UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-00816 | |||||||||||||||||||

| AMERICAN CENTURY MUTUAL FUNDS, INC. | ||||||||||||||||||||

| (Exact name of registrant as specified in charter) | ||||||||||||||||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| JOHN PAK 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||||||||||||||||

| (Name and address of agent for service) | ||||||||||||||||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||||||||||||||||

| Date of fiscal year end: | 10-31 | |||||||||||||||||||

| Date of reporting period: | 10-31-2022 | |||||||||||||||||||

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) Provided under separate cover.

| Annual Report | |||||

| October 31, 2022 | |||||

| Balanced Fund | |||||

| Investor Class (TWBIX) | |||||

| I Class (ABINX) | |||||

| R5 Class (ABGNX) | |||||

| Table of Contents | ||

| President’s Letter | |||||

| Performance | |||||

| Portfolio Commentary | |||||

| Fund Characteristics | |||||

| Shareholder Fee Example | |||||

| Schedule of Investments | |||||

| Statement of Assets and Liabilities | |||||

| Statement of Operations | |||||

| Statement of Changes in Net Assets | |||||

| Notes to Financial Statements | |||||

| Financial Highlights | |||||

| Report of Independent Registered Public Accounting Firm | |||||

| Management | |||||

| Approval of Management Agreement | |||||

| Proxy Voting Results | |||||

| Additional Information | |||||

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

| President’s Letter | ||

Jonathan Thomas

Jonathan ThomasDear Investor:

Thank you for reviewing this annual report for the period ending October 31, 2022. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

High Inflation, Rising Rates, Volatility Challenged Investors

The broad economic and investment backdrops grew knottier as the fiscal year progressed. Challenges began to surface early in the period, as the Federal Reserve (Fed) and other central banks finally admitted inflation was entrenched rather than transitory. Investors grew more cautious amid growing expectations for less accommodative monetary policy in the new year.

By early 2022, inflation soared to levels last seen in the early 1980s. Massive fiscal and monetary support unleashed during the pandemic was partly to blame. In addition, escalating energy prices, supply chain breakdowns, labor market shortages and Russia’s invasion of Ukraine further aggravated the inflation backdrop.

The Fed responded to surging inflation with a rate hike in March, three months after the Bank of England (BofE) launched its tightening campaign. Through October, the Fed lifted rates a total of 3 percentage points, while the BofE hiked 2.9 percentage points. The European Central Bank (ECB) waited until July to start tightening. Facing record-high inflation, the ECB raised rates 2 percentage points through October.

In addition to fostering recession risk, the combination of elevated inflation and hawkish central banks helped push bond yields sharply higher and stock prices significantly lower. Amid persistent market unrest, most stock, bond and real estate indices ended the 12-month period with steep losses. While U.S. stock returns were broadly negative, growth stocks significantly underperformed their value stock peers.

Staying Disciplined in Uncertain Times

We expect market volatility to linger as investors navigate a complex environment of high inflation, rising interest rates and economic uncertainty. In addition, Russia’s invasion of Ukraine complicates an increasingly tense geopolitical backdrop and threatens global energy markets. We will continue to monitor this evolving situation and what it broadly means for investors across asset classes.

We appreciate your confidence in us during these extraordinary times. Our firm has a long history of helping clients weather unpredictable markets, and we’re confident we will continue to meet today’s challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

| Performance | ||

| Total Returns as of October 31, 2022 | ||||||||||||||||||||

| Average Annual Returns | ||||||||||||||||||||

| Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date | |||||||||||||||

| Investor Class | TWBIX | -16.94% | 4.62% | 6.60% | — | 10/20/88 | ||||||||||||||

| Blended Index | — | -14.73% | 6.30% | 8.07% | — | — | ||||||||||||||

| S&P 500 Index | — | -14.61% | 10.44% | 12.78% | — | — | ||||||||||||||

| Bloomberg U.S. Aggregate Bond Index | — | -15.68% | -0.54% | 0.74% | — | — | ||||||||||||||

| I Class | ABINX | -16.76% | 4.82% | 6.82% | — | 5/1/00 | ||||||||||||||

| R5 Class | ABGNX | -16.76% | 4.83% | — | 5.64% | 4/10/17 | ||||||||||||||

Average annual returns since inception are presented when ten years of performance history is not available.

The blended index combines monthly returns of two widely known indices in proportion to the asset mix of the fund. The S&P 500 Index represents 60% of the index and the remaining 40% is represented by the Bloomberg U.S. Aggregate Bond Index.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

3

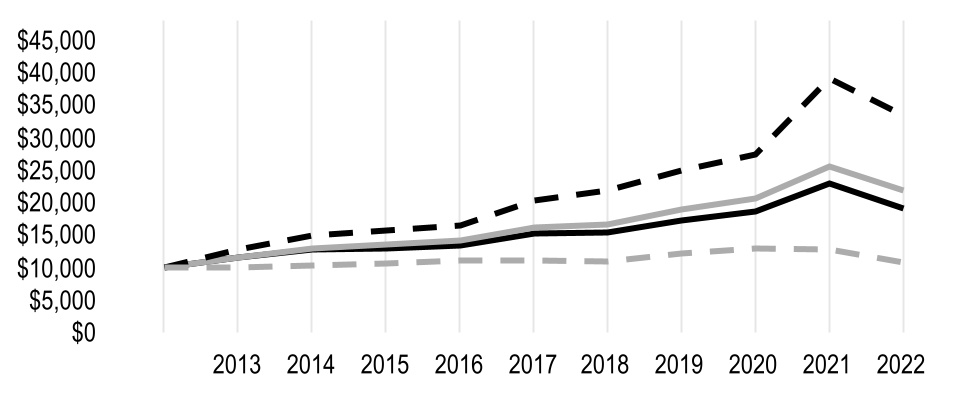

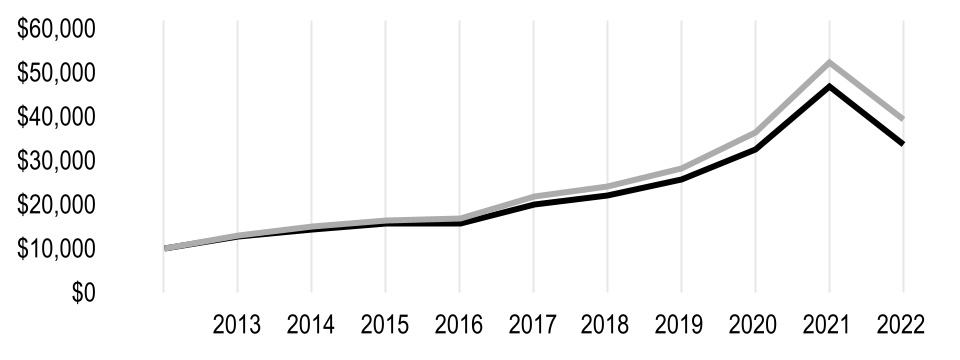

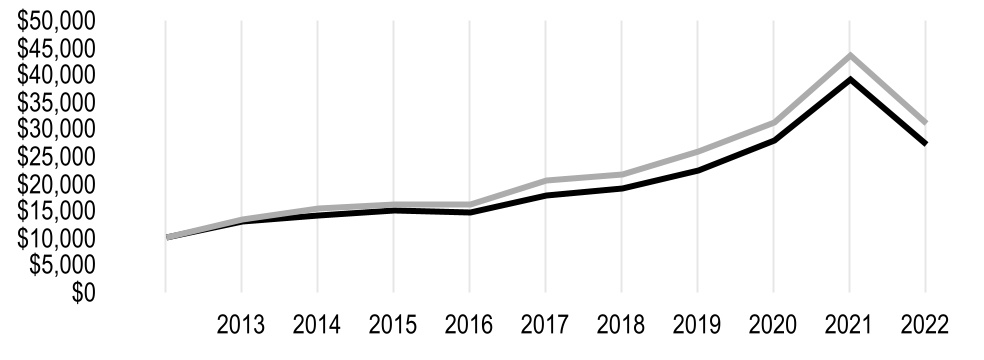

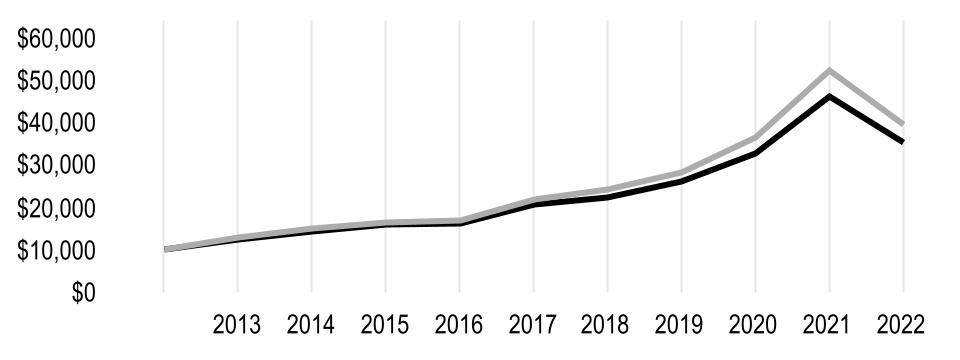

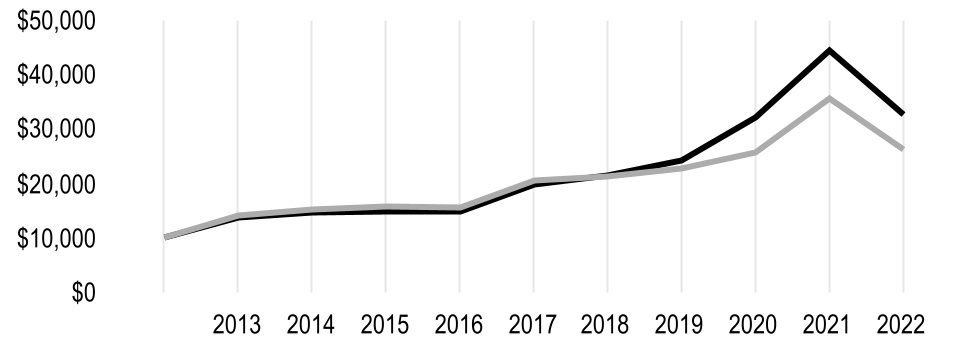

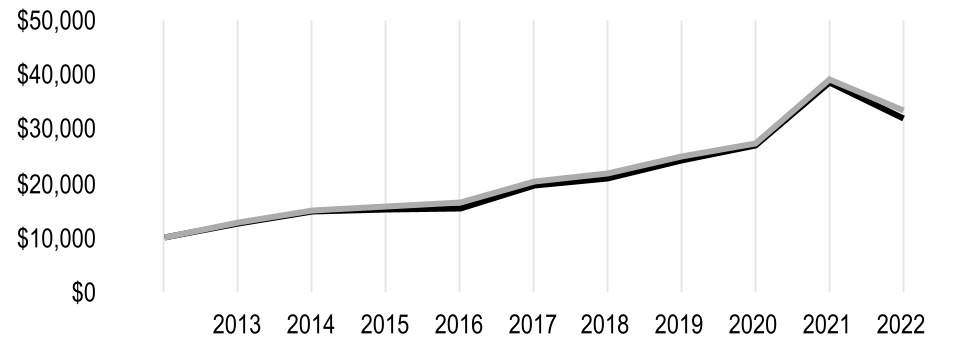

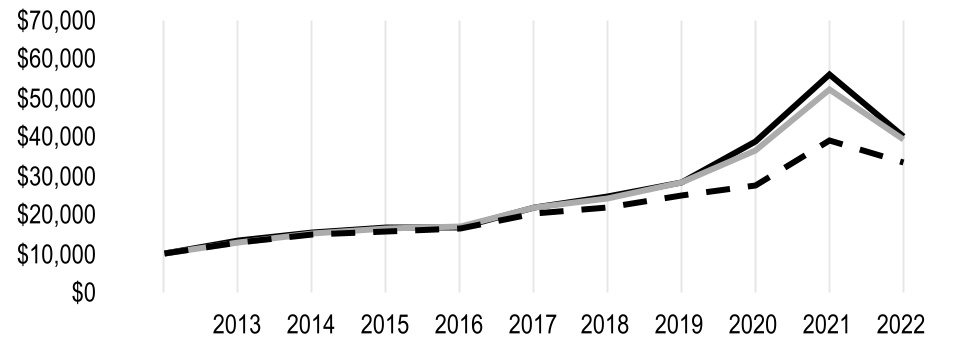

| Growth of $10,000 Over 10 Years | ||

| $10,000 investment made October 31, 2012 | ||

| Performance for other share classes will vary due to differences in fee structure. | ||

| Value on October 31, 2022 | |||||

| Investor Class — $18,950 | |||||

| Blended Index — $21,735 | |||||

| S&P 500 Index — $33,308 | |||||

| Bloomberg U.S. Aggregate Bond Index — $10,764 | |||||

| Total Annual Fund Operating Expenses | ||||||||

| Investor Class | I Class | R5 Class | ||||||

| 0.90% | 0.70% | 0.70% | ||||||

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

4

| Portfolio Commentary | ||

Equity Portfolio Managers: Joseph Reiland, Justin Brown and Robert Bove

Fixed-Income Portfolio Managers: Bob Gahagan, Charles Tan and Jason Greenblath

Performance Summary

Balanced returned -16.94%* for the 12 months ended October 31, 2022. By comparison, the fund’s benchmark (a blended index consisting of 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index) returned -14.73%.

Balanced seeks long-term capital growth and current income by investing approximately 60% of its assets in equity securities and the remainder in bonds and other fixed-income securities. The purpose of the broad bond market exposure is to reduce the volatility of the equity portfolio, providing a more attractive overall risk/return profile for investors. Unfortunately, however, fixed-income markets endured one of the worst stretches on record during the fiscal year due to concerns about surging inflation and aggressive tightening of Federal Reserve (Fed) policy. In that environment, both the equity and fixed-income portions of the portfolio declined in absolute terms and underperformed their benchmarks.

Information Technology Hampered Equity Performance

Significant detractors in the information technology sector included Apple, which beat analysts’ expectations on both revenues and earnings. Our underweight allocation to the consumer electronics giant hurt relative performance. PayPal Holdings delivered quarterly results and forward guidance below expectations, with deceleration in key metrics. We eliminated our position in the digital payments company due to lower engagement trends following the pandemic, as well as management’s poor execution on margins and several growth initiatives. Microsoft was hurt by foreign exchange headwinds, COVID-19-related shutdowns in China that limited personal computer (PC) inventory and a deterioration in PC demand.

Aptiv, an Ireland-based automotive technology supplier, underperformed following Russia’s invasion of Ukraine on concerns about production disruptions, higher commodity costs, continued supply chain constraints and negative impacts to European automobile demand. Not owning Exxon Mobil and Chevron detracted from performance compared with the benchmark as their stocks rose on higher fossil fuel prices following Russia’s invasion of Ukraine.

Communication Services Stocks Benefited Equity Performance

During the period, we eliminated the stock of Facebook’s parent Meta Platforms, which has been hurt more than other digital advertising platforms by both Apple iOS platform changes and TikTok competition. The fund’s resulting underweight helped performance in the communication services sector as the stock fell sharply. Not owning Netflix also benefited relative performance. The streaming video service announced more layoffs amid weak subscriber growth. An expected renormalization of subscriber growth following the gains of the pandemic has not materialized.

Elsewhere, our holding of ConocoPhillips was a top contributor. This is consistent with our process, which uses a proprietary multifactor model that considers a company's financial metrics and environmental, social and governance (ESG) characteristics. Rather than exclude certain sectors entirely, our process seeks to identify the most attractive companies within their respective sectors. Our approach led us to overweight positions in select energy companies. The oil giant reported solid quarterly earnings and increased its 2022 capital return guidance by 50%. The management

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

5

team continues to demonstrate strong execution and capital return discipline. Schlumberger, the Netherlands-based oil field services company, benefited from the jump in fossil fuel prices stemming from Russia’s invasion in Ukraine, which disrupted energy markets by calling into question global supply chains, with an acute focus on Europe.

In addition, managed care companies, including Cigna, benefited from what many investors perceive to be their defensive profile, meaning they are believed to be relatively insulated from both rising prices and recession risk. Our research also indicates that Cigna’s pharmacy benefit division may benefit from new biosimilar pharmaceutical launches in the coming years. Defense contractor Lockheed Martin was another solid contributor. The defense group experienced relative outperformance as investors rotated to lower growth and more defensive names. Russia’s invasion of Ukraine sparked additional outperformance for the stock on expectations that rising geopolitical tensions will lead to higher global defense spending.

Bonds Also Endured Difficult Performance

Inflation surged to a four-decade high during the period, and the Fed raised rates at the fastest pace since the early 1980s. In those conditions, bond yields surged and prices fell. The benchmark 10-year Treasury yield began the period at 1.55% and ended the fiscal year at 4.10%, according to Fed data. As a result, fixed-income markets endured one of the worst stretches of performance on record, and all sectors declined. Reflecting the rapid increase in prices and demand for inflation protection, inflation-linked securities held up better than nominal Treasury bonds; corporate bonds finished somewhere in between, as measured by the Bloomberg bond indices. In that environment, the fixed-income portion of the portfolio declined in absolute terms and underperformed its benchmark.

Outlook

War, inflation and recession risk all suggest difficult, volatile conditions ahead. Markets will continue to deal with the contrasting risks of rising inflation and interest rates, even as the global economy teeters on the verge of recession. The ongoing war in Ukraine also highlights political and economic risks at present. COVID-19, war and tariffs also continue to disrupt global supply chains, putting further upward pressure on prices. We will continue to monitor the situation and invest appropriately. We believe that the continued economic and market uncertainty highlights the benefits of a balanced approach involving exposure to both stocks and bonds, which is intended to reduce overall price fluctuations and improve risk-adjusted performance.

Of course, we understand it can be frustrating when stocks and bonds fall together, but investors should recall that these sorts of balanced portfolios have performed very well over time on both an absolute and risk-adjusted basis. We prefer to think this is a temporary speed bump and that diversification remains the best way to maximize risk-adjusted returns over time.

An investment strategy that focuses on ESG factors seeks to invest, under normal market conditions, in securities that meet certain ESG criteria or standards in an effort to promote sustainable characteristics, in addition to seeking superior, long-term, risk-adjusted returns. This investment focus may limit the investment opportunities available to a portfolio. Therefore, the portfolio may underperform or perform differently than other portfolios that do not have an ESG investment focus.

6

| Fund Characteristics | ||

| OCTOBER 31, 2022 | |||||

| Types of Investments in Portfolio | % of net assets | ||||

| Common Stocks | 61.5% | ||||

| U.S. Treasury Securities | 11.4% | ||||

| Corporate Bonds | 9.6% | ||||

| U.S. Government Agency Mortgage-Backed Securities | 8.7% | ||||

| Collateralized Loan Obligations | 2.6% | ||||

| Asset-Backed Securities | 2.5% | ||||

| Collateralized Mortgage Obligations | 1.6% | ||||

| Commercial Mortgage-Backed Securities | 0.7% | ||||

| Municipal Securities | 0.6% | ||||

| U.S. Government Agency Securities | 0.3% | ||||

| Sovereign Governments and Agencies | 0.1% | ||||

| Exchange-Traded Funds | 0.1% | ||||

| Bank Loan Obligations | 0.1% | ||||

| Short-Term Investments | 1.5% | ||||

| Other Assets and Liabilities | (1.3)% | ||||

| Top Five Common Stocks Industries* | % of net assets | ||||

| Software | 5.5% | ||||

| Health Care Providers and Services | 3.6% | ||||

| Technology Hardware, Storage and Peripherals | 3.0% | ||||

| Semiconductors and Semiconductor Equipment | 2.8% | ||||

| Pharmaceuticals | 2.8% | ||||

*Exposure indicated excludes Exchange-Traded Funds. The Schedule of Investments provides additional information on the fund's portfolio holdings.

7

| Shareholder Fee Example | ||

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from May 1, 2022 to October 31, 2022.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments mutual fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

| Beginning Account Value 5/1/22 | Ending Account Value 10/31/22 | Expenses Paid During Period(1) 5/1/22 - 10/31/22 | Annualized Expense Ratio(1) | |||||||||||

| Actual | ||||||||||||||

| Investor Class | $1,000 | $938.70 | $4.50 | 0.92% | ||||||||||

| I Class | $1,000 | $939.60 | $3.52 | 0.72% | ||||||||||

| R5 Class | $1,000 | $939.60 | $3.52 | 0.72% | ||||||||||

| Hypothetical | ||||||||||||||

| Investor Class | $1,000 | $1,020.57 | $4.69 | 0.92% | ||||||||||

| I Class | $1,000 | $1,021.58 | $3.67 | 0.72% | ||||||||||

| R5 Class | $1,000 | $1,021.58 | $3.67 | 0.72% | ||||||||||

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

9

| Schedule of Investments | ||

OCTOBER 31, 2022

| Shares/ Principal Amount | Value | |||||||

| COMMON STOCKS — 61.5% | ||||||||

| Aerospace and Defense — 0.9% | ||||||||

| Lockheed Martin Corp. | 14,643 | $ | 7,126,455 | |||||

| Air Freight and Logistics — 0.5% | ||||||||

| United Parcel Service, Inc., Class B | 25,298 | 4,244,245 | ||||||

| Auto Components — 0.4% | ||||||||

Aptiv PLC(1) | 40,600 | 3,697,442 | ||||||

| Automobiles — 0.9% | ||||||||

Tesla, Inc.(1) | 31,935 | 7,266,490 | ||||||

| Banks — 2.1% | ||||||||

| Bank of America Corp. | 51,623 | 1,860,493 | ||||||

| JPMorgan Chase & Co. | 62,630 | 7,883,865 | ||||||

| Regions Financial Corp. | 334,736 | 7,347,455 | ||||||

| 17,091,813 | ||||||||

| Beverages — 1.1% | ||||||||

| PepsiCo, Inc. | 52,519 | 9,536,400 | ||||||

| Biotechnology — 1.6% | ||||||||

| AbbVie, Inc. | 43,677 | 6,394,313 | ||||||

| Amgen, Inc. | 13,245 | 3,580,786 | ||||||

Vertex Pharmaceuticals, Inc.(1) | 9,439 | 2,944,968 | ||||||

| 12,920,067 | ||||||||

| Building Products — 1.0% | ||||||||

| Johnson Controls International PLC | 101,421 | 5,866,191 | ||||||

| Masco Corp. | 52,802 | 2,443,148 | ||||||

| 8,309,339 | ||||||||

| Capital Markets — 2.7% | ||||||||

| Ameriprise Financial, Inc. | 13,154 | 4,066,165 | ||||||

| BlackRock, Inc. | 7,524 | 4,859,827 | ||||||

| Intercontinental Exchange, Inc. | 26,961 | 2,576,663 | ||||||

| Morgan Stanley | 100,014 | 8,218,150 | ||||||

| S&P Global, Inc. | 9,201 | 2,955,821 | ||||||

| 22,676,626 | ||||||||

| Chemicals — 1.4% | ||||||||

| Air Products and Chemicals, Inc. | 11,206 | 2,805,982 | ||||||

| Ecolab, Inc. | 15,310 | 2,404,742 | ||||||

| Linde PLC | 22,975 | 6,831,616 | ||||||

| 12,042,340 | ||||||||

| Communications Equipment — 1.2% | ||||||||

| Cisco Systems, Inc. | 215,188 | 9,775,991 | ||||||

| Consumer Finance — 0.3% | ||||||||

| American Express Co. | 18,652 | 2,768,889 | ||||||

| Containers and Packaging — 0.3% | ||||||||

| Ball Corp. | 52,283 | 2,582,257 | ||||||

| Diversified Telecommunication Services — 0.6% | ||||||||

| Verizon Communications, Inc. | 138,953 | 5,192,674 | ||||||

| Electric Utilities — 1.3% | ||||||||

| NextEra Energy, Inc. | 134,363 | 10,413,132 | ||||||

10

| Shares/ Principal Amount | Value | |||||||

| Electrical Equipment — 0.8% | ||||||||

| Eaton Corp. PLC | 26,279 | $ | 3,943,689 | |||||

Generac Holdings, Inc.(1) | 6,580 | 762,688 | ||||||

| Rockwell Automation, Inc. | 8,276 | 2,112,863 | ||||||

| 6,819,240 | ||||||||

| Electronic Equipment, Instruments and Components — 1.4% | ||||||||

| CDW Corp. | 28,767 | 4,971,225 | ||||||

| Cognex Corp. | 22,152 | 1,024,087 | ||||||

Keysight Technologies, Inc.(1) | 30,511 | 5,313,491 | ||||||

| 11,308,803 | ||||||||

| Energy Equipment and Services — 1.5% | ||||||||

| Schlumberger NV | 241,127 | 12,545,838 | ||||||

| Entertainment — 0.9% | ||||||||

| Electronic Arts, Inc. | 17,904 | 2,255,188 | ||||||

Liberty Media Corp.-Liberty Formula One, Class C(1) | 20,109 | 1,160,892 | ||||||

Walt Disney Co.(1) | 40,637 | 4,329,466 | ||||||

| 7,745,546 | ||||||||

| Equity Real Estate Investment Trusts (REITs) — 1.3% | ||||||||

| Prologis, Inc. | 96,642 | 10,703,101 | ||||||

| Food and Staples Retailing — 1.7% | ||||||||

| Costco Wholesale Corp. | 7,134 | 3,577,701 | ||||||

| Kroger Co. | 75,667 | 3,578,293 | ||||||

| Sysco Corp. | 76,915 | 6,657,762 | ||||||

| 13,813,756 | ||||||||

| Food Products — 0.5% | ||||||||

| Mondelez International, Inc., Class A | 68,629 | 4,219,311 | ||||||

Vital Farms, Inc.(1) | 25,270 | 334,575 | ||||||

| 4,553,886 | ||||||||

| Health Care Equipment and Supplies — 0.7% | ||||||||

Edwards Lifesciences Corp.(1) | 54,222 | 3,927,299 | ||||||

| Medtronic PLC | 9,368 | 818,201 | ||||||

| ResMed, Inc. | 5,108 | 1,142,609 | ||||||

| 5,888,109 | ||||||||

| Health Care Providers and Services — 3.6% | ||||||||

| Cigna Corp. | 29,026 | 9,377,140 | ||||||

| CVS Health Corp. | 63,799 | 6,041,765 | ||||||

| Humana, Inc. | 5,779 | 3,225,144 | ||||||

| UnitedHealth Group, Inc. | 20,720 | 11,502,708 | ||||||

| 30,146,757 | ||||||||

| Hotels, Restaurants and Leisure — 0.6% | ||||||||

Booking Holdings, Inc.(1) | 1,352 | 2,527,537 | ||||||

Chipotle Mexican Grill, Inc.(1) | 855 | 1,281,072 | ||||||

Expedia Group, Inc.(1) | 12,801 | 1,196,510 | ||||||

| 5,005,119 | ||||||||

| Household Products — 1.0% | ||||||||

| Colgate-Palmolive Co. | 32,152 | 2,374,104 | ||||||

| Procter & Gamble Co. | 44,159 | 5,946,892 | ||||||

| 8,320,996 | ||||||||

| Industrial Conglomerates — 0.6% | ||||||||

| Honeywell International, Inc. | 25,045 | 5,109,681 | ||||||

11

| Shares/ Principal Amount | Value | |||||||

| Insurance — 1.5% | ||||||||

| Marsh & McLennan Cos., Inc. | 26,755 | $ | 4,320,665 | |||||

| Prudential Financial, Inc. | 39,577 | 4,163,105 | ||||||

| Travelers Cos., Inc. | 21,676 | 3,998,355 | ||||||

| 12,482,125 | ||||||||

| Interactive Media and Services — 2.6% | ||||||||

Alphabet, Inc., Class A(1) | 220,720 | 20,860,247 | ||||||

Alphabet, Inc., Class C(1) | 12,978 | 1,228,498 | ||||||

| 22,088,745 | ||||||||

| Internet and Direct Marketing Retail — 1.6% | ||||||||

Amazon.com, Inc.(1) | 132,115 | 13,533,861 | ||||||

| IT Services — 2.7% | ||||||||

| Accenture PLC, Class A | 21,547 | 6,117,193 | ||||||

| Mastercard, Inc., Class A | 19,230 | 6,310,902 | ||||||

| Visa, Inc., Class A | 46,821 | 9,699,438 | ||||||

| 22,127,533 | ||||||||

| Life Sciences Tools and Services — 1.3% | ||||||||

| Agilent Technologies, Inc. | 41,066 | 5,681,481 | ||||||

| Thermo Fisher Scientific, Inc. | 10,605 | 5,450,652 | ||||||

| 11,132,133 | ||||||||

| Machinery — 1.4% | ||||||||

| Cummins, Inc. | 19,361 | 4,733,958 | ||||||

| Deere & Co. | 5,823 | 2,304,860 | ||||||

| Parker-Hannifin Corp. | 6,524 | 1,896,005 | ||||||

| Xylem, Inc. | 26,205 | 2,684,178 | ||||||

| 11,619,001 | ||||||||

| Multiline Retail — 0.3% | ||||||||

| Target Corp. | 13,523 | 2,221,153 | ||||||

| Oil, Gas and Consumable Fuels — 1.7% | ||||||||

| ConocoPhillips | 112,132 | 14,138,724 | ||||||

| Personal Products — 0.1% | ||||||||

| Estee Lauder Cos., Inc., Class A | 5,776 | 1,158,030 | ||||||

| Pharmaceuticals — 2.8% | ||||||||

| Bristol-Myers Squibb Co. | 103,231 | 7,997,306 | ||||||

| Eli Lilly & Co. | 6,130 | 2,219,612 | ||||||

| Merck & Co., Inc. | 51,746 | 5,236,695 | ||||||

| Novo Nordisk A/S, B Shares | 30,871 | 3,356,642 | ||||||

| Zoetis, Inc. | 27,468 | 4,141,625 | ||||||

| 22,951,880 | ||||||||

| Road and Rail — 0.8% | ||||||||

| Norfolk Southern Corp. | 13,273 | 3,027,173 | ||||||

Uber Technologies, Inc.(1) | 35,454 | 942,013 | ||||||

| Union Pacific Corp. | 12,574 | 2,478,838 | ||||||

| 6,448,024 | ||||||||

| Semiconductors and Semiconductor Equipment — 2.8% | ||||||||

Advanced Micro Devices, Inc.(1) | 44,076 | 2,647,205 | ||||||

| Analog Devices, Inc. | 37,194 | 5,304,608 | ||||||

| Applied Materials, Inc. | 52,342 | 4,621,275 | ||||||

| ASML Holding NV | 6,280 | 2,945,864 | ||||||

GLOBALFOUNDRIES, Inc.(1) | 22,030 | 1,249,101 | ||||||

| NVIDIA Corp. | 48,772 | 6,582,757 | ||||||

| 23,350,810 | ||||||||

12

| Shares/ Principal Amount | Value | |||||||

| Software — 5.5% | ||||||||

Adobe, Inc.(1) | 3,782 | $ | 1,204,567 | |||||

Cadence Design Systems, Inc.(1) | 14,549 | 2,202,573 | ||||||

| Microsoft Corp. | 158,838 | 36,871,065 | ||||||

Salesforce, Inc.(1) | 21,021 | 3,417,804 | ||||||

ServiceNow, Inc.(1) | 3,182 | 1,338,795 | ||||||

Workday, Inc., Class A(1) | 6,793 | 1,058,485 | ||||||

| 46,093,289 | ||||||||

| Specialty Retail — 1.9% | ||||||||

| Home Depot, Inc. | 30,425 | 9,009,755 | ||||||

| TJX Cos., Inc. | 71,842 | 5,179,808 | ||||||

| Tractor Supply Co. | 8,742 | 1,921,230 | ||||||

| 16,110,793 | ||||||||

| Technology Hardware, Storage and Peripherals — 3.0% | ||||||||

| Apple, Inc. | 164,653 | 25,247,891 | ||||||

| Textiles, Apparel and Luxury Goods — 0.6% | ||||||||

Deckers Outdoor Corp.(1) | 6,235 | 2,181,813 | ||||||

| NIKE, Inc., Class B | 29,094 | 2,696,432 | ||||||

| 4,878,245 | ||||||||

TOTAL COMMON STOCKS (Cost $469,103,524) | 513,187,229 | |||||||

| U.S. TREASURY SECURITIES — 11.4% | ||||||||

| U.S. Treasury Bonds, 5.00%, 5/15/37 | $ | 200,000 | 217,480 | |||||

| U.S. Treasury Bonds, 4.625%, 2/15/40 | 1,300,000 | 1,352,508 | ||||||

| U.S. Treasury Bonds, 1.375%, 11/15/40 | 200,000 | 123,641 | ||||||

| U.S. Treasury Bonds, 2.25%, 5/15/41 | 500,000 | 360,771 | ||||||

| U.S. Treasury Bonds, 4.375%, 5/15/41 | 1,400,000 | 1,403,254 | ||||||

| U.S. Treasury Bonds, 3.75%, 8/15/41 | 300,000 | 275,232 | ||||||

| U.S. Treasury Bonds, 2.00%, 11/15/41 | 1,800,000 | 1,227,937 | ||||||

| U.S. Treasury Bonds, 3.125%, 11/15/41 | 1,000,000 | 830,391 | ||||||

| U.S. Treasury Bonds, 3.00%, 5/15/42 | 1,400,000 | 1,135,477 | ||||||

| U.S. Treasury Bonds, 3.25%, 5/15/42 | 3,200,000 | 2,706,500 | ||||||

| U.S. Treasury Bonds, 3.375%, 8/15/42 | 3,500,000 | 3,020,391 | ||||||

| U.S. Treasury Bonds, 2.75%, 11/15/42 | 1,700,000 | 1,310,992 | ||||||

| U.S. Treasury Bonds, 2.875%, 5/15/43 | 1,300,000 | 1,019,992 | ||||||

| U.S. Treasury Bonds, 3.75%, 11/15/43 | 600,000 | 542,156 | ||||||

| U.S. Treasury Bonds, 3.125%, 8/15/44 | 500,000 | 405,195 | ||||||

| U.S. Treasury Bonds, 3.00%, 11/15/44 | 600,000 | 474,973 | ||||||

| U.S. Treasury Bonds, 2.50%, 2/15/45 | 1,500,000 | 1,080,352 | ||||||

| U.S. Treasury Bonds, 3.00%, 2/15/48 | 300,000 | 237,012 | ||||||

| U.S. Treasury Bonds, 3.375%, 11/15/48 | 1,460,000 | 1,247,986 | ||||||

| U.S. Treasury Bonds, 2.875%, 5/15/49 | 800,000 | 623,453 | ||||||

| U.S. Treasury Bonds, 2.25%, 8/15/49 | 1,500,000 | 1,020,498 | ||||||

| U.S. Treasury Bonds, 2.375%, 11/15/49 | 2,400,000 | 1,678,969 | ||||||

| U.S. Treasury Bonds, 2.375%, 5/15/51 | 2,400,000 | 1,662,891 | ||||||

| U.S. Treasury Bonds, 2.00%, 8/15/51 | 1,500,000 | 945,527 | ||||||

| U.S. Treasury Bonds, 1.875%, 11/15/51 | 63,000 | 38,402 | ||||||

| U.S. Treasury Bonds, 2.25%, 2/15/52 | 300,000 | 201,281 | ||||||

| U.S. Treasury Bonds, 2.875%, 5/15/52 | 2,400,000 | 1,863,375 | ||||||

U.S. Treasury Notes, 1.50%, 2/15/25(2) | 1,500,000 | 1,402,793 | ||||||

| U.S. Treasury Notes, 1.75%, 3/15/25 | 7,000,000 | 6,576,992 | ||||||

| U.S. Treasury Notes, 2.875%, 6/15/25 | 2,500,000 | 2,403,516 | ||||||

13

| Shares/ Principal Amount | Value | |||||||

| U.S. Treasury Notes, 2.75%, 6/30/25 | $ | 2,400,000 | $ | 2,299,687 | ||||

| U.S. Treasury Notes, 3.00%, 7/15/25 | 4,500,000 | 4,334,678 | ||||||

| U.S. Treasury Notes, 0.25%, 8/31/25 | 4,000,000 | 3,558,594 | ||||||

| U.S. Treasury Notes, 3.50%, 9/15/25 | 4,200,000 | 4,094,672 | ||||||

| U.S. Treasury Notes, 4.25%, 10/15/25 | 700,000 | 696,336 | ||||||

| U.S. Treasury Notes, 2.625%, 12/31/25 | 200,000 | 189,477 | ||||||

| U.S. Treasury Notes, 1.625%, 10/31/26 | 100,000 | 90,078 | ||||||

| U.S. Treasury Notes, 1.75%, 12/31/26 | 700,000 | 632,270 | ||||||

| U.S. Treasury Notes, 1.875%, 2/28/27 | 3,000,000 | 2,714,648 | ||||||

| U.S. Treasury Notes, 2.75%, 4/30/27 | 1,000,000 | 937,266 | ||||||

| U.S. Treasury Notes, 2.625%, 5/31/27 | 11,000,000 | 10,254,922 | ||||||

| U.S. Treasury Notes, 4.125%, 9/30/27 | 2,400,000 | 2,387,156 | ||||||

| U.S. Treasury Notes, 0.625%, 12/31/27 | 3,500,000 | 2,915,801 | ||||||

| U.S. Treasury Notes, 1.125%, 2/29/28 | 1,000,000 | 851,328 | ||||||

| U.S. Treasury Notes, 1.25%, 3/31/28 | 1,700,000 | 1,453,633 | ||||||

| U.S. Treasury Notes, 1.25%, 4/30/28 | 3,600,000 | 3,071,672 | ||||||

| U.S. Treasury Notes, 1.875%, 2/28/29 | 1,500,000 | 1,305,527 | ||||||

| U.S. Treasury Notes, 2.875%, 4/30/29 | 2,500,000 | 2,309,277 | ||||||

| U.S. Treasury Notes, 3.25%, 6/30/29 | 1,300,000 | 1,227,789 | ||||||

| U.S. Treasury Notes, 2.625%, 7/31/29 | 1,000,000 | 908,066 | ||||||

| U.S. Treasury Notes, 3.125%, 8/31/29 | 2,700,000 | 2,530,617 | ||||||

| U.S. Treasury Notes, 3.875%, 9/30/29 | 2,500,000 | 2,455,859 | ||||||

| U.S. Treasury Notes, 2.875%, 5/15/32 | 6,600,000 | 5,981,250 | ||||||

| U.S. Treasury Notes, 2.75%, 8/15/32 | 500,000 | 447,500 | ||||||

TOTAL U.S. TREASURY SECURITIES (Cost $105,860,674) | 95,038,040 | |||||||

| CORPORATE BONDS — 9.6% | ||||||||

| Aerospace and Defense — 0.1% | ||||||||

| Lockheed Martin Corp., 5.25%, 1/15/33 | 191,000 | 191,727 | ||||||

| Raytheon Technologies Corp., 4.125%, 11/16/28 | 570,000 | 531,071 | ||||||

| Raytheon Technologies Corp., 3.125%, 7/1/50 | 200,000 | 131,756 | ||||||

| 854,554 | ||||||||

Air Freight and Logistics† | ||||||||

| GXO Logistics, Inc., 2.65%, 7/15/31 | 335,000 | 239,501 | ||||||

| Airlines — 0.1% | ||||||||

British Airways 2021-1 Class A Pass Through Trust, 2.90%, 9/15/36(3) | 95,301 | 76,193 | ||||||

Delta Air Lines, Inc. / SkyMiles IP Ltd., 4.75%, 10/20/28(3) | 318,000 | 296,043 | ||||||

Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd., 6.50%, 6/20/27(3) | 621,907 | 615,632 | ||||||

| 987,868 | ||||||||

Auto Components† | ||||||||

| Aptiv PLC, 3.10%, 12/1/51 | 290,000 | 162,223 | ||||||

| Automobiles — 0.2% | ||||||||

| General Motors Co., 5.15%, 4/1/38 | 191,000 | 155,737 | ||||||

| General Motors Financial Co., Inc., 2.75%, 6/20/25 | 780,000 | 718,150 | ||||||

| General Motors Financial Co., Inc., 2.40%, 10/15/28 | 315,000 | 248,510 | ||||||

| Toyota Motor Credit Corp., 1.90%, 4/6/28 | 420,000 | 355,666 | ||||||

| 1,478,063 | ||||||||

| Banks — 1.4% | ||||||||

| Banco Santander SA, VRN, 1.72%, 9/14/27 | 400,000 | 326,711 | ||||||

| Banco Santander SA, VRN, 4.18%, 3/24/28 | 200,000 | 176,440 | ||||||

14

| Shares/ Principal Amount | Value | |||||||

| Bank of America Corp., VRN, 3.38%, 4/2/26 | $ | 400,000 | $ | 376,001 | ||||

| Bank of America Corp., VRN, 2.55%, 2/4/28 | 51,000 | 44,162 | ||||||

| Bank of America Corp., VRN, 3.42%, 12/20/28 | 1,512,000 | 1,335,803 | ||||||

| Bank of America Corp., VRN, 2.88%, 10/22/30 | 701,000 | 571,530 | ||||||

| Bank of America Corp., VRN, 4.57%, 4/27/33 | 200,000 | 177,518 | ||||||

| Bank of America Corp., VRN, 5.02%, 7/22/33 | 248,000 | 227,723 | ||||||

| Bank of America Corp., VRN, 2.48%, 9/21/36 | 345,000 | 246,923 | ||||||

Bank of Ireland Group PLC, VRN, 2.03%, 9/30/27(3) | 129,000 | 105,009 | ||||||

| Citigroup, Inc., VRN, 0.78%, 10/30/24 | 89,000 | 84,168 | ||||||

| Citigroup, Inc., VRN, 3.07%, 2/24/28 | 481,000 | 424,422 | ||||||

| Citigroup, Inc., VRN, 3.67%, 7/24/28 | 100,000 | 89,774 | ||||||

| Citigroup, Inc., VRN, 3.52%, 10/27/28 | 514,000 | 456,202 | ||||||

| Citigroup, Inc., VRN, 3.79%, 3/17/33 | 110,000 | 91,256 | ||||||

Commonwealth Bank of Australia, VRN, 3.61%, 9/12/34(3) | 440,000 | 353,985 | ||||||

| FNB Corp., 2.20%, 2/24/23 | 460,000 | 454,897 | ||||||

| HSBC Holdings PLC, VRN, 0.73%, 8/17/24 | 320,000 | 303,492 | ||||||

HSBC Holdings PLC, VRN, 7.39%, 11/3/28(4) | 315,000 | 315,486 | ||||||

| HSBC Holdings PLC, VRN, 2.80%, 5/24/32 | 280,000 | 200,886 | ||||||

| HSBC Holdings PLC, VRN, 5.40%, 8/11/33 | 200,000 | 173,681 | ||||||

| JPMorgan Chase & Co., VRN, 1.58%, 4/22/27 | 315,000 | 271,106 | ||||||

| JPMorgan Chase & Co., VRN, 2.95%, 2/24/28 | 770,000 | 678,104 | ||||||

| JPMorgan Chase & Co., VRN, 2.07%, 6/1/29 | 642,000 | 519,410 | ||||||

| JPMorgan Chase & Co., VRN, 2.52%, 4/22/31 | 1,178,000 | 930,231 | ||||||

National Australia Bank Ltd., 2.33%, 8/21/30(3) | 278,000 | 201,968 | ||||||

| Royal Bank of Canada, 6.00%, 11/1/27 | 465,000 | 467,983 | ||||||

| Toronto-Dominion Bank, 2.00%, 9/10/31 | 279,000 | 207,093 | ||||||

| Toronto-Dominion Bank, 2.45%, 1/12/32 | 290,000 | 220,333 | ||||||

| Toronto-Dominion Bank, 4.46%, 6/8/32 | 163,000 | 146,658 | ||||||

| Truist Financial Corp., VRN, 4.12%, 6/6/28 | 148,000 | 137,000 | ||||||

| US Bancorp, VRN, 5.85%, 10/21/33 | 305,000 | 304,240 | ||||||

| Wells Fargo & Co., VRN, 4.54%, 8/15/26 | 220,000 | 211,768 | ||||||

| Wells Fargo & Co., VRN, 3.35%, 3/2/33 | 234,000 | 188,860 | ||||||

| Wells Fargo & Co., VRN, 3.07%, 4/30/41 | 605,000 | 410,943 | ||||||

| Wells Fargo & Co., VRN, 4.61%, 4/25/53 | 171,000 | 136,648 | ||||||

| 11,568,414 | ||||||||

| Beverages — 0.2% | ||||||||

| Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc., 4.90%, 2/1/46 | 500,000 | 429,479 | ||||||

| Anheuser-Busch InBev Worldwide, Inc., 4.75%, 1/23/29 | 630,000 | 613,329 | ||||||

| Keurig Dr Pepper, Inc., 4.05%, 4/15/32 | 175,000 | 153,417 | ||||||

| PepsiCo, Inc., 3.90%, 7/18/32 | 131,000 | 121,444 | ||||||

| 1,317,669 | ||||||||

| Biotechnology — 0.3% | ||||||||

| AbbVie, Inc., 3.20%, 11/21/29 | 770,000 | 673,657 | ||||||

| AbbVie, Inc., 4.40%, 11/6/42 | 515,000 | 421,386 | ||||||

| Amgen, Inc., 4.05%, 8/18/29 | 820,000 | 757,630 | ||||||

CSL Finance PLC, 4.25%, 4/27/32(3) | 257,000 | 232,627 | ||||||

| 2,085,300 | ||||||||

Building Products† | ||||||||

| Fortune Brands Home & Security, Inc., 4.50%, 3/25/52 | 180,000 | 119,092 | ||||||

| Capital Markets — 1.0% | ||||||||

| Bank of New York Mellon Corp., VRN, 5.83%, 10/25/33 | 330,000 | 330,744 | ||||||

15

| Shares/ Principal Amount | Value | |||||||

| CME Group, Inc., 2.65%, 3/15/32 | $ | 435,000 | $ | 350,401 | ||||

| Deutsche Bank AG, 5.37%, 9/9/27 | 475,000 | 450,827 | ||||||

| Deutsche Bank AG, VRN, 4.30%, 5/24/28 | 200,000 | 183,069 | ||||||

FS KKR Capital Corp., 4.25%, 2/14/25(3) | 121,000 | 112,335 | ||||||

| Goldman Sachs Group, Inc., VRN, 1.76%, 1/24/25 | 580,000 | 548,290 | ||||||

| Goldman Sachs Group, Inc., VRN, 1.95%, 10/21/27 | 714,000 | 607,108 | ||||||

| Goldman Sachs Group, Inc., VRN, 2.64%, 2/24/28 | 710,000 | 614,180 | ||||||

| Goldman Sachs Group, Inc., VRN, 3.81%, 4/23/29 | 94,000 | 83,482 | ||||||

| Goldman Sachs Group, Inc., VRN, 3.10%, 2/24/33 | 200,000 | 156,844 | ||||||

| Golub Capital BDC, Inc., 2.50%, 8/24/26 | 168,000 | 139,956 | ||||||

| Moody's Corp., 2.55%, 8/18/60 | 275,000 | 141,338 | ||||||

| Morgan Stanley, VRN, 0.53%, 1/25/24 | 1,163,000 | 1,145,661 | ||||||

| Morgan Stanley, VRN, 1.16%, 10/21/25 | 699,000 | 633,803 | ||||||

| Morgan Stanley, VRN, 2.63%, 2/18/26 | 999,000 | 926,444 | ||||||

| Morgan Stanley, VRN, 2.70%, 1/22/31 | 385,000 | 308,697 | ||||||

| Morgan Stanley, VRN, 2.51%, 10/20/32 | 285,000 | 214,857 | ||||||

| Morgan Stanley, VRN, 6.34%, 10/18/33 | 355,000 | 360,424 | ||||||

| Morgan Stanley, VRN, 2.48%, 9/16/36 | 156,000 | 110,619 | ||||||

| Owl Rock Capital Corp., 3.40%, 7/15/26 | 72,000 | 61,408 | ||||||

| OWL Rock Core Income Corp., 3.125%, 9/23/26 | 183,000 | 153,078 | ||||||

UBS Group AG, VRN, 1.49%, 8/10/27(3) | 634,000 | 522,873 | ||||||

| 8,156,438 | ||||||||

| Chemicals — 0.1% | ||||||||

| CF Industries, Inc., 5.15%, 3/15/34 | 330,000 | 298,197 | ||||||

| CF Industries, Inc., 4.95%, 6/1/43 | 240,000 | 192,082 | ||||||

| 490,279 | ||||||||

| Commercial Services and Supplies — 0.1% | ||||||||

| Republic Services, Inc., 2.30%, 3/1/30 | 358,000 | 293,074 | ||||||

| Waste Connections, Inc., 3.20%, 6/1/32 | 370,000 | 308,782 | ||||||

| Waste Management, Inc., 2.50%, 11/15/50 | 150,000 | 87,502 | ||||||

| 689,358 | ||||||||

Construction and Engineering† | ||||||||

| Quanta Services, Inc., 2.35%, 1/15/32 | 465,000 | 336,176 | ||||||

Construction Materials† | ||||||||

| Eagle Materials, Inc., 2.50%, 7/1/31 | 310,000 | 227,919 | ||||||

| Martin Marietta Materials, Inc., 2.40%, 7/15/31 | 195,000 | 149,628 | ||||||

| 377,547 | ||||||||

Consumer Finance† | ||||||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust, 1.65%, 10/29/24 | 162,000 | 147,112 | ||||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust, 3.00%, 10/29/28 | 172,000 | 139,077 | ||||||

Avolon Holdings Funding Ltd., 4.375%, 5/1/26(3) | 31,000 | 27,276 | ||||||

| 313,465 | ||||||||

| Containers and Packaging — 0.1% | ||||||||

| Sonoco Products Co., 2.25%, 2/1/27 | 447,000 | 392,138 | ||||||

| WRKCo, Inc., 3.00%, 9/15/24 | 201,000 | 190,969 | ||||||

| 583,107 | ||||||||

Diversified Consumer Services† | ||||||||

| Novant Health, Inc., 3.17%, 11/1/51 | 245,000 | 156,634 | ||||||

| Pepperdine University, 3.30%, 12/1/59 | 355,000 | 214,051 | ||||||

| 370,685 | ||||||||

16

| Shares/ Principal Amount | Value | |||||||

| Diversified Financial Services — 0.3% | ||||||||

Antares Holdings LP, 2.75%, 1/15/27(3) | $ | 256,000 | $ | 202,475 | ||||

| Block Financial LLC, 3.875%, 8/15/30 | 456,000 | 383,509 | ||||||

| Capital One Financial Corp., VRN, 4.99%, 7/24/26 | 146,000 | 140,366 | ||||||

Corebridge Financial, Inc., VRN, 6.875%, 12/15/52(3) | 300,000 | 271,018 | ||||||

| GE Capital International Funding Co. Unlimited Co., 4.42%, 11/15/35 | 600,000 | 530,169 | ||||||

| PG&E Energy Recovery Funding LLC, 2.82%, 7/15/48 | 775,000 | 511,525 | ||||||

UBS Group AG, VRN, 4.75%, 5/12/28(3) | 75,000 | 68,784 | ||||||

| 2,107,846 | ||||||||

| Diversified Telecommunication Services — 0.3% | ||||||||

| AT&T, Inc., 4.35%, 3/1/29 | 321,000 | 298,630 | ||||||

| AT&T, Inc., 4.50%, 5/15/35 | 357,000 | 308,153 | ||||||

| AT&T, Inc., 4.90%, 8/15/37 | 386,000 | 338,341 | ||||||

| AT&T, Inc., 4.55%, 3/9/49 | 444,000 | 346,720 | ||||||

| AT&T, Inc., 3.55%, 9/15/55 | 180,000 | 114,937 | ||||||

Ooredoo International Finance Ltd., 2.625%, 4/8/31(3) | 550,000 | 454,324 | ||||||

| Telefonica Emisiones SA, 4.90%, 3/6/48 | 285,000 | 203,748 | ||||||

| Verizon Communications, Inc., 4.33%, 9/21/28 | 333,000 | 312,503 | ||||||

| Verizon Communications, Inc., 4.27%, 1/15/36 | 545,000 | 458,831 | ||||||

| 2,836,187 | ||||||||

| Electric Utilities — 0.7% | ||||||||

| AEP Texas, Inc., 2.10%, 7/1/30 | 370,000 | 285,314 | ||||||

| Baltimore Gas and Electric Co., 2.25%, 6/15/31 | 237,000 | 187,133 | ||||||

| Baltimore Gas and Electric Co., 4.55%, 6/1/52 | 158,000 | 129,617 | ||||||

| CenterPoint Energy Houston Electric LLC, 4.45%, 10/1/32 | 370,000 | 347,189 | ||||||

| Commonwealth Edison Co., 3.20%, 11/15/49 | 355,000 | 236,002 | ||||||

| Duke Energy Carolinas LLC, 2.55%, 4/15/31 | 154,000 | 124,842 | ||||||

| Duke Energy Corp., 2.55%, 6/15/31 | 180,000 | 141,226 | ||||||

| Duke Energy Corp., 5.00%, 8/15/52 | 230,000 | 190,752 | ||||||

| Duke Energy Florida LLC, 1.75%, 6/15/30 | 370,000 | 285,380 | ||||||

| Duke Energy Florida LLC, 3.85%, 11/15/42 | 220,000 | 166,166 | ||||||

| Duke Energy Progress LLC, 2.00%, 8/15/31 | 440,000 | 336,417 | ||||||

| Duke Energy Progress LLC, 4.15%, 12/1/44 | 335,000 | 261,283 | ||||||

| Entergy Arkansas LLC, 2.65%, 6/15/51 | 180,000 | 102,366 | ||||||

| Exelon Corp., 4.45%, 4/15/46 | 150,000 | 117,921 | ||||||

Exelon Corp., 4.10%, 3/15/52(3) | 80,000 | 58,996 | ||||||

| Florida Power & Light Co., 2.45%, 2/3/32 | 231,000 | 186,163 | ||||||

| Florida Power & Light Co., 4.125%, 2/1/42 | 169,000 | 137,474 | ||||||

| MidAmerican Energy Co., 4.40%, 10/15/44 | 290,000 | 238,303 | ||||||

| NextEra Energy Capital Holdings, Inc., 5.00%, 7/15/32 | 345,000 | 328,172 | ||||||

| Northern States Power Co., 3.20%, 4/1/52 | 240,000 | 159,695 | ||||||

| Pacific Gas and Electric Co., 4.20%, 6/1/41 | 155,000 | 109,301 | ||||||

| PacifiCorp, 3.30%, 3/15/51 | 310,000 | 204,576 | ||||||

| PECO Energy Co., 4.375%, 8/15/52 | 330,000 | 268,190 | ||||||

| Public Service Co. of Colorado, 1.875%, 6/15/31 | 312,000 | 241,054 | ||||||

| Public Service Electric and Gas Co., 3.10%, 3/15/32 | 283,000 | 237,909 | ||||||

| Southern Co. Gas Capital Corp., 1.75%, 1/15/31 | 370,000 | 272,201 | ||||||

| Union Electric Co., 3.90%, 4/1/52 | 238,000 | 179,511 | ||||||

| Xcel Energy, Inc., 3.40%, 6/1/30 | 330,000 | 284,026 | ||||||

| Xcel Energy, Inc., 4.60%, 6/1/32 | 136,000 | 125,413 | ||||||

| 5,942,592 | ||||||||

17

| Shares/ Principal Amount | Value | |||||||

Energy Equipment and Services† | ||||||||

| Schlumberger Investment SA, 2.65%, 6/26/30 | $ | 340,000 | $ | 284,373 | ||||

| Entertainment — 0.1% | ||||||||

| Netflix, Inc., 4.875%, 4/15/28 | 323,000 | 307,021 | ||||||

Warnermedia Holdings, Inc., 3.76%, 3/15/27(3) | 248,000 | 220,762 | ||||||

Warnermedia Holdings, Inc., 5.05%, 3/15/42(3) | 158,000 | 115,856 | ||||||

Warnermedia Holdings, Inc., 5.14%, 3/15/52(3) | 172,000 | 120,338 | ||||||

| 763,977 | ||||||||

| Equity Real Estate Investment Trusts (REITs) — 0.3% | ||||||||

| Alexandria Real Estate Equities, Inc., 4.50%, 7/30/29 | 40,000 | 36,591 | ||||||

| American Tower Corp., 3.95%, 3/15/29 | 355,000 | 314,515 | ||||||

| Broadstone Net Lease LLC, 2.60%, 9/15/31 | 175,000 | 126,509 | ||||||

| Corporate Office Properties LP, 2.00%, 1/15/29 | 206,000 | 153,909 | ||||||

| Crown Castle, Inc., 3.65%, 9/1/27 | 256,000 | 231,701 | ||||||

| EPR Properties, 4.75%, 12/15/26 | 191,000 | 164,642 | ||||||

| EPR Properties, 4.95%, 4/15/28 | 241,000 | 198,087 | ||||||

| GLP Capital LP / GLP Financing II, Inc., 5.375%, 4/15/26 | 420,000 | 401,440 | ||||||

| National Retail Properties, Inc., 4.80%, 10/15/48 | 270,000 | 212,905 | ||||||

| Phillips Edison Grocery Center Operating Partnership I LP, 2.625%, 11/15/31 | 201,000 | 144,076 | ||||||

| Realty Income Corp., 5.625%, 10/13/32 | 278,000 | 271,943 | ||||||

SBA Tower Trust, 3.45%, 3/15/48(3) | 648,000 | 641,735 | ||||||

| 2,898,053 | ||||||||

| Food and Staples Retailing — 0.1% | ||||||||

| Sysco Corp., 5.95%, 4/1/30 | 464,000 | 474,531 | ||||||

| Food Products — 0.1% | ||||||||

JDE Peet's NV, 2.25%, 9/24/31(3) | 475,000 | 342,979 | ||||||

| Kraft Heinz Foods Co., 5.00%, 6/4/42 | 379,000 | 328,532 | ||||||

| Mondelez International, Inc., 2.75%, 4/13/30 | 208,000 | 173,227 | ||||||

| 844,738 | ||||||||

| Health Care Equipment and Supplies — 0.2% | ||||||||

| Baxter International, Inc., 1.92%, 2/1/27 | 510,000 | 438,742 | ||||||

| Baxter International, Inc., 2.54%, 2/1/32 | 720,000 | 549,523 | ||||||

| Becton Dickinson and Co., 4.30%, 8/22/32 | 150,000 | 135,872 | ||||||

| Zimmer Biomet Holdings, Inc., 1.45%, 11/22/24 | 900,000 | 830,427 | ||||||

| 1,954,564 | ||||||||

| Health Care Providers and Services — 0.6% | ||||||||

| Centene Corp., 2.45%, 7/15/28 | 560,000 | 461,446 | ||||||

| Centene Corp., 4.625%, 12/15/29 | 244,000 | 221,220 | ||||||

| Centene Corp., 3.375%, 2/15/30 | 399,000 | 332,068 | ||||||

| CVS Health Corp., 4.78%, 3/25/38 | 160,000 | 139,189 | ||||||

| CVS Health Corp., 5.05%, 3/25/48 | 220,000 | 187,285 | ||||||

| Duke University Health System, Inc., 3.92%, 6/1/47 | 160,000 | 121,378 | ||||||

| HCA, Inc., 2.375%, 7/15/31 | 235,000 | 175,447 | ||||||

| Humana, Inc., 2.15%, 2/3/32 | 1,144,000 | 861,644 | ||||||

| Kaiser Foundation Hospitals, 3.00%, 6/1/51 | 260,000 | 161,016 | ||||||

Roche Holdings, Inc., 2.61%, 12/13/51(3) | 440,000 | 275,041 | ||||||

| UnitedHealth Group, Inc., 5.35%, 2/15/33 | 780,000 | 783,113 | ||||||

| UnitedHealth Group, Inc., 5.875%, 2/15/53 | 250,000 | 255,497 | ||||||

Universal Health Services, Inc., 1.65%, 9/1/26(3) | 427,000 | 358,181 | ||||||

Universal Health Services, Inc., 2.65%, 10/15/30(3) | 330,000 | 247,224 | ||||||

| 4,579,749 | ||||||||

18

| Shares/ Principal Amount | Value | |||||||

Hotels, Restaurants and Leisure† | ||||||||

| Marriott International, Inc., 3.50%, 10/15/32 | $ | 212,000 | $ | 169,608 | ||||

| Household Durables — 0.1% | ||||||||

| D.R. Horton, Inc., 2.50%, 10/15/24 | 310,000 | 292,352 | ||||||

| Safehold Operating Partnership LP, 2.85%, 1/15/32 | 338,000 | 247,464 | ||||||

| 539,816 | ||||||||

| Household Products — 0.1% | ||||||||

| Clorox Co., 4.60%, 5/1/32 | 684,000 | 635,062 | ||||||

| Insurance — 0.1% | ||||||||

| American International Group, Inc., 6.25%, 5/1/36 | 305,000 | 308,204 | ||||||

Athene Global Funding, 1.99%, 8/19/28(3) | 326,000 | 256,857 | ||||||

Sammons Financial Group, Inc., 4.75%, 4/8/32(3) | 167,000 | 134,034 | ||||||

SBL Holdings, Inc., 5.125%, 11/13/26(3) | 254,000 | 217,538 | ||||||

| 916,633 | ||||||||

Interactive Media and Services† | ||||||||

Meta Platforms, Inc., 3.85%, 8/15/32(3) | 117,000 | 99,679 | ||||||

| Internet and Direct Marketing Retail — 0.1% | ||||||||

| Amazon.com, Inc., 3.60%, 4/13/32 | 530,000 | 475,091 | ||||||

IT Services† | ||||||||

| Fiserv, Inc., 2.65%, 6/1/30 | 345,000 | 279,511 | ||||||

| Life Sciences Tools and Services — 0.1% | ||||||||

| Danaher Corp., 2.80%, 12/10/51 | 320,000 | 199,617 | ||||||

| Illumina, Inc., 2.55%, 3/23/31 | 413,000 | 315,647 | ||||||

| 515,264 | ||||||||

| Machinery — 0.1% | ||||||||

| John Deere Capital Corp., 4.85%, 10/11/29 | 150,000 | 147,620 | ||||||

| John Deere Capital Corp., 4.35%, 9/15/32 | 460,000 | 432,445 | ||||||

| 580,065 | ||||||||

| Media — 0.2% | ||||||||

| Charter Communications Operating LLC / Charter Communications Operating Capital, 5.125%, 7/1/49 | 275,000 | 203,304 | ||||||

Comcast Corp., 5.50%, 11/15/32(4) | 155,000 | 154,442 | ||||||

| Comcast Corp., 5.65%, 6/15/35 | 127,000 | 124,924 | ||||||

| Comcast Corp., 6.50%, 11/15/35 | 205,000 | 215,830 | ||||||

| Comcast Corp., 3.75%, 4/1/40 | 440,000 | 339,478 | ||||||

| Comcast Corp., 2.94%, 11/1/56 | 285,000 | 165,200 | ||||||

| Paramount Global, 4.95%, 1/15/31 | 175,000 | 152,945 | ||||||

| Paramount Global, 4.375%, 3/15/43 | 145,000 | 97,843 | ||||||

| Time Warner Cable LLC, 4.50%, 9/15/42 | 440,000 | 301,174 | ||||||

| 1,755,140 | ||||||||

| Metals and Mining — 0.1% | ||||||||

Glencore Funding LLC, 2.625%, 9/23/31(3) | 440,000 | 330,412 | ||||||

| Nucor Corp., 3.125%, 4/1/32 | 207,000 | 167,953 | ||||||

South32 Treasury Ltd., 4.35%, 4/14/32(3) | 340,000 | 284,971 | ||||||

| 783,336 | ||||||||

| Multi-Utilities — 0.2% | ||||||||

| Ameren Corp., 3.50%, 1/15/31 | 430,000 | 365,458 | ||||||

| Ameren Illinois Co., 3.85%, 9/1/32 | 177,000 | 157,571 | ||||||

| CenterPoint Energy, Inc., 2.65%, 6/1/31 | 285,000 | 226,008 | ||||||

| Dominion Energy, Inc., 4.90%, 8/1/41 | 270,000 | 228,493 | ||||||

| Dominion Energy, Inc., 4.85%, 8/15/52 | 220,000 | 181,079 | ||||||

| Sempra Energy, 3.25%, 6/15/27 | 180,000 | 162,916 | ||||||

19

| Shares/ Principal Amount | Value | |||||||

| WEC Energy Group, Inc., 1.375%, 10/15/27 | $ | 490,000 | $ | 402,862 | ||||

| 1,724,387 | ||||||||

| Multiline Retail — 0.1% | ||||||||

| Target Corp., 4.50%, 9/15/32 | 403,000 | 380,493 | ||||||

| Target Corp., 3.90%, 11/15/47 | 30,000 | 23,312 | ||||||

| 403,805 | ||||||||

| Oil, Gas and Consumable Fuels — 0.8% | ||||||||

Aker BP ASA, 3.75%, 1/15/30(3) | 440,000 | 374,699 | ||||||

Aker BP ASA, 4.00%, 1/15/31(3) | 160,000 | 135,863 | ||||||

| BP Capital Markets America, Inc., 3.06%, 6/17/41 | 250,000 | 175,256 | ||||||

| Cenovus Energy, Inc., 2.65%, 1/15/32 | 280,000 | 216,234 | ||||||

Continental Resources, Inc., 2.27%, 11/15/26(3) | 310,000 | 264,241 | ||||||

| Diamondback Energy, Inc., 6.25%, 3/15/33 | 320,000 | 321,619 | ||||||

| Enbridge, Inc., 3.40%, 8/1/51 | 130,000 | 84,369 | ||||||

| Energy Transfer LP, 3.60%, 2/1/23 | 160,000 | 159,403 | ||||||

| Energy Transfer LP, 4.25%, 3/15/23 | 370,000 | 368,124 | ||||||

| Energy Transfer LP, 3.75%, 5/15/30 | 400,000 | 340,451 | ||||||

| Energy Transfer LP, 4.90%, 3/15/35 | 270,000 | 225,235 | ||||||

| Enterprise Products Operating LLC, 4.85%, 3/15/44 | 460,000 | 379,088 | ||||||

| Enterprise Products Operating LLC, 3.30%, 2/15/53 | 220,000 | 138,027 | ||||||

| Equinor ASA, 3.25%, 11/18/49 | 230,000 | 159,280 | ||||||

Galaxy Pipeline Assets Bidco Ltd., 2.94%, 9/30/40(3) | 869,877 | 655,203 | ||||||

| Kinder Morgan Energy Partners LP, 6.50%, 9/1/39 | 250,000 | 236,979 | ||||||

| MPLX LP, 2.65%, 8/15/30 | 300,000 | 236,506 | ||||||

| Petroleos Mexicanos, 3.50%, 1/30/23 | 300,000 | 297,856 | ||||||

| Petroleos Mexicanos, 6.625%, 6/15/35 | 50,000 | 34,807 | ||||||

SA Global Sukuk Ltd., 2.69%, 6/17/31(3) | 1,000,000 | 820,253 | ||||||

| Sabine Pass Liquefaction LLC, 5.625%, 3/1/25 | 520,000 | 518,116 | ||||||

| Shell International Finance BV, 2.375%, 11/7/29 | 320,000 | 270,063 | ||||||

| 6,411,672 | ||||||||

Paper and Forest Products† | ||||||||

Georgia-Pacific LLC, 2.10%, 4/30/27(3) | 370,000 | 325,343 | ||||||

Personal Products† | ||||||||

GSK Consumer Healthcare Capital US LLC, 4.00%, 3/24/52(3) | 275,000 | 197,652 | ||||||

| Pharmaceuticals — 0.2% | ||||||||

| Bristol-Myers Squibb Co., 2.95%, 3/15/32 | 427,000 | 361,649 | ||||||

| Bristol-Myers Squibb Co., 2.55%, 11/13/50 | 337,000 | 202,483 | ||||||

| Merck & Co., Inc., 1.70%, 6/10/27 | 330,000 | 287,747 | ||||||

| Utah Acquisition Sub, Inc., 3.95%, 6/15/26 | 840,000 | 765,719 | ||||||

| Viatris, Inc., 4.00%, 6/22/50 | 91,000 | 52,900 | ||||||

| 1,670,498 | ||||||||

Real Estate Management and Development† | ||||||||

| Essential Properties LP, 2.95%, 7/15/31 | 316,000 | 225,163 | ||||||

| Road and Rail — 0.2% | ||||||||

Ashtead Capital, Inc., 5.50%, 8/11/32(3) | 304,000 | 275,209 | ||||||

| Burlington Northern Santa Fe LLC, 4.15%, 4/1/45 | 300,000 | 239,976 | ||||||

| Burlington Northern Santa Fe LLC, 3.30%, 9/15/51 | 200,000 | 136,813 | ||||||

| CSX Corp., 4.10%, 11/15/32 | 270,000 | 243,303 | ||||||

DAE Funding LLC, 1.55%, 8/1/24(3) | 195,000 | 176,966 | ||||||

| Norfolk Southern Corp., 4.55%, 6/1/53 | 200,000 | 163,073 | ||||||

| Union Pacific Corp., 3.55%, 8/15/39 | 450,000 | 350,520 | ||||||

| 1,585,860 | ||||||||

20

| Shares/ Principal Amount | Value | |||||||

| Semiconductors and Semiconductor Equipment — 0.1% | ||||||||

Broadcom, Inc., 4.00%, 4/15/29(3) | $ | 273,000 | $ | 239,707 | ||||

Broadcom, Inc., 4.93%, 5/15/37(3) | 295,000 | 243,722 | ||||||

| Intel Corp., 4.90%, 8/5/52 | 220,000 | 181,773 | ||||||

| Intel Corp., 3.20%, 8/12/61 | 443,000 | 256,002 | ||||||

| Micron Technology, Inc., 6.75%, 11/1/29 | 200,000 | 200,316 | ||||||

| 1,121,520 | ||||||||

| Software — 0.1% | ||||||||

| Oracle Corp., 3.90%, 5/15/35 | 165,000 | 127,926 | ||||||

| Oracle Corp., 3.85%, 7/15/36 | 122,000 | 91,484 | ||||||

| Oracle Corp., 3.60%, 4/1/40 | 395,000 | 267,910 | ||||||

| 487,320 | ||||||||

| Specialty Retail — 0.3% | ||||||||

| Dick's Sporting Goods, Inc., 3.15%, 1/15/32 | 495,000 | 376,294 | ||||||

| Home Depot, Inc., 4.50%, 9/15/32 | 680,000 | 645,167 | ||||||

| Home Depot, Inc., 3.90%, 6/15/47 | 710,000 | 545,419 | ||||||

| Lowe's Cos., Inc., 2.625%, 4/1/31 | 690,000 | 553,069 | ||||||

| Lowe's Cos., Inc., 4.25%, 4/1/52 | 710,000 | 528,818 | ||||||

| O'Reilly Automotive, Inc., 4.70%, 6/15/32 | 253,000 | 236,830 | ||||||

| 2,885,597 | ||||||||

| Technology Hardware, Storage and Peripherals — 0.1% | ||||||||

| Apple, Inc., 3.25%, 8/8/29 | 645,000 | 586,770 | ||||||

| Dell International LLC / EMC Corp., 8.10%, 7/15/36 | 111,000 | 117,776 | ||||||

| 704,546 | ||||||||

Trading Companies and Distributors† | ||||||||

Aircastle Ltd., 5.25%, 8/11/25(3) | 221,000 | 206,859 | ||||||

| Water Utilities — 0.1% | ||||||||

| American Water Capital Corp., 4.45%, 6/1/32 | 480,000 | 442,921 | ||||||

| Essential Utilities, Inc., 2.70%, 4/15/30 | 380,000 | 309,095 | ||||||

| 752,016 | ||||||||

| Wireless Telecommunication Services — 0.2% | ||||||||

| T-Mobile USA, Inc., 4.75%, 2/1/28 | 844,000 | 800,112 | ||||||

| T-Mobile USA, Inc., 3.375%, 4/15/29 | 625,000 | 541,941 | ||||||

| T-Mobile USA, Inc., 4.375%, 4/15/40 | 280,000 | 228,576 | ||||||

| Vodafone Group PLC, VRN, 4.125%, 6/4/81 | 465,000 | 330,964 | ||||||

| 1,901,593 | ||||||||

TOTAL CORPORATE BONDS (Cost $95,143,632) | 80,169,385 | |||||||

| U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES — 8.7% | ||||||||

| Adjustable-Rate U.S. Government Agency Mortgage-Backed Securities — 0.1% | ||||||||

| FHLMC, VRN, 3.04%, (1-year H15T1Y plus 2.25%), 9/1/35 | 61,092 | 61,938 | ||||||

| FHLMC, VRN, 3.25%, (12-month LIBOR plus 1.87%), 7/1/36 | 16,075 | 16,195 | ||||||

| FHLMC, VRN, 4.08%, (1-year H15T1Y plus 2.14%), 10/1/36 | 60,379 | 61,504 | ||||||

| FHLMC, VRN, 3.06%, (1-year H15T1Y plus 2.26%), 4/1/37 | 66,531 | 67,320 | ||||||

| FHLMC, VRN, 3.67%, (12-month LIBOR plus 1.87%), 7/1/41 | 40,639 | 41,110 | ||||||

| FHLMC, VRN, 2.95%, (12-month LIBOR plus 1.63%), 1/1/44 | 67,082 | 66,497 | ||||||

| FHLMC, VRN, 3.54%, (12-month LIBOR plus 1.60%), 6/1/45 | 32,719 | 32,721 | ||||||

| FHLMC, VRN, 3.77%, (12-month LIBOR plus 1.63%), 8/1/46 | 89,583 | 89,551 | ||||||

| FHLMC, VRN, 3.11%, (12-month LIBOR plus 1.64%), 9/1/47 | 159,764 | 156,518 | ||||||

| FNMA, VRN, 3.18%, (6-month LIBOR plus 1.57%), 6/1/35 | 31,167 | 31,805 | ||||||

| FNMA, VRN, 3.29%, (6-month LIBOR plus 1.57%), 6/1/35 | 28,444 | 29,026 | ||||||

| FNMA, VRN, 3.51%, (1-year H15T1Y plus 2.15%), 3/1/38 | 60,173 | 61,227 | ||||||

21

| Shares/ Principal Amount | Value | |||||||

| FNMA, VRN, 3.18%, (12-month LIBOR plus 1.61%), 3/1/47 | $ | 106,526 | $ | 101,019 | ||||

| FNMA, VRN, 3.12%, (12-month LIBOR plus 1.61%), 4/1/47 | 57,484 | 54,597 | ||||||

| FNMA, VRN, 3.19%, (12-month LIBOR plus 1.62%), 5/1/47 | 86,561 | 85,015 | ||||||

| 956,043 | ||||||||

| Fixed-Rate U.S. Government Agency Mortgage-Backed Securities — 8.6% | ||||||||

| FHLMC, 2.50%, 3/1/42 | 1,511,781 | 1,278,306 | ||||||

| FHLMC, 3.00%, 1/1/50 | 1,760,759 | 1,508,670 | ||||||

| FHLMC, 3.50%, 5/1/50 | 322,357 | 286,376 | ||||||

| FHLMC, 2.50%, 5/1/51 | 2,117,481 | 1,752,432 | ||||||

| FHLMC, 3.50%, 5/1/51 | 2,090,193 | 1,860,672 | ||||||

| FHLMC, 3.00%, 7/1/51 | 1,155,245 | 997,426 | ||||||

| FHLMC, 3.00%, 7/1/51 | 812,081 | 694,495 | ||||||

| FHLMC, 2.00%, 8/1/51 | 1,733,733 | 1,373,555 | ||||||

| FHLMC, 2.50%, 8/1/51 | 1,921,606 | 1,581,791 | ||||||

| FHLMC, 4.00%, 8/1/51 | 770,293 | 707,621 | ||||||

| FHLMC, 2.50%, 10/1/51 | 1,040,145 | 860,676 | ||||||

| FHLMC, 3.00%, 12/1/51 | 1,207,430 | 1,032,044 | ||||||

| FHLMC, 3.50%, 5/1/52 | 1,456,513 | 1,287,088 | ||||||

| FHLMC, 4.00%, 5/1/52 | 1,276,182 | 1,162,986 | ||||||

| FHLMC, 4.00%, 5/1/52 | 1,655,425 | 1,508,354 | ||||||

| FHLMC, 5.00%, 7/1/52 | 758,971 | 737,342 | ||||||

| UMBS, 6.00%, TBA | 3,617,000 | 3,635,478 | ||||||

| FNMA, 3.50%, 3/1/34 | 109,988 | 103,832 | ||||||

| FNMA, 2.00%, 5/1/36 | 976,529 | 859,737 | ||||||

| FNMA, 2.00%, 6/1/36 | 3,227,211 | 2,841,167 | ||||||

| FNMA, 2.00%, 1/1/37 | 1,245,470 | 1,096,509 | ||||||

| FNMA, 2.00%, 1/1/37 | 486,474 | 427,089 | ||||||

| FNMA, 4.50%, 9/1/41 | 145,152 | 140,187 | ||||||

| FNMA, 2.50%, 3/1/42 | 1,420,702 | 1,201,295 | ||||||

| FNMA, 3.50%, 5/1/42 | 693,710 | 630,065 | ||||||

| FNMA, 2.50%, 6/1/42 | 1,198,596 | 1,013,604 | ||||||

| FNMA, 3.50%, 6/1/42 | 235,554 | 213,941 | ||||||

| FNMA, 3.00%, 6/1/50 | 2,328,201 | 1,995,522 | ||||||

| FNMA, 3.00%, 6/1/51 | 153,401 | 132,887 | ||||||

| FNMA, 2.50%, 12/1/51 | 1,375,057 | 1,130,750 | ||||||

| FNMA, 2.50%, 12/1/51 | 1,168,713 | 961,741 | ||||||

| FNMA, 3.00%, 2/1/52 | 1,192,653 | 1,019,756 | ||||||

| FNMA, 2.00%, 3/1/52 | 3,110,408 | 2,471,553 | ||||||

| FNMA, 2.50%, 3/1/52 | 1,450,908 | 1,195,263 | ||||||

| FNMA, 3.00%, 3/1/52 | 2,544,066 | 2,183,976 | ||||||

| FNMA, 3.50%, 4/1/52 | 778,398 | 685,779 | ||||||

| FNMA, 4.00%, 4/1/52 | 1,554,671 | 1,420,841 | ||||||

| FNMA, 4.00%, 4/1/52 | 521,908 | 476,243 | ||||||

| FNMA, 4.00%, 4/1/52 | 736,465 | 672,336 | ||||||

| FNMA, 3.00%, 5/1/52 | 1,233,146 | 1,061,484 | ||||||

| FNMA, 3.50%, 5/1/52 | 1,856,070 | 1,652,155 | ||||||

| FNMA, 3.00%, 6/1/52 | 551,969 | 475,128 | ||||||

| FNMA, 4.50%, 7/1/52 | 1,588,057 | 1,493,669 | ||||||

| FNMA, 5.00%, 8/1/52 | 3,607,351 | 3,488,490 | ||||||

| FNMA, 5.00%, 9/1/52 | 1,054,975 | 1,022,192 | ||||||

| FNMA, 5.00%, 10/1/52 | 1,682,000 | 1,625,996 | ||||||

22

| Shares/ Principal Amount | Value | |||||||

| FNMA, 5.50%, 10/1/52 | $ | 1,797,884 | $ | 1,777,576 | ||||

| GNMA, 7.00%, 4/20/26 | 8,884 | 8,999 | ||||||

| GNMA, 7.50%, 8/15/26 | 5,971 | 6,075 | ||||||

| GNMA, 7.00%, 5/15/31 | 17,436 | 18,094 | ||||||

| GNMA, 5.50%, 11/15/32 | 41,863 | 43,800 | ||||||

| GNMA, 4.50%, 6/15/41 | 156,649 | 153,296 | ||||||

| GNMA, 3.50%, 6/20/42 | 272,180 | 250,538 | ||||||

| GNMA, 3.50%, 3/15/46 | 1,275,075 | 1,173,764 | ||||||

| GNMA, 3.00%, 4/20/50 | 586,246 | 516,316 | ||||||

| GNMA, 3.00%, 5/20/50 | 597,527 | 525,943 | ||||||

| GNMA, 3.00%, 6/20/50 | 894,669 | 790,489 | ||||||

| GNMA, 3.00%, 7/20/50 | 1,578,612 | 1,388,683 | ||||||

| GNMA, 2.00%, 10/20/50 | 4,811,655 | 3,983,951 | ||||||

| GNMA, 2.50%, 11/20/50 | 2,103,364 | 1,771,863 | ||||||

| GNMA, 2.50%, 2/20/51 | 1,494,661 | 1,272,944 | ||||||

| GNMA, 3.50%, 6/20/51 | 1,030,619 | 933,589 | ||||||

| GNMA, 2.50%, 9/20/51 | 1,264,313 | 1,075,761 | ||||||

| 71,650,180 | ||||||||

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES (Cost $78,739,724) | 72,606,223 | |||||||

| COLLATERALIZED LOAN OBLIGATIONS — 2.6% | ||||||||

ABPCI Direct Lending Fund CLO IV Ltd., Series 2017-2A, Class BR, VRN, 6.26%, (3-month LIBOR plus 1.90%), 10/27/33(3) | 600,000 | 548,915 | ||||||

AIMCO CLO Ltd., Series 2019-10A, Class BR, VRN, 5.92%, (3-month LIBOR plus 1.60%), 7/22/32(3) | 740,000 | 687,898 | ||||||

Arbor Realty Commercial Real Estate Notes Ltd., Series 2019-FL2, Class A, VRN, 4.69%, (1-month SOFR plus 1.31%), 9/15/34(3) | 526,849 | 523,335 | ||||||

ARES LII CLO Ltd., Series 2019-52A, Class BR, VRN, 5.97%, (3-month LIBOR plus 1.65%), 4/22/31(3) | 550,000 | 510,727 | ||||||

Ares XL CLO Ltd., Series 2016-40A, Class BRR, VRN, 5.88%, (3-month LIBOR plus 1.80%), 1/15/29(3) | 500,000 | 467,042 | ||||||

BDS Ltd., Series 2021-FL7, Class C, VRN, 5.14%, (1-month LIBOR plus 1.70%), 6/16/36(3) | 1,125,000 | 1,070,856 | ||||||

BDS Ltd., Series 2021-FL8, Class C, VRN, 4.99%, (1-month LIBOR plus 1.55%), 1/18/36(3) | 500,000 | 471,920 | ||||||

BDS Ltd., Series 2021-FL8, Class D, VRN, 5.34%, (1-month LIBOR plus 1.90%), 1/18/36(3) | 400,000 | 376,407 | ||||||

Bean Creek CLO Ltd., Series 2015-1A, Class AR, VRN, 5.26%, (3-month LIBOR plus 1.02%), 4/20/31(3) | 575,000 | 560,175 | ||||||

BXMT Ltd., Series 2020-FL2, Class C, VRN, 5.14%, (1-month SOFR plus 1.76%), 2/15/38(3) | 1,090,000 | 1,039,000 | ||||||

Canyon Capital CLO Ltd., Series 2017-1A, Class BR, VRN, 5.68%, (3-month LIBOR plus 1.60%), 7/15/30(3) | 350,000 | 329,338 | ||||||

Carlyle Global Market Strategies CLO Ltd., Series 2013-1A, Class BRR, VRN, 5.11%, (3-month LIBOR plus 2.20%), 8/14/30(3) | 450,000 | 423,259 | ||||||

CarVal CLO III Ltd., Series 2019-2A, Class BR, VRN, 5.84%, (3-month LIBOR plus 1.60%), 7/20/32(3) | 500,000 | 474,694 | ||||||

Cedar Funding X CLO Ltd., Series 2019-10A, Class BR, VRN, 5.84%, (3-month LIBOR plus 1.60%), 10/20/32(3) | 450,000 | 417,441 | ||||||

Cerberus Loan Funding XXXIII LP, Series 2021-3A, Class A, VRN, 5.64%, (3-month LIBOR plus 1.56%), 7/23/33(3) | 800,000 | 762,351 | ||||||

Cerberus Loan Funding XXXVI LP, Series 2021-6A, Class A, VRN, 5.48%, (3-month LIBOR plus 1.40%), 11/22/33(3) | 375,251 | 372,353 | ||||||

CFIP CLO Ltd., Series 2014-1A, Class AR, VRN, 5.26%, (3-month LIBOR plus 1.32%), 7/13/29(3) | 474,830 | 469,078 | ||||||

23

| Shares/ Principal Amount | Value | |||||||

FS Rialto Issuer LLC, Series 2022-FL6, Class A SEQ, VRN, 6.05%, (1-month SOFR plus 2.58%), 8/17/37(3) | $ | 566,000 | $ | 560,598 | ||||

KKR CLO Ltd., Series 2018, Class BR, VRN, 5.79%, (3-month LIBOR plus 1.60%), 7/18/30(3) | 575,000 | 548,826 | ||||||

KKR CLO Ltd., Series 2022A, Class A, VRN, 5.39%, (3-month LIBOR plus 1.15%), 7/20/31(3) | 450,000 | 436,850 | ||||||

KKR CLO Ltd., Series 2030A, Class BR, VRN, 5.68%, (3-month LIBOR plus 1.60%), 10/17/31(3) | 725,000 | 679,096 | ||||||

KREF Ltd., Series 2021-FL2, Class B, VRN, 5.06%, (1-month LIBOR plus 1.65%), 2/15/39(3) | 800,000 | 747,078 | ||||||

Madison Park Funding XXXVII Ltd., Series 2019-37A, Class BR, VRN, 5.73%, (3-month LIBOR plus 1.65%), 7/15/33(3) | 1,075,000 | 1,007,819 | ||||||

MF1 Ltd., Series 2021-FL7, Class AS, VRN, 4.89%, (1-month LIBOR plus 1.45%), 10/16/36(3) | 1,075,000 | 1,028,845 | ||||||

Octagon Investment Partners XV Ltd., Series 2013-1A, Class BRR, VRN, 5.73%, (3-month LIBOR plus 1.50%), 7/19/30(3) | 800,000 | 751,803 | ||||||

Palmer Square Loan Funding Ltd., Series 2022-2A, Class A2, VRN, 5.76%, (3-month SOFR plus 1.90%), 10/15/30(3) | 550,000 | 529,230 | ||||||

Parallel Ltd., Series 2019-1A, Class BR, VRN, 6.04%, (3-month LIBOR plus 1.80%), 7/20/32(3) | 825,000 | 768,394 | ||||||

Park Avenue Institutional Advisers CLO Ltd., Series 2018-1A, Class BR, VRN, 6.34%, (3-month LIBOR plus 2.10%), 10/20/31(3) | 750,000 | 684,322 | ||||||

PFP Ltd., Series 2021-8, Class C, VRN, 5.21%, (1-month LIBOR plus 1.80%), 8/9/37(3) | 807,000 | 776,201 | ||||||

Sound Point CLO XXII Ltd., Series 2019-1A, Class BR, VRN, 5.94%, (3-month LIBOR plus 1.70%), 1/20/32(3) | 750,000 | 697,444 | ||||||

TCW CLO Ltd., Series 2018-1A, Class BR, VRN, 6.01%, (3-month LIBOR plus 1.65%), 4/25/31(3) | 725,000 | 685,954 | ||||||

THL Credit Wind River CLO Ltd., Series 2013-2A, Class BR2, VRN, 5.76%, (3-month LIBOR plus 1.57%), 10/18/30(3) | 1,150,000 | 1,088,790 | ||||||

TSTAT Ltd., Series 2022-1A, Class B, VRN, 5.82%, (3-month SOFR plus 3.27%), 7/20/31(3) | 500,000 | 495,429 | ||||||

Wellfleet CLO Ltd., Series 2022-1A, Class B1, VRN, 6.21%, (3-month SOFR plus 2.35%), 4/15/34(3) | 400,000 | 378,900 | ||||||

TOTAL COLLATERALIZED LOAN OBLIGATIONS (Cost $22,503,196) | 21,370,368 | |||||||

| ASSET-BACKED SECURITIES — 2.5% | ||||||||

Aaset Trust, Series 2021-2A, Class A SEQ, 2.80%, 1/15/47(3) | 1,496,490 | 1,169,159 | ||||||

Aligned Data Centers Issuer LLC, Series 2021-1A, Class B, 2.48%, 8/15/46(3) | 642,000 | 533,958 | ||||||

Applebee's Funding LLC / IHOP Funding LLC, Series 2019-1A, Class A2I SEQ, 4.19%, 6/5/49(3) | 826,650 | 780,857 | ||||||

Applebee's Funding LLC / IHOP Funding LLC, Series 2019-1A, Class A2II SEQ, 4.72%, 6/5/49(3) | 878,130 | 787,955 | ||||||

Blackbird Capital Aircraft, Series 2021-1A, Class A SEQ, 2.44%, 7/15/46(3) | 783,666 | 627,223 | ||||||

Castlelake Aircraft Structured Trust, Series 2017-1R, Class A SEQ, 2.74%, 8/15/41(3) | 564,759 | 489,924 | ||||||

Clsec Holdings 22t LLC, Series 2021-1, Class B, 3.46%, 5/11/37(3) | 1,506,361 | 1,269,939 | ||||||

Credit Acceptance Auto Loan Trust, Series 2022-3A, Class B, 7.52%, 12/15/32(3)(4) | 700,000 | 699,893 | ||||||

DI Issuer LLC, Series 2021-1A, Class A2 SEQ, 3.72%, 9/15/51(3) | 1,900,000 | 1,656,790 | ||||||

Edgeconnex Data Centers Issuer LLC, Series 2022-1, Class A2 SEQ, 4.25%, 3/25/52(3) | 943,260 | 846,946 | ||||||

FirstKey Homes Trust, Series 2021-SFR1, Class D, 2.19%, 8/17/38(3) | 950,000 | 782,380 | ||||||

FirstKey Homes Trust, Series 2021-SFR1, Class E1, 2.39%, 8/17/38(3) | 1,100,000 | 905,328 | ||||||

24

| Shares/ Principal Amount | Value | |||||||

Flexential Issuer, Series 2021-1A, Class A2 SEQ, 3.25%, 11/27/51(3) | $ | 1,150,000 | $ | 985,109 | ||||

Goodgreen Trust, Series 2018-1A, Class A, VRN, 3.93%, 10/15/53(3) | 340,821 | 309,688 | ||||||

Goodgreen Trust, Series 2020-1A, Class A SEQ, 2.63%, 4/15/55(3) | 636,966 | 514,952 | ||||||

Goodgreen Trust, Series 2021-1A, Class A SEQ, 2.66%, 10/15/56(3) | 447,579 | 391,325 | ||||||

J.G. Wentworth XL LLC, Series 2017-3A, Class B, 5.43%, 2/15/69(3) | 88,326 | 83,691 | ||||||

J.G. Wentworth XLII LLC, Series 2018-2A, Class B, 4.70%, 10/15/77(3) | 550,000 | 477,062 | ||||||

J.G. Wentworth XXXIX LLC, Series 2017-2A, Class B, 5.09%, 9/17/74(3) | 164,160 | 148,292 | ||||||

J.G. Wentworth XXXVIII LLC, Series 2017-1A, Class B, 5.43%, 8/15/62(3) | 198,191 | 183,418 | ||||||

Lunar Structured Aircraft Portfolio Notes, Series 2021-1, Class A SEQ, 2.64%, 10/15/46(3) | 1,128,018 | 902,315 | ||||||

MAPS Trust, Series 2021-1A, Class A SEQ, 2.52%, 6/15/46(3) | 1,515,013 | 1,215,076 | ||||||

Navigator Aircraft ABS Ltd., Series 2021-1, Class A SEQ, 2.77%, 11/15/46(3) | 1,125,000 | 928,628 | ||||||

New Economy Assets Phase 1 Sponsor LLC, Series 2021-1, Class A1 SEQ, 1.91%, 10/20/61(3) | 1,095,000 | 919,393 | ||||||

New Economy Assets Phase 1 Sponsor LLC, Series 2021-1, Class B1, 2.41%, 10/20/61(3) | 1,925,000 | 1,564,274 | ||||||

Progress Residential Trust, Series 2021-SFR3, Class C, 2.09%, 5/17/26(3) | 500,000 | 423,416 | ||||||

Progress Residential Trust, Series 2021-SFR8, Class E1, 2.38%, 10/17/38(3) | 450,000 | 369,466 | ||||||

Sierra Timeshare Receivables Funding LLC, Series 2021-1A, Class C, 1.79%, 11/20/37(3) | 251,433 | 229,307 | ||||||

Slam Ltd., Series 2021-1A, Class A SEQ, 2.43%, 6/15/46(3) | 604,105 | 494,777 | ||||||

VSE VOI Mortgage LLC, Series 2018-A, Class B, 3.72%, 2/20/36(3) | 195,344 | 188,214 | ||||||

TOTAL ASSET-BACKED SECURITIES (Cost $24,789,061) | 20,878,755 | |||||||

| COLLATERALIZED MORTGAGE OBLIGATIONS — 1.6% | ||||||||

| Private Sponsor Collateralized Mortgage Obligations — 1.3% | ||||||||

| ABN Amro Mortgage Corp., Series 2003-4, Class A4, 5.50%, 3/25/33 | 3,254 | 2,844 | ||||||

| Adjustable Rate Mortgage Trust, Series 2004-4, Class 4A1, VRN, 3.42%, 3/25/35 | 78,097 | 76,702 | ||||||

| Banc of America Mortgage Trust, Series 2004-E, Class 2A6 SEQ, VRN, 3.59%, 6/25/34 | 56,236 | 53,524 | ||||||

Bellemeade Re Ltd., Series 2019-3A, Class B1, VRN, 6.09%, (1-month LIBOR plus 2.50%), 7/25/29(3) | 400,000 | 393,791 | ||||||

Bellemeade Re Ltd., Series 2019-3A, Class M1C, VRN, 5.54%, (1-month LIBOR plus 1.95%), 7/25/29(3) | 360,000 | 356,005 | ||||||

Bellemeade Re Ltd., Series 2020-2A, Class M1C, VRN, 7.59%, (1-month LIBOR plus 4.00%), 8/26/30(3) | 56,584 | 56,649 | ||||||

Chase Mortgage Finance Corp., Series 2021-CL1, Class M1, VRN, 4.20%, (30-day average SOFR plus 1.20%), 2/25/50(3) | 346,616 | 295,334 | ||||||

CHNGE Mortgage Trust, Series 2022-1 Class A1 SEQ, VRN, 3.01%, 1/25/67(3) | 715,190 | 636,815 | ||||||

| Citigroup Mortgage Loan Trust, Inc., Series 2004-UST1, Class A5, VRN, 3.71%, 8/25/34 | 170,824 | 163,761 | ||||||

| Countrywide Home Loan Mortgage Pass-Through Trust, Series 2005-17, Class 1A11, 5.50%, 9/25/35 | 1,083 | 964 | ||||||

Credit Suisse Mortgage Trust, Series 2021-NQM2, Class A2 SEQ, VRN, 1.38%, 2/25/66(3) | 295,210 | 250,476 | ||||||

25

| Shares/ Principal Amount | Value | |||||||

Credit Suisse Mortgage Trust, Series 2021-RPL3, Class A1 SEQ, VRN, 2.00%, 1/25/60(3) | $ | 395,715 | $ | 342,536 | ||||

Credit Suisse Mortgage Trust, Series 2022-NQM2, Class A3 SEQ, VRN, 4.00%, 2/25/67(3) | 600,000 | 452,485 | ||||||

Deephaven Residential Mortgage Trust, Series 2020-2, Class M1, VRN, 4.11%, 5/25/65(3) | 525,000 | 486,857 | ||||||

Deephaven Residential Mortgage Trust, Series 2021-3, Class A3, VRN, 1.55%, 8/25/66(3) | 288,015 | 230,848 | ||||||

Eagle RE Ltd., Series 2021-1, Class M1C, VRN, 5.70%, (30-day average SOFR plus 2.70%), 10/25/33(3) | 525,000 | 522,327 | ||||||

| First Horizon Alternative Mortgage Securities Trust, Series 2004-AA4, Class A1, VRN, 4.01%, 10/25/34 | 68,912 | 68,058 | ||||||

GCAT Trust, Series 2021-CM2, Class A1 SEQ, VRN, 2.35%, 8/25/66(3) | 1,098,548 | 1,025,663 | ||||||

GCAT Trust, Series 2021-NQM1, Class A3 SEQ, VRN, 1.15%, 1/25/66(3) | 244,610 | 205,031 | ||||||

| GSR Mortgage Loan Trust, Series 2004-5, Class 3A3, VRN, 2.78%, 5/25/34 | 39,587 | 36,544 | ||||||

| GSR Mortgage Loan Trust, Series 2004-7, Class 3A1, VRN, 3.16%, 6/25/34 | 16,932 | 15,103 | ||||||

| GSR Mortgage Loan Trust, Series 2005-AR1, Class 3A1, VRN, 3.46%, 1/25/35 | 47,932 | 45,226 | ||||||

Home RE Ltd., Series 2021-1, Class M1B, VRN, 5.14%, (1-month LIBOR plus 1.55%), 7/25/33(3) | 303,969 | 302,054 | ||||||

Home RE Ltd., Series 2022-1, Class M1A, VRN, 5.85%, (30-day average SOFR plus 2.85%), 10/25/34(3) | 425,000 | 415,745 | ||||||

JP Morgan Mortgage Trust, Series 2017-1, Class A2, VRN, 3.45%, 1/25/47(3) | 129,998 | 111,564 | ||||||

JP Morgan Mortgage Trust, Series 2020-3, Class A15, VRN, 3.50%, 8/25/50(3) | 188,009 | 163,005 | ||||||

JP Morgan Mortgage Trust, Series 2022-4, Class A3, VRN, 3.00%, 10/25/52(3) | 386,747 | 311,252 | ||||||

JP Morgan Mortgage Trust, Series 2022-LTV1, Class A3 SEQ, VRN, 3.52%, 7/25/52(3) | 605,848 | 472,977 | ||||||

| MASTR Adjustable Rate Mortgages Trust, Series 2004-13, Class 3A7, VRN, 3.88%, 11/21/34 | 68,851 | 63,976 | ||||||

| Merrill Lynch Mortgage Investors Trust, Series 2005-3, Class 2A, VRN, 3.00%, 11/25/35 | 33,281 | 31,297 | ||||||

| Merrill Lynch Mortgage Investors Trust, Series 2005-A2, Class A1, VRN, 2.77%, 2/25/35 | 67,016 | 62,667 | ||||||

MFA Trust, Series 2021-INV2, Class A3 SEQ, VRN, 2.26%, 11/25/56(3) | 754,568 | 600,859 | ||||||

MFA Trust, Series 2022-INV1, Class A1 SEQ, VRN, 3.91%, 4/25/66(3) | 469,137 | 437,919 | ||||||

NewRez Warehouse Securitization Trust, Series 2021-1, Class A, VRN, 4.34%, (1-month LIBOR plus 0.75%), 5/25/55(3) | 750,000 | 735,579 | ||||||

PRMI Securitization Trust, Series 2021-1, Class A5, VRN, 2.50%, 4/25/51(3) | 855,646 | 643,841 | ||||||

Sofi Mortgage Trust, Series 2016-1A, Class 1A4 SEQ, VRN, 3.00%, 11/25/46(3) | 39,988 | 36,225 | ||||||

Starwood Mortgage Residential Trust, Series 2020-2, Class B1E, VRN, 3.00%, 4/25/60(3) | 446,000 | 444,408 | ||||||