Exhibit 99.2

CONSOLIDATED FINANCIAL STATEMENTS

THIRD QUARTER ENDED SEPTEMBER 30, 2008

CONSOLIDATED STATEMENTS OF LOSS

Periods ended September 30,

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars, except per share amounts)

| | | | Three months | | Nine months | |

| | Note | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | | |

Operating revenues | | | | $ | 993.6 | | $ | 1,172.1 | | $ | 2,983.6 | | $ | 3,423.5 | |

| | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | |

Cost of sales | | | | 824.3 | | 951.9 | | 2,481.3 | | 2,807.1 | |

Selling, general and administrative | | | | 78.8 | | 95.9 | | 255.3 | | 275.3 | |

Securitization fees | | | | — | | 6.0 | | — | | 15.7 | |

Depreciation and amortization | | | | 56.8 | | 60.4 | | 176.3 | | 181.0 | |

Impairment of assets, restructuring and other charges | | 7 | | 6.7 | | 55.2 | | 54.3 | | 101.8 | |

| | | | 966.6 | | 1,169.4 | | 2,967.2 | | 3,380.9 | |

| | | | | | | | | | | |

Operating income | | | | 27.0 | | 2.7 | | 16.4 | | 42.6 | |

| | | | | | | | | | | |

Financial expenses | | 8 | | 72.7 | | 92.4 | | 211.3 | | 148.6 | |

| | | | | | | | | | | |

Dividends on preferred shares classified as liability | | | | 0.9 | | 2.9 | | 4.6 | | 5.7 | |

| | | | | | | | | | | |

Reorganization items | | 4 | | 26.4 | | — | | 68.2 | | — | |

| | | | | | | | | | | |

Loss from continuing operations before income taxes | | | | (73.0 | ) | (92.6 | ) | (267.7 | ) | (111.7 | ) |

| | | | | | | | | | | |

Income taxes | | | | (9.4 | ) | (37.3 | ) | 22.2 | | (76.6 | ) |

Loss from continuing operations before minority interest | | | | (63.6 | ) | (55.3 | ) | (289.9 | ) | (35.1 | ) |

| | | | | | | | | | | |

Minority interest | | | | — | | — | | — | | (0.3 | ) |

Loss from continuing operations | | | | (63.6 | ) | (55.3 | ) | (289.9 | ) | (34.8 | ) |

| | | | | | | | | | | |

Net loss from discontinued operations (net of tax) | | 10 | | (0.6 | ) | (259.8 | ) | (715.4 | ) | (339.5 | ) |

Net loss | | | | $ | (64.2 | ) | $ | (315.1 | ) | $ | (1,005.3 | ) | $ | (374.3 | ) |

| | | | | | | | | | | |

Net income allocated to holders of preferred shares | | 9 | | 4.5 | | 4.7 | | 13.6 | | 16.7 | |

Loss allocated to holders of equity shares | | | | $ | (68.7 | ) | $ | (319.8 | ) | $ | (1,018.9 | ) | $ | (391.0 | ) |

| | | | | | | | | | | |

Loss per share: | | | | | | | | | | | |

Basic and diluted: | | 9 | | | | | | | | | |

Continuing operations | | | | $ | (0.35 | ) | $ | (0.45 | ) | $ | (1.72 | ) | $ | (0.39 | ) |

Discontinued operations | | | | — | | (1.97 | ) | (4.06 | ) | (2.57 | ) |

| | | | $ | (0.35 | ) | $ | (2.42 | ) | $ | (5.78 | ) | $ | (2.96 | ) |

| | | | | | | | | | | |

Weighted-average number of equity shares outstanding: | | | | | | | | | | | |

(in millions) | | | | | | | | | | | |

Basic and diluted | | 9 | | 194.2 | | 132.0 | | 176.4 | | 131.9 | |

See accompanying Notes to Consolidated Financial Statements.

2

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

Periods ended September 30,

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars)

| | | | Three months | | Nine months | |

| | Note | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | | |

Net loss | | | | $ | (64.2 | ) | $ | (315.1 | ) | $ | (1,005.3 | ) | $ | (374.3 | ) |

Other comprehensive loss, net of income tax: | | 17, 18 | | | | | | | | | |

Unrealized gain (loss) on foreign currency translation adjustment | | | | 7.6 | | (42.4 | ) | 41.2 | | (90.4 | ) |

Portion of foreign currency translation adjustment in income as a result of the business disposals | | 10 | | — | | — | | 273.3 | | — | |

Unrealized net gain (loss) on derivative financial instruments related to cash flow hedges | | | | — | | 2.9 | | (0.1 | ) | 9.8 | |

Reclassification of realized net loss (gain) on derivative financial instruments to the statement of income | | | | (2.7 | ) | 0.9 | | (6.6 | ) | 3.9 | |

Comprehensive loss | | | | $ | (59.3 | ) | $ | (353.7 | ) | $ | (697.5 | ) | $ | (451.0 | ) |

See accompanying Notes to Consolidated Financial Statements.

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS (DEFICIT)

Periods ended September 30,

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars)

| | | | Three months | | Nine months | |

| | Note | | 2008 | | 2007 | | 2008 | | 2007 | |

Retained earnings (deficit), beginning of period, as previously reported: | | | | $ | (2,775.4 | ) | $ | 338.1 | | (1,813.3 | ) | $ | 393.4 | |

Cumulative effect of change in accounting policy - Inventories | | 3 | | — | | — | | (21.0 | ) | — | |

Retained earnings (deficit), beginning of period: | | | | $ | (2,775.4 | ) | $ | 338.1 | | $ | (1,834.3 | ) | $ | 393.4 | |

Net loss | | | | (64.2 | ) | (315.1 | ) | (1,005.3 | ) | (374.3 | ) |

Redemption of convertible notes | | | | — | | — | | — | | 15.9 | |

Dividends on preferred shares | | | | — | | (4.7 | ) | — | | (16.7 | ) |

Retained earnings (deficit), end of period | | | | $ | (2,839.6 | ) | $ | 18.3 | | $ | (2,839.6 | ) | $ | 18.3 | |

See accompanying Notes to Consolidated Financial Statements.

3

CONSOLIDATED STATEMENTS OF CASH FLOWS

Periods ended September 30,

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars)

| | | | Three months | | Nine months | |

| | Note | | 2008 | | 2007 | | 2008 | | 2007 | |

Cash flows from operating activities: | | | | | | | | | | | |

Net loss | | | | $ | (64.2 | ) | $ | (315.1 | ) | $ | (1,005.3 | ) | $ | (374.3 | ) |

Adjustments for: | | | | | | | | | | | |

Reorganization items | | 4 | | 2.0 | | — | | 21.3 | | — | |

Depreciation of property, plant and equipment | | | | 56.8 | | 77.2 | | 198.3 | | 226.9 | |

Impairment of assets and non-cash portion of restructuring and other charges | | | | — | | 128.0 | | 18.8 | | 160.6 | |

Goodwill impairment charge | | | | — | | 166.0 | | — | | 166.0 | |

Future income taxes | | | | (29.8 | ) | (57.0 | ) | (10.2 | ) | (96.1 | ) |

Amortization of other assets | | | | 3.7 | | 5.2 | | 14.2 | | 16.4 | |

Amortization of financing costs | | 8 | | — | | 0.9 | | 55.6 | | 3.0 | |

Change in fair value of restricted cash | | | | — | | — | | 3.1 | | — | |

Loss on business disposals | | 10 | | 0.6 | | 1.7 | | 685.3 | | 12.7 | |

Prepayment premium on early redemption of debts | | | | — | | 53.1 | | — | | 53.1 | |

Other | | | | 14.0 | | (2.8 | ) | 4.5 | | (10.0 | ) |

| | | | (16.9 | ) | 57.2 | | (14.4 | ) | 158.3 | |

Net changes in non-cash balances related to operations: | | | | | | | | | | | |

Accounts receivable | | | | (39.3 | ) | (66.7 | ) | 130.6 | | (10.1 | ) |

Inventories | | | | (32.1 | ) | (42.8 | ) | 17.3 | | (24.4 | ) |

Trade payables and accrued liabilities | | | | 103.8 | | (12.7 | ) | 54.0 | | 39.2 | |

Other current assets and liabilities | | | | 51.2 | | 23.3 | | (15.3 | ) | 10.5 | |

Other non-current assets and liabilities | | | | (47.0 | ) | (0.1 | ) | (72.8 | ) | (40.0 | ) |

| | | | 36.6 | | (99.0 | ) | 113.8 | | (24.8 | ) |

Cash flows provided by (used in) operating activities | | | | 19.7 | | (41.8 | ) | 99.4 | | 133.5 | |

Cash flows from financing activities: | | | | | | | | | | | |

Net change in bank indebtedness | | | | (8.0 | ) | — | | (68.4 | ) | — | |

Issuance of long-term debt, net of issuance costs | | | | — | | — | | — | | 43.0 | |

Issuance of DIP Term Loan, net of issuance costs | | | | — | | — | | 556.5 | | — | |

Repayment of DIP Term Loan | | | | — | | — | | (74.5 | ) | — | |

Net borrowing under revolving DIP Facility | | | | 10.6 | | — | | 60.0 | | — | |

Repayments of long-term debt | | | | (4.1 | ) | (10.1 | ) | (18.0 | ) | (12.3 | ) |

Redemption of convertible notes | | | | — | | — | | — | | (119.5 | ) |

Net borrowings under revolving bank facility | | | | 0.3 | | 110.8 | | 58.7 | | 166.4 | |

Net change in secured financing | | | | — | | — | | 48.6 | | — | |

Repayment of North American securitization program subsequent to Insolvency Proceedings | | | | — | | — | | (413.0 | ) | — | |

Net proceeds from issuance of equity shares | | | | — | | 1.4 | | — | | 4.3 | |

Dividends on preferred shares | | | | — | | (5.9 | ) | — | | (17.6 | ) |

Cash flows provided by (used in) financing activities | | | | (1.2 | ) | 96.2 | | 149.9 | | 64.3 | |

Cash flows from investing activities: | | | | | | | | | | | |

Business acquisitions, net of cash and cash equivalents | | | | — | | — | | — | | (3.5 | ) |

Net proceeds from business disposals, net of cash and cash equivalent | | 10 | | (0.6 | ) | — | | 43.4 | | — | |

Additions to property, plant and equipment | | | | (18.0 | ) | (62.5 | ) | (79.4 | ) | (197.2 | ) |

Net proceeds from disposal of assets | | | | 3.0 | | 28.5 | | 25.3 | | 69.0 | |

Restricted cash | | | | — | | (0.5 | ) | (2.5 | ) | (6.8 | ) |

Restricted cash related to Insolvency Proceedings | | | | (1.6 | ) | — | | (51.7 | ) | — | |

Cash flows used in investing activities | | | | (17.2 | ) | (34.5 | ) | (64.9 | ) | (138.5 | ) |

Effect on foreign currency | | | | (0.2 | ) | (18.9 | ) | (37.0 | ) | (41.7 | ) |

Net changes in cash and cash equivalents | | | | 1.1 | | 1.0 | | 147.4 | | 17.6 | |

Cash and cash equivalents, beginning of period | | | | 207.4 | | 34.4 | | 61.1 | | 17.8 | |

Cash and cash equivalents, end of period | | | | $ | 208.5 | | $ | 35.4 | | $ | 208.5 | | $ | 35.4 | |

Supplemental cash flow information: | | | | | | | | | | | |

Interest payment | | | | $ | 11.5 | | $ | 63.8 | | $ | 36.1 | | $ | 129.6 | |

Dividends paid on preferred shares classified as liability | | | | — | | 3.0 | | — | | 5.7 | |

Income tax paid (net of refund) | | | | (0.9 | ) | (12.2 | ) | 6.6 | | 1.2 | |

See accompanying Notes to Consolidated Financial Statements.

4

CONSOLIDATED BALANCE SHEETS

(Under creditor protection as of January 21, 2008 - Note 1)

(In millions of US dollars)

| | | | September 30, | | December 31, | |

| | Note | | 2008 | | 2007 | |

| | | | | | | |

Assets | | | | | | | |

| | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | | | | $ | 208.5 | | $ | 61.1 | |

Accounts receivable | | | | 715.1 | | 1,030.8 | |

Receivables from related parties | | | | 41.5 | | 16.1 | |

Inventories | | 3 | | 259.4 | | 368.1 | |

Income taxes receivable | | | | 7.8 | | 15.7 | |

Future income taxes | | | | 20.7 | | 28.6 | |

Prepaid expenses and other | | | | 43.1 | | 18.5 | |

Total current assets | | | | 1,296.1 | | 1,538.9 | |

| | | | | | | |

Property, plant and equipment | | 3 | | 1,388.4 | | 2,009.0 | |

Goodwill | | | | 342.0 | | 342.3 | |

Restricted cash | | | | 106.0 | | 54.9 | |

Receivables from related parties | | | | 4.5 | | 4.4 | |

Future income taxes | | | | 5.9 | | 11.2 | |

Other assets | | | | 291.5 | | 202.3 | |

Total Assets | | | | $ | 3,434.4 | | $ | 4,163.0 | |

| | | | | | | |

Liabilities and Shareholders’ deficit | | | | | | | |

| | | | | | | |

Current liabilities : | | | | | | | |

Bank indebtedness | | | | $ | 4.8 | | $ | 73.2 | |

Trade payables and accrued liabilities | | | | 533.1 | | 994.8 | |

Payables to related parties | | | | 21.2 | | 13.3 | |

Income and other taxes payable | | | | 48.3 | | 39.8 | |

Future income taxes | | | | 0.8 | | 1.0 | |

Secured financing | | | | — | | 462.5 | |

Current portion of long-term debt | | 11 | | 587.7 | | 1,023.7 | |

Liabilities subject to compromise | | 5 | | 2,876.8 | | — | |

Total current liabilities | | | | 4,072.7 | | 2,608.3 | |

| | | | | | | |

Long-term debt | | 11 | | 7.3 | | 1,313.6 | |

Other liabilities | | | | 231.0 | | 363.4 | |

Future income taxes | | | | 97.3 | | 132.2 | |

Preferred shares | | 12 | | 42.7 | | 178.5 | |

| | | | | | | |

Shareholders’ deficit: | | | | . | | | |

Capital stock | | 12 | | 1,591.4 | | 1,457.4 | |

Contributed surplus | | | | 103.0 | | 102.1 | |

Deficit | | | | (2,839.6 | ) | (1,813.3 | ) |

Accumulated other comprehensive income (loss) | | 17 | | 128.6 | | (179.2 | ) |

| | | | (1,016.6 | ) | (433.0 | ) |

Total Liabilities and Shareholders’ deficit | | | | $ | 3,434.4 | | $ | 4,163.0 | |

See accompanying Notes to Consolidated Financial Statements.

5

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Periods ended September 30, 2008 and 2007

(Under creditor protection as of January 21, 2008 – Note 1)

(Tabular amounts are expressed in millions of US dollars, except per share and option amounts)

(Unaudited)

1. Creditor Protection and Restructuring

On January 21, 2008 (the “Filing Date”), Quebecor World Inc. (“Quebecor World” or the “Company”) obtained an order (the “Initial Order”) from the Quebec Superior Court (the “Court”) granting creditor protection under the Companies’ Creditors Arrangement Act (the “CCAA”) for itself and for 53 U.S. subsidiaries (the “U.S. subsidiaries” and, collectively with the Company, the “Applicants”). On the same date, the U.S. subsidiaries filed a petition under Chapter 11 of the U.S. Bankruptcy Code (“Chapter 11”) in the U.S. Bankruptcy Court for the Southern District of New York (the “U.S. Bankruptcy Court”). The proceedings under the CCAA are hereinafter referred to as the “Canadian Proceedings”, the proceedings under Chapter 11 are hereinafter referred to as the “U.S. Proceedings” and the Canadian Proceedings and the U.S. Proceedings are hereinafter collectively referred to as the “Insolvency Proceedings”. The Company’s Latin American subsidiaries are not subject to the Insolvency Proceedings and, prior to their disposition as discussed below, nor were the European subsidiaries. Pursuant to the Insolvency Proceedings, the Applicants are provided with the authority to, among other things, continue operating the Applicants’ business (subject to court approval for certain activities), file with the Court and submit to creditors a plan of compromise or arrangement under the CCAA (the “Plan”) and operate an orderly restructuring of the Applicants’ business and financial affairs, in accordance with the terms of the Initial Order. Ernst & Young Inc. (the “Monitor”) has been appointed by the Court as Monitor in the Canadian Proceedings. Pursuant to the terms of the orders made in the Insolvency Proceedings, as amended, the Monitor was appointed to monitor the business and financial affairs of the Applicants and, in connection with such role, the Initial Order imposes a number of duties and functions on the Monitor, including, but not limited to, assisting the Applicants in connection with their restructuring and reporting to the Court on the state of the business and financial affairs of the Applicants and on developments in the Insolvency Proceedings, as the Monitor considers appropriate. Reference should be made to the Initial Order for a more complete description of the duties and functions of the Monitor.

Chapter 11 provides for all actions and proceedings against the U.S. Subsidiaries to be stayed during the continuation of the U.S. Proceedings. The Initial Order also provides for a general stay, and, pursuant to subsequent orders of the Court rendered on February 19, 2008, May 9, 2008, July 18, 2008 and September 29, 2008 respectively, this stay period was extended first to May 12, 2008 and then subsequently to July 25, 2008, September 30, 2008, and December 14, 2008 in Canada. The stay period is subject to further extensions as the Court may deem appropriate. The applicable stays generally preclude parties from taking any actions against the Applicants. The purpose of the stay period and the Insolvency Proceedings is to provide the Applicants the opportunity to stabilize their operations and businesses and to develop a business plan, all with a view to proposing a final Plan. Any such Plan will be subject to approval by affected creditors, as well as court approval.

The Company became in default under its revolving bank facility, its equipment financing credit facility and its North American securitization program on January 16, 2008. On January 24, 2008 pursuant to the Insolvency Proceedings entered into by the Company, an amount of $417.6 million, including fees, was paid in order to terminate the North American securitization program.

The Insolvency Proceedings also triggered defaults under substantially all of the Applicants’ other debt obligations. Generally, the Insolvency Proceedings have stayed actions against the Applicants, including actions to collect pre- filing indebtedness or to exercise control over any of the Applicants’ property. As a result of the stay, the Applicants have ceased making payments of interest and principal on substantially all of their pre-petition debt obligations. The orders granted in the Insolvency Proceedings have provided the Applicants with the authority, among other things: (a) to pay outstanding and future employee wages, salaries and benefits; (b) to make rent payments under existing arrangements payable after the Filing Date; and (c) to honour obligations to customers.

The Applicants are in the process of developing comprehensive business and financial plans, which will serve as a basis for discussions with stakeholders, with the advice and guidance of their financial advisors and the Monitor. The Applicants presented their business plan to the Ad Hoc Bondholder Group, the Bank Syndicate and the Official Committee of Unsecured Creditors (collectively, the “Committees”) at the beginning of June 2008. An overview of the Applicants’ five-year business plan was presented as well as details related to each of the major business segments. The business plan that was presented will serve as a basis for discussions with the creditor constituencies in anticipation of the formulation of a Plan or Plans of reorganization and, subject to receipt of necessary approvals from affected creditors, the Court and the U.S. Bankruptcy Court, the Applicants will implement one or more Plans. There can be no assurance, however, that a successful Plan or Plans of reorganization will be proposed by the Applicants, supported by the Applicants’ creditors or confirmed by the Court and the U.S. Bankruptcy Court, or that any such Plan or Plans will be consummated.

6

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

Another important step in the Company’s restructuring activities has been the sale of the Company’s European operations to a subsidiary of Hombergh Holdings B.V. (“HHBV”), a Netherlands-based investment group (Note 10). On June 17, 2008, the Court and the U.S. Bankruptcy Court approved the proposed sale transaction, which closed on June 26, 2008. Under the terms of the agreement, the Company received €52.2 million in cash at closing. HHBV issued a €21.5 million five-year note bearing interest at 7% per year payable to Quebecor World. The sale was made substantially on an “as is, where is” basis.

Should the stay period and any subsequent extensions thereof, if granted, not be sufficient to develop and present a Plan or should the Plan not be accepted by affected creditors and, in any such case, the Applicants lose the protection of the stay of proceedings, substantially all debt obligations of the Applicants will then become due and payable immediately, creating an immediate liquidity crisis which would in all likelihood lead to the liquidation of the Applicants’ assets. Failure to implement a Plan and obtain sufficient exit financing within the time granted by the Court and the U.S. Bankruptcy Court will also result in substantially all of the Applicants’ debt obligations becoming due and payable immediately, which would in all likelihood lead to the liquidation of the Applicants’ assets.

As detailed in Note 10, the Company’s UK subsidiary was placed into administration on January 28, 2008.

On September 29, 2008, the Court authorized the Company to conduct a claims procedure for the identification, resolution and barring of claims against Quebecor World Inc. The Canadian claims procedure contemplates that any person with any claim against the Company of any kind or nature arising prior to January 21, 2008, and any claim arising on or after January 21, 2008, that arose further to the repudation, termination or restructuring of any contract, lease, employment agreement or other agreement (“Restructuring Claim”), with the exception of certain excluded claims, must file its claim with the Monitor on or prior to December 5, 2008 (the “Claims Bar Date”).

Pursuant to orders entered by the U.S. Bankruptcy Court, the U.S. Subsidiaries filed their schedule of assets and liabilities and a statement of financial affairs on July 18, 2008. On September 29, 2008, concurrently with the order granted by the Court with respect to the Canadian claims procedure, the U.S. Bankruptcy Court authorized the U.S. Subsidiaries to conduct a claims procedure setting December 5, 2008 as the bar date by which all creditors of the U.S. Subsidiaries must file proofs of their respective claims and interests against the U.S. Subsidiaries.

As at the date hereof, it is not possible to determine the extent of the claims that will be filed, whether or not such claims will be disputed and whether or not such claims will be subject to discharge in the Insolvency Proceedings. It is also not possible at this time to determine whether to establish any additional liabilities in respect of claims. Once all claims against the Applicants have been filed, the Applicants will review all claims filed and begin the claims reconciliation process. In connection with the review and reconciliation process, the Applicants will also determine the additional liabilities, if any, that should appropriately be established in respect of such claims.

On September 29, 2008, the Court granted an order lifting the stay of proceedings for the sole purpose of permitting certain of the noteholders to file a paulian action (namely, an action by which a creditor who suffers prejudice through a juridical act made by its debtor in fraud of its rights seeks to obtain a declaration that the act may not be set up against it) against, inter alia, the Company, contesting the opposability of security granted by Quebecor World and certain of its subsidiaries in September and October 2007 to the lenders under its revolving bank facility and equipment financing facility at such time. The order expressly provides that, immediately following the issuance and service of the paulian action, all further proceedings with respect to such paulian action be immediately stayed until further order of the Court.

Furthermore, on September 29, 2008, the Company was authorized by the Court to enter into a share purchase agreement providing for the sale to Bandhu Industrial Resources Private Limited of its interest in TEJ Quebecor Printing Limited (“TQPL”), which operates a printing facility located in Gurgaon, India. If completed, the transaction would also include a loan settlement agreement with respect to certain loans owing by TQPL to the Company and master release and indemnity agreements between the purchaser and the Company concerning its liabilities in relation to TQPL and the printing facility. It is currently estimated that the total net consideration payable to the Company would be $0.15 million. The transaction is not conditional on obtaining any further approval of the Court.

On September 30, 2008, the Monitor commenced a case under Chapter 15 of the U.S. Bankruptcy Code on behalf of the Company in the U.S. Bankruptcy Court. The Monitor is seeking recognition of the Company’s CCAA proceeding as a foreign main proceeding and enforcement in the US of the Claims Procedure Order of the Court dated September 29, 2008, in order to facilitate the claims administration process for the Company. The Chapter 15 filing applies only to Quebecor World Inc. which has not been part of the Chapter 11 cases for the U.S. Subsidiaries that are pending before the U.S Bankruptcy Court. The claims process for Quebecor World Inc. will not affect the claims process for creditors of the U.S. Subsidiaries nor will it affect other aspects of the U.S. Proceedings. The recognition hearing before the U.S. Bankruptcy Court is scheduled for November 13, 2008.

7

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

Contributing factors

Quebecor World’s financial performance has suffered in the past few years, especially with respect to its European operations, which were funded, in part, with cash flows generated by the North American operations, as a result of a combination of factors, including declining prices and sales volume, and temporary disturbances and inefficiencies caused by a major retooling and restructuring of its printing operations initiated in 2004. The combination of significant capital investments and continued operating losses, principally as a result of its European operations, resulted in increased financing needs. During the last quarter of 2007, it was also necessary for the Company to repurchase certain senior notes in order to avoid breaching certain financial ratios, while also facing reduction in amounts available under its revolving bank facility.

Other events further hindered the Company’s efforts to improve its balance sheet and financial position. First, on November 20, 2007, Quebecor World announced the withdrawal of a refinancing plan previously announced on November 13, 2007 due to adverse financial market conditions. Second, on December 13, 2007, Quebecor World announced that it would not be able to consummate a previously announced transaction to sell/merge its European operations, which otherwise would have resulted in proceeds being paid to Quebecor World.

On December 31, 2007, the Company obtained a waiver from its bank syndicate lenders and from the sponsors of its North American securitization program, subject to the satisfaction of certain conditions and refinancing milestones, including obtaining $125 million in new financing by January 15, 2008. On January 16, 2008, the Company failed to satisfy the conditions and refinancing milestones set by the bank syndicate lenders, which resulted in the Company and certain of its subsidiaries being in default of its obligations under its revolving bank facility, its equipment financing credit facility and its North American securitization program.

As a result of the unsuccessful efforts of the Company to obtain new financing, the inability at the time to conclude the first proposed sale of its European operations and the operational demands of the Company, by mid-January 2008, the Company was experiencing a severe lack of liquidity and concluded it no longer had the ability to meet obligations which were falling due.

8

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

Basis of presentation and going concern issues

These financial statements have been prepared using the same Canadian GAAP as applied by the Company prior to the Insolvency Proceedings. While the Applicants have filed for and been granted creditor protection, these financial statements continue to be prepared using the going concern concept, which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The Insolvency Proceedings provide the Company with a period of time to stabilize its operations and financial condition and develop a Plan. During the period, Debtor-In-Possession (“DIP”) financing has been approved by the Court and the U.S. Bankruptcy Court and is available, subject to borrowing conditions, as described below. Management believes that these actions make the going concern basis appropriate. However, it is not possible to predict the outcome of these proceedings and, as such, realization of assets and discharge of liabilities is subject to significant uncertainty. Accordingly, substantial doubt exists as to whether the Company will be able to continue as a going concern. Further, it is not possible to predict whether the actions taken in any restructuring will result in improvements to the financial condition of the Company sufficient to allow it to continue as a going concern. If the going concern basis is not appropriate, adjustments will be necessary to the carrying amounts and/or classification of assets and liabilities, and to the expenses in these financial statements.

The accompanying financial statements do not purport to reflect or provide for the consequences of the Insolvency Proceedings. In particular, such financial statements do not purport to show: (a) as to assets, their realizable value on a liquidation basis or their availability to satisfy liabilities; (b) as to pre-petition liabilities, the amounts that may be allowed for claims or contingencies, or the status and priority thereof; (c) as to shareholders accounts, the effect of any changes that may be made in the capitalization of the Company; or (d) as to operations, the effect of any changes that may be made in its business.

While the Company is under creditor protection, it will make adjustments to the financial statements to isolate assets, liabilities, revenues, and expenses related to the reorganization and restructuring activities so as to distinguish these events and transactions from those associated with the ongoing operation of the business. Further, claims allowed arising under the Insolvency Proceedings may be recorded as liabilities and presented separately on the consolidated balance sheets. If a restructuring occurs and there is substantial realignment of the equity and non-equity interests in the Company, the Company will be required, under Canadian GAAP, to adopt “fresh start” reporting. Under fresh start reporting, the Company would undertake a comprehensive re-evaluation of its assets and liabilities based on the reorganization value as established and confirmed in the Plan. The financial statements do not present any adjustments that may be required during the period that the Company remains under creditor protection, or that may be required under fresh start reporting.

In accordance with Canadian GAAP appropriate for a going concern, property, plant and equipment is carried at cost less accumulated amortization and any impairment losses and they are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Goodwill is carried at cost less any impairment losses. Goodwill is tested for impairment annually and between annual tests when an event or circumstance occurs that more likely than not reduces the fair value of a reporting unit below its carrying amount. The series of events that led the Company to the Insolvency Proceedings and the events since then triggered impairment tests for its property, plant and equipment, and goodwill. The Company made assumptions, such as expected growth, maintaining customer base and achieving costs reductions, about the future cash flows expected from the use of its assets. There can be no assurance that expected future cash flows will be realized or will be sufficient to recover the carrying amount of long lived assets or goodwill. The Company completed its annual goodwill impairment testing in the second quarter of 2008 and it concluded that the goodwill for its North America segment was not impaired.

The preparation of financial statements in conformity with Canadian GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. The Insolvency Proceedings materially affect the degree of uncertainty associated with the measurement of many amounts in the financial statements. More specifically, it could impact the recoverability tests and fair value assumptions used in the impairment test of property, plant and equipment, and goodwill, the valuation of future income tax assets and of contract acquisition costs.

In light of the Insolvency Proceedings, it is unlikely that the Company’s existing Multiple Voting Shares, Redeemable First Preferred Shares and Subordinate Voting Shares will have any material value following the approval of a Plan. There is a risk such shares could be cancelled.

9

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

DIP financing

On January 21, 2008, the Court approved a Senior Secured Superpriority DIP Credit Agreement (as subsequently amended by amendments dated January 25, 2008, February 26, 2008, March 27, 2008 and August 5, 2008, the “DIP Credit Agreement”) between Quebecor World Inc. and Quebecor World (USA) Inc., each a debtor-in-possession under the U.S. Proceedings and a petitioner under the Canadian Proceedings, as Borrowers, Credit Suisse, as Administrative Agent, Initial Issuing Bank and Initial Swing Line Lender, General Electric Capital Corporation and GE Canada Finance Holding Company, as Collateral Agent, Morgan Stanley Senior Funding, Inc., and Wells Fargo Foothill, LLC, as Co-Syndication Agents, and Wachovia Bank, N.A., as Documentation Agent.

The DIP financing is comprised of both a revolving credit facility with sub-facilities for Canadian dollar borrowings, swing line loans and issuance of letters of credit for an aggregate maximum commitment of the lenders of $400 million (the “Revolving DIP Facility”) bearing interest at variable rates based on Base rate, or Eurodollar rate, Canadian Banker’s Acceptance rate or Canadian prime rate, plus applicable margins and a $600 million term loan (“DIP Term Loan”), bearing interest at variable rates based on Base rate, or Eurodollar rate, plus applicable margins, which was fully drawn immediately following the Initial Order and the interim order of the U.S. Bankruptcy Court, dated January 23, 2008 (the “Interim DIP Order”). Amounts borrowed under the DIP Term Loan and repaid or prepaid may not be re-borrowed. Under the Revolving DIP Facility, the availability of funds is determined by a borrowing base based on percentages of eligible receivables and inventory. The unused portion of the Revolving DIP Facility is subject to a commitment fee of 0.50% per annum. From the date of the Interim DIP Order up to the date of the final order of the U.S. Bankruptcy Court dated April 1, 2008 (the “Final DIP Order”), the maximum availability under the Revolving DIP Facility was $150 million. By the entry of the Final DIP Order by the U.S. Bankruptcy Court, the maximum availability under the Revolving DIP Facility became $400 million. On June 30, 2008, the Company repaid $74.5 million on the DIP Term Loan. As at September 30, 2008 and November 4, 2008, the Company had drawn an aggregate of $562.3 million and $562.0 million, respectively, on the DIP Term Loan and Revolving DIP Facility.

The DIP Credit Agreement contains certain restrictive financial covenants which were met as of September 30, 2008.

The Revolving DIP Facility and DIP Term Loan are secured by a perfected lien on, and security interest in, all present and after-acquired property of Quebecor World, the U.S. Subsidiaries subject to the U.S. Proceedings and certain subsidiaries in Latin America. The liens are junior to the liens securing the Company’s syndicated revolving bank facility with Royal Bank of Canada as administrative agent and its equipment financing credit facility with Société Générale (Canada) as lender up to an aggregate amount of $170 million, which was granted prior to the Filing Date to the extent such liens are valid, perfected and not voidable. The Revolving DIP Facility and DIP Term Loan are also guaranteed by substantially all of the Company’s direct and indirect North American subsidiaries and certain foreign subsidiaries.

The Revolving DIP Facility and DIP Term Loan mature on the earliest to occur of (a) July 21, 2009 and (b) the substantial consummation of a Plan. The DIP Credit Agreement may be prepaid or accelerated upon the occurrence of an event of default and contains mandatory prepayments including, among other things, the net proceeds of certain asset sales, issuance of certain debt and certain extraordinary receipts.

Should the Court dismiss the Insolvency Proceedings or enter any order granting relief from the stays provided for thereunder, this would constitute an event of default under the DIP Credit Agreement and the debt could become due and payable immediately, which would, in all likelihood, lead to the liquidation of all the Applicants’ assets.

The DIP Credit Agreement provides for various restrictions on, among other things, the ability of the Company and its subsidiaries to incur additional debt, secure such debt, make investments, dispose of their assets (including pursuant to sale and leaseback transactions and sales of receivables under securitization programs) and make capital expenditures. Each of these transactions would require the consent of a majority of the Company’s DIP lenders if they exceed certain thresholds set forth in the DIP Credit Agreement, and may, in certain cases, require the consent of the Monitor and/or the Courts.

The Court limits the amounts of funding available for its Latin America subsidiaries to $10 million, in addition to a $5 million amount for subsidiaries that are not Applicants. As of November 4, 2008, $10 million was utilized to fund Latin America subsidiaries, while a supplemental $3 million was used to fund Latin America subsidiaries and other non-Applicant subsidiaries. The Company is considering the future needs of its subsidiaries and will request additional funding flexibility from its creditors, if required

10

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Creditor Protection and Restructuring (Cont’d)

Accounting policies applicable to an entity under Creditor Protection

As a result of the Insolvency Proceedings, the Company is following accounting policies, including disclosure items, applicable to entities that are under creditor protection. In addition to Canadian GAAP, the Company is applying the guidance in the American Institute of Certified Public Accountants Statement of Position 90-7, “Financial Reporting by Entities in Reorganization under the Bankruptcy Code” (SOP 90-7). While SOP 90-7 refers specifically to Chapter 11 in the United States, its guidance, in management’s view, is also applicable to an entity restructuring under CCAA where it does not conflict with Canadian GAAP.

Consistent with Canadian GAAP, SOP 90-7 does not change the manner in which financial statements are prepared. However, SOP 90-7 does require that the financial statements for periods ending subsequent to the Filing Date distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business. Revenues, expenses, gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the business are reported separately as reorganization items (see Note 4). Cash flows related to reorganization items have been disclosed separately.

While payments may not be made on liabilities subject to compromise, including long-term debt, interest on debt obligations continue to be recognized. Interest is not a reorganization item. The consolidated balance sheet distinguishes pre-filing liabilities subject to compromise from both those pre-filing liabilities that are not subject to compromise and from post-filing liabilities (see Note 5). Liabilities that may be affected by the Plan may be settled for lesser amounts and the resulting adjustments may be material. On September 29, 2008, the Court rendered a Claims Procedure Order setting out, among other matters, the procedure to be followed for submission by creditors of proofs of claims as well as a Claims Bar Date of December 5, 2008.

Consolidated financial statements that include one or more entities in reorganization proceedings and one or more entities not in reorganization proceedings are required to include disclosure of entities in reorganization proceedings, including disclosure of Condensed Combined Financial Information of the entities in the reorganization proceedings, including disclosure of the amount of intercompany receivables and payables therein (see Note 6).

SOP 90-7 has been applied effective January 21, 2008, and for subsequent reporting periods while the Company continues to operate under creditor protection.

The resulting changes in reporting are described in Note 4 - Reorganization Items, Note 5 - Liabilities Subject to Compromise and Note 6 - Condensed Combined Financial Information.

11

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2. Basis of Presentation

The consolidated financial statements included in this report are unaudited and reflect normal and recurring adjustments which are, in the opinion of the Company, considered necessary for a fair presentation. These consolidated financial statements have been prepared in conformity with Canadian GAAP. The same accounting policies as described in the Company’s latest consolidated financial statements prior to the Insolvency Proceedings have been used, except changes described in Note 1 and 3. However, these consolidated financial statements do not include all disclosures required under Canadian GAAP for annual financial statements and, accordingly, should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s latest annual consolidated financial statements.

Seasonality

The operations of the Company’s business are seasonal, with the majority of historical operating income recognized in the second half of the fiscal year, primarily as a result of the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions. Within any year, the seasonality could adversely affect the Company’s cash flow and results of operations on a quarterly basis.

Comparative figures

Certain comparative figures have been reclassified to conform to the presentation of the current period.

12

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

3. Change in Accounting Standards

Effective January 1, 2008, the Company adopted the following Canadian Institute of Chartered Accountants (“CICA”) Handbook sections:

· Section 1535, Capital Disclosures, which requires the disclosure of both qualitative and quantitative information that enables users of financial statements to evaluate the entity’s objectives, policies and processes for managing capital. The adoption of this section requires disclosure of information on capital management, which is included in Note 15, Capital and Liquidity Management.

· Section 3862, Financial Instruments – Disclosures, and Section 3863, Financial Instruments – Presentation, which require additional disclosures relating to financial instruments. The adoption of these sections required disclosure of risks associated with financial instruments to which the Company is exposed, including sensitivity analysis and how the Company manages those risks. This information is included in Note 14, Financial Instruments.

· Section 3031, Inventories, which provides more extensive guidance on the recognition and measurement of inventories, and related disclosures. Upon adoption of this new section, in accordance with the transition rules, the Company has adjusted opening retained earnings as if the new rules had always been applied in the past, without restating comparative figures of prior years. Accordingly, the following adjustments were recorded in the consolidated financial statements as at January 1, 2008:

· Decrease of inventory by $32.9 million

· Increase of property, plant and equipment by $7.2 million

· Decrease of future income taxes liabilities by $4.7 million

· Increase of deficit by $21.0 million

Future changes in accounting standards and accounting policies

· The Company intends to change the September 30 annual measurement date of plan assets and accrued benefit obligations to December 31 with respect to its pension and post-retirement benefits. The Company is currently evaluating the effect of this change in accounting policy on its consolidated financial statements.

· In February 2008, the CICA issued Section 3064, “Goodwill and Intangible Assets”, replacing Section 3062, “Goodwill and Other Intangible Assets”. The new section clarifies the requirements for recognizing intangible assets on costs that may only be deferred when they relate to an item that meets the definition of an asset. Section 3064 effectively converges Canadian GAAP for intangible assets with International Financial Reporting Standards (“IFRS”). This standard is effective for the Company for the first quarter of 2009. The Company is currently assessing the impact of the adoption of this new section on its financial statements.

· The Canadian Accounting Standards Board requires all public companies to adopt IFRS for interim and annual financial statements relating to fiscal years beginning on or after January 1, 2011. Early adoption is permitted if certain conditions are met. Companies will be required to provide IFRS comparative information for the previous fiscal year. We cannot at this time reasonably estimate the impact of adopting IFRS on our consolidated financial statements.

13

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

4. Reorganization Items

Reorganization items represent post-filing revenues, expenses, gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the Applicants. The cash flow usage related to reorganization and restructuring items since the Filing Date amounts to $46.9 million ($24.4 million for the third quarter of 2008) and relates primarily to professional fees. The following outlines amounts that have been included in the Consolidated Statement of Loss:

| | Three months ended | | Nine months ended | |

| | September 30, | | September 30, | |

| | 2008 | | 2008 | |

Amortization of financing costs | | $ | — | | $ | 15.1 | |

Amortization of embedded derivatives and hedges interest rate risk | | — | | (11.2 | ) |

Professional fees | | 21.3 | | 52.7 | |

Other expenses | | 5.1 | | 11.6 | |

| | $ | 26.4 | | $ | 68.2 | |

5. Liabilities Subject to Compromise

Liabilities subject to compromise refers to liabilities incurred prior to the Filing Date that may be dealt with as affected claims under a Plan in the Insolvency Proceedings, as well as claims arising out of any repudiated leases, contracts, and other arrangements. It is possible that items not currently considered as liabilities subject to compromise in these unaudited Consolidated Financial Statements will be added or reclassified to this category of liabilities at a later date. The amounts below are the liabilities subject to compromise as of September 30, 2008 and are subject to future adjustments as a result of negotiations, U.S. Bankruptcy Court and Court orders, proofs of claim, and other events. Any additions to this category of liabilities and any adjustments may be material and, depending on their nature, may be recorded as a reorganization adjustment. The Plan will determine how a particular class of affected claims will be settled, including payment terms, if applicable.

These unaudited consolidated financial statements do not include intercompany liabilities (Note 6) as these are eliminated in the preparation of the unaudited Consolidated Financial Statements. However, depending on the ultimate determination and approval of the Plan, certain of these liabilities, including amounts between entities that have not filed for bankruptcy relief under Insolvency Proceedings and those that have filed, may be subject to compromise and these amounts may be material.

The Company continues to accrue for interest on debt that is subject to compromise. No interest has been paid on unsecured debt of the Company subsequent to January 21, 2008, the date of the CCAA filing.

| | Note | | September 30, 2008 | |

Accounts payable and accrued liabilities | | | | $ | 406.7 | |

Income tax and other taxes payable | | | | 19.5 | |

Long-term debt | | 11 | | 2,361.4 | |

Other liabilities | | | | 89.2 | |

| | | | $ | 2,876.8 | |

14

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

6. Condensed Combined Financial Information

As stated in Note 1, unaudited Consolidated Financial Statements should provide disclosure of Condensed Combined Financial Information of the Applicants, including disclosure of the amount of intercompany receivables and payables between Applicants and non-Applicants. Presented below is the Condensed Combined Financial Information of the Applicants as at and for the period ending September 30, 2008.

Entities in Insolvency Proceedings exclude Latin American operations and included the European operations before their disposals (Note 10).

Condensed Combined Statements of Loss

Periods ended September 30, 2008

(Unaudited)

| | | | Entities in Insolvency Proceedings | |

| | Note | | Three months | | Nine months | |

Operating revenues | | | | $ | 921.0 | | $ | 2,765.6 | |

Operating expenses: | | | | | | | |

Cost of sales | | | | 769.2 | | 2,314.6 | |

Selling, general and administrative | | | | 74.5 | | 237.7 | |

Depreciation and amortization | | | | 53.5 | | 166.4 | |

Impairment of assets, restructuring and other charges | | | | 6.1 | | 52.7 | |

| | | | 903.3 | | 2,771.4 | |

Operating income (loss) | | | | 17.7 | | (5.8 | ) |

Financial expenses | | | | 92.3 | | 302.5 | |

Dividends on preferred shares classified as liability | | | | 0.9 | | 4.6 | |

Reorganization items | | | | 26.4 | | 68.2 | |

Loss from continuing operations before income taxes | | | | (101.9 | ) | (381.1 | ) |

Income taxes | | | | (10.9 | ) | 14.7 | |

Net loss from continuing operations | | | | (91.0 | ) | (395.8 | ) |

Net loss from discontinued operations (net of tax) | | 10 | | (0.6 | ) | (685.3 | ) |

Net loss | | | | $ | (91.6 | ) | $ | (1,081.1 | ) |

15

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

6. Condensed Combined Financial Information (Cont’d)

Condensed Combined Statement of Cash Flows

Periods ended September 30, 2008

(Unaudited)

| | Entities in Insolvency Proceedings | |

From continuing operations | | Three months | | Nine months | |

Cash flows used in operating activities | | $ | (21.9 | ) | $ | 50.3 | |

| | | | | |

Cash flows from financing activities: | | | | | |

Issuance of DIP Term Loan, net of issuance costs | | — | | 556.5 | |

Repayment of DIP Term Loan | | — | | (74.5 | ) |

Net borrowing under revolving DIP Facility | | 10.6 | | 60.0 | |

Repayments of long-term debt | | (4.1 | ) | (18.0 | ) |

Net borrowings under revolving bank facility | | 0.3 | | 58.7 | |

Net change in secured financing | | — | | (15.0 | ) |

Repayment of North American securitization program subsequent to Insolvency Proceedings | | — | | (413.0 | ) |

Cash flows provided by financing activities | | 6.8 | | 154.7 | |

Cash flows from investing activities: | | | | | |

Net proceeds from business disposals, net of cash and cash equivalent | | (0.6 | ) | 76.0 | |

Additions to property, plant and equipment | | (14.2 | ) | (67.1 | ) |

Net proceeds from disposal of assets | | 3.0 | | 24.7 | |

Restricted cash related to Insolvency Proceedings | | (1.6 | ) | (51.7 | ) |

Cash flows used in investing activities | | (13.4 | ) | (18.1 | ) |

| | | | | |

Effect on foreign currency | | 20.7 | | (16.5 | ) |

| | | | | |

Net changes in cash and cash equivalents | | (7.8 | ) | 170.4 | |

Cash and cash equivalents, beginning of period | | 178.6 | | 0.4 | |

Cash and cash equivalents, end of period | | $ | 170.8 | | $ | 170.8 | |

16

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

6. Condensed Combined Financial Information (Cont’d)

Condensed Combined Balance Sheet

September 30, 2008

(Unaudited)

| | Entities in | |

| | Insolvency | |

| | Proceedings | |

Assets | | | |

Current assets | | $ | 1,082.2 | |

Property, plant, and equipment | | 1,276.8 | |

Goodwill | | 342.0 | |

Restricted cash | | 51.7 | |

Receivables from related parties | | 4.5 | |

Future income taxes | | 2.6 | |

Other assets | | 274.7 | |

Total Assets | | $ | 3,034.5 | |

| | | |

Liabilities and Shareholders’ deficit | | | |

Other current liabilities | | $ | 453.3 | |

Current portion of long-term debt | | 585.0 | |

Liabilities subject to compromise | | 2,876.8 | |

Intercompany payables subject to compromise (a) | | 2,595.2 | |

Total current liabilities | | 6,510.3 | |

| | | |

Long-term debt | | 7.3 | |

Other liabilities | | 206.5 | |

Future income taxes | | 93.8 | |

Preferred shares | | 42.7 | |

Shareholders’ deficit | | (3,826.1 | ) |

| | | |

Total Liabilities and Shareholders’ deficit | | $ | 3,034.5 | |

(a) Intercompany receivables and payables, subject to elimination upon consolidation, are disclosed on a net basis and are recorded at their face value.

17

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

7. Impairment of Assets, Restructuring and Other Charges

The following table details the charge for impairment of assets, restructuring and other charges and pension settlements related to continuing operations:

| | | | Three months ended September 30, | | Nine months ended September 30, | |

| | Note | | 2008 | | 2007 | | 2008 | | 2007 | |

Impairment of assets | | | | $ | — | | $ | 52.1 | | $ | 16.7 | | $ | 71.7 | |

Restructuring and other charges | | | | 6.7 | | 3.1 | | 37.6 | | 25.3 | |

Pension settlements | | 16 | | — | | — | | — | | 4.8 | |

| | | | $ | 6.7 | | $ | 55.2 | | $ | 54.3 | | $ | 101.8 | |

(a) Impairment of assets

Following impairment tests on various specific units, the Company concluded that no assets were impaired at the end of the third quarter. For the nine months period ended September 30, 2008, the Company recorded impairment charges related to long-lived assets in North America totalling $16.7 million on certain machinery and equipment.

(b) Restructuring and other charges

The following table details the Company’s restructuring and other charges and the change in the reserve for restructuring and other charges:

| | | | Nine months ended September 30, 2008 | |

| | | | 2008 | | Prior Year | | | |

| | Note | | Initiatives | | Initiatives | | Total | |

Expenses | | | | | | | | | |

Workforce reduction | | | | $ | 29.8 | | $ | 0.9 | | $ | 30.7 | |

Leases and carrying costs for closed facilities | | | | 4.5 | | 3.5 | | 8.0 | |

| | | | 34.3 | | 4.4 | | 38.7 | |

Underspending | | | | | | | | | |

Workforce reduction | | | | — | | (0.8 | ) | (0.8 | ) |

Leases and carrying costs for closed facilities | | | | — | | (0.3 | ) | (0.3 | ) |

| | | | — | | (1.1 | ) | (1.1 | ) |

Payments | | | | | | | | | |

Workforce reduction | | | | (18.9 | ) | (4.0 | ) | (22.9 | ) |

Leases and carrying costs for closed facilities | | | | (4.5 | ) | (3.6 | ) | (8.1 | ) |

| | | | (23.4 | ) | (7.6 | ) | (31.0 | ) |

Net change | | | | 10.9 | | (4.3 | ) | 6.6 | |

Foreign currency changes | | | | (0.2 | ) | (0.1 | ) | (0.3 | ) |

Business disposals | | 10 | | — | | (7.9 | ) | (7.9 | ) |

Balance, beginning of period | | | | — | | 17.0 | | 17.0 | |

Balance, end of period | | | | $ | 10.7 | | $ | 4.7 | | $ | 15.4 | |

2008 restructuring initiatives

During the third quarter of 2008, there were various workforce reductions across North America. In the first half of 2008, there were restructuring initiatives in North America related to the closures of North Haven, CT and Magog, QC facilities, a significant downsizing of the Islington, ON facility and various workforce reductions across North America. The total cost expected for these initiatives is $42.4 million, of which $30.9 million is for workforce reduction and $11.5 million is for leases and carrying costs for closed facilities. These initiatives are expected to be completed by the end of 2008.

18

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

7. Impairment of Assets, Restructuring and Other Charges (Cont’d)

(b) Restructuring and other charges (cont’d)

As at September 30, 2008, the balance of the restructuring reserve was $15.4 million. The total cash disbursement related to this reserve is expected to be $15.2 million for the remainder of 2008. Finally, the Company expects to record a charge of $8.1 million in upcoming quarters for the restructuring initiatives that have already been announced as at September 30, 2008.

8. Financial Expenses

| | Three months ended | | Nine months ended | |

| | September 30, | | September 30, | |

| | 2008 | | 2007 | | 2008 | | 2007 | |

Interest expenses (a) | | $ | 54.2 | | $ | 40.7 | | $ | 168.5 | | $ | 127.0 | |

Prepayment premium on the early redemption of debts | | — | | 53.1 | | — | | 53.1 | |

Bank and other charges | | 1.0 | | 3.0 | | 6.2 | | 8.1 | |

Amortization of financing costs | | 2.5 | | 0.9 | | 58.1 | | 3.0 | |

Change in fair value of restricted cash | | — | | — | | 3.1 | | — | |

Net loss (gain) on foreign exchange | | 18.3 | | (62.9 | ) | 6.2 | | (110.5 | ) |

Derivative financial instruments (b) | | (2.4 | ) | 72.6 | | (21.8 | ) | 106.1 | |

| | 73.6 | | 107.4 | | 220.3 | | 186.8 | |

Interest capitalized to the cost of equipment | | (0.9 | ) | (0.9 | ) | (2.7 | ) | (4.5 | ) |

| | | | | | | | | |

| | $ | 72.7 | | $ | 106.5 | | $ | 217.6 | | $ | 182.3 | |

| | | | | | | | | |

Portion included in discontinued operations | | — | | 14.1 | | 6.3 | | 33.7 | |

| | | | | | | | | |

| | $ | 72.7 | | $ | 92.4 | | $ | 211.3 | | $ | 148.6 | |

(a) Interest expenses include interest on long-term debt, convertible notes, secured financing and long-term debt of Applicants subject to compromise. Interest on DIP financing amounted to $9.9 million for the three-month period ended September 30, 2008 and $33.4 million for the nine-month period ended September 30, 2008.

(b) During the three-month period ended September 30, 2008, the Company reclassified a net gain of $2.4 million from accumulated other comprehensive income (loss) to earnings related to derivative financial instruments for which cash flow hedge accounting was terminated in a prior period. A net loss of $70.4 million was recorded for the same period in 2007 on embedded derivatives not closely related to their host contracts and derivative financial instruments for which hedge accounting was not used. During the first nine months of the year 2008, the Company recorded a net gain of $34.3 million, of which $12.3 million is presented as Reorganization items (Note 4) (a net loss of $104.6 million in 2007).

19

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

9. Loss per Share

The following table sets forth the computation of basic and diluted loss per share from continuing operations:

| | Three months ended | | Nine months ended | |

| | September 30, | | September 30, | |

| | 2008 | | 2007 | | 2008 | | 2007 | |

Net loss | | $ | (63.6 | ) | $ | (55.3 | ) | $ | (289.9 | ) | $ | (34.8 | ) |

Net income allocated to holders of preferred shares | | 4.5 | | 4.7 | | 13.6 | | 16.7 | |

| | | | | | | | | |

Net loss allocated to holders of equity shares | | $ | (68.1 | ) | $ | (60.0 | ) | $ | (303.5 | ) | $ | (51.5 | ) |

| | | | | | | | | |

(In millions) | | | | | | | | | |

| | | | | | | | | |

Weighted average number of diluted equity shares outstanding | | 194.2 | | 132.0 | | 176.4 | | 131.9 | |

| | | | | | | | | |

Loss per share: | | | | | | | | | |

Basic and diluted | | $ | (0.35 | ) | $ | (0.45 | ) | $ | (1.72 | ) | $ | (0.39 | ) |

For the purpose of calculating diluted loss per share, the effects of the convertible notes (repaid in June 2007) and the effects of all stock options were excluded, since their inclusion was anti-dilutive, for both 2008 and 2007.

10. Discontinued Operations

On June 26, 2008, the Company sold its European operations to a subsidiary of Hombergh Holdings B.V. (“HHBV”). The total consideration for the Company was €52.2 million ($82.1 million) in cash and a €21.5 million five-year note bearing interest at 7% per year, which is carried in other assets at its fair value of €14.1 million ($22.3 million). The net cash proceeds were mainly used by the Company to repay the DIP Term Loan. This transaction resulted in a loss on disposal of $653.3 million, including the cumulative translation adjustment impact and is presented as part of the net loss from discontinued operations.

On January 28, 2008, the Company abandoned its UK subsidiary, Quebecor World PLC (“QWP”), based in Corby, and placed it into administration. As a result, the Company ceased to have control or significant influence over QWP as the ability to determine strategic, operating, investing and financing policies was transferred to the administrators. The administrators ceased to operate QWP on February 15, 2008, and all of QWP’s long-lived assets, primarily buildings and machinery and equipment, will be liquidated by the administrators. As a result, the Company recorded an impairment charge of $32.0 million (including the write-down of an intercompany receivable) in the first quarter of 2008. The Company is an unsecured creditor for its intercompany receivable of $28.0 million from QWP and, as of September 30, 2008, the Company has written down the receivable to its estimated amount recoverable of $5.0 million.

20

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

10. Discontinued Operations (Cont’d)

Summary of discontinued operations

| | Three months ended | | Nine months ended | |

| | September 30, | | September 30, | |

| | 2008 | | 2007 | | 2008 | | 2007 | |

Operating revenues | | $ | — | | $ | 242.5 | | $ | 485.8 | | $ | 744.6 | |

| | | | | | | | | |

Operating expenses: | | | | | | | | | |

Cost of sales | | — | | 220.1 | | 452.5 | | 682.4 | |

Selling, general and administrative | | — | | 16.3 | | 35.6 | | 53.8 | |

Securitization fees | | — | | 2.3 | | — | | 5.9 | |

Depreciation and amortization | | — | | 16.8 | | 22.1 | | 45.9 | |

Impairment of assets, restructuring and other charges | | — | | 77.5 | | 2.8 | | 96.4 | |

Goodwill impairmnt charge | | — | | 166.0 | | — | | 166.0 | |

| | — | | 499.0 | | 513.0 | | 1,050.4 | |

Operating loss | | — | | (256.5 | ) | (27.2 | ) | (305.8 | ) |

Financial expenses | | — | | 14.1 | | 6.3 | | 33.7 | |

Net loss before income taxes and loss on business disposals | | — | | (270.6 | ) | (33.5 | ) | (339.5 | ) |

Income taxes | | — | | (12.5 | ) | (3.4 | ) | (12.7 | ) |

| | | | | | | | | |

Net loss before loss on business disposals | | — | | (258.1 | ) | (30.1 | ) | (326.8 | ) |

Loss on business disposals, net of tax | | (0.6 | ) | (1.7 | ) | (685.3 | ) | (12.7 | ) |

Net loss from discontinued operations | | $ | (0.6 | ) | $ | (259.8 | ) | $ | (715.4 | ) | $ | (339.5 | ) |

Summary of assets and liabilities sold and abandoned

| | September 30, 2008 | |

Assets sold and abandoned: | | | |

Cash and cash equivalents | | $ | 32.6 | |

Non-cash operating working capital | | 135.5 | |

Property, plant and equipment | | 482.8 | |

Other assets | | 5.2 | |

| | | |

Liabilities sold and abandoned: | | | |

Secured Financing | | 98.0 | |

Long-term debt | | 14.3 | |

Other liabilities | | 28.1 | |

Future income taxes | | 5.4 | |

| | | |

Net assets | | $ | 510.3 | |

Effect of cumulative translation adjustment | | $ | 273.3 | |

Proceeds: | | | |

Cash | | $ | 82.1 | |

Note receivable | | 22.3 | |

Transaction fees | | (6.1 | ) |

| | $ | 98.3 | |

Net loss on business disposals and abandoned | | $ | 685.3 | |

21

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

11. Long-Term Debt

On January 16, 2008, since the Company had not obtained $125.0 million of new financing, as had been required under the terms of the revolving bank facility and North American securitization program waivers, the Company became in default under its revolving bank facility, its equipment financing facility and its North American securitization program. Upon filing for creditor protection in the Insolvency Proceedings on January 21, 2008, the Company became in default under substantially all of its other debt agreements and instruments.

The following table summarizes changes in long-term debt:

| | Maturity | | September 30, 2008 | | December 31, 2007 | |

Revolving bank facility and other short-term lines | | 2008 | | $ | 700.1 | | $ | 643.1 | |

Senior Notes 4.875% and 6.125% | | 2008, 2013 | | 600.0 | | 598.1 | |

Senior Notes 9.75% | | 2015 | | 400.0 | | 400.0 | |

Equipment financing credit facility | | 2015 | | 150.0 | | 168.5 | |

Senior Notes 8.75% | | 2016 | | 450.0 | | 450.0 | |

Senior Debentures 6.50% | | 2027 | | 3.2 | | 3.2 | |

Capital leases | | 2008-2016 | | 58.1 | | 43.8 | |

Other debts | | 2008-2022 | | — | | 24.0 | |

| | | | 2,361.4 | | 2,330.7 | |

Amortization of effect of fair value hedge on interest rate risk | | | | — | | (1.9 | ) |

Adjustment related to embedded derivatives | | | | — | | 9.4 | |

Financing fees, net of amortization | | | | — | | (25.4 | ) |

| | | | | | | |

Long-term debt of Applicants subject to compromise - subsequent to January 21, 2008 (Note 5) | | | | 2,361.4 | | — | |

DIP financing (a) | | 2009 | | 585.0 | | — | |

Capital leases | | 2008-2014 | | 7.3 | | 18.7 | |

Other debts | | 2008-2022 | | 2.7 | | 5.8 | |

| | | | | | | |

Long-term debt | | | | 595.0 | | 2,337.3 | |

| | | | | | | |

Less current maturities | | | | 587.7 | | 1,023.7 | |

| | | | | | | |

Total Long-term debt | | | | $ | 7.3 | | $ | 1,313.6 | |

(a) As described in Note 1, on January 21, 2008, the Court approved the DIP Credit Agreement. The effective interest rate on the DIP Credit Agreement as at September 30, 2008 was 8.25%. The DIP Credit Agreement contains certain restrictive financial and operating covenants, which are all met as at September 30, 2008.

The Company incurred debt issuance costs of $43.5 million which were completely expensed during the first quarter of 2008.

22

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

12. Capital Stock

| | September 30, 2008 | | December 31, 2007 | |

(Thousands of shares) | | Number | | Amount | | Number | | Amount | |

| | | | | | | | | |

Multiple Voting Shares | | 46,987 | | $ | 93.5 | | 46,987 | | $ | 93.5 | |

Subordinate Voting Shares | | 153,738 | | 1,285.4 | | 85,585 | | 1,151.4 | |

Redeemable First Preferred Shares - Series 3 Classified as Shareholders’ equity | | 12,000 | | 212.5 | | 12,000 | | 212.5 | |

Total Capital Stock | | | | $ | 1,591.4 | | | | $ | 1,457.4 | |

| | | | | | | | | |

Redeemable First Preferred Shares - Series 5 Classified as Liability | | 1,763 | | 42.7 | | 7,000 | | 178.5 | |

Total Preferred Shares Classified as Liability | | | | $ | 42.7 | | | | $ | 178.5 | |

During the first nine months of 2008, no Subordinate Voting Shares were issued under the Company’s stock option plan (22,500 in the same period of 2007) and no Subordinate Voting Shares were issued under the Company’s employee stock purchase plans (334,657 in the same period of 2007 for a total cash consideration of $4.3 million).

On February 26, 2008, the Company announced that it had determined the final conversion rate applicable to the 3,975,663 Series 5 Cumulative Redeemable First Preferred Shares (“Series 5 Preferred Shares”) that were converted into Subordinate Voting Shares effective as of March 1, 2008. Taking into account all accrued and unpaid dividends on the 3,975,663 Series 5 Preferred Shares up to and including March 1, 2008, the Company has determined that, in accordance with the provisions governing the Series 5 Preferred Shares, each Series 5 Preferred Share was converted on March 1, 2008 into 12.93125 Subordinate Voting Shares. Consequently, 51.4 million new Subordinate Voting Shares were issued by the Company to holders of Series 5 Preferred Shares on March 1, 2008 resulting in an increase of $101.6 million in Capital Stock.

On May 30, 2008, the Company announced that it has determined the final conversion rate applicable to the 517,184 Series 5 Preferred Shares that were converted into Subordinate Voting Shares effective as of June 1, 2008. Taking into account all accrued and unpaid dividends on the 517,184 Series 5 Preferred Shares up to and including June 1, 2008, the Company has determined that, in accordance with the provisions governing the Series 5 Preferred Shares, each Series 5 Preferred Share was converted on June 1, 2008 into 13.146875 Subordinate Voting Shares. Consequently, 6.8 million new Subordinate Voting Shares were issued by the Company to holders of Series 5 Preferred Shares on June 1, 2008, resulting in an increase of $13.7 million in Capital Stock.

On August 28, 2008, the Company announced that it has determined the final conversion rate applicable to the 744,124 Series 5 Preferred Shares that were converted into Subordinate Voting Shares effective as of September 1, 2008. Taking into account all accrued and unpaid dividends on the 744,124 Series 5 Preferred Shares up to and including September 1, 2008, the Company has determined that, in accordance with the provisions governing the Series 5 Preferred Shares, each Series 5 Preferred Share was converted on September 1, 2008 into 13.3625 Subordinate Voting Shares. Consequently, 9.9 million new Subordinate Voting Shares were issued by the Company to holders of Series 5 Preferred Shares on September 1, 2008, resulting in an increase of $18.7 million in Capital Stock.

On September 26, 2008, the Company received notices with respect to 66,601 of its remaining 1,763,029 issued and outstanding Series 5 Preferred Shares requesting conversion into the Company’s Subordinate Voting Shares effective as of December 1, 2008.

Following the suspension of the dividend payments in November 2007, no dividends were declared in the first nine months of 2008. Dividends declared in 2007 but unpaid on the Series 3 Preferred Shares and Series 5 Preferred Shares were CA$4.6 million ($4.5 million) and CA$0.8 million ($0.7 million). The decrease of unpaid dividends on Series 5 Preferred Shares, compared to December 31, 2007, is explained by their conversion into Subordinate Voting Shares.

As at September 30, 2008, the dividends in arrears on the Series 3 Preferred Shares and Series 5 Preferred Shares were CA$15.3 million ($14.8 million) and CA$2.5 million ($2.5 million) respectively.

23

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

13. Stock-Based Compensation

The following table summarizes information about stock options:

| | September 30, 2008 | | December 31, 2007 | |

Number of stock options at the end of the period (in thousands): | | | | | |

Outstanding | | 5,562.3 | | 6,942.5 | |

Exercisable | | 2,930.2 | | 3,984.0 | |

The total stock-based compensation expense recorded in the first nine months of 2008 was $0.9 million ($2.9 million for the same period in 2007).

In January 2008, the Company cancelled the employee stock purchase plan in the United States and the employee share investment plan in Canada for eligible employees. In February 2008, the Company terminated the deferred stock unit plan for the benefit of the Company’s directors.

14. Financial Instruments

(a) Fair value of financial instruments

The estimated fair value of the Company’s Liabilities Subject to Compromise is not reasonably determinable given the current status of the Company while under creditor protection during the Insolvency Proceedings (see Note 1). The carrying value of other financial instruments approximated fair value due to the short maturities or the terms and conditions attached to these instruments.

(b) Risks arising from financial instruments

The Company’s risk management policies are established to identify and analyze the risks faced by the Company, to set appropriate risk limits and controls, and to monitor risks and adherence to limits. Risk management policies are reviewed regularly to reflect changes in market conditions and the Company’s activities. From its use of financial instruments, the Company is exposed to credit risk, liquidity risk and market risk, which comprises foreign exchange risk, interest rate risk and commodity risk.

As described in Note 1 of these unaudited Consolidated Financial Statements, on January 21, 2008, the Company obtained an Initial Order from the Court granting creditor protection. Subsequent to the Insolvency Proceedings and under provisions of the signed International Swap and Derivatives Association (“ISDA”) agreements, the counterparties of the Company’s derivative financial instruments exercised their contractual right to terminate substantially all of the foreign exchange forward contracts; interest rate swap and commodity swap agreements in place on that date. Consequently, the Company was not able to effectively manage certain market risks described below as at September 30, 2008. It is, however, the Company’s intention to effectively manage these risks in a manner similar to that conducted prior to the Filing Date as soon as practicable.

The effective management of the risks arising from financial instruments described below portrays the strategy in place prior to the Insolvency Proceedings. Where such risk management procedures were in place as at September 30, 2008, they are identified below as such.

Credit risk

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises principally from credit losses that could result from defaults by customers and counterparties when using financial instruments.

The Company is exposed to credit risk with respect to its cash equivalents, accounts receivable, other long-term receivables and derivative financial instruments.

The Company, in the normal course of business, continuously monitors the financial condition of its customers, reviews the credit history of each new customer and generally does not require collateral. As at September 30, 2008, no customer balance represented more than 4% of the Company’s consolidated accounts receivable and the Company’s 10 largest customers accounted for 28% of consolidated revenues. In addition, 76% of the Company’s accounts receivable as at September 30, 2008 were not considered past due.

24

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Financial Instruments (Cont’d)

(b) Risks arising from financial instruments (cont’d)

The Company establishes an allowance for doubtful accounts that corresponds to the specific credit risk of its customers, historical trends and other information on the state of the economy. The Company has an insurance program that mitigates its risk on certain accounts receivable. The Company does not believe that it is exposed to an unusual level of customer credit risk. The following tables show the aging of the receivables and the continuity of the allowance for doubtful accounts.

Accounts receivable aging

| | September 30, 2008 | |

Current | | $ | 497.7 | |

1-30 days overdue | | 75.3 | |

31-90 days overdue | | 23.4 | |

More than 90 days overdue | | 60.5 | |

| | 656.9 | |

Allowance for doubtful accounts | | (52.8 | ) |

Other receivables | | 111.0 | |

| | $ | 715.1 | |

Allowance for doubtful accounts

| | Note | | | |

Balance as at December 31, 2007 | | | | $ | 43.5 | |

Bad debt expense | | | | 17.6 | |

Business disposals | | 10 | | (5.4 | ) |

Other | | | | (2.9 | ) |

Balance as at September 30, 2008 | | | | $ | 52.8 | |

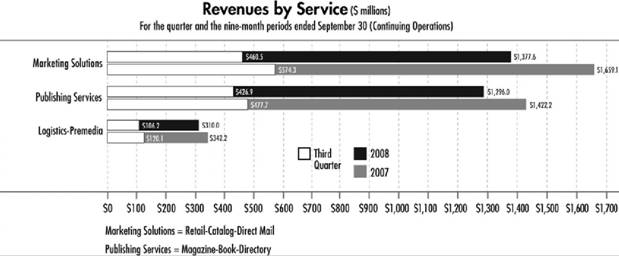

The Company believes that the diversity of its products as well as the diversity of its customer base are significant factors in reducing its credit risk, as well as the impact on the Company of fluctuations in local market or product- line demand. The following table shows revenues by print service, which is representative of the diversity of the accounts receivable.

25

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Financial Instruments (Cont’d)

(b) Risks arising from financial instruments (cont’d)