UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2007

Commission File Number:1-14118

2007 FIRST QUARTER RESULTS

QUEBECOR WORLD INC.

(Translation of Registrant's Name into English)

612 Saint-Jacques Street, Montreal, Quebec H3C 4M8

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F o Form 40-F ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Fork 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

QUEBECOR WORLD INC.

Filed in this Form 6-K

Documents index

- Press Release dated May 9, 2007; Financial Highlights

- Management's Discussion and Analysis of Financial Condition and Results of Operations

- Consolidated Financial Statements

2

May 9, 2007 12/07

For immediate release Page 1 of 8

QUEBECOR WORLD RELEASES FIRST QUARTER RESULTS

HIGHLIGHTS

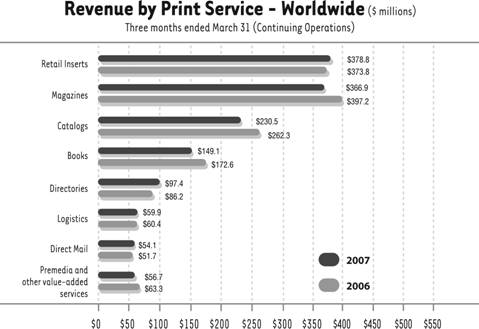

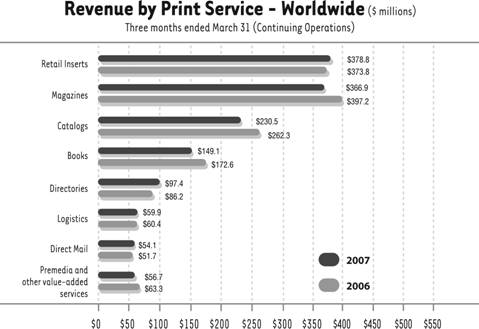

- Revenue of $1.39 billion in first quarter compared to $1.47 billion in first quarter 2006

- Retooling and restructuring initiatives accelerated to be completed by third quarter of 2007, temporarily causing a negative impact on results

- 6 facilities closed or sold in first quarter

- 8 new or relocated presses installed in first quarter

- Recently restructured and retooled North American businesses delivering improved financial results

- European results lower due to heavy retooling, restructuring and challenging markets

Montréal, Canada - Quebecor World Inc. (NYSE:IQW, TSX:IQW) announces for the first quarter 2007 a net loss from continuing operations of $38.1 million or a loss of $0.34 per share, compared to the first quarter 2006's net income from continuing operations of $6.3 million or a loss of $0.04 per share. First quarter 2007 results incorporate impairment of assets, restructuring and other charges (net of taxes) of $23.1 million or $0.17 per share compared to $16.9 million or $0.13 per share in 2006. Excluding impairment of assets, restructuring and other charges, adjusted loss per share was $0.17 compared to adjusted diluted earnings per share of $0.09 in the first quarter of 2006. On the same basis, adjusted operating income in the first quarter was $11.2 million compared to $49.6 million during the first quarter last year. This shortfall reflects the negative variance of more than $17 million of non-recurring specific charges such as the loss on the sale of the facility in Lille, France. The rest of the variance is due to lower revenues as well as temporary inefficiencies related to the acceleration of the retooling and restructuring programs. Consolidated revenues for the quarter were $1.39 billion compared to $1.47 billion in the first quarter of 2006.

"As we stated in our fourth quarter earnings release, our first quarter results were negatively impacted by the acceleration of our retooling and restructuring initiatives in the first half of 2007 as we complete our retooling program earlier than planned, and finalize it in time for our customers' busy season," commented Wes Lucas. President and CEO, Quebecor World Inc. "In the first quarter we completed the closure or sale of six facilities and installed or relocated eight presses in North America and Europe. This large undertaking created temporary inefficiencies, but we fully expect that this pain will deliver significant gains for our customers and shareholders in the near future and long term."

1

For immediate release Page 2 of 8

In the first quarter, Quebecor World generated adjusted EBITDA of $92.0 million compared to $128.5 million in the first quarter of 2006. First quarter 2007 adjusted EBITDA results were impacted by specific charges, including an $11.0 million loss on the disposal of the Lille, France facility, and the fact that first quarter 2006 results benefited from a $6.3 million VAT refund.

"We are seeing improved results in our divisions where the retooling is essentially completed such as our U.S. book and magazine divisions", added Mr. Lucas. "In addition results increased in several businesses such as logistics, direct marketing and retail. This improved performance was more than offset by major retooling and challenging market conditions in Europe, as well as plant closures and retooling in Canada and our U.S. catalog division."

Actions on 5-Point Transformation Plan

Customer value: In the quarter Quebecor World renewed a long-term agreement with Hachette Filipacchi Media U.S. Hachette has entrusted Quebecor World to supply virtually 100% of its magazine print solutions and distribution needs. Quebecor World creates significant value for Hachette by implementing a world class solution across their entire print supply chain, through reduced cycle time, co-mail technology, mail list services and an outstanding delivery performance. Also in the quarter, Quebecor World signed a new agreement to increase its services to Primedia Publishing. These and other customer wins and renewals demonstrate the different ways Quebecor World is creating greater customer value by offering complete solutions by combining more value before and after printing.

Best People: Quebecor World's Best People initiative is focused on building high performance teams to ensure the Company has the best people in place to create maximum shareholder value. Recently the Company strengthened its leadership team by naming Kevin Akeroyd as President of the Targeted Direct Marketing Division. Mr. Akeroyd has extensive experience in marketing and advertising and will play a key role in leading the Direct Group as one of the key elements in providing our customers with a multi-channel marketing solution.

2

For immediate release Page 3 of 8

Great Execution: Quebecor World's Execution Initiative includes multiple elements focused on reducing costs and improving efficiencies across the Company. One area of this initiative is our Continuous Improvement Program in our North American platform. The first wave of 41 projects is well developed. The benefits from Wave I projects are estimated at $10 million. The Second Wave totaling 46 more projects is scheduled to be launched in the second quarter of 2007. These projects focus on high impact improvement areas with low capital requirements and high returns. Given our initial progress, the Company expects to reach its target of $100 million in annualized cost savings and productivity improvements, run rate by the end of 2008.

Retooling program: In the first quarter of 2007, the Company completed the installation or relocation of eight presses in its North American and European platforms. This is compared to only 2 during the same period last year. Quebecor World's three-year retooling program is being accelerated in order to be completed before its customers' busy season in the later part of 2007 creating significant extra costs and inefficiencies. The Company completed the start-up of the tenth and final press as part of its U.S. Magazine retooling plan. To maximize the benefits of the retooling the Company is also continuing with its restructuring initiatives that in the first quarter involved the closure or disposal of six facilities: Lincoln NE, Phoenix AZ, Washington DC, L'Eclaireur QC, Elk Grove IL and Lille, France. This is compared to the sale of 3 facilities in the first quarter of 2006. The first quarter restructuring initiatives eliminated 733 positions, of which 344 positions have been elimin ated as of March 31, 2007 and 389 are expected to be eliminated. However, the Company estimated that 374 new jobs would be needed in the retooling initiative, for a net reduction totalling 359 positions.

Balance sheet: Quebecor World is committed to strengthening its balance sheet in a responsible manner. At the end of the first quarter the Company had more than $900 million in undrawn credit availability from its $1 billion unsecured revolving credit facility. To diversify its financing base, in the first quarter the Company executed a sale-leaseback of two of its Canadian facilities for a total consideration of CA$40 million. In addition, both strategic and tactical actions are being explored to improve the balance sheet.

North America

North American revenues for the first quarter of 2007 were $1.08 billion, down 6.2 % from $1.15 billion in 2006. Volume in North America decreased during the first quarter of 2007 mainly due to the restructuring initiatives resulting from the 5 plant closures and press installations. The Canadian Group continued to be affected by less favourable foreign exchange contracts on sales to its U.S. customers. In North America results improved in businesses that were recently retooled and restructured offset by FX impact in Canada and significant retooling and restructuring activities in our U.S. catalog division which included the closure of our Elk Grove, IL facility and major retooling in our Corinth, MS facility to increase customer value. Year-over-year, the North American workforce was reduced by 2,051 employees, or approximately 8.7%. In the first quarter of 2007, the Company completed the closure of 5 facilities.

3

For immediate release Page 4 of 8

Europe

European revenues for the first quarter of 2007 were $253.3 million, down 3.3% from $262.1 million in 2006. Volume decreased in the first quarter of 2007, mainly in France. The decrease in France is mainly a result of inefficiencies due to press start-ups, transfers and restructuring activities. Volume in France was also negatively impacted by the disposal of the Lille facility. The volume shortfall was slightly offset by higher volume in Austria in the first quarter of 2007 due essentially to productivity gains stemming from Quebecor World's retooling initiative. Operating income was down significantly in the first quarter as a result of the retooling and European market conditions.

Latin America

Latin America's revenues for the first quarter of 2007 were $63.9 million, up 11.2% from $57.5 million in 2006. Volume increased for the first quarter of 2007 on account of strong customer sales in Peru and Colombia. Price, including the effect of work mix and currency, had a slight favourable impact on revenues during the quarter. Overall, these factors contributed to the increased operating income during the first quarter of 2007 compared to last year in addition to cost reductions realized during the same period.

Dividend

The Board of Directors of Quebecor World Inc. declared today a dividend of CA$0.3845 per share on Series 3 Preferred Shares and CA$0.43125 on Series 5 Preferred Shares. The dividends are payable on June 1st, 2007 to shareholders of record at the close of business on May 22nd, 2007. These dividends are designated to be eligible dividends, as provided under subsection 89(14) of the Income Tax Act (Canada) and its provincial counterpart.

Full Financial Information

Management Discussion and Analysis ("MD&A")

Please refer to the MD&A for the reconciliation to Canadian generally accepted accounting principles of certain figures used to explain these results. The MD&A can be found on the Company's website atwww.quebecorworld.com and through the SEDAR and SEC filings.

Financial statements are available on the Company's website and through the SEDAR and SEC filings.

Sedar web address:www.sedar.com

4

For immediate release Page 5 of 8

SEC web address:www.sec.gov

Conference Call

Quebecor World to include slide presentation in its Quarterly Investor Conference Call

Quebecor World to Webcast Investor Conference Call and Presentation on May 9, 2007

Quebecor World Inc. will broadcast its first conference call live over the Internet on May 9, 2007 at 4:00 PM (Eastern Time).

The conference call and accompanying PowerPoint presentation will be broadcast live and can be accessed on the Quebecor World Website:

http://www.quebecorworldinc.com/main.aspx?id=209

The presentation and an archive of the Webcast will be available on the Quebecor World Web site following the conference call.

Prior to the call please ensure that you have the appropriate software. The Quebecor World web address listed above has instructions and a direct link to download the necessary software, free of charge.

Anyone unable to attend this conference call may listen to the replay tape by phoning (877) 293-8133 or (403) 266-2079 - passcode 403934#, available from May 9, 2007 to June 9, 2007.

Forward looking statements

This press release may include "forward-looking statements" that involve risks and uncertainties. All statements other than statements of historical facts included in this press release, including statements regarding the prospects of the industry and prospects, plans, financial position and business strategy of Quebecor World Inc. (the "Company"), may constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Canadian securities legislation and regulations. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "will," "expect," "intend," "estimate," "anticipate," "plan," "foresee," "believe" or "continue" or the negatives of these terms or variations of them or similar terminology. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been c orrect. Forward-looking statements do not take into account the effect that transactions or non-recurring or other special items announced or occurring after the statements are made have on the Company's business. For example, they do not include the effect of dispositions, acquisitions, other business transactions, asset writedowns or other charges announced or occurring after forward-looking statements are made.

5

For immediate release Page 6 of 8

Investors and others are cautioned that undue reliance should not be placed on any forward-looking statements. For more information on the risks, uncertainties and assumptions that could cause the Company's actual results to differ from current expectations, please refer to the Company's public filings available at www.sedar.com, www.sec.gov and www.quebecorworld.com. In particular, further details and descriptions of these and other factors are disclosed in the "Risks and Uncertainties related to the Company's business" section of the Company's Management's Discussion and Analysis for the year ended December 31, 2006, and the "Risk Factors" section of the Company's Annual Information Form for the year ended December 31, 2006.

The forward-looking statements in this press release reflect the Company's expectations as of May 9, 2007 and are subject to change after this date. The Company expressly disclaims any obligation or intention to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by the applicable securities laws.

The Company

Quebecor World Inc. (NYSE:IQW, TSX:IQW) is a world leader in providing high-value, complete marketing and advertising solutions to leading retailers, catalogers, branded-goods companies and other businesses with marketing and advertising activities, as well as complete, full-service print solutions for publishers. The Company is a market leader in most of its major product categories, which include advertising inserts and circulars, catalogs, direct mail products, magazines, books, directories, digital premedia, logistics, mail list technologies and other value-added services. Quebecor World has approximately 29,000 employees working in more than 120 printing and related facilities in the United States, Canada, Argentina, Austria, Belgium, Brazil, Chile, Colombia, Finland, France, India, Mexico, Peru, Spain, Sweden, Switzerland and the United Kingdom.

Web address:www.quebecorworld.com

- 30 -

6

For immediate release Page 7 of 8

For further Information contact:

Tony Ross

Vice President, Communications

Quebecor World Inc.

(514) 877-5317

(800) 567-7070 | Roland Ribotti

Vice President, Investor Relations and

Assistant Treasurer

Quebecor World Inc.

(514) 877-5143

(800) 567-7070 | | |

7

For immediate release Page 8 of 8

Quebecor World Inc.

Financial Highlights

(In millions of US dollars, except per share data)

(Unaudited)

| | Three-month periods ended

March 31 | |

| | 2007 | | 2006 | |

| | | | | |

Consolidated Results from Continuing Operations | | | | | |

Revenues | | $ | 1,393.4 | | $ | 1,467.5 | |

Adjusted EBITDA | | 92.0 | | 128.5 | |

Adjusted EBIT | | 11.2 | | 49.6 | |

IAROC | | 29.5 | | 22.1 | |

Operating income (loss) | | (18.3 | ) | 27.5 | |

Net income (loss) from continuing operations | | (38.1 | ) | 6.3 | |

Net income (loss) | | (38.1 | ) | 5.2 | |

Adjusted EBITDA margin * | | 6.6 | % | 8.8 | % |

Adjusted EBIT margin * | | 0.8 | % | 3.4 | % |

Operating margin * | | (1.3 | )% | 1.9 | % |

| | | | | |

Segmented Information from Continuing Operations | | | | | |

Revenues | | | | | |

North America | | $ | 1,077.2 | | $ | 1,148.1 | |

Europe | | 253.3 | | 262.1 | |

Latin America | | 63.9 | | 57.5 | |

| | | | | |

Adjusted EBIT | | | | | |

North America | | $ | 37.3 | | $ | 42.5 | |

Europe | | (26.5 | ) | 3.7 | |

Latin America | | 2.5 | | 2.8 | |

| | | | | |

Adjusted EBIT margin * | | | | | |

North America | | 3.5 | % | 3.7 | % |

Europe | | (10.4 | )% | 1.4 | % |

Latin America | | 4.0 | % | 4.8 | % |

| | | | | |

Selected Cash Flow Information | | | | | |

Cash provided by operating activities | | $ | 73.4 | | $ | 32.4 | |

Free cash flow ** | | 25.8 | | 4.7 | |

| | | | | |

Per Share Data | | | | | |

Earnings (loss) from continuing operations | | | | | |

Diluted | | $ | (0.34 | ) | $ | (0.04 | ) |

Adjusted diluted | | $ | (0.17 | ) | $ | 0.09 | |

| | Three-month

period ended

March 31 | | Twelve-month

period ended

December 31 | |

| | 2007 | | 2006 | |

| | | | | |

Financial Position | | | | | |

Working capital | | $ | (108.4 | ) | $ | (76.0 | ) |

Total assets | | 5,823.0 | | 5,823.4 | |

Long-term debt (including convertible notes) | | 2,113.4 | | 2,132.4 | |

Shareholders’ equity | | 1,982.2 | | 2,032.4 | |

Debt-to-capitalization | | 52:48 | | 51:49 | |

Debt-to-Adjusted-EBITDA ratio (times) *** | | 3.9 | | 3.7 | |

Interest coverage ratio (times) *** | | 3.9 | | 4.3 | |

| | | | | | | |

EBITDA: Operating income before depreciation and amortization.

IAROC: Impairment of assets, restructuring and other charges.

Adjusted: Defined as before IAROC and before goodwill impairment charge.

Debt-to-Ajusted-EBITDA ratio: Total debt divided by Adjusted EBITDA.

Interest coverage ratio: Adjusted EBITDA divided by financial expenses.

* Margins calculated on revenues.

** Cash provided by operating activities, less capital expenditures and preferred share dividends, net of proceeds from disposals of assets and proceeds from business disposals.

*** For continuing operations.

MANAGEMENT’S DISCUSSION AND ANALYSIS

First Quarter 2007

Table of Contents

Management’s Discussion and Analysis | 2 |

|

INTRODUCTION

The following is a discussion of the consolidated financial condition and results of operations of Quebecor World Inc. (the “Company” or “Quebecor World”) for the three-month periods ended March 31, 2007 and 2006, and it should be read together with the Company’s corresponding interim Consolidated Financial Statements and the 2006 annual Management’s Discussion and Analysis (“MD&A”). The interim Consolidated Financial Statements and MD&A have been reviewed by the Company’s Audit Committee and approved by its Board of Directors. This discussion contains forward-looking information that is qualified by reference to, and should be read together with, the discussion regarding forward-looking statements that is part of this MD&A. Management determines whether or not information is “material” based on whether it believes a reasonable investor’s decision to buy, sell or hold securities in the Company would likely be influenced or changed if the information were omitted or misstated.

A complete review of Quebecor World’s profile and strategy can be found in the “Overview” section of the Company’s 2006 annual MD&A.

Presentation of financial information

Financial data have been prepared in conformity with Canadian generally accepted accounting principles (“Canadian GAAP”).

The Company reports on certain non-GAAP measures that are used by management to evaluate performance of business segments. These measures used in this discussion and analysis do not have any standardized meaning under Canadian GAAP, although management believes that such measures are meaningful and helpful to understanding the Company’s affairs, operations and results. When used, these measures are defined in such terms as to allow the reconciliation to the closest Canadian GAAP measure. Numerical reconciliations are provided in Figures 5 and 6. It is unlikely that these measures could be compared to similar measures presented by other companies.

The Company’s reporting currency is the U.S. dollar, and its functional currency is the Canadian dollar.

Forward-looking statements

This MD&A includes “forward-looking statements” that involve risks and uncertainties. All statements other than statements of historical facts included in this MD&A, including statements regarding the prospects of the industry, and prospects, plans, financial position and business strategy of the Company, may constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Canadian securities legislation and regulations. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”, “believe” or “continue” or the negatives of these terms or variations of them or similar terminology. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. Forward-looking statements do not take into account the effect that transactions or non-recurring or other special items announced or occurring after the statements are made have on the Company’s business. For example, they do not include the effect of dispositions, acquisitions, other business transactions, asset write-downs or other charges announced or occurring after forward-looking statements are made. Investors and others are cautioned that undue reliance should not be placed on any forward-looking statements.

For more information on the risks, uncertainties and assumptions that would cause the Company’s actual results to differ from current expectations, please also refer to the Company’s public filings available at www.sedar.com, www.sec.gov and www.quebecorworld.com. In particular, further details and descriptions of these and other factors are disclosed in the “Risks and uncertainties related to the Company’s business” section in the MD&A for the year ended December 31, 2006 and in the “Risk Factors” section of the Company’s Annual Information Form for the year ended December 31, 2006.

The forward-looking statements in this MD&A reflect the Company’s expectations as of May 9, 2007 and are subject to change after this date. The Company expressly disclaims any obligation or intention to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by the applicable securities laws.

Management’s Discussion and Analysis | 3 |

|

1. Overall performance and outlook for 2007

1.1 First quarter 2007 at a glance

Quebecor World continues to build on the progress it achieved in 2006 with regard to the Company’s five-point transformation plan. Concretely, the following was achieved in the first quarter of 2007:

Customer Value; Quebecor World renewed a long-term agreement with Hachette Filipacchi Media U.S. Hachette has entrusted Quebecor World to supply virtually 100% of its magazine print solutions and distribution needs. Also in the quarter, Quebecor World signed a new agreement to increase its portion of premedia services for Primedia Publishing. These and other customer wins and renewals demonstrate the different ways Quebecor World is creating greater customer value by offering complete solutions by combining new services before and after printing.

Best people; Quebecor World’s Best People initiative is focused on building high performance teams to ensure the Company has the best people in place to create maximum shareholder value. Recently the Company strengthened its leadership team by naming Kevin Akeroyd as President of the Targeted Direct Marketing Division. Mr. Akeroyd has extensive experience in marketing and advertising and will play a key role in leading the Direct Group as one of the key elements in providing our customers with a multi-channel marketing solution.

Great Execution; The Company continued to make progress on its Continuous Improvement Program across its North American platform. The first wave of 41 projects is well developed and the second wave totalling 46 more projects is scheduled to be launched in the second quarter of 2007. These projects focus on high impact improvement areas with low capital requirements and high returns.

Retooling; In the first quarter of 2007, the Company completed the installation or relocation of eight presses in its North American and European platforms. This is compared to only two during the same period last year. Quebecor World’s three-year retooling program is being accelerated in order to be completed before its customers’ busy season in the later part of 2007 creating significant extra costs and inefficiencies. The Company completed the start-up of the tenth and final press as part of its U.S. Magazine retooling plan. To maximize the benefits of the retooling the Company is also continuing with its restructuring initiatives that in the first quarter involved the closure or disposal of six facilities: Lincoln NE, Phoenix AZ, Washington DC, L’Eclaireur QC, Elk Grove IL and Lille, France. This is compared to the disposal of 3 facilities in the first quarter of 2006.

Balance sheet; Quebecor World is committed to strengthening its balance sheet in a responsible manner. At the end of the first quarter of 2007, the Company had more than $900 million in undrawn credit availability from its $1 billion unsecured revolving credit facility. To diversify its financing base, in the first quarter the Company executed a sale-leaseback of two of its Canadian facilities for a total consideration of CA$40 million. In addition, both strategic and tactical actions are being explored to improve the balance sheet.

Quebecor World’s European operations faced continuing poor market conditions in the first quarter of 2007. This environment, combined with intense retooling and restructuring activities with the start-up of the two wide-web gravure presses in Charleroi, Belgium and the disposal of the Lille, France facility had a negative impact on the Company’s consolidated results. However, management believes the retooling and restructuring activities will strengthen the segment’s competitive position and maximize value to shareholders.

Overall, Quebecor World’s operating income was lower in the first quarter of 2007 when compared to the same period in 2006 and more than 80% of the shortfall was attributable to the Company’s European segment. The results for the quarter incorporate specific charges that are non-recurring in nature, including a significant loss on the disposal of the Lille, France facility, and these charges are discussed in the “Financial Review” section of this MD&A. Management continues to believe that the successful implementation of the Company’s five-point transformation plan will promote long-term earnings growth and create more value for Quebecor World’s customers, people and shareholders.

Management’s Discussion and Analysis | 4 |

|

1.2 Outlook for 2007

The Company anticipates that 2007 will be a challenging year as it will continue to face highly competitive market conditions. In response, the Company is taking measures to implement over time its five-point transformation plan, described in the 2006 annual MD&A. The Company is making progress on all five points within the transformation plan, in order to deliver on its targeted benefits. These benefits are expected to be $100 million in reduced costs and higher efficiencies from the Execution initiative, and $300 million in new revenues from the Customer Value initiative, both targeted run rates to be achieved by the end of 2008.

The Company recently announced that it intends to finalize the retooling program before Quebecor World’s customers busy season in the later part of 2007, significantly earlier than previously planned, which was in 2008. The Company expects this should have positive benefits on the results for the second half of 2007. However, the Company anticipates that the results of the second quarter of 2007 will continue to be negatively affected by this accelerated program.

The Company’s operations in Europe are expected to continue to be affected by the difficult market conditions throughout the rest of 2007, mainly in France and the United Kingdom. Quebecor World will, among other actions, continue to implement its retooling plan in this platform that will deliver improved execution in the long-term.

1.3 Subsequent event

As a result of an analysis done in April and May of 2007, the Company has determined that the $159.1 million carrying value of goodwill for its European reporting unit may not be recoverable. The Company expects to complete the impairment analysis in the coming months and the resulting impairment of such goodwill may amount to as much as its carrying value.

2. Financial review

The Company assesses performance based on, among other measures, operating income and Adjusted EBIT (Figure 5). The following financial review focuses only on continuing operations.

Figure 1

Management’s Discussion and Analysis | 5 |

|

2.1 First quarter review

The Company’s consolidated revenues for the first quarter of 2007 were $1.39 billion, a 5.0% decrease when compared to $1.47 billion for the same period in 2006. Excluding the impact of currency translation (Figure 2), revenues were $1.37 billion for the quarter, down 6.4% compared to 2006. The decrease in revenues resulted from temporary restructuring dislocations and plant closures affecting volumes and continued price pressures as further discussed in the “Segment results” section. In the first quarter of 2007, Adjusted EBIT decreased to $11.2 million compared to $49.6 million in 2006. Adjusted EBIT margin was 0.8% for the first quarter, compared to 3.4% for the same period in 2006. These results were impacted by significant non-recurring specific charges that are discussed hereafter.

Impact of Foreign Currency

($ millions)

| | Three months ended | |

| | March 31, 2007 | |

Foreign currency favorable impact on revenues | | $ | 19.5 | |

Foreign currency unfavorable impact on operating income | | $ | (2.0 | ) |

Paper sales, excluding the effect of currency translation, decreased by 10.8% for the first quarter of 2007, compared to the same period in 2006. Although the variance in paper sales has an impact on revenues, it has little impact on operating income because the cost is generally passed on to the customer. Most of the Company’s long-term contracts with its customers include price-adjustment clauses based on the cost of materials in order to minimize the effects of fluctuation in the price of paper.

Cost of sales for the first quarter of 2007 decreased by 5.2% to $1.18 billion compared to $1.24 billion for the corresponding period in 2006. The decrease compared to 2006 is explained mostly by decreases in sales volume and labor costs. Gross profit margin was 15.6% in the first quarter of 2007 compared to 15.4% in 2006. Excluding the negative impact of currency, gross profit margin increased to 15.7% in the first quarter of 2007. The improvement in Quebecor World’s gross profit margin principally reflects initial productivity gains in business groups where the retooling and restructuring initiatives have been completed.

Selling, general and administrative expenses for the first quarter of 2007 were $113.4 million compared with $95.2 million in 2006. Excluding the unfavorable impact of currency translation of $1.3 million, selling, general and administrative expenses increased by 17.9% compared to the same period last year. The increase is due in part to items not expected to reoccur, changes in the timing of accrual of compensation charges in 2007 compared to 2006 and additional charges related to the launch of the Great Execution initiative of the Company’s five-point transformation plan.

Securitization fees totalled $5.9 million for the first quarter of 2007, down from $6.2 million for the first quarter of 2006. The decrease for the quarter was mainly due to lower usage of the program partially offset by higher interest rates underlying the program fees. Servicing revenues and expenses did not have a significant impact on the Company’s results.

Depreciation and amortization expenses were $75.2 million in the first quarter of 2007, compared with $72.8 million in 2006. Excluding the unfavorable impact of currency translation of $1.1 million, the change in depreciation and amortization expenses compared to last year was not significant.

Loss on business disposals for the first quarter of 2007 was $11.0 million related to the disposal of the Lille, France facility. The loss of $2.2 million in 2006 was mainly attributable to the disposal of a facility in North America.

During the first quarter of 2007, the Company recorded impairment of assets, restructuring and other charges (“IAROC”) of $29.5 million, compared to $22.1 million last year. The charge for the quarter was mainly related to the closure and consolidation of facilities in North America as well as the impairment of long-lived assets in Europe and the pension settlement charges related to prior year initiatives. These measures are described in the “Impairment of assets and restructuring initiatives” section.

Management’s Discussion and Analysis | 6 |

|

Financial expenses were $33.9 million in the first quarter of 2007, compared to $27.5 million in 2006. The variance of $6.4 million was mainly explained by the effect of higher interest rates and a higher level of debt, partially offset by net gains on foreign exchange.

Income tax recovery was $14.1 million in the first quarter of 2007, compared to $6.2 million in 2006. Income tax recovery before IAROC was $7.7 million in the first quarter of 2007, compared to $1.0 million for the same period last year. The increase in income tax recovery in the first quarter of 2007 was mainly due to increased losses in jurisdictions with high tax rates.

For the first quarter ended March 31, 2007, the Company reported a loss per share of $0.34 compared to a loss per share of $0.04 in 2006. These results incorporated IAROC, net of income taxes, of $23.1 million or $0.17 per share compared with $16.9 million or $0.13 per share in 2006. Adjusted loss per share was $0.17 in the first quarter of 2007 compared with Adjusted diluted earnings per share of $0.09 in the same period of 2006.

2.2 Quarterly trends

Selected Quarterly Financial Data (Continuing Operations)

($ millions, except per share data)

| | 2007 | | 2006 | | 2005 | |

| | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | |

Consolidated Results | | | | | | | | | | | | | | | | | |

Revenues | | $ | 1,393.4 | | $ | 1,620.4 | | $ | 1,546.2 | | $ | 1,452.2 | | $ | 1,467.5 | | $ | 1,664.0 | | $ | 1,577.2 | | $ | 1,491.1 | |

Adjusted EBITDA | | 92.0 | | 170.2 | | 150.6 | | 130.6 | | 128.5 | | 167.9 | | 178.7 | | 167.4 | |

Adjusted EBIT | | 11.2 | | 74.2 | | 67.3 | | 50.4 | | 49.6 | | 87.3 | | 97.2 | | 84.4 | |

IAROC | | 29.5 | | 46.2 | | 11.6 | | 31.4 | | 22.1 | | 11.9 | | 17.2 | | 31.8 | |

Goodwill impairment charge | | - | | - | | - | | - | | - | | 243.0 | | - | | - | |

Operating income (loss) | | (18.3 | ) | 28.0 | | 55.7 | | 19.0 | | 27.5 | | (167.6 | ) | 80.0 | | 52.6 | |

Operating margin | | (1.3 | )% | 1.7 | % | 3.6 | % | 1.3 | % | 1.9 | % | (10.1 | )% | 5.1 | % | 3.5 | % |

Adjusted EBIT margin | | 0.8 | % | 4.6 | % | 4.3 | % | 3.5 | % | 3.4 | % | 5.3 | % | 6.2 | % | 5.7 | % |

Net income (loss) from continuing operations | | (38.1 | ) | 11.6 | | 19.2 | | (6.5 | ) | 6.3 | | (205.0 | ) | 30.9 | | 9.5 | |

Net income (loss) | | (38.1 | ) | 11.4 | | 18.9 | | (7.2 | ) | 5.2 | | (210.6 | ) | 29.7 | | 2.0 | |

Per Share Data | | | | | | | | | | | | | | | | | |

Earnings (loss) | | | | | | | | | | | | | | | | | |

Basic and diluted | | $ | (0.34 | ) | $ | 0.03 | | $ | 0.09 | | $ | (0.11 | ) | $ | (0.04 | ) | $ | (1.64 | ) | $ | 0.16 | | $ | — | |

Adjusted diluted | | $ | (0.17 | ) | $ | 0.28 | | $ | 0.17 | | $ | 0.10 | | $ | 0.09 | | $ | 0.21 | | $ | 0.28 | | $ | 0.22 | |

|

| | | | | | | | | | | |

IAROC: Impairment of assets, restructuring and other charges | | Figure 3 | |

Adjusted: Defined as before IAROC and before goodwill impairment charge | | | | | |

| | | | | | | | | | | | | |

Adjusted EBITDA trend

Adjusted EBITDA for the first quarter of 2007 was lower than previous quarters due to price and volume declines, significant non-recurring specific charges and the acceleration of restructuring activities. Year-over-year improvements have been realized in the first quarter of 2007 in groups that have completed the retooling and restructuring processes. Overall performance for the last quarter of 2005 and the four quarters of 2006 was also affected by operational inefficiencies mainly in plants involved in the installation of new equipment or press closures. In all four quarters of 2006, the Company continued to face difficult market conditions, resulting in price erosion worldwide and decreased volume in certain of the Company’s markets.

Seasonal impact

Revenues generated by the Company are seasonal with a greater part of volume being realized in the second half of the fiscal year, primarily due to the higher number of magazine pages, new product launches, back-to-school ads, marketing by retailers, increased catalog activity, and holiday promotions. Therefore, an analysis of the consecutive quarters is not a true measurement of the revenue trend (Figure 3).

IAROC impact

Impairment of assets, restructuring and other charges (“IAROC”) have been a major focus of the Company’s cost reduction initiatives undertaken during the previous years that involved a reduction in workforce, closure or downsizing of facilities, decommissioning of under-performing assets, lowering of overhead expenses, consolidating corporate functions and relocating sales and administrative offices into plants. This determined focus on cost containment has reduced the Company’s long-term cost structure and is expected to improve efficiency across the platform. As at March 31, 2007, the Company recorded IAROC of $29.5 million relating to its European and North

Management’s Discussion and Analysis | 7 |

|

American platforms. Of that amount, $21.3 million related to restructuring charges incurred in the first quarter of 2007 for the closure of North American facilities and the continuation of prior year initiatives, and $8.2 million was related to an impairment charge of long-lived assets for European facilities. The increase in the first quarter of 2007 compared to previous quarters is a result of the acceleration of the retooling and restructuring activities, as was previously announced.

Goodwill impairment charge impact

The European reporting unit suffered from poor market conditions throughout 2005, namely continued price erosion and decreased volumes, as well as several production inefficiencies and the loss of an important client in the United Kingdom. As a result, the Company concluded that the carrying amount of goodwill for the European reporting unit was not fully recoverable and a pre-tax impairment charge of $243.0 million was taken at December 31, 2005.

General market conditions impact

The Company’s performance for the last eight quarters was primarily affected by the difficult market environment, which more than offset the initial benefits from Quebecor World’s restructuring process and the decreased costs from other initiatives mentioned above. Competition in the industry remains intense as the industry is in the process of consolidation, evidenced by several recent mergers. The publishing market is largely constant in volumes, while the primary demand for printed marketing materials is stable with low growth. The Company is focusing on adding customer value and improving productivity through continuous improvement projects and the deployment of next generation technology, in order to create an operating network capable of being highly competitive in this market.

2.3 Segment results

The following is a review of activities by segment which, except as otherwise indicated, focuses only on continuing operations.

Segment Results of Continuing Operations ($ millions)

Selected Performance Indicators

Three months ended | | North America | | Europe | | Latin America | | Inter-Segment

and Others | | Total | |

March 31 | | 2007 | | 2006 | | 2007 | | 2006 | | 2007 | | 2006 | | 2007 | | 2006 | | 2007 | | 2006 | |

Revenues | | $ | 1,077.2 | | $ | 1,148.1 | | $ | 253.3 | | $ | 262.1 | | $ | 63.9 | | $ | 57.5 | | $ | (1.0 | ) | $ | (0.2 | ) | $ | 1,393.4 | | $ | 1,467.5 | |

Adjusted EBITDA | | 100.7 | | 105.8 | | (12.2 | ) | 16.2 | | 5.5 | | 5.7 | | (2.0 | ) | 0.8 | | 92.0 | | 128.5 | |

Adjusted EBIT | | 37.3 | | 42.5 | | (26.5 | ) | 3.7 | | 2.5 | | 2.8 | | (2.1 | ) | 0.6 | | 11.2 | | 49.6 | |

IAROC | | 17.8 | | 13.5 | | 11.7 | | 8.1 | | - | | 0.5 | | - | | - | | 29.5 | | 22.1 | |

Operating income (loss) | | 19.5 | | 29.0 | | (38.2 | ) | (4.4 | ) | 2.5 | | 2.3 | | (2.1 | ) | 0.6 | | (18.3 | ) | 27.5 | |

Adjusted EBITDA margin | | 9.3 | % | 9.2 | % | (4.8 | )% | 6.2 | % | 8.6 | % | 10.0 | % | | | | | 6.6 | % | 8.8 | % |

Adjusted EBIT margin | | 3.5 | % | 3.7 | % | (10.4 | )% | 1.4 | % | 4.0 | % | 4.8 | % | | | | | 0.8 | % | 3.4 | % |

Operating margin | | 1.8 | % | 2.5 | % | (15.0 | )% | (1.7 | )% | 4.0 | % | 3.9 | % | | | | | (1.3 | )% | 1.9 | % |

| | | | | | | | | | | | | | | | | | | | | |

Capital expenditures (1) | | $ | 46.1 | | $ | 30.0 | | $ | 29.6 | | $ | 9.3 | | $ | 0.9 | | $ | 11.5 | | $ | 0.5 | | $ | (1.6 | ) | $ | 77.1 | | $ | 49.2 | |

Change in non-cash balances related to operations, cash flow (outflow)(1) | | 32.3 | | (96.1 | ) | (28.5 | ) | (14.4 | ) | (2.3 | ) | 1.2 | | 39.5 | | 31.8 | | 41.0 | | (77.5 | ) |

|

| |

IAROC: Impairment of assets, restructuring and other charges

Adjusted: Defined as before IAROC and before goodwill impairment charge

(1) Including both continuing and discontinued operations | Figure 4 |

North America

The North American segment is comprised of the following business groups: Magazine, Retail, Catalog, Book & Directory, Direct, Canada, Logistics, Premedia and other value added services. North American revenues for the first quarter of 2007 were $1,077.2 million, down 6.2% from $1,148.1 million in 2006. Excluding the effect of currency translation and the unfavorable impact of paper sales, revenues decreased by 2.4% in the first quarter compared to the same period last year. Revenues in the North American segment continued to be impacted by negative price pressures. Volume in North America decreased during the first quarter of 2007 mainly due to the restructuring initiatives in the Magazine and Book & Directory groups. Moreover, reduction of volume from major contractual customers in the Canada group and the loss of a customer in the Catalog group had a negative impact on sales during the first quarter of 2007. Finally, the Canada group continued to be affected by less favourable foreign exchange contracts on sales to its U.S. customers.

Operating income and margin in North America decreased in the first quarter of 2007 compared to 2006. Operating income in North America was impacted by the competitive market conditions as well as the inefficiencies and costs related to the acceleration of the Company’s retooling plan during the quarter. The decrease was partly offset by continued growth realized through productivity gains in the Retail group and cost reductions in the Book & Directory group. Although the Book & Directory group was impacted by a positive change in work mix, these gains were partly offset by higher costs due to the complexity of the work demand.

Management’s Discussion and Analysis | 8 |

|

Year-over-year, the North American workforce was reduced by 2,051 employees, or approximately 8.7%. In the first quarter of 2007, the Company completed the closure of its facilities in Lincoln, NE (Magazine group), Elk Grove Village, IL (Catalog group) and Phoenix, AZ (Retail group) as well as the L’Eclaireur facility (Canada group) and the consolidation of a secondary facility in the Premedia group.

In the first quarter of 2007, the Company completed the start-up of the tenth and final press as part of its U.S. Magazine retooling plan. Quebecor World also started a new directory press in its Hazleton, PA based facility. Management expects to complete its North American retooling process during the third quarter of 2007.

Europe

The European segment operates mainly in the Magazine, Retail, Catalog and Book markets. European revenues for the first quarter of 2007 were $253.3 million, down 3.3% from $262.1 million in 2006. Excluding the impact of currency translation and paper sales, revenues were down 7.2% for the first quarter of 2007 compared to the same period last year. Overall, volume decreased in the first quarter of 2007, mainly in France. The decrease in France is mainly a result of inefficiencies due to press start-ups and transfers. Volume in France was also negatively impacted by the disposal of the Lille facility completed in the first quarter of 2007. The decrease also reflected lower hard-cover book volume in Spain. The volume shortfall was slightly offset by higher volume in Austria in the first quarter of 2007 due essentially to productivity gains stemming from Quebecor World’s retooling initiative. These productivity gains were a result of the successful ramp-up of the 72-page press recently installed at the Oberndorfer, Austria facility.

The operating income and margin for the European segment decreased in the first quarter of 2007 compared to the same period in 2006, but remained constant in Finland and Sweden. The increased Austrian volume did not translate into increased operating income as its positive effects were offset by negative work mix in the quarter. The negative variance in operating income in Europe for the first quarter also reflected a loss of $11.0 million on the disposal of the Lille, France facility. The trend in this segment’s operating income and margin reflects price pressures and temporary inefficiencies experienced with the installation of new presses and transfer of volumes between plants.

Year-over-year, the European workforce was reduced by approximately 12.1% or 510 employees. In the first quarter of 2007, the Company completed the disposal of the Lille facility in France.

Latin America

Latin America operates mainly in the Book, Directory, Magazine, Catalog and Retail markets. Latin America’s revenues for the first quarter of 2007 were $63.9 million, up 11.2% from $57.5 million in 2006. Excluding the impact of foreign currency and paper sales, revenues for the first quarter of 2007 were up 2.5% compared to last year. Volume increased for the first quarter of 2007 on account of greater printing production in Peru and Colombia. Price, including the effect of work mix, had a slightly favourable impact on revenues during the quarter. Overall, in addition to cost reductions realized during the same period, these factors contributed to the growth in operating income during the first quarter of 2007 compared to last year.

2.4 Impairment of assets and restructuring initiatives

Quebecor World has undertaken various restructuring initiatives in order to ensure facilities are producing optimal pressroom efficiencies and higher returns. Restructuring costs relate largely to plant closures and workforce reductions related to current and prior years’ initiatives. A description of these initiatives is provided in the Notes to the Consolidated Financial Statements for the period ended March 31, 2007.

The restructuring initiatives in the first quarter of 2007 affected 733 employees in total, of which 344 positions have been eliminated as of March 31, 2007 and 389 are expected to be eliminated. However, the Company estimates that 374 new jobs would be created in other facilities. The execution of prior years’ initiatives resulted in the elimination of 740 jobs for the three-month period ended March 31, 2007 and 242 are still to come.

As at March 31, 2007, the balance of the restructuring reserve was $41.3 million. The total cash disbursement related to this reserve is expected to be $35.3 million for the year 2007. Finally, the Company expects to record a charge of $24.6 million in upcoming quarters for the restructuring initiatives that have already been announced at March 31, 2007.

Management’s Discussion and Analysis | 9 |

|

Reconciliation of non-GAAP measures

($ millions, except per share data)

| | Three months ended March 31 | |

| | 2007 | | 2006 | |

Operating income from continuing operations- adjusted | | | | | |

Operating income (loss) (“EBIT”) | | $ | (18.3 | ) | $ | 27.5 | |

Impairment of assets, restructuring and other charges (“IAROC”) | | 29.5 | | 22.1 | |

Adjusted EBIT | | $ | 11.2 | | $ | 49.6 | |

Operating income (loss) (“EBIT”) | | $ | (18.3 | ) | $ | 27.5 | |

Depreciation of property, plant and equipment(1) | | 75.2 | | 72.8 | |

Amortization of other assets (1) | | 5.6 | | 6.1 | |

Operating income before depreciation and amortization (“EBITDA”) | | $ | 62.5 | | $ | 106.4 | |

IAROC | | 29.5 | | 22.1 | |

Adjusted EBITDA | | $ | 92.0 | | $ | 128.5 | |

| |

Earnings (loss) per share from continuing operations | | | | | |

Net income (loss) from continuing operations | | $ | (38.1 | ) | $ | 6.3 | |

IAROC (2) | | 23.1 | | 16.9 | |

Adjusted net income (loss) from continuing operations | | $ | (15.0 | ) | $ | 23.2 | |

Net income allocated to holders of preferred shares | | 7.2 | | 11.2 | |

Adjusted net income (loss) from continuing operations available to holders of equity shares | | (22.2 | ) | 12.0 | |

Diluted average number of equity shares outstanding (in millions) | | 131.8 | | 131.1 | |

Earnings (loss) per share from continuing operations | | | | | |

Diluted | | $ | (0.34 | ) | $ | (0.04 | ) |

Adjusted diluted | | $ | (0.17 | ) | $ | 0.09 | |

| |

Free Cash Flow | | | | | |

Cash provided by operating activities | | $ | 73.4 | | $ | 32.4 | |

Dividends on preferred shares | | (7.1 | ) | (14.2 | ) |

Additions to property, plant and equipment | | (77.1 | ) | (49.2 | ) |

Net proceeds from disposal of assets | | 36.6 | | 8.4 | |

Net proceeds from business disposals | | - | | 27.3 | |

Free cash flow | | $ | 25.8 | | $ | 4.7 | |

Figure 5

Adjusted: Defined as before IAROC and goodwill impairment charge

(1) As reported in the Consolidated Statements of Cash Flows

(2) Net of income taxes of $6.4 million for the first quarter of 2007 ($5.2 million in 2006)

Management’s Discussion and Analysis | 10 |

|

Reconciliation of non-GAAP measures

($ millions)

| | Three months | | Twelve months | |

| | ended March 31 | | ended December 31 | |

| | 2007 | | 2006 | |

Debt-to-capitalization | | | | | |

Current portion of long-term debt | | $ | 30.9 | | $ | 30.7 | |

Long-term debt | | 1,964.2 | | 1,984.0 | |

Convertible notes | | 118.3 | | 117.7 | |

Total debt | | $ | 2,113.4 | | $ | 2,132.4 | |

Minority interest | | 1.2 | | 1.3 | |

Shareholders’ equity | | 1,982.2 | | 2,032.4 | |

Capitalization | | $ | 4,096.8 | | $ | 4,166.1 | |

Debt-to-capitalization | | 52:48 | | 51:49 | |

| |

Total Debt and Accounts Receivable Securitization | | | | | |

Total debt | | $ | 2,113.4 | | $ | 2,132.4 | |

Accounts receivable securitization | | 434.0 | | 579.5 | |

Total debt and accounts receivable securitization | | $ | 2,547.4 | | $ | 2,711.9 | |

Minority interest | | 1.2 | | 1.3 | |

Shareholders’ equity | | 1,982.2 | | 2,032.4 | |

Capitalization, including securitization | | $ | 4,530.8 | | $ | 4,745.6 | |

Debt-to-capitalization, including securitization | | 56:44 | | 57:43 | |

| |

Coverage Ratios from continuing operations | | | | | |

Adjusted EBITDA | | $ | 92.0 | | $ | 579.9 | |

YTD December previous year | | 579.9 | | - | |

First quarter previous year | | (128.5 | ) | - | |

Adjusted EBITDA - Last 12 months | | $ | 543.4 | | $ | 579.9 | |

Financial expenses | | $ | 33.9 | | $ | 134.2 | |

YTD December previous year | | 134.2 | | - | |

First quarter previous year | | (27.5 | ) | - | |

Financial expenses adjusted - Last 12 months | | $ | 140.6 | | $ | 134.2 | |

Interest coverage ratio (times) | | 3.9 | | 4.3 | |

Total debt | | $ | 2,113.4 | | $ | 2,132.4 | |

Debt-to-Adjusted-EBITDA ratio (times) | | 3.9 | | 3.7 | |

Figure 6

Management’s Discussion and Analysis | 11 |

|

3. Liquidity and capital resources

3.1 Operating activities

Cash provided by operating activities ($ millions) | | Three months ended March 31 | |

| | 2007 | | 2006 | |

| | $ | 73.4 | | $ | 32.4 | |

| | | | | | | |

Cash flow from operating activities was $73.4 million for the first quarter of 2007, compared to $32.4 million for the same period in 2006. The increase was mainly attributable to a higher level of trade payables and accrued liabilities as well as an increase in net income taxes payable, partly offset by the decline in net income.

The deficiency in working capital was $108.4 million at March 31, 2007, compared to $76.0 million at December 31, 2006. The change is due mainly to an increase in trade payables and accrued liabilities that was partly offset by an increase in trade receivables (net of securitization). The Company manages its trade payables in order to take advantage of prompt payment discounts. Also, the Company maximizes the use of its accounts receivable securitization program, since the cost of these programs is lower than that of its credit facilities. The amount of trade receivables under securitization varies from month to month, based principally on the previous month’s volume (for example, March securitization is based on receivables at the end of February).

3.2 Financing activities

Cash used in financing activities ($ millions) | | Three months ended March 31 | |

| | 2007 | | 2006 | |

| | $ | — | | $ | (3.2 | ) |

| | | | | | | |

In the first quarter of 2007, Quebecor World paid dividends on preferred shares totalling $7.1 million compared to $14.2 million during the same period in 2006. The decrease is due to the repurchase of the Company’s cumulative redeemable 6.75% First Preferred Shares, Series 4 in April 2006. Quebecor World paid dividends on equity shares totalling $13.2 million in the first quarter of 2006.

3.3 Investing activities

Cash used in investing activities ($ millions) | | Three months ended March 31 | |

| | 2007 | | 2006 | |

| | $ | (46.5 | ) | $ | (13.6 | ) |

| | | | | | | |

Additions to property, plant and equipment

In the first quarter of 2007, the Company invested $77.1 million in capital projects, compared to $49.2 million in 2006. Of that amount, approximately 80% was for organic growth, including expenditures for new capacity requirements and productivity improvement. The remaining portion was spent on the maintenance of the Company’s existing structure. In 2006, the organic growth spending amounted to 65%.

Key expenditures for the first quarter of 2007 included approximately $13.6 million in North America and $27.4 million in Europe as part of the strategic retooling plans and a customer related project. Other notable projects are related to the Corinth, MS facility transformation into a dual-process, premier rotogravure and offset catalog facility.

Proceeds from business disposals and disposal of assets

During the first quarter of 2007, proceeds on disposal of assets amounted to $36.6 million compared to $8.4 million in 2006. These proceeds included $34.2 million related to the sale and leaseback of real estate properties of two Canadian facilities completed on March 23, 2007.

Management’s Discussion and Analysis | 12 |

|

4. Financial position

4.1 Free cash flow

Free cash flow ($ millions) | | Three months ended March 31 | |

| | 2007 | | 2006 | |

| | $ | 25.8 | | $ | 4.7 | |

| | | | | | | |

The Company reports free cash flow because it is a key measure used by management to evaluate its liquidity (Figure 5). Free cash flow reflects cash flow available for business acquisitions, dividends on equity shares, repayments of long-term debt and repurchases of equity securities. Free cash flow is not a calculation based on Canadian or U.S. GAAP and should not be considered as an alternative to the Consolidated Statement of Cash Flows. Free cash flow is a measure that can be used to gauge the Company’s performance over time. Investors should be cautioned that free cash flow as reported by Quebecor World may not be comparable in all instances to free cash flow as reported by other companies.

The increase in free cash flow was due mainly to a significant increase in operating cash flows as described in the “Operating activities” section and in proceeds from disposal of assets. The increase was partly offset by a decrease in proceeds from business disposals and by higher capital expenditures, reflecting the acceleration of the retooling initiative of the Company’s five-point transformation plan.

4.2 Financial ratios, financial covenants and credit ratings

Financial ratios

The key financial ratios used by management to evaluate the Company’s financial position are the interest coverage ratio, the debt-to-Adjusted-EBITDA ratio, and the debt-to-capitalization ratio. Calculations of key financial ratios are presented in Figure 6. At the end of the first quarter of 2007, the debt-to-capitalization ratio was 52:48, compared to 51:49 at December 31, 2006. As at March 31, 2007, total debt plus accounts receivable securitization was $2,547.4 million, $164.5 million lower compared to December 31, 2006.

Financial covenants

The Company is subject to certain financial covenants in some of its major financing agreements. Concurrent with the offering in 2006 of $400.0 million aggregate principal amount of 9.75% Senior Notes (as discussed in the “Financing activities” section in the MD&A for the year ended December 31, 2006), the Company obtained temporary accommodation of certain covenants under its bank credit facilities in order to provide itself with greater financial flexibility. There can be no assurance that, in the event the Company requires similar accommodations in the future, as a result of weaker than expected financial performance or otherwise, Quebecor World will obtain such accommodations or be able to renegotiate the terms and conditions of the Company’s financing agreements and securitization programs, which may in turn require the Company to redeem, repay or repurchase its obligations prior to their scheduled maturity. As at March 31, 2007, the Company was in compliance with all significant debt covenants.

Credit ratings

As at April 26, 2007, the following credit ratings had been attributed to the senior unsecured debt of the Company:

Rating Agency | | Rating | |

Moody’s Investors Service | | B2 | |

Standard and Poor’s | | B+ | |

Dominion Bond Rating Service Limited | | BB | |

| | | |

Management’s Discussion and Analysis | 13 |

|

4.3 Contractual cash obligations

The following table sets forth the Company’s contractual cash obligations for the items described therein as at March 31, 2007:

Contractual Cash Obligations

($ millions)

| | Remainder of | | | | | | | | | | 2012 and | | | |

| | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | thereafter | | Total | |

Long-term debt and convertible notes | | $ | 27.7 | | $ | 214.8 | | $ | 236.1 | | $ | 183.6 | | $ | 12.1 | | $ | 1,443.5 | | $ | 2,117.8 | |

Capital leases | | 3.2 | | 3.1 | | 8.0 | | 1.3 | | 2.1 | | 6.1 | | 23.8 | |

Interest payments on long-term debt, convertible notes and capital leases(1) | | 106.3 | | 159.1 | | 135.4 | | 126.4 | | 118.0 | | 380.8 | | 1,026.0 | |

Operating leases | | 127.8 | | 72.5 | | 51.1 | | 32.9 | | 23.6 | | 112.3 | | 420.2 | |

Capital asset purchase commitments | | 71.3 | | 2.1 | | - | | - | | - | | - | | 73.4 | |

Total contractual cash obligations | | $ | 336.3 | | $ | 451.6 | | $ | 430.6 | | $ | 344.2 | | $ | 155.8 | | $ | 1,942.7 | | $ | 3,661.2 | |

Figure 7

(1) Interest payments were calculated using the interest rate that would prevail should the debt be reimbursed as planned, and the outstanding balance as at March 31, 2007.

The Company has major operating leases pursuant to which it will pay to purchase the underlying equipment (presses and binders) at the end of the term, and it has historically acquired most of the equipment when it is used for production. Some of these major operating leases are expiring in 2007 with a terminal value of $74.8 million, of which $44.4 million is guaranteed. The total terminal value of the leases expiring between 2008 and 2013 is approximately $48.1 million.

The Company monitors the funded status of its pension plans very closely. During the quarter ended March 31, 2007, the Company made contributions of $12.3 million ($6.5 million in 2006), which were in accordance with the minimum required contributions as determined by the Company’s actuaries. Minimum required contributions are estimated at $64.7 million for 2007.

The Company believes that its liquidity, capital resources and cash flows from operations will be sufficient to fund planned capital expenditures, working capital requirements, pension contributions, interest and principal payment obligations.

5. Off-balance sheet arrangements and other disclosures

5.1 Off-balance sheet arrangements

The Company is party to various off-balance sheet arrangements. The Company’s 2006 annual MD&A contains a complete description of these arrangements.

Sales of trade receivables

As at March 31, 2007, the amounts outstanding under the Canadian, U.S. and European securitization programs were CA$57.0 million ($49.3 million), $274.0 million and EUR 82.7 million ($110.7 million), respectively (CA$58.0 million ($49.7 million), $380.0 million and EUR 102.4 million ($124.3 million), as at March 31, 2006). The Company had a retained interest in the trade receivables sold of $197.6 million ($133.7 million in 2006), which was recorded in the Company’s trade receivables. As at March 31, 2007, an aggregate amount of $631.6 million ($687.7 million in 2006) of accounts receivable had been sold under the three programs. Consistent with its U.S. securitization agreement, the Company sells all of its U.S. receivables to a wholly-owned subsidiary, Quebecor World Finance Inc., through a true-sale transaction.

The Company is subject to certain requirements under the securitization programs. In conjunction with the credit facility amendments of December 2006, the Company similarly modified certain covenants of the U.S. and European

Management’s Discussion and Analysis | 14 |

|

securitization programs. The Company was in compliance with all its covenants under the agreements governing its securitization programs as of March 31, 2007.

5.2 Derivative financial instruments

The Company uses a number of derivative financial instruments to manage its exposure to fluctuations in foreign exchange, interest rates and commodity prices. The Company’s 2006 annual MD&A contains a complete description of these derivative financial instruments. The estimated fair value of derivative financial instruments at March 31, 2007 is detailed in Figure 8.

Fair Value of Derivative Financial Instruments (Continuing Operations)

($ millions)

| | March 31, 2007 | | December 31, 2006 | |

| | Book Value | | Fair Value | | Book Value | | Fair Value | |

Derivative financial instruments

Interest rate swap agreements | | $ | (7.5 | ) | $ | (7.5 | ) | $ | - | | $ | (7.5 | ) |

Foreign exchange forward contracts | | (9.5 | ) | (9.5 | ) | (12.7 | ) | (15.5 | ) |

Commodity swaps | | (3.4 | ) | (3.4 | ) | (1.4 | ) | (13.7 | ) |

Embedded derivatives | | 13.0 | | 13.0 | | - | | - | |

| | | | | | | | | | | | | |

Figure 8

During the three-month period ended March 31, 2007, the Company recorded a net gain of $4.4 million on derivative financial instruments for which hedge accounting was not used ($0.3 million in 2006). During the same period, the Company recorded a net loss of $3.0 million for the ineffective portion of its fair value hedges. Related to its cash flow hedges, a net gain of $10.0 million was recorded to other comprehensive income for the same period as a result of the adoption of the new accounting standards for financial instruments and hedges as at January 1, 2007 (See section “Change in accounting policy”) in the first quarter.

5.3 Related party transactions

Related Party Transactions

($ millions)

| | Three months ended March 31 | |

| | 2007 | | 2006 | |

Companies under common control: | | | | | |

Revenues | | $ | 13.6 | | $ | 14.8 | |

Selling, general and administrative expenses | | 4.7 | | 3.7 | |

Management fees billed by Quebecor Inc. | | 1.2 | | 1.2 | |

| | | | | | | |

Figure 9

The Company has entered into transactions with the parent company and its other subsidiaries, which were accounted for at prices and conditions prevailing in the market. Intercompany revenues from the parent company’s media subsidiaries involved mostly printing of magazines.

The Company is currently in discussion with a company under common control, Quebecor Media Inc., regarding the joint use of assets, in particular printing equipment located in Islington, Ontario and Mirabel, Quebec. Agreements are expected to be entered into in 2007. As of March 31, 2007, the Company had invested CA$34.0 million ($29.5 million) in these assets.

Management’s Discussion and Analysis | 15 |

|

5.4 Outstanding share data

Figure 10 discloses the Company’s outstanding share data as at April 26, 2007.

Outstanding Share Data

($ in millions and shares in thousands)

| | April 26, 2007 | |

| | Issued and | | | |

| | outstanding shares | | Book value | |

Multiple Voting Shares | | 46,987 | | $ | 93.5 | |

Subordinate Voting Shares | | 84,876 | | 1,148.4 | |

First Preferred Shares, Series 3 | | 12,000 | | 212.5 | |

First Preferred Shares, Series 5 | | 7,000 | | 113.9 | |

| | | | | | |

Figure 10

As of April 26, 2007, a total of 7,801,465 options to purchase Subordinate Voting Shares were outstanding, of which 3,472,251 were exercisable.

5.5 Controls and procedures

Management’s report on internal control over financial reporting

This section should be read in conjunction with Section 6.5, “Controls and procedures” of the Company’s annual MD&A for the year ended December 31, 2006 containing Management’s report on internal control over financial reporting.

The Company disclosed in its 2006 annual MD&A that management was not able to conclude as to the effectiveness of the Company’s internal control over financial reporting, as it had identified a material weakness in the Company’s internal control over financial reporting. Management also disclosed in its 2006 annual MD&A that it has put in place remediation plans intended to address the conditions leading to the material weakness that had been identified, which remediation plans consist of :

· Developing and deploying a more exhaustive checklist to identify, capture and communicate the required information and documentation;

· Continuing to implement additional controls to identify, capture and timely communicate financial information to apply the Company’s policy pertaining to the impairment of long-term assets;

· Continuing to improve its forecasting systems;

· Providing finance training for managers, process owners and accounting personnel.

The Company will keep investors apprised of the progress that it expects to make in the above described remediation plans in its future Management’s Discussions and Analyses.

No other changes to internal control over financial reporting have come to management’s attention during the three months ended March 31, 2007 that have materially adversely affected, or are reasonably likely to materially adversely affect, the Company’s internal control over financial reporting.

6. Critical accounting estimates and accounting policies

6.1 Critical accounting estimates

The preparation of financial statements in conformity with Canadian GAAP requires the Company to make estimates and assumptions which affect the reported amounts of assets and liabilities, disclosure with respect to contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. The Ontario Securities Commission defines critical accounting estimates as those requiring assumptions made about matters that are highly uncertain at the time the estimate is made, and when the use of different reasonable estimates or changes to the accounting estimates would have a material impact on a company’s financial condition or results of operations. A complete discussion of the critical accounting estimates made by the Company is included in the 2006 annual MD&A. Management has not made any significant changes to these estimates and assumptions during the quarter ended March 31, 2007, with the exception of the impairment test on

Management’s Discussion and Analysis | 16 |

|

goodwill for the European reporting unit discussed under the “Subsequent event” section. Actual results could differ from those estimates.

6.2 Change in accounting policy

Financial instruments

Effective January 1, 2007, the Company adopted the Canadian Institute of Chartered Accountants (CICA) Handbook Section 1530, Comprehensive Income, Section 3855, Financial Instruments — Recognition and Measurement and Section 3865, Hedges. Changes in accounting policies in conformity with these new accounting standards are as follows:

(a) Comprehensive income

Section 1530 introduces the concept of comprehensive income, which is calculated by including other comprehensive income with net income. Other comprehensive income represents changes in shareholders’ equity arising from transactions and other events with non-owner sources such as unrealized gains and losses on financial assets classified as available-for-sale, changes in translation adjustment of self-sustaining foreign operations and changes in the fair value of the effective portion of cash flow hedging instruments. With the adoption of this section, the consolidated financial statements now include consolidated statements of comprehensive income. The comparative statements were restated solely to include the translation adjustment of self-sustaining foreign operations as provided by transition rules.

(b) Financial instruments

Section 3855 establishes standards for recognizing and measuring financial assets, financial liabilities and derivatives. Under this standard, financial instruments are now classified as held-for-trading, available-for-sale, held-to-maturity, loans and receivables, or other financial liabilities and measurement in subsequent periods depends on their classification. Transaction costs are expensed as incurred for financial instruments classified as held-for-trading. For other financial instruments, transaction costs are capitalized on initial recognition and presented as a reduction of the underlying financial instruments. Financial assets and financial liabilities held-for-trading are measured at fair value with changes recognized in income. Available-for-sale financial assets are measured at fair value or at cost, in the case of financial assets that do not have a quoted market price in an active market, and changes in fair value are recorded in comprehensive income.

Financial assets held-to-maturity, loans and receivables, and other financial liabilities are measured at amortized cost using the effective interest method of amortization. The Company has classified its restricted and unrestricted cash and cash equivalents and temporary investments as held for trading. Trade receivables, receivables from related parties, loans and other long-term receivables included in other assets were classified as loans and receivable. Portfolio investments were classified as available for sale. All of the Company’s financial liabilities were classified as other financial liabilities.

Derivative instruments are recorded as financial assets or liabilities at fair value, including those derivatives that are embedded in financial or non-financial contracts that are not closely related to the host contracts. Changes in the fair values of the derivatives are recognized in financial expenses with the exception of derivatives designated in a cash flow hedge for which hedge accounting is used. In accordance with the new standards, the Company selected January 1, 2003 as its transition date for adopting this standard related to embedded derivatives.

(c) Hedges

Section 3865 specifies the criteria that must be satisfied in order for hedge accounting to be applied and the accounting for each of the permitted hedging strategies.

Accordingly, for derivatives designated as fair value hedges, such as certain cross currency interest rate swaps used by the Company, changes in the fair value of the hedging derivative recorded in income are substantially offset by changes in the fair value of the hedged item to the extent that the hedging relationship is effective. When a fair value hedge is discontinued, the carrying value of the hedged item is no longer adjusted and the cumulative fair value adjustments to the carrying value of the hedged item are amortized to income over the remaining term of the original hedging relationship.

For derivative instruments designated as cash flow hedges, such as certain commodity swaps and forward exchange contracts used by the Company, the effective portion of a hedge is reported in other comprehensive income until it is recognized in income during the same period in which the hedged item affects income, while the ineffective portion is immediately recognized in the consolidated statement of income. When a cash flow

Management’s Discussion and Analysis | 17 |

|

hedge is discontinued, the amounts previously recognized in accumulated other comprehensive income are reclassified to income when the variability in the cash flows of the hedged item affects income.

Upon adoption of these new sections, the transition rules require that the Company adjust either the opening retained earnings or accumulated other comprehensive income as if the new rules had always been applied in the past, without restating comparative figures of prior years. Accordingly, the following adjustments were recorded in the consolidated financial statements as at January 1, 2007: