QuickLinks -- Click here to rapidly navigate through this documentFiled Pursuant to Rule 424(b)(5)

Registration No. 333-128160-01

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 27, 2005

PROSPECTUS SUPPLEMENT

(To Prospectus Dated September 7, 2005)

$250,000,000

Tanger Properties Limited Partnership

% Senior Notes Due 2015

Tanger Properties Limited Partnership is offering $250 million aggregate principal amount of % Senior Notes due 2015. We will pay interest on the notes on May 15 and November 15 of each year, beginning on May 15, 2006. The notes will mature on November 15, 2015. We may redeem some or all the notes at our option, at any time in whole or from time to time in part, at the redemption price described under "Description of Notes—Optional Redemption."

The notes will be unsecured senior obligations and will rank equally with all other unsecured senior indebtedness of Tanger Properties Limited Partnership from time to time outstanding.

The notes will not be listed on any securities exchange. Currently, there is no public market for the notes.

Investing in the notes involves risks. See "Risk Factors" on page S-8 of this prospectus supplement and page 2 in the accompanying prospectus.

| | Per Note

| | Total

|

|---|

| Public offering price(1) | | | % | $ | |

| Underwriting discount | | | % | $ | |

| Proceeds to us (before expenses)(1) | | | % | $ | |

- (1)

- Plus accrued interest, if any, from November , 2005 if settlement occurs after that date.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect that the notes will be ready for delivery in book-entry form through The Depository Trust Company on or about November , 2005.

Joint Book-Running Managers

| Banc of America Securities LLC | Merrill Lynch & Co. |

Co-Managers

| Goldman, Sachs & Co. | Wachovia Securities |

The date of this prospectus supplement is November , 2005.

You should rely only on the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus is accurate as of any date other than the date on the front of this prospectus supplement.

TABLE OF CONTENTS

Prospectus Supplement

| | Page

|

|---|

| Forward-Looking Statements | | ii |

| Prospectus Supplement Summary | | S-1 |

| Risk Factors | | S-8 |

| Use of Proceeds | | S-12 |

| Ratio of Earnings to Fixed Charges | | S-13 |

| Capitalization | | S-14 |

| Selected Financial Data | | S-15 |

| The Operating Partnership | | S-21 |

| Management | | S-32 |

| Description of Notes | | S-34 |

| Federal Income Tax Considerations for Holders of our Notes | | S-45 |

| Underwriting | | S-50 |

| Experts | | S-51 |

| Legal Matters | | S-52 |

| Where You Can Find More Information | | S-52 |

Prospectus

| | Page

|

|---|

| The Company and the Operating Partnership | | 1 |

| Risk Factors | | 2 |

| Use of Proceeds | | 4 |

| Ratios of Earnings To Fixed Charges and Earnings To Combined Fixed Charges and Preferred Share Dividends | | 5 |

| Where You Can Find More Information | | 6 |

| Forward-Looking Statements | | 7 |

| Description of Debt Securities | | 9 |

| Description of Common Shares | | 27 |

| Description of Common Share Warrants | | 30 |

| Description of Preferred Shares | | 31 |

| Description of Depositary Shares | | 41 |

| Material Federal Income Tax Considerations to Tanger Properties Limited Partnership of its REIT Election | | 45 |

| Plan of Distribution | | 59 |

| Experts | | 60 |

| Legal Matters | | 60 |

i

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus include forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to risks, uncertainties, and assumptions about the company and the operating partnership, including, among other things:

- •

- national and local general economic and market conditions;

- •

- demographic changes; our ability to sustain, manage or forecast our growth; existing governmental regulations and changes in or the failure to comply with, government regulations;

- •

- adverse publicity; liability and other claims asserted against us;

- •

- competition;

- •

- the risk that we may not be able to finance our planned development activities;

- •

- risks related to the retail real estate industry in which we compete, including the potential adverse impact of external factors such as inflation, tenant demand for space, consumer confidence, unemployment rates and consumer tastes and preferences;

- •

- the risk that historically high fuel prices may impact consumer travel and spending habits;

- •

- risks associated with our development activities, such as the potential for cost overruns, delays and lack of predictability with respect to the financial returns associated with these development activities;

- •

- risks associated with real estate ownership, such as the potential adverse impact of changes in the local economic climate on the revenues and the value of our properties;

- •

- risks that we incur a material, uninsurable loss of our capital investment and anticipated profits from one of our properties, such as those that result from wars, earthquakes or hurricanes;

- •

- risks that a significant number of tenants may become unable to meet their lease obligations, including as a result of tenant bankruptcies, or that we may be unable to renew or re-lease a significant amount of available space on economically favorable terms;

- •

- fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans;

- •

- business disruptions;

- •

- the ability to attract and retain qualified personnel;

- •

- the ability to realize planned costs savings in acquisitions; and

- •

- retention of earnings.

Additional factors that may cause risks, uncertainties and assumptions include those discussed in the section entitled "Business" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2004 or annual report, including the subheadings entitled "Recent Developments," "The Factory Outlet Concept," "Our Factory Outlet Centers," "Business, Growth and Operating Strategy," "Capital Strategy," "Competition," and the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the annual report.

We disclaim any obligation to publicly update or revise any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes.

ii

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights the information contained in this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in the notes. You should read the prospectus supplement and the prospectus, as well as the documents incorporated herein and therein by reference. Unless the context indicates otherwise, the term the "operating partnership" refers to Tanger Properties Limited Partnership and its consolidated subsidiaries and the term "company" refers to Tanger Factory Outlet Centers, Inc. and its consolidated subsidiaries. The terms "we," "our" and "us" refer to the operating partnership or the operating partnership and the company together, as the context requires. Unless otherwise indicated, (i) property and financial information in this prospectus supplement is presented as of, or for the period ended, September 30, 2005 and (ii) the pro forma financial information in this prospectus supplement is provided assuming this offering, the priced offering of Preferred Shares, the early repayment of certain mortgages, the drawdown on our unsecured lines of credit and the Charter Oak portfolio acquisition had occurred as of the beginning of each respective period for which such financial information is provided.

Tanger Factory Outlet Centers, Inc. and Tanger Properties Limited Partnership

The Operating Partnership

We are one of the largest owners and operators of factory outlets in the United States. We are controlled by the company, a fully-integrated, self-administered and self-managed real estate investment trust, or REIT, and focus exclusively on developing, acquiring, owning, operating and managing factory outlet centers. As of September 30, 2005, we owned interests in or managed 33 factory outlet centers in 22 states with a total gross leasable area, or GLA, of approximately 8.7 million square feet. These factory outlet centers were 97% occupied and contained over 2,000 stores, representing over 400 store brands.

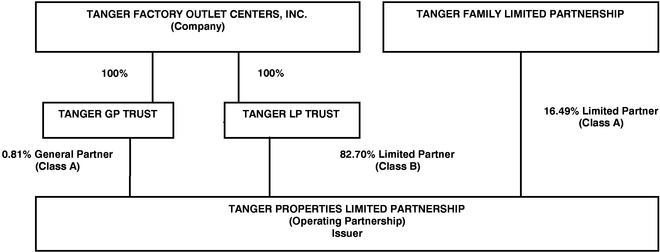

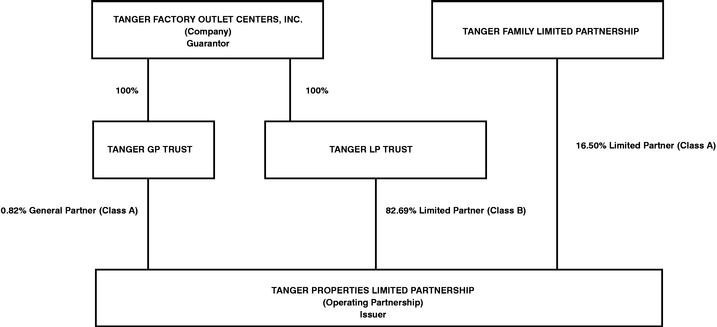

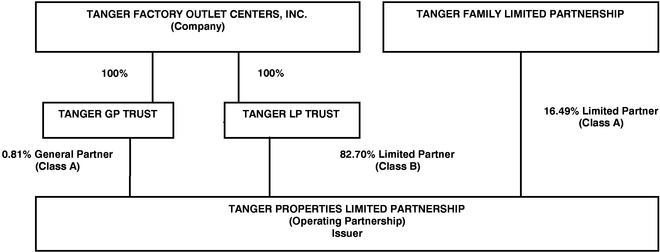

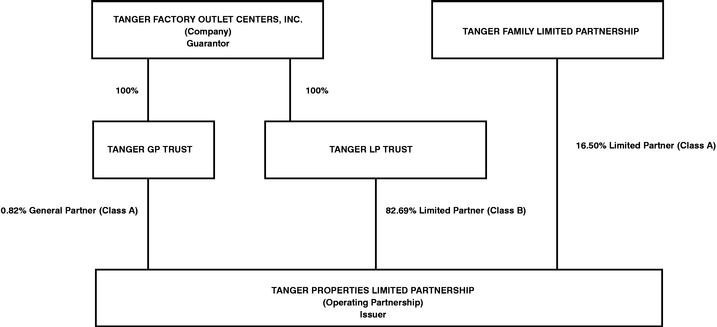

Tanger GP Trust, the company's wholly owned subsidiary, serves as our general partner. The factory outlet centers and other assets of our business are owned by, and all of the company's operations are conducted through, us. Accordingly, the descriptions of our business, employees and properties are also descriptions of the business, employees and properties of the company.

Competitive Strengths

We believe that our key competitive strengths are the following:

- •

- Industry Consolidation and Barriers to Entry. During the last several years, the factory outlet industry has experienced consolidation, with smaller, less capitalized owners struggling to compete with, or being acquired by, larger, national factory outlet owners. Since 2000 the number of factory outlet centers in the United States has decreased, while the average size of each factory outlet center has increased. During this period of consolidation, the high barriers to entry in the factory outlet center industry, including the need for extensive relationships with premier brand name manufacturers, has minimized the number of new factory outlet centers. Since January 2000 only 14 new factory outlet centers have opened. This consolidation trend combined with high barriers to entry, our national presence, and access to capital; as well as our tenant relationships, have allowed us to grow our business and improve our market position.

- •

- Diverse Tenant Base and Geographic Distribution. We believe that our portfolio is well diversified both geographically and by tenant. We have a diverse tenant base comprised of over 400 different well-known, upscale, national designer or brand name store concepts, such as Liz Claiborne, Reebok, Tommy Hilfiger, Polo Ralph Lauren, GAP, Banana Republic, Old Navy, Nautica, Coach Leatherware, Brooks Brothers, Zales and Nike. No single tenant or their affiliates accounted for 10% or more of combined annual base and percentage rental revenues during the nine months ended

S-1

September 30, 2005, and for the years ended December 31, 2004, 2003 or 2002. As of September 30, 2005, our largest tenant, The Gap, Inc., including all of its store concepts, accounted for approximately 7.0% of our total GLA. Our centers are located coast-to-coast throughout 22 states.

- •

- Experienced and Incentivized Management Team. Our management team, led by Stanley K. Tanger and Steven B. Tanger, has extensive experience developing and managing factory outlet centers, with an average of over 17 years of experience in the outlet industry. As of September 30, 2005, the company's management beneficially owned approximately 19.0% of all the company's outstanding shares in the aggregate (assuming the partnership units held by the Tanger Family Limited Partnership or TFLP, are exchanged for the company's common shares but without giving effect to the exercise of any outstanding share and partnership unit options).

- •

- Brand Name Recognition of Tanger Name. Each of our factory outlet centers carries the Tanger brand name. We believe that both national manufacturers and consumers identify the Tanger name with outlet shopping centers that offer recognized high-quality brands at lower prices than department stores and retail malls in a convenient and appealing setting.

- •

- Successful Development and Expansion Experience. Since the company's initial public offering in June 1993, we have added approximately 7.2 million square feet of GLA to our portfolio through strategic new development, expansions of existing centers, acquisitions and dispositions. We have pursued a balanced investment program since the company's initial public offering, developing 11 centers totaling approximately 1.8 million square feet, acquiring 17 centers totaling approximately 4.6 million square feet, expanding 22 centers totaling approximately 2.0 million square feet and disposing of 12 centers totaling approximately 1.2 million square feet.

- •

- Long-Standing Tenant Relationships. As one of the original participants in the factory outlet industry, we have developed long-standing relationships with many national and regional manufacturers. Our relationship with Phillips Van-Heusen Corporation began in 1982. Our relationship with Polo Ralph Lauren began in 1984 with one of their first outlet stores. Our relationship with Liz Claiborne began in 1986 with their first outlet store. Our relationship with The Gap, Inc. began in 1997 with their first outlet store. Each of these relationships has expanded over time and continues today.

Business Objective and Strategies

We seek to enhance our operating performance and financial position by pursuing the following business objectives and strategies:

- •

- Develop and Acquire New Properties. We typically seek opportunities to develop or acquire new factory outlet centers in locations that have at least 1.0 million residents within a one-hour drive, an average household income within a 30-mile radius of at least $50,000 per year and access to frontage on a major or interstate highway with a traffic count of at least 45,000 cars per day. We will vary our minimum conditions based on the particular characteristics of a site, especially if the site is located at or near a tourist destination. Our current goal is to target sites that are large enough to support factory outlet centers with approximately 75 stores totaling at least 300,000 square feet of GLA.

- •

- Increase Cash Flow and the Long-Term Value of the Real Estate Portfolio. Our capital strategy is to increase revenues through new development, selective acquisitions and expansions of factory outlet centers while minimizing our operating expenses by designing low maintenance properties and achieving economies of scale. We continue to focus on strengthening our tenant base in our centers by replacing low volume tenants with high volume premier brand retailer concepts, such as Liz Claiborne, Reebok, Tommy Hilfiger, Polo Ralph Lauren, GAP, Banana Republic, Old Navy, Nautica, Coach Leatherware, Brooks Brothers, Zales and Nike.

S-2

- •

- Maintain a Strong and Flexible Financial Position. We intend to maintain a strong and flexible financial position by (i) managing our leverage position when pursuing new development and expansion opportunities, (ii) extending and staggering debt maturities, (iii) managing our interest rate risks through a proper mix of fixed and variable rate debt, (iv) maintaining our liquidity by using our lines of credit in a conservative manner, and (v) preserving internally-generated sources of capital by strategically divesting of underperforming assets, maintaining a conservative distribution payout ratio and reinvesting a significant portion of our cash flow into our portfolio.

From time to time, we evaluate and consider opportunities for acquiring portfolios of properties and new business developments in the factory outlet industry, and we are currently evaluating proposals for such transactions. We cannot, however, assure you that we will complete any such transaction on terms acceptable to us or that we will complete any such transaction.

Organizational Chart

In order for the company to maintain its qualification as a REIT for U.S. federal income tax purposes, it is required to distribute at least 90% of its taxable income (excluding capital gains) each year. In addition, to avoid the U.S. federal income tax that would otherwise be imposed on its undistributed taxable income, the company would have to distribute 100% of its net taxable income each year.

We and the company are both organized under the laws of the state of North Carolina and maintain our principal executive office at 3200 Northline Avenue, Suite 360, Greensboro, North Carolina 27408 and the telephone number at that address is (336) 292-3010. Our website can be accessed at www.tangeroutlet.com. A copy of our 10-K's, 10-Q's and 8-K's can be obtained, free of charge, on our website. Information on our website is not, however, a part of this prospectus supplement or the accompanying prospectus.

Recent Developments

Acquisition of Joint Venture Partner Interest in COROC Holdings, LLC

On August 22, 2005, we announced an agreement to acquire for $282.5 million in cash, the remaining two-thirds interest in the Charter Oak portfolio owned by an affiliate of Blackstone Real Estate Advisors. The Charter Oak portfolio, comprised of nine factory outlet centers (including approximately 3.3 million square feet), was acquired in December 2003 by a joint venture company, in which we owned a one-third interest and Blackstone owned a two-thirds interest. We have provided management, leasing and marketing services for these factory outlet centers since December 2003. As a result of this acquisition, the total amount of wholly-owned square feet in our real estate portfolio will increase by 66.0%, from approximately 5.0 million square feet to 8.2 million square feet. We plan to finance this acquisition, in part, using the proceeds of this

S-3

offering and the offering of 2,000,000 of the company's 7.5% Class C Preferred Shares having a liquidation preference of $25.00 per share, which priced on October 26, 2005 at a public offering price of $25.00 per share. The net proceeds of the Class C Preferred Share offering, which we expect to be $48.1 million, will be contributed by the company to us in exchange for preferred units of partnership interest. However, this offering is not contingent or conditioned on the consummation of such Class C Preferred Shares offering. Closing of the acquisition is subject to certain customary conditions including those contained within an existing GMAC loan currently collateralizing the properties. We believe these conditions will be met and expect that the transaction will close by the end of 2005.

3,000,000 Common Share Offering

On September 2, 2005, the company completed a 3,000,000 common share offering at a price of $27.09 per share to Cohen & Steers Capital Management, Inc., on behalf of itself and as investment adviser to certain investment advisory clients. Net proceeds from the sale were approximately $81.0 million and were contributed to us in exchange for additional common units of partnership interest. The proceeds were used to pay down amounts outstanding under our unsecured lines of credit and to repay a portion of the John Hancock mortgages discussed below.

Mortgage Repayments

On October 3, 2005, we completed the prepayment of John Hancock mortgages totaling $77.4 million, which were secured by four properties in our portfolio. Interest rates on these mortgages ranged from 7.875% to 7.98%. In addition to the $77.4 million of principal and interest, we also paid a prepayment premium of $9.4 million. We funded the transaction using a portion of the proceeds from the company's September common share offering, as described above, as well as amounts available under our unsecured lines of credit. The repayment of the mortgages unencumbered the following factory outlet centers: Kittery, Maine; San Marcos, Texas; West Branch, Michigan and Williamsburg, Iowa.

Debt Rating Upgrade

In October 2005, Standard and Poor's, a division of The McGraw-Hill Companies, or Standard & Poor's, announced an upgrade in our senior unsecured debt rating to BBB-, citing the recent paydown of $77.4 million of mortgage debt along with expectations of lower encumbrance levels going forward. The Standard and Poor's announcement also stated that the financial outlook of our company was stable as a result of our "well-leased and profitable portfolio."

During the second quarter of 2005, Moody's Investors Service, Inc. announced an upgrade of our senior unsecured debt rating to an investment grade rating of Baa3, citing our success in integrating the Charter Oak portfolio, improved performance of our portfolio of properties and progress in unencumbering a number of our properties. The rating also takes into account our staggered debt maturity schedule and our sufficient liquidity.

Locust Grove, Georgia Center Expansion

We are currently constructing a 46,400 square foot expansion at our Locust Grove, Georgia center. The total estimated cost of the expansion of this factory outlet center is $6.6 million. Currently, 75% of this expansion is open for operation, and we expect the remaining 25% of the space to commence operations in the fourth quarter of 2005. The tenants in the expansion include Polo/Ralph Lauren, Sketchers, and Children's Place. Upon completion of the expansion, the center will total approximately 294,000 square feet.

S-4

Foley, Alabama Center Expansion

We are also currently constructing a 21,300 square foot expansion at our Foley, Alabama factory outlet center. The estimated cost of the expansion is $3.8 million. We currently expect to complete the expansion with stores commencing operations during the fourth quarter of 2005. The tenants in the expansion include Ann Taylor, Skechers, and Tommy Hilfiger. Upon completion of the expansion, the center will total approximately 557,000 square feet.

Development Projects: Wisconsin Dells, Wisconsin; Charleston, South Carolina; Deer Park (Long Island), New York and Pittsburgh, Pennsylvania

We continue the pre-development and leasing of four previously announced sites. Our minimum internal pre-leasing requirement of 50% has been met for our Charleston, South Carolina project and our Wisconsin Dells, Wisconsin project. We are currently in the process of closing on the acquisition of the land for both projects, subject to closing conditions within the respective purchase agreements, and expect to begin construction prior to the end of 2005. We expect that the properties located in Charleston, South Carolina and Wisconsin Dells, Wisconsin will be completed in the fourth quarter of 2006 and that the properties in Deer Park, New York and Pittsburgh, Pennsylvania will be completed in the fourth quarter of 2007.

S-5

The Offering

The offering terms are summarized below solely for your convenience. This summary is not a complete description of the notes. You should read the full text and more specific details contained elsewhere in this prospectus supplement and the accompanying prospectus. For a more detailed description of the notes, see the discussion under the caption "Description of Notes" beginning on page S-33 in this prospectus supplement.

| Issuer | | Tanger Properties Limited Partnership, a North Carolina limited partnership. |

Securities Offered |

|

$250 million aggregate principal amount of % Senior Notes due 2015. |

Maturity Date |

|

The notes will mature on November 15, 2015. |

Interest Payment Dates |

|

May 15 and November 15 of each year, commencing on May 15, 2006. |

Optional Redemption |

|

We may redeem the notes, in whole at any time or in part from time to time, at our option, on not less than 30 nor more than 60 days' notice, at the redemption prices described under "Description of Notes–Optional Redemption." |

Ranking |

|

The notes: |

|

|

• |

|

will be unsecured obligations; |

|

|

• |

|

will rank equally and ratably with all our existing and future unsecured and unsubordinated indebtedness; |

|

|

• |

|

will be senior to any future subordinated indebtedness; |

|

|

• |

|

will be junior to any secured debt to the extent of the assets securing such indebtedness; and |

|

|

• |

|

will be effectively junior to all existing and future indebtedness and other liabilities of our subsidiaries. |

Covenants |

|

The notes will contain covenants restricting our ability, subject to certain exceptions, to incur debt secured by liens, or to merge or consolidate with another entity or sell all or substantially all of our assets to another person. |

Limitations on Incurrence of Indebtedness |

|

The notes contain various covenants, including the following: |

|

|

• |

|

We will not incur any Indebtedness (other than permitted Indebtedness) if, immediately after giving effect to the incurrence of such Indebtedness, the aggregate principal amount of all of our Indebtedness on a consolidated basis is greater than 60% of the sum of (1) our Total Assets as of the end of the fiscal quarter covered by our most recent report on Form 10-K or Form 10-Q, as the case may be, and (2) any increase in our Total Assets from the end of that quarter including any increase in Total Assets caused by the incurrence of the additional Indebtedness (that increase together with our Total Assets is referred to as "Adjusted Total Assets"). |

| | | | | |

S-6

| | | • | | We will not incur any Indebtedness if the ratio of our Consolidated Income Available for Debt Service to our Annual Debt Service Charge for the four consecutive fiscal quarters most recently ended prior to the date on which the additional Indebtedness is to be incurred would be less than 1.5 to 1.0, calculated on a pro forma basis after giving effect to the incurrence of that additional Indebtedness and the application of the proceeds from that incurrence, computed on a consolidated basis and subject to certain additional adjustments. |

| | | • | | We will not incur any Secured Indebtedness if, immediately after giving effect to the incurrence of such Secured Indebtedness, the aggregate principal amount of all of our Secured Indebtedness on a consolidated basis is greater than 40% of our Adjusted Total Assets. |

| | | • | | We will maintain Total Unencumbered Assets of not less than 135% of the aggregate outstanding principal amount of our Unsecured Debt, computed on a consolidated basis. |

| | | The foregoing summary of certain covenants applicable to the notes is not complete and you should carefully review the information, including the definitions of some of the capitalized terms used above, appearing in this prospectus supplement under "Description of Notes" and in the accompanying prospectus under "Description of Debt Securities," as well as the indenture under which the notes will be issued, for more information. |

| Use of Proceeds | | We intend to use the proceeds of this offering to fund, in part, our previously announced $282.5 million acquisition of the remaining two-thirds interest in the Charter Oak portfolio owned by an affiliate of Blackstone Real Estate Advisors. We will use the remaining proceeds, if any, for general operating purposes. |

| Settlement Date | | Delivery of the notes will be made against payment therefore on or about November , 2005. |

| Form | | The notes will be issued and maintained in book-entry form registered in the name of the nominee of The Depositary Trust Company. |

| Risk Factors | | See "Risk Factors" on page S-8 of this prospectus supplement and on page 2 of the accompanying prospectus for other information you should consider before buying our notes. |

S-7

RISK FACTORS

An investment in the notes involves risks. In addition to the matters discussed under the heading "Risk Factors" on page 2 of the accompanying prospectus and other information in this prospectus supplement, the accompanying prospectus and other documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus, you should consider carefully the following risk factors before deciding to invest in the notes.

The notes will be effectively subordinated to all existing and future liabilities of our subsidiaries and our secured indebtedness.

Although the indenture under which the notes will be issued and other debt instruments to which we are a party limit our ability and the ability of our subsidiaries to incur additional indebtedness, both we and our subsidiaries have the right to incur substantial additional secured and unsecured indebtedness. As of September 30, 2005, our total indebtedness was approximately $434.6 million. In addition, between September 30, 2005 and October 26, 2005, we borrowed an additional $57.3 million under our unsecured lines of credit. On October 3, 2005, we completed the prepayment of certain mortgage indebtedness totaling $77.4 million. In addition to the $77.4 million of principal and interest, we also paid a prepayment premium of $9.4 million. The notes will be effectively subordinated to all existing and future indebtedness and other liabilities, including guarantees, of our subsidiaries. The notes will also be effectively subordinated to all of our existing and future indebtedness that is guaranteed by our subsidiaries to the extent of those guarantees. In the event of a bankruptcy, liquidation or similar proceedings involving any of our subsidiaries, the creditors of that subsidiary (including, in the case of any subsidiary that has guaranteed any of our existing or future indebtedness, our creditor with respect to the guaranteed indebtedness) will generally be entitled to payment of their claims from the assets of that subsidiary before any assets are made available for distribution to us.

The notes are unsecured and therefore will be subordinated to any secured indebtedness we may incur to the extent of the value of the assets securing such indebtedness. In the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation, administration, reorganization, or other insolvency or bankruptcy proceeding, holders of secured indebtedness will have prior claim to those of our assets that constitute their collateral. Holders of the notes will participate ratably with all holders of our unsecured indebtedness that is deemed to be of the same class as the notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the notes. As a result, holders of notes may receive less, ratably, than holders of the liabilities of our subsidiaries and the holders of our secured indebtedness.

We are subject to the risks associated with debt financing.

We are subject to the risks associated with debt financing, including the risk that the cash provided by our operating activities will be insufficient to meet required payments of principal and interest and the risk that we will not be able to repay or refinance existing indebtedness or that the terms of any refinancing will not be as favorable as the terms of existing indebtedness. If we are unable to refinance our indebtedness on acceptable terms, we might be forced to dispose of properties on disadvantageous terms, which might result in losses.

There is no established trading market for the notes.

Prior to the offering, there has been no public market for the notes. The underwriters have advised us that they intend to make a market in the notes; however, the underwriters are not obligated to do so. The underwriters may discontinue any market-making at any time, and there is no assurance that an active public market for the notes will develop or, if it develops, that it will be maintained. Further, declines and volatility

S-8

in the market for securities generally, as well as changes in our financial performance or prospects, may adversely affect the liquidity of, and trading market for, the notes.

We may not be able to close our $282.5 million acquisition of the remaining two-thirds interest in the Charter Oak portfolio owned by an affiliate of Blackstone Real Estate Advisors.

The purchase agreement relating to our acquisition of the remaining two-thirds interest in the Charter Oak portfolio contains closing conditions that need to be satisfied before the acquisition can be consummated. The satisfaction of some of these conditions is outside our control, and we therefore cannot assure you that the acquisition will be consummated. If the acquisition is not consummated, our shareholders will not realize the benefits of the proposed transaction as described in this prospectus supplement and the pro forma information presented in, or incorporated by reference into, this prospectus supplement and accompanying prospectus will not be accurate.

We face competition for the acquisition of factory outlet centers, and we may not be able to complete acquisitions that we have identified.

One component of our business strategy is expansion through acquisitions, and we may not be successful in completing acquisitions that are consistent with our strategy. We compete with institutional pension funds, private equity investors, REITs, small owners of factory outlet centers, specialty stores and others who are engaged in the acquisition, development or ownership of factory outlet centers and stores. These competitors may affect the supply/demand dynamics and, accordingly, increase the price we must pay for factory outlet centers we seek to acquire, and these competitors may succeed in acquiring those factory outlet centers themselves. Also, our potential acquisition targets may find our competitors to be more attractive acquirors because they may have greater marketing and financial resources, may be willing to pay more, or may have a more compatible operating philosophy. In addition, the number of entities competing for these factory outlet centers may increase in the future, which would increase demand for factory outlet centers and the prices we must pay to acquire them. If we pay higher prices for factory outlet centers, our profitability may be reduced. Also, once we have identified potential acquisitions, such acquisitions are subject to the successful completion of due diligence, the negotiation of definitive agreements and the satisfaction of customary closing conditions, and we cannot assure you that we will be able to reach acceptable terms with the sellers or that these conditions will be satisfied.

The economic performance and the market value of our factory outlet centers are dependent on risks associated with real property investments.

Real property investments are subject to varying degrees of risk. The economic performance and values of real estate may be affected by many factors, including changes in the national, regional and local economic climate, inflation, unemployment rates, consumer confidence, local conditions such as an oversupply of space or a reduction in demand for real estate in the area, the attractiveness of the properties to tenants, competition from other available space, our ability to provide adequate maintenance and insurance and increased operating costs.

We may be unable to successfully bid for and develop economically attractive factory outlet centers.

We intend to actively pursue factory outlet center development projects, including the expansion of existing centers. These projects generally require expenditure of capital on projects that may not be completed as well as various forms of government and other approvals. We cannot be assured that we will be able to get financing on acceptable terms or be able to get the necessary approvals.

S-9

Our earnings and therefore our profitability is entirely dependent on rental income from real property.

Substantially all of our income is derived from rental income from real property. Our income and funds for distribution would be adversely affected if a significant number of our tenants were unable to meet their obligations to us or if we were unable to lease a significant amount of space in our centers on economically favorable lease terms. In addition, the terms of factory outlet store tenant leases traditionally have been significantly shorter than in other retail segments. There can be no assurance that any tenant whose lease expires in the future will renew such lease or that we will be able to re-lease space on economically favorable terms.

We are substantially dependent on the results of operations of our retailers.

Our operations are necessarily subject to the results of operations of our retail tenants. A portion of our rental revenues are derived from percentage rents that directly depend on the sales volume of certain tenants. Accordingly, declines in these tenants' results of operations would reduce the income produced by our properties. If the sales of our retail tenants decline sufficiently, such tenants may be unable to pay their existing rents as such rents would represent a higher percentage of their sales. Any resulting leasing delays, failures to make payments or tenant bankruptcies could result in the termination of such tenants' leases.

A number of companies in the retail industry including some of our tenants have declared bankruptcy or have voluntarily closed certain of their stores in recent years. The bankruptcy of a major tenant or number of tenants may result in the closing of certain affected stores, and we may not be able to re-lease the resulting vacant space for sometime or for equal or greater rent. Such bankruptcy could have a material adverse effect on our results of operations and could result in a lower level of funds for distribution.

We may be subject to environmental regulation.

Under various federal, state and local laws, ordinances and regulations, we may be considered an owner or operator of real property and may be responsible for paying for the disposal or treatment of hazardous or toxic substances released on or in our property or disposed of by us, as well as certain other potential costs which could relate to hazardous or toxic substances (including governmental fines and injuries to persons and property). This liability may be imposed whether or not we knew about, or were responsible for, the presence of hazardous or toxic substances.

The company is required by law to make distributions to its shareholders and therefore we must make distributions to the company.

To obtain the favorable tax treatment associated with its qualification as a REIT, generally, the company is required to distribute to its common and preferred shareholders at least 90.0% of its net taxable income (excluding capital gains) each year. The company depends upon distributions or other payments from us to make distributions to its common and preferred shareholders.

We may be unable to develop new factory outlet centers or expand existing factory outlet centers successfully.

We continue to develop new factory outlet centers and expand factory outlet centers as opportunities arise. However, there are significant risks associated with our development activities in addition to those generally associated with the ownership and operation of established retail properties. While we have policies in place designed to limit the risks associated with development, these policies do not mitigate all development risks associated with a project. These risks include the following:

- •

- significant expenditure of money and time on projects that may be delayed or never be completed;

- •

- higher than projected construction costs;

S-10

- •

- shortage of construction materials and supplies;

- •

- failure to obtain zoning, occupancy or other governmental approvals or to the extent required, tenant approvals; and

- •

- late completion because of construction delays, delays in the receipt of zoning, occupancy and other approvals or other factors outside of our control.

Any or all of these factors may impede our development strategy and adversely affect our overall business.

An uninsured loss or a loss that exceeds the insurance policies on our factory outlet centers could subject us to lost capital or revenue on those centers.

Some of the risks to which our factory outlet centers are subject, including risks of war and earthquakes, hurricanes and other natural disasters, are not insurable or may not be insurable in the future. Should a loss occur that is uninsured or in an amount exceeding the combined aggregate limits for the insurance policies noted above or in the event of a loss that is subject to a substantial deductible under an insurance policy, we could lose all or part of our capital invested in and anticipated revenue from one or more of our factory outlet centers, which could adversely affect our results of operations and financial condition, as well as our ability to make payments on our indebtedness, including the notes.

Under the terms and conditions of our leases, tenants generally are required to indemnify and hold us harmless from liabilities resulting from injury to persons and contamination of air, water, land or property, on or off the premises, due to activities conducted in the leased space, except for claims arising from negligence or intentional misconduct by us or our agents. Additionally, tenants generally are required, at the tenant's expense, to obtain and keep in full force during the term of the lease, liability and property damage insurance policies issued by companies acceptable to us. These policies include liability coverage for bodily injury and property damage arising out of the ownership, use, occupancy or maintenance of the leased space. All of these policies may involve substantial deductibles and certain exclusions.

Historically high fuel prices may impact consumer travel and spending habits.

Our markets are currently experiencing record high fuel prices. Most shoppers use private automobile transportation to travel to our factory outlet centers and many of our centers are not easily accessible by public transportation. Increasing fuel costs may reduce the number of trips to our centers thus reducing the amount spent at our centers. Many of our factory outlet center locations near tourist destinations may experience an even more acute reduction of shoppers if there were a reduction of people opting to drive to vacation destinations. Such reductions in traffic could adversely impact our percentage rents and ability to renew and release space at current rental rates.

Increasing fuel costs may also reduce disposable income and decrease demand for retail products. Such a decrease could adversely affect the results of operations of our retail tenants and adversely impact our percentage rents and ability to renew and release space at current rental rates.

S-11

USE OF PROCEEDS

We estimate the net proceeds of this offering to be approximately $248.1 million, after deducting the underwriting discount and our offering expenses. We intend to use such proceeds to fund, in part, our previously announced $282.5 million acquisition of the remaining two-thirds interest in the Charter Oak portfolio owned by an affiliate of Blackstone Real Estate Advisors. The company has priced a preferred shares offering on October 26, 2005, the net proceeds of which we estimate will be approximately $48.1 million, after deducting the underwriting discount and our offering expenses. Such proceeds would also be used to fund, in part, the Charter Oak portfolio acquisition. However, this offering is not contingent or conditioned on the consummation of such Class C Preferred Shares offering. We will use the remaining proceeds, if any, for general operating purposes.

S-12

RATIOS OF EARNINGS TO FIXED CHARGES

The following table sets forth our ratios of earnings to fixed charges for the periods shown.

| | Nine Months

Ended September 30,

| | Year Ended December 31,

|

|---|

| | Pro Forma

| | Actual

| | Pro Forma

| | Actual

| |

| |

| |

| |

|

|---|

| | 2005

| | 2005

| | 2004

| | 2004

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

|---|

| Ratio of Earnings to Fixed Charges | | 1.6x | | 2.2x | | 1.9x | | 1.5x | | 2.0x | | 1.6x | | 1.3x | | 1.1x | | 1.2x |

The ratios of earnings to fixed charges were computed by dividing earnings by fixed charges. For this purpose, earnings has been calculated by adding fixed charges (excluding capitalized interest), amortization of capitalized interest and distributed income of unconsolidated joint ventures to income from continuing operations before adjustment for equity in earnings of unconsolidated joint ventures and minority interests. Fixed charges consist of interest costs, whether expensed or capitalized, the amortization of debt issue costs, whether expensed or capitalized and the interest factor of rental expense.

The pro forma ratio of earnings to fixed charges includes adjustments to increase interest expense by $7.6 million for the nine months ended September 30, 2005 and $11.3 million for the year ended December 31, 2004. These adjustments give effect to the expected sale of $250.0 million in unsecured debt (with an assumed coupon rate of 6.00%) pursuant to this prospectus supplement and the draw down of $51.6 million under our unsecured lines of credit (with an interest rate of 4.79%) to fund in part the acquisition of the Charter Oak portfolio. The increased interest expense is partially offset by the early prepayment of $77.4 million of mortgage debt with interest rates ranging from 7.875% to 7.98% on October 3, 2005.

S-13

CAPITALIZATION

The following table sets forth our capitalization as of September 30, 2005 on a historical basis and on an as adjusted basis giving effect to:

- •

- the sale by us of $250.0 million in unsecured debt pursuant to this prospectus supplement and the estimated net proceeds from the unsecured debt offering of $248.1 million, after deducting the underwriting discount and estimated offering expenses;

- •

- the sale by the company of the 2,000,000 Class C Preferred Shares with a liquidation preference value of $25 per share in an offering priced on October 26, 2005 and the estimated net proceeds from such offering of $48.1 million, after deducting the underwriting discount and estimated offering expenses, which will be contributed to the operating partnership; and

- •

- the expected use of proceeds from the unsecured debt offering, the company's commenced Class C Preferred Share offering, an available $24.75 million of cash equivalents and short-term investments as of September 30, 2005 and a draw down of $51.6 million on our unsecured lines of credit to acquire the remaining two-thirds interest in the Charter Oak portfolio and to prepay the John Hancock mortgages totaling $77.4 million and related prepayment premium of $9.4 million.

| | September 30, 2005

| |

|---|

| | Actual

| | As adjusted(3)

| |

|---|

| | (in thousands)

| |

|---|

| Debt: | | | | | | | |

| | Senior, unsecured notes | | $ | 100,000 | | $ | 350,000 | |

| | Mortgages payable | | | 281,069 | | | 202,482 | |

| | Unsecured note | | | 53,500 | | | 53,500 | |

| | Unsecured lines of credit | | | — | | | 51,643 | |

| | |

| |

| |

| | | Total debt | | | 434,569 | | | 657,625 | |

| | |

| |

| |

Minority interest in consolidated joint venture |

|

|

227,234 |

|

|

— |

|

| | |

| |

| |

| Partners' equity: | | | | | | | |

| | Preferred units, no units outstanding, historical; 2,000,000 units outstanding, as adjusted(1) | | | — | | | 50,000 | |

| | Other partners' capital: | | | | | | | |

| | | General partner, 150,000 general partnership units outstanding | | | 418 | | | 418 | |

| | | Limited partners, 18,245,913 limited partnership units outstanding(2) | | | 260,205 | | | 248,502 | |

| | | Deferred compensation | | | (5,930 | ) | | (5,930 | ) |

| | | Accumulated other comprehensive income | | | 1,356 | | | 1,356 | |

| | |

| |

| |

| | | Total partners' equity | | | 256,049 | | | 294,346 | |

| | |

| |

| |

| | | | Total capitalization | | $ | 917,852 | | $ | 951,971 | |

| | |

| |

| |

- (1)

- Assumes no exercise of the underwriters' over-allotment option for the preferred share offering.

- (2)

- Does not include 288,110 units issuable upon the exercise of outstanding unit options.

- (3)

- As adjusted data is derived from the pro forma data on our Current Report on Form 8-K/A dated October 26, 2005.

S-14

SELECTED FINANCIAL DATA

The following selected financial and other operating data should be read in conjunction with all of the financial statements and notes thereto and "Management's Discussion and Analysis of Financial Condition and Results of Operations" incorporated herein by reference from our Annual Report on Form 10-K for the year ended December 31, 2004, Quarterly Report on Form 10-Q for the period ended September 30, 2005 and Current Report on Form 8-K/A dated October 26, 2005. The historical data as of and for the years ended December 31, 2004, 2003 and 2002 have been derived from historical financial statements. The historical data for the nine months ended September 30, 2005 and September 30, 2004 have been derived from our unaudited historical financial statements. In the opinion of management, this historical data includes all adjustments (consisting only of normal recurring adjustments) necessary to present fairly the information set forth. However, operating results for the nine months ended September 30, 2005 are not necessarily indicative of results that may be expected for the year ended December 31, 2005.

The accompanying unaudited pro forma data as of and for the nine months ended September 30, 2005 and for the year ended December 31, 2004 are based on our historical statements after giving effect to the completion of the company's Class C Preferred Shares offering, the proposed offering of unsecured debt pursuant to this prospectus supplement and the use of proceeds from the company's Class C Preferred Share offering, this offering, certain cash equivalents and short-term investments and the draw down on the unsecured lines of credit to acquire the remaining two-thirds interest in the Charter Oak portfolio and to prepay the John Hancock mortgages. The unaudited pro forma data for the nine months ended September 30, 2005 and the year ended December 31, 2004 assume the completion of the company's Class C Preferred Share offering, this offering, the draw down on unsecured lines of credit, the acquisition of the Charter Oak portfolio and early repayment of the John Hancock mortgages had occurred as of the beginning of each respective period. We note that this offering is not contingent or conditioned on the consummation of the company's priced Class C Preferred Share offering.

The pro forma consolidated financial statements have been prepared by our management. These pro forma statements may not be indicative of the results that would have actually occurred if the completion of the company's Class C Preferred Share offering, this offering, the draw down on the unsecured lines of credit, the acquisition of the Charter Oak portfolio and the early repayment of the John Hancock mortgages had occurred on the date indicated, nor does it purport to represent the results of operations for future periods. The unaudited pro forma consolidated financial statements should be read in conjunction with our unaudited pro forma consolidated financial statements (which are contained in our Current Report on Form 8-K/A dated October 26, 2005), unaudited financial statements and notes thereto as of September 30, 2005 and for the nine months then ended (which are contained in our Quarterly Report on Form 10-Q for the period ended September 30, 2005), and the audited financial statements and notes thereto as of December 31, 2004 and for the year then ended (which are contained in our Annual Report on Form 10-K for the year ended December 31, 2004).

The accompanying unaudited pro forma consolidated financial statements reflect a preliminary allocation of the purchase price of the Charter Oak portfolio under Statement of Financial Accounting Standards No. 141, "Business Combinations" ("FAS 141"). This allocation is subject to final adjustment following such acquisition. We expect to finalize the valuation following the consummation of such transaction. Changes in the allocation of the purchase price and/or estimated useful lives from those used in the unaudited pro forma consolidated financial statements would result in an increase or decrease in pro forma income from continuing operations and related pro forma earnings per share. The following table summarizes our

S-15

preliminary allocation of purchase price plus closing costs and the estimated useful lives used for the pro forma calculations.

| | Amount (in thousands)

| | Average estimated useful life (in years)

|

|---|

| Land | | $ | 4,873 | | |

| Buildings, improvements and fixtures | | | 41,048 | | 24.4 |

| Deferred lease and other intangibles: | | | | | |

| | Above (below) market leases, net | | | (4,754 | ) | 3.2 |

| | Other lease related intangibles (principally tenant relationships | | | | | |

| | and lease in place value) | | | 16,186 | | 5.7 |

| Debt premium | | | 1,173 | | 3.0 |

| Minority interest | | | 227,234 | | |

| | |

| | |

| | Net assets acquired | | $ | 285,760 | | |

| | |

| | |

The information presented in this prospectus supplement includes financial information prepared in accordance with generally accepted accounting principles in the United States, or GAAP, as well as funds from operations, or FFO, a financial measure that is not required by or presented in accordance with GAAP. As described more fully in note 2 to the table of "Other Data" below, we believe this non-GAAP measure provides meaningful additional information about our performance and is generally recognized as the industry standard for reporting the operations of REITs. This non-GAAP financial measure should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Please see note 2 below for further discussion of this measure.

| | Nine Months Ended

September 30,

| |

| |

| |

| |

| |

|---|

| | Year Ended December 31,

| |

|---|

| | Pro

Forma

| |

| |

| |

|---|

| | Actual

| | Pro Forma

| | Actual

| |

|---|

| | 2005

| | 2005

| | 2004

| | 2004

| | 2004

| | 2003

| | 2002

| |

|---|

| | (dollars in thousands, except per unit data)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | | | |

| Base Rentals(a) | | $ | 100,299 | | $ | 99,370 | | $ | 96,380 | | $ | 131,122 | | $ | 129,884 | | $ | 78,319 | | $ | 71,109 | |

| | Percentage rentals | | | 3,968 | | | 3,968 | | | 2,958 | | | 5,338 | | | 5,338 | | | 3,179 | | | 3,526 | |

| | Expense reimbursements | | | 41,165 | | | 41,165 | | | 37,956 | | | 52,585 | | | 52,585 | | | 33,053 | | | 28,642 | |

| | Other income(b) | | | 3,673 | | | 3,747 | | | 5,054 | | | 6,746 | | | 6,746 | | | 3,508 | | | 3,211 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | Total revenues | | | 149,105 | | | 148,250 | | | 142,348 | | | 195,791 | | | 194,553 | | | 118,059 | | | 106,488 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Expenses | | | | | | | | | | | | | | | | | | | | | | |

| | Property operating | | | 46,911 | | | 46,911 | | | 43,095 | | | 59,759 | | | 59,759 | | | 38,968 | | | 33,584 | |

| | General and administrative | | | 10,333 | | | 10,333 | | | 9,757 | | | 12,820 | | | 12,820 | | | 9,551 | | | 9,211 | |

| | Depreciation and amortization(c) | | | 39,775 | | | 36,458 | | | 39,154 | | | 55,868 | | | 51,446 | | | 28,231 | | | 27,048 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | Total expenses | | | 97,019 | | | 93,702 | | | 92,006 | | | 128,447 | | | 124,025 | | | 76,750 | | | 69,843 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Operating income | | | 52,086 | | | 54,548 | | | 50,342 | | | 67,344 | | | 70,528 | | | 41,309 | | | 36,645 | |

| Interest expense(d) | | | 31,958 | | | 24,327 | | | 26,684 | | | 46,407 | | | 35,117 | | | 26,486 | | | 28,460 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income before equity in earnings of unconsolidated joint ventures, minority interest, discontinued operations and loss on sale of real estate | | | 20,128 | | | 30,221 | | | 23,658 | | | 20,937 | | | 35,411 | | | 14,823 | | | 8,185 | |

| Equity in earnings of unconsolidated joint ventures | | | 714 | | | 714 | | | 799 | | | 1,042 | | | 1,042 | | | 819 | | | 392 | |

| Minority interest in consolidated joint venture(e) | | | — | | | (20,211 | ) | | (20,410 | ) | | — | | | (27,144 | ) | | (941 | ) | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income from continuing operations | | $ | 20,842 | | | 10,724 | | | 4,047 | | $ | 21,979 | | | 9,309 | | | 14,701 | | | 8,577 | |

| | |

| | | | | | | |

| | | | | | | | | | |

S-16

| Discontinued operations | | | | | | — | | | (683 | ) | | | | | (683 | ) | | 1,698 | | | 5,703 | |

| | | | | |

| |

| | | | |

| |

| |

| |

| Income before loss on sale of real estate | | | | | | 10,724 | | | 3,364 | | | | | | 8,626 | | | 16,399 | | | 14,280 | |

| Loss on sale of real estate | | | | | | (4,690 | ) | | — | | | | | | — | | | — | | | — | |

| | | | | |

| |

| | | | |

| |

| |

| |

| Net income | | | | | | 6,034 | | | 3,364 | | | | | | 8,626 | | | 16,399 | | | 14,280 | |

| Less applicable preferred unit distributions | | | | | | — | | | — | | | | | | — | | | (806 | ) | | (1,771 | ) |

| | | | | |

| |

| | | | |

| |

| |

| |

| Net income available to partners | | | | | | 6,034 | | | 3,364 | | | | | | 8,626 | | | 15,593 | | | 12,509 | |

| Income allocated to limited partners | | | | | | 5,981 | | | 3,333 | | | | | | 8,548 | | | 15,417 | | | 12,347 | |

| | | | | |

| |

| | | | |

| |

| |

| |

| Income allocated to general partner | | | | | $ | 53 | | $ | 31 | | | | | $ | 78 | | $ | 176 | | $ | 162 | |

| | | | | |

| |

| | | | |

| |

| |

| |

| Unit Data: | | | | | | | | | | | | | | | | | | | | | | |

| | Basic: | | | | | | | | | | | | | | | | | | | | | | |

| | | Income from continuing operations(f) | | $ | 0.99 | | $ | 0.36 | | $ | 0.25 | | $ | 1.01 | | $ | 0.56 | | $ | 1.06 | | $ | 0.60 | |

| | | Net income | | | N/A | | $ | 0.36 | | $ | 0.20 | | | N/A | | $ | 0.52 | | $ | 1.19 | | $ | 1.11 | |

| | | Weighted average common units(g) | | | 18,215 | | | 16,874 | | | 16,518 | | | 18,055 | | | 16,555 | | | 13,085 | | | 11,356 | |

| | Diluted: | | | | | | | | | | | | | | | | | | | | | | |

| | | Income from continuing operations | | $ | 0.98 | | $ | 0.36 | | $ | 0.24 | | $ | 1.00 | | $ | 0.56 | | $ | 1.04 | | $ | 0.59 | |

| | | Net income | | | N/A | | $ | 0.36 | | $ | 0.20 | | | N/A | | $ | 0.52 | | $ | 1.17 | | $ | 1.08 | |

| | | Weighted average common units | | | 18,327 | | | 16,986 | | | 16,611 | | | 18,150 | | | 16,650 | | | 13,300 | | | 11,539 | |

| Distributions paid per common unit | | | N/A | | $ | 1.915 | | $ | 1.865 | | | N/A | | $ | 2.49 | | $ | 2.46 | | $ | 2.46 | |

Balance Sheet Data (at period end): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Real estate assets, before depreciation(h) | | $ | 1,128,107 | | $ | 1,082,186 | | $ | 1,069,978 | | | N/A | | $ | 1,077,393 | | $ | 1,078,553 | | $ | 622,399 | |

| Total assets(h)(i) | | | 974,570 | | | 940,451 | | | 962,123 | | | N/A | | | 936,105 | | | 986,815 | | | 477,380 | |

| Total debt(h)(j)(k)(l) | | | 657,625 | | | 434,569 | | | 511,492 | | | N/A | | | 488,007 | | | 540,319 | | | 345,005 | |

| Total partners' equity(m)(n) | | | 294,346 | | | 256,049 | | | 201,754 | | | N/A | | | 196,754 | | | 206,600 | | | 114,265 | |

Note that the lettered footnotes below refer to the related pro forma columns.

- (a)

- To reflect amortization of the portion of the purchase price assigned to above and below market leases in accordance with FAS 141.

- (b)

- To reflect the elimination of interest income earned from available cash equivalents and short-term investments remaining from the proceeds from the company's September 2, 2005 issuance of 3.0 million common shares, which were contributed to the operating partnership.

- (c)

- To reflect depreciation and amortization on the partial step-up of assets to fair value.

- (d)

- To reflect (1) interest expense from the assumed issuance of $250.0 million in unsecured public debt with an assumed coupon rate of 6.00% (effective rate of 6.08% after underwriting discount; an increase or decrease of 100 basis points in the coupon rate would result in an increase or decrease in interest expense of $2.5 million on an annual basis); (2) the amortization of debt issuance costs ($1.9 million amortized over ten years); (3) reduction in the amortization of debt premium of $1.2 million amortized over three years; (4) adjustments to interest expense to reflect an assumed $51.6 million balance outstanding on available lines of credit at an interest rate of 4.79% based on one month LIBOR plus 0.85%; and (5) the elimination of interest paid during the year on the John Hancock mortgage loans,

S-17

which were repaid early on October 3, 2005, totaling $77.4 million with interest rates ranging from 7.875% to 7.89% and their associated loan cost amortization.

- (e)

- To eliminate the minority interest in the net income of the consolidated joint venture that is being acquired as part of the acquisition of the Charter Oak portfolio.

- (f)

- Pro forma income per common unit is computed as follows: Income from continuing operations less preferred unit distributions of $2.8 million for the nine months ended September 30, 2005 and $3.8 million for the year ended December 31, 2004 (from the issuance of 2.0 million preferred units to the company in exchange for the proceeds from the company's issuance of 2.0 million preferred shares at a price of $25.00 per share and at a coupon rate of 7.5%) divided by pro forma weighted average common units outstanding.

- (g)

- To reflect the company's issuance of 3.0 million common shares on September 2, 2005, the proceeds of which the company contributed to the operating partnership in exchange for 1.5 million common units which had a weighted average of 159,500 units outstanding for the nine months ended September 30, 2005, as if the units had been issued as of the beginning of the nine month period.

- (h)

- To reflect the assumed acquisition of the two-thirds share of the difference between the fair value of the Charter Oak Portfolio and underlying book value of the assets and liabilities.

- (i)

- To reflect (1) the assumed use of $4.75 million in available cash equivalents and $20.0 million in short-term investments as of September 30, 2005 as part of the funding of the acquisition of the Charter Oak portfolio, (2) $1.9 million in deferred financing costs from the assumed issuance of unsecured public debt and (3) the write-off of $.4 million in deferred financing costs associated with the early repayment of the John Hancock mortgages on October 3, 2005.

- (j)

- To reflect the assumed issuance of $250.0 million of unsecured public debt generating net proceeds of $248.1 million.

- (k)

- To reflect the early repayment of the John Hancock mortgages loans totaling $77.4 million on October 3, 2005.

- (l)

- To reflect the assumed draw down of $51.6 million of available unsecured lines of credit as part of the funding of the acquisition of the Charter Oak portfolio.

- (m)

- To reflect the company's issuance of 2.0 million preferred shares at a coupon rate of 7.5% with net proceeds of approximately $48.1 million, as part of the funding of the acquisition of the Charter Oak portfolio, which were contributed to the operating partnership in exchange for 2.0 million preferred units.

- (n)

- To reflect the debt prepayment premium of $9.4 million and the write-off of $.4 million in deferred financing costs associated with the early repayment of the John Hancock mortgages on October 3, 2005.

S-18

| | Nine Months Ended September 30,

| | Year Ended December 31,

| |

|---|

| | (dollars in thousands)

| |

|---|

| | Pro

Forma

| | Historical

| | Pro

Forma

| | Historical

| |

|---|

| | 2005

| | 2005

| | 2004

| | 2004

| | 2004

| | 2003

| | 2002

| |

|---|

| Other Data: | | | | | | | | | | | | | | | | | | | | | | |

| Cash flows provided by (used in): | | | | | | | | | | | | | | | | | | | | | | |

| | Operating activities | | | N/A | | $ | 60,292 | | $ | 62,634 | | | N/A | | $ | 84,774 | | $ | 46,593 | | $ | 39,695 | |

| | Investing activities | | | N/A | | $ | (41,754 | ) | $ | 8,862 | | | N/A | | $ | 2,607 | | $ | (327,068 | ) | $ | (26,883 | ) |

| | Financing activities | | | N/A | | $ | (16,433 | ) | $ | (54,259 | ) | | N/A | | $ | (93,156 | ) | $ | 289,271 | | $ | (12,247 | ) |

| Funds from operations(2) | | $ | 58,735 | | $ | 47,564 | | $ | 45,336 | | $ | 76,540 | | $ | 63,018 | | $ | 47,039 | | $ | 41,695 | |

| Gross leasable area open (thousands of square feet) (at period end): | | | | | | | | | | | | | | | | | | | | | | |

| | Wholly owned | | | 8,227 | | | 4,956 | | | 5,066 | | | 8,337 | | | 5,066 | | | 5,299 | | | 5,469 | |

| | Partially owned (consolidated) | | | — | | | 3,271 | | | 3,271 | | | — | | | 3,271 | | | 3,273 | | | — | |

| | Partially owned (unconsolidated) | | | 402 | | | 402 | | | 391 | | | 402 | | | 402 | | | 324 | | | 260 | |

| | Managed | | | 65 | | | 65 | | | 432 | | | 105 | | | 105 | | | 434 | | | 457 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total gross leasable area open (thousands of square feet) (at period end): | | | 8,694 | | | 8,694 | | | 9,160 | | | 8,844 | | | 8,844 | | | 9,330 | | | 6,186 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Number of centers (at period end): | | | | | | | | | | | | | | | | | | | | | | |

| | Wholly owned | | | 31 | | | 22 | | | 23 | | | 32 | | | 23 | | | 26 | | | 28 | |

| | Partially owned (consolidated) | | | — | | | 9 | | | 9 | | | — | | | 9 | | | 9 | | | — | |

| | Partially owned (unconsolidated) | | | 1 | | | 1 | | | 1 | | | 1 | | | 1 | | | 1 | | | 1 | |

| | Managed | | | 1 | | | 1 | | | 4 | | | 3 | | | 3 | | | 4 | | | 5 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total number of centers (at period end) | | | 33 | | | 33 | | | 37 | | | 36 | | | 36 | | | 40 | | | 34 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Occupancy rate (at period end)(1) | | | N/A | | | 97.0 | % | | 96.0 | % | | N/A | | | 97.0 | % | | 96.0 | % | | 98.0 | % |

- (1)

- Includes only factory outlet centers in which we have an ownership interest and not the factory outlet center we only manage.

- (2)

- FFO represents net income before extraordinary items and gains (losses) on sale or disposal of depreciable operating properties, plus depreciation and amortization uniquely significant to real estate and after adjustments for unconsolidated partnerships and joint ventures. The following table is a reconciliation of FFO to net income for the periods indicated and as adjusted to give effect to the prepayment of $77.4 million of mortgage debt, the completion of the company's Class C Preferred Share offering and the proposed unsecured debt offering, and the acquisition of the Charter Oak portfolio.

S-19

| | Nine Months Ended September 30,

| | Year Ended

December 31,

| |

|---|

| | (dollars in thousands)

| |

|---|

| | As adjusted

| | Historical

| | As adjusted

| | Historical

| |

|---|

| | 2005

| | 2005

| | 2004

| | 2004

| | 2004

| | 2003

| | 2002

| |

|---|

| Income from continuing operations(b) | | $ | 20,842 | | $ | 10,724 | | $ | 4,047 | | $ | 21,979 | | $ | 9,309 | | $ | 14,701 | | $ | 8,577 | |

| Discontinued operations (including gain or (loss) on sale of real estate) | | | — | | | — | | | (683 | ) | | (683 | ) | | (683 | ) | | 1,698 | | | 5,703 | |

| Loss on sale of real estate | | | (4,690 | ) | | (4,690 | ) | | — | | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income | | | 16,152 | | | 6,034 | | | 3,364 | | | 21,296 | | | 8,626 | | | 16,399 | | | 14,280 | |

| Applicable preferred unit distributions(c) | | | (2,813 | ) | | — | | | — | | | (3,750 | ) | | — | | | | | | | |

| Minority interest adjustment — consolidated joint venture(d) | | | — | | | (549 | ) | | 18 | | | — | | | (180 | ) | | (33 | ) | | — | |

| Depreciation and amortization attributable to discontinued operations | | | — | | | — | | | 554 | | | 554 | | | 554 | | | 1,466 | | | 1,942 | |

| Depreciation and amortization uniquely significant to real estate—consolidated(e) | | | 39,592 | | | 36,275 | | | 38,985 | | | 55,646 | | | 51,224 | | | 27,959 | | | 26,753 | |

| Depreciation and amortization uniquely significant to real estate—unconsolidated joint ventures | | | 1,114 | | | 1,114 | | | 955 | | | 1,334 | | | 1,334 | | | 1,101 | | | 422 | |

| (Gain)/loss on sale of real estate | | | 4,690 | | | 4,690 | | | 1,460 | | | 1,460 | | | 1,460 | | | 147 | | | (1,702 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Funds from operations | | $ | 58,735 | | $ | 47,564 | | $ | 45,336 | | $ | 76,540 | | $ | 63,018 | | $ | 47,039 | | $ | 41,695 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Fully diluted weighted average common units | | | 18,327 | | | 16,986 | | | 16,611 | | | 18,150 | | | 16,650 | | | 13,300 | | | 11,539 | |

- (a)

- FFO is intended to exclude GAAP historical cost depreciation of real estate, which assumes that the value of real estate assets diminish predictably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO excludes depreciation and amortization, gains and losses from property dispositions and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing prospective not immediately apparent from net income.

- We present FFO because we consider it an important supplemental measure of our operating performance and believe it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is widely used by us and others in our industry to evaluate and price potential acquisition candidates. The National Association of Real Estate Investment Trusts, Inc., of which we are a member, has encouraged its member companies to report their FFO as a supplemental, industry-wide standard measure of REIT operating performance. In addition, our employment agreements with certain members of management base bonus compensation on our FFO performance.

- FFO has significant limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

- •

- FFO does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

- •

- FFO does not reflect changes in, or cash requirements for, our working capital needs;

- •

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and FFO does not reflect any cash requirements for such replacements;

- •

- FFO does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations; and

- •

- Other companies in our industry may calculate FFO differently than we do, limiting its usefulness as a comparative measure.

- Because of these limitations, FFO should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or our dividend paying capacity. We compensate for these limitations by relying primarily on our GAAP results and using FFO only supplementally. See the Statements of Cash Flow included in our Annual Report on Form 10-K for the year ended December 31, 2004 and the Quarterly Report on Form 10-Q for the period ended September 30, 2005, incorporated by reference into this prospectus supplement and the accompanying prospectus.

- The above reconciliation of FFO begins with "Income from continuing operations," as shown in the "Statement of Operations Data," in contrast to "Net income," as prescribed by the NAREIT definition. However, the reconciliation as presented includes the results of discontinued operations and gains (losses) on sales of real estate which comprise the only differences.

- Note that the lettered footnotes (b) through (d) refer to the related As adjusted columns.

- (b)

- As adjusted data is derived from the pro forma data in our Current Report on Form 8-K/A dated October 26, 2005.

- (c)

- To reflect preferred unit distributions of $2.8 million for the nine months ended September 30, 2005 and $3.8 million for the year ended December 31, 2004 (from the issuance of 2.0 million preferred units to the company in exchange for the proceeds from the company's issuance of 2.0 million preferred shares at a price of $25.00 per share and at a coupon rate of 7.5%).

- (d)

- To eliminate the minority interest in the FFO of the consolidated joint venture being acquired in this transaction.

- (e)

- To reflect depreciation and amortization on the partial step-up of assets to fair value in accordance with FAS 141.

S-20

THE OPERATING PARTNERSHIP

We are one of the largest owners and operators of factory outlets in the United States. We are controlled by the company, a fully-integrated, self-administered and self-managed REIT and focus exclusively on developing, acquiring, owning, operating and managing factory outlet centers. As of September 30, 2005, we owned interests in or managed 33 factory outlet centers in 22 states with a total gross leasable area, or GLA, of approximately 8.7 million square feet. These factory outlet centers were 97% occupied and contained over 2,000 stores, representing over 400 store brands.