UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2006 |

OR

| [_] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-27264

CORAUTUS GENETICS INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 33-0687976 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification no.) |

70 Mansell Court, Suite 100, Roswell, Georgia 30076

(Address of principal executive offices) (Zip code)

Registrant’s Telephone Number, Including Area Code:

(404) 526-6200

Securities Registered Pursuant to Section 12(b) of the Act

NONE

Securities Registered Pursuant to Section 12(g) of the Act:

| | |

Title of Class | | Name of Each Exchange Where Registered |

| Common Stock, $.001 par value | | NASDAQ Capital Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by checkmark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form-10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and larger accelerated filer” in Rule 12b-2 of the Exchange Act. Check one:

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s outstanding common stock held by non-affiliates of the registrant as of June 30, 2006 was $11,505,467. As of March 26, 2007, there were 19,728,854 shares of the registrant’s common stock ($0.001 par value) outstanding.

Documents Incorporated by Reference: Specifically identified portions of the Proxy Statement for the 2007 Annual Meeting of Stockholders, to be filed not later than 120 days after the end of the fiscal year covered by this Report, are incorporated by reference in Part III hereof.

TABLE OF CONTENTS

CORAUTUS GENETICS INC.

(A DEVELOPMENT-STAGE ENTERPRISE)

FORM 10-K

-i-

CAUTIONARY FACTORS THAT MAY AFFECT FUTURE RESULTS

We believe it is important to communicate our expectations to investors. However, there may be events in the future that we are not able to predict accurately or that we do not fully control that could cause actual results to differ materially from those expressed or implied. This annual report and the documents incorporated by reference in this annual report may contain forward–looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain factors, risks and uncertainties that may cause actual results, events and performances to differ materially from those referred to in such statements. These risks include statements that address operating performance, events or developments that we expect or anticipate will occur in the future, such as such as the likelihood of identifying and securing life sciences opportunities upon which to focus our resources and the adequacy of our cash position to transition to new opportunities if found, and other risks that could cause actual results to differ materially. The forward–looking statements are based on information available to us on the date hereof, and we assume no obligation to update any such forward–looking statements.

PART I

The following discussion must be read in conjunction with, and is subject to, the risks and uncertainties set forth in “Risk Factors” in Item 1A of this report.

Recent Events

On October 30, 2006, our board of directors determined that it was in the best interests of the company and its stockholders to not conduct further clinical trials for Vascular Endothelial Growth Factor 2, or VEGF-2, for the treatment of cardiovascular and peripheral vascular disease. The board of directors authorized management to immediately reduce its cash spending and to continue identifying other life sciences technologies that it could acquire or in-license, or other life sciences opportunities. We have been actively seeking new product opportunities, as well as a merger or business combination, due to the refocus of our business away from our VEGF-2 product candidates.

On February 7, 2007, we entered into an Agreement and Plan of Merger and Reorganization with VIA Pharmaceuticals, Inc., a Delaware corporation that currently is privately-held, and our wholly owned subsidiary, Resurgens Merger Corp. Pursuant to the merger agreement, Resurgens will merge with and into VIA, with VIA surviving as a wholly-owned subsidiary of Corautus. In exchange for their VIA capital stock, VIA stockholders will receive shares of Corautus common stock. Currently, we expect that former VIA stockholders will hold approximately 78% of our common stock post-transaction. Additionally, if the transaction with VIA is consummated, Corautus’ clinical operations will focus on VIA’s product candidates.

We expect that a proxy statement for a special meeting of the stockholders will be mailed to all Corautus stockholders of record on a date to be set by our Board of Directors. Interested parties should review carefully this proxy statement when available for terms of the merger with VIA.

We expect the merger to be completed in the second quarter of 2007. If the merger is not completed, we will need to consider other alternatives, which will include liquidation and dissolution. Due to liquidation preferences of our Series C, Series D, and Series E Preferred Stock, in the event of liquidation, all cash held by Corautus would be distributed to the holders of preferred stock.

1

On May 25, 2006, we received a notice from the NASDAQ Stock Market indicating that we were not in compliance with the NASDAQ Stock Market’s requirements for continued listing because, for the previous 30 consecutive business days, the bid price of our common stock had closed below the minimum $1.00 per share requirement for continued inclusion under NASDAQ Marketplace Rule 4310(c)(4). We had until November 21, 2006 to achieve compliance with the minimum requirements for continued listing. On November 22, 2006, we received a notice from the NASDAQ Stock Market indicating that we remained in non-compliance with the NASDAQ Stock Market’s requirements for continued listing because we had failed to achieve a bid price of our common stock above $1.00 per share. However, because we met all criteria for initial listing on the NASDAQ Capital Market at that time (other than the bid price requirement), we were granted an additional 180 days, or until May 21, 2007, to regain compliance with the NASDAQ Stock Market’s requirements for continued listing.

On December 8, 2006, we received a further notification from NASDAQ that our common stock would be delisted from the NASDAQ Capital Market on December 19, 2006 unless we requested an appeal no later than December 15, 2006. In its notification, NASDAQ stated that it believes we currently are not engaged in active business operations and are therefore a “public shell,” which, in NASDAQ’s determination, could be detrimental to the interests of the investing public. Marketplace Rule 4300 provides NASDAQ with discretionary authority to apply more stringent criteria for continued listing and terminate the inclusion of particular securities based on any event that occurs, that in the opinion of NASDAQ, makes inclusion of the securities in NASDAQ inadvisable or unwarranted, even though the securities meet all enumerated criteria for continued inclusion on NASDAQ.

On December 15, 2006, Corautus appealed the NASDAQ Staff’s “public shell” determination to a NASDAQ Listing Qualifications Panel. On February 8, 2007, Corautus presented its arguments to the Qualifications Panel. During the oral hearing, we requested relief from the “public shell” determination for a 90-day period, or until May 9, 2007, in order to complete the proposed merger. On March 23, 2007, we received a decision from the Qualifications Panel providing us until April 17, 2007 to mail proxy materials to our stockholders regarding the transaction with VIA Pharmaceuticals, Inc., and until May 21, 2007 to consummate such transaction. There can be no assurance that we can meet these deadlines.

Overview

Corautus is a development stage company dedicated to the development of innovative products in the life sciences industry. Corautus, formerly known as GenStar Therapeutics Corporation and Urogen Corp., was formed as a Delaware corporation on June 30, 1995. Prior to November 1, 2006, Corautus was primarily focused on the clinical development of gene therapy products using a vascular growth factor gene, Vascular Endothelial Growth Factor 2 (VEGF-2), for the treatment of severe cardiovascular disease. Corautus was the sponsor of a Phase IIb clinical trial to study the efficacy of VEGF-2 for the treatment of severe cardiovascular disease, known as the GENASIS trial. In addition, Corautus supported initial clinical trials studying the efficacy of VEGF-2 for the treatment of peripheral artery disease and diabetic neuropathy.

Our gene therapy treatment approach was based upon the research of the late Dr. Jeffrey Isner, former Chief of Vascular Medicine and Cardiovascular Research at Caritas St. Elizabeth’s Medical Center of Boston, Inc. Our VEGF-2 product candidates were designed to induce therapeutic angiogenesis, which is the stimulation of blood vessel formation, to restore blood flow to ischemic, or oxygen deprived, muscle caused by cardiovascular or peripheral vascular disease. In this way, we sought to treat a cause of the underlying condition rather than the symptoms of the disease. Our approach to therapeutic angiogenesis involved the injection of naked plasmid DNA, or DNA that is formulated without modifying materials such as liposomes or pegylation, directly into the ischemic muscle.

2

We enrolled 30 Class III and Class IV angina patients in our Phase I clinical trial. From our investigator’s published data, a significant improvement in angina class was noted at the two-year follow-up; no patients evaluated as having Class IV angina; only three were evaluated as having Class III angina; and the remaining were evaluated as having Class I or II angina. Our 19 patient Phase I/IIa trial was a multicenter, randomized study testing VEGF-2 in two dosages (200 and 800 microgram) plus a placebo. The investigators reported a significant improvement in symptoms of angina, including an average increase in exercise tolerance time of almost two minutes in the VEGF-2 treated patients, a reduction of angina class, and a reduction in frequency of angina episodes in the VEGF-2 treated patients compared to the placebo patients.

We initiated the GENASIS trial on August 31, 2004. GENASIS was a multicenter, randomized, four-arm, double-blind study of up to 404 patients in approximately 30 institutions in the United States evaluating the efficacy and safety of three doses (20, 200, 800 micrograms) of VEGF-2 versus placebo percutaneously delivered via the Stiletto™ catheter. Prior to cessation, 295 patients were treated in the GENASIS clinical trial. The primary endpoint of the GENASIS trial was the improvement in exercise tolerance time on a treadmill 90 days following patient treatment, with additional follow-up at 6 and 12 months.

On March 14, 2006, we announced that in conjunction with Boston Scientific Corporation, we had temporarily suspended patient treatments in our GENASIS clinical trial. Boston Scientific requested the voluntary suspension as a result of three reported serious adverse events of pericardial effusion, which did not appear to be related to the VEGF-2 biologic. We notified the FDA of the voluntary suspension prior to making the public announcement, and in a subsequent teleconference, we were informed that the FDA had placed the trial on clinical hold.

As part of the process to address the clinical hold, the independent Data Monitoring Committee, or DMC, reviewed safety information. To better consider safety in the context of risk/benefit in this trial, the DMC also requested and subsequently reviewed a limited amount of available unblinded summary efficacy data related to the increase in exercise tolerance time, or ETT, which is measured by a patient’s performance on a treadmill. The DMC recommended to us that, based on available efficacy data, enrollment should be terminated under the current protocol as the DMC saw very little chance for significant efficacy as to the primary endpoint. On April 10, 2006, we announced that we had accepted the DMC’s recommendation that enrollment in the GENASIS trial be terminated and notified the FDA of the termination of enrollment.

Corautus locked the database on August 14, 2006 for the 295 patients treated in the GENASIS clinical trial. The efficacy and safety analyses performed on the database included 295 patients at 3 months, 241 patients at 6 months and 103 patients at 12 months. On October 10, 2006 Corautus announced that the final efficacy results from its GENASIS clinical trial did not achieve a statistically significant difference from placebo in any active dose group for the primary efficacy endpoint. The primary efficacy endpoint in the GENASIS clinical trial was an improvement of at least one minute in ETT from baseline to three months. The data indicated considerable overlap in results between the active and placebo groups for the secondary endpoints as well, and no clear dose effect was seen. In general, a majority of patients in all treatment arms (active and placebo) significantly improved from their baseline status in both primary and secondary efficacy endpoints; however, there was no significant separation from the placebo in any active dose group.

Collaborative Efforts and Intellectual Property

We established a portfolio of licensed patents, intellectual property rights and technologies relating to the development and use of the VEGF-2 technology for the gene therapy treatment. We do not own any of

3

the patents or patent applications relating to our core VEGF-2 technology. We hold exclusive licenses, through our wholly-owned subsidiary Vascular Genetics Inc., from Human Genome Sciences, Inc. and Vical Incorporated, and non-exclusive licenses from Caritas St. Elizabeth’s and Boston Scientific to certain U.S. patents, pending U.S. patent applications, and corresponding foreign patent applications.

In connection with the anticipated refocus of our business away from VEGF-2 and towards VIA’s product candidates, we expect to terminate all of our material agreements relating to VEGF-2.

Government Regulation

New drugs and biologics, including gene therapy products, are subject to regulation under the Federal Food, Drug, and Cosmetic Act. In addition to being subject to certain provisions of that Act, biologics are also regulated under the Public Health Service Act. We believe that any pharmaceutical products developed by us will be regulated either as biological products or as new drugs. Both statutes and their corresponding regulations govern, among other things, the testing, manufacturing, distribution, safety, efficacy, labeling, storage, record keeping, advertising and other promotional practices involving biologics or new drugs. FDA approval or other clearances must be obtained before clinical testing, manufacturing and marketing of biologics and drugs. Obtaining FDA approval has historically been a costly and time-consuming process.

In addition, any gene therapy products developed by us will require regulatory approvals prior to human trials and additional regulatory approvals prior to marketing. New human gene therapy products are subject to extensive regulation by the FDA and the Center for Biological Evaluation and Research and comparable agencies in other countries. Currently, each human-study protocol is reviewed by the FDA and, in some instances, the National Institutes of Health, on a case-by-case basis. The FDA and the National Institutes of Health have published guidance documents with respect to the development and submission of gene therapy protocols.

In order to commercialize any proposed products, we must sponsor and file an investigational new drug application and be responsible for initiating and overseeing the human studies to demonstrate the safety and efficacy and, for a biologic product, the potency, which are necessary to obtain FDA approval of any such products. For Corautus-sponsored investigational new drug applications, we will be required to select qualified investigators (usually physicians within medical institutions) to supervise the administration of the products, and we will be required to ensure that the investigations are conducted and monitored in accordance with FDA regulations and the general investigational plan and protocols contained in the investigational new drug application.

The FDA receives reports on the progress of each phase of testing, and it may require the modification, suspension, or termination of trials if an unwarranted risk is presented to patients. If the FDA imposes a clinical hold, trials may not recommence without FDA authorization and then only under terms authorized by the FDA. The investigational new drug application process can thus result in substantial delay and expense. Human gene therapy products, which is the primary area in which we were seeking to develop products, are a new category of therapeutics. Because this is a relatively new and expanding area of novel therapeutic interventions, there can be no assurance as to the length of the trial period, the number of patients the FDA will require to be enrolled in the trials in order to establish the safety, efficacy and potency of human gene therapy products, or that the data generated in these studies will be acceptable to the FDA to support marketing approval.

After the completion of clinical trials of a new drug or biologic product, FDA marketing approval must be obtained. If the product is regulated as a biologic, the Center for Biological Evaluation and Research will require the submission and approval, depending on the type of biologic, of either a biologic license

4

application or a product license application and an establishment license application before commercial marketing of the biologic. If the product is classified as a new drug, we must file a new drug application with the Center for Drug Evaluation and Research and receive approval before commercial marketing of the drug. In limited circumstances, such as in our trial, both divisions are involved. The new drug application or biologic license applications must include results of product development, laboratory, animal and human studies, and manufacturing information. The testing and approval processes require substantial time and effort and there can be no assurance that the FDA will accept the new drug application or biologic license applications for filing and, even if filed, that any approval will be granted on a timely basis, if at all. In the past, new drug applications and biologic license applications submitted to the FDA have taken, on average, one to two years to receive approval after submission of all test data. If questions arise during the FDA review process, approval can take more than two years.

Notwithstanding the submission of relevant data, the FDA may ultimately decide that the new drug application or biologic license application does not satisfy its regulatory criteria for approval and require additional studies. In addition, the FDA may condition marketing approval on the conduct or specific post-marketing studies to further evaluate safety and effectiveness. Rigorous and extensive FDA regulation of pharmaceutical products continues after approval, particularly with respect to compliance with current good manufacturing practices, or “GMPs,” reporting of adverse effects, advertising, promotion and marketing. Discovery of previously unknown problems or failure to comply with the applicable regulatory requirements may result in restrictions on the marketing of a product or withdrawal of the product from the market as well as possible civil or criminal sanctions.

Ethical, social and legal concerns about gene therapy, genetic testing and genetic research could result in additional regulations restricting or prohibiting the processes we or our suppliers may use. Federal and state agencies, congressional committees and foreign governments have expressed interest in further regulating biotechnology. More restrictive regulations or claims that our products are unsafe or pose a hazard could prevent us from commercializing any products.

In addition to the foregoing, state and federal laws regarding environmental protection and hazardous substances, including the Occupational Safety and Health Act, the Resource Conservancy and Recovery Act and the Toxic Substances Control Act, affect our business. These and other laws govern our use, handling and disposal of various biological, chemical and radioactive substances used in, and wastes generated by, our operations. If our operations result in contamination of the environment or expose individuals to hazardous substances, we could be liable for damages and governmental fines. We believe that we are in material compliance with applicable environmental laws and that continued compliance therewith will not have a material adverse effect on our business. We cannot predict, however, how changes in these laws may affect our future operations.

Competition

The pharmaceutical and biotechnology industries are intensely competitive. Any product candidate developed by us would compete with existing drugs and therapies and with others under development. There are many pharmaceutical companies, biotechnology companies, public and private universities and research organizations actively engaged in research and development of products for the treatment of cardiovascular and vascular disease. Many of these organizations have financial, technical, research, clinical, manufacturing and marketing resources that are greater than ours. If a competing company develops or acquires rights to a more efficient, more effective, or safer competitive therapy for treatment of the same diseases we have targeted, or one that offers significantly lower costs of treatment, our business, financial condition and results of operations could be materially adversely affected. We believe that the most significant competitive factor in the gene therapy field is the effectiveness and safety of a product due to the relatively early stage of the industry.

5

We believe that our business will be subject to significant competition from companies using alternative technologies, as well as to increasing competition from companies that develop and apply technologies similar to ours. Other companies may succeed in developing products earlier than we do, obtaining approvals for these products from the FDA more rapidly than we do or developing products that are safer and more effective than those under development or proposed to be developed by us. We cannot assure you that research and development by others will not render our technology or potential products obsolete or non-competitive or result in treatments superior to any therapy developed by us, or that any therapy developed by us will be preferred to any existing or newly developed technologies.

Research and Development Expenses

Research and development expenses totaled approximately $9,614,000, $15,949,000, and $6,593,000 for the years ended December 31, 2006, 2005 and 2004, respectively.

Employees

During the fourth quarter of 2006, in connection with our board of directors’s determination to reduce cash spending, we significantly reduced our workforce. We currently have two employees, both in the administrative operations. In addition, we have consulting arrangements with three of our former officers.

Available Information

A copy of this Annual Report on Form 10-K, as well as our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to these reports, are available free of charge on the Internet at our website, www.corautus.com, as soon as reasonably practicable after we electronically file these reports with, or furnish these reports to, the Securities and Exchange Commission. The reference to our website address does not constitute incorporation by reference of the information contained on the website and the information on our website should not be considered part of this document. Copies of any materials we file with, or furnish to, the SEC can also be obtained free of charge through the SEC’s website at http//www.sec.gov or at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

You should carefully consider the risks described below before making an investment decision. You should also refer to the other information in this annual report, including the information incorporated by reference into this annual report. The risks and uncertainties we describe below are those that we currently believe may materially affect us. Additional risks and uncertainties that we are unaware of or that we currently deem immaterial also may become important factors that affect us.

Risks Related to the Proposed Transaction with VIA

The number of shares that VIA stockholders will be entitled to receive at closing of the merger is dependent upon the net cash balance of Corautus at closing. The lesser the amount of Corautus’ net cash at closing, the greater the number of shares of Corautus common stock VIA stockholders will be entitled to receive in the merger and the more the present ownership in Corautus will be diluted.

As of the date of this report and assuming the merger closes in the second quarter of 2007, Corautus anticipates having approximately $11.25 million of net cash at closing. As a result, Corautus currently

6

anticipates that holders of VIA’s equity securities will be entitled to receive in the aggregate approximately 124,279,574 shares of Corautus common stock and options to purchase Corautus common stock at closing and will own approximately 77.59% of the capital stock of the combined company (on a fully-diluted basis), with current Corautus equityholders owning approximately 22.41% of the capital stock of the combined company (on a fully-diluted basis) at closing. The merger agreement provides that the exchange ratio is subject to upward and downward adjustment based on the net cash balance of Corautus (as calculated pursuant to the merger agreement) at the closing of the merger and the aggregate fully-diluted number of shares of each of Corautus and VIA outstanding immediately prior to the closing of the merger. If the net cash balance of Corautus at the closing of the merger is below $11.25 million, the exchange ratio will be adjusted to increase the number of shares of Corautus common stock that holders of VIA’s equity securities will be entitled to receive pursuant to the merger, which would further dilute current Corautus stockholders’ ownership in the combined company. If the net cash balance of Corautus at the closing of the merger is below $11.0 million, Corautus would be unable to satisfy a closing condition for the merger, and VIA may elect not to consummate the merger. If the net cash balance of Corautus at the closing of the merger is greater than $11.25 million, the exchange ratio will be adjusted to decrease the number of shares of Corautus common stock that holders of VIA’s equity securities will be entitled to receive pursuant to the merger, which would dilute current VIA equity holders’ ownership in the combined company. The items that will constitute Corautus’ net cash balance at the closing of the merger are subject to many factors, many of which are outside of Corautus’ control. The following table sets forth the approximate percentage ownership of Corautus that VIA equity holders and current Corautus equity holders would be expected to hold immediately following the closing of the merger, assuming net cash balances of Corautus at the closing of the merger of $11.0 million, $11.25 million, $11.5 million, $11.75 million, $12.0 million, $12.25 million and $12.5 million.

| | | | | | |

Corautus’ Net Cash Balance at Closing | | Corautus Stockholders’

Approximate

Ownership Percentage

in the Combined

Company at Closing | | | VIA Stockholders’

Approximate Ownership Percentage

in the Combined

Company at Closing | |

$11,000,000 | | 22.02 | % | | 77.98 | % |

$11,250,000 | | 22.41 | % | | 77.59 | % |

$11,500,000 | | 22.79 | % | | 77.21 | % |

$11,750,000 | | 23.17 | % | | 76.83 | % |

$12,000,000 | | 23.55 | % | | 76.45 | % |

$12,250,000 | | 23.92 | % | | 76.08 | % |

$12,500,000 | | 24.29 | % | | 75.71 | % |

The ownership percentages set forth above represent ownership percentages of Corautus at the time of closing of the merger. Corautus will require substantial additional funding shortly after consummation of the merger. Any such financing will further dilute ownership interest in Corautus.

Because the lack of a public market for VIA’s capital stock makes it difficult to evaluate the fairness of the merger, the stockholders of VIA may receive consideration in the merger that is greater than or less than the fair market value of VIA’s capital stock.

The outstanding capital stock of VIA is privately-held and is not traded in any public market. The lack of a public market makes it extremely difficult to determine the fair market value of VIA. Since the percentage of Corautus equity to be issued to VIA stockholders was determined based on negotiations between the parties, it is possible that the value of Corautus common stock to be issued to VIA stockholders in connection with the merger will be greater than the fair market value of VIA. Alternatively, it is possible that the value of the shares of Corautus common stock to be issued in connection with the merger will be less than the fair market value of VIA.

7

The exchange ratio is not adjustable based on the market price of Corautus common stock and if the market price of Corautus common stock increases, the aggregate value of the shares of Corautus common stock that VIA stockholders will be entitled to receive pursuant to the merger could be significantly higher.

The merger agreement has set the exchange ratio for the VIA capital stock and such exchange ratio is only adjustable upward or downward depending upon Corautus’ net cash balance, as calculated pursuant to the merger agreement, at the closing of the merger, not the market price of Corautus common stock. Accordingly, any changes in the market price of Corautus common stock will not affect the number of shares that VIA stockholders will be entitled to receive pursuant to the merger.

Some of Corautus’ officers and directors have interests in the merger that may be different from yours and may influence them to support the merger without regard to your interests.

Certain officers and directors of Corautus participate in arrangements that provide them with interests in the merger that may be different from yours, including, among others, severance benefits, the acceleration of stock and stock option vesting and continued indemnification. These interests, among others, may influence the officers and directors of Corautus to support or approve the merger.

Failure to complete the merger may result in Corautus paying a termination fee to VIA and could harm Corautus’ future business and operations and cause the price of Corautus’ common stock to decline.

If the merger is not completed, Corautus may be subject to the following risks:

| • | | if the merger agreement is terminated, under certain circumstances Corautus will be required to pay VIA a termination fee of $425,000, plus an amount equal to VIA’s reasonable documented out-of-pocket expenses incurred in connection with the merger agreement up to $425,000; |

| • | | the price of Corautus stock may decline; and |

| • | | our costs related to the merger, such as legal, accounting and certain financial advisory fees, must be paid, even if the merger is not completed. |

In addition, if the merger agreement is terminated and Corautus’ or VIA’s board of directors determines to seek another business combination, there can be no assurance that Corautus will be able to find a partner willing to provide equivalent or more attractive consideration than the consideration to be provided by VIA in the merger. In such circumstances, Corautus’ board of directors may elect to attempt to complete another strategic transaction like the merger or take the steps necessary to liquidate all of Corautus’ remaining assets, and in such cases, the consideration that Corautus receives for its remaining assets may be less attractive than the consideration to be received by Corautus’ stockholders pursuant to the merger agreement.

If the conditions to the merger are not met, the merger may not occur.

Even if the necessary approvals are obtained from the stockholders of Corautus and VIA, specified conditions must be satisfied or waived for the merger to be consummated. These conditions include, among others, Corautus having a net cash balance of at least $11.0 million at closing, and are described in detail in the merger agreement. We cannot assure you that all of the conditions will be satisfied. If the conditions are not satisfied or waived, the merger will not occur or will be delayed, and we may lose some or all of the intended benefits of the merger.

8

VIA is a development stage company subject to risks related to, among others, technology efficacy, intellectual property and financing. Because VIA’s business will constitute the business of the combined company after the closing of the merger, if any negative events occur with respect to VIA’s technology, intellectual property, or financing, those events could cause the potential benefits of the merger not to be realized.

Corautus is in the process of winding-down its operations related to its terminated GENASIS Phase II trial, and, as a result, the business of the combined company immediately following the merger will be the business conducted by VIA immediately prior to the merger. As a result, if a negative event should occur with respect to VIA’s technology or intellectual property, those events could cause the potential benefits of the merger not to be realized, a difficulty in identifying and obtaining financing, and the market price of Corautus’ common stock to decline.

Risks Related to Our Business

If the merger with VIA is not completed, Corautus may not have continuing business operations.

Our board of directors has authorized the termination of our operations and clinical trials related to VEGF-2, which was our only product candidate. Additionally, we are in the process of terminating many of our intellectual property license agreements. Should we not complete the merger with VIA, we may not have any ongoing business operations, and our board of directors will need to consider other alternatives, including liquidation and dissolution.

Corautus’ business to date has been largely dependent on the success of VEGF-2 in the treatment of cardiovascular and vascular disease, which were the subjects of the Phase IIb GENASIS clinical trial that we terminated in 2006. Although we ceased the development of VEGF-2 and have reduced our workforce, we may be unable to successfully manage our remaining resources, including available net cash, while we seek to wind-down operations related to VEGF-2 and implement the merger with VIA.

Corautus’s Phase IIb GENASIS clinical trial testing the safety and efficiency of VEGF-2 in patients with cardiovascular and vascular disease was discontinued during 2006 based upon the recommendation of the independent Data and Safety Monitoring Board, or DSMB, with oversight responsibility for these clinical trials. The DSMB concluded that the clinical trial data were unlikely to provide significant evidence of achievement of the primary endpoint for VEGF-2-treated patients versus patients who received placebo. We had previously devoted substantially all of our research, development and clinical efforts and financial resources to the development of VEGF-2. In connection with the termination of our clinical trial for VEGF-2, we announced a realignment of our business activities, including significant workforce reductions, and incurred approximately $1.4 million of severance and related costs in 2006, the substantial majority of which were cash expenditures. As a result of the discontinuation of our clinical trials, we are in the process of terminating many of our remaining intellectual property license agreements, development programs and manufacturing operations for VEGF-2. We may be unable to successfully reduce expenses associated with our existing manufacturing agreement, intellectual property agreements, clinical trial agreements and other commitments related to VEGF-2.

If the merger with VIA is not consummated and we were to liquidate and dissolve, no distributions would be made to common stockholders.

If the merger with VIA is not completed and we were to liquidate and dissolve, we cannot predict when, or if, we would be able to make a distribution to our stockholders. However, our Series C Preferred Stock, Series D Preferred Stock, and Series E Preferred Stock have preferences to distributions upon liquidation that exceed the amount of cash now available, and we anticipate that upon liquidation all of our assets would be distributed to the holders of our preferred stock, and the holders of common stock would receive no distributions.

9

If the merger with VIA is not consummated, we will need substantial additional funding to identify and develop product candidates or life science opportunities and for our future operations.

In the event the merger with VIA is not consummated, we will need to identify other business opportunities or develop other product candidates, which will require a commitment of substantial funds to conduct the costly and time-consuming research and due diligence, pre-clinical and clinical testing necessary to obtain regulatory approvals and bring our product candidates to market. We will need to raise substantial additional capital to fund our future operations. We cannot be certain that additional financing will be available on acceptable terms, or at all. To the extent we raise additional funds by issuing equity securities, our existing stockholders will be diluted. If additional funds are raised through the issuance of debt securities, these securities are likely to have rights, preferences and privileges senior to our common stock and preferred stock. Moreover, we may enter into financing transactions at prices that represent a substantial discount to market price. A negative reaction by investors and securities analysts to any discounted sale of our equity securities could result in a decline in the market price of our common stock.

If the merger with VIA is not consummated, we may continue to incur the expense of complying with public company reporting requirements.

We have an obligation to continue to comply with the applicable reporting requirements of the Securities Exchange Act of 1934, or the Exchange Act, even though compliance with such reporting requirements is economically burdensome. If the merger with VIA is not completed and we were to liquidate and dissolve, then to curtail such expenses, we might seek relief from the Securities and Exchange Commission, or the SEC, for a substantial portion of the periodic reporting requirements under the Exchange Act after filing our certificate of dissolution upon stockholder approval of a plan of liquidation. There can be no assurance that we would be able to obtain such relief and that we would not deplete our cash in an effort to comply.

We may not have the staff or infrastructure necessary to develop or exploit life science opportunities or product candidates that we may identify.

On October 30, 2006, our board of directors determined that it was in the best interests of the company to significantly reduce our workforce. That workforce has now been reduced to two employees and one part-time consultant. Identifying life sciences opportunities, conducting clinical trials, and obtaining development, manufacturing and distribution partners requires knowledgeable and experienced employees as well as a developed infrastructure. In the event the merger with VIA is not consummated, we may not have sufficient staff or infrastructure to identify new life sciences opportunities or develop and commercialize product candidates based upon such life science opportunities, and we may be unsuccessful in outsourcing the work that could have been performed by employees.

We have substantially reduced our workforce as part of our wind-down of operations.

During 2006, we significantly reduced our work-force to two employees and one part-time consultant. If the merger with VIA is not completed, it may be difficult for us to identify new business opportunities or efficiently implement the staged wind-down of our business.

We are highly dependent on key management personnel.

We are highly dependent on the principal members of our management staff, particularly our President and Chief Executive Officer and Chief Financial Officer. Our President and Chief Executive Officer ceased being a full-time employee on January 1, 2007 and serves as a part-time consultant. As a result of the termination of our VEGF-2 business, it may be difficult to adequately incent our remaining two

10

employees to continue working for us. The loss of either of these employees or our consultant could have a material adverse effect on our ability to identify new business opportunities if the merger with VIA is not consummated.

We may be unable to maintain our listing on the NASDAQ Capital Market. Failure to maintain our listing could adversely affect our business, and the liquidity of our common stock and stock price would be negatively affected.

Our common stock is currently traded on the NASDAQ Capital Market. To maintain a listing on NASDAQ, we must maintain minimum listing requirements, including certain levels of stockholders’ equity, market capitalization and minimum bid price for our common stock. Currently, we do not satisfy certain of these requirements. Additionally, NASDAQ may consider, among other things, the nature of the business, financial integrity and future outlook of a company in considering whether to de-list a company. If our common stock is de-listed from NASDAQ, it would reduce the liquidity of our common stock, and could decrease the market price of our common stock and negatively impact our ability to obtain additional capital.

We are a development stage company with a history of insignificant revenues and significant net losses. We currently do not have a lead product candidate in clinical trials. We expect continued net losses for the foreseeable future, and we may never become profitable.

We are a development stage company, and we have not yet generated significant revenues. From our inception in July 1991 to December 31, 2006, we have incurred net losses of approximately $125 million, including net losses of approximately $15 million in 2006, almost all of which consisted of research and development, clinical trials and general and administrative expenses. Our board of directors determined in the fourth quarter of 2006 that it was in our best interest and the best interest of our stockholders at the present time to not conduct further clinical trials of VEGF-2 for the treatment of cardiovascular and peripheral vascular disease, and we instead are redirecting our focus to other life science opportunities. In addition, we do not expect to generate revenues from sales for a number of years, if at all. As a result, we expect our net losses from operations to continue for the foreseeable future.

Our ability to generate revenues and become profitable will depend on our ability, alone or with collaborators, to timely, efficiently and successfully identify and develop product candidates, conduct pre-clinical and clinical tests, obtain necessary regulatory approvals, and manufacture and market product candidates. We may not be successful in identifying and securing life sciences opportunities with commercial promise. We may never generate profits and, even if we do achieve profitability, we cannot predict the level or sustainability of such profitability.

We currently do not have a product candidate.

We previously have focused our operations on clinical trials related to VEGF-2 product candidates. Because of our board of directors’ determination to cease VEGF-2 clinical trials, we currently do not have a product candidate. Therefore, we will need to identify new technology in order to have a product candidate. Failure to develop a product candidate will significantly limit our ability to generate revenue.

Any product candidate requires additional research, development, testing and regulatory approvals prior to marketing. If any product candidates are delayed or fail, our financial condition will be negatively affected, and we may have to curtail or cease our operations.

We are in the early stage of product development. We currently do not sell any products, do not have any product candidates, and do not expect to have any product candidates commercially available for several years, if at all. Any proposed product candidates require additional research and development, clinical testing and regulatory clearances prior to marketing. There are many reasons that proposed product candidates may fail or not advance beyond clinical testing, including the possibility that:

| | • | | proposed product candidates may be ineffective, unsafe or associated with unacceptable side effects; |

11

| | • | | proposed product candidates may fail to receive necessary regulatory approvals or otherwise fail to meet applicable regulatory standards; |

| | • | | proposed product candidates may be too expensive to develop, manufacture or market; |

| | • | | physicians, patients, third-party payers or the medical community in general may not accept or use proposed product candidates; |

| | • | | collaborators may withdraw support for or otherwise impair the development and commercialization of proposed product candidates; |

| | • | | other parties may hold or acquire proprietary rights that could prevent us or our collaborators from developing or marketing proposed product candidates; or |

| | • | | others may develop equivalent or superior products candidates. |

In addition, proposed product candidates are subject to the risks of failure inherent in the development of medical therapy products based on innovative technologies. As a result, we are not able to predict whether our research, development and testing activities will result in any commercially viable products or applications. If product candidates are delayed or we fail to successfully identify, develop and commercialize product candidates, our financial condition may be negatively affected, and we may have to curtail or cease our operations.

Because we cannot predict whether or when we will obtain regulatory approval to commercialize any product candidates, we cannot predict the timing of any future revenue from these product candidates.

We cannot commercialize any product candidates to generate revenue until the appropriate regulatory authorities have reviewed and approved the applications for the product candidates. We cannot assure you that the regulatory agencies will complete their review processes in a timely manner or that we will obtain regulatory approval for any product candidate we or our collaborators develop. Satisfaction of regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. Outside the United States, the ability to market a product is also contingent upon receiving clearances from appropriate foreign regulatory authorities. In addition, we may experience delays or rejections based upon additional government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical trials and FDA regulatory review. If the delays are significant, they would negatively affect our financial results, ability to raise capital and our commercial prospects for future product candidates.

We may not successfully establish and maintain collaborative and licensing arrangements, which could adversely affect our ability to develop and commercialize product candidates. We are also limited by the collaboration and marketing arrangements on which we rely.

Our strategy for the development, testing, manufacturing and commercialization of product candidates relies on establishing and maintaining collaborations with corporate partners, licensors and other third parties. We may not be able to maintain or expand these licenses and collaborations or establish additional licensing and collaboration arrangements necessary to develop and commercialize product candidates. Even if we are able to maintain or establish licensing or collaboration arrangements, these arrangements may not be on favorable terms. Any failure to maintain or establish licensing or collaboration arrangements on favorable terms could adversely affect our business prospects, financial condition or ability to develop and commercialize product candidates.

12

We rely on third parties to manufacture any product candidates. There can be no guarantee that we can obtain sufficient and acceptable quantities of any product candidates on acceptable terms, which may delay or impair our ability to develop, test and market such product candidates.

We currently do not have any manufacturing capabilities. Our business strategy relies on third parties to manufacture and produce any product candidates. These third party manufacturers are subject to extensive government regulation and must receive FDA approval before they can produce clinical material or commercial product. Regulatory difficulties experienced by others could affect our ability to obtain products when needed. Any product candidates may be subject to delays if third party manufacturers give other products greater priority than our product candidates. These third parties may also not deliver sufficient quantities of our product candidates, manufacture our product candidates in accordance with specifications, or comply with applicable government regulations. Additionally, if the manufactured product candidates fail to perform as specified, our business and reputation could be severely impacted.

We depend on clinical trial arrangements with medical institutions to advance our technology, and the loss of these arrangements could impair the development of product candidates.

We may rely upon medical institutions for the conduct of any clinical trials. The early termination of any of these clinical trial arrangements or the failure of these institutions to comply with the regulations and requirements governing clinical trials would hinder the progress of our clinical trial program. If any of these relationships are terminated, the clinical trial might not be completed, and the results might not be able to be evaluated.

If we are unable to maintain agreements with third parties to perform sales, marketing and distribution functions, we will be required to develop these capabilities to commercialize any proposed product candidates.

We currently have no sales, marketing or distribution capabilities. Therefore, to commercialize any product candidates, if and when such products have been approved and are ready for marketing, we must collaborate with third parties to perform these functions. We cannot assure you that we will be able to enter into arrangements with companies to commercialize any product candidates. We have no experience in developing, training or managing a sales force, and we will incur substantial additional expenses if we are forced to market our product candidates directly. Developing a marketing and sales force is also time consuming and could delay launch of our product candidates. In addition, we will compete with many companies that currently have extensive and well-funded marketing and sales operations. Our marketing and sales efforts may be unable to compete successfully against these companies.

If we do not comply with applicable regulatory requirements in the manufacture and distribution of product candidates, we may incur penalties that may inhibit our ability to commercialize our product candidates and adversely affect our revenue.

Our failure or the failure of our collaborators or third party manufacturers to comply with applicable FDA or other regulatory requirements including manufacturing, quality control, labeling, safety surveillance, promoting and reporting may result in criminal prosecution, civil penalties, recall or seizure of our product candidates, total or partial suspension of production or an injunction, as well as other regulatory action against our product candidates or us. Discovery of previously unknown problems with a product, supplier, manufacturer or facility may result in restrictions on the sale of our product candidates, including a withdrawal of the product candidates from the market.

13

We are exposed to potential risks resulting from Section 404 of the Sarbanes-Oxley Act of 2002.

We are evaluating our internal controls to allow management to report on, and our independent registered certified public accounting firm to attest to, our internal controls, as required by Section 404 of the Sarbanes-Oxley Act of 2002. We may encounter unexpected delays in implementing the requirements relating to internal controls; therefore, we cannot be certain about the timing of completion of our evaluation, testing and remediation actions or the impact that these activities will have on our operations since there is no precedent available by which to measure the adequacy of our compliance. We also expect to incur additional expenses and diversion of management’s time as a result of performing the system and process evaluation, testing and remediation required in order to comply with the management certification and independent registered certified public accounting firm attestation requirements. If we are not able to timely comply with the requirements set forth in Section 404, we might be subject to sanctions or investigation by regulatory authorities. Any such action could adversely affect our business and financial results. The requirement to comply with Section 404 of the Sarbanes-Oxley Act of 2002 is expected to become effective, at the earliest, for our fiscal year ending December 31, 2007.

In addition, in our system of internal controls we may rely on the internal controls of third parties. In our evaluation of our internal controls, we will consider the implication of our reliance on the internal controls of third parties. Until we have completed our evaluation, we are unable to determine the extent of our reliance on those controls, the extent and nature of the testing of those controls, and remediation actions necessary where that reliance cannot be adequately evaluated and tested.

Risks Related to Intellectual Property

If our right to use intellectual property we license from third parties is terminated or adversely affected, our financial condition, operations or ability to develop and commercialize any proposed product candidates will be materially harmed.

We do not own any patents and have not filed any patent applications. We may rely on licenses to use certain technologies that are material to our operations, both to have freedom to carry out our business and to protect our market from competitors. The success of our operations will depend in part on our ability and that of our licensors to:

| | • | | obtain patent protection for our methods of gene therapy, therapeutic genes and/or gene-delivery methods both in the United States and in other countries with substantial markets; |

| | • | | defend patents once obtained against third party infringers; |

| | • | | maintain trade secrets and operate without infringing patents and proprietary rights of others; and |

| | • | | obtain and maintain appropriate licenses upon reasonable terms to patents or proprietary rights held by others that are necessary or useful to us in commercializing our technology, both in the United States and in other countries with substantial markets. |

In addition, the license agreements may include certain milestones that we must meet in order to maintain these licenses. There is no assurance that we can meet such upcoming milestones in either license or that we can obtain any necessary extensions of the milestones in the future. Our licensors may terminate these licenses if we fail to meet the applicable milestones.

If we or our licensors are not able to obtain and maintain adequate patent protection for our product candidates, we may be unable to commercialize our product candidates or to prevent others from using our technology in competitive products.

14

Our success will depend in part on our ability to obtain patent protection both in the United States and in other countries for our product candidates and their use. We have no patents in our own name. We have, however, licensed patents and patent applications and other proprietary rights from third parties that cover our product candidates. Our ability to protect our product candidates from unauthorized or infringing use by third parties depends at least initially on the willingness and cooperation of our licensors to assert the patent rights licensed to us. Due to evolving legal standards relating to the patentability, validity and enforceability of patents covering biotechnology inventions and the scope of claims made under these patents, the ability of our licensors to obtain and enforce patents is uncertain and involves complex legal and factual considerations. Accordingly, rights under any issued patents may not provide us with sufficient protection for our product candidates or provide sufficient protection to afford us a commercial advantage against our competitors or their competitive products or processes. In addition, we cannot guarantee that any patents will be issued from any pending or future patent applications licensed to us. Even if issued, we cannot guarantee that the claims of these patents are, or will be, valid or enforceable, or provide us with any significant protection against competitive products or otherwise be commercially valuable to us. In addition, others may challenge, seek to invalidate, infringe or circumvent any patents or patent applications we license, and rights we receive under those patents or patent applications may not provide competitive advantages to us. Further, the manufacture, use or sale of our product candidates may infringe the patent rights of others.

We may not have identified all patents, published applications or published literature that affect our business either by blocking our ability to commercialize our drugs, by negatively impacting the patentability of our product candidates to our licensees, or by disclosing the same or similar technologies on which basis our licensors’ patents may not be valid, limit the scope of our or our licensors’ future patent claims or adversely affect our ability to market our product candidates. For example, patent applications in the United States are maintained in confidence for up to 18 months after the filing of their earliest priority application. In some cases, however, patent applications, such as those filed prior to November 29, 2000, remain confidential in the United States Patent and Trademark Office, or USPTO, for the entire time prior to issuance as a U.S. patent. Similarly, patent applications filed in foreign countries are typically published 18 months after the filing date of their earliest priority application. Publication of discoveries in the scientific or patent literature often lags behind actual discoveries. Therefore, we cannot be certain that our licensors were the first to invent, or the first to file, patent applications covering our product candidates or their use. In the event that a third party has also filed a U.S. patent application covering our product candidates or a similar invention, we may have to participate in an adversarial proceeding, known as an interference, in the USPTO to determine priority of invention in the United States. The costs of these proceedings could be substantial, and our efforts could be unsuccessful, resulting in a loss of our U.S. patent position. The laws of some foreign jurisdictions do not protect intellectual property rights to the same extent as in the United States and many companies have encountered significant difficulties in protecting and defending such rights in foreign jurisdictions. If we or our licensors encounter such difficulties in protecting or are otherwise precluded from effectively protecting our intellectual property rights in foreign jurisdictions, our business prospects could be substantially harmed.

We may not have adequate protection for our unpatented proprietary information, which could adversely affect our competitive position.

We also rely on unpatented trade secrets and know-how to maintain our competitive position, which we seek to protect, in part, by confidentiality agreements with employees, consultants and others. These parties may breach or terminate these agreements, and we may not have adequate remedies for any breach. Our trade secrets may also be independently discovered by competitors. We rely on certain technologies to which we do not have exclusive rights or which may not be patentable or proprietary and thus may be available to competitors.

15

Risks Related to Our Industry

Negative public opinion and increased regulatory scrutiny of gene therapy and genetic research may adversely affect our ability to conduct our business or obtain regulatory approvals for our product candidates.

Ethical, social and legal concerns about gene therapy and genetic research could result in additional regulations restricting or prohibiting the products and processes we may use. Even with the requisite approvals, the commercial success of any product candidates will depend in part on public acceptance of the use of such therapies for the treatment of human disease. Public attitudes may be influenced by claims that gene therapy is unsafe, and gene therapy may not gain the acceptance of the public or the medical community. More restrictive government regulations or negative public opinion would have a negative effect on our business or financial condition and may delay or impair the development and commercialization of our product candidates.

We are subject to significant government regulation with respect to our product candidates. Compliance with government regulation can be a costly and time-consuming process, with no assurance of ultimate regulatory approval. If these approvals are not obtained, we will not be able to sell our product candidates.

We and our collaborators are subject to extensive and rigorous government regulation in the United States and foreign countries. The FDA, the National Institutes of Health and comparable agencies in foreign countries impose many requirements on the introduction of new pharmaceutical products through lengthy and detailed clinical testing procedures and other costly and time consuming compliance procedures. These requirements vary widely from country to country and make it difficult to estimate when our product candidates will be commercially available, if at all. In addition, gene therapies such as those being developed by us are relatively new and are only beginning to be tested in humans. Regulatory authorities may require us or our collaborators to demonstrate that product candidates are improved treatments relative to other therapies or may significantly modify the requirements governing gene therapies, which could result in regulatory delays or rejections. If we are delayed or fail to obtain required approvals for our product candidates, our operations and financial condition would be damaged. We may not sell product candidates without applicable regulatory approvals.

Numerous regulations in the United States and abroad also govern the manufacturing, safety, labeling, storage, record keeping, reporting and marketing of any product candidates. Compliance with these regulatory requirements is time consuming and expensive. If we fail to comply with regulatory requirements, either prior to approval or in marketing our product candidates after approval, we could be subject to regulatory or judicial enforcement actions. These actions could result in withdrawal of existing approvals, product recalls, injunctions, civil penalties, criminal prosecution, and enhanced exposure to product liabilities.

We face the risk of product liability claims, which could adversely affect our business and financial condition.

Our operations will expose us to potential product liability risks that are inherent in the testing, manufacturing and marketing of gene therapy products and could prevent or delay the commercialization of our product candidates or negatively affect our financial condition. Regardless of the merit or eventual outcome, product liability claims may result in withdrawal of proposed product candidates from clinical trials, costs of litigation, and substantial monetary awards to plaintiffs and decreased demand for products.

16

Product liability may result from harm to patients using our product candidates as a result of mislabeling, misuse or product failure. While we require all patients enrolled in our clinical trials to sign consents, which explain the risks involved with participating in the trial, the consents provide only a limited level of protection. Additionally, we indemnify the clinical centers and related entities in connection with losses they may incur through their involvement in the clinical trials. Product liability insurance is expensive and we may not be able to maintain our product liability coverage on acceptable terms or obtain adequate coverage against potential liabilities.

Risks Related to Our Common Stock

Our stock price has been and may continue to be volatile, and an investment in our common stock could significantly decline in value.

The market prices for securities of pharmaceutical and biotechnology companies in general, have been highly volatile and may continue to be highly volatile in the future. The market price of our common stock has been and may continue to be volatile based on the following factors, in addition to other risk factors described herein and in light of the low volume of trades in our common stock:

| | • | | developments concerning any research and development, clinical trials, manufacturing, and marketing collaborations; |

| | • | | announcements of technological innovations or new commercial products by our competitors or us; |

| | • | | developments concerning proprietary rights, including patents; |

| | • | | publicity regarding actual or potential results relating to medicinal products under development by our competitors or us; |

| | • | | regulatory developments in the United States and other countries; |

| | • | | economic and other external factors, including disasters or crises; or |

| | • | | period-to-period fluctuations in financial results. |

You may have difficulty selling your shares of common stock at or above the price paid for such shares or at the time you would like to sell.

We have a low volume of daily trades in our common stock on the NASDAQ Capital Market, which could make it difficult to conduct large transactions in our common stock. In addition, any sales by stockholders of a large number of shares of our common stock, or the perception that the holders of a large number of our shares intend to sell our common stock, may cause a significant reduction in the price of our common stock. In this regard, we have a significant number of shares of common stock underlying outstanding options and warrants that are currently exercisable and eligible for immediate sale in the public market. The issuance of common stock upon the exercise of stock options and warrants would also dilute existing investors.

Our quarterly operating results may fluctuate, causing volatility in our stock price.

17

We do not receive any revenues from sales. Our results of operations historically have fluctuated on a quarterly basis, which we expect to continue. Our results of operations at any given time will be based primarily on the following factors:

| | • | | the status of development of product candidates; |

| | • | | whether we enter into collaboration agreements and the timing and accounting treatment of payments, if any, to us under those agreements; |

| | • | | whether and when we achieve specified development or commercialization milestones; and |

| | • | | the addition or termination of research programs or funding support. |

We believe that quarterly comparisons of our financial results are not necessarily meaningful and should not be relied upon as an indication of future performance. These fluctuating results may cause the price of our stock to fluctuate, perhaps substantially.

We may be unable to maintain our listing on the NASDAQ Capital Market. Failure to maintain our listing could adversely affect our business, and the liquidity of our common stock would be seriously limited.

Our common stock is currently traded on the NASDAQ Capital Market. To maintain a listing on NASDAQ, we must maintain minimum listing requirements, including certain levels of stockholders’ equity, market capitalization, and minimum bid price for our common stock. Currently, we do not satisfy certain of these requirements. Additionally, NASDAQ may consider, among other things, nature of the business, financial integrity and future outlook of a company in considering whether to de-list a company. If our common stock is de-listed from NASDAQ, it could reduce the liquidity of our common stock, decrease the market price of our common stock and negatively impact our ability to obtain additional capital. As discussed above, we currently are not in compliance with the NASDAQ Stock Market’s requirements for continued listing because the bid price of our common stock had closed below the minimum $1.00 per share requirement for continued inclusion under NASDAQ Marketplace Rule 4310(c)(4). We have until May 21, 2007, to regain compliance with the NASDAQ Stock Market’s requirements for continued listing.

Additionally, we received a notification from NASDAQ that our common stock would be delisted from the NASDAQ Capital Market because NASDAQ believes we currently are not engaged in active business operations and are therefore a “public shell.” On March 23, 2007, we received a decision from the hearing panel providing us until April 17, 2007 to mail proxy materials to our stockholders regarding the transaction with VIA Pharmaceuticals, Inc., and until May 21, 2007 to consummate such transaction. There are no assurances that we can meet these deadlines, and failure to meet these deadlines could result in the loss of our listing on the NASDAQ Capital Market.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

NONE

We currently lease approximately 375 square feet of administrative offices in Roswell, Georgia. The lease for this office is on a month to month basis with a forty-five day notice period.

18

We also currently lease approximately 2,200 square feet of laboratory and office space in San Jose, California. The lease for this space expires in July 2007.

We believe that our current leased facilities are adequate for our current needs.

NONE

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year ended December 31, 2006.

| ITEM 4A. | EXECUTIVE OFFICERS OF THE REGISTRANT |

Set forth below, in accordance with General Instruction G(3) of Form 10-K and Instruction 3 of Item 401(b) of Regulation S-K, are the names, ages and positions of our executive officers along with their business experience during the past five years. Unless otherwise indicated, the information set forth is as of December 31, 2006. The age of each officer listed is as of the date of the filing of this report. Unless otherwise indicated, all of our executive officers have served continuously since the dates indicated. There are no family relationships among the officers.

| | |

Name, Age and Position with the Company | | Dates Elected or Appointed |

Richard E. Otto, Age 57 | | |

Chief Executive Officer | | February 7, 2003 |

President | | April 11, 2003 (1) |

| |

Jack W. Callicutt, Age 40 | | |

Senior Vice President and Chief Financial Officer | | January 1, 2007 (2) |

| (1) | Richard E. Otto is our Chief Executive Officer, President and director and has served as Chief Executive Officer and director since the merger between GenStar and Vascular Genetics in February 2003. Mr. Otto became President of Corautus in April 2003. Effective December 31, 2006, Mr. Otto’s employment with Corautus was terminated, and Mr. Otto entered into a consulting agreement whereunder Mr. Otto will continue to serve as President and Chief Executive Officer of Corautus. Prior to the merger, he served as Chief Executive Officer, President and a director of Vascular Genetics since January 2002. From March 1998 through January 2002, Mr. Otto served as a consultant to various charitable and commercial organizations. Mr. Otto has spent the past 35 years in the cardiac therapy industry. From September 1995 to March 1998 he served as Chief Executive Officer and a director of CardioDynamics International Corporation, a publicly traded company listed on NASDAQ that develops, manufactures and markets noninvasive heart-monitoring devices. Mr. Otto has served as a consultant to the founder of WebMD and as a consultant to the Cardiac Rhythm Management division of St. Jude Medical. His career includes key management positions with Cardiac Pacemakers Inc. (now a Guidant company). Mr. Otto also held positions at Intermedics, Inc., Medtronic Inc., and Eli Lilly and Company. Mr. Otto has served on the Georgia board of directors of the Juvenile Diabetes Foundation, and Leukemia Society. Mr. Otto was a semifinalist in the 1997 Entrepreneur of the Year Award for the Southern California Region. He received a B.S. in chemistry from the University of Georgia. |

19

| (2) | Jack W. Callicutt was elected as Chief Financial Officer of Corautus as of January 1, 2007. Prior to such time, Mr. Callicutt served as Vice President—Finance and Administration, Chief Accounting Officer and Assistant Secretary since September 2003. Prior to joining Corautus, Mr. Callicutt spent 14 years with Deloitte & Touche, the last six years as an audit senior manager. Mr. Callicutt is a Certified Public Accountant and graduated, with honors, from Delta State University in 1989 with degrees in Accounting and Computer Information Systems. |

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock is currently traded on the NASDAQ Capital Market under the symbol “VEGF.” Prior to October 13, 2004, our common stock was traded on the American Stock Exchange under the symbol “CAQ.” As of March 8, 2007, there were approximately 469 registered holders of record of common stock.

As of December 31, 2006, there were outstanding options to purchase 5,419,439 shares of our common stock and warrants to purchase 1,169,024 shares of our common stock. There are 2,000 shares of our Series C preferred stock, 1,385,377 shares of our Series D Preferred Stock, and 2,475,659 shares of our Series E Preferred Stock outstanding.

We have never paid any cash dividends on our common stock to date. We currently anticipate that we will retain all future earnings, if any, to fund the development and growth of our business and do not anticipate paying any cash dividends for at least the next five years, if ever.

The following table shows for the periods indicated the high and low closing prices for our common stock on the NASDAQ Capital Market.

| | | | | | |

| | | HIGH | | LOW |

FISCAL YEAR ENDED December 31, 2005: | | | | | | |

First Quarter | | $ | 5.74 | | $ | 3.99 |

Second Quarter | | $ | 5.00 | | $ | 3.58 |

Third Quarter | | $ | 5.85 | | $ | 3.79 |

Fourth Quarter | | $ | 4.61 | | $ | 3.88 |

FISCAL YEAR ENDED December 31, 2006: | | | | | | |

First Quarter | | $ | 5.26 | | $ | 3.32 |

Second Quarter | | $ | 3.51 | | $ | 0.67 |

Third Quarter | | $ | 0.88 | | $ | 0.65 |

Fourth Quarter | | $ | 0.68 | | $ | 0.32 |

FISCAL YEAR ENDED December 31, 2007: | | | | | | |

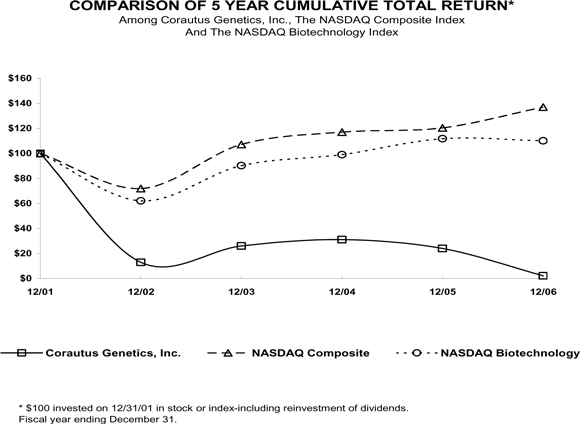

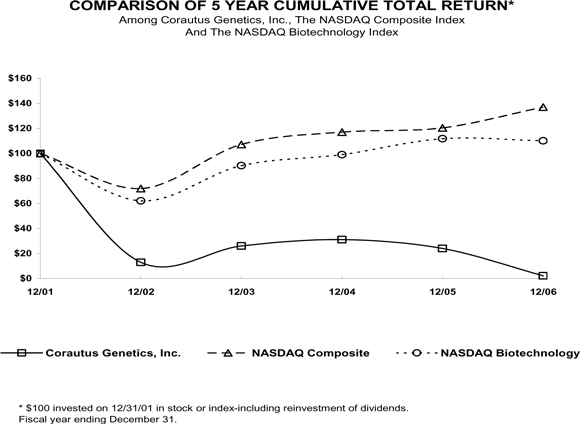

First Quarter (through March 23, 2007) | | $ | 0.72 | | $ | 0.36 |