Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

TWIN similar filings

- 3 Aug 11 Departure of Directors or Certain Officers

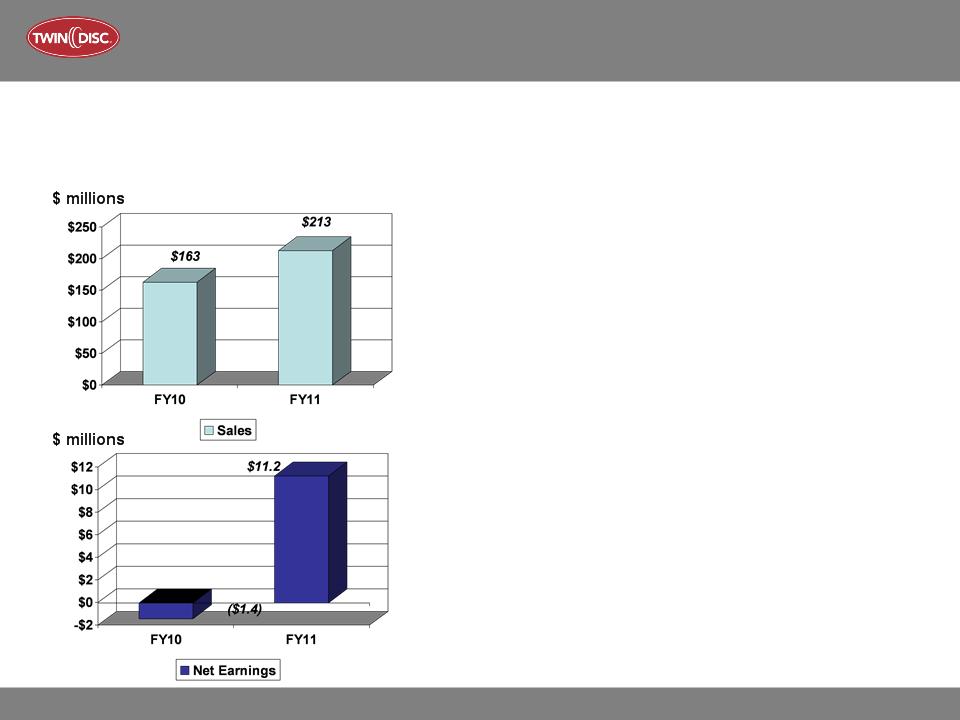

- 2 Aug 11 Twin Disc, Inc. Announces Fiscal 2011

- 18 May 11 Entry into a Material Definitive Agreement

- 27 Apr 11 Regulation FD Disclosure

- 19 Apr 11 Twin Disc, Inc. Announces Fiscal 2011

- 24 Jan 11 Twin Disc, Inc., Announces Fiscal 2011

- 8 Nov 10 Regulation FD Disclosure

Filing view

External links