UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant Filed by the Registrant

|  Filed by a Party other than the Registrant Filed by a Party other than the Registrant

|

Check the appropriate box: |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §.240.14a-12 |

IMPAX LABORATORIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: |

(2) Aggregate number of securities to which transaction applies: |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction: |

(5) Total fee paid: |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid: |

(2) Form, Schedule or Registration Statement No.: |

(3) Filing Party: |

(4) Date Filed: |

Back to Contents

30831 Huntwood Avenue, Hayward, California 94544

Notice of 2012 Annual Meeting of Stockholders |

MAY 22, 2012

9:00 a.m., Pacific Daylight Time

Marriott Hotel located at 1770 South Amphlett Blvd., San Mateo, California 94402

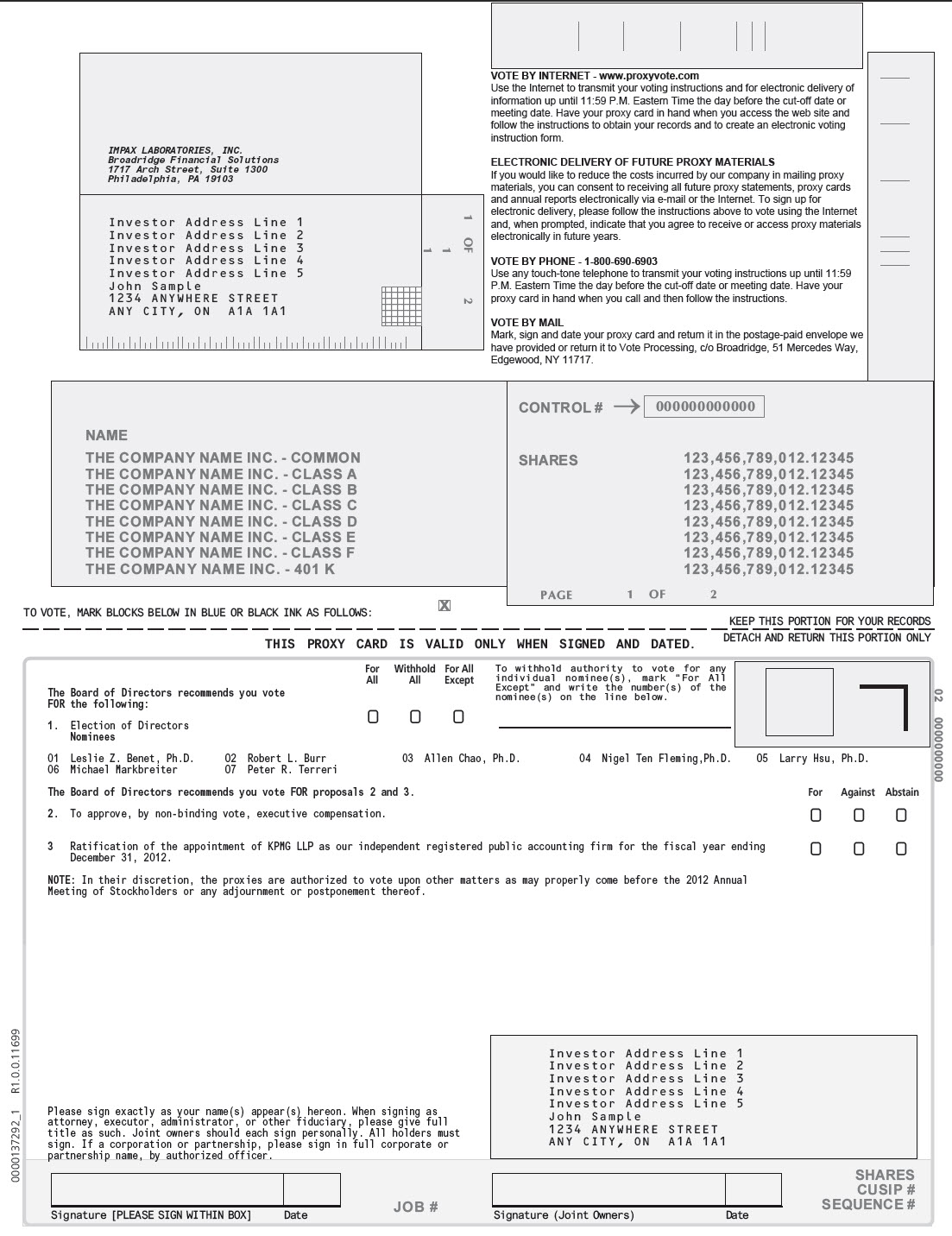

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 22, 2012: the Proxy Statement and the Annual Report to Stockholders are available at www.proxyvote.com

To Our Stockholders:

The 2012 Annual Meeting of Stockholders of Impax Laboratories, Inc. will be held on Tuesday, May 22, 2012, at 9:00 a.m., Pacific Daylight Time, at the Marriott Hotel located at 1770 South Amphlett Blvd., San Mateo, California 94402, for the following purposes:

(i)

to elect seven directors, as described in the accompanying proxy statement;

(ii)

to hold an advisory vote to approve named executive compensation (“say-on-pay”);

(iii)

to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012; and

(iv)

to transact such other business as may properly come before the annual meeting or any postponement or adjournment thereof.

You may obtain directions to the Marriott Hotel by contacting it directly at (650) 653-6000 or accessing the hotel’s Web site at http://www.marriott.com/hotels/maps/directions/sfosa-san-mateo-marriott-san-francisco-airport.

Only stockholders of record at the close of business on April 5, 2012 are entitled to notice of, and to vote at, the annual meeting and at any postponements or adjournments thereof. A list of such stockholders will be available for inspection by our stockholders at the annual meeting, as well as at our principal executive offices located at 30831 Huntwood Avenue, Hayward, California 94544 during ordinary business hours for the ten-day period prior to the annual meeting.

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE URGED TO VOTE YOUR SHARES PROMPTLY TO ENSURE THEY ARE REPRESENTED AT THE ANNUAL MEETING. YOU MAY SUBMIT YOUR PROXY VOTE BY TELEPHONE OR ELECTRONICALLY THROUGH THE INTERNET AS DESCRIBED IN THE FOLLOWING MATERIALS OR BY COMPLETING AND SIGNING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE SELF-ADDRESSED ENVELOPE PROVIDED. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. Voting by telephone, Internet or mail will not prevent you from later revoking that proxy and voting in person at the Annual Meeting. If you want to vote at the Annual Meeting, but your shares are held in street name by a broker, trust, bank or other nominee, you will need to obtain proof of ownership as of April 5, 2012 and a proxy to vote the shares from such broker, trust, bank or other nominee.

April 19, 2012

Hayward, California

| By Order of the Board of Directors, |

|

|

| Mark A. Schlossberg |

| Senior Vice President, General Counsel and Corporate Secretary |

Back to Contents

Table of Contents

Back to Contents

Dear Stockholder:

You are cordially invited to attend the 2012 Annual Meeting of Stockholders of Impax Laboratories, Inc. to be held on Tuesday, May 22, 2012 at 9:00 a.m., Pacific Daylight Time, at the Marriott Hotel located at 1770 South Amphlett Blvd., San Mateo, California 94402.

Details regarding the business to be conducted at the annual meeting are described in the accompanying notice of the annual meeting and proxy statement. We have also made available a copy of our 2011 Annual Report, which includes our audited financial statements and provides information about our business and products. We encourage you to read these materials carefully.

Your vote is important. Whether you plan to attend the annual meeting in person or not, we hope you will vote as soon as possible. You may vote by proxy electronically through the Internet or by telephone, as described in the accompanying materials, or by completing and signing the enclosed proxy card and returning it in the self-addressed envelope provided for your convenience. Please review the instructions on each of your voting options described in this proxy statement.

On behalf of our board of directors, I would like to express our appreciation for your continued support. We look forward to seeing you at the annual meeting.

April 19, 2012

| Sincerely, |

|

|

| Robert L. Burr |

| Chairman of the Board of Directors |

Back to Contents

PROXY STATEMENT

2012 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

Why am I receiving these materials?

This proxy statement is furnished to you as a holder of our common stock, par value $0.01 per share, in connection with the solicitation of proxies by our board of directors for use at the 2012 Annual Meeting of Stockholders or at any postponement or adjournment thereof. References in this proxy statement to “Impax,” “the Company,” “we,” “us,” and “our” mean Impax Laboratories, Inc. and its subsidiaries unless the context indicates otherwise.

The notice of the annual meeting, this proxy statement, the enclosed proxy card and the annual report to stockholders, collectively referred to as the “proxy materials,” will be first sent or given to our stockholders on or about April 19, 2012.

When and where will the annual meeting be held?

The annual meeting will be held on Tuesday, May 22, 2012, at 9:00, a.m., Pacific Daylight Time, at the Marriott Hotel located at 1770 South Amphlett Blvd., San Mateo, California 94402.

What proposals will be voted on at the annual meeting?

At the annual meeting, stockholders will consider and vote upon:

(i)

the election of seven directors, as described in this proxy statement;

(ii)

an advisory vote to approve executive compensation, referred to as “say-on-pay;”

(iii)

the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012; and

(iv)

such other business as may properly come before the annual meeting or any postponement or adjournment thereof.

Our board is not aware of any other matters that will come before the annual meeting or any postponement or adjournment of the annual meeting.

How does the board of directors recommend that I vote?

The board unanimously recommends that stockholders vote:

(i)

“FOR” the election of the seven nominees for director named in the section entitled “Proposal One – Election of Directors” of this proxy statement;

(ii)

“FOR” the approval of the compensation of our named executive officers, as disclosed in this proxy statement; and

(iii)

“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012.

What is a proxy?

A proxy is your legal designation of another person, also referred to as the “proxy,” to vote on your behalf. By properly signing and returning the enclosed proxy card or by voting by Internet or telephone, you are giving the persons who our board designated as proxies the authority to vote your shares in the manner that you indicate on your proxy card or by voting by Internet or telephone. The board has designated Michael Nestor, President of Impax Pharmaceuticals, our branded products division, and Dr. Carole Ben-Maimon, President of Global Pharmaceuticals, our generic products division, to serve as proxies for the annual meeting. If any other matters properly come before the meeting or any postponement or adjournment of the meeting, the persons designated as proxies intend to vote in accordance with their best judgment on such matters.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 1

Back to Contents

Whether or not you are able to attend the annual meeting, you are urged to complete and return your proxy, which will be voted as you direct on your proxy when properly completed. In the event no directions are specified, such proxies will be voted in the manner recommended by our board on all matters presented in this proxy statement.

In addition, the proxy confers discretionary authority to vote with respect to any and all of the following matters that may come before the annual meeting: (i) matters to be presented at the annual meeting of which we did not have notice on or prior to February 15, 2012; (ii) the election of any person to any office for which a bona fide nominee named in this proxy statement is unable to serve or for good cause will not serve; (iii) any proposal omitted from this proxy statement and form of proxy pursuant to Rules 14a-8 or 14a-9 under the Securities Exchange Act of 1934, as amended, referred to as the “Exchange Act;” and (iv) matters incident to the conduct of the annual meeting.

Who is entitled to vote at the annual meeting?

Our board set the close of business on April 5, 2012 as the “record date” for the determination of stockholders entitled to notice of and to vote at the annual meeting. Only stockholders of record at the close of business on the record date are entitled to notice of and to vote at the annual meeting or any postponement or adjournment thereof. On April 5, 2012, there were 67,290,708 shares of common stock issued and outstanding.

How do I vote my shares?

Stockholders of Record

If your shares of common stock are registered directly in your name with our transfer agent, StockTrans, you are considered, with respect to those shares, the stockholder of record. Stockholders of record may vote in person at the annual meeting or by proxy using the enclosed proxy card, by telephone or electronically through the Internet.

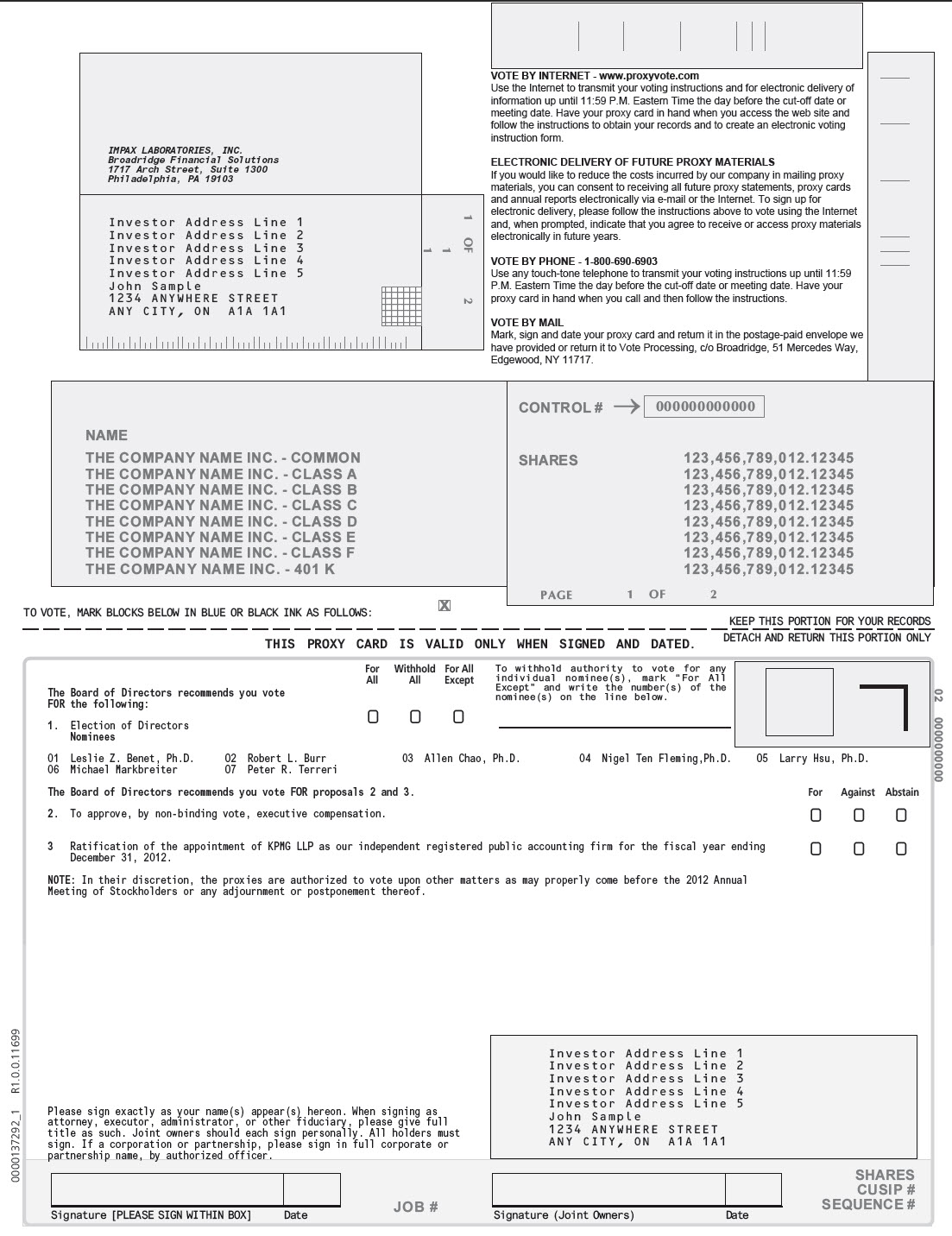

The deadline for stockholders of record to vote by telephone or electronically through the Internet is 11:59 p.m., Eastern Time, on May 21, 2012. Set forth below is a summary of the three voting methods which stockholders of record may utilize to submit their votes by proxy:

Vote by Telephone

1-800-690-6903. Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week. Have your proxy card (which contains your control number) in hand when you call, and follow the instructions provided.

Vote Electronically through the Internet

http://www.proxyvote.com. Use the Internet to vote your proxy 24 hours a day, 7 days a week. Have your proxy card (which contains your control number) in hand when you access the Web site. Follow the instructions to obtain your records and to create an electronic voting instruction form.

Vote by Mail

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided you or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

Whether or not you plan to attend the annual meeting, we urge you to vote promptly using one of these methods to ensure your vote is counted.

If you vote by telephone or electronically through the Internet, you do not need to return your proxy card.

Please note that although there is no charge to you for voting by telephone or electronically through the Internet, there may be costs associated with electronic or telephonic access such as usage charges of Internet service providers and telephone companies. We do not cover these costs; they are solely your responsibility. Please note, the telephone and Internet voting procedures available to you are valid forms of granting proxies under the General Corporation Law of the State of Delaware.

Beneficial Owners of Shares Held in Street Name

If your shares of common stock are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and you should have received these proxy materials from that organization rather than us. The organization holding your shares is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct the organization holding your shares on how to vote the shares held in your account using the voting instructions received from such organization. You may vote in person at the annual meeting only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares at the annual meeting.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote your uninstructed shares on “routine” matters but cannot vote on “non-routine” matters. The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012 (Proposal Three) is considered routine under applicable rules. The organization that holds your shares may generally vote without your instruction on Proposal Three. The election of directors (Proposal One) and the advisory vote to approve executive compensation (Proposal Two) are matters considered non-routine under applicable rules. If the organization that holds your shares does not receive instructions from you on how to vote your shares on Proposal One or Proposal Two, the organization that holds your shares will not be able to vote your shares on such matter. This would be a “broker non-vote” and these shares will not be counted as having been voted on the applicable proposal. However, “broker non-votes” will be considered present at the annual meeting and will be counted towards determining whether or not a quorum is present. Please instruct your bank or broker so your vote can be counted.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 2

Back to Contents

What vote is required to approve each proposal?

Each share of common stock that is outstanding as of the record date is entitled to one vote on each matter to be presented at the annual meeting. For Proposal One, directors are elected by a plurality of the votes of the shares of common stock that are present in person or represented by proxy at the annual meeting and are entitled to vote on the election of directors. Therefore, the seven nominees for director receiving the most “FOR” votes will be elected to serve on the board. Under Delaware law, an abstention or a broker non-vote will have no legal effect on the election of directors.

The approval of Proposal Two and Proposal Three and the approval of any other business as may properly come before the annual meeting, or any postponement or adjournment thereof, will require the affirmative vote of the majority of the shares of common stock that are present in person or represented by proxy at the annual meeting and are entitled to vote at the annual meeting. Under Delaware law, an abstention will be considered present and entitled to vote at the annual meeting and therefore will have the same legal effect as an “against” vote on Proposal Two and Proposal Three. A broker non-vote will not be counted as shares entitled to vote and accordingly will not affect the outcome of Proposal Two or Proposal Three.

What constitutes a quorum?

A quorum of stockholders is necessary to hold a valid annual meeting. In order for a quorum to be present at the annual meeting, a majority of the issued and outstanding shares of common stock at the close of business on the record date must be present in person or represented by proxy at the annual meeting. All such shares that are present in person or represented by proxy at the annual meeting will be counted in determining whether a quorum is present, including abstentions and broker non-votes.

Can I revoke my proxy?

Yes, you may revoke your proxy at any time before it is voted at the annual meeting. If you are a stockholder of record, you may revoke your proxy by submitting a later-dated proxy electronically through the Internet or by telephone, or another signed proxy with a later date to Mark A. Schlossberg, our Senior Vice President, General Counsel and Corporate Secretary, or by attending the annual meeting and voting in person.

Attendance at the annual meeting will not in itself constitute a revocation of your proxy.

Before the taking of the vote at the annual meeting, any written notice of revocation should be sent to Impax Laboratories, Inc., 30831 Huntwood Avenue, Hayward, California 94544, attention: Mark A. Schlossberg, or hand delivered to Mr. Schlossberg at the annual meeting.

If you are a beneficial owner of shares of common stock held in street name, please review the voting instructions provided by the organization holding your shares or contact such organization regarding how to change your vote. If you want to vote at the annual meeting, you will need to obtain a proxy to vote the shares from the organization holding your shares.

Where can I find the voting results of the annual meeting?

The voting results will be tallied by the inspector of election and published in our Current Report on Form 8-K, which we are required to file with the Securities and Exchange Commission, referred to as the “SEC,” within four business days following the annual meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K with the SEC within four business days of the day the final results are available.

Who will bear the cost of the solicitation of proxies?

We will bear the cost of the solicitation of proxies and will reimburse the reasonable expenses of brokerage firms, banks, broker-dealers or other similar organizations incurred in forwarding material to beneficial owners of common stock.

Who will solicit proxies on behalf of the board of directors?

In addition to mailing the proxy materials, proxies for use at the annual meeting may be solicited by our directors, officers and employees, none of whom will receive additional compensation for such solicitation activities, in person or by telephone.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 3

Back to Contents

PROPOSAL 1 ELECTION OF DIRECTORS

Our amended and restated bylaws provide that the number of directors on the board will consist of not less than one or more than ten, with the exact number to be fixed by the board.

At the annual meeting, the stockholders will elect seven directors, each to serve for a term of one year and until his successor has been elected and qualified or until the director’s earlier death, resignation or removal. The board has nominated the following individuals for election as director at the annual meeting: Leslie Z. Benet, Ph.D.; Robert L. Burr; Allen Chao, Ph.D.; Nigel Ten Fleming, Ph.D.; Larry Hsu, Ph.D.; Michael Markbreiter; and Peter R. Terreri. Each nomination for director was based upon the recommendation of our nominating committee. All nominees have consented to be named and have indicated their intent to serve if elected. The board has no reason to believe that any of the nominees will decline or will be unable to serve as a director.

Unless directed otherwise, the persons named in the enclosed proxy intend to vote all proxies received by them “FOR” (i) the election as directors of the seven nominees listed above, or (ii) if any of these nominees becomes unavailable for election, for a substitute nominee designated by the board in accordance with their best judgment as they deem advisable.

The following table sets forth information, as of the record date, concerning our current directors who are nominees for election to the board:

Name | Age | | Director Since | Positions Held | Committee Memberships |

Leslie Z. Benet, Ph.D. | 74 | | 2001 | Director | Compensation Committee and Nominating Committee |

Robert L. Burr | 61 | | 2001 | Chairman and Director | Audit Committee, Compensation Committee(1) and Nominating Committee |

Allen Chao, Ph.D. | 66 | | 2010 | Director | Audit Committee |

Nigel Ten Fleming, Ph.D. | 58 | | 1999 | Director | Compensation Committee and Nominating Committee(1) |

Larry Hsu, Ph.D. | 63 | | 1999 | President, Chief Executive Officer and Director | — |

Michael Markbreiter | 50 | | 1997 | Director | Audit Committee |

Peter R. Terreri | 54 | | 2003 | Director | Audit Committee(1) |

(1) Chairman of the committee. |

Our employment agreement with Dr. Hsu, which was effective as of January 1, 2010, provides that during the term of his employment, the board will nominate and recommend to stockholders his election as our director.

Other than the employment agreement with Dr. Hsu described above, none of our directors, nominees for director or executive officers is a party to any arrangement or understanding with any other person with respect to nominations of directors. In addition, there is no family relationship between any of our directors, nominees for director or executive officers.

Set forth below is the business experience of, and any other public company or registered investment company directorships held by, the current members of the board and nominees for director for at least the past five years, as well as a summary of their specific experience, qualifications, attributes or skills that led to the conclusion that they are qualified to serve as our directors.

Current Directors and Nominees for Director

Leslie Z. Benet, Ph.D. has been a Professor since 1969 of, and has also served as Chairman of, the Department of Bioengineering and Therapeutic Sciences (1978-1998), University of California, San Francisco (UCSF). Dr. Benet has been a founder of four biopharmaceutical start-up companies, for one of which he presently serves as chair of the Scientific Advisory Board (Hurel Corp). He received his A.B. (English), B.S. (Pharmacy), and M.S. from the University of Michigan, and his Ph.D. from the University of California. Dr. Benet has received eight honorary doctorates: Uppsala University, Sweden (Pharm.D., 1987); Leiden University, The Netherlands (Ph.D., 1995); University of Illinois at Chicago (D.Sc., 1997); Philadelphia College of Pharmacy and Science (D.Sc., 1997); Long Island University (D.Sc., 1999); University of Athens, Greece (Ph.D., 2005); Catholic University of Leuven, Belgium (Ph.D., 2010) and University of Michigan (D.Sc., 2011). In 1985, Dr. Benet served as President of the APhA Academy of Pharmaceutical Sciences. During 1986, Dr. Benet was a founder and first President of the American Association of Pharmaceutical Scientists. In 1987, Dr. Benet was elected to membership in the Institute of Medicine of the National Academy of Sciences. Dr. Benet formerly served as Chair of the FDA Expert Panel on Individual Bioequivalence and the FDA Center for Biologics Peer Review Committee, and as a member of the FDA Science Board and the Generic Drugs Advisory Committee. Dr. Benet presently serves as a member of the IOM Forum on Drug Discovery, Development and Translation. Dr. Benet brings to the board deep knowledge and understanding of the biopharmaceutical industry, as well as policies and practices of the U.S. Food and Drug Administration, and provides the board with a unique perspective in the development of our corporate strategy based on his more than 40 years of experience in the science underlying our business.

Robert L. Burr has been a self-employed investment manager since May 2008. Mr. Burr was employed by J.P. Morgan Chase & Co. and associated entities from 1995 to May 2008, at which time he resigned his position as Managing Partner of the Fleming US Discovery III Funds. From October 2001 to October 2005, Mr. Burr was also a Partner at Windcrest Discovery Investments LLC, an investment management firm. Mr. Burr previously served as a director of Hudson Technologies, Inc., a publicly traded refrigerant services company, from 1999 to 2007. From 1992 to 1995, Mr. Burr was head of Private Equity at the investment banking firm Kidder, Peabody & Co., Inc. Prior to that time, Mr. Burr served as the Managing General Partner of Morgan Stanley Ventures and General Partner of Morgan Stanley Venture Capital Fund I, L.P. and was a corporate lending officer with Citibank, N.A. Mr. Burr received an MBA from Columbia University and a BA from Stanford University. Mr. Burr’s financial acumen and his extensive knowledge of capital markets represent a valuable resource to the board in the assessment of our capital and liquidity needs. In addition, Mr. Burr’s venture capital and private equity investment experience gives him the leadership and consensus-building skills to guide the board on a variety of matters, including compensation, corporate governance and risk assessment.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 4

Back to Contents

Allen Chao, Ph.D. , has been Chairman of Newport Healthcare Advisors, LLC, a healthcare investment management and consulting company, since January 2008. Dr. Chao was a co-founder of Watson Pharmaceuticals, Inc., a specialty pharmaceutical company, serving as a director from 1985 to May 2008, Chairman of the board of directors from May 1996 to May 2008, and Chief Executive Officer from 1985 to September 2007. While at Watson, Dr. Chao oversaw the company’s growth, through internal R&D, licensing and acquisitions of pharmaceutical products and technologies, as well as mergers and acquisition activities. Dr. Chao received a Ph.D. in industrial and physical pharmacy from Purdue University in 1973. In May of 2000, he received the degree of Doctor of Science from Purdue Dr. Chao’s experience brings to the board a profound understanding of financial investment, business development, strategic planning and operational management in our industry and can provide invaluable practical guidance, insight and perspective with respect to our operations, strategy, and corporate governance.

Nigel Ten Fleming, Ph.D. has served as the Executive Chairman of A-Cube, Inc., a monoclonal antibody and DNA vaccine therapeutics company, since November 2011 and previously served as its Chief Executive Officer and director from November 2009 to November 2011. Dr. Fleming also currently serves as Chairman of G2B Pharma Inc., a company which he founded in 2008, and as a member of the board of directors of Genmedica Therapeutics, a diabetes company based in Barcelona. He previously founded Athena Diagnostics, a neurological diagnostics reference laboratory, serving in various capacities, including as Chairman, CEO and Vice President of Business Development prior to the company’s 1995 sale to Athena Neurosciences/Elan Pharmaceuticals and subsequent 2011 sale to Quest Diagnostics, Inc. Dr. Fleming also served on the board of directors of Exemplar Corporation, a subsidiary of publicly traded Transgenic Sciences Inc., from 1992 to 1994 and also consulted for, and served in various leadership roles at a number of early-stage biotechnology companies, including with Gamera Biosciences from 1995 to 1997, Nephros from 1993 to 1995, TheraMed Partners from 1997 to 1998 and Plant Cell Technologies from 1996 to 1998. Dr. Fleming obtained his Ph.D. in Clinical Biochemistry from the University of Cambridge in England, completed a post-doctorate at Boston University School of Medicine from 1983 to 1984 and was a lecturer and researcher at Harvard Medical School from 1984 to 1989. Dr. Fleming’s experience at life sciences companies as well as his extensive knowledge of biochemistry provides the board with the depth of understanding of our company’s business as well as valuable financial, operational and strategic expertise. In addition, Dr. Fleming also brings to the board a perspective on corporate governance and compensation matters.

Larry Hsu, Ph.D. has been our President and Chief Executive Officer since October 2006. Prior to holding these positions, Dr. Hsu served as our President and Chief Operating Officer beginning in 1999. Dr. Hsu co-founded Impax Pharmaceuticals, Inc. in 1994 and served as its President, Chief Operating Officer and a member of the board from its inception until its merger with us in in 1999. From 1980 to 1995, Dr. Hsu worked at Abbott Laboratories, where, during his last four years, he served as Director of Product Development. Dr. Hsu obtained his Ph.D. in pharmaceutics from the University of Michigan. Dr. Hsu’s experience as our co-founder, President and Chief Executive Officer, and previously our President and Chief Operating Officer, provides the board with unique insights into our operations, challenges and opportunities. In addition, his 30-year background in the pharmaceutical industry and knowledge in the underlying science brings special expertise to the board in developing our business strategies.

Michael Markbreiter , a private investor, was a portfolio manager for Morgan Stanley from October 2004 to May 2005 and Sofaer Capital, a global hedge fund, from December 2000 to September 2001. From August 1995 to December 1998, Mr. Markbreiter was a portfolio manager for private equity investments for Kingdon Capital Management Corp., a New York hedge fund. In April 1994, he co-founded Ram Investment Corp., a venture capital company. From March 1993 to January 1994, Mr. Markbreiter was an analyst at Alliance Capital Management Corp. From July 1983 to September 1989, Mr. Markbreiter was an Executive Editor for Arts of Asia magazine. Mr. Markbreiter graduated from Cambridge University with a degree in Engineering. Mr. Markbreiter’s experience in executive management brings to the board his business and financial expertise as well as comprehensive knowledge of risk-management matters.

Peter R. Terreri is President, Chief Executive Officer and director of CGM, Inc., a manufacturing company that he has owned and operated since 2000. He previously served as Senior Vice President and Chief Financial Officer of Teva Pharmaceuticals USA from 1985 through 2000 and as an auditor at PricewaterhouseCoopers LLP from 1981 to 1984. Mr. Terreri received his B.S. in Accounting from Drexel University and has been a certified public accountant since 1981. Mr. Terreri’s more than 20 years of experience in the pharmaceutical industry provides the board with comprehensive understanding of our operations and strategy. His prior experience as Chief Financial Officer of a major generic pharmaceutical company also brings to the board deep understanding of accounting and risk management issues.

Board and Committee Matters

Board Leadership Structure

We separate the roles of Chairman and Chief Executive Officer in recognition of the differences between the two roles. Mr. Burr serves as the Chairman of the board, and Dr. Hsu serves as a director as well as our President and Chief Executive Officer. Our Chief Executive Officer is responsible for setting our strategic direction and for our day to day leadership and performance, while our Chairman provides guidance to the Chief Executive Officer, sets the agenda for board meetings and presides over meetings of the board. Our Chairman qualifies as an independent director. See “— Independence.”

The board has selected this leadership structure in the belief that separating the principal executive officer and board chairman positions allows for a more efficient division of responsibilities in light of the high demands on the time of each. The board believes that its leadership structure is well suited to the company’s business because it contributes to a more independent board, leads to productive internal board dynamics and allows Dr. Hsu to concentrate on our business and operations.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 5

Back to Contents

Board’s Role in Risk Oversight

We are exposed to a number of risks and undertake at least annually an enterprise risk management review to identify and evaluate these risks and to develop plans to manage them effectively. It is management’s responsibility to manage risk and bring the material risks applicable to the company to the board’s attention. The board has oversight responsibility of the processes established to report and monitor these risks. On behalf of the board, the audit committee plays a key role in the oversight of our enterprise risk management function. Mr. Koch, our Chief Financial Officer, is directly responsible for our enterprise risk management function and reports both to the President and Chief Executive Officer and to the audit committee in this capacity. In fulfilling his risk-management responsibilities, Mr. Koch works closely with members of our senior management and meets with the audit committee at least four times a year to discuss the risks facing our company, highlighting any new risks that may have arisen since the committee last met. The audit committee also reports to the board on a regular basis to apprise them of their discussions with Mr. Koch regarding our enterprise risk management efforts. Finally, Mr. Koch reports directly to the board on at least an annual basis to apprise it directly of our enterprise risk management efforts. In addition to the audit committee, the other committees of the board consider the risks within their areas of responsibility. For example, the compensation committee considers the risks related to our compensation programs and, in setting compensation, strives to create incentives that do not encourage risk-taking behavior that is inconsistent with the company’s business strategy. The nominating committee considers risks related to succession planning and oversees the appropriate allocation of responsibility for risk oversight among the committees of the board. We believe that our current leadership structure supports the board’s risk oversight role.

Independence

The board has determined, after considering all relevant facts and circumstances, including issues that may arise as a result of any director compensation (whether direct or indirect) or any charitable contribution we may make to organizations with which a director is affiliated, that each of our current directors other than Dr. Larry Hsu, our president and chief executive officer, is independent under the independence standards contained in the listing requirements of The NASDAQ Stock Market LLC, referred to as “NASDAQ.”

Meetings of the Board and Committees

In 2011, there were nine board meetings. The board has three standing committees: the audit committee, the compensation committee and the nominating committee. Our audit committee held five meetings, our compensation committee held six meetings and our nominating committee held four meetings in 2011. During 2011, each of our current directors attended at least 80% of the aggregate of (i) all of the meetings of the board and (ii) all of the meetings of all committees of the board on which such director served. The board regularly holds executive sessions without members of management present.

Committees of the Board

Audit Committee

The board has appointed a standing audit committee, currently consisting of Peter R. Terreri, as chairman, and Robert L. Burr, Allen Chao, Ph.D., and Michael Markbreiter. The board has determined that each member of the audit committee is independent, as defined in the applicable NASDAQ and SEC rules and regulations. In addition, the board has determined that Mr. Terreri qualifies as an “audit committee financial expert” as defined under Item 407 of Regulation S-K promulgated by the SEC.

The audit committee is governed by a written charter approved by the board, which is posted on our Web site (www.impaxlabs.com) and accessible via the “Investor Relations” page. The principal purpose of the audit committee is to oversee our accounting and financial reporting processes and the audit of our financial statements. The audit committee is directly responsible for the appointment, compensation, retention and oversight of the firm selected to be engaged as our independent registered public accounting firm, and pre-approves the engagement of the independent registered public accounting firm for all non-audit activities permitted under the Sarbanes-Oxley Act of 2002. In addition, the audit committee establishes procedures for the receipt, retention and treatment of complaints we receive regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

Compensation Committee

The board has appointed a standing compensation committee, currently consisting of Robert L. Burr, as chairman, and Leslie Z. Benet, Ph.D. and Nigel Ten Fleming, Ph.D. The board has determined that each member of the compensation committee is independent, as defined in the applicable rules and regulations of NASDAQ and the SEC.

The board has adopted a written compensation committee charter, which is posted on our Web site (www.impaxlabs.com) and accessible via the “Investor Relations” page. The principal duties of the compensation committee are to formulate, evaluate and recommend the compensation of our executive officers and directors to the board and the oversight of all compensation programs involving the issuance of our stock and other equity securities. Our Chief Executive Officer makes recommendations concerning the amount and form of executive compensation, other than his own compensation, to the compensation committee.

The committee uses the consulting services of Radford, a division of Aon Hewitt, which is a subsidiary of Aon Corporation, referred to as “Radford,” as its outside compensation consultant in evaluating executive compensation.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 6

Back to Contents

Radford as Compensation Committee Consultant

The compensation committee has retained Radford as its outside compensation consultant as a result of a competitive bidding process conducted by management on behalf of the compensation committee. Management did not specifically recommend Radford. Radford regularly meets with the compensation committee and provides advice regarding the design and implementation of our executive compensation program as well as our director compensation program. In particular, upon the compensation committee’s request, Radford:

•

reviews and makes recommendations regarding executive and director compensation (including amounts and forms of compensation);

•

provides market data and performs benchmarking;

•

advises the compensation committee as to best practices and regulatory or legislative changes; and

•

assists in the preparation of our compensation-related disclosure included in this proxy statement.

In providing services to the compensation committee, with the compensation committee’s knowledge, Radford may contact our management from to time to time to obtain data and other information about us and to work together in the development of proposals and alternatives for the compensation committee to review and consider.

In addition, in fiscal 2011, (i) Aon Hewitt Health & Benefits, an affiliate of Radford, provided services as an insurance broker for our medical insurance and employee benefits insurance, (ii) Aon Hewitt Executive Benefits, an affiliate of Radford, provided services as a third party administrator of our non-qualified deferred compensation plan and additional company-paid executive health and disability benefit plans, and (iii) Aon Risk Services, an affiliate of Radford, provided services as an insurance broker for our products liability insurance and other commercial business insurance.

The compensation committee regularly evaluates the nature and scope of the services provided by Radford. The compensation committee approved the fiscal 2011 executive and director compensation consulting services described above. Although the compensation committee was aware of the other services performed by Aon Hewitt Health & Benefits, Aon Hewitt Executive Benefits and Aon Risk Services, and considered any potential conflict with Radford’s independence, the compensation committee did not review such other services as those services were reviewed and approved by management in the ordinary course of business.

In order to ensure that Radford is independent, Radford is only engaged by, takes direction from, and reports to, the compensation committee and, accordingly, only the compensation committee has the right to terminate or replace Radford at any time. Further, Radford maintains certain internal controls within Aon Corporation which include, among other things:

•

Radford is managed separately within Aon Corporation and performance is measured solely on the Radford business;

•

no commissions or cross revenue is provided to Aon Corporation in the event that Aon Corporation introduces Radford to an account, and no Aon Corporation staff member is paid commissions or incentives for Radford services;

•

Radford is not rewarded for selling Aon Corporation services nor is Radford required to cross-sell services;

•

Radford maintains its own account management structure, contact database and IT network and its survey data is on a separate IT platform from Aon Corporation; and

•

no member of Radford’s team is involved in, or sits on, any Aon Corporation committee for purposes of selling Aon Corporation services.

Risk Assessment in Compensation Policies and Practices for Employees

The compensation committee reviewed the elements of our compensation policies and practices for all employees, including executive officers, in order to evaluate whether risks that may arise from such compensation policies and practices are reasonably likely to have a material adverse effect on our company. The compensation committee concluded that the following features of our compensation programs guard against excessive risk-taking:

•

compensation programs provide a balanced mix of short-term and longer-term incentives in the form of cash and equity compensation;

•

base salaries are consistent with employees’ duties and responsibilities;

•

corporate performance goals are appropriately set to avoid targets that, if not achieved, result in a large percentage loss of compensation;

•

cash incentive awards are capped by the compensation committee;

•

cash incentive awards are tied mostly to corporate performance goals, rather than individual performance goals; and

•

vesting periods for equity awards encourage executives to focus on sustained stock price appreciation.

The compensation committee believes that, for all employees, including executive officers, our compensation programs do not lead to excessive risk-taking and instead encourage behavior that supports sustainable value creation. We believe that risks that may arise from our compensation policies and practices for our employees, including executive officers, are not reasonably likely to have a material adverse effect on our company.

Nominating Committee

The board has appointed a standing nominating committee, currently consisting of Nigel Ten Fleming, Ph.D., as chairman, and Leslie Z. Benet, Ph.D. and Robert L. Burr. The board has determined that each member of the nominating committee is independent, as defined in the applicable NASDAQ and SEC rules and regulations.

The nominating committee is governed by a written charter approved by the board, which is posted on our Web site (www.impaxlabs.com) and accessible via the “Investor Relations” page. The principal purposes of the nominating committee are to develop and recommend to the board certain corporate governance policies, establish criteria for selecting new directors and identify, screen, recommend and recruit new directors. The nominating committee is also responsible for recommending directors for committee membership to the board.

The information regarding the audit committee, compensation committee and nominating committee on our Web site listed above is not, and should not be, considered part of this proxy statement and is not incorporated by reference in this document. The Web site is, and is intended only to be, an inactive textual reference.

Qualifications of Director Nominees

The nominating committee has not established specific education or years of business experience requirements for potential director nominees, but in general, expects that qualified nominees will possess a proven record of business acumen, success and leadership, including experience or expertise in one or more of the following areas: business, financial or accounting matters generally, the pharmaceutical industry, technical matters generally and the specific technologies we use and develop. In addition, potential director nominees will be evaluated by reference to requirements relating to the board and committee composition under the law and applicable NASDAQ listing standards.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 7

Back to Contents

Our bylaws provide that each director must be at least 21 years of age and that each director or nominee for election as our director must deliver to our Corporate Secretary a completed written questionnaire with respect to his or her background and qualifications and also agree, among other matters, that he or she is not and will not become party to any agreement with a third party concerning how he or she will act or vote on any issue or question, any similar agreement that could limit or interfere with the ability to comply with his or her duties as a director, or any undisclosed agreement providing for any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director.

Director Nominee Selection Process and Diversity Policy

In the case of an incumbent director whose term of office expires, the nominating committee reviews such director’s service during the past term, including the number of board and committee meetings attended, as applicable, quality of participation and whether the candidate continues to meet the qualifications for a director, including the director’s independence, as well as any special qualifications required for membership on any committees on which such director serves.

In the case of a new director candidate, the selection process for director candidates includes the following steps:

•

identification of director candidates by the nominating committee based upon suggestions from current directors and executives and recommendations received from stockholders, and possible engagement of a director-search firm;

•

interviews of candidates by the nominating committee;

•

reports to the board by the nominating committee on the selection process;

•

recommendations by the nominating committee; and

•

formal nominations by the board for inclusion in the slate of directors at the annual meeting.

The nominating committee does not have a formal policy with respect to diversity; however, the board and the nominating committee believe that it is essential that the board members represent diverse viewpoints. The nominating committee seeks nominees with a broad diversity of experience, professions, skills, geographic representation and backgrounds. The nominating committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. We believe that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the board to fulfill its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

Procedures for Stockholder Submissions of Director Nominations

A director nominee nominated by our stockholder is eligible for election as our director at any stockholders’ meeting only if such person is nominated in accordance with the procedures set forth in our amended and restated bylaws. Set forth below is a brief summary of such procedures provided in our amended and restated bylaws. This summary is not intended to be complete and is qualified in its entirety by reference to the detailed provisions of our amended and restated bylaws.

A stockholder can submit nominations of persons to be elected as one of our directors at a stockholders’ meeting, provided such stockholder:

•

is a stockholder of record (i) on the date of the giving of the notice provided for in our amended and restated bylaws, (ii) on the record date for the determination of the stockholders entitled to vote at such meeting of stockholders, and (iii) at the time of such meeting of stockholders;

•

is entitled to vote at the meeting of stockholders; and

•

submits a written notice of nomination of persons for election to our board at a meeting of stockholders and complies with other specific notice procedures set forth in our amended and restated bylaws as to such nominations, including, but not limited to, the procedures regarding such notice’s timeliness and required form.

Stockholder’s Notice of Nomination

A stockholder’s written notice of nomination of persons for election to the board at an annual meeting should be submitted to our Corporate Secretary at our principal executive offices, at 30831 Huntwood Avenue, Hayward, California 94544. As set forth in our amended and restated bylaws, submissions must include the name, age and address of the proposed nominee, information regarding the proposed nominee that is required to be disclosed in a proxy statement or other filings in a contested election pursuant to Section 14(a) under the Exchange Act, information regarding the proposed nominee’s indirect and direct interests in shares of the Company’s common stock, and a completed and signed questionnaire, representation and agreement of the proposed nominee. Our amended and restated bylaws also specify further requirements as to the form and content of a stockholder’s notice.

In addition, we may require any proposed nominee to furnish such other information as may reasonably be required by us to determine the eligibility of such proposed nominee to serve as an independent director or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such nominee.

Deadline for Submitting Stockholder’s Notice of Nomination

For nominations of directors for election at an annual meeting of stockholders, see the section entitled “Stockholder Proposals” of this proxy statement for information on when a stockholder’s notice of nomination will be considered timely.

In case of a special meeting of stockholders, the proper form of a stockholder’s notice of nomination must be delivered to our Corporate Secretary not earlier than the close of business on the 120th calendar day prior to the date of such special meeting and not later than the close of business on the later of the 90th calendar day prior to the date of such special meeting or, if our first public disclosure of the date of such special meeting is less than 100 days prior to the date of such special meeting, not later than the 10th calendar day following the day on which we first make public disclosure of the date of the special meeting and of the nominees proposed by the board to be elected at such meeting.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 8

Back to Contents

Stockholder Nominee Recommendation Policy

The nominating committee will consider recommendations received from stockholders of potential director nominees in a manner consistent with the nominating committee’s charter and its consideration of potential director nominees generally. The ultimate decision of whether to nominate a potential director nominee remains solely within the discretion of the board.

Any stockholder recommendation of a potential director nominee proposed for consideration by the nominating committee should include the potential director nominee’s name and qualifications for board membership and should be addressed to:

Corporate Secretary

Impax Laboratories, Inc.

30831 Huntwood Avenue

Hayward, California 94544

All stockholder recommendations of potential director nominees which are intended to be considered by the nominating committee in any year must be received at least 120 days prior to the date on which we first mailed our proxy material for the prior year’s annual meeting in order, upon a determination by the nominating committee to recommend such potential director nominee, for such nominee to be included in the proxy statement and the form of proxy relating to the annual meeting. See “Stockholder Proposals” for the deadline for submitting recommendations of potential director nominees for the 2013 annual meeting.

Communication with the Board

Stockholders may communicate with the board or individual members of the board, including the respective chairs of the board’s nominating committee, compensation committee and audit committee, by sending correspondence to the following address: Corporate Secretary, Impax Laboratories, Inc., 30831 Huntwood Avenue, Hayward, California 94544. We will periodically forward all correspondence received to the board or to the individual member of the board to whom the correspondence is addressed.

Director Attendance at Annual Meeting

The board has adopted a policy that all of our directors should attend the annual meeting, absent exceptional cause. In 2011, each of the seven members of the board attended the annual meeting.

Director Compensation for Year Ended December 31, 2011

The following table sets forth information regarding the compensation of our non-employee directors during the year ended December 31, 2011.

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Option Awards ($)(1)(3) | Total ($) |

Leslie Z. Benet, Ph.D. | 63,125 | — | 273,657 | 336,782 |

Robert L. Burr | 116,250 | 111,880 | 144,030 | 372,160 |

Allen Chao, Ph.D. | 63,125 | 111,880 | 144,030 | 319,035 |

Nigel Ten Fleming, Ph.D. | 71,875 | 111,880 | 144,030 | 327,785 |

Michael Markbreiter | 63,125 | 111,880 | 144,030 | 319,035 |

Peter R. Terreri | 85,000 | 111,880 | 144,030 | 340,910 |

(1) Represents the aggregate grant date fair value of stock or option awards, as applicable, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, referred to as “ASC Topic 718,” based on assumptions set forth in Note 13 to the consolidated financial statements included in our Annual Report on Form 10-K filed with the SEC on February 28, 2012 and without giving effect to the estimate of forfeitures related to service-based vesting conditions. (2) At December 31, 2011, each of Mr. Burr, Dr. Chao, Dr. Fleming, Mr. Markbreiter and Mr. Terreri held 10,666, 7,200, 10,666, 10,666 and 10,666, respectively, shares of restricted common stock under the Impax Laboratories, Inc. Amended and Restated 2002 Equity Incentive Plan, referred to as the “2002 plan.” (3) At December 31, 2011, options to purchase, in the aggregate, 114,000, 57,500, 22,000, 56,000, 42,500 and 92,000 shares of our common stock were outstanding for Dr. Benet, Mr. Burr, Dr. Chao, Dr. Fleming, Mr. Markbreiter and Mr. Terreri, respectively, under the Impax Laboratories, Inc. 1999 Equity Incentive Plan, referred to as the “1999 plan,” and the 2002 plan. |

Narrative Disclosure to Director Compensation Table

Members of the board who are our employees do not receive any compensation for their services as our directors. Prior to March 10, 2011, each non-employee director received an annual retainer of $45,000, payable in quarterly installments, and each member of the audit, compensation and nominating committees received an annual retainer of $12,500, $7,500 and $5,000, respectively, payable in quarterly installments. In addition, we paid a $30,000 annual retainer to our Chairman of the board and a $12,500, $5,000 and $5,000 annual retainer to our chairmen of the audit, compensation and nominating committees, respectively. On March 10, 2011, the compensation committee adopted a new compensation program pursuant to which each non-employee director receives an annual retainer of $50,000, payable in quarterly installments, and each member of the audit, compensation and nominating committees receives an annual retainer of $15,000, $10,000 and $5,000, respectively, payable in quarterly installments. In addition, we pay, in quarterly installments, a $30,000 annual retainer to our Chairman of the board and a $25,000, $10,000 and $10,000 annual retainer to our chairmen of the audit, compensation and nominating committees, respectively. Our non-employee directors were reimbursed for out-of-pocket expenses incurred in attending board and committee meetings.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 9

Back to Contents

On May 11, 2011, we made annual grants of stock options, at the exercise price of $27.97 per share, and restricted stock to our non-employee directors. Under the annual grant, we awarded (i) options to purchase 19,000 shares of common stock to Dr. Benet and 10,000 shares of common stock to each of the remaining non-employee directors; and (ii) 4,000 shares of restricted stock to each of the non-employee directors (excluding Dr. Benet). The stock options and restricted stock described above vest in three equal annual installments beginning on May 11, 2012.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION AS DIRECTORS OF THE SEVEN NOMINEES NAMED IN THIS PROXY STATEMENT.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 10

Back to Contents

EXECUTIVE OFFICERS

Set forth below are the names of our executive officers, their ages as of the record date, and their positions with Impax.

Name | Age | Positions with Impax |

Larry Hsu, Ph.D. | 63 | President, Chief Executive Officer and Director |

Arthur A. Koch, Jr. | 58 | Executive Vice President, Finance, and Chief Financial Officer |

Michael J. Nestor | 59 | President, Impax Pharmaceuticals Division |

Carole Ben-Maimon, M.D. | 53 | President, Global Pharmaceuticals Division |

Mark A. Schlossberg | 51 | Senior Vice President, General Counsel and Corporate Secretary |

Set forth below are the principal occupations or employment for at least the past five years of our executive officers, other than Dr. Hsu, whose information is included above in “Proposal One — Election of Directors.”

Arthur A. Koch, Jr. joined us in February 2005 and served as our Senior Vice President, Finance and Chief Financial Officer from April 2005 to March 2011, when he was promoted to the position of Executive Vice President, Finance and Chief Financial Officer. Prior to joining us, he had been with Strategic Diagnostics Inc. from July 1997 until January 2005, a company that develops, manufactures and markets immunoassay-based diagnostic test kits, including six years as Chief Operating Officer, five months as interim Chief Executive Officer and five years as Chief Financial Officer and Vice President. Mr. Koch has held further Chief Financial Officer positions at Paracelsian Inc., IBAH Inc., Liberty Fish Company and Premier Solutions Ltd. In addition, he has served as a corporate finance and operations consultant for numerous private companies, and spent the first eight years of his career at KPMG LLP, rising to the rank of senior manager. Mr. Koch holds a Bachelor of Business Administration from Temple University and has been a Certified Public Accountant since 1977.

Michael J. Nestor has served as President of our branded products division, Impax Pharmaceuticals, since March 2008. Before joining us, he was Chief Operating Officer of Piedmont Pharmaceuticals, a specialty pharmaceutical company, from July 2007 to March 2008. Prior to Piedmont, Mr. Nestor was CEO of NanoBio, a startup biopharmaceutical company from December 2004 to November 2006, prior to which he was employed by Alpharma, initially as President of its generic pharmaceutical business and later as President of its branded pharmaceutical business. Before Alpharma, he was President, International business at Banner Inc., a global contract manufacturing concern. Prior to Banner, Mr. Nestor spent 16 years at Lederle Laboratories / Wyeth holding increasing positions of responsibility including Vice President, Cardiovascular business, Vice President / General Manager of Lederle-Praxis Biologics, and Vice President of Wyeth-Lederle Vaccines and Pediatrics. Mr. Nestor has a Bachelor of Business Administration degree from Middle Tennessee State University and a MBA from Pepperdine University.

Carole S. Ben-Maimon, M.D. has served as President of our generic products division, Global Pharmaceuticals, since September 2011. Prior to joining the Company, she served as Senior Vice President, Corporate Strategy at Qualitest Pharmaceuticals, Inc. from July 2009 to July 2010. Prior to her role at Qualitest, she served as Founder, President and Chief Executive Officer and director of Alita Pharmaceuticals, Inc., an early stage, privately held specialty pharmaceutical company, from September 2006 to June 2009. Dr. Ben-Maimon also held executive positions with and served as a member of the board with Barr Pharmaceuticals from 2001 to 2006, including as president and chief operating officer of Duramed Research, Inc. (a wholly owned subsidiary of Barr Pharmaceuticals Inc.). Dr. Ben-Maimon also held executive positions with Teva Pharmaceuticals USA where she served as Senior Vice President, Science and Public Policy from 2000 to 2001, Senior Vice President, Research and Development from 1996 to 2000 and Vice President, Medical and Regulatory Affairs with Lemmon Company, a wholly owned subsidiary of Teva Pharmaceuticals, Inc. from 1993 to 1996. She served as the Chairman of the Board of the Generic Pharmaceutical Association from 1999 to 2002, and is also a published author of numerous scientific and clinical articles. Dr. Ben-Maimon is a graduate of Thomas Jefferson Medical College and received a Bachelor of Arts in biology from The University of Pennsylvania where she graduated magna cum laude. She is board certified in internal medicine, and completed clinical and research training in nephrology at Thomas Jefferson University.

Mark A. Schlossberg has served as our Senior Vice President, General Counsel and Corporate Secretary since May 2011. Prior to joining the Company, he served as Vice President, Associate General Counsel of Amgen Inc. from September 2004 to May 2011. Prior to joining Amgen, he held legal and business positions at Medtronic, Inc., and legal positions at Diageo plc, RJR Nabisco, Inc. and Mudge Rose Guthrie Alexander & Ferdon. He earned a Bachelor of Sciences in business administration and finance from the University of Southern California and a Juris Doctor degree from Emory University.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 11

Back to Contents

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following discussion provides an analysis of our compensation program for the executive officers named in the Summary Compensation Table in “Executive Compensation” and discusses the material factors involved in our decisions regarding the compensation of the following named executive officers:

•

Larry Hsu, Ph.D., our President and Chief Executive Officer;

•

Arthur A. Koch, Jr., our Executive Vice President, Finance, and Chief Financial Officer;

•

Michael J. Nestor, President of Impax Pharmaceuticals, our branded-products division;

•

Carole S. Ben-Maimon, President of Global Pharmaceuticals, our generics division; and

•

Mark A. Schlossberg, Senior Vice President, General Counsel and Corporate Secretary.

The following discussion cross-references those specific tabular and narrative disclosures that appear following this subsection where appropriate. You should read this Compensation Discussion and Analysis in conjunction with such tabular and narrative disclosures.

2011 Performance Summary

Our overall compensation goal is to reward our executive officers in a manner that supports our pay-for-performance philosophy while maintaining an overall level of compensation that we believe is reasonable and competitive. Our performance during the year ended December 31, 2011 was strong and, in our compensation decision-making process described below, we took this performance into consideration.

During 2011, we continued to make significant progress toward our goal of transforming us into a fast growing specialty pharmaceutical company. In our branded products division, we filed a new drug application for our late stage branded pharmaceutical product candidate for the treatment of idiopathic Parkinson’s disease, IPX066, in December 2011, which was subsequently accepted for filing by the Food and Drug Administration, referred to as the FDA, in February 2012. Our Prescription Drug User Fee Act or PDUFA review date is October 21, 2012. In 2011, we also initiated a Phase IIb clinical study in patients with moderate to severe Restless Leg Syndrome for our second branded pharmaceutical program, IPX159. Earlier this year, we entered into an exclusive license agreement with AstraZeneca for the exclusive U.S. commercial rights to Zomig® (zolmitriptan) tablet, orally disintegrating tablet, and nasal spray formulations. As part of the Distribution, License, Development and Supply Agreement, we will also have non-exclusive rights to develop new products containing zolmitriptan and to exclusively commercialize these products in the U.S. in connection with the Zomig® brand. The Zomig® license agreement marks our first completed major branded product strategic transaction which we believe will fit well with the capabilities of our neurology focused specialty sales force and will support the growth of our commercial organization as we prepare for the launch of IPX066. We similarly remained very active in our generic products division in 2011, with the filing of 11 abbreviated new drug applications with the FDA.

Our net income for the year ended December 31, 2011 declined as expected by $184.9 million to $65.5 million, compared to $250.4 million for the year ended December 31, 2010, primarily attributable to lower revenue in 2011 from the sale of our tamsulosin product, a generic version of Flomax®. During 2010, sales of our tamsulosin product benefited from an eight week contractual market exclusivity period which commenced in March 2010, and for which there was no similar contractual market exclusivity period in the year ended December 31, 2011. The decrease in revenue was also attributable to the change in the accounting treatment related to our strategic alliance agreement with Teva Pharmaceuticals Curacao N.V., a subsidiary of Teva Pharmaceutical Industries Limited, referred to as the Teva Agreement, in the year ended December 31, 2010. The change in the accounting for the Teva Agreement resulted in an increase of approximately $64.2 million to net income in the year ended December 31, 2010. For additional information on the accounting afforded the Teva Agreement, see “Part III – Item 15. Exhibits and Financial Statement Schedules — Note 11, Alliance and Collaboration Agreements — Strategic Alliance Agreement with Teva” of our Annual Report on Form 10-K for the year ended December 31, 2011. We continued to earn significant revenues and gross profit from sales of our authorized generic Adderall XR® products, and fenofibrate products, during the year ended December 31, 2011. With respect to our authorized generic Adderall XR® products, we are dependent on a third-party pharmaceutical company to supply us with the finished product we market and sell through our generic products division. We experienced disruptions related to the supply of our authorized generic Adderall XR® from this third-party pharmaceutical company during the year ended December 31, 2011. For further discussion of our financial performance for the year ended December 31, 2011, please see “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations” of our Annual Report on Form 10-K for the year ended December 31, 2011.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 12

Back to Contents

Compensation Philosophy and Objectives

At its core, our executive compensation program recognizes that our success is dependent upon our ability to attract, motivate and retain the highly talented individuals we need to achieve our business results. The program reflects the following key principles:

•

To attract, motivate and retain the best talent we can obtain, our compensation should be competitive. We strongly believe that our future success rests with our people, including our executive officers. To be successful, we must be able to attract, motivate and retain quality executive officers. As compensation is a key tool to achieve this objective, one facet of our compensation program is to provide our named executive officers pay amounts and components that are competitive with those of other companies in our industry.

•

Our compensation program should encourage and reward positive performance. Our executive compensation program is designed to promote and reward positive performance. In doing so, we consider both the overall performance of our business as well as the individual performance of each named executive officer. Positive performance on the part of our company and management will permit our named executive officers to be eligible to receive incentive compensation. On the other hand, when our business is facing financial or other challenges or an individual executive does not meet stated objectives, this incentive compensation may be appropriately reduced or eliminated.

•

We seek to align the interests of our named executive officers and stockholders. We believe that equity compensation is an excellent way to encourage our executive officers to act in the best interests of our stockholders. We provide our named executive officers with equity awards as part of their overall compensation to encourage equity ownership and to align their interests with those of our stockholders.

•

Compensation should encourage teamwork and executive cohesion. While individual performance is carefully reviewed and considered, we have also maintained a philosophy of similar compensation for officers who are at similar executive levels. We believe that following such a plan of pay equity fosters teamwork and cohesion and discourages internal comparison of compensation packages among executives.

•

Our compensation program should balance our short- and long-term financial and operational goals. We generally strive to achieve a balance between achievement of both short- and long-term goals through the use of both salary and annual cash incentives and equity-based incentives. Our management incentive program primarily rewards short-term performance by paying out base salary and annual cash incentive awards based on performance over a period of one year. Equity-based awards are generally designed to reward long-term financial performance.

We believe that the mix and design of the elements of our executive compensation discussed in this proxy statement do not encourage management to assume excessive risks. See “— Risk Assessment in Compensation Policies and Practices for Employees.”

Our Compensation Decision-Making Process

Role of Chief Executive Officer and Compensation Committee

In general, as to most items of compensation, the Chief Executive Officer annually evaluates each named executive officer, other than himself, and recommends to the compensation committee each component of compensation for all of those named executive officers. Compensation that is generally not covered by the Chief Executive Officer’s evaluation includes benefits and other compensation mandated or determined by reference to an existing employment or similar agreement or benefits and other programs generally available to all of our employees.

As to the compensation of our Chief Executive Officer, the compensation committee discusses and creates a proposal as to the amount of and any changes to his compensation. The committee also evaluates the Chief Executive Officer’s proposals as to the compensation of our other named executive officers. The compensation committee then submits its recommendations regarding the compensation of all of our named executive officers to the board for final approval.

Generally, as part of its process of setting and approving the executive annual compensation, the compensation committee and the board, as applicable, review gains realized from prior compensation or compensation to be received upon a future termination of employment or a change in control. Severance and change-in-control compensation is intended to maximize stockholder value and assure continuity of leadership by allowing executives to perform their duties without regard to any concerns that they may have regarding their continued employment.

Role of Compensation Consultants

In 2011, as in recent years past, we retained the consulting services of Radford to assist in the evaluation of our compensation program for our named executive officers. Radford was engaged by, and reports directly to, the compensation committee, and the compensation committee has the general authority to retain and dismiss the compensation consultants.

Review of Executive Compensation

In 2008, the compensation committee, with the assistance of Radford, conducted a comprehensive review of our executive compensation to ensure that we were paying our executive officers competitive levels of compensation that best reflect their individual responsibilities and contributions to our operations and provide incentives to achieve our business objectives. This review included an in-depth examination of Radford compensation survey data, described below in “— Benchmarking Executive Compensation,” which led the compensation committee to conclude that the total compensation for our named executive officers required adjustment to bring our compensation to a level competitive with that of other companies in our peer group and to make our compensation internally equitable for officers at similar levels of responsibility. To that end, our compensation committee and the board, with the assistance of Radford, developed a new compensation philosophy that targets executive compensation at the 50th percentile of Radford compensation survey data for salary, cash incentive awards and equity awards.

IMPAX LABORATORIES, INC. – 2012 Notice of Annual Meeting of Stockholders and Proxy Statement – 13

Back to Contents

In 2011, as in 2010, Radford reevaluated our executive compensation and recommended that the compensation of our executive officers continue to be targeted at the 50th percentile of Radford compensation survey data for salary, cash incentive awards and equity awards.

Benchmarking Executive Compensation

In 2010, with the assistance of Radford, the compensation committee established the following peer group of companies for comparison purposes for 2011. Comparative compensation data from the following peer group was considered by the compensation committee in making decisions around bonus payouts, merit increases, and executive equity grants in 2011:

• Abraxis Bioscience, Inc.; | • Endo Pharmaceuticals Holdings, Inc.; | • Salix Pharmaceuticals, Ltd.; |

• Alkermes, Inc.; | • King Pharmaceuticals, Inc.; | • The Medicines Company; |

• Amylin Pharmaceuticals, Inc.; | • Martek Biosciences Corporation; | • United Therapeutics Corporation; |

• BioMarin Pharmaceuticals, Inc.; | • Medicis Pharmaceutical Corporation; | • Valeant Pharmaceuticals International; |

• Biovail Corporation; | • OSI Pharmaceuticals, Inc.; | • ViroPharma Incorporated; and |