UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | Filed by the Registrant x Filed by a Party other than the Registrant ¨ |

| | Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

SILICON IMAGE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 11, 2012

To Our Stockholders:

You are cordially invited to attend the 2012 Annual Meeting of Stockholders of Silicon Image, Inc. to be held at our headquarters located at 1140 East Arques Ave., Sunnyvale, California, 94085, on Wednesday, May 16, 2012, at 2:00 p.m., Pacific Time.

The matters expected to be acted upon at the meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

It is important that you use this opportunity to take part in the affairs of Silicon Image by voting on the business to come before this meeting. Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

We look forward to seeing you at the meeting.

SILICON IMAGE, INC.

1140 East Arques Ave.

Sunnyvale, California 94085

______________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

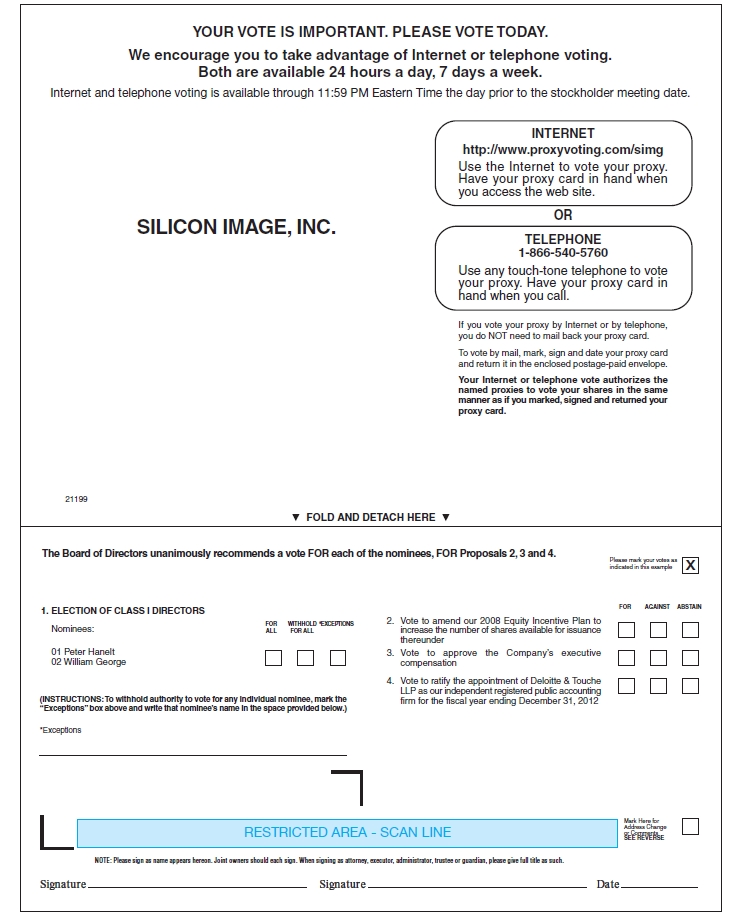

NOTICE IS HEREBY GIVEN that the 2012 Annual Meeting of Stockholders of Silicon Image, Inc. will be held at our headquarters located at 1140 East Arques Ave., Sunnyvale, California 94085, on Wednesday, May 16, 2012, at 2:00 p.m., Pacific Time, for the following purposes:

| | 1. | To elect two Class I directors of Silicon Image, Inc., each to serve until the 2015 Annual Meeting of Stockholders and until his successor has been elected and qualified, or until his earlier death, resignation or removal. Silicon Image’s Board of Directors intends to present the following nominees for election as Class I directors: |

| | Peter Hanelt | William George |

| | 2. | To approve an amendment to the Company’s 2008 Equity Incentive Plan to increase the number of shares available for issuance thereunder. |

| | 3. | To approve the Company’s executive compensation. |

| | 4. | To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of Silicon Image, Inc. for the fiscal year ending December 31, 2012. |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on March 23, 2012 are entitled to notice of and to vote at, the meeting or any adjournment or postponement thereof.

| | By Order of the Board of Directors |

Sunnyvale, California

April 11, 2012

Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope, or vote by telephone or Internet according to the directions on the accompanying proxy, so that your shares may be represented at the meeting.

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR |

| THE STOCKHOLDER MEETING TO BE HELD ON MAY 16, 2012: |

| THIS PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT |

| http://ir.siliconimage.com/sec.cfm |

| | | |

| | 1 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 3 |

| | 7 |

| | 9 |

| | 10 |

| | 18 |

| | 19 |

| | 19 |

| | 19 |

| | 20 |

| | 22 |

| | 24 |

| | 25 |

| | 26 |

| | 28 |

| | 32 |

| | 33 |

| | 34 |

| | 36 |

| | 37 |

| | 38 |

| | 41 |

| | 43 |

| | 43 |

| | 43 |

| | 45 |

| | 46 |

| | 47 |

| | 48 |

| | 49 |

| | 49 |

| | 49 |

| | 49 |

| | 49 |

| | 49 |

Table of Contents

SILICON IMAGE, INC.

1140 East Arques Ave.

Sunnyvale, California 94085

______________________________

PROXY STATEMENT

______________________________

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of Silicon Image, Inc., a Delaware corporation (“Silicon Image” or the “Company”), for use at the 2012 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at our headquarters located at 1140 East Arques Ave., Sunnyvale, California 94085, on Wednesday, May 16, 2012, at 2:00 p.m., Pacific Time. This Proxy Statement and the accompanying form of proxy were first mailed to stockholders on or about April 17, 2012. An annual report for the year ended December 31, 2011 is enclosed with this Proxy Statement.

Only holders of record of our common stock at the close of business on March 23, 2012, which is the record date, will be entitled to vote at the Annual Meeting. At the close of business on March 23, 2012, we had 83,131,329 shares of common stock outstanding and entitled to vote. Holders of Silicon Image common stock are entitled to one vote for each share held as of the above record date. A quorum is required for our stockholders to conduct business at the Annual Meeting. A majority of the shares of our common stock entitled to vote on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business.

For Proposal No. 1, directors will be elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors, which means that the two nominees receiving the highest number of “for” votes will be elected. To be approved, each of Proposals No. 2, 3 and 4 requires the affirmative vote of the majority of shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. If stockholders abstain from voting, including brokers holding their clients’ shares of record who cause abstentions to be recorded, these shares will be considered present and entitled to vote at the Annual Meeting and will be counted towards determining whether or not a quorum is present. Abstentions will have no effect with regard to Proposal No. 1, since approval of a percentage of shares present or outstanding is not required for this proposal, but will have the same effect as negative votes with regard to Proposals No. 2 and 4. Additionally, abstentions will not be counted as either a vote cast “For” or “Against” with respect to Proposal 3. All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will tabulate affirmative and negative votes, votes withheld, and abstentions.

Brokers who hold shares for the accounts of their clients may vote such shares either as directed by their clients or in the absence of such direction, in their own discretion if permitted by the stock exchange or other organization of which they are members. Members Brokers are permitted to vote their clients’ proxies in their own discretion as to certain “routine” proposals, such as Proposal No. 4. If a broker votes shares that are not voted by its clients for or against a proposal, those shares are considered present and entitled to vote at the Annual Meeting. Those shares will be counted towards determining whether or not a quorum is present. Those shares will also be taken into account in determining the outcome of all of the proposals. For Proposals No. 1, 2 and 3, which are not “routine,” a broker who has received no instructions from its clients generally does not have discretion to vote its clients’ unvoted shares on those proposals. When a broker indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, the missing votes are referred to as “broker non-votes.” Those shares would be considered present for purposes of determining whether or not a quorum is present, but would not be considered entitled to vote on the proposal. Those shares would not be taken into account in determining the outcome of the non-routine proposal.

The proxy accompanying this Proxy Statement is solicited on behalf of the Board of Directors of Silicon Image for use at the Annual Meeting. Stockholders are requested to complete, date and sign the accompanying proxy and promptly return it in the enclosed envelope. All signed returned proxies that are not revoked will be voted in accordance with the instructions contained therein. However, returned signed proxies that give no instructions as to how they should be voted on a particular proposal at the Annual Meeting will be counted as votes “for” such proposal, or in the case of the election of the Class I directors, as a vote “for” election to Class I of the Board of all nominees presented by the Board. In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitations of proxies. Any such adjournment would require the affirmative vote of the majority of the outstanding shares present in person or represented by proxy and entitled to vote at the Annual Meeting provided a quorum is present.

The expenses of soliciting proxies to be voted at the Annual Meeting will be paid by Silicon Image. Following the original mailing of the proxies and other soliciting materials, Silicon Image and/or its agents may also solicit proxies by mail, telephone, telegraph or in person. Following the original mailing of the proxies and other soliciting materials, Silicon Image will request those brokers, custodians, nominees and other record holders of its common stock forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. In such cases, Silicon Image, upon the request of the record holders, will reimburse such holders for their reasonable expenses. Georgeson Shareholder Communications, Inc. will assist Silicon Image in obtaining the return of proxies at an estimated cost to Silicon Image of $6,000.

Any person signing a proxy in the form accompanying this Proxy Statement has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote pursuant to the proxy. A proxy may be revoked by a writing delivered to Silicon Image stating that the proxy is revoked, by a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before or at the Annual Meeting, or by attendance at the Annual Meeting and voting in person. Please note, however, that if a stockholder’s shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the Annual Meeting, the stockholder must bring to the Annual Meeting a letter from the broker, bank or other nominee confirming that stockholder’s beneficial ownership of the shares.

For stockholders with shares registered in the name of a brokerage firm or bank, a number of brokerage firms and banks are participating in a program for shares held in “street name” that offers telephone and Internet voting options. Stockholders with shares registered directly in their names with Computershare Shareowner Services LLC, Silicon Image’s transfer agent, will also be able to vote using the telephone and Internet. If your shares are held in an account at a brokerage firm or bank participating in this program or registered directly in your name with Computershare Shareowner Services LLC, you may vote those shares by calling the telephone number specified on your proxy or accessing the Internet website address specified on your proxy instead of completing and signing the proxy itself. The giving of such a telephonic or Internet proxy will not affect your right to vote in person should you decide to attend the Annual Meeting.

The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. Stockholders voting via the telephone or Internet should understand that there may be costs associated with telephonic or electronic access, such as usage charges from telephone companies and Internet access providers, that must be borne by the stockholder.

Table of Contents

Silicon Image’s Board of Directors is presently comprised of six (6) members, who are divided into three classes, designated as Class I, Class II and Class III. One class of directors is elected by the stockholders at each annual meeting to serve until the third succeeding annual meeting.

Peter Hanelt and William George have been designated as Class I directors, Masood Jabbar and John Hodge have been designated as Class II directors and William Raduchel and Camillo Martino have been designated as Class III directors. Mr. Hanelt serves as Chairman of the Board. The Class I directors are standing for reelection at the 2012 Annual Meeting of Stockholders, the Class II directors will stand for reelection or election at the 2013 Annual Meeting of Stockholders and the Class III directors will stand for reelection or election at the 2014 Annual Meeting of Stockholders. Unless otherwise provided by law, any vacancy on the Board, including a vacancy created by an increase in the authorized number of directors, may only be filled by the affirmative vote of a majority of the directors then in office or by a sole remaining director. Any director so elected to fill a vacancy shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified, or until his or her earlier death, resignation or removal.

Each of the nominees for election as a Class I director is currently a director of Silicon Image. If elected at the Annual Meeting, each of the nominees would serve until the 2015 Annual Meeting of Stockholders and until his successor is elected and qualified, or until such director’s earlier death, resignation or removal. Directors will be elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. Shares represented by an executed proxy will be voted “for” the election of the two nominees recommended by the Board unless the proxy is marked in such a manner as to withhold authority so to vote. In the event that any nominee for any reason is unable to serve, or for good cause will not serve, the proxies will be voted for such substitute nominee as the present Board may determine. Silicon Image is not aware of any nominee who will be unable to serve, or for good cause will not serve, as a director.

The names of the nominees for election as Class I directors at the Annual Meeting and of the incumbent Class II and Class III directors and certain information about them, including their ages as of February 29, 2012, are included below.

| | | | | | | |

| | Age | | | | Director Since |

| Nominees for election as Class I directors with term expiring in 2015: | | | | | | |

| Peter Hanelt(1)(2)(3) | | 66 | | Business Consultant | | 2005 |

| William George(2)(3) | | 69 | | Independent Consultant | | 2005 |

| | | | |

| Incumbent Class II directors with term expiring in 2013: | | | | | | |

| Masood Jabbar(1)(2)(3) | | 62 | | Independent Consultant and Private Investor | | 2005 |

| John Hodge(1)(4) | | 44 | | Partner, Rubicon Technology Partners | | 2006 |

| | | | |

| Incumbent Class III directors with term expiring in 2014: | | | | | | |

| William Raduchel(2)(4) | | 65 | | Individual Investor and Strategic Advisor | | 2005 |

| Camillo Martino | | 49 | | Chief Executive Officer of Silicon Image | | 2010 |

| _________________ | | | | | | |

| (1) | Member of the Audit Committee |

| (2) | Member of the Compensation Committee |

| (3) | Member of the Governance and Nominating Committee |

| (4) | Member of Corporate Development Committee |

Table of Contents

William George has served as a director of Silicon Image since October 2005. Dr. George served as Executive Vice President of Manufacturing Services for ON Semiconductor Corporation and SCI, LLC from June 2007 until his retirement from the company in September, 2008. From August 1999 until June 2007, he served as Executive Vice President of Operations at ON. He served as Corporate Vice President and Director of Manufacturing of Motorola’s Semiconductor Components Group from June 1997 until August 1999. Prior to that time, Dr. George held several executive and management positions at Motorola, including Corporate Vice President and Director of Manufacturing of Motorola’s Semiconductor Products Sector. From 1991 to 1994, he served as Executive Vice President and Chief Operations Officer of Sematech, a consortium of leading semiconductor companies. From October 2003 until December 2004, Dr. George served as a director of the Supervisory Board of Metron Technology N.V., a global provider of marketing, sales, manufacturing, service and support solutions to semiconductor materials and equipment suppliers and semiconductor manufacturers in Europe, Asia and the United States. Since August 2005, Dr. George has served as a director, chair of the Governance and Nominating Committee and a member of the Compensation Committee of Ramtron International Corporation, a semiconductor supplier located in Colorado Springs, Colorado. In 2011, he also was named to the Ramtron Audit Committee and assumed the chairmanship of the Compensation Committee. In April 2009, he joined the Board of Directors of publicly-traded Power Integrations, Inc., a leading supplier of high voltage integrated circuits for energy efficient power conversion. He is also currently a member of the Compensation Committee of the Board of Directors of Power Integrations, Inc. Since December 2011, Dr. George also served as a member of the Audit Committee of the Board of Directors of Power Integrations, Inc. Dr. George received his Bachelor’s degree in Metallurgical Engineering in 1964 from the University of Oklahoma and earned a Ph.D. in Materials Science from Purdue University in 1968.

Through his extensive experience as an executive officer in a number of semiconductor companies, Dr. George brings to our Board of Directors his broad management expertise and a knowledge and understanding of the semiconductor industry. Through his vast experience and deep understanding of the semiconductor industry, he provides our Board of Directors valuable insights and ideas about analyzing and focusing on improving the various aspects of our Company, including operations, research and development, strategies and financial performance.

Peter Hanelt has served as a director of Silicon Image since May 2005, including as Chairman of the Board since July 2005. Mr. Hanelt has been a self-employed business consultant since November 2003. Mr. Hanelt served as Chief Restructuring Officer and Chief Operating Officer of the Good Guys, Inc., a publicly traded regional consumer electronics retailer, from December 2001 through July 2003 and as a consultant from July 2003 through October 2003. Mr. Hanelt is also a Chairman, director and a member of the Nominating and Corporate Governance and Compensation Committee and the chair of the Audit Committee of Bidz.com, a publicly-traded online bidding service. Mr. Hanelt also serves as a Chairman and director of Patelco Credit Union and a director of Dignity Health, formerly Catholic Healthcare West, both not for profit companies and InterHealth Nutraceuticals, Inc. and Coast Asset Management LLC, both private companies. From 1997 to May 2008, Mr. Hanelt served as a director of Shoe Pavilion, Inc., a publicly traded shoe retailer. Shoe Pavilion, Inc. filed for protection under Chapter 11 of the United States Bankruptcy Code in July 2008. Mr. Hanelt holds a Bachelor of Science degree in Engineering from the United States Military Academy at West Point, and earned his MBA degree at the University of California, Berkeley.

Through Mr. Hanelt’s experience as a chief executive officer and his significant experience on audit committees and the board of directors of other companies, he brings his analytical skills and extensive expertise in analyzing numerous aspects of our business, including strategy, organizational design and planning as well as formulating and driving strategic direction and change. In particular, Mr. Hanelt’s experience with a wide range of companies provides the Board with valuable insight to best-in-class examples of successful companies against which we can model growth and culture to enable scaling of the organization in an optimal manner. Mr. Hanelt’s experience as a director in other companies provides him with an understanding of the operation of other boards of directors that he can contribute in his role as the Chairman of our Board of Directors. In addition, Mr. Hanelt holds an active CPA license and has spoken at several educational forums for CPA firms on the role of audit committees and board members, both of which also contribute to his qualifications.

Table of Contents

John Hodge has served as a director of Silicon Image since February 2006. Since January 2012, Mr. Hodge has been a partner at Rubicon Technology Partners, a middle market private equity firm. From June 2006 to July 2011, Mr. Hodge served as Senior Managing Director and Senior Advisor in the Private Equity Division at Blackstone Group, a private equity firm. From December 2006 to July 2008, Mr. Hodge served on the Board of Directors as well as member of the Audit Committee of Freescale Semiconductor, Inc. Mr. Hodge has advised clients from the brightest startups to the largest global leaders completing over 250 transactions for companies, such as Apple, Applied Materials, ASML, Broadcom, Cadence, Conexant, Compaq, Cypress, Google, Handspring, Hewlett-Packard, Intel, Intuit, KLA-Tencor, Lam Research, Linear Technology, National Semiconductor, Oracle, Philips, Rockwell, Samsung, SMIC, Solectron, Synopsys, ST Microelectronics, Texas Instruments, Verisign and Xilinx. From 1998 to February 2006, Mr. Hodge was Senior Advisor, Managing Director and Global Head of Corporate Finance of the Technology Group of Credit Suisse First Boston. He also previously held positions at Morgan Stanley and Robertson Stephens. Mr. Hodge holds a Bachelor of Science degree in Biology from Stanford University.

Mr. Hodge’s years of experience in private equity, corporate finance and merger acquisitions transactions and his extensive experience as a director of semiconductor companies have exposed him to a broad range of issues affecting businesses, including a number of businesses in our industry. In particular, Mr. Hodge’s experience as an operating executive in the private equity and financial institutions provides our Board of Directors and our management with knowledge and perspective on the Company’s daily operating challenges. He brings to our Board of Directors his financial expertise and his work has included analyzing and focusing on improving various aspects of businesses, including operations, strategies and financial performance.

Masood Jabbar has served as a director of Silicon Image since May 2005. Mr. Jabbar is currently a private investor. From November 2004 to September 2006, Mr. Jabbar served as the Chief Executive Officer of XDS Inc., a privately held services company. In September 2003, Mr. Jabbar retired from Sun Microsystems, Inc. after sixteen years, where he held a variety of senior positions, including Executive Vice President and Advisor to the Chief Executive Officer from July 2002 through September 2003, Executive Vice President of Global Sales Operations from July 2000 to June 2002, President of the Computer Systems Division from February 1998 to June 2002 and, prior to that, Vice President, Chief Financial Officer and Chief of Staff of Sun Microsystems Computer Corporation from May 1994 to January 1998. Prior to joining Sun Microsystems, Inc., Mr. Jabbar worked for ten years at Xerox Corporation and prior to Xerox, two years at IBM Corporation. Mr. Jabbar serves on the Board of Directors and as a member of the Audit Committee of JDS Uniphase Corporation, a publicly traded company, and as a member of the Board of Directors and a member of the Audit Committee of RF Micro Devices, Inc., a publicly traded company. He is also a member of the Board of Directors of Calypso Technology Inc. a privately held company. Mr. Jabbar holds a MA in International Management from the American Graduate School of International Management, a Master of Business Administration degree from West Texas A&M University and a Bachelor of Arts degree in Economics & Statistics from the University of the Punjab, Pakistan.

Mr. Jabbar’s years of experience as an executive officer at Sun Microsystems, Inc. and as the Chief Executive Officer of XDS, Inc. have provided him with broad leadership and executive experience. Moreover, his MA in International Management provides him with a perspective on global business operations. In addition, his experience as a director in other companies provides him with an understanding of the operation of other boards of directors that he can contribute in his role as the Chairman of the Compensation Committee and a member of the Governance and Nominating Committee of our Board of Directors.

Camillo Martino has served as a director and Chief Executive Officer of Silicon Image since January 2010. Mr. Martino served as a board member of SAI Technology Inc. (“SAI”), a privately held company, from June 2006 to November 2010 and, prior to his appointment as Chief Executive Officer of the Company, Mr. Martino served as Chief Operating Officer of SAI from January 2008 to January 2010. From July 2005 to June 2007, Mr. Martino served as the President and CEO of Cornice Inc., a privately held company. From August 2001 to July 2005, Mr. Martino served as the Executive Vice President and Chief Operating Officer at Zoran Corporation, a publicly held company. Prior to August 2001, Mr. Martino also worked at National Semiconductor Corporation for a total of nearly 14 years. Mr. Martino holds a Bachelor of Applied Science in Electrical Engineering from the University of Melbourne, Parkville/Melbourne, Australia and a Graduate Diploma in Digital Communications from Monash University, Clayton, Australia.

Mr. Martino’s over 25 years of experience in the high-tech industry, including various executive management roles focusing on consumer electronics, communications and computing markets, contribute to his qualifications to sit on our Board of Directors. Mr. Martino’s day-to-day involvement in the Company’s business has provided him with extensive knowledge and understanding of the Company and its industry. As Chief Executive Officer, he is able to provide the Company’s Board of Directors with insight and information related to the Company’s strategy, operations, and business. His prior employment in public companies in a number of substantial management and executive roles at Zoran Corporation and National Semiconductor Corporation provided him with extensive experience in business, operations, research and development and management.

William Raduchel has served as a director of Silicon Image since December 2005. Dr. Raduchel served as non-executive vice chairman of Silicon Image’s wholly-owned subsidiary Simplay Labs, LLC (formerly known as PanelLink Cinema LLC) from January 2005 until his election as a director of Silicon Image. From April 2003 until his election as a director, Dr. Raduchel also served as a consultant to Silicon Image. Dr. Raduchel is an adjunct professor at the McDonough School of Business, Georgetown University and an outside director. He is a director of ePals, Live Intent, MokaFive and Virident, all private companies except for ePals, a public company listed on the Toronto Stock Exchange. He is a strategic advisor to Daily Mail and General Trust PLC, a leading U.K. media company, and to Naspers, Ltd. From March 2004 until June 2006, he was the Chairman of the Board of Directors and from May 2004 to January 2006, Chief Executive Officer, of Ruckus Network, Inc., a privately-held digital entertainment network for students at colleges and universities over the university network. From September 1999 through January 2001, he was Chief Technology Officer of AOL, Inc., becoming Chief Technology Officer of AOL Time Warner (now known as Time Warner Inc.) in January 2001, a position he held through December 2002. After leaving AOL Time Warner, he served as a part-time strategic advisor to America Online, Inc. (a subsidiary of Time Warner Inc.) from March 2003 through February 2004. After attending Michigan Technological University, which gave him an honorary doctorate in 2002, Dr. Raduchel received his undergraduate degree in Economics from Michigan State University and earned his A.M. and Ph.D. degrees in Economics at Harvard University.

In addition to being an economist, Dr. Raduchel is a recognized expert on the future of technology and media, and his vision assists the Company in its strategy. He understands both our industry and our customers. In addition, he brings a wealth of management experience from his career at AOL Time Warner, AOL, Inc., Sun Microsystems, Inc., Xerox Corporation and The McGraw-Hill Companies, Inc., at all of which he was an executive officer. His corporate governance expertise includes decades of board service.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINATED DIRECTORS

Table of Contents

Board of Directors.

The Board of Directors has determined that each of Peter Hanelt, William George, John Hodge, Masood Jabbar and William Raduchel representing a majority of its current members, is independent under the rules of the NASDAQ Stock Market and the rules of the Securities and Exchange Commission.

During fiscal year 2011, the Board met formally thirty-one times and acted by written consent one time. All of the directors attended at least 80% of the meetings of the Board and the total number of meetings held by all committees of the Board on which such director served.

Standing committees of the Board include an audit committee, a compensation committee, a governance and nominating committee and a corporate development committee. Each of these committees has adopted a written charter. Current copies of these charters are available on the Investor Relation’s section of Silicon Image’s website at http://ir.siliconimage.com by clicking on "Committee Charters" under “Corporate Governance”.

Audit Committee. The Audit Committee consists of Peter Hanelt, Masood Jabbar and John Hodge. Mr. Hanelt has served as chairman of the Audit Committee since June 2005. The Board has determined that Messrs. Hanelt and Jabbar are each an “audit committee financial expert”, as defined by the rules of the Securities and Exchange Commission and that each of the members of the Audit Committee meets the financial sophistication requirements of the NASDAQ Stock Market. In addition, the Board has determined that each of the members of the Audit Committee meets the independence requirements of the NASDAQ Stock Market. During fiscal year 2011, the Audit Committee met eight times. The Audit Committee reviews our financial reporting process, our system of internal controls and the audit process. The Audit Committee also reviews the performance and independence of our external auditors and recommends to the Board the appointment or discharge of our external auditors.

Compensation Committee. The Compensation Committee consists of William George, Peter Hanelt, William Raduchel and Masood Jabbar. Mr. Jabbar has served as chairman of the Compensation Committee since June 2005. The Board has determined that each of the current members of the Compensation Committee meets the independence requirements of the rules of the NASDAQ Stock Market. During fiscal year 2011, the Compensation Committee met seven times and acted by written consent one time. The Compensation Committee has the authority to approve the form and amount of compensation to be paid or awarded to all employees of Silicon Image. The Compensation Committee, in conjunction with the non-executive members of the Board, sets the base salaries of Silicon Image’s executive officers, including the Chief Executive Officer, and approves bonus programs for the executive officers. The Compensation Committee administers the issuance of stock options and other equity awards under equity based compensation plans and agreements thereunder as well as non-plan options. The Board also has the authority to approve the issuance of stock options and other equity awards and has delegated to our chief executive officer the authority to grant stock options to non-officer employees, subject to certain limitations. The Compensation Committee and the Board each has the authority to approve director compensation.

Governance and Nominating Committee. The Governance and Nominating Committee consists of Masood Jabbar, Peter Hanelt and William George. Dr. George joined the Governance and Nominating Committee and became its chairman in July 2007. The Board has determined that each of the current members of the Governance and Nominating Committee meets the independence requirements of the rules of the NASDAQ Stock Market. During fiscal year 2011, the Governance and Nominating Committee met two times and acted by written consent one time. The Governance and Nominating Committee is responsible for reviewing and evaluating Silicon Image’s corporate governance principles and code of business conduct and ethics and advising the full Board on other corporate governance matters.

The Governance and Nominating Committee is also responsible for interviewing, evaluating, approving and recommending individuals for membership on the Board. The goal of the Governance and Nominating Committee is to ensure that our Board possesses a variety of experiences, perspectives, qualifications, attributes and skills derived from high-quality business and professional experience. The Governance and Nominating Committee seeks to achieve a diversity of knowledge, experience, backgrounds, viewpoints, characteristics and capability on our Board. To this end, the Governance and Nominating Committee seeks nominees with high professional and personal ethics and values, an understanding of our business lines and industry, diversity of business experience and expertise, broad-based business acumen and the ability to think strategically, without regard to their race, gender, national origin or sexual orientation. In addition, the Governance and Nominating Committee considers the level of the candidate’s commitment to active participation as a director, both at Board and Board committee meetings and otherwise. Although the Governance and Nominating Committee uses these and other criteria to evaluate potential nominees, we have no stated minimum criteria for nominees. The Governance and Nominating Committee does not use different standards to evaluate nominees depending on whether they are proposed by our directors and management or by our stockholders. The Governance and Nominating Committee has previously retained outside search consultants to assist in identifying potential candidates for membership on the Board.

The Governance and Nominating Committee believes the current nominees for election as Class I directors as well as the Class II and Class III directors are composed of a diverse group of leaders in their respective fields. Many of nominees and current directors have leadership experience at major private and public companies, including experience on other companies’ boards, which provides an understanding of different business processes, challenges and strategies. The Governance and Nominating Committee and the Board believe that the above-mentioned attributes provide Silicon Image with the perspectives and judgment necessary to guide the Company’s strategies and monitor their execution.

Corporate Development Committee. The Corporate Development Committee consists of John Hodge and William Raduchel. Messrs. Hodge and Raduchel have served as co-chairmen of the Corporate Development Committee since February 2008. During fiscal year 2011, the Corporate Development Committee met twice. The purpose of the Corporate Development Committee is to assist the Board in fulfilling its responsibilities for overseeing and facilitating the development and implementation of the Company’s business strategies and plans.

Board Leadership Structure. The Board has determined that having an independent director serve as Chairman of the Board is in our best interests and those of our stockholders. Mr. Hanelt, a non-employee director, serves as our Chairman of the Board and presides over meetings of the Board and holds such other powers and carries out such other duties as are customarily carried out by the Chairman of our Board. This structure ensures a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board. Generally, regular meetings of our Board include a meeting of our independent directors without management present.

Risk Management. The Board is actively involved in oversight of risks that could affect the Company. This oversight is conducted in part through the Audit Committee, but the full Board has retained responsibility for general oversight of risks. The Board satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks and discussions with those officers and other personnel.

Risk Oversight. Our Board is responsible for the oversight of our company-wide risk management efforts and delegates the assessment and implementation of our day-to-day risk management policies to our management. Our Board is directly involved in overseeing risk management issues related to significant matters such as our overall business strategy, major strategic transactions and executive officer succession through its regular communications with management.

Additionally, each of our standing Board committees, namely the Audit Committee, the Compensation Committee and the Governance and Nominating Committee, have individual oversight responsibilities:

| | • | | Our Audit Committee oversees our financial reporting and controls, as well as the work performed by our independent registered public accounting firm and our internal audit function. The Audit Committee regularly discusses with management and our independent registered public accounting firm the major risks related to our financial reporting and controls, and the steps taken to monitor and control our exposure to those risks. In addition, under the supervision of the Audit Committee, we have established an anonymous and confidential ethics reporting system, which encourages and allows any employee to submit concerns directly to senior management and the Audit Committee. Our Audit Committee also oversees risks relating to our investments, financing activities and world-wide insurance programs and is responsible for reviewing and approving related person transactions. |

| | • | | Our Compensation Committee is responsible for overseeing risks related to our cash and equity-based compensation programs and practices. Our Compensation Committee aims to establish compensation policies and practices that motivate contributions to long term stockholder value and do not promote unnecessary or excessive risk-taking. For additional information regarding the Compensation Committee’s assessment of our compensation-related risk, please see the section of this Proxy Statement titled “Compensation Risk Assessment.” |

Table of Contents

| | • | | Our Governance and Nominating Committee is responsible for overseeing risks related to our overall corporate governance, as well as any potential issues related to the composition and structure of our Board of Directors and its committees. In this regard, our Governance and Nominating Committee conducts an annual evaluation of our Board and Board committees and periodically reviews Board member and executive officer succession plans. It also reviews and makes recommendations with respect to our corporate governance policies and principles, and the chairperson may investigate concerns raised through our confidential ethics reporting system, as applicable to our Board and its committees. |

Policy regarding Stockholder Nominations. The Governance and Nominating Committee considers stockholder recommendations for director candidates. The Governance and Nominating Committee has established the following procedure for stockholders to submit director nominee recommendations:

| | • | | If a stockholder would like to recommend a director candidate for the next annual meeting, he or she must submit the recommendations by mail to Silicon Image’s Corporate Secretary at Silicon Image’s principal executive offices, no later than the 120th calendar day before the anniversary of the date that Silicon Image last mailed its proxy statement to stockholders in connection with the previous year’s annual meeting. |

| | • | | Recommendations for candidates must be accompanied by personal information of the candidate, including a list of the candidate’s references, the candidate’s resume or curriculum vitae and such other information as determined by Silicon Image’s Corporate Secretary and as necessary to satisfy Securities and Exchange Commission rules and Silicon Image’s Bylaws, together with a letter signed by the proposed candidate consenting to serve on the Board if nominated and elected. |

| | • | | The Governance and Nominating Committee considers nominees based on Silicon Image’s need to fill vacancies or to expand the Board and also considers Silicon Image’s need to fill particular roles on the Board or committees thereof (e.g. independent director, or audit committee financial expert). |

| | • | | The Governance and Nominating Committee evaluates candidates in accordance with its charter and policies regarding director qualifications, qualities and skills. |

Stock Ownership Guidelines. In February 2010, the Board of Directors approved stock ownership guidelines for non-employee directors. These guidelines require that each non-employee director own at least the lesser of (i) 25,000 shares of Silicon Image’s common stock and (ii) shares of Silicon Image common stock having a value equal to $75,000. The guidelines allow a four-year period to attain the target ownership level beginning the date of the adoption by the Board of the guidelines or the non-employee director’s election to the Board. To facilitate share ownership, non-employee directors will retain at least 25% of any shares of Silicon Image common stock acquired through the exercise or vesting of any equity awards (after taking into account any shares sold or withheld, as the case may be, to satisfy the payment of the exercise price, if any, or taxes) until the ownership threshold is achieved. Thereafter, the requirement to retain shares lapses unless a non-employee director’s ownership falls below the target level.

The Compensation Committee of Silicon Image’s Board is currently comprised of William George, Peter Hanelt, William Raduchel and Masood Jabbar. None of these individuals has at any time been an officer or employee of Silicon Image. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

Table of Contents

We are asking stockholders to amend the Silicon Image 2008 Equity Incentive Plan (the “2008 Plan”), to increase the number of shares of common stock reserved for issuance under the 2008 Plan by 7,000,000 shares. Approval of the amendment and increase in the number of shares reserved for issuance under the 2008 Plan was approved by the Board of Directors on March 27, 2012.

Approval of the amendment of the 2008 Plan (the “Amendment”) is intended to ensure that Silicon Image is able to continue offering stock-based incentive compensation to its eligible employees and non-employee directors. As of February 29, 2012, the total number of shares that remained available for issuance under 2008 Plan and were not subject to awards already outstanding was 4,307,941 shares. Without stock options or other forms of equity incentives, Silicon Image would be forced to consider cash replacement alternatives to provide a market-competitive total compensation package necessary to attract, retain and motivate the employee talent critical to the future successes of the company. These cash replacement alternatives would, among other things, potentially reduce the cash available for investment in growth and development of new and existing products. Moreover, regardless of cash position, recruiting without equity would put the Company at a competitive disadvantage particularly for critical technical talent, as a result the Company’s go forward success would be substantially at risk.

In order to better manage and control the amount of our common stock used for equity compensation, our Board of Directors adopted a Burn Rate Policy for fiscal years 2010 — 2012. During this three-year period, beginning with our 2010 fiscal year and ending with our 2012 fiscal year, our Burn Rate Policy has required us to limit the number of shares that we grant subject to stock awards over the three-year period to an annual average of 5.27% of our outstanding common stock (which is equal to the average of the median burn rate plus one standard deviation for the 2009 and 2010) calendar years for Russell 3000 companies in our Global Industry Classification Standards Peer Group (4530 Semiconductors and Semiconductor Equipment), as published by Institutional Shareholder Services in 2009). Our annual burn rate is calculated as the number of shares subject to stock awards (including stock options, stock appreciation rights, restricted stock, restricted stock units and other stock awards) granted during our fiscal year and the number of shares subject to performance units and performance shares that are paid out during a fiscal year divided by our outstanding common stock, measured as of the last day of each fiscal year, both as reported in our periodic filings with the SEC. Awards that are settled in cash, awards that are granted pursuant to a stockholder approved exchange programs, awards sold under our employee stock purchase plan and awards assumed or substituted in acquisitions will be excluded from our burn rate calculation. For purposes of our calculation, each share subject to a full value award (i.e., restricted stock, restricted stock unit, performance share and any other award that does not have an exercise price per share equal to the per share fair market value of our common stock on the grant date) will be counted as 1.5 shares.

In April 2008, the Board of Directors adopted, and in May 2008, our stockholders approved, the 2008 Plan and reserved a total of 4,000,000 shares thereunder. The 2008 Plan replaced our 1999 Equity Incentive Plan (the “1999 Plan”) and our other equity compensation plans prior to their expiration and became our primary plan for providing equity-based incentive compensation to our eligible employees and non-employee directors. On March 30, 2010, our Board of Directors approved the first amendment to the 2008 Plan to increase the number of shares reserved for issuance under the 2008 Plan by 9,000,000 shares, which amendment was subsequently approved by our stockholders at the 2010 Annual Meeting of Stockholders. On March 30, 2010, our Board of Directors also approved the supplemental amendment to the 2008 Plan to increase the number of shares reserved that could only be used for the Stock Option Exchange Program by 2,000,000 shares, which amendment was subsequently approved by our stockholders at the 2010 Annual Meeting of Stockholders. As of February 29, 2012, there were 4,307,941 shares available for grant under the 2008 Plan, subject to adjustment only to reflect stock splits and similar events, and an aggregate of 5,989,257 options outstanding with a weighted average price of $6.03 and a weighted average term of 5.02 years. Also, as of February 29, 2012, there were 2,325,098 full value awards outstanding.

Background on Stock Compensation at Silicon Image

We firmly believe that a broadly-utilized, equity-based incentive compensation program is a necessary and powerful employee incentive and retention tool that benefits all of Silicon Image’s stockholders. The use of equity-based incentive compensation has long been a vital component of Silicon Image’s overall compensation philosophy, which is based on the principle that long-term incentive compensation should be closely aligned with stockholders’ interests. Equity ownership programs put employees’ interests directly into alignment with those of other stockholders, as they reward employees upon improved stock price performance. A broadly-utilized, equity-based incentive compensation program focuses employees at every level of the Company on achieving strong corporate performance as we have embedded in our culture the necessity for employees to think and act as stockholders. Historically, Silicon Image has granted equity incentives to its non-employee directors and the majority of its employees. Equity incentives are an important component of our long-term employee incentive and retention strategy and has been effective in enabling us to attract and retain the talent critical for an innovative and growth-focused company.

Purpose of 2008 Plan

The 2008 Plan allows Silicon Image, under the direction of the Compensation Committee of the Board of Directors or those persons to whom administration of the 2008 Plan, or part of the 2008 Plan, has been delegated or permitted by law, to make grants of stock options, restricted stock awards, restricted stock units, stock appreciation rights, performance shares and stock bonus awards to employees, directors, consultants, independent contractors and advisors. The purpose of these stock awards is to attract and retain talented employees, directors, consultants, independent contractors and advisors and further align their interests and those of our stockholders by continuing to link a portion of their compensation with Silicon Image’s performance.

The following is a summary of the key provisions of the 2008 Plan.

| Plan Term: | | May 21, 2008 to May 21, 2018. |

| | | |

| Eligible Participants: | | All of our employees, directors, consultants, advisors and independent contractors will be eligible to receive awards under the 2008 Plan, provided they render bona fide services to Silicon Image. The Compensation Committee will determine which individuals will participate in the 2008 Plan. As of the record date, there were approximately 598 employees and five non-employee directors eligible to participate in the 2008 Plan. |

| | | |

| Shares Authorized: | | If Proposal No. 2 is approved, an additional 7,000,000 shares will be authorized under the 2008 Plan, resulting in a total of 11,307,941 shares authorized and available for issuance. Shares subject to awards that are cancelled, forfeited or that expire by their terms are returned to the pool of shares available for grant and issuance under the 2008 Plan. As of February 29, 2012, there were a total of 5,989,257options and 2,325,098 full value awards outstanding. The 2008 Plan originally provided for an aggregate of 4,000,000 shares authorized. During our 2010 Annual Meeting of Stockholders held on May 19, 2010, our stockholders approved an increase of 9,000,000 shares to the number of shares that can be issued under the 2008 Plan and also approved an increase of up to 2,000,000 additional shares that we could only use for the stockholders-approved Stock Option Exchange Program. We completed the Stock Option Exchange Program in September 2010 and 1,695,935 of the 2,000,000 maximum issuable shares for the exchange program were used. If Proposal No. 2 is approved, the amended 2008 Plan will authorize an aggregate of 21,695,935 shares. |

| Award Types: | | (1) Non-qualified and incentive stock options |

| | | (2) Restricted stock awards |

| | | (3) Stock bonus awards |

| | | (4) Stock appreciation rights |

| | | (5) Restricted stock units |

| | | (6) Performance shares |

| | | |

| Full-Value Share Multiple for Determining the Number of Shares Available for Grant: | | For purposes of determining the number of shares available for grant under the 2008 Plan against the maximum number of shares authorized, any full-value award (i.e., any award other than a stock option or a stock appreciation right) will reduce the number of shares available for issuance under the 2008 Plan by 1.5 shares. |

| | | |

| Vesting: | | Vesting schedules are determined by the Compensation Committee when each award is granted. Options generally vest over four years. |

| | | |

| Award Terms: | | Stock options have a term no longer than seven years, except in the case of incentive stock options granted to holders of more than 10% of Silicon Image’s voting power, which have a term no longer than five years. Stock appreciation rights have a term no longer than seven years. Stock options and stock appreciation rights must be granted at 100% of fair market value under the 2008 Plan. |

| | | |

| Automatic Grants to Non-Employee Directors: | | Non-employee directors are eligible to receive discretionary grants under the 2008 Plan, which will be granted either on a discretionary basis or pursuant to policy adopted by the Committee, including the Director Compensation Plan described in the section entitled “Director Compensation” below. Discretionary grants to our non-employee directors may have a term no longer than seven years. In the event of a corporate transaction (commonly known as a “change of a control), all outstanding awards granted to our non-employee directors will vest and to the extent applicable, become exercisable. |

| | | |

| Repricing Prohibited: | | Re-pricing or reducing the exercise price of a stock option or stock appreciation right or issuance of new stock options or stock appreciation rights having a lower exercise price in substitution for cancelled stock options or stock appreciation rights, including exchanges for cash/full value awards, are prohibited without stockholder approval. |

New Plan Benefits

The following table shows, in the aggregate, the number of restricted stock units (RSUs) that will be granted automatically in fiscal 2012 to our five non-employee directors, pursuant to the 2008 Plan. These grants will be made regardless of whether the Amendment is approved by the stockholders.

| Name and Position | | Dollar Value ($) | | Number of RSUs |

| | | | | |

| Non-employee Director Annual Grant | | $75,000 | | Calculated as of the date of grant as follows: $75,000 divided by the thirty (30) day trailing average of the closing price of our common stock as reported on the NASDAQ Global Select Market |

| | | | | |

| Non-employee Board Chair Annual Grant | | $15,000 | | Calculated as of the date of grant as follows: $15,000 divided by the thirty (30) day trailing average of the closing price of our common stock reported on the NASDAQ Global Select Market |

Future awards under the 2008 Plan to executive officers, employees or other eligible participants and any additional future discretionary awards to non-employee directors in addition to those granted automatically pursuant to the grant formula described above, are discretionary and cannot be determined at this time. We therefore have not included any such awards in the table above.

Terms applicable to Stock Options and Stock Appreciation Rights

The exercise price of stock options or stock appreciation rights granted under the 2008 Plan may not be less than the fair market value (the closing price of Silicon Image common stock on the date of grant and if that is not a trading day, the closing price of Silicon Image common stock on the trading day immediately succeeding the date of grant) of our common stock. On the record date, the closing price of our common stock was $5.94 per share. The term of these awards may not be longer than seven years. The Compensation Committee determines at the time of grant the other terms and conditions applicable to such award, including vesting and exercisability.

Terms applicable to Restricted Stock Awards, Restricted Stock Unit Awards, Performance Shares and Stock Bonus Awards

The Compensation Committee determines the terms and conditions applicable to the granting of restricted stock awards, restricted stock unit awards, performance shares and stock bonus awards. The Compensation Committee may make the grant, issuance, retention and/or vesting of restricted stock awards, restricted stock unit awards, performance shares and stock bonus awards contingent upon continued employment with Silicon Image, the passage of time, or such performance criteria and the level of achievement versus such criteria as it deems appropriate.

Eligibility Under Section 162(m)

Awards may, but need not, include performance criteria that satisfy Section 162(m) of the Code. To the extent that awards are intended to qualify as “performance-based compensation” under Section 162(m), the performance criteria may include among other criteria, one of the following criteria, either individually, alternatively or in any combination, applied to either the Company as a whole or to a business unit or subsidiary, either individually, alternatively, or in any combination and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre established target, to previous years’ results or to a designated comparison group, in each case as specified by the Compensation Committee in the award:

| | • | Net revenue and/or net revenue growth |

| | | |

| | • | Operating income and/or operating income growth |

| | | |

| | • | Earnings per share and/or earnings per share growth |

| | | |

| | • | Return on equity |

| | | |

| | • | Operating cash flow return on income |

| | | |

| | • | Adjusted operating cash flow return on income |

| | | |

| | • | Individual business objectives |

| | | |

| | • | Company-specific operational metrics |

| | | |

| | • | Earnings before income taxes and amortization and/or earnings before income taxes and amortization growth |

| | | |

| | • | Net income and/or net income growth |

| | | |

| | • | Total stockholder return and/or total stockholder return growth |

| | | |

| | • | Economic value added |

The foregoing factors may be on a GAAP or non-GAAP basis.

To the extent that an award under the 2008 Plan is designated as a “performance award,” but is not intended to qualify as performance-based compensation under Section 162(m), the performance criteria can include the achievement of strategic objectives as determined by the Board of Directors.

Notwithstanding satisfaction of any completion of any performance criteria described above, to the extent specified at the time of grant of an award, the number of shares of common stock, number of shares subject to stock options or other benefits granted, issued, retainable and/or vested under an award on account of satisfaction of performance criteria may be reduced by the Compensation Committee on the basis of such further considerations as the Compensation Committee in its sole discretion determines.

Transferability

Except as otherwise provided in the 2008 Plan, awards granted under the 2008 Plan may not be sold, pledged, assigned, hypothecated, transferred or disposed of, for consideration or otherwise, except by will or the laws of descent and distribution. No award may be made subject to execution, attachment or other similar process.

The Compensation Committee will continue to administer the 2008 Plan. The Compensation Committee selects the persons who receive awards, determine the number of shares covered thereby and, subject to the terms and limitations expressly set forth in the 2008 Plan, establish the terms, conditions and other provisions of the grants. The Compensation Committee may construe and interpret the 2008 Plan and prescribe, amend and rescind any rules and regulations relating to the 2008 Plan.

The Board may terminate or amend the 2008 Plan at any time, provided that no action may be taken by the Board of Directors (except those described in “Adjustments”) without stockholder approval to:

(1) Permit the repricing or other exchange of outstanding stock options or stock appreciation rights under the 2008 Plan for new options, other equity awards or cash; or

(2) Otherwise implement any amendment to the 2008 Plan required to be approved by stockholders under the rules of The NASDAQ Stock Market.

In the event of a stock dividend, recapitalization, stock split, reverse stock split, subdivision, combination, reclassification or any similar event affecting our common stock, the Committee shall adjust the number and class of shares available for grant under the 2008 Plan, the annual limitations on the number of shares an individual is permitted to receive under the 2008 Plan, and subject to the various limitations set forth in the 2008 Plan, the number and class of shares subject to outstanding awards under the 2008 Plan, and the exercise or settlement price of outstanding stock options and of other awards shall be proportionately adjusted, subject to any required action by the Board or the stockholders.

In the event of a corporate transaction, such as a merger, asset sale, or other change of control transaction, except in the case of awards held by non-employee directors, any or all outstanding awards may be assumed or an equivalent award substituted by a successor corporation. In the event the successor corporation refuses to assume or substitute the awards outstanding under the 2008 Plan, the outstanding awards will expire on such terms and at such time as the Board or the Committee shall determine. The Board or the Compensation Committee may, in its discretion, accelerate the vesting of such awards in connection with the corporate transaction. The vesting of outstanding awards held by non-employee directors will accelerate in full prior to the consummation of a corporate transaction (i.e., a change of control) on such terms as the Compensation Committee may determine.

The following is a general summary as of the date of this proxy statement of the United States federal income tax consequences to Silicon Image and participants in the 2008 Plan. The federal tax laws may change and the federal, state and local tax consequences for any participant will depend upon his or her individual circumstances.

Non-Qualified Stock Options

A participant will realize no taxable income at the time a non-qualified stock option is granted under the plan, but generally at the time such non-qualified stock option is exercised, the participant will realize ordinary income in an amount equal to the excess of the fair market value of the shares on the date of exercise over the stock option exercise price. Upon a disposition of such shares, the difference between the amount received and the fair market value on the date of exercise will generally be treated as a long-term or short-term capital gain or loss, depending on the holding period of the shares. Silicon Image will generally be entitled to a deduction for federal income tax purposes at the same time and in the same amount as the participant is considered to have realized ordinary income in connection with the exercise of the non-qualified stock option.

A participant will realize no taxable income and Silicon Image will not be entitled to any related deduction, at the time any incentive stock option is granted. If certain employment and holding period conditions are satisfied, then no taxable income will result upon the exercise of such option and Silicon Image will not be entitled to any deduction in connection with the exercise of such stock option. Upon disposition of the shares after expiration of the statutory holding periods, any gain realized by a participant will be taxed as long-term capital gain and any loss sustained will be long-term capital loss and Silicon Image will not be entitled to a deduction in respect to such disposition. While no ordinary taxable income is recognized at exercise (unless there is a “disqualifying disposition,” see below), the excess of the fair market value of the shares over the stock option exercise price is a preference item that is recognized for alternative minimum tax purposes.

Except in the event of death, if shares acquired by a participant upon the exercise of an incentive stock option are disposed of by such participant before the expiration of the statutory holding periods (i.e., a “disqualifying disposition”), such participant will be considered to have realized as compensation taxed as ordinary income in the year of such disposition an amount, not exceeding the gain realized on such disposition, equal to the difference between the stock option price and the fair market value of such shares on the date of exercise of such stock option. Generally, any gain realized on the disposition in excess of the amount treated as compensation or any loss realized on the disposition will constitute capital gain or loss, respectively. If a participant makes a “disqualifying disposition,” generally in the fiscal year of such “disqualifying disposition” Silicon Image will be allowed a deduction for federal income tax purposes in an amount equal to the compensation realized by such participant.

Stock Appreciation Rights

A grant of a stock appreciation right (which can be settled in cash or Silicon Image common stock) has no federal income tax consequences at the time of grant. Upon the exercise of stock appreciation rights, the value received is generally taxable to the recipient as ordinary income and Silicon Image generally will be entitled to a corresponding tax deduction.

A participant receiving restricted stock may be taxed in one of two ways: the participant (i) pays tax when the restrictions lapse (i.e., they become vested) or (ii) makes a special election to pay tax in the year the grant is made. At either time the value of the award for tax purposes is the excess of the fair market value of the shares at that time over the amount (if any) paid for the shares. This value is taxed as ordinary income and is subject to income tax withholding. Silicon Image receives a tax deduction at the same time and for the same amount taxable to the participant. If a participant elects to be taxed at grant, then, when the restrictions lapse, there will be no further tax consequences attributable to the awarded stock until the recipient disposes of the stock.

In general, no taxable income is realized upon the grant of a restricted stock unit award. The participant will generally include in ordinary income the fair market value of the award of stock at the time shares of stock are delivered to the participant or at the time the restricted stock unit vests. Silicon Image generally will be entitled to a tax deduction at the time and in the amount that the participant recognizes ordinary income.

The participant will not realize income when a performance share is granted, but will realize ordinary income when shares are transferred to him or her. The amount of such income will be equal to the fair market value of such transferred shares on the date of transfer. Silicon Image will be entitled to a deduction for federal income tax purposes at the same time and in the same amount as the participant is considered to have realized ordinary income as a result of the transfer of shares.

The plan is intended to enable Silicon Image to provide, in its discretion, certain forms of performance-based compensation to executive officers that will meet the requirements for tax deductibility under Section 162(m) of the Code. Section 162(m) provides that, subject to certain exceptions, Silicon Image may not deduct compensation paid to any one of certain executive officers in excess of $1 million in any one year. Section 162(m) excludes certain performance-based compensation from the $1 million limitation.

The plan is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974, as amended.

The affirmative vote of the majority of shares entitled to vote, present in person or by proxy and cast affirmatively or negatively is required to approve the Amendment. An abstention will have the effect of a negative vote.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE AMENDMENT TO 2008 EQUITY INCENTIVE PLAN.

We are requesting your approval of the fiscal year 2011 compensation of our named executive officers as disclosed in the Compensation Discussion and Analysis section, the compensation tables, and the narrative discussion set forth in this Proxy Statement. This is a non-binding advisory vote and is commonly referred to as a “say on pay” vote.

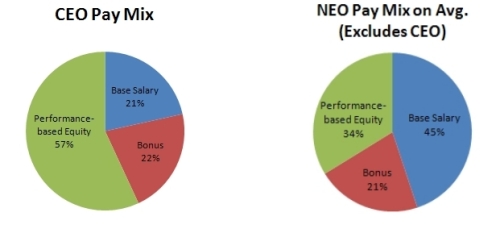

Our Compensation Committee, which is responsible for structuring and administering the compensation program for our named executive officers, has designed our executive compensation program to provide a competitive and internally equitable compensation and benefits package that reflects company performance, job complexity and strategic value of the position, while ensuring long-term retention, motivation and alignment with the long-term interests of the Company’s stockholders. We believe the compensation program for our named executive officers has been instrumental in helping Silicon Image achieve strong financial performance in fiscal 2011 despite the challenging macroeconomic environment. We encourage you to carefully review the Compensation Discussion and Analysis section, the compensation tables, and the narrative discussion of this Proxy Statement for additional details on the Company’s executive compensation program, including the Company’s compensation philosophy and objectives, as well as the processes our Compensation Committee used to determine the structure and amounts of the compensation for our named executive officers in fiscal year 2011.

We are asking you to indicate your support for the compensation of our named executive officers as described in this Proxy Statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we are asking you to vote, on an advisory (non-binding) basis, “For” the following resolution at the Annual Meeting:

“RESOLVED, that the compensation paid to Silicon Image, Inc.’s named executive officers, as disclosed pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the Compensation Discussion and Analysis, compensation tables and narrative discussion set forth on this Proxy Statement, is hereby approved.”

While the results of this advisory vote are not binding, the Compensation Committee will consider the outcome of the vote in deciding whether to take any action as a result of the vote and when making future compensation decisions for our named executive officers.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected Deloitte & Touche LLP to be Silicon Image’s independent registered public accounting firm for the fiscal year ending December 31, 2012 and recommends that the stockholders vote for ratification of such appointment. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. Representatives of Deloitte & Touche LLP will be present at the Annual Meeting, will have the opportunity to make a statement at the Annual Meeting if they desire to do so and will be available to respond to appropriate questions.

Audit Fees.

The aggregate fees billed or to be billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu and their respective affiliates (collectively, “Deloitte & Touche”), for professional services rendered for (i) the audit of Silicon Image’s annual financial statements set forth in Silicon Image’s Annual Report for the fiscal year ended December 31, 2011, (ii) the review of Silicon Image’s quarterly financial statements set forth in Silicon Image’s Quarterly Reports on Form 10-Q for the quarters ended March 31, June 30 and September 30, 2011, (iii) the issuances of consents and review of documents filed with the Securities and Exchange Commission and (iv) the fiscal year 2011 audit of Silicon Image’s internal controls under Section 404 of the Sarbanes-Oxley Act were $889,592 for the fiscal year ended December 31, 2011.

For the fiscal year ended December 31, 2010, the aggregate fees billed by Deloitte & Touche for professional services rendered in connection with (i) the audit of Silicon Image’s annual financial statements set forth in Silicon Image’s Annual Report for the fiscal year ended December 31, 2010, (ii) the review of Silicon Image’s quarterly financial statements set forth in Silicon Image’s Quarterly Reports on Form 10-Q for the quarters ended March 31, June 30 and September 30, 2010, (iii) the issuances of consents and review of documents filed with the Securities and Exchange Commission (iv) the fiscal year 2010 audit of Silicon Image’s internal controls under Section 404 of the Sarbanes-Oxley Act and (v) the fiscal year 2009 statutory audits of Silicon Image’s Netherlands and Germany subsidiaries were $649,905 for the fiscal year ended December 31, 2010.

Audit-Related Fees.

There were no audit-related fees billed by Deloitte & Touche for the fiscal years ended December 31, 2011 and 2010.

Tax Fees.

The aggregate fees billed or to be billed by Deloitte & Touche for professional services rendered for tax consultancy and tax return preparation for our Germany subsidiary for the fiscal years ended December 31, 2011 and 2010 were $14,509 and $13,765, respectively.

All Other Fees.

There were no other fees billed by Deloitte & Touche for the fiscal years ended December 31, 2011 and 2010.

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent accountants. These services may include audit services, audit-related services, tax services and other services. The Audit Committee generally pre-approves particular services or categories of services on a case-by-case basis. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with these pre-approvals and the fees for the services performed to date.

All of the services of Deloitte & Touche for the fiscal years ended December 31, 2011 and 2010, described above, were pre-approved by the Audit Committee.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE.

The following table presents information as to the beneficial ownership of our common stock as of February 29, 2012 by:

| | • | | each stockholder known by us to be the beneficial owner of 5% or more of our common stock; |

| | • | | each of our current directors; |

| | • | | each of our “Named Executive Officers”, as such term is defined under the rules of the Securities and Exchange Commission; and |

| | • | | all current directors and executive officers as a group. |

Our Named Executive Officers consist of Mr. Martino, who served as our Principal Executive Officer in 2011, Mr. Granberry, who served as our Principal Financial Officer in 2011, and the three other most highly compensated executive officers in 2011 (Messrs. Lopez, Vehling and Almgren).