⌧ Definitive Proxy Statement.

⌧ No fee required.

THE NEEDHAM FUNDS, INC.

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

March 12, 2021

Dear Fellow Shareholders:

You are invited to attend a special shareholder meeting (the “Meeting”) of The Needham Funds, Inc. (the “Company”), which will be held in virtual meeting format only on April 23, 2021, at 1:00 p.m. Eastern Time. The purpose of the Meeting is to seek shareholder approval of the election of two nominees (each, a "Nominee" and, together, the "Nominees") to the Board of Directors (the “Board”) of the Company. As discussed below, one of the Nominees already serves as a Director of the Company but has not yet been elected to the Board by Company shareholders. The second Nominee has been nominated by the Board to serve as a Director, subject to shareholder approval.

You are being asked to elect each of the following two individuals as Directors of the Company: John W. Larson and David T. Shukis. Mr. Larson currently serves as a Director of the Company and has served as a Director since his appointment by the Board in 2006, but has not previously been elected by shareholders. The second nominee, Mr. Shukis, does not currently serve as a Director of the Company, but the Board has unanimously nominated Mr. Shukis to serve as a Director on the Board.

The reasons behind the elections arise from legal requirements that apply to the Company pursuant to the Investment Company Act of 1940, as amended. Vacancies on the Board may be filled by appointment of a Director (without a shareholder vote) if immediately after such appointment at least two-thirds of the Directors then holding office have been elected by shareholders. Two of the three current Directors were elected by shareholders.

The Board recently determined to add another Director to the Board. However, the Board is unable to appoint a new Director to the Board because immediately after such appointment, less than two-thirds of the Directors (two out of four or 50%) would be elected by shareholders. Therefore, shareholder approval is required to add Mr. Shukis to the Board. Mr. Larson also has been nominated for election to the Board by shareholders so that the entire Board will have been elected by shareholders, thereby avoiding the need to incur the expenses of a future shareholder meeting should vacancies arise.

The Board has unanimously approved these nominations and recommends that you vote "FOR" the election of the Nominees.

Due to the public health and safety concerns surrounding the COVID-19 pandemic, and to support the health and well-being of the Company's shareholders and officers, and other attendees, the Meeting will be held in virtual meeting format only. Shareholders will not be able to attend the Meeting in person. To virtually attend and participate in the Meeting, please visit www.needhamfunds.com/shareholdervote to receive information on how you can attend the Meeting.

The attached Proxy Statement describes each Nominee’s qualifications and the voting process for shareholders. The Board asks that you read the Proxy Statement carefully and vote in favor of the Nominees. Please return your proxy card in the postage-paid envelope as soon as possible. You also may vote over the Internet or by telephone. Please follow the instructions on the enclosed proxy card to use these methods of voting.

Thank you for your continued support.

Sincerely,

/s/ George A. Needham

George A. Needham

President, Chairman and Director

The Needham Funds, Inc.

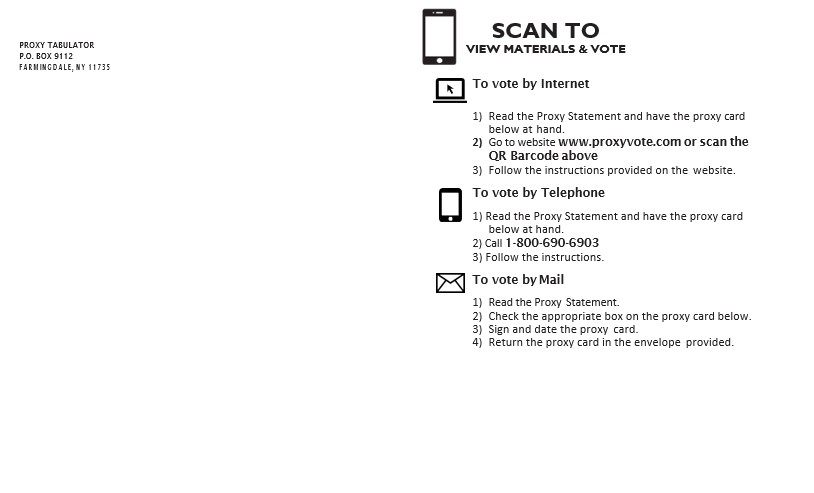

To vote, you may use any of the following methods:

| • | By Internet. Have your proxy card available. Go to the website listed on your card. Follow the instructions found on the website. |

| • | By Telephone. Have your proxy card available. Call the toll-free number listed on your card. Follow the recorded instructions. |

| • | By Mail. Please complete, date and sign your proxy card before mailing it in the enclosed postage-paid envelope. |

| • | At the Meeting. Any shareholder who attends the meeting virtually may vote by Internet during the meeting. |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 23, 2021

THE NEEDHAM FUNDS, INC.

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of The Needham Funds, Inc. (the "Company") will be held on April 23, 2021, at 1:00 p.m. Eastern Time.

To attend and participate in the Meeting please visit www.needhamfunds.com/shareholdervote to receive information on how you can attend the Meeting.

At the Meeting, shareholders of the Company will be asked to act upon the following proposals, which is more fully described in the accompanying Proxy Statement:

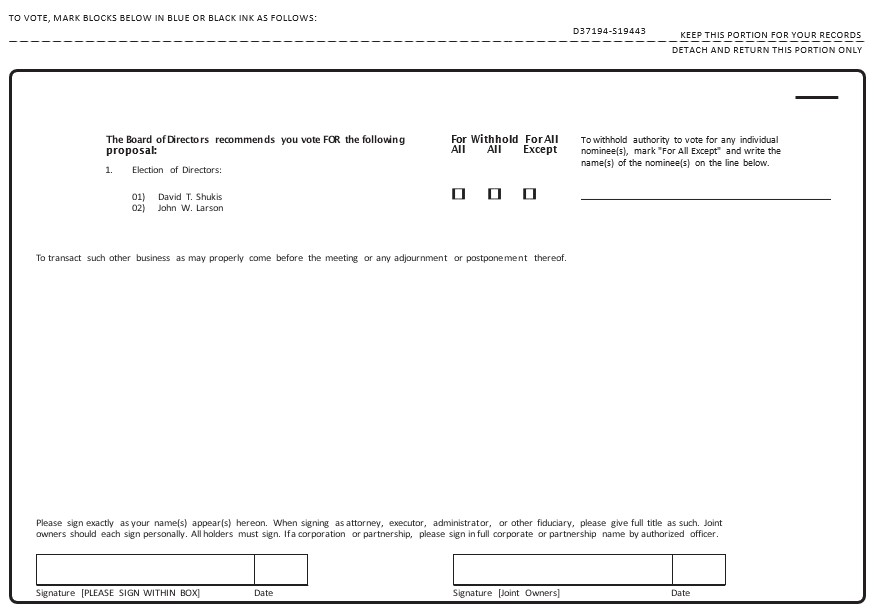

| PROPOSAL 1: | To elect each of Mr. John W. Larson and Mr. David T. Shukis as a Company Director, each to serve for an indefinite term and until his successor is duly elected and qualified. |

| PROPOSAL 2: | To transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

THE BOARD OF DIRECTORS, INCLUDING ALL OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH NOMINEE FOR DIRECTOR.

The Board has fixed the close of business on March 19, 2021 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Meeting or any postponement or adjournment thereof. The enclosed proxy is being solicited on behalf of the Board and each series of the Company named above. Please read the enclosed Proxy Statement for a full discussion of the proposals.

By order of the Board of Directors of the Company,

/s/ James W. Giangrasso

James W. Giangrasso

Chief Financial Officer, Treasurer and Secretary

March 12, 2021

Your vote is important – please vote your shares promptly.

Please note, no representatives from the Board will be attending the Meeting. Shareholders are urged to vote using the touch-tone telephone or Internet voting instructions found on the enclosed proxy card or indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask for your cooperation in responding promptly, no matter how large or small your holdings may be.

THE NEEDHAM FUNDS, INC.

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

PROXY STATEMENT

MARCH 12, 2021

FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 23, 2021

Introduction

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of The Needham Funds, Inc. (the “Company”) of proxies to be voted at the Special Meeting of Shareholders of the Company and any adjournment or postponement thereof (the “Meeting”). The Meeting will be held in virtual meeting format only on April 23, 2021, at 1:00 p.m. Eastern Time.

Due to the public health and safety concerns surrounding the COVID-19 pandemic, and to support the health and well-being of the Company's shareholders and officers, and other attendees, the Meeting will be held in a virtual meeting format only, via the Internet, and no in-person meeting will be held. To attend and participate in the Meeting, please visit www.needhamfunds.com/shareholdervote to receive information on how you can attend the Meeting.

At the Meeting, shareholders of the Company will be asked to act upon the following proposals:

| PROPOSAL 1: | To elect each of Mr. John W. Larson and Mr. David T. Shukis (each, a "Nominee" and, together, the "Nominees") as a Company Director, each to serve for an indefinite term and until his successor is duly elected and qualified. |

| PROPOSAL 2: | To transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

Shareholders of record at the close of business on March 19, 2021 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. The Notice of Special Meeting of Shareholders (the “Notice”), this Proxy Statement and the enclosed proxy card are being mailed to shareholders on or about March 30, 2021.

The Company is an open-end management investment company organized as a corporation under the laws of the State of Maryland on October 12, 1995. The Company currently consists of three series, Needham Growth Fund, Needham Aggressive Growth Fund, and Needham Small Cap Growth Fund (each, a “Fund", and, collectively, the “Funds”). Shareholders of each Fund are being asked to vote on the proposals.

Each Fund's financial statements are included in its Annual Report, which is mailed to shareholders. Shareholders may obtain copies of the Annual Report or Semi-Annual Report free of charge by writing the Company c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202, or by calling the Funds (toll-free) at 1-800-625-7071.

PROPOSAL 1 – ELECTION OF DIRECTORS TO THE BOARD

The Board currently consists of three members: George A. Needham, John W. Larson, and F. Randall Smith. Mr. Larson, a Nominee for election, has served as a Director since 2006, when he was appointed to his position by the Board in accordance with Section 16(a) of the Investment Company Act of 1940, as amended (the “1940 Act”). Under the 1940 Act, his appointment as a Director by the Board was not required to be approved by Company shareholders.

At a meeting held on January 26, 2021, the Board, including all of the Directors who are not “interested persons” (as defined in the 1940 Act) of the Company (“Independent Directors”), nominated David T. Shukis for election to the Board. The Board also recommended that Mr. Larson be nominated for election by shareholders, as he had not previously been elected by shareholders. If elected, Mr. Shukis would serve as an Independent Director of the Company.

As indicated under “Directors and Officers” below, Mr. Shukis has considerable business experience in the investment management industry. The Directors believe Mr. Shukis would enhance the Board’s ability to oversee the operations of the Company.

The reasons behind the elections arise from legal requirements that apply to the Company pursuant to the 1940 Act. Vacancies on the Board may be filled by appointment of a Director (without a shareholder vote) if immediately after such appointment at least two-thirds of the directors then holding office have been elected by shareholders. Two of the three current Directors were elected by shareholders.

The Board recently determined to add another Director to the Board. However, the Board is unable to appoint Mr. Shukis to the Board because immediately after such appointment, less than two-thirds of the Directors (two out of four or 50%) would be elected by shareholders. Therefore, shareholder approval is required to add Mr. Shukis to the Board. Mr. Larson also has been nominated for election to the Board by shareholders so that the entire Board will have been elected by shareholders, thereby avoiding the need to incur the expenses of a future shareholder meeting should vacancies arise.

Required Vote

Directors shall be elected by vote of the holders of a plurality of the shares present at the Meeting in person or by proxy and entitled to vote. The votes of the shareholders of each Fund will be considered in the aggregate to determine if the required vote has been achieved. Virtual attendance at the Meeting constitutes in person attendance for purposes of calculating the required vote.

Each Nominee has indicated that he is able and willing to serve as a Director and, if elected, will serve as a Director for an indefinite term until his successor is duly elected and qualifies or until his earlier death, resignation, or removal. If for any reason the Nominees become unable to serve before the Meeting, proxies will be voted for a substitute nominee by the Board unless instructed otherwise.

Directors and Officers

The Nominees, Directors and officers of the Company, their addresses, ages, positions with the Company, term of office and length of time served, principal occupations during the past five years, number of portfolios overseen by each of them and other directorships held by each of them are set forth below.

The Directors are responsible for the overall supervision of the Funds and their affairs, as well as evaluating Needham Investment Management LLC, the investment adviser to the Funds (the “Adviser”), consistent with their duties as directors under the corporate laws of the State of Maryland and have approved contracts, under which certain companies provide essential management services to the Funds.

| Name, Address and Age | Position with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships Held by Director During Past Five Years |

Interested Director of the Company

George A. Needham * 250 Park Avenue New York, NY 10177 Year of Birth: 1943 | President, Chairman and Director | Indefinite; since 1996 | Founder and Chairman of the Board of The Needham Group, Inc. and Needham Holdings, LLC since December 2004. President and Chief Executive Officer of Needham Asset Management, LLC since April 2006. Chairman of the Board from 1996 to December 2004 and Chief Executive Officer from 1985 to December 2004 of Needham & Company, LLC. Managing Member of Needham Capital Management, LLC from 2000 to 2019. | 3 | None. |

| Name, Address and Age | Position with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships Held by Director During Past Five Years |

| Independent Director of the Company |

F. Randall Smith 250 Park Avenue New York, NY 10177 Year of Birth: 1938 | Director | Indefinite; since 1996 | Founder, Member of Investment Committee, Investment Analyst, and Portfolio Manager of Capital Counsel LLC (a registered investment adviser) since September 1999; President from 1999-2014. Co-Founder and Chief Investment Officer of Train, Smith Counsel (a registered investment adviser) from 1975 to August 1999. | 3 | None. |

| Name, Address and Age | Position with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships Held by Director/Nominee for Director During Past Five Years |

| Independent Director of the Company and Nominee |

John W. Larson 250 Park Avenue New York, NY 10177 Year of Birth: 1935 | Director | Indefinite; since 2006 | Currently retired. Partner at the law firm of Morgan, Lewis & Bockius LLP from 2003 until retiring in December 2009. Partner at the law firm of Brobeck, Phleger & Harrison LLP from 1969 until 2003. From 1971 to 1973 worked in government service as Assistant Secretary of the United States Department of the Interior and Counselor to George P. Schultz, Chairman of the Cost of Living Council. | 3 | Director of Wage Works, Inc. (an employee benefits company) from 2000 until 2018 and its Chairman from 2006 to 2016. Director of Sangamo BioSciences, Inc. from 1996 to 2016. Trustee of Buck Institute for Research on Aging from 2013 to 2020. |

| Name, Address and Age | Position with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Portfolios in Fund Complex Overseen by Director | Other Directorships Held by Nominee for Director During Past Five Years |

| Nominee for Independent Director |

David T. Shukis 250 Park Avenue New York, NY 10177 Year of Birth: 1951 | None | N/A | Currently retired. Head of Global Investment Services (and other positions) at Cambridge Associates, LLC (financial services firm) from 1989 to 2016. | N/A | Director and Chair of Cambridge Associates Fiduciary Trust Company from 2015 to 2018. Director, from 2011 to 2016, and Audit Committee Chair, since 2016, of Boston Lyric Opera. |

Officers of the Company

| Name, Address and Age | Position with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past Five Years |

John O. Barr 250 Park Avenue New York, NY 10177 Year of Birth: 1956 | Executive Vice President and Co-Portfolio Manager of Needham Growth Fund; Executive Vice President and Portfolio Manager of Needham Aggressive Growth Fund | One year; since 2010 | Portfolio Manager of Needham Asset Management since 2010. Managing Director of Needham Asset Management, LLC since 2009. Founding and Managing Member of Oliver Investment Management, LLC from 2008 to 2009. Portfolio Manager and Analyst at Buckingham Capital, from 2002 to 2008. From 2000 to 2002, Managing Director and a Senior Analyst at Robertson Stephens following semiconductor technology companies. From 1995 to 2000, Managing Director and Senior Analyst at Needham and Company. He also served as Director of Research. Director of Coventor, Inc. from 2009 to 2017. |

Name, Address and Age

| Position with the Company

| Term of Office

and Length of

Time Served

| Principal Occupations(s) During Past Five Years

|

Christopher J. Retzler 250 Park Avenue New York, NY 10177 Year of Birth: 1971 | Executive Vice President and Co-Portfolio Manager of Needham Growth Fund; Executive Vice President and Portfolio Manager of Needham Small Cap Growth Fund | One year; since 2008 | Portfolio Manager of Needham Asset Management, LLC since 2008. Managing Director of Needham Asset Management, LLC since 2005. Head of Winterkorn, a healthcare manufacturing and distribution company, from 2002 to 2005. |

James W. Giangrasso 250 Park Avenue New York, NY 10177 Year of Birth: 1962 | Chief Financial Officer, Secretary and Treasurer | One year; since 2011 | Chief Financial Officer of Needham Asset Management, LLC and Needham Investment Management, LLC since 2011. Principal and Controller of Needham Asset Management, LLC from 2006 to 2011. |

James M. Abbruzzese 250 Park Avenue New York, NY 10177 Year of Birth: 1969 | Chief Compliance Officer | One year; since 2004 | Chief Compliance Officer of Needham Asset Management, LLC since April 2006. Chief Compliance Officer and Managing Director of Needham & Company, LLC from 2008 through 2012. Chief Administrative Officer of Needham & Company LLC since 2012. Chief Compliance Officer of Needham Capital Management, LLC from 2000 to 2019. |

* An “interested person” (as defined in the 1940 Act) of the Funds or the Adviser. Mr. Needham is deemed to be an interested person because he may be deemed to be an “affiliated person” (as defined in the 1940 Act) of the Adviser and of Needham & Company, LLC, the Funds' distributor.

The Board met four times during the fiscal year ended December 31, 2020. During the fiscal year, all of the incumbent Directors attended 100% of the Board meetings and the meetings of the Board Committee on which they served.

Additional Information Concerning the Board of Directors

The Role of the Board

The Board oversees the management and operations of the Company. Like all mutual funds, the day-to-day management and operation of the Company is the responsibility of the various service providers to the Company, such as the Adviser, the distributor, the administrator, the custodian, and the transfer agent. The Board has appointed various senior employees of the Adviser as officers of the Company, with responsibility to monitor and report to the Board on the Company’s operations. The role of the Board and of any individual Director is one of oversight and not of management of the day-to-day affairs of the Company and its oversight role does not make the Board a guarantor of the Company’s investments, operations or activities.

Board Leadership Structure

The Board has structured itself in a manner that it believes allows it to perform its oversight function effectively. It has established one standing committee – an Audit Committee – which is discussed in greater detail below under “Company Committee.” The Board currently is comprised of three Directors, two of whom are Independent Directors. Thus, two-thirds of the Board is presently independent. George A. Needham, President and Chief Executive Officer of the Funds, acts as Chairman of the Board and is an “interested person” (as that term is defined in the 1940 Act) of the Funds. The Chairman presides at all meetings of the Board.

The Board has appointed F. Randall Smith, Chairman of the Funds’ Audit Committee, to serve as Lead Independent Director. The Lead Independent Director, among other things, chairs executive sessions of the Independent Directors, serves as a spokesperson for the Independent Directors and serves as a liaison between the Funds’ other Independent Director and the Funds’ management, Chief Compliance Officer, service providers, auditors and counsel between Board meetings. The Funds believe this structure allows the Lead Independent Director to participate in the full range of the Board’s responsibilities with respect to its oversight of the Funds’ management. The Board has access to independent legal counsel for the Funds and the Independent Directors for consultation concerning any issues that may occur during or between regularly scheduled Board meetings. The Board has determined that this leadership structure, including the role of the Lead Independent Director, is appropriate given the size and complexity of the Funds, the number of Directors overseeing the Funds and the Board’s oversight responsibilities.

Company Committee

The Company has one standing committee: the Audit Committee.

The Audit Committee is comprised entirely of Independent Directors. The Audit Committee operates under a written charter approved by the Board and reviews the audits of the Funds and recommends a firm to serve as independent registered public accounting firm of the Funds, among other things. The Audit Committee met two times during the fiscal year ended December 31, 2020.

Board Oversight of Risk Management

Consistent with its responsibility for oversight of the Funds, the Board, among other things, oversees risk management of the Funds’ investment program and business affairs directly and through the committee structure that it has established. The Board, and particularly the Lead Independent Director, has substantial ongoing contacts with the Adviser to review its investment strategies, techniques, policies and procedures designed to manage these risks.

The Board requires the Adviser and the Chief Compliance Officer of the Funds and the Adviser to report to the full Board on a variety of matters at regular meetings of the Board, including matters relating to risk management. The Audit Committee also receives regular reports from the Funds’ independent registered public accounting firm on internal control and financial reporting matters. On a quarterly basis, the Board meets with the Funds’ Chief Compliance Officer to discuss issues related to Fund compliance. On an annual basis, the Board receives a written report from the Chief Compliance Officer on the operation of the Funds’ policies and procedures and those of its service providers. The report addresses the operation of the policies and procedures of the Funds and each service provider since the last report, any material changes to the policies and procedures since the last report, any recommendations for material changes to the policies and procedures as a result of the annual review and any material compliance matters since the date of the last report. These annual reviews are conducted in conjunction with the Board’s risk oversight function and enable the Board to review and assess any material risks facing the Funds or their service providers.

In addition, at regular Board meetings, and on an as needed basis, the Board receives and reviews reports from the Adviser and the Funds' administrator related to the investments, performance and operations of the Funds. The Board also requires the Adviser to report to the Board on other matters relating to risk management, including the liquidity risk management program, on a regular and as-needed basis. The Lead Independent Director periodically meets with representatives of the Funds’ service providers, including the Adviser, administrator, transfer agent, custodian and independent registered public accounting firm, to review and discuss the activities of the Funds and to provide direction with respect thereto.

Information about Each Director’s Qualification, Experience, Attributes or Skills

The Board believes that each of the Directors has the qualifications, experience, attributes and skills (“Director Attributes”) appropriate to his continued service as a Director of the Company in light of the Company’s business and structure. In addition to a demonstrated record of business and/or professional accomplishment, each of the Directors has served on the Board for a number of years. They have substantial board experience and, in their service to the Company, have gained substantial insight as to the operation of the Company. They have demonstrated a commitment to discharging their oversight duties as Directors in the interests of shareholders. The Board annually performs a self-assessment on the current members, which includes a review of the size of the Board; use of committees and committee structure; number of committees; exposure and access to management; Board composition, including skills and diversity; committee member selection and rotation and criteria for selection of Board members.

In addition to the information provided in the chart above, below is certain additional information concerning each particular Director and Nominee and his Director Attributes. The information is not all-inclusive. Many Director Attributes involve intangible elements, such as intelligence, integrity, work ethic, the ability to work together, the ability to communicate effectively, the ability to exercise judgement, to ask incisive questions, and commitment to shareholder interests.

The Chairman of the Board, George A. Needham, has been a Director of the Funds since their inception. Mr. Needham founded Needham & Company, Inc. (predecessor to The Needham Group, Inc.) in 1985. Mr. Needham is the Founder and Chairman of the Board of The Needham Group, Inc. and Needham Holdings, LLC, and President and Chief Executive Officer of Needham Asset Management, LLC. Mr. Needham received a B.S. degree from Bucknell University and an M.B.A. from the Stanford University Graduate School of Business. Mr. Needham is also a principal of the respective general partners of several private investment limited partnerships.

John W. Larson has been an Independent Director of the Funds since 2006. Mr. Larson was a partner at the law firm of Morgan, Lewis & Bockius LLP from 2003 until his retirement in December 2009. Mr. Larson served as partner at the law firm of Brobeck, Phleger & Harrison LLP (“Brobeck”) from 1969 until 2003, except for the period from July 1971 to September 1973 when he was in government service as Assistant Secretary of the United States Department of the Interior and Counselor to George P. Shultz, Chairman of the Cost of Living Council. From 1988 until March 1996, Mr. Larson was Chief Executive Officer of Brobeck. Mr. Larson served on the board of Wage Works, Inc. (an employee benefits company) from 2000 until 2018, and was its Chairman from 2006 to 2016, and Sangamo BioSciences, Inc. from 1996 to 2016. He served on the board of Buck Institute for Research on Aging from 2013 to 2020. Mr. Larson holds a LL.B and a B.A. degree, with distinction, in economics from Stanford University.

F. Randall Smith, Lead Independent Director and Chairman of the Audit Committee, has been an Independent Director of the Funds since their inception. Mr. Smith is founder (and, formerly, President) of Capital Counsel LLC, a registered investment advisory firm. He was a co-founder and Chief Investment Officer of Train, Smith Counsel, a registered investment advisory firm, from 1975 to 1999. Before that he co-founded National Journal, a weekly publication on the U.S. Government, and served as Special Assistant to the Undersecretary of State for Economic Affairs prior to founding Train, Smith Counsel. Mr. Smith received a B.A. degree from Williams College and attended Fordham University. The Board has determined that Mr. Smith is an “audit committee financial expert.”

David T. Shukis has substantial investment and executive experience in the asset management industry, including his position as Head of Global Investment Services of Cambridge Associates, LLC (global investment consulting firm). He has also served as a board member of a trust company and non-profit organizations. Mr. Shukis received a B.A. degree from the University of Pittsburgh and an M.B.A. from the Harvard Graduate School of Business Administration, and completed graduate level work at Brown University. The Board believes Mr. Shukis possesses the Director Attributes appropriate to service as a Director of the Company in light of the Company’s business and structure.

Ownership of the Funds

The following table shows the dollar range of each Director's and Nominee's “beneficial ownership” of the equity securities of the Funds and the aggregate dollar range of each Director's and Nominee’s “beneficial ownership” interest in all series of the Company overseen by the Director as of December 31, 2020. “Beneficial ownership” is determined in accordance with Rule 16a-1(a)(2) under the Securities Exchange Act of 1934, as amended. As of December 31, 2020, the Directors, Nominee, and officers of the Company, as a group, beneficially owned approximately 9.1% of the outstanding shares of Needham Growth Fund, approximately 15.1% of the outstanding shares of Needham Aggressive Growth Fund and approximately 1.7% of the outstanding shares of Needham Small Cap Growth Fund.

| Name | Needham Growth Fund | Needham Aggressive Growth Fund | Needham Small Cap Growth Fund | Aggregate Dollar Range of Equity Securities in All Fund Series Overseen by Directors |

| Interested Director | | | | |

| George A. Needham | Over $100,000 | Over $100,000 | Over $100,000 | Over $100,000 |

| Independent Director | | | | |

| F. Randall Smith | None | None | None | None |

| Independent Director and Nominee | | | | |

| John W. Larson | None | None | None | None |

| Nominee | | | | |

| David T. Shukis | None | None | None | None |

Compensation

Each Independent Director receives a quarterly retainer of $3,000 and a per-meeting fee of $500 for each Board meeting attended in person or by telephone. Each Independent Director is also a member of the Audit Committee and receives a fee of $500 per meeting attended. No retirement benefits are received by any Director from the Funds. These fees are paid by the Company.

For the fiscal year ended December 31, 2020, the Directors received the following compensation from the Company:

| Director | Aggregate Compensation from Company | Pension or Retirement Benefits Accrued As Part of Fund Expenses | Estimated Annual Benefits upon Retirement | Total Compensation from Company & Fund Complex |

| Interested Director |

George A. Needham | $0 | $0 | $0 | $0 |

| Independent Directors |

John W. Larson | $15,000 | $0 | $0 | $15,000 |

F. Randall Smith | $15,000 | $0 | $0 | $15,000 |

The officers of the Funds receive no compensation from the Company for the performance of any duties with respect to the Funds.

The Board recommends that the Company’s shareholders vote "FOR" the election of the Nominees as Directors of the Company.

GENERAL INFORMATION

Solicitation of Proxies

In addition to solicitation of proxies by mail, certain officers of the Company, officers and employees of the Adviser or other representatives of the Company, who will not be paid for their services, may also solicit proxies by telephone. The Company has engaged the proxy solicitation firm of Broadridge Financial Solutions, Inc. ("Broadridge") who will be paid approximately $4,000, plus out-of-pocket expenses (such as printing and mailing costs), for its services. The Funds will pay for the expenses incident to the solicitation of proxies in connection with the Meeting, which include the fees and expenses of tabulating the results of the proxy solicitation and the fees and expenses of Broadridge. The Funds also will reimburse upon request persons holding shares as nominees for their reasonable expenses in sending soliciting materials to their principals. The expenses incurred in connection with preparing the Proxy Statement and its enclosures and all related legal and solicitation expenses will be paid by the Funds.

Householding

The Securities and Exchange Commission has adopted rules that permit investment companies, such as the Company, to satisfy delivery requirements for proxy statements with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” could result in extra convenience and cost savings for the Funds and their shareholders. If you participate in householding, and unless the Funds have received contrary instructions, only one copy of this Proxy Statement will be mailed to two or more shareholders who share an address. If you need additional copies, do not want your mailings to be householded or would like your mailings householded in the future, please call 1-800-625-7071 or write to the Funds c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202. Copies of this Proxy Statement will be delivered to you promptly upon oral or written request.

Copies of the Funds’ most recent annual and semi-annual reports are available without charge upon request to the Funds c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202, on the Funds’ website at https://www.needhamfunds.com/resources-forms/, or by calling, toll-free, at 1-800-625-7071.

Voting Procedures

You can vote at the Meeting, by mail, on the Internet or by phone by following the instructions on your proxy card. To vote by mail, sign and send us the enclosed proxy voting card in the envelope provided.

Shares represented by timely and properly executed proxies will be voted as specified. If you do not specify your vote with respect to a particular matter, the proxy holder will vote your shares in accordance with the recommendation of the Board. You may revoke your proxy at any time before it is exercised by sending a written revocation addressed to James W. Giangrasso, c/o The Needham Funds, Inc., 250 Park Avenue, New York, NY 10177, or by properly executing and delivering a later-dated proxy. Attendance at the Meeting, however, will not revoke the proxy.

Each whole share will be entitled to one vote as to any matter on which it is entitled to vote, and each fractional share will be entitled to a proportionate fractional vote. There is no cumulative voting in the election of Directors.

Quorum and Methods of Tabulation

The presence at the Meeting, in person or by proxy, of shareholders entitled to cast one-third of the votes entitled to be cast at the meeting shall constitute a quorum for the transaction of business for the Company at the Meeting. Votes cast by proxy will be counted by persons appointed by the Board as inspectors for the Meeting. Virtual attendance at the Meeting constitutes in person attendance for purposes of calculating the quorum. Shares represented by properly executed proxies with respect to which a vote is withheld, or for which a broker does not vote, will be treated as shares that are present and entitled to vote for purposes of determining a quorum, but will not constitute a vote “for” a proposal and will have no effect on the result of the vote.

Adjournment

If a quorum is not present at the Meeting, or if a quorum is present but sufficient votes to approve a proposal are not received, the chairperson of the Meeting shall have the power to adjourn the Meeting from time to time, without notice other than announcement at the Meeting.

Investment Adviser

The investment adviser to the Funds is Needham Investment Management LLC, located at 250 Park Avenue, New York, New York 10177.

Other Service Providers

The Company’s administrator, transfer and dividend disbursing agent is U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202. The Company’s distributor is Needham & Company, LLC, 250 Park Avenue, New York, New York 10177.

Independent Registered Public Accounting Firm

KPMG LLP (“KPMG”), located at 345 Park Avenue, New York, New York 10154, has served as the independent registered public accounting firm to the Company since 2011. Upon recommendation of the Company’s Audit Committee, the Board has selected KPMG as the independent registered public accounting firm to audit and certify the Company’s financial statements for each Fund’s most recent and current fiscal year ending December 31, 2021. Representatives of KPMG will not be present at the Meeting.

Audit Fees

For each Fund’s two most recent fiscal years ended December 31, 2020 and 2019, aggregate fees billed by KPMG for the audit of the Funds’ annual financial statements and services that are normally provided by KPMG in connection with statutory and regulatory filings or engagements for those two fiscal years were $80,471 and $78,500, respectively.

Audit-Related Fees

KPMG did not perform any assurance or services related to the performance of the audits of each Fund’s financial statements for the two most recent fiscal years ended in December 31, 2020 and 2019, which are not set forth under “Audit Fees” above.

Tax Fees

KPMG prepared each Fund’s federal and state income tax returns for the two most recent fiscal years ended December 31, 2020 and 2019. Aggregate fees expected to be billed for 2020 and billed for 2019 to the Funds by KPMG for professional services for tax compliance, tax advice, and tax planning were $24,675 and $23,925, respectively. All of these fees were required to be approved by the Audit Committee.

All Other Fees

KPMG neither performed services for the Company nor delivered any products to the Company for the Funds’ two most recent fiscal years ended December 31, 2020 and 2019, other than as set forth above.

Pre-Approval of Certain Services

The Audit Committee Charter requires pre-approval by the Company of all auditing and permissible non-audit services to be provided to the Company by KPMG, including fees. Accordingly, all of these non-audit services were required to be pre-approved, and all of these non-audit services were pre-approved by the Audit Committee.

Non-Audit Fees Paid by Adviser and its Affiliate

For the Funds’ two most recent fiscal years ended December 31, 2020 and 2019, KPMG is expected to bill $8,700 and billed $8,300, respectively, to the Adviser or its affiliate. The Audit Committee has considered whether the provision of non-audit services that were rendered to the Adviser is compatible with maintaining KPMG’s independence and has concluded that the provision of such non-audit services has not compromised KPMG’s independence.

Outstanding Shares

The Company currently offers shares of three series, each of which represents a separate investment portfolio. The total number of shares outstanding of the Company as a whole as of March 3, 2021 was 15,178,990. The number of shares of each Fund and class issued and outstanding as of March 3, 2021 is shown in the table below.

| Name of Fund/Class | Number of Issued and Outstanding Shares |

| Needham Growth Fund – Retail Class | 1,452,126 |

| Needham Growth Fund – Institutional Class | 1,032,593 |

| Needham Aggressive Growth Fund – Retail Class | 1,239,391 |

| Needham Aggressive Growth Fund – Institutional Class | 1,115,413 |

| Needham Small Cap Growth Fund – Retail Class | 3,898,036 |

| Needham Small Cap Growth Fund – Institutional Class | 6,441,431 |

A principal shareholder is any person who owns of record or beneficially 5% or more of the outstanding shares of a Fund. A control person is one who owns beneficially or through controlled companies more than 25% of the voting securities of a company or acknowledges the existence of control. As of March 3, 2021, to the knowledge of management, the following persons held of record or beneficially owned 5% or more of each Class of each Fund’s outstanding common stock:

Needham Growth Fund – Retail Class

| Name and Address | Percent Held | Nature of Ownership |

Charles Schwab & Co., Inc. 101 Montgomery Street San Francisco, CA 94104 | 28.46% | Record |

| | | |

National Financial Services Corp. 200 Liberty Street New York, NY 10281 | 27.94% | Record |

| | | |

TD Ameritrade Inc. P.O. Box 2226 Omaha, NE 68103-2226 | 6.48% | Record |

Needham Growth Fund – Institutional Class

| Name and Address | Percent Held | Nature of Ownership |

National Financial Services Corp. 200 Liberty Street New York, NY 10281 | 27.22% | Record |

| | | |

George A. Needham New York, NY 10075-0202 | 20.09% | Beneficial |

Needham Aggressive Growth Fund – Retail Class

| Name and Address | Percent Held | Nature of Ownership |

National Financial Services Corp. 200 Liberty Street New York, NY 10281 | 37.07% | Record |

| | | |

Charles Schwab & Co., Inc. 101 Montgomery Street San Francisco, CA 94104 | 25.35% | Record |

| | | |

TD Ameritrade Inc. P.O. Box 2226 Omaha, NE 68103-2226 | 8.87% | Record |

Needham Aggressive Growth Fund – Institutional Class

| Name and Address | Percent Held | Nature of Ownership |

George A. Needham New York, NY 10075-0202 | 22.86% | Beneficial |

| | | |

National Financial Services Corp. 200 Liberty Street New York, NY 10281 | 16.07% | Record |

| | | |

Barrett Foundation Boulder, CO 80306-1701 | 11.03% | Beneficial |

| | | |

Steven B. Thornton Trust La Jolla, CA 92037 | 9.42% | Beneficial |

Pershing LLC P.O. Box 2052 Jersey City, NJ 07303 | 8.41% | Record |

| | | |

Charles Schwab & Co., Inc. 101 Montgomery Street San Francisco, CA 94104 | 7.90% | Record |

Needham Small Cap Growth Fund – Retail Class

| Name and Address | Percent Held | Nature of Ownership |

National Financial Services Corp. 200 Liberty Street New York, NY 10281 | 44.82% | Record |

| | | |

Charles Schwab & Co., Inc. 101 Montgomery Street San Francisco, CA 94104 | 31.89% | Record |

| | | |

TD Ameritrade Inc. P.O. Box 2226 Omaha, NE 68103-2226 | 10.60% | Record |

Needham Small Cap Growth Fund – Institutional Class

| Name and Address | Percent Held | Nature of Ownership |

| | | |

Charles Schwab & Co., Inc. 101 Montgomery Street San Francisco, CA 94104 | 29.06% | Record |

| | | |

TD Ameritrade Inc. P.O. Box 2226 Omaha, NE 68103-2226 | 25.24% | Record |

| | | |

Wells Fargo Clearing Services LLC 1 North Jefferson Avenue St. Louis, MO 63103-2254 | 14.16% | Record |

| | | |

National Financial Services Corp. 200 Liberty Street New York, NY 10281 | 9.57% | Record |

| | | |

Other Matters

The Board knows of no other matters that may come before the Meeting, other than the proposals as set forth above. If any other matter properly comes before the Meeting, the persons named as proxies will vote on the same in their discretion.

Future Meetings; Shareholder Proposals

The Company is generally not required to hold annual meetings of shareholders and the Company generally does not hold a meeting of shareholders in any year unless certain specified shareholder actions such as election of directors or approval of a new advisory agreement are required to be taken under the 1940 Act or the Company’s articles of incorporation and By-Laws. By observing this policy, the Company seeks to avoid the expenses customarily incurred in the preparation of proxy material and the holding of shareholder meetings.

A shareholder desiring to submit a proposal intended to be presented at any meeting of shareholders of the Company hereafter called should send the proposal to the Secretary of the Company at the Company’s principal offices within a reasonable time before the solicitation of the proxies for such meeting. Shareholders who wish to recommend a nominee for election to the Board may do so by submitting the appropriate information about the candidate to the Company’s Secretary. The mere submission of a proposal by a shareholder does not guarantee that such proposal will be included in the Proxy Statement because certain rules under the federal securities laws must be complied with before inclusion of the proposal is required. Also, the submission does not mean that the proposal will be presented at the meeting. For a shareholder proposal to be considered at a shareholder meeting, it must be a proper matter for consideration under Maryland law.

By Order of the Board of Directors,

/s/ James W. Giangrasso

James W. Giangrasso

Chief Financial Officer, Treasurer and Secretary

New York, New York

March 12, 2021