SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Definitive Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to sec. 240.14a-11(c) or sec. 240.14a-12 |

Zoran Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ZORAN CORPORATION

1390 Kifer Road

Sunnyvale, California 94086

July 20, 2005

Dear Stockholder:

Zoran Corporation’s 2005 Proxy Statement was previously delivered to you. The 2005 Proxy Statement solicits your vote on several important matters, including the proposed adoption of the 2005 Equity Incentive Plan (the “2005 Plan”). Subsequent to the distribution of our 2005 Proxy Statement, we were informed by Institutional Shareholder Services (“ISS”) that it was recommending a vote against the 2005 Plan. In light of the importance of the 2005 Plan to our ability to attract and retain employees of the highest caliber, we decided to consider certain modifications to the 2005 Plan that would allow us to comply with the requirements of ISS. In order to provide time for our Board of Directors to consider modifications to the 2005 Plan to comply with the conditions upon which ISS would reverse its recommendation against the 2005 Plan, the stockholders approved adjournment of the Annual Meeting until July 29, 2005.

After considering the ISS analysis of the 2005 Plan, the Board of Directors has adopted resolutions to amend the 2005 Plan in two respects:

First, the number of shares of our common stock authorized for issuance under the 2005 Plan (and under incentive stock options) has been reduced from 4,500,000 to 1,950,000 shares. As described in our 2005 Proxy Statement, this share authorization may be increased by up to 1,250,000 shares that may be issued pursuant to restricted stock unit awards granted in replacement of options cancelled in the option exchange program described in Proposal No. 3 contained in the 2005 Proxy Statement if that proposal is approved by the stockholders.

Second, the share accounting provisions of the 2005 Plan have been modified to change the manner in which certain transactions in connection with awards granted under the 2005 Plan will be counted against the maximum number of shares authorized for issuance under the 2005 Plan. Accordingly, the second paragraph under the heading “Share Accounting and Adjustments” contained in Proposal No. 2 of the 2005 Proxy Statement is amended in its entirety to read as follows:

If any award granted under the 2005 Plan expires or otherwise terminates for any reason without having been exercised or settled in full, or if shares subject to forfeiture or repurchase are forfeited or repurchased by Zoran for not more than the participant’s purchase price, any such shares reacquired or subject to a terminated award will again become available for issuance under the 2005 Plan. Shares will not be treated as having been issued under the 2005 Plan and will therefore not reduce the number of shares available for issuance to the extent an award is settled in cash. Upon the payment of shares pursuant to the exercise of a stock appreciation right, the number of shares available under the 2005 Plan will be reduced by the gross number of shares for which the award is exercised. If shares are tendered in payment of the exercise price of an option or the option is exercised by means of a net-exercise procedure, the number of shares available under the 2005 Plan will be reduced by the gross number of shares for which the option is exercised. Shares withheld or reacquired by Zoran in satisfaction of a tax withholding obligation will not again become available under the 2005 Plan. Appropriate adjustments will be made to the number of shares authorized under the 2005 Plan, to the numerical limits on awards described below, and to outstanding awards in the event of any change in our common stock through merger, consolidation, reorganization, reincorporation, recapitalization, reclassification, stock dividend, stock split, reverse stock split, split-up, split-off, spin-off, combination of shares, exchange of shares or similar change in our capital structure, or if we make a distribution to our stockholders in a form other than common stock (excluding normal cash dividends) that has a material effect on the fair market value of our common stock. In such circumstances, the Compensation Committee also has the discretion under the 2005 Plan to adjust the terms of outstanding awards as it deems appropriate. Without affecting the number of shares available for issuance under the 2005 Plan, the Compensation Committee may authorize the issuance or assumption of benefits under the 2005 Plan in connection with any merger, consolidation or similar transaction on such terms and conditions as it deems appropriate.

For additional information regarding the 2005 Plan, please refer to the 2005 Proxy Statement that was previously mailed to stockholders and otherwise available atwww.sec.gov.

If you have already voted and do not wish to change your vote, you need not take any further action.If you have not yet voted or if you wish to change your vote, you may vote by (1) completing, signing, dating and returning the enclosed proxy card before the Company reconvenes the Annual Meeting at 11:00 a.m. on July 29, 2005 or (2) by attending the meeting and voting in person.

The Board of Directors recommends a vote FOR Proposal 2, approval of the adoption of the 2005 Equity Incentive Plan. Your vote is very important regardless of how many shares you own. Please sign, date and mail the enclosed proxy today!

We look forward to seeing you at the Annual Meeting.

Very truly yours,

/s/ Levy Gerzberg

Levy Gerzberg, Ph.D.

President and Chief Executive Officer

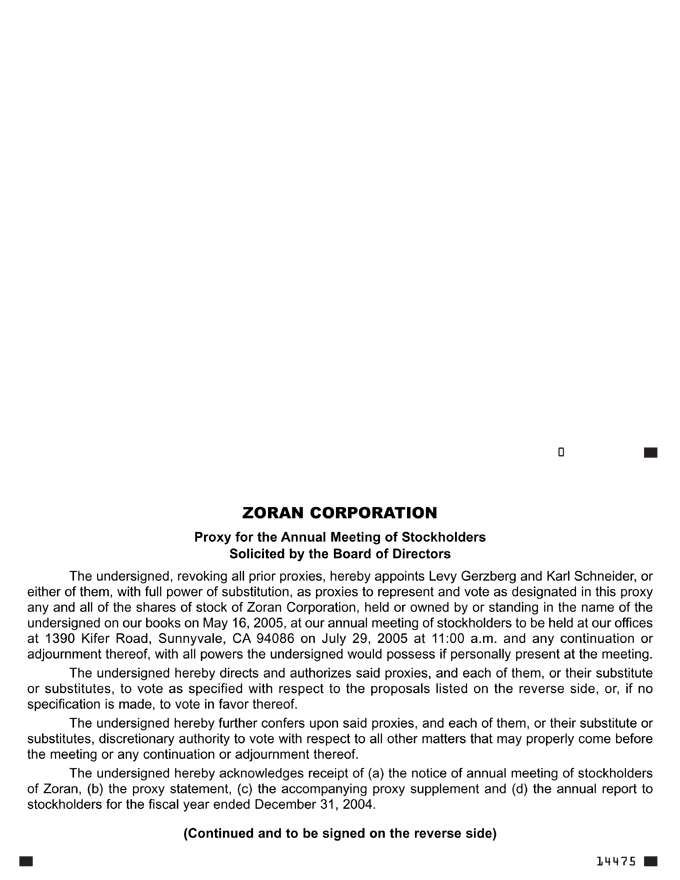

ZORAN CORPORATION

Proxy for the Annual Meeting of Stockholders

Solicited by the Board of Directors

The undersigned, revoking all prior proxies, hereby appoints Levy Gerzberg and Karl Schneider, or

either of them, with full power of substitution, as proxies to represent and vote as designated in this proxy

any and all of the shares of stock of Zoran Corporation, held or owned by or standing in the name of the

undersigned on our books on May 16, 2005, at our annual meeting of stockholders to be held at our offices

at 1390 Kifer Road, Sunnyvale, CA 94086 on July 29, 2005 at 11:00 a.m. and any continuation or

adjournment thereof, with all powers the undersigned would possess if personally present at the meeting.

The undersigned hereby directs and authorizes said proxies, and each of them, or their substitute

or substitutes, to vote as specified with respect to the proposals listed on the reverse side, or, if no

specification is made, to vote in favor thereof.

The undersigned hereby further confers upon said proxies, and each of them, or their substitute or

substitutes, discretionary authority to vote with respect to all other matters that may properly come before

the meeting or any continuation or adjournment thereof.

The undersigned hereby acknowledges receipt of (a) the notice of annual meeting of stockholders

of Zoran, (b) the proxy statement, (c) the accompanying proxy supplement and (d) the annual report to

stockholders for the fiscal year ended December 31, 2004.

(Continued and to be signed on the reverse side)

14475

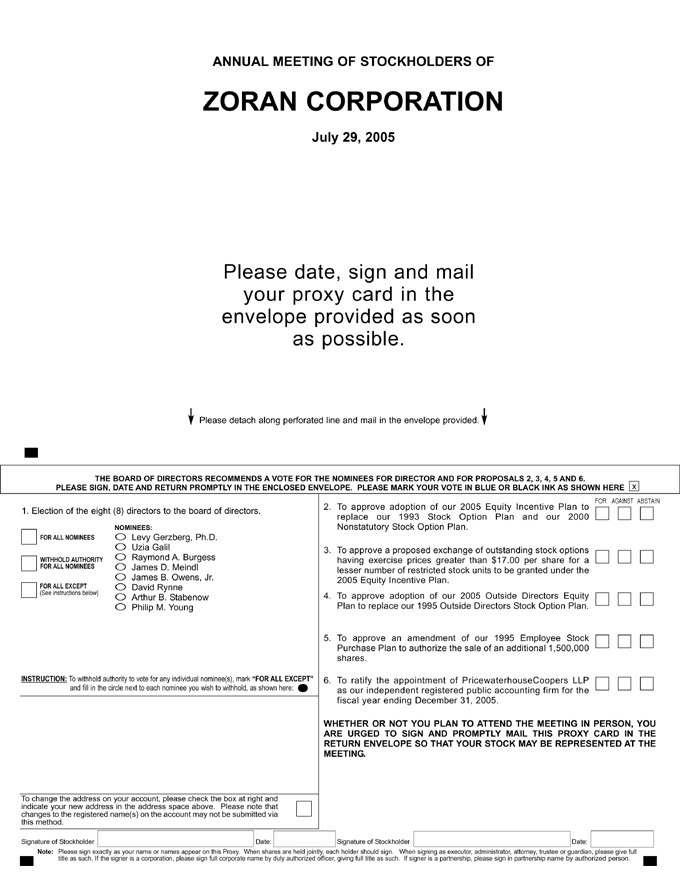

ANNUAL MEETING OF STOCKHOLDERS OF

ZORAN CORPORATION

July 29, 2005

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

Signature of Stockholder Date: Signature of Stockholder Date:

Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full

title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

To change the address on your account, please check the box at right and

indicate your new address in the address space above. Please note that

changes to the registered name(s) on the account may not be submitted via

this method.

1. Election of the eight (8) directors to the board of directors.

Levy Gerzberg, Ph.D.

Uzia Galil

Raymond A. Burgess

James D. Meindl

James B. Owens, Jr.

David Rynne

Arthur B. Stabenow

Philip M. Young

2. To approve adoption of our 2005 Equity Incentive Plan to

replace our 1993 Stock Option Plan and our 2000

Nonstatutory Stock Option Plan.

3. To approve a proposed exchange of outstanding stock options

having exercise prices greater than $17.00 per share for a

lesser number of restricted stock units to be granted under the

2005 Equity Incentive Plan.

4. To approve adoption of our 2005 Outside Directors Equity

Plan to replace our 1995 Outside Directors Stock Option Plan.

5. To approve an amendment of our 1995 Employee Stock

Purchase Plan to authorize the sale of an additional 1,500,000

shares.

6. To ratify the appointment of PricewaterhouseCoopers LLP

as our independent registered public accounting firm for the

fiscal year ending December 31, 2005.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, YOU

ARE URGED TO SIGN AND PROMPTLY MAIL THIS PROXY CARD IN THE

RETURN ENVELOPE SO THAT YOUR STOCK MAY BE REPRESENTED AT THE

MEETING.

FOR AGAINST ABSTAIN

FOR ALL NOMINEES

WITHHOLD AUTHORITY

FOR ALL NOMINEES

FOR ALL EXCEPT

(See instructions below)

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT”

and fill in the circle next to each nominee you wish to withhold, as shown here:

NOMINEES:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE NOMINEES FOR DIRECTOR AND FOR PROPOSALS 2, 3, 4, 5 AND 6.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x

Please detach along perforated line and mail in the envelope provided.