SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For ANNUAL REPORT 2002 |

| | |

QUEBECOR WORLD INC. |

(Translation of Registrant’s Name into English) |

| | |

612 Saint-Jacques Street, Montreal, Quebec H3C 4M8 |

(Address of Principal Executive Office) |

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F o Form 40-F ý

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes o No ý

QUEBECOR WORLD INC.

Filed in this Form 6-K

Documents index

1. Annual Report 2002

Table of Contents

| 1 | Financial Highlights |

| |

2 | Message to Shareholders |

| |

6 | Our Commitment |

| |

8 | Our Customers, Our Strength |

| |

12 | Our People, Our Edge |

| |

16 | Our Leadership, Our Innovation |

| |

20 | Our Environment, Our Responsibility |

| |

24 | Our Community, Our Promise |

| |

28 | Our Global Reach, Our Competitive Advantage |

| |

30 | Our Products, Our Diversity |

| |

34 | QW North America |

| |

36 | QW Europe |

| |

38 | QW Latin America |

| |

40 | Corporate Governance |

| |

41 | Board of Directors |

| |

42 | Senior Management |

| |

43 | Main Business Locations |

| |

44 | Shareholder Information |

| |

| |

| |

|

|

| |

| Quebecor World Inc. (NYSE; TSX: IQW) is the largest commercial printer in the world. It is a market leader in most of its major product categories, which include magazines, inserts and circulars, books, catalogs, specialty printing and direct mail, directories, digital premedia, logistics, mail list technologies and other value added services. Quebecor World Inc. has approximately 39,000 employees working in more than 160 printing and related facilities in the United States, Canada, Brazil, France, the United Kingdom, Belgium, Spain, Austria, Sweden, Switzerland, Finland, Chile, Argentina, Peru, Colombia, Mexico and India. |

Financial

Highlights

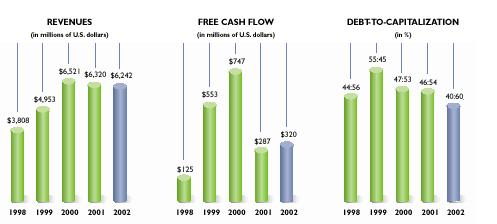

(In millions of U.S. dollars, except per share data) | | 2002 | | % Change | | 2001 | | % Change | | 2000 | |

| | | | | | | | | | | |

Consolidated Results | | | | | | | | | | | |

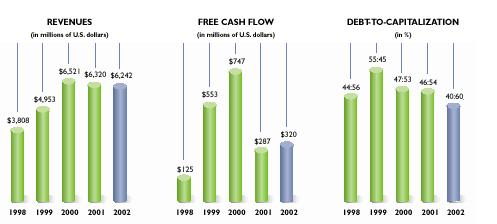

Revenues | | $ | 6,242.0 | | (1 | ) | $ | 6,320.1 | | (3 | ) | $ | 6,521.1 | |

Operating income before restructuring and other charges | | 562.8 | | (9 | ) | 617.8 | | (15 | ) | 724.8 | |

Restructuring and other charges | | 19.6 | | | | 270.0 | | | | (2.7 | ) |

Operating income | | 543.2 | | 56 | | 347.8 | | (52 | ) | 727.5 | |

Net income* | | 279.3 | | 1147 | | 22.4 | | (92 | ) | 295.4 | |

Cash provided from operating activities | | 513.4 | | (11 | ) | 576.5 | | (37 | ) | 917.8 | |

Free cash flow from operations** | | 319.8 | | 11 | | 287.2 | | (62 | ) | 747.3 | |

Operating margin before restructuring and other charges | | 9.0 | % | | | 9.8 | % | | | 11.1 | % |

Operating margin | | 8.7 | % | | | 5.5 | % | | | 11.2 | % |

| | | | | | | | | | | |

Financial Position | | | | | | | | | | | |

Working capital | | $ | (209.3 | ) | | | $ | (194.5 | ) | | | $ | (66.5 | ) |

Property, plant and equipment | | 2,610.6 | | | | 2,634.0 | | | | 2,683.0 | |

Total assets | | 6,205.5 | | | | 6,186.5 | | | | 6,520.8 | |

Long-term debt (including convertible notes) | | 1,822.1 | | | | 2,132.2 | | | | 2,208.7 | |

Debt-to-capitalization | | 40:60 | | | | 46:54 | | | | 47:53 | |

| | | | | | | | | | | |

Per Share Data | | | | | | | | | | | |

Earnings* | | | | | | | | | | | |

Diluted | | $ | 1.76 | | | | $ | — | | | | $ | 1.91 | |

Diluted before restructuring and other special charges | | $ | 1.92 | | 22 | | $ | 1.58 | | (17 | ) | $ | 1.90 | |

Dividends on equity shares | | $ | 0.49 | | 7 | | $ | 0.46 | | 39 | | $ | 0.33 | |

Book value | | $ | 15.92 | | 11 | | $ | 14.39 | | (7 | ) | $ | 15.47 | |

* Effective January 1, 2002, net income and earnings per share reflect the new accounting policy adopted by the Company

under which goodwill is no longer amortized.

** Cash provided from operating activities, less capital expenditures net of proceeds from disposals, and preferred share dividends.

Quebecor World

1

Message to Shareholders

Our Commitment to You

Commitment is a word we don’t take lightly at Quebecor World. When we make one we do everything in our power to deliver. Going into 2002, our commitment was to focus on three key areas of discipline – restructuring and cost containment, strong free cash flow and debt repayment. The result is a more efficient manufacturing platform, with a lower cost base both in terms of operational costs and financial expense. This process is not yet completed and cost reduction will continue to be our major focus going forward.

In the face of a significant economic headwind, Quebecor World’s diluted earnings per share, before restructuring and other special charges and removing the impact of goodwill amortization in previous years, held relatively steady at $1.92 in 2002 compared with $1.99 in 2001. Free cash flow increased 11% to $320 million. Much of this was used to pay down debt, reducing our debt-to-capitalization ratio to 40:60. These results were achieved despite weaker advertising spending in our key North America market causing volume and price pressures due to excess capacity in the industry.

New Business

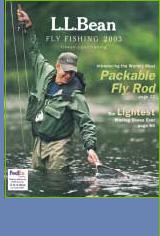

Another commitment was to win new business and strengthen our existing customer franchise. We delivered. One example is our

2

“Quebecor World is committed to providing the strongest management team in the industry.”

agreement to print 100% of the catalogs for L.L. Bean, the leading cataloger in the United States. Another is our agreement to be the principal print supplier for Simon & Schuster. Still another is our agreement with U.S. retailer Albertsons to produce the lion’s share of their retail flyer program. Our message of one-stop global shopping and technological leadership is being heard and is paying off in expanded business as our customers use their relationship with us to capture their own economies of scale. The same is true for customers who are printing with us on more than one continent. Avon, Telefónica de España, Reader’s Digest, IKEA, Scholastic, Hachette, Forbes, and Office Depot are just a few examples of customers who are using our global platform to expand their business into new markets.

Restructuring Initiatives

Last year we committed to a restructuring program that centered on our strategy of having fewer, but larger, more specialized facilities. This involved the closing of more than 10 facilities during the year and the elimination of more than 3,000 employee positions, primarily in North America.

In the fourth quarter of 2002, the Company recognized restructuring and other special charges for a net of $19.6 million, pre-tax. The largest component of these charges is the cost of new restructuring initiatives being undertaken in France as a result of difficult market conditions, severe price pressures and a decrease in operating income. The charges also include the write-down of an investment in a CD ROM replication business.

North America

In North America, which accounts for over 80% of our revenues, we continued to experience soft demand in most of our markets as well as competitive pricing. Despite these conditions, operating income increased in all our business groups except for the Commercial/Direct Group, Premedia Services and East Group which have been affected by the weak market for promotional advertising.

Our message of one-stop global shopping and technological leadership is being heard and is paying off in expanded business.

European Revenues Increase

Quebecor World’s European operations, in countries outside of France, increased revenues and operating income in 2002 in spite of difficult print market conditions. Overall in Europe, operating margin declined as a result of our under-performing French operations. The Company is committed to correcting this situation through the aforementioned restructuring initiatives under way.

Continuing Double-Digit Growth in Latin America

In Latin America, our business continued to grow. Revenues continued to grow at a double-digit rate of 13% to $183 million. Operating income before restructuring and other charges, increased by 37% for the year and the operating margin improved to 7.8% from 6.5% in 2001.

Through our commitment to providing world-class quality and service, our Latin American team is gaining market share and providing a Latin American solution for our North American and European customers.

3

A Strategy for Growth

Quebecor World remains committed to its long-term strategic plan to expand through acquisitions and internal investments. However, given the difficult economic environment, management decided, in mid-2001, to suspend all acquisitions. The only exception to this was the acquisition of the European printing assets of Hachette Filipacchi Medias, completed in March 2002, which came with an enabling contract for us to print many of Hachette’s magazines in France. As well, the benefits of our strategy of establishing closer ties with leaders such as Hachette has been confirmed with the subsequent signing of additional Hachette contracts in other parts of Europe as well as in the U.S.

Quebecor World remains committed to its long-term strategic plan to expand through acquisitions and internal investments.

We continue to invest in our existing operations, with much focus in 2002 on our retail platform, where we are investing in new presses as well as a new facility in Riverside, California. We are now the only printer in North America offering a coast-to-coast web offset and gravure platform for the production of retail inserts and Sunday magazines.

Leadership Transition

Quebecor World is committed to providing the strongest management team in the industry. On February 3, 2003, Charles G. Cavell became Deputy Chairman of the Board relinquishing his role of President and Chief Executive Officer of Quebecor World, the position he had held since December, 1997. Mr. Cavell, through his leadership of a strong executive team, has helped build a legacy, the world’s largest commercial printer. With the full support of the controlling shareholder Quebecor Inc., Charlie and Jean Neveu, our former Chairman and CEO, together with the rest of the senior management team, began an aggressive acquisition program in the late ‘80s that addressed the potential opportunity of the North American Free Trade Agreement and brought the Company to the number one position in just 10 years. As Deputy Chairman, Charlie will continue to contribute to the Company’s growth and success.

Michel Desbiens was appointed President and Chief Executive Officer effective February 3, 2003. To facilitate the transition process, Mr. Desbiens was appointed to the position of Chief Executive Officer, International Operations, in November 2002. He has also been a Board Member since April 2002. He brings many years of experience in the paper industry and in public company administration. As the former President and Chief Executive Officer of Donohue Inc., Mr. Desbiens is uniquely qualified for his new role, having led that corporation’s growth to become one of most profitable paper companies in the world. Claude Hélie, who worked closely with Mr. Desbiens at Donohue, will become Chief Financial Officer of Quebecor World effective February 17, 2003, thus reuniting this effective team to help ensure that your Company will continue to grow and deliver value to shareholders.

Another major leadership change has been the appointment in 2002 of John Paloian and David Boles as Chief Operating Officers of our North American operations. Together they

4

“Our focus will continue to be on cost containment and free cash flow. Our strategy of deploying assets into larger, more specialized facilities will help ensure that we remain the lowest cost provider.”

have more than 30 years of experience in the printing industry and were instrumental in implementing the merger of Quebecor Printing and World Color. Thanks to the strong “bench strength” of our management team, their former responsibilities as Group Presidents are being assumed by a new generation of talented and proven leaders.

Our Greatest Asset

As Quebecor World undergoes a year of leadership transition, it is important to acknowledge the fundamental role that each of our 39,000 employees has played in making us who we are today. While the Company’s leaders provide vision, values, and other direction, it is our employees who turn these guidelines into reality. We thank each of you for being true to our corporate values, for sharing our dreams, and especially for that extra caring you provide our customers. After all, machines don’t create customer satisfaction or shareholder value. People do.

Outlook

We believe that market conditions in our industry will remain difficult for the first half of 2003. Our focus will continue to be on cost containment and free cash flow. Our strategy of deploying assets into larger, more specialized facilities will help ensure that we remain the lowest cost provider. This will give us the necessary operating leverage to take advantage of an eventual economic and advertising recovery.

In 2002, we witnessed an accelerated trend toward vendor consolidation. Businesses are looking to fewer vendors who can provide more integrated turnkey services than ever before. Our breadth of capabilities coupled with our multi-plant platform position us to be a strategic partner to our customers and not just a vendor. By fine-tuning our equipment and leveraging the whole Quebecor World platform we can satisfy the most demanding customers whose requirements can only be met by a company with our resources and capabilities.

The difficult economic conditions we continue to face means that it is now more than ever time for the Company to stay true to its core values - the values against which we bench-mark our performance. That is what has made Quebecor World the number one global printer today, and that is what will ensure we continue to grow and evolve as the leader for many years to come.

/s/ Brian Mulroney | |

The Right Honourable Brian Mulroney, |

Chairman of the Board |

|

/s/ Michel Desbiens, | |

Michel Desbiens, |

President and Chief Executive Officer |

|

February 3, 2003 |

5

Quebecor World is committed to the focused, disciplined and ethical pursuit of value for all our stakeholders. We do this by optimizing the contribution of people, technology and capital to meet or exceed our customers’ expectations.

6

Our business practices are guided by a set of social, environmental and financial values based on the highest standards of excellence and integrity.

7

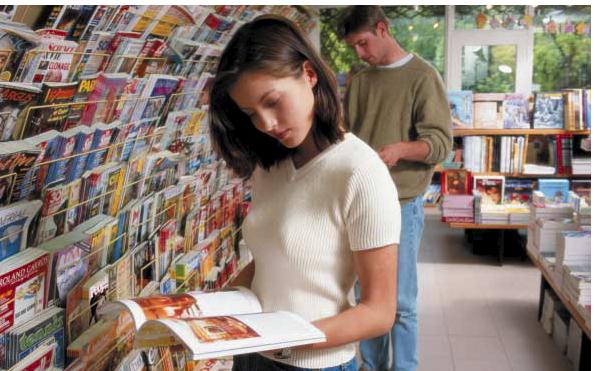

Our Customers

Our Strength |

|

|

Quebecor World is committed to providing customers with superior printing and print-related services. Our customers expect us to meet our commitments and be proactive in always looking for ways to serve them better. We strive for long-term, mutually rewarding relationships that demonstrate a partnership approach to doing business. We actively engage the appropriate resources of our entire Company in helping customers be successful in their endeavors. |

|

| L.L. Bean was founded in 1912 by Leon Leonwood Bean (or “L.L.”) on a passion for the outdoors, a profound belief in honesty and an unwavering commitment to quality and customer satisfaction. Quebecor World is proud to be the sole provider of print services for L.L. Bean’s extensive catalog program involving over 200 million catalogs per year. |

|

|

| | |

8

“Our decision to move all of our work to Quebecor World was made after a careful assessment of all marketplace options. The strength and diversity of Quebecor World’s manufacturing platform offers us a level of flexibility that we feel is critical to the success of our catalog program.”

Steve Fuller, Vice President of Corporate Marketing, L.L.Bean

9

Albertsons is one of the world’s largest food and drug retailers with annual revenues in the $38 billion range. Quebecor World recently expanded its relationship with Albertsons to print a majority of its advertising inserts, some 40 million inserts per week placed in more than 250 newspapers across the U.S. Quebecor World is the only printer in North America that can offer a coast-to-coast web offset and gravure platform for the production of retailers’ inserts and mailers.

| “Quebecor World’s combination of service and its extensive platform offer us the geographic scope required by a company of our size, as well as a significant cost savings benefit.” |

| Pam Powell, Group Vice President, Marketing & Advertising, Albertsons |

10

Time Inc. is the type of company Quebecor World has structured itself to support. Time’s ability to take advantage of the size, diversity and flexibility of our manufacturing and distribution platform – worldwide – leads to significant benefits for both companies.

In 2002, we signed another multi-year contract extension with Time Inc. to print 20 of its Time, Southern Progress and Oxmoor House titles. Additionally, Quebecor World took on the printing of This Old House magazine.

| |

“Over the years, Time Inc. has enjoyed a very successful relationship with Quebecor World and we look forward to continuing to work with them in the future.” |

|

Barry Meinerth, Senior Vice President, Production, Time Inc. |

| |

11

Our People Our Edge The employees of Quebecor World are the most important factor in the success of the Company. Employees at all levels are respected for the value they add to our products and services and are accorded an appropriate and equal opportunity for personal and professional growth, for reward and achievement within the organization. |

|

| |

| Our ALLSTAR Customer Service Training program was recently selected by The American Society of Training & Development, the world’s premier resource on workplace learning and performance, to receive the coveted “Excellence in Practice” award. The program has been recognized for its effectiveness in helping Quebecor World standardize its account management practices throughout North America and reinforce a customer-centric corporate culture. Other organizations have noted the success of ALLSTAR’s banquet team-building activity and have used this model in management training efforts. |

| | |

12

"ALLSTAR helped me realize that my customers could be on my team as well. It also gave me a lot of confidence in my ability to be a good CSR through teamwork, communication, and being really responsive to customer needs."

Rhonda Knopp,

Customer Service Representative (CSR), QW Dubuque

13

“By getting more involved in the reduction of unnecessary waste, we’re better able to have control over the bottom line.” Mike Jacobs, Operator, QW Dyersberg | QWEST is a program aimed at providing employees with the tools they need to identify opportunities for process and cost improvements. For example, through a QWEST project at our Dyersberg, Tennessee plant, bindery waste is now measured daily and the results are released each week. Once a month, the Continuous Improvement Manager meets with the bindery supervisors and operators for a detailed review of the progress being made and how the results could be improved further. |

| |

| The LEAD program was launched in 2002 to identify and develop the future leaders of this Company. More than 75 LEAD participants are being provided with special training, guidance and development opportunities to help fast track their careers. “The LEAD program has been outstanding, as far as my experience in it. The coach that was assigned to me has helped me tremendously, especially with my new responsibility of helping develop the assistants for sales. When I run into a difficult situation, I can speak candidly with my coach and he helps guide me in the right direction.” Debbie Leopoldi,

Sales Representative, Book Services Group |

14

“When a corporation is willing to invest in its people through this type of extensive training, it sends a message that they want us to succeed and that they care about building bench strength and getting the right people into the right positions.” Rich Dunn,

Vice President, Division Manager, QW Dubuque | Quebecor World’s Training Initiatives ALLSTAR: Award-winning Customer Service Training LEAD: Identification and development of High Potential Employees CAP: “Corrective Action Process” for problem analysis and prevention QWEST: Quebecor World Employee Suggestion Teams CCHPL: Customer-Centric High Performance Leadership training for executives |

|

| |

CCHPL is a new program designed for executives at the Vice Presidential level and up. It aims to develop such skills as public speaking, interpreting financial statements, negotiating, and teambuilding. Shown above is Rich Dunn (second from right) addressing some of his employees (from left to right) Ramon Mejia, 3rd Press Operator; Shawn Fuller, 1st Press Operator; and Jamie Kruser, 2nd Press Operator. |

15

Our Leadership Our Innovation |

|

|

As the leader in our industry, Quebecor World carries the added responsibity of continuously improving all aspects of our business. We invest in the research and development of new printing technologies and materials that will bring new benefits to our customers and the marketplace. |

| |

| Process Neutrality — Quebecor World is the only printer with a coast-to-coast offset and rotogravure network that is dedicated to the production of retail inserts and Sunday magazines. This technological advantage provides us with the unique ability to offer our customers a choice between rotogravure and offset printing. Many of our large national customers will offset print their regional, highly versioned runs, and rotogravure print their national, longer runs. Our process neutrality allows customers to take advantage of the high speed in rotogravure while not compromising the number of versions they require for regional runs. |

| | |

16

|

| |

“The main reason we partnered with Quebecor World Retail was their ability to offer a “process neutral” manufacturing platform, where the focus in on the printed product, not on the process.” Jim Pilsner,

Vice President, Advertising, Rite Aid |

17

|

|

Agfa’s DelanoTM is a new software suite designed to facilitate communication and process management between pre-press and print professionals, creative and customer support personnel. What’s so unique about this web-enabled software is that it provides real time information on the status of print projects at every stage – initial customer contact, prepress, printing, post-press activity – as well as workflow analysis, regardless of the brand of the digital workflow systems in use. It puts a powerful set of project management tools at the fingertips of customer service representatives – helping printers create and deliver jobs more efficiently and productively than ever before. Quebecor World demonstrated its technological leadership when it initiated the development of this software by approaching Agfa, the leading supplier of prepress solutions, to be its partner in this project. This revolutionary technology was pilot-tested in two of our plants last year and is currently being rolled out in additional plants. What’s more, through our continued partnership with Agfa, the Delano solution will continue to be enhanced and Agfa will soon be offering this software to other print media companies. |

| |

| One example of our technological leadership is the extent to which we can calibrate the quality and colors of high volume retail insert programs being printed in multiple plants. Any fine-tuning of color can be directed from the main plant and the customer can be provided with a statistical record of how the product was produced at every site.

|

This takes the guesswork out of the process and allows the customer to get uniform quality from a single supplier on a multi-plant program. |

| | |

18

Forbes Global is an example of a global customer benefiting from our technological leadership. Data for this magazine is transmitted from New York to Austria for printing 24 times per year. The magazines are then distributed throughout Europe, the Middle East, India and Pakistan. To maximize flexibility for the customer, Quebecor World utilizes the most up-to-date technology, including a PDF workflow, Mass Transit for data transmission from North America to Europe, and the latest in ink jet equipment which allows us to ink jet directly onto poly material rather than carrier card, saving time and money. |

| |

|

| |

“Quebecor World’s technology enhancements allow us to operate with a fast-paced schedule for Forbes Global, shrinking the time from writer/editor to reader. Technology affords us the flexibility of accommodating late-breaking editorials as well as limited late advertising. All of this ultimately means that we can insure the relevance of our publication in today’s fast-paced world, bring in more revenue and demonstrate our speed to market.” Elaine Fry, Group Director, Manufacturing and Production, Forbes Global |

19

Our Environment

Our Responsibility Quebecor World aims to use resources efficiently and we apply pollution-prevention measures in all our printing and related operations worldwide in an effort to maintain a healthy environment for present and future generations. |

|

| |

| Each year hundreds of Quebecor World employees participate in a variety of Earth Day events. One example is our employees’ efforts over the last three years in the reforestation of a large park near the Richmond Hill plant, just north of Toronto, Ontario, Canada. In 2002, employees planted 300 saplings and more mature trees, all donated by the Company. The reforestation project is expected to continue for another five years. “The work is bringing back nature to an area that’s seen quite a lot of devastation. In the long term, the trees will grow and provide shade and cooling for the streams so that the fish can spawn. It’s very satisfying to know that, in a small way, we’ve done something to make that happen.” |

Michael Druce, Environmental Coordinator, QW Aurora/Richmond Hill |

| | |

20

|

| |

“Quebecor World has been printing the Earth Day Canada posters and other critical communications pieces on our behalf since 1996. Not only do we get the work done for free, but they also make our work look so much more professional. This has been an invaluable resource to us and one that we value very much.” Jed Goldberg, President, Earth Day Canada |

21

“Quebecor World is one of the first to install Regenerative Thermal Oxidizer technology in the printing industry where the destruction efficiency exceeds local and national Regulatory Compliances. We are proud to be a Supplier/Partner of a company such as Quebecor World that it is determined to always use cutting-edge technology to ensure a clean and safe environment.” |

Alan Fiers,

President, MEGTEC SYSTEMS (RTO manufacturer) |

| |

|

|

Quebecor World makes it a point to have its printing plants equipped with the best available technology for emission control. That’s why we continue to invest in Regenerative Thermal Oxidizers or RTOs. Now, more than 50 RTOs are installed in 40 of our plants, replacing their less efficient, energy-consuming counterparts by outperforming them in every aspect. They destroy 99% of the pollutants that would otherwise be released into the atmosphere, and use up to 95% less fuel (natural gas) than the other most commonly used control device. In 2003, we plan to install at least five more RTOs. |

22

Limiting air emissions is the main environmental concern that we face as a printer, but we are also concerned about recycling paper and ink, processing waste water, recovering solvent, and looking for other opportunities to reduce, reuse and recycle. Recycling initiatives are under way throughout Quebecor World. In North America alone, we sent close to 700,000 metric tonnes of paper for recycling last year. As the largest buyer of paper in the world, we consider it an important responsibility to invest in better equipment for segregating, shredding and baling our waste paper for recycling. For example, our plant in Lebanon, Ohio recently installed two new baler systems and a vertical shredder which enable it to segregate waste paper and handle larger volumes. |

|

|

| |

Waste paper for recycling is headed to new shredder at Lebanon, Ohio facility (left). New paper balers at Lebanon facility (right) |

| |

|

| |

Our employees are instrumental in finding new ways to reduce, reuse and recycle. Our plant in Covington, Tennessee, for example, found an outlet for its core plugs, shown directly above, which come from each of the rolls of paper it uses. These plugs are now picked up free of charge to be reused by a nearby coated paper facility rather than being sent to the local landfill. The combined impact of projects such as these makes a huge difference to our impact on the environment. |

| |

Quebecor World is committed to: |

Complying with applicable laws and regulations and other requirements pertaining to the environment. |

Opting for processes and management practices that promote a more rational use of energy. |

Optimizing the 3R (Reduce, Reuse, and Recycle) approach in its pollution-prevention strategy by adopting, as much as possible, products and processes that allow for reduction at source, and the reuse and recycling of waste materials and by-products. |

Collaborating closely with clients, suppliers, and various stakeholders (government, industry, community groups, etc.) to improve the protection of the environment. |

Maintaining an efficient organizational structure and developing methods and procedures to help fulfill its commitments. |

Training, motivating, and educating its employees to ensure their support in implementing this policy. |

Verifying periodically the compliance of its activities with its policy and submitting reports to the appropriate management bodies, headed by the Environment Committee. |

23

Our Community

Our Promise Across our global platform, Quebecor World and its employees are constantly looking for ways to reach out and make our communities better. The Company believes in making a significant contribution to the growth and prosperity of the communities in which it operates through education, donation and social programs, and by providing employment. |

|

| |

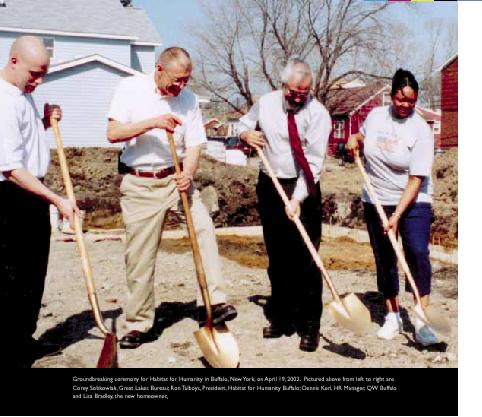

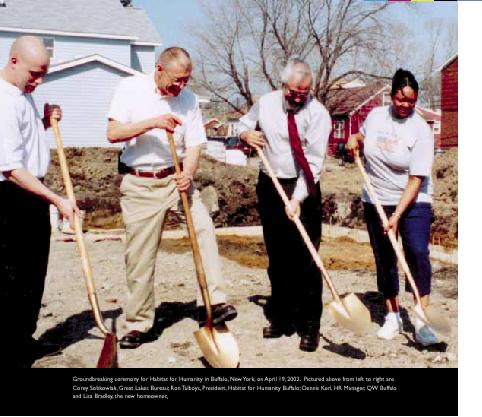

| Habitat For Humanity is one of the most successful continuous community service projects in history. Quebecor World, its employees and their families are enthusiastic supporters of this program, which helps provide housing for families in need. Over the last few years, employees assisted with the construction of homes for families in several U.S. communities — Versailles, Kentucky; Franklin, Kentucky; Mount Morris, Illinois and Buffalo, New York. Our Buffalo plant has driven the fundraising of three Habitat houses over the last four years. Based on its unique fundraising approach and demonstrated commitment to Habitat for Humanity, our Buffalo plant was awarded the Oprah Winfrey Angel award. |

| | |

24

|

| |

“There is a real reward in building a house. You can see what you accomplish and feel the difference. It’s almost magic when you help someone and the one thing you get in return is a smile." Liz Cash, Production Assistant, QW Buffalo |

25

|

| |

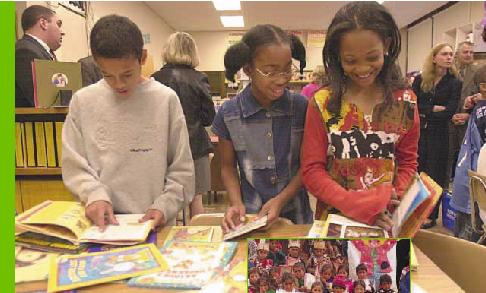

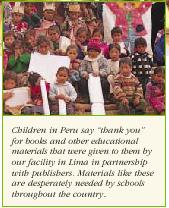

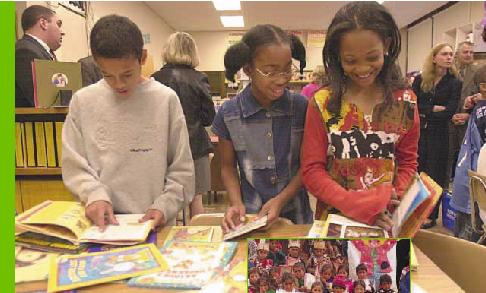

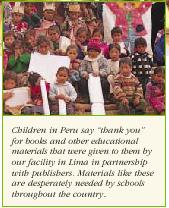

Quebecor World and our employees help support more than 100 educational and literacy institutions and associations across North America through donations and volunteer work. We are the global leader in books, with book printing facilities in North America, Europe and Latin America. As part of our desire to give back to the community, Quebecor World and our publishers donate books to schools and libraries in many countries. |

Our book facility in Buffalo alone, in partnership with its publishers, has donated more than one million books for children’s literacy. We are also a founding member of Libraries for Kids, which donates books to schools in the area. In Latin America, we have donated books to schools and organizations in several countries. We believe that participating in local initiatives and giving back to the community adds value for our employees, customers and ultimately our shareholders. |

| |

|

26

“Giving back is important. As a global Company, we believe it is important to invest in the communities where we operate to try to help improve people’s lives, especially in areas of education.” Guy Trahan, President,

QW Latin America |

| |

|

| |

|

| |

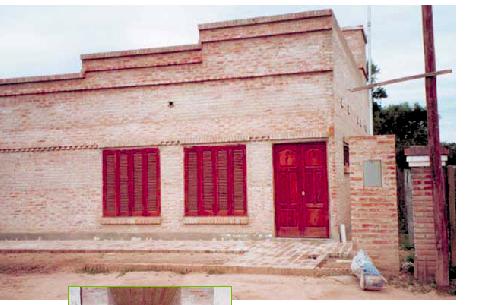

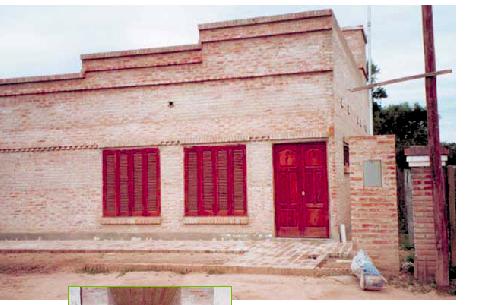

In 2002, Quebecor World initiated a project to build a school in Argentina in partnership with A-Z Editora. The school in Pampa del Infierno is now completed. The village’s first school will allow 70 local children to receive academic instruction without having to leave their home village. Quebecor World helped fund the project, while A-Z Editora donated books and other school materials. |

27

| Our Global Reach Our Competitive Advantage | |

|

| Quebecor World’s global platform helps our customers expand their business into new markets. Publishers and retailers can benefit from the knowledge and support of a trusted supplier that is already established in those markets. | |

Our globally linked, diversified network, in North America, Europe and Latin America creates significant cross-selling opportunities, leverages our global purchasing power and makes us less dependent on any one economy. |

| |

28

|

Quebecor World’s global one-stop shopping is an important advantage for customers such as Forbes, Hachette, Office Depot, Avon, Scholastic, McGraw-Hill, IKEA, Santillana and many others who are doing business with us on more than one continent. Multinational customers can obtain print production from a single supplier and benefit from manufacturing in, or closer to, their foreign markets. |

29

Our Products

Our Diversity

Magazines

Quebecor World is the world’s leading printer of consumer magazines. We print more than 1,000 magazine titles including: Time, Sports Illustrated, People, Rolling Stone, Elle, TV Guide, Good Housekeeping, Car and Driver, among others. Our customer list includes the major players in magazine publishing, such as AOL Time Warner, Primedia, Hachette Filipacchi Medias, Condé Nast Publications, Hearst Corporation, and Scholastic.

Catalogs

Quebecor World is the largest printer of catalogs in the world. We print several hundred different catalogs on an annual basis for many of North America’s retailers such as L.L. Bean, Office Depot, Brylane, JCPenney, Avon, Blair Corporation, Williams-Sonoma, Oriental Trading Company, United Stationers, and Spiegel, to name a few. We are also a leading catalog printer in Europe, where we print the IKEA catalog in four countries and serve most of the major mail-order companies.

*For North America only.

30

Quebecor World offers an unrivaled range of print media products and services. Customers can call on us at every step of the way from premedia to distribution, for their local, national and even international print programs.

Retail Inserts and Sunday Magazines

Quebecor World is the leading North American printer of retail inserts and Sunday magazines. We offer the only coast-to-coast web offset and gravure platform for the North American retail sector. Our customers include almost every major national retailer and Sunday magazine, including Sears, Parade, CVS, USA Weekend, and JCPenney. We are also a major player in the European Sunday magazine market, particularly in the U.K., where we have 40 percent of the domestic market.

Specialty Printing and Direct Mail

These products include brochures, annual reports, calendars, promotional games, direct mail, highly personalized catalog and magazine cover wraps, and promotions for the automotive, travel, pharmaceutical, telecommunications, financial services and other industries. Our unparalleled in-line and offline finishing capabilities allow us to produce complex personalized promotional packages that add impact and increase response rates. Customers include News America, International Masters Publishers, AT&T Wireless, Pfizer, JCPenney, Tiffany and Co., Mary Kay Cosmetics, and Prudential Insurance of America.

31

Our Products

Our Diversity

Books

With manufacturing facilities in North America, Latin America and Europe, Quebecor World is the largest international manufacturer of books. We provide a wide range of services for the world’s leading publishers of consumer, educational, religious and specialty books including Simon & Schuster, McGraw-Hill, AOL Time Warner, Scholastic, Reed Elsevier, Thomson, Houghton Mifflin, Pearson and Reader’s Digest.

Directories

Quebecor World is a leading printer of directories in North America and Latin America, and we recently began printing directories in Europe. We are a major supplier to all of the leading directory publishers in North America including SBC SMART Yellow Pages, Qwest Dex, Verizon Information Services, TransWestern Publishing, Yellow Book USA, Yellow Pages Group, and MTS Advanced.

32

Premedia Services

Que-Net MediaTM provides premedia services primarily to our print customers. These services include a full array of capabilities including creative, photography, digital prepress, color management, content management, automated publishing and workflow solutions. Que-Net Media’sTM customers include Sears, McGraw Hill, Advo, Primedia, and Hachette Filipacchi Medias.

Logistics

Quebecor World Logistics is the industry leader in print logistics services, offering complete customized door-to-door distribution planning management, transportation, delivery and tracking solutions to our customers. We are the largest business partner of the United States Postal Service (USPS) and have been formally recognized by the USPS as having the best on-time delivery record in the industry. Our customer list includes major players in all classes of mail such as Scholastic, Sears, L.L. Bean and Forbes.

*North America only.

33

QW NorthAmerica

Strong Leadership

David Boles, | John Paloian, |

Chief Operating Officer,

QW North America | Chief Operating Officer,

QW North America |

| |

• Retail and Sunday

Magazine | • Magazine and Catalog |

• Commercial and Direct |

• Book Services | • Logistics Services |

• Directory Group | |

• Premedia Services | |

In North America 2002 was, like 2001, a difficult year in the printing industry. Across most markets, we continued to see soft demand, extremely competitive pricing and pressure on our margins. As the market leader, our customers, employees, investors, and suppliers looked to us to provide leadership in these times, to show them that, as uncertain as the markets were, a strong company can weather such events, and forge a path toward profitable growth. That is what a leader does.

In 2002 Quebecor World fulfilled its obligation to lead. We invested in new equipment, we invested in training and we gained market share. As a leader committed to the printing industry, part of our strategy is independent of cyclical market swings. We are the leading printer in the world and we understand that we need to constantly invest in new technology, to train and empower our employees, and to constantly grow our market share. It is what we do, regardless of natural economic cycles. Our commitment to this strategy is what has made us a leader and what will keep us at the forefront in delivering value to our constituents. That is what a leader does.

In 2002 we had impressive wins in all our business groups, thanks in part to the growing success of our one-stop shopping concept.

34

Our North American coast-to-coast gravure and offset platform coupled with our logistics and premedia businesses offer an exceptional range and mix of services. Our Logistics group is recognized by the U.S. Postal Service as having the best on-time performance in the USPS network. These and other advantages continue to attract the biggest and best publishers and retailers. For example, we do business with the top twenty magazine and catalog publishers in the U.S. and these relationships are growing because of our multi-service offering. That is what a leader does.

A leader also develops a strong bench strength of management. In 2002 we saw just how strong that bench strength was with the appointment of John Paloian and David Boles as Chief Operating Officers of QW North America. Together, they have more than thirty years of experience in the printing industry. John Paloian continues to oversee the Magazine/Catalog Group, but has reached into the ranks to appoint new leaders to manage the day-to-day responsibilities of his Group. He now also oversees the Commercial/Direct and Logistics Groups. Similarly, David Boles continues to oversee the Retail/Sunday Magazine Group, and has added the Book Services, Directory and Premedia Groups to his responsibilities. They and their teams have stepped into their new roles with vigor and clarity of purpose, continuing the strategic vision that their mentors taught them. Without missing a beat, Quebecor World moves on, eyes on the future, investing in its platform and people, and delivering more value to its customers day by day. That is what a leader does.

35

QW Europe

Successes and Challenges

Vincent Bastien, | John Dickin, |

President, | Executive Vice President, |

QW Europe | QW Europe |

In Europe we are committed to delivering margins that are broadly in line with those we enjoy in North America, expanding the range of services we can offer our customers, and increasing our geographic reach. In 2002 we made tremendous strides toward delivering on those commitments.

Our businesses outside France have been successfully restructured and margins have improved substantially so that they are now broadly in line with North American levels. This is particularly encouraging, given the global economic recession. In France however, we have experienced delays and difficulties primarily related to social and legal issues that are unique to France. Our French management team has a clearly defined strategy that is designed to systematically tackle these issues, ultimately bringing down the cost base to ensure that we can increase margins to acceptable levels.

Our geographic reach was expanded in 2002 with the acquisition of the European printing assets of Hachette Filipacchi Medias. This acquisition provided us with a unique opportunity to expand our gravure platform in Europe, enter the Belgium market, and secure a 10-year $400 million contract with

36

one of the world’s major publishers. Our Belgian gravure facility will also allow us to produce work for the U.K. market. As well, we have recently signed new Hachette contracts and renewed existing agreements in Spain, the United Kingdom, Sweden and France. This demonstrates the clear benefits of our strategy of partnering with the largest and most successful users of print media products.

In Spain we entered into our first European directory agreement with Telefónica de España. Our greenfield directory operation, Roto Alpha, based in Barcelona, began printing telephone directories. This partnership with Telefónica is also leading to new agreements with their subsidiaries in Latin America.

Our sales and marketing personnel have also made great strides in working together to ensure that our customers have the benefits of our multi-plant network. We are witnessing a growing trend of international companies centralizing their own purchasing operations and we have been able to deal successfully with them and provide mutually beneficial print solutions. One such company, IKEA, through its offices in Belgium, deals with Quebecor World for all its global printing requirements. This has resulted in work for our plants in the U.S., France, Sweden and Finland for IKEA operating companies in Denmark, Norway, Finland, Russia, Canada, USA, Kuwait, Saudi Arabia and Dubai.

In summary, 2002 was a year that saw good progress in achieving our goals; however, there is still much to do in France. We are committed to working through the problems there and strongly believe that we have the basis of a solid business that offers strategic benefits to the whole platform.

37

QW Latin America

Opportunity for Growth

Pablo Petit, | Guy Trahan, | Pedro Isasi, |

Regional Vice President, | President, | Regional Vice President, |

Mexico | QW Latin America | Peru, Argentina and |

| | Colombia |

Growth is defined as the act or process of development. For Quebecor World Latin America, growth is not an end in itself but rather the means to an end - improving shareholder value. We are confident that reasonable, medium-term improvements in Latin American personal disposable income will drive significant increases in print demand. In the short term, we believe that the regional market is sufficiently fragmented to allow Quebecor World to achieve double-digit growth through increases in market share.

For Latin America, 2002 was a year of economic challenge, but the real difficulties of a 0.5% decrease in regional Gross Domestic Product, average regional inflation of 12% and devaluations in Argentina and Brazil proved the soundness of Quebecor World’s strategy. Quebecor World Latin America marked its fifth year of operations in the region with a 13% growth in sales and a 37% increase in operating profit before restructuring and other charges, all calculated in U.S. dollars. The strategy to accomplish this was simple:

• Develop a network of plants, diversified by product and location, to minimize risks

• Cover all Latin American population centers with a global offering

• Leverage communication networks to standardize products and reduce costs

• Increase product specialization.

38

In five years, the Company has established operations in Mexico, Colombia, Peru, Chile, Argentina and Brazil. Acquisitions were complemented with substantial organic growth as the firm installed 23 presses and 18 binders to serve new clients. In 2002, weakness in the Southern Cone nations of Argentina, Brazil and Chile were offset by stronger economic performance in Peru and Mexico. Product diversification has increased as strong growth in books (particularly textbooks) and directories has balanced market weakness in magazines and inserts. Country and product specific risk has been reduced.

Latin America is a market of almost 500 million consumers but it is a region of large distances and great cultural diversity. To succeed, Quebecor World has located facilities in each of the largest population centers and staffed the plants with capable local management. Individual plants are linked with fibre optic and satellite communications and processes and quality are standardized. This permits our growing local sales forces to sell the network even as individual plants can specialize in particular products.

This network is also linked to the Company’s North American and European clients and facilities. Multinational clients can source print production from one supplier but benefit from distributed manufacturing. Less time-sensitive clients who may have moved production to Asia in search of reduced costs can now achieve the same financial benefits in Latin America but with dramatically improved delivery times.

These advantages have translated into results in 2002. Multi-year agreements have been signed with Telefónica de España, Reader’s Digest, Editora Abril, Book of Hope, Rezza Editores, Zamora Ediciones, and A-Z Editores, among others. Ongoing relationships have grown with multi-regional clients such as Wal-Mart, Planeta, Santillana, Avon, Thomas Nelson and McGraw Hill. Management looks to 2003 with confidence that the market successes of 2002 will be the basis for sustained earnings growth in the coming year.

39

Corporate Governance

Board of Directors

The Board of Directors of the Company considers good corporate governance practices an important factor in the overall success of Quebecor World Inc. The Company has recently approved and adopted various new and revised corporate governance practices following the comprehensive review of its corporate governance undertaken in 2002. These new and revised practices were adopted in order to best comply with the proposed TSX Disclosure and Continued Listing Requirements and Guidelines (and other Canadian securities legislation), as well as the NYSE proposed Corporate Governance Listing Standards, the Sarbanes-Oxley Act and other U.S. securities legislation to which the Company is subject.

Following its corporate governance review, the Board of Directors adopted new mandates (a general description of which is provided below), which will be effective immediately following Quebecor World’s Annual Meeting of Shareholders to be held on April 2, 2003:

• A new mandate for the Board of Directors, recognizing that, although Quebecor World’s management conducts the Company’s day-to-day operations, the Board of Directors has a duty of stewardship and will regularly assess and monitor the performance of management.

• A revised mandate for the Audit Committee, pursuant to which the Audit Committee will assist the Board of Directors in overseeing the Company’s financial controls and reporting. This committee will also monitor whether the Company is in compliance with its financial covenants and legal and regulatory requirements governing financial disclosure matters.

• A new mandate for the newly created “Nominating and Corporate Governance Committee,” pursuant to which the committee will be responsible for assisting the Board in developing the Company’s approach to corporate governance issues, proposing new board nominees and assessing the effectiveness of the Board and its committees, their respective chairs and individual directors.

• A revised mandate for the Human Resources and Compensation Committee (formerly “Compensation Committee”), pursuant to which the committee will assist the Board of Directors in discharging its responsibilities relating to executive and other human resources hiring, assessment, compensation and succession planning.

• A revised mandate for the Pension Committee, providing that the committee will assist the Board of Directors in discharging its responsibilities with respect to the Company’s pension plans.

• A new mandate for the Executive Committee, pursuant to which the Executive Committee will deal with such matters as cannot be effectively dealt with by the Board of Directors in a timely fashion.

• A formal mandate for the non-executive Chairman of the Board, confirming his responsibility for taking all reasonable measures to ensure that the Board of Directors fully executes its mandate and that directors clearly understand and respect the boundaries between Board and management responsibilities.

• A formal mandate for the Chief Executive Officer of the Company for the management of Quebecor World’s strategic and operational agenda, and for the execution of the Board’s decisions.

Effective February 3, 2003, the Company has also adopted:

• A policy that prohibits both the extension of any new personal loans to directors or executive officers of the Company and the renewal of, or material modification to, any existing personal loans to such persons.

• A policy that permits individual members of the Board of Directors and certain committees to seek legal or expert advice from a source independent of management at Quebecor World’s expense.

40

Board of Directors

The Right Honourable Brian Mulroney | | Raymond Lemay |

Chairman | | Corporate Director |

QUEBECOR WORLD INC. | | |

Senior Partner | | Eileen A. Mercier |

OGILVY RENAULT | | Vice-Chair of the Board, |

| | Workplace Safety and Insurance Board (Ontario) |

Érik Péladeau | | |

Vice Chairman and Senior Executive Vice President | | Jean Neveu |

QUEBECOR WORLD INC. | | Chairman |

Vice Chairman | | QUEBECOR INC. |

QUEBECOR MEDIA INC. and QUEBECOR INC. | | and GROUPE TVA INC. |

| | |

Reginald K. Brack | | Robert Normand |

Former Chairman and Chief Executive Officer | | Corporate Director |

TIME INC. | | |

| | Pierre Karl Péladeau |

Charles G. Cavell | | President and Chief Executive Officer |

Deputy Chairman | | QUEBECOR MEDIA INC., QUEBECOR INC. |

QUEBECOR WORLD INC. | | and Chairman, NURUN INC. |

| | |

Robert Coallier | | Alain Rhéaume |

President and Chief Executive Officer | | President and Chief Executive Officer |

CERVEJARIAS KAISER | | MICROCELL PCS |

| | |

Michel Desbiens | | |

President and Chief Executive Officer | | |

QUEBECOR WORLD INC. | | |

| | |

James Doughan | | |

Corporate Director, Consultant | | |

| | |

| | |

| | |

41

Senior Management

SENIOR MANAGEMENT | | Magazine and Catalog | | Pedro Isasi |

QUEBECOR WORLD INC. | | | | Regional Vice President, Peru, |

| | Rick Marcoux | | Argentina and Colombia |

| | President, Magazine Services | | |

Michel Desbiens | | | | Reynaldo Mina |

President and Chief Executive Officer | | George Zengo | | Vice President, Sales, Brazil |

| | President, | | |

Érik Péladeau | | Catalog and Direct Services | | Pablo Petit |

Vice Chairman and | | | | Regional Vice President, Mexico |

Senior Executive Vice President | | | | |

| | Que-Net Media™ | | Ron Steele |

Claude Hélie | | | | Vice President, Operations, Directories |

Executive Vice President and | | John Bertuccini | | |

Chief Financial Officer | | President | | Alberto Umaña |

| | | | Vice President, Operations, Book Division |

| | Retail and Sunday Magazine | | |

| | | | Carlos Herman Aguirre Vargas |

QW NORTH AMERICA | | Brian Freschi | | General Manager, Quebecor World Chile |

| | President | | |

David Boles | | | | Ruben Vicente |

Chief Operating Officer, | | Hans Nielsen | | Vice President, Human Resources |

Quebecor World North America | | President, Retail Offset Group | | |

| | | | |

John Paloian | | Tony Galasso | | CORPORATE OFFICERS |

Chief Operating Officer, | | President, Magazine, Catalog and | | |

Quebecor World North America | | Specialty Groups, Canada | | Denis Aubin |

| | | | Senior Vice President, |

John Bertuccini | | East Group Canada | | Corporate Finance and Treasury |

President, International Sales | | | | |

| | Richard Tremblay | | Yves Bertrand |

Rick Lane | | President | | Vice President, Internal Audit |

Executive Vice President, | | | | |

North America Services | | | | David Blair |

| | | | Senior Vice President, Manufacturing, |

Heidi Nolte | | QW EUROPE | | Environment and Technology |

Senior Vice President, | | | | |

Information Technology | | Vincent Bastien | | Diane Dubé |

| | President | | Assistant Vice President, |

Daniel O’Brien | | | | Corporate Controller |

Senior Vice President, Paper Operations | | John Dickin | | |

| | Executive Vice President | | Carl Gauvreau |

Paul Runko | | | | Senior Vice President |

Vice President, Client Financial Services | | Mike Young | | and Chief Accounting Officer |

| | Senior Vice President, | | |

Mark Shapiro | | International Financial Operations | | Bruce W. Hannah |

Senior Vice President, Human Resources | | and Control | | Vice President, Human Resources |

| | | | |

Troy Reed | | Paul Jones | | Claire Lanctôt |

Executive Vice President, Operations | | Vice President, International Sales | | Vice President, Business Development |

| | | | |

Robert Stepusin | | Antonio Fernandez Jurado | | Nicolas Lavoie |

Executive Vice President, Finance | | Managing Director, Spain | | Assistant Treasurer, Corporate Finance |

and Administration | | | | |

| | Erwin Loderbauer | | Raynald Lecavalier |

Book Services | | Managing Director, Austria | | Vice President, Corporate General |

| | | | Counsel and Secretary |

Jerry Allee | | Rainier Ruckelhausen | | |

President | | Director Sales and Marketing, Germany | | Sylvain Levert |

| | | | Vice President, Corporate Services |

Commercial and Direct | | Tomas Salzmann | | and Logistics (Switzerland) |

| | Managing Director, Nordic | | |

Fran Canzano | | | | Pierre R.Martel |

President | | Thierry Zemour | | Vice President, Taxation and Real Estate |

| | Chief Information Officer | | (Switzerland) |

Directory Group | | | | |

| | | | Jeremy Roberts |

David Bragen | | QW LATIN AMERICA | | Vice President, Corporate Finance |

President | | | | and Investor Relations |

| | Guy Trahan | | |

Logistics Services | | President | | |

| | | | |

Daniel J. Scapin | | Sean Twomey | | |

President | | Senior Vice President | | |

| | | | |

| | Tony Scaringi | | |

| | Vice President, Finance | | |

42

Quebecor World Inc. | | | | | |

| | | | | |

Quebecor World | | Quebecor World | | Quebecor World | |

Head Office | | North America | | Latin America | |

612 Saint Jacques Street | | 340 Pemberwick Road | | Maipu 939, 1 er piso | |

Montreal, Quebec | | Greenwich, CT 06831 | | (1006) Buenos Aires | |

Canada H3C 4M8 | | United States | | Argentina | |

Tel.: (514) 954-0101 | | Tel.: (203) 532-4200 | | Tel.: 54 114 313 7107 | |

(800) 567-7070 | | Fax: (203) 532-4373 | | Fax: 54 114 314 6266 | |

Fax: (514) 954-9624 | | | | | |

| | | | | |

| | Quebecor World Europe | | | |

Quebecor World | | 114, avenue Charles de Gaulle | | | |

Route des Arsenaux 15 | | 92522 Neuilly-sur-Seine | | | |

1700 Fribourg | | France | | | |

Switzerland | | Tel.: 33 (1) 55 62 11 11 | | | |

Tel.: 41 26 347 4777 | | Fax: 33 (1) 55 62 11 01 | | | |

Fax: 41 26 347 4778 | | | | | |

43

Shareholder Information

Five-Year Financial Review

Income, Cash Provided from Operating Activities and Free Cash Flow (in millions of U.S. dollars except per share data)

| | 2002 | | Q4 | | Q3 | | Q2 | | Q1 | | 2001 | | 2000 | | 1999 | | 1998 | |

| | | | | | | | | | | | | | | | | | | |

Revenues | | 6,242.0 | | 1,693.4 | | 1,617.9 | | 1,471.5 | | 1,459.2 | | 6,320.1 | | 6,521.1 | | 4,952.5 | | 3,808.2 | |

Cost of sales | | 4,842.9 | | 1,324.1 | | 1,238.7 | | 1,140.0 | | 1,140.1 | | 4,878.9 | | 4,991.7 | | 3,846.1 | | 2,979.9 | |

Selling, general and administrative expenses | | 500.7 | | 123.1 | | 127.9 | | 120.3 | | 129.4 | | 485.6 | | 459.5 | | 347.9 | | 287.4 | |

Depreciation and amortization | | 335.6 | | 85.9 | | 83.4 | | 83.4 | | 82.9 | | 337.8 | | 345.1 | | 286.0 | | 223.8 | |

Operating income before restructuring and other charges | | 562.8 | | 160.3 | | 167.9 | | 127.8 | | 106.8 | | 617.8 | | 724.8 | | 472.5 | | 317.1 | |

Restructuring and other charges | | 19.6 | | 19.6 | | — | | — | | — | | 270.0 | | (2.7 | ) | 180.0 | | — | |

Operating income | | 543.2 | | 140.7 | | 167.9 | | 127.8 | | 106.8 | | 347.8 | | 727.5 | | 292.5 | | 317.1 | |

Financial expenses | | 170.2 | | 42.7 | | 39.8 | | 42.2 | | 45.5 | | 208.8 | | 231.5 | | 122.2 | | 64.3 | |

Income taxes | | 90.9 | | 26.3 | | 29.1 | | 20.8 | | 14.7 | | 52.0 | | 137.7 | | 48.4 | | 72.9 | |

Minority interest | | 2.8 | | 1.1 | | 0.5 | | 0.6 | | 0.6 | | 3.2 | | 2.4 | | 12.7 | | 3.2 | |

Goodwill amortization, net of income taxes | | — | | — | | — | | — | | — | | 61.4 | | 60.5 | | 31.7 | | 17.0 | |

Net income before restructuring and other special charges | | 303.4 | | 94.7 | | 98.5 | | 64.2 | | 46.0 | | 248.7 | | 293.4 | | 204.5 | | 159.7 | |

Net income** | | 279.3 | | 70.6 | | 98.5 | | 64.2 | | 46.0 | | 22.4 | | 295.4 | | 77.5 | | 159.7 | |

Non-cash items in net income: | | | | | | | | | | | | | | | | | | | |

Depreciation of property, plant and equipment | | 313.2 | | 79.9 | | 77.8 | | 78.2 | | 77.3 | | 314.9 | | 325.3 | | 269.7 | | 214.2 | |

Amortization of goodwill and deferred charges | | 22.4 | | 6.0 | | 5.6 | | 5.2 | | 5.6 | | 84.3 | | 80.3 | | 48.0 | | 26.6 | |

Non-cash portion of restructuring and other charges | | (0.5 | ) | (0.5 | ) | — | | — | | — | | 142.6 | | (7.0 | ) | 111.3 | | — | |

Future income taxes | | 56.7 | | 16.5 | | 17.9 | | 10.0 | | 12.3 | | (42.8 | ) | 91.8 | | (8.7 | ) | 29.6 | |

Other | | 8.3 | | 5.3 | | (1.1 | ) | 2.0 | | 2.1 | | 10.5 | | (0.1 | ) | 10.1 | | (5.3 | ) |

Changes in non-cash balances related to operations: | | | | | | | | | | | | | | | | | | | |

Trade receivables | | (91.0 | ) | 76.1 | | (117.8 | ) | 89.1 | | (138.4 | ) | 190.0 | | 128.6 | | 175.8 | | 20.1 | |

Inventories | | (21.0 | ) | 30.0 | | (17.7 | ) | (22.8 | ) | (10.5 | ) | 77.2 | | 8.8 | | 34.2 | | 29.0 | |

Trade payables and accrued liabilities | | (18.4 | ) | 33.0 | | 55.1 | | (106.5 | ) | — | | (138.9 | ) | 18.6 | | (44.9 | ) | (49.8 | ) |

Other current assets and liabilities | | 43.7 | | 35.3 | | 27.8 | | (8.9 | ) | (10.5 | ) | 20.3 | | (48.6 | ) | 33.0 | | (4.7 | ) |

Other non-current assets and liabilities | | (79.3 | ) | (51.3 | ) | (15.9 | ) | (1.1 | ) | (10.9 | ) | (104.0 | ) | 24.7 | | 4.1 | | (5.5 | ) |

Cash provided from operating activities | | 513.4 | | 300.8 | | 130.2 | | 109.4 | | (27.0 | ) | 576.5 | | 917.8 | | 710.1 | | 413.9 | |

Free cash flow from operations* | | 319.8 | | 262.4 | | 97.4 | | 40.1 | | (80.1 | ) | 287.2 | | 747.3 | | 552.6 | | 124.8 | |

Per share data | | | | | | | | | | | | | | | | | | | |

Earnings** | | | | | | | | | | | | | | | | | | | |

Diluted | | 1.76 | | 0.44 | | 0.64 | | 0.40 | | 0.28 | | — | | 1.91 | | 0.54 | | 1.29 | |

Diluted before restructuring and other special charges | | 1.92 | | 0.61 | | 0.64 | | 0.40 | | 0.28 | | 1.58 | | 1.90 | | 1.55 | | 1.29 | |

* Cash provided from operating activities, less capital expenditures net of proceeds from disposals, and preferred share dividends.

** Effective January 1, 2002, net income and earnings per share reflect the new accounting policy adopted by the Company under which goodwill is no longer amortized.

44

Consolidated Balance Sheets (in millions of U.S. dollars)

| | 2002 | | Q4 | | Q3 | | Q2 | | Q1 | | 2001 | | 2000 | | 1999 | | 1998 | |

| | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | 2.7 | | 2.7 | | 1.4 | | 1.3 | | 3.9 | | 85.5 | | 52.7 | | 3.6 | | 0.3 | |

Trade receivables | | 480.5 | | 480.5 | | 538.4 | | 429.0 | | 509.6 | | 368.5 | | 587.1 | | 743.3 | | 695.9 | |

Inventories | | 409.4 | | 409.4 | | 430.4 | | 417.8 | | 387.8 | | 377.1 | | 461.4 | | 486.2 | | 233.0 | |

Income taxes receivable | | 21.7 | | 21.7 | | 41.8 | | 50.1 | | 24.9 | | 36.6 | | 36.1 | | 31.2 | | 0.2 | |

Future income taxes | | 27.8 | | 27.8 | | 58.2 | | 58.2 | | 58.0 | | 58.0 | | 58.1 | | 36.4 | | 9.4 | |

Prepaid expenses | | 25.2 | | 25.2 | | 28.0 | | 30.0 | | 23.1 | | 24.1 | | 26.0 | | 27.8 | | 25.1 | |

Total current assets | | 967.3 | | 967.3 | | 1,098.2 | | 986.4 | | 1,007.3 | | 949.8 | | 1,221.4 | | 1,328.5 | | 963.9 | |

Property, plant and equipment, net | | 2,610.6 | | 2,610.6 | | 2,635.1 | | 2,703.0 | | 2,662.8 | | 2,634.0 | | 2,683.0 | | 2,895.3 | | 2,222.0 | |

Goodwill | | 2,514.3 | | 2,514.3 | | 2,493.3 | | 2,500.0 | | 2,462.9 | | 2,470.7 | | 2,459.5 | | 2,526.7 | | 639.4 | |

Other assets | | 113.3 | | 113.3 | | 123.8 | | 123.5 | | 130.7 | | 132.0 | | 156.9 | | 153.8 | | 81.2 | |

Total assets | | 6,205.5 | | 6,205.5 | | 6,350.4 | | 6,312.9 | | 6,263.7 | | 6,186.5 | | 6,520.8 | | 6,904.3 | | 3,906.5 | |

| | | | | | | | | | | | | | | | | | | |

Liabilities and shareholders’ equity | | | | | | | | | | | | | | | | | | | |

Bank indebtedness | | 0.3 | | 0.3 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 3.1 | | 5.6 | | 15.6 | |

Trade payables and accrued liabilities | | 1,067.0 | | 1,067.0 | | 1,004.1 | | 960.7 | | 1,037.2 | | 1,024.1 | | 1,155.5 | | 1,103.2 | | 606.5 | |

Income and other taxes payable | | 70.8 | | 70.8 | | 89.8 | | 70.2 | | 46.9 | | 63.1 | | 42.1 | | 70.0 | | 42.4 | |

Current portion of long-term debt and convertible notes | | 38.5 | | 38.5 | | 43.2 | | 49.3 | | 50.2 | | 57.0 | | 87.2 | | 77.2 | | 51.1 | |

Total current liabilities | | 1,176.6 | | 1,176.6 | | 1,137.2 | | 1,080.3 | | 1,134.4 | | 1,144.3 | | 1,287.9 | | 1,256.0 | | 715.6 | |

Long-term debt | | 1,668.6 | | 1,668.6 | | 1,937.0 | | 2,037.8 | | 2,046.9 | | 1,961.9 | | 2,015.6 | | 2,582.9 | | 1,140.9 | |

Other liabilities | | 228.9 | | 228.9 | | 251.8 | | 247.1 | | 243.5 | | 245.6 | | 290.8 | | 290.2 | | 155.6 | |

Future income taxes | | 291.7 | | 291.7 | | 282.8 | | 267.9 | | 254.7 | | 234.0 | | 326.1 | | 255.0 | | 255.3 | |

Convertible notes | | 115.0 | | 115.0 | | 114.5 | | 114.1 | | 113.7 | | 113.3 | | 105.9 | | 179.8 | | 58.2 | |

Minority interest | | 20.9 | | 20.9 | | 9.8 | | 13.2 | | 14.4 | | 14.2 | | 20.6 | | 22.0 | | 17.4 | |

Shareholders’ equity | | 2,703.8 | | 2,703.8 | | 2,617.3 | | 2,552.5 | | 2,456.1 | | 2,473.2 | | 2,473.9 | | 2,318.4 | | 1,563.5 | |

Total liabilities and shareholders’ equity | | 6,205.5 | | 6,205.5 | | 6,350.4 | | 6,312.9 | | 6,263.7 | | 6,186.5 | | 6,520.8 | | 6,904.3 | | 3,906.5 | |

45

Free Cash Flow vs

Mandatory Debt Repayment In the past three years, Quebecor World has generated $1.4 billion of free cash flow from operations compared to mandatory debt repayments over the coming three years of only $75 million.

* Funded debt (long-term debts and convertible notes). | |

|

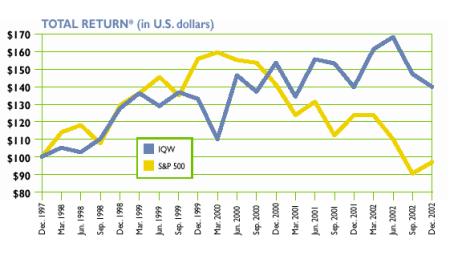

Valuation Comparisons During the period 1990-2002, diluted earnings per share grew 14% annually. With a price-earnings multiple of approximately 10 times, an investment in Quebecor World shares provides growth at a reasonable price when compared to the S&P/TSX or the S&P 500 companies generally.

(1) Using closing price as at February 7, 2003 and 2003 First Call consensus. (2) CAGR: Compounded Annual Growth Rate | |

|

46

Free Cash Flow Yield Over the past 3 years, Quebecor World has generated $1.4 billion of free cash flow from operations, representing an average of $3.04 per share annually. | |

|

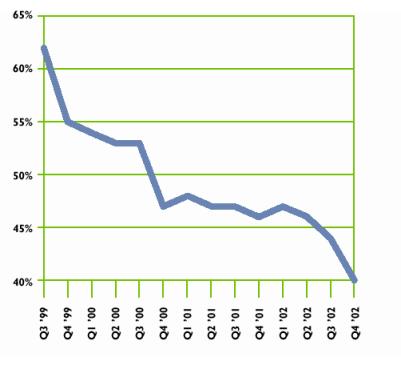

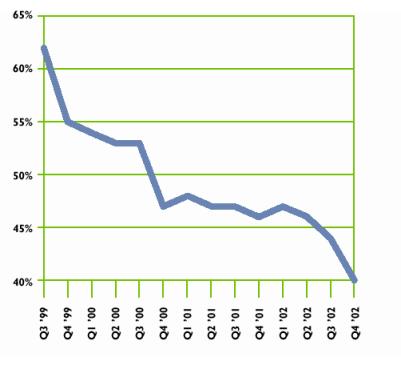

Debt-to-Capitalization Ratio Quebecor World’s ability to generate free cash flow has allowed it to reduce its debt-to-capitalization ratio to 40:60 at December 31, 2002 compared with a high of 62:38 at the time of the World Color acquisition. | |

|

47

Average Trading Volume

2000 | | 308,674 | |

2001 | | 369,838 | |

2002 | | 397,872 | |

* Value of $100 invested at the end of 1997 in Quebecor World and the S&P 500.

New York Stock Exchange (in U.S.dollars)

| | High(1) | | Low(1) | | Close | |

2000 | | $ | 26.25 | | $ | 17.56 | | $ | 25.19 | |

2001 | | $ | 27.61 | | $ | 19.23 | | $ | 22.56 | |

2002 | | $ | 29.60 | | $ | 20.30 | | $ | 22.32 | |

Toronto Stock Exchange (in CDN dollars)

| | High(1) | | Low(1) | | Close | |

2000 | | $ | 39.10 | | $ | 25.60 | | $ | 37.60 | |

2001 | | $ | 42.65 | | $ | 30.25 | | $ | 35.88 | |

2002 | | $ | 46.09 | | $ | 32.25 | | $ | 35.00 | |

(1) Closing Prices

Stock Listing

Quebecor World Inc. Subordinate Voting Shares are listed on the New York Stock Exchange and on the Toronto Stock Exchange under the symbol IQW.

Annual Meeting

The Annual General Meeting will be held at 10:00 am on April 2, 2003, at:

Le Windsor |

1170 Peel Street |

Montreal, Quebec |

Annual Information Form

The Annual Information Form may be obtained by writing to:

Corporate Secretary Quebecor World Inc.

612 Saint Jacques Street

Montreal, Quebec

H3C 4M8

Or through SEDAR at www.sedar.com

Transfer Agent and Registrar

Computershare Trust Company of Canada

Place Montreal Trust

1800 McGill College

Montreal, Quebec

H3A 3K9

Co-Transfer Agents

Computershare Trust Company, Inc.

Denver, Colorado

Auditors

KPMG LLP

Pour obtenir la version française de ce rapport annuel, s’adresser à :

Quebecor World Inc., 612, rue Saint-Jacques, Montréal (Québec), H3C 4M8

Version électronique : www.quebecorworld.com

48

[GRAPHIC]

Produced by St. Remy Media Inc.

Concept and Design: Market Fusion

Designer: François Daxhelet

Photography: Jim Arbogast; Pierre Crié; Ghislain & Marie David de Lossy;

John Kelly; Malcolm Sanders; Micheal Simpson; The Buffalo News; Daniel Wiener.

Prepress and Printing: Imprimerie Quebecor World Graphique-Couleur

Cover: Centura Dull Cover 100 lb.

Text: Centura Dull Text 100 lb.

Financial Section: Domtar Cream Text 80 lb.

Printed in Canada

49

TABLE OF

Contents

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

Financial Condition and Results of Operations

OVERVIEW

Quebecor World Inc. is the largest commercial print media services company in the world. We are market leaders in most of our product categories and geographies. This market-leading position has been built through a combination of successfully integrated acquisitions, investment in key strategic technologies and a commitment to build long-term partnerships with the world’s leading print media customers.

We have facilities in the United States, Canada, France, the United Kingdom, Spain, Switzerland, Sweden, Finland, Austria, Belgium, Brazil, Chile, Argentina, Peru, Colombia, Mexico and India.

For the year ended December 31, 2002, the Company reported diluted earnings per share of $1.76 compared to nil in 2001. These results incorporate restructuring and other special charges of a net $19.6 million or $0.16 per share compared with $270 million or $1.58 per share in 2001. Excluding the effect of the restructuring and other special charges and removing the impact of goodwill amortization in the previous year, 2002 resulted in diluted earnings per share of $1.92 compared with $1.99 in 2001. The reduction in earnings, presented on a comparable basis, was affected mostly by market conditions in two major sectors of our business: the French operations and the Commercial & Direct segment in North America. However, the Company remained focused in its other business segments and on its financial condition as illustrated by the strong generation of free cash flow and repayment of debt.

We generated free cash flow of $320 million, compared with $287 million for the same period in 2001, an increase of 11%. Free cash flow was primarily dedicated to reduce our debt, and this contributed to an 18% reduction in our financial expenses this year compared with 2001. Our cash coverage of fixed charges ratio has increased to a comfortable level above five times and our debt to capitalization ratio decreased to 40:60 from 46:54 at the end of December 2001.

Also, in 2002, following the continued struggle in France and the identification of other cost reduction opportunities in North America, the Company took additional restructuring charges which also included asset and investment write-downs and overspending on its 2001 restructuring initiatives, net of the reversal of unused reserves from 2001.

In 2001, it was in response to the significant drop in volume, that we announced a restructuring plan to shut down under-performing business units, redeploy assets and reduce our workforce. We turned the problem of unsold capacity, impacting the entire industry, into an opportunity by undertaking a restructuring that would result in fewer, larger and more specialized plants, with essentially the same capacity, but approximately 8% fewer employees. Most of the 2001 restructuring program was completed in 2002 and benefits began to accrue to the income statement in the back half of the year for our North American business groups and in European countries other than France.

Management’s focus on cost reduction, free cash flow and debt repayment resulted in higher levels of efficiency, which has uniquely positioned us to benefit from operating leverage and a solid financial condition as we enter 2003.

MARKET AND SEGMENT REVIEW

The print media industry ended a difficult year in 2001, facing unexpected declines in volume impacting most of our business groups in all three geographic regions. As we began 2002, it was expected that there would be little or no recovery in the industry, at least for the first six months.

The first half of 2002 turned out as expected, with the difficult economic environment persisting. Magazine advertising pages, as measured by the Publishers Information Bureau, remained down compared to last year for the first two quarters (figure 1). Volume pressures continued and prices were lower compared to 2001, resulting from excess industry capacity and an increased competitive environment. According to the U.S. Federal Reserve Board, the average printing capacity utilization in 2002 was 78.8%, which is one of the lowest rates in the last ten years (figure 2). The environment in the second half was stronger and allowed the Company to increase earnings and margin in the fourth quarter.

2

Magazine & Catalog

The Magazine & Catalog Group’s revenues fell by 6% to $1,671 million in 2002, from $1,785 million in 2001. The 4th quarter was the only period in which we benefited from an increase in revenues, as the magazine advertising pages (see figure 1) improved somewhat. Despite the revenue shortfall year-to-date, operating margins increased in each quarter in 2002, compared to the same periods in 2001. This is a direct result of the benefits of our restructuring programs and strict attention to costs.

The Magazine & Catalog Group is our largest business platform and contributed to our market share growth by attracting successful customers such as L.L.Bean, which recently contracted to place 100% of their catalog business and distribution with Quebecor World.

Commercial & Direct

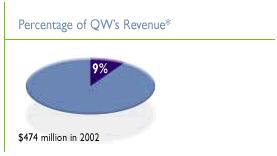

The Commercial & Direct Group’s revenues fell by 17% to $687 million in 2002, from $829 million in 2001. This Group suffered significantly in the 4th quarter of 2001 and this trend continued in 2002 with the weak promotional advertising environment.

However, the impact on operating income was softened by plant closures and the redeployment of equipment as well as the cost reductions put in place in early 2002.

During 2002, we have seen an accelerated trend toward vendor consolidation. Businesses are looking to fewer vendors who can provide more integrated turn-key services than ever before. Our breadth of capabilities coupled with our multi-facility platform position us to be a strategic partner to our clients and not just a vendor. By fine-tuning our equipment and leveraging the whole Quebecor World platform, we can satisfy the most demanding customers, such as AT&T Wireless and Johnson & Johnson, whose requirements can only be met by a company with our resources and capabilities.

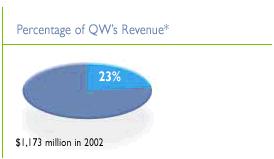

Retail

The Retail Group’s revenues increased by 9% to $1,173 million in 2002, from $1,074 million in 2001. This increase includes incremental revenue of $48 million from the acquisition of Retail Printing Corporation, which took place in July 2001. Excluding the incremental impact of this acquisition, revenues, as well as operating income, were favourable in 2002 when compared to 2001. The success in this market segment is derived from strategic capital investments in both rotogravure and offset, restructuring initiatives and our numerous gains in the area of new customer contracts. Our performance in 2002 is particularly rewarding given the price pressures we experienced in the retail print market in 2002. We have invested heavily in this market segment over the last few years to build the only coast-to-coast gravure and offset platform in North America. Our strategy is working, as a number of large, growing and successful retailers chose Quebecor World as their leading service provider in 2002.

Book Services

The Book Group’s revenues fell by 4% to $513 million in 2002, from $532 million in 2001, but operating income and margin improved compared to year 2001. Overall, our business performed well, with solid improvement in our trade book facilities and continuing strength in our educational markets. However, other book market segments remained soft, with a lower level of reprint activity.

The closing of the Hawkins facility, redeployment of assets to the Kingsport and Versailles plants, and the expansion of our Dubuque facility to service the growing educational market, better position the Group to compete in 2003. While the start-up of both new and transferred equipment at Kingsport presented challenges to us in 2002, we are confident that our turnaround plan will get the situation under control in 2003 as significant changes in executive management and plant management were made to specifically address this issue.

Directory