Note 1 — Organization

Seasons Series Trust (the “Trust”), a Massachusetts business trust, is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end management investment company. The Trust is currently comprised of 19 portfolios (each, a “Portfolio,” and collectively, the “Portfolios”). SunAmerica Asset Management, LLC (“SAAMCo” or the “Adviser”), an indirect wholly owned subsidiary of Corebridge Financial, Inc. (“Corebridge”), serves as investment adviser for all the Portfolios of the Trust. For purposes of the Investment Advisers Act and the Investment Company Act, American International Group, Inc.'s (“AIG”) share ownership of Corebridge, and the rights granted to AIG by Corebridge as part of a separation agreement between AIG and Corebridge, provide AIG with control over Corebridge's corporate and business activities.

Shares of the Portfolios are issued and redeemed in connection with investments in and payments under variable annuity contracts and variable life policies (collectively, the “Variable Contracts”) offered by life insurance companies affiliated with the Adviser (the “Life Companies”), and are also offered to certain affiliated mutual funds. All shares may be purchased or redeemed at net asset value without any sales or redemption charges.

Class 1 shares, Class 2 shares and Class 3 shares of each Portfolio may be offered in connection with certain variable contracts. Class 2 and 3 shares of a given Portfolio are identical in all respects to Class 1 shares of the same Portfolio, except that (i) each class may bear differing amounts of certain class-specific expenses; (ii) Class 2 shares and Class 3 shares are subject to service fees while Class 1 shares are not; and (iii) Class 2 shares and Class 3 shares have voting rights on matters that pertain to the Rule 12b-1 plan adopted with respect to Class 2 shares and Class 3 shares. Class 2 and Class 3 shares of each Portfolio pay service fees at an annual rate of 0.15% and 0.25%, respectively, of each class’s average daily net assets. The Board of Trustees may establish additional portfolios or classes in the future.

Each of the Portfolios represents a separate managed portfolio of securities with its own investment objectives. The Board of Trustees may establish additional portfolios or classes in the future. Six of the Portfolios, called the “Seasons Strategies Portfolios,” are available only through the selection of one of four “strategies” described in the Seasons Variable Contract prospectus. The Seasons Strategies Portfolios may also be available indirectly through certain investment options under other Variable Contracts offered by the Life Companies. Thirteen additional Portfolios, called the “Seasons Select Portfolios,” the “Seasons Focused Portfolio” and the “Seasons Managed Allocation Portfolios,” are available in addition to the Seasons Strategies Portfolios as variable investment options under Variable Contracts offered by the Life Companies. Please refer to your Seasons Variable Contract prospectus for sales and/or redemption charges under your Variable Contract.

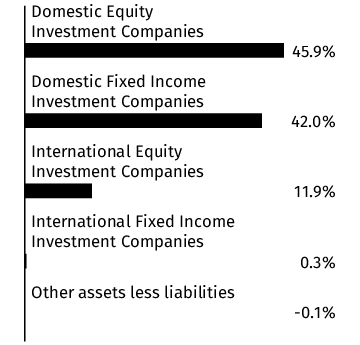

Each Seasons Manged Allocation Portfolio is structured as a “fund-of-funds” which means that it pursues its principal investment strategy by investing its assets in a combination of the portfolios of the Trust and certain other affiliated mutual funds (collectively, the “Underlying Portfolios”).

Each Portfolio is diversified with the exception of SA Multi-Managed Large Cap Growth Portfolio and SA T. Rowe Price Growth Stock Portfolio, which are non-diversified as defined by the 1940 Act.

The investment goal for each Portfolio is as follows:

Seasons Strategies Portfolios

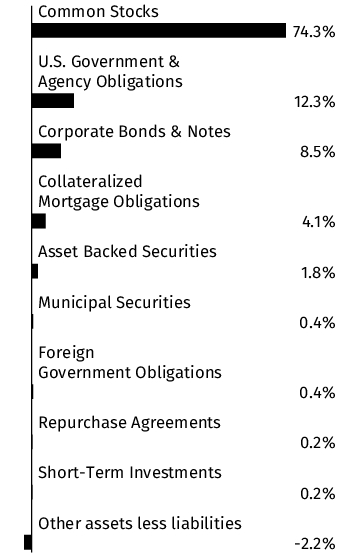

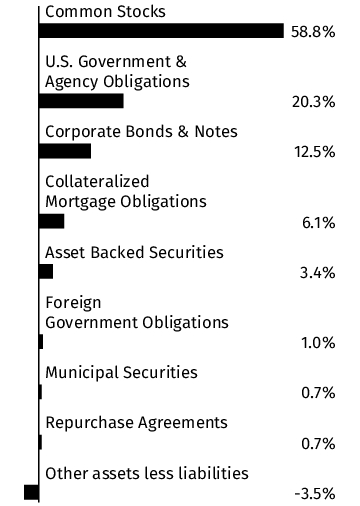

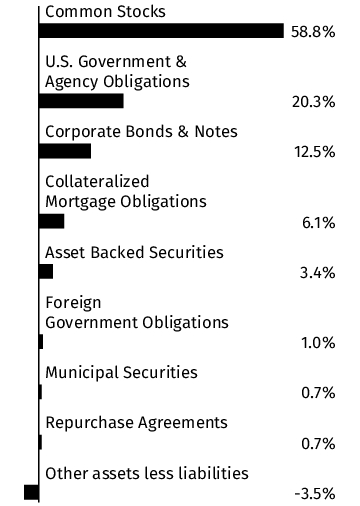

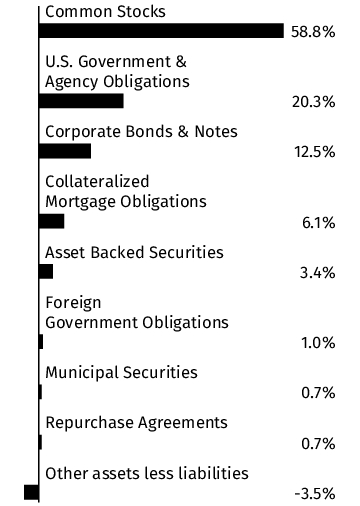

The SA Multi-Managed Growth Portfolio seeks long-term growth of capital by allocating its assets among three distinct, actively-managed investment components, each with a different investment strategy, which include a small-cap growth component, a fixed income component and a growth component.

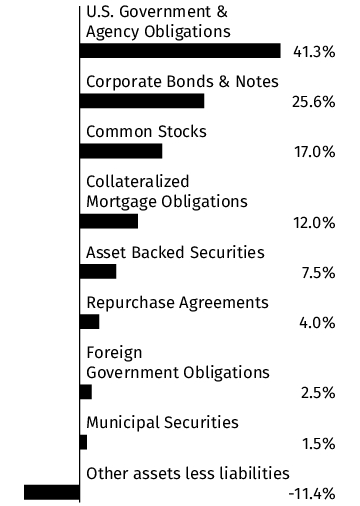

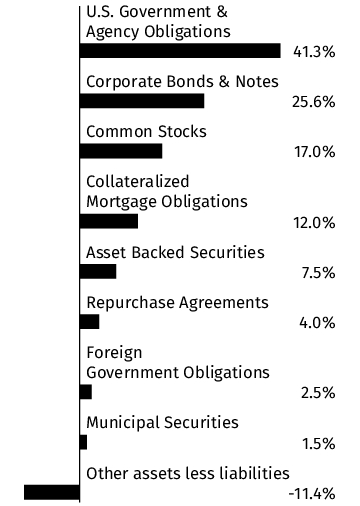

The SA Multi-Managed Income Portfolio seeks capital preservation by allocating its assets among two distinct, actively managed investment components, each with a different investment strategy which include a fixed income component and a growth component.

The SA Multi-Managed Income/Equity Portfolio seeks conservation of principal while maintaining some potential for long-term growth of capital by allocating its assets among two distinct, actively-managed investment components, each with a different investment strategy, which include a fixed income component and a growth component.

The SA Multi-Managed Moderate Growth Portfolio seeks long-term growth of capital, with capital preservation as a secondary objective by allocating its assets among three distinct, actively-managed investment components, each with a different investment strategy, which include a small-cap growth component, a fixed income component and a growth component.

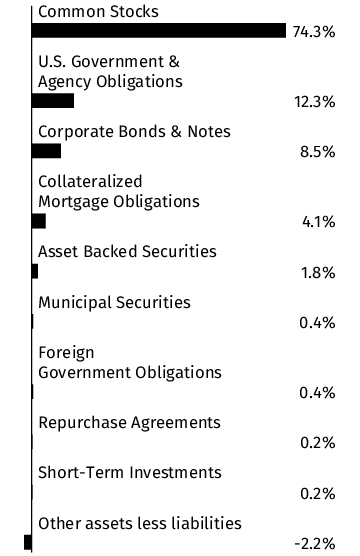

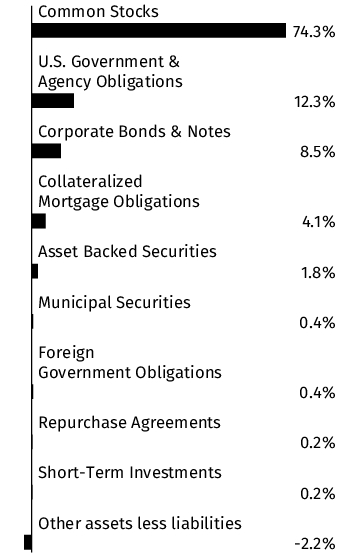

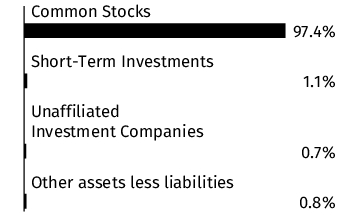

The SA Putnam Asset Allocation Diversified Growth Portfolio seeks capital appreciation by investing, under normal circumstances, through strategic allocation of approximately 80% (with a range of 65-95%) of its assets in equity securities and approximately 20% (with a range of 5-35%) of its assets in fixed income securities.

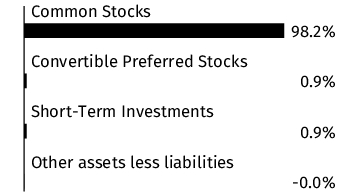

The SA T. Rowe Price Growth Stock Portfolio seeks long-term capital appreciation with a secondary objective of increasing dividend income by investing, under normal circumstances, at least 80% of its net assets in common stocks of a diversified group of growth companies.

Seasons Select Portfolios

The SA American Century Inflation Portfolio seeks long-term total return using a strategy that seeks to protect against U.S. inflation.

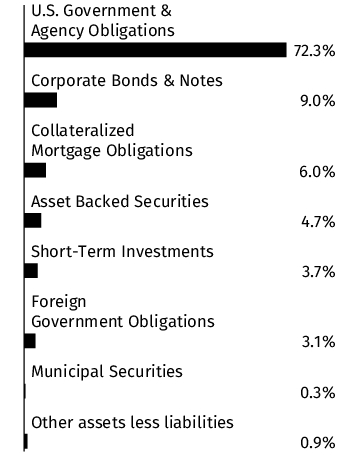

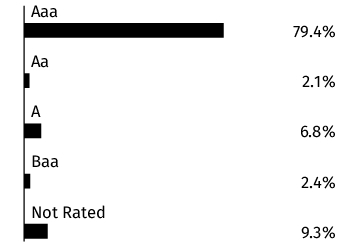

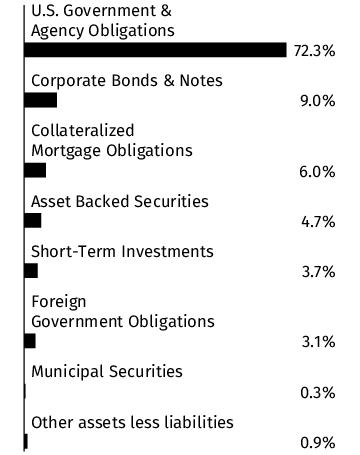

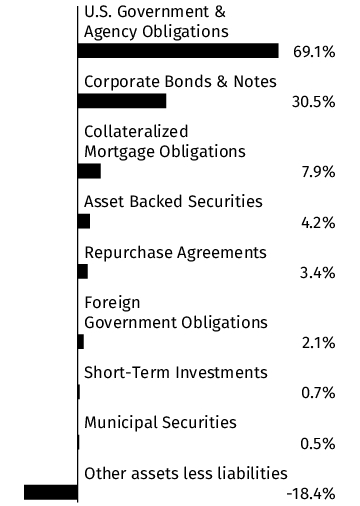

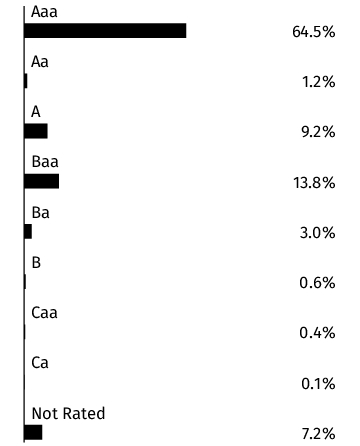

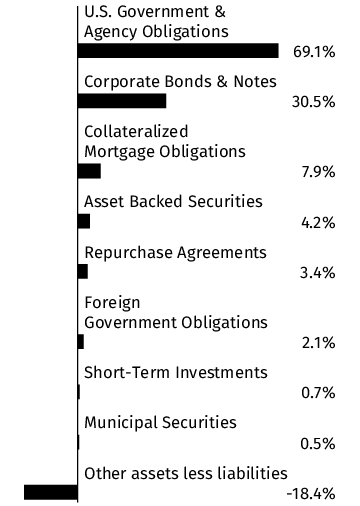

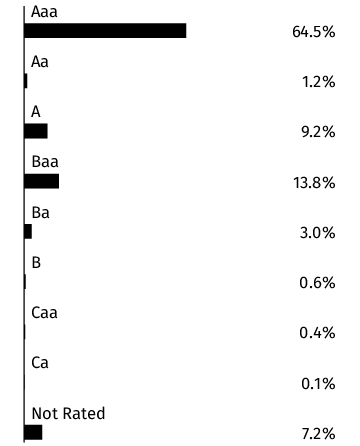

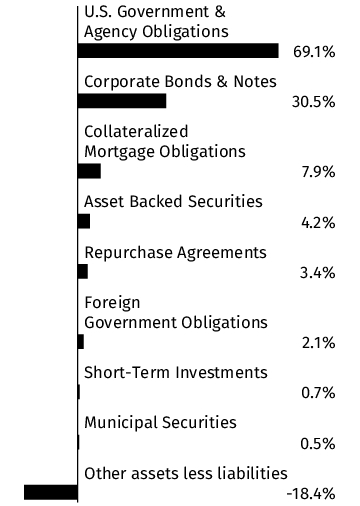

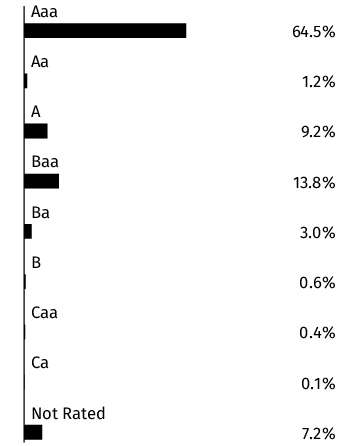

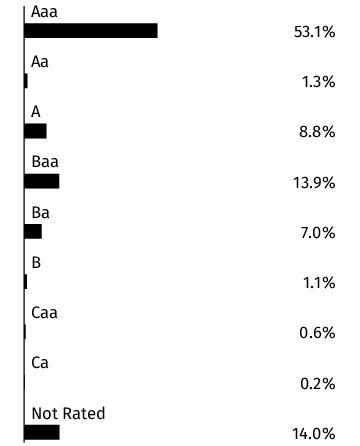

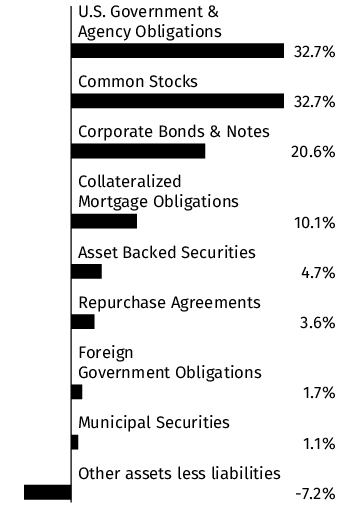

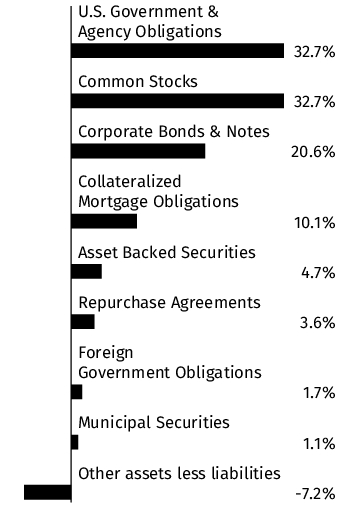

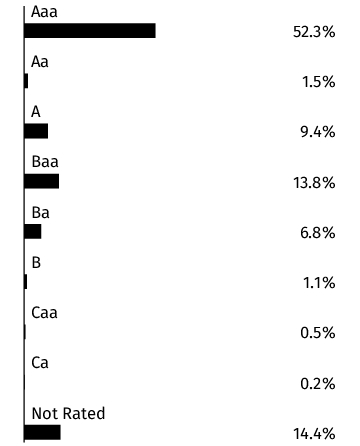

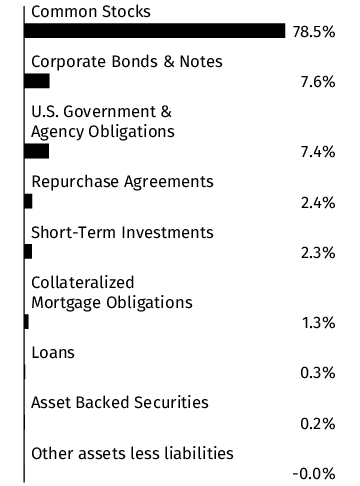

The SA Multi-Managed Diversified Fixed Income Portfolio seeks relatively high current income and, secondarily, capital appreciation by investing, under normal circumstances, at least 80% of its net assets in fixed income securities including U.S. and foreign government securities, asset- and mortgage-backed securities, investment-grade debt securities, and lower-rated fixed income securities, or junk bonds.

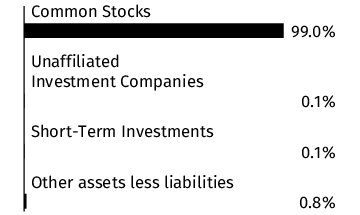

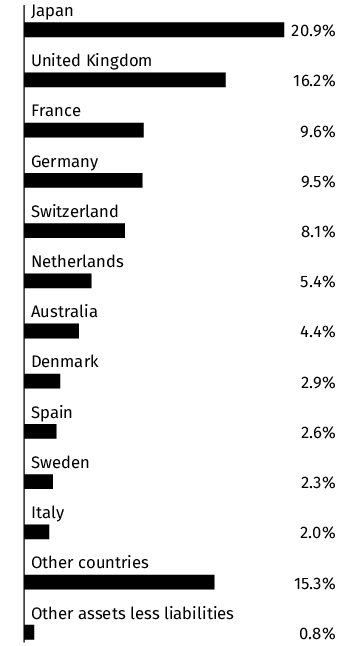

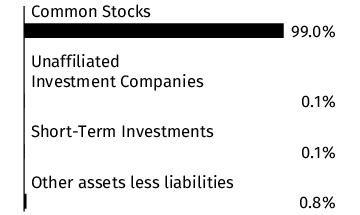

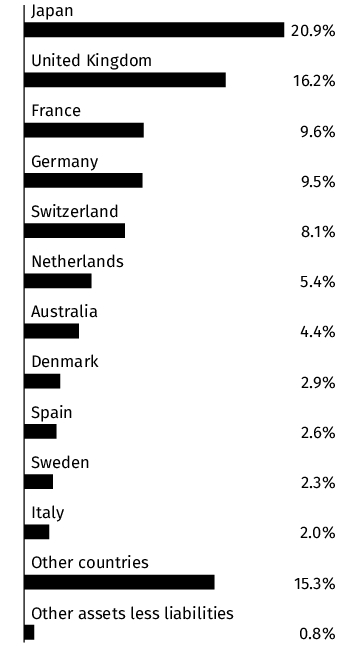

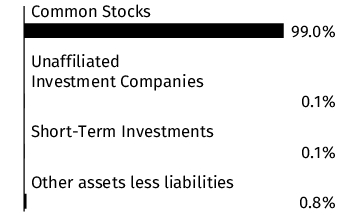

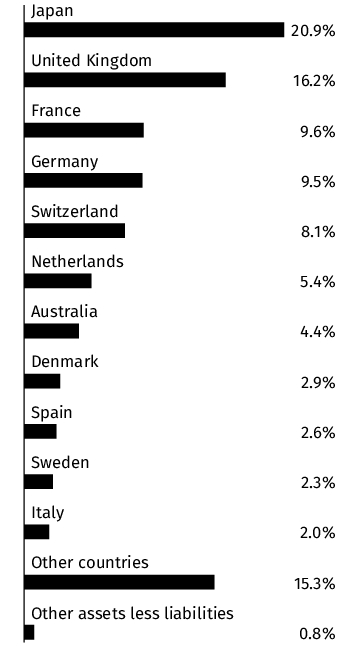

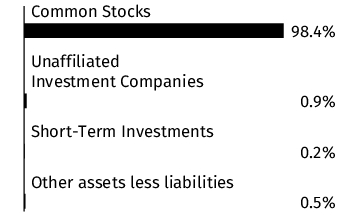

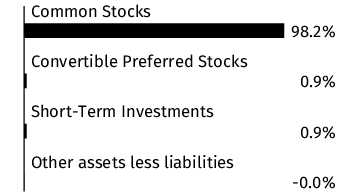

The SA Multi-Managed International Equity Portfolio seeks long-term growth of capital by investing, under normal circumstances, at least 80% of its net assets in equity securities of issuers in at least three countries other than the U.S.