QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.3

World Color Press Inc.

(Formerly Quebecor World Inc.)

MANAGEMENT'S DISCUSSION AND ANALYSIS

SECOND QUARTER ENDED JUNE 30, 2009

TABLE OF CONTENTS

| | | | | | |

Subject | | Page |

|---|

| Introduction | | 3 |

1. | | Creditor protection and the plan of reorganization | |

5 |

2. | | Financial review | |

13 |

| | | 2.1 | | Industry trends and outlook | | 13 |

| | | 2.2 | | Second quarter review | | 14 |

| | | 2.3 | | Year-to-date review | | 16 |

| | | 2.4 | | Segment results | | 18 |

| | | 2.5 | | Impairment of assets and restructuring initiatives | | 19 |

3. | | Critical accounting estimates, changes in accounting standards and adoption of new accounting policies | |

22 |

| | | 3.1 | | Critical accounting estimates | | 22 |

| | | 3.2 | | Changes in accounting standards and adoption of new accounting policies | | 22 |

4. | | Liquidity and capital resources | |

23 |

| | | 4.1 | | DIP financing | | 23 |

| | | 4.2 | | Exit financing | | 23 |

| | | 4.3 | | New unsecured notes | | 24 |

| | | 4.4 | | Cash flow | | 24 |

5. | | Financial position | |

26 |

| | | 5.1 | | Free cash flow | | 26 |

| | | 5.2 | | Credit ratings | | 26 |

6. | | Off-balance sheet arrangements, derivative financial instruments and other disclosures | |

26 |

| | | 6.1 | | Financial instruments | | 26 |

| | | 6.2 | | Contractual obligations | | 27 |

| | | 6.3 | | Share capitalization | | 28 |

7. | | Quarterly trends | |

30 |

8. | | Controls and procedures | |

31 |

| | | 8.1 | | Evaluation of disclosure controls and procedures | | 31 |

| | | 8.2 | | Changes in internal control over financial reporting | | 32 |

9. | | Additional information | |

32 |

2

Introduction

The following is a discussion of the consolidated financial condition and results of operations of Quebecor World Inc. ("we", "us", "our", the "Corporation", "QWI", or Quebecor World"), the predecessor corporation of World Color Press Inc. ("World Color") for the three-month and six-month periods ended June 30, 2009 and 2008, and it should be read together with the Corporation's corresponding interim consolidated financial statements as well as the Corporation's annual report on Form 20-F for the year ended December 31, 2008. All references made to "Notes" in the interim Management's Discussion and Analysis ("MD&A") correspond to the Notes to the interim consolidated financial statements for the period ended June 30, 2009. The interim consolidated financial statements and this interim MD&A have been reviewed by the Corporation's Audit Committee and approved by its Board of Directors. This discussion contains forward-looking information that is qualified by reference to, and should be read together with, the discussion regarding forward-looking statements that is part of this interim MD&A. Management determines whether or not information is "material" based on whether it believes a reasonable investor's decision to buy, sell or hold securities in the Corporation would likely be influenced or changed if the information were omitted or misstated.

Presentation of financial information

As described in Note 1 to the 2008 annual consolidated financial statements, on January 21, 2008 (the "Filing Date") Quebecor World obtained an order from the Quebec Superior Court granting creditor protection under theCompanies' Creditors Arrangement Act (Canada) ("CCAA") for itself and for 53 U.S. subsidiaries (the "U.S. subsidiaries" and, collectively with the Corporation, the "Applicants"). On the same date, the U.S. subsidiaries filed a petition under Chapter 11 of the U.S. Bankruptcy Code in the Bankruptcy Court for the Southern District of New York (the "U.S. Bankruptcy Court"). The proceedings under the CCAA and the proceedings under Chapter 11 are hereinafter collectively referred to as the "Insolvency Proceedings".

On June 22, 2009, the creditors approved a plan of compromise or reorganization (the "Plan") under the CCAA and Chapter 11 and on June 30, 2009 the Plan was sanctioned by the Quebec Superior Court and it was confirmed by the U.S. Bankruptcy Court on July 2, 2009. The Plan was implemented following various transactions that were completed on July 21, 2009 (the "Effective Date") as further described in Section 1 "Creditor protection and the plan of reorganization". Accordingly, the Applicants emerged from bankruptcy protection and the Corporation was renamed and has begun operating as World Color. For clarity, World Color and its operations on or after July 31, 2009, the effective "fresh start" date, will be referred to as the "Successor". QWI and its operations prior to July 31, 2009 will be referred to as the "Predecessor".

The consolidated financial statements included in this interim MD&A have been prepared using the same accounting principles generally accepted in Canada ("Canadian GAAP"), as applied by the Corporation prior to the Insolvency Proceedings. While the Applicants were granted creditor protection in the periods covered by the interim financial statements, the financial statements continued to be prepared using the going concern concept, which assumes that the Corporation will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future.

The Corporation reports on certain non-GAAP measures that are used by management to evaluate performance of business segments. These measures used in this MD&A do not have any standardized meaning under Canadian GAAP. When used, these measures are defined in such terms as to allow the reconciliation to the closest Canadian GAAP measure. Numerical reconciliations are provided in Figure 4. It is unlikely that these measures could be compared to similar measures presented by other companies.

The Corporation's reporting currency is the U.S. dollar, and its functional currency is the Canadian dollar.

3

Forward-looking statements

To the extent any statements made in this interim MD&A contain information that is not historical, these statements are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are forward-looking information within the meaning of the "safe harbor" provisions of applicable Canadian securities legislation (collectively "forward-looking statements"). These forward-looking statements relate to, among other things, prospects of World Color's industry and its objectives, goals, strategies, beliefs, intentions, plans, estimates, projections and outlook, and can generally be identified by the use of words such as "may," "will," "expect," "intend," "estimate," "anticipate," "plan," "foresee," "believe" or "continue" or the negatives of these terms, variations on them and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. The Corporation has based these forward-looking statements on its current expectations about future events. Forward-looking statements do not take into account the effect of transactions or other items announced or occurring after the statements are made. For example, they do not include the effect of dispositions, acquisitions, other business transactions, asset write-downs or other charges announced or occurring after the forward-looking statements are made.

Although the Corporation believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct, and forward-looking statements inherently involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such forward-looking statements.

Important factors and assumptions as well as the Corporation 's ability to anticipate and manage the risks associated therewith that could cause actual results to differ materially from these expectations are detailed from time to time in the Corporation's filings with the U.S. Securities and Exchange Commission ("SEC") and the securities regulatory authorities in Canada, available at www.sec.gov and www.sedar.com (copies of which are available on www.quebecorworld.com). The Corporation cautions that any such list of important factors that could affect future results is not exhaustive. Investors and others should carefully consider the factors detailed from time to time in the Corporation's filings with the SEC and the securities regulatory authorities in Canada and other uncertainties and potential events when relying on its forward-looking statements to make decisions with respect to the Corporation.

Unless mentioned otherwise, the forward-looking statements in this interim MD&A reflect the Corporation's expectations as of August 13, 2009, being the date at which they have been approved, and are subject to change after this date. The Corporation expressly disclaims any obligation or intention to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable securities laws.

New risk factors

This section should be read in conjunction with Item 3-D "Key Information—Risks Factors" of the Corporation's Annual Report on Form 20-F for the year ended December 31, 2008.

The Corporation's actual financial results may vary significantly from the projections filed with the U.S. Bankruptcy Court.

In connection with the Plan process, the Corporation was required to prepare projected financial information to demonstrate to the U.S. Bankruptcy Court the feasibility of the Plan and the Corporation's ability to continue operations upon emergence from bankruptcy protection. The

4

Corporation filed projected financial information with the U.S. Bankruptcy Court most recently on May 18, 2009 as part of the Disclosure Statement approved by the U.S. Bankruptcy Court. The projections reflect numerous assumptions concerning anticipated future performance and prevailing and anticipated market and economic conditions that were and continue to be beyond management's control and that may not materialize either in whole or in part. Projections are inherently subject to uncertainties and to a wide variety of significant business, economic and competitive risks. The Corporation's actual results will vary from those contemplated by the projections for a variety of reasons, including the fact that given the Corporation's recent emergence from bankruptcy protection, the Corporation will have to apply CICA Handbook Section 1625,Comprehensive Revaluation of Assets and Liabilities ("Section 1625"), regarding fresh start accounting. As indicated in the Disclosure Statement, the projections applied fresh-start accounting provisions. However, these projections were limited by the information available as of the date of the preparation of the projections. Therefore variations from the projections may be material. The projections have not been incorporated by reference into the unaudited interim financial statements for the six-month period ended June 30, 2009 nor into this interim MD&A, and neither these projections nor any version of the Disclosure Statement should be considered or relied upon in connection with the purchase of any of the Corporation's new securities.

Because the Corporation's consolidated financial statements will reflect fresh-start accounting adjustments starting in the third quarter of 2009, and because of the effects of the transactions that became effective pursuant to the Plan, financial information in future financial statements will not be comparable to the Corporation's financial information from prior periods.

On the Corporation's emergence from creditor protection under Chapter 11 and the CCAA, the Corporation will be required, under Canadian GAAP, to adopt "fresh start" reporting in accordance with Section 1625. Under fresh start reporting, the Successor will undertake a comprehensive re-evaluation of its assets and liabilities based on the enterprise value of $1.5 billion as established in the Plan and will result in World Color becoming a new entity for financial reporting purposes. This will include fresh start reporting assumptions as to the reorganized equity value of World Color and certain adjustments to reflect the fair value of the Corporation's assets and liabilities as of the fresh start date. The Corporation's unaudited interim financial statements for the six-month period ended June 30, 2009 include a pro-forma balance sheet reflecting the assumed effect of Plan consummation as if it had occurred on June 30, 2009. The Corporation will be required to reflect such estimates or actual balances as of the fresh start date, which will occur in the third quarter of 2009. Such determination will be based upon the estimated fair value of its assets and liabilities as of that date, which could be materially greater or lower than the values assumed in the foregoing estimates of the pro-forma fresh start balance sheet as of June 30, 2009. The pro-forma fresh start reporting adjustments anticipate that the reorganization value of the Successor will exceed the fair value of the net assets.

In addition to fresh start accounting, the consolidated financial statements do not reflect all of the effects of transactions contemplated by the Plan. Thus the future financial statements of financial position and statements of operations, which will reflect all of the effects of the transactions contemplated by the Plan, will not be comparable in many respects to the Corporation's statement of financial position and statement of operations for periods prior to the adoption of fresh-start accounting and prior to accounting for the effects of the Plan.

1. Creditor protection and the plan of reorganization

The Plan

As described in Note 1 to the 2008 annual consolidated financial statements, on January 21, 2008 Quebecor World obtained an order from the Quebec Superior Court granting creditor protection under

5

the Companies' Creditors Arrangement Act for itself and for 53 U.S. subsidiaries. On the same date, the U.S. Subsidiaries filed a petition under Chapter 11 of the U.S. Bankruptcy Code in the Bankruptcy Court for the Southern District of New York (the "U.S. Bankruptcy Court"). The proceedings under the CCAA and the proceedings under Chapter 11 are hereinafter collectively referred to as the "Insolvency Proceedings". The Corporation's Latin American subsidiaries were not subject to the Insolvency Proceedings. On January 28, 2008, the Corporation's UK subsidiary, Quebecor World PLC was placed into administration. In addition, prior to their disposition on June 26, 2008, the European subsidiaries were not subject to the Insolvency Proceedings. During the Insolvency Proceedings, the Applicants continued to operate under the protection of the relevant courts.

On June 22, 2009, the creditors of the Applicants approved a plan of compromise and reorganization (the "Plan") under both the CCAA and Chapter 11. On June 30, 2009, the Plan was sanctioned by the Quebec Superior Court, and it was confirmed by the U.S. Bankruptcy Court on July 2, 2009. The Plan was implemented following various transactions that were completed on July 21, 2009 (the "Effective Date"). Accordingly, the Applicants emerged from bankruptcy protection and the Corporation was renamed and began operating as World Color Press Inc. ("World Color") on the Effective Date.

The implementation of the Plan on July 21, 2009 resulted in a substantial realignment of the interests in the Corporation between its existing creditors and shareholders as of the Filing Date. As a result, the Corporation would have been required to adopt fresh start accounting effective July 21, 2009. However, in light of the proximity of the Effective Date to the end of its accounting period immediately following July 21, 2009, which is July 31, 2009, the Corporation has elected to adopt fresh-start reporting and account for the effects of the Plan, including the cancellation of the old share capital of QWI and the creation and issuance of World Color's new share capital, as if such events had occurred on July 31, 2009 (the "Fresh-start Date"). The Corporation evaluated the activity between July 22, 2009 and July 31, 2009 and, based upon the immateriality of such activity, concluded that the use of July 31, 2009 to reflect the fresh start accounting adjustments was appropriate for financial reporting purposes. The use of the July 31, 2009 date is for financial reporting purposes only and does not affect the Effective Date of the Plan.

For clarity, World Color and its operations on or after the Fresh-start Date will be referred to as the "Successor", and QWI and its operations prior to the Fresh-start Date will be referred to as the "Predecessor".

Following implementation of the Plan, which is based on an assumed enterprise value of the Successor of $1.5 billion, World Color reorganized its capital structure and issued (or will issue) the following securities in exchange for $3.1 billion of Liabilities Subject to Compromise ("LSTC"):

- •

- New unsecured notes in the aggregate principal amount of approximately $50 million;

- •

- 12.5 million new convertible Class A preferred shares;

- •

- 73.3 million new common shares; and

- •

- 10.7 million new Series I barrier warrants and 10.7 million new Series II barrier warrants;

The implementation of the Plan also involved the following refinancing transactions:

- •

- Repayment of $585.1 million under the Predecessor's debtor-in-possession ("DIP") financing; and

- •

- Entering into a new exit financing credit facility of $800 million.

Therefore, the DIP financing was reclassified to long term as at June 30, 2009.

6

In addition, cash payments of $100 million in satisfaction of certain claims were made to holders of the Predecessor's senior secured debt, all of which were paid on the Effective Date. Also, the Corporation will make payments of approximately $66 million in connection with secured, administrative, priority tax and small convenience unsecured claims, of which $10 million was paid on the Effective Date.

Under the Plan, QWI's then existing Multiple Voting Shares, Redeemable First Preferred Shares and Subordinate Voting Shares were effectively cancelled for no consideration, on the Effective Date, in accordance with the Articles of Reorganization that were filed as one of the steps to implement the Plan.

Status of Liabilities Subject to Compromise

LSTC refers to liabilities incurred prior to the Filing Date that may be dealt with as affected claims against the Corporation, of any kind or nature arising prior to January 21, 2008 ("Affected Claims"), under the Plan, as well as claims arising on or after January 21, 2008, further to the repudiation, termination or restructuring of any contract, lease, employment agreement or other agreement ("Restructuring Claims"). The Corporation continues to review the LSTC amounts. Further details are outlined in Note 5—Liabilities Subject to Compromise.

Accounting policies applicable to an entity under creditor protection

The Corporation's financial statements have been prepared using the same Canadian generally accepted accounting principles ("GAAP") as applied by the Corporation prior to the Insolvency Proceedings. While the Applicants filed for and were granted creditor protection, the financial statements continued to be prepared using the going concern concept, which assumed that the Corporation would be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future.

As a result of the Insolvency Proceedings, the Corporation followed accounting policies, including disclosure items, applicable to entities that are under creditor protection. In addition to Canadian GAAP, the Corporation applied the guidance in the American Institute of Certified Public Accountants Statement of Position 90-7, "Financial Reporting by Entities in Reorganization under the Bankruptcy Code" (the "SOP 90-7"). While SOP 90-7 refers specifically to Chapter 11 in the United States, its guidance, in management's view, is also applicable to an entity restructuring under CCAA where it does not conflict with Canadian GAAP.

Consistent with Canadian GAAP, SOP 90-7 did not change the manner in which financial statements were prepared. However, SOP 90-7 does require that the financial statements for periods ending subsequent to the Filing Date, and prior to the Effective Date, distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business. Revenues, expenses, gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the business are reported separately as reorganization items (Note 4). Cash flows related to reorganization items have also been disclosed separately.

While payments may not be made on LSTC, including long-term debt, interest on debt obligations continued to be recognized. Interest is not a reorganization item. The consolidated balance sheet distinguishes pre-filing liabilities subject to compromise from both pre-filing liabilities that are not subject to compromise and from post-filing liabilities (Note 5). Liabilities that are affected by the Plan, or will otherwise be allowed by the Court and the U.S. Bankruptcy Court, may be settled for lesser amounts in accordance with the Plan and the resulting adjustments may be material and may be reflected in the financial results of the Successor.

7

Consolidated financial statements that include one or more entities in reorganization proceedings and one or more entities not in reorganization proceedings are required to include disclosure of entities in reorganization proceedings, including disclosure of Condensed Combined Financial Information of the entities in the reorganization proceedings, and disclosure of the amount of intercompany receivables and payables therein (Note 6).

SOP 90-7 has been applied effective January 21, 2008 and for subsequent reporting periods while the Corporation continued to operate under creditor protection.

The resulting changes in reporting are described in Note 4—Reorganization Items, Note 5—Liabilities Subject to Compromise and Note 6—Condensed Combined Financial Information.

Basis of presentation and going concern issues

While under creditor protection, DIP financing was approved by the courts and was available, subject to borrowing conditions, up to July 21, 2009 as described in Note 1 to the 2008 annual consolidated financial statements. Management believed that these actions made the going concern basis of accounting appropriate while the Corporation was under creditor protection.

All estimates, assumptions, valuations, appraisals and financial projections, including any fair value adjustments in the accompanying financial statements, do not purport to reflect or provide for the terms of the Plan. In particular, these financial statements do not purport to show: (a) as to shareholders' accounts, the effect of changes that were made in the capitalization of the Successor; or (b) as to liabilities, the effect of the new Unsecured Notes and Credit Facility and the elimination of LSTC following implementation of the Plan. The Corporation will be required, under Canadian GAAP, to adopt "fresh start" reporting. Under fresh start reporting, the Successor will undertake a comprehensive re-evaluation of its assets and liabilities based on the reorganization value as established and confirmed in the Plan. With the exception of the pro-forma fresh start balance sheet discussed below, these financial statements do not present any adjustments that may be required under fresh start reporting.

The Corporation has made adjustments to the financial statements to isolate assets, liabilities, revenues, and expenses related to the reorganization and restructuring activities so as to distinguish these events and transactions from those associated with the ongoing operation of the business. In accordance with Canadian GAAP, property, plant and equipment is carried at cost less accumulated amortization and any impairment losses. Property, plant and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. The series of events that led the Corporation to filing for creditor protection under the Insolvency Proceedings and the events since then triggered impairment tests in certain reporting periods for its property, plant and equipment. The Corporation made assumptions about certain matters, such as expected growth, maintaining customer base, achieving cost reductions and the future cash flows expected from the use of its assets. There can be no assurance that expected future cash flows will be realized or will be sufficient to recover the carrying amount of long-lived assets.

The preparation of financial statements in conformity with Canadian GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. The Insolvency Proceedings and the current downturn in the economy materially affect the degree of uncertainty associated with the measurement of many amounts in the financial statements. More specifically, these uncertainties could impact the enterprise and equity value of the Successor included in the pro-forma fresh start consolidated balance sheet below, recoverability tests and fair value assumptions used in the impairment test of property, plant and equipment, the valuation of future income tax assets and of intangible assets.

8

Pro-forma Fresh Start Consolidated Balance Sheet

As previously noted, the Corporation will be required, under Canadian GAAP, to adopt "fresh start" reporting. Under fresh start reporting, the Successor will undertake a comprehensive re-evaluation of its assets and liabilities based on the enterprise value of $1.5 billion as established in the Plan and will result in World Color becoming a new entity for financial reporting purposes. The process for allocation of the enterprise value was not completed as of the date of issuance of the Corporation's financial statements and the amounts assigned to the assets and liabilities may be adjusted subsequently as a result of the finalization of this process. Upon adoption of fresh start accounting, in the third quarter of 2009, World Color's financial statements will not be comparable to any of the previously issued financial statements.

A pro-forma fresh start consolidated balance sheet (the "Pro-forma") as of June 30, 2009 is set out below with adjustments summarized in the columns captioned a) Plan of Reorganization, b) Exit Financing and c) Fresh Start Adjustments. These adjustments reflect the assumed effect of the Plan's implementation, including the compromise of various liabilities, the issuance of new securities and various cash payments, as more thoroughly described in the Plan, as if they had occurred on June 30, 2009. Certain assumptions that were made are set out below.

The estimates of fair value are based on independent appraisals and valuations, some of which will be updated to the Fresh-start Date. Where independent appraisals and valuations are not finalized or not used, management has estimated the fair value using prices for similar assets in the marketplace (market approach) or discounted future cash flows (income approach).

To determine the enterprise value of the Successor, management developed a set of financial projections for the Successor using a number of estimates and assumptions. With the assistance of financial advisors, management determined the enterprise value and corresponding equity value of the Successor based on these financial projections using various valuation methods, including (a) a selected publicly-traded companies' analysis, (b) a selected transactions analysis and (c) a discounted cash flow analysis. Based upon these analyses, management estimates that the going concern enterprise value of the Successor is in a range between $1.25 billion and $1.75 billion. The enterprise value and the corresponding equity value are dependent on achieving the future financial results set forth in the Corporation's projections, as well as the realization of certain other assumptions. The financial projections and estimates of enterprise value are not incorporated in these financial statements.

All estimates, assumptions, valuations, appraisals and financial projections, including the fresh start adjustments, the enterprise value and equity value projections, are inherently subject to significant uncertainties outside of management's control. Accordingly, there can be no assurance that the estimates, assumptions, valuations, appraisals and financial projections will be realized and actual results could vary materially.

Plan of Reorganization

In the Plan of Reorganization column, LSTC of $3.1 billion in the Predecessor will be discharged with the issuance of new Common Shares, new Preferred Shares, new Warrants and new Unsecured Notes by World Color. Certain other claims of holders under the Predecessor's senior secured debt and certain other secured, administrative, priority tax and convenience unsecured claims of approximately $166 million will be paid in cash, of which $110 million was paid on the Effective Date. The remaining balance will be recorded in Trade payables and accrued liabilities or Income and other taxes payable. In addition, certain income tax liabilities amounting to $25.8 million that were subject to compromise are expected to be settled against income taxes receivable from the current and prior years. Finally, the Plan provides for the repudiation of the non-qualified pension plans, collectively defined as "Rejected Employee Agreements". As of August 10, 2009, almost all of the participants in the Rejected Employee Agreements have agreed to participate in new non-qualified benefit plans and agreements (collectively,

9

the "New Benefits Plan"). As a result, an amount of $32.1 million will be recorded to recognize the unfunded liability of the New Benefits Plan, and reflected as Other liabilities, in settlement of the liability for Rejected Employee Agreements which was subject to compromise.

Projected future income tax liabilities of approximately $178 million will be recognized on this debt discharge. The discharge of debt gives rise to cancellation of debt ("COD") income for income tax purposes and is projected to reduce certain of the Corporation's tax attributes, such as net operating loss ("NOL") and NOL carry forwards and capital losses carry forwards and the tax basis of the Corporation's depreciable and non-depreciable assets, which will increase the Corporation's income tax obligation. Because some of the debtors' outstanding indebtedness will be satisfied under the Plan by way of consideration other than cash, the amount of COD income, and accordingly the amount of tax attributes that may be reduced, will depend in part on the fair market value of such non-cash consideration. These future income tax liabilities were calculated in accordance with financial interpretation ("FIN") 48—"Accounting for Uncertainty in Income Taxes", which provides that a tax benefit from an uncertain tax position may be recognized when it is more likely than not that such position will be sustained on examination based on the technical merits.

Exit Financing

The Corporation obtained exit financing of $800 million, as previously described, including a Term Loan of $450 million, fully drawn, and a Revolving Credit Facility of $350 million, of which $89 million was drawn on the Effective Date. Transaction fees and debt issuance costs of $76 million have been reflected as a reduction to the face value of the Term Loan and draws on the Revolving Credit Facility. Net cash raised from the Credit Facility was used to repay the DIP financing of the Predecessor.

Fresh-Start Adjustments

The pro-forma includes fresh start reporting assumptions as to the reorganized equity value of World Color and certain adjustments to reflect the fair value of the Corporation's assets and liabilities as of June 30, 2009. World Color will be required to reflect such estimates or actual balances as of the Fresh-start Date. Such determination will be based upon the fair value of its assets and liabilities as of that date, which could be materially greater or lower than the values assumed in the foregoing estimates. The reorganization value of the Successor may exceed the fair value of World Color's net assets. This excess, if any, will be recorded as a reduction to capital stock under Canadian GAAP. The significant fresh start reporting adjustments reflected in the Pro-forma, based on current estimates, are summarized as follows:

A fresh start adjustment of approximately $32 million is expected to be required to reduce the historical cost of the fixed assets (mainly machinery and equipment) to their estimated fair values.

- (c)

- Intangibles and Other assets:

A fresh start adjustment of approximately $350 million is expected to be required to record finite-life intangible assets representing the estimated fair value of World Color's customer relationships and contracts. These intangible assets will be amortized on a straight-line basis over their estimated useful lives.

10

Other fresh start adjustments will include the write-off of pension assets to other liabilities amounting to $134 million, the reversal of contract acquisition costs of $83 million which are effectively included in the aforementioned intangible assets and other estimated fair value adjustments of $17 million.

- (d)

- Other liabilities:

A fresh start adjustment of approximately $56 million, which reduces net future income tax liabilities, is assumed for the recognition of net future income tax assets related to the aforementioned fresh start adjustments made to property, plant and equipment, other assets and other liabilities.

- (f)

- Shareholders' equity (deficit):

Adopting fresh start reporting results in a new reporting entity with no retained earnings or deficit. All Predecessor capital stock has been eliminated and replaced by the new equity structure of World Color. The fresh start adjustments include the cancellation of existing capital stock, preferred shares, contributed surplus, deficit and accumulated other comprehensive income, as well as a reduction to the new Capital Stock as a result of "goodwill" stemming from fresh start reporting.

11

Pro-forma fresh start consolidated balance sheet

The pro-forma balance sheet is based on preliminary valuations as of June 30, 2009. Actual fair value of the assets and liabilities as of the fresh-start date could be materially greater or lower than the fair value estimates below.

| | | | | | | | | | | | | | | | | |

| | Predecessor June 30, 2009 | | Plan of Reorganization | | Exit Financing | | Fresh Start | | Successor June 30, 2009 | |

|---|

Assets | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | |

| | Cash and cash equivalents | | $ | 321.6 | | $ | (103.5 | ) | $ | (113.1 | ) | $ | — | | $ | 105.0 | |

| | Accounts receivable | | | 484.9 | | | (21.7 | ) | | — | | | — | | | 463.2 | |

| | Inventories | | | 176.8 | | | — | | | — | | | — | | | 176.8 | |

| | Income taxes receivable | | | 31.4 | | | (25.8 | ) | | — | | | — | | | 5.6 | |

| | Future income taxes | | | 11.2 | | | (3.5 | ) | | — | | | — | | | 7.7 | |

| | Prepaid expenses and deposits | | | 44.7 | | | 5.0 | | | — | | | — | | | 49.7 | |

| | | | | | | | | | | | |

Total current assets | | | 1,070.6 | | | (149.5 | ) | | (113.1 | ) | | — | | | 808.0 | |

Property, plant and equipment | | | 1,119.7 | | | 12.7 | | | — | | | (32.4 | ) | | 1,100.0 | |

Intangible assets | | | — | | | — | | | — | | | 350.0 | | | 350.0 | |

Restricted cash | | | 92.1 | | | (32.5 | ) | | — | | | — | | | 59.6 | |

Future income taxes | | | 5.7 | | | 2.9 | | | — | | | — | | | 8.6 | |

Other assets | | | 353.4 | | | — | | | — | | | (234.2 | ) | | 119.2 | |

| | | | | | | | | | | | |

Total assets | | $ | 2,641.5 | | $ | (166.4 | ) | $ | (113.1 | ) | $ | 83.4 | | $ | 2,445.4 | |

| | | | | | | | | | | | |

Liabilities and Shareholders' equity (deficit) | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | |

| | Bank indebtedness | | $ | 0.7 | | $ | — | | $ | — | | $ | — | | $ | 0.7 | |

| | Trade payables and accrued liabilities | | | 373.2 | | | 29.9 | | | 14.9 | | | 2.1 | | | 420.1 | |

| | Income and other taxes payable | | | 38.1 | | | 17.3 | | | — | | | (29.9 | ) | | 25.5 | |

| | Future income taxes | | | 0.4 | | | — | | | — | | | — | | | 0.4 | |

| | Current portion of long term debt | | | 13.0 | | | — | | | — | | | — | | | 13.0 | |

| | Current portion of liabilities subject to compromise | | | 166.0 | | | (166.0 | ) | | — | | | — | | | — | |

| | | | | | | | | | | | |

Total current liabilities | | | 591.4 | | | (118.8 | ) | | 14.9 | | | (27.8 | ) | | 459.7 | |

Liabilities subject to compromise | | | 2,909.6 | | | (2,909.6 | ) | | — | | | — | | | — | |

DIP financing | | | 590.7 | | | — | | | (590.7 | ) | | — | | | — | |

Long-term debt | | | 58.9 | | | 6.2 | | | — | | | 3.8 | | | 68.9 | |

Exit financing | | | — | | | — | | | 462.7 | | | — | | | 462.7 | |

Unsecured Notes | | | — | | | 50.0 | | | — | | | — | | | 50.0 | |

Other liabilities | | | 183.8 | | | 32.1 | | | — | | | 275.2 | | | 491.1 | |

Future income taxes | | | 43.0 | | | 177.5 | | | — | | | (56.4 | ) | | 164.1 | |

Preferred shares—Predecessor | | | 23.9 | | | — | | | — | | | (23.9 | ) | | — | |

Preferred shares—Successor | | | — | | | 95.0 | | | — | | | — | | | 95.0 | |

Shareholders' equity (deficit): | | | | | | | | | | | | | | | | |

| | Capital stock—Predecessor | | | 1,609.4 | | | — | | | — | | | (1,609.4 | ) | | — | |

| | Capital stock—Successor | | | — | | | 786.0 | | | — | | | (132.1 | ) | | 653.9 | |

| | Contributed surplus | | | 106.6 | | | — | | | — | | | (106.6 | ) | | — | |

| | Deficit | | | (3,675.4 | ) | | 1,715.2 | | | — | | | 1,960.2 | | | — | |

| | Accumulated other comprehensive income (loss) | | | 199.6 | | | — | | | — | | | (199.6 | ) | | — | |

| | | | | | | | | | | | |

| | | (1,759.8 | ) | | 2,501.2 | | | — | | | (87.5 | ) | | 653.9 | |

| | | | | | | | | | | | |

Total liabilities and shareholders' equity (deficit) | | $ | 2,641.5 | | $ | (166.4 | ) | $ | (113.1 | ) | $ | 83.4 | | $ | 2,445.4 | |

| | | | | | | | | | | | |

See accompanying assumptions

12

2. Financial review

2.1. Industry trends and outlook

Global economic conditions affect our customers' businesses and the markets they serve. The credit crisis and global economic weakness have resulted in constrained advertising spending and, in certain cases, customer financial difficulties in our North American segment. This has put significant downward pressure on both volumes and, to a lesser degree, on price, across nearly all of North America's printing and related services.

During 2008 and continuing in 2009, we undertook various initiatives to adapt our cost structure to the rapidly changing economic environment including:

- •

- Divested our non-strategic operations in Europe in June 2008, which allowed us to remain focused on our core business in the Americas and reduced the operational risks associated with the uncertainty of the long-term profitability of the European operations.

- •

- Implemented significant profit improvement initiatives to align our costs with anticipated volume decreases. In June 2008, we integrated and rationalized the number of business divisions in the U.S. from six to three, which allowed us to better serve existing and new customers by having more streamlined and customer-driven operations. Three facilities were closed in 2008, one in April 2009 and one in July 2009. Corporate and plant staff levels were reduced by more than 10% in 2008 and were reduced a further 12% in the first half of 2009.

- •

- Froze the salaries of all non-unionized North American employees effective January 1, 2009, suspended employer's contributions for non-unionized U.S. employees to the 401(k) plans effective February 1, 2009, and reduced Senior Management salaries by 5%.

- •

- Implemented a significant cost reduction plan in North America, effective April 19, 2009. This plan includes a 10% wage reduction for non-unionized salaried and hourly employees (including sales commissions), a reduction of employees' paid vacation entitlement by one week, suspension of the employer's contribution for non-unionized U.S. employees for the 401(a) plans, standardization in pay for work on holidays to time-and-a-half, and changes to the Corporation's severance and overtime policies. In connection with the implementation of this cost savings plan, all the collective agreements have been re-opened during the second quarter of 2009 and the Corporation has obtained similar concessions from its union employees. The annual cost savings relating to these initiatives are estimated at approximately $100 million.

The current North American recession is expected to continue to put downward pressure on volumes and prices as retailers and publishers further adjust their budgets for printing services. Competition in the industry remains intense as the industry is still in the process of consolidating and is still suffering from overcapacity. Under these conditions, we are focusing on improving our product and segment mix, adding customer value through initiatives such as our new integrated multi-channel solutions and improving productivity through continuous improvement projects and technology. We are also aggressively aligning our cost structure to mitigate the impact of the economic downturn.

Latin America has not been, nor is it expected to be, as affected by the global economic weakness as North America. With planned investments in new capacity, this segment's revenues are forecast to increase in line with expected growth from an existing customer base.

13

2.2. Second quarter review

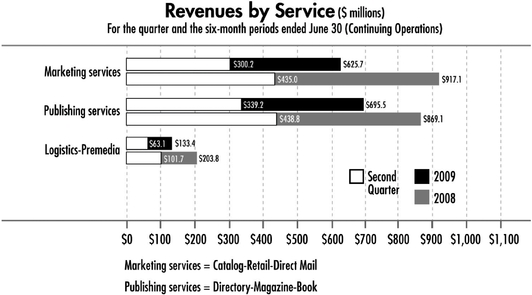

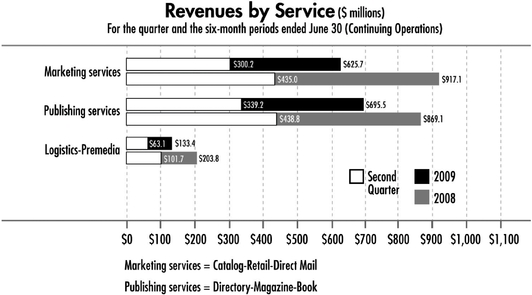

Figure 1

Management assesses the Corporation's performance based on, among other measures, operating income and Adjusted EBIT. Certain of these measures are not defined by Canadian GAAP. A reconciliation of non-GAAP measures to their respective closest GAAP measures, together with a discussion of their use, is provided in Figure 4.

Operating revenues

Our consolidated operating revenues for the second quarter of 2009 were $702.5 million, a 28% decrease when compared to $975.5 million for the same period in 2008. Excluding the negative impact of currency translation (Figure 2), operating revenues were down 25% compared to the same period in 2008. The decrease in operating revenues resulted primarily from lower volumes mostly due to the North American recession and, to a lesser extent, negative price pressures. Management believes that the impact of the Insolvency Proceedings is diminishing in 2009. More details are provided in the "Segment results" section.

Paper sales, excluding the effect of currency translation, decreased by 25% for the second quarter of 2009, compared to the same period in 2008. The decrease in paper sales is mostly explained by lower volumes. The variance in paper sales has an impact on operating revenues, but it has little impact on operating income because the cost of paper is generally passed on to the customer.

Impact of Foreign Currency and Paper Sales

($ millions)

| | | | | | | |

| | Three months ended

June 30, 2009 | | Six months ended

June 30, 2009 | |

|---|

Foreign currency unfavorable impact on revenues | | $ | (28.8 | ) | $ | (67.1 | ) |

Paper sales unfavorable impact on revenues | | | (63.0 | ) | | (123.8 | ) |

Foreign currency favorable impact on operating income | | | 0.9 | | | 3.5 | |

Figure 2

14

Operating income and adjusted EBIT

In the second quarter of 2009, adjusted EBIT decreased to $5.5 million compared to $27.8 million for the same period in 2008. Adjusted EBIT margin was 0.8% for the second quarter of 2009, compared to 2.8% for the same period in 2008. The decrease of adjusted EBIT margin is mostly due to lower volumes and, to a lesser degree, a decrease in scrap paper revenues explained by a significant drop in market prices. However, cost initiatives taken in 2008 and 2009 offset the EBIT lost due to volume and price decreases by approximately 40%. Excluding depreciation and amortization of $43.1 million for the second quarter of 2009 ($56.7 million for the same period in 2008), cost of sales for the second quarter of 2009 decreased by 28% to $587.5 million, compared to $811.2 million for the corresponding period in 2008. Excluding depreciation and amortization, gross profit margin was 16.4% in the second quarter of 2009 compared to 16.8% in 2008.

Selling, general and administrative expenses for the second quarter of 2009 were $66.4 million, a decrease of 17% compared to $79.8 million for the same period in 2008. Excluding depreciation and amortization expenses of $5.1 million for the second quarter of 2009 and $2.3 million for the same period in 2008 and excluding the favorable impact of currency translation of $3.0 million, selling, general and administrative expenses decreased by 17%, compared to the same period in 2008. The favorable variance is mainly explained by various workforce reduction initiatives as well as reduction in salaries and benefits due to the significant cost reduction plan implemented in April 2009, and lower commission expenses. Excluding the gain on sale of a corporate aircraft of $9.9 million in 2008, selling, general and administrative expenses have decreased by 26%.

The total depreciation and amortization included in cost of sales and selling, general and administrative expenses above were $48.2 million for the second quarter of 2009, compared to $59.0 million for the second quarter of 2008. Excluding the favorable impact of currency translation of $1.6 million, depreciation and amortization expenses decreased by 16%, compared to the same period last year. The lower depreciation and amortization resulted mainly from the lower level of capital investment following the finalization of the extensive retooling plan in 2007, the impairment of long-lived assets that was recorded in the fourth quarter of 2008, as well as plant closures that occurred during the last four quarters.

Operating income for the quarter ended June 30, 2009 was $1.8 million, compared to $16.8 million for the second quarter ended June 30, 2008, explained by the same factors that lowered adjusted EBIT, and partly offset by lower Impairment of Assets, Restructuring and Other Charges ("IAROC").

As discussed in greater detail in the "Industry trends and outlook" section, the Corporation put in place in 2009 a number of initiatives, including salaries and benefits reductions as well as the closure of two plants, which are intended to help reverse the negative earnings trend resulting from the recent drops in volume. Some benefits from those initiatives only began to be realized in the second quarter of 2009.

Other items

During the second quarter of 2009, we recorded IAROC of $3.7 million, compared to $11.0 million for the same period in 2008. The charge for the quarter was mainly related to plant closures and workforce reductions in North America. These measures are described below under "Impairment of assets and restructuring initiatives".

Financial expenses were $6.5 million in the second quarter of 2009, compared to $52.9 million for the same period in 2008. The decrease is mainly due to gains on foreign exchange due to favorable movement in the Canadian dollar, partly offset by higher interest expenses.

We recorded reorganization items which represent post-filing expenses, gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the

15

Applicants amounting to $35.8 million in the second quarter of 2009 ($27.6 million in 2008). Following the Corporation's emergence from the Insolvency Proceedings on July 21, 2009, these fees will be significantly reduced beginning in the third quarter of 2009.

Income tax expense was $18.5 million in the second quarter of 2009, compared to $12.7 million for the same period in 2008. Income tax expense before IAROC was $19.7 million in the second quarter of 2009 compared to $16.2 million for the same period last year. In 2009, the effective income tax rate was impacted by the non-deductibility of interest on pre-petition U.S. debt as well as additional valuation allowance mainly related to tax benefits whose realization is not foreseen in Canada and in the U.S. In addition, the 2009 effective income tax rate was favorably affected by foreign tax rate differences.

Net loss

For the second quarter ended June 30, 2009, we reported a net loss of $59.5 million compared to a net loss from continuing operations of $77.7 million for the same period in 2008. These results incorporated IAROC, net of income taxes, of $2.5 million compared with $7.5 million for the same period in 2008 and reorganization items, net of taxes, of $33.7 million compared to $24.2 million for the same period in 2008.

2.3. Year-to-date review

Operating revenues

On a year-to-date basis, our consolidated operating revenues were $1.46 billion, a 27% decrease when compared to $1.99 billion for the same period in 2008. Excluding the negative impact of currency translation (Figure 2), operating revenues were down 24% compared to the same period in 2008. The decrease in operating revenues resulted primarily from lower volumes mostly due to the North American recession and, to a lesser extent, negative price pressures. We believe that the impact of the Insolvency Proceedings is diminishing in 2009. More details are provided in the "Segment results" section.

Paper sales, excluding the effect of currency translation, decreased by 24% for the first half of 2009, compared to the same period in 2008. The decrease in paper sales is mostly explained by lower volumes. Variance in paper sales has an impact on operating revenues, but it has little impact on operating income because the cost is generally passed on to the customer.

Operating income and adjusted EBIT

On a year-to-date basis, adjusted EBIT decreased to $(9.4) million compared to $37.0 million for the same period in 2008. Adjusted EBIT margin was (0.6%) for the first half of 2009, compared to 1.9% for the same period in 2008. The decrease of adjusted EBIT margin is mostly due to lower volumes and, to a lesser degree, a decrease in scrap paper revenues explained by a significant drop in market prices. However, cost initiatives taken in 2008 and 2009 partly offset the EBIT lost due to volume and price decreases. Excluding depreciation and amortization of $86.8 million for the first half of 2009 ($114.7 million for the same period in 2008), cost of sales for the first half of 2009 decreased by 25% to $1.24 billion, compared to $1.66 billion for the corresponding period in 2008. Excluding depreciation and amortization, gross profit margin was 14.9% in the first half of 2009 compared to 16.7% in 2008.

Selling, general and administrative expenses were $139.2 million on a year-to-date basis, lower by 23% compared to $181.3 million for the same period in 2008. Excluding depreciation and amortization expenses of $7.6 million for the first half of 2009 and $4.8 million for the same period in 2008 and excluding the favorable impact of currency translation of $7.9 million, selling, general and

16

administrative expenses decreased by 21%, compared to the same period in 2008. The favorable variance is explained mainly by various workforce reduction initiatives, as well as reduction in salaries and benefits due to the significant cost reduction plan implemented in April 2009, and lower commission expenses.

The total depreciation and amortization included in cost of sales and selling, general and administrative expenses above were $94.4 million for the first half of 2009, compared to $119.5 million for the first half of 2008. Excluding the favorable impact of currency translation of $3.4 million, depreciation and amortization expenses decreased by 18%, compared to the same period last year. Lower depreciation and amortization resulted mainly from the lower level of capital investment following the finalization of our extensive retooling plan in 2007, the impairment of long-lived assets that was recorded in the fourth quarter of 2008, as well as plant closures that occurred during the last four quarters.

On a year-to-date basis, operating loss was $28.3 million, compared to operating loss of $10.6 million for the first half ended June 30, 2008, explained by the same factors that lowered adjusted EBIT and partly offset by lower IAROC.

As discussed in greater details in the "Industry trends and outlook" section, the Corporation put in place in 2009 a number of initiatives including salaries and benefits reductions as well as the closure of two plants,which are intended to help reverse the negative earnings trend resulting from the recent drops in volume. Some benefits from those initiatives only began to be realized in the second quarter of 2009.

Other items

On a year-to-date basis, we recorded IAROC of $18.9 million, compared to $47.6 million for the same period in 2008. The charge for the first half was mainly related to plant closures and workforce reductions in North America. These measures are described below under "Impairment of assets and restructuring initiatives".

Financial expenses were $94.6 million on a year-to-date basis, compared to $138.6 million for the same period in 2008. The decrease is mainly due to the write-off of deferred financing costs amounting to $58.3 million recorded in the second quarter of 2008, gains on foreign exchange due to favorable movement in the Canadian dollar partly offset by higher interest expenses.

We recorded reorganization items which represent post-filing expenses, gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the Applicants totaling $52.7 million in the first half of 2009 ($41.8 million in 2008). Further to the Corporation's emergence from Insolvency Proceedings on July 21, 2009, these fees will be significantly reduced beginning in the third quarter of 2009.

Income tax expense was $8.7 million on a year-to-date basis, compared to $31.6 million for the same period in 2008. Income tax expense before IAROC was $14.8 million in the first half of 2009 compared to $36.5 million for the same period last year. In 2009, the effective income tax rate was impacted by the non-deductibility of interest on pre-petition U.S. debt as well as additional valuation allowance mainly related to tax benefits whose realization is not foreseen in Canada and in the U.S. In addition, in 2009, the effective income tax rate was favorably affected by foreign tax rate differences.

Net loss

On a year-to-date basis, we reported a net loss of $185.4 million compared to a net loss from continuing operations of $226.3 million for the same period in 2008. These results incorporated IAROC, net of income taxes, of $12.9 million compared with $42.7 million for the same period in 2008

17

and reorganization items, net of taxes, of $49.1 million compared to $38.3 million for the same period in 2008.

2.4. Segment results

The following is a review of activities by segment which, except as otherwise indicated, focuses only on continuing operations. The reporting structure includes two segments, North America and Latin America.

Segment Results of Continuing Operations ($ millions)

Selected Performance Indicators

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | North America | | Latin America | | Inter-Segment

and Others | | Total | |

|---|

| | 2009 | | 2008 | | 2009 | | 2008 | | 2009 | | 2008 | | 2009 | | 2008 | |

|---|

Three months ended June 30 | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating revenues | | $ | 645.5 | | $ | 898.7 | | $ | 55.6 | | $ | 76.8 | | $ | 1.4 | | $ | — | | $ | 702.5 | | $ | 975.5 | |

Adjusted EBITDA | | | 54.6 | | | 84.3 | | | 5.1 | | | 6.6 | | | (1.7 | ) | | 1.8 | | | 58.0 | | | 92.7 | |

Adjusted EBIT | | | 5.4 | | | 22.9 | | | 2.1 | | | 3.0 | | | (2.0 | ) | | 1.9 | | | 5.5 | | | 27.8 | |

IAROC | | | 3.4 | | | 10.1 | | | 0.2 | | | 0.9 | | | 0.1 | | | — | | | 3.7 | | | 11.0 | |

Operating income (loss) | | | 2.0 | | | 12.8 | | | 1.9 | | | 2.1 | | | (2.1 | ) | | 1.9 | | | 1.8 | | | 16.8 | |

Adjusted EBITDA margin | | | 8.5 | % | | 9.4 | % | | 9.2 | % | | 8.5 | % | | | | | | | | 8.3 | % | | 9.5 | % |

Adjusted EBIT margin | | | 0.8 | % | | 2.6 | % | | 3.8 | % | | 3.9 | % | | | | | | | | 0.8 | % | | 2.8 | % |

Operating margin | | | 0.3 | % | | 1.4 | % | | 3.4 | % | | 2.8 | % | | | | | | | | 0.3 | % | | 1.7 | % |

Capital expenditures(1) | | $ | 16.4 | | $ | 35.0 | | $ | 2.6 | | $ | 1.6 | | $ | — | | $ | 2.0 | | $ | 19.0 | | $ | 38.6 | |

Change in non-cash balances | | | | | | | | | | | | | | | | | | | | | | | | | |

| | related to operations, cash | | | | | | | | | | | | | | | | | | | | | | | | | |

| | flow (outflow)(1) | | | 41.9 | | | (19.7 | ) | | 5.7 | | | (8.6 | ) | | 8.3 | | | 32.0 | | | 55.9 | | | 3.7 | |

| | | | | | | | | | | | | | | | | | |

Six months ended June 30 | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating revenues | | $ | 1,343.3 | | $ | 1,844.7 | | $ | 111.3 | | $ | 145.3 | | $ | — | | $ | — | | $ | 1,454.6 | | $ | 1,990.0 | |

Adjusted EBITDA | | | 88.0 | | | 160.7 | | | 10.7 | | | 11.6 | | | (5.1 | ) | | (5.4 | ) | | 93.6 | | | 166.9 | |

Adjusted EBIT | | | (8.9 | ) | | 37.7 | | | 5.0 | | | 4.7 | | | (5.5 | ) | | (5.4 | ) | | (9.4 | ) | | 37.0 | |

IAROC | | | 18.3 | | | 46.6 | | | 0.3 | | | 1.0 | | | 0.3 | | | — | | | 18.9 | | | 47.6 | |

Operating income (loss) | | | (27.2 | ) | | (8.9 | ) | | 4.7 | | | 3.7 | | | (5.8 | ) | | (5.4 | ) | | (28.3 | ) | | (10.6 | ) |

Adjusted EBITDA margin | | | 6.6 | % | | 8.7 | % | | 9.6 | % | | 8.0 | % | | | | | | | | 6.4 | % | | 8.4 | % |

Adjusted EBIT margin | | | (0.7) | % | | 2.0 | % | | 4.5 | % | | 3.2 | % | | | | | | | | (0.6) | % | | 1.9 | % |

Operating margin | | | (2.0) | % | | (0.5) | % | | 4.2 | % | | 2.5 | % | | | | | | | | (1.9) | % | | (0.5) | % |

Capital expenditures(1) | | $ | 35.7 | | $ | 52.9 | | $ | 4.5 | | $ | 2.2 | | $ | — | | $ | 6.3 | | $ | 40.2 | | $ | 61.4 | |

Change in non-cash balances | | | | | | | | | | | | | | | | | | | | | | | | | |

| | related to operations, cash | | | | | | | | | | | | | | | | | | | | | | | | | |

| | flow (outflow)(1) | | | 199.8 | | | 54.3 | | | 1.0 | | | (2.6 | ) | | 20.7 | | | 25.5 | | | 221.5 | | | 77.2 | |

| | | | | | | | | | | | | | | | | | |

Figure 3

IAROC: Impairment of assets, restructuring and other charges

Adjusted: Defined as before IAROC

- (1)

- Including both continuing and discontinued operations

North America

North American operating revenues for the second quarter of 2009 were $645.5 million, down 28% from $898.7 million in 2008. Excluding the effect of currency translation, operating revenues decreased by 26% in the second quarter of 2009, compared to the same period in 2008. Operating revenues in the

18

North American segment continued to be principally impacted by volume declines and, to a lesser extent, negative price pressures. Volume in North America decreased during the second quarter of 2009 as a result of the North American recession and, we believe, due to the impact of the Insolvency Proceedings.

Adjusted EBITDA in North America decreased in the second quarter of 2009 compared to the same period in 2008. The Adjusted EBITDA margin decreased in the second quarter of 2009 to 8.5% compared to 9.4% for the same period of 2008. Adjusted EBITDA in North America continues to be impacted by challenging market conditions. The impact of the decrease in volume, as discussed above, was partially mitigated by restructuring initiatives, the reduction in salaries and benefits (more details are provided in the "Industry trends and outlook" section) and efficiencies realized through productivity gains.

Year-over-year, the North American workforce was reduced by 3,552 employees, down 18%, of which 874 positions were eliminated in the second quarter of 2009, mainly explained by various restructuring initiatives, including the significant downsizing of the Covington, TN facility which was closed in July 2009, the closure of the Memphis, TN facility in the second quarter of 2009 and the closure of the Islington facility in Ontario, which was completed in the fourth quarter of 2008. We also reduced our workforce in most of our other facilities, including our corporate offices, in order to better align our costs with current market conditions.

Latin America

Latin America operates mainly in the Book, Directory, Magazine, Catalog and Retail markets. Latin America's operating revenues for the second quarter of 2009 were $55.6 million, down 28% from $76.8 million for the same period in 2008 primarily due to the unfavorable impact of foreign currency. Excluding the impact of foreign currency, operating revenues for the second quarter of 2009 were down 13%, compared to 2008. Overall, second quarter of 2009 adjusted EBITDA was down 23% compared to the same period in 2008. These results were negatively impacted by the economic slowdown, a decrease in exports to North America as well as timing of work expected in the second half of 2009 which were mainly offset by the positive impact of profit-improvement initiatives.

2.5. Impairment of assets and restructuring initiatives

Impairment of assets

During the second quarter of 2008, impairment tests were triggered in North America as a result of the retooling plan and the relocation of existing presses and we recorded impairment charges of $16.7 million mainly on machinery and equipment.

Restructuring initiatives

We have undertaken various restructuring initiatives in order to ensure that our facilities are operating at optimal pressroom efficiencies and generating higher returns. Restructuring costs relate largely to plant closures and workforce reductions that occurred in current and prior years. A description of these initiatives is provided in Note 7 to our interim consolidated financial statements for the period ended June 30, 2009.

The 2009 restructuring initiatives affected a total of 1,378 employees, of which 1,248 positions were eliminated as of June 30, 2009 and a further 130 are expected to be eliminated. However, we estimate that 161 new jobs will be created in other facilities with respect to the 2009 initiatives. During the first half of 2009, the execution of prior years' initiatives resulted in the elimination of 370 positions with 62 positions still to be eliminated.

19

�� As at June 30, 2009, the balance of the restructuring reserve was $22.6 million, of which $9.3 million is presented as liabilities subject to compromise. The total cash disbursement related to this reserve, excluding liabilities subject to compromise, is expected to be $13.1 million for the remainder of 2009. Finally, the Corporation expects to record a charge of $9.3 million in upcoming quarters for restructuring initiatives that have already been announced in the first half of 2009.

Reconciliation of non-GAAP measures

($ millions)

| | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, | |

|---|

| | 2009 | | 2008 | | 2009 | | 2008 | |

|---|

Operating income (loss) from continuing operations—adjusted | | | | | | | | | | | | | |

Operating income (loss) | | $ | 1.8 | | $ | 16.8 | | $ | (28.3 | ) | $ | (10.6 | ) |

Impairment of assets, restructuring and other charges ("IAROC") | | | 3.7 | | | 11.0 | | | 18.9 | | | 47.6 | |

| | | | | | | | | | |

Adjusted EBIT(1) | | $ | 5.5 | | $ | 27.8 | | $ | (9.4 | ) | $ | 37.0 | |

| | | | | | | | | | |

Operating income (loss) | | $ | 1.8 | | $ | 16.8 | | $ | (28.3 | ) | $ | (10.6 | ) |

Depreciation of property, plant and equipment(2) | | | 48.2 | | | 69.8 | | | 94.4 | | | 141.5 | |

Amortization of other assets(2) | | | 4.3 | | | 6.0 | | | 8.6 | | | 10.5 | |

Less depreciation and amortization from discontinued operations | | | — | | | (10.9 | ) | | — | | | (22.1 | ) |

| | | | | | | | | | |

Operating income (loss) before depreciation and amortization ("EBITDA") | | $ | 54.3 | | $ | 81.7 | | $ | 74.7 | | $ | 119.3 | |

IAROC | | | 3.7 | | | 11.0 | | | 18.9 | | | 47.6 | |

| | | | | | | | | | |

Adjusted EBITDA(1) | | $ | 58.0 | | $ | 92.7 | | $ | 93.6 | | $ | 166.9 | |

| | | | | | | | | | |

Figure 4

- (1)

- Adjusted EBIT and Adjusted EBITDA are the measures the Corporation has historically used to assess segment profitability. Adjusted EBITDA excludes the following items: IAROC, financial expenses, dividends on preferred shares classified as liability, dividends, depreciation, amortization, reorganization expenses and income taxes, that are not under the control of the business segments and that are not considered in the measurement of their profitability. These items are typically managed by World Color's corporate head office which focuses on strategy development and oversees governance, policy, compliance, human resources, legal, tax and other financial matters. These measures do not have any standardized meanings provided by GAAP and are therefore unlikely to be comparable to similar measures presented by other companies.

- (2)

- As reported in the Consolidated Statement of Cash Flows.

20

Reconciliation of non-GAAP measures

($ millions)

| | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, | |

|---|

| | 2009 | | 2008 | | 2009 | | 2008 | |

|---|

Free cash flow(1) | | | | | | | | | | | | | |

Cash provided by (used in) operating activities | | $ | 46.8 | | $ | (5.9 | ) | $ | 141.7 | | $ | 79.7 | |

Additions to property, plant and equipment | | | (19.0 | ) | | (38.6 | ) | | (40.2 | ) | | (61.4 | ) |

Net proceeds from disposal of assets | | | 0.3 | | | 21.2 | | | 1.6 | | | 22.3 | |

Net proceeds from business disposals | | | — | | | 44.0 | | | — | | | 44.0 | |

| | | | | | | | | | |

Free cash flow | | $ | 28.1 | | $ | 20.7 | | $ | 103.1 | | $ | 84.6 | |

| | | | | | | | | | |

Figure 4

- (1)

- We present free cash flow as additional information as we believe it is a useful indicator of our ability to operate without reliance on additional borrowing or usage of existing cash. Free cash flow is a measure of the net cash generated which is available for debt repayment and investment in strategic opportunities. Free cash flow is not a calculation based on or derived from Canadian or U.S. GAAP and should not be considered as an alternative to the Consolidated Statement of Cash Flows and is unlikely to be comparable to similar measures presented by other companies.

21

3. Critical accounting estimates, changes in accounting standards and adoption of new accounting policies

3.1. Critical accounting estimates

The preparation of financial statements in conformity with Canadian GAAP requires the Corporation to make estimates and assumptions which affect the reported amounts of assets and liabilities, disclosure with respect to contingent assets and liabilities at the date of the financial statements and reported amounts of operating revenues and expenses during the reporting period. Critical accounting estimates are generally defined as those requiring assumptions made about matters that are highly uncertain at the time the estimate is made, and when the use of different reasonable estimates or changes to the accounting estimates would have a material impact on a company's financial condition or results of operations. A complete discussion of the critical accounting estimates made by the Corporation is included in its Annual Report on Form 20-F.

Actual results could differ from those estimates, as further explained in Note 1 and Note 5 to the Corporation's interim consolidated financial statements for the three months and six months ended June 30, 2009.

3.2. Changes in accounting standards and adoption new accounting policies

Adoption of new accounting policies

The Canadian Accounting Standards Board ("AcSB") requires all public companies to adopt the International Financial Reporting Standards ("IFRS") for interim and annual financial statements relating to fiscal years beginning on or after January 1, 2011. Early adoption is permitted if certain conditions are met. Companies will be required to provide IFRS comparative information for the previous fiscal year.

Furthermore, in May 2008, the Canadian Securities Administrators issued Staff Notice 52-320, which provides guidance on the disclosure of changes in expected accounting policies related to the change over to IFRS. In accordance with the notice, we are required to provide an update on our IFRS conversion plan in each financial reporting period prior to conversion.

We expect that the transition from Canadian GAAP to IFRS will be applicable for the Corporation for the first quarter of 2011 when we will prepare both the current and comparative financial information using IFRS. We expect the transition to IFRS to impact financial reporting, business processes and information systems.

In 2008, we launched an internal initiative to govern the conversion process and we are currently in the process of evaluating the potential impact of the conversion to IFRS on our financial statements. Our project consists of 3 phases: (1) diagnostic; (2) development; and (3) implementation. We completed the awareness and initial assessment phase, during the second quarter of 2008, which involved a high level review of the major differences between current Canadian GAAP and IFRS. We are in the process of completing a more detailed assessment which involves detailed systematic gap analyses of accounting and disclosure differences between Canadian GAAP and IFRS, and conducting an analysis of the available accounting choices to be made to address these differences and options available under IFRS. However, as the assessment will be impacted by our future capital structure and fresh start reporting and, given the uncertainties described in Note 1 to the Corporation's interim consolidated financial statements for the three and six months ended June 30, 2009, we cannot at this time reasonably estimate the impact of adopting IFRS on our future financial position and results of operations.

22

4. Liquidity and capital resources

4.1. DIP Financing

As further discussed in Section 1 of this MD&A, on July, 21, 2009, immediately prior to emergence from the Insolvency Proceedings, the Corporation fully repaid all outstanding drawings on the DIP comprising $525.5 million on the DIP Term Loan and $59.6 million on the Revolving DIP Facility.

World Color and certain of its subsidiaries, from time to time, grant irrevocable standby letters of credit to third parties to indemnify them in the event we do not perform our contractual obligations. As of July, 21, 2009, guarantee instruments issued under the DIP Credit Agreement amounted to CA$2.3 million maturing at various dates in 2009.

4.2. Exit Financing

On July 21, 2009, the Corporation obtained exit financing comprised of (a) a senior secured asset-based revolving credit facility, with sub-facilities for Canadian dollar borrowings, swing line loans and issuance of letters of credit, for an aggregate maximum commitment by the lenders of $350 million (the "Revolving Credit Facility") bearing interest at variable rates based on Libor or Eurodollar rate, Canadian Banker's Acceptance rate or Canadian prime rate, plus applicable margins, which will total a minimum of 7.5% and (b) a $450 million senior secured term loan (the "Term Loan"), bearing interest at variable rates based on Libor, or Eurodollar rate, plus applicable margins, which will total a minimum of 9.0%, and which was fully drawn immediately following the Corporation's emergence from the Insolvency Proceedings. Together, the Revolving Credit Facility and the Term Loan are referred to as the "Credit Facility". Amounts borrowed under the Term Loan and repaid or prepaid may not be re-borrowed. Under the Revolving Credit Facility, the availability of funds is determined by a borrowing base calculated on percentages of eligible receivables and inventory. The unused portion of the Revolving Credit Facility is subject to a commitment fee of between 0.75% and 1.00% per annum. The Credit Facility is secured by a perfected first-priority security interest and hypothec over substantially all present and after-acquired consolidated assets of the Successor. As of August 10, 2009, the Corporation had drawn an aggregate amount of $534 million under the Credit Facility.

The Credit Facility matures on the earliest to occur of (a) July 21, 2012 and (b) the acceleration of the Term Loan payments, and a termination of the commitments, upon the occurrence of required prepayments resulting from, among other things, excess cash flow, the net proceeds of certain asset sales, issuance of certain debt, certain extraordinary receipts and change of control. The Term Loan also has mandatory repayment requirements of $3.25 million in the first year after the issuance date and $32.5 million in each of the second and third years after the issuance date.

The Credit Facility provides for various restrictions on, among other things, the ability of World Color and its subsidiaries to incur additional debt, secure such debt, make investments, dispose of their assets (including pursuant to sale and leaseback transactions and sales of receivables under securitization programs), make capital expenditures and pension contributions, as well as for limitations on dividend payments, repurchases of equity interests and cash interest payments on the Unsecured Notes. Each of these transactions would require the consent of a majority of the Credit Facility lenders if they exceed certain thresholds set forth in the agreements governing the Credit Facility.

The Credit Facility agreements also contain certain restrictive financial covenants, including requirements to maintain a maximum level of consolidated leverage and minimum consolidated cash fixed charge coverage, as defined in the agreements, and minimum liquidity. In addition, under the terms of the Credit Facility, World Color is required to comply with various other terms and conditions such as maintaining guarantee coverage of substantially all of its consolidated assets and consolidated earnings before interest, income taxes, depreciation, amortization and restructuring (EBITDAR).

23

Management believes that liquidity and capital resources are sufficient to fund operating activities subsequent to the emergence from the Insolvency Proceedings.

4.3. New Unsecured Notes

The Corporation expects to issue $50 million of unsecured notes ("Unsecured Notes" or the "Notes") bearing cash interest at a rate of 10% per annum or paid-in-kind ("PIK") interest at a rate of 13% per annum and maturing on July 15, 2013. The Notes are to be issued to creditors of certain of the U.S. Subsidiaries holding general unsecured claims against such U.S. Subsidiaries (categorized as Class 3-claims under the U.S. plan). Each such creditor will receive Unsecured Notes equal to 50% of its allowed claim, provided that the maximum aggregate amount of Unsecured Notes is limited to $75 million. In the event that the total allowed claims of all such creditors exceed $150 million, then each such creditor will receive its pro rata amount of $75 million in aggregate total of the Unsecured Notes. Management estimates that the allowed amount of Class 3 claims will be approximately $100 million, which would result in the issuance and distribution of $50 million of Unsecured Notes. However, it is not possible at this time to evaluate the final amount of Class 3 claims that will ultimately be allowed by the U.S. Bankruptcy Court. It is possible that allowed claims may be materially in excess of the amount estimated given the magnitude of the claims asserted (Note 5), and therefore the Unsecured Notes issued could reach the maximum aggregate principal amount of $75 million. The Unsecured Notes indenture provides for various restrictions on, among other things, the ability of World Color and its subsidiaries to incur additional debt, secure such debt, make investments, dispose of some of their assets, as well as for limitations on dividend payments and repurchases of equity. The Corporation may redeem all or a portion of the Notes, with all accrued and unpaid interest thereon, at any time on or after July 21, 2010 at redemption prices of 105% in the second year after issuance date, 103% in the third year and 101% in the fourth year.

4.4. Cash Flow

The following describes our cash flow including the discontinued operations for the three-month periods ended June 30, 2009 and 2008 and six-month periods ended June 30, 2009 and 2008.

Operating activities

| | | | | | | | | | | | | |