UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | T |

| Filed by a Party other than the Registrant | £ |

Check the appropriate box:

| £ | Preliminary Proxy Statement |

| £ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

T | Definitive Proxy Statement |

£ | Definitive Additional Materials |

£ | Soliciting Materials Pursuant to §240.14a-12 |

| AMERICAN CENTURY MUTUAL FUNDS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant |

Payment of Filing Fee (Check the appropriate box):

| T | No Fee required. | |

| £ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| £ | Fee paid previously with preliminary materials. | |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

Proxy Statement

April 2, 2010

Important Voting Information Inside

American Century Asset Allocation Portfolios, Inc.

American Century Capital Portfolios, Inc.

American Century Growth Funds, Inc.

American Century Mutual Funds, Inc.

American Century Strategic Asset Allocations, Inc.

American Century Variable Portfolios, Inc.

American Century World Mutual Funds, Inc.

American Century Investments

4500 Main Street

Kansas City, Missouri 64111

April 2, 2010

Dear Shareholder,

I would like to invite you to an upcoming special meeting of shareholders to be held on June 16, 2010 at 10:30 a.m. Central time. The shareholder meeting will be held at American Century’s office at 4500 Main Street, Kansas City, Missouri. Shareholders of American Century funds are being asked to vote on the election of one Director to the funds’ Boards of Directors and to approve new management agreements between the funds and their American Century advisor. In addition, shareholders of certain funds are being asked to approve new subadvisory agreements with those funds’ current subadvisors. Finally, some shareholders are being asked to approve an amendment to the Articles of Incorporation relating to their funds.

More detailed information is contained in the enclosed materials. The Boards of Directors of these funds, including all of the Independent Directors, unanimously approved and recommend that you vote FOR the proposals.

Your vote is extremely important, no matter how large or small your holdings. Please review the enclosed materials and vote online, by phone, or by signing and returning your proxy card(s) in the enclosed postage-paid envelope. If we do not hear from you after a reasonable time, you may receive a call from our proxy solicitor, Broadridge Financial Solutions, Inc., reminding you to vote. If you have any questions or need assistance in completing your proxy card(s), please contact Broadridge at 1-866-450-8467.

Thank you for investing with American Century Investments.

Sincerely,

Jonathan S. Thomas

President and Chief Executive Officer

American Century Investments

American Century Asset Allocation Portfolios, Inc.

American Century Capital Portfolios, Inc.

American Century Growth Funds, Inc.

American Century Mutual Funds, Inc.

American Century Strategic Asset Allocations, Inc.

American Century Variable Portfolios, Inc.

American Century World Mutual Funds, Inc.

IMPORTANT NEWS FOR SHAREHOLDERS

While we encourage you to read all of the proxy materials, you will find a brief overview of the proposals below. The overview and accompanying Q&A contain limited information, should be read in conjunction with, and are qualified by reference to, the more detailed information contained elsewhere in the Proxy Statement.

| • | Shareholders of each of the issuers listed above (the “Issuers”) are being asked to approve the election of one nominated Director (the “Nominee”) to the Board of Directors of each Issuer. | |

| • | Shareholders of each of the Issuers’ funds (the “Funds”) are being asked to approve a management agreement with American Century Investment Management, Inc. (“ACIM”) | |

| • | Shareholders of the Equity Index Fund are being asked to approve a subadvisory agreement between ACIM and Northern Trust Investments, N.A. | |

| • | Shareholders of the International Value Fund are being asked to approve a subadvisory agreement by and among ACIM, Templeton Investment Counsel, LLC and Franklin Templeton Investments (Asia) Limited. | |

| • | Shareholders of American Century Capital Portfolios, Inc., American Century Mutual Funds, Inc. and American Century World Mutual Funds, Inc. are being asked to approve an amendment to those Issuers’ Articles of Incorporation. |

Questions and Answers

| Q. | When will the special meeting be held? Who can vote? |

| A. | The special meeting will be held on June 16, 2010, at 10:30 a.m. Central time at American Century’s office at 4500 Main Street, Kansas City, Missouri. Please note, this will be a business meeting only. No presentations about the Funds are planned. If you owned shares of one of the Funds at the close of business on March 19, 2010, you are entitled to vote, even if you later sold the shares. Each shareholder is entitled to one vote per dollar of shares owned, with fractional dollars voting proportionally. |

| Q | Who is the Nominee for election to the Board of Directors? | |

| A. | The Nominee, John R. Whitten, currently serves on the Boards of Directors (the “Boards”) but has not previously been elected by shareholders. | |

| Q. | Why are shareholders being asked to approve management agreements for the Funds? | |

| A. | On February 16, 2010, Co-Chairman Richard W. Brown succeeded James E. Stowers, Jr., the 86-year-old founder of American Century Investments, as trustee of a trust that holds a greater-than-25% voting interest in American Century Companies, Inc. (“ACC”). Under the Investment Company Act of 1940 (the “1940 Act”), this voting interest is presumed to represent control of ACC even though it is less than a majority interest. Because ACC is the parent corporation of each Fund’s advisor, the change of trustee is considered a technical assignment of the Funds’ management agreements. Under the 1940 Act, an assignment automatically terminates such agreements. Shareholders are being asked to approve new management agreements that are substantially identical to the terminated agreements. The Funds are cur rently being managed pursuant to interim management agreements. Further information on the deemed assignment and termination of the agreements is contained in the Proxy Statement. | |

| Q. | How are the Funds currently being managed? | |

| A. | American Century continues to manage the Funds pursuant to interim management agreements approved by the Funds’ Boards. These agreements are substantially identical to the recently terminated agreements (with the exception of different effective and termination dates) and do not change the Funds, their investment objectives or strategies, fees or services provided. | |

| Q. | Who is being asked to approve Fund management agreements? | |

| A. | Shareholders of each Fund are being asked to approve the new management agreements. However, because management agreements for new share classes of some Funds took effect after the change of trustee described above, they did not terminate and do not require shareholder approval. | |

| Q. | Why are some shareholders being asked to approve an amendment to Articles of Incorporation? |

| A. | This proposal is intended to achieve consistency among the Articles of Incorporation of all the Issuers served by the Boards. The law of Maryland, the Issuers’ state of incorporation, permits corporations to provide directors with some protection from personal liability. All of the Issuers whose shareholders are not being asked to approve this amendment already have such a provision in their Articles of Incorporation. |

| Q. | How do the Boards recommend that I vote? |

| A. | The Boards, including all of the Independent Directors, unanimously recommend you vote FOR all of the proposals. For a discussion of the factors the Boards considered in approving these proposals, see the accompanying materials. |

| Q. | My holdings in the Funds are small, why should I vote? |

| A. | Your vote makes a difference. If many shareholders do not vote their proxies, your Fund may not receive enough votes to go forward with its special meeting. This means additional costs will be incurred to solicit votes to determine the outcome of the proposals. |

| Q. | Why are multiple proxy cards enclosed? |

| A. | You will receive a proxy card for each of the Funds in which you are a shareholder. In addition, if you own shares of the same Fund in multiple accounts that are titled differently, you will receive a proxy card for each account. |

| Q. | How do I cast my vote? |

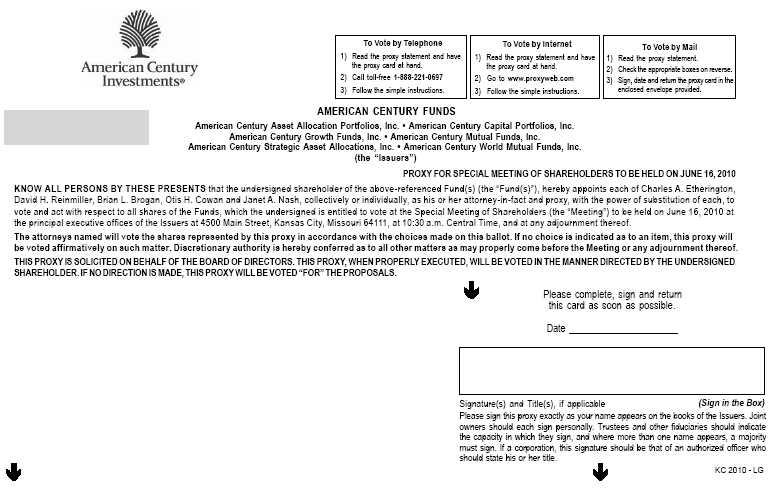

| A. | You may vote online, by phone, by mail or in person at the special meeting. To vote online, access the Web site listed on a proxy card. To vote by telephone, call the toll-free number listed on a proxy card. To vote online or by telephone, you will need the number that appears in the gray box on each of your proxy cards. To vote by mail, complete, sign and send us the enclosed proxy card(s) in the enclosed postage-paid envelope. You also may vote in person at the special meeting on June 16, 2010. If you need more information or have any questions on how to cast your vote, call our proxy solicitor at 1-866-450-8467. |

Your vote is important. Please vote today and avoid the need

for additional solicitation expenses.

AMERICAN CENTURY ASSET ALLOCATION PORTFOLIOS, INC.

AMERICAN CENTURY CAPITAL PORTFOLIOS, INC.

AMERICAN CENTURY GROWTH FUNDS, INC.

AMERICAN CENTURY MUTUAL FUNDS, INC.

AMERICAN CENTURY STRATEGIC ASSET ALLOCATIONS, INC.

AMERICAN CENTURY VARIABLE PORTFOLIOS, INC.

AMERICAN CENTURY WORLD MUTUAL FUNDS, INC.

4500 Main Street

Kansas City, Missouri 64111

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

June 16, 2010

A special meeting (the “Meeting”) of the shareholders of the above-listed issuers (each an “Issuer” and together the “Issuers”) will be held at 10:30 a.m. Central time on June 16, 2010 at 4500 Main Street, Kansas City, Missouri 64111 to consider the following proposals (each, a “Proposal”):

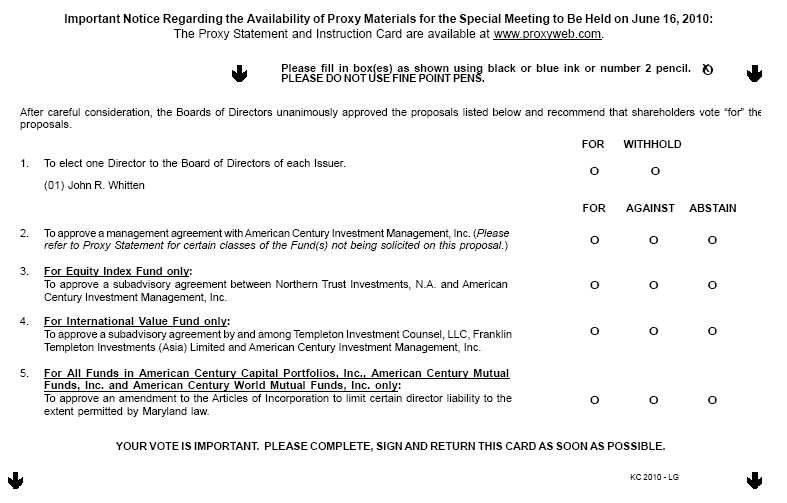

| 1. | To elect one director to the Board of Directors of each Issuer; | |

| 2. | To approve management agreements between each of the Issuers’ funds (the “Funds”) and American Century Investment Management, Inc.; | |

| 3. | Solely with respect to the Equity Index Fund, to approve a subadvisory agreement between American Century Investment Management, Inc. and Northern Trust Investments, N.A.; | |

| 4. | Solely with respect to the International Value Fund, to approve a subadvisory agreement by and among American Century Investment Management, Inc., Templeton Investments Counsel, LLC and Franklin Templeton Investments (Asia) Limited; and | |

| 5. | Solely with respect to American Century Capital Portfolios, Inc., American Century Mutual Funds, Inc. and American Century World Mutual Funds, Inc., to approve an amendment to their Articles of Incorporation. |

Shareholders of record as of the close of business on March 19, 2010 are entitled to notice of and to vote at the Meeting and any adjournments or postponements thereof. Shareholders of each of the Issuers will vote separately on Proposal 1. Shareholders of each of the Funds will vote separately on Proposal 2. If a Fund has Institutional Class shares, holders of

those shares will vote separately on Proposal 2. In addition, for the Funds issued by American Century Variable Portfolios, Inc. other than VP Income & Growth, holders of Class I shares will vote with holders of Class III shares, if any, but holders of Class II shares, if any, will vote with holders of Class IV shares, if any. Management Agreements for the following share classes, which launched on March 1, 2010, remain in effect and, accordingly, their shareholders will not be solicited with respect to Proposal 2: C Class shares of the LIVESTRONG¨ Funds, Growth Fund, and Mid Cap Value Fund; C Class shares and R Class shares of the Small Cap Value and International Discovery Funds; A Class shares, C Class shares and R Class shares of the International Opportunities Fund and the New Opportunities Fund; and the Institutional Class shares of the New Opportunities Fund. Shareholders of the Equity Index Fund will vote on Proposal 3. Shareholders of the International Value Fund will vote on Proposal 4. Shareholders of American Century Capital Portfolios, Inc., American Century Mutual Funds, Inc. and American Century World Mutual Funds, Inc. will vote separately on Proposal 5.

In the event that a quorum is not present or in the event that a quorum is present but sufficient votes in favor of a Proposal have not been received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies as to any Proposal without further notice other than by announcement at the Meeting. However, if the Meeting is adjourned for more than 90 days from the date of the Meeting, then the Funds are required to send a new shareholder meeting notice to shareholders. Any adjournment of the Meeting for the further solicitation of proxies for a Proposal will require the affirmative vote of a majority of the total number of shares entitled to vote on the Proposal that are present in person or by proxy at the Meeting to be adjourned. The persons named as proxies will vote those pr oxies that they are entitled to vote in their discretion as to any such adjournment. A shareholder vote may be taken on any Proposal on which there is a quorum prior to such adjournment. Such vote will be considered final regardless of whether the Meeting is adjourned to permit additional solicitation with respect to any other Proposal. Unless revoked, proxies that have been properly executed and returned by shareholders without instructions will be voted in favor of the Proposal(s).

By Order of the Boards of Directors of the Issuers,

Ward D. Stauffer

Secretary

AMERICAN CENTURY ASSET ALLOCATION PORTFOLIOS, INC.

AMERICAN CENTURY CAPITAL PORTFOLIOS, INC.

AMERICAN CENTURY GROWTH FUNDS, INC.

AMERICAN CENTURY MUTUAL FUNDS, INC.

AMERICAN CENTURY STRATEGIC ASSET ALLOCATIONS, INC.

AMERICAN CENTURY VARIABLE PORTFOLIOS, INC.

AMERICAN CENTURY WORLD MUTUAL FUNDS, INC.

PROXY STATEMENT

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Boards of Directors (each a “Board” and collectively the “Boards”) of the above-listed issuers, (each an “Issuer” and together the “Issuers”). The Boards are soliciting the proxies of shareholders of the Issuers for use in connection with a Special Meeting (the “Meeting”) of shareholders that will be held at 10:30 a.m. Central time on June 16, 2010 at American Century’s office at 4500 Main Street, Kansas City, Missouri 64111. Each Issuer has one or more funds that are organized as series of the Issuer (each a “Fund” and collectively the “Funds”). The Meeting notice, this Proxy Statement and one or more proxy cards are being sent to shareholders of record as of the close of business on March 19, 2010 (the “Record Date”) beginning on or about April 2, 2010. Please read this Proxy Statement and keep it for future reference. Each Fund has previously sent its annual report and semiannual report to its shareholders. A copy of a Fund’s most recent annual report and semiannual report may be obtained without charge by writing to the Fund at the address listed above or by calling 1-800-345-2021. If you have any questions regarding this Proxy Statement, please contact our proxy solicitor, Broadridge Financial Solutions, Inc., at 1-866-450-8467.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on June 16, 2010: This Proxy Statement is available on the Internet at the website listed on your proxy card(s). On this website, you also will be able to access the Notice of Special Meeting of Shareholders, the form of proxy cards and any amendments or supplements to the foregoing materials that are required to be furnished to shareholders.

1

Table of Contents

PROXY STATEMENT | 1 |

SUMMARY OF PROPOSALS AND FUNDS VOTING | 4 |

Applicable Only to American Century Variable Portfolios, Inc.: | 6 |

PROPOSAL 1: ELECTION OF DIRECTOR | 6 |

Overview and Related Information | 6 |

Information Regarding the Directors | 7 |

Qualifications of Directors | 9 |

Responsibilities of the Boards | 10 |

Board Leadership Structure and Standing Board Committees | 11 |

Risk Oversight by the Boards | 13 |

Board Compensation | 13 |

Beneficial Ownership of Affiliates by Independent Directors | 17 |

Officers | 17 |

Share Ownership | 18 |

Independent Registered Public Accounting Firm | 18 |

Required Approval for Proposal 1 | 20 |

PROPOSAL 2: APPROVAL OF MANAGEMENT AGREEMENTS | 20 |

Overview | 20 |

Reason for Proposed Management Agreements | 21 |

Information Regarding ACIM | 22 |

Description of the Management Agreements | 22 |

Interim Management Agreements | 23 |

Proposed Management Agreements | 24 |

Comparison of the Prior Management Agreements and the Proposed Management Agreements | 24 |

Management Services | 24 |

Fees and Expenses | 24 |

Termination | 25 |

Merger of ACIM and ACGIM | 25 |

Advisory Services to Other Funds | 25 |

Basis for the Boards’ Approval of the Proposed Management Agreements | 27 |

Affiliated Brokerage | 31 |

Required Approval for Proposal 2 | 33 |

PROPOSAL 3: APPROVAL OF A SUBADVISORY AGREEMENT FOR THE EQUITY INDEX FUND | 33 |

Overview and Related Information | 33 |

Information Regarding Northern Trust | 33 |

Comparison of the Prior Subadvisory Agreement and the Proposed Subadvisory Agreement | 34 |

Advisory Services | 35 |

Expenses | 35 |

Compensation | 35 |

Liability of NTI | 35 |

Additional Information about NTI | 36 |

Basis for the Board’s Approval of the Proposed NTI Subadvisory Agreement | 36 |

Required Approval for Proposal 3 | 37 |

PROPOSAL 4: APPROVAL OF A SUBADVISORY AGREEMENT FOR THE INTERNATIONAL VALUE FUND | 37 |

2

Overview and Related Information | 37 |

Information Regarding Templeton and Franklin Asia | 37 |

Comparison of the Prior Subadvisory Agreements and the Proposed Combined Subadvisory Agreement | 38 |

Advisory Services | 39 |

Expenses | 39 |

Compensation | 39 |

Liability of Templeton and Franklin Asia | 40 |

Additional Information about Templeton and Franklin Asia | 40 |

Basis for the Board’s Approval of the Proposed Combined Subadvisory Agreement | 40 |

Required Approval for Proposal 4 | 41 |

PROPOSAL 5: APPROVAL OF AMENDMENT TO THE ARTICLES OF INCORPORATION TO LIMIT CERTAIN DIRECTOR LIABILITY TO THE EXTENT PERMITTED BY MARYLAND LAW | 41 |

Overview | 41 |

Scope of Maryland Law | 42 |

Reason for and Text of Amendment | 42 |

Required Approval for Proposal 5 | 43 |

Other Information | 43 |

Meetings of Shareholders | 43 |

Date, Time and Place of the Meeting | 44 |

Use and Revocation of Proxies | 44 |

Voting Rights and Required Votes | 45 |

Outstanding Shares and Significant Shareholders | 46 |

Other Service Providers | 46 |

Pending Litigation | 46 |

Where to Find Additional Information | 47 |

Other Matters and Discretion of Attorneys Named in the Proxy | 48 |

Exhibit A | A-1 |

Exhibit B | B-1 |

Exhibit C | C-1 |

Exhibit D | D-1 |

Exhibit E | E-1 |

Exhibit F | F-1 |

Exhibit G | G-1 |

Exhibit H | H-1 |

Exhibit I | I-1 |

Exhibit J | J-1 |

Exhibit K | K-1 |

3

SUMMARY OF PROPOSALS AND FUNDS VOTING

The following table describes the proposals (each a “Proposal” and together the “Proposals”) to be considered at the Meeting and the shareholders that are entitled to vote on each Proposal:

| Issuers Solicited | Funds Solicited | Classes Solicited |

| Proposal 1: To elect one director to the Board of Directors of each Issuer. | ||

| All Issuers | All Funds | All Classes |

| Proposal 2: To approve a management agreement with American Century Investment Management, Inc. | ||

American Century Asset Allocation Portfolios, Inc. | LIVESTRONG Income Portfolio LIVESTRONG 2015 Portfolio LIVESTRONG 2020 Portfolio LIVESTRONG 2025 Portfolio LIVESTRONG 2030 Portfolio LIVESTRONG 2035 Portfolio LIVESTRONG 2040 Portfolio LIVESTRONG 2045 Portfolio LIVESTRONG 2050 Portfolio One Choice Portfolio: Conservative One Choice Portfolio: Very Conservative One Choice Portfolio: Moderate One Choice Portfolio: Aggressive One Choice Portfolio: Very Aggressive | All classes to vote as a group except Institutional Class shareholders, if any, will vote separately. C Class shareholders will not be solicited.* |

American Century Capital Portfolios, Inc. | Equity Income, Equity Index, Large Company Value, Mid Cap Value, NT Large Company Value, NT Mid Cap Value, Real Estate, Small Cap Value, Value | All classes to vote as a group except Institutional Class shareholders, if any, will vote separately. C Class shareholders of Mid Cap Value and Small Cap Value, and R Class shareholders of Small Cap Value will not be solicited.* |

American Century Growth Funds, Inc. | Legacy Focused Large Cap Legacy Large Cap Legacy Multi Cap | All classes to vote as a group except Institutional Class shareholders will vote separately. |

American Century Mutual Funds, Inc. | Balanced, Capital Growth, Capital Value, Focused Growth, Fundamental Equity, Giftrust, Growth, Heritage, New Opportunities, NT Growth, NT Vista, Select, Small Cap Growth, Ultra, Veedot, Vista | All classes to vote as a group except Institutional Class shareholders, if any, will vote separately. A Class, C Class and R Class shareholders of New Opportunities, and C Class shareholders of Growth and Vista will not be solicited.* |

American Century Strategic Asset Allocations, Inc. | Strategic Allocation: Aggressive Strategic Allocation: Conservative Strategic Allocation: Moderate | All classes to vote as a group except Institutional Class shareholders will vote separately. |

American Century Variable Portfolios, Inc. | VP Balanced, VP Capital Appreciation, VP Income & Growth | All classes to vote as a group. |

VP International, VP Large Company Value, VP Mid Cap Value, VP Value, VP Vista, VP Ultra | Class I shareholders and Class III shareholders, if any, to vote as a group, and Class II shareholders, if any, and Class IV shareholders, if any, to vote as a separate group. | |

4

American Century World Mutual Funds, Inc. | Emerging Markets, Global Growth, International Discovery, International Growth, International Opportunities, International Stock, International Value, NT Emerging Markets, NT International Growth | All classes to vote as a group except Institutional Class shareholders, if any, will vote separately. C Class and R Class shareholders of International Discovery and International Opportunities, and A Class shareholders of International Opportunities will not be solicited.* | |

| Proposal 3: To approve a subadvisory agreement between Northern Trust Investments, N.A. and American Century Investment Management, Inc. | |||

American Century Capital Portfolios, Inc. | Equity Index | All Classes | |

| Proposal 4: To approve a subadvisory agreement by and among Templeton Investment Counsel, LLC, Franklin Templeton Investments (Asia) Limited and American Century Investment Management, Inc. | |||

American Century World Mutual Funds, Inc. | International Value | All Classes | |

| Proposal 5: To approve an amendment to the Articles of Incorporation to limit certain director liability to the extent permitted by Maryland law. | |||

American Century Capital Portfolios, Inc. | All Funds | All Classes | |

American Century Mutual Funds, Inc. | All Funds | All Classes | |

American Century World Mutual Funds, Inc. | All Funds | All Classes | |

| * | The management agreements relating to these new share classes took effect on March 1, 2010 and were not terminated by the change in control described under Proposal 2. Accordingly, the shareholders of these classes are not being asked to approve new management agreements. |

Shareholders of record on the Record Date are entitled to notice of and to vote at the Meeting and are entitled to vote at any adjournments or postponements thereof. Shareholders of each Issuer will vote separately on Proposal 1. Shareholders of each of the Funds will vote separately on Proposal 2. If a Fund has Institutional Class shares, holders of those shares will vote separately on Proposal 2 (or will not be solicited, as indicated above). In addition, for the Funds issued by American Century Variable Portfolios, Inc. other than VP Income & Growth, holders of Class I shares will vote with holders of Class III shares, if any, but holders of Class II shares, if any, will vote with holders of Class IV shares, if any. Shareholders of the Equity Index Fund will vote on Proposal 3. Shareholders of the International Value Fund will vot e on Proposal 4. Shareholders of American Century Capital Portfolios, Inc., American Century Mutual Funds, Inc. and American Century World Mutual Funds, Inc. will vote separately by Issuer on Proposal 5.

5

Applicable Only to American Century Variable Portfolios, Inc.:

Shares of VP Balanced, VP Capital Appreciation, VP Income & Growth, VP International, VP Large Company Value, VP Mid Cap Value, VP Ultra, VP Value and VP Vista (the “VP Funds”), all series of American Century Variable Portfolios, Inc., are sold only to separate accounts of certain insurance companies in connection with the issuance of variable annuity contracts and/or variable life insurance contracts by the insurance companies. With respect to Proposal 1, to elect one director of American Century Variable Portfolios, Inc., and with respect to Proposal 2, to approve new management agreements, insurance company separate accounts, as shareholders of a VP Fund, will request voting instructions from the owners of variable life insurance policies and variable annuity contracts (“Variable Contract Owners”) of the se parate accounts, and will vote the accounts’ shares in the VP Fund in accordance with the voting instructions received. Each separate account is required to vote its shares of a VP Fund in accordance with instructions received from Variable Contract Owners. Each separate account will vote shares of a VP Fund held in each of its respective variable accounts for which no voting instructions have been received in the same proportion as the separate account votes shares held by variable accounts for which it has received instructions. Shares held by an insurance company in its general account, if any, must be voted in the same proportions as the votes cast with respect to shares held in all of the insurance company’s variable accounts in the aggregate. Such proportional voting may result in a relatively small number of Variable Contract Owners determining the outcome of a proposal. Proposal 1 and Proposal 2 are the only proposals described in this Proxy Statement that relate to American Century Varia ble Portfolios, Inc.

The Boards recommend that you vote FOR each Proposal.

PROPOSAL 1: ELECTION OF DIRECTOR

Overview and Related Information

Each of the following eight individuals currently serves on the Boards: Jonathan S. Thomas, Thomas A. Brown, Andrea C. Hall, James A. Olson, Donald H. Pratt, Gale E. Sayers, M. Jeannine Strandjord and John R. Whitten. Each of these individuals, with the exception of Mr. Whitten, previously has been elected by each Issuer’s shareholders. Mr. Whitten was appointed to the Board in 2008 to fill the vacancy created by the resignation of another director. The other members of the Boards have nominated Mr. Whitten for election by shareholders at the Meeting. Hereafter the current Board members will be referred to as the “Directors,” and Mr. Whitten will be referred to as the “Nominee.” It is being proposed that the shareholders of e ach Issuer approve the Nominee. If approved by the shareholders, the Nominee will continue to serve until his death, retirement, resignation or removal from office. The mandatory retirement age for directors who are not “interested persons” (hereinafter “Independent Directors”), as that term is defined in the Investment Company Act of 1940 (the “1940 Act”), is 72. However, the

6

mandatory retirement age may be extended or changed with the approval of the remaining Independent Directors.

Further information regarding each of the Directors is listed below. Mr. Thomas is the only Director who is an “interested person” as that term is defined in the 1940 Act because Mr. Thomas serves as President and Chief Executive officer of American Century Companies, Inc. (“ACC”), the parent company of American Century Investment Management, Inc. (“ACIM”) and American Century Global Investment Management, Inc. (“ACGIM”). ACIM and ACGIM are referred to collectively as the “Advisors.” The remaining Directors, including the Nominee, are not “interested persons” under the 1940 Act and therefore will be referred to as “Independent Directors.”

The Nominee has consented to continue to serve as a director, if elected. In case he shall be unable or shall fail to serve as a director by virtue of an unexpected occurrence, persons named as proxies will vote in their discretion for such other nominee as the Independent Directors may recommend.

Information Regarding the Directors

The following table presents certain information about the Directors (including the Nominee). The mailing address for each Director is 4500 Main Street, Kansas City, Missouri 64111.

Independent Directors

Thomas A. Brown

Year of Birth: 1940

Offices with the Issuers: Director

Length of Time Served: Since 1980

Principal Occupation During the Past Five Years: Managing Member, Associated Investments, LLC (real estate investment company); Brown Cascade Properties, LLC (real estate investment company) (2001 to 2009)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director: None

Education/Other Professional Experience: BS in Mechanical Engineering, University of Kansas; formerly, Chief Executive Officer, Associated Bearings Company; formerly, Area Vice President, Applied Industrial Technologies (bearings and power transmission company)

Andrea C. Hall

Year of Birth: 1945

Offices with the Issuers: Director

Length of Time Served: Since 1997

Principal Occupation During the Past Five Years: Retired as Advisor to the President, Midwest Research Institute (not-for-profit research organization) (June 2006)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director: None

Education/Other Professional Experience: BS in Biology, Florida State University; PhD in Biology, Georgetown University; formerly, Senior Vice President and Director of Research Operations, Midwest Research Institute

7

James A. Olson

Year of Birth: 1942

Offices with the Issuers: Director

Length of Time Served: Since 2007

Principal Occupation During the Past Five Years: Member, Plaza Belmont LLC (private equity fund manager); Chief Financial Officer, Plaza Belmont LLC (September 1999 to September 2006)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director: Saia, Inc. and Entertainment Properties Trust

Education/Other Professional Experience: BS in Business Administration and MBA, St. Louis University; CPA; 21 years of experience as a partner in the accounting firm of Ernst & Young LLP

Donald H. Pratt

Year of Birth: 1937

Offices with the Issuers: Director, Chairman of the Board

Length of Time Served: Since 1995

Principal Occupation During the Past Five Years: Chairman and Chief Executive Officer, Western Investments, Inc. (real estate company)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director: None

Education/Other Professional Experience: BS in Industrial Engineering, Wichita State University; MBA, Harvard Business School; serves on the Board of Governors of the Independent Directors Council and Investment Company Institute; formerly, Chairman of the Board, Butler Manufacturing Company (metal buildings producer)

Gale E. Sayers

Year of Birth: 1943

Offices with the Issuers: Director

Length of Time Served: Since 2000

Principal Occupation During the Past Five Years: President, Chief Executive Officer and Founder, Sayers40, Inc. (technology products and services provider)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director: None

Education/Other Professional Experience: BS in Physical Education and M.Ed. in Educational Administration, University of Kansas; Recipient of the Ernst & Young Entrepreneur of the Year Award; inducted into the Chicago Entrepreneurship Hall of Fame and the National Football League Hall of Fame

M. Jeannine Strandjord

Year of Birth: 1945

Offices with the Issuers: Director

Length of Time Served: Since 1994

Principal Occupation During the Past Five Years: Retired, formerly, Senior Vice President, Process Excellence, Sprint Corporation (telecommunications company) (January 2005 to September 2005)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director: DST Systems Inc., Euronet Worldwide Inc., Charming Shoppes, Inc.

Education/Other Professional Experience: BS in Business Administration and Accounting, University of Kansas; CPA; formerly, Senior Vice President of Financial Services and Treasurer and Chief Financial Officer, Global Markets Group; Sprint Corporation; formerly, with the accounting firm of Ernst & Whinney

8

John R. Whitten

Year of Birth: 1946

Offices with the Issuers: Director

Length of Time Served: Since 2008

Principal Occupation During the Past Five Years: Project Consultant, Celanese Corp. (industrial chemical company)

Number of Funds in Fund Complex Overseen by Director: 63

Other Directorships Held by Director: Rudolph Technologies, Inc.

Professional Education/Experience: BS in Business Administration, Cleveland State University; CPA; formerly, Chief Financial Officer and Treasurer, Applied Industrial Technologies, Inc.; thirteen years of experience with accounting firm Deloitte & Touche LLP

Interested Director

Jonathan S. Thomas

Year of Birth: 1963

Offices with the Issuers: Director and President

Length of Time Served: Since 2007

Principal Occupation During the Past Five Years: President and Chief Executive Officer, ACC (March 2007 to present); Chief Administrative Officer, ACC (February 2006 to February 2007); Executive Vice President, ACC (November 2005 to February 2007). Also serves as: Chief Executive Officer and Manager, American Century Services, LLC (“ACS”); Executive Vice President, American Century Investment Management (“ACIM”) and American Century Global Investment Management (“ACGIM”); Director, ACIM, ACGIM, American Century Investment Services, Inc. (“ACIS”) and other ACC subsidiaries; Global Chief Operating Officer and Managing Director, Morgan Stanley (investment management) (March 2000 to November 2005)

Number of Funds in Fund Complex Overseen by Director: 104

Other Directorships Held by Director: None

Education/Other Professional Experience: BA in Economics, University of Massachusetts; MBA, Boston College; formerly held senior leadership roles with Fidelity Investments, Boston Financial Services and Bank of America; serves on the Board of Governors of the Investment Company Institute

Qualifications of Directors

Generally, no one factor was decisive in the original selection of the Directors to the Boards, nor in the nomination of the Nominee. Qualifications considered by the Board to be important to the selection and retention of Directors include the following: (i) the individual’s business and professional experience and accomplishments; (ii) the individual’s educational background and accomplishments; (iii) the individual’s experience and expertise performing senior policy-making functions in business, government, education, accounting, law and/or administration; (iv) how the individual’s expertise and experience would contribute to the mix of relevant skills and experience on the Board; (v) the individual’s ability to work effectively with the other members of the Board; and (vi) the individual’ ;s ability and willingness to make the time commitment necessary to serve as an effective director. In addition, the individual’s ability to review and critically evaluate information, their ability to evaluate fund service providers, their ability to

9

exercise good business judgment on behalf of fund shareholders, their prior service on the Boards, and their familiarity with the Funds are considered important assets.

When assessing potential new directors, the Boards have a policy of considering individuals from various and diverse backgrounds. Such diverse backgrounds may include differences in professional experience, education, individual skill sets and other individual attributes. The Boards’ Policy and Procedures for Director Nominations is attached as Exhibit A. Each Director’s individual educational and professional experience is summarized in the table above and was considered as part of his or her nomination to, or retention on, the Boards.

Responsibilities of the Boards

The Boards are responsible for overseeing the Advisors’ management and operations of the Funds pursuant to the management agreements. Directors also have significant responsibilities under the federal securities law. Among other things, they

| • | oversee the performance of the Funds; |

| • | monitor the quality of the advisory and shareholder services provided by the Advisors; |

| • | review annually the fees paid to the Advisors for their services; |

| • | monitor potential conflicts of interest between the Funds and the Advisors; |

| • | monitor custody of assets and the valuation of securities; and |

| • | oversee the Funds' compliance program. |

In performing their duties, Board members receive detailed information about the Funds and the Advisors regularly throughout the year, and meet at least quarterly with management of the Advisors to review reports about fund operations. The directors’ role is to provide oversight and not to provide day-to-day management.

The Boards have all powers necessary or convenient to carry out their responsibilities. Consequently, the Boards may adopt bylaws providing for the regulation and management of the affairs of the Issuers and may amend and repeal them to the extent that such bylaws do not reserve that right to the Issuers’ shareholders. They may increase or reduce the number of Board members and may, subject to the 1940 Act, fill Board vacancies. Board members also may elect and remove such officers and appoint and terminate such agents as they consider appropriate. They may establish and terminate committees consisting of two or more directors who may exercise the powers and authority of the Boards as determined by the directors. They may, in general, delegate such authority as they consider desirable to any officer of the Issuers, to any Board com mittee and to any agent or employee of the Issuers or to any custodian, transfer or investor servicing agent, principal underwriter or other service provider for a Fund.

10

The Boards met six times in 2009. Each Director then in office attended at least 75% of the aggregate of the total number of Board meetings, and the total number of meetings held by all Board committees on which the Director served, with the exception of Gale Sayers who attended one of the two Governance Committee meetings. Unlike public operating companies, mutual funds do not typically hold annual meetings. Accordingly, the Issuers do not have a policy pertaining to attendance at annual shareholder meetings by directors.

To communicate with the Boards, or a member of the Boards, a shareholder should send a written communication addressed to the attention of the corporate secretary (the “Corporate Secretary”) at American Century Funds, P.O. Box 418210, Kansas City, Missouri 64141-9210. Shareholders who prefer to communicate by email may send their comments to corporatesecretary@americancentury.com. The Corporate Secretary will forward all such communications to each member of the Compliance and Shareholder Communications Committee, or if applicable, the individual director(s) and/or committee chair named in the correspondence. However, if a shareholder communication is addressed exclusively to the Fund’s independent directors, the Corporate Secretary will forward the communication to the Compliance and Shareholder Communications Committe e chair, who will determine the appropriate action.

Board Leadership Structure and Standing Board Committees

Donald H. Pratt currently serves as the independent Chairman of the Board and has served in such capacity since 2005. Of the Boards’ eight members, Jonathan S. Thomas is the only member who is an “interested person” as that term is defined in the 1940 Act. The remaining members are Independent Directors. The Independent Directors meet separately, as needed and at least in conjunction with each quarterly meeting of the Boards, to consider a variety of matters that are scheduled to come before the Boards and meet periodically with the Funds’ Chief Compliance Officer and Fund auditors. They are advised by independent legal counsel. No Independent Director may serve as an officer or employee of a Fund. The Boards have also established several committees, as described below. Each committee is comprised solely of Indepe ndent Directors, except the Executive Committee. The Boards believe that the current leadership structure, with Independent Directors filling all but one position on the Boards, with an Independent Director serving as Chairman of the Boards, and with the Board committees comprised only of Independent Directors (with the exception of the Executive Committee), is appropriate and allows for independent oversight of the Funds.

Each Board has an Audit Committee that approves the Issuer’s engagement of the independent registered public accounting firm and recommends approval of such engagement to the Independent Directors. The committee also oversees the activities of the accounting firm, receives regular reports regarding fund accounting, oversees securities valuation (approving the

11

Funds’ valuation policy and receiving reports regarding instances of fair valuation thereunder) and receives regular reports from the Advisors’ internal audit department. The committee currently consists of Thomas A. Brown, Andrea C. Hall, James A. Olson and Gale E. Sayers. It met four times in 2009.

Each Board has a Governance Committee that is responsible for reviewing Board procedures and committee structures. The committee also considers and recommends individuals for nomination as directors, and may recommend the creation of new committees. The names of potential director candidates may be drawn from a number of sources, including recommendations from members of the Board, management (in the case of Interested Directors only) and shareholders. Shareholders may submit director nominations at any time to the Corporate Secretary, American Century Funds, P.O. Box 418210, Kansas City, MO 64141-9210. When submitting nominations, shareholders should include the name, age and address of the candidate, as well as a detailed resume of the candidate’s qualifications and a signed statement from the candidate of his/her willingne ss to serve on the Boards. Shareholders submitting nominations should also include information concerning the number of Fund shares and length of time held by the shareholder, and if applicable, similar information for the potential candidate. All nominations submitted by shareholders will be forwarded to the chair of the Governance Committee for consideration. The Corporate Secretary will maintain copies of such materials for future reference by the committee when filling Board positions.

If this process yields more than one desirable candidate, the committee will rank them by order of preference depending on their qualifications and the Funds’ needs. The candidate(s) may then be contacted to evaluate their interest and be interviewed by the full committee. Based upon its evaluation and any appropriate background checks, the committee will decide whether to recommend a candidate’s nomination to the Boards.

The Governance Committee also may recommend the creation of new committees, evaluate the membership structure of new and existing committees, consider the frequency and duration of Board and committee meetings and otherwise evaluate the responsibilities, processes, resources, performance and compensation of the Boards. The committee currently consists of Donald H. Pratt, Andrea C. Hall, John R. Whitten and Gale E. Sayers. None of its members are “interested persons” as that term is defined in the 1940 Act. The committee operates pursuant to a written charter, which is included as Exhibit B. It met two times in 2009.

Each Board also has a Compliance and Shareholder Communications Committee, which reviews the results of the Funds’ compliance testing program, meets regularly with the Funds’ Chief Compliance Officer, reviews shareholder communications, reviews quarterly reports regarding the quality of shareholder service provided by the Advisors, and monitors implementation of the Funds’ Code of Ethics. The committee currently consists of Donald H. Pratt, M. Jeannine Strandjord and John R. Whitten. It met four times in 2009.

12

Each Board has a Fund Performance Review Committee that meets quarterly to review the investment activities and strategies used to manage fund assets and monitor investment performance. The committee regularly receives reports from the Advisors’ chief investment officer, portfolio managers and other investment personnel concerning the Funds’ efforts to achieve their investment objectives. The committee also receives information regarding fund trading activities and monitors derivative usage. It currently consists of all of the Independent Directors. The committee met four times in 2009.

Finally, each Board has an Executive Committee that performs the functions of the Board between Board meetings, subject to the limitations on its power set out in the Maryland General Corporation Law and except for matters requiring the action of the entire Board under the 1940 Act. The committee currently consists of Donald H. Pratt, Jonathan S. Thomas and M. Jeannine Strandjord. It did not meet in 2009.

Risk Oversight by the Boards

As previously disclosed, the Boards oversee the management of the Issuers and the Funds and meet at least quarterly with management of the Advisors to review reports and receive information regarding fund operations. Risk oversight relating to the Issuers and the Funds is one component of the Boards’ oversight and is undertaken in connection with the duties of the Boards. As described above, the Boards’ committees assist the Boards in overseeing various types of risks relating to the Issuers and the Funds, including, but not limited to, investment risk, operational risk and enterprise risk. The Boards receive regular reports from each committee regarding the committee’s areas of responsibility and, through those reports and its regular interactions with management of the Advisors during and between meetings, analyzes, e valuates, and provides feedback on the Advisors’ risk management processes. In addition, the Boards receive information regarding, and have discussions with senior management of the Advisors about, the Advisors’ enterprise risk management systems and strategies, including an annual review of the Advisors’ risk management practices. Within the past 12 months, members of the Board’s Governance Committee have participated in industry conferences discussing directors’ role in risk oversight. There can be no assurance that all elements of risk, or even all elements of material risk, will be disclosed to or identified by the Boards.

Board Compensation

Each Independent Director receives compensation for service as a member of the Boards based on a schedule that takes into account the number of meetings attended and the assets of the Funds for which the meetings are held. None of the Interested Directors or officers of the Funds receives compensation from the Funds. Compensation expenses are allocated to the Issuers based in part on their relative net assets. Under the terms of each management agreement with the Advisors, the Funds are responsible for paying such fees and expenses. For each Issuer’s last fiscal year, each Issuer

13

and the American Century Family of Funds paid the Independent Directors the amounts shown in the following table. Note that the table reflects multiple overlapping periods, so that total compensation shown for any one fiscal year includes compensation also counted for other fiscal years.

| Issuer | FYE of Issuer | Thomas A. Brown | Andrea C. Hall | James A. Olson |

American Century Capital Portfolios, Inc. | 3/31/2009 | $42,949 | $42,196 | $42,419 |

Total Compensation from the American Century Family of Funds for FYE 3/31/2009(1) | $166,577 | $163,577 | $164,577 | |

American Century Asset Allocation Portfolios, Inc. | 7/31/2009 | $4,284 | $4,183 | $4,244 |

American Century Growth Funds, Inc. | 7/31/2009 | $216 | $213 | $213 |

Total Compensation from the American Century Family of Funds for FYE 7/31/2009(2) | $162,680 | $159,680 | $160,680 | |

American Century Mutual Funds, Inc. | 10/31/2009 | $69,477 | $68,618 | $69,477 |

Total Compensation from the American Century Family of Funds for FYE 10/31/2009(3) | $160,257 | $158,257 | $160,257 | |

American Century Strategic Asset Allocations, Inc. | 11/30/2009 | $11,784 | $11,739 | $11,892 |

American Century World Mutual Funds, Inc. | 11/30/2009 | $13,890 | $15,520 | $14,024 |

Total Compensation from the American Century Family of Funds for FYE 11/30/2009(4) | $158,782 | $158,282 | $160,282 | |

American Century Variable Portfolios, Inc. | 12/31/2009 | $10,722 | $10,652 | $10,694 |

Total Compensation from the American Century Family of Funds for FYE 12/31/2009(5) | $160,308 | $159,808 | $159,808 |

| Issuer | FYE of Issuer | Donald H. Pratt | Gale E. Sayers | M. Jeannine Strandjord | John R. Whitten |

American Century Capital Portfolios, Inc. | 3/31/2009 | $49,933 | $40,649 | $43,214 | $36,927 |

Total Compensation from the American Century Family of Funds for FYE 3/31/2009(1) | $193,577 | $157,577 | $167,577 | $142,744 |

14

| Issuer | FYE of Issuer | Donald H. Pratt | Gale E. Sayers | M. Jeannine Strandjord | John R. Whitten |

American Century Asset Allocation Portfolios, Inc. | 7/31/2009 | $4,984 | $3,961 | $4,304 | $3,924 |

American Century Growth Funds, Inc. | 7/31/2009 | $252 | $202 | $218 | $197 |

Total Compensation from the American Century Family of Funds for FYE 7/31/2009(2) | $189,680 | $151,680 | $163,680 | $148,680 | |

American Century Mutual Funds, Inc. | 10/31/2009 | $81,611 | $57,287 | $69,477 | $64,279 |

Total Compensation from the American Century Family of Funds for FYE 10/31/2009(3) | $188,257 | $132,077 | $160,257 | $148,257 | |

American Century Strategic Asset Allocations, Inc. | 11/30/2009 | $13,967 | $9,519 | $11,892 | $11,001 |

American Century World Mutual Funds, Inc. | 11/30/2009 | $16,481 | $11,149 | $14,024 | $12,973 |

Total Compensation from the American Century Family of Funds for FYE 11/30/2009(4) | $188,282 | $127,923 | $160,282 | $148,282 | |

American Century Variable Portfolios, Inc. | 12/31/2009 | $12,671 | $9,234 | $10,813 | $10,125 |

Total Compensation from the American Century Family of Funds for FYE 12/31/2009(5) | $189,808 | $137,808 | $161,808 | $151,808 |

| 1 | Includes deferred compensation as follows: Mr. Brown, $25,115; Dr. Hall, $121,000; Mr. Olson, $155,577; Mr. Pratt, $22,437; Mr. Sayers $157,577 and Mr. Whitten, $103,744. |

| 2 | Includes deferred compensation as follows: Mr. Brown, $23,936; Dr. Hall, $69,267; Mr. Olson, $136,680; Mr. Pratt, $21,552; Mr. Sayers, $151,680; and Mr. Whitten, $107,680. |

| 3 | Includes deferred compensation as follows: Mr. Brown, $23,051; Dr. Hall, $29,467; Mr. Olson, $69,477; Mr. Pratt, $20,888; Mr. Sayers, $132,077; and Mr. Whitten, $103,257. |

| 4 | Includes deferred compensation as follows: Mr. Brown, $22,756; Dr. Hall, $19,133; Mr. Olson, $122,782; Mr. Pratt, $20,667; Mr. Sayers, $127,923; and Mr. Whitten, $101,782. |

| 5 | Includes deferred compensation as follows: Mr. Brown, $22,462; Mr. Olson, $112,308; Mr. Pratt, $20,446; Mr. Sayers, $137,808; and Mr. Whitten, $100,308. |

None of the Issuers currently provides any pension or retirement benefits to the Directors except pursuant to the American Century Mutual Funds’ Independent Directors’ Deferred Compensation Plan adopted by the Issuers. Under the plan, the Independent Directors may defer receipt of all or any part of the fees to be paid to them for serving as Directors of the Funds. All deferred fees are credited to accounts established in the names of the directors. The

15

amounts credited to each account then increase or decrease, as the case may be, in accordance with the performance of one or more American Century funds selected by the director. The account balance continues to fluctuate in accordance with the performance of the selected fund or funds until final payment of all amounts credited to the account. Directors are allowed to change their designation of funds from time to time.

No deferred fees are payable until such time as a director resigns, retires or otherwise ceases to be a member of the Board. Directors may receive deferred fee account balances either in a lump sum payment or in substantially equal installment payments to be made over a period not to exceed 10 years. Upon the death of a director, all remaining deferred fee account balances are paid to the director’s beneficiary or, if none, to the director’s estate.

The plan is an unfunded plan and, accordingly, the Funds have no obligation to segregate assets to secure or fund the deferred fees. To date, the Funds have voluntarily funded their obligations. The rights of directors to receive their deferred fee account balances are the same as the rights of a general unsecured creditor of the Funds. The plan may be terminated at any time by the administrative committee of the plan. If terminated, all deferred fee account balances will be paid in a lump sum.

Exhibit C to this Proxy Statement shows the dollar range the Directors beneficially owned as of December 31, 2009 in the equity securities of any of the Funds, and, on an aggregate basis, equity securities of all of the Issuers.

On December 23, 1999, American Century Services, LLC (ACS), an affiliate of the Advisors, entered into an agreement with DST Systems, Inc. (DST) under which DST would provide back office software and support services for transfer agency services provided by ACS (the “Agreement”). ACS pays DST fees based in part on the number of accounts and the number and type of transactions processed for those accounts. For the 12 months ended December 31, 2009, DST received $18,230,115 in fees from ACS. DST’s revenue for the calendar year ended December 31, 2009, was approximately $2.2 billion.

Ms. Strandjord is a director of DST and a holder of 21,345 shares and possesses options to acquire an additional 55,890 shares of DST common stock, the sum of which is less than one percent (1%) of the shares outstanding. Because of her official duties as a director of DST, she may be deemed to have an “indirect interest” in the Agreement. However, the Boards were not required to nor did they approve or disapprove the Agreement, since the provision of the services covered by the Agreement is within the discretion of ACS. DST was chosen by ACS for its industry-leading role in providing cost-effective back office support for mutual fund service providers such as ACS. DST is the largest mutual fund transfer agent, servicing more than 121.1 million mutual fund accounts on its shareholder recordkeeping system. Ms. Strandjord’ ;s role as a director of DST was not considered by ACS; she was not involved in any way with the negotiations between ACS and DST; and her status as a director

16

of either DST or the Funds was not a factor in the negotiations. The Boards and counsel to the Independent Directors of the Funds have concluded that the existence of this Agreement does not impair Ms. Strandjord’s ability to serve as an independent director under the 1940 Act.

Beneficial Ownership of Affiliates by Independent Directors

No Independent Director or his or her immediate family members beneficially owned shares of the Advisors, the Issuers’ principal underwriter or any other person directly or indirectly controlling, controlled by, or under common control with the Advisors or the Issuers’ principal underwriter as of December 31, 2009.

Officers

The following table presents certain information about the executive officers of the Issuers. Each officer serves as an officer for each of the 104 investment companies in the American Century Family of Funds, unless otherwise noted. No officer is compensated for his or her service as an officer of the Funds. The listed officers are interested persons of the Funds and are appointed or re-appointed on an annual basis. The mailing address for each of the officers listed below is 4500 Main Street, Kansas City, Missouri 64111.

| Name (Age) | Offices with the Issuers | Principal Occupation During the Past Five Years |

Jonathan Thomas (47) | Director and President since 2007 | President and Chief Executive Officer, ACC (March 2007 to present); Chief Administrative Officer, ACC (February 2006 to February 2007); Executive Vice President, ACC (November 2005 to February 2007). Also serves as: Chief Executive Officer and Manager, ACS; Executive Vice President, ACIM, ACGIM; Director, ACIM, ACGIM and other ACC subsidiaries; Managing Director, Morgan Stanley (March 2000 to November 2005) |

Barry Fink (55) | Executive Vice President since 2007 | Chief Operating Officer and Executive Vice President, ACC (September 2007 to present); President, ACS (October 2007 to present); Managing Director, Morgan Stanley (2000 to 2007); Global General Counsel, Morgan Stanley (2000 to 2006). Also serves as: Manager, ACS and Director, ACC, ACIS and other ACC subsidiaries |

Maryanne Roepke (54) | Chief Compliance Officer since 2006 and Senior Vice President since 2000 | Chief Compliance Officer, American Century funds, ACIM, ACGIM and ACS (August 2006 to present); Assistant Treasurer, ACC (January 1995 to August 2006); and Treasurer and Chief Financial Officer, various American Century funds (July 2000 to August 2006). Also serves as: Senior Vice President, ACS |

Charles Etherington (52) | General Counsel since 2007 and Senior Vice President since 2006 | Attorney, ACC (February 1994 to present); Vice President, ACC (November 2000 to present), General Counsel, ACC (March 2007 to present); Also serves as General Counsel, ACIM, ACGIM, ACS and other ACC subsidiaries; and Senior Vice President, ACIM, ACGIM and ACS |

17

| Name (Age) | Offices with the Issuers | Principal Occupation During the Past Five Years |

Robert Leach (43) | Vice President, Treasurer and Chief Financial Officer since 2006 | Vice President, ACS (February 2000 to present); and Controller, various American Century funds (1997 to September 2006) |

David Reinmiller (46) | Vice President since 2000 | Attorney, ACC (January 1994 to present); Associate General Counsel, ACC (January 2001 to present); Chief Compliance Officer, American Century funds, ACIM and ACGIM (January 2001 to February 2005). Also serves as Associate General Counsel, ACIM, ACGIM, ACS, ACIS and other ACC subsidiaries; Vice President, ACIM, ACGIM and ACS |

Ward Stauffer (49) | Secretary since 2005 | Attorney, ACC (June 2003 to Present) |

Share Ownership

As of March 19, 2010, each director and officer individually, and as a group, owned beneficially less than 1% of the outstanding shares of each class of the Funds. For more information about significant share ownership of the Funds, see “Other Information—Outstanding Shares and Significant Shareholders.”

Independent Registered Public Accounting Firm

The Audit Committees and each Board selected the independent public accounting firm of Deloitte & Touche LLP to serve as independent registered public accountants of the Issuers for their most recent fiscal year. Representatives of Deloitte & Touche are not expected to be present at the Meeting, but will have the opportunity to make a statement if they wish, and will be available should any matter arise requiring their presence.

Fees Paid to Independent Registered Public Accounting Firm

The aggregate fees paid to Deloitte & Touche LLP and other member firms of Deloitte Touche Tahmatsu and their respective affiliates (collectively referred to as the “Deloitte Entities”) for professional services rendered by the Deloitte Entities for the audit of the annual financial statements of the Funds and other professional services for the fiscal years ended as indicated below were:

| Issuer | Audit Fees (a) | Audit Related Fees (b) | Tax Fees (c) | All Other Fees (d) |

| American Century Asset Allocation Portfolios, Inc. | ||||

| 07/31/2009 | $114,612 | $0 | $0 | $0 |

| 07/31/2008 | $76,990 | $0 | $0 | $0 |

| American Century Capital Portfolios, Inc | ||||

| 03/31/2009 | $166,905 | $0 | $0 | $0 |

| 03/31/2008 | $157,806 | $0 | $1,498 | $0 |

18

| Issuer | Audit Fees (a) | Audit Related Fees (b) | Tax Fees (c) | All Other Fees (d) |

| American Century Growth Funds, Inc. | ||||

| 07/31/2009 | $44,065 | $0 | $0 | $0 |

| 07/31/2008 | $45,980 | $0 | $0 | $0 |

| American Century Mutual Funds, Inc. | ||||

| 10/31/2009 | $281,906 | $0 | $0 | $0 |

| 10/31/2008 | $317,528 | $0 | $0 | $0 |

| American Century Strategic Asset Allocations, Inc. | ||||

| 11/30/2009 | $79,469 | $0 | $0 | $0 |

| 11/30/2008 | $67,248 | $0 | $0 | $0 |

| American Century Variable Portfolios, Inc. | ||||

| 12/31/2009 | $165,859 | $0 | $0 | $0 |

| 12/31/2008 | $164,383 | $0 | $0 | $0 |

| American Century World Mutual Funds, Inc. | ||||

| 11/30/2009 | $204,457 | $0 | $0 | $0 |

| 11/30/2008 | $239,403 | $0 | $0 | $0 |

(a) Audit Fees

These fees relate to professional services rendered by the Deloitte Entities for the audits of the Funds’ annual financial statements or services normally provided by an independent registered public accounting firm in connection with statutory and regulatory filings or engagements. These services included the audits of the financial statements of the Funds, issuance of consents, income tax provision procedures and assistance with review of documents filed with the Securities and Exchange Commission.

(b) Audit Related Fees

These fees relate to assurance and related services by the Deloitte Entities in connection with semi-annual financial statements.

(c) Tax Fees

These fees relate to professional services rendered by the Deloitte Entities for tax compliance, tax advice, and tax planning. These services relate to the review of the Funds’ federal and state income tax returns, and review of excise tax calculations and returns.

(d) All Other Fees

These fees relate to products and services provided by the Deloitte Entities other than those reported under “Audit Fees,” “Audit Related Fees,” and “Tax Fees.”

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee approves the engagement of the accountant prior to the accountant rendering any audit or non-audit services to the Issuers. The aggregate non-audit fees billed by the Deloitte Entities for services rendered

19

to the Advisors and service affiliates for the years ended December 31, 2008 and December 31, 2009 were $93,552 and $55,065, respectively.

The Audit Committee considered and concluded that the provisions for non-audit services to the Advisors and their affiliates that did not require pre-approval are compatible with maintaining Deloitte’s independence, and has determined that the provision of these services do not compromise Deloitte’s independence.

Required Approval for Proposal 1

Proposal 1, the election of the Nominee, must be approved by a plurality of the votes cast in person or by proxy at the Meeting at which a quorum exists. The shareholders of each Issuer, voting together as a single class that includes the votes of the shares of each Fund that is a series of that Issuer, will vote separately for the election of the Nominee to that Issuer’s Board. Approval of the Proposal by an Issuer is not contingent upon approval of the Proposal by any other Issuer.

The Boards Recommend that the Shareholders Vote to Elect the Nominee.

PROPOSAL 2: APPROVAL OF MANAGEMENT AGREEMENTS

Overview

American Century Investment Management, Inc. (“ACIM”) and American Century Global Investment Management, Inc. (“ACGIM” and, together with ACIM, the “Advisors”) currently serve as investment advisors to the Funds. The Advisors previously served as investment advisors to the Funds pursuant to management agreements approved by Fund shareholders (the “Prior Management Agreements”). The Prior Management Agreements terminated automatically on February 16, 2010 (the “Termination Date”) due to a deemed “change of control” of the Advisors’ parent company, American Century Companies, Inc. (“ACC”). The change in control is described in further detail below. To ensure the continuity of the investment advisory services to the Funds after the aforementioned termi nation of the Prior Management Agreements, and before shareholder approval of new management agreements described below (“Proposed Management Agreements”), the Boards approved interim management agreements between the Advisors and the Issuers on behalf of the respective Funds (the “Interim Management Agreements”). The Advisors are currently managing the Funds pursuant to the Interim Management Agreements. Shareholders of the Funds are being asked to approve Proposed Management Agreements with ACIM.* The Proposed Management Agreements are identical

__________________________________

* | Management agreements for new share classes of the Funds that were launched after the Termination Date did not terminate, have not been replaced by Interim Management Agreements, and do not require approval of Proposed Management Agreements. |

20

to the Prior Management Agreements except for (i) the date, (ii) the substitution of ACIM for ACGIM as advisor of those Funds currently managed by ACGIM, and (iii) certain other non-material changes. A form of the Proposed Management Agreements is attached as Exhibit D.

Reason for Proposed Management Agreements

You are being asked to approve the Proposed Management Agreements in order to ensure the continued provision of advisory services to the Funds. Under the 1940 Act, the change in trustee of the Trust described below may technically be considered a “change in control” of ACC and, therefore, also a change in control of the Advisors even though there has been no change to their management and none is anticipated. The “change in control” resulted in the assignment and automatic termination of the Prior Management Agreements, as required under their terms and the 1940 Act.

ACIM is a wholly owned subsidiary of ACC, and ACGIM is a wholly owned subsidiary of ACIM. ACC’s certificate of incorporation provides for three classes of common stock: Class A, Class B and Class C. Class A common stock represents one vote per share; Class B common stock represents 10,000 votes per share; and Class C common stock has no voting rights. Class B shares are entitled to elect 75% of ACC’s Board of Directors. A trust (the “Trust”) holds Class B shares that represent approximately 40% of the combined voting power of the common stock. Prior to the Termination Date, James E. Stowers, Jr. served as the trustee of the Trust. Pursuant to the trust agreement governing the Trust (hereinafter the “Trust Agreement”), as trustee of the Trust, Mr. Stowers had the ability to vote and to dispose of the Cl ass B shares owned by the Trust. Under Section 2(a)(9) of the 1940 Act, Mr. Stowers’ control of greater than 25% of the voting securities created a presumption that he controlled ACC.

On the Termination Date, pursuant to the terms of the Trust Agreement, Mr. Richard W. Brown succeeded Mr. Stowers as the trustee of the Trust. Mr. Brown currently serves as co-chairman of the Board of Directors of ACC and also serves as co-chairman of the Board of Directors of Stowers Resource Management, Inc. (“SRM”) and chairman of the Board of Directors of the Stowers Institute for Medical Research (“SIMR”). As trustee, Mr. Brown has the responsibility to manage the affairs of the Trust, which include managing the Trust property, distributing income to its beneficiaries, voting the shares of ACC stock held by the Trust, and complying with the Trust Agreement’s dispositive provisions upon the occurrence of specific events. During his lifetime, Mr. Brown may designate other qualified individuals and corporations to act as trustee. Should he fail to do so, David A. Welte shall become the successor trustee. Mr. Welte currently serves as a member of the Board of Directors of ACC and also serves as Executive Vice President and General Counsel of SRM and as a member of the Board of Directors of SRM and SIMR. Should neither Mr. Brown nor Mr. Welte be able to act as trustee or designate someone to act in his place, a majority of the members of the

21

Executive Committee of the SRM Board of Directors shall make such appointment. Pursuant to the terms of the Trust Agreement, the ultimate beneficiary of the Trust, including the ACC stock held by the Trust, is SRM, SIMR or another tax-exempt member of the Stowers Group of Companies.*

Information Regarding ACIM

ACIM is a wholly owned subsidiary of ACC and has been providing management and advisory services to the American Century family of funds since 1958. Currently, ACGIM is wholly owned by ACIM. However, in order to streamline American Century’s corporate organization, ACGIM is being merged into ACIM as of June 16, 2010. This merger will not change in any way how the Funds are managed, the personnel who manage the Funds, the advisory fees for such management services or any other matter relating to the operations of the Funds. The only change is that the named party in all advisory agreements will be ACIM. The following table lists the names, positions and principal occupations of the directors and principal executive officer of ACIM:

| Name | Position with ACIM | Principal Occupation |

| Enrique Chang | President, Chief Executive Officer and Chief Investment Officer | Chief Investment Officer |

James E. Stowers, Jr. | Director | Founder, Co-Chairman and Director, ACC; Director, ACIM, ACS, ACIS and other ACC subsidiaries |

Jonathan S. Thomas | Executive Vice President, Director | President and Chief Executive Officer, ACC; Chief Executive Officer and Manager, ACS; Director, ACIM, ACIS and other ACC subsidiaries |

Officers of the Advisors and the Funds who own ACC stock are Otis Cowan, Charles Etherington, David Reinmiller, Maryanne Roepke and Ward Stauffer. The address for the Advisors and each of their officers and directors is 4500 Main Street, Kansas City, Missouri 64111.

Description of the Management Agreements

The Advisors previously served as investment advisors to each of the Funds pursuant to the Prior Management Agreements, and currently serve as investment advisors pursuant to the Interim Management Agreements. The table included as Exhibit E shows the dates of the Interim Management Agreements, as well as the dates and reason the Prior Management Agreements were last submitted to shareholders for approval. Under the Proposed Management Agreements, ACIM will provide the same services to

__________________________________

* | The Stowers Group of Companies is a not-for-profit biomedical research organization dedicated to finding the keys to the causes, treatment and prevention of disease. |

22

the Funds as were provided by the Advisors under the Prior and Interim Management Agreements.

Each of the Prior Management Agreements, as required by Section 15 of the 1940 Act, provides for its automatic termination in the event of its assignment (as defined by the 1940 Act). Any change in control of the Advisors or their parent company may cause an assignment. As previously described, on February 16, 2010, there was a deemed change in control of the Advisors’ parent company, ACC, which caused an “assignment” of the Prior Management Agreements resulting in their automatic termination. Accordingly, the Boards have determined it to be in the best interests of each Fund and its shareholders to approve a new management agreement between ACIM and the respective Issuers on behalf of each Fund. Each Board, including the Independent Directors, approved the Proposed Management Agreements and recommended their approval b y shareholders, as required by the 1940 Act.

To ensure the continuity of the investment advisory services to the Funds after the aforementioned termination of the Prior Management Agreements, and before shareholder approval of the Proposed Management Agreements, the Boards approved Interim Management Agreements between the Advisors and the Issuers on behalf of the Funds in accordance with Rule 15a-4 of the 1940 Act. See “Basis for the Boards’ Approval of the Proposed Management Agreements” for a discussion of the factors the Boards considered in their approval of the Proposed Management Agreements.

Interim Management Agreements

The terms of the Interim Management Agreements are substantially identical to those of the corresponding Prior Management Agreements. However, there are differences relating to effective dates, duration and termination provisions as described below.

The Interim Management Agreements were effective upon the termination of the Prior Management Agreements and will continue to be effective until the earlier of (i) 150 days following the date of their execution or (ii) the effective date of the Proposed Management Agreements (provided such agreements have been approved in the manner required under the 1940 Act), unless terminated sooner in accordance with their terms. If shareholders of the Funds do not approve the Proposed Management Agreements on behalf of their respective Funds, the Boards will take such action as they deem to be in the best interests of the Funds, which may include further solicitation of shareholders. In addition, each Interim Management Agreement may be terminated with respect to any Fund by the Board, by a vote of a majority of the outstanding voting securities (a s defined by the 1940 Act) of such Fund, or by the Advisors without payment of any penalty, upon 60 days’ written notice to the other party.

The rate of compensation paid to the Advisors by each Fund under the Interim Management Agreements is the same as that paid under the corresponding Prior Management Agreements.

23

Proposed Management Agreements

The Boards have unanimously approved and recommended that shareholders approve the Proposed Management Agreements with ACIM on behalf of their respective Funds. The approval of a Proposed Management Agreement by one Fund is not contingent upon the approval of a Proposed Management Agreement by any other Fund, including Funds that are series of the same Issuer. The Advisors’ fee under each Prior Management Agreement on behalf of the respective Funds and share classes will be the same under the corresponding Proposed Management Agreement. A form of the Proposed Management Agreements is attached as Exhibit D. The description of the terms of the Proposed Management Agreements is qualified in its entirety by reference to Exhibit D.

Comparison of the Prior Management Agreements and the Proposed Management Agreements

The terms of the Proposed Management Agreements are substantially identical to those of the corresponding Prior Management Agreements except for (i) the date, (ii) the substitution of ACIM for ACGIM as advisor of those Funds currently managed by ACGIM, and (iii) certain other non-material changes.

Management Services