QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2005

Commission File Number:1-14118

2005 THIRD QUARTER RESULTS

QUEBECOR WORLD INC.

(Translation of Registrant's Name into English)

612 Saint-Jacques Street, Montreal, Quebec H3C 4M8

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F o Form 40-F ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Fork 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

QUEBECOR WORLD INC.

Filed in this Form 6-K

Documents index

- Press Release dated November 1, 2005; Financial Highlights

- Management's Discussion and Analysis of Financial Condition and Results of Operations

- Consolidated Financial Statements

- Certifications of Interim Filings

November 1, 2005 13/05

For immediate release Page 1 of 8

QUEBECOR WORLD ANNOUNCES THIRD QUARTER RESULTS

HIGHLIGHTS

- Net income from continuing operations for the third quarter of $31 million compared to $46 million

- Third quarter revenue was $1.58 billion

- Volume increases offset by lower pricing in most segments and weak performance in France and the UK

- Operating income before impairment of assets, restructuring and other charges (IAROC) at $97 million compared to $112 million

- Earnings per share before IAROC $0.28 compared to $0.36

- IAROC of $17 million in quarter compared to $13 million

Montréal, Canada — Quebecor World (NYSE:IQW, TSX:IQW.SV) announces that for the third quarter 2005 the Company reported net income of $31 million from continuing operations compared to $46 million in the third quarter of last year. The continuing operations do not include a previously identified group of non-core group assets slated for sale and the third quarter results for 2004 have been restated to reflect this fact. On the same basis, diluted earnings per share in the third quarter were $0.16 compared to $0.28 in 2004. Operating income before IAROC was $97 million compared to $112 million during the same period last year. Consolidated revenues for the quarter were $1.58 billion compared to $1.57 billion last year.

In the third quarter 2005, the Company recorded impairment of assets, restructuring and other charges of $17 million or $0.12 per share compared to $13 million or $0.08 per share in the third quarter last year. Before impairment of assets restructuring and other charges, earnings per share for continuing operation were $0.28 compared to $0.36 in the third quarter of 2004.

1

For immediate release Page 2 of 8

"These results are indicative of lower prices for many print products, higher energy costs and the poor performance of our operations in France and the United Kingdom," said Pierre Karl Péladeau, President and CEO, Quebecor World Inc. "We are continuing to renew existing customers, and are winning new ones. These sales successes are positioning us to realize the maximum benefits of our new equipment as we move forward with the implementation of our North American and European retooling plans."

Quebecor World is on schedule with its current equipment investment plan that will see the installation of 22 new wide-web offset presses. Five of those presses will be in operation in U.S. facilities in the fourth quarter. The remainder will come into service in 2006 and 2007.

"Not only are our new presses being installed on time but because of the strong support form our suppliers and the diligent efforts of our employees, these presses have not experienced the usual start-up delays," said Mr. Péladeau. "To date, the new equipment is performing as advertised and we expect this to continue as we move forward with our investment plan."

To address the underperformance of certain sectors of its European operations and to further strengthen the overall platform the Company expects to announce a comprehensive European investment plan in the first quarter of 2006.

"Our European investment plan will be based on the criteria we established for our North America platform. We will invest in state-of-the-art technology and locate it where it can best serve our customers" added Mr. Péladeau.

As part of its effort to improve results in Europe, restructuring initiatives in the third quarter included workforce reductions at the Helio Corbeil facility in France and other plants across the Company. The cash cost of the third quarter restructuring initiatives was $9.5 million.

Quebecor World continues to reduce costs across its global platform. In the third quarter 2005, selling, general and administrative expenses were $95 million compared to $108 million in the third quarter of 2004, a decrease of 12% or $15 million excluding the unfavourable impact of currency translation.

Year-to-date

For the first nine months of 2005, net income from continuing operations was $56 million or $0.20 per share compared to $94 million or $0.50 per share last year. Before impairment of assets, restructuring and other charges, diluted earnings per share for the first three quarters of 2005 were $0.77 compared to $0.86 last year. Operating income before IAROC was $270 million in 2005 compared to $310 million last year. Consolidated revenue for the first nine months of 2005 was $4.62 billion compared to $4.52 billion in 2004.

2

For immediate release Page 3 of 8

Impairment of assets, restructuring and other charges for nine months stands at $82 million compared to $67 million for 2004. On the cost side, for the first nine months of 2005, SG&A expenses were $294 million compared to $318 million in the first three quarters last year. Excluding the unfavourable impact of currency translation, SG&A expenses were lower by $32 million year-to-date. The savings are due to ongoing cost-containment initiatives and workforce reductions.

Discontinued Operations

Quebecor World's core printing activities involve the printing of magazines, catalogs, retail inserts, books, directories and direct mail for the world's largest publishers and retailers. As the Company has grown by acquisition certain facilities were included in those transactions that do not relate to these core businesses. Approximately a dozen facilities in North America are involved in the printing of short-run contractual work such as marketing materials, annual reports, travel and fashion brochures. These activities are different from Quebecor World's core businesses and do not benefit from the advantages and synergies of the Company's global platform. The Company has announced its intention to sell this non-core group. Consequently the operating results related to these activities have been presented separately in the Company's consolidated financial results as discontinued operations and comparative figures have been restated to conform to the presentation adopted during the quart er ended September 30, 2005.

Dividend

The Board of Directors declared a dividend of $0.14 per share on Multiple Voting Shares and Subordinate Voting Shares. The Board also declared a dividend of CDN$0.3845 per share on Series 3 Preferred Shares, CDN$0.421875 per share on Series 4 Preferred Shares and CDN$0.43125 on Series 5 Preferred Shares. The dividends are payable on December 1, 2005 to shareholders of record at the close of business November 16, 2005.

Full Financial Information

Management Discussion and Analysis

Please refer to the MD&A for the reconciliation to Canadian generally accepted accounting principles of certain figures used to explain these results. The MD&A can be found on the Company's website atwww.quebecorworld.com and through the SEDAR and SEC filings.

3

For immediate release Page 4 of 8

Financial statements are available on the Company's website and through the SEDAR and SEC filings.

Sedar web address:www.sedar.com

SEC web address:www.sec.gov

Conference Call

Quebecor World To Webcast Investor Conference Call on November 1, 2005

Quebecor World Inc. will broadcast its Third Quarter conference call live over the Internet on November 1, 2005 at 4:00 PM (Eastern Time).

The conference call will be webcast live and can be accessed on the Quebecor World web site:

http://www.quebecorworld.com/en/investors/webcasts/Q305

Prior to the call please ensure that you have the appropriate software. The Quebecor World web address listed above has instructions and a direct link to download the necessary software, free of charge.

Anyone unable to attend this conference call may listen to the replay tape by phoning (877) 293-8133 or (403) 266-2079 – passcode 294645#, available from November 1, 2005 to December 3, 2005.

Forward looking statements

Except for historical information contained herein, the statements in this release are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company's actual results in future periods to differ materially from forecasted results. Those risks include, among others, changes in customers' demand for the Company's products, changes in raw material and equipment costs and availability, seasonal changes in customer orders, pricing actions by the Company's competitors, and general changes in economic conditions.

4

For immediate release Page 5 of 8

The Company

Quebecor World Inc. (NYSE:IQW, TSX:IQW.SV) is one of the largest commercial printers in the world. It is a market leader in most of its major product categories which include magazines, inserts and circulars, books, catalogs, direct mail, directories, digital pre-media, logistics, mail list technologies and other value added services. The Company has approximately 34,000 employees working in more than 160 printing and related facilities in the United States, Canada, Argentina, Austria, Belgium, Brazil, Chile, Colombia, Finland, France, India, Mexico, Peru, Spain, Sweden, Switzerland and the United Kingdom.

Web address:www.quebecorworld.com

- 30 -

For further Information contact:

Tony Ross

Director, Communications

Quebecor World Inc.

(514) 877-5317

(800) 567-7070 | Philippe Cloutier

Director, Finance and

Investor Relations

Quebecor World Inc.

(514) 877-5147

(800) 567-7070 | | |

5

For immediate release Page 6 of 8

QUEBECOR WORLD INC.

FINANCIAL HIGHLIGHTS

Periods ended September 30

(In millions of US dollars, except per share data)

(Unaudited)

| | Three months

| | Nine months

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Consolidated Results from Continuing Operations | | | | | | | | | | | | | |

| Revenues | | $ | 1,577.2 | | $ | 1,569.6 | | $ | 4,619.3 | | $ | 4,516.8 | |

Operating income before depreciation

and amortization and before IAROC | | | 178.7 | | | 197.4 | | | 520.8 | | | 570.3 | |

| Operating income before IAROC | | | 97.2 | | | 112.3 | | | 270.2 | | | 309.7 | |

| IAROC | | | 17.2 | | | 12.8 | | | 82.3 | | | 67.2 | |

| Operating income | | | 80.0 | | | 99.5 | | | 187.9 | | | 242.5 | |

| Net income from continuing operations | | | 30.9 | | | 45.8 | | | 56.2 | | | 93.6 | |

Operating margin before depreciation

and amortization and before IAROC* | | | 11.3 | % | | 12.6 | % | | 11.3 | % | | 12.6 | % |

| Operating margin before IAROC* | | | 6.2 | % | | 7.2 | % | | 5.8 | % | | 6.9 | % |

| Operating margin * | | | 5.1 | % | | 6.3 | % | | 4.1 | % | | 5.4 | % |

Segmented Information from Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | $ | 1,253.6 | | $ | 1,228.5 | | $ | 3,559.4 | | $ | 3,462.4 | |

| | Europe | | | 270.7 | | | 295.7 | | | 886.2 | | | 920.8 | |

| | Latin America | | | 54.4 | | | 45.0 | | | 177.2 | | | 136.2 | |

Operating income (loss) before IAROC |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | $ | 100.0 | | $ | 110.4 | | $ | 264.3 | | $ | 284.3 | |

| | Europe | | | (4.8 | ) | | 9.3 | | | (0.8 | ) | | 33.6 | |

| | Latin America | | | 2.8 | | | 1.1 | | | 9.3 | | | 3.1 | |

Operating margins before IAROC* |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | | 8.0 | % | | 9.0 | % | | 7.4 | % | | 8.2 | % |

| | Europe | | | (1.8 | %) | | 3.1 | % | | (0.1 | %) | | 3.6 | % |

| | Latin America | | | 5.1 | % | | 2.5 | % | | 5.2 | % | | 2.3 | % |

Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by operating activities | | $ | 6.5 | | $ | 41.4 | | $ | 191.2 | | $ | 106.9 | |

| Free cash flow (outflow) from operations** | | $ | (80.1 | ) | $ | (0.1 | ) | $ | (43.2 | ) | $ | (18.3 | ) |

| Working capital | | | | | | | | $ | 142.6 | | $ | 92.8 | |

| Total assets | | | | | | | | $ | 6,122.4 | | $ | 6,281.0 | |

| Long-term debt (including convertible notes) | | | | | | | | $ | 2,003.6 | | $ | 2,162.2 | |

| Shareholders' equity | | | | | | | | $ | 2,499.4 | | $ | 2,529.9 | |

| Debt-to-capitalization | | | | | | | | | 44:56 | | | 46:54 | |

| Debt-to-EBITDA ratio (times)*** | | | | | | | | | 2.6 | | | 2.9 | |

| EBITDA interest coverage ratio (times)*** | | | | | | | | | 6.3 | | | 5.0 | |

Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from continuing operations | | | | | | | | | | | | | |

| | Diluted | | $ | 0.16 | | $ | 0.28 | | $ | 0.20 | | $ | 0.50 | |

| | Diluted before IAROC | | $ | 0.28 | | $ | 0.36 | | $ | 0.77 | | $ | 0.86 | |

| Dividends on equity shares | | $ | 0.14 | | $ | 0.13 | | $ | 0.42 | | $ | 0.39 | |

| Book value | | | | | | | | $ | 15.62 | | $ | 15.65 | |

IAROC: Impairment of assets, restructuring and other charges.

Debt-to-EBITDA ratio: Total debt divided by operating income before depreciation and amortization and before IAROC.

EBIDTA interest coverage ratio: Operating income before depreciation and amortization and before IAROC divided by financial expenses.

- *

- Margins calculated on revenues.

- **

- Cash provided by operating activities, less capital expenditures net of proceeds from disposals, and preferred share dividends.

- ***

- Calculations based on a rolling twelve-month period for continuing operations.

6

For immediate release Page 7 of 8

APPENDIX — SEGMENTED RESULTS

North America

In the third quarter, revenues from North American operations were $1.25 billion compared to $1.23 billion in 2004. Year-to-date revenues were $3.56 billion compared to $3.46 billion last year. Operating income in the third quarter before impairment of assets restructuring and other charges was $100 million compared to $110 million and operating margin on the same basis was 8.0% compared to 9.0%. In the third quarter, increases in revenue and volume in several product groups were offset by continuing negative price pressure and lower volume in some groups.

Magazine/Direct

In the Magazine and Direct group, volume increased 5% in the Direct Mail segment but was offset by a 3% volume decrease in magazines. To improve productivity and customer service, two new 48 page presses in the magazine platform will be operational in the fourth quarter.

Retail/Catalog

In the Retail group, net volume increased 4% in the quarter due to new customers and additional work from existing ones as well as by the addition of an offset printing facility in Pittsburg, CA. In Catalogs, volume increased 2% but excluding the positive impact of paper sales, revenues were lower. Also, as part of the North American investment plan, a new 64-page press will be in operation in the fourth quarter to serve catalog customers in the Company's Jonesboro facility.

Book/Directory

In the Book and Directory group, revenues and volume decreased in the quarter compared to the same period last year. Two new 64 page presses will be operating in the fourth quarter to serve book publishers. In the quarter, the Company announced a major long-term contract with one of North America's largest directory publishers which will significantly increase volumes starting in 2007.

Canada

In Canada, volume increased slightly in the quarter mainly due to increases in the retail sector. Pricing impact was compensated by cost containment and operational efficiency. In the third quarter, Quebecor World announced an investment in new presses in partnership with Quebecor Inc.'s subsidiary Quebecor Media. The investment includes a new printing facility in the Toronto area to print newspapers and directories.

7

For immediate release Page 8 of 8

Europe

In Europe, revenues in the third quarter were $271 million compared to $296 million in the third quarter of 2004. Excluding the positive impact of currency translation, revenues for the quarter were down 8%. Volume in Europe decreased 14% in the third quarter. The decrease was largely due to the loss of a major customer in the United Kingdom and lower volume in the French magazine market. In the third quarter, operations in Europe recorded a negative operating margin due to lower volume and pricing. This was due to the poor performance of the French platform and the first full quarter without volume from a major customer at the UK facility. Some of this volume has been replaced but at lower margins. Operating income and margin increased in the third quarter and year-to-date in Spain, Finland and Austria.

Latin America

In Latin America, revenues in the third quarter increased 21% to $54 million compared to $45 million in the same period last year. Excluding the positive impact of currency translation and paper sales, revenues in the quarter increased 5%. Volume in the quarter decreased 13% compared to the same period last year. The volume decrease is specifically related to the timing of the production of certain directories. Operating income and margin increased due to operational efficiency, an increase in prices in certain segments and a favourable product mix. The Latin American operations are continuing to benefit from an earlier initiative that positioned these assets as a low-cost alternative to publishers who are having products produced in Asia. This initiative is attracting increased interest and sales from North American and European publishers.

8

Management's Discussion and Analysis

The following is a discussion of the consolidated financial condition and results of operations of Quebecor World Inc. (the "Company") for the three-month and nine-month periods ended September 30, 2005 and 2004, and should be read together with the Company's interim consolidated financial statements and the annual "Management's Discussion and Analysis" included in the 2004 Annual Report. The interim consolidated financial statements and Management's Discussion and Analysis have been reviewed by the Company's Audit Committee and approved by its Board of Directors. This discussion contains forward-looking information that is qualified by reference to, and should be read together with, the discussion regarding forward-looking statements that is part of this document. Management determines whether or not information is "material" based on whether it believes a reasonable investor's decision to buy, sell or hold securities in the Company would likely be influenced or changed if the information were omitted or misstated.

Financial data have been prepared in conformity with Canadian generally accepted accounting Principles ("Canadian GAAP"). However, certain measures used in this discussion and analysis do not have any standardized meaning under Canadian GAAP. When used, these measures are defined in such terms as to allow the reconciliation to the closest Canadian GAAP measure. Numerical reconciliations are provided in figure 6. It is unlikely that these measures could be compared to similar measures presented by other companies.

The Company's functional currency is the Canadian dollar and its reporting currency is the U.S. dollar.

FORWARD-LOOKING STATEMENTS

Except for historical information contained herein, the statements in this document are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from forecasted results. Those risks include, among others, changes in customer demand for products, changes in raw material and equipment costs and availability, seasonal changes in customer orders, pricing actions by competitors and general changes in economic conditions.

OVERVIEW

Quebecor World Inc. is one of the largest commercial print media services companies in the world. Quebecor World is a market leader in the product categories and geographies it serves. This market-leading position has been built through a combination of integrating acquisitions, investing in key strategic technologies and a commitment to building long-term partnerships with the world's leading print media customers.

Quebecor World has facilities in the United States, Canada, Argentina, Austria, Belgium, Brazil, Chile, Colombia, Finland, France, India, Mexico, Peru, Spain, Sweden, Switzerland and the United Kingdom.

The Company offers its customers a broad range of printed products and related communication services, such as magazines, retail inserts, catalogs, direct mail, books, directories, logistics, pre-media and other value-added services.

The Company operates in the commercial print media segment of the printing industry and its business groups are located in three geographical regions: North America, which has historically represented approximately 80% of the Company's revenues, Europe and Latin America.

Operations in this segment of the print industry are seasonal with a greater part of volume being realized in the second half of the fiscal year, primarily due to the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions. The interim results of operations analyzed hereafter are not necessarily indicative of full year results.

Consolidation of the printing industry is ongoing because of global overcapacity, which has led to negative price pressures. As smaller plants disappear, larger plants continue to grow and deploy more efficient equipment. Global capacity is also affected by the emergence of Asian competitors in particular in the Book segment where the timing of deliveries is less of an issue. In response to this competition, the Company offers its clients the Latin American platform as a low-cost alternative. Overall, global overcapacity will remain an issue and will likely continue to impact prices in most segments.

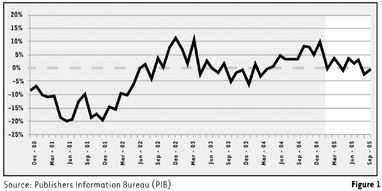

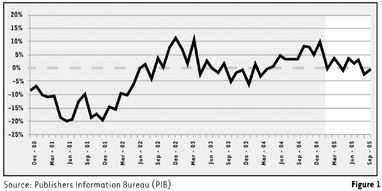

The primary drivers affecting the Company are consumer confidence and economic growth rates. These are key drivers of demand for commercial print media because they affect the level of advertising and merchandising activity. The Company uses magazine advertising pages as an important indicator of demand for printing products and services. This indicator, as measured in the United States by the Publishers Information Bureau, showed some positive signs throughout 2004, but was uneven in the first nine months of 2005 (Figure 1).

U.S. Magazine Advertising Pages 2001-2005 (Monthly)

Percentage Year-Over-Year Change

The Company also emphasizes two additional key success factors — administrative and manufacturing efficiency — and addresses them on a continual basis. In recent years, the Company has undertaken restructuring initiatives that resulted in downsizing across the platform and several plant closures or combinations. These measures are ongoing and are expected to continue through the rest of 2005. In the current challenging environment, the positive effects of the ongoing restructuring initiatives did not translate into increases in operating income because of the continuing price reductions, rising energy costs and the underperformance of the French and British operations.

The Company's strategy is to reduce its fixed cost base and increase its efficiency by consolidating smaller facilities into larger groups of operations, grouping similar types of assets into larger facilities using available space and optimizing all aspects of pressroom efficiencies. As is the case with other manufacturing industries, technology in the printing industry is constantly evolving and it will continue to play an important role in improving Quebecor World's manufacturing efficiency. The Company is focused on improving speeds, reducing manning, lowering downtime and paper waste as well as shorter make-ready times.

As part of these efforts, the Company approved a three-year investment plan in 2004 that calls for over $300 million in investments in newer, more efficient presses in North America. The installation of the first group of presses was underway in the third quarter of 2005 at facilities in Merced (California), Dallas (Texas), Jonesboro (Arkansas) and Versailles (Kentucky).

9

In Europe, the Company is also working on a retooling plan to be announced in the first quarter of 2006. The Company intends to rapidly implement the necessary programs to improve its competitive position in this segment.

In addition, the Company divested certain smaller operations in France and North America. Finally, during the fourth quarter, the Company expects to complete its divestiture program that was previously announced.

On October 21, 2005, the Company released an outlook for 2005. Management estimated at that time that earnings per share for the third and fourth quarters of 2005 would be lower than 2004 and below market expectations. The actual results for the third quarter are below those of the corresponding period in 2004, and the first nine months of 2005 have been particularly difficult for the Company. These lower results reflect the challenging market conditions that the Company has faced, especially with regard to continuing worldwide price erosion and rising energy costs. In addition, European results are down significantly compared to 2004 as a result of the loss of an important customer in the United Kingdom and the underperformance of French operations. The French operations suffered from continued price pressure coupled with operational inefficiencies throughout the first nine months of 2005. The United Kingdom's results for the second and third quarters reflect the volume lost because an important contract was terminated. The Company is addressing both the situation in France and the United Kingdom as part of the European retooling plan currently under development.

The current charge for impairment of assets, restructuring and other charges reflects smaller initiatives undertaken in the first nine months and definite plans to eliminate inefficient and idle equipment. As such, a detailed review of activities took place in 2005 at the facility in Corby, United Kingdom. This resulted in the implementation of the first two parts of a workforce reduction plan as well as impairments of long-lived assets. The Company anticipates additional restructuring charges in the upcoming quarters related to the restructuring of this facility, as discussed in the "Impairment of Assets and Restructuring Initiatives" section.

DISCONTINUED OPERATIONS

Over the years, Quebecor World has strived to build a global printing platform that allows publishers and retailers to print in multiple plants, in various countries, reducing lead-time and distribution costs. The Company's core printing activities, mainly the printing of magazines, catalogs, retail inserts, books and directories, benefit from this platform. However, as the Company grew by acquisitions, certain facilities were included in these transactions that do not concentrate on Quebecor World's core printing activities. As a result, there are approximately a dozen facilities in North America whose primary activities are non-core general commercial printing. These activities consist primarily of short-run, non-contractual work such as annual reports, marketing materials, travel, fashion and automobile brochures and packaging. This market is highly competitive and fragmented with many small local and regional players. Unlike Quebecor World's previously described core business, these activities do not benefit from the advantages and synergies of the Company's global platform. As a result, on May 10, 2005, the Company announced a plan to sell its group of non-core printing facilities in North America (the "non-core Group").

At the end of the second quarter of 2005, the Company completed the sale of a unit in Los Angeles, California. During the third quarter, the Company completed the sale of a unit in Westwood, Massachusetts and signed agreements to sell the remaining units included in the non-core Group, subject to the fulfillment of certain conditions by the Company and the purchasers. The units should be sold in the last quarter of 2005 if the conditions of the agreements are met by the Company and the purchasers. Consequently, the operating results related to these activities have been presented separately in the Company's consolidated financial statements as discontinued operations and comparative figures have been restated to conform to the presentation adopted in 2005. The assets and liabilities related to the remaining plants are presented as held for sale in Note 5 to the consolidated financial statements as at September 30, 2005.

The results of the non-core Group have been significantly impacted by the loss on disposition of the Los Angeles and Westwood facilities as well as specific charges related to these facilities in the second and third quarters of 2005 and pension curtailment costs in the third quarter.

REVIEW OF THIRD QUARTER AND YEAR-TO-DATE

The Company assesses performance based on operating income before impairment of assets, restructuring and other charges. The following operating analyses are before impairment of assets, restructuring and other charges. The review focused only on continuing operations.

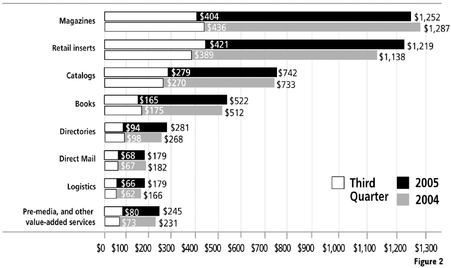

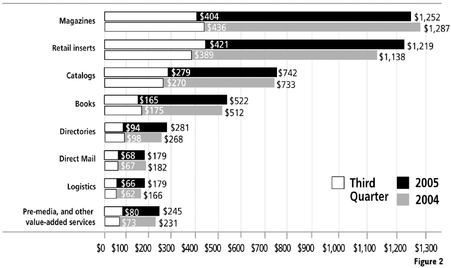

The Company's consolidated revenues for the quarter were $1,577 million compared to $1,570 million for the same period in 2004. On a year-to-date basis, revenues were $4,619 million, up 2% from $4,517 million in 2004. Excluding the favorable impact of currency translation (see figure 3), revenues were $1,554 for the quarter, down 1% compared to 2004 and $4,529 for the first nine months of 2005, flat compared to 2004. This situation is mainly due to continued pressure on prices, and a volume decrease in certain segments. Revenue by product is shown in figure 2.

Revenue by Product-Worldwide

($ millions)

For the quarter and the nine-month periods ended September 30

(Continuing Operations)

For the third quarter of 2005, operating income decreased 13% to $97 million, from $112 million in 2004. On a year-to-date basis, operating income was $270 million, down 13% from $310 million in 2004. Operating margin for the quarter was 6.2% compared to 7.2% for the same period in 2004. For the year 2005 to date, operating margin was 5.8% down from 6.9% in 2004.

Impact of Foreign Currency

($ millions)

(Continuing Operations)

| | Three months ended

September 30, 2005

| | Nine months ended

September 30, 2005

|

|---|

| Foreign currency favorable impact on revenues | | $ | 23.3 | | $ | 89.6 |

| Foreign currency favorable impact on operating income | | $ | 1.2 | | $ | 2.6 |

Figure 3

10

Paper sales, excluding the effect of currency translation, increased by 7% in the third quarter of 2005, compared to the same period in 2004. On the same basis, for the first nine months of 2005, paper sales increased by 8% compared to the same period in 2004. The increase for the quarter and year-to-date is mainly due to the increase in paper sales to customers and the increase in paper prices compared to 2004. Although the increase in paper sales has a positive impact on revenues, it has little or no impact on operating income because the cost is generally passed on to the customer and, as a result, it contributes to the lower operating margin. Most of the Company's long-term contracts with its customers include price-adjustment clauses based on the cost of materials in order to minimize the effects of fluctuation in the price of paper.

Cost of sales for the third quarter 2005 increased 3% at $1,305 million compared to $1,268 million last year. For the year 2005 to date, cost of sales was $3,808 million, a 5% increase compared to $3,639 million for the same period in 2004. Gross profit margin was 17.3% in the third quarter of 2005, down from 19.2% in 2004. On a year-to-date basis, gross profit margin was 17.6% compared to 19.4% in 2004. The cost of sales for the first nine months of 2005 included specific charges of $12 million, mainly due to lease provisions, compared to $1 million for the same period in 2004. Cost of sales was not significantly impacted by specific charges in the third quarter of 2005 and 2004. Excluding the unfavorable impact of currency translation, gross profit margin for the quarter was 17.3%, down from 19.5% for the same quarter last year. On a year-to-date basis in 2005, gross profit margin, excluding specific items as well as the unfavorable impact of currency translation, was 17.9% compared to 19.4% for 2004. The decrease compared to 2004 is explained by continued pressure on prices, rising energy costs and a higher level of paper sales. On a year-to-date basis, these were partly offset by a $52 million decrease in labor costs compared to the same period in 2004. This reflects the effect of the ongoing restructuring initiatives undertaken by the Company and described in the "Impairment of Assets and Restructuring Initiatives" section hereafter.

Selling, general and administrative expenses for the third quarter of 2005 were $95 million compared to $108 million in 2004, a decrease of 12%. On a year-to-date basis, selling, general and administrative expenses were $294 million in 2005, compared to $318 million in 2004 or a decrease of 8%. Excluding the unfavorable impact of currency translation of $2 million, selling, general and administrative expenses were lower by $15 million for the third quarter compared to last year. On a year-to-date basis, excluding the negative impact of currency translation of $8 million, selling, general and administrative expenses improved by $32 million. The savings were mostly explained by cost-containment initiatives and headcount reductions.

Segmented Results of Continuing Operations

($ millions)

Selected Performance Indicators

| | North America

| | Europe

| | Latin America

| | Inter-Segment and Others

| | Total

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Three months ended September 30, | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 1,253.6 | | $ | 1,228.5 | | $ | 270.7 | | $ | 295.7 | | $ | 54.4 | | $ | 45.0 | | $ | (1.5 | ) | $ | 0.4 | | $ | 1,577.2 | | $ | 1,569.6 | |

| Operating income (loss) before depreciation and amortization and before IAROC | | | 165.2 | | | 174.9 | | | 8.5 | | | 26.7 | | | 5.6 | | | 3.9 | | | (0.6 | ) | | (8.1 | ) | | 178.7 | | | 197.4 | |

| Operating income (loss) before IAROC | | | 100.0 | | | 110.4 | | | (4.8 | ) | | 9.3 | | | 2.8 | | | 1.1 | | | (0.8 | ) | | (8.5 | ) | | 97.2 | | | 112.3 | |

| IAROC | | | 3.3 | | | 6.0 | | | 13.7 | | | 6.1 | | | 0.2 | | | 0.5 | | | — | | | 0.2 | | | 17.2 | | | 12.8 | |

| Operating income (loss) | | | 96.7 | | | 104.4 | | | (18.5 | ) | | 3.2 | | | 2.6 | | | 0.6 | | | (0.8 | ) | | (8.7 | ) | | 80.0 | | | 99.5 | |

| Operating margin before depreciation and amortization and before IAROC | | | 13.2 | % | | 14.2 | % | | 3.2 | % | | 9.0 | % | | 10.3 | % | | 8.7 | % | | | | | | | | 11.3 | % | | 12.6 | % |

| Operating margin before IAROC | | | 8.0 | % | | 9.0 | % | | (1.8 | %) | | 3.1 | % | | 5.1 | % | | 2.5 | % | | | | | | | | 6.2 | % | | 7.2 | % |

| Operating margin | | | 7.7 | % | | 8.5 | % | | (6.8 | %) | | 1.1 | % | | 4.7 | % | | 1.5 | % | | | | | | | | 5.1 | % | | 6.3 | % |

| Capital expenditures(1) | | $ | 64.3 | | $ | 26.7 | | $ | 22.8 | | $ | 8.9 | | $ | 1.2 | | $ | 0.2 | | $ | 0.2 | | $ | 0.1 | | $ | 88.5 | | $ | 35.9 | |

| Changes in non-cash balances related to operations, cash flow (outflow)(1) | | | (123.6 | ) | | (129.8 | ) | | 3.3 | | | (13.6 | ) | | (14.1 | ) | | (0.3 | ) | | 11.6 | | | 24.8 | | | (122.8 | ) | | (118.9 | ) |

Nine months ended September 30, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues | | $ | 3,559.4 | | $ | 3,462.4 | | $ | 886.2 | | $ | 920.8 | | $ | 177.2 | | $ | 136.2 | | $ | (3.5 | ) | $ | (2.6 | ) | $ | 4,619.3 | | $ | 4,516.8 | |

| Operating income (loss) before depreciation and amortization and before IAROC | | | 462.1 | | | 484.2 | | | 43.2 | | | 85.0 | | | 17.4 | | | 11.4 | | | (1.9 | ) | | (10.3 | ) | | 520.8 | | | 570.3 | |

| Operating income (loss) before IAROC | | | 264.3 | | | 284.3 | | | (0.8 | ) | | 33.6 | | | 9.3 | | | 3.1 | | | (2.6 | ) | | (11.3 | ) | | 270.2 | | | 309.7 | |

| IAROC | | | 19.7 | | | 56.6 | | | 61.9 | | | 9.0 | | | 0.7 | | | 1.1 | | | — | | | 0.5 | | | 82.3 | | | 67.2 | |

| Operating income (loss) | | | 244.6 | | | 227.7 | | | (62.7 | ) | | 24.6 | | | 8.6 | | | 2.0 | | | (2.6 | ) | | (11.8 | ) | | 187.9 | | | 242.5 | |

| Operating margin before depreciation and amortization and before IAROC | | | 13.0 | % | | 14.0 | % | | 4.9 | % | | 9.2 | % | | 9.8 | % | | 8.4 | % | | | | | | | | 11.3 | % | | 12.6 | % |

| Operating margin before IAROC | | | 7.4 | % | | 8.2 | % | | (0.1 | %) | | 3.6 | % | | 5.2 | % | | 2.3 | % | | | | | | | | 5.8 | % | | 6.9 | % |

| Operating margin | | | 6.9 | % | | 6.6 | % | | (7.1 | %) | | 2.7 | % | | 4.9 | % | | 1.5 | % | | | | | | | | 4.1 | % | | 5.4 | % |

| Capital expenditures(1) | | $ | 174.9 | | $ | 82.4 | | $ | 39.5 | | $ | 15.0 | | $ | 2.3 | | $ | 3.3 | | $ | 0.2 | | $ | 0.1 | | $ | 216.9 | | $ | 100.8 | |

| Changes in non-cash balances related to operations, cash flow (outflow)(1) | | | (121.1 | ) | | (323.4 | ) | | (28.2 | ) | | (41.3 | ) | | (19.0 | ) | | 5.4 | | | (11.1 | ) | | 26.9 | | | (179.4 | ) | | (332.4 | ) |

| Figure 4 | |

IAROC: Impairment of assets, restructuring and other charges.

(1) Including both continued and discontinued operations

11

Depreciation and amortization were $74 million in the third quarter of 2005 compared to $79 million in the same period of 2004. On a year-to-date basis, depreciation and amortization were $231 million in 2005, compared to $242 million in 2004. Excluding the impact of currency movement, depreciation and amortization decreased by 6% for the third quarter and year-to-date in 2005 compared to last year. The decrease is mostly due to impairment charges taken during the last twelve months.

Securitization fees totaled $6 million for the third quarter of 2005 ($3 million for the third quarter of 2004) and $16 million for the first nine months of 2005 ($9 million for the same period in 2004). The increase for the first nine months of 2005 was mainly due to higher market interest rates underlying the program fees. Servicing revenues and expenses did not have a significant impact on the Company's results.

During the first three quarters of 2005, the Company continued its restructuring initiatives and recorded a net impairment of assets and restructuring charges of $82 million, which reflected further workforce reductions across the Company. These measures are described in the section "Impairment of Assets and Restructuring Initiatives".

Financial expenses were $31 million in the third quarter of 2005, compared to $32 million in 2004. On a year to-date basis, financial expenses were $91 million in 2005, compared to $102 million in 2004. The lower expenses on a year-to-date basis, were mainly due to a lower average volume of debt in 2005 and a $2 million non-recurring charge on extinguishments of long-term debt in 2004.

In the third quarter of 2005, income taxes were $18 million compared to $21 million for the same period in 2004 or an effective tax rate of 37.2% compared to 30.9% in 2004. On a year-to-date basis, income taxes were $41 million in 2005, compared to $42 million in 2004, or an effective tax rate of 42.2% compared to 29.8% in 2004. The rates were significantly higher in 2005 due to valuation allowances recorded on tax benefits related to the impairment of long-lived assets, restructuring and other charges. Before impairment of assets, restructuring and other charges, income taxes were $19 million for the third quarter of 2005 compared to $23 million for the same period last year or an effective tax rate of 29.3% for 2005 compared to 28.7% in 2004. On the same basis, the year-to-date income taxes were $48 million compared to $62 million in 2004, or an effective tax rate of 26.8% compared to 29.8% for 2004. The decrease in income tax rate was mainly due to a decrease in profits before taxes in jurisdictions with higher tax rates.

Net income for the third quarter was $30 million compared to $48 million in 2004. For the nine-month period, net income was $48 million in 2005, compared to $99 million for the same period last year. Diluted earnings per share of continuing operations were $0.16 for the third quarter of 2005, down from $0.28 in 2004. These results incorporated impairment of assets, restructuring and other charges of $17 million ($16 million net of taxes) or $0.12 per share compared with $13 million ($11 million net of taxes) or $0.08 per share in 2004. Excluding the effect of impairment of assets, restructuring and other charges, the third quarter of 2005 resulted in diluted earnings per share of $0.28 compared with $0.36 in the same period of 2004. Diluted earnings per share were $0.20 for the first nine months of 2005 compared to $0.50 for the same period in 2004. These results incorporated impairment of assets, restructuring and other charges of $82 million ($75 million net of taxes) or $0.57 per share compared with $67 million ($47 million net of taxes) or $0.36 per share in 2004. Excluding the effect of impairment of assets, restructuring and other charges, the first three quarters of 2005 resulted in diluted earnings per share of $0.77 compared with $0.86 in the same period of 2004.

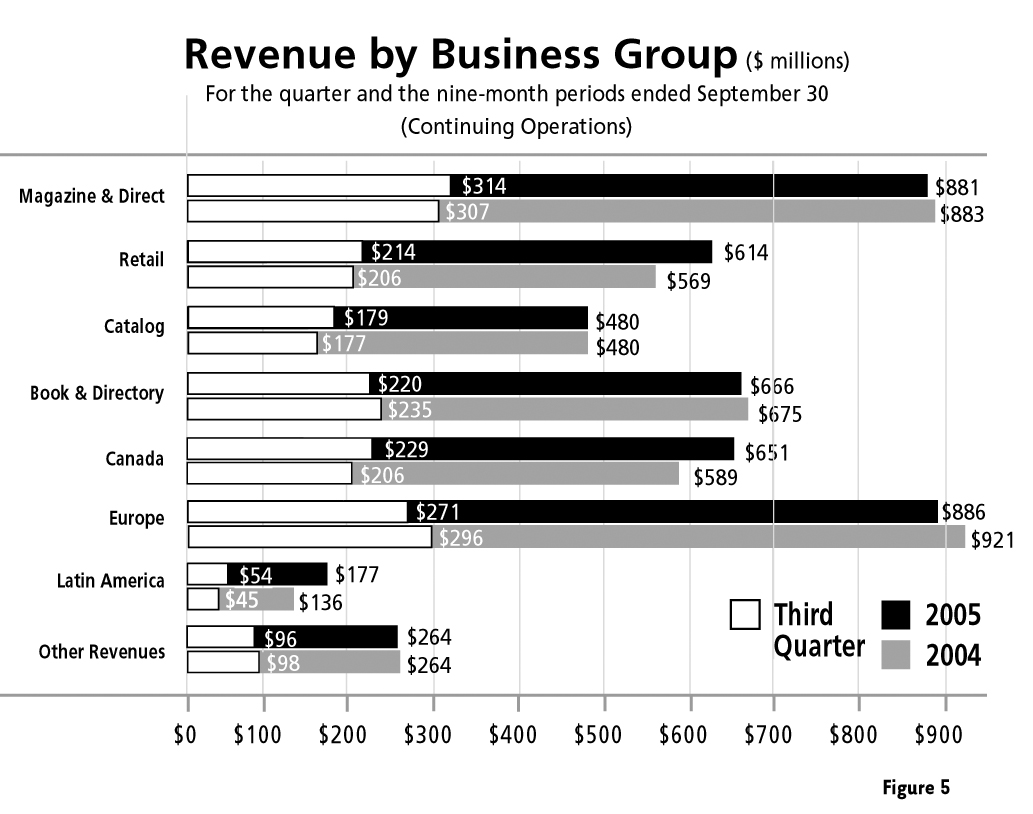

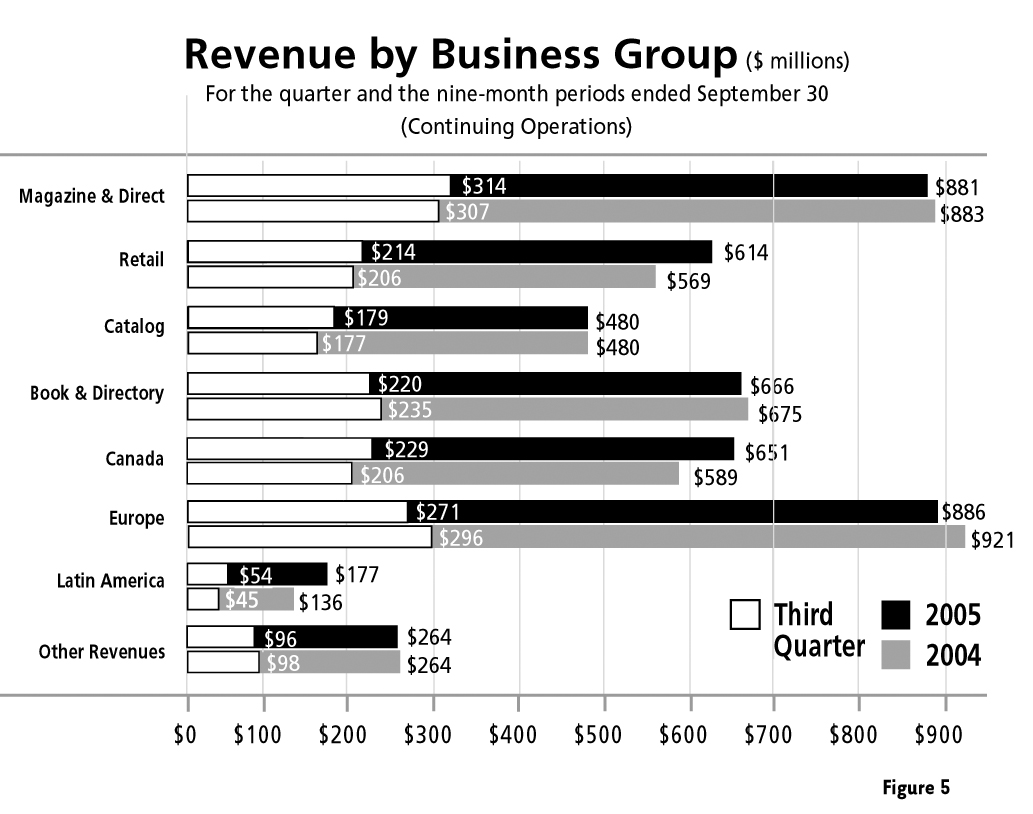

SEGMENT REVIEW

The following review of operating activities by business group (figure 5) is before impairment of assets, restructuring and other charges. Also, the review focuses only on continuing operations.

Revenue by Business Group

($ millions)

For the quarter and the nine-month periods ended September 30

(Continuing Operations)

North America

North American revenues for the third quarter of 2005 were $1,254 million, up 2% from $1,228 million in 2004. On a year-to-date basis, revenues were $3,559 in 2005 up 3% from $3,462 in 2004. Excluding the effect of currency translation and the favorable impact of paper sales, revenues decreased by 2% in the third quarter and 1% on a year-to-date basis mainly due to price erosion. Selling, general and administrative expenses decreased across the North American platform in the third quarter and on a year-to-date basis in 2005 compared to 2004, due to savings from facility closures, cost-containment initiatives and corporate headcount reductions, mostly in 2004. Year-over-year headcount was reduced in North America by 1,342 employees, or approximately 5%.

The following is a review of the North American activities by business group. The North American segment is made up of the following business groups: Magazine & Direct, Retail, Catalog, Book & Directory, Canada and Other Revenues.

Magazine & Direct

Magazine & Direct revenues for the third quarter of 2005 were $314 million, up 2% from $307 million in 2004. On a year-to-date basis, revenues were $881 million in 2005, down slightly from $883 million in 2004. Revenue increased in the third quarter due mainly to increased paper sales in both groups and a 5% volume increase in the Direct group which was offset by a 3% volume shortfall in the Magazine group as well as continued price erosion in the Direct group. Revenue decreased on a year-to-date basis due to the volume shortfalls of 4% in the Magazine group with continued price erosion in both groups. These shortfalls were partially offset by increased paper sales in both groups. Volume in the Magazine group was negatively impacted due to the non-renewal of certain important contracts. Operating income and margin decreased in the third quarter and on a year-to-date basis due mainly to the volume decreases and price erosion, but was partly offset by a decrease in labor costs from headcount reduction. As part of the ongoing investment plan to improve operational efficiencies, new presses are being installed in three facilities for magazine customers with two of them expected to be in operation in the fourth quarter of 2005.

Retail

Retail revenues for the third quarter of 2005 were $214 million, up 4% from $206 million in 2004. On a year-to-date basis, revenues were $614 million in 2005, up 8% from $569 million in 2004. Excluding the favorable impact of paper sales, revenues decreased 1% in the third quarter and increased 2% on a year-to-date basis compared to the

12

| | Three months ended Sept. 30,

| | Nine months ended Sept. 30,

| |

|---|

Reconciliation of non GAAP measures

($ millions)

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Operating Income from Continuing Operations | | | | | | | | | | | | | |

| | Operating income | | $ | 80.0 | | $ | 99.5 | | $ | 187.9 | | $ | 242.5 | |

| | IAROC | | | 17.2 | | | 12.8 | | | 82.3 | | | 67.2 | |

| | |

| |

| |

| |

| |

| | Operating income before IAROC | | $ | 97.2 | | $ | 112.3 | | $ | 270.2 | | $ | 309.7 | |

| | |

| |

| |

| |

| |

| | Operating income | | $ | 80.0 | | $ | 99.5 | | $ | 187.9 | | $ | 242.5 | |

| | Depreciation of property, plant and equipment(1) | | | 74.3 | | | 81.0 | | | 234.9 | | | 248.7 | |

| | Amortization of deferred charges(1) | | | 7.2 | | | 6.6 | | | 19.9 | | | 19.4 | |

| | Less depreciation and amortization from discontinued operations(2) | | | — | | | (2.5 | ) | | (4.2 | ) | | (7.5 | ) |

| | |

| |

| |

| |

| |

| | Operating income before depreciation and amortization | | $ | 161.5 | | $ | 184.6 | | $ | 438.5 | | $ | 503.1 | |

| | IAROC | | | 17.2 | | | 12.8 | | | 82.3 | | | 67.2 | |

| | |

| |

| |

| |

| |

| | Operating income before depreciation and amortization and before IAROC | | $ | 178.7 | | $ | 197.4 | | $ | 520.8 | | $ | 570.3 | |

| | |

| |

| |

| |

| |

Earnings per share from Continuing Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Net income from Continuing Operations | | $ | 30.9 | | $ | 45.8 | | $ | 56.2 | | $ | 93.6 | |

| | IAROC (net of income taxes of $1 million for the third quarter of 2005 ($7 million year-to-date) and $2 million for the third quarter of 2004 ($20 million year-to-date)) | | | 16.0 | | | 10.6 | | | 75.1 | | | 47.1 | |

| | |

| |

| |

| |

| |

| | Net income from continuing operations before IAROC | | $ | 46.9 | | $ | 56.4 | | $ | 131.3 | | $ | 140.7 | |

| | Net income available to holders of preferred shares | | | 10.1 | | | 9.0 | | | 29.8 | | | 26.9 | |

| | |

| |

| |

| |

| |

| | Net income from continuing operations available to holders of equity shares before IAROC | | $ | 36.8 | | $ | 47.4 | | $ | 101.5 | | $ | 113.8 | |

| | Diluted average number of equity shares outstanding (in millions) | | | 130.9 | | | 132.7 | | | 132.1 | | | 132.5 | |

| | Earnings per share from continuing operations | | | | | | | | | | | | | |

| | | Diluted | | $ | 0.16 | | $ | 0.28 | | $ | 0.20 | | $ | 0.50 | |

| | | Diluted before IAROC | | $ | 0.28 | | $ | 0.36 | | $ | 0.77 | | $ | 0.86 | |

| | |

| |

| |

| |

| |

Free Cash Flow (Outflow) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Cash provided by operating activities | | $ | 6.5 | | $ | 41.4 | | $ | 191.2 | | $ | 106.9 | |

| | Dividends on preferred shares | | | (2.4 | ) | | (5.9 | ) | | (27.0 | ) | | (26.1 | ) |

| | Additions to property, plant and equipment | | | (88.5 | ) | | (35.9 | ) | | (216.9 | ) | | (100.8 | ) |

| | Net proceeds from disposal of assets | | | 4.3 | | | 0.3 | | | 9.5 | | | 1.7 | |

| | |

| |

| |

| |

| |

| | Free cash flow (outflow) from operations | | $ | (80.1 | ) | $ | (0.1 | ) | $ | (43.2 | ) | $ | (18.3 | ) |

| | |

| |

| |

| |

| |

Debt-to-capitalization |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Bank indebtedness | | | | | | | | $ | — | | $ | 1.5 | |

| | Current portion of long-term debt | | | | | | | | | 9.2 | | | 11.7 | |

| | Long-term debt | | | | | | | | | 1,880.2 | | | 2,038.3 | |

| | Convertible notes | | | | | | | | | 114.2 | | | 112.2 | |

| | | | | | | | |

| |

| |

| | Total debt | | | | | | | | $ | 2,003.6 | | $ | 2,163.7 | |

| | Minority interest | | | | | | | | | 0.6 | | | 27.8 | |

| | Shareholders' equity | | | | | | | | | 2,499.4 | | | 2,529.9 | |

| | | | | | | | |

| |

| |

| | Capitalization | | | | | | | | $ | 4,503.6 | | $ | 4,721.4 | |

| | | | | | | | |

| |

| |

| | Debt-to-capitalization | | | | | | | | | 44:56 | | | 46:54 | |

| | | | | | | | |

| |

| |

Book value per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Shareholders' equity | | | | | | | | $ | 2,499.4 | | $ | 2,529.9 | |

| | Preferred shares | | | | | | | | | (456.6 | ) | | (456.6 | ) |

| | | | | | | | |

| |

| |

| | | | | | | | | | $ | 2,042.8 | | $ | 2,073.3 | |

| | Ending number of equity shares (in millions) | | | | | | | | | 130.8 | | | 132.5 | |

| | | | | | | | |

| |

| |

| | Book value per share | | | | | | | | $ | 15.62 | | $ | 15.65 | |

| | | | | | | | |

| |

| |

Figure 6

IAROC: Impairment of assets, restructuring and other charges

- (1)

- As reported in the Consolidated Statements of Cash Flows

- (2)

- As reported in Note 5 "Discontinued Operations"

13

same period in 2004. The increase in revenue year-to-date was due to a volume increase, partially offset by the negative impact of lower priced work. The volume increase is explained by both new gains as well as additional volume from existing customers and the addition of the offset printing facility in Pittsburg, California. Operating income and margin decreased in the third quarter and year-to-date basis of 2005 compared to the same periods in 2004, due mainly to the price erosions partially offset by the savings from restructuring initiatives.

Catalog

Catalog revenues for the third quarter of 2005 were $179 million, up 1% from $177 million in 2004. On a year-to-date basis, revenues were $480 million in 2005 and 2004, respectively. Excluding the favorable impact of paper sales, revenues decreased 2% and 1% in the third quarter and year-to-date respectively, due to the continuing price erosion. The price erosion was a result of the overall competitive catalog market. Operating income and margin decreased in the third quarter and year-to-date basis due mainly to the negative impact of lower pricing that was partly offset by cost containment initiatives and headcount reduction. As part of the ongoing investment plan to improve operational efficiencies, a new 64-page press is being installed in one of the Catalog facilities to be in operation in the fourth quarter of 2005.

Book & Directory

Book & Directory revenues for the third quarter of 2005 were $220 million, down 6% from $235 million in 2004. On a year-to-date basis, revenues were $666 million in 2005, down 1% from $675 million in 2004. The decrease in revenue in the third quarter and year-to-date was due mainly to the volume shortfalls and price erosion in both the Book and Directory groups compared to the same periods in 2004. Volume decreased in the third quarter of 2005 by 4% in the Book group and 10% in the Directory group. On a year-to-date basis, volume decreased 1% in the Book group and 3% in the Directory group. Operating income and margin decreased in the third quarter and year-to-date basis compared to 2004 due to volume shortfalls, continued price erosion and some operational inefficiencies. One facility's volume output was negatively affected by the down time caused to install a new press. The Book group has continued to enhance its position by increasing competitive efficiencies with the addition of 64-page presses at two facilities that are expected to be operational in the fourth quarter of 2005. Also, the Directory group has added two new ten-year contracts with existing customers, Yellow Book USA and Dex Media. The Company currently anticipates that this additional volume will significantly increase its market share in the directory business beginning in 2007.

Canada

The Canadian business group operates mainly in the Retail, Magazine, Direct, Catalog, and Directory markets. Canadian revenues for the third quarter of 2005 were $229 million, up 11% from $206 million in 2004. On a year-to-date basis, revenues were $651 million in 2005, up 11% from $589 million in 2004. Excluding the favorable impact of currency translation and paper sales, revenues decreased by 2% for the quarter and remained flat on year-to-date basis compared to the same periods in 2004. Volume was relatively flat in the third quarter of 2005, but increased 1% year-to-date compared to the same periods last year, mainly due to volume growth in the Retail markets. Despite a volume increase, market conditions remained extremely competitive as reflected in the pricing. However, operating income and margin increased in both the third quarter and year-to-date compared to the same periods last year mainly due to savings from cost control initiatives and operational efficiency gains.

In April 2005, the Company announced a plan to reorganize a portion of its East Group printing operations to better position itself to compete in a challenging market environment. The plan included the consolidation of prepress and sales operations at its Laval facility with other plants in Quebec and the cessation of printing operations in Laval. Approximately 50 employees were transferred to other facilities and approximately 140 positions were eliminated as a result of this reorganization.

In August 2005, Quebecor Inc. announced a major investment that will include a new print facility in Islington, Ontario to be operated by a new entity co-owned by Quebecor Media (another subsidiary of the mother company) and Quebecor World (the Company), serving both its customers. The new entity will print newspapers for Quebecor Media in Ontario as well as Quebecor World's print contracts for its North American customers, including some of the larger directory publishers.

Other Revenues

Other sources of revenues in North America include Quebecor World Premedia and Logistics.

The Quebecor World Premedia revenues for the third quarter of 2005 were $15 million, down 9% from $16 million in 2004. On a year-to-date basis, revenues were $43 million in 2005, down 13% from $49 million in 2004. The decrease in revenue for the third quarter compared to 2004 was due to a 14% decrease in volume partly offset by an increase in price, essentially due to product mix. On a year-to-date basis, volume decreased 5% year over year and changes in the type of prepress work and the price erosion earlier in the year caused a negative impact on revenue. The economic environment has led customers to continue looking for ways to reduce their costs by putting pressure on reducing prices, re-using previously captured images and taking more of the prepress production in-house. Operating income and margin for the third quarter and year-to-date 2005 compared to the same periods last year decreased due mainly to decreased volume.

Logistics revenue for the third quarter of 2005 was $84 million, up 5% from $80 million in 2004. On a year-to-date basis, revenues were $228 million in 2005, up 4% from $220 million in 2004. The increase in revenue was due mainly to higher retail commodity shipments in both the third quarter and year-to-date. However, gross profit margins decreased in the third quarter and year-to-date due to more truck shipments for time-sensitive products. Higher margin airfreight in the United States continued to grow slowly with pricing pressure from fuel surcharge and security fees. Operating income and margin were relatively flat in third quarter of 2005 and decreased year-to-date compared to the same periods last year due mainly to the continuing rise in fuel charges and a shift in the sales mix due to increased retail freight with lower margins.

Europe

The European business group operates mainly in the Magazine, Retail, Catalog and Book markets. European revenues for the third quarter of 2005 were $271 million, down 8% from $296 million in 2004. On a year-to-date basis, revenues were $886 million in 2005 down 4% from $921 million in 2004. Excluding the impact of currency translation, revenues were down 8% for the third quarter and down 7% year-to-date compared to the same periods last year. Overall volume decreased by 14% in the third quarter and 8% year-to-date mainly explained by the Magazine markets in France and the wind-down of an important contract not renewed at the Corby (England) facility. Price erosion continued to have a negative impact on the European results.

The operating income and margin for the European segment were negative for the third quarter and year-to-date and represented a significant decrease compared to the same periods in 2004. The negative operating results were mainly due to the loss of the contract at the Corby (England) facility in the UK. Volumes related to this contract began to decrease in the first half of 2005 and the contract was terminated at the end of May. The facility has been able to replace some of the lost volume, but at a lower margin. France also reported negative operating results for both the third quarter and nine-months of 2005 compared to the same periods last year. The decrease in volume combined with various inefficiencies and the continued price pressure negatively affected the French results. The lack of investment and unproductive assets in France and elsewhere in the platform have also contributed to poor operating results. However, operating income and margin increased in the third quarter and year-to-date in Spain, Finland and Austria.

14

Europe is a key element in the Company's global service offering and, therefore, the Company will be implementing a retooling program for the manufacturing platform that will improve its competitiveness and reduce its costs. Management is putting together a comprehensive investment plan to equip this platform with the right mix of technology. It is currently anticipated that a more detailed announcement will be made in the first quarter of 2006.

Selling, general and administrative expenses, when excluding the effect of currency translation, decreased in the third quarter and the nine-months of 2005 compared to the same periods in 2004 as a result of lower volume and headcount reductions. Year-over-year headcount decreased by 735 employees or approximately 13%, mostly in the United Kingdom and Sweden.

Latin America

Latin America operates mainly in the Book, Directory, Magazine, and Retail markets. Latin America's revenues for the third quarter of 2005 were $54 million, up 21% from $45 million in 2004. On a year-to-date basis, revenues were $177 million in 2005, up 30% from $136 million in 2004. Excluding the favorable impact of currency translation and paper sales, revenues increased by 5% for the quarter and by 6% on a year-to-date basis. Overall print volume decreased by 13% for the quarter compared to the same period last year due to the volume shortfall in Peru, Colombia and Recife offset by positive impact on revenues of currency translation along with increased paper sales and increased bindery volume in the Book market in Argentina. The volume decrease in the quarter is partly due to the timing of the production of certain directories. On a year-to-date basis, revenues increased due to print volume increase of 6%, the positive impact of currency translation, an increase in paper sales, and the volume increase of cross selling with the North American and European groups. During the third quarter of 2004, the Company had embarked on an initiative to link more closely the Latin American Book and Directory facilities with its North American counterparts to expand the capacity and capabilities to its overall customer base. This initiative has continued through the third quarter of 2005. For the third quarter, prices, expressed in local currency, have increased significantly as a result of a positive product mix and a recovering economy in Argentina. On a year-to-date basis, prices remained stable in all countries and increased in Argentina as explained earlier, compared to the same period in 2004. Operating income and margin increased in the third quarter compared to the same period last year mainly due to the increased prices and cost saving initiatives. On a year-to-date basis, operating income and margin increased due to higher volume and operational efficiencies.

Selling, general and administrative expenses, when excluding the effect of currency translation, decreased in the third quarter and the nine-months of 2005 compared to the same periods in 2004, due mainly to savings from cost containment initiatives and headcount reductions. Year-over-year headcount was reduced by 294 employees, or approximately 13%.

CRITICAL ACCOUNTING ESTIMATES

The Company's critical accounting estimates are discussed in the Company's annual "Management's Discussion and Analysis" included in the 2004 Annual Report. The preparation of financial statements in conformity with Canadian GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management has not made any significant changes to the estimates and assumptions in the quarter ended September 30, 2005 from those described in its 2004 Annual Report. Actual results could differ from those estimates.

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

The Company measures its liquidity performance using the calculation of free cash flow as described in figure 6. Free cash flow reflects liquidity available for business acquisitions, equity dividends and repayments of long-term debt. Free cash flow for the third quarter of 2005 amounted to an outflow of $80 million, compared to an outflow of $0.1 million for the same quarter last year. On a year-to-date basis, free cash flow for 2005 amounted to an outflow of $43 million, compared to an outflow of $18 million for the same period of 2004. The decrease is due mainly to increased capital expenditures in connection with the North American retooling plan and decrease in cash provided by operating activities.

The Company's Debt-to-EBITDA ratio before IAROC, on continuing operations, for the rolling twelve months ended September 30, 2005 was 2.6 compared to 2.9 for the same period in 2004. Furthermore, on the same basis, the EBITDA interest coverage ratio for the period ended September 30, 2005 was 6.3 compared to 5.0 for the same period in 2004 (see figure 7).

Coverage ratios

($ millions)

(Rolling twelve-month period ending)

| | Sept. 30, 2005

| | Sept. 30, 2004

|

|---|

EBITDA before IAROC from continuing

YTD September | |

$ |

520.8 | |

$ |

570.3 |

| Fourth quarter of previous year | | | 252.2 | | | 175.4 |

|

| EBITDA — Last 12 months | | $ | 773.0 | | $ | 745.7 |

|

Financial expenses from continuing operations | | | | | | |

| YTD September | | $ | 91.2 | | $ | 101.8 |

| Fourth quarter of previous year | | | 31.3 | | | 79.2 |

Loss on extinguishment of long-term debt

YTD September | | | | | |

(30.0) |

| Fourth quarter of previous year | | | | | | (2.2) |

|

| Financial expenses adjusted — Last 12 months | | $ | 122.5 | | $ | 148.8 |

|

| EBITDA Interest Coverage ratio (times) | | | 6.3 | | | 5.0 |

|

|

| Total Debt | | $ | 2,003.6 | | $ | 2,163.7 |

|

| Debt-to-EBITDA ratio (times) | | | 2.6 | | | 2.9 |

|

EBITDA: Operating income before depreciation and amortization

These ratios are non-GAAP mesures | |

|

|

|

|

Figure 7 |

Operating Activities

Working capital was $143 million as at September 30, 2005, compared to $93 million as at September 30, 2004. This increase in working capital of $50 million was largely due to a decrease in trade payables and accrued liabilities partly offset by a decrease in trade receivables, essentially attributable to a higher level of securitization. The Company manages its trade payables in order to take advantage of prompt payment discounts. Also, the Company maximizes the use of its accounts receivable securitization program, since the cost of these programs is relatively low compared to that of its secured credit facility. The amount of trade receivables under securitization varies from month to month, based on the previous month's volume (September securitization is based on outstanding receivables at the end of August).

15

Financing Activities

As at September 30, 2005, the Company's total consolidated debt was $2,004 million, a $160 million decrease compared to the end of September 2004. The debt-to-capitalization ratio was 44:56 compared to 46:54 in September 2004 (see figure 6). The same ratio was 43:57 as at December 31, 2004. Including accounts receivable securitization, total debt would be $2,619 million, $128 million lower than last year. The debt-to-capitalization ratio, including accounts receivable securitization, was 51:49 as at September 30, 2005, compared to 52:48 in September 2004 (see figure 8).

Total Debt and Accounts Receivable Securitization

($ millions)

| | Sept. 30, 2005

| | Sept. 30, 2004

|

|---|

| Bank indebtedness | | $ | — | | $ | 1.5 |

| Current portion of long-term debt | | | 9.2 | | | 11.7 |

| Long-term debt | | | 1,880.2 | | | 2,038.3 |

| Convertible notes | | | 114.2 | | | 112.2 |

| | |

| |

|

| Total debt | | $ | 2,003.6 | | $ | 2,163.7 |

| Accounts receivable securitization | | | 614.9 | | | 583.2 |

| | |

| |

|

| Total debt and accounts receivable securitization | | $ | 2,618.5 | | $ | 2,746.9 |

| Minority interest | | | 0.6 | | | 27.8 |

| Shareholders' equity | | | 2,499.4 | | | 2,529.9 |

| | |

| |

|

| Capitalization, including securitization | | $ | 5,118.5 | | $ | 5,304.6 |

| | |

| |

|

| Debt-to-Capitalization, including securitization | | | 51:49 | | | 52:48 |

These ratios are non-GAAP measures. |

|

|

|

|

|

Figure 8 |

The Company is subject to certain financial covenants in some of its major financing agreements. The key financial ratios are the earnings before interest, tax and depreciation and amortization (EBITDA) coverage ratio and the debt-to-capitalization ratio. As at September 30, 2005, the Company was in compliance with all of its significant debt covenants.

The Company's 7.20% Senior Notes for a principal amount of $250 million will mature in March 2006. The Company currently expects to repay these Senior Notes by using its long-term revolving bank facility or other sources of long-term financing available to it at such time and, as such, these Notes have not been included in the current portion of long-term debt.

The Company's Series 4 Cumulative Redeemable First Preferred Shares are redeemable at its option on and after March 15, 2006 at Cdn$25.00, or with regulatory approval, the preferred shares may be converted into equity shares by the Company. On and after June 15, 2006, these preferred shares may be converted at the option of the holder into equity shares, subject to the right of the Company prior to the conversion date to redeem for cash or find substitute purchasers for such preferred shares. The Company currently intends to redeem these shares in March 2006 using its revolving bank facility.

Contractual Cash Obligations

($ millions)

(Continuing Operations)

| | Remainder of 2005

| | 2006

| | 2007

| | 2008

| | 2009

| | 2010 and thereafter

|

|---|

| Long-term debt and convertible notes | | $ | — | | $ | 250 | | $ | 745 | | $ | 202 | | $ | — | | $ | 772 |

| Capital leases | | | 2 | | | 8 | | | 4 | | | 3 | | | 8 | | | 9 |

| Operating leases | | | 35 | | | 77 | | | 58 | | | 36 | | | 27 | | | 100 |

| Capital asset purchase commitments | | | 51 | | | 102 | | | 12 | | | — | | | — | | | — |

| | |

| |

| |

| |

| |

| |

|

| Total contractual cash obligations | | $ | 88 | | $ | 437 | | $ | 819 | | $ | 241 | | $ | 35 | | $ | 881 |

| | |

| |

| |

| |

| |

| |

|

Figure 9

On May 13, 2005, the Company commenced a normal course issuer bid for a maximum of 7,300,000 Subordinate Voting Shares, which represented approximately 10% of the public float for the Subordinate Voting Shares at the time of the announcement. The purchases are to be made at prevailing market prices, on the open market through the facilities of the Toronto Stock Exchange and the bid expires on May 12, 2006. In the third quarter of 2005, the Company repurchased 106,000 shares at an average price of Cdn$23.73 for a net cash consideration of Cdn$2.6 million ($2.1 million). For the year 2005 to date, the Company repurchased 2,438,500 shares at an average price of Cdn$23.85 for a net cash consideration of Cdn$58.2 million ($46.6 million). The excess of the price paid over the book value of the shares repurchased amounting to $0.4 million for the third quarter and $9.8 million for the year to date was charged to retained earnings. The normal course issuer bid is funded using the Company's revolving bank facility. The Company has not repurchased any Subordinated Voting Shares since August 12, 2005 and does not have the intention of repurchasing any in the upcoming months. As at September 30, 2005, the unused portion of the bank facility was $611 million.

The minimum legal requirement for pension contributions is $50 million in 2005 of which $46 million has been paid as of September 30, 2005 (total annual contribution in 2004 was $77 million).

As at September 30, 2005, the following credit ratings applied to the long-term unsecured debt of the Company:

Rating Agency

| | Rating

|

|---|

| Moody's Investors Service | | Ba2 |

| Standard & Poor's | | BB+ |

| Dominion Bond Rating Service Limited | | BBB (low) |

On August 26, 2005, Moody's Investors Service lowered the Company's credit rating from Baa3 to Ba2. Similarly, Standard and Poor's lowered the Company's credit rating from BBB- to BB+ on September 8, 2005. The financial costs of certain debts have increased due to these lower credit ratings.

The Company believes that its liquidity, capital resources and cash flow from operations are sufficient to fund planned capital expenditures, working capital requirements, interest and principal payments for the foreseeable future.

Investing Activities

In the third quarter, the Company invested $89 million in capital projects compared to $36 million in 2004. On a year-to-date basis, $217 million has been invested in capital projects in 2005 compared to $101 million in 2004. Of that amount, 80% (80% in 2004) was for organic growth, including expenditures for new capacity requirements and productivity improvement, and 20% (20% in 2004) was for the maintenance of the Company's structure.

Key expenditures for the third quarter of 2005 included approximately $44 million for the purchase and installation of new presses in the United-States and Europe. Other notable projects included the lease buyback of the land and building in Fernley (USA), an efficiency improvement program in Cayfosa (Spain), the purchase of two folder lines in Graphic Brochage (France) and the relocation of equipment from the closed Interprint (Sweden) plant to Helprint (Finland) and Hélio Charleroi (Belgium).

On a year-to-date basis, the investment in the purchasing and installation of new presses in the United-States and Europe amounted to approximately $128 million. Other key expenditures included the replacement of a bindery line in Islington (Canada) and the upgrade of the co-mailing system in the United-States.

During the third quarter of 2005, the Company placed four firm orders for new presses. Also, as part of the U.S. industrial plan announced in 2004, the Company has placed a total of 18 firm orders for new presses. The Company has now placed a total of 22 firm orders for new presses representing a total cost of approximately $265 million of which $116 million has been already disbursed.

For the remainder of 2005, the Company projects capital expenditures of approximately $150 million, of which a portion is related to the U.S. industrial plan and a significant lease buyout. The Company expects to fund these expenditures using cash flows from operations, drawings on the Company's revolving bank facility and other sources of financing such as the following.

The Company is in the process of implementing a financing of its new equipment that are part of its U.S. retooling plan. The application for insured export financing was approved by Euler Hermes Kreditversicherungs-AG ("Hermes"), the agent acting on behalf of the German government, for approximately 110 million Euros. The Company intends to finalize this agreement before year-end.

In addition, the Company expects to generate cash flows in excess of its net book value for the disposal of its non-core Commercial printing group as described below.

In September, the Company signed agreements to sell the remaining units of its North American non-core printing Group subject to the fullfilment of certain conditions by the Company and the purchasers. The transactions should be finalized in the last quarter of 2005.

In April 2005, the Company purchased assets of a web offset printing facility in Pittsburg, California for a consideration of $9 million. This facility complements and strengthens the Company's Retail insert platform and add capacity for customers in the West coast market.

16

Selected Quarterly Financial Data (Continuing Operations)

(in millions of dollars, except per share data)

| | 2005

| | 2004

| | 2003

| |

|---|

| | |

|---|

| | Q3

| | Q2

| | Q1

| | Q4

| | Q3

| | Q2

| | Q1