QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2006

Commission File Number:1-14118

2005 FOURTH QUARTER RESULTS

QUEBECOR WORLD INC.

(Translation of Registrant's Name into English)

612 Saint-Jacques Street, Montreal, Quebec H3C 4M8

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F o Form 40-F ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Fork 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

QUEBECOR WORLD INC.

Filed in this Form 6-K

Documents index

- Press Release dated February 16, 2006; Financial Highlights

- Management's Discussion and Analysis of Financial Condition and Results of Operations

- Consolidated Financial Statements

2

February 16, 2006 05/06

For immediate release Page 1 of 8

QUEBECOR WORLD ANNOUNCES

FOURTH QUARTER AND 2005 RESULTS

HIGHLIGHTS

- Revenue was $1.7 billion in fourth quarter and $6.3 billion in 2005

- Non-cash goodwill impairment charge of $243 million or $1.77 per share in fourth quarter related to European operations

- Impairment of assets, restructuring and other charges (IAROC) of $12 million in fourth quarter or $0.08 per share

- Excluding IAROC and goodwill impairment, earnings per share from continuing operations in the fourth quarter were $0.21 compared to $0.59 last year.

- On the same basis, earnings per share in 05 were $0.98 compared to $1.45 in 04

- Capital Expenditures of $394 million in 05 compared to $133 million in 04 due to major retooling program

Montréal, Canada – Quebecor World Inc. (NYSE:IQW, TSX:IQW.SV) announces that for the fourth quarter 2005 the Company reported a net loss of $205 million from continuing operations compared to net income of $46 million in the fourth quarter of last year. On the same basis, loss per share in the fourth quarter was $1.64 compared to diluted earnings per share of $0.27 in 2004. Quebecor World's fourth quarter and 2005 results were negatively impacted by a previously announced non-cash goodwill impairment charge of $243 million, ($232 million after tax, or $1.77 per share), related to the Company's European operations. Consolidated revenues for the quarter were $1.7 billion compared to $1.8 billion last year.

In the fourth quarter 2005, the Company recorded impairment of assets, restructuring and other charges (IAROC) of $12 million or $0.08 per share compared to $48 million or $0.32 per share in the fourth quarter last year. Operating income before IAROC and goodwill impairment in the fourth quarter was $87 million compared to $161 million during the same period last year.

3

For immediate release Page 2 of 8

Earnings per share from continuing operations before IAROC and goodwill impairment were $0.21 compared to $0.59 in the fourth quarter of 2004.

Quebecor World's fourth quarter results were hampered by a lower pricing environment compared to last year, higher energy costs, under performing operations in France and the United Kingdom, the absence of an additional week in the quarter compared to 2004 which negatively impacted revenues in North America by approximately 7%, additional freight costs and inefficiencies related to press start-ups.

"We continue to face a very challenging environment on several fronts which is reflected in our results. Our retooling plan is underway and despite some inefficiencies in the fourth quarter, we expect this equipment to deliver as promised in the medium and long-term as it reaches full-capacity and as we replace previously lost volume," said Pierre Karl Péladeau, President and CEO, Quebecor World Inc. "In the short-term we are taking additional measures to reduce our costs by being more efficient in our energy consumption and through additional restructuring initiatives. The Company is also utilizing its distinct competitive advantages to focus on securing higher margin volume from leading publishers and retailers."

Quebecor World's three-year retooling plan is based on strategically installing state-of-the-art technology across its global platform and decommissioning older less productive equipment to enhance service, reduce costs and improve efficiencies. The previously announced plan calls for an investment of $330 million in North America and $250 million in Europe. The Company's retooling program on two continents is one of the largest ever undertaken in the printing industry and the full effect of these efforts will be realized over time.

Due to the retooling program in North America and Europe, Quebecor World recorded capital expenditures of $394 million in 2005 compared to $133 million in 2004 and generated free cash flow of $119 million in 2005 compared to $319 million in 2004.

As announced in January 2006, the European retooling program includes installing two new gravure presses in Belgium and wide-web offset presses in Austria and Spain as well as additional potential investments in the United Kingdom and France. In February 2006, the Company successfully concluded negotiations with its employees' representatives in the United Kingdom that will quickly bring the cost structure in line with the market. Similar negotiations are progressing more slowly in France. This could be a lengthy process which might negatively impact our performance.

4

For immediate release Page 3 of 8

Full-year 2005

In 2005, net loss was $149 million or $1.43 per share compared to net income of $140 million or $0.77 per share last year. Before IAROC and goodwill impairment, diluted earnings per share in 2005 were $0.98 compared to $1.45 last year. Operating income before IAROC and goodwill impairment was $358 million in 2005 compared to $471 million last year. Consolidated revenue for 2005 were essentially flat at $6.3 billion compared to 2004.

Impairment of assets, restructuring and other charges for 2005 were $94 million compared to $116 million in 2004. Selling General and Administrative expenses were $397 million compared to $432 million last year. Excluding the unfavourable impact of currency translation, SG&A expenses were lower by $42 million compared to the previous year.

Outlook 2006

In 2006, Quebecor World anticipates its operations will continue to be affected by negative pricing pressures and previously announced volume reductions. While the Company has made significant progress in replacing this volume, many of these new agreements only come into force in the later half of 2006 and in 2007. The Company intends to address these challenges by continuing to implement cost containment measures. These measures include retooling plans for North America and Europe, additional restructuring initiatives and decommissioning of older presses resulting in a more efficient manufacturing platform. The Company will also develop projects to help reduce energy consumption. Furthermore, Quebecor World will use its distinct competitive advantages to seek higher margin business. However, as this is a long-term process and as the Company anticipates additional start-up related inefficiencies in upcoming quarters, the full effect of these efforts will be realized over time.

Discontinued Operations

Quebecor World's core printing activities involve the printing of magazines, catalogs, retail inserts, books, directories and direct mail for the world's largest publishers and retailers. As the Company has grown by acquisition certain facilities were included in those transactions that did not relate to these core businesses. Approximately a dozen facilities in North America were involved in the printing of short-run contractual work such as marketing materials, annual reports, travel and fashion brochures. These activities were different from Quebecor World's core businesses and did not benefit from the advantages and synergies of the Company's global platform. The Company completed the sale of these assets in the fourth quarter 2005. Consequently the operating results related to these activities have been presented separately in the Company's consolidated financial results as discontinued operations and comparative figures have been restated to conform to the presentation adopted for t he year-ended December 31, 2005.

5

For immediate release Page 4 of 8

Dividend

The Board of Directors declared a dividend of $0.10 per share on Multiple Voting Shares and Subordinate Voting Shares. The Board also declared a dividend of CDN$0.3845 per share on Series 3 Preferred Shares, CDN$0.421875 per share on Series 4 Preferred Shares and CDN$0.43125 on Series 5 Preferred Shares.

The dividends are payable on March 1st, 2006 to shareholders of record at the close of business February 27, 2006.

Full Financial Information

Management Discussion and Analysis

Please refer to the MD&A for the reconciliation to Canadian generally accepted accounting principles of certain figures used to explain these results. The MD&A can be found on the Company's website at www.quebecorworld.com and through the SEDAR and SEC filings.

Financial statements are available on the Company's website and through the SEDAR and SEC filings.

Sedar web address:www.sedar.com

SEC web address:www.sec.gov

Conference Call

Quebecor World To Webcast Investor Conference Call on February 16, 2006

Quebecor World Inc. will broadcast its fourth quarter and year-end conference call live over the Internet on February 16, 2006 at 4:00 PM (Eastern Time).

The conference call will be webcast live and can be accessed on the Quebecor World web site:

http://www.quebecorworld.com/en/investors/webcasts/Q104http://www.quebecorworldinc.com/main.aspx?id=958&lang=en

6

For immediate release Page 5 of 8

Prior to the call please ensure that you have the appropriate software. The Quebecor World web address listed above has instructions and a direct link to download the necessary software, free of charge.

Anyone unable to attend this conference call may listen to the replay tape by phoning (877) 293-8133 or (403) 266-2079 &150; passcode 305789#, available from February 16, 2006 to March 17, 2006.

Forward looking statements

Except for historical information contained herein, the statements in this release are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company's actual results in future periods to differ materially from forecasted results. Those risks include, among others, changes in customers' demand for the Company's products, changes in raw material and equipment costs and availability, seasonal changes in customer orders, pricing actions by the Company's competitors, and general changes in economic conditions.

The Company

Quebecor World Inc. (NYSE:IQW, TSX:IQW.SV) is one of the largest commercial printers in the world. It is a market leader in most of its major product categories which include magazines, inserts and circulars, books, catalogs, direct mail, directories, digital pre-media, logistics, mail list technologies and other value added services. Quebecor World has approximately 31,000 employees working in more than 130 printing and related facilities in the United States, Canada, Argentina, Austria, Belgium, Brazil, Chile, Colombia, Finland, France, India, Mexico, Peru, Spain, Sweden, Switzerland and the United Kingdom.

Web address: www.quebecorworld.com - - 30 -

For further Information contact:

Tony Ross

Director, Communications

Quebecor World Inc.

(514) 877-5317

(800) 567-7070 | | | Philippe Cloutier

Director, Finance and

Investor Relations

Quebecor World Inc.

(514) 877-5147

(800) 567-7070 | |

- 30 -

For immediate release Page 6 of 8

QUEBECOR WORLD INC.

FINANCIAL HIGHLIGHTS

Periods ended December 31

(In millions of US dollars, except per share data)

(Unaudited)

| | Three months

| | Twelve months

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Consolidated Results from Continuing Operations | | | | | | | | | | | | | |

| Revenues | | $ | 1,664.0 | | $ | 1,822.7 | | $ | 6,283.3 | | $ | 6,339.5 | |

| Adjusted EBITDA | | | 167.9 | | | 251.9 | | | 688.7 | | | 822.2 | |

| Adjusted EBIT | | | 87.3 | | | 161.4 | | | 357.5 | | | 471.1 | |

| IAROC | | | 11.9 | | | 48.4 | | | 94.2 | | | 115.6 | |

| Goodwill impairment charge | | | 243.0 | | | – | | | 243.0 | | | – | |

| Operating income (loss) | | | (167.6 | ) | | 113.0 | | | 20.3 | | | 355.5 | |

| Net income (loss) from continuing operations | | | (205.0 | ) | | 46.3 | | | (148.8 | ) | | 139.9 | |

| Adjusted EBITDA margin* | | | 10.1 | % | | 13.8 | % | | 11.0 | % | | 13.0 | % |

| Adjusted EBIT margin* | | | 5.3 | % | | 8.9 | % | | 5.7 | % | | 7.4 | % |

| Operating margin* | | | (10.1 | ) % | | 6.2 | % | | 0.3 | % | | 5.6 | % |

|

| Segmented Information from Continuing Operations |

| | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | |

| | North America | | $ | 1,321.7 | | $ | 1,387.9 | | $ | 4,881.1 | | $ | 4,850.3 | |

| | Europe | | | 276.7 | | | 376.6 | | | 1,162.9 | | | 1,297.4 | |

| | Latin America | | | 64.5 | | | 56.2 | | | 241.7 | | | 192.4 | |

Adjusted EBIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | $ | 89.2 | | $ | 137.1 | | $ | 353.5 | | $ | 421.4 | |

| | Europe | | | (2.8 | ) | | 16.5 | | | (3.6 | ) | | 50.1 | |

| | Latin America | | | 3.7 | | | (1.8 | ) | | 13.0 | | | 1.3 | |

Ajusted EBIT margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | North America | | | 6.8 | % | | 9.9 | % | | 7.2 | % | | 8.7 | % |

| | Europe | | | (1.0 | ) % | | 4.4 | % | | (0.3 | ) % | | 3.9 | % |

| | Latin America | | | 5.7 | % | | (3.2 | ) % | | 5.4 | % | | 0.7 | % |

|

Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by operating activities | | $ | 278.3 | | $ | 380.9 | | $ | 469.5 | | $ | 487.8 | |

| Free cash flow** | | $ | 158.2 | | $ | 337.7 | | $ | 119.2 | | | 319.4 | |

| Working capital | | | | | | | | $ | (58.9 | ) | $ | (35.3 | ) |

| Total assets | | | | | | | | $ | 5,705.6 | | | 6,273.8 | |

| Long-term debt (including convertible notes) | | | | | | | | $ | 1,855.1 | | $ | 1,950.1 | |

| Shareholder's equity | | | | | | | | $ | 2,250.6 | | $ | 2,612.6 | |

| Debt-to-capitalization | | | | | | | | | 45:55 | | | 43:57 | |

| Debt-to-Adjusted-EBITDA ratio (times)*** | | | | | | | | | 2.7 | | | 2.4 | |

| Interest coverage ratio (times)*** | | | | | | | | | 5.8 | | | 6.3 | |

|

Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) from continuing operations | | | | | | | | | | | | | |

| | Diluted | | $ | (1.64 | ) | $ | 0.27 | | $ | (1.43 | ) | $ | 0.77 | |

| | Adjusted Diluted | | $ | 0.21 | | $ | 0.59 | | $ | 0.98 | | $ | 1.45 | |

| Dividends on equity shares | | $ | 0.14 | | $ | 0.13 | | $ | 0.56 | | $ | 0.52 | |

| Book value | | | | | | | | $ | 13.69 | | $ | 16.26 | |

|

IAROC: Impairment of assets, restructuring and other charges.

Adjusted: Defined as before IAROC and before goodwill impairment charge.

Debt-to-Adjusted-EBITDA ratio: Total debt divided by Adjusted EBITDA.

Interest coverage ratio: Adjusted EBITDA divided by financial expenses.

- *

- Margins calculated on revenues.

- **

- Cash provided by operating activities, less capital expenditures and preferred share dividends, net of proceeds from disposals of assets and proceeds from business disposals.

- ***

- For continuing operations.

7

For immediate release Page 7 of 8

APPENDIX — SEGMENTED RESULTS

North America

In the fourth quarter, revenues from North American operations were down 5% to $1.32 billion from to $1.39 billion in 2004. Year-to-date revenues were $4.88 billion compared to $4.85 billion last year. Operating income in the fourth quarter before impairment of assets, restructuring and other charges was $89.2 million compared to $137.1 million and operating margin on the same basis was 6.8% compared to 9.9%. In the fourth quarter, the lack of an additional week compared to 2004, negative price pressures, higher energy costs and certain inefficiencies related to new press installations led to lower revenues and operating margins.

Magazine/Direct

In the Magazine segment volume was down (9% for the quarter and 5% for 2005) due to the lack of an additional week compared to 2004 and reduced volume from an important customers. During the year the magazine segment continued to secure market share by reaching new agreements with Time Inc., Primedia, Wenner Media and Morris Communications. In the Direct Mail segment volume decreased 6% in the quarter and 1% for the year, essentially due to the absence of the 53rd week.

Retail/Catalog

In the Retail group, volume remained stable for the quarter and increased 5% for the year. Revenues in the quarter decreased 3% and increased 5% for the year essentially due to increased paper sale. The increased volume for the year is related to additional volume from exiting customers and the addition of an offset printing facility in Pittsburg, California. In the Catalog segment volume decreased 6% in the quarter and 1% for the full-year due to the lack of the 53rd week. The catalog group is continued to secure market share by extending contracts and winning new customers such as Bass Pro Shops and School Specialty. As part of the North American investment plan, a new 64-page press became operational in the catalog platform in the fourth quarter.

Book/Directory

In the Book and Directory group, revenues were down 13% compared to fourth quarter 2004 and 5% for the full-year. Revenue decreases are in part due to a volume decrease of 6% in the Book group and a 16% in the Directory group in the fourth quarter and 3% and 7% respectively for the full-year. The volume decrease in the directory group is due to the loss of one customer from the fourth quarter 2005 and the change in format of another one.

8

For immediate release page 8 of 8

Canada

In Canada, volume decreased 7% from the fourth quarter and 1% for the year. The decrease in magazine volume was partially offset by an increase in catalog and retail volume. Revenues for our Canadian segment decreased 3% compared to the fourth quarter of 2004 (including the favourable impact of currency translation and paper sales).

Europe

In Europe, revenues in the fourth quarter were down 27% to $277 million compared to $376 million in the fourth quarter of 2004. Excluding the positive impact of currency translation, revenues for the quarter were down 16% and 9% for the full year. Volume in Europe decreased 23% in the fourth quarter and 13% for the year. The decrease was largely due the continued impact of the loss of a major customer at our Corby, UK, facility, where some lost volume has been replaced at lower margins. France also reported negative operating results for the fourth quarter as a result of decreased volumes, workforce inefficiencies and lower pricing. Excluding the effect of currency translation, Selling, General & Administrative costs in our European segment decreased in the fourth quarter over the previous year. Operating income and margins increased on a year-to-date basis in Spain and Austria.

Latin America

In Latin America, revenues in the fourth quarter increased 15% to $65 million compared to $56 million in the same period last year. Excluding the positive impact of currency translation and paper sales, revenues in the quarter increased 6%. Volume in the quarter increased 3% compared to the same period last year, explained by increased directory volume in our Brazilian and Mexican facilities. Operating income and margin increased in the fourth quarter and full year as a result of cost saving initiatives, as well as improved pricing in the Argentinean market due to economic recovery.

The Latin American operations are continuing to benefit from an earlier initiative that positioned these assets as a low-cost alternative to publishers who are having products produced in Asia. This initiative is attracting increased interest and sales from North American and European publishers.

9

MANAGEMENT'S DISCUSSION AND ANALYSIS

The following is a discussion of the consolidated financial condition and results of operations of Quebecor World Inc. (the "Company") for the years ended December 31, 2005 and 2004, and it should be read together with the Company's consolidated financial statements. The annual consolidated financial statements and Management's Discussion and Analysis have been reviewed by the Company's Audit Committee and approved by its Board of Directors. This discussion contains forward-looking information that is qualified by reference to, and should be read together with, the discussion regarding forward-looking statements that is part of this document. Management determines whether or not information is "material" based on whether it believes a reasonable investor's decision to buy, sell or hold securities in the Company would likely be influenced or changed if the information were omitted or misstated.

FORWARD-LOOKING STATEMENTS

Except for historical information contained herein, the statements in this document are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from forecasted results. Those risks include, among others, changes in customer demand for print services, changes in raw material and equipment costs and availability, seasonal changes in customer orders, pricing actions by competitors and general changes in economic conditions.

OVERVIEW

BUSINESS PROFILE

Quebecor World Inc. is one of the largest commercial print media services companies in the world. Quebecor World is a market leader in the product categories and geographies it serves. This market-leading position has been built through a combination of integrating acquisitions, investing in key strategic technologies and a commitment to building long-term partnerships with the world's leading print media customers.

Quebecor World has facilities in the United States, Canada, Argentina, Austria, Belgium, Brazil, Chile, Colombia, Finland, France, India, Mexico, Peru, Spain, Sweden, Switzerland and the United Kingdom.

The Company offers its customers a broad range of print services, such as magazines, retail inserts, catalogs, books, directories, direct mail, logistics, premedia and other value-added services.

The Company operates in the commercial print media segment of the printing industry and its business groups are located in three geographical regions: North America, which has historically represented approximately 80% of the Company's revenues, Europe and Latin America.

INDUSTRY PROFILE

Operations in this segment of the print industry are seasonal with a greater part of volume being realized in the second half of the fiscal year, primarily due to the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions.

Consolidation of the printing industry is ongoing because of global overcapacity, which has led to negative price pressures. The disappearance of smaller plants creates the opportunity for larger plants to continue to grow and deploy more efficient equipment. Global capacity is also affected by the emergence of Asian competitors in particular in the Book segment where the timing of deliveries is less of an issue. In response to this competition, the Company offers its clients the Latin American platform as a low-cost alternative. Overall, global overcapacity will remain an issue and will likely continue to impact prices in most segments.

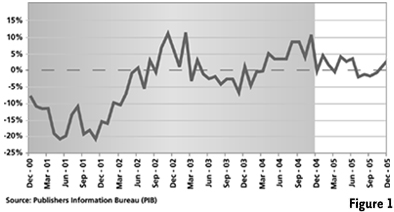

The primary drivers affecting the Company are consumer confidence and economic growth rates. These are key drivers of demand for commercial print media because they affect the level of advertising and merchandising activity. The Company uses magazine advertising pages as an important indicator of demand for printing products and services. This indicator, as measured in the United States by the Publishers Information Bureau, showed some positive signs throughout 2004, but was uneven through most of 2005 (Figure 1).

STRATEGY

The Company's objective is to be the preferred low-cost provider of print services. As part of this goal, the Company has adopted the following related strategies.

The Company intends to use technology to improve efficiency and reduce costs. As is the case with other manufacturing industries, technology in the printing industry is constantly evolving and it will continue to play an important role in improving Quebecor World's manufacturing platform. The Company is focused on improving speeds, reducing manning, lowering downtime and paper waste and reducing make-ready times.

The Company also intends to continue to reduce its fixed cost base and increase its efficiency. The Company has identified two key success factors — manufacturing and administrative efficiency — and addresses them on a continual basis. In recent years, the Company has undertaken restructuring initiatives that resulted in consolidating smaller facilities into larger groups of operations, grouping similar types of assets into larger facilities using available space and optimizing all aspects of pressroom efficiencies. The Company has also reviewed and streamlined its administrative structure. These measures are ongoing and are expected to continue through 2006. Although these restructuring initiatives have generated several positive effects, in the current challenging environment, these positive effects did not translate into increases in operating income because of continuing price reductions, rising energy costs and the underperformance of the French and British operations.

U.S. Magazine Advertising Pages 2001-2005 (Monthly)

% Change Year-over-Year

10

2005 AT A GLANCE

2005 was a year in which Quebecor World faced significant challenges and issues as the Company continued through a transitional period that is needed to achieve its objectives. The Company has also set forth several initiatives that it believes are crucial as it implements its retooling strategy to further improve efficiency, customer service and productivity.

In 2004, the Company approved a $330 million investment plan calling for newer, wider and more efficient presses for its North American platform. The implementation of this plan began in the second half of 2005 with the installation of the first five presses. In 2006, the Company intends to install ten additional presses. The deployment of such an extensive plan cannot be accomplished without experiencing certain temporary inefficiencies. Some of these inefficiencies, primarily related to the installation of new presses and the decommissioning of less productive ones, were encountered in the fourth quarter of 2005, negatively affecting operating income. The Company anticipates that it will continue to experience certain inefficiencies in upcoming quarters as more presses come online. The Company has set up a dedicated task force whose primary objective is to mitigate costs related to the plan.

On January 18, 2006, the Company announced the completion of a strategic review of its operations in Europe and announced a capital investment program that it believes will improve the platform's competitive position, lower its cost base and provide better service to customers. The program provides for investments up to $250 million, of which $87 million were disbursed in 2005, and involves the purchase of new state-of-the-art technology to be installed in facilities in Belgium, Spain, Austria as well as additional potential investments in the United Kingdom and France. The Company also successfully completed labor negotiations in February 2006 with its employee representatives in the United Kingdom that will quickly bring the facility in line with the market. Finally, similar negotiations are progressing more slowly in France. This could be a lengthy process which might negatively impact the Company's performance. The Company intends to install four presses in Europe in 2006.

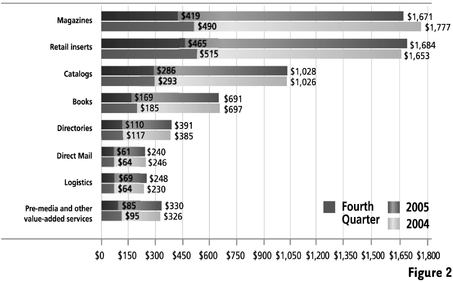

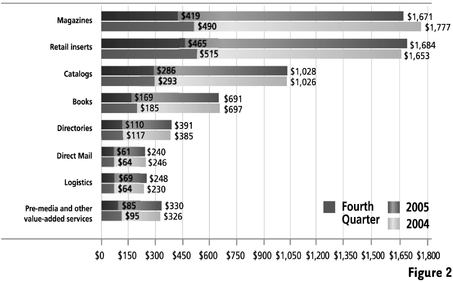

Revenue by Print Service — Worldwide ($ millions)

For the quarter and the year ended December 31

(Continuing Operations)

In addition, the Company disposed of its non-core printing group as discussed in the "Discontinued Operations" section hereafter as well as certain smaller operations in France and North America.

The current charge for impairment of long-lived assets, restructuring and other charges reflects smaller initiatives undertaken in 2005 and definite plans to eliminate inefficient and idle equipment. As such, a detailed review of activities took place in 2005 at the facility in Corby, United Kingdom. This resulted in the implementation of the first two phases of a workforce reduction plan as well as an impairment charge on long-lived assets as discussed in the "Impairment of Assets and Restructuring Initiatives" section.

On October 21, 2005, the Company communicated its financial outlook for 2005. Management estimated at that time that earnings per share for the remainder of 2005 would be lower than 2004 and below market expectations. The actual results for the second half of 2005 are below those of the corresponding period in 2004. These results principally reflect the challenging market conditions the Company has faced as well as the temporary inefficiencies related to the installation of new presses as previously discussed.

OUTLOOK 2006

In 2006, Quebecor World anticipates its operations will continue to be affected by negative pricing pressures and previously announced volume reductions. While the Company has made significant progress in replacing this volume, many of these new agreements only come into force in the later half of 2006 and in 2007. The Company intends to address these challenges by continuing to implement cost containment measures. These measures include retooling plans for North America and Europe, additional restructuring initiatives and decommissioning of older presses resulting in a more efficient manufacturing platform. The Company will also develop projects to help reduce energy consumption. Furthermore, Quebecor World will use its distinct competitive advantages to seek higher margin business. However, as this is a long-term process and as the Company anticipates additional start-up related inefficiencies in upcoming quarters, the full effec t of these efforts will be realized over time.

PRESENTATION OF FINANCIAL INFORMATION

Financial data have been prepared in conformity with Canadian generally accepted accounting principles ("Canadian GAAP"). However, certain measures used in this discussion and analysis do not have any standardized meaning under Canadian GAAP. When used, these measures are defined in such terms as to allow the reconciliation to the closest Canadian GAAP measure. Numerical reconciliations are provided in figures 7 and 8. It is unlikely that these measures could be compared to similar measures presented by other companies.

The Company's functional currency is the Canadian dollar and its reporting currency is the U.S. dollar.

The Company's annual reporting period usually lasts 52 weeks. Every five or six years, the annual reporting period lasts 53 weeks, as was the case in 2004. The additional week had an impact on the comparison of the 2005 results with those from 2004 as well as the comparison of 2004 with 2003. The estimated impact on revenues and operating income is $(130) million and $(12) million, respectively, for the fourth quarter of 2005 compared to the same period in 2004. The estimated impact on revenues and operating income is $88 million and $5 million, respectively, for the fourth quarter of 2004 compared to the same period in 2003. The comparative impact varies from one year to the next because of the timing differences related to the beginning and closing of accounting periods, which vary year-over-year.

11

Impact of Foreign Currency ($ millions)

| | Periods ended December 31, 2005

|

|---|

| | Three months

| | Twelve months

|

|---|

| Foreign currency favorable (unfavorable) impact on revenues | | $ | (10.8 | ) | $ | 78.8 |

| Foreign currency favorable impact on operating income | | $ | 0.7 | | $ | 3.3 |

Figure 3

DISCONTINUED OPERATIONS

Over the years, Quebecor World has strived to build a global printing platform that allows publishers and retailers to print in multiple plants, in various countries, reducing lead-time and distribution costs. The Company's core print services, mainly the printing of magazines, catalogs, retail inserts, books, directories and direct mail, benefit from this platform.

However, as the Company grew through acquisitions, certain facilities were included in these transactions that do not concentrate on Quebecor World's core print services. As a result, there were approximately a dozen facilities in North America whose primary activities were non-core general commercial printing. These activities consist primarily of short-run, non-contractual work such as annual reports, marketing materials, travel, fashion and automobile brochures and packaging. This market is highly competitive and fragmented with many small local and regional players. Unlike Quebecor World's previously described core business, these activities do not benefit from the advantages and synergies of the Company's global platform. As a result, on May 10, 2005, the Company announced a plan to sell its group of non-core printing facilities in North America (the "non-core Group").

In the second half of 2005, the Company completed the disposal of all business units of its non-core Group in five separate transactions. These disposals are further discussed in the "Financial Condition, Liquidity and Capital Resources" section. Consequently, the operating results related to these activities have been presented separately in the Company's consolidated financial statements as discontinued operations and comparative figures have been restated to conform to the presentation adopted in 2005 as shown in Note 7 to the Consolidated Financial Statements.

The results of the non-core Group were significantly impacted in 2005 by a $3 million gain ($12 million loss, net of taxes) on the various disposals of units as well as specific charges related to these facilities and pension curtailment costs.

FINANCIAL REVIEW

The Company assesses performance based on operating income before impairment of assets, restructuring and other charges, and goodwill impairment charge ("Adjusted EBIT", Figures 7 and 8). The following operating analyses are before impairment of assets, restructuring and other charges, and goodwill impairment charge, except where otherwise indicated. The review focusses only on continuing operations.

On January 18, 2006, the Company announced the completion of its annual goodwill impairment test. The European reporting unit suffered from poor market conditions throughout 2005, namely continued price erosion and decreased volumes, as well as several production inefficiencies and the loss of an important client. As a result, the Company concluded that the carrying amount of goodwill for the European reporting unit was not fully recoverable and a pre-tax impairment charge of $243 million was taken at December 31, 2005.

FOURTH QUARTER 2005

Overall, results deteriorated in the fourth quarter of 2005 compared to 2004. The Company suffered from pricing pressures, production inefficiencies related to the start-up of presses in the North American platform and rising energy costs. It should be noted however that the results for the fourth quarter of 2004 included fourteen weeks whereas the corresponding quarter in 2005 includes only thirteen.

The Company's consolidated revenues for the fourth quarter were $1,664 million, a 9% decrease when compared to $1,823 million for the same period in 2004. Excluding the unfavorable impact of currency translation (Figure 3), revenues were down 8% due mainly to decrease in volumes and continued price pressures in North America and Europe. Excluding the negative impact of the additional week in 2004, volume increased in the fourth quarter of 2005 for the North American segment in general.

In the fourth quarter of 2005, Adjusted EBIT decreased by 46% to $87 million compared to $161 million in 2004. Operating margin, on the same basis, was 5.3% down from 8.9% in 2004.

Paper sales, excluding the effect of currency translation, decreased by 3% in the fourth quarter of 2005, compared to the same period in 2004. The decrease for the quarter is mainly due to a decrease in paper sales to customers. Although the variance in paper sales has an impact on revenues, it has little or no impact on operating income because the cost is generally passed on to the customer. Most of the Company's long-term contracts with its customers include price-adjustment clauses based on the cost of materials in order to minimize the effects of fluctuation in the price of paper.

Cost of sales for the fourth quarter of 2005 decreased by 4% compared to last year, mostly explained by a decrease in sales volume and a decrease in labor costs. Gross profit margin was 16.3% in the fourth quarter of 2005 compared to 20.0% in 2004. Excluding the favorable impact of currency translation, gross profit margin for the quarter decreased to 16.2% compared to 20.0% last year.

Selling, general and administrative expenses were $103 million compared with $114 million in 2004, a decrease of $11 million. Currency fluctuations did not have a material impact on selling, general and administrative expenses in the fourth quarter of 2005. The savings were mostly explained by workforce reduction, which contributed to the decrease in salaries and benefits. A reduction in bonuses and stock option expenses also contributed to the variance.

12

Depreciation and amortization was $73 million compared with $83 million in 2004. Excluding the impact of currency translation, depreciation and amortization decreased by 11% for the fourth quarter of 2005. The expense decreased compared to 2004 as a result of impairment charges on long-lived assets booked in 2005 and 2004.

Securitization fees totaled $8 million for the fourth quarter of 2005 compared to $6 million for the same period in 2004. The increase for the fourth quarter of 2005 was mainly due to higher market interest rates underlying the program fees. Servicing revenues and expenses did not have a significant impact on the Company's results.

During the fourth quarter, the Company continued its restructuring initiatives and recorded an impairment of long-lived assets, restructuring and other charges of $12 million, which included the workforce reduction in North America and Europe and the continuation of prior initiatives. These measures are described in the section "Impairment of Assets and Restructuring Initiatives".

Financial expenses were $28 million in the fourth quarter of 2005, compared to $31 million in 2004. The variance of $3 million was mainly explained by an increase of interest capitalized to the cost of equipment, and foreign exchange gain partly offset by losses on derivative instruments.

Income taxes were $10 million in the fourth quarter of 2005 compared to $35 million in 2004. Income taxes before impairment of assets, restructuring and other charges, and goodwill impairment charge, were $22 million in the fourth quarter of 2005 compared to $40 million in 2004. The decrease in income taxes was due to a decrease in profits before taxes in countries with a higher overall tax rate.

For the fourth quarter ended December 31, 2005, the Company reported a loss per share of $1.64 compared to diluted earnings per share of $0.27 in 2004. These results incorporated impairment of assets, restructuring and other charges, and a goodwill impairment charge of $255 million ($243 million net of taxes) or $1.85 per share compared with $48 million ($44 million net of taxes) or $0.32 per share in 2004. Excluding the effect of impairment of assets, restructuring and other charges and goodwill impairment charge, the fourth quarter of 2005 resulted in diluted earnings per share of $0.21 compared with $0.59 in the same period of 2004.

YEAR 2005

The Company's consolidated revenues for 2005 were $6,283 million, a 1% decrease when compared to $6,340 million in 2004. Excluding the favorable impact of currency translation (Figure 3) revenues were down 2% due to a decrease in volume and continued pressure on prices in North America and Europe.

Paper sales, excluding the effect of currency translation, increased by 5% in 2005 when compared to the same period in 2004. The increase is mainly due to the increase in paper sales to customers and the increase in paper prices compared to 2004.

In 2005, Adjusted EBIT decreased by 24% to $358 million compared to $471 million in 2004. Operating margin, on the same basis, decreased to 5.7% from 7.4% in 2004. The significant decreases in both operating income and margin are due mainly to the decrease in volume and price pressures that were partially offset by cost containment initiatives and headcount reduction.

Cost of sales in 2005 increased by 2% compared to last year, mostly explained by an increase in paper sales, as described above and an increase in utilities costs during the year that were partly offset by a reduction in labor costs as a result of cost containment initiatives. Gross profit margin was 17.2% in 2005 compared to 19.6% in 2004. Excluding the unfavorable impact of currency translation, gross profit margin for the year was 17.2% compared to 19.6% last year.

Selected Annual Information (Continuing Operations)

($ millions, except per share data)

| | Years ended December 31(1)

| |

|---|

| | 2005

| | 2004

| | 2003

| |

|---|

| Consolidated Results | | | | | | | | | | |

| Revenues | | $ | 6,283.3 | | $ | 6,339.5 | | $ | 6,048.1 | |

| Adjusted EBITDA | | | 688.7 | | | 822.2 | | | 654.8 | |

| Adjusted EBIT | | | 357.5 | | | 471.1 | | | 306.4 | |

| IAROC | | | 94.2 | | | 115.6 | | | 94.5 | |

| Goodwill impairment charge | | | 243.0 | | | — | | | — | |

| Operating income | | | 20.3 | | | 355.5 | | | 211.9 | |

| Net income (loss) from continuing operations | | | (148.8 | ) | | 139.9 | | | (32.7 | ) |

| Net income (loss) | | | (162.6 | ) | | 143.7 | | | (31.4 | ) |

Financial Position |

|

|

|

|

|

|

|

|

|

|

| Total assets | | | 5,705.6 | | | 6,273.8 | | | 6,256.9 | |

| Total long-term debt and convertible notes | | | 1,855.1 | | | 1,950.1 | | | 2,009.0 | |

Per Share Data |

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) | | | | | | | | | | |

| | Basic and Diluted | | | (1.43 | ) | | 0.77 | | | (0.51 | ) |

| | Adjusted diluted | | | 0.98 | | | 1.45 | | | 0.00 | |

| Dividends on preferred shares | | | 1.33 | | | 1.26 | | | 1.17 | |

| Dividends on equity shares | | | 0.56 | | | 0.52 | | | 0.52 | |

Figure 4

| IAROC: Impairment of assets, restructuring and other charges. | | |

| Adjusted: Defined as before IAROC and before goodwill impairment charge. | | |

| (1) Annual information for 2004 consisted of 53 weeks whereas information for 2003 and 2005 consisted of 52 weeks. | | |

13

Selling, general and administrative expenses were $397 million compared to $432 million in 2004, a decrease of $35 million. Excluding the unfavorable impact of currency translation of $7 million, selling, general and administrative expenses were favorable by $42 million in 2005, compared to last year. The savings were explained by workforce reductions, which contributed to the decrease in salaries and benefits. A reduction in bonuses, stock options as well as travel and entertainment expenses also contributed to the variance.

Securitization fees totaled $24 million compared to $15 million in 2004. The increase was mainly due to high market interest rates underlying the program fees. Servicing revenues and expenses did not have a significant impact on the Company's results.

Depreciation and amortization was $304 million in 2005 and $325 million in 2004. Excluding the impact of currency translation, depreciation and amortization decreased by 7% in 2005 as compared to 2004, as a result of impairment charges, on long-lived assets booked in 2005 and 2004.

The Company continued its restructuring initiatives in 2005 and recorded a net restructuring charge of $94 million, which reflected closure of facilities in North America and Europe, further workforce reductions, and additional impairment of assets in Europe. These measures are described in the section "Impairment of Assets and Restructuring Initiatives".

Financial expenses were $119 million in 2005, compared to $133 million in 2004. Two elements lowered the 2005 financial expenses: a lower average debt combined with the increase in interest capitalized to the cost of equipment.

Income taxes were $50 million in the year 2005 compared to $77 million in 2004. Income taxes before impairment of assets, restructuring and other charges and goodwill impairment charge were $70 million in 2005 compared to $102 million in 2004. The decrease is mostly explained by a decrease in profits before tax in countries with higher overall tax rates.

For the year ended December 31, 2005, the Company reported a loss per share of $1.43 compared to diluted earnings per share of $0.77 in 2004. These results include impairment of assets, restructuring and other charges and a goodwill impairment charge of $337 million ($318 million net of taxes) or $2.41 per share compared with $116 million ($91 million net of taxes) or $0.68 per share in 2004. Excluding the effect of impairment of assets, restructuring and other charges, and goodwill impairment charge, 2005 diluted earnings per share were $0.98 compared with $1.45 in 2004.

YEAR 2004

The Company's consolidated revenues for 2004 were $6,340 million, a 5% increase when compared to $6,048 million in 2003. Excluding the favorable impact of currency translation and the additional week in 2004, revenues were essentially flat compared to 2003.

On a full year basis, the Company incurred specific charges that reduced operating income by $15 million for various items including provisions for leases, favorable legal claim settlements, and workers' compensation claims related to closed plants, mainly in North America. In 2003, the Company incurred specific charges that reduced operating income by $74 million, of which $54 million was related to North America, $8 million to Latin America, $6 million to Europe and the balance to other provisions.

Segmented Results of Continuing Operations ($ millions)

Selected Performance Indicators

| | North America

| | Europe

| | Latin America

| | Inter-Segment

and Others

| | Total

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Three months ended December 31 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 1,321.7 | | $ | 1,387.9 | | $ | 276.7 | | $ | 376.6 | | $ | 64.5 | | $ | 56.2 | | $ | 1.1 | | $ | 2.0 | | $ | 1,664.0 | | $ | 1,822.7 | |

| Adjusted EBITDA | | | 153.6 | | | 205.8 | | | 10.3 | | | 35.5 | | | 6.5 | | | 0.9 | | | (2.5 | ) | | 9.7 | | | 167.9 | | | 251.9 | |

| Adjusted EBIT | | | 89.2 | | | 137.1 | | | (2.8 | ) | | 16.5 | | | 3.7 | | | (1.8 | ) | | (2.8 | ) | | 9.6 | | | 87.3 | | | 161.4 | |

| IAROC | | | 2.9 | | | 11.7 | | | 9.0 | | | 31.6 | | | — | | | 4.6 | | | — | | | 0.5 | | | 11.9 | | | 48.4 | |

| Goodwill impairment charge | | | — | | | — | | | 243.0 | | | — | | | — | | | — | | | — | | | — | | | 243.0 | | | — | |

| Operating income (loss) | | | 86.3 | | | 125.4 | | | (254.8 | ) | | (15.1 | ) | | 3.7 | | | (6.4 | ) | | (2.8 | ) | | 9.1 | | | (167.6 | ) | | 113.0 | |

| Adjusted EBITDA margin | | | 11.6 | % | | 14.8 | % | | 3.7 | % | | 9.4 | % | | 10.0 | % | | 1.7 | % | | | | | | | | 10.1 | % | | 13.8 | % |

| Adjusted EBIT margin | | | 6.8 | % | | 9.9 | % | | (1.0 | )% | | 4.4 | % | | 5.7 | % | | (3.2 | )% | | | | | | | | 5.3 | % | | 8.9 | % |

| Operating margin | | | 6.5 | % | | 9.0 | % | | (92.1 | )% | | (4.0 | )% | | 5.7 | % | | (11.4 | )% | | | | | | | | (10.1 | )% | | 6.2 | % |

| Capital expenditures(1) | | $ | 111.5 | | $ | 24.1 | | $ | 63.8 | | $ | 7.2 | | $ | 1.8 | | $ | 0.5 | | $ | — | | $ | — | | $ | 177.1 | | $ | 31.8 | |

| Change in non-cash balances related to operations, cash flow (outflow)(1) | | | 210.0 | | | 121.4 | | | (0.9 | ) | | 42.4 | | | 1.0 | | | 12.6 | | | (16.4 | ) | | (3.3 | ) | | 193.7 | | | 173.1 | |

Years ended December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues | | $ | 4,881.1 | | $ | 4,850.3 | | $ | 1,162.9 | | $ | 1,297.4 | | $ | 241.7 | | $ | 192.4 | | $ | (2.4 | ) | $ | (0.6 | ) | $ | 6,283.3 | | $ | 6,339.5 | |

| Adjusted EBITDA | | | 615.7 | | | 690.0 | | | 53.5 | | | 120.5 | | | 23.9 | | | 12.3 | | | (4.4 | ) | | (0.6 | ) | | 688.7 | | | 822.2 | |

| Adjusted EBIT | | | 353.5 | | | 421.4 | | | (3.6 | ) | | 50.1 | | | 13.0 | | | 1.3 | | | (5.4 | ) | | (1.7 | ) | | 357.5 | | | 471.1 | |

| IAROC | | | 22.6 | | | 68.3 | | | 70.9 | | | 40.6 | | | 0.7 | | | 5.7 | | | — | | | 1.0 | | | 94.2 | | | 115.6 | |

| Goodwill impairment charge | | | — | | | — | | | 243.0 | | | — | | | — | | | — | | | — | | | — | | | 243.0 | | | — | |

| Operating income (loss) | | | 330.9 | | | 353.1 | | | (317.5 | ) | | 9.5 | | | 12.3 | | | (4.4 | ) | | (5.4 | ) | | (2.7 | ) | | 20.3 | | | 355.5 | |

| Adjusted EBITDA margin | | | 12.6 | % | | 14.2 | % | | 4.6 | % | | 9.3 | % | | 9.9 | % | | 6.4 | % | | | | | | | | 11.0 | % | | 13.0 | % |

| Adjusted EBIT margin | | | 7.2 | % | | 8.7 | % | | (0.3 | )% | | 3.9 | % | | 5.4 | % | | 0.7 | % | | | | | | | | 5.7 | % | | 7.4 | % |

| Operating margin | | | 6.8 | % | | 7.3 | % | | (27.3 | )% | | 0.7 | % | | 5.1 | % | | (2.3 | )% | | | | | | | | 0.3 | % | | 5.6 | % |

| Capital expenditures(1) | | $ | 286.4 | | $ | 106.5 | | $ | 103.3 | | $ | 22.2 | | $ | 4.1 | | $ | 3.8 | | $ | 0.2 | | $ | 0.1 | | $ | 394.0 | | $ | 132.6 | |

| Change in non-cash balances related to operations, cash flow (outflow)(1) | | | 88.9 | | | (202.0 | ) | | (29.1 | ) | | 1.1 | | | (18.0 | ) | | 18.0 | | | (27.5 | ) | | 23.6 | | | 14.3 | | | (159.3 | ) |

Figure 5

IAROC: Impairment of assets, restructuring and other charges.

Adjusted: Defined as before IAROC and before goodwill impairment charge.

(1) Including both continued and discontinued operations. | | |

14

In 2004, Adjusted EBIT increased by 54% to $471 million compared to $306 million in 2003. Operating margin, on the same basis, increased to 7.4% from 5.1% in 2003. The significant increases in both operating income and margin are due mainly to the increase in volume, cost containment initiatives and headcount reduction, partially offset by price pressures.

Cost of sales for the full year of 2004 increased by 4% compared to last year, mostly explained by the additional week in 2004. Gross profit margin was 19.6% in 2004 compared to 18.8% in 2003. The 2004 and 2003 cost of sales included specific charges of $5 million and $36 million, respectively. Excluding these specific charges as well as the unfavorable impact of currency translation, gross profit margin for the year was 19.7% compared to 19.4% last year. Despite an increase in sales volume across the platform in 2004, labor decreased by $6 million. Gains on other materials and higher paper prices on scrap paper sales contributed to a reduction in cost of materials by approximately $48 million. These elements were partly offset by operational inefficiencies in certain plants, mainly those involved with installation and transfer of equipment, in the third quarter. Excluding the negative impact of currency translation, these items contributed to improve the gross profit margin for 2004.

Selling, general and administrative expenses were $432 million compared with $494 million in 2003, a decrease of $62 million. Excluding the specific charges of $9 million in 2004 and $38 million in 2003, as well as the unfavorable impact of currency translation of $15 million, selling, general and administrative expenses were favorable by $48 million in 2004, compared to last year. On a year-to-date basis, the savings were explained by workforce reductions which contributed to the decrease in salaries and benefits as well as travel and entertainment expenses.

For the year ended December 31, 2004, securitization fees were $15 million compared to $14 million in 2003. Servicing revenues and expenses did not have a significant impact on our results.

Depreciation and amortization were $325 million in both 2004 and 2003. Excluding the impact of currency translation, depreciation and amortization decreased by 3% in 2004 as compared to 2003.

The Company continued its restructuring initiatives in 2004 and recorded a net restructuring charge of $116 million, which reflected closure of facilities in North America and Europe, further workforce reductions, and additional impairment of assets across the platform. These measures are described in the section "Impairment of Assets and Restructuring Initiatives".

Financial expenses were $133 million in 2004, compared to $205 million in 2003. Two non-recurring events affected the 2003 financial expenses. First, the Company redeemed the 8.375% Senior Notes and repurchased 89.6% of the 7.75% Senior Notes which resulted in a $30 million charge on extinguishment of long-term debt in 2003. Furthermore, the financial expenses for 2003 included a $5 million exchange loss on the currency translation adjustment due to the reduction of a net investment in Latin America. Excluding these two events, financial expenses were down by $37 million in 2004 compared to 2003. Part of the decrease is a direct effect of the above-mentioned repurchase and redemption of Senior Notes. A lower average debt mainly explained the rest of the reduction in 2004 combined with reduced losses on foreign exchange compared with 2003.

Income taxes were $77 million in 2004 compared to $37 million in 2003. Income taxes before impairment of assets, restructuring and other charges were $102 million in 2004 compared to $63 million in 2003. The 2003 income taxes before impairment of assets, restructuring and other charges included two non-recurring items which occurred in 2003; an unfavorable adjustment of the average tax rate applied on cumulative temporary differences within different states in the United States for $28 million and an additional charge of $25 million reflecting the Company's revised expectation of tax asset recovery and liabilities from prior years. When excluding these items, income taxes before impairment of assets, restructuring and other charges increased in the year 2004. The increase in income taxes was due to an increase in profits before taxes in countries with a higher overall tax rate and as a result of valuation allowances recorded on certain tax assets.

For the year ended December 31, 2004, the Company reported a diluted earnings per share of $0.77 compared to a loss per share of $0.51 in 2003. These results incorporated impairment of assets, restructuring and other charges of $116 million ($91 million net of taxes) or $ 0.68 per share compared with $94 million ($69 million net of taxes) or $0.51 per share in 2003. Excluding the effect of impairment of assets, restructuring and other charges, 2004 diluted earnings per share were $1.45 compared to nil in 2003.

In 2003, a series of non-recurring items, such as a $30 million charge on extinguishment of long-term debt, a $5 million loss from currency translation adjustment and the combined effect on the income tax expense of the items described above ($53 million), reduced earnings per share by $0.56.

SEGMENT REVIEW

The following is a review of activities by segment. The operating analysis is before impairment of assets, restructuring and other charges, and before goodwill impairment charge. Also, the review focuses only on continuing operations.

NORTH AMERICA

North American revenues for the fourth quarter of 2005 were $1,322 million, down 5% from $1,388 million in 2004. On a full year basis, revenues increased 1% to $4,881 million in 2005 from $4,850 million in 2004. Excluding the effect of currency translation and the impact of paper sales, revenues decreased by 5% in the fourth quarter and 2% on a year-to-date basis compared to 2004. As mentioned in the "Overview" section, the additional week in 2004 had an impact on comparative figures. This impact is reflected most significantly in the results of the North American segment and explained a portion of the decrease in revenues, operating income and volume in all business groups. Although the extra week impacted the entire North American platform in the fourth quarter, if its effects are discounted, the Catalog, Retail, Direct, Book and Canada groups would have registered volume increases.

Operating income and margin decreased compared to 2004 for both the quarter and the full year. This was a result of the challenging market conditions impacting most of the North American business groups with continued price erosion, rising energy costs as well as temporary inefficiencies related to installation and start-up of new presses related to the retooling plan.

15

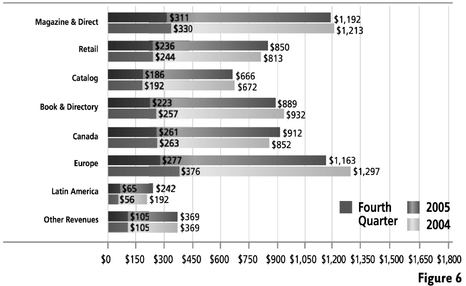

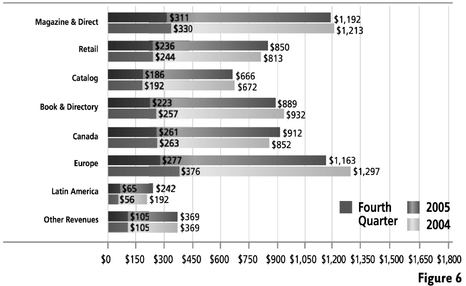

Revenue by Business Group ($ million)

For the quarter and the year ended December 31

(Continuing Operations)

Selling, general and administrative expenses decreased across the North American platform in 2005 compared to 2004, mainly due to savings from facility closures, cost-containment initiatives and corporate headcount reductions, mostly in 2004. Year-over-year headcount was reduced in North America by 484 employees, or approximately 2%.

The following is a review of the North American activities by business group. The North American segment is made up of the following business groups: Magazine & Direct, Retail, Catalog, Book & Directory, Canada and Other Revenues. (Figure 6)

Magazine & Direct

Magazine & Direct revenues for the fourth quarter of 2005 were $311 million, down 5% from $330 million in 2004. On a full year basis, revenues decreased by 2% to $1,192 million in 2005, from $1,213 million in 2004, despite a 2% increase in paper sales, mainly in the Magazine group.

Prices were down in the Magazine group for the fourth quarter and were down year-to-date for both Magazine & Direct compared to 2004. Volume for the Magazine group was down 9% for the quarter and 5% year-to-date, due to the absence of the 53rd week, the non-renewal of one customer and reduced volume from another. In the Direct group, volume decreased by 6% for the quarter and 1% year-to-date, essentially explained by the 53rd week in 2004. However, coupled with declining pricing, this market suffered from mergers in the banking and the telecom sectors resulting in less demand.

As part of the ongoing retooling plan to improve operational efficiencies, new presses are being installed in five facilities for magazine customers. Two of them were operating in the fourth quarter of 2005. This process resulted in certain inefficiencies from the preparation, installation and the start-up of the new equipment, which negatively affected the results.

Over the year and despite the challenging market, the Magazine group continued to secure market share by extending current contracts and increasing volume for customers by signing multi-year agreements of more than a billion dollars. Customers include Time, Primedia, Wenner Media, Morris Communications, Disney/ESPN and Ascend Media.

Retail

Retail revenues for the fourth quarter of 2005 were $236 million, down 3% from $244 million in 2004. On a full year basis, revenues increased by 5% to $850 million in 2005, from $813 million in 2004, essentially explained by increased paper sales.

Volume remained stable for the quarter and increased by 5% on a year-to-date basis. The increased volume is explained by new gains as well as additional volume from existing customers such as: Sports Authority, Wal-Mart, Big 5 Sporting Goods, Walgreen and Best Buy. Volume increased also because of the addition of the offset printing facility in Pittsburg, California. However, this increase has been partially offset by the negative impact of lower priced work for both the quarter and the full year compared to 2004. While selected customers are opting for increased versioning in their retail campaigns, Quebecor World's coast-to-coast dual processes platforms (gravure/offset) is uniquely positioned to fulfill their needs.

Catalog

Catalog revenues for the fourth quarter of 2005 were $186 million, down 3% from $192 million in 2004. On a full-year basis, revenues decreased by 1% to $666 million in 2005, from $672 million in 2004.

Volume was down 6% for the quarter and 1% for the full year. Price erosion continued for both the quarter and the full-year resulting in decreased operating margins compared to last year. As part of the ongoing retooling plan to improve efficiencies, a new 64-page press has been installed in the Catalog platform in the fourth quarter of 2005 and experienced some start-up inefficiencies, which also contributed to the lower operating margins.

The Catalog group is continuing to secure market share by extending current contracts and winning new customers such as: Bass Pro Shops, School Specialty and Brookstone.

Book & Directory

Book & Directory revenues for the fourth quarter of 2005 were $223 million, down 13% from $257 million in 2004. On a full-year basis, revenues decreased by 5% to $889 million in 2005, from $932 million in 2004. The decrease in revenue in the fourth quarter and for the full year was due mainly to the volume shortfalls and price erosion in both the Book and Directory groups compared to the same periods in 2004. Volume decreased in the fourth quarter of 2005 by 6% in the Book group and by 16% in the Directory group. On a full-year basis, volume decreased by 3% in the Book group and 7% in the Directory group. The volume shortfall in Directory is due to lower volumes from two customers.

The Book group has continued to enhance its position by increasing competitive efficiencies with the addition of 64-page presses at two facilities that were in operation in the fourth quarter of 2005. Also, the Directory group has signed two new multi-year contracts with Yellow Book USA and DEX Media. The Company currently anticipates that this additional volume will significantly increase its market share in the directory business beginning in 2007.

16

Canada

The Canadian business group operates mainly in the Retail, Magazine & Direct, Catalog and Directory markets. Canadian revenues for the fourth quarter of 2005 were $261 million, essentially flat compared to 2004. On a full-year basis, revenues increased by 7% to $912 million in 2005, from $852 million in 2004. Excluding the favorable impact of currency translation and paper sales, revenues decreased by 3% for the quarter and 1% for the full year compared to 2004. Volume decreased by 7% in the fourth quarter and 1% for the full year compared to the same periods in 2004. Magazine volume decreased in the fourth quarter and year-to-date, both partly offset by an increase in Retail and Catalog across the platform. Market conditions remained extremely competitive as reflected in the pricing.

In August 2005, Quebecor inc. announced a major investment that will include a new print facility in Islington, Ontario to be operated by a new entity co-owned by Quebecor Media (another subsidiary of the parent company) and Quebecor World, serving both of their customers. The new entity will print newspapers for Quebecor Media in Ontario as well as Quebecor World's print contracts for its North American customers, including some of the larger directory publishers.

Other Revenue

Other sources of revenue in North America include Quebecor World Premedia and Logistics.

Premedia revenues for the fourth quarter were $15 million, down 6% from $16 million in 2004. On a full-year basis, revenues were $58 million in 2005, down 11% from $66 million in 2004. The decrease in revenue for the fourth quarter compared to 2004 was due to a 12% decrease in volume partly offset by an increase in price, essentially due to product mix. On a full-year basis, volume decreased by 7% year-over-year and changes in type of prepress work and the price erosion earlier in the year caused a negative impact on revenue. The economic environment has led customers to continue looking for ways to reduce their costs by putting pressure on reducing prices, re-using previously captured images and taking more of the prepress production in-house.

Logistics revenues for the fourth quarter were $93 million, up 4% from $89 million in 2004. On a full year basis, revenues were $321 million in 2005, up 4% from $309 million in 2004. The increase in revenue was due mainly to higher retail commodity shipments in both the fourth quarter and the full year. However, gross profit margins decreased in the fourth quarter and year-to-date due to more unscheduled truck shipments for time-sensitive products, higher operating costs due to effects of hurricanes in the Gulf Coast and higher fuel prices.

EUROPE

The European business group operates mainly in the Magazine, Retail, Catalog and Book markets. European revenues for the fourth quarter of 2005 were $277 million, down 27% from $377 million in 2004. On a full-year basis, revenues were $1,163 million, down 10% from $1,297 million in 2004. Excluding the impact of currency translation and paper sales, revenues were down 16% for the fourth quarter and 9% for the full year compared to the same periods last year. Overall volume decreased by 23% in the fourth quarter and 13% year-to-date mainly explained by the Magazine and the Retail markets in France and the wind-down of an important contract not renewed at the Corby, United Kingdom facility. Price erosion continued to have a negative impact on the European results throughout the year. During the year 2005, the Company sold investments in some facilities in France, which also contributed to the decrease in revenues when compared to year 2004.

Operating income and margin for the European segment were negative for the fourth quarter and the full year and represented a significant decrease compared to the same periods in 2004. The negative operating results were in part due to the loss of the contract at the Corby facility. Volumes related to this contract began to decrease in the first half of 2005 and the contract was terminated at the end of May. The facility has been able to replace some of the lost volume, but at lower margins. France also reported negative operating results for both the fourth quarter and the full year of 2005 compared to the same periods last year. The decrease in volume combined with various workforce related inefficiencies and the continued price pressure negatively affected the French results. The less productive assets, mainly in France, have also contributed to poor operating results. However, operating income and margin increased in Spain and Austria for the year 2005 compared to 2004.

The Company recently completed a strategic review of its operations in the whole platform and announced a capital investment program of approximately $250 million. Europe is an important element in the Company's global service offering and it is expected that this program will improve the platform's competitive position, lower its cost base and allow the Company to provide better service to customers. The program will affect selected European operations and involves the purchase of new state-of-the-art equipment to be installed in facilities in Belgium, Spain, Austria as well as additional potential investments in the United Kingdom and France. The Company also successfully completed labor negotiations in February 2006 with its employee representatives in the United Kingdom that will quickly bring the facility in line with the market. Finally, similar negotiations are progressing more slowly in France. This could be a lenghty process which might negatively impact the Company's performance.

Selling, general and administrative expenses, when excluding the effect of currency translation, decreased in the fourth quarter and the full year of 2005 compared to the same periods in 2004 as a result of headcount reductions. Year-over-year headcount decreased by 790 employees or approximately 14% mostly in the United Kingdom, Sweden and France.

LATIN AMERICA

Latin America operates mainly in the Book, Directory, Magazine, and Retail markets. Latin America's revenues for the fourth quarter of 2005 were $65 million, up 15% from $56 million in 2004. On a full-year basis, revenues were $242 million in 2005, up 26% from $192 million in 2004. Excluding the favorable impact of currency translation and paper sales, revenues increased by 6% for both the fourth quarter and the full year compared to 2004. Overall volume increased by 3% for the quarter compared to the same period last year explained by increased directory volume in the Recife, Brazil and Mexico facilities. On a full-year basis, volume increased by 5% reflecting strengthened local economies, which led to general increases in all markets coupled with the increased volume of cross selling efforts with the North American and European segments. During the third quarter of 2004, the Company had embarked on an initiative to more closely link the Latin American Book and Directory facilities with its North American counterparts to expand the capacity and capabilities to its overall customer base. This initiative has continued through the fourth quarter of 2005.

For both the fourth quarter and the full year, prices, expressed in local currency, remained essentially stable with the exception of Argentina which increased significantly as a result of a recovering economy in that country. Operating income and margin increased in the fourth quarter compared to the same period last year, mainly due to increased prices and cost saving initiatives. On a year-to-date basis, operating income and margin increased due to higher volume and operational efficiencies.

Selling, general and administrative expenses, when excluding the effect of currency translation, decreased in the fourth quarter and for the full year of 2005 compared to the same periods in 2004, due mainly to savings from cost containment initiatives and headcount reductions. Year-over-year headcount was reduced by 84 employees, or approximately 4%.

17

Reconciliation of non GAAP measures

($ millions)

| | Years ended December 31

| |

|---|

| | 2005

| | 2004

| | 2003

| |

|---|

| Operating Income from Continuing Operations | | | | | | | | | | |

| | Operating income ("EBIT") | | $ | 20.3 | | $ | 355.5 | | $ | 211.9 | |

| | Impairment of assets, restructuring and other charges ("IAROC") | | | 94.2 | | | 115.6 | | | 94.5 | |

| | Goodwill impairment charge | | | 243.0 | | | — | | | — | |

| | |

| |

| |

| |

| | Adjusted EBIT | | $ | 357.5 | | $ | 471.1 | | $ | 306.4 | |

| | |

| |

| |

| |

| | EBIT | | $ | 20.3 | | $ | 355.5 | | $ | 211.9 | |

| | Depreciation of property, plant and equipment(1) | | | 308.1 | | | 334.5 | | | 333.2 | |

| | Amortization of deferred charges(1) | | | 27.3 | | | 27.0 | | | 26.2 | |

| | Less depreciation and amortization from discontinued operations(2) | | | (4.2 | ) | | (10.4 | ) | | (11.0 | ) |

| | |

| |

| |

| |

| | Operating income before depreciation and amortization ("EBITDA") | | $ | 351.5 | | $ | 706.6 | | $ | 560.3 | |

| | IAROC | | | 94.2 | | | 115.6 | | | 94.5 | |

| | Goodwill impairment charge | | | 243.0 | | | — | | | — | |

| | |

| |

| |

| |

| | Adjusted EBITDA | | $ | 688.7 | | $ | 822.2 | | $ | 654.8 | |

| | |

| |

| |

| |

Earnings (loss) per share from Continuing Operations |

|

|

|

|

|

|

|

|

|

|

| | Net income (loss) from Continuing Operations | | $ | (148.8 | ) | $ | 139.9 | | $ | (32.7 | ) |

| | IAROC (net of income taxes of $8.2 million in 2005, | | | | | | | | | | |

| | | | $24.8 million in 2004 and $25.7 million in 2003) | | | 86.0 | | | 90.8 | | | 68.8 | |

| | Goodwill impairment charge (net of income taxes of $10.9 million in 2005) | | | 232.1 | | | — | | | — | |

| | |

| |

| |

| |

| | Adjusted net income from continuing operations | | $ | 169.3 | | $ | 230.7 | | $ | 36.1 | |

| | Net income available to holders of preferred shares | | | 39.6 | | | 37.5 | | | 36.5 | |

| | |

| |

| |

| |

| | Adjusted net income from continuing operations available to holders of equity shares | | $ | 129.7 | | $ | 193.2 | | $ | (0.4 | ) |

| | Diluted average number of equity shares outstanding (in millions) | | | 131.8 | | | 132.6 | | | 136.0 | |

| | Earnings (loss) per share from continuing operations | | | | | | | | | | |

| | | Diluted | | $ | (1.43 | ) | $ | 0.77 | | $ | (0.51 | ) |

| | | Adjusted diluted | | $ | 0.98 | | $ | 1.45 | | $ | — | |

| | |

| |

| |

| |

Free Cash Flow |

|

|

|

|

|

|

|

|

|

|

| | Cash provided by operating activities | | $ | 469.5 | | $ | 487.8 | | $ | 461.3 | |

| | Dividends on preferred shares | | | (39.6 | ) | | (38.8 | ) | | (37.7 | ) |

| | Additions to property, plant and equipment | | | (394.0 | ) | | (132.6 | ) | | (243.1 | ) |

| | Net proceeds from disposal of assets | | | 16.4 | | | 3.0 | | | 2.8 | |

| | Proceeds from business disposals | | | 66.9 | | | — | | | — | |

| | |

| |

| |

| |

| | Free cash flow | | $ | 119.2 | | $ | 319.4 | | $ | 183.3 | |

| | |

| |

| |

| |

Book value per share |

|

|

|

|

|

|

|

|

|

|

| | Shareholders' equity | | $ | 2,250.6 | | $ | 2,612.6 | | $ | 2,503.4 | |

| | Preferred shares | | | (456.6 | ) | | (456.6 | ) | | (456.6 | ) |

| | |

| |

| |

| |

| | | $ | 1,794.0 | | $ | 2,156.0 | | $ | 2,046.8 | |

| | Ending number of equity shares (in millions) | | | 131.0 | | | 132.6 | | | 132.0 | |

| | |

| |

| |

| |

| | Book value per share | | $ | 13.69 | | $ | 16.26 | | $ | 15.51 | |

| | |

| |

| |

| |

Figure 7

Adjusted: Defined as before IAROC and before goodwill impairment charge

(1) As reported in the Consolidated Statements of Cash Flows

(2) As reported in Note 7 "Discontinued Operations" | | |

18

Reconciliation of non GAAP measures

($ millions)

| | Years ended December 31

| |

|---|

| | 2005

| | 2004

| | 2003

| |

|---|

| Debt-to-capitalization | | | | | | | | | | |

| | Bank indebtedness | | $ | — | | $ | — | | $ | 1.3 | |

| | Current portion of long-term debt and convertible notes | | | 7.7 | | | 11.7 | | | 23.9 | |

| | Long-term debt | | | 1,731.9 | | | 1,825.8 | | | 1,874.4 | |

| | Convertible notes | | | 115.5 | | | 112.6 | | | 110.7 | |

| | |

| |

| |

| |