Tanger Inc.

Preferred Shares, Depositary Shares, Common Shares and Common Share Warrants

Tanger Properties Limited Partnership

Debt Securities

Tanger Inc., a North Carolina corporation, may from time to time offer:

| | (2) preferred | shares represented by depositary shares; |

| | (4) warrants | to purchase our common shares; and |

Tanger Properties Limited Partnership, a North Carolina limited partnership, may from time to time offer in one of more series its debt securities, which may either be senior or subordinated.

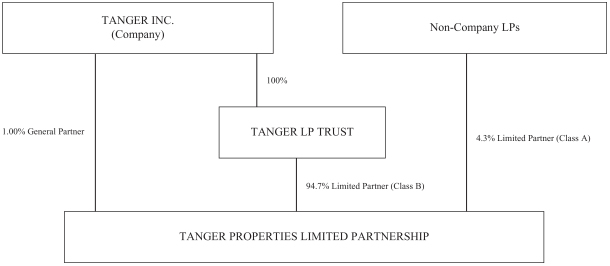

Tanger Inc., together with its consolidated subsidiaries, is referred to in this prospectus as the “Company,” and Tanger Properties Limited Partnership, together with its consolidated subsidiaries, is referred to in this prospectus as the “Operating Partnership.” The terms “we”, “our” and “us” refer to the Company and the Operating Partnership together, as the context requires. In statements regarding qualification as a real estate investment trust (“REIT”), such terms refer solely to Tanger Inc. On November 16, 2023, we changed our legal name from Tanger Factory Outlet Centers, Inc. to Tanger Inc. We will refer to Tanger Inc.’s current legal name throughout this prospectus.

The preferred shares, depositary shares, common shares, warrants to purchase our common shares and debt securities (collectively, the “Offered Securities”) may be offered, separately or together, in separate series, in amounts, at prices and on terms that will be set forth in one or more prospectus supplements to this prospectus. Under this Registration Statement, the Company can issue equity securities and debt guarantees, but not debt securities, and the Operating Partnership can issue only debt securities. Except as provided in the following sentence, the Company will unconditionally guarantee the payment of principal and a premium, if any, and interest on debt securities offered by the Operating Partnership, to the extent and on the terms described herein and in any accompanying prospectus supplement to this prospectus. If the Operating Partnership issues non-convertible investment grade debt securities, the applicable prospectus supplement will provide whether the securities are guaranteed by the Company.

This prospectus describes some of the general terms that may apply to these securities. The specific terms of any securities to be offered will be described in a supplement to this prospectus. The specific terms may include limitations on direct or beneficial ownership and restrictions on transfer, in each case as may be appropriate to preserve our status as a REIT for federal income tax purposes. The supplement may also add, update or change information contained in this prospectus with respect to that offering discussed in the supplement. You should read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

Investing in our securities involves risks. See “Risk Factors” beginning on page 3 of this Prospectus and any similar section contained in the applicable prospectus supplement for a description of certain factors that should be considered by purchasers of our securities.

Our securities may be offered directly, through agents designated from time to time by us, or to or through underwriters or dealers. If any agents or underwriters are involved in the sale of any of our securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them, will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. None of our securities may be sold without delivery of the applicable prospectus supplement describing the method and terms of the offering of those securities.

This prospectus describes some of the general terms that may apply to these securities. The specific terms of any securities to be offered will be described in a supplement to this prospectus.

Our common shares are listed on the New York Stock Exchange under the symbol “SKT.” On December 5, 2023, the last reported sale price of our common shares on the New York Stock Exchange was $26.72 per share.

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated December 6, 2023