio managers' compensation structure, other accounts managed by

the portfolio managers and the portfolio managers' ownership of securities in

the Fund.

The composition of the team may change without notice from time to time.

Prior to November 1, 2004, the Fund had retained the Investment Adviser to

provide administrative services and to manage the investment of the Fund's

assets pursuant to an investment management agreement (the "Management

Agreement") pursuant to which the Fund paid the Investment Adviser a monthly

management fee as full compensation for the services and facilities furnished to

the Fund, and for Fund expenses assumed by the Investment Adviser at the annual

rate of 0.75% of the portion of the daily net assets not exceeding $2 billion;

and 0.725% of the portion of the daily net assets exceeding $2 billion.

Effective November 1, 2004, the Board of Trustees approved an amended and

restated investment advisory agreement to remove the administrative services

component from the Management Agreement and to reduce the investment advisory

fee to the annual rate of 0.67% of the portion of the daily net assets not

exceeding $500 million; 0.645% of the portion of the daily net assets exceeding

$500 million but not exceeding $2 billion; 0.62% of the portion of the daily net

assets exceeding $2 billion but not exceeding $3 billion; and 0.595% of the

portion of the daily net assets exceeding $3 billion. The administrative

services previously provided to the Fund by the Investment Adviser are being

provided by Morgan Stanley Services Company Inc. (the "Administrator") pursuant

to a separate administration agreement entered into by the Fund with the

Administrator. Such change resulted in a 0.08% reduction in the investment

advisory fee concurrent with the implementation of a 0.08% administration fee

pursuant to the new administration agreement.

Although the entities providing administration services to the Fund have

changed, the Morgan Stanley personnel performing such services remains the same.

Furthermore, the changes have not resulted in any increase in the amount of

total combined fees paid by the Fund for investment advisory and administration

services, or any decrease in the nature or quality of the investment advisory or

administration services received by the Fund.

For the fiscal year ended July 31, 2005, the Fund paid compensation to the

Investment Adviser amounting to 0.69% of the Fund's average daily net assets.

A discussion regarding the basis for the Board of Trustees' approval of the

investment advisory agreement is available in the Fund's annual report to

shareholders for the fiscal year ended July 31, 2005.

10

SHAREHOLDER INFORMATION

PRICING FUND SHARES

[GRAPHIC]

The price of Fund shares (excluding sales charges), called "net asset value," is

based on the value of the Fund's portfolio securities. While the assets of each

Class are invested in a single portfolio of securities, the net asset value of

each Class will differ because the Classes have different ongoing distribution

fees.

The net asset value per share of the Fund is determined once daily at 4:00 p.m.

Eastern time on each day that the New York Stock Exchange is open (or, on days

when the New York Stock Exchange closes prior to 4:00 p.m., at such earlier

time). Shares will not be priced on days that the New York Stock Exchange is

closed.

The value of the Fund's portfolio securities is based on the securities' market

price when available. When a market price is not readily available, including

circumstances under which the Investment Adviser determines that a security's

market price is not accurate, a portfolio security is valued at its fair value,

as determined under procedures established by the Fund's Board of Trustees.

In addition, with respect to securities that primarily are listed on foreign

exchanges, when an event occurs after the close of such exchanges that is likely

to have changed the value of the securities (for example, a percentage change in

value of one or more U.S. securities indices in excess of specified thresholds),

such securities will be valued at their fair value, as determined under

procedures established by the Fund's Board of Trustees. Securities also may be

fair valued in the event of a significant development affecting a country or

region or an issuer-specific development which is likely to have changed the

value of the security. In these cases, the Fund's net asset value will reflect

certain portfolio securities' fair value rather than their market price. Fair

value pricing involves subjective judgment and it is possible that the fair

value determined for a security is materially different than the value that

could be realized upon the sale of that security. With respect to securities

that are primarily listed on foreign exchanges, the value of the Fund's

portfolio securities may change on days when you will not be able to purchase or

sell your shares.

To the extent the Fund invests in open-end management companies that are

registered under the Investment Company Act of 1940, as amended ("Investment

Company Act") the Fund's net asset value is calculated based upon the net asset

value of such fund. The prospectuses for such funds explain the circumstances

under which they will use fair value pricing and its effects.

11

An exception to the Fund's general policy of using market prices concerns its

short-term debt portfolio securities. Debt securities with remaining maturities

of 60 days or less at the time of purchase are valued at amortized cost.

However, if the cost does not reflect the securities' market value, these

securities will be valued at their fair value.

HOW TO BUY SHARES

[GRAPHIC]

You may open a new account to buy Fund shares or buy additional Fund shares for

an existing account by contacting your Morgan Stanley Financial Advisor or other

authorized financial representative. Your Financial Advisor will assist you,

step-by-step, with the procedures to invest in the Fund. The Fund's transfer

agent, Morgan Stanley Trust ("Transfer Agent"), in its sole discretion, may

allow you to purchase shares directly by calling and requesting an application.

To help the government fight the funding of terrorism and money laundering

activities, federal law requires all financial institutions to obtain, verify

and record information that identifies each person who opens an account. What

this means to you: when you open an account, we will ask your name, address,

date of birth and other information that will allow us to identify you. If we

are unable to verify your identity, we reserve the right to restrict additional

transactions and/or liquidate your account at the next calculated net asset

value after your account is closed (less any applicable sales/account charges

and/or tax penalties) or take any other action required by law.

Because every investor has different immediate financial needs and long-term

investment goals, the Fund offers investors four Classes of shares: Classes A,

B, C and D. Class D shares are only offered to a limited group of investors.

Each Class of shares offers a distinct structure of sales charges, distribution

and service fees, and other features that are designed to address a variety of

needs. Your Morgan Stanley Financial Advisor or other authorized financial

representative can help you decide which Class may be most appropriate for you.

When purchasing Fund shares, you must specify which Class of shares you wish to

purchase.

The Fund currently expects to stop selling shares to new investors when its net

assets reach approximately $2 billion; if the Fund does so, shareholders already

invested in the Fund will be able to buy additional shares.

When you buy Fund shares, the shares are purchased at the next share price

calculated (plus any applicable front-end sales charge for Class A shares) after

we receive your purchase order. Your payment is due on the third business day

after you place your purchase order. The Fund, in its sole discretion, may waive

the minimum initial and additional investment amounts in certain cases. We

reserve the right to reject any order for the purchase of Fund shares for any

reason.

ORDER PROCESSING FEE. Morgan Stanley DW charges clients an order processing fee

of $5.25 (except in certain circumstances, including, but not limited to,

activity in fee-based accounts, exchanges, dividend reinvestments and systematic

investment and withdrawal plans) when a client

[SIDENOTE]

CONTACTING A FINANCIAL ADVISOR

IF YOU ARE NEW TO THE MORGAN STANLEY FUNDS AND WOULD LIKE TO CONTACT A MORGAN

STANLEY FINANCIAL ADVISOR, CALL TOLL-FREE 1-866-MORGAN8 FOR THE TELEPHONE NUMBER

OF THE MORGAN STANLEY OFFICE NEAREST YOU. YOU MAY ALSO ACCESS OUR OFFICE LOCATOR

ON OUR INTERNET SITE AT: www.morganstanley.com/funds

12

buys or redeems shares of the Fund. Please consult your Morgan Stanley Financial

Advisor for more information regarding this fee.

MINIMUM INVESTMENT AMOUNTS

MINIMUM INVESTMENT

-------------------------

INVESTMENT OPTIONS INITIAL ADDITIONAL

Regular Account $ 1,000 $ 100

Individual Retirement Account $ 1,000 $ 100

Coverdell Education Savings Account $ 500 $ 100

EasyInvest(R)

(Automatically from your checking or savings account or Money Market Fund) $ 100* $ 100*

* Provided your schedule of investments totals $1,000 in 12 months.

There is no minimum investment amount if you purchase Fund shares through: (1)

the Investment Adviser's mutual fund asset allocation program; (2) a program,

approved by the Fund's distributor, in which you pay an asset-based fee for

advisory, administrative and/or brokerage services; (3) the following programs

approved by the Fund's distributor: (i) qualified state tuition plans described

in Section 529 of the Internal Revenue Code or (ii) certain other investment

programs that do not charge an asset-based fee; (4) employer-sponsored employee

benefit plan accounts; or (5) the reinvestment of dividends in additional Fund

shares.

INVESTMENT OPTIONS FOR CERTAIN INSTITUTIONAL AND OTHER INVESTORS/CLASS D SHARES.

To be eligible to purchase Class D shares, you must qualify under one of the

investor categories specified in the "Share Class Arrangements" section of this

PROSPECTUS.

SUBSEQUENT INVESTMENTS SENT DIRECTLY TO THE FUND. In addition to buying

additional Fund shares for an existing account by contacting your Morgan Stanley

Financial Advisor, you may send a check directly to the Fund. To buy additional

shares in this manner:

- - Write a "letter of instruction" to the Fund specifying the name(s) on the

account, the account number, the social security or tax identification

number, the Class of shares you wish to purchase and the investment amount

(which would include any applicable front-end sales charge). The letter must

be signed by the account owner(s).

- - Make out a check for the total amount payable to: Morgan Stanley Aggressive

Equity Fund.

- - Mail the letter and check to Morgan Stanley Trust at P.O. Box 1040, Jersey

City, NJ 07303.

LIMITED PORTABILITY

[GRAPHIC]

Most Fund shareholders hold their shares with Morgan Stanley DW. Please note

that your ability to transfer your Fund shares to a brokerage account at another

securities dealer may be limited. Fund shares may only be transferred to

accounts held at a limited number of securities

[SIDENOTE]

EASYINVEST(R)

A PURCHASE PLAN THAT ALLOWS YOU TO TRANSFER MONEY AUTOMATICALLY FROM YOUR

CHECKING OR SAVINGS ACCOUNT OR FROM A MONEY MARKET FUND ON A SEMI-MONTHLY,

MONTHLY OR QUARTERLY BASIS. CONTACT YOUR MORGAN STANLEY FINANCIAL ADVISOR FOR

FURTHER INFORMATION ABOUT THIS SERVICE.

13

dealers or financial intermediaries that have entered into agreements with the

Fund's distributor. After a transfer, you may purchase additional shares of the

Morgan Stanley Funds you owned before the transfer, but you may not be able to

purchase shares of any other Morgan Stanley Funds or exchange shares of the

Fund(s) you own for shares of other Morgan Stanley Funds (as described below

under "How to Exchange Shares"). If you wish to transfer Fund shares to a

securities dealer or other financial intermediary that has not entered into an

agreement with the Fund's distributor, you may request that the securities

dealer or financial intermediary maintain the shares in an account at the

Transfer Agent registered in the name of such securities dealer or financial

intermediary for your benefit. You may also hold your Fund shares in your own

name directly with the Transfer Agent. Other options may also be available;

please check with the respective securities dealer or financial intermediary. If

you choose not to hold your shares with the Transfer Agent, either directly or

through a securities dealer or other financial intermediary, you must redeem

your shares and pay any applicable CDSC.

HOW TO EXCHANGE SHARES

[GRAPHIC]

PERMISSIBLE FUND EXCHANGES. You may exchange shares of any Class of the Fund for

the same Class of any other continuously offered Multi-Class Fund, or for shares

of a No-Load Fund, a Money Market Fund or the Limited Duration U.S. Treasury

Trust, without the imposition of an exchange fee. Front-end sales charges are

not imposed on exchanges of Class A shares. See the inside back cover of this

PROSPECTUS for each Morgan Stanley Fund's designation as a Multi-Class Fund,

No-Load Fund or Money Market Fund. If a Morgan Stanley Fund is not listed,

consult the inside back cover of that fund's current prospectus for its

designation.

The current prospectus for each fund describes its investment objective(s),

policies and investment minimums, and should be read before investment. Since

exchanges are available only into continuously offered Morgan Stanley Funds,

exchanges are not available into any new Morgan Stanley Fund during its initial

offering period, or when shares of a particular Morgan Stanley Fund are not

being offered for purchase. An exchange of Fund shares held for less than seven

days from the date of purchase will be subject to the 2% redemption fee

described under the section "How to Sell Shares."

EXCHANGE PROCEDURES. You can process an exchange by contacting your Morgan

Stanley Financial Advisor or other authorized financial representative.

Otherwise, you must forward an exchange privilege authorization form to the

Transfer Agent and then write the Transfer Agent or call toll-free (800)

869-NEWS to place an exchange order. You can obtain an exchange privilege

authorization form by contacting your Morgan Stanley Financial Advisor or other

authorized financial representative or by calling toll-free (800) 869-NEWS. If

you hold share certificates, no exchanges may be processed until we have

received all applicable share certificates.

An exchange to any Morgan Stanley Fund (except a Money Market Fund) is made on

the basis of the next calculated net asset values of the funds involved after

the exchange instructions, as described above, are received. When exchanging

into a Money Market Fund, the Fund's shares are sold at their next calculated

net asset value and the Money Market Fund's shares are purchased at their net

asset value on the following business day.

14

The Fund may terminate or revise the exchange privilege upon required notice or

in certain cases without notice. See "Limitations on Exchanges." The check

writing privilege is not available for Money Market Fund shares you acquire in

an exchange.

TELEPHONE EXCHANGES. For your protection when calling Morgan Stanley Trust, we

will employ reasonable procedures to confirm that exchange instructions

communicated over the telephone are genuine. These procedures may include

requiring various forms of personal identification such as name, mailing

address, social security or other tax identification number. Telephone

instructions also may be recorded.

Telephone instructions will be accepted if received by the Transfer Agent

between 9:00 a.m. and 4:00 p.m. Eastern time on any day the New York Stock

Exchange is open for business. During periods of drastic economic or market

changes, it is possible that the telephone exchange procedures may be difficult

to implement, although this has not been the case with the Fund in the past.

MARGIN ACCOUNTS. If you have pledged your Fund shares in a margin account,

contact your Morgan Stanley Financial Advisor or other authorized financial

representative regarding restrictions on the exchange of such shares.

TAX CONSIDERATIONS OF EXCHANGES. If you exchange shares of the Fund for shares

of another Morgan Stanley Fund, there are important tax considerations. For tax

purposes, the exchange out of the Fund is considered a sale of Fund shares--and

the exchange into the other fund is considered a purchase. As a result, you may

realize a capital gain or loss.

You should review the "Tax Consequences" section and consult your own tax

professional about the tax consequences of an exchange.

LIMITATIONS ON EXCHANGES. Certain patterns of past exchanges and/or purchase or

sale transactions involving the Fund or other Morgan Stanley Funds may result in

the Fund rejecting, limiting or prohibiting, at its sole discretion, and without

prior notice, additional purchases and/or exchanges and may result in a

shareholder's account being closed. Determinations in this regard may be made

based on the frequency or dollar amount of the previous exchanges or purchase or

sale transactions. The Fund reserves the right to reject an exchange request for

any reason.

CDSC CALCULATIONS ON EXCHANGES. See the "Share Class Arrangements" section of

this PROSPECTUS for a discussion of how applicable contingent deferred sales

charges (CDSCs) are calculated for shares of one Morgan Stanley Fund that are

exchanged for shares of another.

For further information regarding exchange privileges, you should contact your

Morgan Stanley Financial Advisor or call toll-free (800) 869-NEWS.

15

HOW TO SELL SHARES

[GRAPHIC]

You can sell some or all of your Fund shares at any time. If you sell Class A,

Class B or Class C shares, your net sale proceeds are reduced by the amount of

any applicable CDSC. Your shares will be sold at the next price calculated after

we receive your order to sell as described below.

OPTIONS PROCEDURES

- ---------------------------------------------------------------------------------------------

Contact Your To sell your shares, simply call your Morgan Stanley Financial

Financial Advisor Advisor or other authorized financial representative. Payment will

be sent to the address to which the account is registered or

deposited in your brokerage account.

By Letter You can also sell your shares by writing a "letter of instruction"

that includes:

- your account number;

- the name of the Fund;

- the dollar amount or the number of shares you wish to sell;

- the Class of shares you wish to sell; and

- the signature of each owner as it appears on the account.

If you are requesting payment to anyone other than the registered

owner(s) or that payment be sent to any address other than the

address of the registered owner(s) or pre-designated bank account,

you will need a signature guarantee. You can obtain a signature

guarantee from an eligible guarantor acceptable to Morgan Stanley

Trust. (You should contact Morgan Stanley Trust toll-free at

(800) 869-NEWS for a determination as to whether a particular

institution is an eligible guarantor.) A notary public CANNOT provide

a signature guarantee. Additional documentation may be required for

shares held by a corporation, partnership, trustee or executor.

Mail the letter to Morgan Stanley Trust at P.O. Box 983, Jersey

City, NJ 07303. If you hold share certificates, you must return the

certificates, along with the letter and any required additional

documentation.

A check will be mailed to the name(s) and address in which the

account is registered, or otherwise according to your instructions.

16

OPTIONS PROCEDURES

- ---------------------------------------------------------------------------------------------

Systematic If your investment in all of the Morgan Stanley Funds has a total

Withdrawal Plan market value of at least $10,000, you may elect to withdraw amounts

of $25 or more, or in any whole percentage of a fund's balance

(provided the amount is at least $25), on a monthly, quarterly,

semi-annual or annual basis, from any fund with a balance of at

least $1,000. Each time you add a fund to the plan, you must meet

the plan requirements.

Amounts withdrawn are subject to any applicable CDSC. A CDSC may be

waived under certain circumstances. See the Class B waiver

categories listed in the "Share Class Arrangements" section of this

PROSPECTUS.

To sign up for the Systematic Withdrawal Plan, contact your Morgan

Stanley Financial Advisor or call toll-free (800) 869-NEWS. You may

terminate or suspend your plan at any time. Please remember that

withdrawals from the plan are sales of shares, not Fund

"distributions," and ultimately may exhaust your account balance.

The Fund may terminate or revise the plan at any time.

PAYMENT FOR SOLD SHARES. After we receive your complete instructions to sell as

described above, a check will be mailed to you within seven days, although we

will attempt to make payment within one business day. Payment may also be sent

to your brokerage account.

Payment may be postponed or the right to sell your shares suspended under

unusual circumstances. If you request to sell shares that were recently

purchased by check, your sale will not be effected until it has been verified

that the check has been honored.

ORDER PROCESSING FEE. Morgan Stanley DW charges clients an order processing fee

of $5.25 (except in certain circumstances, including, but not limited to,

activity in fee-based accounts, exchanges, dividend reinvestments and systematic

investment and withdrawal plans) when a client buys or redeems shares of the

Fund. Please consult your Morgan Stanley Financial Advisor for more information

regarding this fee.

TAX CONSIDERATIONS. Normally, your sale of Fund shares is subject to federal and

state income tax. You should review the "Tax Consequences" section of this

PROSPECTUS and consult your own tax professional about the tax consequences of a

sale.

REINSTATEMENT PRIVILEGE. If you sell Fund shares and have not previously

exercised the reinstatement privilege, you may, within 35 days after the date of

sale, invest any portion of the proceeds in the same Class of Fund shares at

their net asset value and receive a pro rata credit for any CDSC paid in

connection with the sale.

INVOLUNTARY SALES. The Fund reserves the right, on 60 days' notice, to sell the

shares of any shareholder (other than shares held in an individual retirement

account ("IRA") or 403(b) Custodial Account) whose shares, due to sales by the

shareholder, have a value below $100, or in the case of an account opened

through EASYINVEST(R), if after 12 months the shareholder has invested less

than $1,000 in the account.

17

However, before the Fund sells your shares in this manner, we will notify you

and allow you 60 days to make an additional investment in an amount that will

increase the value of your account to at least the required amount before the

sale is processed. No CDSC will be imposed on any involuntary sale.

MARGIN ACCOUNTS. If you have pledged your Fund shares in a margin account,

contact your Morgan Stanley Financial Advisor or other authorized financial

representative regarding restrictions on the sale of such shares.

REDEMPTION FEE. Fund shares redeemed within seven days of purchase will be

subject to a 2% redemption fee, payable to the Fund. The redemption fee is

designed to protect the Fund and its remaining shareholders from the effects of

short-term trading. The redemption fee is not imposed on redemptions made: (i)

through systematic withdrawal/exchange plans, (ii) through pre-approved asset

allocation programs, (iii) of shares received by reinvesting income dividends or

capital gain distributions, (iv) through certain collective trust funds or other

pooled vehicles and (v) on behalf of advisory accounts where client allocations

are solely at the discretion of the Morgan Stanley Investment Management

investment team. The redemption fee is based on, and deducted from, the

redemption proceeds. Each time you redeem or exchange shares, the shares held

the longest will be redeemed or exchanged first.

The redemption fee may not be imposed on transactions that occur through certain

omnibus accounts at financial intermediaries. Certain financial intermediaries

may apply different methodologies than those described above in assessing

redemption fees, may impose their own redemption fee that may differ from the

Fund's redemption fee or may impose certain trading restrictions to deter market

timing and frequent trading. If you invest in the Fund through a financial

intermediary, please read that financial intermediary's materials carefully to

learn about any other restrictions or fees that may apply.

DISTRIBUTIONS

[GRAPHIC]

The Fund passes substantially all of its earnings from income and capital gains

along to its investors as "distributions." The Fund earns income from stock and

interest from fixed-income investments. These amounts are passed along to Fund

shareholders as "income dividend distributions." The Fund realizes capital gains

whenever it sells securities for a higher price than it paid for them. These

amounts may be passed along as "capital gain distributions."

The Fund declares income dividends separately for each Class. Distributions paid

on Class A and Class D shares usually will be higher than for Class B and Class

C shares because distribution fees that Class B and Class C shares pay are

higher. Normally, income dividends are distributed to shareholders annually.

Capital gains, if any, are usually distributed in December. The Fund, however,

may retain and reinvest any long-term capital gains. The Fund may at times make

payments from sources other than income or capital gains that represent a return

of a portion of your investment.

[SIDENOTE]

TARGETED DIVIDENDS(SM)

YOU MAY SELECT TO HAVE YOUR FUND DISTRIBUTIONS AUTOMATICALLY INVESTED IN OTHER

CLASSES OF FUND SHARES OR CLASSES OF ANOTHER MORGAN STANLEY FUND THAT YOU OWN.

CONTACT YOUR MORGAN STANLEY FINANCIAL ADVISOR FOR FURTHER INFORMATION ABOUT THIS

SERVICE.

18

Distributions are reinvested automatically in additional shares of the same

Class and automatically credited to your account, unless you request in writing

that all distributions be paid in cash. If you elect the cash option, the Fund

will mail a check to you no later than seven business days after the

distribution is declared. However, if you purchase Fund shares through a Morgan

Stanley Financial Advisor or other authorized financial representative within

three business days prior to the record date for the distribution, the

distribution will automatically be paid to you in cash, even if you did not

request to receive all distributions in cash. No interest will accrue on

uncashed checks. If you wish to change how your distributions are paid, your

request should be received by the Transfer Agent at least five business days

prior to the record date of the distributions.

FREQUENT PURCHASES AND REDEMPTIONS OF FUND SHARES

[GRAPHIC]

Frequent purchases and redemptions of Fund shares by Fund shareholders are

referred to as "market-timing" or "short-term trading" and may present risks for

other shareholders of the Fund, which may include, among other things, dilution

in the value of Fund shares held by long-term shareholders, interference with

the efficient management of the Fund's portfolio, increased brokerage and

administrative costs, incurring unwanted taxable gains and forcing the Fund to

hold excess levels of cash.

In addition, the Fund is subject to the risk that market timers and/or

short-term traders may take advantage of time zone differences between the

foreign markets on which the Fund's portfolio securities trade and the time as

of which the Fund's net asset value is calculated ("time-zone arbitrage"). For

example, a market timer may purchase shares of the Fund based on events

occurring after foreign market closing prices are established, but before the

Fund's net asset value calculation, that are likely to result in higher prices

in foreign markets the following day. The market timer would redeem the Fund's

shares the next day when the Fund's share price would reflect the increased

prices in foreign markets, for a quick profit at the expense of long-term Fund

shareholders.

The Fund's policies with respect to valuing portfolio securities are described

in "Shareholder Information--Pricing Fund Shares."

The Fund discourages and does not accommodate frequent purchases and redemptions

of Fund shares by Fund shareholders and the Fund's Board of Trustees has adopted

policies and procedures with respect to such frequent purchases and redemptions.

The Fund's policies with respect to purchases, redemptions and exchanges of Fund

shares are described in the "How to Buy Shares," "How to Exchange Shares" and

"How to Sell Shares" sections of this PROSPECTUS. Except as described in each of

these sections, and with respect to trades that occur through omnibus accounts

at intermediaries as described below, the Fund's policies regarding frequent

trading of Fund shares are applied uniformly to all shareholders. With respect

to trades that occur through omnibus accounts at intermediaries, such as

investment managers, broker-dealers, transfer agents and third party

administrators, the Fund (i) has requested assurance that such intermediaries

currently selling Fund shares have in place internal policies and procedures

reasonably designed to address market-timing concerns and has instructed such

intermediaries to notify the Fund immediately if they are unable to comply with

such policies and procedures and (ii) requires all prospective intermediaries to

agree to cooperate in enforcing the Fund's policies with respect to frequent

purchases, redemptions and exchanges of Fund shares.

Omnibus accounts generally do not identify customers' trading activity to the

Fund on an individual basis. Therefore, with respect to trades through omnibus

accounts at intermediaries, the Fund is currently limited in its ability to

monitor

19

trading activity or enforce the redemption fee with respect to customers of such

intermediaries. The ability of the Fund to monitor exchanges made by the

underlying shareholders in omnibus accounts, therefore, is severely limited.

Consequently, the Fund must rely on the financial intermediary to monitor

frequent short-term trading within the Fund by the financial intermediary's

customers. Certain intermediaries may not have the ability to assess a

redemption fee. There can be no assurance that the Fund will be able to

eliminate all market-timing activities.

TAX CONSEQUENCES

[GRAPHIC]

As with any investment, you should consider how your Fund investment will be

taxed. The tax information in this PROSPECTUS is provided as general

information. You should consult your own tax professional about the tax

consequences of an investment in the Fund.

Unless your investment in the Fund is through a tax-deferred retirement account,

such as a 401(k) plan or IRA, you need to be aware of the possible tax

consequences when:

- - The Fund makes distributions; and

- - You sell Fund shares, including an exchange to another Morgan Stanley Fund.

TAXES ON DISTRIBUTIONS. Your distributions are normally subject to federal and

state income tax when they are paid, whether you take them in cash or reinvest

them in Fund shares. A distribution also may be subject to local income tax. Any

income dividend distributions and any short-term capital gain distributions are

taxable to you as ordinary income. Any long-term capital gain distributions are

taxable as long-term capital gains, no matter how long you have owned shares in

the Fund. Under current law, a portion of the ordinary income dividends you

receive may be taxed at the same rate as long-term capital gains. However, even

if income received in the form of ordinary income dividends is taxed at the same

rates as long-term capital gains, such income will not be considered long-term

capital gains for other federal income tax purposes. For example, you generally

will not be permitted to offset ordinary income dividends with capital losses.

Short-term capital gain distributions will continue to be taxed at ordinary

income rates.

If more than 50% of the Fund's assets are invested in foreign securities at the

end of any fiscal year, the Fund may elect to permit shareholders to take a

credit or deduction on their federal income tax return for foreign taxes paid by

the Fund.

Every January, you will be sent a statement (IRS Form 1099-DIV) showing the

taxable distributions paid to you in the previous year. The statement provides

information on your dividends and capital gains for tax purposes.

TAXES ON SALES. Your sale of Fund shares normally is subject to federal and

state income tax and may result in a taxable gain or loss to you. A sale also

may be subject to local income tax. Your exchange of Fund shares for shares of

another Morgan Stanley Fund is treated for tax purposes like a sale of your

original shares and a purchase of your new shares. Thus, the exchange may, like

a sale, result in a taxable gain or loss to you and will give you a new tax

basis for your new shares.

When you open your Fund account, you should provide your social security or tax

identification number on your investment application. By providing this

information, you will avoid being subject to federal backup withholding tax on

taxable distributions and redemption proceeds (as of the date of this PROSPECTUS

this rate is 28%). Any withheld amount would be sent to the IRS as an advance

payment of your taxes due on your income.

20

SHARE CLASS ARRANGEMENTS

[GRAPHIC]

The Fund offers several Classes of shares having different distribution

arrangements designed to provide you with different purchase options according

to your investment needs. Your Morgan Stanley Financial Advisor or other

authorized financial representative can help you decide which Class may be

appropriate for you.

The general public is offered three Classes: Class A shares, Class B shares and

Class C shares, which differ principally in terms of sales charges and ongoing

expenses. A fourth Class, Class D shares, is offered only to a limited category

of investors. Shares that you acquire through reinvested distributions will not

be subject to any front-end sales charge or CDSC--contingent deferred sales

charge.

Sales personnel may receive different compensation for selling each Class of

shares. The sales charges applicable to each Class provide for the distribution

financing of shares of that Class.

The chart below compares the sales charge and annual 12b-1 fee applicable to

each Class:

CLASS SALES CHARGE MAXIMUM ANNUAL 12b-1 FEE

A Maximum 5.25% initial sales charge reduced for purchases of $25,000 or

more; shares purchased without an initial sales charge are generally

subject to a 1.00% CDSC if sold during the first 18 months 0.25%

B Maximum 5.00% CDSC during the first year decreasing to 0% after six years 1.00%

C 1.00% CDSC during the first year 1.00%

D None None

Certain shareholders may be eligible for reduced sales charges (i.e., breakpoint

discounts), CDSC waivers and eligibility minimums. Please see the information

for each Class set forth below for specific eligibility requirements. You must

notify your Morgan Stanley Financial Advisor or other authorized financial

representative (or Morgan Stanley Trust if you purchase shares directly through

the Fund) at the time a purchase order (or in the case of Class B or C shares, a

redemption order) is placed, that the purchase (or redemption) qualifies for a

reduced sales charge (i.e., breakpoint discount), CDSC waiver or eligibility

minimum. Similar notification must be made in writing when an order is placed by

mail. The reduced sales charge, CDSC waiver or eligibility minimum will not be

granted if: (i) notification is not furnished at the time of order; or (ii) a

review of the records of Morgan Stanley DW or other authorized dealer of Fund

shares, or the Transfer Agent does not confirm your represented holdings.

In order to obtain a reduced sales charge (i.e., breakpoint discount) or to meet

an eligibility minimum, it may be necessary at the time of purchase for you to

inform your Morgan Stanley Financial Advisor or other authorized financial

representative (or Morgan Stanley Trust if you purchase shares directly through

the Fund) of the existence of other accounts in which there are holdings

eligible to be aggregated to meet the sales load breakpoints or eligibility

minimums. In order to verify your eligibility, you may be required to provide

account statements and/or confirmations regarding shares of the Fund or other

Morgan Stanley funds held in all related accounts described below at Morgan

Stanley or by other authorized dealers, as well as shares held by related

parties, such as members of the same family or household, in order to determine

whether you have met a sales load breakpoint or eligibility minimum. The Fund

makes available, in a clear and prominent

21

format, free of charge, on its web site, www.morganstanley.com, information

regarding applicable sales loads, reduced sales charges (i.e., breakpoint

discounts), sales load waivers and eligibility minimums. The web site includes

hyperlinks that facilitate access to the information.

CLASS A SHARES Class A shares are sold at net asset value plus an initial sales

charge of up to 5.25% of the public offering price. The initial sales charge is

reduced for purchases of $25,000 or more according to the schedule below.

Investments of $1 million or more are not subject to an initial sales charge,

but are generally subject to a CDSC of 1.00% on sales made within 18 months

after the last day of the month of purchase. The CDSC will be assessed in the

same manner and with the same CDSC waivers as with Class B shares. Class A

shares are also subject to a distribution and shareholder services (12b-1) fee

of up to 0.25% of the average daily net assets of the Class. The maximum annual

12b-1 fee payable by Class A shares is lower than the maximum annual 12b-1 fee

payable by Class B or Class C shares.

The offering price of Class A shares includes a sales charge (expressed as a

percentage of the public offering price) on a single transaction as shown in the

following table:

FRONT-END SALES CHARGE

--------------------------------------------------

AMOUNT OF PERCENTAGE OF APPROXIMATE PERCENTAGE

SINGLE TRANSACTION PUBLIC OFFERING PRICE OF NET AMOUNT INVESTED

Less than $25,000 5.25% 5.54%

$25,000 but less than $50,000 4.75% 4.99%

$50,000 but less than $100,000 4.00% 4.17%

$100,000 but less than $250,000 3.00% 3.09%

$250,000 but less than $500,000 2.50% 2.56%

$500,000 but less than $1 million 2.00% 2.04%

$1 million and over 0.00% 0.00%

You may benefit from a reduced sales charge (i.e., breakpoint discount) for

purchases of Class A shares of the Fund, by combining, in a single transaction,

your purchase with purchases of Class A shares of the Fund by the following

related accounts:

- - A single account (including an individual, trust or fiduciary account).

- - A family member account (limited to spouse, and children under the age of

21).

- - Pension, profit sharing or other employee benefit plans of companies and

their affiliates.

- - Employer sponsored and individual retirement accounts (including IRAs, Keogh,

401(k), 403(b), 408(k) and 457(b) Plans).

- - Tax-exempt organizations.

- - Groups organized for a purpose other than to buy mutual fund shares.

[SIDENOTE]

FRONT-END SALES CHARGE OR FSC

AN INITIAL SALES CHARGE YOU PAY WHEN PURCHASING CLASS A SHARES THAT IS BASED ON

A PERCENTAGE OF THE OFFERING PRICE. THE PERCENTAGE DECLINES BASED UPON THE

DOLLAR VALUE OF CLASS A SHARES YOU PURCHASE. WE OFFER THREE WAYS TO REDUCE YOUR

CLASS A SALES CHARGES--THE COMBINED PURCHASE PRIVILEGE, RIGHT OF ACCUMULATION

AND LETTER OF INTENT.

22

COMBINED PURCHASE PRIVILEGE. You will have the benefit of reduced sales charges

by combining purchases of Class A shares of the Fund for any related account in

a single transaction with purchases of any class of shares of other Morgan

Stanley Multi-Class Funds for the related account or any other related account.

For the purpose of this combined purchase privilege, a "related account" is:

- - A single account (including an individual account, a joint account and a

trust account established solely for the benefit of the individual).

- - A family member account (limited to spouse, and children under the age of 21,

but including trust accounts established solely for the benefit of a spouse,

or children under the age of 21).

- - An IRA and single participant retirement account (such as a Keogh).

- - An UGMA/UTMA account.

RIGHT OF ACCUMULATION. You may benefit from a reduced sales charge if the

cumulative net asset value of Class A Shares of the Fund purchased in a single

transaction, together with the net asset value of all classes of shares of

Morgan Stanley Multi-Class Funds (including shares of Morgan Stanley

Non-Multi-Class Funds which resulted from an exchange from Morgan Stanley

Multi-Class Funds) held in related accounts, amounts to $25,000 or more. For the

purposes of the rights of accumulation privilege, a related account is any one

of the accounts listed under "Combined Purchase Privilege" above.

NOTIFICATION. You must notify your Morgan Stanley Financial Advisor or other

authorized financial representative (or Morgan Stanley Trust if you purchase

shares directly through the Fund) at the time a purchase order is placed that

the purchase qualifies for a reduced sales charge under any of the privileges

discussed above. Similar notification must be made in writing when an order is

placed by mail. The reduced sales charge will not be granted if: (i)

notification is not furnished at the time of the order; or (ii) a review of the

records of Morgan Stanley DW or other authorized dealer of Fund shares or the

Transfer Agent does not confirm your represented holdings.

In order to obtain a reduced sales charge under any of the privileges discussed

above, it may be necessary at the time of purchase for you to inform your Morgan

Stanley Financial Advisor or other authorized financial representative (or

Morgan Stanley Trust if you purchase shares directly through the Fund) of the

existence of other accounts in which there are holdings eligible to be

aggregated to meet the sales load breakpoint and/or right of accumulation

threshold. In order to verify your eligibility, you may be required to provide

account statements and/or confirmations regarding shares of the Fund or other

Morgan Stanley Funds held in all related accounts described above at Morgan

Stanley or by other authorized dealers, as well as shares held by related

parties, such as members of the same family or household, in order to determine

whether you have met the sales load breakpoint and/or right of accumulation

threshold. The Fund makes available, in a clear and prominent format, free of

charge, on its web site, www.morganstanley.com, information regarding applicable

sales loads and reduced sales charges (i.e., breakpoint discounts). The web site

includes hyperlinks that facilitate access to the information.

LETTER OF INTENT. The above schedule of reduced sales charges for larger

purchases also will be available to you if you enter into a written "Letter of

Intent." A Letter of Intent provides for the purchase of Class A shares of the

Fund or other Multi-Class Funds within a 13-month period. The initial purchase

under a Letter of Intent must be at least 5% of the stated investment goal. The

Letter of Intent does not preclude the Fund (or any other Multi-Class Fund) from

23

discontinuing sales of its shares. To determine the applicable sales charge

reduction, you may also include: (1) the cost of shares of other Morgan Stanley

Funds which were previously purchased at a price including a front-end sales

charge during the 90-day period prior to the distributor receiving the Letter of

Intent, and (2) the historical cost of shares of other funds you currently own

acquired in exchange for shares of funds purchased during that period at a price

including a front-end sales charge. You may combine purchases and exchanges by

family members (limited to spouse, and children under the age of 21) during the

periods referenced in (1) and (2) above. You should retain any records necessary

to substantiate historical costs because the Fund, its Transfer Agent and any

financial intermediaries may not maintain this information. You can obtain a

Letter of Intent by contacting your Morgan Stanley Financial Advisor or other

authorized financial representative, or by calling toll-free (800) 869-NEWS. If

you do not achieve the stated investment goal within the 13-month period, you

are required to pay the difference between the sales charges otherwise

applicable and sales charges actually paid, which may be deducted from your

investment. Shares acquired through reinvestment of distributions are not

aggregated to achieve the stated investment goal.

OTHER SALES CHARGE WAIVERS. In addition to investments of $1 million or more,

your purchase of Class A shares is not subject to a front-end sales charge (or a

CDSC upon sale) if your account qualifies under one of the following categories:

- - A trust for which a banking affiliate of the Investment Adviser provides

discretionary trustee services.

- - Persons participating in a fee-based investment program (subject to all of

its terms and conditions, including termination fees and mandatory sale or

transfer restrictions on termination) approved by the Fund's distributor,

pursuant to which they pay an asset-based fee for investment advisory,

administrative and/or brokerage services.

- - Qualified state tuition plans described in Section 529 of the Internal

Revenue Code and donor-advised charitable gift funds (subject to all

applicable terms and conditions) and certain other investment programs that

do not charge an asset-based fee and have been approved by the Fund's

distributor.

- - Employer-sponsored employee benefit plans, whether or not qualified under the

Internal Revenue Code, for which an entity independent from Morgan Stanley

serves as recordkeeper under an alliance or similar agreement with Morgan