UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

PHARMACEUTICAL PRODUCT DEVELOPMENT, INC.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

PHARMACEUTICAL PRODUCT DEVELOPMENT, INC.

3151 South Seventeenth Street

Wilmington, North Carolina 28412

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 19, 2004

TO THE SHAREHOLDERS OF

PHARMACEUTICAL PRODUCT DEVELOPMENT, INC.

The 2004 annual meeting of shareholders of Pharmaceutical Product Development, Inc. will be held at the Louise Wells Cameron Art Museum located at 3201 South Seventeenth Street, Wilmington, North Carolina, on Wednesday, May 19, 2004, at 10:00 a.m., for the following purposes:

| | 1. | To elect a board of nine directors; and |

| | 2. | To act upon such other matters as may properly come before the meeting or any adjournment thereof. |

These matters are more fully described in the proxy statement accompanying this notice.

The Board of Directors has fixed the close of business on March 19, 2004 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting or any adjournment thereof. All of these shareholders are cordially invited to attend the meeting in person. However, to assure your representation at the meeting, you are urged to mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. You can vote in person at the meeting, even if you returned a proxy.

Our proxy statement, proxy and Annual Report to Shareholders for the year ended December 31, 2003 are enclosed with this notice.

Important – Your proxy is enclosed.

Whether or not you plan to attend the annual meeting, please mark, sign, date and promptly return your proxy in the enclosed envelope. No postage is required for mailing in the United States.

Wilmington, North Carolina

Dated: April 6, 2004

| | |

By Order of the Board of Directors |

|

/s/ B. Judd Hartman

|

By: | | B. Judd Hartman |

| | | Secretary |

PHARMACEUTICAL PRODUCT DEVELOPMENT, INC.

3151 South Seventeenth Street

Wilmington, North Carolina 28412

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 19, 2004

Your vote is important. Therefore, the Board of Directors is requesting that you allow your common stock to be represented at the annual meeting by the proxies named in the proxy card enclosed with this proxy statement. This proxy statement has been prepared by the management of Pharmaceutical Product Development, Inc. “We”, “our”, “PPDI” and the “Company” each refers to Pharmaceutical Product Development, Inc. We will begin sending this proxy statement to our shareholders on or about April 6, 2004.

GENERAL INFORMATION ABOUT VOTING

Who Can Vote

You are entitled to vote your common stock if you held shares as of the close of business on March 19, 2004. At the close of business on March 19, 2004, a total of 56,210,927 shares of common stock were outstanding and entitled to vote. Each share of common stock has one vote.

Voting by Proxies

If your common stock is held by a broker, bank or other nominee, they should send you instructions that you must follow in order to have your shares voted. If you hold shares in your own name, you may vote by signing, dating and mailing the proxy card in the postage paid envelope which we have provided to you. The proxies will vote your shares in accordance with your instructions. Of course, you can always come to the meeting and vote your shares in person. If you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board of Directors. We are not now aware of any other matters to be presented except for those described in this proxy statement. If any matters not described in the proxy statement are presented at the meeting, the proxies will use their own judgment to determine how to vote your shares. If the meeting is adjourned, the proxies may vote your common stock on the new meeting date as well, unless you revoke your proxy instructions before then.

Revoking your Proxy Instructions

You may revoke your proxy. To do so, you must either (1) advise our corporate Secretary, B. Judd Hartman, in writing before the meeting, (2) deliver later proxy instructions before the meeting, or (3) attend the meeting and vote in person.

Counting Votes

The annual meeting will be held if a majority of the outstanding common stock entitled to vote is represented at the meeting. If you have returned valid proxy instructions or attend the meeting in person, your common stock will be counted for the purpose of determining whether there is a quorum, even if you abstain from voting on some or all matters introduced to the meeting. Broker non-votes also count for quorum purposes. If you hold your common stock through a broker, bank or other nominee, generally the nominee may only vote the common stock that it holds for you in accordance with your instructions. However, if the nominee has not received your instructions before the meeting, the nominee may vote on matters that are determined to be routine by the

Nasdaq National Market. If a nominee cannot vote on a particular matter because it is not routine, there will be a “broker non-vote” on that matter. We do not count broker non-votes as votes for or against any proposal. We do count abstentions as votes against a proposal. Although there is no definitive statutory or case law in North Carolina regarding broker non-votes and abstentions, we believe that our intended treatment of them is appropriate. An independent inspector of election will count all votes cast at the meeting and report the results thereof on each matter presented at the meeting.

Cost of this Proxy Solicitation

We will pay the cost of this proxy solicitation. In addition to soliciting proxies by mail, our employees might solicit proxies personally and by telephone. None of these employees will receive any additional compensation for this. We will, upon request, reimburse brokers, banks and other nominees for their expenses in sending proxy materials to their principals and obtaining their proxies.

Attending the Annual Meeting

If you are a holder of record and plan to attend the annual meeting, please bring your proxy or a photo identification to confirm your identity. If you are a beneficial owner of common stock held by a bank or broker, i.e., in “street name”, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote in person your common stock held in street name, you must get a proxy in your name from the registered holder.

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

Our bylaws currently provide that the number of directors constituting the Board of Directors shall be not less than eight nor more than twelve. The Board of Directors may establish the number of directors within this range, and the number of director seats is currently fixed at nine. There are nine directors presently serving on our Board and nine directors will be elected at this annual meeting.

Vote Required

Directors are elected by a plurality of the votes cast at the annual meeting. This means that the nine nominees receiving the highest number of votes will be elected.

Voting by the Proxies

The proxies will vote your common stock in accordance with your instructions. Unless you give specific instructions to the contrary, your common stock will be voted for the election of the nominees named in this proxy statement. Each nominee has agreed to serve, and we expect that each of the nominees will be able to serve if elected. However, if any nominee is unavailable for election, the proxies will vote your common stock to elect a substitute nominee proposed by the Board of Directors.

2

Nominees

The Nominating and Governance Committee unanimously recommends the nine nominees listed below for election to the Board. Each nominee currently serves as a director of the Company. The Board of Directors has determined that each director, other than Dr. Eshelman, the Company’s Chief Executive Officer, is independent as defined in Rule 4200(a)(15) of the Nasdaq Stock Market listing standards. In addition, none of the nominees is related by blood, marriage or adoption to any other nominee or any executive officer of the Company.

| | | | | | |

Name of Nominee

| | Age

| | Director

Since

| | Position on

Board

|

Stuart Bondurant, M.D. | | 74 | | 1994 | | Director |

Fredric N. Eshelman | | 55 | | 1990 | | Vice Chairman |

Marye Anne Fox | | 56 | | 2002 | | Director |

Frederick Frank | | 71 | | 1996 | | Director |

David L. Grange | | 56 | | 2003 | | Director |

Catherine M. Klema | | 45 | | 2000 | | Director |

Terry Magnuson | | 53 | | 2001 | | Director |

Ernest Mario | | 65 | | 1993 | | Chairman |

John A. McNeill, Jr. | | 54 | | 1989 | | Director |

Stuart Bondurant, M.D. currently serves as a Professor of the School of Medicine at the University of North Carolina (Chapel Hill). He served as Dean of the School of Medicine at the University of North Carolina (Chapel Hill) from 1979 to 1994 and as Interim Dean from July 1996 until May 1997. Dr. Bondurant served as Director of Epidemiologic Studies at the New York Academy of Medicine from January 1995 until March 1996. Dr. Bondurant has served as President of the American College of Physicians and the Association of American Physicians. He has also served as Vice President of the American Heart Association and the American Society for Clinical Investigation. He served as the Chairman of the Board of Directors of the North Carolina Biotechnology Center from 1988 to 1992.

Fredric N. Eshelmanhas served as Chief Executive Officer of the Company since July 1990, and as Vice Chairman of the Board of Directors since July 1993. Dr. Eshelman founded the Company’s predecessor and served as its Chief Executive Officer until its sale to the Company in 1989. Dr. Eshelman served as Senior Vice President, Development and as a director of Glaxo Inc., a subsidiary of Glaxo Holdings, PLC, from 1989 through 1990 before rejoining the Company.

Marye Anne Fox has served as Chancellor of North Carolina State University and Distinguished University Professor of Chemistry since 1998. From 1976 to 1998, she was a member of the faculty of the University of Texas, where she taught chemistry and held the Waggoner Regents Chair in Chemistry from 1991 to 1998. She served as the University’s Vice President for Research from 1994 to 1998. Dr. Fox also is a member of the Board of Directors of Red Hat Corp., Boston Scientific Corporation and W. R. Grace Co., a specialty chemical company that filed a petition for reorganization under Chapter 11 of the Federal Bankruptcy Code in April 2001. Dr. Fox is the Co-Chair of the National Academy of Sciences’ Government-University-Industry Research Roundtable and serves on President Bush’s Council of Advisors on Science and Technology. She has served as the Vice Chair of the National Science Board.

Frederick Frankserved as a director of Applied Bioscience International Inc. from 1988 until its acquisition by the Company in September 1996. Mr. Frank has been an investment banker with Lehman Brothers since 1969 and is currently Vice Chairman of that firm. Previously, Mr. Frank served as a Partner of Lehman Brothers from 1969 to 1972, as Managing Director from 1972 to 1993, and as Senior Managing Director from 1993 to 1995. Mr. Frank also serves on the Boards of Directors of Diagnostic Products Corporation and Landec Corporation.

3

General David L. Grangehas served since November 1999 as Executive Vice President and Chief Operating Officer of the Robert R. McCormick Tribune Foundation, a charitable grantmaking organization that supports work in journalism, communities, citizenship and education. General Grange joined the Foundation after thirty years in the U.S. Army with his final position as Commanding General of the First Infantry Division, know as the “Big Red One.” During his military career, General Grange served as a Ranger, Green Beret, Aviator, Infantryman, and as a member of Delta Force. General Grange also serves as a National Security Analyst for CNN, WGN-TV, WGN Radio and CLTV.

Catherine M. Klema is currently President of Nettleton Advisors LLC, a consulting firm established by Ms. Klema in 2001. Ms. Klema served as Managing Director, Healthcare Investment Banking at SG Cowen Securities from 1997 to 2001. Ms. Klema also served as Managing Director, Healthcare Investment Banking at Furman Selz LLC from 1994 until 1997, and was employed by Lehman Brothers from 1987 until 1994. Ms. Klema is also a director of Watson Pharmaceuticals, Inc.

Terry Magnuson, Ph.D. currently serves as the Sarah Graham Kenan Professor and Chair of the Department of Genetics of the School of Medicine, the Director of the Program in Cancer Genetics of the Lineberger Comprehensive Cancer Center and the Director of the Carolina Center for Genome Sciences at the University of North Carolina (Chapel Hill). Prior to joining the School of Medicine at the University of North Carolina (Chapel Hill) in 2000, Dr. Magnuson was a Professor of Genetics and Director of the Developmental Biology Center at Case Western Reserve University. Dr. Magnuson has served on numerous advisory panels, including the National Institute of Health Genetic Basis of Disease Review Committee from 1990 to 1995, and as a member of the Secretariat of the International Mannheim Genome Society from 1999 to 2001. He currently is a member of the Board of Directors of the Society for Developmental Biology and a member of the Board of Scientific Overseers for the Jackson Laboratory. Dr. Magnuson also currently serves as co-Editor in Chief forgenesis: The Journal of Genetics and Development.

Ernest Mario, Ph.D. serves as Chairman and CEO of Reliant Pharmaceuticals, LLC, an emerging pharmaceutical company. Prior to joining Reliant in April 2003, Dr. Mario served as Chairman and Chief Executive Officer of IntraBiotics Pharmaceuticals, Inc., a pharmaceutical company, from April 2002 to April 2003 and continues to serve as the non-executive Chairman of IntraBiotics’ board of directors. Prior to 2002, Dr. Mario served as Chairman of the Board of Directors and Chief Executive of ALZA Corporation, a pharmaceutical company. Before joining ALZA in 1993, Dr. Mario served as Chief Executive of Glaxo Holdings plc from 1989 to March 1993 and as Deputy Chairman and Chief Executive of Glaxo Holdings plc, a pharmaceutical company, from January 1992 to March 1993. In addition to serving as a director on IntraBiotics’ board, Dr. Mario is also a director of Boston Scientific Corporation and Maxygen, Inc.

John A. McNeill, Jr. served as the Company’s President until 1990 and as its Chairman of the Board until July 1993. Mr. McNeill currently serves as Chief Executive Officer of Liberty Healthcare Services, LLC, a provider of nursing homes, assisted living facilities, independent living facilities, home healthcare agencies, home medical equipment and intravenous services.

Information About the Board of Directors and its Committees

The Board of Directors is responsible for the general management of the Company. In 2003, the board held eight meetings. Each incumbent member of the board during the time he or she served as a director of the Company attended at least 75% of the 2003 meetings of the Board of Directors and board committees of which he or she was a member.

Although the Company does not have a formal written policy with respect to Board members’ attendance at its annual meeting of shareholders, it is customary for all directors to attend that meeting. In addition, as disclosed below in “Other Information – Director Compensation,” Board members are compensated for attending our annual shareholder meetings. In 2003, all directors, except Paul Rizzo who did not stand for re-election, attended the annual meeting of shareholders held on May 14, 2003.

Shareholders may send any communications regarding Company business to the Board of Directors or any individual director in care of the Secretary of the Company at our principal executive offices located at 3151 South Seventeenth Street, Wilmington, North Carolina 28412. The Secretary will forward all such communications to the addressee.

4

The Board of Directors has established a Finance and Audit Committee, a Compensation Committee and a Nominating and Governance Committee. Mr. Frank, Chairman, Mr. McNeill and Dr. Bondurant, each of whom is independent under the Nasdaq Stock Market listing standards, are the members of the Finance and Audit Committee. In 2003, the Finance and Audit Committee held five meetings. The Finance and Audit Committee is responsible for the engagement of the independent auditors, reviews with management and with the independent auditors the scope and results of the Company’s audits, the internal accounting controls of the Company, financial reporting processes, and audit policies and practices, and pre-approves all professional services furnished by the independent auditors.

Mr. McNeill, Chairman, Dr. Fox, Ms. Klema and Dr. Magnuson, each of whom is independent under the Nasdaq listing standards, are the members of the Compensation Committee. During 2003, the Compensation Committee held four meetings. The Compensation Committee reviews and approves all compensation arrangements for the officers of the Company and administers our Equity Compensation Plan.

Dr. Mario, Chairman, Mr. Frank and Dr. Magnuson, each of whom is independent under the Nasdaq listing standards, are the members of the Nominating and Governance Committee. The Nominating and Governance Committee did not hold any meetings in 2003. A copy of the Nominating and Governance Committee charter is attached to this Proxy Statement as Appendix A.

To be considered as a director nominee, an individual must have high personal and professional character and integrity, exceptional ability and judgment, experience at a strategy/policy setting or high managerial level, relevant career specialization or technical skills, sufficient time to devote to Company matters, and an ability to work with the other director nominees to collectively serve the long-term interests of the shareholders. In addition to these minimum requirements, the Committee will also evaluate whether the nominee’s skills are complementary to the existing directors’ skills, and the Board’s need for operational, management, financial, international, industry-specific or other expertise. The Nominating and Governance Committee invites Board members to submit nominations for director. In addition to candidates submitted by Board members, director nominees recommended by shareholders will be considered. Shareholder recommendations must be made in accordance with the procedures described in the following paragraph and will receive the same consideration that other nominees receive. All nominees are evaluated by the Nominating and Governance Committee to determine whether they meet these minimum qualifications and whether they will satisfy the Board’s needs for specific expertise at that time. The Committee recommends to the full Board nominees for election as directors at the Company’s annual meeting of shareholders.

Our bylaws permit any shareholder of record to nominate directors. You must give written notice of your intent to make nominations by personal delivery or by certified mail, postage prepaid, to the Secretary of the Company. Any such timely notice will be forwarded to the Nominating and Governance Committee. If the election is to be held at the annual meeting of shareholders, you must give your notice not more than 90 days nor less than 50 days before the meeting. If the election is to be held at a special meeting of shareholders called to elect directors, you must give your notice by the tenth business day following the date on which notice of the special meeting is first given to shareholders. Your notice must include the following: (1) your name and address, as they appear on the Company’s books, and the name and residence address of the persons to be nominated; (2) the class and number of shares of the Company which you beneficially own; (3) a representation that you are a shareholder of record of the Company entitled to vote at the meeting and intend to appear in person or by proxy to nominate the persons specified in your notice; (4) a description of all arrangements or understandings between you and each nominee and any other persons, by name, as to how you will make the nominations; (5) all other information regarding each nominee you propose which is required to be disclosed in a solicitation of proxies for election of directors or is required under Regulation 14A of the Securities Exchange Act of 1934, including any information required to be included in a proxy statement if the nominee had been nominated by the Board of Directors; and (6) the written consent of each nominee to be named in a proxy statement to serve as a director, if elected.

General David L. Grange was elected to the Board of Directors effective October 15, 2003 to fill a vacancy on the Board. General Grange was nominated by Dr. Eshelman, the Company’s Chief Executive Officer and largest shareholder.

No shareholder has properly nominated anyone for election as a director at this annual meeting.

5

OTHER INFORMATION

Principal Shareholders

The following table shows the number of shares of the Company’s common stock beneficially owned as of March 1, 2004 by (1) each person known by the Company to own beneficially more than 5% of the outstanding shares of common stock, (2) each director and nominee for director, (3) each of our executive officers named in the Summary Compensation Table below, and (4) all current directors and executive officers of the Company as a group. Except as indicated in footnotes to this table, the persons named in this table have sole voting and investment power with respect to all shares of common stock shown. As of March 1, 2004, the Company had 56,179,261 shares of common stock outstanding. Share ownership in each case also includes shares issuable upon exercise of outstanding options that can be exercised within 60 days after March 1, 2004 for purposes of computing the percentage of common stock owned by the person named. Options owned by such person are not included for purposes of computing the percentage owned by any other person.

| | | | | |

Name

| | Shares Beneficially

Owned

| | Percentage Owned

| |

Linda Baddour (1) | | 58,756 | | | * |

Stuart Bondurant (2) | | 20,000 | | | * |

Paul S. Covington (3) | | 79,866 | | | * |

Fred B. Davenport, Jr. (4) | | 202,999 | | | * |

Fredric N. Eshelman (5) | | 5,302,408 | | 9.4 | % |

Marye Anne Fox (6) | | 14,000 | | | * |

Frederick Frank (2) | | 45,500 | | | * |

David L. Grange (6) | | 8,000 | | | * |

Catherine M. Klema (6) | | 26,000 | | | * |

Terry Magnuson (6) | | 26,000 | | | * |

Ernest Mario (7) | | 841,968 | | 1.5 | % |

John A. McNeill, Jr. (8) | | 1,749,520 | | 3.1 | % |

Mellon Financial Corporation (9) | | 3,383,453 | | 6.0 | % |

W. Richard Staub (10) | | 17,311 | | | * |

Wasatch Advisors, Inc. (11) | | 3,306,694 | | 5.9 | % |

All directors and current executive officers as a group (13 persons) (12) | | 8,392,328 | | 14.9 | % |

| (1) | Includes 500 shares of common stock held through an individual retirement account for the benefit of Ms. Baddour and 56,166 shares of common stock issuable pursuant to options. |

| (2) | Includes 18,000 shares of common stock issuable pursuant to options. |

| (3) | Includes 66,668 shares of common stock issuable pursuant to options. |

| (4) | Includes 2,000 shares of common stock held through an individual retirement account for the benefit of Mr. Davenport and 199,999 shares of common stock issuable pursuant to options. |

| (5) | Includes 343,333 shares of common stock issuable pursuant to options. Dr. Eshelman’s address is 3151 South Seventeenth Street, Wilmington, North Carolina 28412. |

| (6) | Consists of shares of common stock issuable pursuant to options. |

| (7) | Includes 278,776 shares of common stock held in a family partnership; 3,700 shares of common stock held in trust for Mrs. Mario; 3,700 shares of common stock held in trust for Dr. Mario; 201,366 shares of common stock held by Dr. Mario’s wife; and 42,000 shares of common stock issuable pursuant to options. |

| (8) | Includes 1,230 shares of common stock held in a family partnership; 1,589,323 shares of common stock held in a limited liability company; 32,034 shares of common stock held in trust for Mr. McNeill’s three children, all of whom reside with Mr. McNeill; and 50,000 shares of common stock issuable pursuant to options. |

6

| (9) | Based on information contained in Schedule 13G filed with the Securities and Exchange Commission on or about January 30, 2004. The address of Mellon Financial Corporation is One Mellon Center, Pittsburgh, Pennsylvania 15258. |

| (10) | Includes 16,667 shares of common stock issuable pursuant to options. |

| (11) | Based on information contained in Schedule 13G filed with the Securities and Exchange Commission on or about February 17, 2004. The address of Wasatch Advisors, Inc. is 150 Social Hall Avenue, Salt Lake City, UT 84111. |

| (12) | Includes all shares of common stock referenced in the table above except those owned by Mellon Financial Corporation and Wasatch Advisors, Inc. |

Director Compensation

Directors who are employees of the Company receive no additional compensation for serving on the Board of Directors. We pay non-employee directors an annual retainer of $20,000 payable in quarterly installments after each regularly scheduled meeting of directors. We also pay each non-employee director $1,000 for each meeting of the Board of Directors attended in person and $1,000 for attendance at our annual meeting of shareholders. We pay each non-employee member of the Finance and Audit Committee $1,500 for each committee meeting attended, and we also pay the chairman of the Committee an annual retainer of $5,000. For all other committees, we pay the chairman $1,500 for each meeting attended and all other non-employee committee members $1,000 per meeting attended. In the discretion of the Chairman of the Board of Directors, we pay each non-employee director $500 for each Board and committee meeting attended by telephone. In addition, we grant each non-employee director a fully vested option to purchase 8,000 shares of common stock on each date he or she is elected or re-elected to the Board.

Executive Compensation Tables

1. Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

| | | Year

| | Annual Compensation

| | Long-Term Compensation Awards

| | All Other

Compensation

($)

|

Name and Principal Position

| | | Salary ($)

| | Bonus ($)(1)

| | Other Annual

Compensation

($)

| | Restricted

Stock Awards ($)(2)

| | Securities

Underlying

Options (#)(3)

| |

Fredric N. Eshelman (4)

Vice Chairman and

Chief Executive Officer | | 2003

2002

2001 | | $

| 623,479

590,812

547,917 | | $

| 0

525,000

493,125 | | $

| —

—

— | | $

| —

—

650,000 | | 60,000

60,000

50,000 | | $

| 8,322

6,743

6,492 |

| | | | | | | |

Fred B. Davenport, Jr. (5)

President and

Assistant Secretary | | 2003

2002

2001 | | $

| 327,825

308,900

277,683 | | $

| 0

180,000

165,000 | | $

| —

—

— | | $

| —

—

200,000 | | 40,000

65,000

22,500 | | $

| 7,242

6,742

6,444 |

| | | | | | | |

Paul S. Covington (6)

Executive Vice President -

Development | | 2003

2002

2001 | | $

| 290,812

273,009

243,225 | | $

| 0

150,000

135,000 | | $

| —

—

— | | $

| —

—

200,000 | | 20,000

35,000

15,000 | | $

| 6,810

6,288

6,030 |

| | | | | | | |

Linda Baddour (7)

Chief Financial Officer,

Treasurer and Assistant Secretary | | 2003

2002

2001 | | $

| 207,000

187,542

148,750 | | $

| 0112,000

59,500 | | $

| —

—

— | | $

| —

—

50,000 | | 25,000

50,000

7,500 | | $

| 6,630

5,836

5,510 |

| | | | | | | |

W. Richard Staub (8)

Senior Vice President - Global

Business Development | | 2003

2002

2001 | | $

| 179,504

156,346

136,906 | | $

| 0

165,457

46,239 | | $

| —

—

— | | $

| —

—

— | | —

32,500

5,000 | | $

| 5,490

5,004

4,732 |

| (1) | All bonuses reported in this table were paid in the calendar year following the year in which they were earned, except for $130,457 of Mr. Staub’s 2002 bonus which was paid to him over the course of 2002. |

| (2) | All restricted stock awards were granted in January 2001. The value of each award was based on the closing price of the Company’s common stock on the date the award was granted. All of the restricted stock awards vested in January 2004. Dr. Eshelman and Mr. |

7

Davenport elected to defer receipt of their shares of restricted stock under the Company’s Deferred Compensation Plan. The aggregate number of shares of restricted stock outstanding on December 31, 2003 was 46,010 shares. Based on the closing price of the Company’s common stock on December 31, 2003, the aggregate value of the outstanding shares of restricted stock was $1,240,890.

| (3) | The number of options reported equals the number of options granted on the grant date. Options granted prior to April 27, 2001, the record date for our one-for-one stock dividend issued on May 11, 2001, have not been adjusted for such stock dividend. |

| (4) | Dr. Eshelman was awarded options to acquire 50,000, 60,000 and 60,000 shares of common stock on December 3, 2001, December 3, 2002 and December 3, 2003, respectively. Dr. Eshelman received other compensation in 2003 consisting of $2,322 in taxable benefit of premiums paid for group life insurance on his behalf and $6,000 in 401(k) plan matching contributions. Dr. Eshelman received other compensation in 2002 consisting of $1,242 in taxable benefit of premiums paid for group term life insurance on his behalf and $5,501 in 401(k) plan matching contributions. Dr. Eshelman received other compensation in 2001 consisting of $1,242 in taxable benefit of premiums paid for group term life insurance on his behalf and $5,250 in 401(k) plan matching contributions. |

| (5) | Mr. Davenport was awarded options to acquire 22,500, 25,000, 40,000 and 40,000 shares of common stock on December 3, 2001, January 15, 2002, December 3, 2002 and December 3, 2003, respectively. Mr. Davenport received other compensation in 2003 consisting of $1,242 in taxable benefit of premiums paid for group term life insurance on his behalf and $6,000 in 401(k) plan matching contributions. Mr. Davenport received other compensation in 2002 consisting of $1,242 in taxable benefit of premiums paid for group term life insurance on his behalf and $5,500 in 401(k) plan matching contributions. Mr. Davenport received other compensation in 2001 consisting of $1,194 in taxable benefits of premiums paid for group term life insurance on his behalf and $5,250 in 401(k) plan matching contributions. |

| (6) | Dr. Covington was awarded options to acquire 15,000, 15,000, 20,000 and 20,000 shares of common stock on December 3, 2001, January 15, 2002, December 3, 2002 and December 3, 2003, respectively. Dr. Covington received other compensation in 2003 consisting of $810 in taxable benefits of premiums paid for group term life insurance on his behalf and $6,000 in 401(k) plan matching contributions. Dr. Covington received other compensation in 2002 consisting of $788 in taxable benefits of premiums paid for group term life insurance on his behalf and $5,500 in 401(k) plan matching contributions. Dr. Covington received other compensation in 2001 consisting of $780 in taxable benefits of premiums paid for group term life insurance on his behalf and $5,250 in 401(k) plan matching contributions. |

| (7) | Ms. Baddour was awarded options to acquire 7,500 shares of common stock on March 12, 2001. Ms. Baddour was awarded 7,500, 22,500, 20,000 and 25,000 options to acquire shares of common stock on February 19, 2002, May 16, 2002, December 3, 2002 and December 3, 2003, respectively. Ms. Baddour received other compensation in 2003 consisting of $630 in taxable benefits of premiums paid for group term life insurance on her behalf and $6,000 in 401(k) plan matching contributions. Ms. Baddour received other compensation in 2002 consisting of $336 in taxable benefits of premiums paid for group term life insurance on her behalf and $5,500 in 401(k) plan matching contributions. Ms. Baddour received other compensation in 2001 consisting of $260 in taxable benefits of premiums paid for group term life insurance on her behalf and $5,250 in 401(k) plan matching contributions. |

| (8) | Mr. Staub was awarded options to acquire 5,000 shares of common stock on March 12, 2001. In 2002, Mr. Staub was awarded 7,500, 10,000 and 15,000 options to acquire shares of common stock on March 11, 2002, May 14, 2002 and December 31, 2002, respectively. Mr. Staub received other compensation in 2003 consisting of $336 in taxable benefits of premiums paid for group term life insurance on his behalf and $5,154 in 401(k) plan matching contributions. Mr. Staub received other compensation in 2002 consisting of $276 in taxable benefits of premiums paid for group term life insurance on his behalf and $4,728 in 401(k) plan matching contributions. Mr. Staub received other compensation in 2001 consisting of $222 in taxable benefits of premiums paid for group term life insurance on his behalf and $4,510 in 401(k) plan matching contributions. |

2. Stock Option/SAR Grants Table – 2003 Grants

| | | | | | | | | | | | | | | | |

| | | Individual Grants(1)

| | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option

Term (2)

|

Name

| | Number of

Securities

Underlying

Options

Granted (#)

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year (3)

| | | Exercise or

Base Price

($/Sh)

| | Expiration

Date

| | 5% ($)

| | 10%($)

|

Fredric N. Eshelman | | 60,000 | | 9.21 | % | | $ | 30.60 | | 12/02/13 | | $ | 1,154,400 | | $ | 2,926,200 |

Fred B. Davenport, Jr. | | 40,000 | | 6.14 | % | | | 30.60 | | 12/02/13 | | | 769,600 | | | 1,950,800 |

Paul S. Covington | | 20,000 | | 3.07 | % | | | 30.60 | | 12/02/13 | | | 384,800 | | | 975,400 |

Linda Baddour | | 25,000 | | 3.84 | % | | | 30.60 | | 12/02/13 | | | 481,000 | | | 1,219,250 |

| (1) | All options to current executive officers named in this table were granted under our Equity Compensation Plan on December 3, 2003. The exercise price per share of all options granted equals the fair market value per share of our common stock on the date of grant. The options are exercisable over a term of ten years from the date of grant and vest ratably over the three-year period starting on the date of the grant, with vesting occurring on the anniversary dates of the grant. All options are non-qualified stock options and expire three |

8

months after termination of employment. However, if employment is terminated because of death or disability, the options can be exercised until one year after death or disability.

| (2) | Potential realizable value of each grant is calculated assuming that the market price of the underlying security appreciates at annualized rates of 5% and 10%, respectively, over the ten-year term of the option. The assumed annual rates of appreciation of 5% and 10% would result in the price of the common stock increasing to $49.84 and $79.37 per share, respectively, for options expiring 12/2/13. These calculations are based on Securities and Exchange Commission disclosure requirements and do not represent the estimated growth of our stock price by PPD nor the present value of these stock options. |

| (3) | We granted a total of 651,715 options to acquire shares of common stock in 2003. |

3. Aggregated Option/SAR Exercises In 2003

and Option/SAR Values as of Year-End 2003

| | | | | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise (#)

| | Value Realized ($)

| | Number of Unexercised Options/SARs at Fiscal Year-End (#)

| | Value of Unexercised In-the-Money Options/SARs at Fiscal Year-End (1) ($)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Fredric N. Eshelman | | — | | | — | | 343,333 | | 116,667 | | $ | 4,646,000 | | $ | 12,500 |

Fred B. Davenport, Jr. | | — | | | — | | 191,166 | | 90,834 | | | 2,202,600 | | | 5,625 |

Paul S. Covington | | — | | | — | | 61,668 | | 48,334 | | | 533,331 | | | 3,750 |

Linda Baddour | | — | | | — | | 48,666 | | 63,334 | | | 372,990 | | | 92,950 |

W. Richard Staub | | 4,334 | | $ | 70,709 | | 17,499 | | 25,001 | | | 38,196 | | | 26,404 |

| (1) | The value of the options is based on the difference between the exercise price and $26.97, the closing price per share of the Company’s common stock on the National Association of Securities Dealers’ Automated Quotation National Market System on December 31, 2003. |

Employment and Severance Agreements

Fred Eshelman, Chief Executive Officer, entered into an employment agreement with the Company effective July 1, 1997. The employment agreement provides for automatic one-year renewals unless either party gives notice that the agreement will not be renewed, and the agreement automatically renewed for a seventh one-year term beginning July 1, 2003. Dr. Eshelman’s annual base salary for the renewal term is $640,000.

Fred B. Davenport, Jr. was promoted to President of the Company on January 15, 2002. Mr. Davenport entered into a new employment agreement with the Company dated January 15, 2002. The initial term of the employment agreement was from January 15, 2002 through December 31, 2003. The employment agreement contains automatic one-year renewals unless either party gives notice that the agreement will not be renewed, and the agreement automatically renewed for a one-year term beginning January 1, 2004. Mr. Davenport’s annual base salary for 2004 is $335,994.

Paul S. Covington was promoted to Executive Vice President - Development of PPD Development, the Company’s contract research organization subsidiary, effective January 15, 2002. Dr. Covington entered into a new employment agreement with PPD Development dated January 15, 2002. The initial term of the agreement was from January 15, 2002 through December 31, 2003. The employment agreement contains automatic one-year renewals unless either party gives notice that the agreement will not be renewed, and the agreement automatically renewed for a one-year term beginning January 1, 2004. Dr. Covington’s annual base salary for 2004 is $298,059.

Linda Baddour was promoted to Chief Financial Officer of the Company effective May 16, 2002, and continues to serve as the Company’s Chief Accounting Officer, her position prior to her promotion. Ms. Baddour entered into an employment agreement with the Company dated May 16, 2002. The employment agreement provides for an initial term of one year and contains automatic one-year renewals unless either party gives notice that the agreement will not be renewed. The agreement automatically renewed for a one-year term on May 16, 2003. Ms. Baddour’s base salary for the renewal term is $212,000.

9

W. Richard Staub was promoted to Senior Vice President - Global Business Development of PPD Development, the Company’s contract research organization subsidiary, on May 1, 2002. Mr. Staub entered into an employment agreement with PPD Development dated May 1, 2002, which provided for an initial term beginning May 1, 2002 and ending December 31, 2002. The employment agreement contains automatic one-year renewals unless either party gives the other notice that the agreement will not be renewed, and the agreement automatically renewed for a one-year term beginning January 1, 2004. Mr. Staub’s base salary for 2004 is $184,050.

Each of the executive officers named in the Summary Compensation Table has entered into a severance agreement with the Company. Each severance agreement provides that upon termination of the executive officer’s employment within one year after a change of control of the Company, including required relocation that he or she declines, the executive officer will be paid an amount equal to one to three times his or her base salary and cash bonus for the prior 12 months. Dr. Eshelman is entitled to a severance payment equal to three times his annual base salary and cash bonus, and Mr. Davenport and Dr. Covington are entitled to a severance payment equal to two and one-half times their annual base salary and cash bonus for the prior 12 months. Dr. Covington’s severance agreement was amended to increase his severance payment when he was promoted to Executive Vice President – Development in January 2002. Ms. Baddour and Mr. Staub are each entitled to a severance payment equal to one times their base salary and cash bonus. In addition to the severance payments, all outstanding unvested stock options and unvested restricted stock granted at least six months prior to the executive officer’s termination of employment will vest upon termination.

Report of the Compensation Committee on Executive Compensation

John A. McNeill, Jr., Chairman, Marye Anne Fox, Catherine M. Klema and Terry Magnuson are the members of the Compensation Committee. The Board of Directors has determined that each member of the Committee is independent as defined in Rule 4200(a)(15) of the Nasdaq Stock Market’s listing standards.

Executive Pay Policy.

The Compensation Committee continues to implement a compensation system that is performance-oriented and designed to achieve long-term shareholder returns. In the past, the Company has engaged Frederic W. Cook & Co., Inc., a compensation consulting firm, to conduct a study on the competitiveness of the Company’s executive compensation programs every three years. Consistent with that practice and at the Committee’s direction, in May 2003 the Company retained the Cook firm for a third time to review the Company’s current executive compensation practices and make recommendations for changes to meet the Committee’s stated compensation objectives and ensure that the Company’s executive compensation plans are competitive.

The Committee received the report from the Cook firm in September 2003. The Cook firm assessed the competitiveness of the Company’s base salary, annual bonus and long-term incentives compensation levels for various executives of the Company, including the Company’s current executive officers, by comparing these programs against a group of companies that included other clinical research organizations and biopharmaceutical companies. The Cook firm concluded that the Company’s cash compensation, consisting of base salary and annual bonus, was competitive with the survey group. However, Cook noted that the Company’s long-term incentives are somewhat conservative when compared to other clinical research organizations and are substantially lower than those provided by biopharmaceutical companies. The Cook firm recommended that the Committee consider increasing option awards to its executive officers and extending awards down to the next level of the Company’s management employees. The Cook firm also recommended that the Company consider using more restricted stock grants if the Financial Accounting Standards Board, or FASB, enacts rules requiring the expensing of stock options. The Cook firm also suggested that the Company consider a stock ownership requirement for certain Company executives.

After further study and deliberation, the Committee took the following actions at its December 2003 meeting.

10

First, the Committee amended the Company’s stock option guidelines to make the next lower level of the Company’s management employees eligible for stock option awards. However, the Committee elected not to increase stock option awards for the Company’s executive officers based on several factors, including input from senior management and a determination that the Company’s stock option awards are more fairly compared to those provided by other clinical research organizations and not biopharmaceutical companies. Although the Company’s stock option awards to executive officers were lower in some instances than awards granted by the other clinical research organizations in the survey group, the Committee determined that the Company’s awards were still competitive.

Second, the Committee elected not to take any action on the recommendation for increasing the use of restricted stock grants unless the FASB enacts rules clarifying the accounting treatment for stock option grants. The Committee intends to re-evaluate the increased use of restricted stock if any such new rules, including the valuation methodology, are finalized by the FASB.

Finally, the Committee considered the Cook firm’s suggestion for a stock ownership requirement for certain of the Company’s executive officers. The Committee discussed the underlying rationale for stock ownership requirements and whether such a program would provide any additional incentive to the Company’s executive officers to achieve long-term shareholder value in addition to the incentives that are built into the Company’s existing executive compensation scheme. The Committee noted that the Chief Executive Officer is currently the Company’s single largest shareholder, and discussed the potential impact on the Company’s other executive officers and its ability to continue to retain their services if such a program were implemented. After deliberation, the Committee elected not to take any action with respect to a stock ownership requirement for its executive officers at the December meeting.

The Committee believes that the Company’s executive compensation programs for its executive officers are competitive, will enable to the Company to continue to attract and retain key executives, and are designed to reward performance and achieve long-term shareholder value. The Committee will continue to periodically evaluate these programs and make changes to ensure that they are designed to achieve the Committee’s stated objectives.

Specific Compensation Programs.

The Company’s compensation program for its executive officers includes a mix of base salary, annual cash bonus awards and long-term incentive compensation in the form of stock options and restricted stock.

Base Salary.The Committee reviews base salaries of the Company’s executive officers on an annual basis and at the time of promotion. Following its 2003 annual performance reviews of the Company’s executive officers, the Committee approved annual salary increases of $9,858, $8,745 and $5,400 for Mr. Davenport, Dr. Covington and Mr. Staub, respectively, a 3% increase over current salaries effective April 1, 2004 in each case. The Committee also approved a salary increase of $10,600, or 5%, for Ms. Baddour effective May 16, 2004, the date on which her employment agreement is scheduled to renew for an additional one-year term. Ms. Baddour’s salary increase for 2004 was also lower than her 2003 salary adjustment due to the Company’s performance in 2003, but was higher than the other salary increases approved by the Committee in order to reflect the responsibilities of her position with the Company and to adjust her salary based on market conditions.

The Committee continues to believe, based on its experience, that employment agreements with shorter terms and annual performance reviews promotes better performance by executives. Thus, the Committee continues to follow its general policy that executive employment agreements will have an initial term of one or two years, with a provision for successive one-year renewal terms unless either party gives notice to the other that the agreement will not be renewed. All of the employment agreements that the Company has with its executive officers include this provision.

Annual Bonus Awards. All current employment agreements with executive officers provide for payment of an annual cash bonus in the discretion of the Compensation Committee. The Committee has adopted an employee incentive compensation plan and reviews and updates the plan each year. Under the 2003 employee incentive compensation plan adopted by the Committee, target bonuses for executive officers who participate in the plan, other than the Chief Executive Officer, were set at 40% of base salary. The Chief Executive Officer’s target bonus for 2003 was set at 70% of his base salary. Mr. Staub’s annual cash bonus is determined under our employee

11

incentive compensation plan and under a separate bonus program based primarily on new business authorizations obtained during the year. As a result of the Company’s lower-than-expected financial and operating performance in 2003, the Committee did not award any cash bonuses under the 2003 employee incentive compensation plan to the Company’s executive officers named in the Summary Compensation Table.

Stock-Based Awards. Under our Equity Compensation Plan, the Compensation Committee may grant executive officers incentive and nonqualified stock options, restricted stock, stock appreciation rights, deferred stock, performance awards and other stock-based awards. Stock option awards received by the Company’s executive officers are made under comprehensive guidelines that are reviewed and updated by the Committee annually. Initial, annual and promotion awards of stock options are based upon the position held or to be held by an executive officer and his or her level of experience. The size of an annual stock option award generally is tied to the overall performance of the Company and the individual performance of the executive officer. In its discretion, the Committee may also issue stock option grants in lieu of increases in base salary or cash bonuses to incentivize executives. The Committee believes this stock-based award program is consistent with its stated objective of establishing a performance-based executive compensation system because the value of the executive’s stock options generally will be related to the Company’s overall performance.

In December 2003, the Committee approved the annual stock option awards for the named executive officers as set forth in the Summary Compensation Table. Each award was made in accordance with the Company’s stock option guidelines. These awards were approved at the high end of the range under these guidelines to incentivize future performance and because the Committee did not anticipate awarding cash bonuses to these individuals under the employee incentive compensation plan.

In January 2001, the Committee approved awards of restricted stock to its executive officers in recognition of the Company’s successful performance in 2000 and to incentivize performance in future years. Adjusted for the May 2001 stock dividend, Dr. Eshelman received 27,188 shares of restricted stock, Mr. Davenport and Dr. Covington each received 8,366 shares, and Ms. Baddour received 2,090 shares. These restricted stock grants were subject to three-year cliff vesting and became fully vested in January 2004.

Chief Executive Officer Compensation.

Dr. Eshelman’s current base salary of $640,000 was established by the Committee following his annual performance review in February 2003. The Committee increased his salary from $609,500 to $640,000, a 5% increase that became effective July 1, 2003, the date on which Dr. Eshelman’s employment agreement was renewed for another one-year term. In establishing his base salary, the Committee considered the Company’s financial and operating performance in 2002, the base salaries paid to chief executive officers of the Company’s competitors and other factors.

In March 2004, in connection with Dr. Eshelman’s 2003 annual performance review, the Committee determined his cash bonus under the 2003 employee incentive compensation plan and reviewed his base salary for adjustment. Due to the Company’s lower-than-expected financial and operating performance in 2003, the Committee did not award a cash bonus to Dr. Eshelman under the 2003 employee incentive compensation plan. The Committee approved a 3% increase in Dr. Eshelman’s base salary from $640,000 to $659,200, effective July 1, 2004, the date on which his employment agreement is scheduled to renew for an additional one-year term.

In January 2001, the Committee awarded Dr. Eshelman 27,188 shares of restricted stock. All of the restricted shares were subject to a three-year cliff vesting schedule and became fully vested in January 2004. On December 3, 2003, the Committee awarded Dr. Eshelman a grant of 60,000 nonqualified stock options at an exercise price of $30.60 per share. Similar to the grants approved for the Company’s other executive officers, this option grant was at the high end of the range and was approved by the Committee to provide additional incentive to Dr. Eshelman and because the Committee did not expect to approve a cash bonus for him under the employee incentive compensation plan.

| | |

Submitted by: | | THE COMPENSATION COMMITTEE |

| |

| | | John A. McNeill, Jr., Chairman |

| | | Marye Anne Fox |

| | | Catherine M. Klema |

| | | Terry Magnuson |

12

Compensation Committee Interlocks and Insider Participation

John A. McNeill, Jr., Chairman, and Catherine M. Klema were members of the Compensation Committee for all of 2003. Marye Anne Fox and Terry Magnuson were elected to the Compensation Committee on May 14, 2003. Stuart Bondurant served as a member of the Compensation Committee until May 14, 2003. None of the members of the Compensation Committee during 2003 was an officer or employee of the Company at any time in 2003. Mr. McNeill served as the Company’s President from 1989 until 1993. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity which has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

Report of the Finance and Audit Committee

The Finance and Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2003 with management. The Committee has discussed with the independent auditors of those financial statements, Deloitte & Touche LLP (“D&T”), the matters required to be discussed by Statement on Auditing Standards No. 61, as modified or supplemented. The Committee has received the written disclosures and the letter from D&T required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, as modified or supplemented, and has discussed with D&T its independence. The Committee has also considered whether the provision of (1) financial information and design services described in paragraph (c)(4)(ii) of Rule 2-01 of Regulation S-X and (2) services other than the audit of the Company’s financial statements and financial information and design services were compatible with maintaining D&T’s independence.

Based on the review and discussions referred to in the foregoing paragraph, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003 for filing with the Securities and Exchange Commission.

The Board of Directors certifies that the Company has, and will continue to have, a Finance and Audit Committee that has at least three members, comprised solely of directors each of whom: (1) meets the definition of independence in Rule 4200(a)(15) of Nasdaq Stock Market’s listing standards; (2) meets the independence requirements in Rule 10A-3(b)(1) of the Securities Exchange Act of 1934; (3) has not participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three fiscal years; and (4) is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. The Board of Directors further certifies that the Committee has, and will continue to have, at least one member that has past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the member’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

In December 2003, the Committee reviewed and reassessed the adequacy of its charter and recommended changes to the Board of Directors. Based on the recommendations of the Committee, the Board of Directors adopted an amended and restated Finance and Audit Committee charter. A copy of the revised Finance and Audit Committee charter is attached to this proxy statement as Appendix B.

The Finance and Audit Committee pre-approves the engagement of the Company’s independent auditor to render audit services to the Company. The Finance and Audit Committee also pre-approves the provision by the Company’s independent auditor of specific permitted non-audit services on a case-by-case basis. The Committee generally limits its pre-approval of non-audit services to a specified period of time and, for some services, to a maximum dollar amount.

| | |

Submitted by: | | THE FINANCE AND AUDIT COMMITTEE |

| |

| | | Frederick Frank, Chairman |

| | | Stuart Bondurant |

| | | John A. McNeill, Jr. |

13

Fees Paid to the Independent Auditors

For the years ended December 31, 2003 and 2002, D&T performed professional services for the Company. The professional services provided by D&T and the fees billed for those services are set forth below.

Audit Fees

The aggregate fees billed by D&T for the audit of the Company’s annual financial statements for the fiscal years ended December 31, 2003 and 2002, and for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q filed during those fiscal years, were $582,000 and $364,000, respectively.

Audit-Related Fees

The aggregate fees billed by D&T for assurance and related services that were reasonably related to the audit or review of the Company’s financial statements for the fiscal years ended December 31, 2003 and 2002, and which are not included in the amounts disclosed above under the caption “Audit Fees,” were $699,000 and $90,000, respectively. These fees related to employee benefit plan audits, due diligence services for acquisitions, potential acquisitions and investments, and accounting consultations.

Tax Fees

The aggregate fees billed by D&T for tax services for the fiscal years ended December 31, 2003 and 2002 were $160,000 and $117,000, respectively. The fees for the fiscal year ended December 31, 2003 were for tax services related to transfer pricing, employee benefit plans, property taxes and investments. The fees for the fiscal year ended December 31, 2002 were for services related to property taxes and tax planning.

All Other Fees

The aggregate fees billed by D&T for services other than those reported above under the captions “Audit Fees,” “Audit-Related Fees” and “Tax Fees” were $0 and $0 for the fiscal years ended December 31, 2003 and 2002, respectively.

14

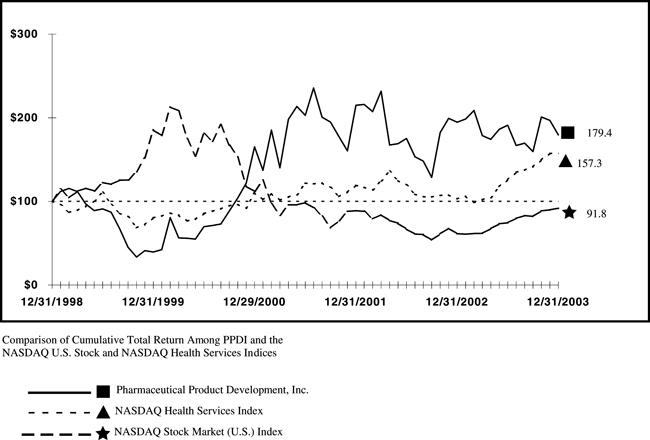

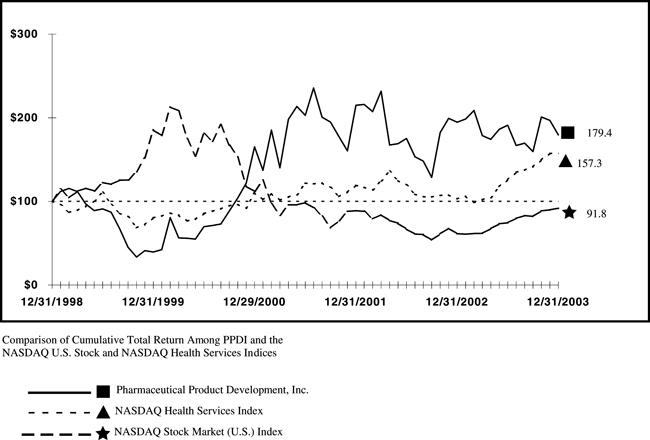

Performance Graph

Below is a graph that compares the cumulative total shareholder return on the Company’s common stock from December 31, 1998 through December 31, 2003, against the cumulative total return for the same period on the NASDAQ Stock Market (U.S.) Index and the NASDAQ Health Services Index. The results are based on an assumed $100 invested on December 31, 1998 and reinvestment of dividends.

| | | | | | | | | | | | |

CRSP Total Returns Index for:

| | 12/31/98

| | 12/31/99

| | 12/29/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

|

PPDI | | 100.0 | | 39.5 | | 165.3 | | 215.0 | | 194.7 | | 179.4 |

NASDAQ Health Services Index | | 100.0 | | 80.4 | | 110.4 | | 119.4 | | 102.9 | | 157.3 |

NASDAQ Stock Market (U.S.) Index | | 100.0 | | 185.4 | | 111.8 | | 88.8 | | 61.4 | | 91.8 |

Deadline for Receipt of Shareholder Proposals

Shareholder proposals to be included in the proxy statement for our next annual meeting of shareholders must be received by the Company not later than December 1, 2004. Under the Company’s bylaws, shareholder proposals to be considered at our next annual meeting must be received by the Company not later than 50 days prior to that meeting. All submissions must comply with all of the requirements of the Company’s bylaws and Rule 14a-8 of the Securities Exchange Act. Proposals should be mailed to B. Judd Hartman, Secretary, Pharmaceutical Product Development, Inc., 3151 South Seventeenth Street, Wilmington, North Carolina 28412.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires our officers and directors and persons who own more than 10% of our outstanding common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. These officers, directors and shareholders are required by regulations under the Securities Exchange Act to furnish us with copies of all forms they file under Section 16(a).

Based solely on our review of the copies of forms we have received, we believe that during 2003 all of our officers, directors and shareholders described above complied with all Section 16(a) filing requirements.

15

OTHER MATTERS

Effective February 25, 2002, the Board of Directors of the Company appointed Deloitte & Touche LLP (“D&T”) to serve as the independent auditors of the Company for the fiscal year ending December 31, 2002. Prior to that, Pricewaterhouse Coopers LLP (“PwC”), and its predecessor, Coopers & Lybrand L.L.P., had audited our financial statements since 1994. PwC was dismissed as our independent auditors on February 25, 2002. The reports prepared and issued on our financial statements for the fiscal years ended December 31, 2001 and December 31, 2000 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, scope or accounting principles. The decision to change independent auditors was recommended by our Audit Committee and approved by our Board of Directors. During the two fiscal years immediately preceding the date of PwC’s dismissal, there were no disagreements with PwC on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of PwC, would have caused PwC to make a reference to the subject matter of the disagreements in connection with their reports on the financial statements for such years. PwC advised the Company that it does not have, and has not had, any direct or indirect financial interest in the Company or its subsidiaries in any capacity other than that of serving as independent auditors. D&T has also advised the Company that it does not have, and has not had, any direct or indirect financial interest in the Company or its subsidiaries in any capacity. Representatives of D&T are expected to attend the annual shareholder meeting. They will have an opportunity to make a statement if they desire, and they also will be available to respond to appropriate questions.

By Order of the Board of Directors

/s/ Fredric N. Eshelman

Fredric N. Eshelman

Chief Executive Officer

16

APPENDIX A

Pharmaceutical Product Development, Inc.

Nominating and Governance Committee Charter

Organization

The Nominating and Governance Committee (the “Committee”) of the Board of Directors of Pharmaceutical Product Development, Inc. (the “Company”) is established pursuant to Article III, Section 8 of the Bylaws of the Company. The Board of Directors will appoint committee members annually for a term of one year. The Board of Directors will also appoint a chairperson for the Committee. The Committee will consist of not less than three nor more than five directors. All Committee members shall meet the independence requirements of the Nasdaq listing standards (subject to any applicable exceptions permitted under such listing standards) and any other applicable laws, rules and regulations governing independence.

Purpose

The purpose of the Committee is to assist the Board in promoting the best interests of the Company and its shareholders through the implementation of sound corporate governance principles and practices. The Committee will accomplish this purpose by assisting the Board in identifying individuals qualified to become Board members and recommending to the Board director nominees for the annual meeting of shareholders, reviewing the composition of the Board and its committees, developing and recommending to the Board any appropriate corporate governance guidelines and overseeing the annual review of the Board’s performance. The Committee shall take a leadership role in shaping the corporate governance policies and practices of the Company.

Duties and Responsibilities

The Committee shall have the following duties and responsibilities:

| • | Develop and recommend to the Board any minimum qualifications for director nominees. |

| • | Identify and evaluate potential candidates for all directorships to be filled by the Board of Directors or by the shareholders, in such manner as the Committee deems appropriate. In evaluating potential director nominees, the Committee shall take into account all factors it considers relevant and appropriate. |

| • | Recommend to the Board a slate of nominees for election as directors at the Company’s annual meeting of shareholders. |

| • | Recommend to the Board individuals to be appointed as directors in connection with director vacancies and any newly created directorships. |

| • | Review the size and composition of the Board and its committees, taking into account such factors as the business experience and specific areas of expertise of each director, and make recommendations to the Board as necessary. |

| • | Develop and recommend to the Board any appropriate corporate governance guidelines. The Committee shall review the guidelines on an annual basis, or more frequently if appropriate, and recommend changes to the Board as necessary. |

| • | Develop and recommend to the Board an annual self-evaluation process for the Board and its committees. The Committee shall oversee the annual self-evaluation process. |

General

| • | The Committee will meet at such times and places as it deems appropriate and will regularly update the Board of Directors about committee activities and recommendations. |

| • | To carry out its duties and responsibilities, the Committee may retain a search firm to assist it in identifying director candidates and may also retain outside counsel and other advisors as it deems necessary. The Committee shall have sole authority to approve related fees and retention terms. |

| • | The Committee will periodically review and assess the adequacy of this charter and recommend changes to the Board. The Board of Directors must approve any amendments to this charter. |

2

APPENDIX B

Pharmaceutical Product Development, Inc.

Finance and Audit Committee Charter

Mission Statement

The Finance and Audit Committee (the “Audit Committee”) will assist the Board of Directors of Pharmaceutical Product Development, Inc. (the “Company”) in fulfilling its oversight responsibilities. The Audit Committee will oversee and appraise the financial reporting process, the audit process, and the Company’s process for monitoring compliance with laws and regulations and with the Company’s codes of conduct and ethics. In performing its duties, the Audit Committee will maintain effective working relationships with the Board of Directors, management, and the internal and external auditors. To properly perform his or her role, each committee member will have an understanding of the responsibilities of committee membership as well as familiarity with the Company’s business, operations, and risks.

Although the Audit Committee has the responsibilities and powers set forth in this charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of management and the external auditors. Nor is it the duty of the Audit Committee to assure compliance with laws and regulations and the Company’s codes of conduct and ethics.

Organization

| • | The Audit Committee will be composed of not less than three nor more than five members of the Board of Directors. |

| • | The Board of Directors will appoint committee members annually for a term of one year. |

| • | The Board of Directors will appoint a chairperson. |

| • | Each committee member shall be able read and understand the Company’s fundamental financial statements, including the Company’s balance sheet, income statement and cash flow statement. |

| • | At least one member of the Audit Committee shall have past employment experience in finance or accounting, professional certification in accounting, or comparable experience or background which results in the individual’s financial sophistication. |

| • | Except as otherwise permitted by Nasdaq’s Marketplace Rules, each committee member (a) must be independent as defined in Nasdaq Marketplace Rule 4200, (b) must not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company or any subsidiary thereof (other than in his or her capacity as a member of the Board of Directors, the Audit Committee or any other board committee), (c) must not be an affiliated person of the Company or any of its subsidiaries and (d) must not have participated in the preparation of the Company’s financial statements at any time during the past three years. |

| • | A majority of the committee members will constitute a quorum. |

| • | The committee will meet at least four times each year, or more frequently as required, and at such times and places as it deems advisable. |

| • | The committee will report to the Board of Directors after each meeting of the committee. |

| • | The external and internal auditors will have the right to appear before and be heard by the Audit Committee. |

| • | The committee will have the right, for the purpose of the proper performance of its functions, to meet at any reasonable time with the external and internal auditors or any of the officers or employees of the Company. |

| • | The Audit Committee shall have the authority to engage and determine funding for independent counsel and other advisers as it deems necessary to carry out its duties. |

| • | The Audit Committee must determine, in its capacity as a committee of the Board of Directors, and the Company must provide for, appropriate funding for the payment of: (i) compensation to any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attestation services for the Company; (ii) compensation to any advisers employed by the Audit Committee as provided above; and (iii) ordinary administrative expenses of the Audit Committee that are necessary or appropriate in carrying out its duties. |

Roles and Responsibilities

Internal Controls

| • | Evaluate whether management is appropriately communicating the importance of internal controls. |

| • | Appraise the extent to which internal and external auditors examine computer systems and applications, the security of such systems and contingency plans for processing financial information in the event of a systems breakdown. |

| • | Determine whether internal control recommendations made by internal and external auditors are responded to by management in a timely fashion. |

| • | Ensure that the external auditors have access to the Audit Committee with regard to issues of fraud, deficiencies in internal controls and related matters. |

Financial Reporting

General

| • | Oversee the accounting and financial reporting processes of the Company. |

| • | Review significant accounting and reporting issues, including recent professional and regulatory pronouncements, and understand their impact on the financial statements. |

| • | Discuss with management and the internal and external auditors significant risks and exposures and the plans to minimize such risks. |

Annual Financial Statements

| • | Consider the annual financial statements and determine whether they are consistent with the information known to committee members. |

2

| • | Discuss judgmental areas such as those involving valuation of assets and liabilities, including, for example, the accounting for and disclosure of revenue recognition, reserves for receivables, IBNR reserves and litigation reserves. |

| • | Meet with management and the external auditors together and separately to discuss the financial statements and the results of the audit. |

| • | Review the annual report before its release and consider whether the information contained therein is consistent with members’ knowledge about the Company and its operations. |

| • | Obligate the external auditors to communicate certain required matters to the committee. |

Interim Financial Statements

| • | Be briefed on how management develops and summarizes quarterly financial information, and the extent to which the external auditors review quarterly financial information. |

| • | Meet with management and, if a pre-issuance review was completed, with the external auditors, either telephonically or in person, to discuss the interim financial statements and the results of the review (this may be done by the committee chairperson or the entire committee). |

Compliance with Laws and Regulations

| • | Appraise the effectiveness of the system for monitoring compliance with laws and regulations and the results of management’s investigation and follow-up (including disciplinary action) on any fraudulent acts or accounting irregularities. |

| • | Periodically obtain updates from management, the Company’s general counsel, and the Company’s tax director regarding compliance. |

| • | Review the findings of any examinations by regulatory agencies such as the Securities and Exchange Commission. |

Codes of Conduct and Ethics

| • | Ensure that a code of conduct is formalized in writing and obligate management to communicate it to all employees. |

| • | Evaluate whether management is appropriately communicating the importance of the code of conduct and the guidelines for acceptable business practices. |

| • | Review the program for monitoring compliance with the code of conduct. |

| • | Periodically obtain updates from management and the general counsel regarding compliance. |

| • | Investigate possible violations of the Company’s code of ethics and report the results and recommendations to the Board of Directors. |

Internal Audit

| • | Review the activities and organizational structure of the internal audit function. |

| • | Review the qualifications of the director of internal audit and concur in the appointment, replacement, reassignment, or dismissal of that individual. |

3

External Audit

| • | The Audit Committee shall be solely responsible for the appointment, compensation, retention and oversight of the external auditors. |