Annual Stockholders Meeting

May 7, 2004

Richard E. Otto

President and Chief Executive Officer

1

Forward-Looking Statements

This presentation may contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain factors, risks and uncertainties that may cause actual results, events and performances to differ materially from those referred to in such statements. These risks include statements which address operating performance, events or developments that we expect or anticipate will occur in the future, such as projections about our future results of operations or our financial condition, benefits from the alliance with Boston Scientific, research, development and commercialization of our product candidates, anticipated trends in our business, manufacture of sufficient and acceptable quantities of our proposed products, approval of our product candidates, meeting additional capital requirements, and other risks that could cause actual results to differ materially. These risks are discussed in Corautus Genetics Inc.’s Securities and Exchange Commission filings, including, but not limited to, the risk factors in Corautus’ Annual Report on Form 10-K for the year ended December 31, 2003 (File No. 001-15833) filed March 30, 2004, which are incorporated by reference into this press release.

2

Company History

Vascular Genetics Inc.

GenStar Therapeutics Inc.

Corautus Genetics Inc.

The Merged Company – February 5, 2003

3

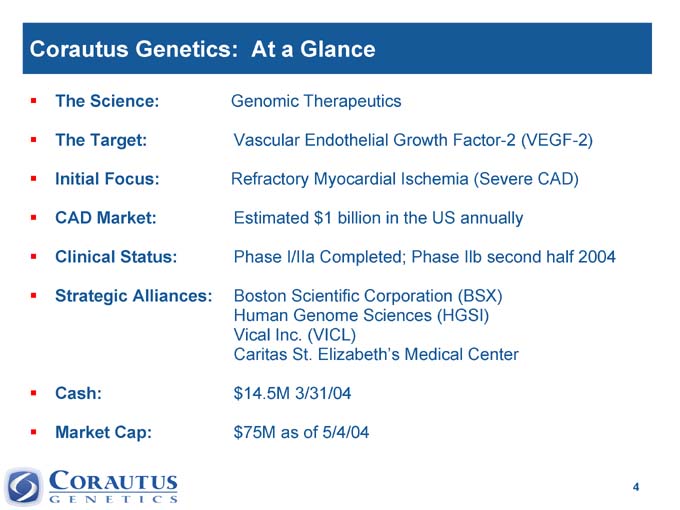

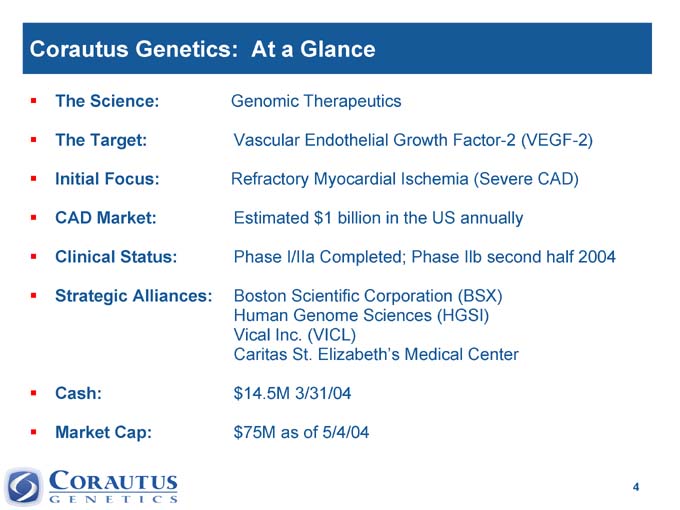

Corautus Genetics: At a Glance

The Science: Genomic Therapeutics

The Target: Vascular Endothelial Growth Factor-2 (VEGF-2)

Initial Focus: Refractory Myocardial Ischemia (Severe CAD)

CAD Market: Estimated $1 billion in the US annually

Clinical Status: Phase I/IIa Completed; Phase Ilb second half 2004

Strategic | | Alliances: Boston Scientific Corporation (BSX) Human Genome Sciences (HGSI) Vical Inc. (VICL) Caritas St. Elizabeth’s Medical Center |

Cash: $14.5M 3/31/04

Market Cap: $75M as of 5/4/04

4

Corautus’ VEGF-2 Technology

• What is VEGF-2

– A naturally occurring growth factor that stimulates the migration and growth of endothelial cells, essential components in the development of new blood vessels

• How does VEGF-2 work

– When injected in to ischemic muscle tissue, the VEGF-2 gene encodes the VEGF-2 protein and is believed to stimulate the creation of new blood vessels into nearby body tissue

5

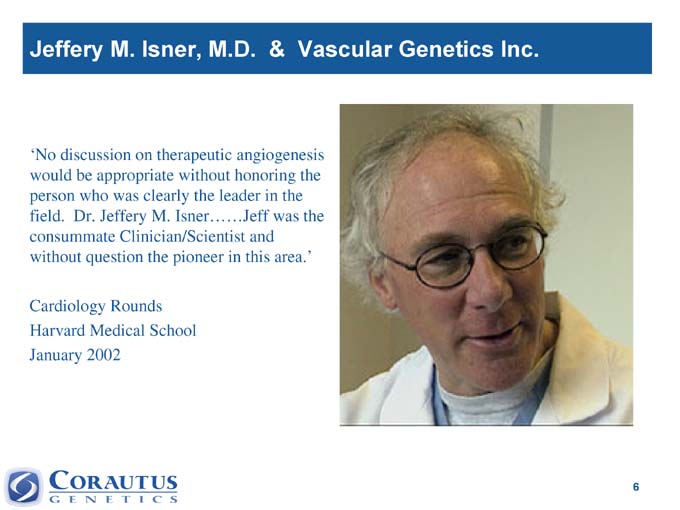

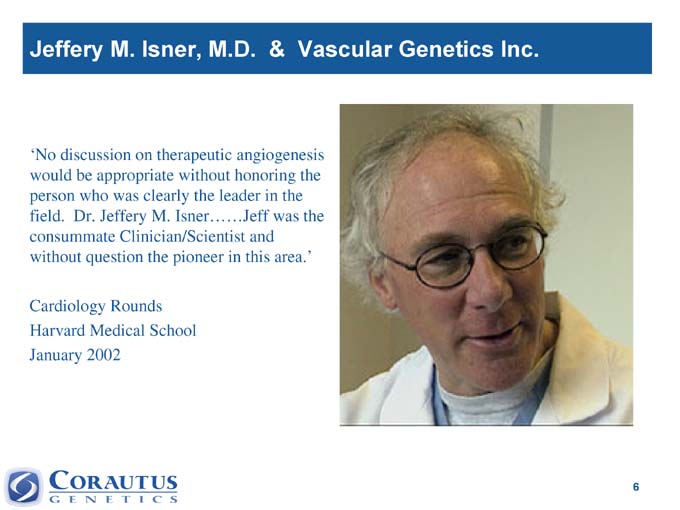

Jeffery M. Isner, M.D. & Vascular Genetics Inc.

‘No discussion on therapeutic angiogenesis would be appropriate without honoring the person who was clearly the leader in the field. Dr. Jeffery M. IsnerJeff was the consummate Clinician/Scientist and without question the pioneer in this area.’

Cardiology Rounds Harvard Medical School January 2002

6

The Vision – Biologic Revascularization

Conventional

Pharmacologic

Treats Symptom

Underlying condition unaltered

vs.

Regenerative

Biologic (Genetic)

Treats Cause

Underlying condition altered

Biologic revascularization may offer superior outcomes in the treatment of refractory angina due to remodeling of ischemic cardiac muscle

7

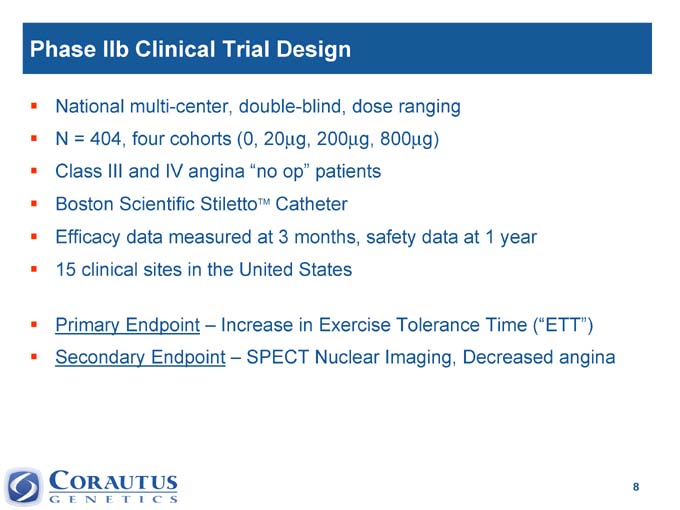

Phase Ilb Clinical Trial Design

National multi-center, double-blind, dose ranging

N = 404, four cohorts (0, 20?g, 200?g, 800?g)

Class III and IV angina “no op” patients

Boston Scientific StilettoTM Catheter

Efficacy data measured at 3 months, safety data at 1 year

15 clinical sites in the United States

Primary Endpoint – Increase in Exercise Tolerance Time (“ETT”)

Secondary Endpoint – SPECT Nuclear Imaging, Decreased angina

8

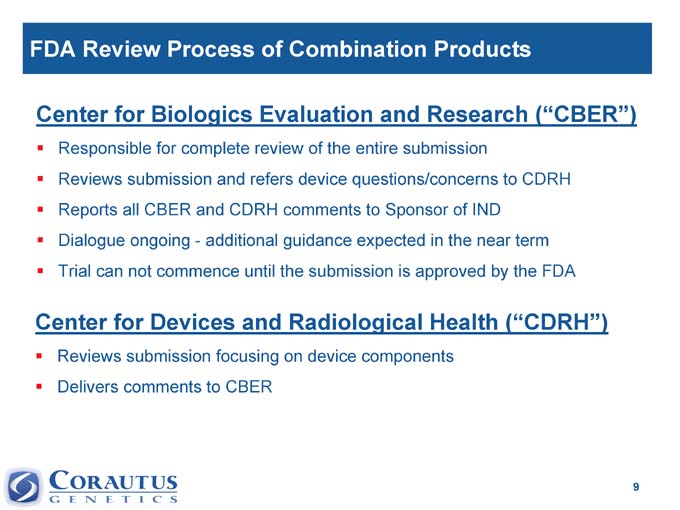

FDA Review Process of Combination Products

Center for Biologics Evaluation and Research (“CBER”)

Responsible for complete review of the entire submission

Reviews submission and refers device questions/concerns to CDRH

Reports all CBER and CDRH comments to Sponsor of IND

Dialogue ongoing—additional guidance expected in the near term

Trial can not commence until the submission is approved by the FDA

Center for Devices and Radiological Health (“CDRH”)

Reviews submission focusing on device components

Delivers comments to CBER

9

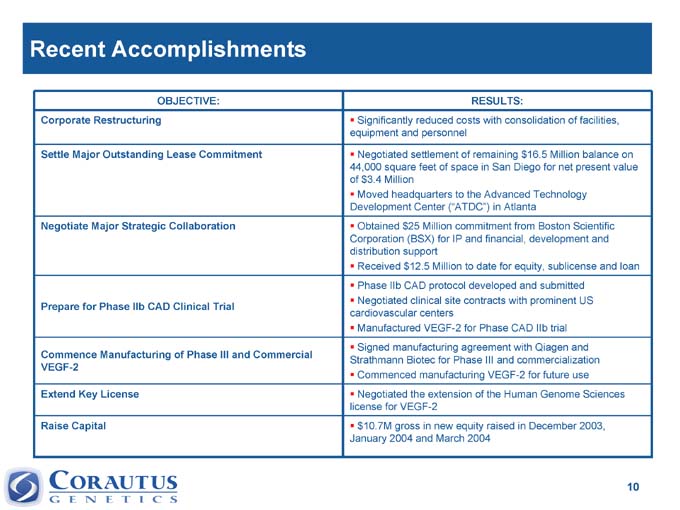

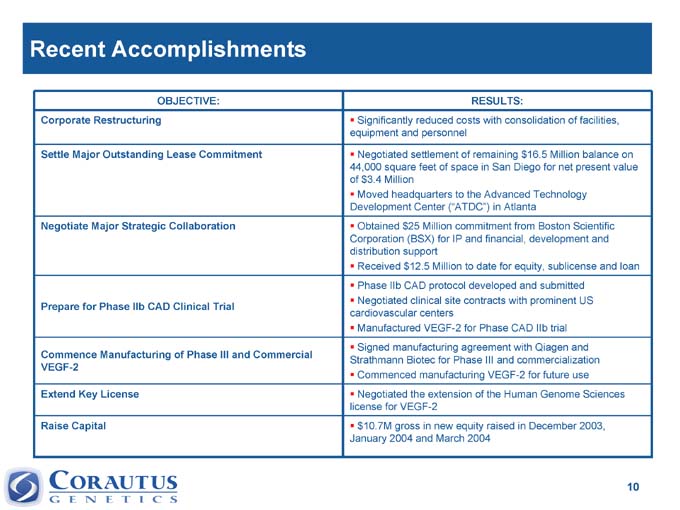

Recent Accomplishments

OBJECTIVE: RESULTS:

Corporate | | Restructuring Significantly reduced costs with consolidation of facilities, equipment and personnel |

Settle | | Major Outstanding Lease Commitment |

Negotiated | | settlement of remaining $16.5 Million balance on 44,000 square feet of space in San Diego for net present value of $3.4 Million |

Moved headquarters to the Advanced Technology Development Center (“ATDC”) in Atlanta

Negotiate Major Strategic Collaboration Obtained $25 Million commitment from Boston Scientific Corporation (BSX) for IP and financial, development and distribution support

Received $12.5 Million to date for equity, sublicense and loan

Prepare for Phase IIb CAD Clinical Trial Phase IIb CAD protocol developed and submitted

Negotiated clinical site contracts with prominent US cardiovascular centers

Commence Manufacturing of Phase III and Commercial VEGF-2 Manufactured VEGF-2 for Phase CAD IIb trial Signed manufacturing agreement with Qiagen and Strathmann Biotec for Phase III and commercialization

Commenced manufacturing VEGF-2 for future use

Extend Key License Negotiated the extension of the Human Genome Sciences license for VEGF-2

Raise Capital 10.7M gross in new equity raised in December 2003, $ January 2004 and March 2004

10

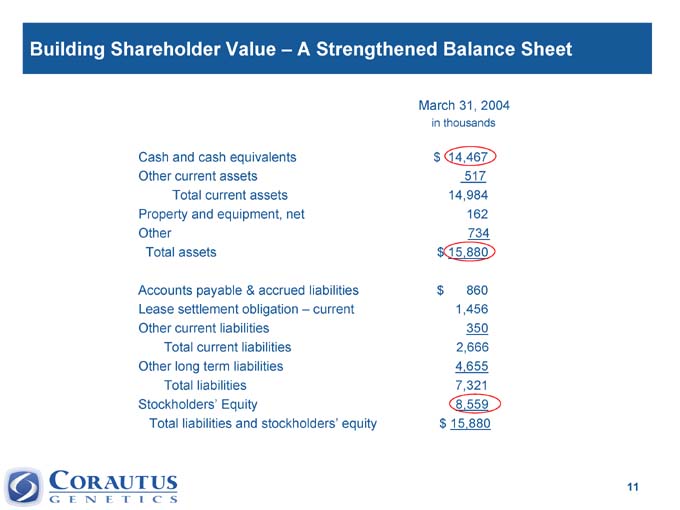

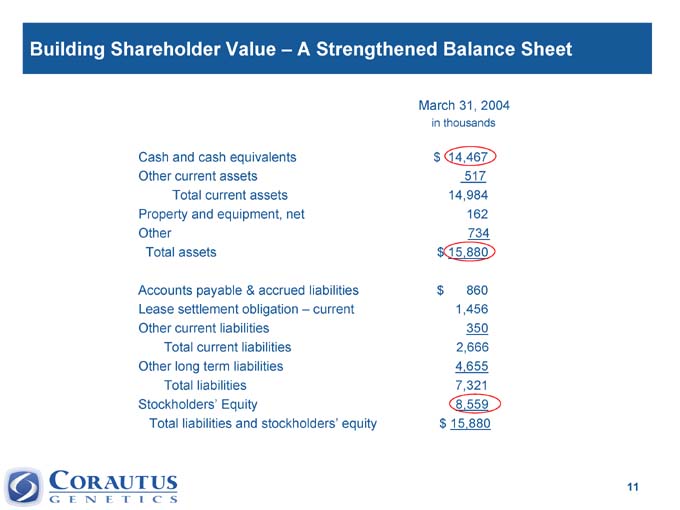

Building Shareholder Value – A Strengthened Balance Sheet

March 31, 2004

in thousands

Cash and cash equivalents $ 14,467

Other current assets 517

Total current assets 14,984

Property and equipment, net 162

Other 734

Total assets $ 15,880

Accounts payable & accrued liabilities $ 860

Lease settlement obligation – current 1,456

Other current liabilities 350

Total current liabilities 2,666

Other long term liabilities 4,655

Total liabilities 7,321

Stockholders’ Equity 8,559

Total liabilities and stockholders’ equity $ 15,880

11

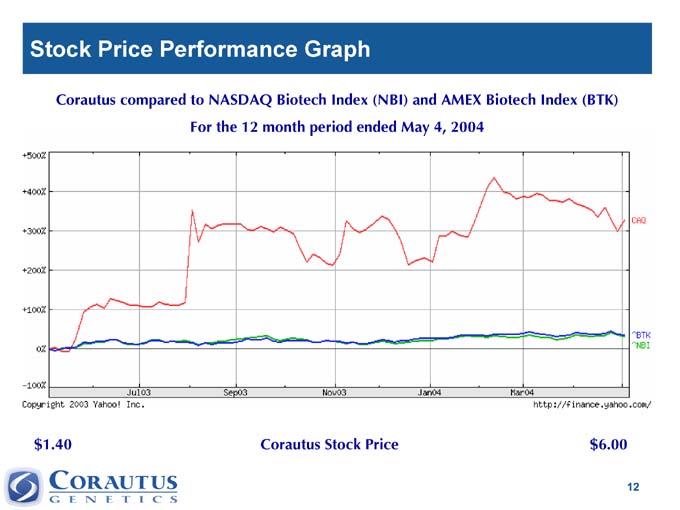

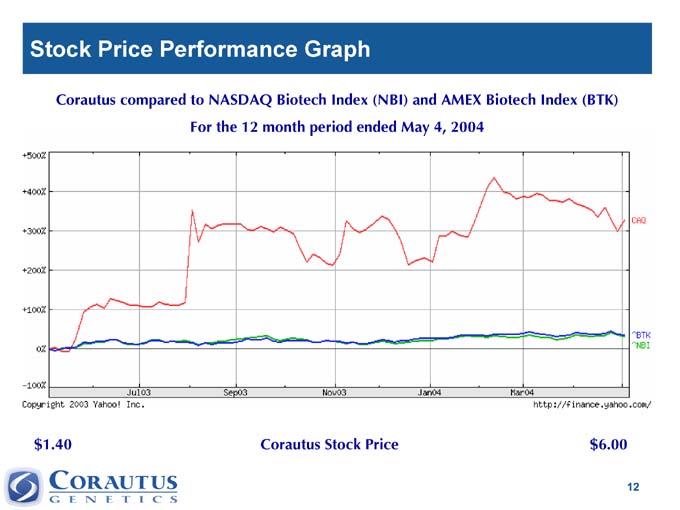

Stock Price Performance Graph

Corautus compared to NASDAQ Biotech Index (NBI) and AMEX Biotech Index (BTK)

For the 12 month period ended May 4, 2004

$1.40 Corautus Stock Price $6.00

12

Management Goals for 2004

Commence and Manage Phase IIb CAD clinical trial

Initiate phase III-commercial product manufacturing

Efficiently deploy capital by controlling costs

Secure additional funding for 2005 and beyond

Consider filing new protocol to existing Investigational New Drug Application (IND) for Peripheral Artery Disease (PAD)

Achieve another year of significant valuation increase

13

Conclusion

“Later-stage” therapeutic serving an unmet medical condition

Support of key opinion leaders in cardiology

$1 billion estimated US annual market opportunity for Refractory CAD

Major collaboration agreement with Boston Scientific Corporation

Strong intellectual property position Strengthened cash resources

Experienced and focused management team with proven record to efficiently enhance shareholder value

14