UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14 (A) OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

[] Preliminary proxy statement [ ] Confidential, for use of the

Commission only (as permitted by Rule 14a-6(e) (2)) [ X ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material pursuant to Sec. 240.14a - -11 (c) or Sec. 240.14a -12

PAINCARE HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person (s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PAINCARE HOLDINGS, INC.

1030 NORTH ORANGE AVENUE

SUITE 105

ORLANDO, FL 32801

October 2, 2006

Dear Stockholder:

You are cordially invited to attend the 2006 Annual Meeting of Stockholders of PainCare Holdings, Inc., to be held on Friday, October 27, 2006 at 10:30 a.m., local time, at the Hyatt Regency Grand Cypress, 1 Grand Cypress Blvd., Regency Hall, Orlando, FL 32836.

The matters to be acted upon at the Annual Meeting, as well as other important information, are set forth in the accompanying Notice of Annual Meeting and Proxy Statement which you are urged to review carefully.

Regardless of your plans for attending in person, it is important that your shares be represented and voted at the Annual Meeting. Accordingly, you are requested to complete, sign, date and return the enclosed proxy card in the enclosed postage paid envelope. Signing this proxy will not prevent you from voting in person should you be able to attend the meeting, but will assure that your vote is counted if, for any reason, you are unable to attend.

We hope that you can attend the 2006 Annual Meeting of Stockholders. Your interest and support in the affairs of PainCare Holdings, Inc. are appreciated.

Sincerely,

/s/ Randy Lubinsky

Randy Lubinsky

Chief Executive Officer

YOUR VOTE IS IMPORTANT

Even if you plan to attend the meeting, please complete, sign, and return promptly the enclosed proxy in the envelope provided to ensure that your vote will be counted. Instructions on voting by Internet, telephone or mail are shown on the Proxy and in the Proxy Statement. You may vote in person if you so desire even if you have previously sent in your proxy. If your shares are held in the name of a bank, brokerage firm or other nominee, please contact the party responsible for your account and direct him or her to vote your shares on the enclosed card.

PAINCARE HOLDINGS, INC.

1030 NORTH ORANGE AVENUE, SUITE 105

ORLANDO, FL 32801

(407) 367-0944

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held October 27, 2006

_____________________________________

To the Stockholders of PainCare Holdings, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of PainCare Holdings, Inc., a Florida corporation (the “Company”), will be held at the Hyatt Regency Grand Cypress, 1 Grand Cypress Blvd., Regency Hall, Orlando, FL 32836 at 10:30 a.m., local time on October 27, 2006, for the following purposes:

1. To elect directors to each serve until the next Annual Meeting of Stockholders of the Company and until their successors have been duly elected and qualified;

2. To ratify the appointment of Beemer, Pricher, Kuehnhackl & Heidbrink, P.A. as independent auditors for the Company for the year ending December 31, 2006; and

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

Only stockholders of record at the close of business on September 25, 2006, are entitled to notice of and to vote at the meeting, or any adjournment thereof. A complete list of such stockholders will be available for examination at the offices of the Company in Orlando, Florida for ten business days prior to the meeting.

Stockholders unable to attend the Annual Meeting in person are requested to read the enclosed Proxy Statement and then complete and deposit the Proxy with the Company’s transfer agent, American Stock Transfer & Trust Company, 59 Maiden Lane, New York, NY 10038 before the time of the Annual Meeting or adjournment thereof or with the chairman of the Annual Meeting, 1030 North Orange Avenue, Suite 105, Orlando, FL 32801, prior to the commencement thereof. Instructions for voting by Internet or telephone are shown on the Proxy and in the Proxy Statement. Stockholders who received the Proxy through an intermediary must deliver the Proxy in accordance with the instructions given by such intermediary. A Proxy may be revoked by a shareholder at any time before the effective exercise thereof.

Also enclosed are copies of the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2005, without exhibits, filed with the SEC on October 2, 2006, and our most recent Quarterly Report on Form 10-Q for the quarter ended June 30, 2006, filed with the SEC on August 14, 2006.

| Orlando, Florida | | BY ORDER OF THE BOARD OF DIRECTORS |

| October 2, 2006 | | |

| | | /s/ Randy Lubinsky |

| | | Randy Lubinsky, Chief Executive Officer |

THE PROXY STATEMENT WHICH ACCOMPANIES THIS NOTICE OF ANNUAL MEETING OF STOCKHOLDERS CONTAINS MATERIAL INFORMATION CONCERNING THE MATTERS TO BE CONSIDERED AT THE MEETING, AND SHOULD BE READ IN CONJUNCTION WITH THIS NOTICE.

PAINCARE HOLDINGS, INC.

1030 North Orange Avenue, Suite 105

Orlando, Florida 32801

(407) 367-0944

PROXY STATEMENT FOR

2006 ANNUAL MEETING OF STOCKHOLDERS

___________________

Annual Meeting.This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of PainCare Holdings, Inc., a Florida corporation (the "Company”) for use at the Annual Meeting of Stockholders (the "Annual Meeting”) to be held at the Hyatt Regency Grand Cypress, 1 Grand Cypress Blvd., Regency Hall, Orlando, FL 32836, at 10:30 a.m., local time, on Friday, October 27, 2006, and at any adjournments thereof for the purpose of considering and voting upon the matters set forth in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”). This Proxy Statement and the accompanying form of proxy are first being mailed to stockholders of the Company (the “Stockholders”) on or about October 2, 2006. All costs of soliciting proxies will be borne by the Company.

Proxy Card. A Proxy Card is enclosed for use at the Annual Meeting. Proxies that are properly completed, signed and received prior to the Annual Meeting will be voted in accordance with the instructions of the persons executing the same. Unless instructed to the contrary, the proxies will be voted FOR Proposal 1 and FOR Proposal 2 set forth in the Notice of the Annual Meeting. If any other matters are properly presented to the Annual Meeting for action, it is intended that the person named in the enclosed Proxy Card and acting thereunder will vote in accordance with his best judgment on such matters. A proxy may be revoked by a stockholder at any time before the effective exercise thereof by submitting a subsequently dated proxy or by appearing in person and voting at the Annual Meeting.

Voting by Telephone or Electronically. If you are a registered stockholder (that is, if you hold your stock in certificate form), you may vote by telephone, or electronically through the Internet, by following the instructions included with your Proxy Card. If your shares are held in “street name,” please check your Proxy Card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically. The deadline for voting by telephone or electronically is 11:59 p.m., Eastern Standard Time, on October 26, 2006.

Record Dates.With respect to all proposals, the close of business on September 25, 2006 has been fixed as the record date ("Record Date") for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. As of the Record Date, there were 66,722,239 shares issued and outstanding, all of which are entitled to vote.

Quorum.The presence, in person or by proxy, of a majority of the outstanding shares of common stock on the Record Date, is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted towards a quorum. If a quorum is not present or represented by proxy at the Annual Meeting, the stockholders present or represented by proxy at the Annual Meeting have the power to adjourn the Annual Meeting from time to time, without notice other then an announcement at the Annual Meeting, until a quorum is present or represented by proxy. At any such adjourned Annual Meeting at which a quorum is present or represented by proxy, any business may be transacted that might have been transacted at the original Annual Meeting.

Voting Requirements.With respect to the election of directors, votes may be cast in favor of or withheld. Directors are elected by a plurality of the votes cast at the Annual Meeting. Any other matter that may be submitted to a vote of the stockholders will be approved if the number of shares of common stock voted in favor of the matter exceeds the number of shares voted against the matter.

1

Abstentions and Broker Non-Votes.Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum at the Annual Meeting, but will not be counted as votes cast for or against Proposal 1 and Proposal 2. Shares referred to as “broker or nominee non-votes” (shares held by brokers or nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary voting power on a particular matter) will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but will not be counted as votes cast for or against Proposal 1 or Proposal 2.

Default Voting.All shares represented by properly executed proxies, unless such proxies have been previously revoked, will be voted at the Annual Meeting in accordance with the directions set forth on such proxies. If no direction is indicated, the shares will be voted FOR THE ELECTION OF THE NOMINEES NAMED HEREIN AS DIRECTORS AND FOR THE RATIFICATION OF BEEMER, PRICHER, KUEHNHACKL & HEIDBRINK, P.A. AS THE COMPANY'S INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS FOR THE FISCAL YEAR ENDED DECEMBER 31, 2006. IF ANY OTHER BUSINESS COMES BEFORE THESTOCKHOLDERS FOR A VOTE AT THE MEETING, THE SHARES WILL BE VOTED IN ACCORDANCE WITH THE DISCRETION OF THE HOLDERS OF THE PROXY.

Tabulation of Votes.All votes will be tabulated by the inspector of elections (the “Inspector”) appointed for the Annual Meeting who will, for each proposal to be voted on, determine the number of shares outstanding, the number of shares entitled to vote, the number of shares represented at the Annual Meeting, the existence of a quorum, and the authenticity, validity and effect of all proxies received by the Company. The Inspector will also separately tabulate affirmative and negative votes and broker “non-votes”, and determine the result for each proposal.

Revocation of Proxy.The enclosed proxy, even though executed and returned, may be revoked at any time prior to the voting of the proxy by (a) the execution and submission of a revised proxy, (b) written notice to the Director of Corporate Services of the Company or (c) voting in person at the Annual Meeting.

ADDITIONAL MATERIALS

Included herewith please find a copy of the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2005, without exhibits, filed with the SEC on October 2, 2006, and our most recent Quarterly Report on Form 10-Q for the quarter ended June 30, 2006, filed with the SEC on August 14, 2006. These documents do not form any part of the material for solicitation of proxies.

The Company will provide, without charge, a copy of the exhibits to its Form 10-K, upon written request to Jennifer Loomis, Director of Corporate Services of the Company, at 1030 North Orange Avenue, Suite 105, Orlando, FL 32801; fax number (407) 367-0950.

SECURITY OWNERSHIP OF MANAGEMENT AND PRINCIPAL STOCKHOLDERS

The following table sets forth the number of shares of the common stock beneficially owned as of September 25, 2006, by (i) each person believed by PainCare to be the beneficial owner of more than 5% of the common stock; (ii) each director; (iii) each executive officer; and (iv) all directors and executive officers as a group. Beneficial ownership by the stockholders has been determined in accordance with the rules promulgated under Section 13(d) of the Securities Exchange Act of 1934, as amended. All shares of the common stock are owned both of record and beneficially, unless otherwise indicated. Unless otherwise indicated, the address of each of the listed beneficial owners is c/o PainCare Holdings, Inc., 1030 North Orange Avenue, Suite 105, Orlando, Florida 32801.

The holders listed below will have sole voting power and investment power over the shares beneficially held by them. The table below includes common shares subject to options, warrants and convertible notes that may be acquired within 60 days of September 30, 2006.

2

| | | | | |

| | | Shares of Common Stock |

| | | Beneficially Owned (1) |

| Name of Beneficial Owners | | Number | | Percentage |

| Merrill Reuter, M.D. (2) | | 1,917,810 | | 2.9% |

| Randy Lubinsky (3)(11) | | 2,601,970 | | 3.8% |

| Mark Szporka (4)(11) | | 2,549,871 | | 3.7% |

| Ronald Riewold (5) | | 1,600,000 | | 2.4% |

| Jay Rosen, M.D. (6) | | 425,000 | | * |

| Arthur J. Hudson (7) (11) | | 570,000 | | * |

| Robert Fusco (8) | | 120,000 | | * |

| Thomas J. Crane (9) | | 29,000 | | * |

| Aldo F. Berti, M.D. (10) | | 25,000 | | * |

| All officers, directors, nominees and | | 9,838,651 | | 14.74% |

| affiliates as a group (9 persons) | | | | |

| |

| * Less than 1% | | | | |

| (1) | Based on an aggregate of 66,722,239 shares of our common stock outstanding as of September 25, 2006. |

| (2) | Includes the impact of the completion of the merger on January 1, 2001 between the Company’s subsidiary, PainCare Acquisition Company I, Inc., and Advanced Orthopaedics of South Florida, Inc., of which Dr. Reuter was a stockholder, at which time a trust controlled by Dr. Reuter received 1,850,000 shares of our common stock and $1,239,000 in convertible debentures which where paid in full in February of 2004. Dr. Reuter received 62,810 shares of common stock as partial consideration for PainCare’s purchase of 50% of his ownership interest in Lake Worth Surgical Center in May 2005. In addition, Pamela Reuter, Dr. Reuter’s wife, owns 5,000 shares of our common stock. |

| (3) | Includes options issued pursuant to the Company’s stock option plans (the “Plans”) to acquire (i) 1,000,000 shares of common stock at $1.00 per share; (ii) 150,000 shares of common stock at $1.93 per share; (iii) 100,000 shares of our common stock at $3.08 per share; (iv) 175,000 shares of common stock at $4.00 per share; (v) 197,531 shares of common stock issued for the exercise of stock options in February 2005; and (vi) 191,599 shares of common stock held in trust directly controlled by Randy Lubinsky. |

| (4) | Includes Plan options to acquire (i) 1,000,000 shares of common stock at $1.00 per share; (ii) 150,000 shares of common stock at $1.93 per share; (iii) 100,000 shares of common stock at $3.08 per share: (iv) 175,000 shares of common stock at $4.00 per share; and (v) 197,531 shares of common stock issued for the exercise of stock options in February 2005. |

| (5) | Includes warrant to acquire 25,000 shares of our common stock at $0.75 per share; Plan options to acquire (i) 775,000 shares of common stock at $1.00 per share; (ii) 190,000 shares of common stock at $3.02 per share; (iii) 310,000 shares of common stock at $1.90 per share; and (iv) 175,000 shares of common stock at $4.00 per share. |

| (6) | Includes Plan options to acquire 25,000 shares of common stock at $2.97 per share. |

| (7) | Includes Plan options to acquire (i) 70,000 shares of common stock at $0.70 per share; (ii) 25,000 shares of common stock at $2.40 per share; and (iii) 25,000 shares of common stock at $2.97 per share. |

| (8) | Includes Plan options to acquire (i) 70,000 shares of common stock at $0.70 per share; (ii) 25,000 shares of common stock at $2.40 per share; and (iii) 25,000 shares of common stock at $2.97 per share. |

| (9) | Includes Plan options to acquire 25,000 shares of common stock at $2.97 per share. |

| (10) | Includes Plan options to acquire 25,000 shares of common stock at $2.97 per share. |

| (11) | Includes Plan options to acquire 150,000 shares of common stock at $2.25 per share, which were granted and fully vested in accordance with a personal guarantee provided by Messrs. Lubinsky, Szporka and Hudson with respect to the guarantee of a WCMA line of credit with Merrill Lynch Business Financial Services, Inc. This line of credit was subsequently closed in February of 2004. |

3

PROPOSAL 1

ELECTION OF DIRECTORS

Director Nominees

The Company’s Board of Directors currently consists of nine members. The directors are elected annually by the stockholders of the Company. The Bylaws of the Company provide that the Board of Directors will determine the number of directors. The stockholders will elect nine directors for the coming year. All of the nominees presently serve as directors of the Company. All of the Company’s current directors are standing for reelection. Should any nominee become unable or unwilling to accept nomination or election, the Board of Directors will either select a substitute nominee or will reduce the size of the Board. If you have submitted a proxy and a substitute nominee is selected, the holders of the proxy will vote your shares FOR the election of the substitute nominee. The Board of Directors has no reason to believe that any nominee will be unable or unwilling to serve if elected.

THE BOARD OF DIRECTORS HAS NOMINATED THE BELOW-REFERENCED DIRECTORSFOR ELECTION BY THE STOCKHOLDERS AND UNANIMOUSLY RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW. THE ELECTION OF THESE DIRECTORS REQUIRES A PLURALITY OF THE VOTES CAST BY THE HOLDERS OF THE SHARES OF COMMON STOCK PRESENT OR REPRESENTED BY PROXY AT THE ANNUAL MEETING AND ENTITLED TO VOTE IN THE ELECTION OF DIRECTORS.

The name and age of each nominee, his principal occupation, and the period during which such person has served as a director is set forth below:

| | | | | First Became a | | |

| Name of Nominee | | Age | | Director of the Company | | Office Held with Company |

| Merrill Reuter, M.D. | | 46 | | 2002 | | Director and Chairman |

| Randy Lubinsky | | 53 | | 2002 | | Director /CEO |

| Mark Szporka | | 50 | | 2002 | | Director/CFO |

| Ron Riewold | | 59 | | 2002 | | Director/President |

| Jay Rosen, M.D. | | 48 | | 2002 | | Director |

| Arthur J. Hudson(1)(2) (3) | | 55 | | 2002 | | Director |

| Robert Fusco(1) | | 56 | | 2002 | | Director |

| Thomas J. Crane (1)(2) (3) | | 49 | | 2004 | | Director |

| Aldo F. Berti, M.D. (2) | | 58 | | 2004 | | Director |

| | ------------------- |

| (1) | Member of Audit Committee. |

| (2) | Member of Compensation Committee. |

| (3) | Member of the Stock Option Committee. |

Merrill Reuter, M.D. is the Company’s Chairman of the Board and is the President of Advanced Orthopaedics of South Florida, Inc. Dr. Reuter founded Advanced Orthopaedics of South Florida, Inc. in Lake Worth, Florida in 1992 and from that date until the present has served as its President and Medical Director. He received a BS degree from Tulane University in 1982 and a Masters in Medical Science and a Medical Degree from Brown University in 1986. Dr. Reuter completed his General Surgical Internship and Orthopedic Surgery Residency Training Program at the University of Texas Medical Branch in Galveston, Texas.

Randy Lubinsky, Chief Executive Officer and Director of the Company, joined the Company on August 1, 2000 and has over 25 years experience as a healthcare entrepreneur and investment banker. He has built businesses

4

from the start-up phase in the healthcare and real estate industries. Mr. Lubinsky received a BA degree in finance from Florida International University.

Mark Szporka, Chief Financial Officer and Director of the Company joined the Company on August 1, 2000 and has in excess of 25 years experience as an investment banker, chief financial officer and strategic planner. Mr. Szporka received a MBA from the University of Michigan and a BBA from the University of Notre Dame. He is a Certified Public Accountant (non-active) in New York.

Ronald L. Riewold is a Director and has been the Company’s President since February 2003. Previously Mr. Riewold served in various capacities for American Enterprise Solutions, Inc., a healthcare delivery system and internet utility located in Tampa, Florida, including consultant, Executive Vice President, President and Chief Operating Officer. Mr. Riewold has a BA degree from Florida State University and a MBA from Temple University.

Jay L. Rosen, M.D., was elected as a Director of the Company in 2000. Dr. Rosen has over 15 years experience as a healthcare entrepreneur. Since 1992, he has served as Chief Executive Officer and Executive Director of Tampa Bay Surgery Center, Inc., an outpatient surgical facility that specializes in minimally invasive spinal surgery and pain management procedures in Tampa, Florida. Dr. Rosen is active in managing Seven Springs Surgery Center in New Port Richey, Florida. Dr. Rosen received a BS degree from Fordham University and Medical Degree from Cetec University. He performed graduate medical research at Hahnemann University in Philadelphia and the Medical Center at SUNY at Stony Brook. Dr. Rosen is a Diplomat of the American Board of Quality Assurance and Utilization Review Physicians. He currently serves on the Board of Directors for Tampa Bay Surgery Center, Inc., Tampa Bay Surgery Associates, Inc., Rehab One, Inc., Open MRI & Diagnostic Center, Inc., Immuvac, Inc., and Intellicare, Inc.

Arthur J. Hudson was elected as a Director of the Company in November 2002. Mr. Hudson has been employed by Fidelitone, Inc., a full service inventory management, distribution and logistics company, since 1974, and currently serves as Fidelitone’s Senior Vice President of Corporate Development. Mr. Hudson is a member of the board of directors of Fidelitone. He received a B.S. degree in economics from Colorado State University.

Robert Fusco was elected as a Director of the Company in November 2002. Mr. Fusco has over twenty years experience in the healthcare industry and was involved in the building of Olsten Corporation into one of the largest home health and specialty pharmaceutical distribution services companies in North America. Since March 2000 when Olsten Corporation was sold to Addecco Corporation, Mr. Fusco has been an independent consultant. Mr. Fusco received a BS degree from Manhattan College.

Thomas J. Cranewas elected as a Director of the Company in November 2004.Since January 1991, Mr. Crane has owned and operated a specialized law practice located in Naples, Florida. Beginning in 2000, Mr. Crane formed, and currently acts as the Managing Director, of Cloverleaf Capital International, LLC, an investment banking firm focused on media, technology, and health care. Mr. Crane sits on the Boards of Compass Knowledge Holdings, Inc. based in Ocoee, Florida, XTEL, Inc., a telecommunications network based in Miami, Florida, and Broadcast Entertainment Corporation, a radio station operator in Texas, New Mexico, and California. Mr. Crane holds a JD from the University of Miami School of Law, Miami, Florida, a BA from Florida State University, Tallahassee, Florida and a Certificate of Languages from the University of Paris (Sorbonne), Paris, France. Mr. Crane is licensed to practice law in the States of Florida and Texas.

Aldo F. Berti, M.Dwas elected as a Director of the Company in November 2004. Since 1980, Dr. Berti has owned and provided physician and neurosurgical services to Aldo F. Berti, M.D. P.A. located in Miami, Florida. Dr. Berti is the Associate Director for Latin America at the Gamma Knife Institute at Jackson Memorial Medical Center at the University of Miami School of Medicine. Dr. Berti is a Fellow at the American College of Surgeons and the American Academy of Pediatrics. Dr. Berti is affiliated with the following hospitals: Cedars Medical Center, Miami, Florida; Jackson Memorial Medical Center -Gamma Knife Institute, Miami, Florida; North Shore Medical Center, Miami, Florida; Palm Springs Hospital, Miami, Florida; and South Miami Hospital, Miami, Florida.

5

During fiscal 2005, the Board of Directors met 6 times. A quorum of directors participated in all boardmeetings.

Stockholder Communications with the Board

Stockholders who wish to communicate with the Board of Directors should send their communications to the Chairman of the Board at the address listed below. The Chairman of the Board is responsible for forwarding communications to the appropriate Board members.

Chairman of the Board

PainCare Holdings, Inc.

1030 N. Orange Avenue

Suite 105

Orlando, FL 32801

Annual Meeting Attendance

The Company encourages all Directors to attend the Annual Meeting of Stockholders either in person or by telephone. Last year, each Director attended the Annual Meeting, either in person or by telephone.

Committees of the Board of Directors

The Company has established a standing Audit Committee, Compensation Committee and Stock Option Committee. The Company has not established a Nominating Committee.

Audit Committee

The Audit Committee retains and oversees the Company’s independent accountants, reviews the scope and results of the annual audit of the Company’s consolidated financial statements, reviews nonaudit services provided to the Company by its independent accountants and monitors transactions among the Company and its affiliates, if any. The Audit Committee currently consists of Mr. Fusco, the chairman of the Audit Committee, Mr. Hudson and Mr. Crane, who are all independent under American Stock Exchange and SEC rules. The Board of Directors has determined that Mr. Fusco, chairman of the Audit Committee, is qualified as an Audit Committee Financial Expert. During fiscal 2005, the Audit Committee held four meetings at which all of the members of the Committee were present.

The Company’s Board of Directors has adopted a written charter for the Audit Committee.

Compensation Committee

The Compensation Committee is responsible for supervising the Company’s compensation policies, administering the employee incentive plans, reviewing officers’ salaries and bonuses, approving significant changes in employee benefits and recommending to the Board such other forms of remuneration as it deems appropriate. The Compensation Committee currently consists of Mr. Crane, the chairman of the Compensation Committee, Dr. Berti and Mr. Hudson, who are all independent. During fiscal 2005, the Compensation Committee held one meeting, at which all of the members of the Committee were present.

6

Stock Option Committee

The Stock Option Committee is responsible for supervising and administering the Company’s Stock Option Plans, approving significant changes in the Plans and recommending to the Board such other forms of remuneration as it deems appropriate. The Stock Option Committee currently consists of Mr. Crane, the Chairman of the Stock Option Committee, and Mr. Hudson, who are independent. During fiscal 2005, the Stock Option Committee held no meetings.

American Stock Exchange Corporate Governance Rule Changes

The Company is required to comply with the corporate governance requirements of the American Stock Exchange. The American Stock Exchange rules require that the Company’s Board of Directors be comprised of a majority of independent directors, and that all members of the audit and compensation committees be independent. Currently, five out of nine of the Company’s directors are independent. If all nominees to the Board are elected, five out of nine of the Company's directors will be independent.

Report of the Audit Committee of the Board of Directors

October 2, 2006

To the Board of Directors of PainCare Holdings, Inc.:

Management is responsible for the Company’s financial reporting process, including its system of internal control, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent auditors are responsible for auditing those financial statements.

In performing our oversight duties we rely on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States. We also rely on the representations of the independent auditors included in their report on the Company’s financial statements.

Our oversight does not provide us with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures. Furthermore, our contacts with management and the independent auditors do not assure that:

- the Company’s financial statements are presented in accordance with generally accepted accountingprinciples,

- the audit of the Company’s financial statements has been carried out in accordance with generallyaccepted auditing standards, or

- the Company’s independent accountants are in fact “independent.”

In connection with the inclusion of the audited financial statements in the Company’s 2005 Annual Report on Form 10-K, the Audit Committee:

- reviewed and discussed the audited financial statements with management,

- discussed with our independent auditors the materials required to be discussed by SAS 61,

- reviewed the written disclosures and the letter from our independent auditors required by IndependentStandards Board Standard No. 1 and discussed with our independent auditors their independence, and

- based on the foregoing review and discussion, recommended to the Board of Directors that the auditedfinancial statements be included in the Company’s 2005 Annual Report on Form 10-K.

7

By the Audit Committee of the Board of Directors of PainCare Holdings, Inc.

Robert Fusco

Arthur Hudson

Thomas Crane

Selection of Board Nominees

The independent members of the Company’s Board of Directors select nominees for election as directors. The Board believes this process has worked well thus far particularly since it has been the Board’s practice to require unanimity of the independent Board members with respect to the selection of director nominees.

While no single factor is determinative, in order to have a Board with skills and attributes needed to function effectively, the following factors are considered by the Board in the process of selecting nominees for election as directors by the Board or by the stockholders:

- if not a Company employee, the ability to be an independent director;

- educational background, work experience and business knowledge generally;

- willingness and ability to dedicate the time and resources necessary for the diligent performance of theduties of a director of the Company;

- professional experience that is relevant to the Company’s business;

- character and ethics;

- reputation in the business community;

- previous service on boards, including public companies;

- actual or potential conflicts of interest;

- whether the person has any history of criminal convictions or violations of governmental rules andregulations; and

- other criteria that are relevant to determining whether the person will function effectively as a director.

In determining whether to elect a director or to nominate any person for election by the stockholders, the Board assesses the appropriate size of the Board of Directors, consistent with its Bylaws, and whether any vacancies on the Board are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, the Board will consider various potential candidates to fill each vacancy. Candidates may come to the attention of the Board through a variety of sources, including from current members of the Board, stockholders, or other persons. The Board of Directors has not yet had the occasion to, but will, consider properly submitted proposed nominations by stockholders who are not directors, officers, or employees of the Company on the same basis as candidates proposed by any other person. Stockholders can make proposals as provided below under the caption “Deadlines for Future Proposals of Stockholders.”

Executive Compensation

Summary Compensation

The following table sets forth compensation paid by the Company to each person who served in the capacity of Chief Executive Officer during 2005, 2004 and 2003, and other officers of the Company whose total annual salary and bonus for the fiscal years ended December 31, 2005, December 31, 2004 and December 31, 2003 exceeded $100,000 (collectively, the “Named Executive Officers”).

8

| SUMMARY COMPENSATION TABLE |

| |

| | | | | | | | | | Long Term Compensation Awards |

| | | | Annual Compensation | | Awards | | Payouts |

| | | | | | | | | | Restricted | | Securities | | | | |

| | | | | | | | | | Stock | | Underlying | | |

| | | | Salary | | Bonus | | Other Annual | | Award(s) | | Options | | LTIP

Payouts | | All Other

Compensation |

| Name & Principal Position | Year | | ($) | | ($) | | Compensation | | $ | | (#) | | ($) | | ($) |

| Randy Lubinsky, CEO | 2005 | | $ 296,667 | | $ 280,000 | | $ 20,892 | | $ -0- | | 175,000 | | $ -0- | | $ -0- |

| (1)(4) | 2004 | | $ 262,500 | | $ 300,000 | | $ 20,603 | | $ -0- | | 100,000 | | $ -0- | | $ -0- |

| | 2003 | | $ 220,833 | | $ 46,739 | | $ 19,390 | | $ -0- | | 1,050,000 | | $ -0- | | $ -0- |

| Mark Szporka, CFO | 2005 | | $ 271,667 | | $ 280,000 | | $ 24,944 | | $ -0- | | 175,000 | | $ -0- | | $ -0- |

| (2)(4) | 2004 | | $ 237,500 | | $ 250,000 | | $ 24,522 | | $ -0- | | 100,000 | | $ -0- | | $ -0- |

| | 2003 | | $ 195,833 | | $ 46,739 | | $ 24,406 | | $ -0- | | 1,050,000 | | $ -0- | | $ -0- |

| Ronald Riewold, President | 2005 | | $ 271,667 | | $ 210,000 | | $ 24,944 | | $ -0- | | 175,000 | | $ -0- | | $ -0- |

| (3)(5) | 2004 | | $ 183,333 | | $ 125,000 | | $ 24,522 | | $ -0- | | 1,250,000 | | $ -0- | | $ -0- |

| | 2003 | | $ 175,000 | | $ -0- | | $ 24,248 | | $ -0- | | -0- | | $ -0- | | $ -0- |

| (1) | Randy Lubinsky has served as our Director and the Chief Executive Officer since our reorganization on August 1, 2000. Pursuant to an employment agreement entered into in August 2000 and amended on August 1, 2002, Mr. Lubinsky received annual salary payments equal to $200,000 and certain perquisites and other benefits. This employment agreement was subsequently amended on August 1, 2003, increasing Mr. Lubinsky’s annual salary to $250,000. This employment agreement was amended again on August 1, 2004, increasing Mr. Lubinsky’s annual salary to $280,000 and subsequently amended on August 1, 2005, increasing Mr. Lubinsky’s annual salary to $320,000. For the fiscal year ended December 31, 2005, the Company paid Mr. Lubinsky a car allowance of $12,000 and paid health and dental insurance premiums of $8,892. See “Employment Agreements.” |

| (2) | Mark Szporka has served as a Director and Chief Financial Officer since our reorganization on August 1, 2000. Pursuant to an employment agreement entered into in August 2000 and amended August 1, 2002, Mr. Szporka received annual salary payments equal to $175,000 and certain perquisites and other benefits. This employment agreement was subsequently amended on August 1, 2003, increasing Mr. Szporka’s annual salary to $225,000. This employment agreement was amended again on August 1, 2004, increasing Mr. Szporka’s annual salary to $255,000 and subsequently amended on August 1, 2005, increasing Mr. Szporka’s annual salary to $295,000. For the fiscal year ended December 31, 2005, the Company paid Mr. Szporka a car allowance of $12,000 and paid health and dental insurance premiums of $12,944. See “Employment Agreements.” |

| (3) | Ronald Riewold has served as a Director since November 8, 2002 and President since February 7, 2003. Pursuant to an employment agreement entered into in February 2003, Mr. Riewold received annual salary payments equal to $175,000 and certain perquisites and other benefits. This employment agreement was amended on November 2, 2004, increasing Mr. Riewold’s annual salary to $225,000. This employment agreement was amended again on August 1, 2005, increasing Mr. Riewold’s annual salary to $295,000. For the fiscal year ended December 31, 2005, the Company paid Mr. Riewold a car allowance of $12,000 and paid health and dental insurance premiums of $12,944. See “Employment Agreements.” |

| (4) | Two hundred thousand (200,000) options were granted to Mr. Lubinsky and 200,000 options were granted to Mr. Szporka on August 1, 2000 under the Company's 2000 Stock Option Plan. One million (1,000,000) options were granted to Mr. Lubinsky and 1,000,000 options were granted to Mr. Szporka on August 1, 2002 under the Company’s 2001 Stock Option Plan. One Hundred Fifty thousand (150,000) options were granted to Mr. Lubinsky and 150,000 options were granted to Mr. Szporka on June 2, 2003 under the Company’s 2001 Stock Option Plan. Nine Hundred thousand (900,000) options were granted to Mr. Lubinsky and 900,000 options were granted to Mr. Szporka on September 11, 2003 under the Company’s 2001 Stock Option Plan. One hundred thousand (100,000) options were granted to Mr. Lubinsky and 100,000 options were granted to Mr. Szporka on August 1, 2004. One hundred seventy-five thousand (175,000) options were granted to Mr. Lubinsky and 175,000 options were granted to Mr. Szporka on August 1, 2005. Except for the initial 200,000 options granted to Messrs. Lubinsky and Szporka which were exercised by these individuals in February 2005, none of these options have been exercised to date. |

| (5) | Seven hundred seventy-five thousand (775,000) options previously granted to Mr. Riewold immediately vested upon the execution of his employment agreement in February 2003. Four hundred seventy-five thousand (475,000) options were granted to Mr. Riewold on February 7, 2004 and seven hundred seventy-five thousand (775,000) options were granted to Mr. Riewold on October 16, 2004. One hundred seventy-five thousand (175,000) options were granted to Mr. Riewold on August 1, 2005. None of these options have been exercised to date. |

9

Stock Options

The following table sets forth information regarding grants of stock options during the fiscal year ending December 31, 2005 made to the Named Executive Officers who have received Company option grants.

| | | | | | | | | | Potential Realizable Value at |

| | | | | | | | | | Assumed Annual Rates of Stock |

| Individual Grants | | Price Appreciation for Option Term |

| | | | | | | | | | | | |

| | Number of Securities | | % of Total Stock | | | | | | | | |

| | Underlying | | Options Granted to | | Exercise or | | | | | | |

| | Stock Options | | Employees in Fiscal | | Base Price | | | | | | |

| Name | Granted (#) | | 2005 | | ($/Sh) | | Expiration Date | | 5% ($) | | 10% ($) |

| Randy Lubinsky | 175,000 | | 19% | | $ 4.00 | | 8/1/10 | | $ 194,250 | | $ 427,000 |

| Mark Szporka | 175,000 | | 19% | | $ 4.00 | | 8/1/10 | | $ 194,250 | | $ 427,000 |

| Ronald Riewold | 175,000 | | 19% | | $ 4.00 | | 8/1/10 | | $ 194,250 | | $ 427,000 |

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information with respect to the executive officers named in the Summary Compensation Table concerning the exercise of options during the year ended December 31, 2005 and unexercised options held as of the end of fiscal 2005.

| | | | | | | Number of Securities | | Value of Unexercised In-the- |

| | | | | | | Underlying Unexercised | | Money Options at FY-End |

| | | Shares Received | | | | Options at FY-End(2) | | ($) (1)(2) |

| Name | | on Exercise | | Value Realized | | Exercisable/Unexercisable | | Exercisable/Unexercisable |

| Randy Lubinsky | | 197,531 | | $634,075 | | 1,575,000/750,000 | | $4,564,000/$2,445,000 |

| Mark Szporka | | 197,531 | | $634,075 | | 1,575,000/750,000 | | $4,564,000/$2,445,000 |

| Ronald Riewold | | 0 | | $0 | | 1,450,000/750,000 | | $4,156,500/$2,445,000 |

| (1) | Calculated based on the fair market value of $3.26 per share at the close of trading on December 30, 2005 as reported by the AMEX, minus the exercise price of the option. |

| (2) | The unvested portion of the unexercised options, vested on January 1, 2006. |

| EQUITY COMPENSATION PLAN INFORMATION |

| |

| | | (a) | | (b) | | (c) |

| |

| Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights | | Weighted-average

exercise price of

outstanding options,

warrants and rights | | Number of securities remaining

available for future issuance under

equity compensation plans

(excluding securities reflected in

column (a)) |

|

|

|

|

Equity compensation plans approved by security

holders | |

9,752,150 | | $ 2.01 | | 247,850 |

|

Equity compensation plans not approved by security

holders | | 3,179,316 | | $ 6.69 | | 0 |

|

Employment Agreements

Randy Lubinsky, CEO. Mr. Lubinsky serves as Chief Executive Officer of the Company for a term expiring on December 31, 2010. The principal terms of Mr. Lubinsky’s employment agreement, as amended, are as follows: (i) an annual salary of $320,000, which may be increased from time to time at the discretion of the board of directors; (ii) stock options to purchase 175,000 (exercisable at $4.00 per share) shares of the Company’s common stock; (iii) health and dental insurance coverage; (iv) term life insurance; (v) an annual bonus of $200,000, plus a discretionary bonus up to 150% of salary and (vi) such other benefits as the Company may provide for its officers in the future.

Mark Szporka, CFO. Mr. Szporka serves as Chief Financial Officer for the Company for a term expiring on December 31, 2010. The principal terms of Mr. Szporka’s current employment agreement, as amended, are as follows: (i) an annual salary of $295,000, which may be increased from time to time at the discretion of the board of directors; (ii) stock options to purchase 175,000 (exercisable at $4.00 per share) shares of the Company’s common stock; (iii) health and dental insurance coverage; (iv) term life insurance; (v) an annual bonus of $200,000, plus a discretionary bonus up to 150% of salary and (vi) such other benefits as the Company may provide for its officers in the future.

Ronald Riewold, President. Mr. Riewold serves as President for the Company for a term expiring on December 31, 2010. The principal terms of Mr. Riewold’s current employment agreement, as amended, are as follows: (i) an annual salary of $295,000, which may be increased from time to time at the discretion of the board of directors; (ii) stock options to purchase 175,000 (exercisable at $4.00 per share) shares of the Company’s common stock; (iii) health and dental insurance coverage; (iv) term life insurance; (v) an annual bonus of $200,000, plus a discretionary bonus up to 150% of salary and (vi) such other benefits as the Company may provide for its officers in the future.

Merrill Reuter, M.D. Advanced Orthopaedics of South Florida II, Inc. (“AOSF”), a wholly-owned subsidiary of the Company, entered into an employment agreement with Merrill Reuter, M.D. to serve as its President and Medical Director for an initial term expiring on December 31, 2009. This employment agreement was amended during 2004, which extended the term through December 31, 2011. The principal terms of Dr. Reuter’s amended employment agreement are as follows: (i) an annual salary of $300,000 during fiscal year 2004, $500,000 during fiscal year 2005 and $750,000 per year for each year thereafter; (ii) stock options to purchase shares of the Company’s common stock as approved by the stock option committee of the Company; and (iii) health and disability insurance coverage. In the event that AOSF terminates the agreement “Without Cause” or Dr. Reuter terminates the agreement “For Cause,” Dr. Reuter will receive a lump sum severance payment of $1,000,000.

Directors' Compensation

Cash fees and stock options will be paid to non-employee directors of the Company by the Company for service on the Board of Directors. For being elected to serve during the term year of November 2004 to November 2005 on the Board of Directors, Arthur Hudson, Robert Fusco, Jay Rosen, M.D., Thomas Crane and Aldo Berti, M.D. have each received 25,000 options, exercisable at $2.97 per share and cash compensation of $5,000. In addition, they will receive cash compensation based on the committees they serve on as follows: $5,000 for the Audit Committee, $2,500 for the Stock Option Committee and $2,500 for the Compensation Committee. Directors of the Company who are also officers of the Company receive no additional compensation for their service as directors. All directors are entitled to reimbursement for reasonable expenses incurred in the performance of their duties as members of the board of directors.

Certain Relationships and Related Transactions

In 2004 the Company entered into a contract with Merill Reuter, M.D., chairman of the Company’s board of directors and an approximately 3.0% shareholder. Under the terms of the contract, which are similar to those entered into with other physicians, the Company is providing real estate development and construction oversight services to Dr. Reuter related to a planned medical facility that is intended to be owned by Dr. Reuter and leased to the Company and others.As of December 31, 2005 and 2004, $427,553 and $406,227, respectively, is due from Dr. Reuter under this contract.

The Company, through a subsidiary, is the majority partner of the PSHS Alpha Partners, Ltd. ("Partnership"). Dr. Merrill Reuter, the Company’s chairman, is a minority partner of the Partnership. The Company owns 67.5% and Dr. Reuter owns 9.75% of the Partnership.

11

Compensation Committee Report on Executive Compensation

This report describes our executive compensation program and the basis on which the 2005 fiscal year compensation determinations were made by us for the executive officers of the Company, including our Chief Executive Officer and the Named Executives. We establish all components of executive pay and recommend or report our decisions to the Board of Directors for approval.

Our duties include recommending to the Board of Directors the base salary levels for all executive officers as well as the design of awards in connection with all other elements of the executive pay program. We also evaluate executive performance and address other matters related to executive compensation.

Compensation Policy and Overall Objectives

In developing recommendations regarding the amount and composition of executive compensation, our goal is to provide a compensation package that will enable the Company to attract and retain highly qualified individuals for its executive positions. In addition, our objectives include rewarding outstanding performance and linking the interests of our executives to the interests of our stockholders. In determining actual compensation levels, we consider all elements of the program in total rather than any one element in isolation.

We believe that each element of the compensation program should target compensation levels at rates that take into account current market practices. Offering market-comparable pay opportunities allows us to maintain a stable, successful management team.

The key elements of our executive compensation are base salary, discretionary annual bonuses, long-term incentives, and various other benefits, including medical insurance, which are generally available to all employees of the Company. Each of these is addressed separately below.

Base Salaries

We regularly review each executive’s base salary. The base salary ranges of the Company's executives are targeted to be in the range of the median base pay ranges of similarly positioned executives in the group of comparable companies selected for compensation comparison purposes.

Base salaries for executives are initially determined by evaluating executives' levels of responsibility, prior experience, breadth of knowledge, internal equity issues and external pay practices. Increases to base salaries are driven primarily by performance, which is evaluated based on sustained levels of contribution to the Company, and/or salary increases in the industry for similar companies with similar performance profiles.

Annual Bonuses

Annual bonus opportunities allow the Company to communicate specific goals that are of primary importance during the coming year and motivate executives to achieve these goals. The Company’s employment agreements with its Chief Executive Officer, Chief Financial Officer, and President, provide for the payment of an annual bonus to said individuals in the total amount of 11% of the Company’s EBITDA. For the year ended December 31, 2005, the foregoing senior executives agreed to accept an annual bonus in the total amount of $770,000, which is less than 11% of the Company’s EBITDA. Effective January 1, 2006, this bonus structure was amended providing the above named officers minimum bonuses of $200,000 up to a maximum of 150% of their base salary in any one calendar year.

Long-Term Incentives

Our stock option program is designed to align the long-term interest of executives, certain middle managers and other key personnel to the long-term interests of our stockholders and, therefore, are typically granted upon commencement of employment. Stock options are granted at an option price not less than the fair market value of the Company's Common Stock on the date of grant. Accordingly, stock options have value only if the stock price

12

appreciates following the date the options are granted. Further, stock options are typically subject to a 36-month vesting period. The Committee awards stock options on the basis of individual performance and/or achievement of internal strategic objectives. This approach focuses executives on the creation of stockholder value over the long term and encourages equity ownership in the Company.

Tax Considerations

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for certain compensation in excess of $1 million paid to the Company's Chief Executive Officer and the four other most highly compensated executive officers. Certain compensation, including qualified performance-based compensation, will not be subject to the deduction limit if certain requirements are met. The Compensation Committee reviews the potential effect of Section 162(m) periodically and uses its judgment to authorize compensation payments that may be subject to the limit when the Compensation Committee believes such payments are appropriate and in the best interests of the Company and its stockholders, after taking into consideration changing business conditions and the performance of its employees.

Conclusion

We believe that attracting and retaining management and employees of high caliber is essential to maintaining a high-performing organization that creates long-term value for its stockholders. We also believe that offering a competitive, performance-based compensation program with a large equity component helps to achieve this objective by aligning the interests of officers and other key employees with those of stockholders. We believe that the Company's 2005 fiscal year compensation program met these objectives.

By the Compensation Committee of the Board of Directors of PainCare Holdings, Inc.

Thomas Crane

Aldo Berti, M.D.

Arthur Hudson

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors and executive officers, and persons who own more than 10% of the Company's common stock, to file with the Securities and Exchange Commission initial reports of ownerships and reports of changes in ownership, and to furnish the Company with copies of all Section 16(a) reports they file. To the Company's knowledge, based solely on review of the copies of such reports and written statements from officers and directors furnished to the Company, all Section 16(a) filing requirements applicable to its officers, directors and beneficial owners of more than 10% of our common stock were complied with during the year.

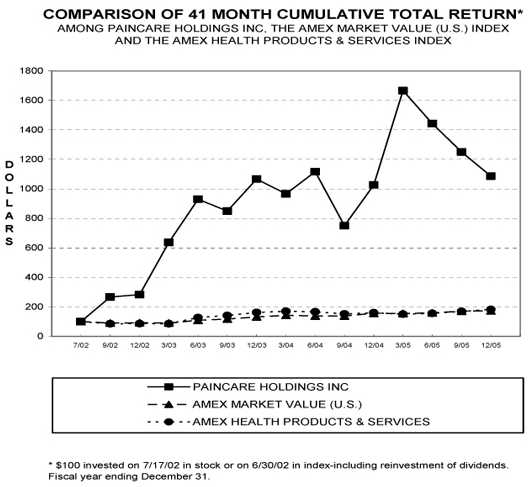

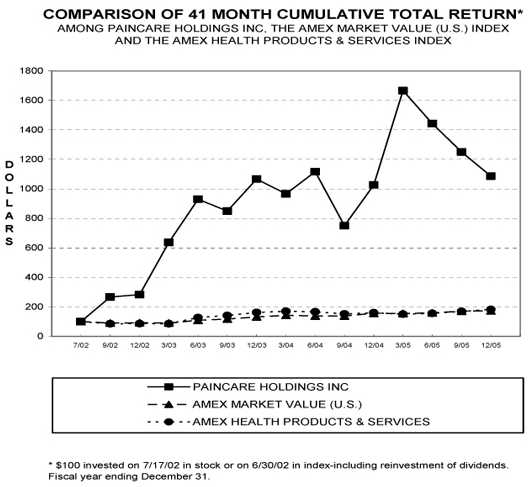

Performance Graph

The following graph shows the change in our cumulative total stockholder return for the period from July 17, 2002, the effective date of our merger with HelpMate Robotics, Inc., through the end of our fiscal year ending December 31, 2005, based upon the market price of our common stock, compared with the cumulative total return on the American Stock Exchange and AMEX Health Products and Services Index. The graph assumes a total initial investment of $100 as of July 17, 2002, and shows a “Total Return” that assumes reinvestment of dividends, if any, and is based on market capitalization at the beginning of each period. The performance on the following graph is not necessarily indicative of future stock price performance.

13

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has selected Beemer, Pricher, Kuehnhackl & Heidbrink, P.A. to serve as the Company’s independent accountants for the year ending December 31, 2006. Beemer, Pricher, Kuehnhackl & Heidbrink, P.A. was engaged on November 16, 2005 by the Company to be the Company’s independent accountant for the year ended December 31, 2005, and continues to serve as the Company’s principal accountant. A representative of Beemer, Pricher, Kuehnhackl & Heidbrink, P.A. is expected to be present at the 2006 Annual Meeting and will have an opportunity to make a statement if he or she so desires. The representative also is expected to be available to respond to appropriate questions from stockholders.

Change in Principal Accountant

Effective as of November 16, 2005, the resignation of Tschopp, Whitcomb & Orr, P.A. as the Company's principal accountant was accepted by the Company's Audit Committee. During Tschopp, Whitcomb & Orr, P.A.’s retention as the Company's principal accountant, there were no disagreements with Tschopp, Whitcomb & Orr, P.A. on any matter of accounting principle or practice, financial statement disclosure, or auditing scope or procedure which, is not resolved to Tschopp, Whitcomb & Orr, P.A.’s satisfaction, would have caused them to make reference to the subject matter of the disagreement in connection with their reports. Similarly, none of the reportable events described under Item 304(a)(1)(v) of Regulation S-K occurred during the time that Tschopp, Whitcomb & Orr, P.A. was engaged as the Company's principal accountant. None of Tschopp, Whitcomb & Orr, P.A.’s audit reports on the Company's consolidated financial statements contained any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

14

During the years ended December 31, 2004 and 2003 and through November 16, 2005, the Company did not, nor did anyone acting on its behalf, consult with Beemer, Pricher, Kuehnhackl & Heidbrink, P.A. regarding the application principles to a specified transaction, either completed or proposed, the type of audit opinion that might be rendered on the Company's financial statements, or any reportable events described under Items 304(a)(2)(ii) of Regulation S-K.

Audit Fees

The aggregate fees billed by the Company's principal accountant for professional services rendered for the audits of the Company’s annual financial statements on Form 10-K and the reviews of the financial statements on Form 10-Q for the fiscal years ended December 31, 2004 and December 31, 2005 were $51,120 and $400,033, respectively. The amount for completion of the 2005 audit that was billed and paid during 2006 was $307,633.

Audit Related Fees

The aggregate fees billed for audit related services by the Company's principal accountant for the fiscal years ended December 31, 2004 and December 31, 2005 were approximately $99,504 and $159,346, respectively. Audit related services include due diligence in connection with acquisitions, consultation on accounting and internal control matters and audits in connection with proposed or consummated acquisitions.

Tax Fees

The aggregate fees billed for tax compliance, tax advice and tax planning rendered by the Company's principal accountant for the fiscal years ended December 31, 2004 and December 31, 2005 were $9,210 and $42,780, respectively. The services comprising these fees include tax consulting and submitting tax returns.

All Other Fees

The aggregate fees billed for all other professional services rendered by the Company's principal accountant for the fiscal years ended December 31, 2004 and December 31, 2005 were $0.

Pre-Approval Policies

The Audit Committee approved 100% of the fees paid to the principal accountant for audit-related, tax and other fees. The Audit Committee pre-approves all non-audit services to be performed by the auditor in accordance with the Audit Committee Charter.

COST OF SOLICITATION

The Company will bear the cost of the solicitation of proxies from its stockholders. In addition to the use of mail, proxies may be solicited by directors, officers and regular employees of the Company in person or by telephone or other means of communication. The directors, officers and employees of the Company will not be compensated additionally for the solicitation, but may be reimbursed for out-of-pocket expenses in connection with this solicitation. Arrangements are also being made with brokerage houses and any other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of the Company, and the Company will reimburse such brokers, custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses. The Company may also retain the services of a solicitation firm to aid in the solicitation of proxies. If it does so, the Company will pay the fees and expenses of such firm.

15

DEADLINE FOR FUTURE PROPOSALS OF STOCKHOLDERS

Proposals of stockholders of the Company which are intended to be presented by such stockholders at the 2007 Annual Meeting must be received by the Company no later than May 31, 2007 in order to have them included in the proxy statement and form of proxy relating to that meeting.

The Company’s by-laws require a stockholder to give advance notice of any business, including the nomination of candidates for the Board of Directors that the stockholder wishes to bring before a meeting of the stockholders of the Company. In general, for business to be brought before an annual meeting by a stockholder, written notice of the stockholder proposal or nomination must be received by the Director of Corporate Services of the Company not less than 90 days nor more than 120 days before the meeting, or if the Company gives less than 40 days notice of the meeting date, written notice of the stockholder proposal or nomination must be received within ten days after the meeting date is announced. With respect to stockholder proposals, the stockholder’s notice to the Director of Corporate Services must contain a brief description of the business to be brought before the meeting and the reasons for conducting such business at the meeting, as well as such other information set forth in the Company’s by-laws or required by law. With respect to the nomination of a candidate for the Board of Directors by a stockholder, the stockholder’s notice to the Director of Corporate Services of the Company must contain certain information set forth in the Company’s by-laws about both the nominee and the stockholder making the nominations.

If a stockholder desires to have a proposal included in the Company’s proxy materials for the Annual Meeting of Stockholders and desires to have such proposal brought before the same Annual Meeting, the stockholder must comply with the both sets of procedures described in the two immediately preceding paragraphs. Any required notices should be sent to PainCare Holdings, Inc. 1030 North Orange Avenue, Suite 105, Orlando, FL 32801, Attention Director of Corporate Services.

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

The Securities and Exchange Commission has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements with respect to multiple stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process of “householding” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers household proxy materials, delivering a single proxy statement to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, or if you are receiving multiple copies of the proxy statement and wish to receive only one, please notify your broker if your shares are held in a brokerage account or us if you hold registered shares. You can notify us by sending a written request to Jennifer Loomis, Director of Corporate Services of the Company, at 1030 North Orange Avenue, Suite 105, Orlando, FL 32801.

OTHER MATTERS

Except as described above, with respect to certain employment agreements, stock option grants and director’s fees, we currently have no transactions nor are there any proposed with our officers, directors, 5% or greater shareholders, and affiliates. Conflicts of interest could arise in the negotiation of the terms of any transaction between us and our shareholders, officers, directors or affiliates. We have no plans or arrangements, including the hiring of an independent third party, for the resolution of disputes between us and such persons, if they arise. Our business and financial condition could be adversely affected should such individuals choose to place their own interests before ours. No assurance can be given that conflicts of interest will not cause us to lose potential opportunities, profits, or management attention. Our Board of Directors has adopted a policy regarding transactions between us and any of our officers, directors, or affiliates, including loan transactions, requiring that all such transactions be approved by a majority of the independent and disinterested members of our Board of Directors and that all such transactions be for a bona fide business purpose and be entered into on terms at least as favorable to us

16

as could be obtained from unaffiliated independent third parties. All ongoing relationships with any of our officers, directors or affiliates are in compliance with our policy. However, if any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment on such matters.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Randy Lubinsky

Randy Lubinsky, Chief Executive Officer

October 2, 2006

Orlando, Florida

17

DEFINITIVE PROXY

PAINCARE HOLDINGS, INC.

ANNUAL MEETING OF STOCKHOLDERS

October 27, 2006

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF PAINCARE HOLDINGS, INC. THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE CHOICES SPECIFIED BELOW.

The undersigned stockholder of PainCare Holdings, Inc. (the “Company”) hereby appoints Mark Szporka, the true and lawful attorney, agent and proxy of the undersigned with full power of substitution for and in the name of the undersigned, to vote all the shares of common stock of the Company at the Annual Meeting of Stockholders of the Company to be held at the Hyatt Regency Grand Cypress, 1 Grand Cypress Blvd., Regency Hall, Orlando, Florida 32836 on Friday, October 27, 2006 at 10:30 a.m., and any and all adjournments thereof, with all of the powers which the undersigned would possess if personally present, for the following purposes:

| 1. | | To elect nine Directors. | | | |

| | | | For | | Withhold |

| Randy Lubinsky | [ ] | | [ ] |

| Mark Szporka | [ ] | | [ ] |

| Merrill Reuter, M.D. | [ ] | | [ ] |

| Ronald Riewold | [ ] | | [ ] |

| Jay L. Rosen, M.D. | [ ] | | [ ] |

| Art Hudson | [ ] | | [ ] |

| Robert Fusco | [ ] | | [ ] |

| Thomas J. Crane | [ ] | | [ ] |

| Aldo F. Berti, M.D. | [ ] | | [ ] |

| | | | | For | | Against | | Abstain |

| 2. | | To ratify the appointment of Beemer, Pricher, Kuehnhackl & Heidbrink, | | [ ] | | [ ] | | [ ] |

| | | P.A. as independent auditors for the Company for the year ending | | | | | | |

| | | December 31, 2006. | | | | | | |

| |

| | | | | For | | Against | | Abstain |

| 3. | | To transact such other business as may properly come before the meeting | | [ ] | | [ ] | | [ ] |

| | | or any Adjournment thereof. | | | | | | |

This Proxy will be voted for the choices specified. If no choice is specified for Items 1 and 2, this Proxy will be votedfor those items.

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting and Proxy Statement dated September 29, 2006.

PLEASE MARK, SIGN AND DATE THIS PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE.

DATED:

__________________________

_______________________________________________

[Signature]

_______________________________________________

[Signature if jointly held]

_______________________________________________

[Printed Name]

Please sign exactly as name appears on stock certificate(s). Joint owners should each sign. Trustees and others acting in a representative capacity should indicate the capacity in which they sign.