Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration Statement 333-125042

Prospectus

Offer to Exchange all Outstanding

6 3/8% Series N Senior Notes due 2015

for

6 3/8% Series O Senior Notes due 2015

of

HOST MARRIOTT, L.P.

We are offering to exchange all of our outstanding 6 3/8% Series N senior notes for our 6 3/8% Series O senior notes. The terms of the Series O senior notes are substantially identical to the terms of the Series N senior notes except that the Series O senior notes are registered under the Securities Act of 1933, as amended, and are therefore freely transferable. The Series N senior notes were issued on March 10, 2005 and, as of the date of this prospectus, an aggregate principal amount of $650 million is outstanding.

Please consider the following:

| • | Our offer to exchange the notes expires at 5:00 p.m., New York City time, on July 15, 2005 unless extended. |

| • | You should carefully review the procedures for tendering the Series N senior notes beginning on page 2 of this prospectus. If you do not follow those procedures, we may not exchange your Series N senior notes for Series O senior notes. |

| • | We will not receive any proceeds from the exchange offer. |

| • | If you fail to tender your Series N senior notes, you will continue to hold unregistered securities and your ability to transfer them could be adversely affected. |

| • | There is currently no public market for the Series O senior notes. We do not intend to list the Series O senior notes on any securities exchange. Therefore, we do not anticipate that an active public market for these notes will develop. |

Information about the Series O senior notes:

| • | The notes will mature on March 15, 2015. We will pay interest on the notes semi-annually in cash in arrears at the rate of 6 3/8% per year payable on March 15 and September 15, commencing September 15, 2005. |

| • | The notes are equal in right of payment with all of our unsubordinated indebtedness and senior to all of our subordinated obligations, subject to certain limitations set forth in the section entitled “Description of Series O Senior Notes.” For further information on ranking, see also the section entitled “Risk Factors.” |

| • | The Series O senior notes will be guaranteed by certain of our subsidiaries, comprising all of our subsidiaries that have also guaranteed our credit facility and other indebtedness. |

| • | As security for the notes, we have pledged the common equity interests of those of our direct and indirect subsidiaries which also secure, on an equal and ratable basis, our credit facility and approximately $2.4 billion of our other outstanding existing senior notes (excluding our Series N senior notes). |

Broker-dealers receiving Series O senior notes in exchange for Series N senior notes acquired for their own account through market-making or other trading activities must deliver a prospectus in any resale of the Series O senior notes.

Investing in the Series O senior notes involves risks. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 15, 2005.

Table of Contents

Each broker-dealer that receives the Series O senior notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Series O senior notes. The letter of transmittal delivered with this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Series O senior notes received in exchange for Series N senior notes where such Series N senior notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period ending on the earlier to occur of (1) the date when all the Series O senior notes held by a broker-dealer have been sold and (2) 180 days after consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained in this prospectus. You must not rely upon any information or representation not contained in this prospectus as if we had authorized it. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which it relates, nor does this prospectus constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

This prospectus contains registered trademarks that are the exclusive property of their respective owners, which are companies other than us, including Marriott®, Ritz-Carlton®, Hyatt®, Four Seasons®, Fairmont®, Hilton® and Westin®. None of the owners of these trademarks, their affiliates or any of their respective officers, directors, agents or employees, is an issuer or underwriter of the Series O Senior Notes being offered. In addition, none of such persons has or will have any responsibility or liability for any information contained in this prospectus.

| Page | ||

| 1 | ||

| 8 | ||

| 23 | ||

| 25 | ||

| 32 | ||

Ratio of Earnings to Fixed Charges and Preferred OP Unit Distributions | 32 | |

| 33 | ||

| 35 | ||

Management’s Discussion and Analysis of Results of Operations and Financial Condition | 36 | |

| 77 | ||

| 80 | ||

| 94 | ||

| 104 | ||

| 107 | ||

| 111 | ||

| 159 | ||

| 160 | ||

| 161 | ||

| 161 | ||

| 161 | ||

| F-1 |

Table of Contents

This summary contains a general summary of the information contained in this prospectus. The summary may not contain all of the information that is important to you, and it is qualified in its entirety by the more detailed information and financial statements, including the notes to those financial statements, that are part of this registration statement. You should carefully consider the information contained in this entire prospectus including the information set forth in the section entitled “Risk Factors,” beginning on page 8 of this prospectus. In this prospectus we use the terms “operating partnership” or “Host LP” to refer to Host Marriott, L.P. and its consolidated subsidiaries and “Host Marriott,” or “HMC” to refer to Host Marriott Corporation, a Maryland Corporation in cases where it is important to distinguish between HMC and Host LP. The terms “we” or “our” refer to Host Marriott and Host LP together, unless the context indicates otherwise.

Host Marriott, L.P.

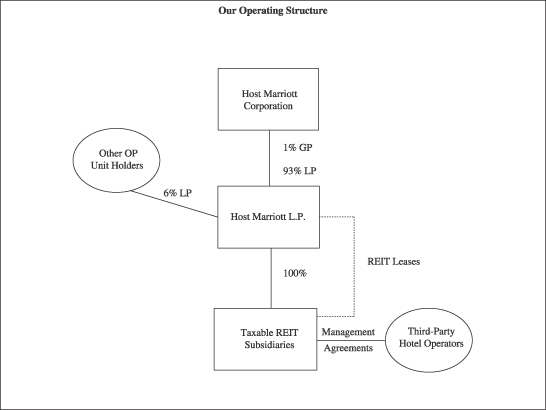

We are a Delaware limited partnership operating through an umbrella partnership structure with HMC as the sole general partner. Together, with HMC, we operate as a self-managed and self-administered real estate investment trust, or REIT. In addition to being the sole general partner, HMC holds approximately 94% of our partnership interests.

As of June 1, 2005, our lodging portfolio consisted of 107 full-service hotels containing approximately 55,000 rooms. Our portfolio is geographically diverse with hotels in most of the major metropolitan areas in 26 states, Washington, D.C., Toronto and Calgary, Canada and Mexico City, Mexico. Our locations include central business districts of major cities, near airports and resort/convention locations. Our hotels are operated under such brand names as Marriott, Ritz-Carlton, Hyatt, Four Seasons, Fairmont, Hilton and Westin.

The address of our principal executive office is 6903 Rockledge Drive, Suite 1500, Bethesda, Maryland, 20817. Our phone number is (240) 744-1000. HMC’s Internet website address is www.hostmarriott.com.

Risk Factors

For information regarding risks relating to our business and for an explanation of risks of investing in the Series O senior notes, see the section entitled “Risk Factors” beginning on page 8 of this prospectus.

1

Table of Contents

THE EXCHANGE OFFER

Securities to be exchanged | On March 10, 2005, we sold $650 million in aggregate principal amount of Series N senior notes in a transaction exempt from the registration requirements of the Securities Act of 1933, or the Securities Act. The terms of the Series N senior notes and the Series O senior notes are substantially identical in all material respects, except that the Series O senior notes will be freely transferable by the holders thereof except as otherwise provided in this prospectus. |

The exchange offer | We are offering to exchange $650 million principal amount of Series N senior notes for a like principal amount of Series O senior notes. Series N senior notes may be exchanged only in multiples of $1,000 principal amount. |

Registration rights agreement | We sold the Series N senior notes on March 10, 2005 in a private placement in reliance on Section 4(2) of the Securities Act. The Series N senior notes were immediately resold by their initial purchasers in reliance on Securities Act Rule 144A. In connection with the sale, we entered into a registration rights agreement with the initial purchasers requiring us to make this exchange offer. Under the registration rights agreement, we are required to cause the registration statement, of which this prospectus forms a part, to become effective on or before the 230th day following the date on which we issued the Series N senior notes, and we are obligated to consummate the exchange offer on or before the 260th day following the issuance of the Series N senior notes. |

Expiration date | Our exchange offer will expire at 5:00 p.m., New York City time, July 15, 2005, or at a later date and time to which we may extend it. |

Withdrawal | You may withdraw a tender of Series N senior notes pursuant to our exchange offer at any time before 5:00 p.m., New York City time, on July 15, 2005, or such later date and time to which we extend the offer. We will return any Series N senior notes that we do not accept for exchange for any reason as soon as practicable after the expiration or termination of our exchange offer. |

Interest on the Series O senior notes and Series N senior notes | Interest on the Series O senior notes will accrue from the date of the original issuance of the Series N senior notes or from the date of the last payment of interest on the Series N senior notes, whichever is later. We will not pay interest on Series N senior notes tendered and accepted for exchange. |

Conditions to our exchange offer | Our exchange offer is subject to customary conditions, which are discussed in the section entitled “The Exchange Offer.” As described in that section, we have the right to waive some of the conditions. |

2

Table of Contents

Procedures for tendering Series N senior notes | We will accept for exchange any and all Series N senior notes that are properly tendered (and not withdrawn) in the exchange offer prior to 5:00 p.m., New York City time, on July 15, 2005. The Series O senior notes issued pursuant to our exchange offer will be delivered promptly following the expiration date. |

If you wish to accept our exchange offer, you must complete, sign and date the letter of transmittal, or a copy, in accordance with the instructions contained in this prospectus and therein, and mail or otherwise deliver the letter of transmittal, or the copy, together with the Series N senior notes and all other required documentation, to the exchange agent at the address set forth in this prospectus. If you are a person holding Series N senior notes through the Depository Trust Company, or DTC, and wish to accept our exchange offer, you may do so pursuant to the DTC’s Automated Tender Offer Program, or ATOP, by which you will agree to be bound by the letter of transmittal. By executing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things:

| • | the Series O senior notes that you acquire pursuant to the exchange offer are being obtained by you in the ordinary course of your business, whether or not you are the registered holder of the Series O senior notes; |

| • | you are not engaging in and do not intend to engage in a distribution of Series O senior notes; |

| • | you do not have an arrangement or understanding with any person to participate in a distribution of Series O senior notes; and |

| • | you are not our “affiliate,” as defined under Securities Act Rule 405. |

Under the registration rights agreement we may be required to file a “shelf” registration statement for a continuous offering pursuant to Rule 415 under the Securities Act in respect of the Series N senior notes, if:

| • | we determine that we are not permitted to effect the exchange offer as contemplated by this prospectus because of any change in law or Securities and Exchange Commission policy; or |

| • | we have commenced and not consummated the exchange offer within 260 days following the date on which we issued the Series N senior notes. |

Exchange agent | The Bank of New York is serving as exchange agent in connection with the exchange offer. |

Federal income tax considerations | We believe the exchange of Series N senior notes for Series O senior notes pursuant to our exchange offer will not constitute a sale or an exchange for Federal income tax purposes. For further information, see the section entitled “Certain United States Federal Tax Consequences.” |

3

Table of Contents

Effect of not tendering | If you do not tender your Series N senior notes or if you do tender them but they are not accepted by us, your Series N senior notes will continue to be subject to the existing restrictions upon transfer. Except for our obligation to file a shelf registration statement under the circumstances described above, we will have no further obligation to provide for the registration under the Securities Act of Series N senior notes. |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the Series O senior notes. |

4

Table of Contents

THE SERIES O SENIOR NOTES

The summary below describes the principal terms of the Series O senior notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. For a more detailed description of the terms and conditions of the Series O senior notes, see the section entitled “Description of Series O Senior Notes.”

Issuer | Host Marriott, L.P. |

Securities Offered | $650,000,000 aggregate principal amount of 6 3/8% Series O senior notes due 2015. |

Maturity | March 15, 2015. |

Interest | Interest on the Series O senior notes will accrue at an annual rate of 6 3/8%. Interest will be paid semi-annually in arrears on March 15 and September 15 of each year, beginning on September 15, 2005. |

Ranking | The Series O senior notes are senior to all of our subordinated obligations and are equal in right of payment to our credit facility, our outstanding series of senior notes issued pursuant to our Amended and Restated Indentures dated August 5, 1998, as supplemented (which we refer to as our “existing senior notes”) set forth below: |

| • | $136 million 7 7/8% Series B senior notes due August 2008; |

| • | $242 million 9 1/4% Series G senior notes due October 2007; |

| • | $450 million 9 1/2% Series I senior notes due January 2007; |

| • | $725 million 7 1/8% Series K senior notes due November 2013; |

| • | $350 million 7% Series M senior notes due 2012; and |

| • | $500 million 3.25% Exchangeable Senior Debentures due April 2024 |

Under the indenture terms governing the Series O senior notes and our outstanding Series K senior notes and Series M senior notes, we and the subsidiary guarantors are permitted to incur up to $300 million of secured indebtedness, even when we are below the consolidated EBITDA-to-interest expense coverage ratio of at least 2.0 to 1.0, which would otherwise limit the incurrence of this new secured debt, so long as the proceeds are used to repay and permanently reduce indebtedness outstanding under our credit facility. Under the terms of several series of our existing senior notes, we may not be permitted to incur this indebtedness while any of such existing senior notes remain outstanding. See “Description of Series O Senior Notes—Covenants—Limitation on Incurrence of Indebtedness and Issuance of Disqualified Stock.” The Series O senior notes and the existing senior notes effectively will be subordinated to all secured indebtedness that may be incurred under

5

Table of Contents

the indenture, to the extent of the value of the collateral securing such indebtedness. For further information on ranking, see “Risk Factors—The Series O senior notes and the related subsidiary guarantees effectively will be junior in right of payment to some other liabilities” and “Description of Series O Senior Notes—General.” |

As of March 25, 2005, as adjusted to give effect to certain redemptions, repayments, and the discharge of our Series E senior notes in April 2005, we and our restricted subsidiaries would have had approximately $5.5 billion of total debt, of which approximately $1.9 billion would have been secured by mortgage liens on various of our hotel properties and related assets of ours and our restricted subsidiaries. See “Capitalization.”

Guarantors | The Series O senior notes are guaranteed by certain of our direct and indirect subsidiaries, representing all of our subsidiaries that have also guaranteed our credit facility, our existing senior notes and certain of our other indebtedness. The guarantees may be released under certain circumstances. We are generally not required to cause future subsidiaries to become guarantors unless they secure our credit facility, the existing senior notes or certain of our other indebtedness. |

Security | The Series O senior notes are secured by a pledge of the common equity interests of certain of our direct and indirect subsidiaries, which common equity interests also secure, on an equal and ratable basis, our credit facility and approximately $2.4 billion of our currently outstanding senior notes and will secure certain future unsubordinated indebtedness ranking equal in right of payment with the Series O senior notes. Under the indenture terms governing the Series O senior notes and our outstanding Series K senior notes and Series M senior notes, we and the subsidiary guarantors may incur up to $300 million of secured indebtedness, even when we are below the consolidated EBITDA-to-interest expense coverage ratio of at least 2.0 to 1.0, which would otherwise limit the incurrence of this new secured debt, so long as the proceeds are used to repay and permanently reduce indebtedness outstanding under our credit facility. Under the terms of several series of our existing senior notes, we may not be permitted to incur this indebtedness while any such existing senior notes remain outstanding. See “Description of Series O Senior Notes—Covenants—Limitation on Incurrence of Indebtedness and Issuance of Disqualified Stock.” The Series O senior notes and our existing senior notes effectively will be subordinated to all secured indebtedness that may be incurred under the indenture, to the extent of the value of the collateral securing such indebtedness. |

For more detail, see the section entitled “Risk Factors—The Series O senior notes effectively will be junior in right of payment to some other liabilities.”

Optional Redemption | At any time prior to March 15, 2010, the Series O senior notes will be redeemable at our option, in whole, but not in part, for 100% of their principal amount, plus the make-whole premium described in this prospectus, plus accrued and unpaid interest to the applicable |

6

Table of Contents

redemption date. For more details, see the section entitled “Description of Series O Senior Notes—Optional Redemption.” |

Beginning March 15, 2010, we may redeem, in whole or in part, the Series O senior notes at any time at the prices set forth in the section entitled “Description of Series O Senior Notes—Optional Redemption.”

In addition, prior to March 15, 2008, we may redeem up to 35% of the aggregate principal amount of the Series O senior notes at the price set forth in the section entitled “Description of Series O Senior Notes—Optional Redemption” together with any accrued and unpaid interest to the applicable redemption date with the net cash proceeds of certain sales of our or HMC’s equity securities.

Mandatory Offer to Repurchase | If we sell certain assets or undergo certain kinds of changes of control, we must offer to repurchase the Series O senior notes as described in the section entitled “Description of Series O Senior Notes—Repurchase of Notes at the Option of the Holder upon a Change of Control Triggering Event.” |

Basic Covenants of the Indenture | The indenture governing the Series O senior notes, among other things, restricts our ability and the ability of our restricted subsidiaries to: |

| • | incur additional indebtedness; |

| • | pay dividends on, redeem or repurchase our equity interests; |

| • | make investments; |

| • | permit payment or dividend restrictions on certain of our subsidiaries; |

| • | sell assets; |

| • | in the case of our restricted subsidiaries, guarantee indebtedness; |

| • | create certain liens; and |

| • | sell certain assets or merge with or into other companies. |

All of these limitations are subject to important exceptions and qualifications described in the section entitled “Description of Series O Senior Notes—Covenants.”

Risk Factors

Investment in the Series O senior notes involves risks. You should carefully consider the information under the section entitled “Risk Factors” and all other information included in this prospectus before investing in the Series O senior notes.

7

Table of Contents

You should carefully consider the following risk factors, in addition to the other information contained in this prospectus, before deciding to tender Series N senior notes in the exchange offer.

Risks Related to the Offering

We have substantial leverage.

We have significant indebtedness and we will continue to have significant indebtedness after the offering of the Series O senior notes. On March 25, 2005, as adjusted to give effect to certain redemptions, repayments and the discharge of our Series E senior notes in April 2005, we and our subsidiaries would have had total indebtedness of approximately $5.5 billion (of which approximately $3.1 billion would have consisted of senior notes, approximately $1.9 billion would have been secured by mortgage liens on various of our hotel properties with related assets, and the balance would have consisted of other debt). We currently also have $575 million of availability under our credit facility.

Our substantial indebtedness could have important consequences. It currently requires us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, which reduces the availability of our cash flow to fund working capital, capital expenditures, expansion efforts, distributions to our partners and other general purposes. Additionally, it could:

| • | make it more difficult for us to satisfy our obligations with respect to the Series O senior notes; |

| • | limit our ability in the future to undertake refinancings of our debt or obtain financing for expenditures, acquisitions, development or other general business purposes on terms and conditions acceptable to us, if at all; or |

| • | affect adversely our ability to compete effectively or operate successfully under adverse economic conditions. |

Because we distribute most of our taxable income to HMC in order that it may maintain its qualification as a REIT, we depend upon external sources of capital for future growth. If our cash flow and working capital were not sufficient to fund our expenditures or service our indebtedness, we would have to raise additional funds through:

| • | the contribution of funds by HMC from the proceeds of sales of its equity; |

| • | the incurrence of additional permitted indebtedness by us; or |

| • | the sale of our assets. |

We cannot assure you that any of these sources of funds would be available to us or, if available, would be on terms that we would find acceptable or in amounts sufficient for us to meet our obligations or fulfill our business plan.

The Series O senior notes and the related Subsidiary Guarantees effectively will be junior in right of payment to some other liabilities.

Only our subsidiaries that have guaranteed payment of certain of our indebtedness ranking equal in priority to the Series O senior notes, including the credit facility and the existing senior notes and future indebtedness that is similarly guaranteed, have guaranteed, and are required to guarantee, our obligations under the Series O senior notes. Although the indenture governing the terms of the Series O senior notes places limits on the overall level of indebtedness that non-guarantor subsidiaries may incur, the Series O senior notes effectively will be junior in right of payment to liabilities of our non-guarantor subsidiaries and to any debt of ours or our subsidiaries that is secured by assets other than the equity interests in our subsidiaries securing the Series O senior notes, to the extent of the value of such assets. Since only those subsidiaries that guarantee the credit facility, the existing

8

Table of Contents

senior notes or certain of our other indebtedness are required to guarantee the Series O senior notes, there can be no assurance as to the number of subsidiaries that will be guarantors of the Series O senior notes at any point in time or as to the value of their assets or significance of their operations.

Under the terms of the indenture applicable to the Series O senior notes, subject to satisfaction of certain other requirements, we, the subsidiary guarantors and our respective restricted subsidiaries may incur debt secured by our respective assets (other than the equity interests of our subsidiaries securing the credit facility, the existing senior notes and the Series O senior notes). For a discussion of our ability to incur such secured debt, see “Description of Series O Senior Notes—Limitation on Incurrence of Indebtedness and Issuance of Disqualified Stock.” Currently, we and such subsidiaries have debt secured by mortgages on 25 of our full-service hotels and related assets. Neither the Series O senior notes nor the related subsidiary guarantees thereof will be secured by those assets and the Series O senior notes and such subsidiary guarantees effectively will be junior in right of payment to this secured debt to the extent of the value of the assets securing such debt. As of March 25, 2005, as adjusted to give effect to certain redemptions, repayments, and the discharge of our Series E senior notes in April 2005, we and our subsidiaries have approximately $1.9 billion of debt secured by mortgages on these hotels and related assets.

In addition, under the indenture covenants that are applicable to the Series K and Series M senior notes, and that will be applicable to the Series O senior notes, we and the subsidiary guarantors may also incur up to $300 million of secured indebtedness, even when we are below the consolidated EBITDA-to-interest expense “coverage” ratio of at least 2.0 to 1.0, which would otherwise limit the incurrence of this new secured debt, so long as the proceeds are used to repay and permanently reduce indebtedness outstanding under our credit facility. Under the indenture covenants applicable to several of our series of existing senior notes, we may not be permitted to incur this indebtedness while any of such existing senior notes remain outstanding. See “Description of Series O Senior Notes—Limitation on Incurrences of Indebtedness and Issuance of Disqualified Stock—Ranking.” The Series O senior notes will be subordinated to this and to all other secured indebtedness that may be incurred under the indenture governing the Series O senior notes, to the extent of the value of the collateral securing such secured indebtedness.

The terms of our debt place restrictions on us and our subsidiaries, reducing operational flexibility and creating default risks.

The documents governing the terms of the Series O senior notes, our existing senior notes and the credit facility contain covenants that place restrictions on us and our subsidiaries. The activities upon which such restrictions exist include, but are not limited to:

| • | acquisitions, merger and consolidations; |

| • | the incurrence of additional debt; |

| • | the creation of liens; |

| • | the sale of assets; |

| • | capital expenditures; |

| • | raising capital; |

| • | the payment of dividends; and |

| • | transactions with affiliates. |

In addition, certain covenants in our credit facility require us and our subsidiaries to meet financial performance tests. The restrictive covenants in the indenture, our credit facility and the documents governing our other debt (including our mortgage debt) will reduce our flexibility in conducting our operations and will limit our ability to engage in activities that may be in our long-term best interest. Our failure to comply with these restrictive covenants could result in an event of default that, if not cured or waived, could result in the acceleration of all or a substantial portion of our debt, including the Series O senior notes offered hereby.

9

Table of Contents

We will be permitted to make distributions to HMC under certain conditions even when we cannot otherwise make restricted payments under the indenture and the credit facility.

Under the indenture terms governing the Series O senior notes and our existing senior notes, we are only allowed to make restricted payments if, at the time we make such a restricted payment, we are able to incur at least $1.00 of indebtedness under the “Limitation on Incurrences of Indebtedness and Issuance of Disqualified Stock” covenant. This covenant requires us to meet certain conditions in order to incur additional debt, including that we have a consolidated EBITDA-to-interest expense “coverage” ratio of at least 2.0 to 1.0 in order to make a restricted payment; except that, in the case of a preferred stock distribution, the covenant applicable to the Series O senior notes and our outstanding 7 1/8% Series K senior notes due 2013 and 7% Series M senior notes due 2012 provides that we are only required to have a consolidated coverage ratio of at least 1.7 to 1.0. For a more complete discussion of the restricted payment and debt incurrence covenants of the indenture applicable to the Series O senior notes, see the following sections of this Offering Memorandum: “Description of Series O Senior Notes—Limitation on Restriction Payments; and Limitation on Incurrences of Indebtedness and Issuance of Disqualified Stock.”

Even when we are unable to make restricted payments during a period in which we are unable to incur $1.00 of indebtedness, the indenture terms governing the Series O senior notes and our outstanding Series K and Series M senior notes permit us, so long as HMC believes in good faith after reasonable diligence that HMC qualifies as a REIT under the Internal Revenue Code of 1986, as amended, or the Code, to make permitted REIT distributions, which are any distributions (1) to HMC equal to the greater of (a) the amount estimated by HMC in good faith after reasonable diligence to be necessary to permit HMC to distribute to its shareholders with respect to any calendar year (whether made during such year or after the end thereof) 100% of the “real estate investment trust taxable income” of HMC within the meaning of Section 857(b)(2) of the Code, determined without regard to deductions for dividends paid and the exclusions set forth in Code Sections 857(b)(2)(C), (D), (E) and (F) but including all net capital gains and net recognized built-in gains within the meaning of Treasury Regulations 1.337(d)-6 (whether or not such gains might otherwise be excluded or excludable therefrom); or (b) the amount that is estimated by HMC in good faith after reasonable diligence to be necessary either to maintain HMC’s status as a REIT under the Code for any calendar year or to enable HMC to avoid the payment of any tax for any calendar year that could be avoided by reason of a distribution by HMC to its shareholders, with such distributions to be made as and when determined by HMC, whether during or after the end of the relevant calendar year; in either the case of (a) or (b) above if: (x) the aggregate principal amount of all our outstanding indebtedness (other than our convertible debt obligation to HMC pertaining to its QUIPs, as defined below) and that of our restricted subsidiaries, on a consolidated basis, at such time is less than 80% of our Adjusted Total Assets (as defined in the indenture) and (y) no Default or Event of Default (as defined in the indenture) shall have occurred and be continuing, and (2) to certain other holders of our partnership units where such distribution is required as a result of, or a condition to, the payment of distributions to HMC.

The indenture terms governing our other series of existing senior notes permit us to make permitted REIT distributions, which are defined therein as any distributions (1) to HMC that are necessary to maintain HMC’s status as a REIT under the Code or to satisfy the distributions required to be made by reason of HMC’s making of the election provided for in Notice 88-19 (or Treasury regulations issued pursuant thereto) if the aggregate principal amount of all of our outstanding indebtedness (other than our convertible debt obligation to HMC pertaining to its QUIPs) and that of our restricted subsidiaries, on a consolidated basis, at such time is less than 80% of Adjusted Total Assets (as defined in the indenture) and (2) to certain other holders of our partnership units where such distribution is required as a result of, or a condition to, the payment of distributions to HMC. We refer to the distribution that we are permitted to make which are summarized in this and the previous paragraph as “permitted REIT distributions”.

Beginning in the third quarter of 2002 and continuing through the fiscal quarter ended March 26, 2004, we were prohibited from making distributions and other restricted payments (other than permitted REIT distributions) because our consolidated EBITDA-to-interest expense coverage ratio was below 2.0 to 1.0. Accordingly, during this period, we were only able to make distributions to the extent HMC had taxable income

10

Table of Contents

and was required to make distributions to maintain its status as a REIT. Currently, our EBITDA-to-interest expense coverage ratio is above 2.0 to 1.0 and we may make distributions in excess of permitted REIT distributions to the extent that we continue to satisfy this and other indenture covenant requirements. We intend, during any future period in which we are unable to make restricted payments under the indenture, and under similar restrictions under the credit facility, to continue our practice of distributing quarterly, based on our estimates of taxable income for any year, an amount of our available cash sufficient to enable HMC to pay quarterly dividends on its preferred and common stock in an amount necessary to satisfy the requirements applicable to REITs under the Code. In the event that we make distributions to HMC in amounts in excess of those necessary for HMC to maintain its status as a REIT, we will be in default under the indenture terms governing all but the Series O senior notes and our outstanding Series K and Series M senior notes. A default under any series of our existing senior notes could lead to a default under the Series O senior notes and the Series K and Series M senior notes. See “Description of Series O Senior Notes—Events of Default”.

We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture.

Upon the occurrence of certain change of control events, we will be required to offer to repurchase all outstanding series of existing senior notes and the Series O senior notes offered hereby. However, it is possible that we will not have sufficient funds at the time of the change of control to make the required repurchase of senior notes or that restrictions in our credit facility will not allow us to make such repurchases. See “Description of Series O Senior Notes—Repurchase of Notes at the Option of the Holder Upon a Change of Control Triggering Event.”

Our failure to repurchase any of the Series O senior notes would be a default under the indenture for all series of senior notes issued thereunder and also under our credit facility.

The Series O senior notes or a guarantee thereof may be deemed a fraudulent transfer.

Under the Federal bankruptcy laws and comparable provisions of state fraudulent transfer laws, a guarantee of the Series O senior notes could be voided, or claims on a guarantee of the Series O senior notes could be subordinated to all other debts of that guarantor if, among other things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee:

| (1) | received less than reasonably equivalent value or fair consideration for the incurrence of such guarantee; and |

| (2) | either: |

| (a) | was insolvent or rendered insolvent by reason of such incurrence; |

| (b) | was engaged in a business or transaction for which the guarantor’s remaining assets constituted unreasonably small capital; or |

| (c) | intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature. |

If such circumstances were found to exist, or if a court were to find that the guarantee were issued with actual intent to hinder, delay or defraud creditors, the court could cause any payment by that guarantor pursuant to its guarantee to be voided and returned to the guarantor, or to a fund for the benefit of the creditors of the guarantor.

In addition, our obligations under the Series O senior notes may be subject to review under the same laws in the event of our bankruptcy or other financial difficulty. In that event, if a court were to find that when we issued the Series O senior notes the factors in clauses (1) and (2) above applied to us, or that the Series O senior notes

11

Table of Contents

were issued with actual intent to hinder, delay or defraud creditors, the court could void our obligations under the Series O senior notes, or direct the return of any amounts paid thereunder to us or to a fund for the benefit of our creditors.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, the operating partnership or a guarantor would be considered insolvent if:

| • | the sum of its debts, including contingent liabilities, were greater than the fair saleable value of all of its assets; or |

| • | the present fair value of its assets were less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

On the basis of historical financial information, recent operating history and other factors, we believe that we and each of our guarantors, after giving effect to the guarantee of the Series O senior notes, will be solvent, will have a reasonable amount of capital for the business in which we or it is engaged and will not have incurred debts beyond our or its ability to pay such debts as they mature. We can offer no assurance, however, as to what standard a court would apply in making such determinations or that a court would agree with our conclusions in this regard.

An active trading market may not develop for the notes.

The Series N senior notes are not listed on any securities exchange. Since their issuance, there has been a limited trading market for such notes. To the extent that Series N senior notes are tendered and accepted in the exchange offer, the trading market for untendered and tendered but unaccepted Series N senior notes will be adversely affected. We cannot assure you that this market will provide liquidity for you if you want to sell your Series N senior notes.

We will not list the Series O senior notes on any securities exchange. These notes are new securities for which there is currently no market. The Series O senior notes may trade at a discount from their initial offering price, depending upon prevailing interest rates, the market for similar securities, our performance and other factors. We have been advised by Goldman, Sachs & Co., Citigroup Global Markets Inc. and Deutsche Bank Securities Inc. that they intend to make a market in the Series O senior notes, as well as the Series N senior notes, as permitted by applicable laws and regulations. However, they are not obligated to do so and their market making activities may be discontinued at any time without notice. In addition, their market making activities may be limited during our exchange offer. Therefore, we cannot assure you that an active market for Series O senior notes will develop.

Financial Risks and Risks of Operation

We depend on external sources of capital for future growth and we may be unable to access capital when necessary.

Unlike corporations, our ability to reduce our debt and finance our growth largely must be funded by external sources of capital because HMC is required to distribute to its stockholders at least 90% of its taxable income in order to qualify as a REIT, including taxable income it recognizes for tax purposes but with regard to which it does not receive corresponding cash. Our ability to access the external capital we require could be hampered by a number of factors many of which are outside of our control, including declining general market conditions, unfavorable market perception of our growth potential, decreases in our current and estimated future earnings, excessive cash distributions or decreases in the market price of HMC’s common stock. In addition, our ability to access additional capital may also be limited by the terms of our existing indebtedness, which, among

12

Table of Contents

other things, restricts our incurrence of debt and the payment of distributions. The occurrence of any of these above-mentioned factors, individually or in combination, could prevent us from being able to obtain the external capital we require on terms that are acceptable to us or at all and the failure to obtain necessary external capital could have a material adverse affect our ability to finance our future growth.

Our revenues and the value of our properties are subject to conditions affecting the lodging industry.

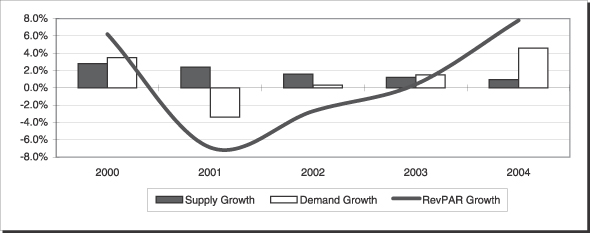

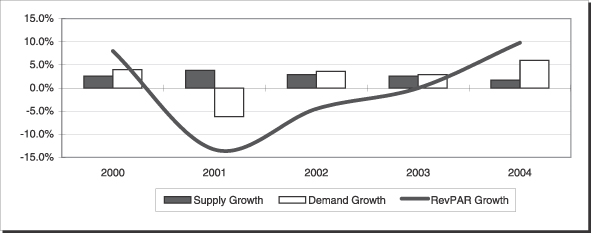

The lodging industry experienced a down-turn from 2001 to 2003, and operations generally declined during this period. The decline was attributed to a number of factors including a weak economy, the effect of terrorist attacks, terror alerts in the United States and the war in Iraq, all of which changed the travel patterns of both business and leisure travelers. While our operations have improved and RevPAR increased in 2004, we cannot provide assurance that changes in travel patterns of both business and leisure travelers are permanent or whether they will continue to evolve creating new opportunities or difficulties for the industry. Any forecast we make regarding our results of operations may be affected and can change based on the following risks:

| • | changes in the national, regional and local economic climate; |

| • | changes in business and leisure travel patterns; |

| • | local market conditions such as an oversupply of hotel rooms or a reduction in lodging demand; |

| • | the attractiveness of our hotels to consumers relative to our competition; |

| • | the performance of the managers of our hotels; |

| • | changes in room rates and increases in operating costs due to inflation and other factors; and |

| • | unionization of the labor force at our hotels. |

Future terrorist attacks or changes in terror alert levels could adversely affect us.

Previous terrorist attacks in the United States and subsequent terrorist alerts have adversely affected the travel and hospitality industries. The impact which terrorist attacks in the United States or elsewhere could have on our business in particular and the U.S. economy, the global economy and global financial markets in general is indeterminable. It is possible that such attacks or the threat of such attacks could have a material adverse effect on our business, our ability to finance our business, our ability to insure our properties and on our results of operations and financial condition as a whole.

Our expenses may not decrease if our revenue drops.

Many of the expenses associated with owning and operating hotels, such as debt payments, property taxes, insurance, utilities, and employee wages and benefits, are relatively inflexible and do not necessarily decrease in tandem with a reduction in revenue at the hotels. Our expenses will also be affected by inflationary increases, and in the case of certain costs, such as wages, benefits and insurance, may exceed the rate of inflation in any given period. Our managers may be unable to offset any such increased expenses with higher room rates. Any of our efforts to reduce operating costs or failure to make scheduled capital expenditures could adversely affect the growth of our business and the value of our hotel properties.

Our ground lease payments may increase faster than the revenues we receive on the hotels situated on the leased properties.

Currently, thirty-nine of our hotels are subject to third party ground leases (encumbering all or a portion of the hotel). These ground leases generally require increases in ground rent payments every five years. Our ability to service our debt could be adversely affected to the extent that our revenues do not increase at the same or a greater rate than the increases in rental payments under the ground leases. In addition, if we were to sell a hotel encumbered by a ground lease, the buyer would have to assume the ground lease, which may result in a lower sales price.

13

Table of Contents

We do not control our hotel operations and we are dependent on the managers of our hotels.

Because Federal income tax laws restrict REITs and their subsidiaries from operating a hotel, we do not manage our hotels. Instead, we lease substantially all of our full-service properties to subsidiaries which qualify as “taxable REIT subsidiaries” under applicable REIT laws, and our taxable REIT subsidiaries retain third-party managers to manage our hotels pursuant to management agreements. Our income from the hotels may be adversely affected if our managers fail to provide quality services and amenities or if they fail to maintain a quality brand name. While our taxable REIT subsidiaries monitor the hotel managers’ performance, we have limited specific recourse under our management agreements if we believe that the hotel managers are not performing adequately. In addition, from time to time, we have had, and continue to have, differences with the managers of our hotels over their performance and compliance with the terms of our management agreements. We generally resolve issues with our managers through discussions and negotiations. However, if we are unable to reach satisfactory results through discussions and negotiations, we may choose to litigate such a dispute. Failure by our hotel managers to fully perform the duties agreed to in our management agreements could adversely affect our results of operations. In addition, our hotel managers manage, and in some cases own or have invested in, hotels that compete with our hotels, which may result in conflicts of interest. As a result, our hotel managers have in the past made and may in the future make decisions regarding competing lodging facilities that are not or would not be in our best interests.

Our ability to make distributions may be limited or prohibited by the terms of our indebtedness.

We are, and may in the future become, parties to agreements and instruments which restrict or prevent the payment of distributions to HMC. Under the terms of our credit facility and our senior notes indenture, distributions to HMC by us, which HMC depends upon in order to obtain the cash necessary to pay dividends, are permitted only to the extent that, at the time of the distributions, we can satisfy certain financial covenant tests and meet other requirements.

For example, beginning in the third quarter of 2002 and continuing through the first quarter of 2004, we were prohibited from making distributions (other than in the amounts required to permit HMC to pay dividends necessary to maintain REIT qualification) because our EBITDA-to-interest coverage ratio as calculated under the indenture governing our senior notes (which measures the ratio of pro forma consolidated EBITDA to pro forma consolidated interest expense) was below 2.0 to 1.0. During this period, we were only able to make distributions to HMC, and HMC was only able to pay dividends, to the extent that we were required to make distributions to maintain HMC’s status as a REIT. While our EBITDA-to-interest coverage ratio is currently above 2.0 to 1.0 and as a result we are no longer limited by this particular restriction, a decline in our operations could once again limit the amount of distributions that we could make, and HMC’s ability to pay dividends, either because our EBITDA-to-interest coverage ratio again falls below 2.0 to 1.0 or because we fail to meet other financial covenant tests or meet other requirements in our credit facility or senior notes indenture.

Our ability to make distributions on our common OP units may also be limited or prohibited by the terms of our preferred units and Convertible Subordinated Debentures.

Under the terms of our outstanding classes of preferred units, we are not permitted to make distributions on our common OP units unless cumulative dividends have been paid (or funds for payment have been set aside for payment) on each such class of preferred units. The amount of aggregate dividends that accrue on our outstanding classes of preferred units each quarter is approximately $8 million.

In the event that we fail to pay the accrued dividends on our preferred units for any reason, including because we are prevented from making such distributions under the terms of our debt instruments (as discussed above), dividends will continue to accrue on all outstanding classes of our preferred units and we will be prohibited from making any distributions on our common OP units until all such accrued but unpaid dividends on our preferred units have been paid (or funds for such payment have been set aside).

14

Table of Contents

We may defer interest payments on the Convertible Subordinated Debentures for a period not to exceed 20 consecutive quarters. If interest payments on the Convertible Subordinated Debentures are deferred, so too are payments on the Convertible Preferred Securities. Under this circumstance, we will not be permitted to declare or pay any cash distributions with respect to our capital stock or debt securities that rank pari passu with or junior to the Convertible Subordinated Debentures.

Foreclosure on our mortgage debt could adversely affect our business.

Twenty-five of our hotels and assets related thereto are subject to various mortgages in an aggregate amount of approximately $1.9 billion. Although the debt is generally non-recourse to us, if these hotels do not produce adequate cash flow to service the debt secured by such mortgages, the mortgage lenders could foreclose on these assets. We may opt to allow such foreclosure rather than make the necessary mortgage payments with funds from other sources. However, our senior notes indenture and credit facility contain cross default provisions, which, depending upon the amount of secured debt defaulted on, could cause a cross default under both of these agreements. Our credit facility, which contains the more restrictive cross default provision as compared to our senior notes indenture, provides that it is a credit facility default in the event we default on non- recourse secured indebtedness in excess of 1% of our total assets (using undepreciated real estate values) or default on other indebtedness in excess of $50 million. For this and other reasons, permitting a foreclosure could adversely affect our long-term business prospects.

Our mortgage debt contains provisions that may reduce our liquidity.

Certain of our mortgage debt requires that, to the extent cash flow from the hotels which secure such debt drops below stated levels, we escrow cash flow after the payment of debt service until operations improve above the stated levels. In some cases, the escrowed amount may be applied to the outstanding balance of the mortgage debt. When such provisions are triggered, there can be no assurance that the affected properties will achieve the minimum cash flow levels required to trigger a release of any escrowed funds. The amounts required to be escrowed may be material and may negatively affect our liquidity by limiting our access to cash flow after debt service from these mortgaged properties.

Rating Agency downgrades may increase our cost of capital.

Both our senior notes and HMC’s preferred stock are rated by Moody’s and Standard & Poor’s. These independent rating agencies may elect to downgrade their ratings on our senior notes and HMC’s preferred stock at any time. These downgrades negatively affect our access to the capital markets and increase our cost of capital.

Our management agreements could impair the sale or financing of our hotels.

Under the terms of our management agreements, we generally may not sell, lease or otherwise transfer the hotels unless the transferee is not a competitor of the manager and the transferee assumes the related management agreements and meets specified other conditions. Our ability to finance or sell our properties, depending upon the structure of such transactions, may require the manager’s consent. If, in these circumstances, the manager does not consent, we may be precluded from taking actions in our best interest without breaching the management agreement.

The acquisition contracts relating to some hotels limit our ability to sell or refinance those hotels.

For reasons relating to tax considerations of the former and current owners of seven hotels, we have agreed to restrictions on selling the hotels, or repaying or refinancing the mortgage debt for varying periods depending on the hotel. We have also agreed not to sell more than 50% of the original allocated value attributable to the former owners of a portfolio of 11 additional hotels, or to take other actions that would result in the recognition and allocation of gain to the former owners of such hotels for income tax purposes. We anticipate that, in

15

Table of Contents

specified circumstances, we may agree to similar restrictions in connection with future hotel acquisitions. As a result, even if it were in our best interests to sell these hotels or repay or otherwise reduce the level of the mortgage debt on such hotels, it may be difficult or costly to do so during their respective lock-out periods.

We may be unable to sell properties because real estate investments are illiquid.

Real estate investments generally cannot be sold quickly. We may not be able to vary our portfolio promptly in response to economic or other conditions. The inability to respond promptly to changes in the performance of our investments could adversely affect our financial condition and our ability to service our debt. In addition, there are limitations under the federal tax laws applicable to REITs that may limit our ability to recognize the full economic benefit from a sale of our assets.

Applicable REIT laws may restrict certain business activities.

As a REIT, HMC is subject to various restrictions on its income, assets and activities. Business activities that could be impacted by applicable REIT laws include, but are not limited to, activities such as developing alternative uses of real estate, including the development and/or sale of timeshare or condominium units, investments in real estate mortgages, investments in securities and dispositions of certain properties.

Due to these restrictions, certain business activities, including those mentioned above, may need to occur in one or more of our taxable REIT subsidiaries. Our taxable REIT subsidiaries are taxable as corporations and are subject to federal, state, and, if applicable, local and foreign taxation on their income at applicable corporate rates. In addition, under REIT laws, the aggregate value of all of our taxable REIT subsidiaries may not exceed 20% of the value of all of the REIT’s assets.

We depend on our key personnel.

Our success depends on the efforts of our executive officers and other key personnel. None of our key personnel have employment agreements and we do not maintain key person life insurance for any of our executive officers. We cannot assure you that these key personnel will remain employed by us. While we believe that we could find replacements for these key personnel, the loss of their services could have a significant adverse effect on our financial performance.

Litigation judgments or settlements could have a material adverse effect on our financial condition.

We are a party to various lawsuits, including lawsuits relating to HMC’s conversion into a REIT (referenced to as the “REIT Conversion”). While we and the other defendants to such lawsuits believe all of the lawsuits in which we are a defendant are without merit and we are vigorously defending against such claims, we can give no assurance as to the outcome of any of the lawsuits. If any of the lawsuits were to be determined adversely to us or a settlement involving a payment of a material sum of money were to occur, there could be a material adverse effect on our financial condition.

Our acquisition of additional properties may have a significant effect on our business, liquidity, financial position and/or results of operations.

As part of our business strategy, we seek to acquire upper-upscale and luxury hotel properties. We may acquire these properties through various structures, including transactions involving portfolios, single assets, joint ventures and acquisitions of all or substantially all of the securities or assets of other REITs or similar real estate entities. We anticipate that our acquisitions will be financed through a combination of methods, including proceeds from equity offerings of HMC, issuance of OP units, advances under our credit facility, and the incurrence or assumption of indebtedness. We may, from time to time, be in the process of identifying, analyzing and negotiating possible acquisition transactions and we expect to continue to do so in the future. We cannot

16

Table of Contents

assure you that we will be successful in consummating future acquisitions on favorable terms or that we will realize the benefits that we anticipate from one or more acquisitions that we consummate. Our inability to consummate one or more acquisitions on such terms, or our failure to realize the intended benefits from one or more acquisitions, could have a material adverse effect on our business, liquidity, financial position and/or results of operations, including as a result of our incurrence of additional indebtedness and related interest expense and our assumption of unforeseen contingent liabilities.

We may acquire hotel properties through joint ventures with third parties that could result in conflicts.

Instead of purchasing hotel properties directly, we may invest as a co-venturer. Co-venturers often share control over the operation of a joint venture. For example, we entered into a joint venture with Marriott International that owns two limited partnerships holding, in the aggregate, 120 Courtyard by Marriott hotels. Subsidiaries of Marriott International manage these Courtyard by Marriott hotels and other subsidiaries of Marriott International serve as ground lessors and mezzanine lender to the partnerships. Actions by a co-venturer could subject the assets to additional risk, including:

| • | our co-venturer in an investment might have economic or business interests or goals that are inconsistent with our, or the joint venture’s, interests or goals; |

| • | our co-venturer may be in a position to take action contrary to our instructions or requests or contrary to our policies or objectives; or |

| • | our co-venturer could go bankrupt, leaving us liable for its share of joint venture liabilities. |

Although we generally will seek to maintain sufficient control of any joint venture to permit our objectives to be achieved, we might not be able to take action without the approval of our joint venture partners. Also, our joint venture partners could take actions binding on the joint venture without our consent.

Environmental problems are possible and can be costly.

We believe that our properties are in compliance in all material respects with applicable environmental laws. Unidentified environmental liabilities could arise, however, and could have a material adverse effect on our financial condition and performance. Federal, state and local laws and regulations relating to the protection of the environment may require a current or previous owner or operator of real estate to investigate and clean up hazardous or toxic substances or petroleum product releases at the property. The owner or operator may have to pay a governmental entity or third parties for property damage and for investigation and clean-up costs incurred by the parties in connection with the contamination. These laws typically impose clean-up responsibility and liability without regard to whether the owner or operator knew of or caused the presence of the contaminants. Even if more than one person may have been responsible for the contamination, each person covered by the environmental laws may be held responsible for all of the clean-up costs incurred. In addition, third parties may sue the owner or operator of a site for damages and costs resulting from environmental contamination emanating from that site. Environmental laws also govern the presence, maintenance and removal of asbestos. These laws require that owners or operators of buildings containing asbestos properly manage and maintain the asbestos, that they notify and train those who may come into contact with asbestos and that they undertake special precautions, including removal or other abatement, if asbestos would be disturbed during renovation or demolition of a building. These laws may impose fines and penalties on building owners or operators who fail to comply with these requirements and may allow third parties to seek recovery from owners or operators for personal injury associated with exposure to asbestos fibers.

Compliance with other government regulations can be costly.

Our hotels are subject to various other forms of regulation, including Title III of the Americans with Disabilities Act, building codes and regulations pertaining to fire safety. Compliance with those laws and

17

Table of Contents

regulations could require substantial capital expenditures. These regulations may be changed from time to time, or new regulations adopted, resulting in additional costs of compliance, including potential litigation. Any increased costs could have a material adverse effect on our business, financial condition or results of operations.

Some potential losses are not covered by insurance.

We carry comprehensive insurance coverage for general liability, property, business interruption and other risks with respect to all of our hotels and other properties. These policies offer coverage features and insured limits that we believe are customary for similar type properties. Generally, our “all-risk” property policies provide coverage that is available on a per occurrence basis and that, for each occurrence, has an overall limit as well as various sub-limits on the amount of insurance proceeds we can receive. Sub-limits exist for certain types of claims such as service interruption, abatement, earthquakes, expediting costs or landscaping replacement, and the dollar amounts of these sub-limits are significantly lower than the dollar amounts of the overall coverage limit. Our property policies also provide that all of the claims from each of our properties resulting from a particular insurable event must be combined together for purposes of evaluating whether the aggregate limits and sub-limits contained in our policies have been exceeded and, in the case of four of our hotels where the manager provides this coverage, any such claims will also be combined with the claims of other owners participating in the managers’ program for the same purpose. That means that, if an insurable event occurs that affects more than one of our hotels, or, in the case of hotels where coverage is provided by the management company, affects hotels owned by others, the claims from each affected hotel will be added together to determine whether the aggregate limit or sub-limits, depending on the type of claim, have been reached and each affected hotel may only receive a proportional share of the amount of insurance proceeds provided for under the policy if the total value of the loss exceeds the aggregate limits available. We may incur losses in excess of insured limits and, as a result, we may be even less likely to receive sufficient coverage for risks that affect multiple properties such as earthquakes or certain types of terrorism.

In addition, there are other risks such as war, certain forms of terrorism such as nuclear, biological or chemical terrorism and some environmental hazards that may be deemed to fall completely outside the general coverage limits of our policies or may be uninsurable or may be too expensive to justify insuring against. If any such risk were to materialize and materially adversely affect one or more of our properties, we would likely not be able to recover our losses.

We may also encounter challenges with an insurance provider regarding whether it will pay a particular claim that we believe to be covered under our policy. Should a loss in excess of insured limits or an uninsured loss occur or should we be unsuccessful in obtaining coverage from an insurance carrier, we could lose all, or a portion of, the capital we have invested in a property, as well as the anticipated future revenue from the hotel. In that event, we might nevertheless remain obligated for any mortgage debt or other financial obligations related to the property.

We may not be able to recover fully under our existing terrorism insurance for losses caused by some types of terrorist acts, and Federal terrorism legislation does not ensure that we will be able to obtain terrorism insurance in adequate amounts or at acceptable premium levels in the future.

We obtain terrorism insurance as part of our all-risk property insurance program. However, as noted above, our all-risk policies have limitations such as per occurrence limits and sublimits which might have to be shared proportionally across participating hotels under certain loss scenarios. Also, all-risk insurers only have to provide terrorism coverage to the extent mandated by the Terrorism Risk Insurance Act (TRIA) for “certified” acts of terrorism—namely those which are committed on behalf of non-United States persons or interests. Furthermore, we do not have full replacement coverage at all of our properties for acts of terrorism committed on behalf of United States persons or interests (“noncertified” events) as our coverage for such incidents is subject to sublimits and annual aggregate limits. In addition, property damage related to war and to nuclear, biological and chemical incidents is excluded under our policies. While TRIA will reimburse insurers for losses resulting from

18

Table of Contents

nuclear, biological and chemical perils, TRIA does not require insurers to offer coverage for these perils and, to date, insurers are not willing to provide this coverage, even with government reinsurance. In addition, TRIA terminates on December 31, 2005, and there is no guarantee that the terrorism coverage that it mandates will be readily available or affordable thereafter. As a result of the above, there remains considerable uncertainty regarding the extent and adequacy of terrorism coverage that will be available to protect our interests in the event of future terrorist attacks that impact our properties.

Federal Income Tax Risks

The lower tax rate on certain dividends from regular C corporations may cause investors to hold stock in those corporations.

While corporate dividends have traditionally been taxed at ordinary income rates, dividends received by individuals through December 31, 2008 from regular C corporations generally will be taxed at the maximum capital gains tax rate of 15% as opposed to the maximum ordinary income tax rate of 35%. REIT dividends are not eligible for the lower capital gains rates, except in certain circumstances where the dividends are attributable to income that has been subject to corporate-level tax. This difference in the taxation of dividends could cause individual investors to view the stock of regular C corporations as more attractive relative to the stock of REITs. Individual investors could hold this view because the dividends from regular C corporations will generally be taxed at a lower rate while dividends from REITs will generally be taxed at the same rate as the individual’s other ordinary income. We cannot predict what effect, if any, this difference in the taxation of dividends may have on the value of the stock of REITs, either in terms of price or relative to other potential investments.

To qualify as a REIT, HMC is required to distribute at least 90% of its taxable income, irrespective of its available cash or outstanding obligations.

To continue to qualify as a REIT, HMC currently is required to distribute to its stockholders with respect to each year at least 90% of its taxable income, excluding net capital gain. In addition, HMC will be subject to a 4% nondeductible excise tax on the amount, if any, by which distributions made by it with respect to the calendar year are less than the sum of 85% of its ordinary income and 95% of its capital gain net income for that year and any undistributed taxable income from prior periods less excess distributions from prior years. HMC intends to make distributions, subject to the availability of cash and in compliance with any debt covenants, to its stockholders to comply with the distribution requirement and to avoid the nondeductible excise tax and will rely for this purpose on distributions from us. However, there are differences in timing between HMC’s recognition of taxable income and its receipt of cash available for distribution due to, among other things, the seasonality of the lodging industry and the fact that some taxable income will be “phantom” income, which is taxable income that is not matched by cash flow to it. Due to some transactions entered into in years prior to the REIT conversion, HMC could recognize substantial amounts of “phantom” income. It is possible that these timing differences could require HMC to borrow funds or to issue additional equity to enable it to meet the distribution requirement and, therefore, to maintain its REIT status, and to avoid the nondeductible excise tax. In addition, because the REIT distribution requirement prevents HMC from retaining earnings, it will generally be required to refinance debt that matures with additional debt or equity. We cannot assure you that any of the sources of funds, if available at all, would be sufficient to meet HMC’s distribution and tax obligations.

Adverse tax consequences would apply if HMC failed to qualify as a REIT.

We believe that HMC has been organized and has operated in such a manner so as to qualify as a REIT under the Internal Revenue Code, commencing with its taxable year beginning January 1, 1999, and HMC currently intends to continue to operate as a REIT during future years. No assurance can be provided, however, that HMC qualifies as a REIT or that new legislation, treasury regulations, administrative interpretations or court decisions will not significantly change the tax laws with respect to its qualification as a REIT or the federal income tax consequences of its REIT qualification. If HMC fails to qualify as a REIT, and any available relief

19

Table of Contents

provisions do not apply, it will not be allowed to take a deduction for distributions to stockholders in computing its taxable income, and it will be subject to Federal and state income tax, including any applicable alternative minimum tax, on its taxable income at regular corporate rates. In addition, unless entitled to statutory relief, it would not qualify as a REIT for the four taxable years following the year during which REIT qualification is lost. Any determination that HMC does not qualify as a REIT would have a materially adverse effect on our results of operations and could reduce the value of HMC’s common stock materially. The additional tax liability to us for the year, or years, in which it did not qualify would reduce its net earnings available for investment, debt service or distributions to its stockholders. Furthermore, HMC would no longer be required to make any distributions to stockholders as a condition to REIT qualification and all of its distributions to stockholders would be taxable as regular corporate dividends to the extent of its current and accumulated earnings and profits, or “E&P.” This means that stockholders taxed as individuals currently would be taxed on those dividends at capital gains rates and corporate stockholders generally would be entitled to the dividends received deduction with respect to such dividends, subject in each case, to applicable limitations under the Internal Revenue Code. HMC’s failure to qualify as a REIT also would cause an event of default under our credit facility that could lead to an acceleration of the amounts due under the credit facility, which, in turn, would constitute an event of default under our outstanding debt securities.

New legislation, enacted October 22, 2004, contained several provisions applicable to REITs, including provisions that could provide relief in the event HMC violates certain provisions of the Internal Revenue Code that otherwise would result in its failure to qualify as a REIT. We cannot assure you that these relief provisions would apply if HMC failed to comply with the REIT qualification laws. Even if the relief provisions do apply, HMC would be subject to a penalty tax of at least $50,000 for each disqualifying event in most cases.

HMC will be disqualified as a REIT at least for taxable year 1999 if it failed to distribute all of its E&P attributable to its non-REIT taxable years.

In order to qualify as a REIT, HMC cannot have at the end of any taxable year any undistributed E&P that is attributable to one of its non-REIT taxable years. A REIT has until the close of its first taxable year as a REIT in which it has non-REIT E&P to distribute its accumulated E&P. HMC was required to have distributed this E&P prior to the end of 1999, the first taxable year for which its REIT election was effective. If it failed to do this, it will be disqualified as a REIT at least for taxable year 1999. We believe that distributions of non-REIT E&P that HMC made were sufficient to distribute all of the non-REIT E&P as of December 31, 1999, but we cannot provide assurance that it met this requirement.

If HMC’s leases are not respected as true leases for Federal income tax purposes, HMC would fail to qualify as a REIT.

To qualify as a REIT, HMC must satisfy two gross income tests, under which specified percentages of its gross income must be passive income, like rent. For the rent paid pursuant to the leases, which constitutes substantially all of its gross income, to qualify for purposes of the gross income tests, the leases must be respected as true leases for Federal income tax purposes and not be treated as service contracts, joint ventures or some other type of arrangement. In addition, the lessees must not be regarded as related party tenants, as defined in the Internal Revenue Code. We believe that the leases will be respected as true leases for federal income tax purposes. There can be no assurance, however, that the IRS will agree with this view. We also believe that Crestline, the lessee of substantially all of our full service hotels prior to January 1, 2001, was not a related party tenant and, as a result of changes in the tax laws effective January 1, 2001, our affiliated lessee will not be treated as a related party tenant so long as it qualifies as a taxable REIT subsidiary. If the leases were not respected as true leases for federal income tax purposes or if the lessee was regarded as a related party tenant, HMC would not be able to satisfy either of the two gross income tests applicable to REITs and it would lose its REIT status. See “Risk Factors—Federal Income Tax Risks—Adverse tax consequences would apply if HMC failed to qualify as a REIT” above.

20

Table of Contents