Proxy StatementPursuant to Section 14(a) of the Securities Exchange Act of 1934 |

| |

| Filed by the registrant [X] |

| Filed by a party other than the registrant |

|

| Check the appropriate box: |

| [ ] | Preliminary proxy statement | | |

| [ ] | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive proxy statement | | |

| [ ] | Definitive additional materials |

| [ ] | Soliciting material pursuant to Rule 14a-12 |

Horizon Financial Corp.

|

| (Name of Registrant as Specified in Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| |

| Payment of filing fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

N/A

|

| (2) | Aggregate number of securities to which transactions applies: |

N/A

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

N/A

|

| (4) | Proposed maximum aggregate value of transaction: |

N/A

|

| (5) | Total fee paid: |

N/A

|

| [ ] | Fee paid previously with preliminary materials: |

N/A

|

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

| (1) | Amount previously paid: |

N/A

|

| (2) | Form, schedule or registration statement no.: |

N/A

|

| (3) | Filing party: |

N/A

|

| (4) | Date filed: |

N/A

|

<PAGE>

June 17, 2005

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Horizon Financial Corp. to be held at the Fox Hall, 1661 W. Bakerview Road, Bellingham, Washington, on Tuesday, July 26, 2005 at 1:00 p.m., Pacific Time.

The attached Notice of Annual Meeting of Shareholders and Proxy Statement describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Corporation. Directors and officers of the Corporation, as well as a representative of Moss Adams LLP, will be present to respond to any questions our shareholders may have.

Please sign, date and return the enclosed proxy card. If you attend the meeting and vote your shares at the meeting, please note the following:

| | 1. | If you are a shareholder of record and you have physical possession of the stock certificates: You may vote in person even if you have voted by proxy previously. |

| |

| | 2. | If your shares are held by a brokerage firm or other nominee, and you want to vote in person at the meeting: Please contact your broker or agent for a"Legal Proxy" from your brokerage firm and bring the Legal Proxy to the meeting for voting. Without the Legal Proxy, you will not be able to vote in person at the meeting. |

Your continued interest and support of the Corporation and Horizon Bank are sincerely appreciated. Sincerely,

/s/ V. Lawrence Evans

V. Lawrence Evans

Chairman of the Board

<PAGE>

HORIZON FINANCIAL CORP.

1500 Cornwall Avenue

Bellingham, Washington 9822

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on July 26, 2005

NOTICE IS HEREBY GIVEN THAT the 2005 Annual Meeting of Shareholders ("Meeting") of Horizon Financial Corp. ("Corporation") will be held at the Fox Hall, which is located at 1661 W. Bakerview Road, Bellingham, Washington, on Tuesday, July 26, 2005 at 1:00 p.m., Pacific Time.

A Proxy Card and Proxy Statement for the Meeting are enclosed herewith.

The Meeting is for the purpose of considering and acting upon: (1) The election of three directors of the Corporation;

(2) The adoption of the 2005 Incentive Stock Plan; and

(3) Such other matters as may properly come before the Meeting or any adjournments thereof.

NOTE: The Board of Directors is not aware of any other business to come before the Meeting.

Any action may be taken on the foregoing proposal at the Meeting on the date specified above, or on any date or dates to which, by original or later adjournment, the Meeting may be adjourned. Shareholders of record at the close of business on June 6, 2005, are the shareholders entitled to notice of and to vote at the Meeting and any adjournments thereof.

You are requested to fill in and sign the enclosed form of proxy, which is solicited by the Board of Directors, and to mail it promptly in the enclosed envelope. The proxy will not be used if you attend the Meeting and vote in person.

BY ORDER OF THE BOARD OF DIRECTORS

/s/Richard P. Jacobson RICHARD P. JACOBSON

& nbsp; SECRETARY

Bellingham, Washington

June 17, 2005

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE YOUR CORPORATION THE EXPENSE OF FURTHER REQUESTS FOR PROXIES IN ORDER TO INSURE A QUORUM. AN ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

<PAGE>

PROXY STATEMENT

OF

HORIZON FINANCIAL CORP.

1500 Cornwall Avenue

Bellingham, Washington 98225

(360) 733-3050

ANNUAL MEETING OF SHAREHOLDERS

July 26, 2005

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Horizon Financial Corp. ("Horizon Financial" or the "Corporation"), the holding company for Horizon Bank ("Horizon Bank" or the "Bank"), to be used at the 2005 Annual Meeting of Shareholders of the Corporation ("Meeting") which will be held at the Fox Hall, 1661 W. Bakerview Road, Bellingham, Washington, on Tuesday, July 26, 2005 at 1:00 p.m., Pacific Time. The accompanying Notice of Annual Meeting of Shareholders and this Proxy Statement are being first mailed to shareholders on or about June 17, 2005.

VOTING AND PROXY PROCEDURE

Shareholders Entitled to Vote. Shareholders of record as of the close of business on June 6, 2005 ("Voting Record Date") are entitled to one vote for each share of common stock ("Common Stock") of the Corporation then held. Shareholders are not permitted to cumulate their votes for the election of directors. As of the Voting Record Date the Corporation had 9,970,125 shares of Common Stock issued and outstanding.

If you are a beneficial owner of the Corporation's Common Stock held by a broker, bank or other nominee (i.e., in "street name"), you will need proof of ownership to be admitted to the Meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of the Corporation's Common Stock held in street name in person at the Meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Quorum. The presence, in person or by proxy, of at least one-third of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Meeting.Abstentions will be counted as shares present and entitled to vote at the Meeting for purposes of determining the existence of a quorum. Broker non-votes will be considered shares present and will be included in determining whether a quorum is present.

Voting. The Board of Directors solicits proxies so that each shareholder has the opportunity to vote on the proposals to be considered at the Meeting. When a proxy card is returned properly signed and dated, the shares represented thereby will be voted in accordance with the instructions on the proxy card. Where no instructions are indi- cated, proxies will be voted in accordance with the recommendations of the Board of Directors. If a shareholder of record attends the Meeting, he or she may vote by ballot. The Board recommends a vote FOR the election of the nominees for director and FOR adoption of the 2005 Incentive Stock Plan.

The affirmative vote of a plurality of the votes cast at the Meeting is required for the election of directors. Shareholders are not permitted to cumulate their votes for the election of directors. Votes may be cast for or withheld from each nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the election because the nominees receiving the greatest number of votes will be elected.

The adoption of the 2005 Incentive Stock Plan requires the affirmative vote of a majority of the outstanding shares of the Common Stock present in person or by proxy and entitled to vote at the Meeting. Abstentions are not affirmative votes and, therefore, will have the same effect as a vote against the proposal and broker non-votes will be disregarded and will have no effect on the outcome of the vote.

Revocation of a Proxy. Shareholders who execute proxies retain the right to revoke them at any time before they are voted. Proxies may be revoked by written notice delivered in person or mailed to the Secretary of the

<PAGE>

Corporation or by filing a later proxy prior to a vote being taken on a particular proposal at the Meeting. Attendance at the Meeting will not automatically revoke a proxy, but a shareholder of record in attendance may request a ballot and vote in person, thereby revoking a prior granted proxy.

If your Common Stock of the Corporation is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker or bank may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form that accompanies this proxy statement. If you wish to change your voting instructions after you have returned your voting instruction form to your broker or bank, you must contact your broker or bank.

Participants in the ESOP. If a shareholder is a participant in the Horizon Bank Employee Stock Ownership Plan ("ESOP"), the proxy card represents a voting instruction to the trustees of the ESOP as to the number of shares in the participant's plan account. Each participant in the ESOP may direct the trustees as to the manner in which shares of Common Stock allocated to the participant's plan account are to be voted. The instructions are confidential and will not be disclosed to the Corporation. Unallocated shares of Common Stock held by the ESOP and allocated shares for which no voting instructions are received will be voted by the trustees in the same proportion as shares for which the trustees have received voting instructions.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Persons and groups who beneficially own in excess of five percent of the Corporation's Common Stock are required to file certain reports with the Securities and Exchange Commission ("SEC"), and provide a copy to the Corporation, disclosing such ownership pursuant to the Securities Exchange Act of 1934, as amended ("Exchange Act").Based on such reports, information as to those persons who were beneficial owners of more than 5% of the outstanding shares of Common Stock. Management knows of no persons who beneficially owned more than 5% of the outstanding shares of Common Stock at the close of business on the Voting Record Date. The following table sets forth, as of the close of business on the Voting Record Date, certain information as to shares of Common Stock beneficially owned by the Corporation's directors, "named executive officers," and all directors and executive officers of the Corporation as a group.

| Number of Shares

Beneficially Owned (1)(2)

| Percent of Shares

Outstanding

|

Name

|

| | | |

| Directors | | |

| |

| Robert C. Diehl | 45,984 | 0.46% |

| Fred R. Miller | 110,988 | 1.11 |

| James A. Strengholt | 9,460 | 0.09 |

| Richard R. Haggen | 77,467 | 0.78 |

| Gary E. Goodman | 5,093 | 0.05 |

| Robert C. Tauscher | 5,508 | 0.06 |

| |

| Named Executive Officers(3) | | |

| |

| V. Lawrence Evans | 247,695 | 2.48 |

| Dennis C. Joines | 16,469 | 0.17 |

| Richard P. Jacobson | 31,287 | 0.31 |

| Steve L. Hoekstra | 4,793 | 0.05 |

| | | |

| All Executive Officers and | | |

| Directors as a Group (11 persons) | 569,419 | 5.71 |

| |

(footnotes on following page) |

2

<PAGE>

| ______________ |

| (1) | Includes all shares owned directly by the named individuals or by the individuals indirectly through a trust or corporation, or by the individuals' spouses and minor children, except as otherwise noted. The named individuals effectively exerci'se sole or shared voting and investment power over these shares. |

| (2) | Includes shares of Common Stock subject to outstanding stock options which are exercisable within 60 days after the Voting Record Date. |

| (3) | Under SEC regulations the term "named executive officer(s)" is defined to include the chief executive officer, regardless of compensation level, and the four most highly compensated executive officers, other than the chief executive officer, whose total annual salary and bonus for the last completed fiscal year exceeded $100,000. Mr. Evans, President, Chief Executive Officer and Chairman of the Board of the Corporation and Chief Executive Officer and Chairman of the Board of the Bank; Mr. Joines, President and Chief Operating Officer of the Bank; Mr. Jacobson, Vice President and Secretary of the Corporation and Executive Vice President of the Bank; and Mr. Hoekstra, Executive Vice President of the Bank; were the Corporation's only "named executive officers" during the fiscal year ended March 31, 2005. |

PROPOSAL I -- ELECTION OF DIRECTORS

The Corporation's Board of Directors consists of eight directors. The Corporation's bylaws provide that directors will be elected for three-year staggered terms with approximately one-third of the directors elected each year. Accordingly, at the Meeting, three directors will be elected to serve for a three-year term, or until their respective successors have been duly elected and qualified. The Board of Directors has nominated for election as directors V. Lawrence Evans, Richard R. Haggen and Robert C. Tauscher, each for three-year terms. Messrs. Evans, Haggen and Tauscher are each current members of the Board of Directors of the Corporation and the Bank.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the above named nominees for the terms specified in the table below. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend or the Board may reduce the number of directors to eliminate the vacancy. At this time the Board of Directors knows of no reason why any nominee might be unavailable to serve.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF MESSRS. EVANS, HAGGEN AND TAUSCHER.

The following table sets forth certain information regarding the nominees for election at the Meeting and those directors continuing in office after the Meeting.

| | Year First Elected

or Appointed Director(2)

| Term to

Expire

|

Name

| Age(1)

|

| |

NOMINEES |

| |

| V. Lawrence Evans | 58 | 1990 | 2008(3) |

| Richard R. Haggen | 60 | 1994 | 2008(3) |

| Robert C. Tauscher | 65 | 2001 | 2008(3) |

| |

| CONTINUING DIRECTORS |

| |

| Robert C. Diehl | 66 | 1976 | 2006 |

| Fred R. Miller | 68 | 1984 | 2006 |

| Gary E. Goodman | 57 | 1998 | 2006 |

| Dennis C. Joines | 55 | 2002 | 2007 |

| James A. Strengholt | 52 | 2000 | 2007 |

| | | | |

3

<PAGE>

___________

| (1) | As of March 31, 2005. |

| (2) | Includes prior service on the Board of Directors of the Bank. |

| (3) | Assuming the individual is re-elected. |

The principal occupation of each director nominee of the Corporation for the last five years is set forth below. Unless otherwise stated, each director resides in the State of Washington.

V. LAWRENCE EVANS joined the Bank in 1972 and served as the Bank's Executive Vice President from 1983 to 1990. Mr. Evans served as President of the Bank from May 14, 1990 to April 23, 2002. He has served as Chief Executive Officer of the Bank since March 26, 1991 and as Chairman of the Bank's Board of Directors since July 1997. Mr. Evans also serves as President and Chief Executive Officer of the Corporation and, effective July 24, 2001, as Chairman of the Board of the Corporation.

RICHARD R. HAGGEN is an owner and co-chairman of the Board of Directors of Haggen, Inc., a retail grocery chain.

ROBERT C. TAUSCHER is the President and Chief Executive Officer of Team Corporation, a manufacturer of vibration testing equipment, in Burlington, Washington.

ROBERT C. DIEHL is the President and General Manager of Diehl Ford, Inc., an automobile dealership.

FRED R. MILLER is the retired and former owner and President of the Skagit Bonded Collectors, Inc., Mount Vernon, Washington.

GARY E. GOODMAN is the refinery manager for the Conoco Phillips Refinery in Ferndale, Washington.

DENNIS C. JOINES is President and Chief Operating Officer of the Bank and a Director of the Corporation and the Bank. He joined the Bank on April 23, 2002 following an extensive career in the Pacific Northwest banking industry for over 30 years. Most recently, Mr. Joines was Senior Vice President/National Small Business and SBA Manager for Washington Mutual Bank from 2001 to 2002. Prior to that time, he served in a variety of key roles at KeyBank from 1993 to 2001.

JAMES A. STRENGHOLT is the Vice President of Strengholt Construction Company, Inc., a general building contractor based in Lynden, Washington.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Boards of Directors of the Corporation and the Bank conduct their business through meetings of the Boards and through their committees. During fiscal 2005, the Board of Directors of the Corporation held eight meetings. No director of the Corporation attended fewer than 75% of the total number of meetings of the Board of Directors and committees on which the director served.A majority of the Board of Directors is comprised of "independent" directors, in accordance with the requirements for companies quoted on The Nasdaq Stock Market. The Board of Directors has determined that all of the members of the Board of Directors are independent, except for Messrs. Evans, who serves as Chairman of the Board, President and Chief Executive Officer of the Corporation and as Chief Executive Officer of the Bank, and Mr. Joines, who serves as President and Chief Operating Officer of the Bank.

Members of the Board of Directors of the Corporation, who are "independent" in accordance with the requirements for companies quoted on The Nasdaq Stock Market, act as a Nominating Committee for the annual selection of the Corporation's nominees for election as directors. Accordingly, the Nominating Committee is composed of Directors Richard R. Haggen, Robert C. Tauscher, Robert C. Diehl, Fred R. Miller, Gary E. Goodman and James A. Strengholt. A charter has not been adopted by the Nominating Committee. The Nominating Committee met on March

4

<PAGE>

22, 2005 to nominate directors for election at the Meeting. The Corporation's Bylaws provide that any nomination to the Board of Directors (except one proposed by the existing Board of Directors of the Corporation in its capacity as the Nominating Committee) must be in writing and delivered or mailed to the Secretary of the Corporation at least 20 days prior to the meeting of shareholders called for the election of directors. The Board of Directors met once during the 2005 fiscal year in its capacity as the Nominating Committee. Only those nominations made by the Nominating Committee or properly presented by shareholders will be voted upon at the Meeting. In its deliberations for selecting candidates for nominees as director, the Nominating Committee considers the candidate's knowledge of the banking business and involvement in community, business and civic affairs, and also considers whether the candidate would provide for adequate representation of its market area. Any nominee for director made by the committee must be highly qualified with regard to some or all the attributes listed in the preceding sentence. In searching for qualified director candidates to fill vacancies in the Board, the committee solicits its current Board of Directors for names of potentially qualified candidates. Additionally, the committee may request that members of the Board of Directors pursue their own business contacts for the names of potentially qualified candidates. The committee would then consider the potential pool of director candidates, select the top candidate based on the candidates' qualifications and the Board's needs, and conduct an investigation of the proposed candidate's background to ensure there is no past history that would cause the candidate not to be qualified to serve as a director of the Corporation. The Nominating Committee does not have a formal policy with regard to the consideration of any director candidates recommended by security holders. At this time, the Board of Directors does not consider such a policy to be necessary, due in large part to the past success of the Nominating Committee in researching and nominating qualified individuals to serve on the Board.

The Executive Committee of the Corporation is composed of Directors Evans (Chairman), Diehl, Goodman, Joines and Miller. This Committee meets at least monthly to advise management of the Corporation between meetings of the Board of Directors. The Executive Committee met 12 times during the 2005 fiscal year.

The Audit Committee of the Corporation is composed of Directors Miller (Chairman), Strengholt and Tauscher. The Audit Committee is responsible for examining and evaluating the activities of the Corporation and reporting its findings to the Board. This examination determines the reliability of information produced on behalf of the Corporation and the effectiveness of internal practices and procedures and the efficiency of operations. The Audit Committee also assists the Board in the selection of independent accountants. The Audit Committee revised its Charter to reflect the new responsibilities imposed by the Sarbanes-Oxley Act of 2002 and the Board of Directors adopted the new charter as of April 27, 2004. A copy of the revised Charter was attached to last year's annual meeting proxy statement as Appendix A. The Board of Directors has determined that there is no "audit committee financial expert," as defined in the SEC regulations. The Board believes that the current members of the Audit Committee are qualified to serve based on their experience and background. Each member of the Audit Committee is "independent," in accordance with the requirements for companies quoted on The Nasdaq Stock Market. The Audit Committee met five times during the year ended March 31, 2005.

The Compensation and Retirement Committee is composed of Directors Diehl (Chairman), Goodman and Miller. This Committee makes recommendations to the Board of Directors concerning corporation compensation packages and retirement plans. The Compensation and Retirement Committee met five times during the 2005 fiscal year.

Board Policies Regarding Communications with the Board of Directors and Attendance at Annual Meetings

The Board of Directors maintains a process for shareholders to communicate with the Board of Directors. Shareholders wishing to communicate with the Board of Directors should send any communication to the Corporate Secretary, Horizon Financial Corp., 1500 Cornwall Avenue, Bellingham, Washington 98225. Any such communication must state the number of shares beneficially owned by the shareholder making the communication. The Corporate Secretary will forward such communication to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is unduly hostile, threatening, illegal or similarly inappropriate, in which case the Corporate Secretary has the authority to take appropriate legal action regarding the communication. The Corporation does not have a policy regarding Board member attendance at annual meetings of shareholders. All eight Board members attended the 2004 Annual Meeting of Shareholders.

5

<PAGE>

Corporate Governance

The Corporation and the Bank are committed to establishing and maintaining high standards of corporate governance. The Corporation's and the Bank's executive officers and the Board of Directors have worked together to establish a comprehensive set of corporate governance initiatives that they believe will serve the long-term interests of the Corporation's shareholders and employees. These initiatives are intended to comply with the provisions contained in the Sarbanes-Oxley Act of 2002, the rules and regulations of the SEC adopted thereunder, and The Nasdaq Stock Market. The Board will continue to evaluate, and improve the Corporation's and the Bank's corporate governance principles and policies as necessary and as required.

Code of Ethics. On April 27, 2004, the Board of Directors adopted Officer and Director Codes of Ethics. The Codes are applicable to each of the Corporation's directors and officers, including the principal executive officer and senior financial officers, and requires individuals to maintain the highest standards of professional conduct. A copy of the Code of Ethics applicable to the principal executive officer and senior financial officers was filed as an exhibit to the Corporation's Annual Report on Form 10-K for the year ended March 31, 2004. The Corporation has not made the Codes of Ethics available on its website. The Corporation will provide a copy of the Codes of Ethics free of charge upon request.

DIRECTORS' COMPENSATION

Each director of the Corporation is also a director of the Bank. Directors of the Corporation received no additional compensation for attendance at any meeting of the Corporation's Board of Directors during the 2005 fiscal year. Members of the Bank's Board of Directors receive an annual retainer of $9,000 and $750 for attendance at each Board meeting. Directors also receive $500 for each committee meeting attended, or a special meeting and $750 for attendance at a special board meeting. Members of the Executive Committee receive $600 per month. Employees of the Bank who are also directors do not receive compensation for their attendance at any board or committee meetings.

6

<PAGE>

EXECUTIVE COMPENSATION

Summary Compensation Table. The following information is furnished forthe Chief Executive Officer of the Corporation and the Bank, and for the executive officers who received salary and bonus in excess of $100,000 during the fiscal year ended March 31, 2005 (the"named executive officers"). No other executive officer's total annual salary and bonus for the last completed fiscal year exceeded $100,000.

| | | | | Long-Term

Compensation

Awards

| |

| | | | | |

| | Annual Compensation*

| |

| | | | | Securities

Underlying

Options(#)(2)

| |

Name and

Position

| | | | Other Annual | All Other

Compensation($)(3)

|

Year

| Salary($)

| Bonus($)

| Compensation($)(1)

|

| |

| V. Lawrence Evans | 2005 | $211,992 | $42,568 | $108,018 | -- | $ 28,984 |

| President, Chief Executive | 2004 | 206,000 | 90,047 | 102,276 | -- | 28,079 |

| Officer and Chairman of | 2003 | 200,004 | 34,974 | 99,653 | -- | 27,331 |

| the Board of the Corporation | | | | | | |

| and Chief Executive Officer | | | | | | |

| and Chairman of the Board | | | | | | |

| of the Bank | | | | | | |

| | | | | | | |

| Dennis C. Joines | 2005 | 179,100 | 35,751 | -- | -- | 17,078 |

| President and Chief | 2004 | 172,500 | 74,945 | -- | -- | 17,826 |

| Operating Officer of the | 2003 | 167,222 | 15,759 | -- | 18,750 | 11,317 |

| Bank and a Director of the | | | | | | |

| Corporation and the Bank | | | | | | |

| | | | | | | |

| Richard P. Jacobson | 2005 | 127,380 | 20,929 | -- | 500 | 18,725 |

| Vice President and Secretary | 2004 | 121,896 | 35,970 | -- | -- | 18,045 |

| of the Corporation and | 2003 | 111,297 | 18,254 | -- | -- | 17,676 |

| Executive Vice President | | | | | | |

| and Secretary of the Bank | | | | | | |

| | | | | | | |

| Steve L. Hoekstra | 2005 | 121,200 | 38,642 | -- | -- | 8,730 |

| Executive Vice President | 2004 | 116,600 | 20,141 | -- | -- | 4,938 |

| of the Bank | 2003 | 85,885 | 10,506 | -- | -- | 276 |

| | | | | | | |

________

| * | All compensation is paid by the Bank. |

| (1) | Amounts reflect: for Mr Evans, deferred compensation under the Bank's deferred compensation plan. |

| (2) | Pursuant to the 1995 Stock Option Plan, Mr. Joines was granted 18,750 options on April 23, 2002, which vest at a rate of 25% per year over a four year period. On March 22, 2005, Mr. Jacobson was granted 500 options under the 1995 Stock Option Plan, which vest at a rate of 50% per year over a two year period. |

| (3) | Amounts for fiscal 2005 reflect: for Mr. Evans, contributions of $2,833 to the Bank's ESOP, $20,522 to the Bank's Retirement Savings and Investment Plan, $1,075 for life insurance premiums; and $4,554 for an automobile and other allowance; for Mr. Joines, contributions of $1,237 to the Bank's ESOP, $10,639 to the Bank's Retirement Savings and Investment Plan, $695 for life insurance premiums, and $4,507 for automobile and other allowance; for Mr. Jacobson, contributions of $1,760 to the Bank's ESOP, $12,594 to the Bank's Retirement Savings and Investment Plan, $250 for life insurance premiums; and $4,121 for an automobile and other allowance; and for Mr. Hoekstra, contributions of $837 to the Bank's ESOP, $7,198 to the Bank's Retirement Savings and Investment Plan, and $695 for life insurance premiums. |

7

<PAGE>

Option Grants in Last Fiscal Year. The following table sets forth information concerning the grant of stock options to the Corporation's named executive officers during the year ended March 31, 2005.

Individual Grants

| | |

| | Percent of

Total Options

Granted to

Employees

in Fiscal

Year

|

| Number of

Securities

Underlying

Options

Granted (1)

| | | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term (2)

|

| | | |

| | Exercise

Price

(per share)

| |

| | Expiration

Date

|

Name

| 5%

| 10%

|

| | | | | | |

| V. Lawrence Evans | -- | --% | $ -- | -- | $ -- | $ -- |

| Dennis C. Joines | -- | -- | -- | -- | -- | -- |

| Richard P. Jacobson | 500 | 4.34 | 19.285 | 3/22/15 | 6,063 | 15,368 |

| Steve L. Hoekstra | -- | -- | -- | -- | -- | -- |

____________________| (1) | Each option grant reported in the table vests at the rate of 50% per annum. Options will become immediately exercisable in the event of a change in control of the Corporation. |

| (2) | The dollar gains under these columns result from calculations required by the SEC's rules and are not intended to forecast future price appreciation of the Corporation's Common Stock. It is important to note that options have value only if the stock price increases above the exercise price shown in the table during the effective option period. In order for the executive officer to realize the potential values set forth in the 5% and 10% columns in the table, the price per share of the Corporation's Common Stock would be approximately $31.41 and $50.02, respectively, as of the expiration date of the options. |

Equity Compensation Plan Information. The following table summarizes share and exercise price information about the Corporation's equity compensation plans as of March 31, 2005, excluding the number of shares under the proposed 2005 Incentive Stock Plan.

Plan category

| Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| Weighted-

average exercise

price of outstanding

options, warrants

and rights

| Number of securities remaining available

for future issuance

under equity

compensation plans (excluding securities reflected in

column (a))

|

| (a) | (b) | (c) |

| Equity compensation plans approved by security holders: | | | |

| Option Plan | 219,903 | $8.867 | -- |

| Equity compensation plans not approved by security holders | --

| --

| --

|

| | | |

| Total | 219,903 | $8.867 | -- |

8

<PAGE>

Option Exercise/Value Table. The following information with respect to options exercised during the fiscal year ended March 31, 2005, and remaining unexercised at the end of the fiscal year, is presented for the Corporation's named executive officers.

| Shares

Acquired on

Exercise (#)

| | Number of

Securities Underlying

Unexercised Options

at Fiscal Year End(#)

| | |

| | Value of Unexercised

In-the-Money Options

at Fiscal Year End($)(1)

|

| | |

| | Value

Realized($)

|

Name

| Exercisable

| Unexercisable

| Exercisable

| Unexercisable

|

| | | | | | |

| V. Lawrence Evans | 18,000 | $224,574 | 14,343 | -- | $174,770 | $ -- |

| Dennis C. Joines | -- | -- | 9,376 | 9,374 | 75,008 | 74,992 |

| Richard P. Jacobson | 8,349 | 106,575 | 15,512 | 500 | 181,800 | -- |

| Steve L. Hoekstra | -- | -- | 3,126 | 3,124 | 22,945 | 22,930 |

_______________

| (1) | Value of unexercised in-the-money stock options equals the market value of shares covered by in-the-money options on March 31, 2005 less the option exercise price. Options are in-the-money if the market value of shares covered by the options is greater than the exercise price. |

Employment and Severance Agreements. The Corporation and the Bank are parties to an employment contract with Mr. Evans. The agreement was for an initial term of 48 months, and extends annually until either of the parties notifies the other in writing of its intent not to renew the contract. Under the agreement, Mr. Evans' current annual base compensation, effective April 1, 2005, is $218,352. In addition, Mr. Evans is entitled to participate in and to receive all benefits which are applicable to the Corporation's executive employees. The agreement also provides for compensation to be paid to Mr. Evans in the event of his disability, termination without cause or in the event of a change in control of the Corporation. In the event of a change in control (as defined in the agreement), Mr. Evans would be entitled to receive an amount equal to 2.99 times the average annual compensation received prior to the date of change of control for the most recent five taxable years, but not to exceed the maximum amount permitted under Section 280G of the Internal Revenue Code of 1986, as amended ("Code"). Assuming that a change in control had occurred during fiscal 2005, Mr. Evans would have been entitled to a cash payment equal to approximately $709,000.

On June 11, 2002, the Bank entered into a severance agreement with Mr. Joines, a director of the Corporation and President, Chief Operating Officer and a director of the Bank, in connection with his employment on April 23, 2002. The agreement was for an initial term of 36 months,and is extended annually unless either party elects not to extend the agreement.The agreement provides that if a "change in control" of the Corporation or the Bank occurs, and within 12 months thereafter the executive's employment is involuntarily terminated without just cause, or the executive voluntarily terminates his employment for good reason, as defined in the agreement, he will be entitled to receive a severance payment equal to 2.99 times his annual compensation, but not to exceed the maximum amount permitted under Section 280G of the Code. Assuming that a change in control had occurred during fiscal 2005, Mr. Joines would have been entitled to a severance payment of approximately $642,000.

The Bank entered into a change of control severance agreement with Mr. Jacobson, Vice President and Secretary of the Corporation and Executive Vice President and Secretary of the Bank, on July 16, 2002. The agreement is for an initial term of 36 months, and may be extended annually unless either party elects not to extend the agreement. The agreement provides that if a "change in control" of the Corporation or the Bank occurs, and within 12 months thereafter the executive's employment is involuntarily terminated without just cause, or the executive voluntarily terminates his employment for good reason, as defined in the agreement, he will be entitled to receive a severance payment equal to 1.99 times his annual compensation, but not to exceed the maximum amount permitted under Section 280G of the Code. Assuming that a change in control had occurred during fiscal 2005, Mr. Jacobson would have been entitled to a severance payment of approximately $295,000.

The Bank entered into a change of control severance agreement with Mr. Hoekstra, Executive Vice President of the Bank, on July 16, 2002. The agreement is for an initial term of 36 months, and may be extended annually unless

9

<PAGE>

either party elects not to extend the agreement. The agreement provides that if a "change in control" of the Corporation or the Bank occurs, and within 12 months thereafter the executive's employment is involuntarily terminated without just cause, or the executive voluntarily terminates his employment for good reason, as defined in the agreement, he will be entitled to receive a severance payment equal to 1.99 times his annual compensation, but not to exceed the maximum amount permitted under Section 280G of the Code. Assuming that a change in control had occurred during fiscal 2005, Mr. Hoekstra would have been entitled to a severance payment of approximately $318,000.

Deferred Compensation Plan. The Bank has established a deferred compensation plan for certain of its executive officers, including Mr. Evans. The plan provides for additional retirement benefits payable over a 12 to 20 year period following retirement. In connection with the funding of the Bank's obligation under the plan, the Bank has acquired life insurance policies on the lives of plan participants. Deferred compensation expense for Mr. Evans amounted to $108,018, $102,276, and $99,653 in fiscal years 2005, 2004 and 2003, respectively.

AUDIT COMMITTEE MATTERS

Audit Committee Charter. The Audit Committee operates pursuant to a Charter approved by the Corporation's Board of Directors. The Audit Committee reports to the Board of Directors and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and the audit process of the Corporation. The Audit Committee Charter sets out the responsibilities, authority and specific duties of the Audit Committee. The Charter specifies, among other things, the structure and membership requirements of the Audit Committee, as well as the relationship of the Audit Committee to the independent accountants, the internal audit department, and management of the Corporation. On April 27, 2004, the Board of Directors amended its Audit Committee Charter that was initially adopted in June 2000, a copy of which was attached to the Proxy Statement for the 2004 Annual Meeting of Shareholders as Appendix A.

Report of the Audit Committee. The Audit Committee reports as follows with respect to the Corporation's audited financial statements for the year ended March 31, 2005:

| | Audit Committee: | | Fred R. Miller, Chairman |

| | | | | | | James A. Strengholt |

| | | | | | | Robert C. Tauscher |

10

<PAGE>

Independence and Other Matters. Each member of the Audit Committee is "independent," as defined, in the case of the Corporation, under The Nasdaq Stock Market Rules. The Audit Committee members do not have any relationship to the Corporation that may interfere with the exercise of their independence from management and the Corporation. None of the Audit Committee members are current officers or employees of the Corporation or its affiliates.

COMPENSATION COMMITTEE MATTERS

Notwithstanding anything to the contrary set forth in any of the Corporation's previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Report of the Compensation Committee and Performance Graph shall not be incorporated by reference into any such filings.

Report of the Compensation Committee. The Compensation and Retirement Committee's ("Compensation Committee") duties are to recommend and administer policies that govern executive compensation for the Corporation and the Bank. The Compensation Committee evaluates executive performances, compensation policies and salaries. The Compensation Committee recommends salaries to be paid to each executive officer. The entire Board of Directors reviews the Compensation Committee's recommendations as to executive compensation, including the Chief Executive Officer, and sets these salaries.

The executive compensation policy of the Corporation and the Bank is designed to establish an appropriate relationship between executive pay and the Corporation's and the Bank's annual and long-term performance, long-term growth objectives, and their ability to attract and retain qualified executive officers. The principles underlying the program are:

- To attract and retain key executives who are vital to the long-term success of the Corporation and the Bank and are of the highest caliber;

To provide levels of compensation competitive with those offered throughout the financial industry; and

To motivate executives to enhance long-term shareholder value by building their ownership in the Corporation.

The Committee also considered a variety of subjective and objective factors in determining the compensation package for individual executives including (1) the performance of the Corporation and the Bank as a whole with an emphasis on annual and long-term performance, (2) the responsibilities assigned to each executive, and (3) the performance of each executive of assigned responsibilities as measured by the progress of the Corporation and the Bank during the year.

Another factor the Compensation Committee (and the Board of Directors) considered when making their decisions was the overall profitability of the Corporation and Bank, rather than establishing compensation levels on the basis of whether specific financial goals had been achieved by the Corporation and the Bank.

Base Salaries. To assist in managing employees' salaries and salary ranges, the Corporation's Compensation and Retirement Committee subscribes to the "Northwest Financial Industry Survey," published by Milliman, Inc., which is an annual salary survey specific to the banking industry in the Pacific Northwest. This provides comprehensive data for the Corporation's and Bank's various job descriptions regarding base salaries and incentive compensation, and is a valuable tool in managing the Corporation's compensation expense.

Compensation of the Chief Executive Officer. In addition to reviewing the Northwest Financial Industry Survey, the Corporation's Compensation and Retirement Committee hired a compensation consultant during fiscal 2005 to assist in analyzing the compensation of the Corporation's and Bank's executive officers. In addition, the consultant assisted

11

<PAGE>

the Compensation and Retirement Committee in the design of the Corporation's proposed Incentive Stock Plan, which is being presented to shareholders for approval at this year's Meeting as Proposal II and is appended to this Proxy Statement as Exhibit A.

The consultant provided the Compensation and Retirement Committee with information regarding all components of executive compensation, including peer group analysis, trends, and a variety of compensation options for consideration. The Committee used this data, in conjunction with the survey data discussed above, in setting the salary level for the Corporation's and Bank's Chief Executive Officer. In addition, the Committee reviewed the Corporation's performance for the year in analyzing the total compensation for the Chief Executive Officer. As indicated in the Current Report on Form 8-K filed with the SEC on March 28, 2005, effective April 1, 2005 the Chief Executive Officer's salary was increased by 3% to $218,352 per year from $211,992.

In addition, the Chief Executive Officer is eligible to receive incentive compensation, based on the performance of the Corporation. Specifically, target levels are set at the beginning of each fiscal year for the following profitability performance measures for the Corporation: diluted earnings per share, return on equity, and efficiency ratio. Each measure is equally weighted in calculating the incentive compensation component. The incentive compensation plan allows for the Chief Executive Officer to receive 40% of his annual base salary if all of these measures are met (and provisions are in place to pro-rate the incentive compensation component up and down, based on the actual performance of the Corporation, and the payout could range from 0% if minimum performance measures are not met, up to a maximum of 60% if aggressive profitability benchmarks are achieved).

For the fiscal year ended March 31, 2005, the Corporation exceeded the target levels for return on equity and diluted earnings per share, however, it did not meet the minimum levels required for efficiency. The incentive plan calculations for the fiscal year ended March 31, 2005 resulted in total incentive compensation of $66,947 for the Corporation's Chief Executive Officer (approximately 32% of his base salary of $211,992 for the year). The majority of the Corporation's incentive plan payout occurs after the end of the fiscal year and, therefore, the amounts paid after March 31, 2005 will be reflected in the Summary Compensation Table contained in next year's Proxy Statement. Accordingly, the Summary Compensation Table contained in this Proxy Statement, reflects $28,439 in incentive compensation paid to the Chief Executive Officer in May 2004 for the period ended March 31, 2004, and $14,129 received in November 2004 for the six-month period ended September 2004.

The Compensation and Retirement Committee reviews the Corporation's incentive plan on at least an annual basis, and believes that the plan is achieving its intended results of motivating the Corporation's and Bank's Chief Executive Officer and other employees to improve the performance of the Corporation. Long-Term Incentive Compensation. The consultant retained by the Compensation and Retirement Committee also assisted the Committee in the review of long-term incentive compensation for the Corporation's executive officers. The Committee used the information provided by the consultant in determining the appropriate design for the proposed Incentive Stock Plan being presented to shareholders for approval at this year's Meeting as Proposal II, including the number of shares to be included in the plan and the variety of forms of granting shares (incentive stock options, restricted stock grants, and related stock incentives). The Committee also obtained guidance from the consultant regarding allocation of shares under the proposed plan based on the Corporation's performance in an effort to ensure that the rewards are properly aligned with the interest of the Corporation's shareholders.

| Compensation and Retirement Committee | Robert C. Diehl |

| | | | Gary E. Goodman |

| | | | Fred R. Miller |

Compensation Committee Interlocks and Insider Participation. No members of the Compensation and Retirement Committee were officers or employees of the Corporation or any of its subsidiaries during the year ended March 31, 2005, were formerly Corporation officers or had any relationships otherwise requiring disclosure.12

<PAGE>

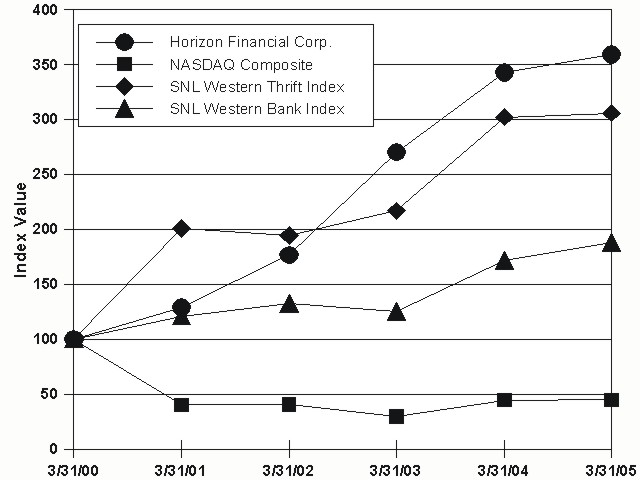

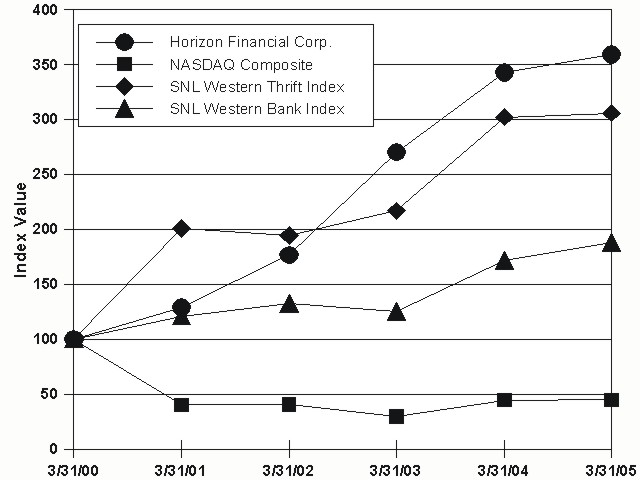

Performance Graph. The following graph compares the cumulative total shareholder return on the Corporation's Common Stock with the cumulative total return on the Nasdaq Index and the SNL Western Thrift Index, and the SNL Western Bank Index which encompasses ten western states. Total return assumes reinvestment of all dividends.

| | Period Ending

|

Index*

| 03/31/00

| 03/31/01

| 03/31/02

| 03/31/03

| 03/31/04

| 03/31/05

|

| Horizon Financial Corp. | 100.00 | 128.81 | 176.56 | 270.15 | 342.69 | 358.74 |

| Nasdaq - Composite | 100.00 | 40.33 | 40.57 | 29.63 | 44.26 | 44.62 |

| SNL Western Thrift Index | 100.00 | 200.38 | 194.33 | 216.72 | 301.94 | 305.53 |

| SNL Western Bank Index | 100.00 | 120.87 | 132.56 | 125.23 | 171.43 | 187.70 |

*Source: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago, 2000. Used with permission. All rights reserved. crsp.com.SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Corporation's executive officers and directors, and persons who own more than 10% of any registered class of the Corporation's equity securities, to file reports of ownership and changes in ownership with the SEC within prescribed time periods. Executive officers, directors and greater than 10% shareholders are required by regulation to furnish the Corporation with copies of all Section 16(a) forms they file.

13

<PAGE>

Based solely on its review of the copies of such forms it has received and written representations provided to the Corporation by the above referenced persons, the Corporation believes that all filing requirements applicable to its reporting officers, directors and greater than 10% shareholders were properly and timely complied with during the fiscal year ended March 31, 2005 except for the filings of a Form 4, Statement of Changes in Beneficial Ownership, for Directors Miller and Tauscher, which were inadvertently not filed within the required two day period.

TRANSACTIONS WITH MANAGEMENT

Federal regulations require that all loans or extensions of credit to executive officers and directors of insured financial institutions must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons, except for loans made pursuant to programs generally available to all employees, and must not involve more than the normal risk of repayment or present other unfavorable features. The Bank is therefore prohibited from making any new loans or extensions of credit to executive officers and directors at different rates or terms than those offered to the general public, except for loans made pursuant to programs generally available to all employees, and has adopted a policy to this effect.

INDEPENDENT AUDITORS

Moss Adams LLP served as the Corporation's auditors for the 2005 fiscal year. Presently, the Board of Directors intends to invite certain firms to submit a proposal for the Corporation's audit work for the 2006 fiscal year. Moss Adams LLP will be included in this process. A representative of Moss Adams LLP will be present at the Meeting to respond to questions from shareholders and will have the opportunity to make a statement if he or she so desires.

The following table sets forth the aggregate fees billed to the Corporation by Moss Adams LLP for professional services rendered for the fiscal years ended March 31, 2005 and 2004.

| Years Ended

March 31,

|

| |

| 2005

| 2004

|

| | |

| Audit Fees | $ 201,500 | $ 79,407 |

| Audit-Related Fees | 6,608 | 16,650 |

| Tax Fees | 20,845 | 73,770 |

| All Other Fees | -- | -- |

The Audit Committee will establish general guidelines for the permissible scope and nature of any permitted non-audit services to be provided by the independent auditors in connection with its annual review of its Charter. Pre-approval may be granted by action of the full Audit Committee or by delegated authority to one or more members of the Audit Committee. If this authority is delegated, all approved non-audit services will be presented to the Audit Committee at its next meeting. In considering non-audit services, the Audit Committee or its delegate will consider various factors, including but not limited to, whether it would be beneficial to have the service provided by the independent auditors and whether the service could compromise the independence of the independent auditors.

The Audit Committee of the Board of Directors determined that the services performed by Moss Adams LLP other than audit services are not incompatible with Moss Adams LLP maintaining its independence.

14

<PAGE>

PROPOSAL II - APPROVAL OF 2005 INCENTIVE STOCK PLANGeneral On March 22, 2005, the Board of Directors of the Corporation unanimously adopted, subject to shareholder approval, the Horizon Financial Corp. 2005 Incentive Stock Plan ("2005 Plan").

The objectives of the 2005 Plan are to reward performance and build the participants' equity interest in the Corporation by providing long-term incentives and rewards to directors, key employees and other persons who provide services to the Corporation and its subsidiaries and who contribute to the success of the Corporation by their innovation, ability, industry, loyalty and exceptional service, and to enable the Corporation to pursue mergers and acquisitions.

The Corporation currently maintains a 1995 Stock Option Plan ("1995 Option Plan"), which was approved by shareholders. Stock options were awarded pursuant to the 1995 Option Plan to officers of the Corporation and the Bank. Awards under the 1995 Option Plan will not be affected by adoption of the 2005 Plan. The Corporation believes that the availability of stock compensation programs is an important element of the Corporation's overall incentive compensation and growth strategies and that the adoption of the 2005 Plan will assist the Corporation in meeting the objectives of these strategies.

The following summary is a brief description of the material features of the 2005 Plan.This summary is qualified in its entirety by reference to the 2005 Plan, a copy of which is attached as Exhibit A.Summary of the 2005 Plan

Types of Awards. The 2005 Plan provides for awards in the form of (i) options to purchase shares of the Corporation's Common Stock for cash, (ii) rights to receive the excess of the market value of the shares of the Corporation's Common Stock on the date exercised over the exercise price, or "stock appreciation rights," and (iii) restricted shares of the Corporation's Common Stock.

Option Grants. The 2005 Plan provides for the grant of incentive stock options ("ISOs"), which are intended to satisfy the requirements for ISO treatment within the meaning of Section 422(b) of the Code, and non-qualified stock options ("NQSOs"), which do not satisfy the requirements for ISO treatment.

Stock Appreciation Rights. The 2005 Plan provides for the grant of stock appreciation rights, which entitle the holder of the right to receive the excess of the market value of the shares of the Corporation's Common Stock on the date exercised over the exercise price. A right may be granted in connection with the grant of an option (a "Related Right" and a "Related Option") or may be granted independently of any option as determined by the Committee. In the case of a Related Option, the Related Option shall cease to be exercisable if the shares of Common Stock with respect to which the Related Right are exercised. Similarly, upon the exercise or termination of a Related Option, any Related Right shall terminate to the extent of the Shares with respect to which the Related Option was exercised or terminated.

Restricted Stock Awards. Restricted stock awards under the 2005 Plan will be made in the form of restricted shares of common stock that are subject to restrictions on transfer of ownership. Holders of restricted stock will be treated as shareholders of the Corporation in all respects, including the right to vote their shares and to receive any dividends paid with respect to such shares. If a recipient terminates service with the Corporation or its subsidiaries for reasons other than death or disability, or normal retirement after attainment of age 62, the recipient forfeits all rights to shares under restriction. If such termination is caused by death, disability, or normal retirement after attainment of age 62, all restrictions expire and all shares allocated become unrestricted. A recipient will be entitled to voting, dividends and other stockholder rights with respect to the shares while restricted.

Administration. The 2005 Plan will be administered by the Corporation's Compensation and Retirement Committee ("Committee"). Subject to the terms of the 2005 Plan and resolutions of the Board, the Committee will interpret the 2005 Plan and will be authorized to make all determinations and decisions thereunder. The Committee also

15

<PAGE>

will determine the individuals to whom stock options and awards of restricted stock will be granted, the type and amount of stock options or restricted stock that will be granted, and the terms and conditions applicable to grants of options or restricted stock.

Participants. All directors, advisory directors, directors emeriti and employees of the Corporation and its subsidiaries are eligible to participate in the 2005 Plan.

Number of Shares of Common Stock Available. The Corporation has reserved 750,000 shares of Common Stock for issuance under the 2005 Plan. The Corporation has reserved up to 400,000 shares of the 750,000 total shares available shares of Common Stock in connection with the issuance of restricted stock awards under the 2005 Plan. Shares of Common Stock to be issued under the 2005 Plan will be authorized but unissued shares. To the extent the Corporation uses authorized but unissued shares to fund the 2005 Plan, the interests of current shareholders will be diluted. If all awards are granted through the use of authorized but unissued Common Stock, current shareholders would be diluted by approximately 7.5% based on the number of shares outstanding on June 6, 2005. Any shares subject to an award which expires or is terminated unexercised or is otherwise forfeited will again be available for issuance under the 2005 Plan.

Adjustments Upon Changes in Capitalization. Shares awarded under the 2005 Plan will be adjusted by the Committee in the event of a reorganization, recapitalization, stock split, stock dividend, combination or exchange of shares, merger, consolidation or other change in corporate structure or the Common Stock of the Corporation.

Exercise Price of Awards. Under the terms of the 2005 Plan, the committee may grant rights or options to purchase shares of the Corporation's Common Stock at a price which may not be less than the fair market value of the common stock, which shall be the average of the highest and lowest selling price as quoted on the Nasdaq National Market on the date the right or option is granted. The closing price of the Common Stock on The Nasdaq Stock Market on June 6, 2005 was $20.30.

The aggregate fair market value of ISO shares granted to any employee that may be exercisable for the first time by an employee during any calendar year (under all stock option plans of the Corporation and its subsidiaries) may not exceed $100,000. The exercise price of an option may be paid in cash, Common Stock or other property, by the immediate sale through a broker of the number of shares being acquired sufficient to pay the purchase price, or by a combination of these methods, as and to the extent permitted by the Committee.

Transferability of Awards. Under the 2005 Plan, no ISO is transferable other than by will or the laws of descent and distribution. Any other option or stock appreciation right shall be transferable by will, the laws of descent and distribution, a "domestic relations order," as defined in the Code, or a gift to any member of the participant's immediate family or to a trust for the benefit of one or more of such immediate family members. Options may become exercisable in full at the time of grant or at such other times and in such installments as the Committee determines or as may be specified in the 2005 Plan. Options may be exercised during periods before and after the participant terminates employment, as the case may be, to the extent authorized by the Committee or specified in the 2005 Plan. However, no ISO may be exercised after the tenth anniversary of the date the option was granted.

Effect of a Change in Control. In the event of a tender offer, exchange offer for shares or a change in control (as defined in the 2005 Plan) of the Corporation, each outstanding stock option grant and stock appreciation right will become fully vested and immediately exercisable. In addition, in the event of a merger or other corporate event in which the Corporation is not the surviving entity, the 2005 Plan provides that the participant may elect to receive the excess of the fair market value of the Common Stock underlying the option or stock appreciation right over the option's or stock appreciation right's exercise price in cash or property, or combination thereof, as determined in the Committee's discretion.

Term of the 2005 Plan. The 2005 Plan will be effective only upon approval by the shareholders of the Corporation. The 2005 Plan will expire on the tenth anniversary of the effective date, unless terminated sooner by the Board.

16

<PAGE>

Prohibition on Repricing Underwater Options. The Committee may not, without the further approval of the shareholders of the Corporation, authorize the amendment of any outstanding option to reduce the exercise price. Furthermore, no option may be canceled and replaced with awards having a lower exercise price without further approval of the shareholders.

Amendment of the 2005 Plan. The 2005 Plan allows the Board to amend, suspend or terminate the 2005 Plan without shareholder approval unless such approval is required to comply with a tax law or regulatory requirement. Shareholder approval will generally be required with respect to an amendment to the 2005 Plan that will (i) increase the aggregate number of securities which may be issued under the 2005 Plan, except as specifically set forth under the 2005 Plan, (ii) materially increase the benefits accruing to participants under the 2005 Plan, (iii) materially change the requirements as to eligibility for participation in the 2005 Plan or (iv) change the class of persons eligible to participate in the 2005 Plan. No amendment, suspension or termination of the 2005 Plan, however, will impair the rights of any participant, without his or her consent, in any award made thereunder.

Certain Federal Income Tax Consequences. The following brief description of the tax consequences of awards under the 2005 Plan is based on federal income tax laws currently in effect and does not purport to be a complete description of the federal income tax consequences.

Stock Options. There are no federal income tax consequences either to the optionee or to the Corporation upon the grant of an ISO or a NQSO. On the exercise of an ISO during employment or within three months thereafter, the optionee will not recognize any income and the Corporation will not be entitled to a deduction, although the excess of the fair market value of the shares on the date of exercise over the option price is includible in the optionee's alternative minimum taxable income, which may give rise to alternative minimum tax liability for the optionee. Generally, if the optionee disposes of shares acquired upon exercise of an ISO within two years of the date of grant or one year of the date of exercise, the optionee will recognize ordinary income, and the Corporation will be entitled to a deduction, equal to the excess of the fair market value of the shares on the date of exercise over the option price (limited generally to the gain on the sale). The balance of any gain or loss will be treated as a capital gain or loss to the optionee. If the shares are disposed of after the two year and one year periods mentioned above, the Corporation will not be entitled to any deduction, and the entire gain or loss for the optionee will be treated as a capital gain or loss.

On exercise of a NQSO, the excess of the date-of-exercise fair market value of the shares acquired over the option price will generally be taxable to the optionee as ordinary income and deductible by the Corporation, provided the Corporation properly reports the income with respect to the exercise. The disposition of shares acquired upon the exercise of a NQSO will generally result in a capital gain or loss for the optionee, but will have no tax consequences for the Corporation.

Stock Appreciation Rights. The exercise of a stock appreciation right will result in the recognition of ordinary income by the recipient on the date of exercise in an amount of cash and/or the fair market value on that date of the shares acquired pursuant to the exercise. The Corporation will be entitled to a corresponding deduction.

Restricted Stock Awards. A participant who has been awarded restricted stock under the 2005 MRP and does not make an election under Section 83(b) of the Code will not recognize taxable income at the time of the award. At the time any transfer or forfeiture restrictions applicable to the restricted stock award lapse, the recipient will recognize ordinary income and the Corporation will be entitled to a corresponding deduction equal to the excess of the fair market value of such stock at such time over the amount (if any) paid therefor.

A recipient of a restricted stock award who makes an election under Section 83(b) of the Code will recognize ordinary income at the time of the award and the Corporation will be entitled to a corresponding deduction equal to the fair market value of such stock at such time over the amount (if any) paid therefor. Any dividends subsequently paid to the recipient on the restricted stock will be dividend income to the recipient and not deductible by the Corporation. If the recipient makes a Section 83(b) election, there are no federal income tax consequences either to the recipient or the Corporation at the time any transfer or forfeiture restrictions applicable to the restricted stock award lapse.

17

<PAGE>

New Plan Benefits Although the Corporation anticipates that awards will be made to directors, officers and employees following the effective date and during the term of the 2005 Plan, no specific determinations have been made regarding the timing, recipients, size or terms of individual awards.

The Board of Directors recommends a vote "FOR" the adoption of the 2005 Incentive Stock Plan attached to this Proxy Statement as Exhibit A.

OTHER MATTERS

The Board of Directors is not aware of any business to come before the Meeting other than the matter described above in this Proxy Statement. However, if any other matters should properly come before the Meeting, it is intended that proxies in the accompanying form will be voted in respect thereof in accordance with the judgment of the person or persons voting the proxies.

The cost of solicitation of proxies will be borne by the Corporation. In addition to solicitations by mail, directors, officers, and regular employees of the Corporation may solicit proxies personally or by telephone at their regular salary or hourly compensation.

The Corporation's 2005 Annual Report to Shareholders has been mailed to all shareholders of record as of the Voting Record Date. Any shareholder who has not received a copy of such annual report may obtain a copy without charge by writing the Corporation. Such annual report is not to be treated as part of the proxy solicitation material nor having been incorporated herein by reference.

SHAREHOLDER PROPOSALS

In order to be eligible for inclusion in the proxy solicitation materials of the Corporation for next year's Annual Meeting of Shareholders, any shareholder proposal to take action at such meeting must be received at the Corporation's main office at 1500 Cornwall Avenue, Bellingham, Washington, no later than February 17, 2006. Any such proposals shall be subject to the requirements of the proxy solicitation rules adopted under the Exchange Act.

BY ORDER OF THE BOARD OF DIRECTORS

/s/Richard P. Jacobson RICHARD P. JACOBSON SECRETARYBellingham, Washington

June 17, 2005

A COPY OF THE ANNUAL REPORT ON FORM 10-K AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS INCLUDED WITH THE PROXY SOLICITATION. ADDITIONAL COPIES WILL BE FURNISHED WITHOUT CHARGE TO SHAREHOLDERS OF RECORD AS OF JUNE 6, 2005, UPON WRITTEN REQUEST TO RICHARD P. JACOBSON, SECRETARY, HORIZON FINANCIAL CORP., 1500 CORNWALL AVENUE, BELLINGHAM, WASHINGTON 98225.

18

<PAGE>

EXHIBIT A

HORIZON FINANCIAL CORP.2005 INCENTIVE STOCK PLAN 1. Plan Purpose. The purpose of the Plan is to foster and promote the long-term success of the Corporation and its shareholders by a means of attracting and retaining directors, advisory directors, directors emeriti and employees of the Corporation and its Affiliates and aligning the interests of Participants, as defined below, with shareholders.

2. Definitions. The following definitions are applicable to the Plan:

"Affiliate" -- means any "parent corporation" or "subsidiary corporation" of the Corporation, as such terms are defined in Section 424(e) and (f), respectively, of the Code.

"Award" -- means the grant by the Committee of an Incentive Stock Option, a Non-Qualified Stock Option, Shares of Restricted Stock, a Right, or any combination thereof, as provided in the Plan.

"Award Agreement" -- means the agreement evidencing the grant of an Award made under the Plan.

"Board" -- means the board of directors of the Corporation.

"Cause" -- means Termination of Service by reason of personal dishonesty, incompetence, willful misconduct, breach of fiduciary duty involving personal profit, intentional failure to perform stated duties or gross negligence.

"Code" -- means the Internal Revenue Code of 1986, as amended.

"Committee" -- means the committee referred to in Section 3 hereof.

"Corporation" -- means Horizon Financial Corp., a Washington corporation, and any successor thereto.

"Disability" -- means any physical or mental injury or disease of a permanent nature which renders a Participant incapable of meeting the requirements of the employment or service performed by such Participant immediately prior to the commencement of such disability. The determination of whether a Participant is disabled shall be made by the Board in its sole and absolute discretion.

"Incentive Stock Option" -- means an option to purchase Shares granted by the Committee which is intended to qualify as an incentive stock option under Section 422(b) of the Code. Unless otherwise set forth in the Award Agreement, any Option which does not qualify as an Incentive Stock Option for any reason shall be deemedab initioto be a Non-Qualified Stock Option.

"Market Value" -- means:

(a) If the Shares are traded or quoted on the Nasdaq Stock Market or other national securities exchange on any date, then the Market Value shall be the average of the highest and lowest selling price on such exchange on such date or, if there were no sales on such date, then on the next prior business day on which there was a sale.

(b) If the Shares are not traded or quoted on the Nasdaq Stock Market or other national securities exchange, then the Market Value shall be a value determined by the Board in good faith on such reasonable basis as it deems appropriate (including but not limited to the valuation method described in Section 20.2031-2 of the Federal Estate Tax Regulations).

A-1

<PAGE>

"Non-Qualified Stock Option" -- means an option to purchase Shares granted by the Committee which does not qualify, for any reason, as an Incentive Stock Option.

"Option" -- means an Incentive Stock Option or a Non-Qualified Stock Option.

"Participant" -- means any director, advisory director, director emeritus or employee of the Corporation or any Affiliate who is selected by the Committee to receive an Award.

"Plan" -- means this Horizon Financial Corp. 2005 Incentive Stock Plan.

"Related" -- means (i) in the case of a Right, a Right which is granted in connection with, and to the extent exercisable, in whole or in part, in lieu of, an Option or another Right and (ii) in the case of an Option, an Option with respect to which and to the extent a Right is exercisable, in whole or in part, in lieu thereof.

"Right" -- means a stock appreciation right with respect to Shares granted by the Committee pursuant to the Plan.

"Restricted Period" -- means the period of time selected by the Committee for the purpose of determining when restrictions are in effect under Section 6 hereof with respect to Restricted Stock awarded under the Plan.

"Restricted Stock" -- means Shares awarded by the Committee to a Participant, which are subject to a Restricted Period.

"Section 409A" - means Code Section 409A and any guidance issued thereunder.

"Shares" -- means the shares of common stock, $1.00 par value, of the Corporation.

"Termination of Service" -- means cessation of service, for any reason, whether voluntary or involuntary, so that the affected individual is not either (i) an employee of the Corporation or any Affiliate for purposes of an Incentive Stock Option, or (ii) a director (including an advisory director or director emeritus) or employee of the Corporation or any Affiliate for purposes of any other Award.

3. Administration. The Plan shall be administered by a Committee consisting of two or more members of the Board, each of whom (i) shall be an "outside director," as defined under Section 162(m) of the Code and the Treasury regulations thereunder, and (ii) shall be a "non-employee director," as defined under Rule 16(b) of the Securities Exchange Act of 1934 or any similar or successor provision. The members of the Committee shall be appointed by the Board. Except as limited by the express provisions of the Plan or by resolutions adopted by the Board, the Committee shall have sole and complete authority and discretion to (i) select Participants and grant Awards; (ii) determine the number of Shares to be subject to types of Awards generally, as well as to individual Awards granted under the Plan; (iii) determine the terms and conditions upon which Awards shall be granted under the Plan; (iv) prescribe the form and terms of Award Agreements; (v) establish from time to time regulations for the administration of the Plan; and (vi) interpret the Plan and make all determinations deemed necessary or advisable for the administration of the Plan.

A majority of the Committee shall constitute a quorum, and the acts of a majority of the members present at any meeting at which a quorum is present, or acts approved in writing by a majority of the Committee without a meeting, shall be acts of the Committee.

The Plan is intended to provide benefits that are not deferred compensation within the meaning of Code Section 409A or any guidance issued thereunder and the Plan shall be administered and interpreted accordingly.

A-2

<PAGE>

4. Shares Subject to Plan.

(a) Options

(i) Subject to adjustment by the operation of Section 7, the maximum number of Shares with respect to which Awards may be made under the Plan is 750,000 available for all types of awards. The Shares with respect to which Awards may be made under the Plan will be authorized and unissued Shares. Shares which are subject to Related Rights and Related Options shall be counted only once in determining whether the maximum number of Shares with respect to which Awards may be granted under the Plan has been exceeded. An Award shall not be considered to have been made under the Plan with respect to any Option which terminates, and new Awards may be granted under the Plan with respect to the number of Shares as to which such termination has occurred.

(ii) During any calendar year, no Participant may be granted Awards under the Plan with respect to more than 100,000 Shares, subject to adjustment as provided in Section 7.