Exhibit 99.1

Exhibit 99.1

2013 BMO Chicago Conference

September 16-17, 2013

RELIABLE. ANSWERS.

RELIABLE. ANSWERS

WHY DUKE REALTY?

Superior Asset Quality

Strategically Located Land Bank and Experienced Development Capabilities

Proven Operational Success and Future Growth Opportunities

Balance Sheet Strength

Relative Value vs. Peers

Talent and Leadership Depth to Execute

2013 Duke Realty Corporation 2

RELIABLE . ANSWERS .

Three-Pronged Strategy for Success

Strategies for delivering shareholder value

2013 Duke Realty Corporation 3

ASSET STRATEGY

2013 Duke Realty Corporation 4

ASSET STRATEGY

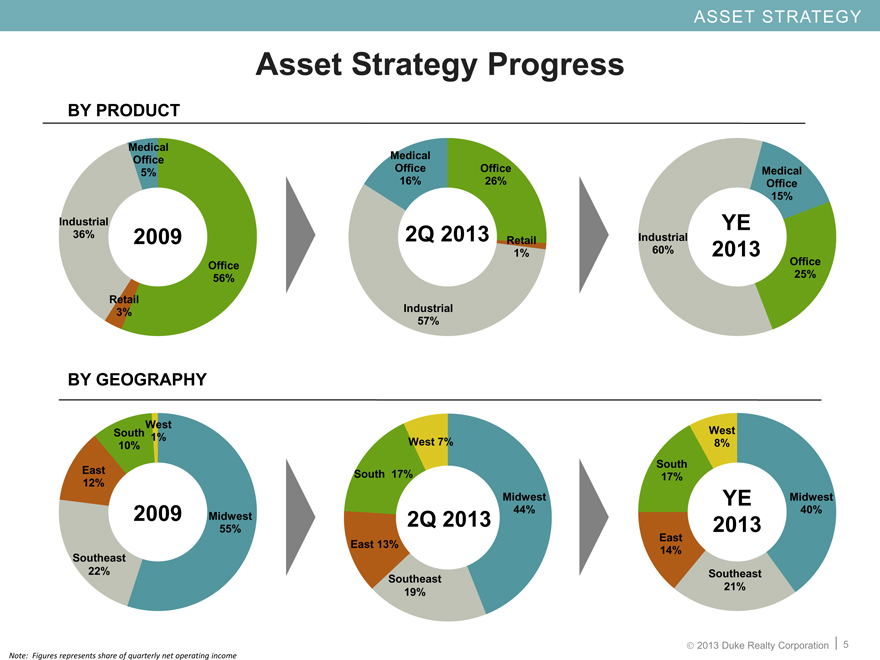

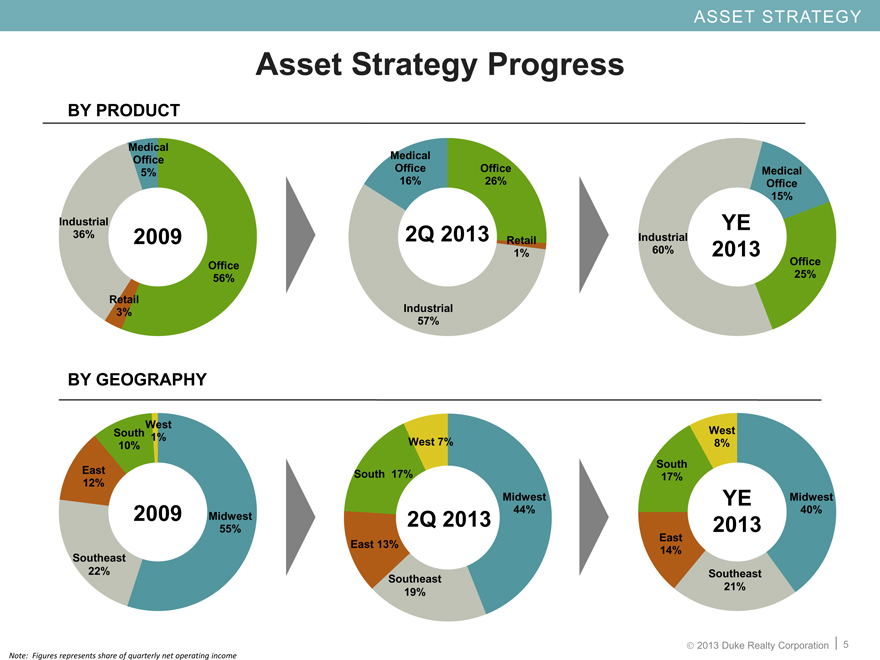

Asset Strategy Progress

BY PRODUCT

Medical

Office Medical

5% Office Office Medical

16% 26% Office

15%

Industrial YE

36% 2009 2Q 2013 Retail Industrial

1% 60% 2013

Office Office

56% 25%

Retail

3% Industrial

57%

BY GEOGRAPHY

South West West

1%

10% West 7% 8%

South

East South 17% 17%

12%

Midwest YE Midwest

2009 Midwest 2Q 2013 44% 2013 40%

55%

East

East 13% 14%

Southeast

22% Southeast

Southeast

19% 21%

2013 Duke Realty Corporation 5

Note: Figures represents share of quarterly net operating income

Highest quality portfolio of large, modern bulk industrial

assets in key distribution markets

Best in class MOB development platform and portfolio with

newest properties and highest hospital system credit

Built-in annual rent and same property growth

Suburban office portfolio now less than 25% with growth

opportunities through lease up

Successful execution of significant asset repositioning

allowing us to focus on growth and a "sharpshooter"

approach for future asset sales

Superior Asset Quality

Asset Strategy

6

New, High Quality Portfolio with Long-term Leases

Premier portfolio of assets

Metric Bulk Industrial Suburban Office Medical Office

Property age 11.2 years 14.8 years 6.8 years

Property size 241,000 SF 117,000 SF 77,000 SF

Lease term 7.5 years 7.1 years 12.7 years

Tenant size 97,000 SF 15,000 SF 13,000 SF

Asset Strategy

ASSET STRATEGY –

INDUSTRIAL PORTFOLIO

9

Leverage 40 years of industrial operating and development experience as

primary driver of company growth

Focus on larger, modern bulk distribution product which results in higher credit

quality tenant base with fewer overall tenants to manage

Geographic strategy focused on major markets in key trucking, rail and

shipping corridors

Growing NOI stream with contractual rent escalations and low capital

expenditures

Leverage current business trends in e-commerce and supply chain

reconfiguration along with key long term relationships

Utilize land positions in existing markets to grow rent through higher yield

development

Strategically seek acquisition opportunities in higher rent growth markets

Industrial Strategy

Asset Strategy

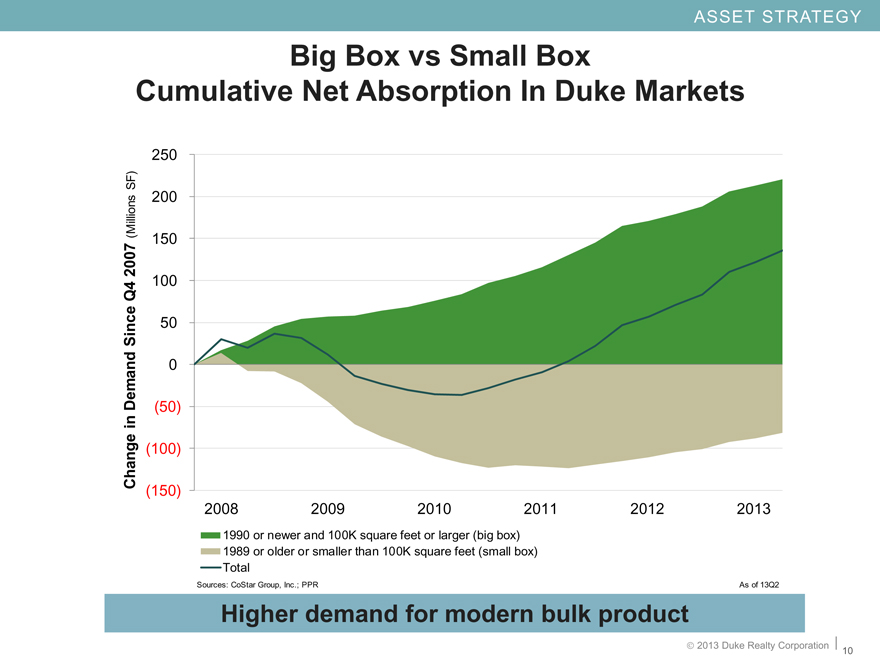

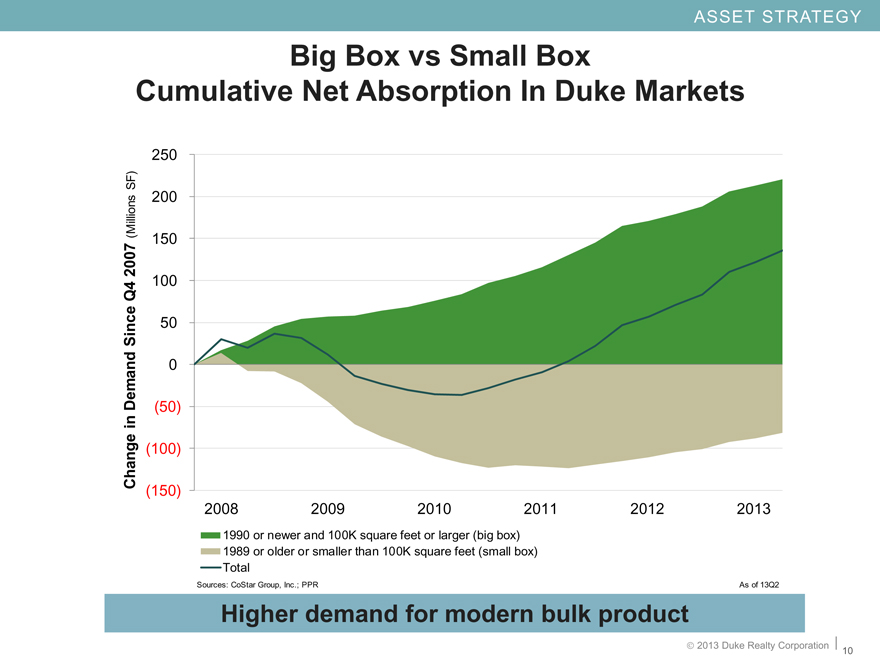

Big Box vs Small Box

Cumulative Net Absorption In Duke Markets

10

Higher demand for modern bulk product

Asset Strategy

11

Asset Strategy

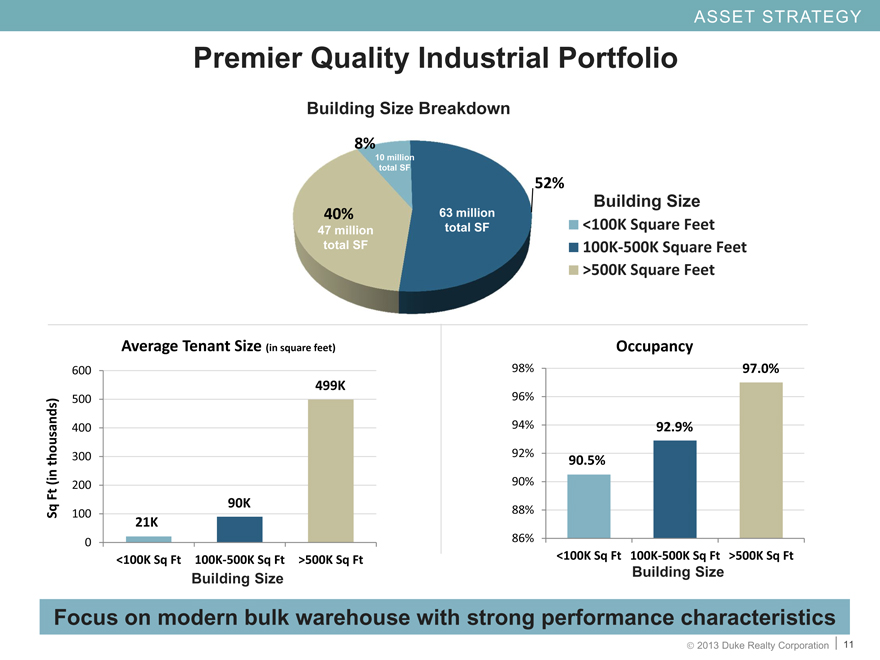

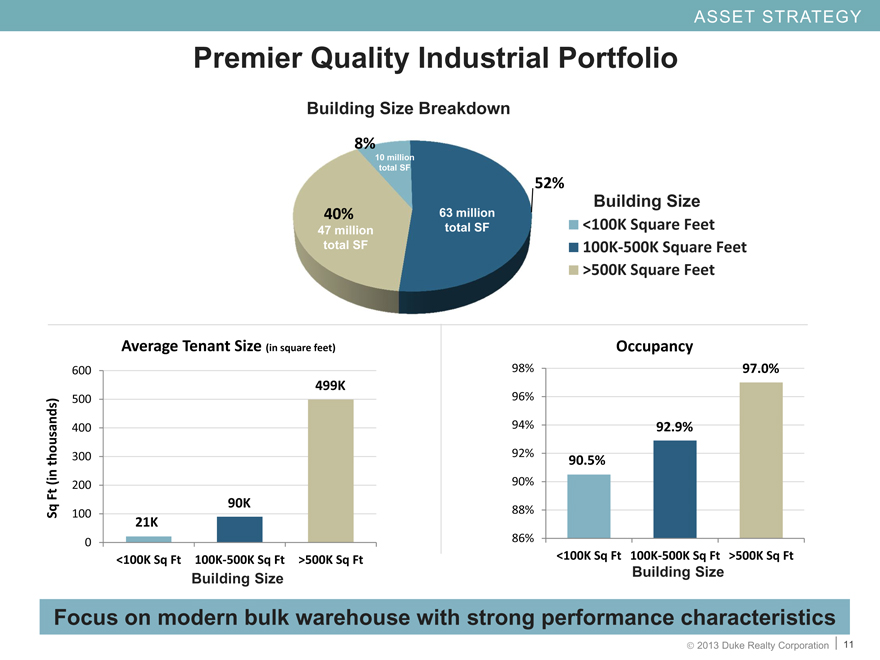

Premier Quality Industrial Portfolio

Premier Quality Industrial Portfolio

(CHART)

(CHART)

Focus on modern bulk warehouse with strong performance characteristics

Building Size

Building Size

63 million

total SF

47 million

total SF

10 million

total SF

Building Size

Building Size Breakdown

12

Asset Strategy

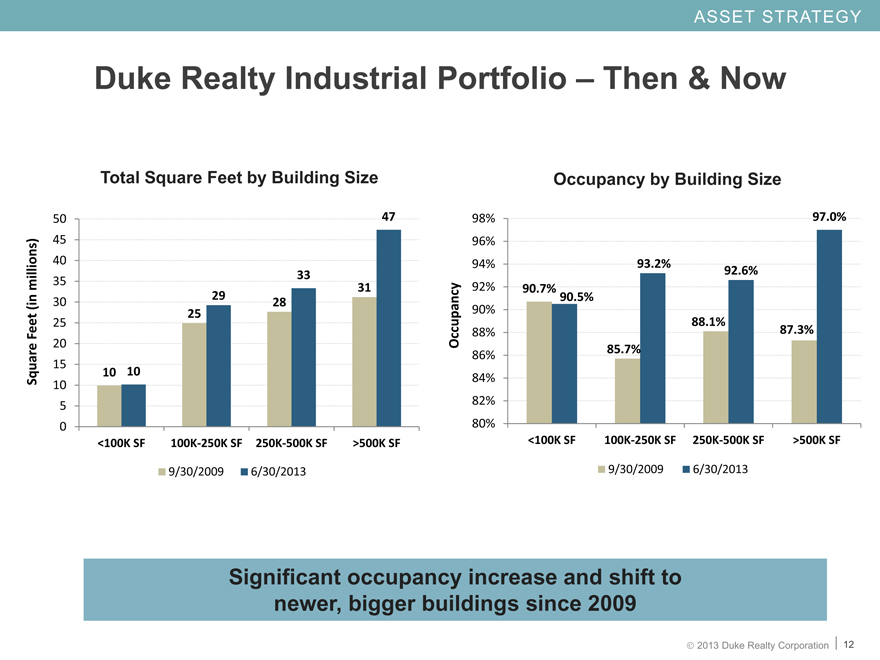

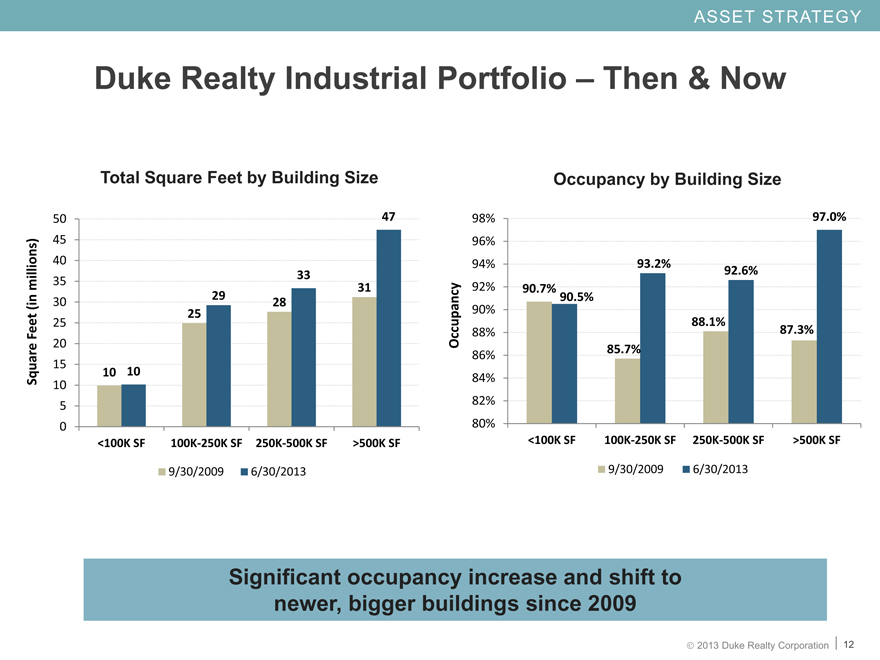

Duke Realty Industrial Portfolio – Then & Now

Duke Realty Industrial Portfolio – Then & Now

Significant occupancy increase and shift to

newer, bigger buildings since 2009

Total Square Feet by Building Size

Occupancy by Building Size

(CHART)

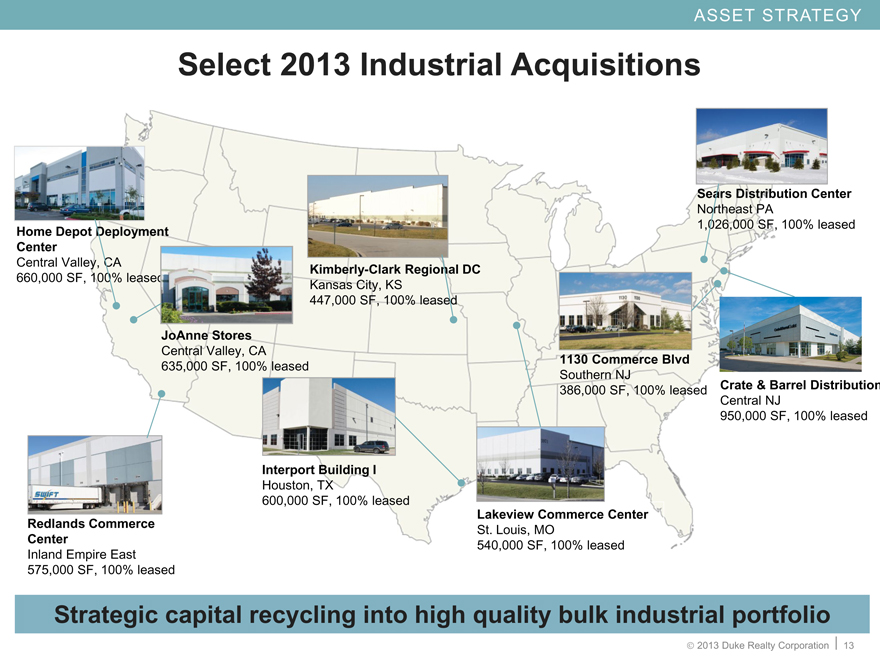

13

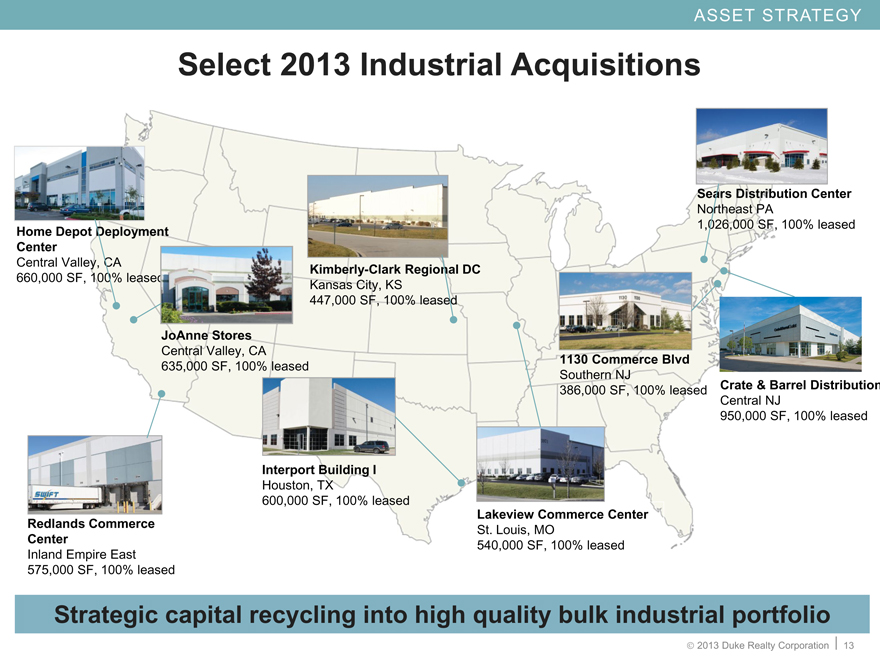

Home Depot Deployment

Center

Central Valley, CA

660,000 SF, 100% leased

JoAnne Stores

Central Valley, CA

635,000 SF, 100% leased

Redlands Commerce

Center

Inland Empire East

575,000 SF, 100% leased

Lakeview Commerce Center

St. Louis, MO

540,000 SF, 100% leased

Kimberly-Clark Regional DC

Kansas City, KS

447,000 SF, 100% leased

Interport Building I

Houston, TX

600,000 SF, 100% leased

1130 Commerce Blvd

Southern NJ

386,000 SF, 100% leased

Sears Distribution Center

Northeast PA

1,026,000 SF, 100% leased

Select 2013 Industrial Acquisitions

Strategic capital recycling into high quality bulk industrial portfolio

Crate & Barrel Distribution

Central NJ

950,000 SF, 100% leased

ASSET Strategy

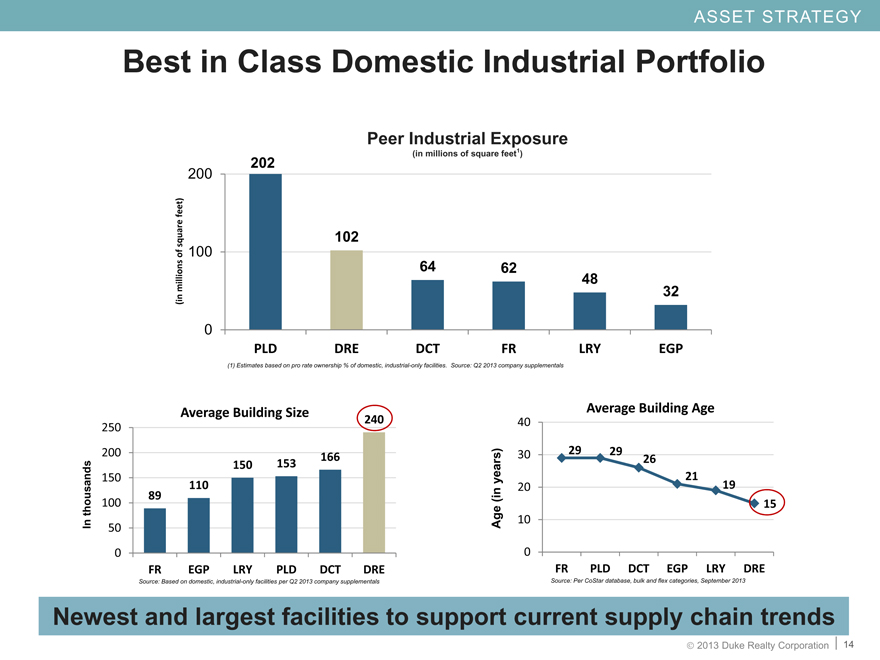

(CHART)

(CHART)

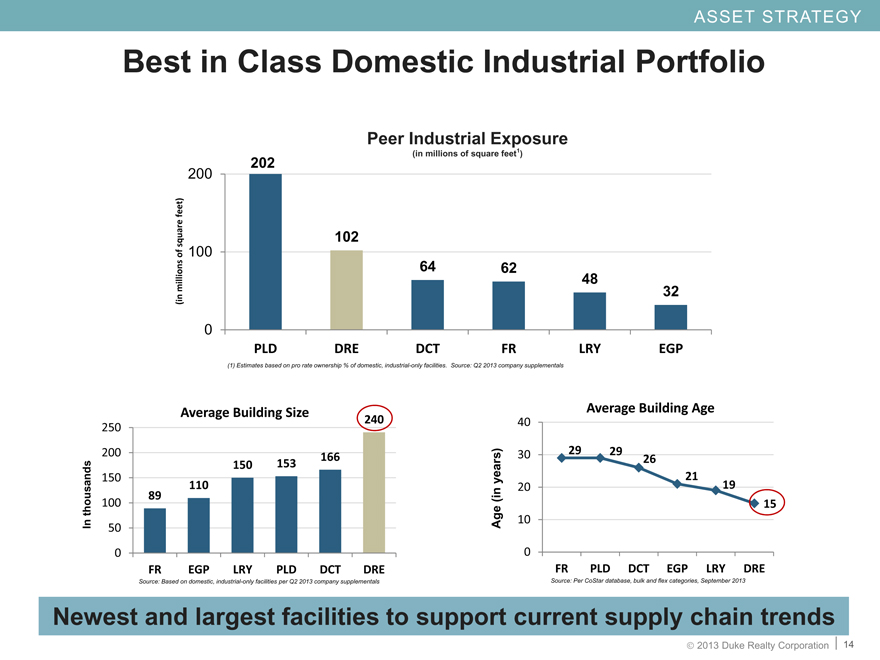

Peer Industrial Exposure

(in millions of square feet1)

14

Asset Strategy

(CHART)

Best in Class Domestic Industrial Portfolio

Newest and largest facilities to support current supply chain trends

(1) Estimates based on pro rate ownership % of domestic, industrial-only facilities. Source: Q2 2013 company supplementals

Source: Per CoStar database, bulk and flex categories, September 2013

202

Source: Based on domestic, industrial-only facilities per Q2 2013 company supplementals

ASSET STRATEGY –

OFFICE PORTFOLIO

15

16

Will reach 25% target by year-end 2013

Continue to sell older, non-strategic assets

Develop remaining office land bank primarily with build

to suit projects

Own highest quality assets in high growth office

markets

Office Strategy

Asset Strategy

17

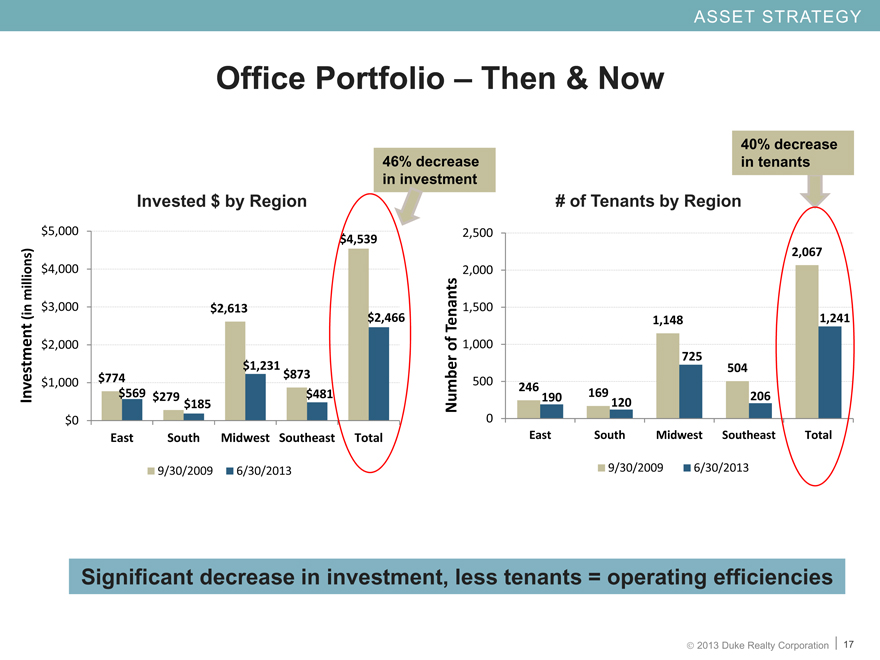

Asset Strategy

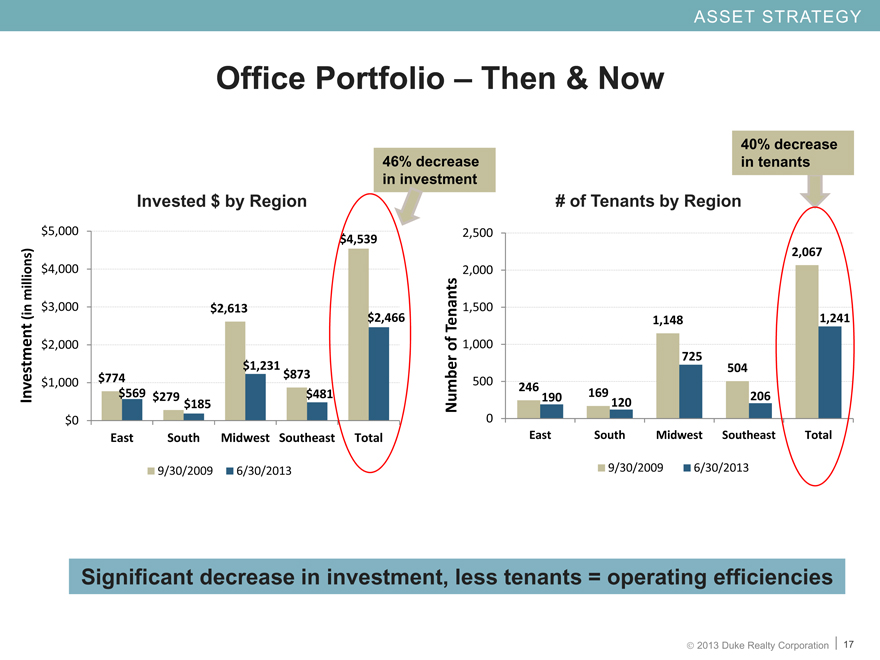

Office Portfolio – Then & Now

Office Portfolio – Then & Now

(CHART)

40% decrease

in tenants

46% decrease

in investment

Significant decrease in investment, less tenants = operating efficiencies

Invested $ by Region

# of Tenants by Region

ASSET STRATEGY –

MEDICAL OFFICE PORTFOLIO

18

19

Asset Strategy

MOB Platform Strategy and Benefits to Duke Realty

Solid NOI growth and low volatility

Growth industry, recession resistant asset class

Best in class development team able to produce consistent

development opportunities through economic cycles

Substantially all on-campus or aligned with major hospital systems

Long term leases averaging over 12 years

Consistent NOI growth with typical leases including 2-3% annual

net rent escalations and expense increase pass-throughs

Recycle selected assets to recognize value created and fund new

development

20

Asset Strategy

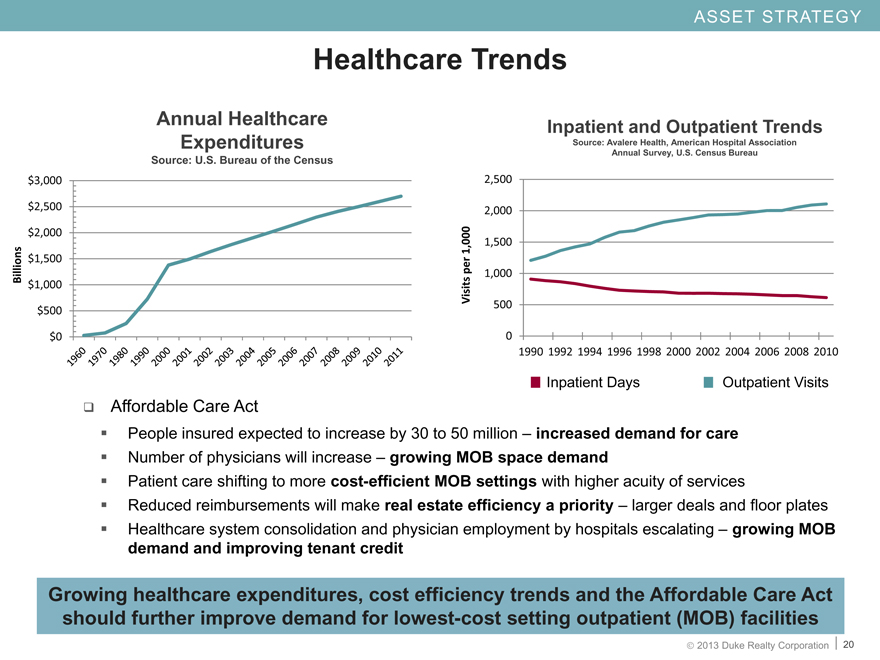

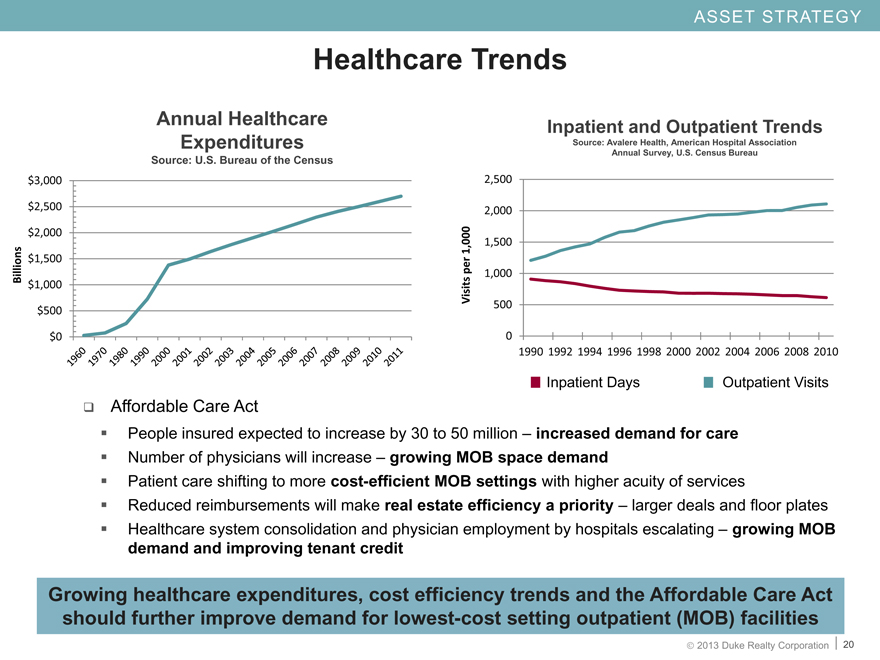

Healthcare Trends

Annual Healthcare

Expenditures

Source: U.S. Bureau of the Census

(CHART)

Growing healthcare expenditures, cost efficiency trends and the Affordable Care Act

should further improve demand for lowest-cost setting outpatient (MOB) facilities

Affordable Care Act

People insured expected to increase by 30 to 50 million – increased demand for care

Number of physicians will increase – growing MOB space demand

Patient care shifting to more cost-efficient MOB settings with higher acuity of services

Reduced reimbursements will make real estate efficiency a priority – larger deals and floor plates

Healthcare system consolidation and physician employment by hospitals escalating – growing MOB

demand and improving tenant credit

(CHART)

Inpatient and Outpatient Trends

Source: Avalere Health, American Hospital Association

Annual Survey, U.S. Census Bureau

Inpatient Days Outpatient Visits

21

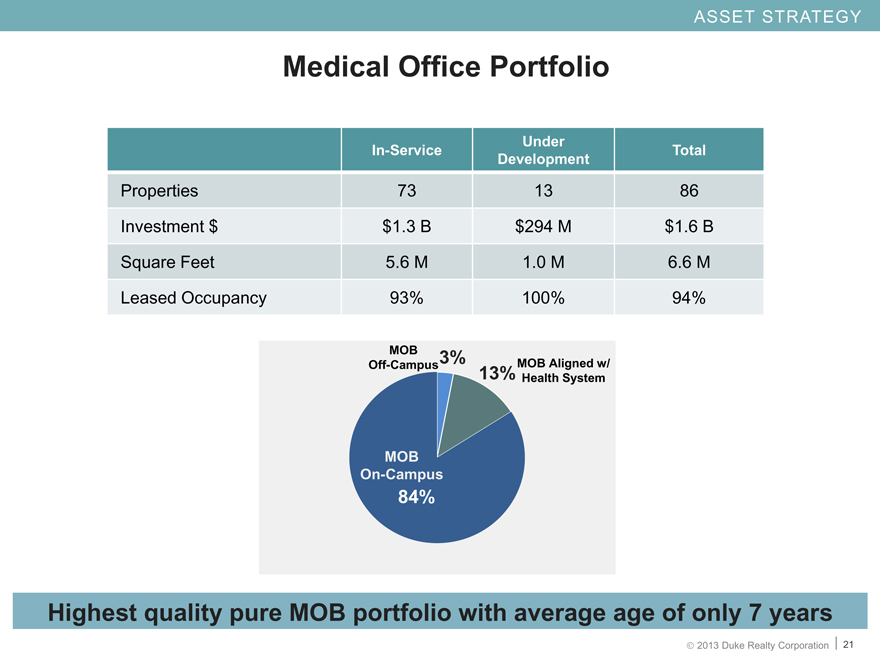

Asset Strategy

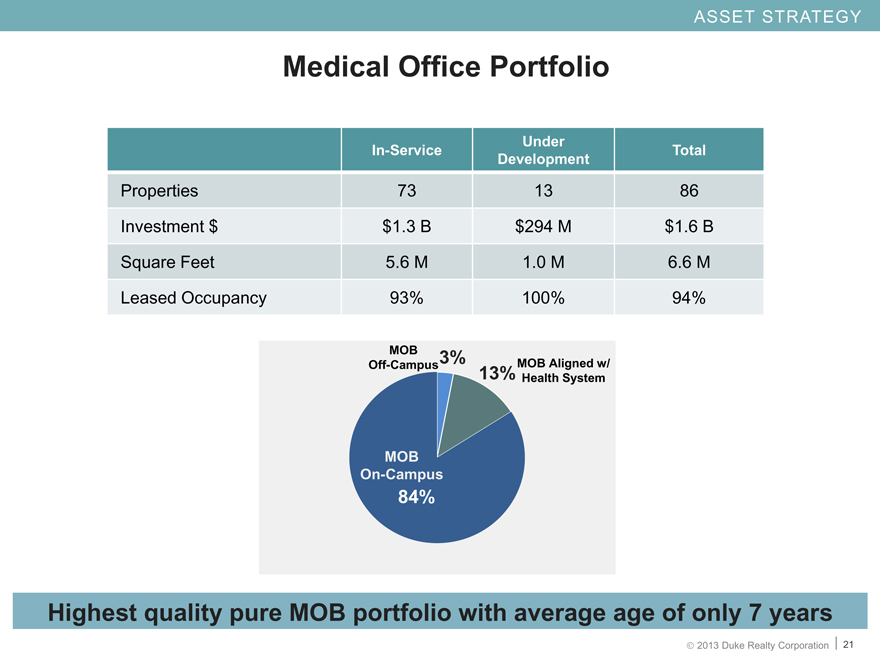

In-Service Under Development Total

Properties 73 13 86

Investment $ $1.3 B $294 M $1.6 B

Square Feet 5.6 M 1.0 M 6.6 M

Leased Occupancy 93% 100% 94%

Investment

by product type

MOB

On-Campus

MOB

Off-Campus

Medical Office Portfolio

Highest quality pure MOB portfolio with average age of only 7 years

MOB Aligned w/

Health System

22

Asset Strategy

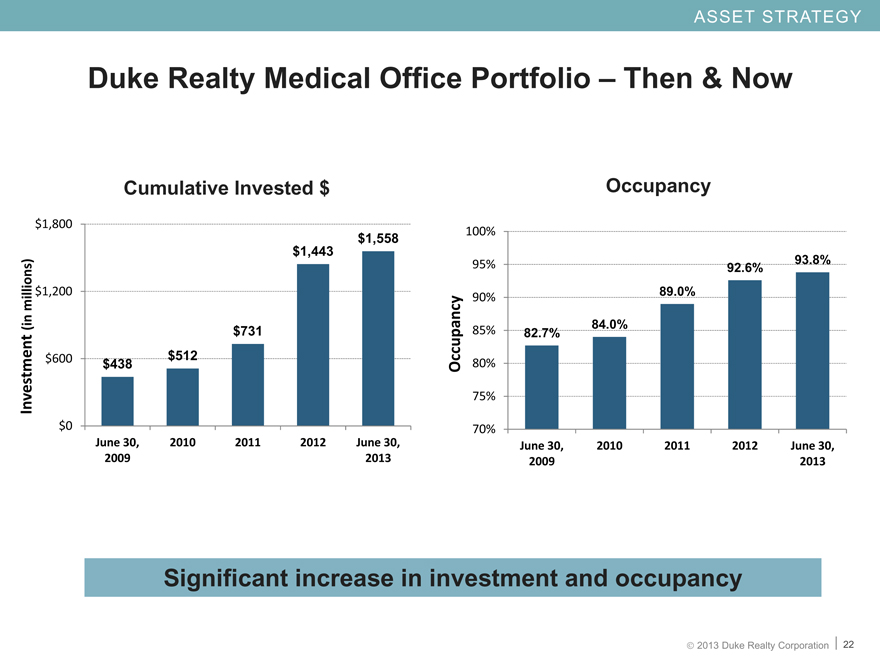

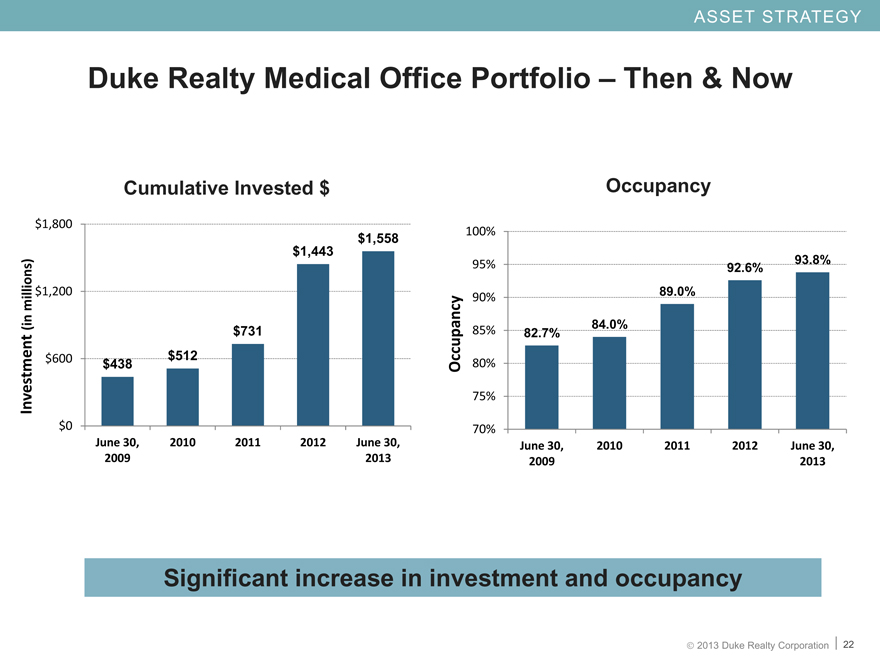

Duke Realty Medical Office Portfolio – Then & Now

Duke Realty Medical Office Portfolio – Then & Now

(CHART)

Significant increase in investment and occupancy

Cumulative Invested $

Occupancy

23

Asset Strategy

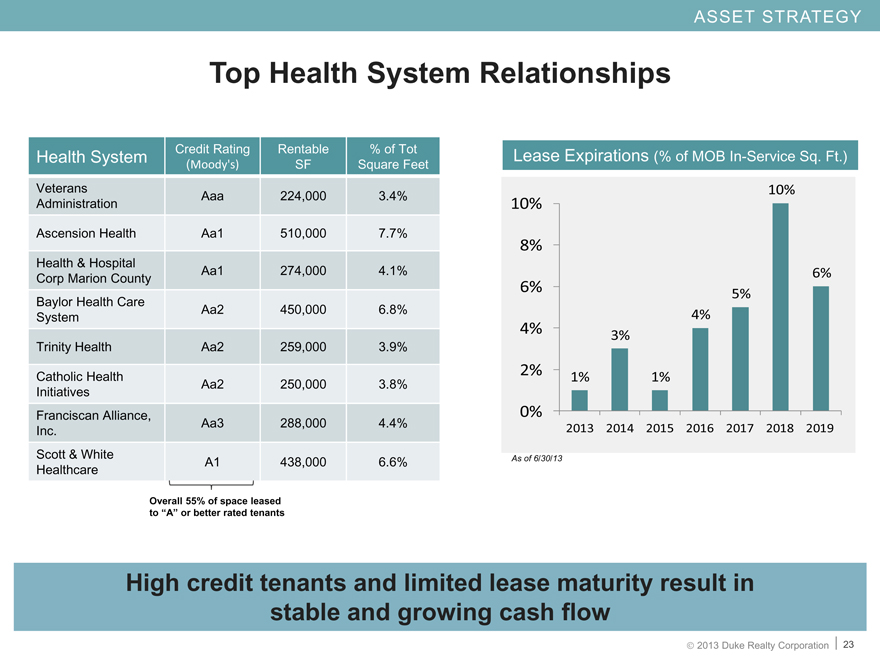

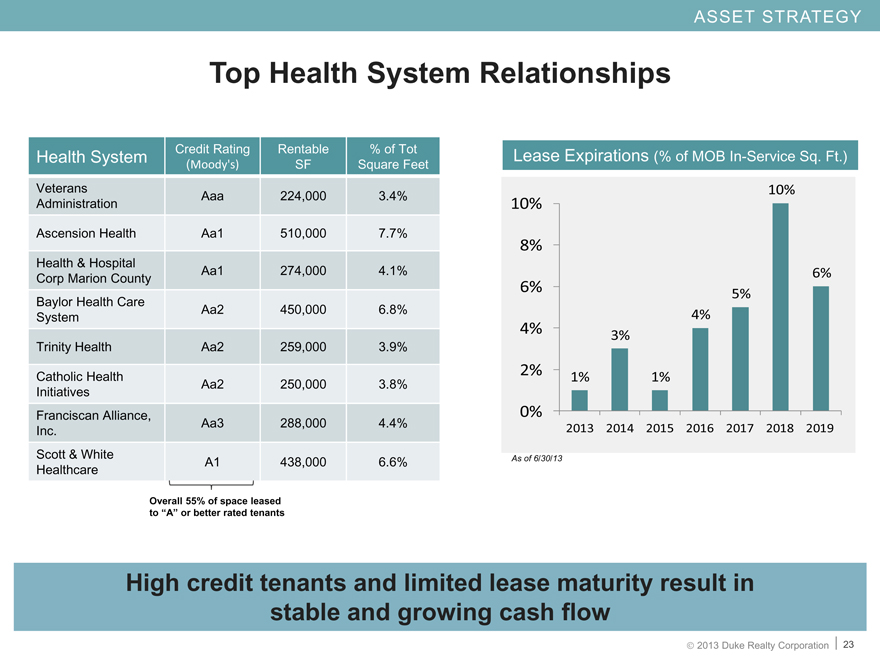

Lease Expirations (% of MOB In-Service Sq. Ft.)

High credit tenants and limited lease maturity result in

stable and growing cash flow

Top Health System Relationships

Health System Credit Rating (Moody’s) Rentable SF % of Tot Square Feet

Veterans Administration Aaa 224,000 3.4%

Ascension Health Aa1 510,000 7.7%

Health & Hospital Corp Marion County Aa1 274,000 4.1%

Baylor Health Care System Aa2 450,000 6.8%

Trinity Health Aa2 259,000 3.9%

Catholic Health Initiatives Aa2 250,000 3.8%

Franciscan Alliance, Inc. Aa3 288,000 4.4%

Scott & White Healthcare A1 438,000 6.6%

As of 6/30/13

Overall 55% of space leased

to "A" or better rated tenants

24

Asset Strategy

Healthcare Development Pipeline

Department of Veterans Affairs

Tampa, FL

117,000 SF, 100% pre-leased

Wishard Health

Indianapolis, IN

274,000 SF, 100% pre-leased

Scott & White Healthcare

College Station, TX

119,000 SF, 100% pre-leased

Scott & White Healthcare

Temple, TX

78,000 SF, 100% pre-leased

Baylor Healthcare (6 Facilities)

Dallas, TX

38,000 square feet each (207,000 total square

feet), 100% pre-leased

Scott & White Healthcare

Waco, TX

35,000 SF, 100% pre-leased

Centerre/Mercy

Springwood, MO

60,000 SF, 100% pre-leased

NSH Cherokee Towne Lake MOB

Woodstock, GA

101,000 SF, 100% pre-leased

ASSET STRATEGY –

DEVELOPMENT CAPABILITIES

25

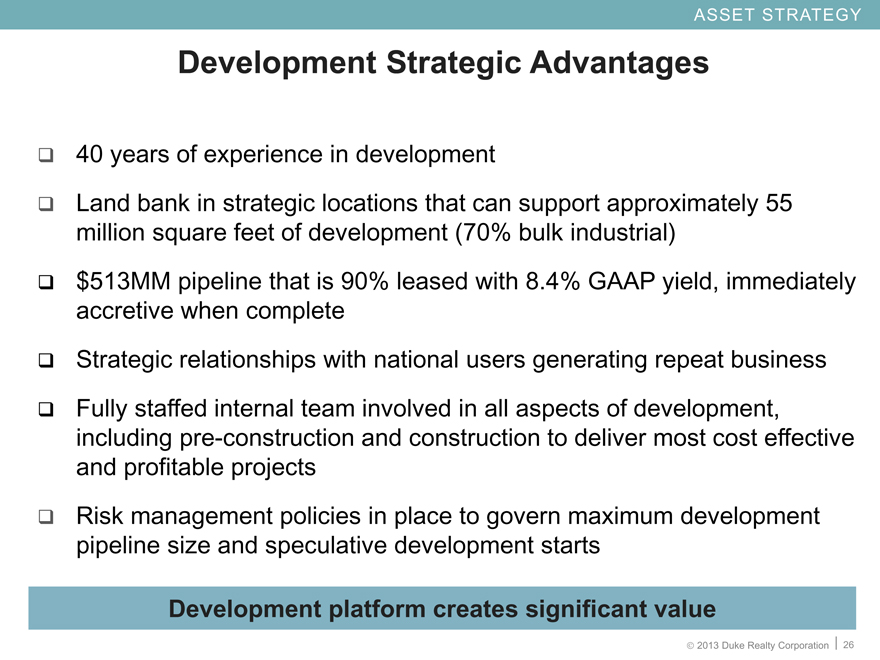

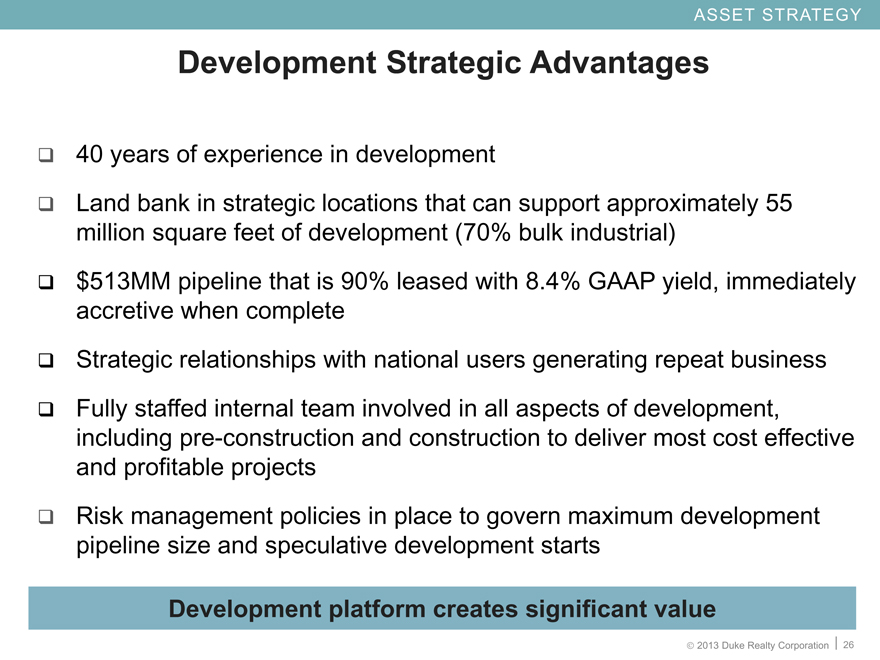

Development Strategic Advantages

Development platform creates significant value

26

40 years of experience in development

Land bank in strategic locations that can support approximately 55

million square feet of development (70% bulk industrial)

$513MM pipeline that is 90% leased with 8.4% GAAP yield, immediately

accretive when complete

Strategic relationships with national users generating repeat business

Fully staffed internal team involved in all aspects of development,

including pre-construction and construction to deliver most cost effective

and profitable projects

Risk management policies in place to govern maximum development

pipeline size and speculative development starts

Asset Strategy

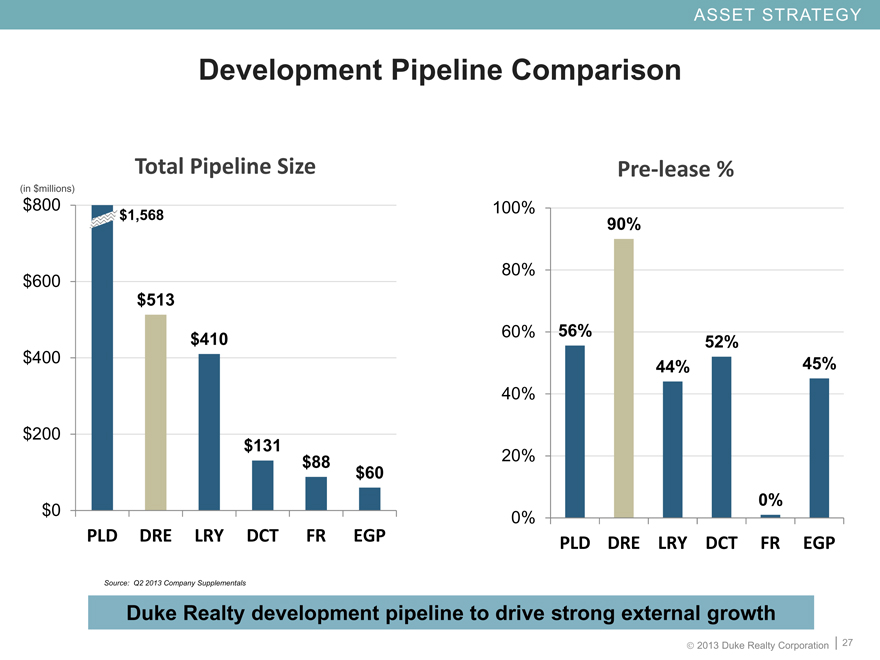

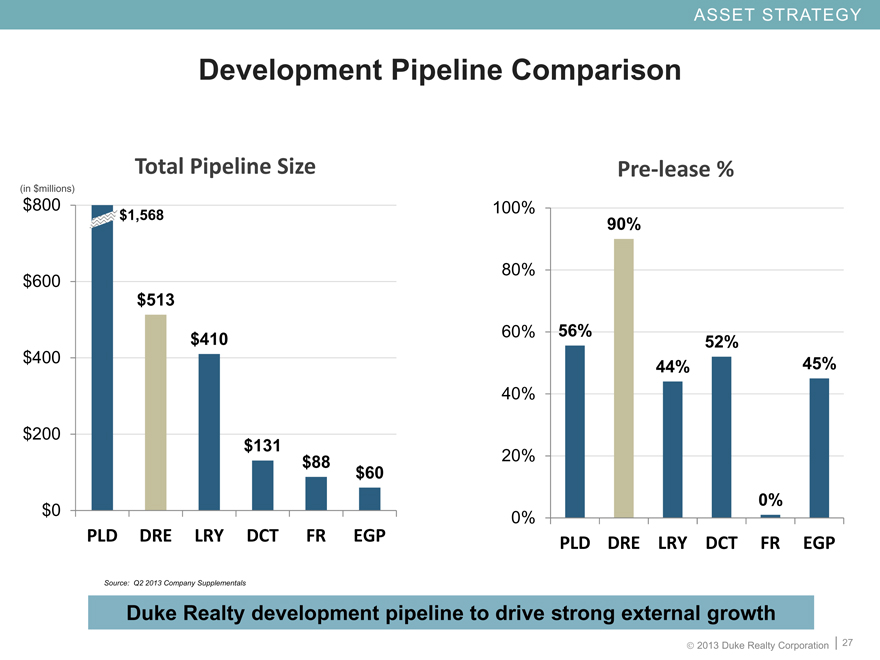

Development Pipeline Comparison

27

Duke Realty development pipeline to drive strong external growth

Asset Strategy

(CHART)

$1,568

(CHART)

(in $millions)

Source: Q2 2013 Company Supplementals

2013 YTD Development Starts

28

Nashville Industrial

Regional distribution center build-to-suit for

Starbucks

680,000 square feet

7.5 year lease term

100% pre-leased

Dallas Medical Office

Five Baylor Emergency (ER) facilities in Metro Dallas

(cities of Rockwell, Murphy, Colleyville, Mansfield and

Burleson)

168,000 total square feet

$15 million project cost each ($71 million total)

100% pre-leased, 15 year lease terms

Dallas Office

Build-to-suit on Duke Realty land

200,000 square feet

16 year lease term

100% pre-leased

Houston Industrial

Speculative development on Duke Realty

land

Airport submarket

240,000 square feet

Waco Medical Office

Scott & White Healthcare

35,000 square feet

15 year term

100% pre-leased

Raleigh Office

Perimeter Two

206,000 square feet

8.2 year lease term

91% pre-leased

Midwest Medical Office

Centerre/Mercy Rehab Hospital

60,000 square feet

15 year lease term

100% pre-leased

Asset Strategy

OPERATIng strategy

29

30

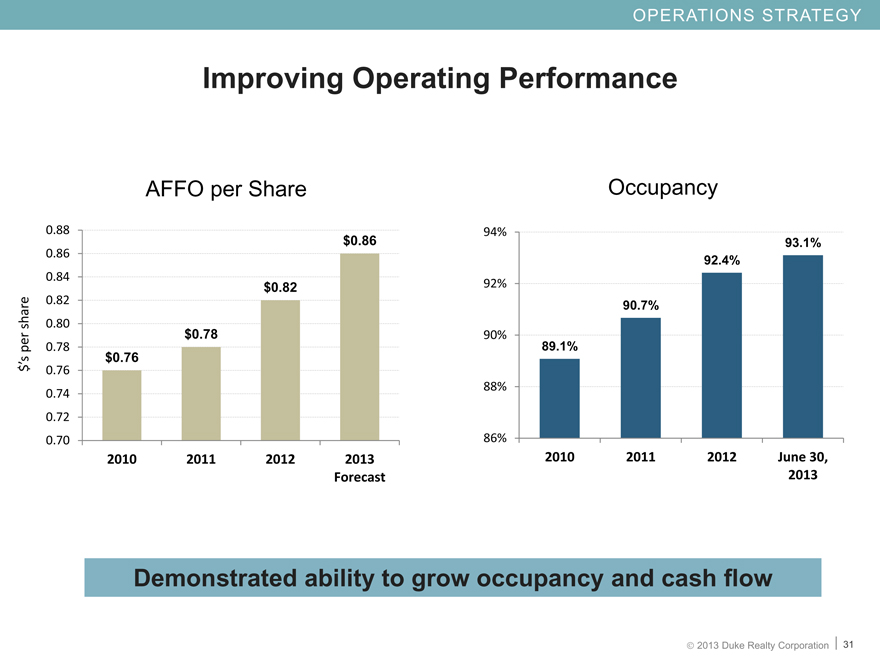

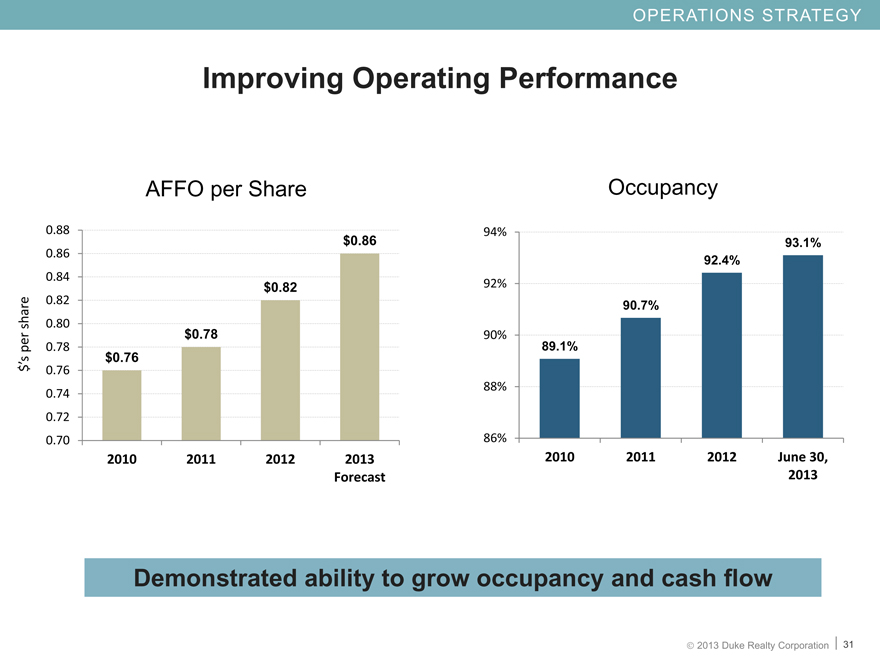

Completed asset repositioning into higher quality, higher growth

assets with minimal FFO per share dilution and annual growth

in AFFO per share

AFFO payout ratio of 72% and AFFO multiple of approximately

17x at the low end of the sector and well positioned for

continued growth

Proven same property NOI outperformance, well positioned for

continuing rental rate growth through lease rent escalations

Ability to push rents because of occupancy and asset quality

Modern bulk product and staggered lease maturities

significantly reduces capex

Operational Success and Future Growth Opportunities

OPERATIONS Strategy

31

Improving Operating Performance

Improving Operating Performance

(CHART)

Demonstrated ability to grow occupancy and cash flow

AFFO per Share

Occupancy

OPERATIONS Strategy

CAPITAL STRATEGY

32

33

CAPITAL Strategy

Will reach original leverage goals established in 2009 by Q4

2013

Continue to delever through assets sales and funding new

development 60/40 equity/debt

Well balanced annual debt maturities

Significant liquidity with $850 million LOC with little to no

borrowings and low near-term maturities

Low percentage of secured and variable rate debt compared to

peer group

Balance Sheet Quality

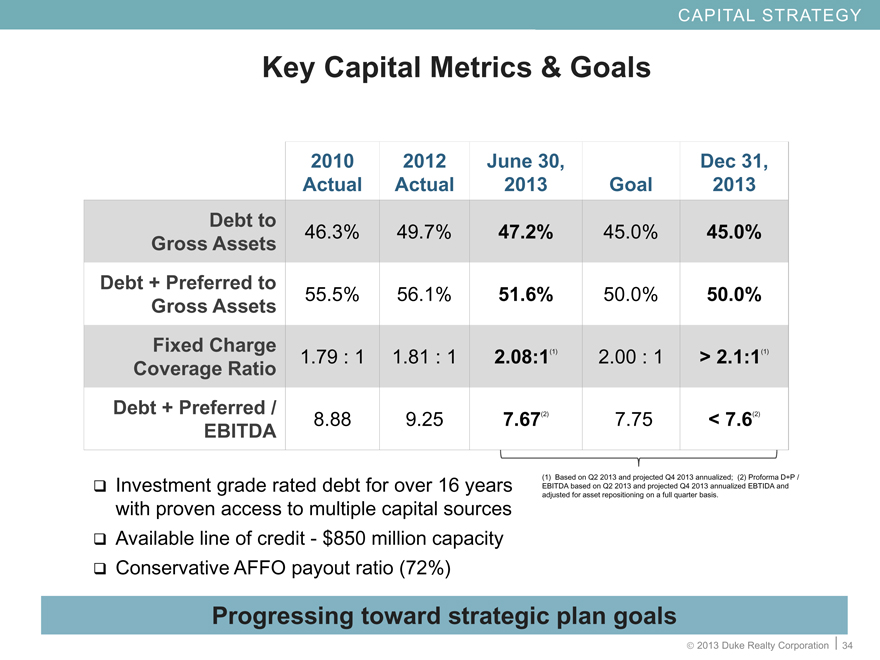

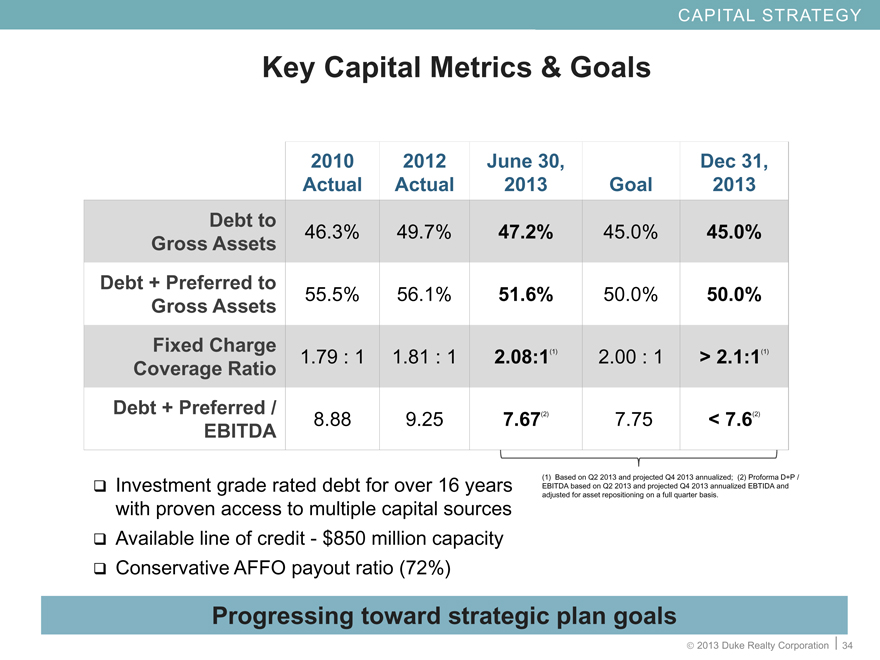

Investment grade rated debt for over 16 years

with proven access to multiple capital sources

Available line of credit—$850 million capacity

Conservative AFFO payout ratio (72%)

34

Key Capital Metrics & Goals

2010 Actual 2012 Actual June 30, 2013 Goal Dec 31, 2013

Debt to Gross Assets 46.3% 49.7% 47.2% 45.0% 45.0%

Debt + Preferred to Gross Assets 55.5% 56.1% 51.6% 50.0% 50.0%

Fixed Charge Coverage Ratio 1.79 : 1 1.81 : 1 2.08:1(1) 2.00 : 1 > 2.1:1(1)

Debt + Preferred / EBITDA 8.88 9.25 7.67(2) 7.75 < 7.6(2)

CAPITAL Strategy

Progressing toward strategic plan goals

(1) | | Based on Q2 2013 and projected Q4 2013 annualized; (2) Proforma D+P / |

EBITDA based on Q2 2013 and projected Q4 2013 annualized EBTIDA and

adjusted for asset repositioning on a full quarter basis.

CAPITAL STRATEGY

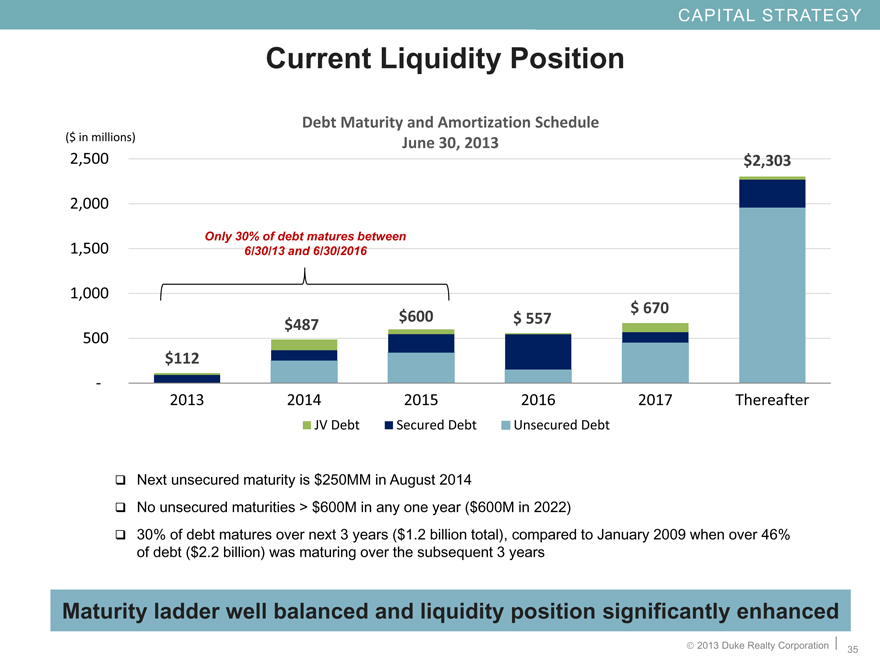

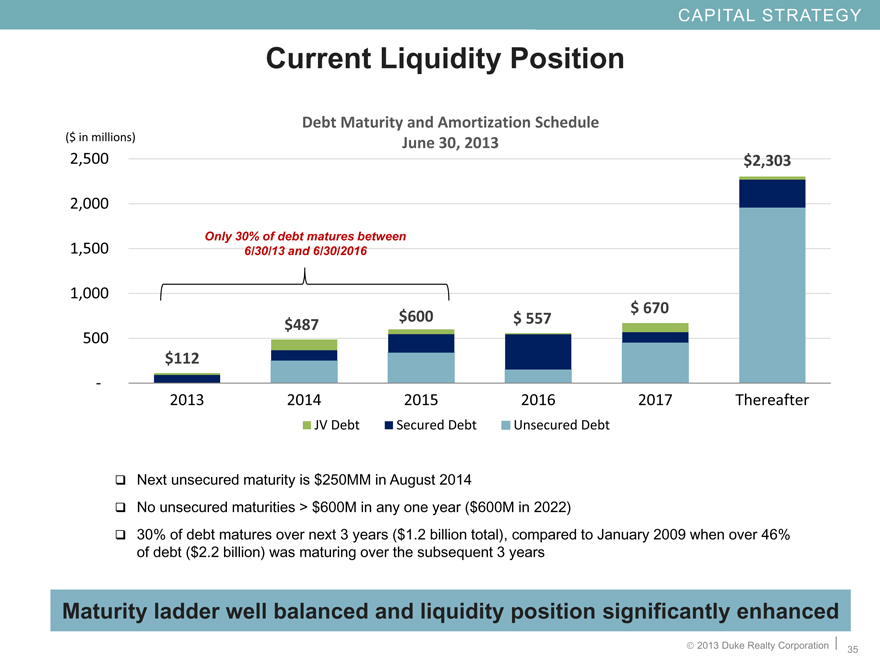

Current Liquidity Position

Debt Maturity and Amortization Schedule

($ in millions) June 30, 2013

2,500 $2,303

2,000

Only 30% of debt matures between

1,500 6/30/13 and 6/30/2016

1,000

$ 670

$487 $600 $ 557

500

$112

2013 2014 2015 2016 2017 Thereafter

JV Debt Secured Debt Unsecured Debt

Next unsecured maturity is $250MM in August 2014

No unsecured maturities > $600M in any one year ($600M in 2022)

30% of debt matures over next 3 years ($1.2 billion total), compared to January 2009 when over 46%

of debt ($2.2 billion) was maturing over the subsequent 3 years

Maturity ladder well balanced and liquidity position significantly enhanced

2013 Duke Realty Corporation 35

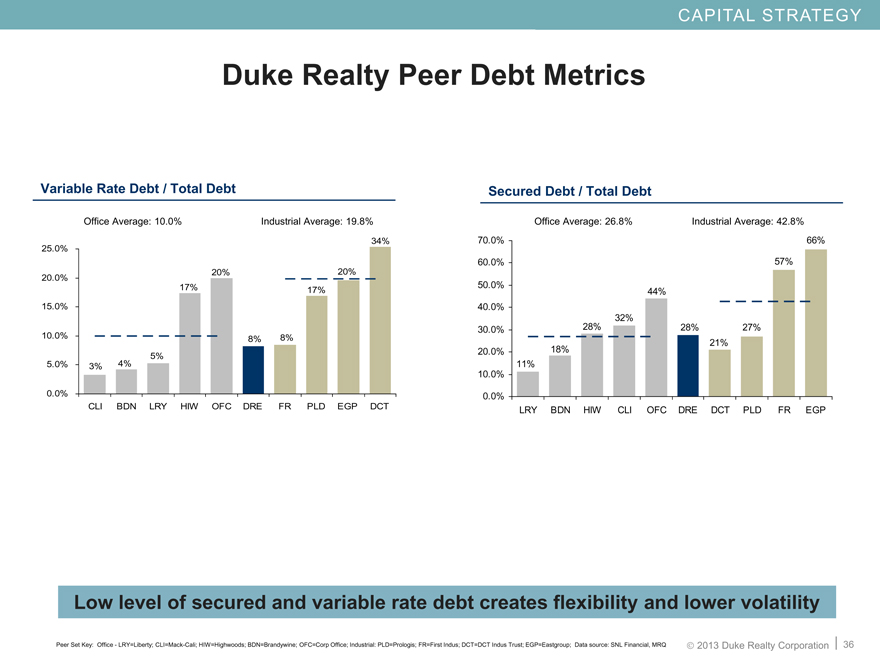

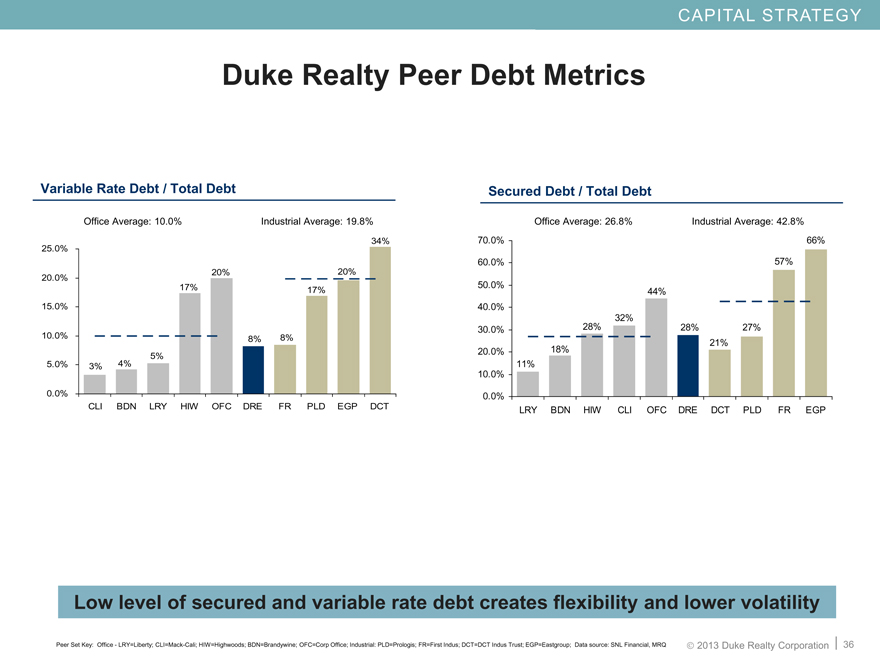

LRY BDN HIW CLI OFC DRE DCT PLD FR EGP

Secured Debt / Total Debt 0.113 0.184 0.282 0.318 0.442 0.276 0.21 0.271 0.569 0.66

Average 0.268 0.268 0.268 0.268 0.268 0.428 0.428 0.428 0.428

Industrial Average: 42.8%

Office Average: 26.8%

Secured Debt / Total Debt

Peer Set Key: Office—LRY=Liberty; CLI=Mack-Cali; HIW=Highwoods; BDN=Brandywine; OFC=Corp Office; Industrial: PLD=Prologis; FR=First Indus; DCT=DCT Indus Trust; EGP=Eastgroup; Data source: SNL Financial, MRQ

36

CLI BDN LRY HIW OFC DRE FR PLD EGP DCT

Variable Debt / Total Debt 0.033 0.042 0.053 0.174 0.2 0.082 0.084 0.169 0.196 0.343

Average 0.1 0.1 0.1 0.1 0.1 0.198 0.198 0.198 0.198

Industrial Average: 19.8%

Office Average: 10.0%

Variable Rate Debt / Total Debt

Low level of secured and variable rate debt creates flexibility and lower volatility

Duke Realty Peer Debt Metrics

CAPITAL Strategy

WHY DUKE REALTY

37

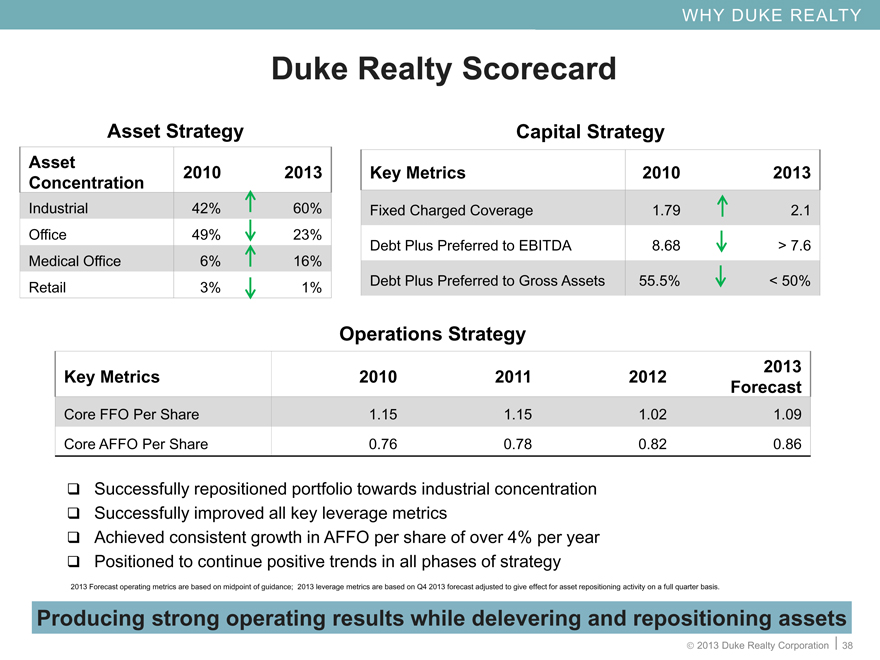

38

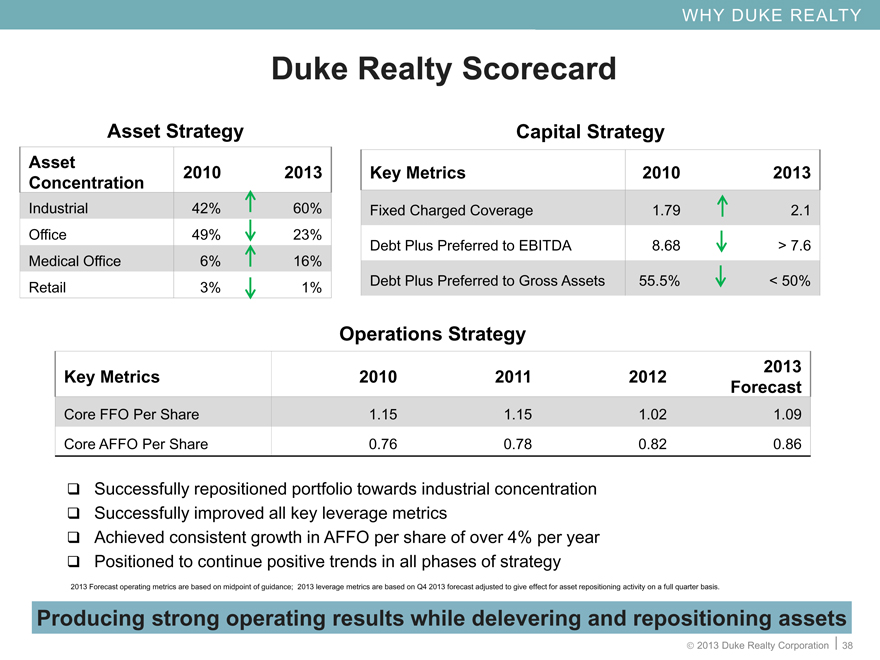

Why duke realty

Duke Realty Scorecard

Asset Strategy Asset Strategy Asset Strategy Asset Strategy

Asset Concentration 2010 2013

Industrial 42% 60%

Office 49% 23%

Medical Office 6% 16%

Retail 3% 1%

Capital Strategy Capital Strategy Capital Strategy Capital Strategy

Key Metrics 2010 2013

Fixed Charged Coverage 1.79 2.1

Debt Plus Preferred to EBITDA 8.68 > 7.6

Debt Plus Preferred to Gross Assets 55.5% < 50%

Operations Strategy Operations Strategy Operations Strategy Operations Strategy Operations Strategy

Key Metrics 2010 2011 2012 2013Forecast

Core FFO Per Share 1.15 1.15 1.02 1.09

Core AFFO Per Share 0.76 0.78 0.82 0.86

Successfully repositioned portfolio towards industrial concentration

Successfully improved all key leverage metrics

Achieved consistent growth in AFFO per share of over 4% per year

Positioned to continue positive trends in all phases of strategy

2013 Forecast operating metrics are based on midpoint of guidance; 2013 leverage metrics are based on Q4 2013 forecast adjusted to give effect for asset repositioning activity on a full quarter basis.

Producing strong operating results while delevering and repositioning assets

39

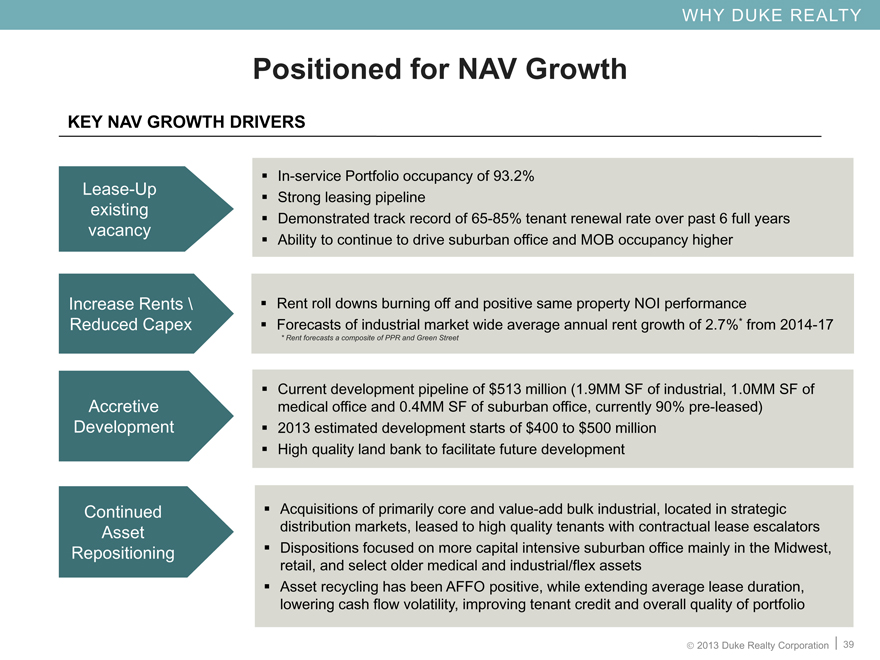

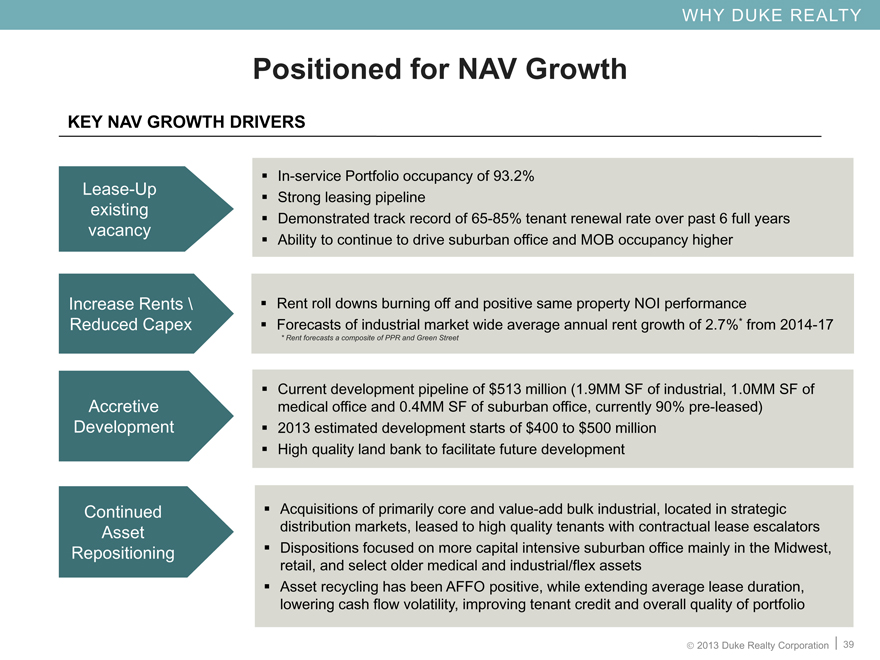

Positioned for NAV Growth

Key NAV Growth Drivers

Lease-Up

existing

vacancy

In-service Portfolio occupancy of 93.2%

Strong leasing pipeline

Demonstrated track record of 65-85% tenant renewal rate over past 6 full years

Ability to continue to drive suburban office and MOB occupancy higher

Accretive

Development

Current development pipeline of $513 million (1.9MM SF of industrial, 1.0MM SF of

medical office and 0.4MM SF of suburban office, currently 90% pre-leased)

2013 estimated development starts of $400 to $500 million

High quality land bank to facilitate future development

Continued

Asset

Repositioning

Acquisitions of primarily core and value-add bulk industrial, located in strategic

distribution markets, leased to high quality tenants with contractual lease escalators

Dispositions focused on more capital intensive suburban office mainly in the Midwest,

retail, and select older medical and industrial/flex assets

Asset recycling has been AFFO positive, while extending average lease duration,

lowering cash flow volatility, improving tenant credit and overall quality of portfolio

Increase Rents \

Reduced Capex

Rent roll downs burning off and positive same property NOI performance

Forecasts of industrial market wide average annual rent growth of 2.7%* from 2014-17

* | | Rent forecasts a composite of PPR and Green Street |

OPERATIONS Strategy

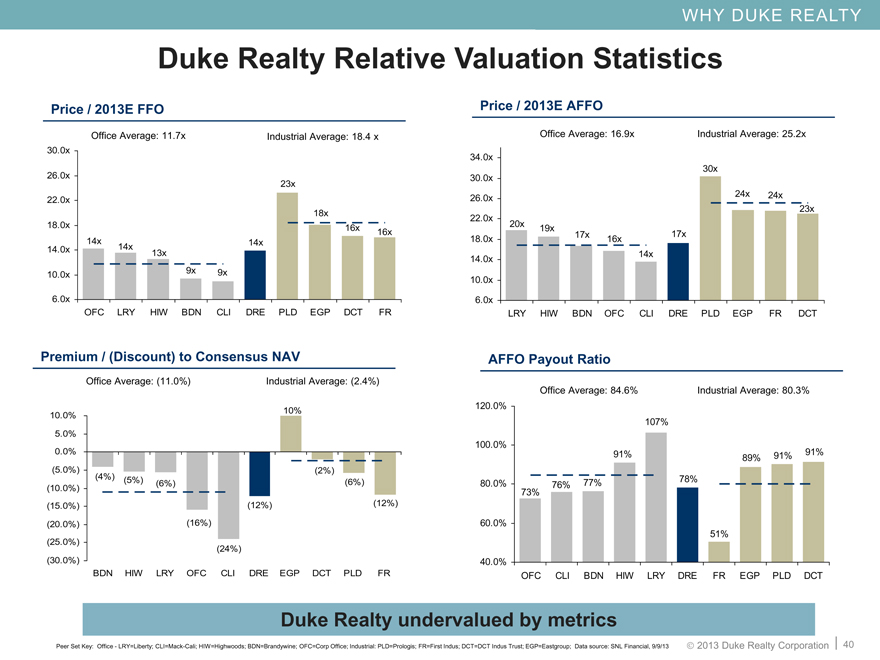

Why duke realty

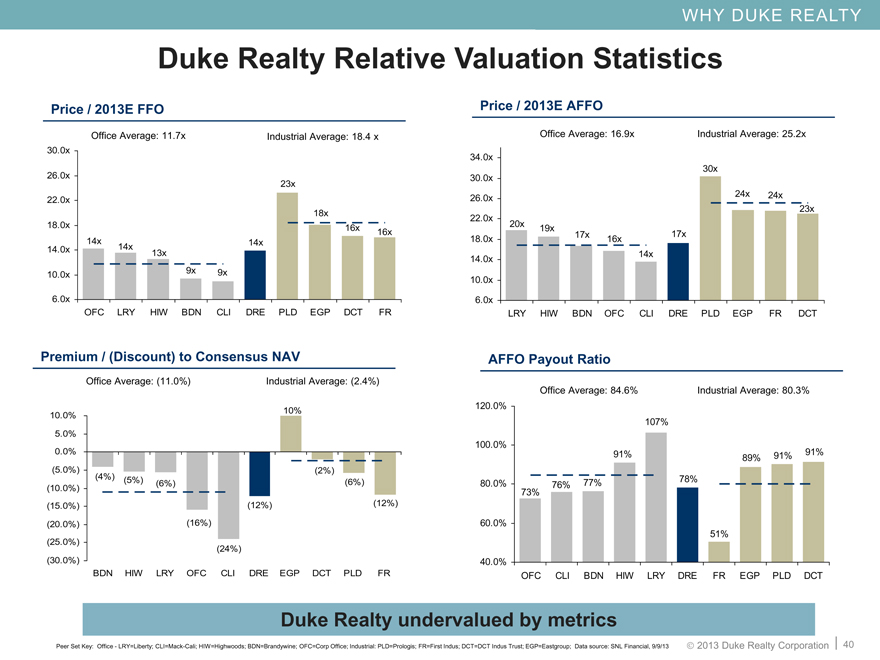

OFC CLI BDN HIW LRY DRE FR EGP PLD DCT

AFFO Payout Ratio 0.725 0.761 0.765 0.912 1.065 0.782 0.506 0.888 0.905 0.913

Average 0.846 0.846 0.846 0.846 0.846 0.803 0.803 0.803 0.803

LRY HIW BDN OFC CLI DRE PLD EGP FR DCT

P / 2013 AFFO 19.8 18.6 16.7 15.7 13.6 17.2 30.4 23.8 23.6 23.1

Average 16.9 16.9 16.9 16.9 16.9 25.2 25.2 25.2 25.2

OFC LRY HIW BDN CLI DRE PLD EGP DCT FR

P / 2013 FFO 14.2 13.5 12.5 9.4 8.9 13.9 23.2 18.1 16.2 16

Average 11.7 11.7 11.7 11.7 11.7 18.4 18.4 18.4 18.4

Industrial Average: 18.4 x

Office Average: 11.7x

Industrial Average: 25.2x

Industrial Average: 80.3%

Office Average: 16.9x

Office Average: 84.6%

Price / 2013E FFO

AFFO Payout Ratio

Price / 2013E AFFO

Peer Set Key: Office—LRY=Liberty; CLI=Mack-Cali; HIW=Highwoods; BDN=Brandywine; OFC=Corp Office; Industrial: PLD=Prologis; FR=First Indus; DCT=DCT Indus Trust; EGP=Eastgroup; Data source: SNL Financial, 9/9/13

Duke Realty Relative Valuation Statistics

40

BDN HIW LRY OFC CLI DRE EGP DCT PLD FR

Premium / (Discount) to NAV -0.04 -0.054 -0.056 -0.159 -0.24 -0.122 0.1 -0.021 -0.057 -0.118

Average -0.11 -0.11 -0.11 -0.11 -0.11 -0.024 -0.024 -0.024 -0.024

Industrial Average: (2.4%)

Office Average: (11.0%)

Premium / (Discount) to Consensus NAV

Duke Realty undervalued by metrics

Why duke realty

41

WHY DUKE REALTY?

Superior Asset Quality

Strategically Located Land Bank and Experienced

Development Capabilities

Proven Operational Success and Future Growth

Opportunities

Balance Sheet Strength

Relative Value vs. Peers

Talent and Leadership Depth to Execute

Medical office strategy

Reliable. answers

Why duke realty

Forward-Looking Statement

This slide presentation contains statements that constitute "forward-looking statements" within the meaning

of the Securities Act of 1933 and the Securities Exchange Act of 1934 as amended by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements include, among others, our statements

regarding (1) strategic initiatives with respect to our assets, operations and capital and (2) the assumptions

underlying our expectations. Prospective investors are cautioned that any such forward-looking statements

are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking statements. A number of important factors could

cause actual results to differ materially from those contemplated by forward-looking statements in this slide

presentation. Many of these factors are beyond our ability to control or predict. Factors that could cause

actual results to differ materially from those contemplated in this slide presentation include the factors set

forth in our filings with the Securities and Exchange Commission, including our annual report on Form10-K,

quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward-looking statements

are reasonable, however, undue reliance should not be placed on any forward-looking statements, which are

based on current expectations. We do not assume any obligation to update any forward-looking statements

as a result of new information or future developments or otherwise.

Certain of the financial measures appearing in this slide presentation are or may be considered to be non-

GAAP financial measures. Management believes that these non-GAAP financial measures provide additional

appropriate measures of our operating results. While we believe these non-GAAP financial measures are

useful in evaluating our company, the information should be considered supplemental in nature and not a

substitute for the information prepared in accordance with GAAP. We have provided for your reference

supplemental financial disclosure for these measures, including the most directly comparable GAAP measure

and an associated reconciliation in our most recent quarter supplemental report, which is available on our

website at www.dukerealty.com. Our most recent quarter supplemental report also includes the information

necessary to recalculate certain operational ratios and ratios of financial position. The calculation of these

non-GAAP measures may differ from the methodology used by other REITs, and therefore, may not be

comparable.

42