Exhibit 99.2

CONSOLIDATED FINANCIAL STATEMENTS

FIRST QUARTER ENDED MARCH 31, 2008

CONSOLIDATED STATEMENTS OF LOSS

Three-month periods ended March 31,

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars, except per share amounts)

(Unaudited)

| | Note | | 2008 | | 2007 | |

| | | | | | | | | |

Operating revenues | | | | $ | 1,264.6 | | $ | 1,393.4 | |

| | | | | | | |

Operating expenses: | | | | | | | |

Cost of sales | | | | 1,081.7 | | 1,176.7 | |

Selling, general and administrative | | | | 114.0 | | 113.4 | |

Securitization fees | | | | — | | 5.9 | |

Depreciation and amortization | | | | 71.7 | | 75.2 | |

Loss on abandonment of business and disposals | | 10 | | 32.0 | | 11.0 | |

Impairment of assets, restructuring and other charges | | 7 | | 39.4 | | 29.5 | |

| | | | 1,338.8 | | 1,411.7 | |

| | | | | | | |

Operating loss | | | | (74.2 | ) | (18.3 | ) |

| | | | | | | |

Financial expenses | | 8 | | 82.0 | | 33.9 | |

| | | | | | | |

Dividends on preferred shares classified as liability | | | | 2.4 | | — | |

| | | | | | | |

Reorganization items | | 4 | | 14.2 | | — | |

| | | | | | | |

Loss from continuing operations before income taxes | | | | (172.8 | ) | (52.2 | ) |

| | | | | | | |

Income taxes | | | | 17.2 | | (14.1 | ) |

| | | | | | | |

Net loss | | | | $ | (190.0 | ) | $ | (38.1 | ) |

| | | | | | | |

Net income allocated to holders of preferred shares | | | | — | | 7.2 | |

Loss available to holders of equity shares | | | | $ | (190.0 | ) | $ | (45.3 | ) |

| | | | | | | |

Loss per share: | | | | | | | |

Basic and diluted | | 9 | | $ | (1.29 | ) | $ | (0.34 | ) |

| | | | | | | |

Weighted-average number of equity shares outstanding: | | | | | | | |

(in millions) | | | | | | | |

Basic and diluted | | 9 | | 147.5 | | 131.8 | |

See accompanying Notes to Consolidated Financial Statements.

2

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

Three-month periods ended March 31,

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars)

(Unaudited)

| | Note | | 2008 | | 2007 | |

| | | | | | | |

Net loss | | | | $ | (190.0 | ) | $ | (38.1 | ) |

| | | | | | | |

Other comprehensive loss, net of income tax: | | 17, 18 | | | | | |

Unrealized gain (loss) on foreign currency translation adjustment | | | | 37.4 | | (7.5 | ) |

Unrealized net gain (loss) on derivative financial instruments related to cash flow hedges | | | | (0.1 | ) | 3.9 | |

Reclassification of realized net loss (gain) on derivative financial instruments to the statement of income | | | | (4.5 | ) | 2.3 | |

Comprehensive loss | | | | $ | (157.2 | ) | $ | (39.4 | ) |

See accompanying Notes to Consolidated Financial Statements.

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS (DEFICIT)

Three-month periods ended March 31,

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars)

(Unaudited)

| | Note | | 2008 | | 2007 | |

| | | | | | | |

Retained earnings (deficit), beginning of period, as previously reported: | | | | $ | (1,813.3 | ) | $ | 393.4 | |

Cumulative effect of change in accounting policy - Inventories | | 3 | | (21.0 | ) | — | |

Retained earnings (deficit), beginning of period: | | | | (1,834.3 | ) | 393.4 | |

Net loss | | | | (190.0 | ) | (38.1 | ) |

Dividends on preferred shares | | | | — | | (7.2 | ) |

Retained earnings (deficit), end of period | | | | $ | (2,024.3 | ) | $ | 348.1 | |

See accompanying Notes to Consolidated Financial Statements.

3

CONSOLIDATED STATEMENTS OF CASH FLOWS

Three-month periods ended March 31,

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars)

(Unaudited)

| | Note | | 2008 | | 2007 | |

Cash flows from operating activities: | | | | | | | |

Net loss | | | | $ | (190.0 | ) | $ | (38.1 | ) |

Adjustments for: | | | | | | | |

Reorganization items | | 4 | | 3.9 | | — | |

Depreciation of property, plant and equipment | | | | 71.7 | | 75.2 | |

Impairment of assets and non-cash portion of restructuring and other charges | | 7 | | 18.8 | | 13.0 | |

Future income taxes | | | | 8.7 | | (35.5 | ) |

Amortization of other assets | | | | 4.5 | | 5.6 | |

Amortizaton of financing costs | | | | 53.9 | | 6.6 | |

Change in fair value of restricted cash | | | | 3.1 | | — | |

Loss on abandonment of business and disposals | | 10 | | 32.0 | | 11.0 | |

Other | | | | 5.5 | | (5.4 | ) |

| | | | 12.1 | | 32.4 | |

Net changes in non-cash balances related to operations: | | | | | | | |

Accounts receivable | | | | 122.1 | | (50.9 | ) |

Inventories | | | | 27.8 | | 9.8 | |

Trade payables and accrued liabilities | | | | (38.4 | ) | 86.3 | |

Other current assets and liabilities | | | | (23.6 | ) | 12.6 | |

Other non-current assets and liabilities | | | | (14.4 | ) | (16.8 | ) |

| | | | 73.5 | | 41.0 | |

Cash flows provided by operating activities | | | | 85.6 | | 73.4 | |

| | | | | | | |

Cash flows from financing activities: | | | | | | | |

Net change in bank indebtedness | | | | (32.2 | ) | — | |

Issuance of long-term debt net of issuance costs | | | | 556.5 | | — | |

Repayments of long-term debt | | | | (10.3 | ) | (2.8 | ) |

Net borrowings under revolving bank facility | | | | 70.9 | | 8.3 | |

Net change in secured financing | | | | 4.2 | | — | |

Repayment of North American securitization program subsequent to Insolvency Proceedings | | | | (413.0 | ) | — | |

Net proceeds from issuance of equity shares | | | | — | | 1.6 | |

Dividends on preferred shares | | | | — | | (7.1 | ) |

Cash flows provided by financing activities | | | | 176.1 | | — | |

| | | | | | | |

Cash flows from investing activities: | | | | | | | |

Additions to property, plant and equipment | | | | (22.8 | ) | (77.1 | ) |

Net proceeds from disposal of assets | | | | 1.1 | | 36.6 | |

Restricted cash | | | | — | | (6.0 | ) |

Restricted cash related to Insolvency Proceedings | | | | (42.1 | ) | — | |

Cash flows used in investing activities | | | | (63.8 | ) | (46.5 | ) |

| | | | | | | |

Effect on foreign currency | | | | (43.8 | ) | (11.9 | ) |

| | | | | | | |

Net changes in cash and cash equivalents | | | | 154.1 | | 15.0 | |

Cash and cash equivalents, beginning of period | | | | 61.1 | | 17.8 | |

Cash and cash equivalents, end of period | | | | $ | 215.2 | | $ | 32.8 | |

| | | | | | | |

Supplemental cash flow information: | | | | | | | |

Interest payment | | | | $ | 13.6 | | $ | 37.3 | |

Income tax paid (net of refund) | | | | 1.3 | | 2.9 | |

See accompanying Notes to Consolidated Financial Statements.

4

CONSOLIDATED BALANCE SHEETS

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars)

| | | | March 31, | | December 31, | |

| | Note | | 2008 | | 2007 | |

| | | | (Unaudited) | | Audited | |

| | | | | | | |

Assets | | | | | | | |

| | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | | | | $ | 215.2 | | $ | 61.1 | |

Accounts receivable | | | | 983.2 | | 1,030.8 | |

Receivables from related parties | | | | 24.1 | | 16.1 | |

Inventories | | 3 | | 309.5 | | 368.1 | |

Income taxes receivable | | | | 12.3 | | 15.7 | |

Future income taxes | | | | 46.7 | | 28.6 | |

Prepaid expenses | | | | 49.3 | | 18.5 | |

Total current assets | | | | 1,640.3 | | 1,538.9 | |

| | | | | | | |

Property, plant and equipment | | 3 | | 1,930.0 | | 2,009.0 | |

Goodwill | | | | 342.2 | | 342.3 | |

Restricted cash | | | | 93.9 | | 54.9 | |

Receivables from related parties | | | | 4.3 | | 4.4 | |

Future income taxes | | | | 5.5 | | 11.2 | |

Other assets | | | | 219.6 | | 202.3 | |

Total Assets | | | | $ | 4,235.8 | | $ | 4,163.0 | |

| | | | | | | |

Liabilities and Shareholders’ deficit | | | | | | | |

| | | | | | | |

Current liabilities: | | | | | | | |

Bank indebtedness | | | | $ | 44.1 | | $ | 73.2 | |

Trade payables and accrued liabilities | | | | 566.6 | | 994.8 | |

Payables to related parties | | | | 11.1 | | 13.3 | |

Income and other taxes payable | | | | 47.3 | | 39.8 | |

Future income taxes | | | | 1.0 | | 1.0 | |

Secured financing | | | | 53.7 | | 462.5 | |

Current portion of long-term debt | | 11 | | 604.4 | | 1,023.7 | |

Liabilities subject to compromise | | 5 | | 2,903.0 | | — | |

Total current liabilities | | | | 4,231.2 | | 2,608.3 | |

| | | | | | | |

Long-term debt | | 11 | | 20.5 | | 1,313.6 | |

Other liabilities | | | | 271.3 | | 363.4 | |

Future income taxes | | | | 147.5 | | 132.2 | |

Preferred shares | | 12 | | 74.0 | | 178.5 | |

| | | | | | | |

Shareholders’ deficit: | | | | | | | |

Capital stock | | 12 | | 1,559.0 | | 1,457.4 | |

Contributed surplus | | | | 103.0 | | 102.1 | |

Deficit | | | | (2,024.3 | ) | (1,813.3 | ) |

Accumulated other comprehensive loss | | 17 | | (146.4 | ) | (179.2 | ) |

| | | | (508.7 | ) | (433.0 | ) |

| | | | | | | |

Total Liabilities and Shareholders’ deficit | | | | $ | 4,235.8 | | $ | 4,163.0 | |

See accompanying Notes to Consolidated Financial Statements.

5

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Three-month periods ended March 31, 2008 and 2007

(Under creditor protection as of January 21, 2008 – Note 1)

(Tabular amounts are expressed in millions of US dollars, except per share and option amounts)

(Unaudited)

1. Creditor Protection and Restructuring

On January 21, 2008 (the “Filing Date”), Quebecor World Inc. (“Quebecor World” or the “Company”) obtained an order (the “Initial Order”) from the Quebec Superior Court (the “Court”) granting creditor protection under the Companies’ Creditors Arrangement Act (the “CCAA”) for itself and for 53 U.S. subsidiaries (the “U.S. Subsidiaries” and, collectively with the Company, the “Applicants”). On the same date, the U.S. Subsidiaries filed a petition under Chapter 11 of the U.S. Bankruptcy Code (“Chapter 11”) in the U.S. Bankruptcy Court for the Southern District of New York (the “U.S. Bankruptcy Court”). The proceedings under the CCAA are hereinafter referred to as the “Canadian Proceedings”, the proceedings under Chapter 11 are hereinafter referred to as the “U.S. Proceedings” and the Canadian Proceedings and the U.S. Proceedings are hereinafter collectively referred to as the “Insolvency Proceedings”. The Company’s European and Latin American subsidiaries are not subject to the Insolvency Proceedings. Pursuant to the Insolvency Proceedings, the Applicants are provided with the authority to, among other things, continue operating the Applicants’ business (subject to court approval for certain activities), file with the Court and submit to creditors a plan of compromise or arrangement under the CCAA (the “Plan”) and operate an orderly restructuring of the Applicants’ business and financial affairs, in accordance with the terms of the Initial Order. Ernst & Young Inc. (the “Monitor”) has been appointed by the Court as Monitor in the Canadian Proceedings. Pursuant to the terms of the orders made in the Insolvency Proceedings, as amended, the Monitor was appointed to monitor the business and financial affairs of the Applicants and, in connection with such role, the Initial Order imposes a number of duties and functions on the Monitor, including, but not limited to, assisting the Applicants in connection with their restructuring and reporting to the Court on the state of the business and financial affairs of the Applicants and on developments in the Insolvency Proceedings, as the Monitor considers appropriate. Reference should be made to the Initial Order for a more complete description of the duties and functions of the Monitor.

Chapter 11 provides for all actions and proceedings against the U.S. Subsidiaries to be stayed during the continuation of the U.S. Proceedings. The Initial Order also provides for a general stay, and, pursuant to subsequent orders of the Court rendered on February 19, 2008 and May 9, 2008, respectively this stay period was extended first to May 12, 2008 and then to July 25, 2008 in Canada. The stay period is subject to further extensions as the Court may deem appropriate. The applicable stays generally preclude parties from taking any actions against the Applicants. The purpose of the stay period and the Insolvency Proceedings is to provide the Applicants the opportunity to stabilize their operations and businesses and to develop a business plan, all with a view to proposing a final Plan. Any such Plan will be subject to approval by affected creditors, as well as court approval.

The Company became in default under its revolving bank facility, its equipment financing credit facility and its North American securitization program on January 16, 2008. On January 24, 2008 pursuant to the Insolvency entered into by the Company, an amount of $413 million was paid in order to terminate the North American securitization program.

The Insolvency Proceedings also triggered defaults under substantially all other debt obligations of the Applicants. Generally, the Insolvency Proceedings have stayed actions against the Applicants, including actions to collect pre-filing indebtedness or to exercise control over any of the Applicants’ property. As a result of the stay, the Applicants have ceased making payments of interest and principal on substantially all of their debt obligations. The orders granted in the Insolvency Proceedings have provided the Applicants with the authority, among other things: (a) to pay outstanding and future employee wages, salaries and benefits; (b) to make rent payments under existing arrangements payable after the Filing Date; and (c) to honour obligations to customers.

The Applicants are in the process of developing comprehensive business and financial plans, which will serve as a basis for discussions with stakeholders, with the advice and guidance of their financial advisors and the Monitor. The Applicants expect that the preparation of the business plan will be completed in the second quarter of 2008. It is anticipated that the business plan will reflect the Applicants’ expectations of future operating performance. Once the business plan has been completed, a Plan will be developed and, subject to receipt of necessary approvals from affected creditors, the Court and the U.S. Bankruptcy Court, the Applicants will implement one or more Plans. There can be no assurance, however, that the Applicants will be able to implement a Plan.

6

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

The Company has indicated that it intends to apply to the Court and the U.S. Bankruptcy Court to extend the stay period beyond July 25, 2008 in order to obtain further time to consult with stakeholders and develop a Plan. Should the stay period and any subsequent extensions, if granted, not be sufficient to develop and present a Plan, or should the Plan not be accepted by affected creditors and, in any such case, the Applicants lose the protection of the stay of proceedings, substantially all debt obligations of the Applicants will then become due and payable immediately, creating an immediate liquidity crisis which would in all likelihood lead to the liquidation of the Applicants’ assets. Failure to implement a Plan and obtain sufficient exit financing within the time granted by the Court and the U.S. Bankruptcy Court will also result in substantially all of the Applicants’ debt obligations becoming due and payable immediately, which would in all likelihood lead to the liquidation of the Applicants’ assets.

As detailed in Note 10, the Company’s UK subsidiary was placed into administration on January 28, 2008.

Contributing factors

Quebecor World’s financial performance has suffered in the past few years, especially with respect to its European operations, which were funded, in part, with cash flows generated by the North American operations, as a result of a combination of factors, including declining prices and sales volume, and temporary disturbances and inefficiencies caused by a major retooling and restructuring of its printing operations initiated in 2004. The combination of significant capital investments and continued operating losses, principally as a result of its European operations, resulted in increased financing needs. During the last quarter of 2007, it was also necessary for the Company to repurchase certain senior notes in order to avoid breaching certain financial ratios, while also facing reduction in amounts available under its revolving bank facility.

More recent events further hindered the Company’s efforts to improve its balance sheet and financial position. First, on November 20, 2007, Quebecor World announced the withdrawal of a refinancing plan previously announced on November 13, 2007 due to adverse financial market conditions. Second, on December 13, 2007, Quebecor World announced that it would not be able to consummate a previously announced transaction to sell/merge its European operations, which otherwise would have resulted in proceeds being paid to Quebecor World.

On December 31, 2007, the Company obtained a waiver from its bank syndicate lenders and from the sponsors of its North American securitization program, subject to the satisfaction of certain conditions and refinancing milestones, including obtaining $125 million in new financing by January 15, 2008. On January 16, 2008, the Company failed to satisfy the conditions and refinancing milestones set by the bank syndicate lenders, which resulted in the Company and certain of its subsidiaries being in default of its obligations under its revolving bank facility, its Equipment financing credit facility and its North American securitization program.

As a result of the unsuccessful efforts of the Company to obtain new financing, the inability to conclude the proposed sale of its European operations and the operational demands of the Company, by mid-January 2008, the Company was experiencing a severe lack of liquidity and concluded it no longer had the ability to meet obligations which were falling due.

Basis of presentation and going concern issues

These financial statements have been prepared using the same Canadian generally accepted accounting principles as applied by the Company prior to the Insolvency Proceedings. While the Applicants have filed for and been granted creditor protection, these financial statements continue to be prepared using the going concern concept, which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The Insolvency Proceedings provide the Company with a period of time to stabilize its operations and financial condition and develop a Plan. During the period, Debtor-In-Possession (“DIP”) financing has been approved by the Court and the U.S. Bankruptcy Court and is available, subject to borrowing conditions, as described below. Management believes that these actions make the going concern basis appropriate. However, it is not possible to predict the outcome of these proceedings and, as such, realization of assets and discharge of liabilities is subject to significant uncertainty. Accordingly, substantial doubt exists as to whether the Company will be able to continue as a going concern. Further, it is not possible to predict whether the actions taken in any restructuring will result in improvements to the financial condition of the Company sufficient to allow it to continue as a going concern. If the going concern basis is not appropriate, adjustments will be necessary to the carrying amounts and/or classification of assets and liabilities, and to the expenses in these financial statements.

7

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

Basis of presentation and going concern issues (cont’d)

The accompanying financial statements do not purport to reflect or provide for the consequences of the Insolvency Proceedings. In particular, such financial statements do not purport to show: (a) as to assets, their realizable value on a liquidation basis or their availability to satisfy liabilities; (b) as to pre-petition liabilities, the amounts that may be allowed for claims or contingencies, or the status and priority thereof; (c) as to shareholders accounts, the effect of any changes that may be made in the capitalization of the Company; or (d) as to operations, the effect of any changes that may be made in its business.

While the Company is under creditor protection, it will make adjustments to the financial statements to isolate assets, liabilities, revenues, and expenses related to the reorganization and restructuring activities so as to distinguish these events and transactions from those associated with the ongoing operation of the business. Further, allowed claims arising under the Insolvency Proceedings may be recorded as liabilities and presented separately on the consolidated balance sheets. If a restructuring occurs and there is substantial realignment of the equity and non-equity interests in the Company, the Company will be required, under Canadian Generally Accepted Accounting Principles (“GAAP”), to adopt “fresh start” reporting. Under fresh start reporting, the Company would undertake a comprehensive revaluation of its assets and liabilities based on the reorganization value as established and confirmed in the Plan. The financial statements do not present any adjustments that may be required during the period that the Company remains under creditor protection, or that may be required under fresh start reporting.

In accordance with Canadian GAAP appropriate for a going concern, property, plant, and equipment is carried at cost less accumulated amortization and any impairment losses and they are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Goodwill is carried at cost less any impairment losses. Goodwill is tested for impairment annually and between annual tests when an event or circumstance occurs that more likely than not reduces the fair value of a reporting unit below its carrying amount. The series of events that led the Company to the Insolvency Proceedings triggered impairment tests as of December 31, 2007 and March 31, 2008 for its property, plant, and equipment, and goodwill. The Company made assumptions, such as expected growth, maintaining customer base and achieving costs reductions, about the future cash flows expected from the use of its assets. There can be no assurance that expected future cash flows will be realized or will be sufficient to recover the carrying amount of long lived assets or goodwill.

The preparation of financial statements in conformity with Canadian GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. The Insolvency Proceedings materially affect the degree of uncertainty associated with the measurement of many amounts in the financial statements. More specifically, it could impact the recoverability tests and fair value assumptions used in the impairment test of property, plant and equipment and goodwill, the valuation of future income tax assets and of contract acquisition costs.

In light of the Insolvency Proceedings, it is unlikely that the Company’s existing Multiple Voting Shares, Redeemable First Preferred Shares and Subordinate Voting Shares will have any material value following the approval of a Plan. There is a risk such shares could be cancelled.

DIP financing

On January 21, 2008, the Court approved a Senior Secured Superpriority DIP Credit Agreement (as subsequently amended by amendments dated January 25, 2008, February 11, 2008 and March 27, 2008, the “DIP Credit Agreement”) between the Company and Quebecor World (USA) Inc., both a debtor-in-possession under the U.S. Proceedings and a petitioner under the Canadian Proceedings, as Borrowers, Credit Suisse, as Administrative Agent, Initial Issuing Bank and Initial Swing Line Lender, General Electric Capital Corporation and GE Canada Finance Holding Company, as Collateral Agent, Morgan Stanley Senior Funding Inc., and Wells Fargo Foothill Inc., as Co-Syndication Agents.

8

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

DIP financing (cont’d)

The DIP financing is comprised of both a revolving credit facility with sub-facilities for Canadian dollar borrowings, swing line loans and issuance of letters of credit for an aggregate maximum commitment of the lenders of $400 million (the “Revolving DIP Facility”) bearing interest at variable rates based on Base rate or Eurodollar or Banker’s Acceptance or Canadian prime rate, plus applicable margin and a $600 million term loan (“DIP Term Loan”), bearing interest at variable rates based on Base rate, Eurodollar, plus applicable margin, which was fully drawn following the Initial Order and the interim order of the U.S. Bankruptcy Court, dated January 23, 2008 (the “Interim DIP Order”). Amounts borrowed under the DIP Term Loan and repaid or prepaid may not be borrowed again. Under the Revolving DIP Facility, the availability of funds is determined by a formula based on a percentage of eligible assets available as security. The unused portion of the DIP Credit Agreement is subject to a commitment fee of 0.50% per annum. From the date of the Interim DIP Order up to the date of the final order of the U.S. Bankruptcy Court dated April 1, 2008 (the “Final DIP Order”), the maximum availability under the Revolving DIP Facility was $150 million. By the entry of the Final DIP Order by the U.S. Bankruptcy Court, the maximum availability under the Revolving DIP Facility became $400 million. As at March 31, 2008 and May 12, 2008, the Company had drawn $600 million and $619.6 million, respectively, on the DIP facilities.

The DIP Credit Agreement contains certain restrictive financial and operating covenants which were met as of March 31, 2008.

The DIP Revolving Facility and DIP Term loan are secured by a perfected lien on, and security interest in, all present and after-acquired property of Quebecor World Inc. and the U.S. subsidiaries subject to the U.S. Proceedings. The liens are junior to the liens securing the Company’s syndicated revolving bank facility with Royal Bank of Canada as administrative agent and its equipment financing credit facility with Société Générale (Canada) as lender up to an aggregate amount of $170 million, which was granted prior to the Filing Date to the extent such liens are valid, perfected and not voidable. The DIP Revolving Facility and DIP Term loan are also guaranteed by substantially all of the Company’s direct and indirect subsidiaries.

The DIP Revolving Facility and DIP Term loan mature on the earliest to occur of (a) July 21, 2009 and (b) the substantial consummation of a Plan. The DIP Credit Agreement may be prepaid or accelerated upon the occurrence of an event of default and contains mandatory prepayments including, among other things, the net proceeds of certain asset sales, issuance of debt securities and certain extraordinary receipts.

Should the Court refuse to grant further extensions of the stay period, this would constitute an event of default under the DIP Credit Agreement and the debt could become due and payable immediately, which would, in all likelihood, lead to the liquidation of all the Applicants’ assets.

The Company’s DIP Revolving Facility and DIP Term loan provide for various restrictions on, among other things, the Company’s ability to incur additional debt, secure such debt, make investments, dispose of its assets (including pursuant to sale and leaseback transactions and sales of receivables under securitization programs) and make capital expenditures. Each of these transactions would require the consent of the Company’s DIP lenders if they exceed certain thresholds set forth in the DIP Facility, and may, in certain cases, require the consent of the Monitor and/or the Courts.

The Court limits the amounts of funding available for the European and Latin America subsidiaries. The maximum amounts are EUR25 million and $10 million, respectively, in addition to a $5 million amount for non-debtor North American or Latin American subsidiaries. As of May 12, 2008, an amount of EUR13 million was funded for the European subsidiaries and $6 million was used to fund Latin American operations.

Accounting policies applicable to an entity under Creditor Protection

As a result of the Insolvency Proceedings, the Company will follow accounting policies, including disclosure items, applicable to entities that are under creditor protection. In addition to Canadian GAAP, the Company is applying the guidance in the American Institute of Certified Public Accountants Statement of Position 90-7, “Financial Reporting by Entities in Reorganization under the Bankruptcy Code” (SOP 90-7). While SOP 90-7 refers specifically to Chapter 11 in the United States, its guidance, in management’s view, is also applicable to an entity restructuring under CCAA where it does not conflict with Canadian GAAP.

9

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

Accounting policies applicable to an entity under Creditor Protection (cont’d)

Consistent with Canadian GAAP, SOP 90-7 does not change the manner in which financial statements are prepared. However, SOP 90-7 does require that the financial statements for periods subsequent to the filing distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business. Revenues, expenses, gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the business will be reported separately as reorganization items (see Note 4). Cash flows related to reorganization items have been disclosed separately.

While payments may not be made on liabilities subject to compromise, including long-term debt, interest on debt obligations will continue to be recognized. Interest is not a reorganization item. The consolidated balance sheet distinguishes pre-filing liabilities subject to compromise on any debt from both those pre-filing liabilities that are not subject to compromise and from post-filing liabilities (see Note 5). Liabilities that may be affected by the Plan may be settled for lesser amounts and the resulting adjustments may be material, no claims procedure has yet been established.

Consolidated financial statements that include one or more entities in reorganization proceedings and one or more entities not in reorganization proceedings are required to include disclosure of entities in reorganization proceedings, including disclosure of Condensed Combined Financial Information of the entities in the reorganization proceedings, including disclosure of the amount of inter-company receivables and payables therein (see Note 6).

SOP 90-7 has been applied effective January 21, 2008, and for subsequent reporting periods while the Company continues to operate under creditor protection.

The resulting changes in reporting are described in Note 4 Reorganization Items, Note 5 Liabilities subject to compromise and Note 6 Condensed Combined Financial Information.

2. Basis of Presentation

The consolidated financial statements included in this report are unaudited and reflect normal and recurring adjustments which are, in the opinion of the Company, considered necessary for a fair presentation. These consolidated financial statements have been prepared in conformity with Canadian GAAP. The same accounting policies as described in the Company’s latest consolidated financial statements prior to the Insolvency Proceedings have been used, except changes described in Note 1 and 3. However, these consolidated financial statements do not include all disclosures required under Canadian GAAP for annual financial statements and, accordingly, should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s latest consolidated financial statements.

Seasonality

The operations of the Company’s business are seasonal, with the majority of historical operating income recognized in the second half of the fiscal year, primarily as a result of the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions. Within any year, the seasonality could adversely affect the Company’s cash flow and results of operations on a quarterly basis.

Comparative figures

Certain comparative figures have been reclassified to conform to the presentation of the current period.

10

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

3. Change in Accounting Standards

Effective January 1, 2008, the Company adopted the following Canadian Institute of Chartered Accountants (“CICA”) Handbook sections:.

· Section 1535, Capital Disclosures, which requires the disclosure of both qualitative and quantitative information that enables users of financial statements to evaluate the entity’s objectives, policies and processes for managing capital. The adoption of this section requires disclosure of information on capital management, which is included in Note 15, Capital and Liquidity Management.

· Section 3862, Financial Instruments – Disclosures, and Section 3863, Financial Instruments – Presentation, which require additional disclosures relating to financial instruments. The adoption of these sections required disclosure of risks associated with financial instruments to which the Company is exposed to including sensitivity analysis and how the Company manages those risks. This information is included in Note 14, Financial Instruments.

· Section 3031, Inventories, which provides more extensive guidance on the recognition and measurement of inventories, and related disclosures. Upon adoption of this new section, in accordance with the transition rules, the Company has adjusted opening retained earnings as if the new rules had always been applied in the past, without restating comparative figures of prior years. Accordingly, the following adjustments were recorded in the consolidated financial statements as at January 1, 2008:

· Decrease of inventory by $32.9 million

· Increase of property, plant and equipment by $7.2 million

· Decrease of future income taxes liabilities by $4.7 million

· Increase of deficit by $21.0 million

4. Reorganization Items

Reorganization items represent post-filing revenues, expenses, gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the Applicants. The cash flow usage related to reorganization and restructuring items since the Filing Date amounts to $3.9 million and relates primarily to professional fees. The following outlines amounts that have been included in the Consolidated Statement of Loss:

| | Three months ended March 31, 2008 | |

| | | |

Amortization of financing costs | | $ | 15.1 | |

Amortization of embedded derivatives and hedges interest rate risk | | (11.2 | ) |

Professional fees | | 10.3 | |

| | $ | 14.2 | |

| | | | | | |

5. Liabilities Subject to Compromise

Liabilities subject to compromise refers to liabilities incurred prior to the Filing Date that may be dealt with as affected claims under a Plan in the Insolvency Proceedings, as well as claims arising out of any repudiated leases, contracts, and other arrangements. It is possible that items not currently considered as liabilities subject to compromise in these unaudited consolidated financial statements will be added or reclassified to this category of liabilities at a later date. The amounts below are the liabilities subject to compromise as of March 31, 2008 and are subject to future adjustments as a result of negotiations, Court orders, proofs of claim, and other events. Any additions to this category of liabilities and any adjustments may be material and, depending on their nature, may be recorded as a reorganization adjustment. The Plan will determine how a particular class of affected claims will be settled, including payment terms, if applicable.

11

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

5. Liabilities Subject to Compromise (Cont’d)

These unaudited consolidated financial statements do not include inter-company liabilities (Note 6) as these are eliminated in the preparation of the unaudited consolidated financial statements. However, depending on the ultimate determination and approval of the Plan, certain of these liabilities, including amounts between entities that have not filed for bankruptcy relief under Insolvency Proceedings and those that have filed, may be subject to compromise and these amounts may be material.

The Company continues to accrue for interest on debt that is subject to compromise. No interest has been paid on unsecured debt of the Company subsequent to January 21, 2008, the date of the CCAA filing.

| | Note | | March 31, 2008 | |

Accounts payable and accrued liabilities | | | | $ | 446.3 | |

Income tax payable and other taxes payable | | | | 8.1 | |

Long-term debt | | 11 | | 2,386.1 | |

Other liabilities | | | | 62.5 | |

| | | | $ | 2,903.0 | |

6. Condensed Combined Financial Information

As stated in Note 1, unaudited consolidated financial statements should provide disclosure of Condensed Combined Financial Information of the Applicants, including disclosure of the amount of intercompany receivables and payables between Applicants and non-Applicants. Presented below are the Condensed Combined Financial Information of the Applicants as at and for the period ending March 31, 2008.

Entities not in Insolvency Proceedings include Latin American and European operations.

Condensed Combined Statement of Loss

Three-month period ended March 31, 2008

(Unaudited)

| | Entities in | |

| | Insolvency | |

| | Proceedings | |

Operating revenues | | $ | 946.0 | |

| | | |

Operating expenses: | | | |

Cost of sales | | 793.3 | |

Selling, general and administrative | | 95.7 | |

Depreciation and amortization | | 57.3 | |

Impairment of assets, restructuring and other charges | | 36.5 | |

| | 982.8 | |

| | | |

Operating loss | | (36.8 | ) |

| | | |

Financial expenses | | 158.6 | |

Dividends on preferred shares classified as liability | | 2.4 | |

Reorganization items | | 14.2 | |

Loss from continuing operations before income taxes | | (212.0 | ) |

Income taxes | | 14.3 | |

| | | |

Net loss | | $ | (226.3 | ) |

12

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

6. Condensed Combined Financial Information (Cont’d)

Condensed Combined Statement of Cash Flows

Three-month period ended March 31, 2008

(Unaudited)

| | Entities in | |

| | Insolvency | |

| | Proceedings | |

Cash flows used in operating activities | | $ | (31.4 | ) |

| | | |

Cash flows from financing activities: | | | |

Issuance of long-term debt net of issuance costs | | 600.9 | |

Repayments of long-term debt | | (10.3 | ) |

Net borrowings under revolving bank facility | | 70.9 | |

Net change in secured financing | | (15.0 | ) |

Repayment of North American securitization program subsequent to Insolvency Proceedings | | (413.0 | ) |

Cash flows provided by financing activities | | 233.5 | |

| | | |

Cash flows from investing activities: | | | |

Additions to property, plant and equipment | | (17.9 | ) |

Net proceeds from disposal of assets | | 1.0 | |

Restricted cash related to Insolvency Proceedings | | (42.1 | ) |

Cash flows used in investing activities | | (59.0 | ) |

| | | |

Effect on foreign currency | | 50.5 | |

| | | |

Net changes in cash and cash equivalents | | 193.6 | |

Cash and cash equivalents, beginning of period | | 0.4 | |

Cash and cash equivalents, end of period | | $ | 194.0 | |

13

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

6. Condensed Combined Financial Information (Cont’d)

Condensed Combined Balance Sheets

March 31, 2008

(Unaudited)

| | Entities in | |

| | Insolvency | |

| | Proceedings | |

Assets | | | |

| | | |

Current assets | | $ | 1,129.5 | |

Property, plant, and equipment | | 1,356.0 | |

Goodwill | | 342.2 | |

Restricted cash | | 42.0 | |

Receivables from related parties | | 4.3 | |

Future income taxes | | 1.8 | |

Other assets | | 186.1 | |

Total Assets | | $ | 3,061.9 | |

| | | |

Liabilities and Shareholders’ deficit | | | |

Current liabilities | | $ | 278.9 | |

Current portion of long-term debt | | 600.0 | |

Liabilities subject to compromise | | 2,903.0 | |

Intercompany payables subject to compromise (a) | | 2,466.7 | |

Total current liabilities | | 6,248.6 | |

| | | |

Long-term debt | | 7.4 | |

Other liabilities | | 218.9 | |

Future income taxes | | 140.1 | |

Preferred shares | | 74.0 | |

Shareholders’ deficit | | (3,627.1 | ) |

| | | |

Total Liabilities and Shareholders’ deficit | | $ | 3,061.9 | |

(a) Intercompany receivables and payables are disclosed on a net basis and are recorded at their face value.

14

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

7. Impairment of Assets, Restructuring and Other Charges

The following table details the charge for impairment of assets, restructuring and other charges and pension settlements:

| | | | Three months ended March 31, | |

| | Note | | 2008 | | 2007 | |

Impairment of assets | | | | $ | 18.8 | | $ | 8.2 | |

Restructuring and other charges | | | | 20.6 | | 16.5 | |

Pension settlements | | 16 | | — | | 4.8 | |

| | | | $ | 39.4 | | $ | 29.5 | |

(a) Impairment of assets

Following impairment tests on specific units in North America and in Europe, the Company concluded that some long-lived assets were impaired and recorded an impairment charge of $18.8 million on certain machinery and equipment during the three-month period ended March 31, 2008.

(b) Restructuring and other charges

The following table details the Company’s restructuring and other charges and the change in the reserve for restructuring and other charges:

| | Three months ended March 31, 2008 | |

| | 2008 | | Prior Year | | | |

| | Initiatives | | Initiatives | | Total | |

Expenses | | | | | | | |

Workforce reduction | | $ | 19.4 | | $ | 1.2 | | $ | 20.6 | |

Leases and carrying costs for closed facilities | | — | | 1.7 | | 1.7 | |

| | 19.4 | | 2.9 | | 22.3 | |

Underspending | | | | | | | |

Workforce reduction | | — | | (1.4 | ) | (1.4 | ) |

Leases and carrying costs for closed facilities | | — | | (0.3 | ) | (0.3 | ) |

| | — | | (1.7 | ) | (1.7 | ) |

Payments | | | | | | | |

Workforce reduction | | (0.9 | ) | (3.0 | ) | (3.9 | ) |

Leases and carrying costs for closed facilities | | — | | (2.2 | ) | (2.2 | ) |

| | (0.9 | ) | (5.2 | ) | (6.1 | ) |

Net change | | 18.5 | | (4.0 | ) | 14.5 | |

Foreign currency changes | | — | | 0.1 | | 0.1 | |

Balance, beginning of period | | — | | 17.0 | | 17.0 | |

Balance, end of period | | $ | 18.5 | | $ | 13.1 | | $ | 31.6 | |

2008 restructuring initiatives

During the first quarter of 2008, there were restructuring initiatives in North America related to the closure of a facility in Quebec and to a significant downsizing of another facility in Ontario. There were also various headcount reductions across North America and Europe. The total cost expected is $26.2 million, of which $20.7 million is for workforce reduction and $5.5 million is for lease and closed facilities. These initiatives are expected to be completed by the end of 2008.

15

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

8. Financial Expenses

| | Three months ended March 31, | |

| | 2008 | | 2007 | |

Interest on long-term debt and convertible notes | | $ | 55.8 | | $ | 40.7 | |

Bank and other charges | | 2.0 | | 2.6 | |

Amortization of financing costs | | 53.9 | | 1.0 | |

Change in fair value of restricted cash | | 3.1 | | — | |

Net gain on foreign exchange and derivative financial instruments (a) | | (31.9 | ) | (7.5 | ) |

| | 82.9 | | 36.8 | |

Interest capitalized to the cost of equipment | | (0.9 | ) | (2.9 | ) |

| | $ | 82.0 | | $ | 33.9 | |

(a) During the three-month period ended March 31, 2008, the Company recorded a net gain of $32.0 million on derivative financial instruments for which hedge accounting was not used ($4.4 million in 2007), of which $12.3 million is presented as Reorganization items (Note 4).

9. Loss per Share

The following table sets forth the computation of basic and diluted loss per share from continuing operations:

| | Three months ended March 31, | |

| | 2008 | | 2007 | |

Net loss | | $ | (190.0) | | $ | (38.1 | ) |

Net income allocated to holders of preferred shares | | — | | 7.2 | |

| | | | | |

Net loss available to holders of equity shares | | $ | (190.0 | ) | $ | (45.3 | ) |

(In millions) | | | | | |

Weighted-average number of equity shares outstanding | | 147.5 | | 131.8 | |

Loss per share: | | | | | |

Basic and diluted | | $ | (1.29) | | $ | (0.34 | ) |

For the purpose of calculating diluted loss per share, the effects of the convertible notes (repaid in June 2007) and the effects of all stock options were excluded, since their inclusion is anti-dilutive, for each of the three-month periods ended March 31, 2008 and 2007.

10. Loss on Abandonment of Business and Disposals

On January 28, 2008, the Company abandoned its UK subsidiary, Quebecor World PLC (“QWP”), based in Corby, and placed it into administration. As a result, the Company ceased to have control or significant influence over QWP as the ability to determine strategic, operating, investing and financing policies was transferred to the administrators. Subsequent to January 28, 2008, QWP’s operations and direct cash flows have been eliminated from the ongoing operations of the Company as a result of the abandonment and the Company has no continuing involvement or obligations in the operations or liquidation of QWP.

16

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

10. Loss on Abandonment of Business and Disposals (Cont’d)

The administrators ceased to operate QWP on February 15, 2008, and all of QWP’s long-lived assets, primarily buildings and machinery and equipment, will be liquidated by the administrators. As a result, the Company recorded an impairment charge of $32.0 million (including the write down of intercompany receivable). The Company is an unsecured creditor for its intercompany receivable of $28.0 million from QWP and, as of March 31, 2008, the Company has written down the receivable to its estimated amount recoverable of $5.0 million.

In March 2007, the Company sold its investment in a facility of its French operations for negligible cash consideration, resulting in a net loss on disposal of $11.0 million.

11. Long-term Debt

On January 16, 2008, since the Company had not obtained the $125.0 million of new financing, as had been required under the terms of the revolving bank facility and North American securitization program waivers, the Company became in default under its revolving bank facility, its Equipment financing facility and its North American securitization program. Upon filing for creditor protection in the Insolvency Proceedings on January 21, 2008, the Company became in default under substantially all of its other debt agreements and instruments.

The following table summarizes changes in long-term debt:

| | | | | | December 31, | |

| | Maturity | | March 31, 2008 | | 2007 | |

| | | | | | | |

Revolving bank facility and other short-term lines | | 2008 | | $ | 717.6 | | $ | 643.1 | |

Senior Notes 4.875% and 6.125% | | 2008, 2013 | | 600.0 | | 598.1 | |

Senior Notes 9.75% | | 2015 | | 400.0 | | 400.0 | |

Equipment financing credit facility | | 2015 | | 151.7 | | 168.5 | |

Senior Notes 8.75% | | 2016 | | 450.0 | | 450.0 | |

Senior Debentures 6.50% | | 2027 | | 3.2 | | 3.2 | |

Capital leases | | 2008-2016 | | 63.6 | | 43.8 | |

Other debts | | 2008-2022 | | — | | 24.0 | |

| | | | 2,386.1 | | 2,330.7 | |

Amortization of effect of fair value hedge on interest rate risk | | | | — | | (1.9 | ) |

Adjustment related to embedded derivatives | | | | — | | 9.4 | |

Financing fees, net of amortization | | | | — | | (25.4 | ) |

Long-term debt of Applicants subject to compromise - subsequent to January 21, 2008 (Note 5) | | | | 2,386.1 | | — | |

| | | | | | | |

DIP financing (a) | | 2009 | | 600.0 | | — | |

Capital leases | | 2008-2014 | | 19.0 | | 18.7 | |

Other debts | | 2008-2022 | | 5.9 | | 5.8 | |

Long-term debt | | | | 624.9 | | 2,337.3 | |

| | | | | | | |

Less current maturities | | | | 604.4 | | 1,023.7 | |

Total Long-term debt | | | | $ | 20.5 | | $ | 1,313.6 | |

(a) As described in Note 1, on January 21, 2008, the Canadian Court approved the DIP Credit Agreement. The effective interest rate on the DIP Credit Agreement as at March 31, 2008 was 8.25%. The DIP Credit Agreement contains certain restrictive financial and operating covenants, which are all met as at March 31, 2008.

The Company incurred debt issuance costs of $43.5 million which were completely amortized during the quarter.

17

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

12. Capital Stock

| | March 31, 2008 | | December 31, 2007 | |

(Thousands of shares) | | Number | | Amount | | Number | | Amount | |

| | | | | | | | | |

Multiple Voting Shares | | 46,987 | | $ | 93.5 | | 46,987 | | $ | 93.5 | |

Subordinate Voting Shares | | 136,995 | | 1,253.0 | | 85,585 | | 1,151.4 | |

Redeemable First Preferred Shares - Series 3 Classified as Shareholders’ equity | | 12,000 | | 212.5 | | 12,000 | | 212.5 | |

Total Capital Stock | | | | $ | 1,559.0 | | | | $ | 1,457.4 | |

Redeemable First Preferred Shares - Series 5 Classified as liability | | 3,024 | | 74.0 | | 7,000 | | 178.5 | |

Total Preferred Shares | | | | $ | 74.0 | | | | $ | 178.5 | |

During the first quarter of 2008, no Subordinate Voting Shares were issued under the Company’s stock option plan and no Subordinate Voting Shares were issued under the Company’s employee stock purchase plans (124,112 in the first quarter of 2007 for a total cash consideration of $1.6 million).

On February 26, 2008, the Company announced that it had determined the final conversion rate applicable to the 3,975,663 Series 5 Cumulative Redeemable First Preferred Shares that were converted into Subordinate Voting Shares effective as of March 1, 2008. Taking into account all accrued and unpaid dividends on the 3,975,663 Series 5 Preferred Shares up to and including March 1, 2008, the Company has determined that, in accordance with the provisions governing the Series 5 Preferred Shares, each Series 5 Preferred Share was converted on March 1, 2008 into 12.93125 Subordinate Voting Shares. Consequently, 51.4 million new Subordinate Voting Shares were issued by the Company to holders of Series 5 Preferred Shares on March 1, 2008 resulting in an increase of $101.6 million in Capital stock.

13. Stock-Based Compensation

The following table summarizes information about stock options:

| | March 31, 2008 | | December 31, 2007 | |

Number of stock options at the end of the period (in thousands): | | | | | |

Outstanding | | 6,288.0 | | 6,942.5 | |

Exercisable | | 3,465.9 | | 3,984.0 | |

The total stock-based compensation expense recorded in the first quarter of 2008 was $0.9 million ($1.1 million for the same period in 2007).

In January 2008, the Company cancelled the employee stock purchase plan in the United States and the employee share investment plan in Canada for eligible employees. In February 2008, the Company terminated the deferred stock unit plan for the benefit of the Company’s directors.

14. Financial Instruments

(a) Fair value of financial instruments

The estimated fair value of the Company’s Liabilities subject to compromise, is not reasonably determinable given the current status of the Company while under creditor protection during the Insolvency Proceedings (see Note 1). The carrying value of other financial instruments approximated fair value due to the short maturities or the terms and conditions attached to these instruments.

18

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Financial Instruments (Cont’d)

(b) Risks arising from financial instruments

The Company’s risk management policies are established to identify and analyze the risks faced by the Company, to set appropriate risk limits and controls, and to monitor risks and adherence to limits. Risk management policies are reviewed regularly to reflect changes in market conditions and the Company’s activities. From its use of financial instruments, the Company is exposed to credit risk, liquidity risk and market risk, which comprises foreign exchange risk, interest rate risk and commodity risk.

As described in Note 1 of these consolidated financial statements, on January 21, 2008, the Company obtained an Initial Order from the Court granting creditor protection. Subsequent to the Insolvency Proceedings and under provisions of the signed ISDA agreements, the counterparties of the Company’s derivative financial instruments exercised their contractual right to terminate substantially all of the foreign exchange forward contracts, interest rate swap and commodity swap agreements in place on that date. Consequently, the Company was not able to effectively manage certain market risks described below as at March 31, 2008. It is, however, the Company’s intention to effectively manage these risks in a manner similar to that conducted prior to the Filing Date as soon as practicable.

The effective management of the risks arising from financial instruments described below portrays the strategy in place prior to the Insolvency Proceedings. Where such risk management procedures were in place as at March 31, 2008, they are identified below as such.

Credit risk

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises principally from credit losses that could result from defaults by customers and counterparties when using financial instruments.

The Company is exposed to credit risk with respect to its cash equivalents, accounts receivable, other long-term receivables and derivative financial instruments.

The Company, in the normal course of business, continuously monitors the financial condition of its customers, reviews the credit history of each new customer and generally does not require collateral. As at March 31, 2008, no customer balance represent more than 2% of the Company’s consolidated operating revenues and the Company’s 10 largest customers accounted for 16% of consolidated revenues. In addition, 78% of the Company’s accounts receivable as at March 31, 2008 were not considered past due.

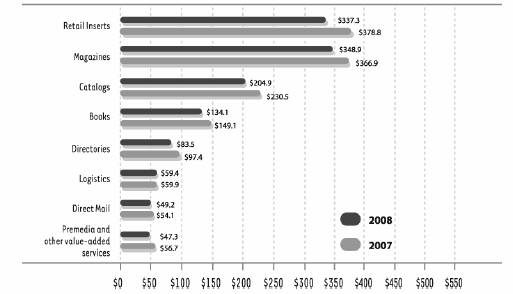

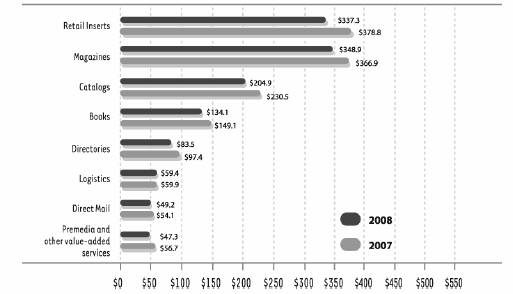

The Company believes that the diversity of its products as well as the diversity of its customer base are instrumental in reducing its credit risk, as well as the impact on the Company of fluctuations in local market or product-line demand. The following table shows revenues by print service, which is representative of the diversity of the accounts receivables.

19

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Financial Instruments (Cont’d)

(b) Risks arising from financial instruments (cont’d)

Revenue by Print Service - Worldwide ($ millions)

Three months ended March 31 (Continuing Operations)

The Company establishes an allowance for doubtful accounts that corresponds to the specific credit risk of its customers, historical trends and other information on the state of the economy. The Company does not believe that it is exposed to an unusual level of customer credit risk.

In addition to the above, the Company is exposed to credit losses resulting from defaults by counterparties to derivative financial instruments. To mitigate this risk, counterparties to derivative financial instruments, either foreign or Canadian, must have a minimum rating of A or its equivalent on long-term unsecured term debt from at least two rating agencies (Standard & Poor’s, Moody’s or DBRS) and are subject to concentration limits. Prior to the Insolvency Proceedings, the Company did not experience any failures by counterparties in meeting their obligations, nor were any such failures expected to occur in the future. As at March 31, 2008, the Company’s maximum exposure to counterparty credit risk was $0.1 million, which represented the carrying value of these financial instruments.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due or the risk that these financial obligations be met at excessive cost. The Company is under creditor protection as of January 21, 2008 (Note 1).

20

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Financial Instruments (Cont’d)

(b) Risks arising from financial instruments (cont’d)

As of March 31, 2008, material financial liabilities related to financial instruments included capital repayment and interest on long-term debt and obligations related to the DIP financing, as described in Note 1, which is collateralized by substantially all of the Company’s assets. Since the Insolvency Proceedings described in Note 1, the Company has ceased to make payments of interest and principal on its debt obligations. These obligations and their maturities, notwithstanding the filing for creditor protection, were as follows:

Financial Liabilities

| | Remainder of

2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 and

thereafter | | Total | |

Bank indebtedness | | $ | 44.1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 44.1 | |

Trade payables and accrued liabilities | | 1,012.9 | | — | | — | | — | | — | | — | | 1,012.9 | |

Income and other taxes payable | | 55.4 | | — | | — | | — | | — | | — | | 55.4 | |

Payables to related parties | | 11.1 | | — | | — | | — | | — | | — | | 11.1 | |

Secured financing | | 53.7 | | — | | — | | — | | — | | — | | 53.7 | |

Long-term debt | | 1,621.0 | | 2.6 | | 2.8 | | 3.0 | | 3.2 | | 1,266.3 | | 2,898.9 | |

Capital leases | | 60.7 | | 7.6 | | 8.0 | | 9.6 | | 9.0 | | 17.2 | | 112.1 | |

Total Financial Liabilities | | $ | 2,858.9 | | $ | 10.2 | | $ | 10.8 | | $ | 12.6 | | $ | 12.2 | | $ | 1,283.5 | | $ | 4,188.2 | |

Market risk

Market risk is the risk that changes in market prices due to foreign exchange rates, interest rates, and commodity prices will affect the Company’s income or the value of its financial instruments.

Foreign exchange risk

The Company has operations worldwide, including Canada, the United States, Europe and Latin America, and as such has foreign denominated sales and related receivables, equipment purchases, debt and other assets and liabilities.

Prior to the Insolvency Proceedings, the Company mitigated its foreign exchange risk by entering into foreign exchange forward contracts to hedge the settlement of the foreign denominated sales and related receivables, equipment purchases, debt, and other assets and liabilities. Substantially all of the contracts were terminated by the counterparties in connection with the Insolvency Proceedings.

The main concentration of foreign currency balances are operations in Euro for the European divisions and operations in Canadian dollars in the Canadian divisions of the Company.

The notional amounts and terms of the outstanding foreign exchange forward contracts as at March 31, 2008, presented by currency, are included in the table below:

Currencies | | March 31, 2008 | |

(sold / bought) | | Notional amounts (1) | | Average rate (2) | |

| | | | | |

GBP / EUR | | | | | |

Less than 1 year | | $ | 1.8 | | 0.7526 | |

| | | | | | |

Other | | | | | |

Less than 1 year | | 8.6 | | — | |

| | $ | 10.4 | | | |

(1) Transactions in foreign currencies are translated using the closing exchange rate as at March 31, 2008.

(2) Rates were expressed as the number of units of the currency sold for the currency bought.

21

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Financial Instruments (Cont’d)

(b) Risks arising from financial instruments (cont’d)

Sensitivity analysis

Assuming all other variables remain constant, a 5% strengthening of the US dollar on the cross-currencies sales during the three-month period ended March 31, 2008 would have had a nominal impact on net income and other comprehensive income.

Interest rate risk

The Company is exposed to interest rate fluctuations as a result of its long-term debt, including the DIP financing. As at March 31, 2008, the floating rate portion of the long-term debt represented approximately 40% of the total, while the remaining amount represented the fixed rate portion.

Prior to the Insolvency Proceedings, the Company managed its interest rate risk by having a balanced schedule of debt maturities, as well as a combination of fixed and floating interest rate obligations. In addition, the Company entered into interest rate swaps to manage its exposure to fluctuations in interest rates on its long-term debt; however, all derivative contracts were terminated in the first quarter of 2008 as a direct result of the Insolvency Proceedings.

Sensitivity analysis

Assuming all other variables remain constant, a 1% increase on all the interest rates during the three-month period ended March 31, 2008 would have had an unfavourable impact of $2.4 million on net income and other comprehensive income, while a 1% decrease in interest would have resulted in an equally favourable increase in net income, assuming no impact from derivative instruments since there were no interest rate derivative contracts outstanding at the end of the quarter.

Commodity risk

The Company is exposed to a financial risk related to fluctuations in natural gas prices to purchase natural gas. Prior to the Insolvency Proceedings, the Company managed a portion of its North American natural gas exposure through commodity swap agreements, whereby the Company was committed to exchange, on a monthly basis, the difference between a fixed price and a floating natural gas price index calculated by reference to the swap notional amounts. The Company has long-term contracts with most of its largest customers. These contracts generally include price adjustment clauses based on the costs of paper and ink.

Sensitivity analysis

Assuming all other variables remain constant, a $1 increase in the price of the natural gas price index during the three-month period ended March 31, 2008 would have had an unfavourable impact of $1.0 million on net income and other comprehensive income, while a $1 decrease in the price of the natural gas price index would have resulted in an equally favourable increase in net income, and assuming no impact from derivative instruments since there were no commodities swap contracts outstanding at the end of the quarter.

22

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

15. Capital and Liquidity Management

The Insolvency Proceedings have significantly affected the Company’s ability to manage its capital structure in the near term.

The Company’s primary short-term objectives of managing capital are:

· To ensure a successful restructuring and financial reorganization of the Company;

· To maintain a level of corporate liquidity necessary to fund the Company’s operating cycle;

· To preserve its financial flexibility in order to benefit from potential opportunities as they arise.

Under the Insolvency Proceedings, the Company manages its liquidity and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets.

16. Pension and Other Postretirement Benefits

The following table presents the Company’s pension and other postretirement benefit costs:

| | Three months ended March 31, | |

| | 2008 | | 2007 | |

Pension benefits | | $ | 12.0 | | $ | 21.1 | |

Postretirement benefits | | 0.7 | | 0.7 | |

Total benefit cost | | $ | 12.7 | | $ | 21.8 | |

The 2007 pension benefit costs included a total settlement loss of $4.8 million, as described in Note 7.

17. Accumulated Other Comprehensive Loss

The following table presents changes in the carrying amount of accumulated other comprehensive loss:

| | Translation | | Cash flow | | | |

| | adjustment | | hedges | | Total | |

Balance, December 31, 2006 | | $ | (82.6 | ) | $ | — | | $ | (82.6 | ) |

Change in accounting policy - Financial Instruments, net of income taxes | | — | | (7.0 | ) | (7.0 | ) |

Other comprehensive income (loss), net of income taxes | | (7.5 | ) | 6.2 | | (1.3 | ) |

Balance, March 31, 2007 | | (90.1 | ) | (0.8 | ) | (90.9 | ) |

Other comprehensive income (loss), net of income taxes | | (97.3 | ) | 9.0 | | (88.3 | ) |

Balance, December 31, 2007 | | (187.4 | ) | 8.2 | | (179.2 | ) |

Other comprehensive income (loss), net of income taxes | | 37.4 | | (4.6 | ) | 32.8 | |

Balance, March 31, 2008 | | $ | (150.0 | ) | $ | 3.6 | | $ | (146.4 | ) |

Over the next twelve months, the Company expects an estimated $2.8 million (net of income tax of $2.9 million) in net gains in other comprehensive income as at March 31, 2008 to be reclassified to net income. During the three-month period ended March 31, 2008, there were no forecasted transactions that failed to occur.

Following the filing of creditor protection under the Insolvency Proceedings on January 21, 2008, substantially all derivative contracts were subsequently terminated by their counterparties. The amount of any gains and losses associated with derivative contracts designated as hedging items that had previously been recognized in other comprehensive income as a result of applying hedge accounting will be carried forward to be recognized in net income in the same periods during which the hedged forecast transaction will occur.

23

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

18. Income Tax Components of Other Comprehensive Loss

The following table presents the income taxes on components of Other Comprehensive Loss for the three-month periods ended March 31, 2008 and 2007:

| | Three months ended March 31, | |

| | 2008 | | 2007 | |

Unrealized loss on foreign currency translation adjustment | | $ | (0.2 | ) | $ | (0.7 | ) |

Unrealized net gain on derivative financial instruments related to cash flow hedges | | (1.4 | ) | (2.3 | ) |

Reclassification of realized net gain (loss) on derivative financial instruments to the statement of income | | 0.9 | | (1.5 | ) |

| | $ | (0.7 | ) | $ | (4.5 | ) |

19. Segmented Information

The Company operates in the printing industry. Its business groups are located in three main segments: North America, Europe and Latin America. These segments are managed separately, since they all require specific market strategies. The Company assesses the performance of each segment based on operating income before impairment of assets, restructuring and other charges and goodwill impairment charge (“Adjusted EBIT”).

| | North | | | | Latin | | | | Inter- | | | |

Three months ended March 31 | | America | | Europe | | America | | Other | | Segment | | Total | |

Revenues | | | | | | | | | | | | | |

2008 | | $ | 946.0 | | $ | 250.1 | | $ | 68.5 | | $ | 0.2 | | $ | (0 .2 | ) | $ | 1,264.6 | |

2007 | | 1,077.2 | | 253.3 | | 63.9 | | 0.1 | | (1.1 | ) | 1,393.4 | |

Impairment of assets | | | | | | | | | | | | | |

2008 | | 16.7 | | 2 .1 | | — | | — | | — | | 18.8 | |

2007 | | — | | 8.2 | | — | | — | | — | | 8.2 | |

Restructuring and other charges | | | | | | | | | | | | | |

2008 | | 19.8 | | 0 .7 | | 0.1 | | — | | — | | 20.6 | |

2007 | | 17.8 | | 3.5 | | — | | — | | — | | 21.3 | |

Adjusted EBIT | | | | | | | | | | | | | |

2008 | | 14.8 | | (43 .4 | ) | 1.7 | | (7.9 | ) | — | | (34.8 | ) |

2007 | | 37.3 | | (26.5 | ) | 2.5 | | (2.1 | ) | — | | 11.2 | |

Operating income (loss) | | | | | | | | | | | | | |

2008 | | (21.7 | ) | (46.2 | ) | 1.6 | | (7.9 | ) | — | | (74.2 | ) |

2007 | | 19.5 | | (38.2 | ) | 2.5 | | (2.1 | ) | — | | (18.3 | ) |

Goodwill | | | | | | | | | | | | | |

As at March 31, 2008 | | 342.2 | | — | | — | | — | | — | | 342.2 | |

As at December 31, 2007 | | 342.3 | | — | | — | | — | | — | | 342.3 | |

| | | | | | | | | | | | | | | | | | | |

24

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

20. Related party transactions

Quebecor Inc., directly and through a wholly-owned subsidiary, holds 77.3% of the outstanding voting interests in Quebecor World. As a result, Quebecor Inc. has the power to determine many matters requiring shareholder approval, including the election of directors and the approval of significant corporate transactions. The interests of Quebecor Inc. may conflict with the interests of other holders of our equity and debt securities. However, the Court has exempted Quebecor World from the requirement to hold an annual meeting of shareholders until such time as the Company emerges from the Insolvency Proceedings. In addition, any fundamental transaction or proposed change to Quebecor World’s organizational documents would require Court approval. Consequently, even though Quebecor Inc. currently holds 77.3% of the Company’s outstanding voting interests, it is unlikely that Quebecor Inc. will be able to exercise its votes during the Insolvency Proceedings in order to change the composition of the Board of Directors or cause fundamental changes in the affairs and organizational documents of the Company.

25